Attached files

| file | filename |

|---|---|

| EX-32.1 - Wiseman Global Ltd | ex32-1.htm |

| EX-31.1 - Wiseman Global Ltd | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

[X] Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2019

[ ] Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from __________ to __________

Commission file number: 333-228130

WISEMAN GLOBAL LIMITED

(Exact name of small business issuer as specified in its charter)

| Nevada | 5731 | 32-0576335 | ||

| (State

or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Number) |

(IRS Employer Identification Number) |

1702, Block B, Wisdom Plaza, No. 4068, Qiaoxiang Road, Shahe Street, Nanshan District

Shenzhen City, Guangdong, People’s Republic of China, 518000

(Address of principal executive offices and Zip Code)

+ (86) 755 8489 9169

(Registrant’s telephone number, including area code)

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock | WISM | OTC Market |

Securities registered under Section 12(b) of the Exchange Act

None

Securities registered under Section 12(g) of the Exchange Act

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company, “and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | (Do not check if a smaller reporting company) | Smaller reporting company [X] |

| Emerging growth company [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of the 54,900,000 shares of common equity stock held by non-affiliates of the Registrant was approximately $4.50 on the last business day of the Registrant’s most recently completed first fiscal quarter, based on the last sale price of the registrant’s common stock on such date of $4.50 per share.

The number of shares outstanding of the Registrant’s common stock as of March 31, 2020 was 102,400,000.

TABLE OF CONTENTS

| 2 |

Forward-looking statements

Statements made in this Form 10-K that are not historical or current facts are “forward-looking statements” made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933 (the “Act”) and Section 21E of the Securities Exchange Act of 1934. These statements often can be identified by the use of terms such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” “approximate” or “continue,” or the negative thereof. We intend that such forward-looking statements be subject to the safe harbors for such statements. We wish to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Any forward-looking statements represent management’s best judgment as to what may occur in the future. However, forward-looking statements are subject to risks, uncertainties and important factors beyond our control that could cause actual results and events to differ materially from historical results of operations and events and those presently anticipated or projected. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statement or to reflect the occurrence of anticipated or unanticipated events.

Financial information contained in this report and in our financial statements is stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

Overview

We are a household appliances and related domestic appliances products company in the PRC. Our principal business activity is the provision of household appliances products and related domestic appliances products. Our products improve the home lifestyle and living solutions experience, predominately through power savings, resources efficiencies and functionalities of products. We sell our products to corporate customers, retail customers and independent distributors predominately in the PRC and intend to expand our business in other countries around the world. Our products are typically used in a home setting of consumers of all demographics on a daily basis and meet the convenience-oriented preferences of today’s consumer across a broad range of household activities. We help make daily life easier through a broad range of products that offer multi-purpose functions. Our diverse product portfolio includes televisions, air-conditioners, laundry appliances, refrigerators and freezers, cooking appliances, dishwashers, mixers and other small domestic appliances. Our products are known for their quality, which is recognized by our consumers, retail customers, and corporate customers alike. We believe our customers know they can rely on our trusted brand. These factors generate loyalty which empowers us to develop and launch new products that expand application scenarios and transforms our product portfolio into the smart household appliances category.

Our business has three main divisions and revenue streams, namely, (i) sales of household appliances and related domestic appliances products, (ii) consultancy, and (iii) integration and installation services. Virtually all of our products are manufactured by independent original equipment manufacturers (“OEMs”) in the PRC. For the year ended December 31, 2019, our revenue was $5.5 million, and our gross profit was approximately $1.7 million. For the year ended December 31, 2018, our revenue was $5,084, and our gross profit was approximately $796. We conduct our business through Shenzhen Wiseman Smart Industrial Co., Limited and its subsidiaries which are founded in the PRC and our Hong Kong subsidiary, Wiseman Global Limited (“Wiseman HK”).

Our Strategies

We have achieved rapid growth since our inception in 2018. While making significant long-term investments in human capital, research and development, brand-building, and distribution. Our continued investment in and expansion of the Wiseman brand, distribution, and product offerings will further increase opportunities to acquire new customers and expand relationships with our existing customer base.

We believe we are creating a meaningful future customer asset. As of December 31, 2019, approximately 26% of customers who have purchased at least once since Wiseman’s inception in 2018 have made repeat purchases. This demonstrates that customers are returning to Wiseman to expand the number of products they own, not merely to replace them. We expect this rate to grow further as we expand our product offerings and increase our brand awareness.

| 3 |

Increase brand awareness and equity to acquire new customers.

Increasing brand awareness and growing favorable brand equity among consumers has been, and remains, central to our growth. We believe brand familiarity and preference will continue to have a significant role in winning customers and the decision to buy household appliances and related domestic appliances products.

Our investment in marketing initiatives from December 31, 2018 to December 31, 2019 totaled $59,161. We drive brand awareness through a combination of sophisticated, multi-layered marketing programs, word-of-mouth referrals, product showcase in our Shenzhen showroom, retail placement expansion, and ongoing product usage. A core principle of our brand growth strategy is offering customers increased ways to engage with our products through increased distributions to authorized distributors and retail stores and integration of our products with renovation companies’ and construction contractors’ projects.

Expand network of retail stores placements and authorized distributors.

We complement our online presence by expanding our physical retail stores placements to deliver additional consumer touchpoints and increase sales and margin. A greater retail stores placements presence helps us to not only increase consumer awareness and education, but also to offer convenient products showcase, multiple purchase options, and flexibility in delivery. As of December 31, 2019, our products were (i) placed in over 5 retail stores; (ii) supplied to 10 domestic distributors and 1 overseas distributor; and (iii) supplied to 2 authorized distributors.

We plan to continue the introduce Wiseman products into more retail stores in order to strengthen our footprint in the PRC, while selectively entering into new international markets. We believe that our current growth strategy is cost efficient and allows us to scale faster in the retail sector in the PRC and we believe there is a significant opportunity for us to further expand our retail stores presence through retail stores placement.

Expand domestically and internationally.

We intend to increase the brand awareness of our products in the PRC and overseas markets by means of marketing and increase the number of authorized distributors and distributors. Our efforts to enhance our brand recognition will also go beyond marketing activities to establish our own brand eventually as a comprehensive smart household appliances brand with increasing diverse products and service offerings. For example, as part of our smart household ecosystem initiative, we plan to introduce our branded “Wiseman Home System” in fourth quarter of 2020 which will connect most of the Wiseman household appliances and allow a user to control Wiseman household appliances remotely through an application developed by our Company.

Currently, our household appliances products are predominately sold in the PRC. We also sell our household appliances products to overseas customers in Cambodia and Hong Kong. For example, in Cambodia we sell our products through a distribution channel. With the establishment of our Cambodia office in 2019, due to its proximity to the Southeast Asian markets, we will be able to expand our business into the Vietnam and Thailand markets. We intend to replicate the rapid expansion we have achieved in the PRC by establishing relationships with established third-party overseas distributors and through retail stores placements as part of marketing and brand promotion efforts. We will also consider to collaborate with other local partners in overseas markets where it would be efficient to do so.

Strengthen our in-house research and development to adapt to changes in technology.

We must keep up with technological developments in order to stay ahead of our competitors. As such, we will continue to strengthen our research and development, and apply various new home technologies and product solutions to further develop the next generation smart household appliances ecosystem with our products. As part of our smart household ecosystem initiative in fourth quarter of 2020, we will also continue to develop our Wiseman Home System to enhance its (i) connectivity of our products; (ii) information distribution, data analysis and processing; and (iii) visualization capabilities of the system to enable our products to be centrally monitored and managed remotely, in order to adapt to different needs and conditions more efficiently.

| 4 |

Based on our current scale, we have a professional research and development team led by our top researcher, Mr. Xiao Zhengwen (“Mr. Xiao”), who has over 10 years of experience in household appliances industry and smart hardware development, software and platform development.

Our Strengths

We believe the following competitive strengths contribute to our success and differentiate us from our competitors:

Experienced management team with track record of success.

Our experienced management team has been essential in driving the growth of our business. Our founder, executive Director and Chief Executive Officer, Mr. Lai Jinpeng, and our executive Director and Chairperson, Ms. Yang Lin, have delivered growing business results by leveraging upon their 15 and 14 years of managerial experience, respectively, in diverse industries. By leveraging on the extensive networks that Mr. Lai and Ms. Yang developed while they were working in the household appliances industry prior to their roles with the Company, we believe these networks can provide valuable future business opportunities for the Company.

We offer comprehensive products offerings with multi-purpose functions and resources efficiencies.

Product innovations and excellence lie at the heart of our business. We offer innovative household appliances products for households and businesses including televisions, air-conditioners, laundry appliances, refrigerators and freezers, cooking appliances, dishwashers, mixers and other small domestic appliances. Our products suits modern lifestyle by offering functions and features, including but not limited to voice control, energy efficient, thermostat sensor and space saving. We will continue to adapt the functions of our products based on the consumers’ demands. Further, the majority of the products that we sell are products that satisfy the standards and technical requirements under certificate for China compulsory product certification. Through multi-purpose functions that we can offer and the resources efficiencies that we are able to achieve, we believe our products are able to improve users’ home lifestyle and living solutions experience. We intend to continuously develop new and/or improve existing functionalities and resources efficiencies benefits in order to stay competitive in the PRC household appliances industry.

Broaden application scenarios and build our ecosystem.

We intend to explore more application scenarios for our products and to further diversify our product portfolio to build our Wiseman smart household appliances ecosystem in order to attract the growing middle class consumers. For example, as part of our smart household ecosystem initiative, we plan to introduce our branded “Wiseman Home System” in fourth quarter of 2020 which will connect most of the Wiseman household appliances and allow a user to control Wiseman household appliances remotely through an application developed by our Company. Further, we also intend to partner with a wide range of hotels, renovation companies and construction contractors to create and to introduce a Wiseman ecosystem in hotels, shopping mall and restaurants.

Our Business

Our principal business activity is the provision of household appliances products and related domestic appliances products. We sell our products to corporate customers, retail customers and independent distributors predominately in the PRC and other countries around the world. Our business has three main divisions and revenue streams, namely, (i) sales of household appliances and related domestic appliances products, (ii) consultancy, and (iii) integration and installation services.

| 5 |

Sales of Household Appliances and Related Domestic Appliances Products

We source a wide range of household appliances and related domestic appliances products for our sales orders. Our product portfolio primarily consists of 4 major household appliances products and 6 related domestic appliances products. The following is a list of our best-selling major household appliances products:

| ● | Televisions |

Wiseman ultra-thin organic light emitting diodes (“OLED”) television model number 55B8 PCA (the “Wiseman TV”):

Key features:

| Internet capabilities. Allows users to have broadband internet access capability through the Wiseman TV, and thus, users can receive and play back various videos, music and other data streams from the internet. Users can also download and access various specially developed applications, including games. | ||

| 1. | New television accessory and multifunction capabilities. The Wiseman TV is equipped with a brand new remote control feature and can interact with mobile devices such as mobile phone and tablet. | |

| 2. | Voice control. Allows users interact and control the Wiseman TV through natural speech recognition. |

approximate price range $256 to $6,085.

| ● | Air-conditioners |

Wiseman air conditioner with smart voice control model number KFR-35GW (the “Wiseman Air-Conditioner”):

| 6 |

Key features:

| Voice control. Allows users interact and control the Wiseman Air-Conditioner through natural speech recognition. | ||

| 1. | Far Field Recognition. Allows users to directly interact with the Wiseman Air-Conditioner through voice control within 5 meters without a handheld microphone or a remote control. | |

| 2. | Super-resolution infrared sensors. Allows the Wiseman Air-Conditioner to sense the human body temperature and can automatically adjust the wind speed and the output temperature. | |

| 3. | Big data storage. Allows the Wiseman Air-Conditioner to store big data in its database. Through the operation of big data, it helps users monitor the operation status of air-conditioner and allows for personalization and diversification of air-conditioning services. |

approximate price range $140 to $1,130.

| ● | Laundry appliances |

Wiseman washing machine model number WD-VH451D55 (the “Wiseman Washing Machine”):

Key features:

Smart controls. The Wiseman Washing Machine is equipped with six precise smart controls, (i) water temperature smart control; (ii) washing foam smart control; (iii) temperature smart control; (iv) 3D smart control; (v) unbalanced smart control; and (vi) cloth smart control.

These controls assist the Wiseman Washing Machine to automatically sense the water level, the amount of foam, the temperature level, and the weight of the clothes. | ||

| 1. | Smart adjustments. Through the smart controls features, the Wiseman Washing Machine can adjust the running speed in time, optimize the current status of washing to synchronize with optimal washing water level, prevent excessive vibration and noise reduction. |

approximate price range $101 to $2,257.

| 7 |

| ● | Refrigerators and freezers |

Wiseman refrigerator model number GR-M2471NQA (the “Wiseman Refrigerator”):

Key features:

Smart sensors. Allows the Wiseman Refrigerator to automatically sense the refrigerated items or ingredients stored in each shelve or compartment and adjust the humidity level* accordingly. This will provide longer shelve life and freshness of refrigerated items or ingredients.

* There are three levels of humidity: high humidity, middle humidity and low humidity. | ||

| 1. | Odor Purification. The Wiseman Refrigerator is equipped with an odor purification device to absorb the impurities and odors in each of its compartments and shelves and decompose them into water and carbon dioxide in order to remove the impurities and odors and keep the air in the refrigerator fresh. | |

| 2. | Smart sterilization. The Wiseman Refrigerator is equipped with a smart sterilization system to circulate sterilization positive and negative ions to provide real-time odor sterilization. The Wiseman Refrigerator is also equipped with a LED real-time display to illustrate the sterilization progress. |

approximate price range $144 to $3,173.

| 8 |

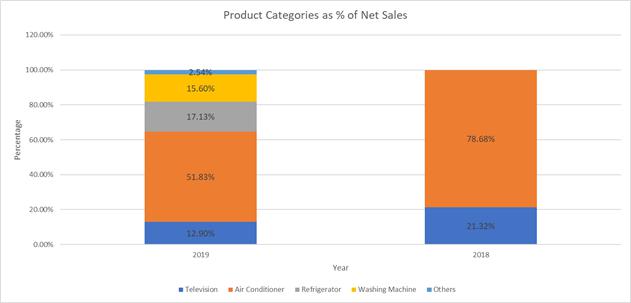

The following chart provides the percentage of net sales for each of our product categories which accounted for 10% or more of our consolidated net sales over the last two years:

We sell the majority of our products, with or without customization, under our brand name “Wiseman”, to domestic customers in the PRC, and to overseas customers in Cambodia and Hong Kong. We intend to expand our business in other countries around the world. Our customers are primarily corporate enterprises and retail customers. While we sell the majority of our household appliances and related domestic appliances products under our “Wiseman” brand name, we do not operate any production facilities. We source our branded household appliances and related domestic appliances products from OEMs certified by us. For details of our contracting arrangement and quality control of our OEMs, please refer to the sections headed “Our Suppliers and OEMs” and “Quality Control.”

Consultancy

Based on our expertise and know-how on operations, we provide advice on the integration and installation of our household appliances products and related domestic appliances products to our corporate customers in respect of hotels, shopping malls and/or restaurants settings. Some of these advice includes floor layout design and input, kitchen design and input, integration application etc. Further, we also provide advice to our distributors on product distributions in retail stores. We receive consultancy fees based on the complexity and workload on the projects.

Integration and Installation Services

As part of our income diversification strategy, we are actively increasing our revenue opportunities in the integration and installation services. We believe the provision of integration and installation services as an after-sales service can supplement our business. Our services involve the installation of our household appliances products and related domestic appliance products into a designated environment to provide better living solutions and/or to create a smart household ecosystem. We have a labor team for our integration and installation services. However, in the future, depending on the size and complexity of a service project, we may engage subcontractor for a service project for internal resources efficiency and cost efficiency reasons.

Our Customers (Including Authorized Distributors)

Our customers in the PRC are primarily corporate customers and retail customers. In addition, we sell our household appliances products and other products to overseas markets such as Cambodia and Hong Kong.

| 9 |

As at December 31, 2019, the Company has 10 domestic distributors, 1 overseas distributor, and has entered into 2 domestic authorized distribution contracts. Our distributors and authorized distributors distribute our products in their retail stores network or distribution networks.

Further, we charge fee for integration and installation services to our customers, in particular hotels, renovation companies, construction contractors, to provide integration and installation services of our products in hotel, shopping mall and/or restaurants owned by our corporate customers. Billings to the customers are generally based on the complexity and workload on the projects. The integration and installation services contracts typically include a single performance obligation.

Our Suppliers and OEMs

We are generally not dependent upon any one source for our household appliances and related domestic appliances products essential to our business. We source our household appliances and related domestic appliances products for our sales orders and sell the majority of them under our brand name “Wiseman.” We do not maintain any facilities to produce our products. We source and outsource the production of our products from and to OEMs certified by us.

We typically seek quotations from our OEMs and other suppliers when we receive a sales order from existing and prospective customers. After we enter into contracts with customers and obtain the specifications and/or functionalities required by our customers, we confirm the orders with our OEMs that possess products with the relevant specifications and/or functionalities and purchase the products.

We have a labor team for our integration and installation services. However, depending on the size and complexity of a service project, we may engage subcontractor for a service project. In that case, we are accountable to our customers for the work performed on an integration and installation services project, including those carried out by our subcontractors. In order to manage our subcontractors, our current labor team for our integration and installation services will work as the in-house project management personnel to supervise the on-site work of our subcontractors. To date, we have not entered into any agreement with any subcontractor.

Distribution

We utilize two routes of distribution to deliver our products to our corporate customers and retail customers. In many cases, we ship directly from our third-party OEMs to our corporate customers. We typically order products from our OEMs and other suppliers after we receive sales order from our customers, this enable us to optimize truckloads and reduce inventory level for all of our product categories. We normally deliver our products to our retail customer upon request or they choose to pick up the product from our storeroom or show room.

Research and Development

We believe our future success depends on our ability to develop our brand into a comprehensive smart household appliances brand with increasing diverse products and service offerings. Our research and development team and our management team co-lead the products development processes. We take a user centric approach to product development. Our research and development team has responded effectively to technological changes, and is driving continued innovation to unleash the potential of the household appliances industry. We are currently in the process of seeking for a prospective company to form a research and development partnership to further develop our Wiseman Home System in order to reduce our research and development cost.

Based on our current scale, we have a professional research and development team led by our top researcher, Mr Xiao whom has over 10 years of experience in household appliances industry and smart hardware development, software and platform development. Our research and development team is primarily based at our headquarters in Shenzhen, PRC. To date, the research and development cost is insignificant.

| 10 |

Seasonality

Our operating results may vary significantly from period to period due to many factors, including seasonal factors that may have an effect on the demand for our products. While seasonality has not been particularly prevalent in our historical results of operations due to the rapid growth of our business, we generally expect to experience higher sales in the second and fourth quarters of each year, primarily attributable to the major shopping festivals across online e-commerce platforms such as “618,” “Singles’ Day” and “Double Twelve,” which are highly popular among Chinese consumers.

Competition

We operate across the household appliances economy, including in the television, air-conditioner, laundry appliance, refrigerator and freezer, cooking appliance, dishwasher, mixer and other small domestic appliances industries. We compete primarily on brand awareness, product quality and breadth, price, and product performance. In general, we compete in a diverse and fragmented market of household appliances retail chains and online retailers in the PRC such as Shenzhen Yitoa Intelligent Control Co. Ltd., a company listed on the Shenzhen Stock Exchange (Shenzhen Stock Exchange, 300131), Guangdong Anjubao Digital Technology Co. Ltd., a company listed on the Shenzhen Stock Exchange (Shenzhen Stock Exchange, 300155), Aishida Co. Ltd., a company listed on the Shenzhen Stock Exchange (Shenzhen Stock Exchange, 002403), and Town Ray Holdings Limited, a company listed on the Hong Kong Stock Exchange (Hong Kong Stock Exchange, 1692). Moreover, our customer base includes large, sophisticated trade customers who have many choices and demand competitive products, services and prices. We believe that we can best compete in the current environment by focusing on introducing new and innovative products, building our brand awareness, improving product quality and breadth, product performance, offering a competitive price, lowering costs, and taking other efficiency-enhancing measures.

Quality Control

We carefully select our OEMs and other suppliers. We also closely monitor the production by our OEMs and other suppliers. We have developed an evaluation system to assess our OEMs and other suppliers regularly based on a set of parameters, such as product quality and timeliness of delivery. We maintain an internal list of approved OEMs and other suppliers. We obtain quotations from different OEMs for each sales order and select them by taking into account the functionalities of products, their track record, scale of operation, product quality, reputation and price. Upon completion of a sales order, we conduct an evaluation and performance review for our future reference by our quality control and research and development personnel.

Sales and Marketing

Our procurement, sales and marketing team is comprised of 4 employees and they are responsible for procurement, sales, marketing and customer service. In search for prospective customers, we actively invest in driving traffic to our e-commerce website, marketing our products to consumers and building our brand. Further, we leased a showroom in Shenzhen, PRC to exhibit and promote our products to existing and prospective customers which in turn may create more business opportunities and further strengthen the corporate image. We did not incur any sales and marketing expenses for the year ended December 31, 2018. We incurred sales and marketing expenses as a percentage of sales revenue of 1% for the year ended December 31, 2019. We believe the increase in sale and marketing expenses contributed to our revenue growth in 2019 and we will continue to invest more in 2020. This improvement reflects more efficient marketing returns as Wiseman expands its product offerings in existing and new categories, increased customer awareness, a higher returning customer mix, growth in our distribution partnership and retail placements by distributors and more effective marketing models as we continue to improve our understanding of our customers.

Employees

As of March 31, 2020, we had 17 employees (excluding our Directors). The following table sets forth the number of employees by function:

| Function | Number of employees | |||

| Procurement, Sales and marketing | 4 | |||

| Quality control and research and development | 7 | |||

| Management, human resources and other administration | 4 | |||

| Finance and accounting | 2 | |||

| Total | 17 | |||

| 11 |

Properties

Our corporate headquarters, which is located in Shenzhen, PRC, is a leased property of approximately 150 square meters. In addition, we currently lease 5 properties, ranging from approximately 150 to 2,300 square meters, in Shenzhen, PRC and Cambodia, which primarily carry out the function of a showroom, storage room and an overseas representative office, respectively.

We lease all of our facilities and do not own any real property. Our leases will expire from 2020 to 2024. We believe that our current facilities are suitable and adequate to meet our current needs. If we require additional space, we expect to obtain additional facilities on commercially reasonable terms.

Inventory

We generally maintain limited inventory of our products. We order products for our orders on an as-needed basis. Where our products are ordered by our customers, we place orders with our OEMs upon receipt of orders from our customers. Occasionally, we order extra inventory for the best-selling products if we expect a higher demand from potential customers.

Intellectual Property

We consider trademarks, patents and copyrights to protect our intellectual property rights critical to our success. We are the registered owner of 1 trademark in Hong Kong. We are the registered owner of 10 computer software copyrights in the PRC. We are currently in the process of transferring an additional 9 trademarks from Shenzhen Wiseman Smart Technology Group Co., Limited, which is owned 66% by our chief executive officer and Director, Mr. Lai Jinpeng. We have recently discussed with Mr. Xiao to acquire his 7 patents in the PRC as we see strategic benefits in incorporating these patents into our Wiseman Home System. We are also the registered owner of one domain name, namely “wisemanglobal.cn.”

Insurance

We purchase pension insurance for our employees and general commercial insurance for our workers pursuant to relevant PRC laws and regulations. We do not have any third-party liability insurance to cover claims in respect of personal injury or property or environmental damage arising from accidents on our property or relating to our operations. Such insurance is not mandatory according to the laws and regulations of the PRC. We believe this practice is consistent with customary subcontracting industry standards adopted by other project management operators in the PRC. As part of our strategy, if we engage subcontractors to work on our integration and installation services projects, we will require them to purchase insurance for our projects. As at December 31, 2019, we have not engaged with any subcontractor.

Warranty

We generally provide a standard warranty for our products. The warranty period is typically 12 months upon delivery and inspection of the products in accordance with PRC national warranty standard. Our warranty includes the repair works for the non-functional products, and the costs of the component parts are not included in our warranty. The determination of our warranty requirements is based on actual historical experience. To date, we have not incurred a material warranty expense on any products. However, as a policy, provisions for warranty liability will be made during the period in which a provision for warranty liability becomes probable and can be reasonably estimated. We consider the cost of the repair work is immaterial, as such, there is no provision for warranty liability made for during the warranty period.

| 12 |

Legal Proceedings

We are not subjected to nor engaged in any litigation, arbitration or claim of material importance, and no litigation, arbitration or claim of material importance is known to us to be pending or threatened by or against our Company that would have a material adverse effect on our Company’s results of operations or financial condition.

You should carefully consider the risks described below and elsewhere in this prospectus, which could materially and adversely affect our business, results of operations or financial condition. Our business faces significant risks and the risks described below may not be the only risks we face. Additional risks not presently known to us or that we currently believe are immaterial may materially affect our business, results of operations, or financial condition. If any of these risks occur, the trading price of our common stock could decline, and you may lose all or part of your investment. You should consider our business and prospects in light of the challenges we face, including the ones discussed in this section. In the event that any of the events described in the risk factors below occur, it could have a material adverse effect on our operations and cash flow and cause the value of our securities to decline in value or become worthless.

Risks Relating to Our Company

We operate in a highly competitive market. If we do not compete effectively, our prospects, operating results, and financial condition could be adversely affected.

The household appliances market of the People’s Republic of China (“PRC”) is highly competitive, with companies offering a variety of competitive products and services. We expect competition in our market to intensify in the future as new and existing competitors introduce new or enhanced products and services that are potentially more competitive than our products and services. The household appliances market has a multitude of participants in the domestic market, including a wide range of appliances product brands with product lines that can be purchased in physical stores or online stores such as Viomi Technology Co., Ltd, as well as many large, broad-based consumer electronics companies in domestic market or overseas market either competing in our market or adjacent markets or have announced plans to do so, including Xiaomi Corporation and Samsung Group. For example, Xiaomi Corporation’s Mijia branded smart home appliances product line offers products ranging from air conditioners to microwaves.

We believe many of our competitors and potential competitors have significant competitive advantages, including but not limited to longer operating histories, ability to leverage their sales efforts and marketing expenditures across a broader portfolio of products and services , larger and broader customer bases, more established relationships with a larger number of suppliers, contract manufacturers, and business partners, greater brand recognition, ability to leverage stores which they may operate, and greater financial, research and development, marketing, distribution, and other capabilities and resources than we do. Our competitors and potential competitors may also be able to develop products and services that are equal or superior to ours, achieve greater market acceptance of their products and services, and increase sales by utilizing different distribution channels than we do. Some of our competitors may aggressively discount their products in order to gain market share, which could result in pricing pressures, reduced profit margins, lost market share, or a failure to grow market share for us. If we are not able to compete effectively against our current or potential competitors, our prospects, operating results, and financial condition could be adversely affected.

If we fail to maintain quality products and value, our sales are likely to be negatively affected.

Our success depends on the safety and quality of products that we obtain from independent original equipment manufacturers (“OEMs”) for our customers. Our future customers will identify our brand name with a certain level of quality and value. If we could not meet this perceived value or level of quality, we may be negatively affected and our operating results may suffer. Additionally, any failure on the part of third-party OEMs to maintain the quality of their products, will in turn substantially harm the results of our business operations, potentially forcing us to identify other third-party OEMs or alter our business strategy significantly.

| 13 |

If we are unable to create brand influence, we may not be able to maintain current or attract new users and customers for our products.

Our operational and financial performance is highly dependent on the strength of our brand. We believe brand familiarity and preference will continue to have a significant role in winning customers and the decision to buy our products and services. In order to further expand our customer base, we may need to substantially increase our marketing expenditures to enhance brand awareness through various online and offline means. Moreover, negative coverage in the media of our company could threaten the perception of our brand, and we cannot assure you that we will be able to defuse negative press coverage about our company to the satisfaction of our investors, customers and business partners. If we are unable to defuse negative press coverage about our company, our brand may suffer in the marketplace, our operational and financial performance may be negatively impacted and the price of our shares may decline.

Currently, we sell our products, with or without customization, under our brand name “Wiseman”, to domestic customers in the PRC and to overseas customers. However, if our competitors initiate a lawsuit against us for infringing their trademark, we may be forced to adopt a new brand name for our flagship mobile application. As a result, we may incur additional marketing cost to raise awareness of such new brand name. We may also be ordered to pay a significant amount of damages, and our business, results of operations and financial condition could be materially and adversely affected.

If we are unable to successfully develop and timely introduce new products or enhance existing products, our business may be adversely affected.

We must continually source, develop and introduce new products and services as well as improve and enhance our existing products and services to maintain or increase our sales. The success of new or enhanced products may depend on a number of factors including, anticipating and effectively addressing user preferences and demand, the success of our sales and marketing efforts, timely and successful research and development, effective forecasting and management of product demand, purchase commitments, and the quality of or defects in our products. The risk of not meeting our customers’ preferences and demands through our products and services may result in a shift in market shares, as customers instead choose products and services offered by our competitors. This may result in lower sales revenue, adversely affecting our business.

We may not be able to manage the growth of our business and our expansion plans and operations or implement our business strategies on schedule or within our budget, or at all.

We are continually executing a number of growth initiatives, strategies and operating plans designed to enhance our business. In 2020, we plan to introduce our branded “Wiseman Home System” to align with our growth strategies. For further details on our business strategies, see “Business —Our Strategies.” Any expansion may increase the complexity of our operations and place a significant strain on our managerial, technological, operational, financial and human resources. Our current and planned personnel, systems, procedures and controls may not be adequate to support our future operations. We cannot assure you that we will be able to effectively manage our growth or to implement all these systems, procedures and control measures successfully. Further, the anticipated benefits from these growth initiatives, strategies and operating plans are based on assumptions that may prove to be inaccurate. Moreover, we may not be able to successfully complete these growth initiatives, strategies and operating plans and realize all of the benefits that we expect to achieve or it may be more costly to do so than we anticipate. If, for any reason, we are not able to manage our growth effectively, the benefits we realize are less than our estimates or the implementation of these growth initiatives, strategies and operating plans adversely affects our operations or costs more or takes longer to effectuate than we expect, and/or if our assumptions prove to be inaccurate, our business and prospects may be materially and adversely affected.

In addition, we may seek and pursue opportunities through joint ventures or strategic partnerships for expansion from time to time, and we may face similar risks and uncertainties as listed above. Failure to properly address these risks and uncertainties may materially and adversely affect our ability to carry out acquisitions and other expansion plans, integrate and consolidate newly acquired or newly formed businesses, and realize all or any of the anticipated benefits of such expansion, which may have a material adverse effect on our business, financial condition, results of operations and prospects.

| 14 |

We have a limited operating history in the PRC household appliances industry, which makes it difficult to evaluate our future prospects.

We launched our household appliances business in July 2018 and thus have a limited operating history. We have limited experience in most aspects of our business operation, such as sourcing inventory for our products and services and in-house development of smart capabilities for our products. As our business develops and as we respond to competition, we may continue to introduce new product offerings and make adjustments to our existing product line and to our business operation in general. Any significant change to our business model that does not achieve expected results may have a material and adverse impact on our financial condition and results of operations. It is therefore difficult to effectively assess our future prospects.

The PRC household appliances industry may not develop as expected. Prospective retail and corporate customers may not be familiar with the development of the market and may have difficulties distinguishing our products from those of our competitors. Convincing prospective retail and corporate customers of the value of our products is important to the success of our business. The risk of failing to convince potential customers or distributors to purchase products and services from us may result in the failure of our business plan. Many customers or distributors may not be interested in purchasing products and services we sell because there is no certainty that our business will succeed.

You should consider our business and prospects in light of the risks and challenges we encounter or may encounter given the rapidly evolving market in which we operate and our limited operating history. These risks and challenges include our ability to, among other things:

| ● | manage our future growth; | |

| ● | increase the utilization of our products by existing and new customers; | |

| ● | maintain and enhance our relationships with retail and corporate customers; | |

| ● | enhance our in-house research and development to support the growth of our business; | |

| ● | improve our operational efficiency; | |

| ● | attract, retain and motivate talented employees; | |

| ● | cope with economic fluctuations; | |

| ● | navigate the evolving regulatory environment; and | |

| ● | defend ourselves against legal and regulatory actions. |

A decline in general economic condition could lead to reduced consumer demand and could negatively impact our business operation and financial condition, which in turn could have a material adverse effect on our business, financial condition and results of operations.

Our operating and financial performance may be adversely affected by a variety of factors that influence the general economy. Consumer spending habits, including spending for the household appliances and related products and services we sell, are affected by, among other things, prevailing economic conditions, levels of unemployment, salaries and wage rates, prevailing interest rates, income tax rates and policies, consumer confidence and consumer perception of economic conditions. In addition, consumer purchasing patterns may be influenced by consumers’ disposable income. In the event of an economic slowdown, consumer spending habits could be adversely affected and we could experience lower net sales than expected on a quarterly or annual basis which could have a material adverse effect on our business, financial condition and results of operations.

The economy of PRC in general might not grow as quickly as expected, which could adversely affect our revenues and business prospects.

Our business and prospects depend on the continuing development of the economy in PRC. We cannot assure you that the PRC economy will continue to grow at the same pace as in the past. Economic growth is determined by countless factors, and it is extremely difficult to predict with any level of absolute certainty. In the event that the PRC economy suffers, demand for our products may diminish, which would in turn result in our profitability. This could in turn result in a substantial need for restructuring of our business objectives and could result in a partial or entire loss of an investment in our Company.

| 15 |

Our failure to comply with anti-corruption laws and regulations, or effectively manage our employees, customers and business partners, could severely damage our reputation, and materially and adversely affect our business, financial condition, results of operations and prospects.

We are subject to risks in relation to actions taken by us, our employees, third-party customers or business partners that constitute violations of the anti-corruption laws and regulations. While we adopt strict internal procedures and work closely with relevant government agencies to ensure compliance of our business operations with relevant laws and regulations, our efforts may not be sufficient to ensure that we comply with relevant laws and regulations at all times. If we, our employees, third-party customers or business partners violate these laws, rules or regulations, we could be subject to fines and/or other penalties. Actions by PRC regulatory authorities or the courts to provide an alternative interpretation of the laws and regulations or to adopt additional anti-bribery or anti-corruption related regulations could also require us to make changes to our operations. Our reputation, corporate image, and business operations may be materially and adversely affected if we fail to comply with these measures or become the target of any negative publicity as a result of actions taken by us, our employees, third-party customers or business partners.

We and our suppliers are subject to laws and regulations that could require us to modify our current business practices and incur increased costs, which could have a material adverse effect on our business, financial condition and results of operations.

In the household appliances industry, we are subject to numerous laws and regulations, including labor, employment and taxation laws to which the industry participants are typically subject to. The formulation, manufacturing, packaging, labeling, distribution, sale and storage of our inventory are subject to extensive regulation by various federal agencies and regulatory bodies. If we fail to comply with those regulations, we would subject to significant penalties or claims, which would harm our business operations. In addition, the adoption of new regulations or changes in the interpretations of existing regulations may result in significant compliance costs or discontinuation of product sales and may impair the marketability of products we may offer, resulting in significant loss of net sales. Our failure to comply with regulations may result in enforcement actions and imposition of penalties or otherwise harm the distribution and sale of products we may offer for sale. The occurrence of any of the foregoing will have a material adverse effect on our business, financial condition and results of operations.

Compliance with changing regulation of corporate governance and public disclosure will result in additional expenses.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002 and related SEC regulations, have created uncertainty for public companies and significantly increased the costs and risks associated with accessing the public markets and public reporting. Our management team will need to invest significant management time and financial resources to comply with both existing and evolving standards for public companies, which will lead to increased general and administrative expenses and a diversion of management time and attention from revenue generating activities to these compliance activities.

We have limited insurance coverage, which could expose us to significant costs and business disruption.

We cannot provide assurances that our current insurance policies are sufficient to cover all of the risks associated with our operations. Any business disruption, litigation or natural disaster may place a strain on management resources, affect our reputation or require us to spend a significant sum of money on legal costs. There is no assurance that the insurance policies we maintain are sufficient or that we will be able to successfully claim our losses under our current insurance policies on a timely basis, or at all. If we incur any loss that is not covered by our insurance policies, or the insured amount is significantly less than our actual loss, our business, financial condition and results of operations could be materially and adversely affected.

| 16 |

The Company’s ability to expand its operations will depend upon the company’s ability to raise significant additional financing as well as to generate continuous income stream.

Developing our business may require significant capital in the future. To meet our capital needs, we expect to rely on our cash flow from operations and, potentially, third-party financing. Third-party financing may not, however, be available on terms favorable to us, or at all. Our ability to obtain additional funding will be subject to various factors, including market conditions, our operating performance, lender sentiment and our ability to incur additional debt. These factors may make the timing, amount, terms and conditions of additional financings unattractive. Our inability to raise capital could lead to a slowdown in our growth.

Adverse developments in our existing areas of operation could adversely impact our results of operations, cash flows and financial condition.

Our operations are focused on utilizing our sales efforts which are principally located in the PRC. As a result, our results of operations, cash flows and financial condition depend upon the demand for our products in the PRC. Due to the lack of broad diversification in industry type and geographic location, adverse developments in our current segment of the midstream industry, or our existing areas of operation, could have a significantly greater impact on our results of operations, cash flows and financial condition than if our operations were more diversified.

We expect our quarterly financial results to fluctuate.

We expect our net sales and operating results to vary significantly from quarter to quarter due to a number of factors, including changes in:

| ● | General economic conditions; | |

| ● | The demand for products under our brand name; | |

| ● | Our ability to retain, grow our business and attract new customers; | |

| ● | Administrative costs; | |

| ● | Advertising and other marketing costs; and | |

| ● | Development costs for the Wiseman Home System. |

As a result of the variability of these and other factors, our operating results in future quarters may be below the expectations of public market analysts and investors.

Our internal controls may be inadequate, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public.

Our management is responsible for establishing and maintaining adequate internal control over our financial reporting. As defined in Exchange Act Rule 13a-15(f), internal control over financial reporting is a process designed by, or under the supervision of, the principal executive and principal financial officer and effected by the board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that: pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company; provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and/or directors of the Company; and provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements. Investors relying upon this misinformation may make an uninformed investment decision. If we could not provide reliable financial reports, our business and operating results could be harmed, investors could lose confidence in our reported financial information. This could result in the trading price of our common stock to drop significantly and result in a loss of some or all of your investment.

| 17 |

We may be unable to protect our intellectual property rights.

We consider trademarks, patents and copyrights to protect our intellectual property rights critical to our success. We are the registered owner of 1 trademark in Hong Kong. We are the registered owner of 10 computer software copyrights in the PRC. We are currently in the process of transferring an additional 9 trademarks from a company which owned 66% by our chief executive officer. We have recently discussed with our top researcher, Mr. Xiao Zhengwen (“Mr. Xiao”) to acquire his 7 patents in the PRC as we see strategic benefits in incorporating these patents into our Wiseman Home System. We are also the registered owner of one domain name, namely “wisemanglobal.cn.” We cannot assure you that counterfeiting or imitation of our products will not occur in the future or, if it does occur, that we will be able to address the problem in a timely and effective manner. Any occurrence of counterfeiting or imitation of our products or other infringement of our intellectual property rights could negatively affect our brand and our reputation, which in turn adversely affects our results of operations.

Litigation to prosecute infringement of our intellectual property rights could be costly and lengthy and will divert our managerial and financial resources. We will have to bear costs of the intellectual property litigation and may be unable to recover such costs from our opposite parties. Protracted litigation could also result in our users deferring or limiting their purchase or use of our products until such litigation is resolved. The occurrence of any of the foregoing will have a material adverse effect on our business, financial condition and results of operations.

We may be subject to intellectual property infringement claims, which may be expensive to defend and may disrupt our business and operations.

We cannot be certain that our operations or any aspects of our business do not or will not infringe upon or otherwise violate trademarks, patents, copyrights, know-how or other intellectual property rights held by third parties. Holders of such intellectual property rights may seek to enforce such intellectual property rights against us in the PRC or other jurisdictions. We may be from time to time in the future subject to legal proceedings and claims relating to the intellectual property rights of others. If any third-party infringement claims are brought against us, we may have to divert management’s time and other resources from our business and operations to defend against these claims.

Additionally, the application and interpretation of the PRC’s intellectual property right laws and the procedures and standards for granting trademarks, patents, copyrights, know-how or other intellectual property rights in the PRC are still evolving and are uncertain. We cannot assure you that PRC courts or regulatory authorities would agree with our legal interpretation. If we were found to have violated the intellectual property rights of others, we may be subject to liability for our infringement activities or may be prohibited from using such intellectual property. We may incur licensing fees or be forced to develop alternatives of our own. As a result, our business and results of operations may be materially and adversely affected.

We may be adversely affected by the performance of third-party contractors.

Our third-party OEMs engaged third-party contractors to carry out logistics services to our customers. Our third-party OEMs endeavor to engage third-party companies with a strong reputation and track record, high performance reliability and adequate financial resources. However, any such third-party contractor may still fail to provide satisfactory logistics services at the level of quality or within the timeframe required by us or our customers. While we generally require our third-party OEMs to fully reimburse us for any losses arising from delay in delivery or non-delivery, our results of operation and financial condition may be adversely affected if any of the losses are not borne by them. If the performance of any third-party contractor used by our third-party OEMs is not satisfactory, we may need to utilize other delivery method or take other remedial actions, which could adversely affect the cost structure and delivery schedule of our products and services and thus have a negative impact on our reputation, financial position and business operations. In addition, as we expand our business into other geographical locations, we may utilize third-party contractors to carry out logistic services and there may be a shortage of third-party contractors that meet our quality standards and other selection criteria in such locations and, as a result, we may not be able to engage a sufficient number of high-quality third-party contractors in a timely manner, which may adversely affect our delivery schedules and delivery costs and hence our business, results of operations and financial conditions.

| 18 |

If our employees do not maintain a strong work ethic and comply with our code of ethics, including our confidentiality requirements, their actions may negatively influence our business and reputation.

Employees with good professional ethics are important for any company’s development. An employee might, either intentionally or unintentionally, disclose confidential information about our Company or our customers and particularly unscrupulous employees might endeavor to sell material information to industry competitors. Furthermore, our employees will develop relationships with our business partners and customers, and may acquire information that could be used to harm their business interests. If this should happen, our business partners and customers might lose faith in our company. While we can never eliminate these ethical risks entirely, we will attempt to reduce the likelihood of breaches of trust and mitigate their impacts of it by hiring highly professional employees and establishing strong internal information management systems.

We also plan to establish a series of policies to reduce the likelihood of such events. However, in the event that any employee discloses confidential information about our Company or our clients or sells material information to industry competitors, it could have a material adverse effect on our reputation, operations and cash flow.

Our success depends substantially on the continuing efforts of our senior executives and other key personnel, and our business may be severely disrupted if we lose their services.

Our future success heavily depends upon the continued services of our senior executives and other key employees. If one or more of our senior management personnel or key employees are unable or unwilling to continue in their present positions, it could disrupt our business operations, and we may not be able to replace them easily or at all. In addition, competition for senior management personnel and key employees in our industry is intense, and we may be unable to retain our senior management personnel and key personnel or attract and retain new senior management personnel and key employees in the future, in which case our business may be severely disrupted.

An overall decline in the health of the economy and other factors impacting consumer spending, such as natural disasters and fluctuations in inflation and foreign currency exchange rates may affect consumer purchases, reduce demand for our products and materially harm our business, results of operations and financial condition.

Our business depends on consumer demand for our products and, consequently, is sensitive to a number of factors that influence consumer confidence and spending, including but not limited to, general current and future economic and political conditions, consumer disposable income, recession and fears of recession, unemployment, minimum wages, availability of consumer credit, consumer debt levels, interest rates, tax rates and policies, inflation, war and fears of war, inclement weather, natural disasters, terrorism, active shooter situations, outbreak of viruses, widespread illness, infectious diseases, contagions and the occurrence of unforeseen epidemics (including the outbreak of the coronavirus and its potential impact on our financial results) and consumer perceptions of personal well-being and security.

For example, there was an outbreak of a novel strain of coronavirus (“COVID-19”) in the PRC, which has spread rapidly to many parts of the world. The epidemic has resulted in quarantines, travel restrictions, and the temporary closure of stores and facilities in China for the past few months. In March, 2020, the World Health Organization declared the COVID-19 a pandemic. In response to the outbreak, the municipal government of Guangdong Province has taken strict control measures to prevent the further outbreak of the disease since January 28, 2020. As a result, a notice issued by the municipal government of Guangdong Province that most of the business entities, including commercial banks, hotels, public transportation and express delivery companies, except for those related to epidemic prevention supply, utility supply, supermarkets, etc., in Shenzhen City were not allowed to resume operations before February 9, 2020, and all of our employees (including staff in our accounting department) were not able to come back to the office. We resumed our operation from February 10 to February 13, 2020. However, on February 14, 2020, we decided to temporarily shut down our operations as the situation worsen. We fully resumed our operations on March 2, 2020. However, we cannot assure you that we will not shut down our offices, storeroom and/or showroom if the COVID-19 situation become worse, or that the municipal government will not pursue such policies in the future. If it happens, our business, financial conditions and results of operations could be adversely affected.

| 19 |

Consumer purchases of discretionary items such as electronics, including our products, often decline during periods when economic or market conditions are unstable or weak. Reduced consumer confidence and spending cutbacks may result in reduced demand for our products and services, which could result in lost sales and/or excessive markdowns. Reduced demand also may require increased selling and promotional expenses, impacting our profitability. Changes in areas around the store locations of our distributors might result in reductions in consumer foot traffic or otherwise render the locations unsuitable and could cause our sales to be less than expected. Prolonged or pervasive economic downturns could slow the pace of our business development, reduce comparable sales or cause setbacks to our operations, which could have a material negative impact on our financial performance. When the economy weakens or as consumer behavior shifts, distributors may be more cautious with orders. A slowing or changing economy in our key markets could adversely affect the financial health of our customers and distributors, which in turn could have an adverse effect on our results of operations and financial condition.

Natural disasters and other events beyond our control could materially adversely affect us and our supplier’s operations.

Natural disasters or other catastrophic events may cause damage or disruption to our operations, and thus could have a strong negative effect on us. Our business operations are subject to interruption by natural disasters, fire, power shortages, pandemics and other events beyond our control. This may result in delivery delays, malfunctioning of supplier’s facilities or shutdown of logistic points. Such events could make it difficult or impossible for us to deliver our products to our customers and could decrease demand for our products. In the past, there was no significant disruption of operation at our supplier’s production facilities and logistic points. However, we could not assure you that our supplier’s production facilities and logistic points will always operate normally in the future.

We are an “emerging growth company” under the JOBS Act of 2012, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. An “emerging growth company” can therefore delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We are choosing to follow the extended transition period, and as a result, we will delay adoption of certain new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies.

General Risks Associated with Business Operations in PRC

American investors may have difficulty enforcing judgments against our Company and Officers.

We are a Nevada corporation and most of our assets are and will be located outside of the United States. Almost all of our operations will be conducted in PRC. In addition, our officers and directors are nationals and residents of a country other than the United States. All of their assets are located outside the United States. As a result, it may be difficult for investors to effect service of process within the United States upon them. It may also be difficult to enforce court judgments on the civil liability provisions of the U.S. federal securities laws against our Company and our officer and director, since he is not a resident in the United States. In addition, there is uncertainty as to whether the courts of Hong Kong or other Asian countries would recognize or enforce judgments of U.S. courts.

| 20 |

Adverse changes in global or the PRC’s economic, political or social conditions or government policies could have a material adverse effect on our business, financial condition and results of operations.

Our revenues are substantially sourced from the PRC. Accordingly, our results of operations, financial condition and prospects are influenced by economic, political and legal developments in the PRC. Economic reforms begun in the late 1970s have resulted in significant economic growth. However, any economic reform policies or measures in the PRC may from time to time be modified or revised. The PRC’s economy differs from the economies of most developed countries in many respects, including with respect to the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. While the PRC economy has experienced significant growth in the past 40 years, growth has been uneven across different regions and among different economic sectors and the rate of growth has been slowing.

The PRC’s economic conditions are sensitive to global economic conditions. The global financial markets have experienced significant disruptions since 2008 and the United States, Europe and other economies have experienced periods of recession. The global macroeconomic environment is facing new challenges and there is considerable uncertainty over the long-term effects of the expansionary monetary and fiscal policies adopted by the central banks and financial authorities of some of the world’s leading economies. Recent international trade disputes, including tariff actions announced by the United States, the PRC and certain other countries, and the uncertainties created by such disputes may cause disruptions in the international flow of goods and services and may adversely affect the Chinese economy as well as global markets and economic conditions. There have also been concerns about the economic effect of the military conflicts and political turmoil or social instability in the Middle East, Europe, Africa and other places. Any severe or prolonged slowdown in the global economy may adversely affect the Chinese economy which in turn may adversely affect our business and operating results.

The PRC government exercises significant control over the PRC’s economic growth through strategically allocating resources, controlling the payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Although the PRC economy has grown significantly in the past decade, that growth may not continue, as evidenced by the slowing of the growth of the PRC economy since 2012. Any adverse changes in economic conditions in the PRC, in the policies of the PRC government or in the laws and regulations in the PRC could have a material adverse effect on the overall economic growth of the PRC. Such developments could adversely affect our business and operating results, lead to reduction in demand for our products and adversely affect our competitive position.

Foreign exchange fluctuations may affect our business.

Fluctuations in exchange rates could have a material adverse effect on our results of operations and the value of your investment. The value of the RMB against the U.S. dollar and other currencies is affected by changes in the PRC’s political and economic conditions and by the PRC’s foreign exchange policies, among other things. In July 2005, the PRC government changed its decades-old policy of pegging the value of the RMB to the U.S. dollar, and the RMB appreciated more than 20% against the U.S. dollar over the following three years. Between July 2008 and June 2010, this appreciation halted and the exchange rate between the RMB and the U.S. dollar remained within a narrow band. Since June 2010, the RMB has fluctuated against the U.S. dollar, at times significantly and unpredictably. On November 30, 2015, the Executive Board of the International Monetary Fund (IMF) completed the regular five-year review of the basket of currencies that make up the Special Drawing Right, or the SDR, and decided that with effect from October 1, 2016, RMB is determined to be a freely usable currency and will be included in the SDR basket as a fifth currency, along with the U.S. dollar, the Euro, the Japanese yen and the British pound. In the fourth quarter of 2016, the RMB has depreciated significantly in the backdrop of a surging U.S. dollar and persistent capital outflows of the PRC. With the development of the foreign exchange market and progress towards interest rate liberalization and RMB internationalization, the PRC government may in the future announce further changes to the exchange rate system and we cannot assure you that the RMB will not appreciate or depreciate significantly in value against the U.S. dollar in the future. It is difficult to predict how market forces or PRC or U.S. government policy may impact the exchange rate between the RMB and the U.S. dollar in the future.

| 21 |