Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Golub Capital BDC 3, Inc. | gbdc3investorpresentation8.htm |

GOLUB CAPITAL BDC 3, INC. INVESTOR PRESENTATION QUARTER ENDED MARCH 31, 2020

Disclaimer Some of the statements in this presentation constitute forward-looking statements, Such forward-looking statements may include statements preceded by, followed by which relate to future events or our future performance or financial condition. The or that otherwise include the words “may,” “might,” “will,” “intend,” “should,” “could,” forward-looking statements contained in this presentation involve risks and “can,” “would,” “expect,” “believe,” “estimate,” “anticipate,” “predict,” “potential,” uncertainties, including statements as to: our future operating results; our business “plan” or similar words. prospects and the prospects of our portfolio companies including our and their We have based the forward-looking statements included in this presentation on ability to achieve our and their respective objectives as a result of the coronavirus information available to us on the date of this presentation. Actual results could ("COVID-19") pandemic ; the effect of investments that we expect to make and the differ materially from those anticipated in our forward-looking statements and competition for those investments; our contractual arrangements and relationships future results could differ materially from historical performance. We undertake no with third parties; actual and potential conflicts of interest with GC Advisors LLC obligation to revise or update any forward-looking statements, whether as a result ("GC Advisors"), our investment adviser, and other affiliates of Golub Capital LLC of new information, future events or otherwise. You are advised to consult any (collectively, "Golub Capital"); the dependence of our future success on the general additional disclosures that we may make directly to you or through reports that we economy and its effect on the industries in which we invest; the ability of our have filed or in the future may file with the Securities and Exchange Commission portfolio companies to achieve their objectives; the use of borrowed money to (“SEC”), including annual reports on Form 10-K, quarterly reports on Form 10-Q and finance a portion of our investments and the effect of the COVID-19 pandemic on current reports on Form 8-K. the availability of equity and debt capital and our use of borrowed funds to finance a portion of our investments; the adequacy of our financing sources and working This presentation contains statistics and other data that have been obtained from capital; the timing of cash flows, if any, from the operations of our portfolio or compiled from information made available by third-party service providers. We companies; general economic and political trends and other external factors, have not independently verified such statistics or data. including the COVID-19 pandemic; changes in political, economic or industry In evaluating prior performance information in this presentation, you should conditions, the interest rate environment or conditions affecting the financial and remember that past performance is not a guarantee, prediction, or projection of capital markets that could result in changes to the value of our assets, including future results, and there can be no assurance that we will achieve similar results in changes from the impact of the COVID-19 pandemic; the ability of GC Advisors to the future. locate suitable investments for us and to monitor and administer our investments; the ability of GC Advisors or its affiliates to attract and retain highly talented professionals; the ability of GC Advisors to continue to effectively manage our business due to the disruptions caused by the COVID-19 pandemic; our ability to qualify and maintain our qualification as a regulated investment company and as a business development company; general price and volume fluctuations in the stock market; the impact on our business of the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules and regulations issued thereunder and any actions toward repeal thereof; and the effect of changes to tax legislation and our tax position. 2

Summary of Financial Results vs. Preliminary Estimates 01

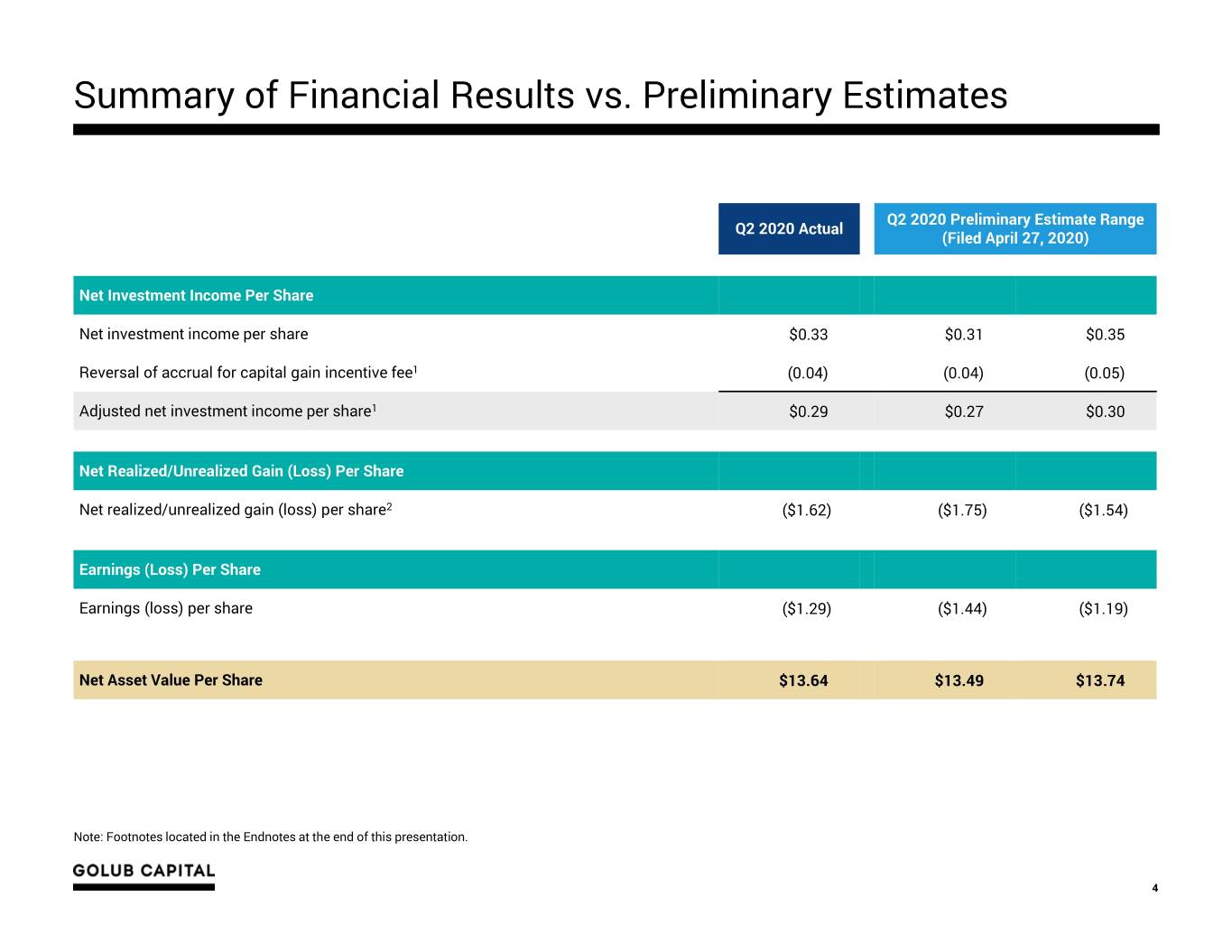

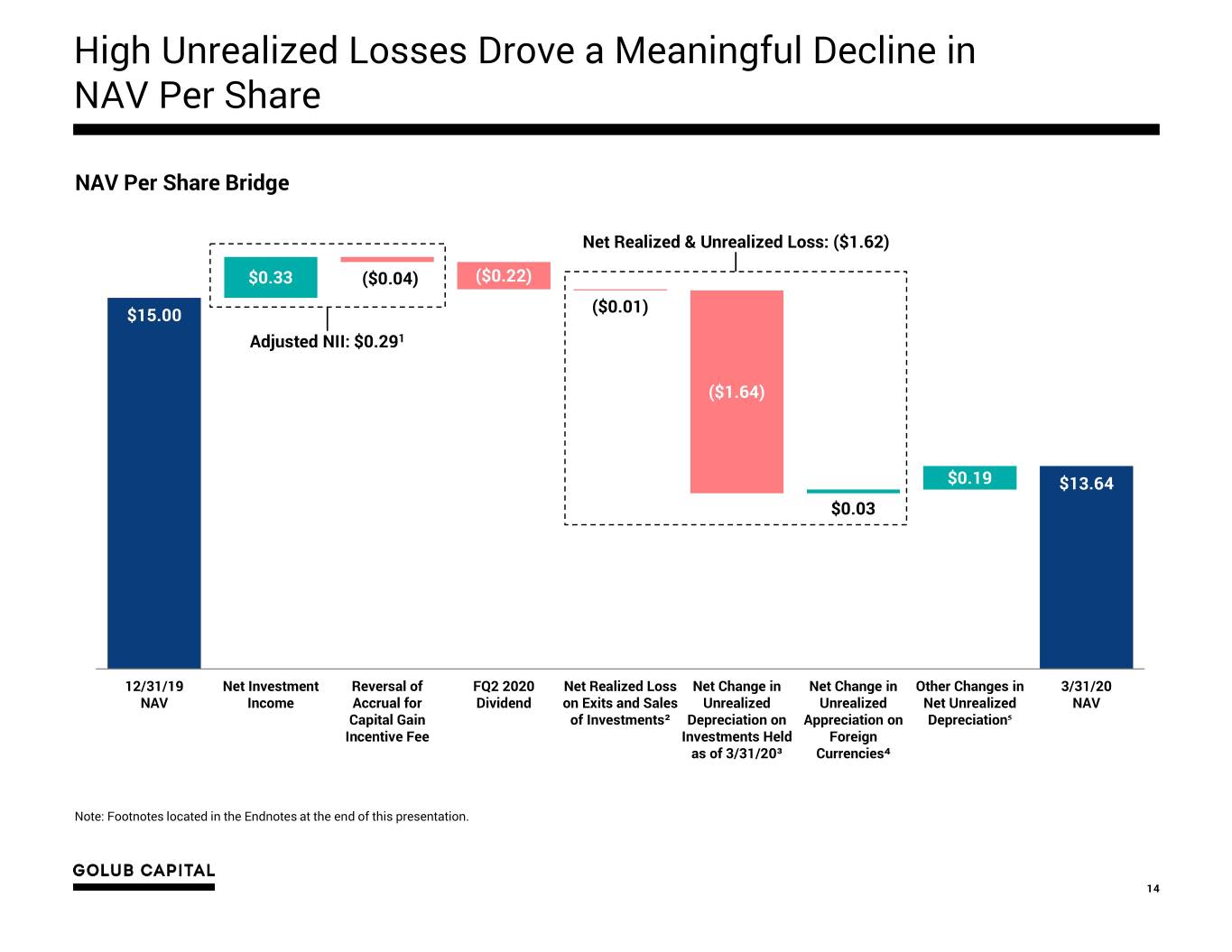

Summary of Financial Results vs. Preliminary Estimates Q2 2020 Preliminary Estimate Range Q2 2020 Actual (Filed April 27, 2020) Net Investment Income Per Share Net investment income per share $0.33 $0.31 $0.35 Reversal of accrual for capital gain incentive fee1 (0.04) (0.04) (0.05) Adjusted net investment income per share1 $0.29 $0.27 $0.30 Net Realized/Unrealized Gain (Loss) Per Share Net realized/unrealized gain (loss) per share2 ($1.62) ($1.75) ($1.54) Earnings (Loss) Per Share Earnings (loss) per share ($1.29) ($1.44) ($1.19) Net Asset Value Per Share $13.64 $13.49 $13.74 Note: Footnotes located in the Endnotes at the end of this presentation. 4

COVID-19 Impact Update: Economy & Markets 02

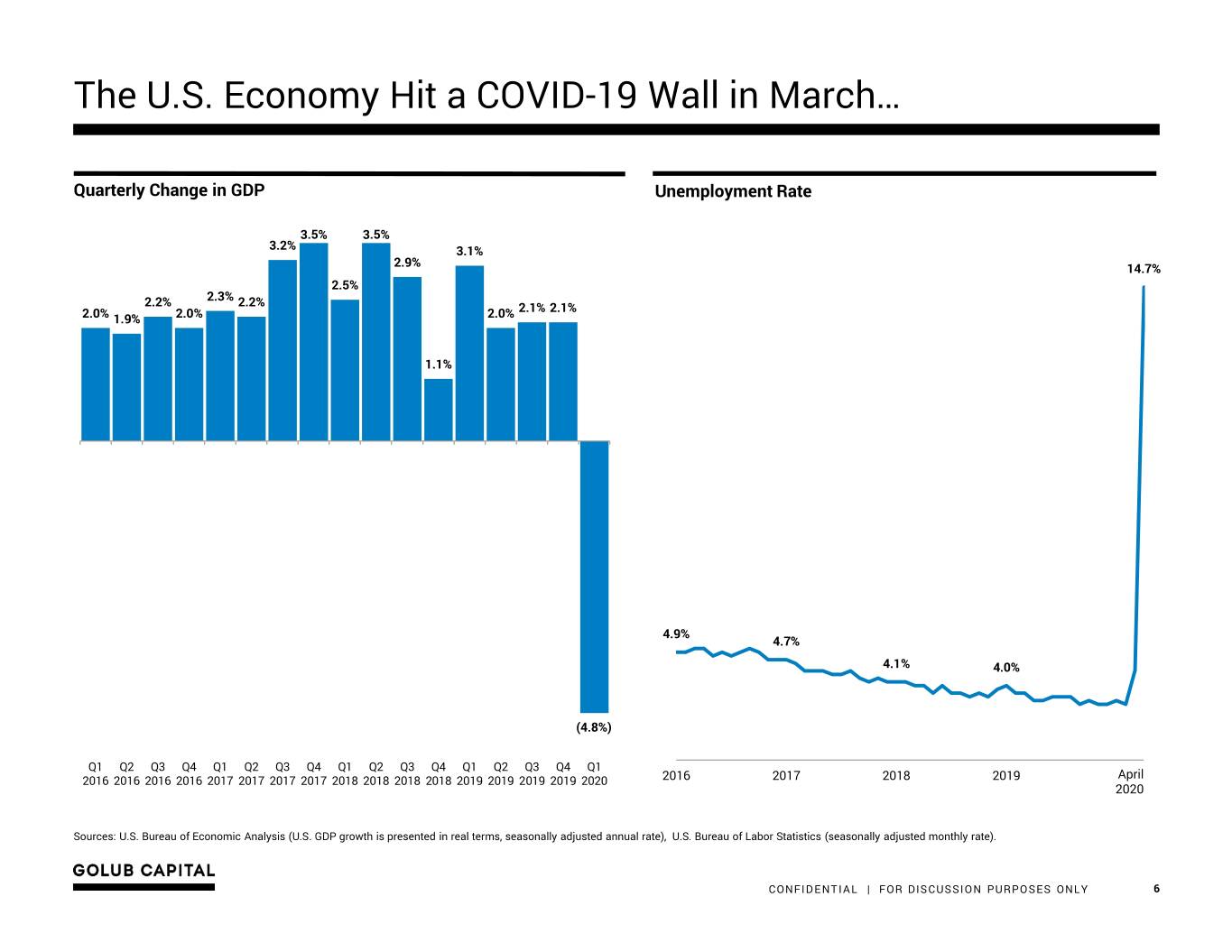

The U.S. Economy Hit a COVID-19 Wall in March… Quarterly Change in GDP Unemployment Rate 3.5% 3.5% 3.2% 3.1% 2.9% 14.7% 2.5% 2.3% 2.2% 2.2% 2.1% 2.1% 2.0% 1.9% 2.0% 2.0% 1.1% 4.9% 4.7% 4.1% 4.0% (4.8%) Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 April 2016 2016 2016 2016 2017 2017 2017 2017 2018 2018 2018 2018 2019 2019 2019 2019 2020 2016 2017 2018 2019 2020 2020 Sources: U.S. Bureau of Economic Analysis (U.S. GDP growth is presented in real terms, seasonally adjusted annual rate), U.S. Bureau of Labor Statistics (seasonally adjusted monthly rate). CONFIDENTIAL | FOR DISCUSSION PURPOSES ONLY 6

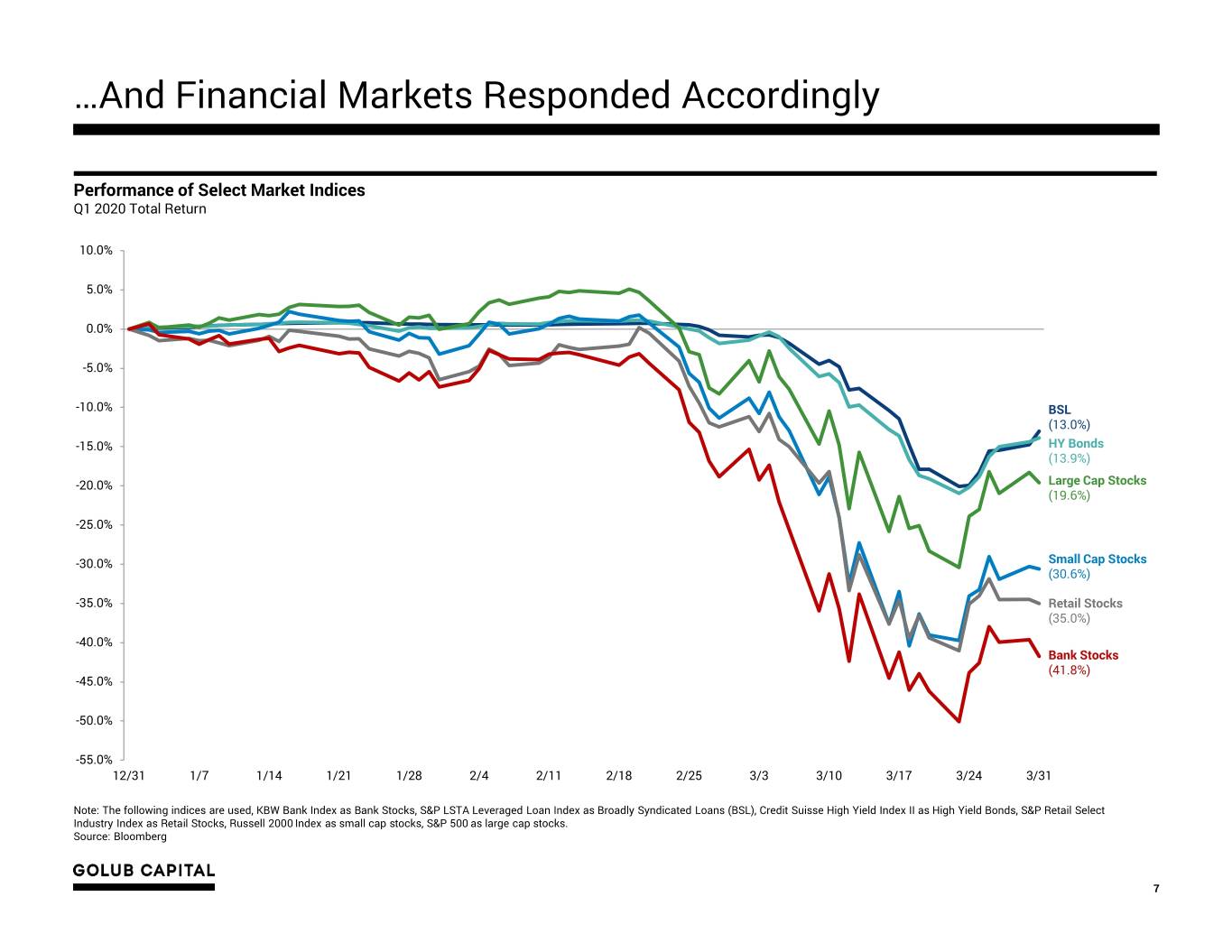

…And Financial Markets Responded Accordingly Performance of Select Market Indices Q1 2020 Total Return 10.0% 5.0% 0.0% -5.0% -10.0% BSL (13.0%) -15.0% HY Bonds (13.9%) -20.0% Large Cap Stocks (19.6%) -25.0% -30.0% Small Cap Stocks (30.6%) -35.0% Retail Stocks (35.0%) -40.0% Bank Stocks (41.8%) -45.0% -50.0% -55.0% 12/31 1/7 1/14 1/21 1/28 2/4 2/11 2/18 2/25 3/3 3/10 3/17 3/24 3/31 Note: The following indices are used, KBW Bank Index as Bank Stocks, S&P LSTA Leveraged Loan Index as Broadly Syndicated Loans (BSL), Credit Suisse High Yield Index II as High Yield Bonds, S&P Retail Select Industry Index as Retail Stocks, Russell 2000 Index as small cap stocks, S&P 500 as large cap stocks. Source: Bloomberg 7

COVID-19 Impact Update: GBDC 3 03

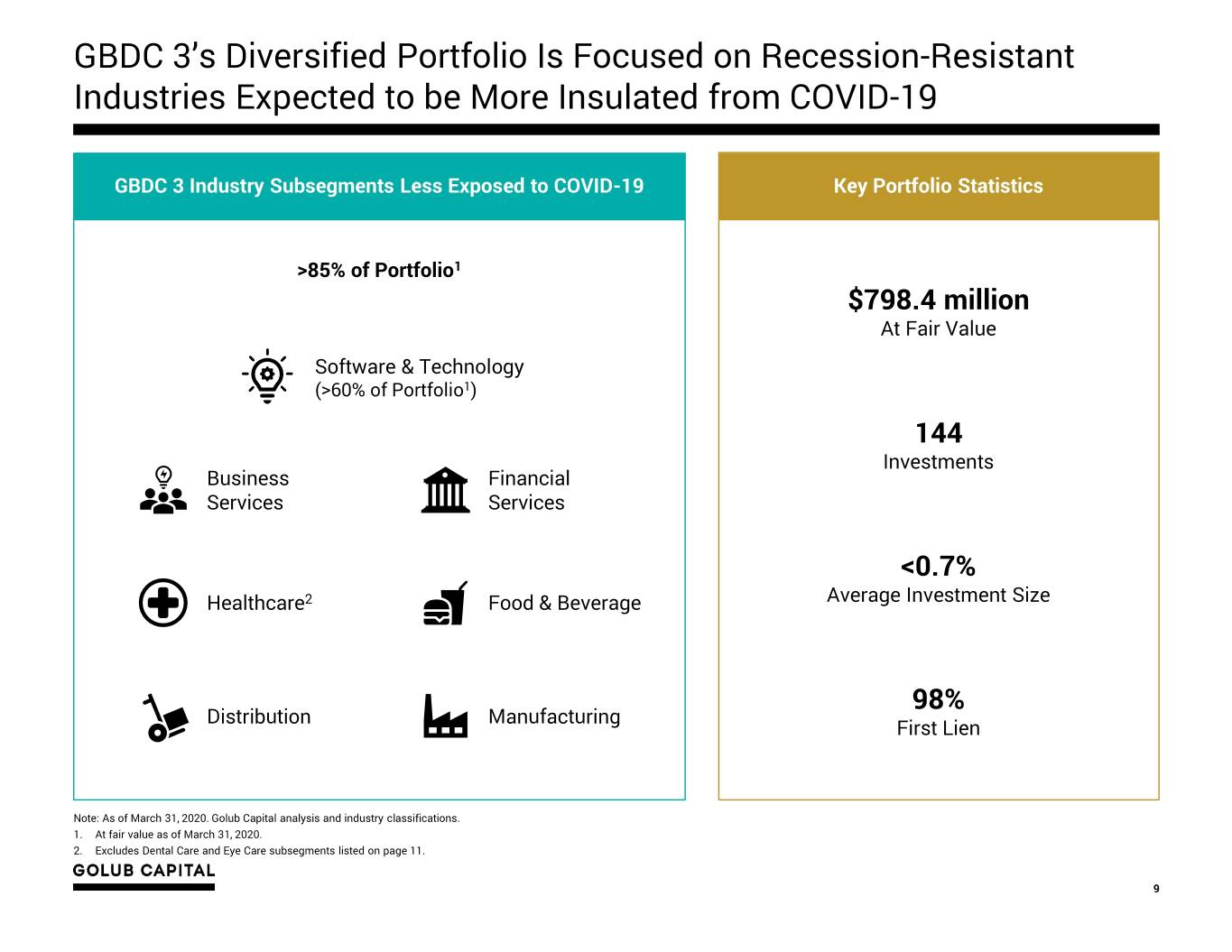

GBDC 3’s Diversified Portfolio Is Focused on Recession-Resistant Industries Expected to be More Insulated from COVID-19 GBDC 3 Industry Subsegments Less Exposed to COVID-19 Key Portfolio Statistics >85% of Portfolio1 $798.4 million At Fair Value Software & Technology (>60% of Portfolio1) 144 Investments Business Financial Services Services <0.7% Healthcare2 Food & Beverage Average Investment Size 98% Distribution Manufacturing First Lien Note: As of March 31, 2020. Golub Capital analysis and industry classifications. 1. At fair value as of March 31, 2020. 2. Excludes Dental Care and Eye Care subsegments listed on page 11. 9

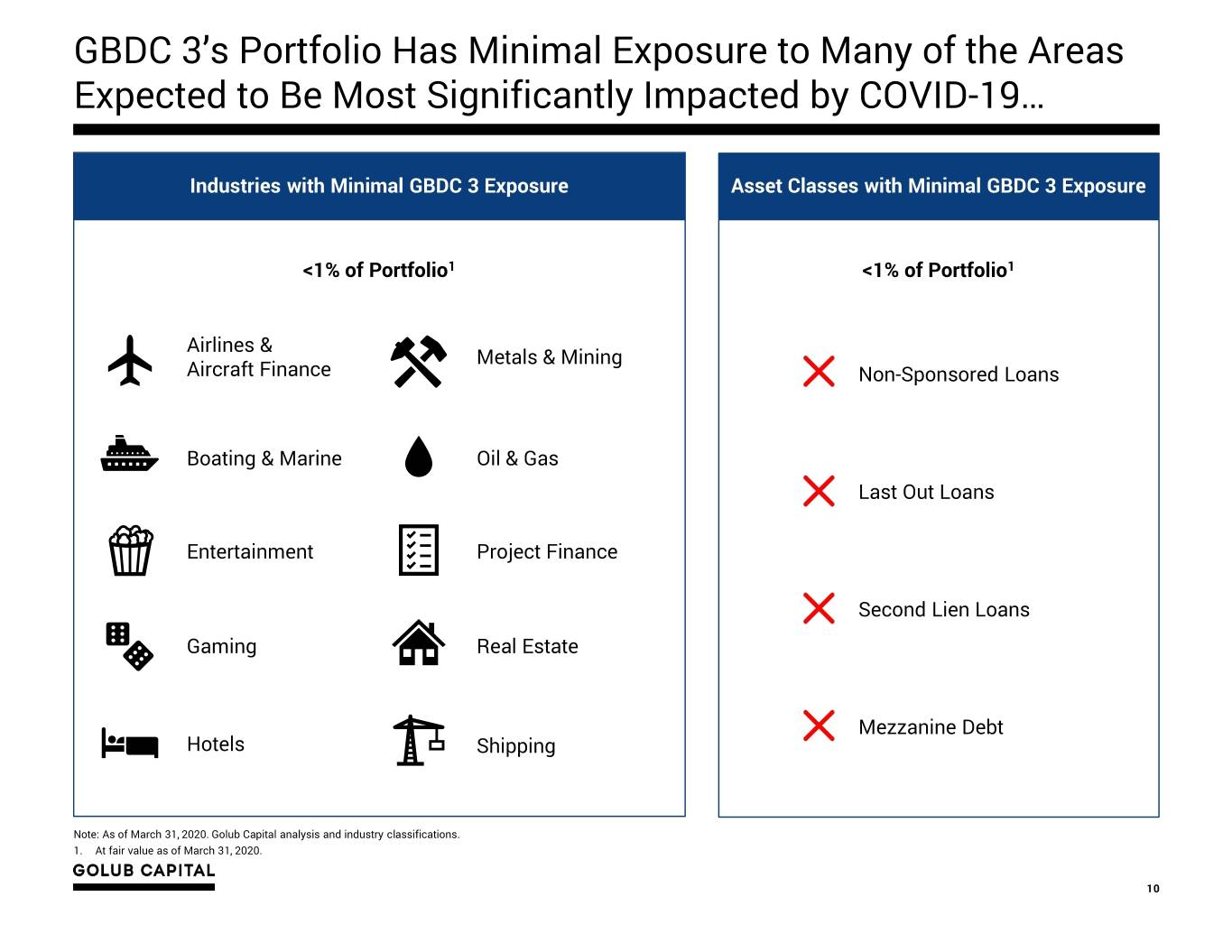

GBDC 3’s Portfolio Has Minimal Exposure to Many of the Areas Expected to Be Most Significantly Impacted by COVID-19… Industries with Minimal GBDC 3 Exposure Asset Classes with Minimal GBDC 3 Exposure <1% of Portfolio1 <1% of Portfolio1 Airlines & Metals & Mining Aircraft Finance Non-Sponsored Loans Boating & Marine Oil & Gas Last Out Loans Entertainment Project Finance Second Lien Loans Gaming Real Estate Mezzanine Debt Hotels Shipping Note: As of March 31, 2020. Golub Capital analysis and industry classifications. 1. At fair value as of March 31, 2020. 10

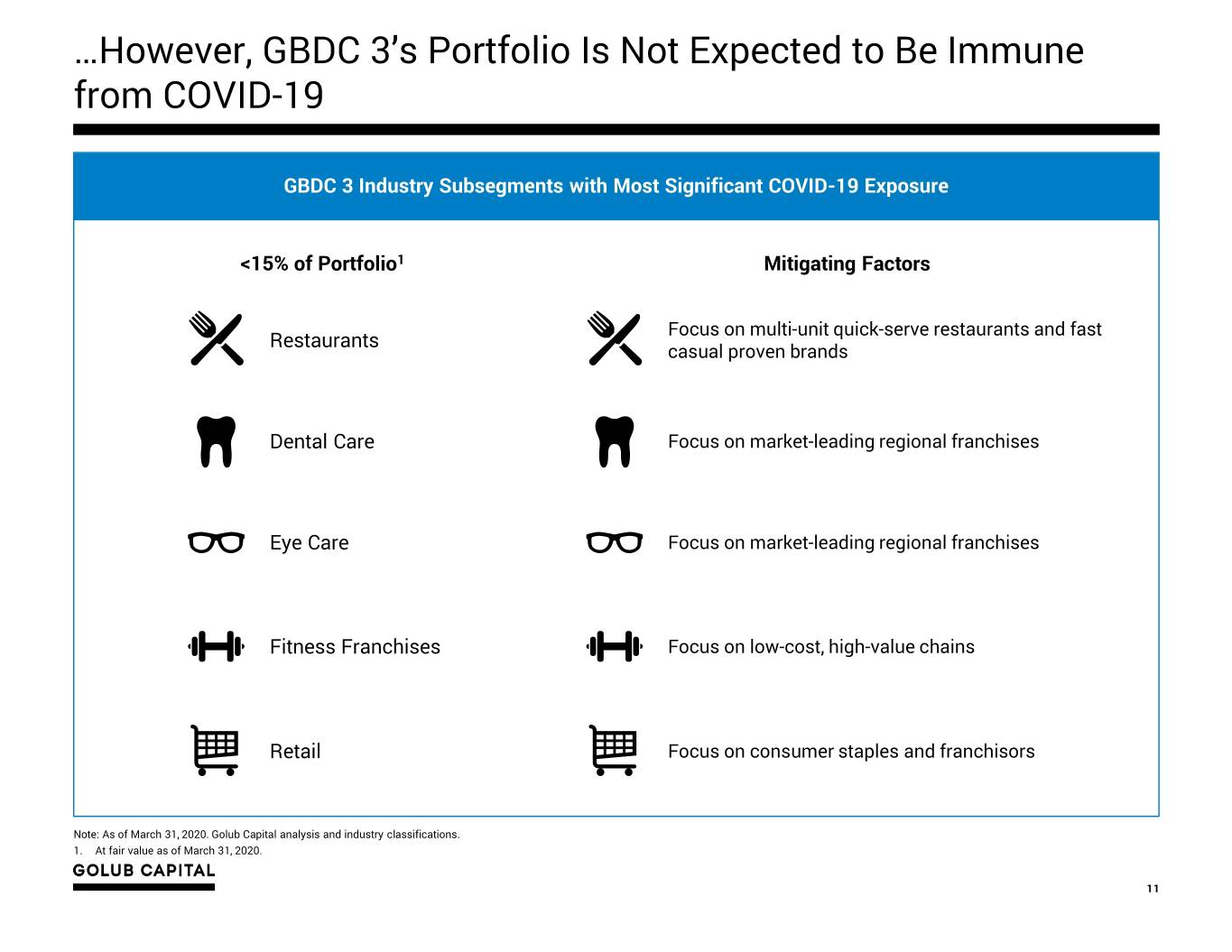

…However, GBDC 3’s Portfolio Is Not Expected to Be Immune from COVID-19 GBDC 3 Industry Subsegments with Most Significant COVID-19 Exposure <15% of Portfolio1 Mitigating Factors Focus on multi-unit quick-serve restaurants and fast Restaurants casual proven brands Dental Care Focus on market-leading regional franchises Eye Care Focus on market-leading regional franchises Fitness Franchises Focus on low-cost, high-value chains Retail Focus on consumer staples and franchisors Note: As of March 31, 2020. Golub Capital analysis and industry classifications. 1. At fair value as of March 31, 2020. 11

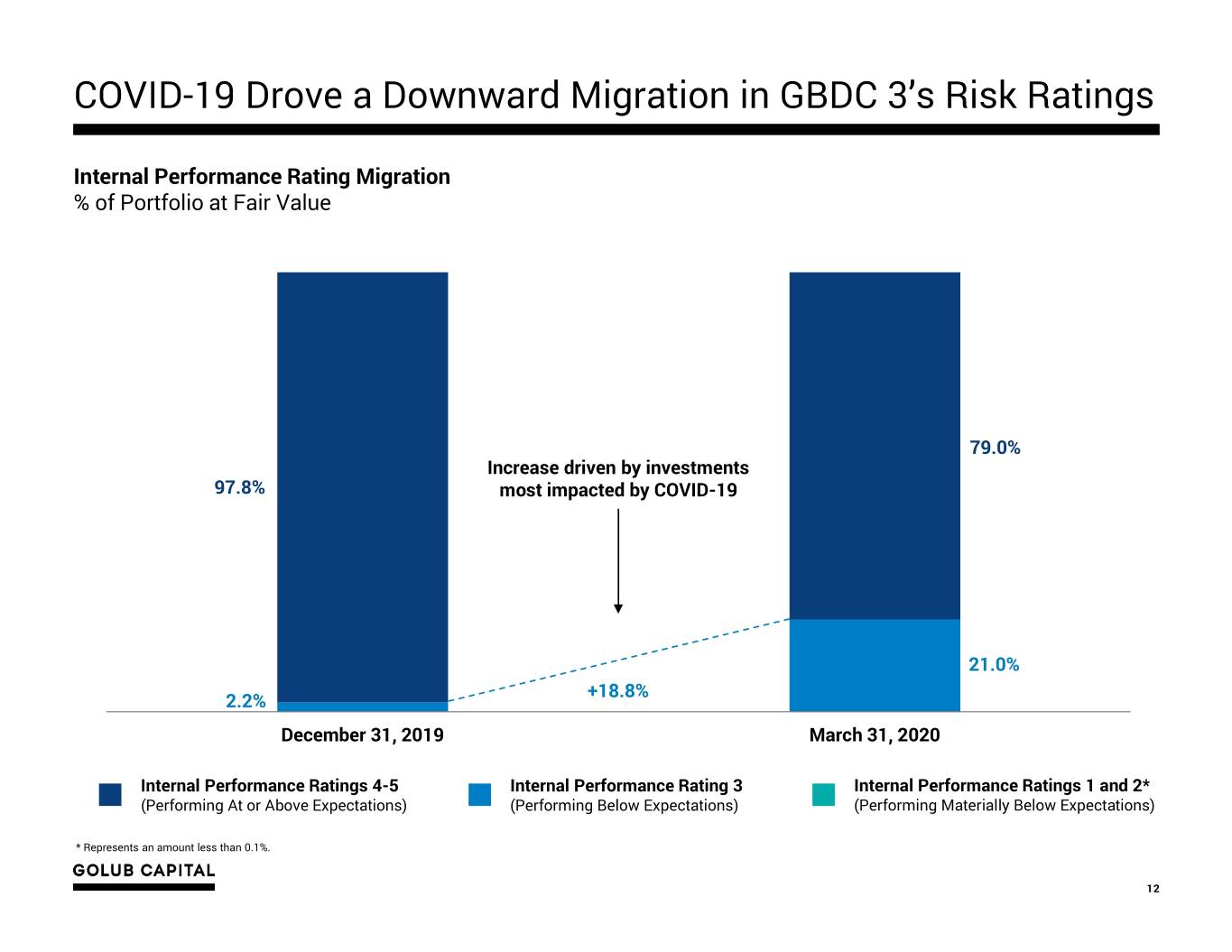

COVID-19 Drove a Downward Migration in GBDC 3’s Risk Ratings Internal Performance Rating Migration % of Portfolio at Fair Value 79.0% Increase driven by investments 97.8% most impacted by COVID-19 21.0% +18.8% 2.2% December 31, 2019 March 31, 2020 Internal Performance Ratings 4-5 Internal Performance Rating 3 Internal Performance Ratings 1 and 2* (Performing At or Above Expectations) (Performing Below Expectations) (Performing Materially Below Expectations) * Represents an amount less than 0.1%. 12

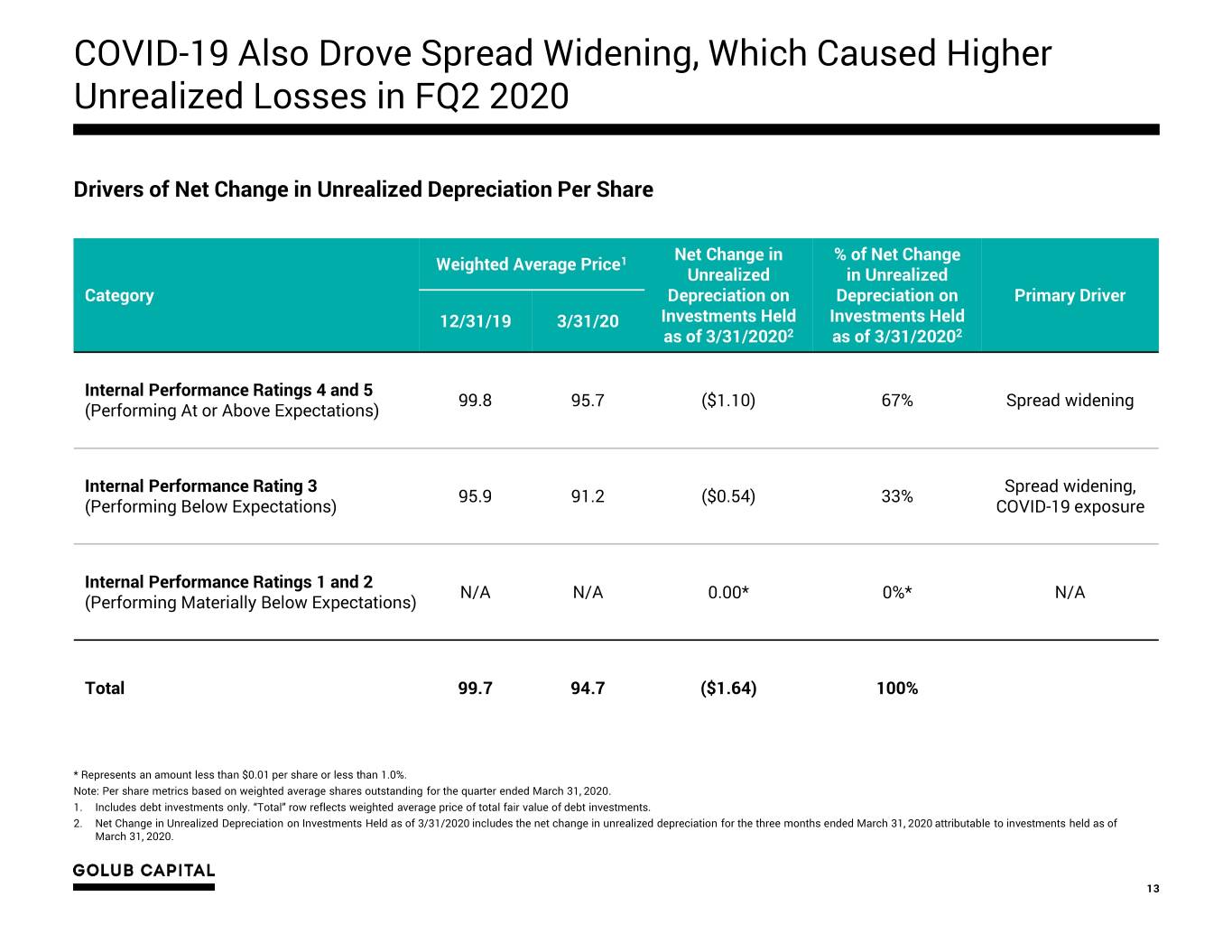

COVID-19 Also Drove Spread Widening, Which Caused Higher Unrealized Losses in FQ2 2020 Drivers of Net Change in Unrealized Depreciation Per Share Net Change in % of Net Change Weighted Average Price1 Unrealized in Unrealized Category Depreciation on Depreciation on Primary Driver 12/31/19 3/31/20 Investments Held Investments Held as of 3/31/20202 as of 3/31/20202 Internal Performance Ratings 4 and 5 99.8 95.7 ($1.10) 67% Spread widening (Performing At or Above Expectations) Internal Performance Rating 3 Spread widening, 95.9 91.2 ($0.54) 33% (Performing Below Expectations) COVID-19 exposure Internal Performance Ratings 1 and 2 N/A N/A 0.00* 0%* N/A (Performing Materially Below Expectations) Total 99.7 94.7 ($1.64) 100% * Represents an amount less than $0.01 per share or less than 1.0%. Note: Per share metrics based on weighted average shares outstanding for the quarter ended March 31, 2020. 1. Includes debt investments only. “Total” row reflects weighted average price of total fair value of debt investments. 2. Net Change in Unrealized Depreciation on Investments Held as of 3/31/2020 includes the net change in unrealized depreciation for the three months ended March 31, 2020 attributable to investments held as of March 31, 2020. 13

High Unrealized Losses Drove a Meaningful Decline in NAV Per Share NAV Per Share Bridge Net Realized & Unrealized Loss: ($1.62) $0.33 ($0.04) ($0.22) $15.00 ($0.01) Adjusted NII: $0.291 ($1.64) $0.19 $13.64 $0.03 12/31/19 Net Investment Reversal of FQ2 2020 Net Realized Loss Net Change in Net Change in Other Changes in 3/31/20 NAV Income Accrual for Dividend on Exits and Sales Unrealized Unrealized Net Unrealized NAV Capital Gain of Investments² Depreciation on Appreciation on Depreciation⁵ Incentive Fee Investments Held Foreign as of 3/31/20³ Currencies⁴ Note: Footnotes located in the Endnotes at the end of this presentation. 14

COVID-19 Strategic Response 04

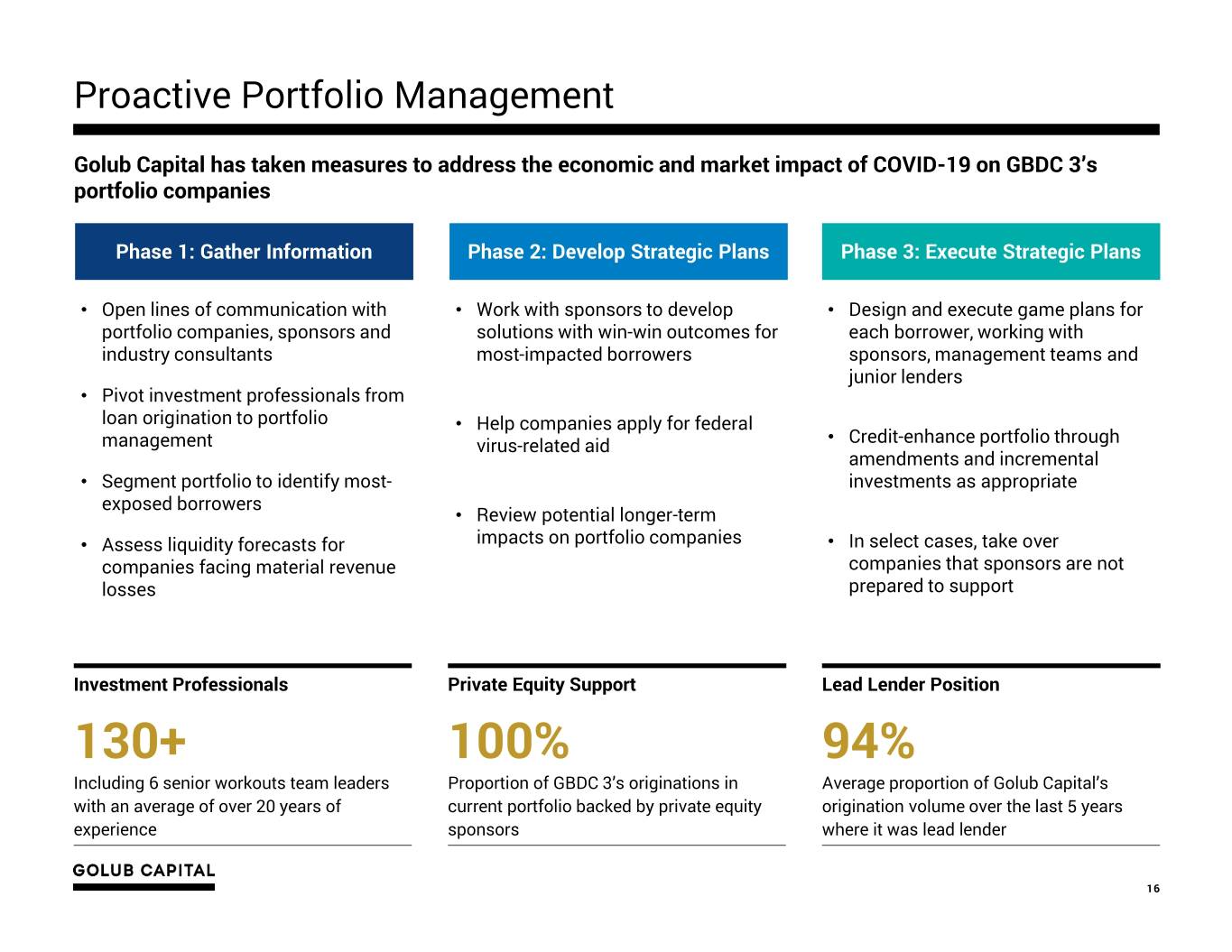

Proactive Portfolio Management Golub Capital has taken measures to address the economic and market impact of COVID-19 on GBDC 3’s portfolio companies Phase 1: Gather Information Phase 2: Develop Strategic Plans Phase 3: Execute Strategic Plans • Open lines of communication with • Work with sponsors to develop • Design and execute game plans for portfolio companies, sponsors and solutions with win-win outcomes for each borrower, working with industry consultants most-impacted borrowers sponsors, management teams and junior lenders • Pivot investment professionals from loan origination to portfolio • Help companies apply for federal management virus-related aid • Credit-enhance portfolio through amendments and incremental • Segment portfolio to identify most- investments as appropriate exposed borrowers • Review potential longer-term • Assess liquidity forecasts for impacts on portfolio companies • In select cases, take over companies facing material revenue companies that sponsors are not losses prepared to support Investment Professionals Private Equity Support Lead Lender Position 130+ 100% 94% Including 6 senior workouts team leaders Proportion of GBDC 3’s originations in Average proportion of Golub Capital’s with an average of over 20 years of current portfolio backed by private equity origination volume over the last 5 years experience sponsors where it was lead lender 16

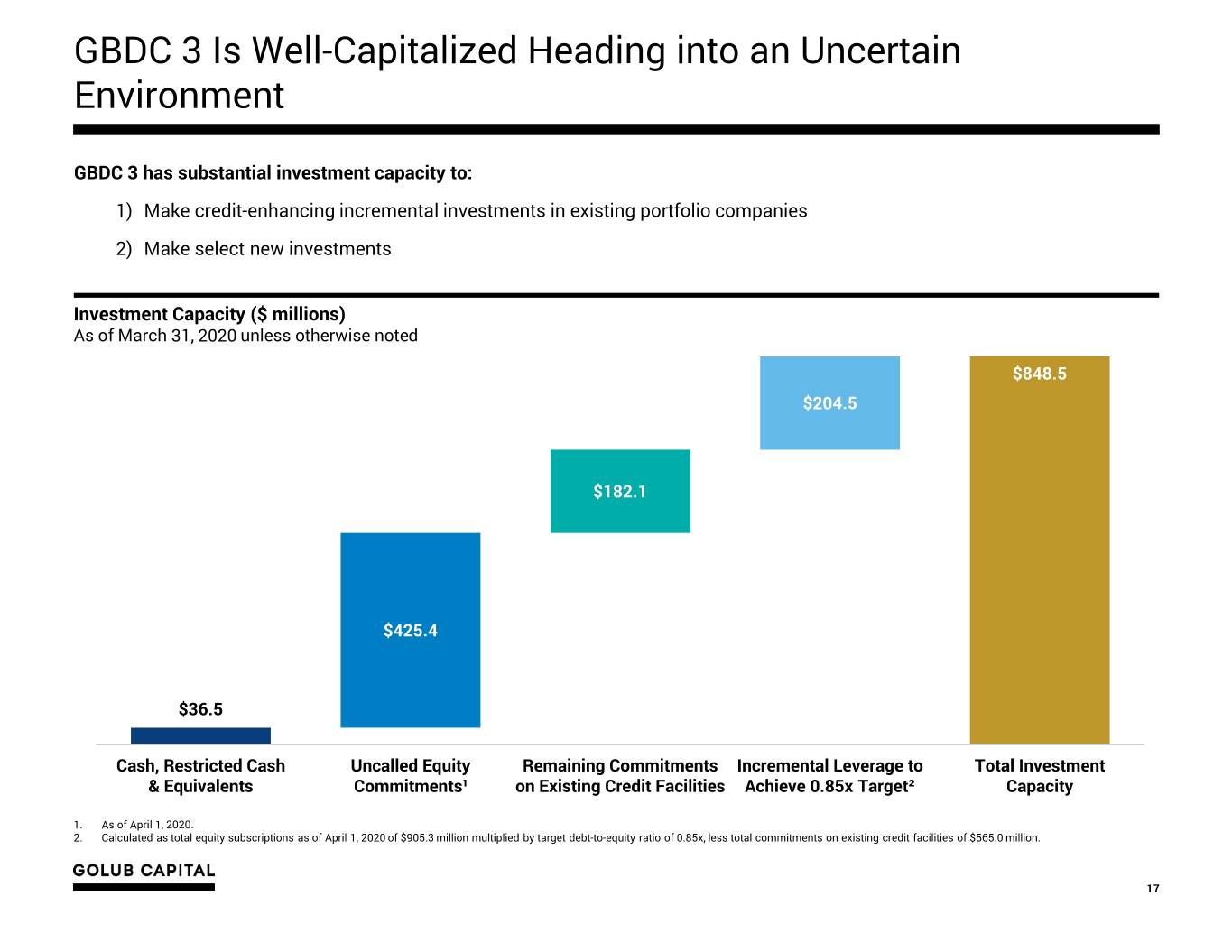

GBDC 3 Is Well-Capitalized Heading into an Uncertain Environment GBDC 3 has substantial investment capacity to: 1) Make credit-enhancing incremental investments in existing portfolio companies 2) Make select new investments Investment Capacity ($ millions) As of March 31, 2020 unless otherwise noted $848.5 $204.5 $182.1 $425.4 $36.5 Cash, Restricted Cash Uncalled Equity Remaining Commitments Incremental Leverage to Total Investment & Equivalents Commitments¹ on Existing Credit Facilities Achieve 0.85x Target² Capacity 1. As of April 1, 2020. 2. Calculated as total equity subscriptions as of April 1, 2020 of $905.3 million multiplied by target debt-to-equity ratio of 0.85x, less total commitments on existing credit facilities of $565.0 million. 17

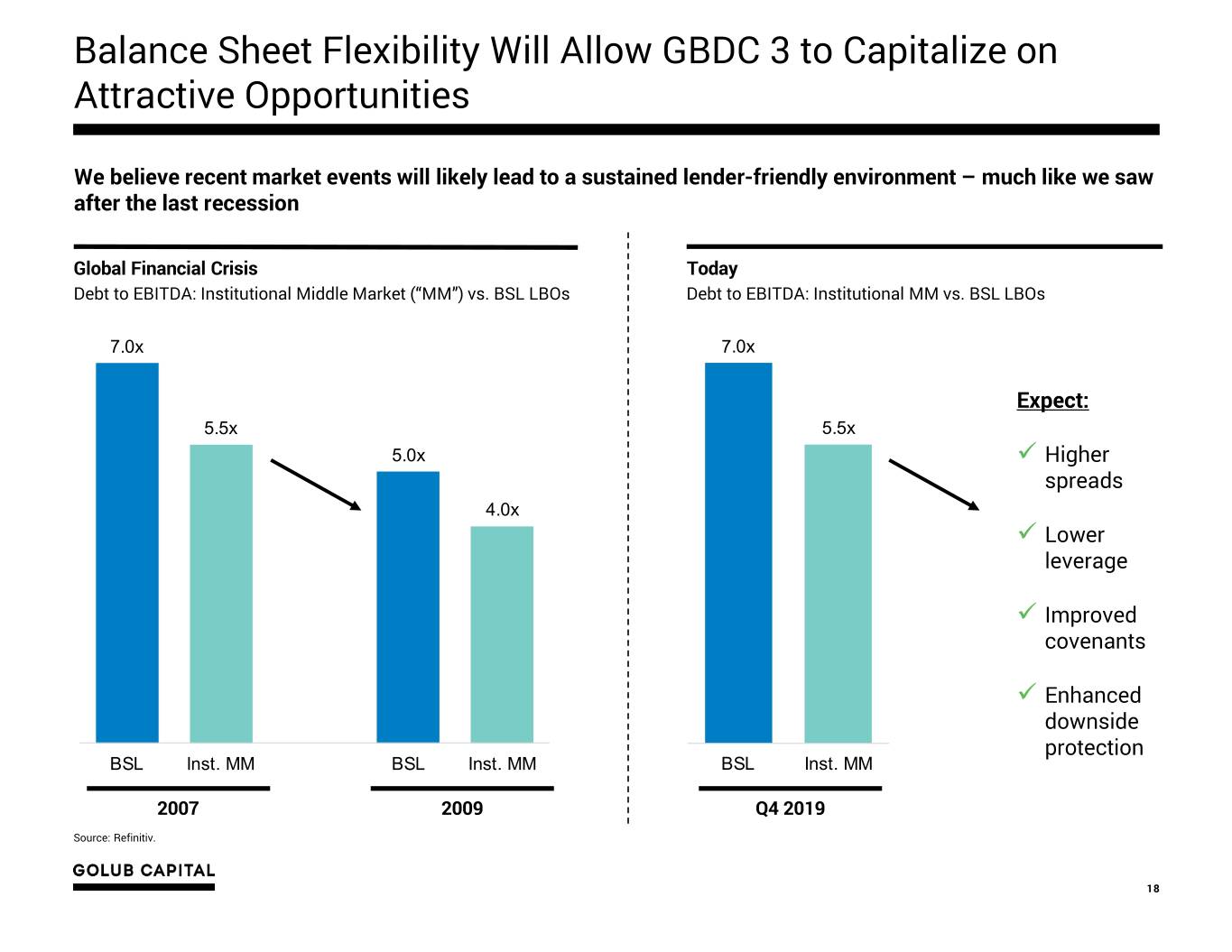

Balance Sheet Flexibility Will Allow GBDC 3 to Capitalize on Attractive Opportunities We believe recent market events will likely lead to a sustained lender-friendly environment – much like we saw after the last recession Global Financial Crisis Today Debt to EBITDA: Institutional Middle Market (“MM”) vs. BSL LBOs Debt to EBITDA: Institutional MM vs. BSL LBOs 7.0x 7.0x Expect: 5.5x 5.5x 5.0x Higher spreads 4.0x Lower leverage Improved covenants Enhanced downside protection BSL Inst. MM BSL Inst. MM BSL Inst. MM 2007 2009 Q4 2019 Source: Refinitiv. 18

Summary of Financial Results for the Quarter Ended March 31, 2020 05

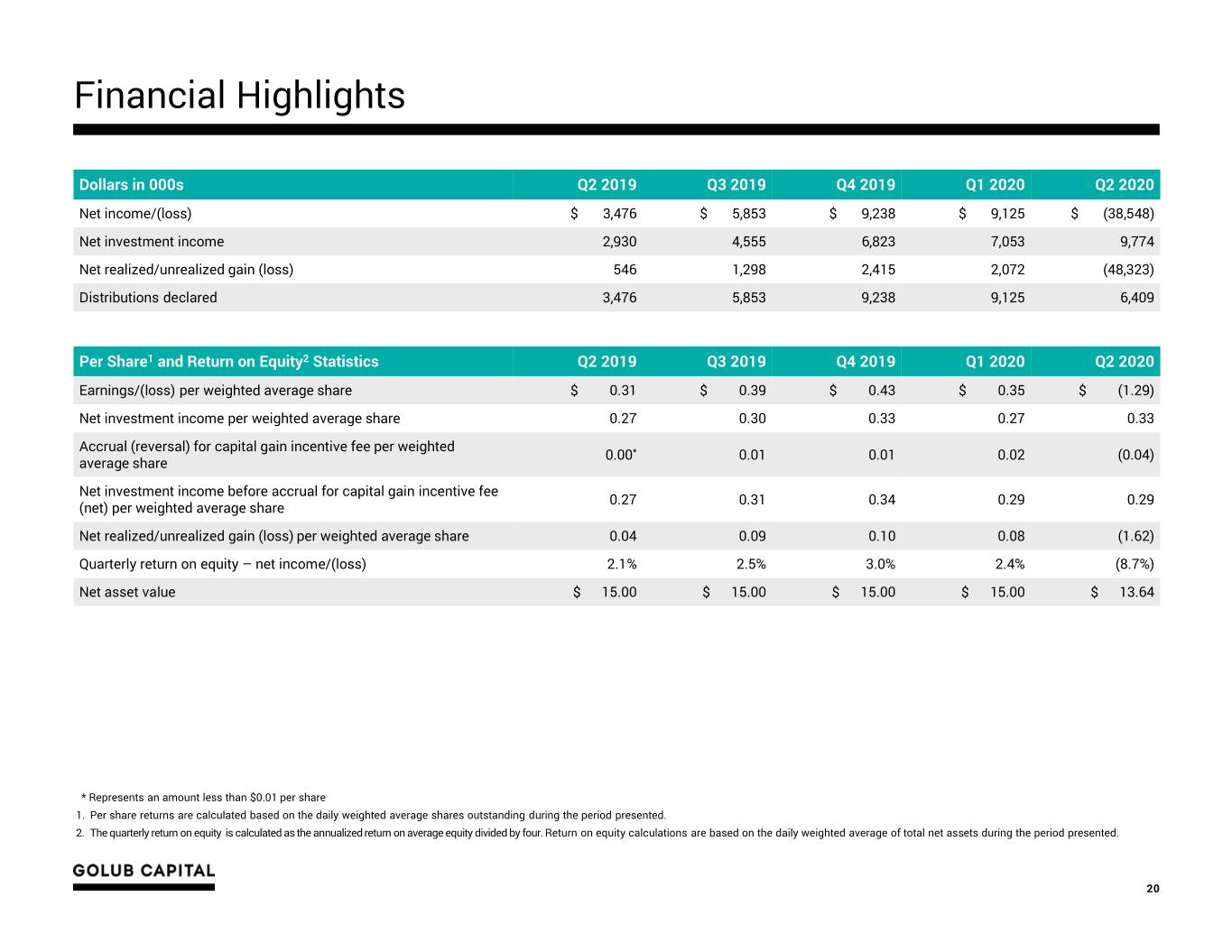

Financial Highlights Dollars in 000s Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Net income/(loss) $ 3,476 $ 5,853 $ 9,238 $ 9,125 $ (38,548) Net investment income 2,930 4,555 6,823 7,053 9,774 Net realized/unrealized gain (loss) 546 1,298 2,415 2,072 (48,323) Distributions declared 3,476 5,853 9,238 9,125 6,409 Per Share1 and Return on Equity2 Statistics Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Earnings/(loss) per weighted average share $ 0.31 $ 0.39 $ 0.43 $ 0.35 $ (1.29) Net investment income per weighted average share 0.27 0.30 0.33 0.27 0.33 Accrual (reversal) for capital gain incentive fee per weighted 0.00* 0.01 0.01 0.02 (0.04) average share Net investment income before accrual for capital gain incentive fee 0.27 0.31 0.34 0.29 0.29 (net) per weighted average share Net realized/unrealized gain (loss) per weighted average share 0.04 0.09 0.10 0.08 (1.62) Quarterly return on equity – net income/(loss) 2.1% 2.5% 3.0% 2.4% (8.7%) Net asset value $ 15.00 $ 15.00 $ 15.00 $ 15.00 $ 13.64 * Represents an amount less than $0.01 per share 1. Per share returns are calculated based on the daily weighted average shares outstanding during the period presented. 2. The quarterly return on equity is calculated as the annualized return on average equity divided by four. Return on equity calculations are based on the daily weighted average of total net assets during the period presented. 20

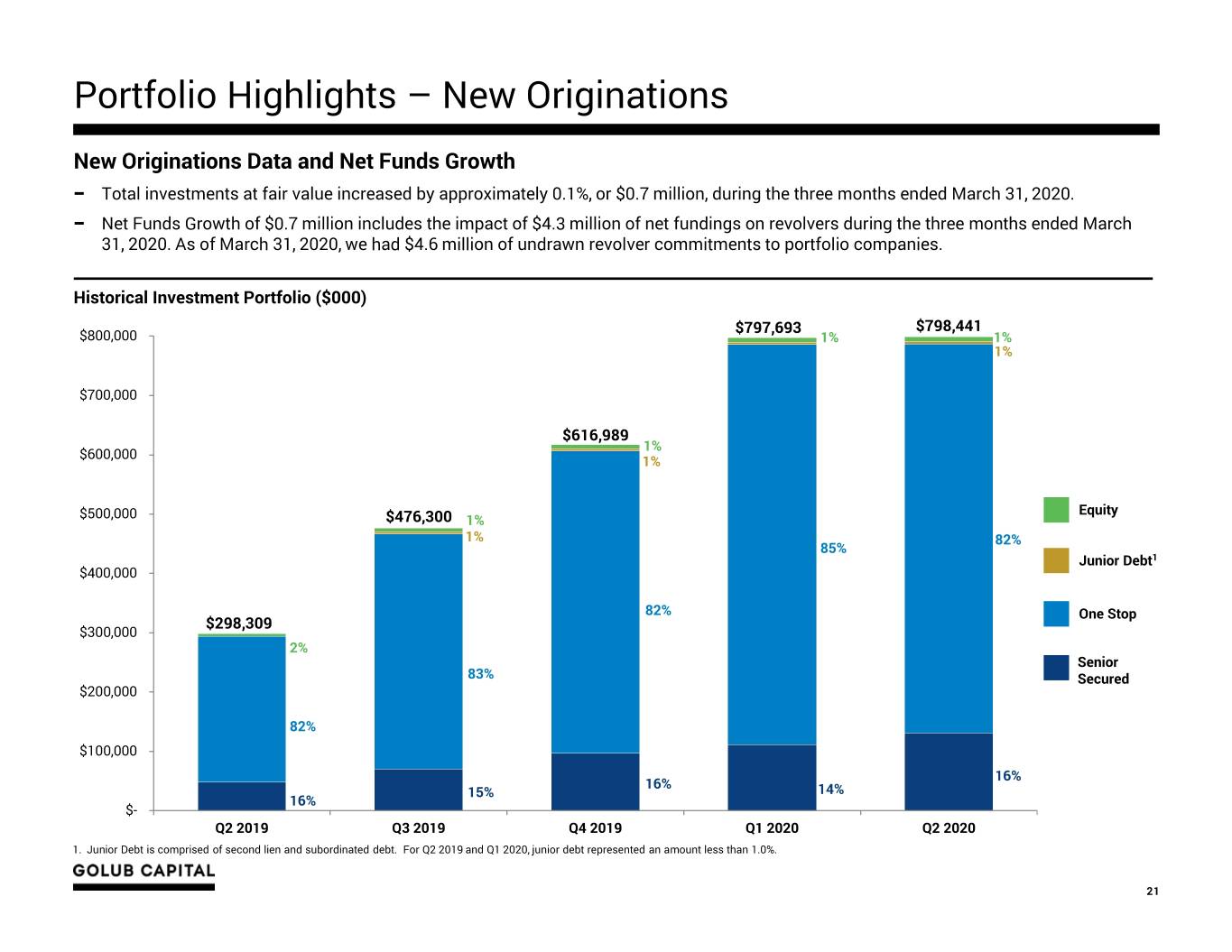

Portfolio Highlights – New Originations New Originations Data and Net Funds Growth − Total investments at fair value increased by approximately 0.1%, or $0.7 million, during the three months ended March 31, 2020. − Net Funds Growth of $0.7 million includes the impact of $4.3 million of net fundings on revolvers during the three months ended March 31, 2020. As of March 31, 2020, we had $4.6 million of undrawn revolver commitments to portfolio companies. Historical Investment Portfolio ($000) $797,693 $798,441 $800,000 1% 1% 1% $700,000 $616,989 1% $600,000 1% Equity $500,000 $476,300 1% 1% 82% 85% Junior Debt1 $400,000 82% One Stop $298,309 $300,000 2% Senior 83% Secured $200,000 82% $100,000 16% 16% 15% 14% 16% $- Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 1. Junior Debt is comprised of second lien and subordinated debt. For Q2 2019 and Q1 2020, junior debt represented an amount less than 1.0%. 21

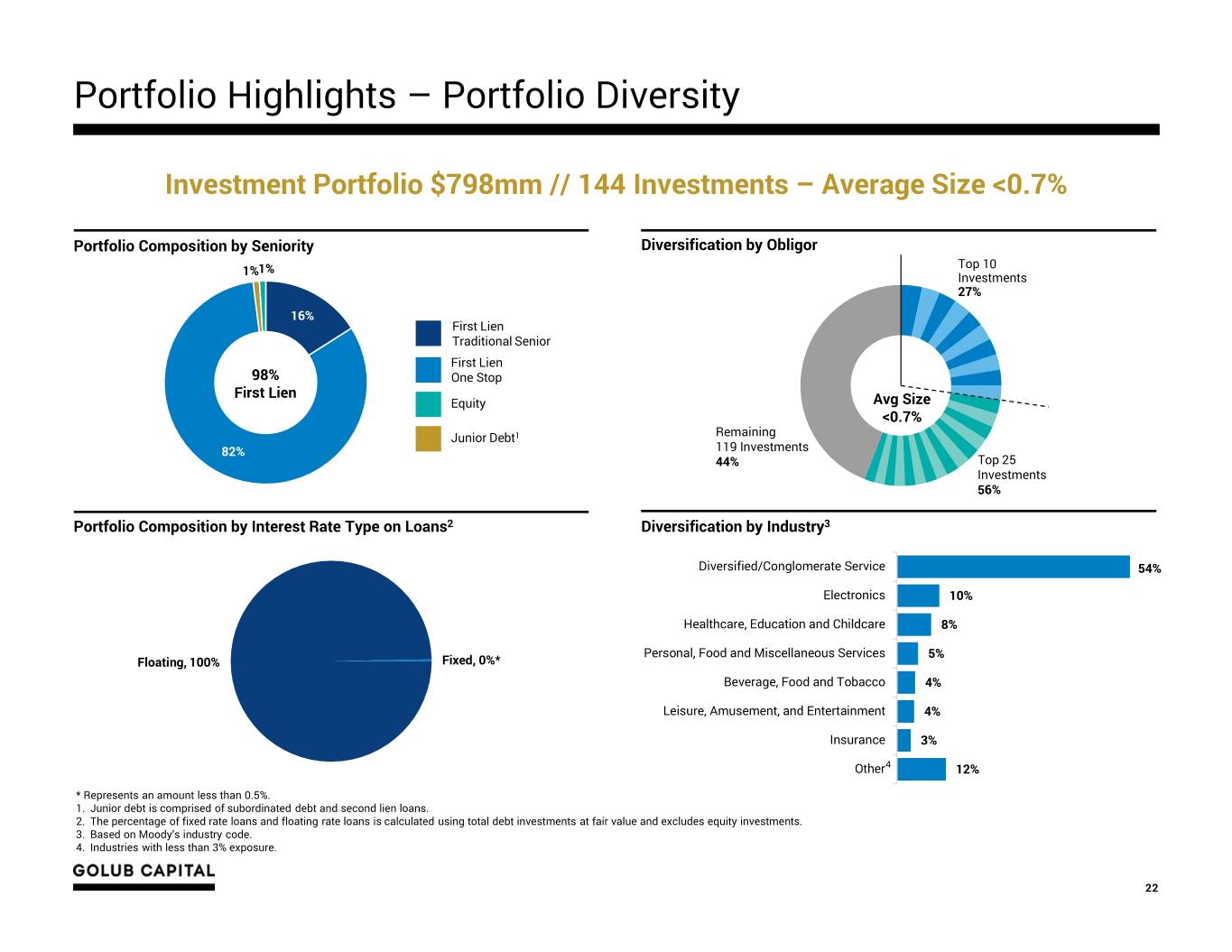

Portfolio Highlights – Portfolio Diversity Investment Portfolio $798mm // 144 Investments – Average Size <0.7% Portfolio Composition by Seniority Diversification by Obligor Top 10 1%1% Investments 27% 16% First Lien Traditional Senior First Lien 98% One Stop First Lien Equity Avg Size <0.7% Junior Debt1 Remaining 82% 119 Investments 44% Top 25 Investments 56% Portfolio Composition by Interest Rate Type on Loans2 Diversification by Industry3 Diversified/Conglomerate Service 54% Electronics 10% Healthcare, Education and Childcare 8% Personal, Food and Miscellaneous Services 5% Floating, 100% Fixed, 0%* Beverage, Food and Tobacco 4% Leisure, Amusement, and Entertainment 4% Insurance 3% Other4 12% * Represents an amount less than 0.5%. 1. Junior debt is comprised of subordinated debt and second lien loans. 2. The percentage of fixed rate loans and floating rate loans is calculated using total debt investments at fair value and excludes equity investments. 3. Based on Moody’s industry code. 4. Industries with less than 3% exposure. 22

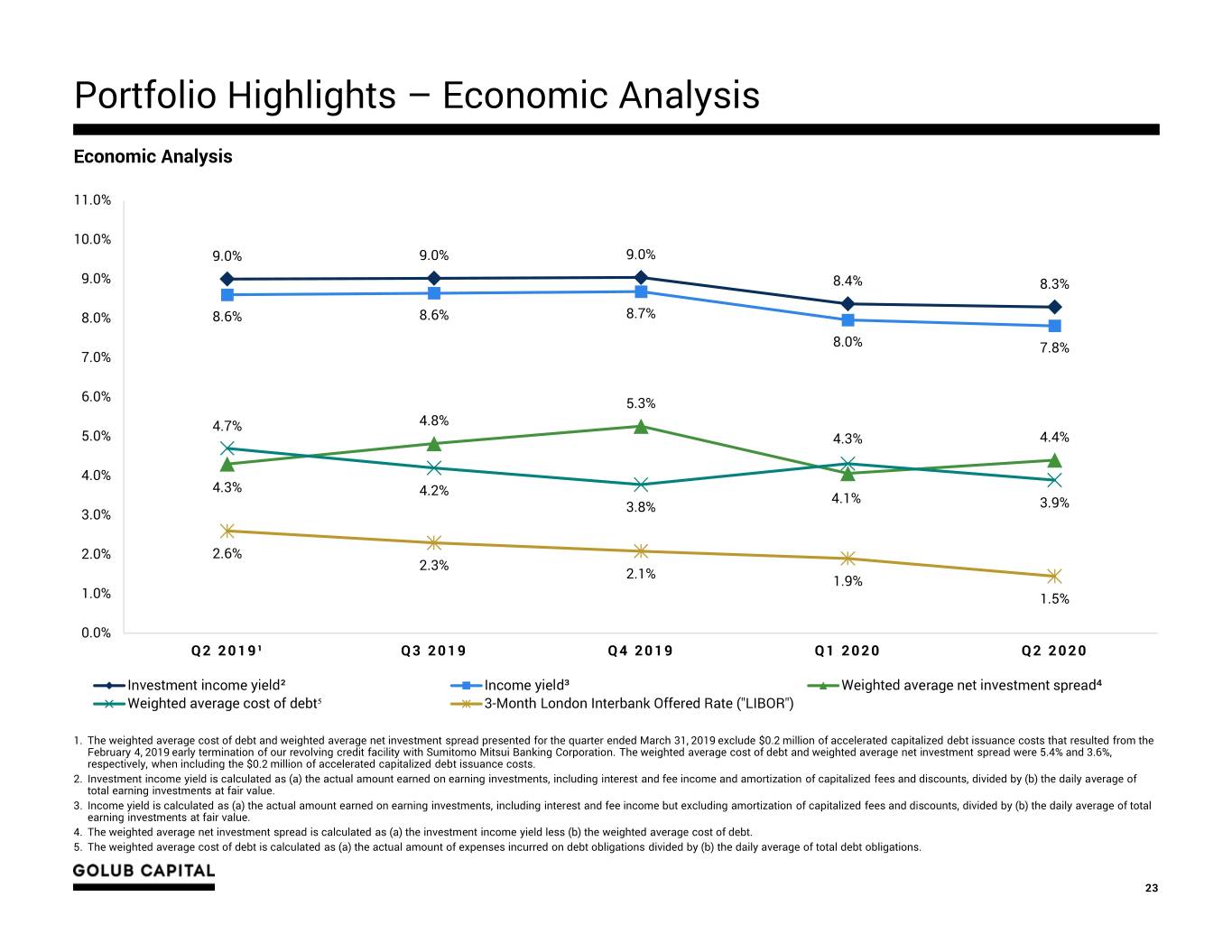

Portfolio Highlights – Economic Analysis Economic Analysis 11.0% 10.0% 9.0% 9.0% 9.0% 9.0% 8.4% 8.3% 8.0% 8.6% 8.6% 8.7% 8.0% 7.8% 7.0% 6.0% 5.3% 4.7% 4.8% 5.0% 4.3% 4.4% 4.0% 4.3% 4.2% 4.1% 3.8% 3.9% 3.0% 2.0% 2.6% 2.3% 2.1% 1.9% 1.0% 1.5% 0.0% Q2 2019¹ Q3 2019 Q4 2019 Q1 2020 Q2 2020 Investment income yield² Income yield³ Weighted average net investment spread⁴ Weighted average cost of debt⁵ 3-Month London Interbank Offered Rate ("LIBOR") 1. The weighted average cost of debt and weighted average net investment spread presented for the quarter ended March 31, 2019 exclude $0.2 million of accelerated capitalized debt issuance costs that resulted from the February 4, 2019 early termination of our revolving credit facility with Sumitomo Mitsui Banking Corporation. The weighted average cost of debt and weighted average net investment spread were 5.4% and 3.6%, respectively, when including the $0.2 million of accelerated capitalized debt issuance costs. 2. Investment income yield is calculated as (a) the actual amount earned on earning investments, including interest and fee income and amortization of capitalized fees and discounts, divided by (b) the daily average of total earning investments at fair value. 3. Income yield is calculated as (a) the actual amount earned on earning investments, including interest and fee income but excluding amortization of capitalized fees and discounts, divided by (b) the daily average of total earning investments at fair value. 4. The weighted average net investment spread is calculated as (a) the investment income yield less (b) the weighted average cost of debt. 5. The weighted average cost of debt is calculated as (a) the actual amount of expenses incurred on debt obligations divided by (b) the daily average of total debt obligations. 23

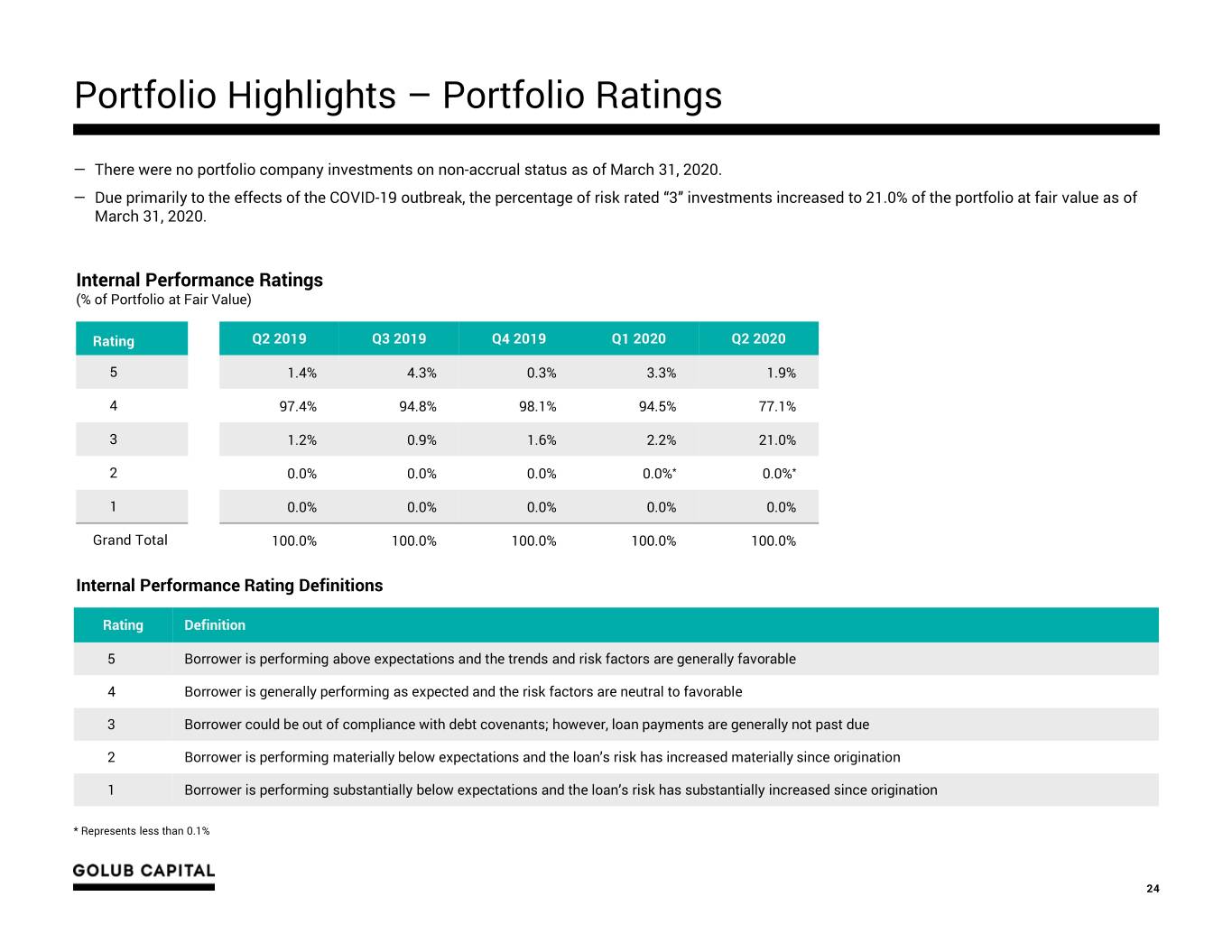

Portfolio Highlights – Portfolio Ratings ― There were no portfolio company investments on non-accrual status as of March 31, 2020. ― Due primarily to the effects of the COVID-19 outbreak, the percentage of risk rated “3” investments increased to 21.0% of the portfolio at fair value as of March 31, 2020. Internal Performance Ratings (% of Portfolio at Fair Value) Rating Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 5 1.4% 4.3% 0.3% 3.3% 1.9% 4 97.4% 94.8% 98.1% 94.5% 77.1% 3 1.2% 0.9% 1.6% 2.2% 21.0% 2 0.0% 0.0% 0.0% 0.0%* 0.0%* 1 0.0% 0.0% 0.0% 0.0% 0.0% Grand Total 100.0% 100.0% 100.0% 100.0% 100.0% Internal Performance Rating Definitions Rating Definition 5 Borrower is performing above expectations and the trends and risk factors are generally favorable 4 Borrower is generally performing as expected and the risk factors are neutral to favorable 3 Borrower could be out of compliance with debt covenants; however, loan payments are generally not past due 2 Borrower is performing materially below expectations and the loan’s risk has increased materially since origination 1 Borrower is performing substantially below expectations and the loan’s risk has substantially increased since origination * Represents less than 0.1% 24

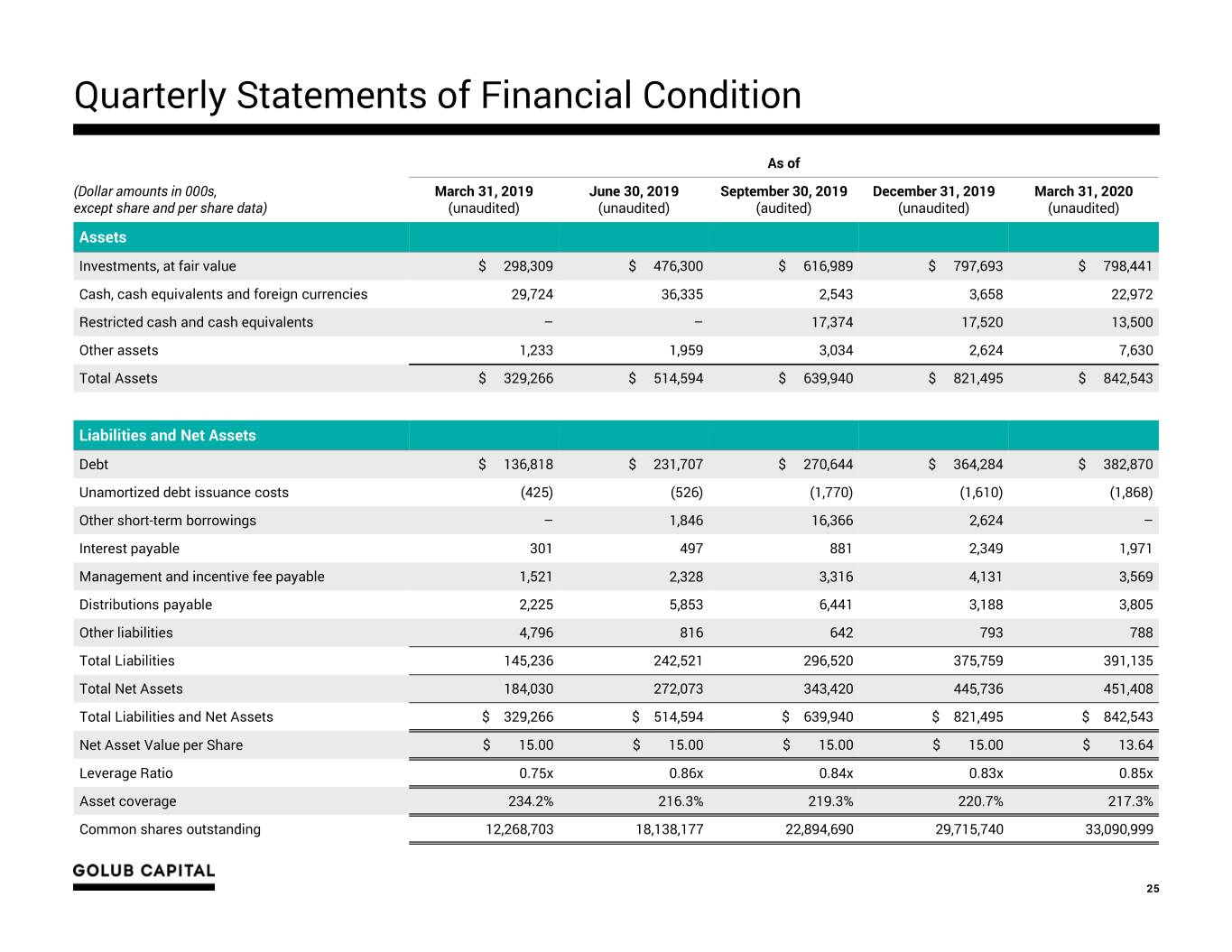

Quarterly Statements of Financial Condition As of (Dollar amounts in 000s, March 31, 2019 June 30, 2019 September 30, 2019 December 31, 2019 March 31, 2020 except share and per share data) (unaudited) (unaudited) (audited) (unaudited) (unaudited) Assets Investments, at fair value $ 298,309 $ 476,300 $ 616,989 $ 797,693 $ 798,441 Cash, cash equivalents and foreign currencies 29,724 36,335 2,543 3,658 22,972 Restricted cash and cash equivalents – – 17,374 17,520 13,500 Other assets 1,233 1,959 3,034 2,624 7,630 Total Assets $ 329,266 $ 514,594 $ 639,940 $ 821,495 $ 842,543 Liabilities and Net Assets Debt $ 136,818 $ 231,707 $ 270,644 $ 364,284 $ 382,870 Unamortized debt issuance costs (425) (526) (1,770) (1,610) (1,868) Other short-term borrowings – 1,846 16,366 2,624 – Interest payable 301 497 881 2,349 1,971 Management and incentive fee payable 1,521 2,328 3,316 4,131 3,569 Distributions payable 2,225 5,853 6,441 3,188 3,805 Other liabilities 4,796 816 642 793 788 Total Liabilities 145,236 242,521 296,520 375,759 391,135 Total Net Assets 184,030 272,073 343,420 445,736 451,408 Total Liabilities and Net Assets $ 329,266 $ 514,594 $ 639,940 $ 821,495 $ 842,543 Net Asset Value per Share $ 15.00 $ 15.00 $ 15.00 $ 15.00 $ 13.64 Leverage Ratio 0.75x 0.86x 0.84x 0.83x 0.85x Asset coverage 234.2% 216.3% 219.3% 220.7% 217.3% Common shares outstanding 12,268,703 18,138,177 22,894,690 29,715,740 33,090,999 25

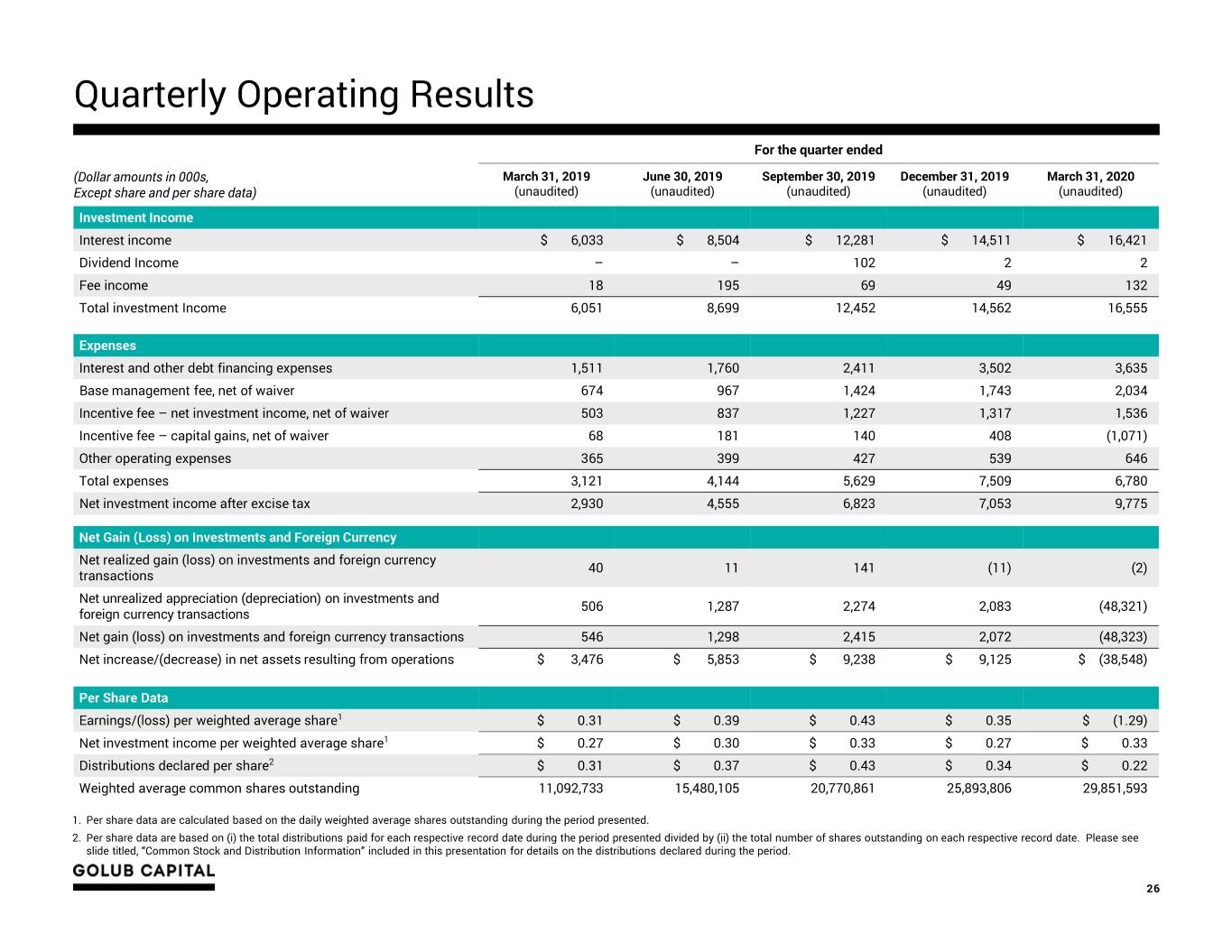

Quarterly Operating Results For the quarter ended (Dollar amounts in 000s, March 31, 2019 June 30, 2019 September 30, 2019 December 31, 2019 March 31, 2020 Except share and per share data) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited) Investment Income Interest income $ 6,033 $ 8,504 $ 12,281 $ 14,511 $ 16,421 Dividend Income – – 102 2 2 Fee income 18 195 69 49 132 Total investment Income 6,051 8,699 12,452 14,562 16,555 Expenses Interest and other debt financing expenses 1,511 1,760 2,411 3,502 3,635 Base management fee, net of waiver 674 967 1,424 1,743 2,034 Incentive fee – net investment income, net of waiver 503 837 1,227 1,317 1,536 Incentive fee – capital gains, net of waiver 68 181 140 408 (1,071) Other operating expenses 365 399 427 539 646 Total expenses 3,121 4,144 5,629 7,509 6,780 Net investment income after excise tax 2,930 4,555 6,823 7,053 9,775 Net Gain (Loss) on Investments and Foreign Currency Net realized gain (loss) on investments and foreign currency 40 11 141 (11) (2) transactions Net unrealized appreciation (depreciation) on investments and 506 1,287 2,274 2,083 (48,321) foreign currency transactions Net gain (loss) on investments and foreign currency transactions 546 1,298 2,415 2,072 (48,323) Net increase/(decrease) in net assets resulting from operations $ 3,476 $ 5,853 $ 9,238 $ 9,125 $ (38,548) Per Share Data Earnings/(loss) per weighted average share1 $ 0.31 $ 0.39 $ 0.43 $ 0.35 $ (1.29) Net investment income per weighted average share1 $ 0.27 $ 0.30 $ 0.33 $ 0.27 $ 0.33 Distributions declared per share2 $ 0.31 $ 0.37 $ 0.43 $ 0.34 $ 0.22 Weighted average common shares outstanding 11,092,733 15,480,105 20,770,861 25,893,806 29,851,593 1. Per share data are calculated based on the daily weighted average shares outstanding during the period presented. 2. Per share data are based on (i) the total distributions paid for each respective record date during the period presented divided by (ii) the total number of shares outstanding on each respective record date. Please see slide titled, “Common Stock and Distribution Information” included in this presentation for details on the distributions declared during the period. 26

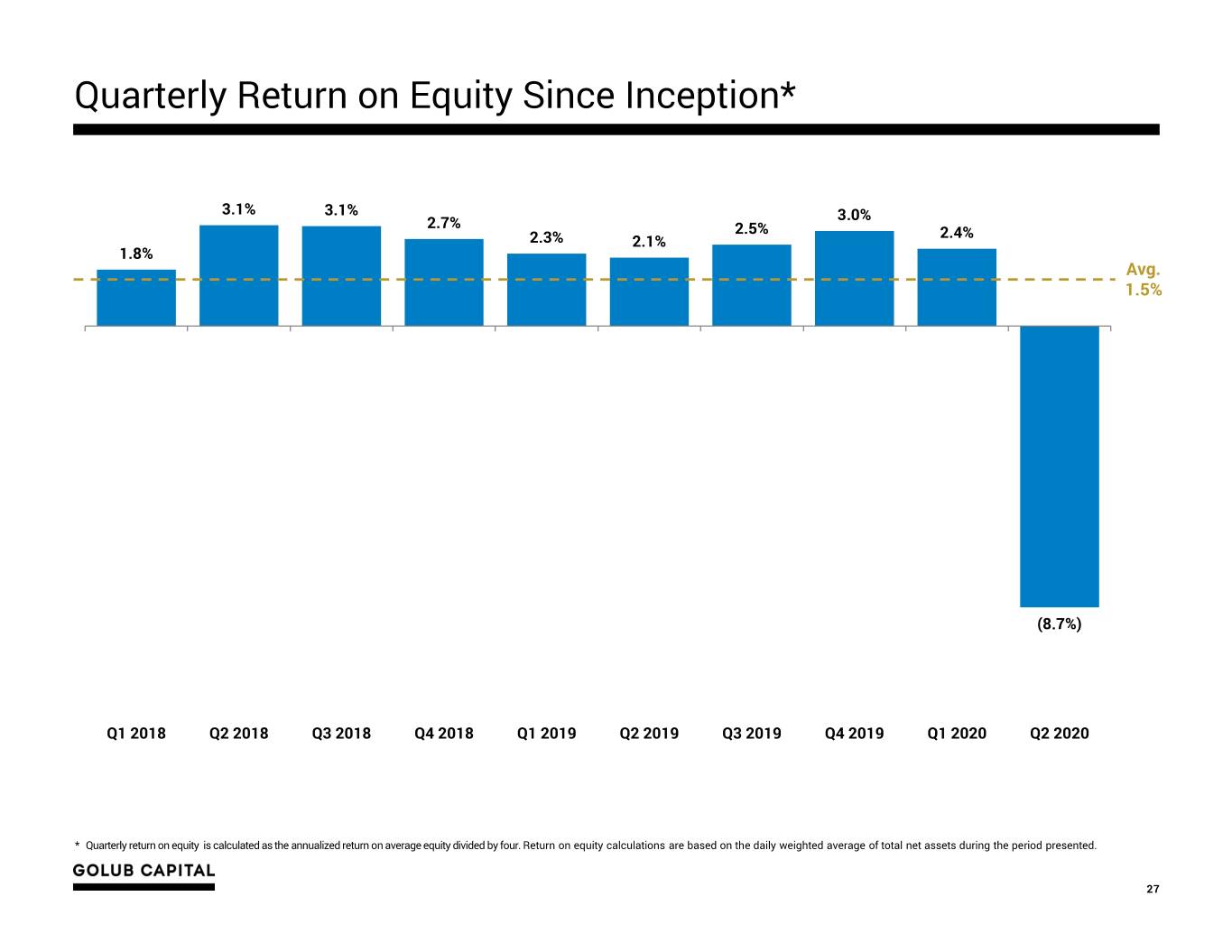

Quarterly Return on Equity Since Inception* 3.1% 3.1% 3.0% 2.7% 2.5% 2.4% 2.3% 2.1% 1.8% Avg. 1.5% (8.7%) Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 * Quarterly return on equity is calculated as the annualized return on average equity divided by four. Return on equity calculations are based on the daily weighted average of total net assets during the period presented. 27

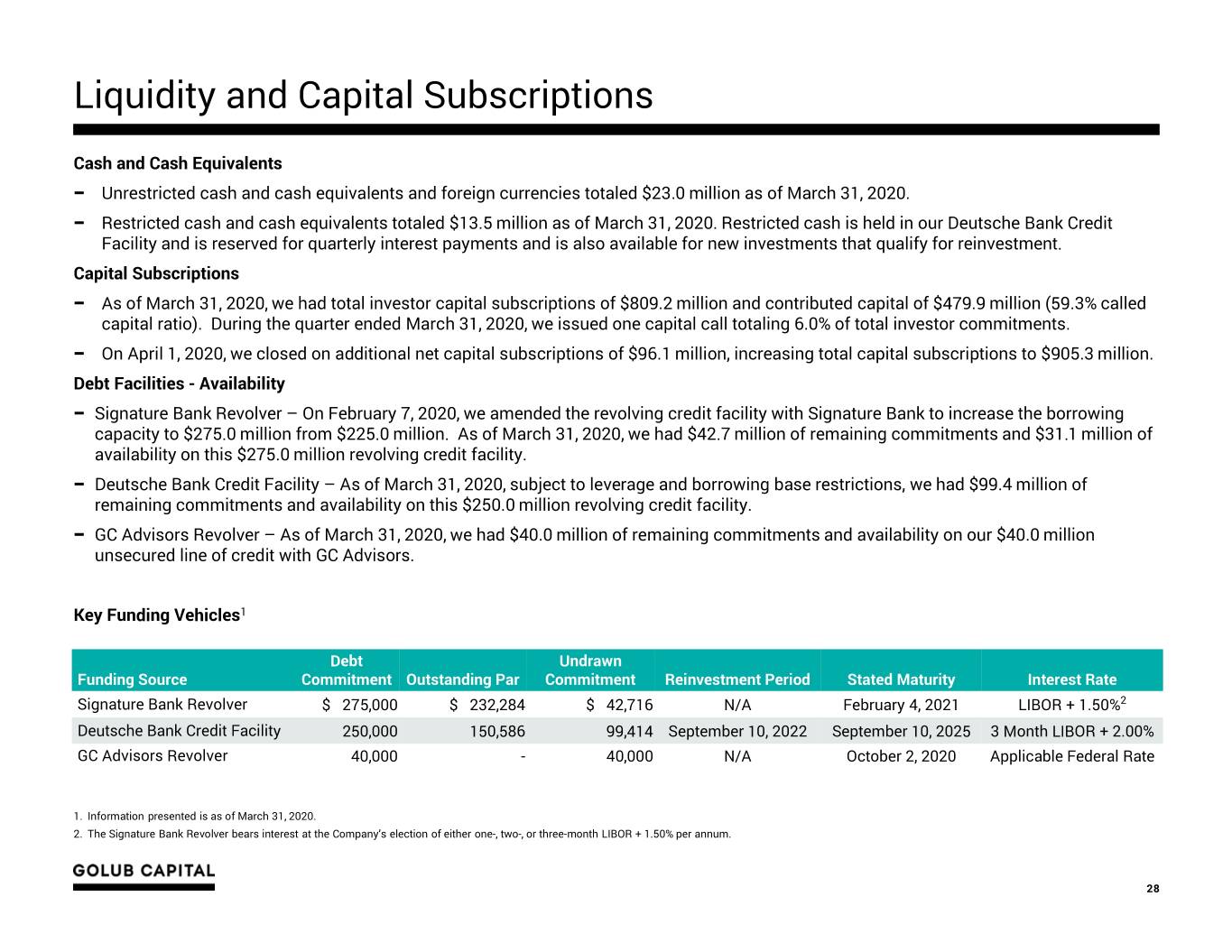

Liquidity and Capital Subscriptions Cash and Cash Equivalents − Unrestricted cash and cash equivalents and foreign currencies totaled $23.0 million as of March 31, 2020. − Restricted cash and cash equivalents totaled $13.5 million as of March 31, 2020. Restricted cash is held in our Deutsche Bank Credit Facility and is reserved for quarterly interest payments and is also available for new investments that qualify for reinvestment. Capital Subscriptions − As of March 31, 2020, we had total investor capital subscriptions of $809.2 million and contributed capital of $479.9 million (59.3% called capital ratio). During the quarter ended March 31, 2020, we issued one capital call totaling 6.0% of total investor commitments. − On April 1, 2020, we closed on additional net capital subscriptions of $96.1 million, increasing total capital subscriptions to $905.3 million. Debt Facilities - Availability − Signature Bank Revolver – On February 7, 2020, we amended the revolving credit facility with Signature Bank to increase the borrowing capacity to $275.0 million from $225.0 million. As of March 31, 2020, we had $42.7 million of remaining commitments and $31.1 million of availability on this $275.0 million revolving credit facility. − Deutsche Bank Credit Facility – As of March 31, 2020, subject to leverage and borrowing base restrictions, we had $99.4 million of remaining commitments and availability on this $250.0 million revolving credit facility. − GC Advisors Revolver – As of March 31, 2020, we had $40.0 million of remaining commitments and availability on our $40.0 million unsecured line of credit with GC Advisors. Key Funding Vehicles1 Debt Undrawn Funding Source Commitment Outstanding Par Commitment Reinvestment Period Stated Maturity Interest Rate Signature Bank Revolver $ 275,000 $ 232,284 $ 42,716 N/A February 4, 2021 LIBOR + 1.50%2 Deutsche Bank Credit Facility 250,000 150,586 99,414 September 10, 2022 September 10, 2025 3 Month LIBOR + 2.00% GC Advisors Revolver 40,000 - 40,000 N/A October 2, 2020 Applicable Federal Rate 1. Information presented is as of March 31, 2020. 2. The Signature Bank Revolver bears interest at the Company’s election of either one-, two-, or three-month LIBOR + 1.50% per annum. 28

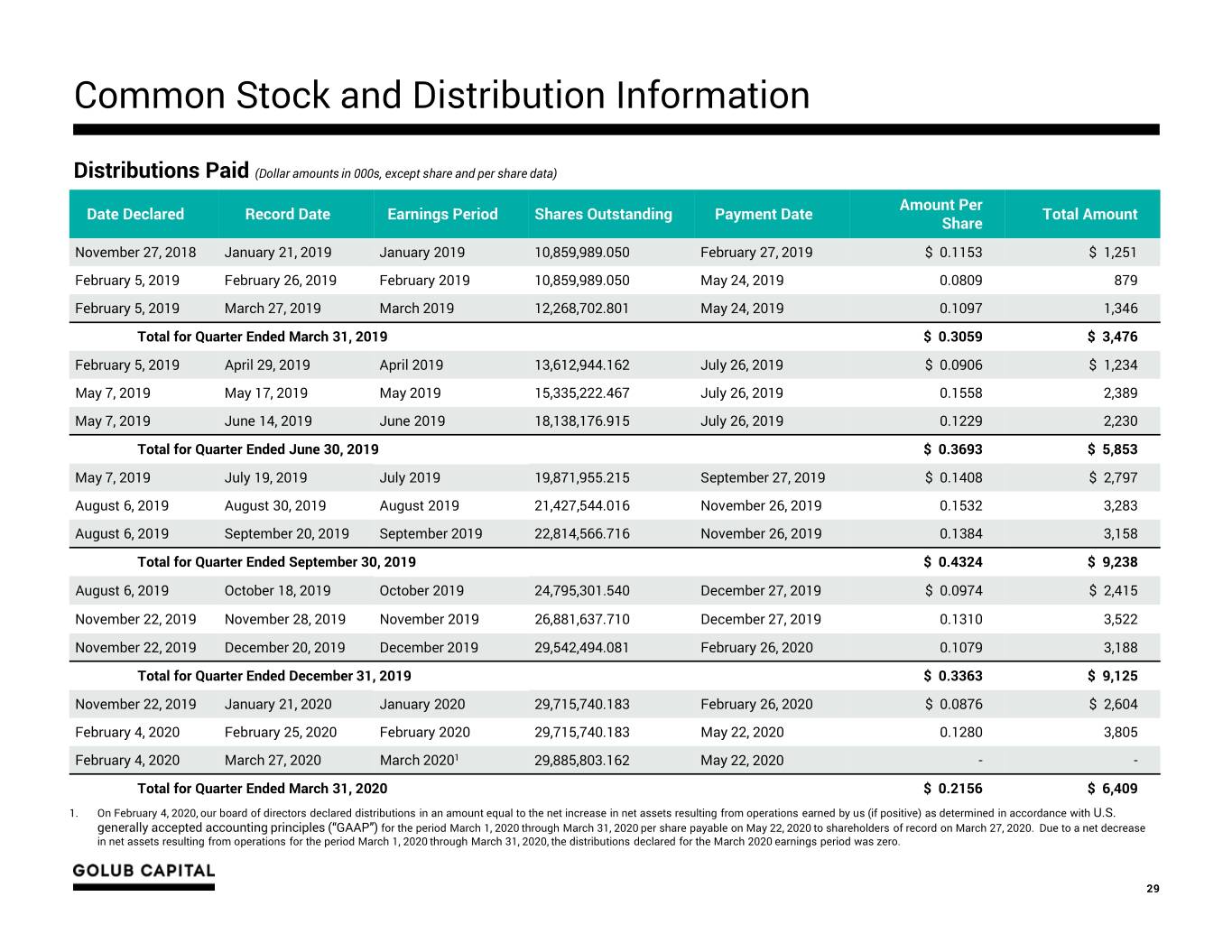

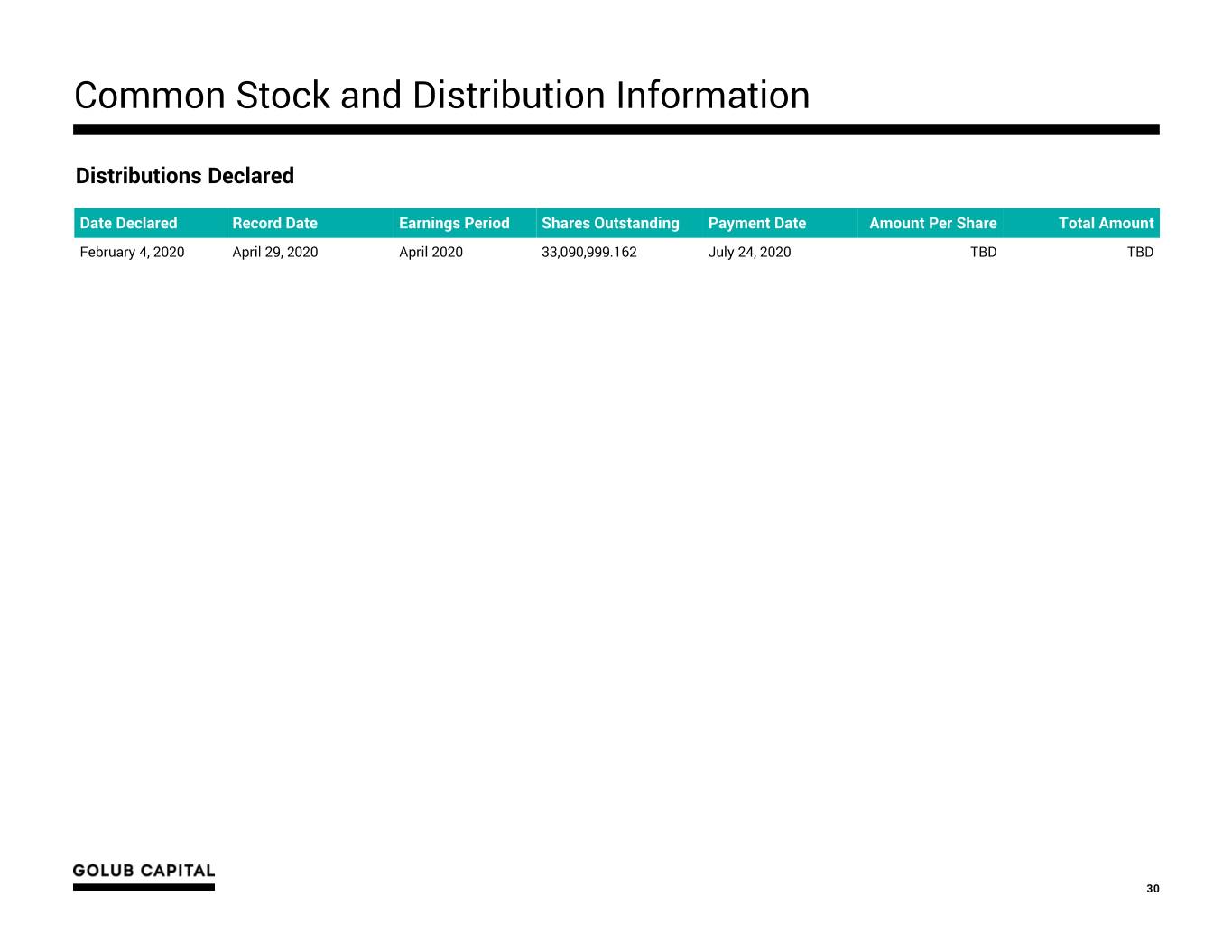

Common Stock and Distribution Information Distributions Paid (Dollar amounts in 000s, except share and per share data) Amount Per Date Declared Record Date Earnings Period Shares Outstanding Payment Date Total Amount Share November 27, 2018 January 21, 2019 January 2019 10,859,989.050 February 27, 2019 $ 0.1153 $ 1,251 February 5, 2019 February 26, 2019 February 2019 10,859,989.050 May 24, 2019 0.0809 879 February 5, 2019 March 27, 2019 March 2019 12,268,702.801 May 24, 2019 0.1097 1,346 Total for Quarter Ended March 31, 2019 $ 0.3059 $ 3,476 February 5, 2019 April 29, 2019 April 2019 13,612,944.162 July 26, 2019 $ 0.0906 $ 1,234 May 7, 2019 May 17, 2019 May 2019 15,335,222.467 July 26, 2019 0.1558 2,389 May 7, 2019 June 14, 2019 June 2019 18,138,176.915 July 26, 2019 0.1229 2,230 Total for Quarter Ended June 30, 2019 $ 0.3693 $ 5,853 May 7, 2019 July 19, 2019 July 2019 19,871,955.215 September 27, 2019 $ 0.1408 $ 2,797 August 6, 2019 August 30, 2019 August 2019 21,427,544.016 November 26, 2019 0.1532 3,283 August 6, 2019 September 20, 2019 September 2019 22,814,566.716 November 26, 2019 0.1384 3,158 DistributionsTotal for Quarter Declared Ended September 30, 2019 $ 0.4324 $ 9,238 August 6, 2019 October 18, 2019 October 2019 24,795,301.540 December 27, 2019 $ 0.0974 $ 2,415 November 22, 2019 November 28, 2019 November 2019 26,881,637.710 December 27, 2019 0.1310 3,522 November 22, 2019 December 20, 2019 December 2019 29,542,494.081 February 26, 2020 0.1079 3,188 Total for Quarter Ended December 31, 2019 $ 0.3363 $ 9,125 November 22, 2019 January 21, 2020 January 2020 29,715,740.183 February 26, 2020 $ 0.0876 $ 2,604 February 4, 2020 February 25, 2020 February 2020 29,715,740.183 May 22, 2020 0.1280 3,805 February 4, 2020 March 27, 2020 March 20201 29,885,803.162 May 22, 2020 - - Total for Quarter Ended March 31, 2020 $ 0.2156 $ 6,409 1. On February 4, 2020, our board of directors declared distributions in an amount equal to the net increase in net assets resulting from operations earned by us (if positive) as determined in accordance with U.S. generally accepted accounting principles (“GAAP”) for the period March 1, 2020 through March 31, 2020 per share payable on May 22, 2020 to shareholders of record on March 27, 2020. Due to a net decrease in net assets resulting from operations for the period March 1, 2020 through March 31, 2020, the distributions declared for the March 2020 earnings period was zero. 29

Common Stock and Distribution Information Distributions Declared Date Declared Record Date Earnings Period Shares Outstanding Payment Date Amount Per Share Total Amount February 4, 2020 April 29, 2020 April 2020 33,090,999.162 July 24, 2020 TBD TBD 30

Endnotes Summary of Financial Results vs. Preliminary Estimates 1. As a supplement to U.S. generally accepted accounting principles (“GAAP”) financial measures, the Company is providing the following non-GAAP financial measure that it believes are useful for the reasons described below: • “Adjusted Net Investment Income Per Share” excludes the reversal of accrual for the capital gain incentive fee required under GAAP (including the portion of such accrual that is not payable under the Company's investment advisory agreement) from net investment income calculated in accordance with GAAP. The Company believes excluding the reversal of accrual of the capital gain incentive fee in the above non-GAAP financial measures is useful as it includes the portion of such accrual that is not contractually payable under the terms of the Company’s investment advisory agreement with GC Advisors LLC. 2. Excludes the impact of different share amounts as a result of calculating certain per share data based on weighted average shares outstanding during the period and certain per share data based on the shares outstanding as of the dividend record date. In accordance with GAAP, when preparing a net asset per share rollforward, any differences resulting from different share amounts are netted in net realized/unrealized gain (loss) per share. High Unrealized Losses Drove a Meaningful Decline in NAV Per Share 1. As a supplement to GAAP financial measures, the Company is providing the following non-GAAP financial measure that it believes are useful for the reasons described below: • “Adjusted Net Investment Income Per Share” excludes the reversal of accrual for the capital gain incentive fee required under GAAP (including the portion of such accrual that is not payable under the Company's investment advisory agreement) from net investment income calculated in accordance with GAAP. The Company believes excluding the reversal of accrual of the capital gain incentive fee in the above non-GAAP financial measures is useful as it includes the portion of such accrual that is not contractually payable under the terms of the Company’s investment advisory agreement with GC Advisors. 2. Amount includes (1) the net realized gain (loss) on investment transactions and (2) the change in unrealized appreciation (depreciation) during the three months ended March 31, 2020 associated with the investments that were sold, exited or restructured. 3. Includes the net change in unrealized depreciation for the three months ended March 31, 2020 reported within the net change in unrealized appreciation (depreciation) on investments included in the consolidated statements of operations attributable to investments held as of March 31, 2020. 4. Net Change in Unrealized Appreciation on Foreign Currencies includes the change in unrealized appreciation (depreciation) associated on forward currency contracts and the translation of assets and liabilities in foreign currencies. 5. Other Changes in Net Unrealized Depreciation includes the adjustment for different share amounts as a result of calculating certain per share data based on weighted average shares outstanding during the period and certain per share data based on the shares outstanding at the end of the period. 31