Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CAPITAL SENIOR LIVING CORP | d833451d8k.htm |

| EX-99.1 - EX-99.1 - CAPITAL SENIOR LIVING CORP | d833451dex991.htm |

Capital Senior Living A leading Owner-Operator of Senior Living Communities and Services Exhibit 99.2

Forward-Looking Statements & Non-GAAP Financial Measures Forward Looking Statements: The forward-looking statements in this presentation are subject to certain risks and uncertainties that could cause results and financial condition to differ materially from those indicated in the forward-looking statements, including, but not limited to, the Company’s ability to generate sufficient cash flow to satisfy its debt and lease obligations and to fund the Company’s capital improvement projects to expand, redevelop, and/or reposition its senior living communities; the Company’s ability to obtain additional capital on terms acceptable to it; the Company’s ability to satisfy its short- and long-term working capital needs with available cash and cash flows from operations, supplemental debt financings, additional proceeds from debt refinancings, and proceeds from the sale of assets; the Company’s ability to extend or refinance its existing debt as such debt matures; the Company’s compliance with its debt and lease agreements, including certain financial covenants, and the risk of cross-default in the event such non-compliance occurs; the Company’s ability to complete acquisitions and dispositions upon favorable terms or at all; the risk of oversupply and increased competition in the markets which the Company operates; the risk of increased competition for skilled workers due to wage pressure and changes in regulatory requirements; the departure of the Company’s key officers and personnel; the cost and difficulty of complying with applicable licensure, legislative oversight, or regulatory changes; the risks associated with a decline in economic conditions generally; the adequacy and continued availability of the Company’s insurance policies and the Company’s ability to recover any losses it sustains under such policies; changes in accounting principles and interpretations; and the other risks and factors identified from time to time in the Company’s reports filed with the Securities and Exchange Commission (“SEC”), to differ materially, including, but not without limitation to, the Company’s ability to complete the refinancing of certain of our wholly owned communities, realize the anticipated savings related to such financing, find suitable acquisition properties at favorable terms, financing, licensing, business conditions, risks of downturns in economic conditions generally, satisfaction of closing conditions such as those pertaining to licensures, availability of insurance at commercially reasonable rates and changes in accounting principles and interpretations among others, and other risks and factors identified from time to time in our reports filed with the Securities and Exchange Commission. The Company assumes no obligation to update or supplement forward-looking statements in this presentation that become untrue because of new information, subsequent events or otherwise. Non-GAAP Financial Measures: Adjusted EBITDAR is a financial valuation measure and Adjusted Net Income/(Loss) and Adjusted CFFO are financial performance measures that are not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). Non-GAAP financial measures may have material limitations in that they do not reflect all of the costs associated with our results of operations as determined in accordance with GAAP. As a result, these non-GAAP financial measures should not be considered a substitute for, nor superior to, financial results and measures determined or calculated in accordance with GAAP. Adjusted EBITDAR is a valuation measure commonly used by our management, research analysts and investors to value companies in the senior living industry. Because Adjusted EBITDAR excludes interest expense and rent expense, it allows our management, research analysts and investors to compare the enterprise values of different companies without regard to differences in capital structures and leasing arrangements. The Company believes that Adjusted Net Income/(Loss) and Adjusted CFFO are useful as performance measures in identifying trends in day-to-day operations because they exclude the costs associated with acquisitions and conversions and other items that do not ordinarily reflect the ongoing operating results of our primary business. Adjusted Net Income/(Loss) and Adjusted CFFO provide indicators to management of progress in achieving both consolidated and individual business unit operating performance and are used by research analysts and investors to evaluate the performance of companies in the senior living industry. The Company strongly urges you to review the reconciliation of net loss to Adjusted EBITDAR and the reconciliation of net (loss) income to Adjusted Net Income/(Loss) and Adjusted CFFO, on the last page of the Company’s first quarter 2020 earnings release dated May 21, 2020, along with the Company’s consolidated balance sheets, statements of operations, and statements of cash flows, which can be found on the Company’s website at www.capitalsenior.com/investor-relations/press-releases/

Operational & Financial Highlights for Q1 2020 The Company reached agreements with all three of its landlords for early terminations of its Master Leases. When the transitions are complete, the agreements are expected to improve the Company’s annual cash flow by approximately $22.0 million. The related lease liabilities on our balance sheet, which were approximately $253.0 million at December 31, 2019, were reduced to $38.8 million at March 31 and will be eliminated by December 31, 2020. On March 31, 2020 the Company closed the sale of a non-core community in Indiana, resulting in approximately $6.9 million in net cash proceeds. NOI increased $2.7 million in the first quarter of 2020 as compared to the fourth quarter of 2019. Adjusted CFFO, excluding COVID-19 expenses, increased $1.9M sequentially. Short-term forbearance agreements were reached with lenders resulting in lower debt payments beginning in April 2020.

COVID-19 Planning, Preparation, and Response Our residents and employees’ safety and health is our first priority Established a multi-disciplinary COVID-19 Task Force in early Q1 Serves as an around-the-clock response team to supporting our communities Consistent virtual and on-site communication from central and regional leadership Enhanced staffing protocols and procedures Detailed staffing plan in place to prevent staffing challenges Implemented a streamlined background check process and in-community drug screenings that allow for a quicker hiring process Created and implemented national job postings for positions at all communities Expanded our supply network and fortified community supply stock of masks, gowns, gloves, face shields, sanitizer and other critical items through eight regional supply hubs Strictly Confidential

Real-time Changes to Operating Model Revised and strengthened existing protocols and procedures tailored for prevention of infectious disease spread beginning in late January In addition, CDC and state health department guidelines fully implemented Diligent screening of all visitors, employees and returning residents Resident interaction limited to appropriate social distancing and reinventing activities in the current environment Created virtual tours for all communities and updated in person tour structure Created guidance for admittance and re-admittance of residents Strictly Confidential

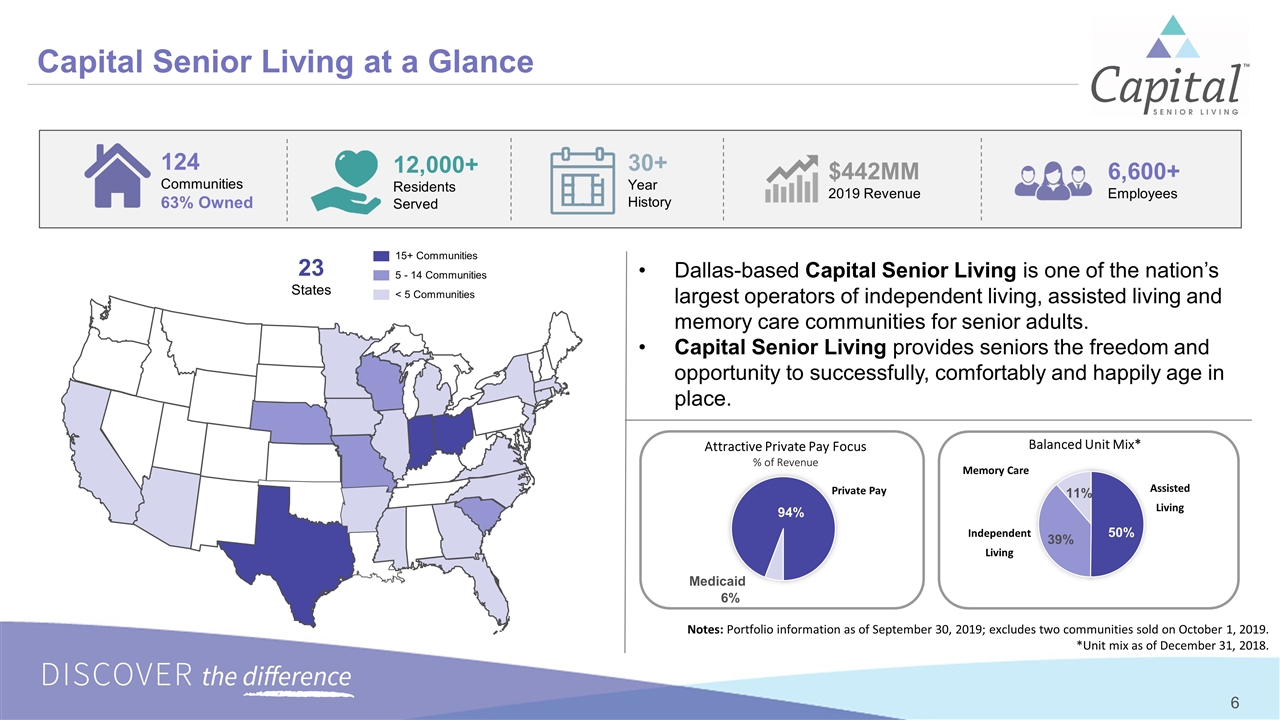

Capital Senior Living at a Glance Dallas-based Capital Senior Living is one of the nation’s largest operators of independent living, assisted living and memory care communities for senior adults. Capital Senior Living provides seniors the freedom and opportunity to successfully, comfortably and happily age in place. 15+ Communities 5 - 14 Communities < 5 Communities 23 States 124 Communities 63% Owned 12,000+ Residents Served 6,600+ Employees $442MM 2019 Revenue 30+ Year History Attractive Private Pay Focus % of Revenue Private Pay Balanced Unit Mix* Memory Care Independent Living Assisted Living Notes: Portfolio information as of September 30, 2019; excludes two communities sold on October 1, 2019. *Unit mix as of December 31, 2018.

Building on Solid Foundation STABILIZE INVEST NURTURE GROW Execution Excellence Resident-Centric Experience Commercial Excellence Market Opportunities Quality Systems & Analytics Operational Leadership Talent and Retention Scale Operating Standards Community upgrades and conversions to AL & MC Innovative and Differentiated Resident Programming Population Health and Wellness Technology Local brand preference Lead generation and sales Digital Transformation and customer engagement Performance-based media strategies Same store organic growth Accretive acquisitions in attractive geographically concentrated markets Foundational Growth 2019 2021 2019-2021 Strategy

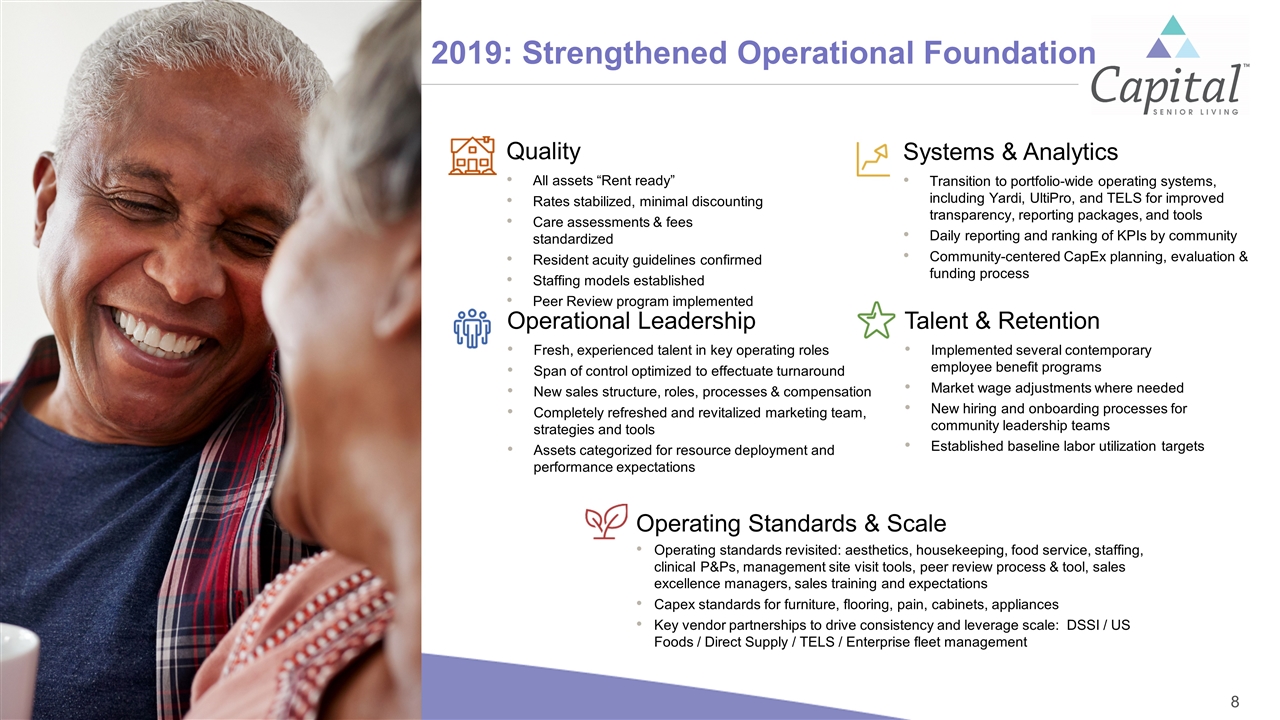

2019: Strengthened Operational Foundation Quality All assets “Rent ready” Rates stabilized, minimal discounting Care assessments & fees standardized Resident acuity guidelines confirmed Staffing models established Peer Review program implemented Systems & Analytics Transition to portfolio-wide operating systems, including Yardi, UltiPro, and TELS for improved transparency, reporting packages, and tools Daily reporting and ranking of KPIs by community Community-centered CapEx planning, evaluation & funding process Operational Leadership Fresh, experienced talent in key operating roles Span of control optimized to effectuate turnaround New sales structure, roles, processes & compensation Completely refreshed and revitalized marketing team, strategies and tools Assets categorized for resource deployment and performance expectations Talent & Retention Implemented several contemporary employee benefit programs Market wage adjustments where needed New hiring and onboarding processes for community leadership teams Established baseline labor utilization targets Operating Standards & Scale Operating standards revisited: aesthetics, housekeeping, food service, staffing, clinical P&Ps, management site visit tools, peer review process & tool, sales excellence managers, sales training and expectations Capex standards for furniture, flooring, pain, cabinets, appliances Key vendor partnerships to drive consistency and leverage scale: DSSI / US Foods / Direct Supply / TELS / Enterprise fleet management

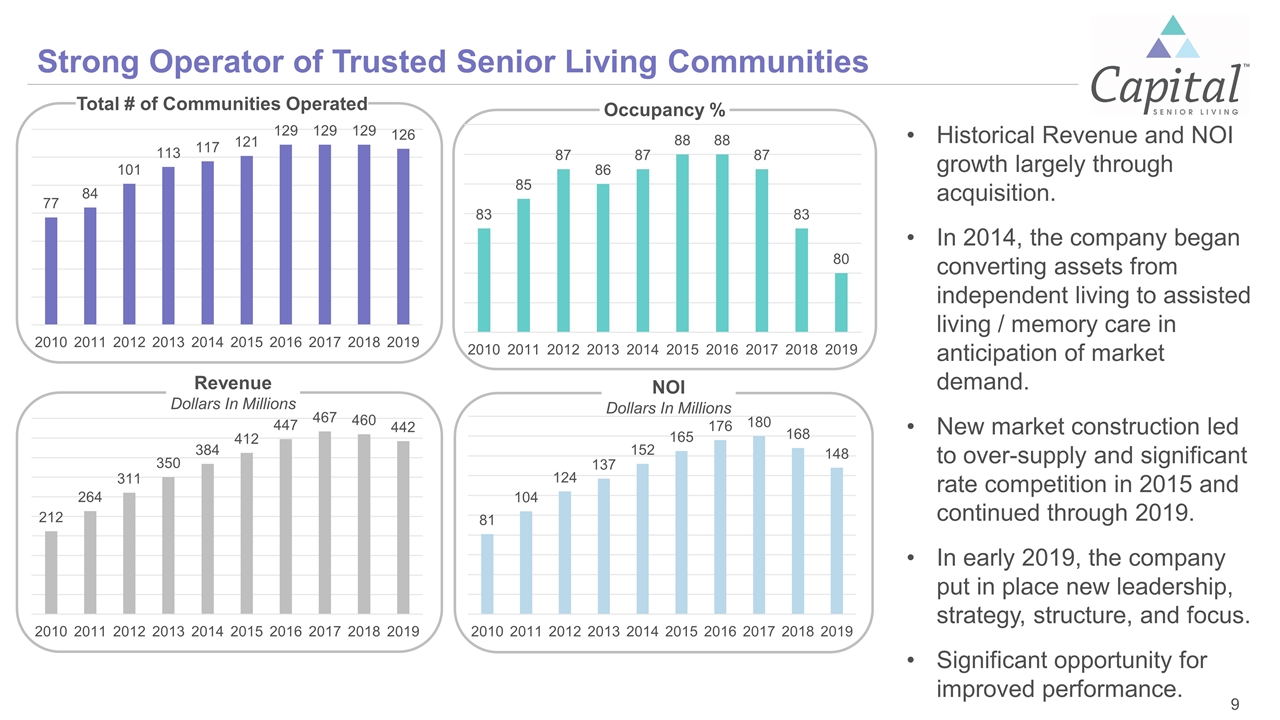

Strong Operator of Trusted Senior Living Communities Revenue Dollars In Millions Total # of Communities Operated NOI Dollars In Millions Historical Revenue and NOI growth largely through acquisition. In 2014, the company began converting assets from independent living to assisted living / memory care in anticipation of market demand. New market construction led to over-supply and significant rate competition in 2015 and continued through 2019. In early 2019, the company put in place new leadership, strategy, structure, and focus. Significant opportunity for improved performance. Occupancy %

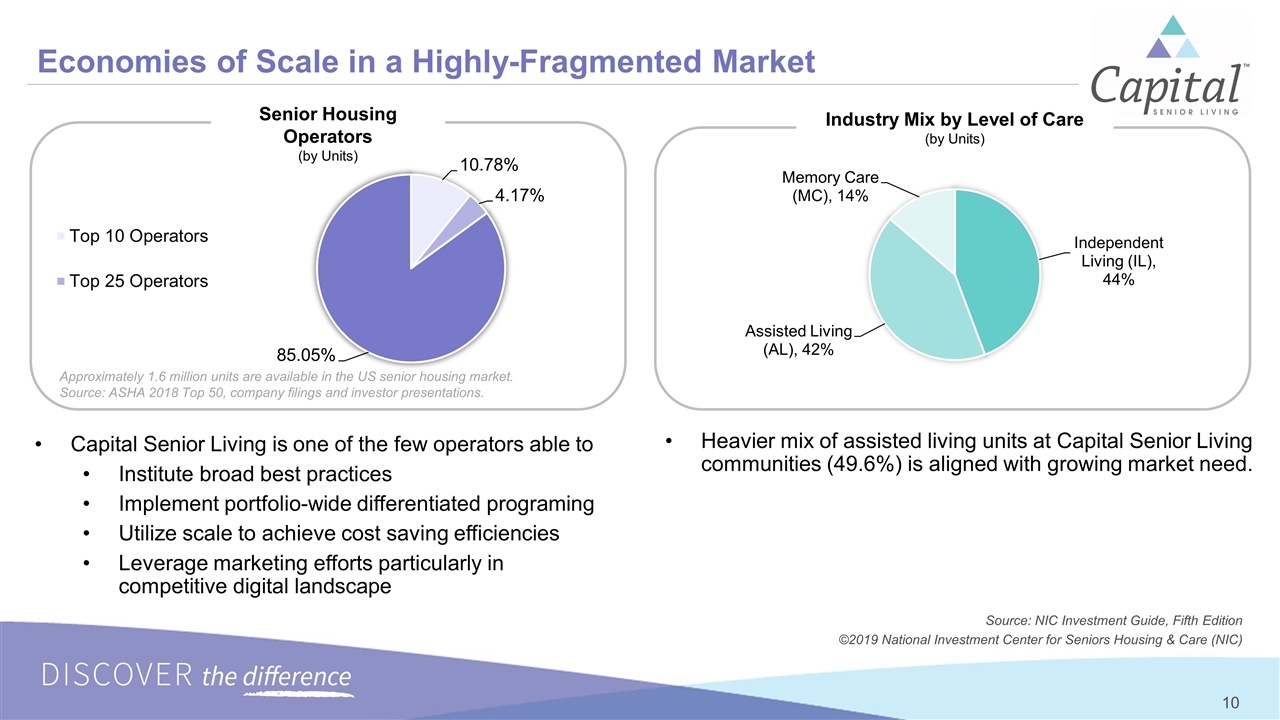

Senior Housing Operators (by Units) Economies of Scale in a Highly-Fragmented Market Capital Senior Living is one of the few operators able to Institute broad best practices Implement portfolio-wide differentiated programing Utilize scale to achieve cost saving efficiencies Leverage marketing efforts particularly in competitive digital landscape Industry Mix by Level of Care (by Units) Approximately 1.6 million units are available in the US senior housing market. Source: ASHA 2018 Top 50, company filings and investor presentations. Source: NIC Investment Guide, Fifth Edition ©2019 National Investment Center for Seniors Housing & Care (NIC) Heavier mix of assisted living units at Capital Senior Living communities (49.6%) is aligned with growing market need.

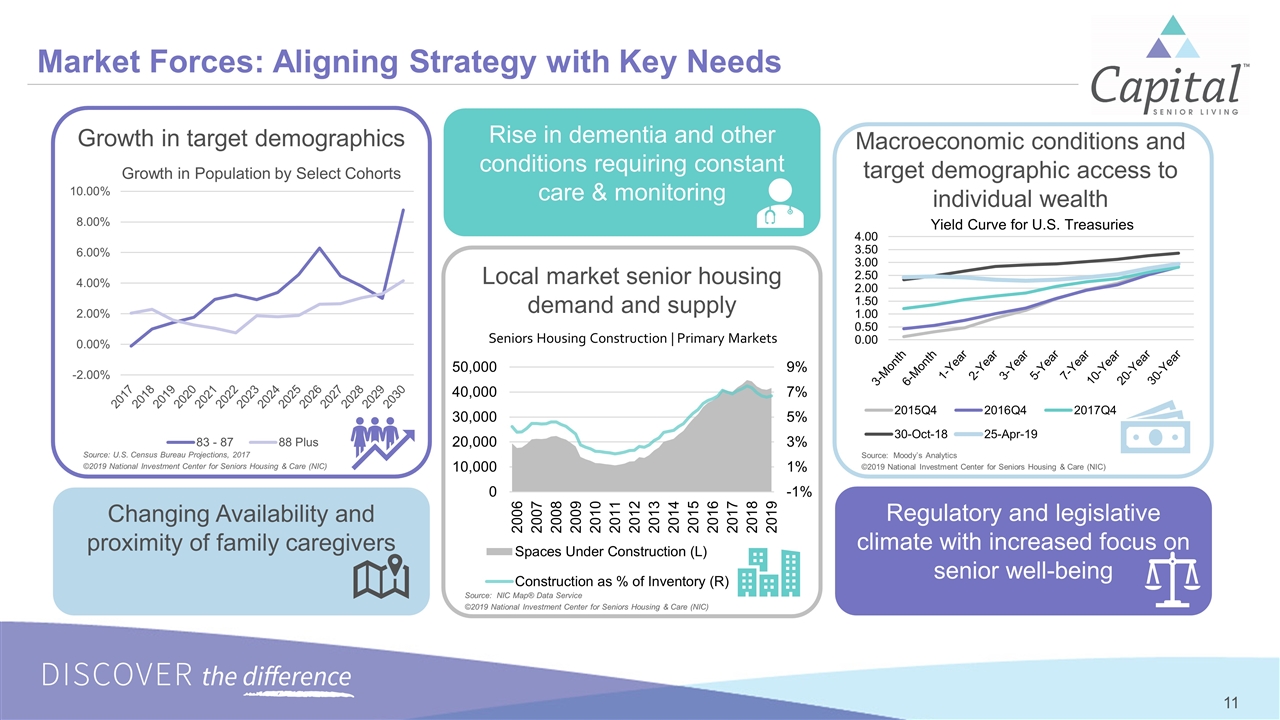

Market Forces: Aligning Strategy with Key Needs Rise in dementia and other conditions requiring constant care & monitoring Changing Availability and proximity of family caregivers Local market senior housing demand and supply Regulatory and legislative climate with increased focus on senior well-being Source: Moody’s Analytics ©2019 National Investment Center for Seniors Housing & Care (NIC) Growth in target demographics Source: U.S. Census Bureau Projections, 2017 ©2019 National Investment Center for Seniors Housing & Care (NIC) Source: NIC Map® Data Service ©2019 National Investment Center for Seniors Housing & Care (NIC) Macroeconomic conditions and target demographic access to individual wealth

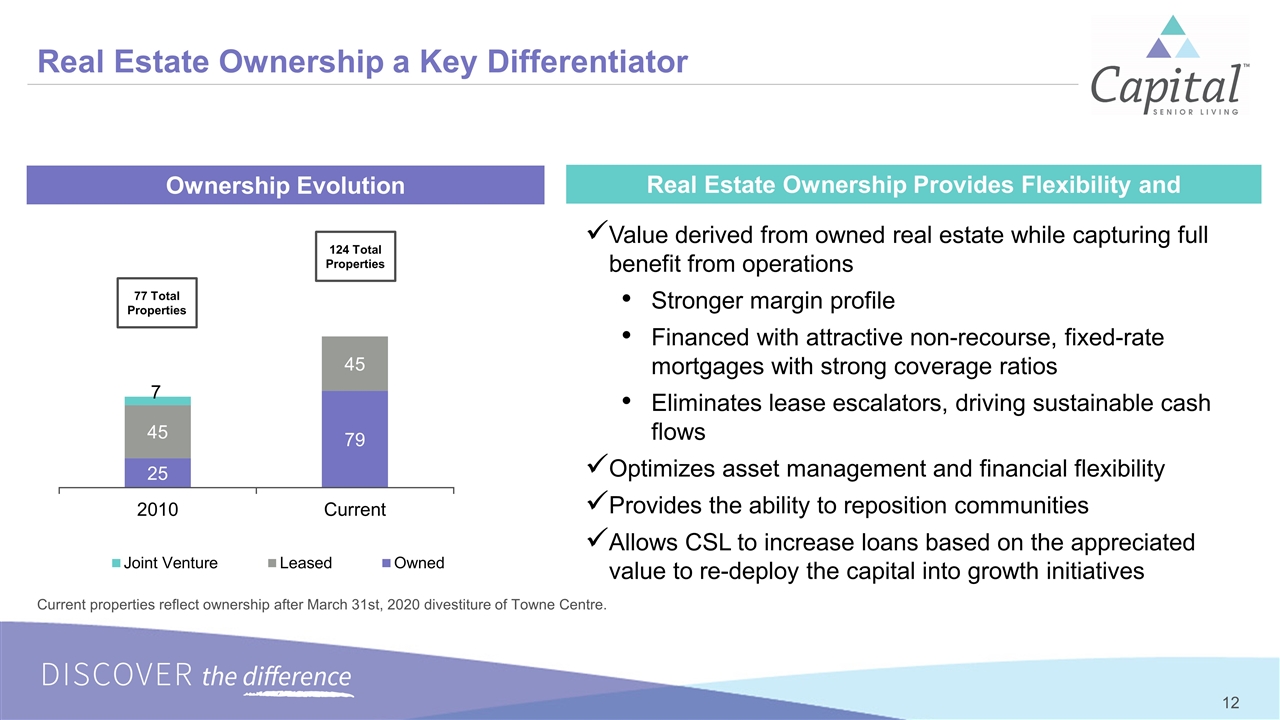

124 Total Properties 77 Total Properties Current properties reflect ownership after March 31st, 2020 divestiture of Towne Centre. Ownership Evolution Real Estate Ownership Provides Flexibility and Opportunities Value derived from owned real estate while capturing full benefit from operations Stronger margin profile Financed with attractive non-recourse, fixed-rate mortgages with strong coverage ratios Eliminates lease escalators, driving sustainable cash flows Optimizes asset management and financial flexibility Provides the ability to reposition communities Allows CSL to increase loans based on the appreciated value to re-deploy the capital into growth initiatives Real Estate Ownership a Key Differentiator

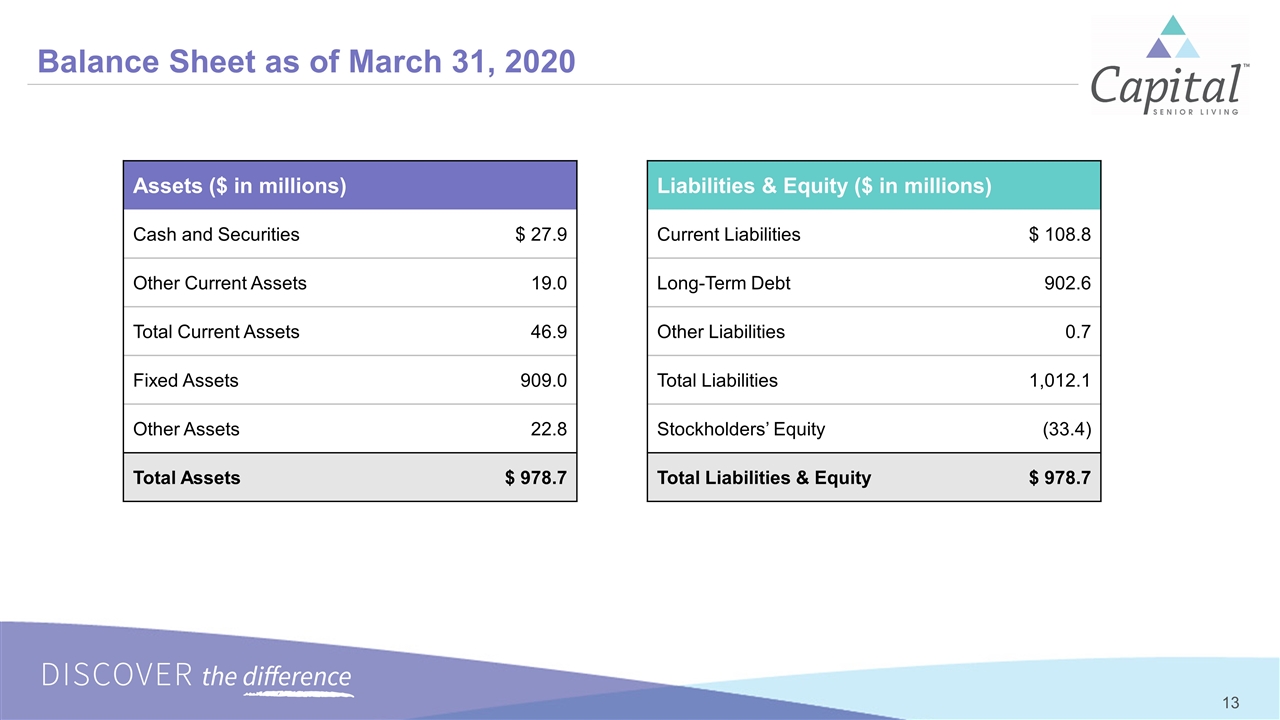

Balance Sheet as of March 31, 2020 Assets ($ in millions) Cash and Securities $ 27.9 Other Current Assets 19.0 Total Current Assets 46.9 Fixed Assets 909.0 Other Assets 22.8 Total Assets $ 978.7 Liabilities & Equity ($ in millions) Current Liabilities $ 108.8 Long-Term Debt 902.6 Other Liabilities 0.7 Total Liabilities 1,012.1 Stockholders’ Equity (33.4) Total Liabilities & Equity $ 978.7

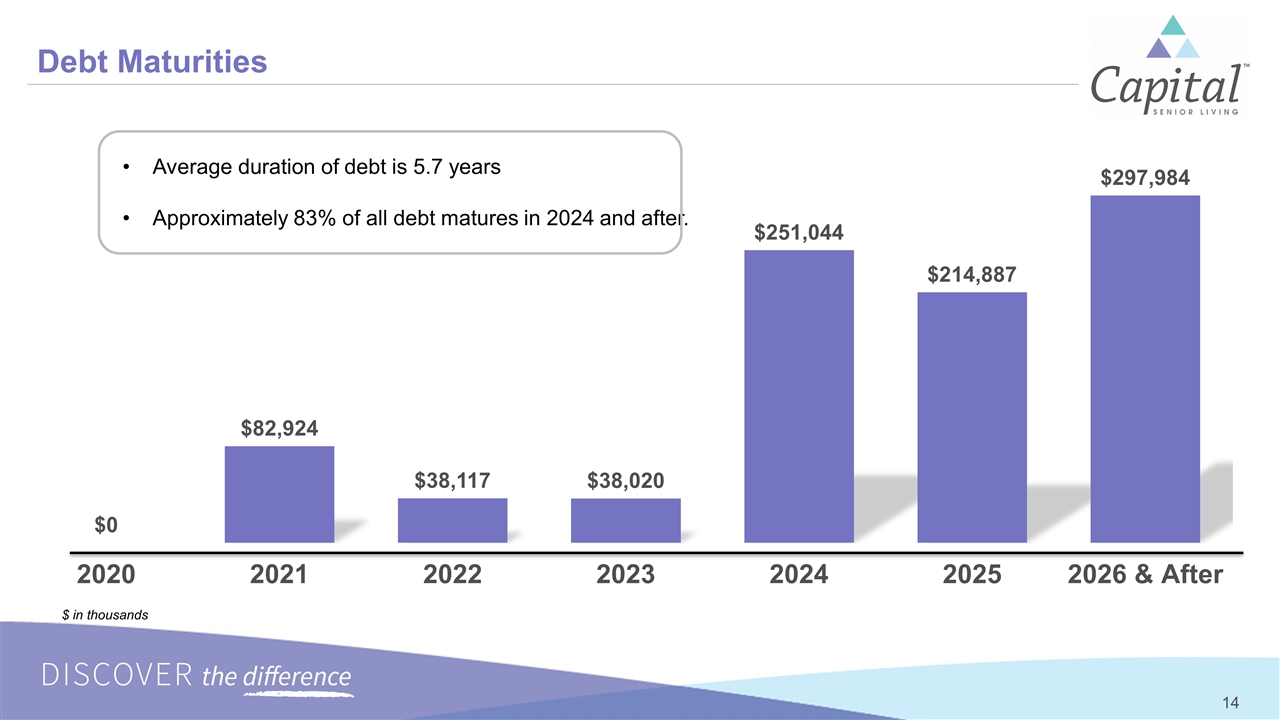

$ in thousands Debt Maturities Average duration of debt is 5.7 years Approximately 83% of all debt matures in 2024 and after.

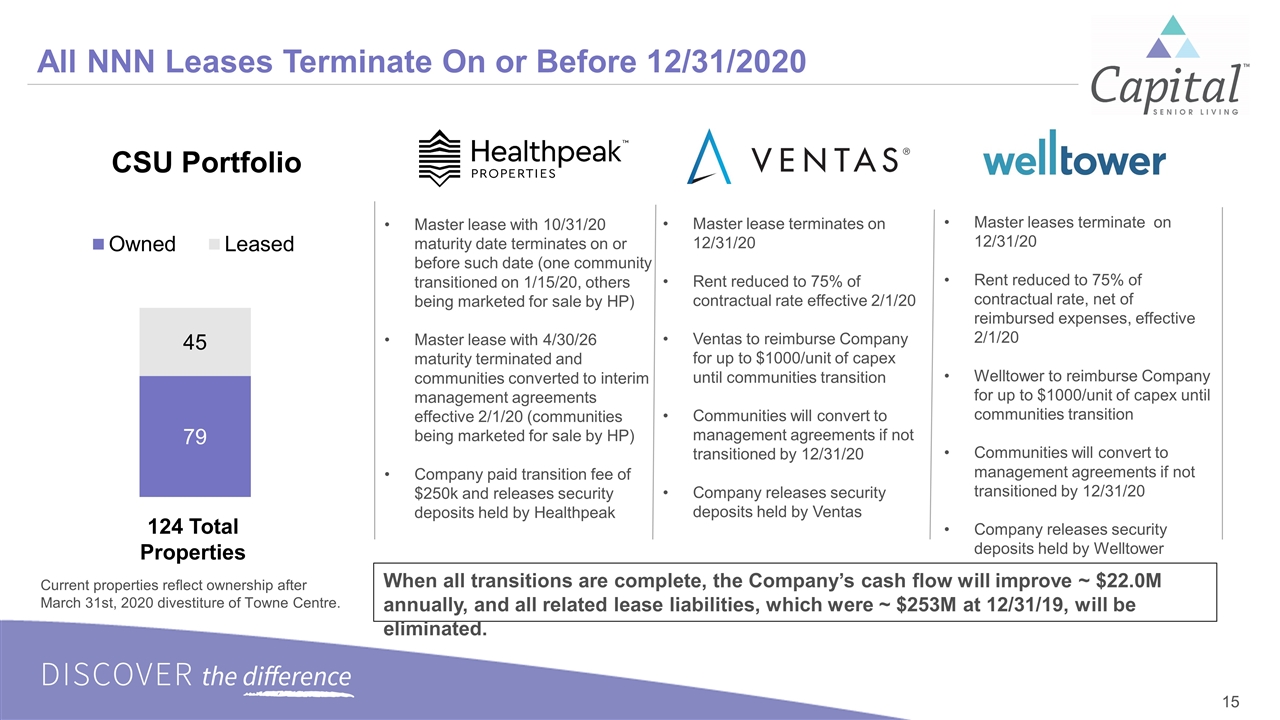

All NNN Leases Terminate On or Before 12/31/2020 124 Total Properties CSU Portfolio Current properties reflect ownership after March 31st, 2020 divestiture of Towne Centre. Master lease terminates on 12/31/20 Rent reduced to 75% of contractual rate effective 2/1/20 Ventas to reimburse Company for up to $1000/unit of capex until communities transition Communities will convert to management agreements if not transitioned by 12/31/20 Company releases security deposits held by Ventas Master leases terminate on 12/31/20 Rent reduced to 75% of contractual rate, net of reimbursed expenses, effective 2/1/20 Welltower to reimburse Company for up to $1000/unit of capex until communities transition Communities will convert to management agreements if not transitioned by 12/31/20 Company releases security deposits held by Welltower Master lease with 10/31/20 maturity date terminates on or before such date (one community transitioned on 1/15/20, others being marketed for sale by HP) Master lease with 4/30/26 maturity terminated and communities converted to interim management agreements effective 2/1/20 (communities being marketed for sale by HP) Company paid transition fee of $250k and releases security deposits held by Healthpeak When all transitions are complete, the Company’s cash flow will improve ~ $22.0M annually, and all related lease liabilities, which were ~ $253M at 12/31/19, will be eliminated.

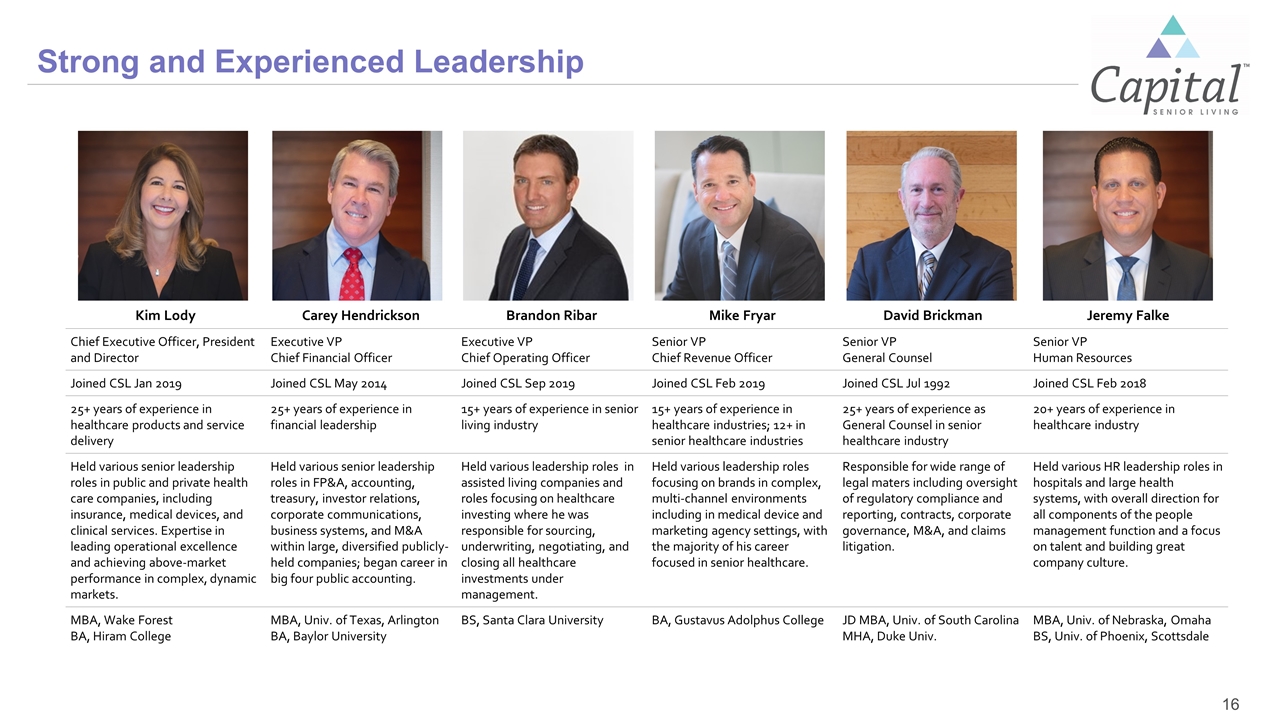

Strong and Experienced Leadership Kim Lody Carey Hendrickson Brandon Ribar Mike Fryar David Brickman Jeremy Falke Chief Executive Officer, President and Director Executive VP Chief Financial Officer Executive VP Chief Operating Officer Senior VP Chief Revenue Officer Senior VP General Counsel Senior VP Human Resources Joined CSL Jan 2019 Joined CSL May 2014 Joined CSL Sep 2019 Joined CSL Feb 2019 Joined CSL Jul 1992 Joined CSL Feb 2018 25+ years of experience in healthcare products and service delivery 25+ years of experience in financial leadership 15+ years of experience in senior living industry 15+ years of experience in healthcare industries; 12+ in senior healthcare industries 25+ years of experience as General Counsel in senior healthcare industry 20+ years of experience in healthcare industry Held various senior leadership roles in public and private health care companies, including insurance, medical devices, and clinical services. Expertise in leading operational excellence and achieving above-market performance in complex, dynamic markets. Held various senior leadership roles in FP&A, accounting, treasury, investor relations, corporate communications, business systems, and M&A within large, diversified publicly-held companies; began career in big four public accounting. Held various leadership roles in assisted living companies and roles focusing on healthcare investing where he was responsible for sourcing, underwriting, negotiating, and closing all healthcare investments under management. Held various leadership roles focusing on brands in complex, multi-channel environments including in medical device and marketing agency settings, with the majority of his career focused in senior healthcare. Responsible for wide range of legal maters including oversight of regulatory compliance and reporting, contracts, corporate governance, M&A, and claims litigation. Held various HR leadership roles in hospitals and large health systems, with overall direction for all components of the people management function and a focus on talent and building great company culture. MBA, Wake Forest BA, Hiram College MBA, Univ. of Texas, Arlington BA, Baylor University BS, Santa Clara University BA, Gustavus Adolphus College JD MBA, Univ. of South Carolina MHA, Duke Univ. MBA, Univ. of Nebraska, Omaha BS, Univ. of Phoenix, Scottsdale

Investment Rationale Sizeable, fragmented markets with unmet needs Owner-operator model provides financial and operational advantages Top talent and emerging culture of learning, collaborating, and winning 30-years of experience caring for seniors Significant opportunity for near-term operational improvement and long-term growth Solid strategy, structure, standards and focus Current valuation provides a compelling investment opportunity