Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - S&W Seed Co | sanw-ex322_6.htm |

| EX-32.1 - EX-32.1 - S&W Seed Co | sanw-ex321_7.htm |

| EX-31.2 - EX-31.2 - S&W Seed Co | sanw-ex312_8.htm |

| EX-31.1 - EX-31.1 - S&W Seed Co | sanw-ex311_11.htm |

| EX-3.3 - EX-3.3 - S&W Seed Co | sanw-ex33_288.htm |

| 10-Q - 10-Q - S&W Seed Co | sanw-10q_20200331.htm |

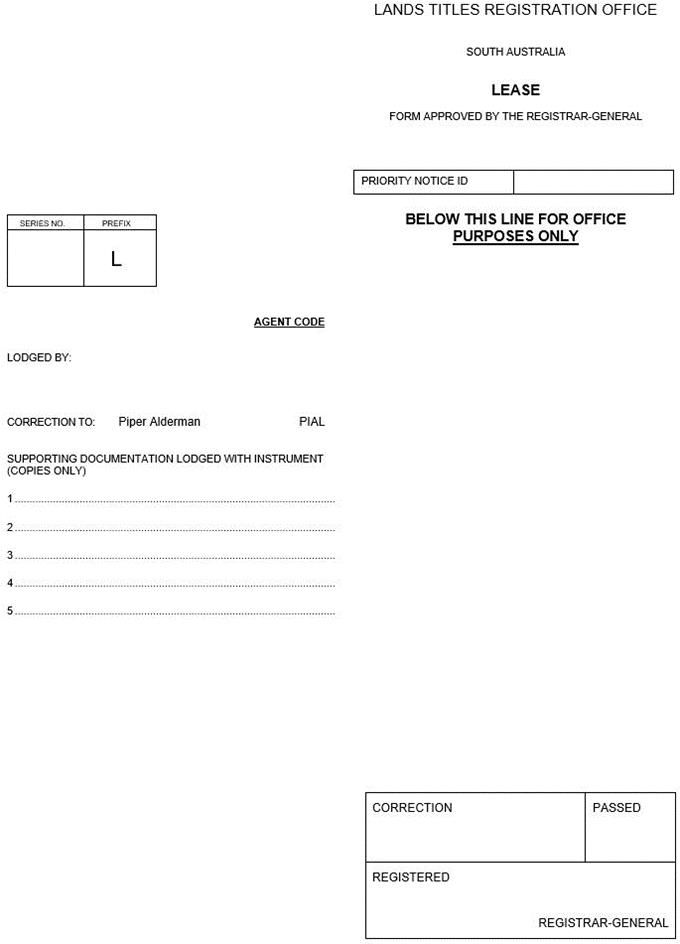

Exhibit 10.1

|

|

|

|

|

Execution Version

relating to shares in Pasture Genetics Pty Ltd ACN 074 290 252 — S&W Seed Company Australia Pty Ltd (Purchaser)

|

Execution Version

relating to shares in Pasture Genetics Pty Ltd ACN 074 290 252

|

~*~ |

|

Details |

6 |

|

|

Agreed terms |

7 |

|

|

1. |

Defined terms & interpretation |

7 |

|

1.1 |

Defined terms |

7 |

|

1.2 |

Interpretation |

12 |

|

1.3 |

Headings |

13 |

|

1.4 |

Foreign Exchange |

13 |

|

2. |

Conditions |

13 |

|

2.1 |

Conditions |

13 |

|

2.2 |

Waiver of Conditions |

14 |

|

2.3 |

Conduct of the parties |

14 |

|

2.4 |

Failure of Condition |

14 |

|

3. |

Sale and purchase of Shares |

14 |

|

3.1 |

Agreement to sell and purchase |

14 |

|

3.2 |

Title and risk |

14 |

|

3.3 |

All of the shares |

15 |

|

3.4 |

Damin obligations |

15 |

|

4. |

Initial Purchase Price of Shares |

15 |

|

4.1 |

Payment of the Initial Purchase Price |

15 |

|

4.2 |

Cleared funds |

15 |

|

4.3 |

Breach of agreement by the Purchaser |

15 |

|

5. |

Obligations before Completion |

15 |

|

5.1 |

Continuity of business |

15 |

|

5.2 |

Prohibited actions |

15 |

|

5.3 |

Exceptions |

17 |

|

5.4 |

Access to Business and Records |

17 |

|

5.5 |

External Debt Estimate |

17 |

|

5.6 |

Purchaser's obligations |

17 |

|

5.7 |

Right to copy and consult |

17 |

|

5.8 |

Release of personal guarantees |

18 |

|

6. |

Completion |

18 |

|

6.1 |

Time and place |

18 |

|

6.2 |

Obligations of the Vendor |

18 |

|

6.3 |

Obligations of the Purchaser |

19 |

|

6.4 |

Simultaneous actions at Completion |

20 |

|

7. |

Completion Accounts |

20 |

|

7.1 |

Preparation of Completion Accounts |

20 |

|

7.2 |

Vendors’ review of Completion Accounts |

20 |

|

7.3 |

Deemed acceptance |

20 |

|

7.4 |

Dispute |

20 |

|

7.5 |

Adjustment Amount |

20 |

Execution Version

|

Adjustment of the Earn-Out Amount |

20 |

|

|

7.7 |

Access to information |

20 |

|

7.8 |

Dispute Resolution Procedure |

21 |

|

7.9 |

Costs |

21 |

|

8. |

Earn-Out Amount |

22 |

|

8.1 |

Calculation of Earn–Out Amount |

22 |

|

8.2 |

Payment of the Earn–Out Amount |

22 |

|

8.3 |

Common Stock |

22 |

|

8.4 |

Cleared funds |

22 |

|

9. |

Preparation of Earn-Out Accounts |

23 |

|

9.1 |

Preparation of Earn–out Accounts |

23 |

|

9.2 |

Access to information to review draft Earn–Out Accounts |

23 |

|

9.3 |

Notice by Vendor |

23 |

|

9.4 |

Consequences of notice by Vendor |

23 |

|

9.5 |

Dispute resolution procedure |

23 |

|

10. |

Vendor Guarantees |

25 |

|

11. |

Warranties |

25 |

|

11.1 |

Mutual Representations and Warranties |

25 |

|

11.2 |

Purchaser’s warranties |

25 |

|

11.3 |

Warranties |

25 |

|

11.4 |

Reliance of the Purchaser |

25 |

|

11.5 |

Application of Warranties |

25 |

|

11.6 |

Qualifications to warranties |

26 |

|

11.7 |

Reduction in Purchase Price |

27 |

|

11.8 |

Right of reimbursement |

27 |

|

11.9 |

Monetary limits |

27 |

|

11.10 |

Time Limits on Claims |

27 |

|

11.11 |

Maximum amount of Claims |

27 |

|

11.12 |

Fraud |

27 |

|

11.13 |

No double recovery |

27 |

|

11.14 |

Purchaser to mitigate Loss |

28 |

|

11.15 |

Survival of Warranties |

28 |

|

11.16 |

Right to rescind |

28 |

|

11.17 |

No representation by Company |

28 |

|

11.18 |

Acknowledgment of parties |

28 |

|

11.19 |

Gross–up for Tax |

28 |

|

12. |

Tax Claims |

29 |

|

12.1 |

Notice of Tax Claim |

29 |

|

12.2 |

Tax Claims process |

29 |

|

12.3 |

Dispute between parties in relation to a Tax Claim |

29 |

|

12.4 |

Tax Audits |

30 |

|

12.5 |

Tax Audit process |

30 |

|

12.6 |

Dispute between parties in relation to a Tax Audit |

30 |

|

13. |

Tax returns |

31 |

|

13.1 |

Pre–Completion returns |

31 |

|

13.2 |

Straddle Returns / Post–Completion returns |

31 |

Execution Version

|

Indemnities |

32 |

|

|

14.1 |

General indemnity |

32 |

|

14.2 |

Setoff |

32 |

|

15. |

Tax Indemnity |

33 |

|

16. |

Restraint |

34 |

|

16.1 |

Definitions |

34 |

|

16.3 |

Duration of prohibition |

35 |

|

16.4 |

Geographic application of prohibition |

35 |

|

16.5 |

Interpretation |

35 |

|

16.6 |

Exceptions |

36 |

|

16.7 |

Acknowledgments |

36 |

|

16.8 |

Indemnity for breach of Restraint |

36 |

|

17. |

Confidentiality and publicity |

36 |

|

17.1 |

Announcements |

36 |

|

17.2 |

Warrantor obligations |

37 |

|

18. |

GST |

37 |

|

18.1 |

Interpretation |

37 |

|

18.2 |

GST gross up |

37 |

|

18.3 |

Reimbursements |

37 |

|

18.4 |

Tax invoice |

37 |

|

19. |

Benefits held on trust |

37 |

|

19.1 |

Vendor |

37 |

|

19.2 |

Purchaser |

38 |

|

20. |

Notices and other communications |

38 |

|

20.1 |

Service of notices |

38 |

|

20.2 |

Effective on receipt |

38 |

|

21. |

Miscellaneous |

38 |

|

21.1 |

Alterations |

38 |

|

21.2 |

Approvals and consents |

38 |

|

21.3 |

Assignment |

38 |

|

21.4 |

Costs |

38 |

|

21.5 |

Stamp duty |

39 |

|

21.6 |

Survival |

39 |

|

21.7 |

Indemnities |

39 |

|

21.8 |

Counterparts |

39 |

|

21.9 |

No merger |

39 |

|

21.10 |

Entire agreement |

39 |

|

21.11 |

Further action |

39 |

|

21.12 |

Severability |

39 |

|

21.13 |

Waiver |

39 |

|

21.14 |

Relationship |

40 |

|

21.15 |

Governing law and jurisdiction |

40 |

|

Schedule 1 - Particulars of Vendor's shareholding in the Company |

41 |

|

Schedule 2 - Details of the Company (clause 1.1) |

42 |

|

Schedule 3 - Business Vehicles Loans |

43 |

|

Schedule 4 - Officers and Key Employees (clause 6.2) |

44 |

Execution Version

|

|

Execution Version

Details

Parties

|

S&W Seed Company Australia Pty Ltd |

|

|

44 061 114 814 |

|

|

Purchaser |

|

|

Office 2, 7 Pomona Road, Stirling SA 5152 Email: andrewcarthew@swseedco.com |

|

|

Attention: Andrew Carthew |

Background

|

B |

The Vendor has agreed to sell and the Purchaser has agreed to purchase the Shares on the terms and conditions set out in this agreement. |

Execution Version

Agreed terms

In this agreement:

1936 Tax Act means the Income Tax Assessment Act 1936 (Cth).

1997 Tax Act means the Income Tax Assessment Act 1997 (Cth).

ABC Laws means all applicable domestic and international anti-bribery and anti-corruption laws and regulations, including but not limited to the Criminal Code Act 1995 (Cth), Foreign Corrupt Practices Act (US), any applicable law promulgated to implement the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions, signed on 17 December 1997, any applicable laws relating to trade sanctions and other applicable laws of similar purpose and scope in any applicable jurisdiction, including commercial bribery offences and books and records offences relating directly or indirectly to a bribe.

Accounting Standards means generally accepted accounting principles applied in the United States.

Accounts means the audited balance sheet of the Company as at the Accounts Date and the profit and loss statement and statement of cash flows of the Company for the previous two (2) financial years ending on the Accounts Date together with the notes to, and the reports of the directors in respect of, those accounts.

Accounts Date means 30 June 2019.

Adjustment Amount means the amount determined in accordance with Item 2 of Schedule 5.

Approval Contract means the DLF Agreement

Assets means the property and assets owned or used by the Company in conducting the Business.

Associate has the meaning given to that term by sections 10 to 17 of the Corporations Act.

Business means the businesses carried on by the Company as at the date of this agreement, including the business of producing and supplying pasture and cropping seed.

|

|

(a) |

for receiving a notice under clause 20, a day that is not a Saturday, Sunday, public holiday or bank holiday in the place where the notice is received; and |

|

|

(b) |

for all other purposes, a day that is not a Saturday, Sunday, public holiday or bank holiday in South Australia, Australia. |

Business Hours means from 9.00am to 5.00pm on a Business Day.

Business Vehicles Loans means the loans listed in Schedule 3.

Calculation Time means the close of Business on the last Business Day before the Completion Date, or any other time and date that the Vendor and the Purchaser agree in writing.

Claim includes a claim, notice, demand, action, proceeding, litigation, investigation, judgment, damage, loss, cost, expense or liability however arising, whether present, unascertained, immediate, future or contingent, whether based in contract, tort or statute and whether involving a third party or a party to this agreement.

Execution Version

Company means Pasture Genetics Pty Ltd ACN 074 290 252, further details of which are set out in Schedule 2.

Company Revolver means the outstanding balance of the loan facility accounts described in Schedule 11 as at the Completion Date.

Completion means completion of the sale and purchase of the Shares contemplated by this agreement.

Completion Accounts means the balance sheet for the Company prepared in accordance with clause 7.1.

Completion Accounts Dispute Notice means a notice outlining a dispute in respect of the draft Completion Accounts under clause 7.2(b).

Completion Date means the later of 21 February 2020 and 5 Business Days after satisfaction or waiver of all the Conditions.

Conditions means the conditions set out in clause 2.1.

Confidential Information means:

|

|

(c) |

all notes, data, reports and other records (whether or not in tangible form) based on, incorporating or derived from information referred to in paragraphs (a) or (b) of this definition; and |

|

|

(d) |

all copies (whether or not in tangible form) of the information, notes, reports and records referred to in paragraphs (a), (b) or (c) of this definition, |

that is not public knowledge (otherwise than as a result of a breach of a confidentiality obligation of a party).

Confidentiality Deed means the Confidentiality Deed entered into by the Company and the Purchaser on 27 June 2017 and the Mutual Nondisclosure Agreement dated 15 November 2019.

Corporations Act means the Corporations Act 2001 (Cth).

Damin Payment means the amount of $200,000.00.

Data Room Material means the due diligence information contained in the USB memory stick exhibited to this agreement.

Determination Date means the date that is 10 Business Days after the date on which the Completion Accounts are agreed or deemed to be the final Completion Accounts and the Adjustment Amount determined.

Director means Ann Elizabeth Damin.

Disclosed means fully and fairly disclosed with sufficient particularity to enable a reasonable person with skills and experience in matters the subject of this agreement and the Business and with the aid of professional advisers, to assess the full impact on the Company of the matter sought to be disclosed.

Disclosure Letter means the letter from the Warrantors to the Purchaser of the same date as this agreement entitled 'Disclosure Letter' and which contains disclosures in respect of the Warranties.

DLF Agreement means the agreement between the Company and DLF Seeds Limited with a commencement date of 20 October 2009.

Due Diligence Material means the information and documents provided by the Vendor or its Representatives to the Purchaser or its Representatives before the date of this agreement, a list

Execution Version

of which is attached to the Disclosure Letter and includes the Data Room Material, the information in this agreement and any schedules or annexures.

Earn-Out Accounts means the Accounts for the Company prepared in accordance with clause 9 and Item 3 of Schedule 5.

Earn-Out Amount means the amount, if any, calculated under clause 8.

Earn-Out Date means 30 September 2022.

EBITDA means the earnings before interest, tax, depreciation and amortization determined in accordance with the Accounting Standards.

External Debt means the Company Revolver and the Business Vehicles Loans, save always that the External Debt must not exceed $12,000,000.

good faith means an act, omission or decision without malice or capriciousness and without an intention of frustrating effect being given to this agreement. For the avoidance of doubt, a party will not be taken not to be acting in good faith merely because:

|

|

(a) |

the party prefers its own interests; |

|

|

(b) |

if the party acted in another way, the party would not be substantially disadvantaged by so acting; or |

|

|

(c) |

another party is substantially disadvantaged by the party so acting. |

Governmental Authority includes any governmental, semi-governmental, municipal or statutory authority, instrumentality, organisation, body or delegate (including any town planning or development authority, public utility, environmental, building, health, safety or other body or authority) having jurisdiction, authority or power over or in respect of the Company, the Business or the Properties.

Group means the Company and each of its subsidiaries.

Guarantee means a guarantee or indemnity granted by the Company to any person in respect of any Liabilities of the Vendor or Associate of the Vendor (excluding the Company).

Independent Accountant means a chartered accountant or firm of chartered accountants appointed under clause 7.8 or 9.5 (as relevant).

Initial Purchase Price means $12,000,000 less the amount of the External Debt, save always that the Initial Purchase Price shall not be less than zero.

Key Employees means the persons named in Item 2 of Schedule 4.

Leases means the leases entered into in respect of the Leasehold Properties in satisfaction of Condition 4 of clause 2.1.

Leasehold Properties means the leasehold properties listed in Schedule 7 utilised in the operations of the Business.

Liabilities includes all liabilities (whether actual, contingent or prospective), losses, damages, costs and expenses of whatever description.

Management Accounts means the un-audited financial statements of the Company as at 31 December 2019

Material Adverse Effect means any event, change, circumstance, effect, occurrence or other matter, whether known or unknown at the time of this agreement and notwithstanding any other provision of this agreement or the course of dealings between the parties in connection with this agreement, that has or could reasonably be expected to have either individually or in aggregate, with or without notice, lapse of time or both, a short term or long term material adverse effect on:

|

|

(a) |

the business, assets, liabilities, properties, condition (financial or otherwise), operating results, operations, reputation or prospects of the Company; or |

Execution Version

|

|

(b) |

the ability of the Vendor to perform its obligations under this agreement or to consummate in a timely manner the transactions contemplated by this agreement, |

and includes, without limitation, any such event, change, circumstance, effect or other matter that has or is reasonably likely to have:

|

|

(c) |

the effect of reducing the profit generated by the Business in respect of the preceding twelve months by $100,000 or more; |

|

|

(d) |

the effect of reducing the consolidated assets of the Company from the amount disclosed in the Accounts by more than $100,000; |

The burden of proof that there has not been, nor could there reasonably be expected to be, a Material Adverse Effect rests with the Vendor.

Necessary Approvals means, in respect of the Approval Contract, all approvals, amendments, consents or waivers required under the terms of that Approval Contract solely in order to effect all of the transactions contemplated by this agreement without:

|

|

(b) |

giving rise to, or permitting any party to the Approval Contract to exercise, any right under the relevant Approval Contract (including any right to terminate the Approval Contract). |

Permitted Security Interest means any of:

|

|

(b) |

a Security Interest in favour of any Government Authority for taxes, rates or charges which are not overdue or are being contested or litigated in good faith. |

Parent Company means S&W Seed Company, a Nevada corporation.

Personal Guarantee means any guarantee given by either the Vendor or Damin to any person in relation to Liabilities of the Company.

PG Amount means the amount calculated as the average PG Earnings for the Company over the two (2) financial years ending 30 June 2021 and 30 June 2022 in accordance with the Earn-Out Accounts.

PG Earnings means the amount shown in the Earn–Out Accounts prepared in accordance with the Accounting Standards and Item 3 of Schedule 5 and agreed by the parties, deemed to be agreed by the parties or determined by the Independent Accountant (as the case may be) under clause 9.

PPSA means the Personal Property Securities Act 2009 (Cth).

Properties means the real property (whether leasehold or freehold) listed in Schedule 7.

Purchase Price means the Initial Purchase Price and the Earn-Out Amount and must not exceed $20,000,000.

Records means all original and copy records, documents, books, files, reports, accounts, plans, correspondence, letters and papers of every description and other material regardless of their form or medium and whether coming into existence before, on or after the date of this agreement, of the Company including certificates of registration, minute books, statutory books and registers, books of account, Tax returns, title deeds and other documents of title, customer lists, price lists, computer programs and software, and trading and financial records.

Representatives means, in relation to a person or entity, its officers, employees, contractors, agents, advisers, or financiers.

RI Chair means the Chair of the Resolution Institute.

Security Interest means a 'security interest' as defined in the PPSA.

Execution Version

Shares means all of the shares in the capital of the Company owned by the Vendor as described in Schedule 1.

Stock means the trading stock, work-in progress, raw materials, consumables and packaging for use in the Business.

Subject Claim means a Claim by the Purchaser against the Vendor arising as a direct or indirect result of a breach of a Warranty, breach of any provision of this agreement or the entry into this agreement by the Purchaser and includes, for the avoidance of doubt, a Tax Subject Claim.

Sunset Date means the date 60 days after the execution of this agreement.

Tax means all forms of taxes, duties, imposts, charges, withholdings, rates, levies or other governmental impositions of whatever nature and by whatever authority imposed, assessed or charged together with all costs, charges, interest, penalties, fines, expenses and other additional statutory charges, incidental or related to the imposition.

Tax Audit means any audit, enquiry or investigation by a Tax Authority regarding the taxation affairs of the Company in relation to a period that includes any day before Completion.

Tax Authority means any government, semi-government, administrative, municipal, statutory, fiscal or judicial body, department, commission, authority, tribunal, agency, entity or person responsible for the collection of any Tax or administration of any law with respect to Tax.

Tax Claim means an assessment, notice, amended assessment, demand or other document issued by or taken by or on behalf of any Tax Authority against the Company whether before or after the date of this agreement as a result of which the Company is liable to make a payment for Tax or is deprived of the benefit of any Tax Relief and also includes any amounts payable by the Company under a valid tax sharing agreement under section 721–25 of the 1997 Tax Act, to the extent that it relates to:

|

|

(a) |

any period up to and including Completion; or |

|

|

(b) |

any fact, circumstance, event, transaction, act or omission occurring or deemed to have occurred prior to Completion. |

Tax Indemnity means the indemnity given by the Warrantors under clause 15.

Tax Law means any law with respect to or imposing any Tax.

Tax Liability means all Liabilities relating to Tax including:

|

|

(a) |

any Tax payable by the Company (or for which the Company is liable, whether directly or pursuant to any agreement relating to Tax) or any loss or reduction of any Tax Relief of the Company; and |

|

|

(b) |

all costs and expenses incurred by or on behalf of the Company in managing any Tax enquiry, dispute or similar action. |

Tax Relief means any credit, rebate, refund, relief, allowance or deduction in relation to Tax (including any carry forward Tax losses that accrue before Completion or become available before Completion).

Tax Subject Claim means a Claim by the Purchaser for a breach of a Tax Warranty or Tax Indemnity.

Tax Warranties means the Warranties that comprise Warranty 13 in Schedule 6.

Third Party means a person that is not a party or an Associate of a party.

Third Party Interest means any:

|

|

(b) |

lease, licence, option, voting arrangement, notation, restriction; |

Execution Version

Transaction Document means each of:

|

|

(a) |

this agreement; |

VWAP means, for any trading day, the volume weighted average trading price of a share of the Parent Company common stock on the NASDAQ Stock market for such trading day.

Warranties means each of the representations and warranties given under clause 11 and set out in Schedule 6.

Warrantors means the Vendor and Damin.

Warranty Claim means a claim that a Warranty given by the Vendor is untrue, inaccurate, incomplete, misleading or otherwise deficient.

In this agreement, except where the context otherwise requires:

|

|

(b) |

another grammatical form of a defined word or expression has a corresponding meaning; |

|

|

(d) |

a reference to a document or instrument includes the document or instrument as novated, altered, supplemented or replaced from time to time; |

|

|

(e) |

a reference to A$, $A, dollar or $ is to Australian currency; |

|

|

(h) |

a reference to a party is to a party to this agreement, and a reference to a party to a document includes the party's executors, administrators, successors and permitted assigns and substitutes; |

|

|

(i) |

a reference to a person includes a natural person, partnership, body corporate, association, governmental or local authority or agency or other entity; |

|

|

(j) |

a reference to a statute, ordinance, code or other law includes regulations and other instruments under it and consolidations, amendments, re‑enactments or replacements of any of them; |

|

|

(k) |

a word or expression defined in the Corporations Act has the meaning given to it in the Corporations Act; |

|

|

(l) |

the meaning of general words is not limited by specific examples introduced by including, for example or similar expressions; |

|

|

(m) |

any agreement, representation, warranty or indemnity by two or more parties (including where two or more persons are included in the same defined term) binds them jointly and severally; |

Execution Version

|

|

(o) |

a rule of construction does not apply to the disadvantage of a party because the party was responsible for the preparation of this agreement or any part of it; |

|

|

(p) |

if a day on or by which an obligation must be performed or an event must occur is not a Business Day, the obligation must be performed or the event must occur on or by the next Business Day; |

|

|

(q) |

a reference to except as disclosed is to something disclosed in this agreement, the Due Diligence Material and/or the Disclosure Letter; and |

Headings are for ease of reference only and do not affect interpretation.

Any amounts payable in this agreement must be paid in $A. Any amounts requiring conversion between $A and USD (including for purposes of determining the subscription price for Parent Company common stock under clause 8.3) shall be done at the USD/AUD closing wholesale spot exchange rate published by the Australian Financial Review for the day that is 2 Business Days before the date set for calculation of the relevant amount.

Completion must not occur until all of the following Conditions are fulfilled:

Execution Version

A Condition may only be waived in writing by each party entitled to the benefit of that Condition (as specified in relation to each Condition in the second column of the table in clause 2.1) and will be effective only to the extent specifically set out in that waiver.

Each party must use all reasonable efforts within its own capacity to ensure that each Condition is fulfilled before 5.00pm on the Sunset Date.

If a party has complied with its obligations under clause 2.3, it may terminate this agreement by giving notice in writing to the other parties if one or more Conditions are not fulfilled by 5.00pm on the Sunset Date or another date agreed by the parties in writing.

The Vendor as legal and beneficial owner agrees to sell to the Purchaser and the Purchaser agrees to buy from the Vendor the Shares:

|

|

(c) |

with all rights, including dividend and voting rights, attached or accrued to them on or after the Completion Date; and |

|

|

(d) |

subject to this agreement. |

Beneficial title to and risk in the Shares passes to the Purchaser on Completion.

Execution Version

The Purchaser will not be obliged to complete the purchase of any of the Shares unless the purchase of all the Shares is completed simultaneously in accordance with this agreement.

|

|

(a) |

In consideration of Damin providing the covenants under clauses 11, 12 and 16, the Purchaser shall pay to Damin the Damin Payment subject to and at Completion. |

|

|

(b) |

Damin acknowledges and agrees that the Damin Payment is reasonable and appropriate consideration for him to provide the covenants under clauses 11, 12 and 16, and he warrants that he has received independent legal advice in respect thereof. |

The Purchaser must pay the Initial Purchase Price on Completion in accordance with clauses 6.3(a) and 4.2.

All payments under this agreement must be paid by bank cheque or telegraphic transfer to an account or accounts nominated by the Vendor in cleared funds.

If the Purchaser breaches a provision of this agreement in a material respect, the Vendor may require the Purchaser to remedy the breach within ten Business Days after receipt of written notice of the breach by the Purchaser. If the Purchaser fails to remedy the breach within that period, then the Vendor may terminate this agreement. For the purposes of this clause 4.3, any breach of any of the provisions of clauses 2 or 6.3 shall be treated as a breach of a provision of this agreement in a material respect.

Until Completion, the Vendor must carry on the Business in the ordinary course.

Subject to clause 5.3, until the earlier of Completion or the termination of this agreement, the Vendor must procure that the Company does not, without the prior written consent of the Purchaser (such consent not to be unreasonably withheld or delayed), do, nor authorise, agree or commit to, any of the following:

|

|

(a) |

alter its constitution or constituent documents; |

|

|

(b) |

adopt or change any of its accounting policies, principles, methods, practices, periods or procedures, including any change in the application or interpretation of any applicable accounting principles; |

Execution Version

|

|

(e) |

issue, deliver, sell, transfer, pledge, grant, dispose of, or create, permit, allow or suffer to exist any Third Party Interest on, any Shares; |

|

|

(i) |

enter into any joint venture, partnership, unincorporated association, alliance or similar arrangement with any person; |

|

|

(j) |

enter into, amend or terminate (or agree to enter into, amend or terminate) a contract or commitment that: |

|

|

(iii) |

is for a term of more than one year. |

|

|

(l) |

incur any capital expenditure exceeding $20,000 for any single item or $50,000 in aggregate for all items; |

|

|

(m) |

purchase, lease or otherwise acquire or agree to acquire any individual asset, with a value of more than $50,000; |

|

|

(n) |

cancel, waive, release or discount in whole or in part any debt, suit, demand, claim or right of more than $50,000; |

|

|

(p) |

shorten or lengthen the customary payment cycle for any of its accounts payable or accounts and notes receivable by more than 60 days; |

|

|

(s) |

do or fail to do anything as a result of which any of the Warranties are breached or are untrue, inaccurate or misleading; |

Execution Version

Nothing in this clause 5 prevents any action to the extent:

|

|

(a) |

contemplated or required by this agreement; |

|

|

(b) |

required, in the written opinion of outside counsel to the Vendor, by law or any Governmental Authority; or |

|

|

(c) |

agreed to in writing between the Vendor and the Purchaser (such agreement not to be unreasonably withheld or delayed). |

The Vendor will allow the Purchaser and its Representatives full access to the Properties and the Records at all reasonable times before Completion to enable the Purchaser to, as is reasonably necessary, become familiar with the Business and the affairs of the Company.

At 5:00pm on the day that is two Business Days before the Completion Date, the Vendor must advise the Purchaser of the amount of External Debt as at that time together with the Vendor's bona fide estimate of any changes to the amount of External Debt as at Completion Date (Estimated External Debt). The Estimated External Debt shall be used for the purposes of calculating the Initial Purchase Price payable at Completion but will be subject to reconciliation as part of preparation of the Completion Accounts in accordance with clause 7.

Before Completion, the Purchaser must provide to the Company a written consent to act as director in respect of each of the persons listed in the third and fourth columns of the table under Item 1 in Schedule 4 (or any other prospective directors notified in writing by the Purchaser to the Vendor before Completion), and consent to act as company secretary and public officer of at least one of them.

For the purposes of clause 5.4, the Purchaser may:

|

|

(a) |

make copies of material examined; |

|

|

(c) |

with the prior consent of the Vendor (which consent may not be unreasonably withheld), consult with employees of the Company. |

Execution Version

|

|

(b) |

If any Listed Guarantee is not released with effect from Completion, the Purchaser must use best endeavours to procure the release of the Vendor or Damin from such Listed Guarantees (including providing a replacement guarantee to the relevant party) as soon as possible after Completion. |

|

|

(c) |

If a Personal Guarantee is not released with effect from Completion, the Purchaser irrevocably and unconditionally indemnifies the Vendor and Damin on a full indemnity basis from and against any Claim or Liability however arising out of the Personal Guarantee that may be suffered or incurred by the Vendor or Damin which relates to debts and Liabilities incurred by the Company after Completion. |

|

|

(d) |

The Vendor and Damin shall from the date of this agreement provide the Purchaser with all reasonable assistance to facilitate any discussions between the Purchaser and beneficiary of any Listed Guarantee. |

If all the Conditions have been fulfilled or waived under clause 2.2, Completion will take place at 11:00am on the Completion Date at the offices of Minter Ellison, Level 10, 25 Grenfell Street Adelaide, South Australia or another time and place agreed by the parties.

|

|

(iii) |

produce to the Purchaser any power of attorney or other authority under which the transfers of the Shares are executed; |

|

|

(A) |

duly executed instruments (prepared by the Purchaser) irrevocably waiving in favour of the Purchaser all rights of pre-emption which any person has in respect of any of the Shares (if any); |

Execution Version

|

|

Completion, in either case from the relevant holders of those Security Interests, and, if applicable, an undertaking to remove all relevant registrations on the PPSA register as soon as practicable but no later than 20 Business Days following the Completion Date; or |

|

|

(D) |

copies of any other consents and waivers required under clause 2 to the extent that those consents and waivers have been obtained; |

|

|

(v) |

cause the change, with effect from Completion, of all authorities relating to bank accounts of the Company to include signatories of the Purchaser; |

|

|

(vi) |

deliver to the Purchaser all Records by leaving them at the places at the Properties at which they are usually located in the normal course of operations of the Business; |

|

|

(vii) |

deliver to the Purchaser all keys and access codes for Properties and for all computer systems and software; |

|

|

(i) |

any consents or waivers required under clause 2; and |

Execution Version

|

|

(a) |

the obligations of the parties under this agreement are interdependent; |

|

|

(b) |

all actions required to be performed will be taken to have occurred simultaneously on the Completion Date; and |

|

|

(c) |

a party need not complete the sale or purchase of any of the Shares unless the sale and purchase of all the Shares is completed simultaneously. |

|

Within 15 Business Days after the Purchaser provides a copy of the draft Completion Accounts to the Vendor under clause 7.1 the Vendor may: |

|

|

(a) |

accept those draft Completion Accounts by written notice to the Purchaser, in which case those draft Completion Accounts will constitute the final Completion Accounts; or |

If the Vendor issues a Completion Accounts Dispute Notice the dispute resolution procedure set out in clause 7.8 will apply.

The final Completion Accounts must be reviewed, and the Adjustment Amount must be calculated, in accordance with Item 2 of Schedule 5.

The Earn-Out Amount shall be adjusted by any Adjustment Amount.

The Purchaser must ensure that all information and assistance reasonably requested by the Vendor is given to review the draft Completion Accounts and must permit Representatives of the Vendor to have reasonable access to, and take extracts from or make copies of, the Records to review the Completion Accounts.

Execution Version

|

|

(i) |

a copy of relevant provisions of this agreement; |

|

|

(ii) |

a description of the dispute or issue to be resolved by the Independent Accountant, being the dispute in relation to the draft Completion Accounts; and |

|

|

(iii) |

the approximate value of, and the technical area involved in, the dispute. |

If the RI Chair nominates a list of persons to be the Independent Accountant rather than one particular person, the first person named on that list will be the Independent Accountant.

The costs of the:

will be borne by the Purchaser and Vendor as to one half each unless the Independent Accountant determines that there was an error of more than 10% in the Adjustment Amount, in which case the costs will be borne by the Purchaser.

Execution Version

Subject to any adjustment in accordance with clause 7.6, the Earn-Out Amount is calculated in accordance with the following.

Where

E means the Earn-Out Amount (which cannot be less than 0 or more than $8,000,000)

The Purchaser must pay the Vendor the Earn–Out Amount on the Earn-Out Date in the following manner:

|

|

(b) |

The purchase price for each of the common stock shares to be purchased by the Vendor (the "Earnout Shares") will be equal to the average VWAP over the 10-day period ending immediately prior to the Earn-Out Date, as determined by Purchaser. In no event shall the number of Earnout Shares exceed 19.9% of the issued and outstanding shares of the Parent Company common stock as of the date of this agreement. |

|

|

(d) |

Following the issue of a notice under clause 8.3(a), if the value of the Second Tranche is such that it would result in the Earn-Out Shares exceeding 19/9% of the issued share capital in the Parent Company, then: |

|

|

(i) |

a portion of the Second Tranche will be applied to issue Earn-Out Shares up to 19.9% of the issued share capital in the Parent Company; and |

|

|

(ii) |

the balance of the Second Tranche will be paid to the Vendor in cash within 14 days of the Earn-Out Date. |

All cash payments under this clause 8 must be paid by bank cheque, telegraphic transfer to an account or accounts nominated by the Vendor or otherwise in cleared funds.

Execution Version

As soon as practicable, and in any event no later than 30 days prior to the Earn-Out Date, the Purchaser must:

|

|

(a) |

prepare draft Earn–Out Accounts in a form consistent with the principles set out in Item (j) of Schedule 5; |

|

|

(b) |

include in the Earn-Out Accounts delivered to the Vendor specific detail of each individual amount in respect of which the Purchaser has claimed a set-off under clause 14.2; and |

The Purchaser must ensure the Vendor and its Representatives are allowed to examine all working papers relating to the draft Earn–Out Accounts reasonably required by them for the purpose of reviewing the draft Earn–Out Accounts.

Within 15 days after receiving the draft Earn–Out Accounts (Objection Period), the Vendor must give the Purchaser notice that the Vendor either:

|

|

(a) |

agrees that the draft Earn–Out Accounts have been properly prepared in accordance with clause 9.1(a) and the Earn-Out Amount has been properly calculated; or |

|

|

(a) |

gives the Purchaser a notice under clause 9.3(a), the draft Earn–Out Accounts, including the Earn-Out Amount, are final and binding on the Purchaser and the Vendor; |

|

|

(b) |

gives the Purchaser a notice under clause 9.3(b) (Dispute Notice), the Disputed Matters must be resolved under clause 9.5; or |

Execution Version

|

|

(i) |

a copy of relevant provisions of this agreement; |

|

|

(iii) |

the approximate value of, and the technical area involved in, the dispute. |

If the RI Chair nominates a list of persons to be the Independent Accountant rather than one particular person, the first person named on that list will be the Independent Accountant.

|

|

(e) |

The Disputed Matters must be referred to the Independent Accountant by written submission, which must include: |

|

|

(iv) |

an extract of the relevant provisions of this agreement; and |

|

|

(v) |

instructions to determine the Disputed Matters no later than 20 Business Days after the Independent Accountant's appointment (or any other period agreed by the parties). |

|

|

(g) |

The Independent Accountant must act as an expert, and not as an arbitrator, in determining the Disputed Matters. |

|

|

(h) |

In the absence of manifest error: |

|

|

(i) |

the Independent Accountant's written determination of the Disputed Matters will be final and binding on the parties; and |

|

|

(i) |

The costs of the: |

will be borne by the Purchaser and Vendor equally unless the Independent Accountant determines that there was an error of more than 10% in the Earn-Out Amount, in which case the costs will be borne by the Purchaser.

Execution Version

Each of the parties represents and warrants that:

|

|

(a) |

it has the power to enter into this agreement and has taken all corporate and other actions necessary to authorise the execution, delivery and performance of this agreement; |

|

|

(b) |

this agreement constitutes a valid, legally binding obligation on it; |

|

|

(d) |

all authorisations, consents and approvals (if any) required from any government agency have been obtained. |

|

|

(a) |

The Purchaser represents and warrants that the issue of any shares of common stock in the Parent Company to the Vendor under clause 8 will comply with the securities laws of the United States of America. |

|

|

(b) |

Each warranty of the Purchaser is separate and independent and unless expressly provided is not limited by any other Purchaser Warranty or provision of this Agreement. |

The Warrantors jointly and severally represent and warrant to the Purchaser that as at execution and exchange of this agreement, each of the Warranties are and, up to and including Completion, will be true and accurate and not misleading.

Each Warrantor acknowledges that the Purchaser enters into this agreement and will complete the sale and purchase of Shares under this agreement in reliance on the Warranties.

|

|

(b) |

is separate and independent and not limited or restricted by any other Warranty or provision of this agreement; and |

Execution Version

|

|

(i) |

companies register maintained by the Australian Securities and Investments Commission; |

|

|

(ii) |

the register of security interests maintained by the registrar under the PPSA; |

|

|

(iii) |

the registers of intellectual property maintained by IP Australia, |

five (5) Business Days before the date of this agreement.

|

|

(b) |

Without limiting clause 11.6(a), the Warrantors are not liable to the Purchaser for any Subject Claim or Liability: |

|

|

(iii) |

if the Claim arises from, or to the extent that amount of the Claim is increased as a result of, a change in the rate of Tax or the method of calculating the rate of Tax in each case after the date of this agreement but which is not actually or prospectively in force as at the date of this agreement; |

|

|

(iv) |

to the extent that the Claim arises or is increased as a result of any change in Accounting Standards after Completion; |

|

|

(v) |

if the liability for that Claim is a contingent liability, unless and until the liability is an actual liability and is due and payable; |

|

|

(vi) |

to the extent that the Liability or loss giving rise to the Claim is indirect or consequential, which for the avoidance of doubt includes any loss which is not reasonably foreseeable by the parties or amounts which are punitive or exemplary in nature; |

|

|

(vii) |

to the extent that any Liability or Claim arises or is increased by the passing of, or any change in any law, rule, decision, administrative practice or policy (including any change in any law, rule, decision, practice or policy, which takes effect retrospectively) after Completion; |

|

|

(viii) |

to the extent that the Claim arises or is increased as a result of action taken or not taken by the Warrantors at the request, and with the prior written approval, of the Purchaser; |

|

|

(ix) |

if the breach is capable of remedy and has been remedied within 15 Business Days to the reasonable satisfaction of the Purchaser. |

Execution Version

If payment is made by the Vendor for a breach of a Warranty or under an indemnity, the payment is to be treated as a reduction in the Purchase Price on a dollar-for-dollar basis.

The Purchaser must reimburse to the Vendor an amount equal to any sum paid by the Vendor in respect of any Claim or Liability which is subsequently recovered by or received by the Purchaser from any third party (including any insurer), less reasonable costs properly incurred by or on behalf of the Purchaser in connection with that payment or its recovery.

|

|

(i) |

any such Claim which may be recovered is not less than $50,000; and |

|

|

(ii) |

all such Claims which may be recovered is not less than $100,000, |

in which case the Warrantors are liable for all of the Claim.

|

|

(b) |

Clause 11.9(a) does not apply in respect of a Claim for a breach of a Tax Warranty, or a breach of Warranties 2, 3, 4, 21 or 26. |

The Warrantors have no Liability for any Claim, unless the Purchaser has given written notice of the Claim to the Warrantors on or before the date that is:

|

|

(a) |

in respect of any Claim for a breach of a Tax Warranty, or a breach of Warranties 2, 3, 4, 18, 21, 26 or 27, 6 years after the Completion Date; and |

|

|

(i) |

Earn-Out Amount calculated under this agreement; or |

|

|

(ii) |

the Initial Purchase Price. |

|

|

(b) |

Clause 11.11(a) does not apply in respect of a Claim for a breach of a Tax Warranty, or a breach of Warranties 2, 3, 4, 21 or 26. |

The provisions of clauses 11.6, 11.8, 11.9, 11.10, 11.11, and 11.14 shall not apply in circumstances where the Claim as a result of fraud or intentional misrepresentation by any of the Warrantors.

The Purchaser is not entitled to recover any Liability or obtain payment, reimbursement, restitution or indemnity more than once in respect of any one Liability, shortfall, deficiency or

Execution Version

other set of circumstances which gives rise to more than one Claim by the Purchaser under this agreement.

The Purchaser or the Company shall take commercially reasonable steps to mitigate or to cause the mitigation of any Liability or loss which it or the Company may suffer or incur and in respect of which it may have a Claim against the Vendor.

Each Warranty survives Completion and is separate and independent and not limited by reference to any other Warranty.

If, prior to Completion, the Purchaser becomes aware that any Warranty given by the Vendor is, or has become untrue, inaccurate or misleading in any material respect or that any material breach of this agreement has occurred, the Purchaser may (without prejudice to any other remedy available to it) immediately terminate this agreement by giving written notice to the Vendor.

Each party acknowledges that:

|

|

(b) |

the party has had the benefit of sophisticated legal, financial, accounting and taxation advice during the negotiation and execution of this agreement. |

|

|

(a) |

If a Warrantor is liable to pay an amount to the Purchaser or the Company pursuant to a Subject Claim and: |

then in addition to the payment by the Vendor or a Warrantor (as the case may be) of the amount pursuant to the Subject Claim, the Vendor or a Warrantor (as the case may be) must promptly pay to the Purchaser or Company or the Head Company of any Consolidated Group of which the Company is a member after Completion, as the case requires, such additional amount as is necessary to ensure that the Purchaser or Company or the Head Company of any Consolidated

Execution Version

Group of which the Company is a member after Completion, as the case requires, is compensated for the value of the Tax Relief lost, or that the net amount retained by the Purchaser or the Company or the Head Company of any Consolidated Group of which the Company is a member after Completion, as the case requires, after deduction of Tax or payment of the increased income tax, equals the amount the Purchaser or the Company or the Head Company of any Consolidated Group of which the Company is a member after Completion, as the case requires, would have retained had the Tax or increased income tax not been payable or the Tax relief not been lost.

|

|

(a) |

The Purchaser must, and must procure that the Company does, notify the Vendor within 10 Business Days of becoming aware of a Tax Claim, providing: |

|

|

(b) |

For the purpose of the notice period in clause 12.1(a), the Purchaser will only be deemed to be aware of a Tax Claim if the Purchaser is actually aware of the Tax Claim. |

Execution Version

|

|

(c) |

Where an expert is appointed: |

|

|

(i) |

the decision of the expert is to be conclusive and binding on the parties in the absence of manifest error; |

|

|

(ii) |

the Vendor and the Purchaser agree to each pay one half of the expert’s costs and expenses in connection with the reference; |

|

|

(iii) |

the expert is appointed as an expert and not as an arbitrator; and |

|

|

(iv) |

the procedures for determination are to be decided by the expert in its absolute discretion. |

|

|

(a) |

The Purchaser must, and must procure that the Company does, notify the Vendor within 10 Business Days of becoming aware of a Tax Audit, providing: |

|

|

(i) |

a description in reasonable detail of the nature of the Tax Audit; and |

|

|

(ii) |

a copy of any documents or materials issued by a Tax Authority in respect of the Tax Audit. |

|

|

(b) |

For the purpose of the notice period in clause 12.4(a), the Purchaser will only be deemed to be aware of a Tax Audit if the Purchaser is actually aware of the Tax Audit. |

|

|

(d) |

The Vendor shall not be responsible for any additional interest and/or penalties resulting from a failure by the Purchaser to comply with clause 12.4(a). |

|

|

(b) |

The Warrantors shall provide the Purchaser with all assistance and cooperation as the Purchaser may reasonably request including providing to the Purchaser documents within the possession or control of the Warrantors. |

|

|

(a) |

If a dispute arises between the Vendor and Purchaser in respect of a Tax Audit under this clause 12, then, within 21 days of a dispute arising, either the Vendor or Purchaser may refer the matter to an expert with the request that the expert make a decision on the matter as soon as practicable after receiving any submissions from the Vendor and Purchaser. |

|

|

(b) |

The expert is to be a person with over ten years' experience in Tax appointed by the Purchaser, being the person selected by the Vendor from the three potential experts nominated by the Purchaser. |

Execution Version

|

|

(i) |

the decision of the expert is to be conclusive and binding on the parties in the absence of manifest error; |

|

|

(ii) |

the Vendor and the Purchaser agree to each pay one half of the expert’s costs and expenses in connection with the reference; |

|

|

(iii) |

the expert is appointed as an expert and not as an arbitrator; and |

|

|

(iv) |

the procedures for determination are to be decided by the expert in its absolute discretion. |

|

|

(b) |

The Vendor must ensure that each Pre–Completion Return is prepared in a manner consistent with the requirements of any Tax Law. |

|

|

(i) |

access to any information and records in relation to Tax, as relevant, within the possession and control of the Purchaser; and |

|

|

(b) |

The Purchaser must ensure that each Straddle Return is prepared in a manner consistent with the requirements of any Tax Law. |

|

|

(i) |

reasonable access to any information and records in respect of the Company in relation to Tax, as relevant, within the possession and control of the Vendor; and |

|

|

(d) |

The Purchaser must deliver each Straddle Return and supporting workpapers to the Vendor within a reasonable time before it is due to be filed for the Vendor’s review and |

Execution Version

|

|

comment, and if the Vendor objects to any items set forth in the Straddle Return, the parties must attempt to resolve the dispute in good faith or failing that, refer the matter to be resolved by an expert as contemplated by clause 12.3 as if the dispute were a dispute in relation to a Tax Claim. |

The Warrantors indemnify the Purchaser and the Company:

|

|

(i) |

a matter which constitutes, or circumstances that constitute, a breach of any of the Warranties or any other covenant or representation of the Warrantors in this agreement; or |

For the avoidance of doubt, the Purchaser is entitled to bring a Claim either on an indemnity basis under this clause 14.1 or on a contractual basis for breach of a Warranty, or both, provided that the Purchaser may not, in connection with facts, matters or circumstances giving rise to a Claim, recover more than its aggregate Liabilities.

|

|

(i) |

remedy the breach giving rise to the Subject Claim, including by payment of the Subject Claim from a source other than the Purchaser’s recourse to set-off against any amounts otherwise payable to the Vendor under clause 8; or |

|

|

(ii) |

dispute the Subject Claim (or a part of it). If the Vendor disputes the Subject Claim or the amount claimed and sought to be the subject of set-off, then: |

|

|

(A) |

the Purchaser's obligation to pay the Earn-Out Amount in accordance with clauses 8 and 9 shall be suspended in relation to so much of the Earn-Out Amount which equals the amount in dispute until the dispute in relation to the Subject Claim is determined, but shall otherwise pay the balance; and |

|

|

(B) |

within 21 days of receipt of the Vendor’s written notice given under clause 14.2(b) the Vendor may refer the matter to an expert with the request that |

Execution Version

|

|

the expert make a decision on the matter as soon as practicable after receiving any submissions from the Vendor and Purchaser. The expert is to be a person with over ten years' experience in the subject matter of the dispute agreed by the Vendor and the Purchaser, or if they do not agree on the person to be appointed within seven days of one party requesting appointment, a person with the same expertise nominated by RI Chair. Where an expert is appointed: |

|

|

(I) |

the decision of the expert is to be conclusive and binding on the parties in the absence of manifest error; |

|

|

(II) |

the Vendor and the Purchaser agree to each pay one half of the expert’s costs and expenses in connection with the reference; |

|

|

(III) |

the expert is appointed as an expert and not as an arbitrator; and |

|

|

(IV) |

the procedures for determination are to be decided by the expert in its absolute discretion. |

|

|

(i) |

(pre–Completion events) any event (including a supply) occurring, or deemed under any Tax Law to occur, in relation to the activities of the Company before Completion; |

|

|

(iii) |

(deductions) the disallowance under Tax Law of an expense, loss or outgoing incurred in relation to the activities of the Company before Completion; |

|

|

(iv) |

(withholdings) any withholding required to be made or any notice required to be given under any Tax Law in relation to the activities of the Company before Completion; |

|

|

(v) |

(credits) the disallowance of a Tax credit or rebate of Tax under any Tax Law relating to a matter referred to in any of clauses 15(a)(i) to 15(a)(iv) (inclusive); |

|

|

(vi) |

(rollovers) an asset of the Company having been before Completion the subject of a claim for rollover relief under any Tax Law; |

|

|

(viii) |

(GST) any supply, transaction, acquisition or importation which has been made or deemed to have been made or attributed to the Company at any time on or before Completion; and |

|

|

(ix) |

(GST group liabilities) any liability incurred by a Company, as a member or representative of a GST group, of which the Company was a member at any time before Completion. |

Execution Version

|

|

(b) |

The Warrantors will not be liable for a Tax Subject Claim to the extent that the Tax Subject Claim: |

|

|

(i) |

relates to a Tax Liability for which adequate provision has been made in the Accounts or the Completion Accounts; |

|

|

(ii) |

arises from any action or omission by the Vendor in accordance with the terms of this agreement, or the prior written approval, consent or agreement of the Purchaser; |

|

|

(iii) |

arises out of or in respect of an increase in the rate of Tax after the date of this agreement; |

|

|

(v) |

arises from any election or choice made by the Company in relation to Tax, on or after Completion; |

|

|

(vi) |

would not have arisen but for any change in ownership of the Company or other restructure of the Business on or after Completion and not otherwise the subject of this agreement or any change in the accounting policy or practice of the Company after Completion; or |

|

|

(vii) |

arises out of the cessation or alteration of the Business after Completion. |

In this clause 16:

engage in means to carry on or prepare to carry on, participate in, provide finance or services, or otherwise be directly or indirectly involved whether solely or jointly with any other person, and whether as a shareholder, unitholder, director, consultant, adviser, contractor, principal, agent, manager, employee, beneficiary, partner, associate, trustee or financier.

Each Warrantor undertakes to the Purchaser (for itself, and as trustee for the Company) that it will not, and it shall cause and ensure that its Prohibited Persons do not, directly or indirectly:

|

|

(iii) |

using deceptively similar logos, trademarks and/or business names as those used by the Business; or |

Execution Version

|

|

(e) |

attempt, counsel, procure or otherwise assist any person to do any of the acts referred to in this clause 16.2. |

The undertakings in clause 16.2 begin on the Completion Date and end on:

The undertakings in clause 16.2 apply only if the activity prohibited by clause 16.2 occurs:

|

|

(a) |

anywhere in the world, or if that area is held to be unenforceable; |

|

|

(c) |

within Europe, Asia, Africa, North America, South America and Oceania, or if that area is held to be unenforceable; |

|

|

(g) |

within Australia and New Zealand, or if that area is held to be unenforceable; |

|

|

(h) |

within Australia, or if that area is held to be unenforceable; |

|

|

(i) |

South Australia. |

Clauses 16.2, 16.3 and 16.4 have effect together as if they consisted of separate provisions, each being severable from the other. Each separate provision results from combining each undertaking in clause 16.2, with each period in clause 16.3, and combining each of those combinations with each area in clause 16.4. If any of those separate provisions is invalid or unenforceable for any reason, the invalidity or unenforceability does not affect the validity or enforceability of any of the other separate provisions or other combinations of the separate provisions of clauses 16.2, 16.3 and 16.4.

Execution Version

This clause 16 does not restrict a Prohibited Person from:

|

|

(c) |

undertaking a prohibited activity with the prior written approval of the Company. |

Each Warrantor acknowledges that:

|

|

(a) |

the prohibitions and restrictions agreed in this clause 16 are material to the Purchaser's decision to enter into this agreement; |

Each Warrantor, jointly and severally, in respect of itself and its Prohibited Persons indemnifies the Purchaser (for itself, and as trustee for the Company) against all loss which may be made, brought against, suffered or incurred by the Purchaser or the Company, and which arises directly or indirectly out of or in connection with any breach of the covenants given in clause 16.2 by the Warrantor, whether or not the loss was within the parties' reasonable contemplation as at the date of this agreement.

A party must not make or authorise a press release or public announcement relating to the negotiations of the parties or the subject matter or provisions of this agreement unless it has the prior written approval of the Purchaser and the Vendor. Notwithstanding the foregoing, Vendor acknowledges and agrees that:

Execution Version

|

|

(b) |

it will not trade (whether by buying or selling) in any securities of the Parent Company after it receives any such material non-public information of the Parent Company. |

|

|

(i) |

must keep confidential any confidential information of the Purchaser and, following Completion, all Confidential Information; and |

|

|

(ii) |

may disclose any confidential information in respect of which that Warrantor has an obligation of confidentiality under clause 17.2(a)(i) only: |

|

|

(B) |

if required (in the written opinion of outside counsel) to do so by law; or |

|

|

(b) |

The provisions of clause 17.2(a) apply in respect of confidential information (including Confidential Information) for five years following Completion. |

In this clause 18, a word or expression defined in the A New Tax System (Goods and Services Tax) Act 1999 (Cth) has the meaning given to it in that Act.

If a party makes a supply under or in connection with this agreement in respect of which GST is payable, the consideration for the supply but for the application of this clause 18.2 (GST exclusive consideration) is increased by an amount equal to the GST exclusive consideration multiplied by the rate of GST prevailing at the time the supply is made.

If a party must reimburse or indemnify another party for a loss, cost or expense, the amount to be reimbursed or indemnified is first reduced by any input tax credit the other party is entitled to for the loss, cost or expense, and then increased in accordance with clause 18.2.

A party need not make a payment for a taxable supply made under or in connection with this agreement until it receives a tax invoice for the supply to which the payment relates.

The Vendor holds the benefit of each indemnity, promise and obligation in this agreement that benefits it, any of its Associates or Representatives or any Representatives of its Associates on its own behalf and on trust for each of those persons.

Execution Version

The Purchaser holds the benefit of each indemnity, promise and obligation in this agreement that benefits it, any of its Associates or Representatives or any Representatives of its Associates on its own behalf and on trust for each of those persons.

A notice, demand, consent, approval or communication under this agreement (Notice) must be:

|

|

(b) |

hand delivered or sent by prepaid post, facsimile or email to the recipient's address for Notices specified in the Details, as varied by any Notice given by the recipient to the sender. |

A Notice given in accordance with clause 20.1 takes effect when taken to be received (or at a later time specified in it), and is taken to be received:

|

|

(a) |

if hand delivered, on delivery; |

|

|

(b) |

if sent by prepaid post, the seventh Business Day after the date of posting (or the tenth Business Day after the date of posting if posted to or from a place outside Australia); |

|

|

(d) |

if sent by email, when sent by the sender unless the sender receives a delivery failure notification indicating that the email has not been delivered to the addressee, |

but if the delivery, receipt or transmission is not on a Business Day or is after 5.00pm on a Business Day at the place of receipt, the Notice is taken to be received at 9.00am on the next Business Day.

This agreement may be altered only in writing signed by each party.

Except where this agreement expressly states otherwise, a party may, in its discretion, give conditionally or unconditionally or withhold any approval or consent under this agreement.

A party may only assign this agreement or a right under this agreement with the prior written consent of each other party.

Each party must pay its own costs of negotiating, preparing and executing this agreement.

Execution Version

Any stamp duty, duties or other taxes of a similar nature (including fines, penalties and interest) in connection with this agreement or any transaction contemplated by this agreement, must be paid by the Purchaser.

Any obligation of confidence under this agreement is independent and survives termination of this agreement. Any other term by its nature intended to survive termination of this agreement survives termination of this agreement.

Each indemnity undertaken by any party pursuant to this agreement:

|

|

(b) |

is separate and independent and not limited by reference to any other indemnity or obligation under this agreement or any other document or agreement; |

|

|

(c) |

does not require the party with the benefit of the indemnity to have actually made a payment before making a demand under the indemnity; and |

This agreement may be executed in counterparts. All executed counterparts constitute one document. A counterpart may be a facsimile, pdf or other electronic form.

The rights and obligations of the parties under this agreement do not merge on completion of any transaction contemplated by this agreement.

This agreement together with the other Transaction Documents constitutes the entire agreement between the parties in connection with its subject matter and supersedes all previous agreements or understandings between the parties in connection with its subject matter.

Each party must do, at its own expense, everything reasonably necessary (including executing documents) to give full effect to this agreement and any transactions contemplated by it.

A term or part of a term of this agreement that is illegal or unenforceable may be severed from this agreement and the remaining terms or parts of the term of this agreement continue in force.

A party does not waive a right, power or remedy if it fails to exercise or delays in exercising the right, power or remedy. A single or partial exercise of a right, power or remedy does not prevent another or further exercise of that or another right, power or remedy. A waiver of a right, power or remedy must be in writing and signed by the party giving the waiver.

Execution Version

Except where this agreement expressly states otherwise, it does not create a relationship of employment, trust, agency or partnership between the parties.

This agreement is governed by the law of South Australia and each party irrevocably and unconditionally submits to the non‑exclusive jurisdiction of the courts of South Australia.

Execution Version

Schedule 1 - Particulars of Vendor's shareholding in the Company

|

Shares |

Beneficial Party |

% of total share capital |

|

|

1 fully paid ordinary share |

Ann Elizabeth Damin |

100% |

Execution Version

Schedule 2 - Details of the Company (clause 1.1)

|

Pasture Genetics Pty Ltd |

|

|

ABN |

33 074 290 252 |

|

C/- Moore Stephens (SA) Pty Ltd |

|

|

6 June 1996 |

|

|

1 fully paid ordinary share, beneficially owned and paid up as set out Schedule 1. |

|

|

Ann Elizabeth Damin |

|

|

Ann Elizabeth Damin |

Execution Version

Schedule 3 - Business Vehicles Loans

|

Plate Number |

Vehicle Description |

Contract Number |

Expiry Date |

Total Liability Balance as at 31 January 2020 |

|

S597BOA |

Toyota Rav 4 |

13055576 |

20 August 2019 |

0.00 |

|

S979BRR |

Toyota Hi Lux |

13118286 |

25 June 2020 |

25,347.87 |

|

S994BRR |

Toyota Hi Lux |

13118297 |

25 June 2020 |

25,952.71 |

|

S997BRR |

Toyota Hi Lux |

13118295 |

25 June 2020 |

25,392.22 |

|

S998BRR |

Toyota Hi Lux |

13118291 |

25 June 2020 |

26,099.78 |

|

S505BTE |

Toyota Hi Lux |

13153889 |

13 October 2020 |

31,920.99 |

|

PST |

Poncho Seed Treater |

AAU1413177 |

1 March 2021 |

71,447.59 |

|

S420BVD |

Toyota Hi Lux |

13203386 |

18 March 2021 |

32,658.49 |

|

S629BVD |

Toyota Prado |

13238069 |

20 July 2021 |

42,451.81 |

|

S630BVD |

Toyota Rugged X |

13238070 |

20 July 2021 |

42,229.84 |

|

S373BWF |

Toyota Landcruiser |

13281783 |

07 December 2021 |

63,562.81 |

|

SB03MD |

Isuzu Truck |

13048226 |

15 December 2021 |

85,972.91 |

|

S047BVC |

Toyota Landcruiser |

13201351 |

05 March 2022 |

93,000.07 |

|

S325CAT |

Toyota Hi Lux |

13353400 |

10 June 2022 |

51,790.33 |

|

S326CAT |

Toyota Hi Lux |

13353284 |

10 June 2022 |

58,070.76 |

|

S347CAT |

Toyota Hi Lux |

13355540 |

18 June 2022 |

51,770.41 |

|

S348CAT |

Toyota Hi Lux |

13355538 |

18/06/2022 |

48,430.82 |

|

XA091P |

Land Rover Discovery |

13362611 |

19/08/2022 |

102,364.68 |

|

S685CBB |

Toyota Hi Lux |

13361426 |

05/08/2022 |

58,338.72 |

|

TOTAL |

936,802.80 |

|||

Execution Version

Schedule 4 - Officers and Key Employees (clause 6.2)

|

1. |

Officers |

|

Outgoing Secretary |

Incoming Director |

Incoming Secretary |

|

|

Ann Elizabeth Damin |

To be notified |

To be notified |

Lucy Damin

Tom Damin

Execution Version

Schedule 5 – Adjustment to Purchase Price/Earn-Out – (clauses 7 and 8)

All calculations must be determined in a manner consistent with the Accounting Standards. This includes that the Accounts have been prepared as special purpose accounts and not general purpose accounts.

The Earn-Out Amount shall be adjusted by the Adjustment Amount determined as follows.

In the event that at Completion (as reflected in the final Completion Accounts) the sum of:

|

|

(a) |

the Company's accounts receivable balance (net of any allowance for doubtful accounts); and |

|

|

(b) |

the value of the Company’s Stock, |

is less than 105% of the sum of:

|

|

(c) |

the full amount outstanding under the Company Revolver; and |

|

|

(d) |

the Company’s accounts payable balance in respect of all accounts related to the acquisition of Stock, |

then the Earn-Out Amount is to be decreased by the same amount as the shortfall. For the purpose of calculating the Company's accounts receivable balance, any sales between Completion and 29 February 2020 are to be included.

|

|

(a) |

Stocktake |

For the purposes of determining the value of Stock in calculating the amount of any Adjustment Amount, the Purchaser, with the Vendor's Representative present, shall undertake a stocktake as at the day before Completion as follows:

|

|

i. |

the Purchaser must conduct the stocktake and the Vendor must allow the Purchaser and its Representatives to be present at the stocktake; |

|

|

1. |

items of Stock will be valued at the lesser of invoiced landed cost (net of rebates) and net realisable value; |

|

|

2. |

items of Stock which are raw materials or finished goods with a shelf life in excess of industry standard for the particular item will be valued at nil; |

|

|

3. |

items of Stock which are obsolete, faulty or damaged or cannot be repackaged will be valued at nil; |

|

|

4. |

items of packaging material and other consumables which cannot be used within 18 months (based on current stock usage rates) will be valued at nil; and |

Execution Version