Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Great Elm Capital Corp. | gecc-ex991_32.htm |

| 8-K - 8-K - Great Elm Capital Corp. | gecc-8k_20200501.htm |

Great Elm Capital Corp. (NASDAQ: GECC) Investor Presentation – Quarter Ended March 31, 2020 May 11, 2020 © 2020 Great Elm Capital Corp. Exhibit 99.2

© 2020 Great Elm Capital Corp. Disclaimer Statements in this communication that are not historical facts are “forward-looking” statements within the meaning of the federal securities laws. These statements are often, but not always, made through the use of words or phrases such as “expect,” “anticipate,” “should,” “will,” “estimate,” “designed,” “seek,” “continue,” “upside,” “potential” and similar expressions. All such forward-looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual results to differ materially from the results expressed in the statements. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are: conditions in the credit markets, the price of GECC common stock, the performance of GECC’s portfolio and investment manager and risks associated with the economic impact of the COVID-19 pandemic on GECC and its portfolio companies. Information concerning these and other factors can be found in GECC’s Annual Report on Form 10-K and other reports filed with the SEC. GECC assumes no obligation to, and expressly disclaims any duty to, update any forward-looking statements contained in this communication or to conform prior statements to actual results or revised expectations except as required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. You should consider the investment objective, risks, charges and expenses of GECC carefully before investing. GECC’s filings with the SEC contain this and other information about GECC and are available by contacting GECC at the phone number and address at the end of this presentation. The SEC also maintains a website that contains the aforementioned documents. The address of the SEC’s website is http://www.sec.gov. These documents should be read and considered carefully before investing. The performance, distributions and financial data contained herein represent past performance, distributions and results and neither guarantees nor is indicative of future performance, distributions or results. Investment return and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than the original cost. GECC’s market price and net asset value will fluctuate with market conditions. Current performance may be lower or higher than the performance data quoted. All information and data, including portfolio holdings and performance characteristics, is as of March 31, 2020, unless otherwise noted, and is subject to change. This presentation does not constitute an offer of any securities for sale.

A Note to Shareholders The first half of 2020 has been characterized by remarkable volatility in the leveraged credit markets, driven by the impact of the COVID-19 pandemic and violent swings in commodity prices We believe we must take every opportunity to bolster liquidity in order to successfully navigate current market volatility and to be in a position to capitalize on attractive investment opportunities when they materialize To best position ourselves, we will strengthen our balance sheet by: Paying a substantial portion of our base distributions in stock Relieving ourselves of the restrictions that typically come with a secured credit facility and, therefore, maintaining the flexibility to utilize cash and other assets to create shareholder value We are confident in the quality of our portfolio investments, our robust liquidity profile and our ability to capitalize on new potential investment opportunities © 2020 Great Elm Capital Corp.

GECC Snapshot GECC Investment Objective Investment Strategy Externally managed, total-return-focused BDC Common stock trades as “GECC” on NASDAQ Liquid balance sheet Employees and affiliates of Great Elm Capital Management, Inc., GECC’s investment manager, own approximately 23% of GECC’s outstanding shares To generate both current income and capital appreciation, while seeking to protect against the risk of capital loss To apply the key principles of value investing to the capital structures of predominantly middle-market companies Portfolio (as of 3/31/2020) $273.6 million of total assets; $165.5 million of portfolio fair value; $50.8 million of net asset value Weighted average current yield of 10.0%1 35 investments (28 debt, 7 equity) in 26 companies across 21 industries (1) Weighted average current yield is based upon the stated coupon rate and fair value of outstanding debt securities at the measurement date. © 2020 Great Elm Capital Corp.

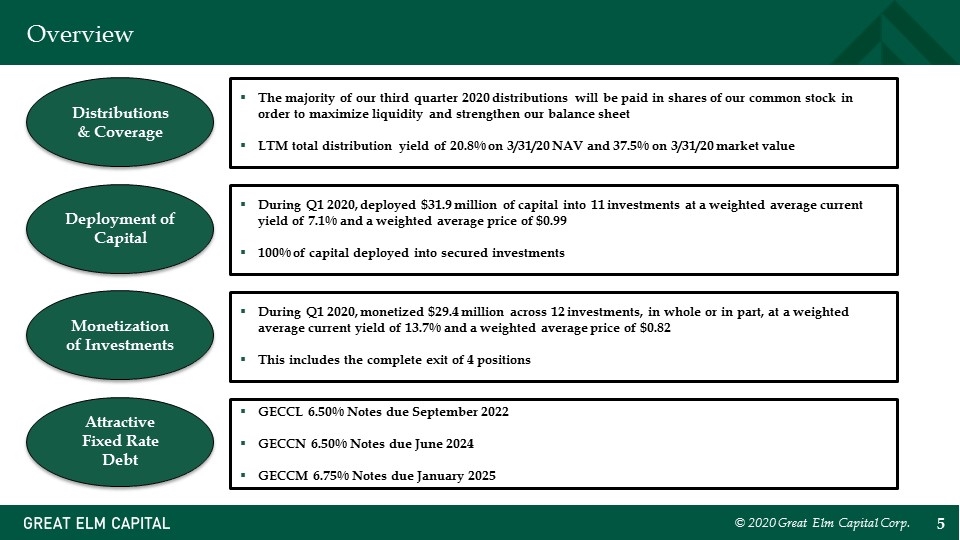

Overview The majority of our third quarter 2020 distributions will be paid in shares of our common stock in order to maximize liquidity and strengthen our balance sheet LTM total distribution yield of 20.8% on 3/31/20 NAV and 37.5% on 3/31/20 market value During Q1 2020, monetized $29.4 million across 12 investments, in whole or in part, at a weighted average current yield of 13.7% and a weighted average price of $0.82 This includes the complete exit of 4 positions During Q1 2020, deployed $31.9 million of capital into 11 investments at a weighted average current yield of 7.1% and a weighted average price of $0.99 100% of capital deployed into secured investments GECCL 6.50% Notes due September 2022 GECCN 6.50% Notes due June 2024 GECCM 6.75% Notes due January 2025 Attractive Fixed Rate Debt Deployment of Capital Monetization of Investments Distributions & Coverage © 2020 Great Elm Capital Corp.

Portfolio Review (Quarter Ended 3/31/2020) © 2020 Great Elm Capital Corp.

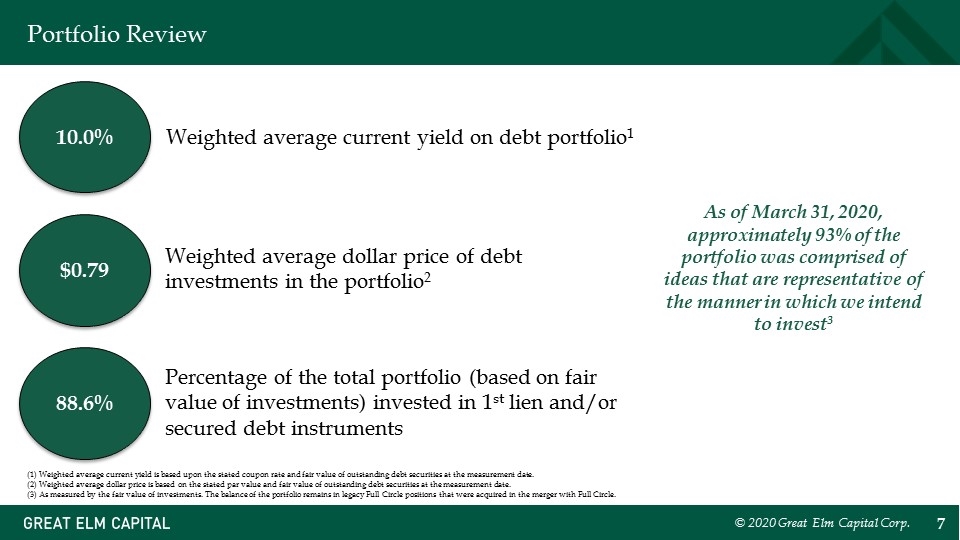

Portfolio Review 10.0% Weighted average current yield on debt portfolio1 88.6% Percentage of the total portfolio (based on fair value of investments) invested in 1st lien and/or secured debt instruments $0.79 Weighted average dollar price of debt investments in the portfolio2 As of March 31, 2020, approximately 93% of the portfolio was comprised of ideas that are representative of the manner in which we intend to invest3 (1) Weighted average current yield is based upon the stated coupon rate and fair value of outstanding debt securities at the measurement date. (2) Weighted average dollar price is based on the stated par value and fair value of outstanding debt securities at the measurement date. (3) As measured by the fair value of investments. The balance of the portfolio remains in legacy Full Circle positions that were acquired in the merger with Full Circle. © 2020 Great Elm Capital Corp.

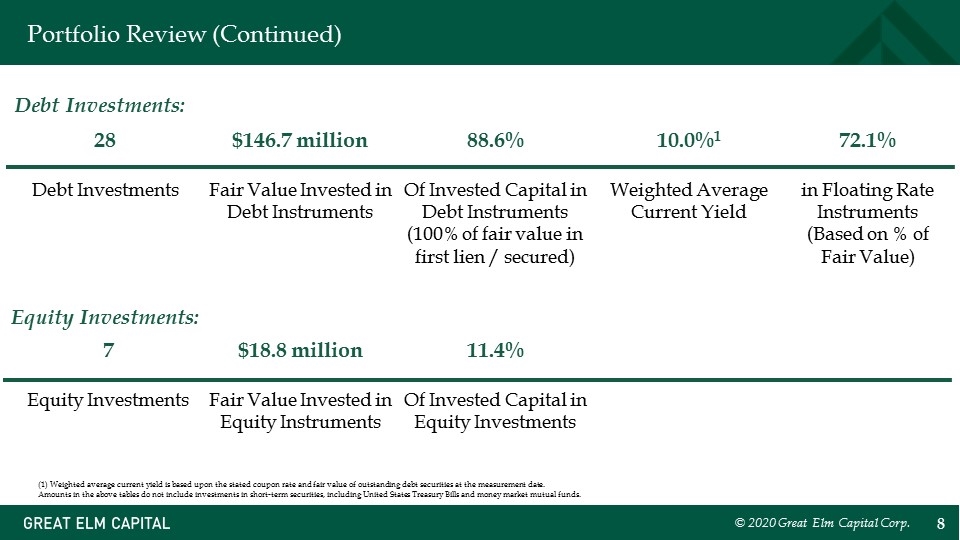

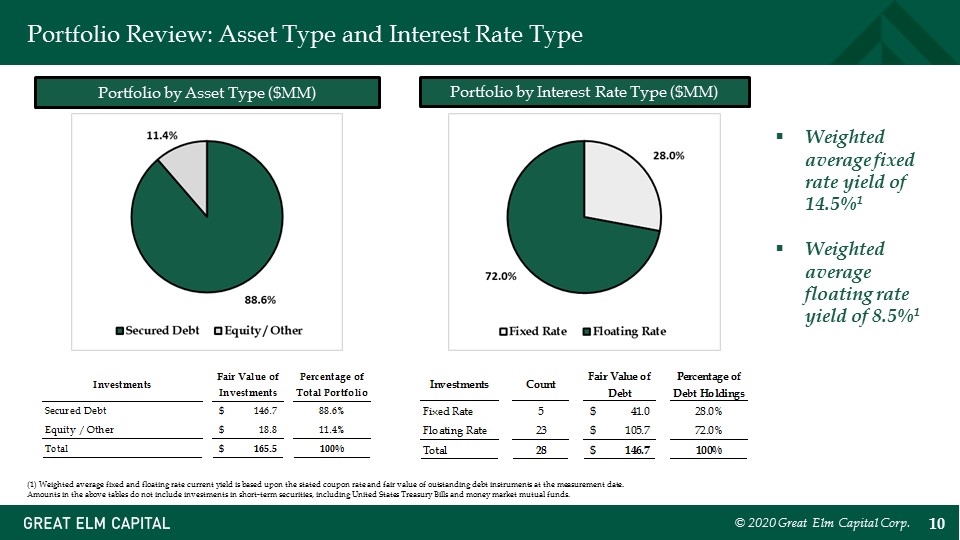

Portfolio Review (Continued) 28 Debt Investments $146.7 million Fair Value Invested in Debt Instruments 72.1% in Floating Rate Instruments (Based on % of Fair Value) 10.0%1 Weighted Average Current Yield 88.6% Of Invested Capital in Debt Instruments (100% of fair value in first lien / secured) 7 Equity Investments $18.8 million Fair Value Invested in Equity Instruments Debt Investments: Equity Investments: 11.4% Of Invested Capital in Equity Investments (1) Weighted average current yield is based upon the stated coupon rate and fair value of outstanding debt securities at the measurement date. Amounts in the above tables do not include investments in short-term securities, including United States Treasury Bills and money market mutual funds. © 2020 Great Elm Capital Corp.

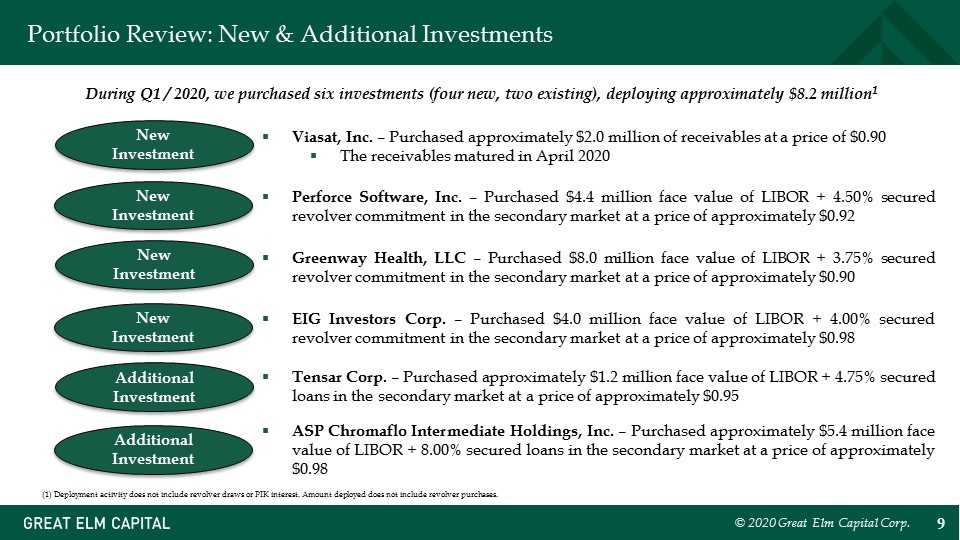

Portfolio Review: New & Additional Investments During Q1 / 2020, we purchased six investments (four new, two existing), deploying approximately $8.2 million1 (1) Deployment activity does not include revolver draws or PIK interest. Amount deployed does not include revolver purchases. Viasat, Inc. – Purchased approximately $2.0 million of receivables at a price of $0.90 The receivables matured in April 2020 New Investment © 2020 Great Elm Capital Corp. New Investment Additional Investment Additional Investment Perforce Software, Inc. – Purchased $4.4 million face value of LIBOR + 4.50% secured revolver commitment in the secondary market at a price of approximately $0.92 Tensar Corp. – Purchased approximately $1.2 million face value of LIBOR + 4.75% secured loans in the secondary market at a price of approximately $0.95 ASP Chromaflo Intermediate Holdings, Inc. – Purchased approximately $5.4 million face value of LIBOR + 8.00% secured loans in the secondary market at a price of approximately $0.98 New Investment New Investment Greenway Health, LLC – Purchased $8.0 million face value of LIBOR + 3.75% secured revolver commitment in the secondary market at a price of approximately $0.90 EIG Investors Corp. – Purchased $4.0 million face value of LIBOR + 4.00% secured revolver commitment in the secondary market at a price of approximately $0.98

Portfolio Review: Asset Type and Interest Rate Type Portfolio by Asset Type ($MM) Portfolio by Interest Rate Type ($MM) Weighted average fixed rate yield of 14.5%1 Weighted average floating rate yield of 8.5%1 (1) Weighted average fixed and floating rate current yield is based upon the stated coupon rate and fair value of outstanding debt instruments at the measurement date. Amounts in the above tables do not include investments in short-term securities, including United States Treasury Bills and money market mutual funds. © 2020 Great Elm Capital Corp. Investments Fair Value of Investments Percentage of Total Portfolio Investments Count Fair Value of Debt Percentage of Debt Holdings Secured Debt $146.69999999999999 0.88640483383685797 Fixed Rate 5 $41.005000369999998 0.2795160216087253 Equity / Other $18.8 0.113595166163142 Floating Rate 23 $105.69499962999998 0.72048397839127465 Total $165.5 1 Total 28 $146.69999999999999 1 Investments Fair Value of Investments Percentage of Total Portfolio Investments Count Fair Value of Debt Percentage of Debt Holdings Secured Debt $146.69999999999999 0.88640483383685797 Fixed Rate 5 $41.005000369999998 0.2795160216087253 Equity / Other $18.8 0.113595166163142 Floating Rate 23 $105.69499962999998 0.72048397839127465 Total $165.5 1 Total 28 $146.69999999999999 1

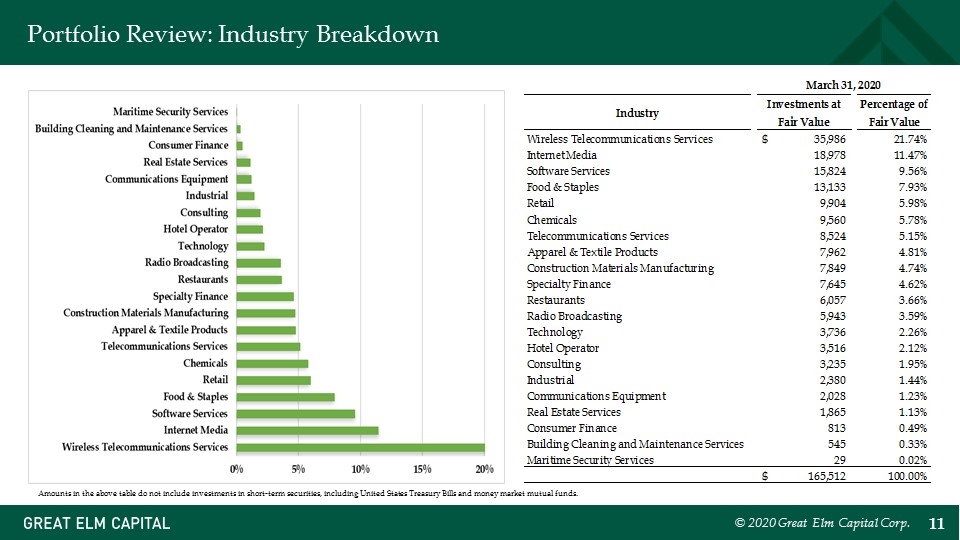

Portfolio Review: Industry Breakdown Amounts in the above table do not include investments in short-term securities, including United States Treasury Bills and money market mutual funds. © 2020 Great Elm Capital Corp. September 30, 2018 Investments at Fair Value Percentage of Fair Value Wireless Telecommunications Services $42,760 0.2103740584580113 Building Cleaning and Maintenance Services 19,934 9.8% Manufacturing 17,281 8.5% Technology Services 15,738 7.7% Retail 15,612 7.7% Industrial Conglomerates 14,536 7.2% Water Transport 10,618 5.2% Business Services 9,918 4.9% Gaming, Lodging & Restaurants 9,841 4.8% Chemicals 9,431 4.6% Software Services 8,957 4.4% Radio Broadcasting 8,847 4.4% Real Estate Services 5,583 2.7% Food & Staples Retailing 5,569 2.7% Hotel Operator 2,751 1.4% Consumer Finance 2,346 1.2% Food Products 1,979 .97364420413565099 Information and Data Services 1,250 .6% Wireless Communications 272 .1% Maritime Security Services 34 16727591177671618.2% Total $,203,257 100.0% December 31, 2018 Industry Investments at Fair Value Percentage of Fair Value Wireless Telecommunications Services $35,631 0.19345118521494575 Building Cleaning and Maintenance Services 18,443 0.10013247478092797 Software Services 15,942 8.6553809735810533E-2 Manufacturing 15,575 8.4561258727590585E-2 Retail 14,227 7.7242570010750009E-2 Industrial Conglomerates 13,365 7.2562518323868258E-2 Water Transport 11,889 6.454887993658584E-2 Gaming, Lodging & Restaurants 9,687 5.2593573887266133E-2 Business Services 9,505 5.1605442324606648E-2 Food & Staples Retailing 8,935 4.8510744573420347E-2 Radio Broadcasting 8,807 4.7815794902978513E-2 Chemicals 7,601 4.1268065976784341E-2 Real Estate Services 4,479 2.4317809171163933E-2 Technology Services 4,428 2.4040915161847264E-2 Hotel Operator 3,212 1.7438893292649821E-2 Consumer Finance 1,830 9.9356085695981242E-3 Wireless Communications 596 3.2358594029947988E-3 Maritime Security Services 34 1.8459600621111268E-4 Total $,184,186 0.99999999999999978 March 31, 2019 Industry Investments at Fair Value Percentage of Fair Value Wireless Telecommunications … $38,956 0.20977017683675447 Building Cleaning ... 20,683 0.11137376957373941 Retail 20,292 0.10926831369677127 Software Services 19,393 0.10442738061903634 Business Services 12,742 6.861309152002068E-2 Water Transport 11,389 6.1327460314041397E-2 Gaming, Lodging & Restaurants 9,766 5.2587933745449844E-2 Food & Staples Retailing 8,904 4.794623818036918E-2 Radio Broadcasting 8,536 4.5964632649105046E-2 Industrial Conglomerates 7,538 4.0590604605078941E-2 Specialty Finance 7,367 3.9669804208757833E-2 Internet Media 3,486 1.8771404570616237E-2 Real Estate Services 3,238 1.7435974756068666E-2 Hotel Operator 3,087 1.6622870312533657E-2 Restaurants 2,903 1.5632067546901586E-2 Apparel & Textile Products 1,983 1.067805371874125E-2 Communications Equipment 1,972 1.0618820944708897E-2 Industrial 1,931 1.0398044241497404E-2 Consumer Finance 1,409 7.5871798737803435E-3 Wireless Communications 103 5.5463415684838565E-4 Maritime Security Services 30 1.6154392917914145E-4 Total $,185,708 0.99999999999999967 June 30, 2019 Industry Investments at Fair Value Percentage of Fair Value Wireless Telecommunications Services $40,044 0.19608457628612561 Building Cleaning and Maintenance Services 19,798 9.6945421069641269E-2 Retail 19,027 9.3170043776748382E-2 Internet Media 16,112 7.8896081638249321E-2 Business Services 14,726 7.2109216621453545E-2 Food & Staples 13,902 6.8074312744224305E-2 Software Services 13,863 6.7883340351976809E-2 Gaming, Lodging & Restaurants 12,023 5.8873360820299876E-2 Water Transport 10,768 5.2727967172335445E-2 Radio Broadcasting 8,299 4.063794572466678E-2 Specialty Finance 7,732 3.7861500945068502E-2 Restaurants 6,809 3.3341820995210998E-2 Apparel & Textile Products 5,810 2.8449989716871186E-2 Industrial 5,355 2.6221978473983686E-2 Real Estate Services 4,663 2.2833442693592141E-2 Hotel Operator 3,177 1.5556904876161749E-2 Consumer Finance 1,392 6.8162453848338543E-3 Construction Materials Manufacturing 474 2.3210490750080796E-3 Wireless Communications 214 1.0478997933580782E-3 Maritime Security Services 30 1.4690184019038478E-4 Total $,204,218 0.99999999999999978 September 30, 2019 Industry Investments at Fair Value Percentage of Fair Value Wireless Telecommunications Services 19476 $38,524 0.19776282219107902 Software Services 14044 24,702 0.12680763248271296 Food & Staples 20,505 0.1052623473426455 Retail 83460 16,502 8.4712960538811805E-2 Internet Media 9530 15,808 8.1150313913315772E-2 Restaurants 9761 12,552 6.443564905363991E-2 Gaming, Lodging & Restaurants 13130 12,253 6.2900733576661066E-2 Water Transport 4202 8,607 4.4184005051360636E-2 Apparel & Textile Products 3284 8,573 4.4009466167690796E-2 Radio Broadcasting 7244 8,024 4.1191176546080829E-2 Specialty Finance 17049 7,671 3.9379052253861672E-2 Industrial 4594 4,970 2.5513477995266917E-2 Real Estate Services 16476 3,610 1.8531922648473555E-2 Construction Materials Manufacturing 3,344 1.7166412558586031E-2 Hotel Operator 14007 3,334 1.7115077592800784E-2 Chemicals 2,710 1.3911775727801477E-2 Building Cleaning and Maintenance Services 7399 1,761 9.0400874747816988E-3 Consumer Finance 7544 1,205 6.1858633771220591E-3 Wireless Communications 216 1.1088352609612986E-3 Maritime Security Services 30 1.540048973557359E-4 Consulting -,102 -5.2361665100950213E-4 $,194,799 1.0000000000000002 December 31, 2019 Industry Investments at Fair Value Percentage of Fair Value Wireless Telecommunications Services 19476 $40,578 0.20533866356298863 Software Services 7399 25,456 0.12881613237861497 Food & Staples 83460 20,975 0.1061407281835893 Internet Media 9530 15,923 8.0575867216557448E-2 Retail 1300 13,470 6.8162841889532672E-2 Gaming, Lodging & Restaurants 12,127 6.1366799079017278E-2 Restaurants 14044 11,972 6.0582445664549754E-2 Apparel & Textile Products 13130 8,744 4.4247653265187356E-2 Water Transport 4202 8,001 4.0487817220352704E-2 Radio Broadcasting 7244 7,795 3.9445386230802321E-2 Construction Materials Manufacturing 17049 7,792 3.9430205196973912E-2 Specialty Finance 9761 7,726 3.9096222452749033E-2 Chemicals 3284 6,917 3.5002403663689501E-2 Industrial 4594 4,200 2.1253447359765198E-2 Hotel Operator 16476 3,361 1.7007818232421628E-2 Real Estate Services 14007 2,065 1.0449611618551223E-2 Consumer Finance 7544 1,050 5.3133618399412996E-3 Building Cleaning and Maintenance Services 9047 819 4.1444222351542138E-3 Maritime Security Services 30 1.5181033828403715E-4 Consulting -,458 -2.3176378311363004E-3 Telecommunications Services -,928 -4.695999797586216E-3 $,197,615 1 March 31, 2020 Industry Investments at Fair Value Percentage of Fair Value Wireless Telecommunications Services 19476 $35,986 0.21742230170622071 Internet Media 7399 18,978 0.11466238097539755 Software Services 83460 15,824 9.5606360868094153E-2 Food & Staples 9530 13,133 7.9347721011165356E-2 Retail 1300 9,904 5.9838561554449221E-2 Chemicals 9,560 5.7760162405142833E-2 Telecommunications Services 14044 8,524 5.1500797525254965E-2 Apparel & Textile Products 13130 7,962 4.8105273333655565E-2 Construction Materials Manufacturing 4202 7,849 4.7422543380540381E-2 Specialty Finance 7244 7,645 4.6190004350137752E-2 Restaurants 17049 6,057 3.6595533858572185E-2 Radio Broadcasting 9761 5,943 3.5906762047464839E-2 Technology 3284 3,736 2.2572381458746193E-2 Hotel Operator 4594 3,516 2.1243172700468847E-2 Consulting 16476 3,235 1.9545410604669147E-2 Industrial 14007 2,380 1.4379622021364009E-2 Communications Equipment 7544 2,028 1.2252888008120258E-2 Real Estate Services 9047 1,865 1.1268065155396587E-2 Consumer Finance 813 4.9120305476340088E-3 Building Cleaning and Maintenance Services 545 3.2928126057325149E-3 Maritime Security Services 29 1.7521388177292282E-4 $,165,512 1

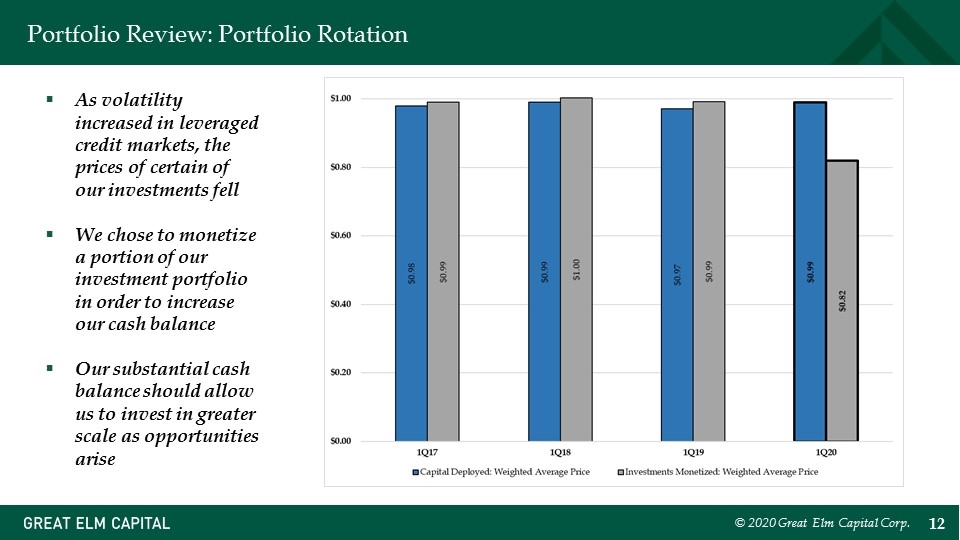

Portfolio Review: Portfolio Rotation © 2020 Great Elm Capital Corp. As volatility increased in leveraged credit markets, the prices of certain of our investments fell We chose to monetize a portion of our investment portfolio in order to increase our cash balance Our substantial cash balance should allow us to invest in greater scale as opportunities arise

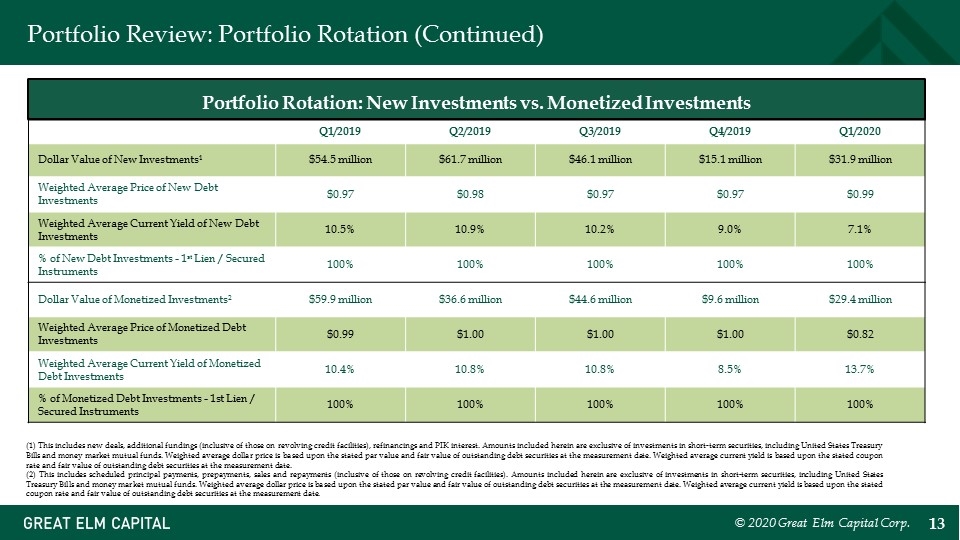

Portfolio Review: Portfolio Rotation (Continued) Q1/2019 Q2/2019 Q3/2019 Q4/2019 Q1/2020 Dollar Value of New Investments1 $54.5 million $61.7 million $46.1 million $15.1 million $31.9 million Weighted Average Price of New Debt Investments $0.97 $0.98 $0.97 $0.97 $0.99 Weighted Average Current Yield of New Debt Investments 10.5% 10.9% 10.2% 9.0% 7.1% % of New Debt Investments - 1st Lien / Secured Instruments 100% 100% 100% 100% 100% Dollar Value of Monetized Investments2 $59.9 million $36.6 million $44.6 million $9.6 million $29.4 million Weighted Average Price of Monetized Debt Investments $0.99 $1.00 $1.00 $1.00 $0.82 Weighted Average Current Yield of Monetized Debt Investments 10.4% 10.8% 10.8% 8.5% 13.7% % of Monetized Debt Investments - 1st Lien / Secured Instruments 100% 100% 100% 100% 100% (1) This includes new deals, additional fundings (inclusive of those on revolving credit facilities), refinancings and PIK interest. Amounts included herein are exclusive of investments in short-term securities, including United States Treasury Bills and money market mutual funds. Weighted average dollar price is based upon the stated par value and fair value of outstanding debt securities at the measurement date. Weighted average current yield is based upon the stated coupon rate and fair value of outstanding debt securities at the measurement date. (2) This includes scheduled principal payments, prepayments, sales and repayments (inclusive of those on revolving credit facilities). Amounts included herein are exclusive of investments in short-term securities, including United States Treasury Bills and money market mutual funds. Weighted average dollar price is based upon the stated par value and fair value of outstanding debt securities at the measurement date. Weighted average current yield is based upon the stated coupon rate and fair value of outstanding debt securities at the measurement date. Portfolio Rotation: New Investments vs. Monetized Investments © 2020 Great Elm Capital Corp.

Subsequent Events (Through May 8, 2020) © 2020 Great Elm Capital Corp.

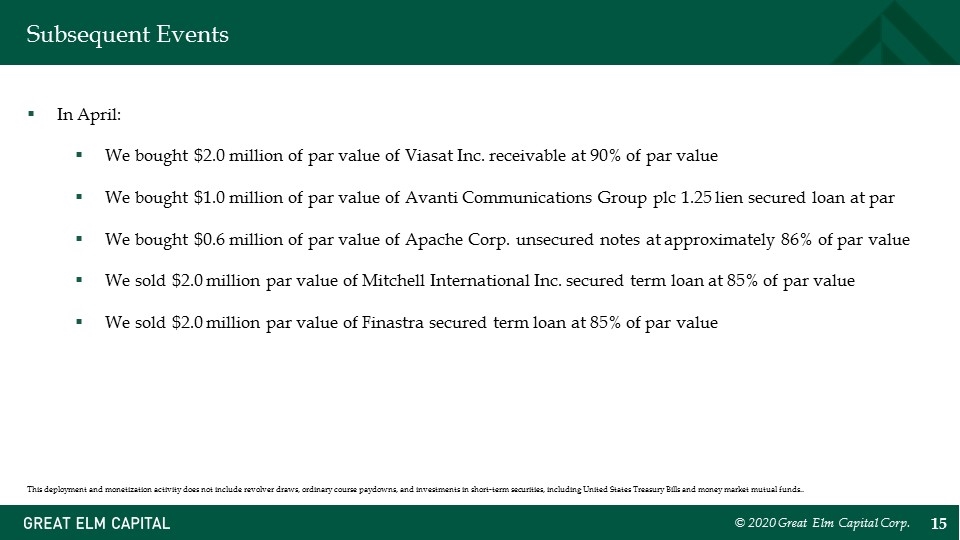

Subsequent Events In April: We bought $2.0 million of par value of Viasat Inc. receivable at 90% of par value We bought $1.0 million of par value of Avanti Communications Group plc 1.25 lien secured loan at par We bought $0.6 million of par value of Apache Corp. unsecured notes at approximately 86% of par value We sold $2.0 million par value of Mitchell International Inc. secured term loan at 85% of par value We sold $2.0 million par value of Finastra secured term loan at 85% of par value © 2020 Great Elm Capital Corp. This deployment and monetization activity does not include revolver draws, ordinary course paydowns, and investments in short-term securities, including United States Treasury Bills and money market mutual funds..

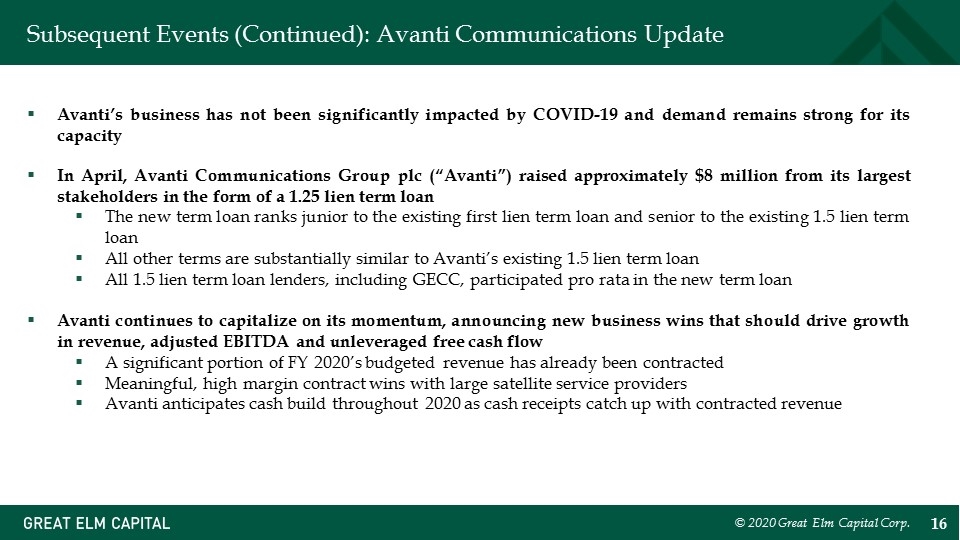

Subsequent Events (Continued): Avanti Communications Update Avanti’s business has not been significantly impacted by COVID-19 and demand remains strong for its capacity In April, Avanti Communications Group plc (“Avanti”) raised approximately $8 million from its largest stakeholders in the form of a 1.25 lien term loan The new term loan ranks junior to the existing first lien term loan and senior to the existing 1.5 lien term loan All other terms are substantially similar to Avanti’s existing 1.5 lien term loan All 1.5 lien term loan lenders, including GECC, participated pro rata in the new term loan Avanti continues to capitalize on its momentum, announcing new business wins that should drive growth in revenue, adjusted EBITDA and unleveraged free cash flow A significant portion of FY 2020’s budgeted revenue has already been contracted Meaningful, high margin contract wins with large satellite service providers Avanti anticipates cash build throughout 2020 as cash receipts catch up with contracted revenue © 2020 Great Elm Capital Corp.

Financial Review (Quarter Ended 3/31/2020) © 2020 Great Elm Capital Corp.

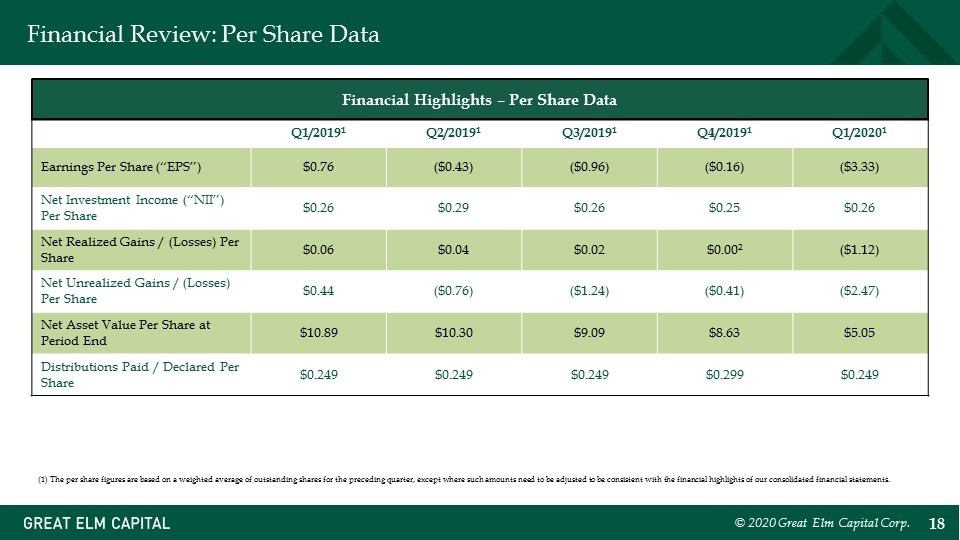

Financial Review: Per Share Data Q1/20191 Q2/20191 Q3/20191 Q4/20191 Q1/20201 Earnings Per Share (“EPS”) $0.76 ($0.43) ($0.96) ($0.16) ($3.33) Net Investment Income (“NII”) Per Share $0.26 $0.29 $0.26 $0.25 $0.26 Net Realized Gains / (Losses) Per Share $0.06 $0.04 $0.02 $0.002 ($1.12) Net Unrealized Gains / (Losses) Per Share $0.44 ($0.76) ($1.24) ($0.41) ($2.47) Net Asset Value Per Share at Period End $10.89 $10.30 $9.09 $8.63 $5.05 Distributions Paid / Declared Per Share $0.249 $0.249 $0.249 $0.299 $0.249 (1) The per share figures are based on a weighted average of outstanding shares for the preceding quarter, except where such amounts need to be adjusted to be consistent with the financial highlights of our consolidated financial statements. Financial Highlights – Per Share Data © 2020 Great Elm Capital Corp.

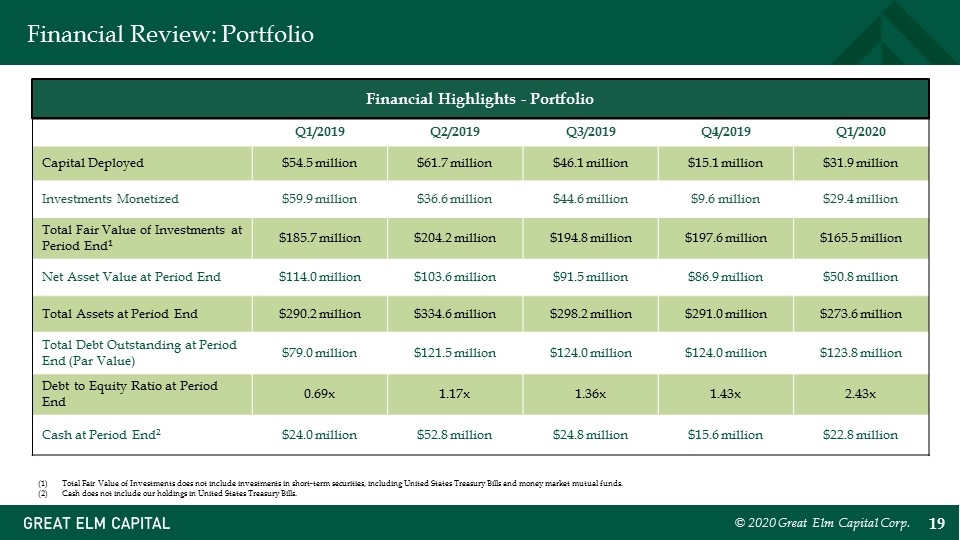

Financial Review: Portfolio Q1/2019 Q2/2019 Q3/2019 Q4/2019 Q1/2020 Capital Deployed $54.5 million $61.7 million $46.1 million $15.1 million $31.9 million Investments Monetized $59.9 million $36.6 million $44.6 million $9.6 million $29.4 million Total Fair Value of Investments at Period End1 $185.7 million $204.2 million $194.8 million $197.6 million $165.5 million Net Asset Value at Period End $114.0 million $103.6 million $91.5 million $86.9 million $50.8 million Total Assets at Period End $290.2 million $334.6 million $298.2 million $291.0 million $273.6 million Total Debt Outstanding at Period End (Par Value) $79.0 million $121.5 million $124.0 million $124.0 million $123.8 million Debt to Equity Ratio at Period End 0.69x 1.17x 1.36x 1.43x 2.43x Cash at Period End2 $24.0 million $52.8 million $24.8 million $15.6 million $22.8 million Total Fair Value of Investments does not include investments in short-term securities, including United States Treasury Bills and money market mutual funds. Cash does not include our holdings in United States Treasury Bills. Financial Highlights - Portfolio © 2020 Great Elm Capital Corp.

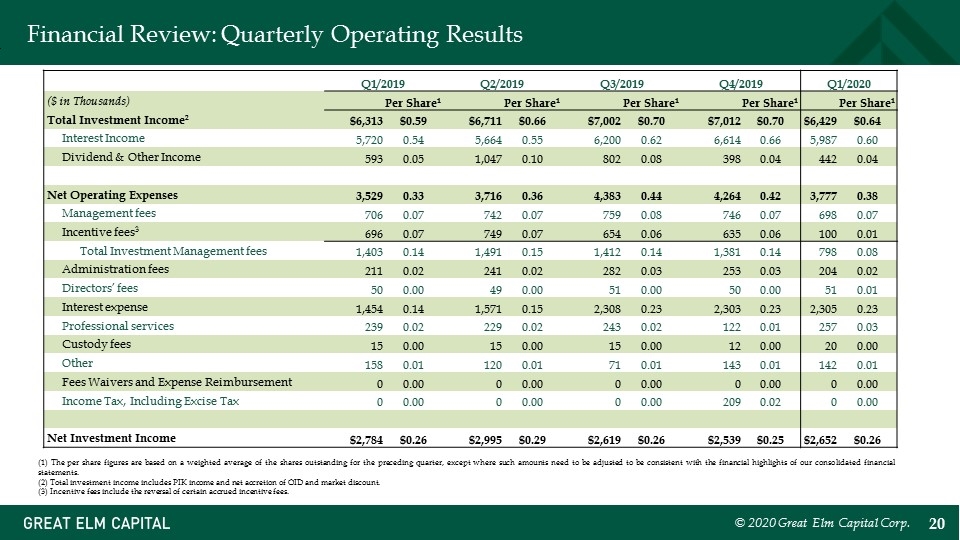

Financial Review: Quarterly Operating Results (1) The per share figures are based on a weighted average of the shares outstanding for the preceding quarter, except where such amounts need to be adjusted to be consistent with the financial highlights of our consolidated financial statements. (2) Total investment income includes PIK income and net accretion of OID and market discount. (3) Incentive fees include the reversal of certain accrued incentive fees. Q1/2019 Q2/2019 Q3/2019 Q4/2019 Q1/2020 ($ in Thousands) Per Share1 Per Share1 Per Share1 Per Share1 Per Share1 Total Investment Income2 $6,313 $0.59 $6,711 $0.66 $7,002 $0.70 $7,012 $0.70 $6,429 $0.64 Interest Income 5,720 0.54 5,664 0.55 6,200 0.62 6,614 0.66 5,987 0.60 Dividend & Other Income 593 0.05 1,047 0.10 802 0.08 398 0.04 442 0.04 Net Operating Expenses 3,529 0.33 3,716 0.36 4,383 0.44 4,264 0.42 3,777 0.38 Management fees 706 0.07 742 0.07 759 0.08 746 0.07 698 0.07 Incentive fees3 696 0.07 749 0.07 654 0.06 635 0.06 100 0.01 Total Investment Management fees 1,403 0.14 1,491 0.15 1,412 0.14 1,381 0.14 798 0.08 Administration fees 211 0.02 241 0.02 282 0.03 253 0.03 204 0.02 Directors’ fees 50 0.00 49 0.00 51 0.00 50 0.00 51 0.01 Interest expense 1,454 0.14 1,571 0.15 2,308 0.23 2,303 0.23 2,305 0.23 Professional services 239 0.02 229 0.02 243 0.02 122 0.01 257 0.03 Custody fees 15 0.00 15 0.00 15 0.00 12 0.00 20 0.00 Other 158 0.01 120 0.01 71 0.01 143 0.01 142 0.01 Fees Waivers and Expense Reimbursement 0 0.00 0 0.00 0 0.00 0 0.00 0 0.00 Income Tax, Including Excise Tax 0 0.00 0 0.00 0 0.00 209 0.02 0 0.00 Net Investment Income $2,784 $0.26 $2,995 $0.29 $2,619 $0.26 $2,539 $0.25 $2,652 $0.26 © 2020 Great Elm Capital Corp.

Capital Activity © 2020 Great Elm Capital Corp.

Capital Activity: Distribution Policy & Declared Distributions We are subject to a minimum asset coverage ratio of 150.0% (the “Minimum ACR”), per the proposal that was approved at our 2018 Annual Stockholders’ Meeting As of March 31, 2020, our asset coverage ratio was approximately 141.1% As a result of falling below the Minimum ACR, we will be subject to certain limitations on our ability to incur additional debt, make cash distributions on junior securities or repurchase junior securities, in each case, in accordance with the Investment Company Act of 1940, as amended, and the indentures governing our outstanding notes, until such time we are above the Minimum ACR As previously announced, in March 2020, our Board declared monthly distributions through the month ending June 30, 2020 of $0.083 per share. Such distributions shall be paid in cash or in shares of our common stock at the election of shareholders, although the total amount of cash to be distributed to all shareholders will be limited to approximately 20% of the total distributions paid to all shareholders. The remainder of the distributions (approximately 80%) will be paid in the form of shares of our common stock In May 2020, our Board set monthly distributions of $0.083 per share for the third quarter of 2020, through the month ending September 30, 2020. The distributions will be paid in cash or shares of our common stock at the election of shareholders, although the total amount of cash to be distributed to all shareholders will be limited to approximately 10% of the total distributions to be paid to all shareholders. The remainder of the distributions (approximately 90%) will be paid in the form of shares of our common stock, in accordance with applicable law and the indentures governing our outstanding notes. © 2020 Great Elm Capital Corp.

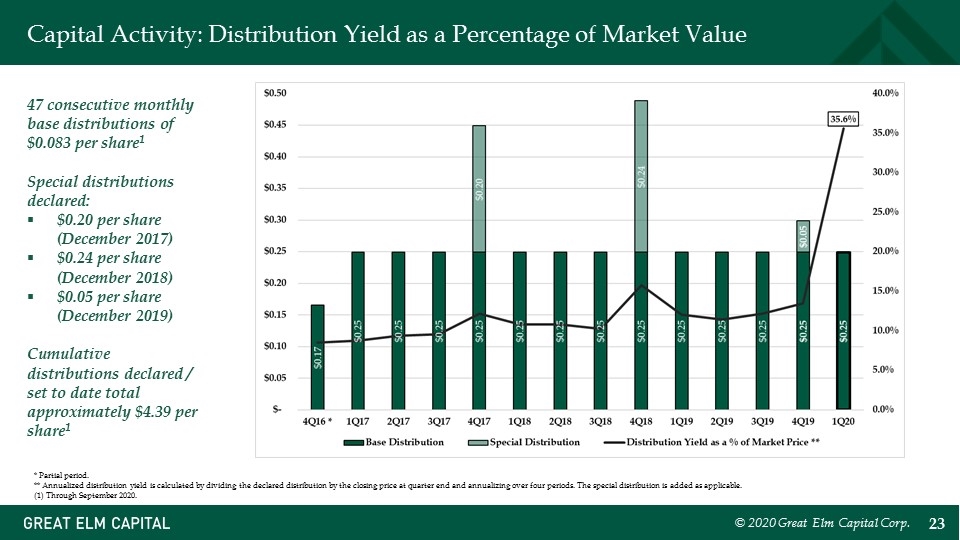

Capital Activity: Distribution Yield as a Percentage of Market Value © 2020 Great Elm Capital Corp. * Partial period. ** Annualized distribution yield is calculated by dividing the declared distribution by the closing price at quarter end and annualizing over four periods. The special distribution is added as applicable. (1) Through September 2020. 47 consecutive monthly base distributions of $0.083 per share1 Special distributions declared: $0.20 per share (December 2017) $0.24 per share (December 2018) $0.05 per share (December 2019) Cumulative distributions declared / set to date total approximately $4.39 per share1

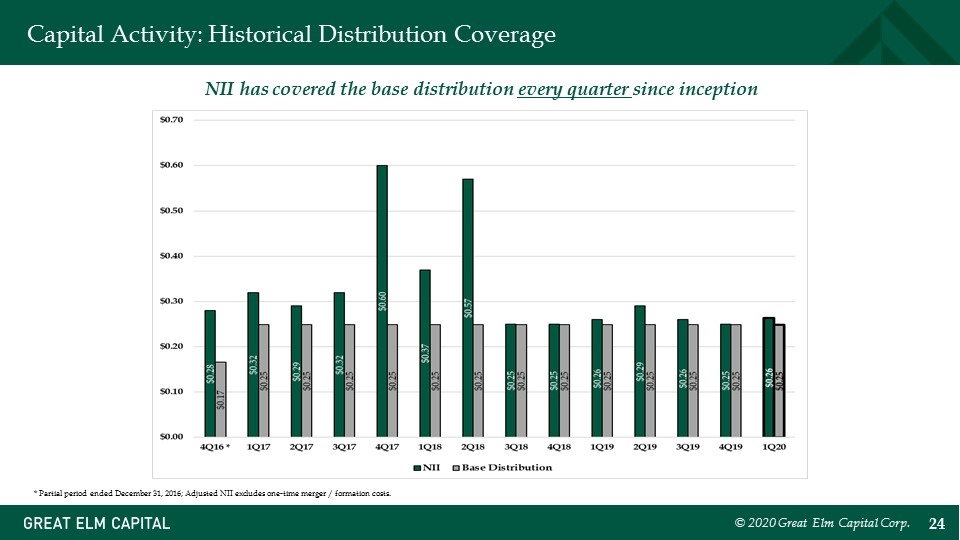

Capital Activity: Historical Distribution Coverage © 2020 Great Elm Capital Corp. * Partial period ended December 31, 2016; Adjusted NII excludes one-time merger / formation costs. NII has covered the base distribution every quarter since inception

Summary © 2020 Great Elm Capital Corp.

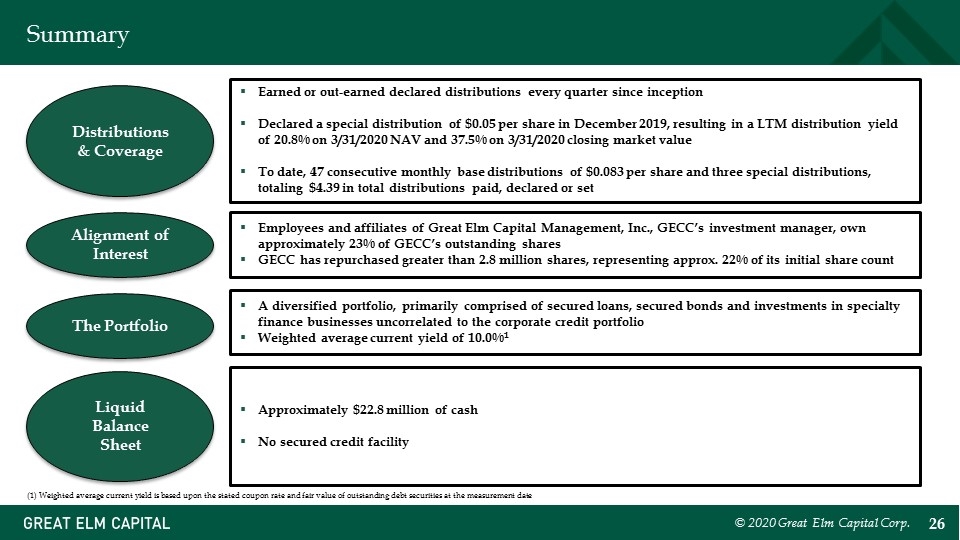

Summary Earned or out-earned declared distributions every quarter since inception Declared a special distribution of $0.05 per share in December 2019, resulting in a LTM distribution yield of 20.8% on 3/31/2020 NAV and 37.5% on 3/31/2020 closing market value To date, 47 consecutive monthly base distributions of $0.083 per share and three special distributions, totaling $4.39 in total distributions paid, declared or set Approximately $22.8 million of cash No secured credit facility Employees and affiliates of Great Elm Capital Management, Inc., GECC’s investment manager, own approximately 23% of GECC’s outstanding shares GECC has repurchased greater than 2.8 million shares, representing approx. 22% of its initial share count Alignment of Interest Liquid Balance Sheet Distributions & Coverage © 2020 Great Elm Capital Corp. The Portfolio A diversified portfolio, primarily comprised of secured loans, secured bonds and investments in specialty finance businesses uncorrelated to the corporate credit portfolio Weighted average current yield of 10.0%1 (1) Weighted average current yield is based upon the stated coupon rate and fair value of outstanding debt securities at the measurement date

Appendix © 2020 Great Elm Capital Corp.

Appendix: General Risks Debt instruments are subject to credit and interest rate risks. Credit risk refers to the likelihood that an obligor will default in the payment of principal or interest on an instrument. Financial strength and solvency of an obligor are the primary factors influencing credit risk. In addition, lack or inadequacy of collateral or credit enhancement for a debt instrument may affect its credit risk. Credit risk may change over the life of an instrument, and debt instruments that are rated by rating agencies are often reviewed and may be subject to downgrade. Our debt investments either are, or if rated would be, rated below investment grade by independent rating agencies. These “junk bonds” and “leveraged loans” are regarded as having predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may be illiquid and difficult to value and typically do not require repayment of principal before maturity, which potentially heightens the risk that we may lose all or part of our investment. Interest rate risk refers to the risks associated with market changes in interest rates. Interest rate changes may affect the value of a debt instrument indirectly (especially in the case of fixed rate obligations) or directly (especially in the case of an instrument whose rates are adjustable). In general, rising interest rates will negatively impact the price of a fixed rate debt instrument and falling interest rates will have a positive effect on price. Adjustable rate instruments also react to interest rate changes in a similar manner although generally to a lesser degree (depending, however, on the characteristics of the reset terms, including the index chosen, frequency of reset and reset caps or floors, among other factors). GECC utilizes leverage to seek to enhance the yield and net asset value of its common stock. These objectives will not necessarily be achieved in all interest rate environments. The use of leverage involves risk, including the potential for higher volatility and greater declines of GECC’s net asset value, fluctuations of dividends and other distributions paid by GECC and the market price of GECC’s common stock, among others. The amount of leverage that GECC may employ at any particular time will depend on, among other things, our Board’s and our adviser’s assessment of market and other factors at the time of any proposed borrowing. As part of our lending activities, we may purchase notes or make loans to companies that are experiencing significant financial or business difficulties, including companies involved in bankruptcy or other reorganization and liquidation proceedings. Although the terms of such financings may result in significant financial returns to us, they involve a substantial degree of risk. The level of analytical sophistication, both financial and legal, necessary for successful financing to companies experiencing significant business and financial difficulties is unusually high. We cannot assure you that we will correctly evaluate the value of the assets collateralizing our investments or the prospects for a successful reorganization or similar action. In any reorganization or liquidation proceeding relating to a portfolio company, we may lose all or part of the amounts advanced to the borrower or may be required to accept collateral with a value less than the amount of the investment advanced by us to the borrower. © 2020 Great Elm Capital Corp.

Appendix: Contact Information Investor Relations 800 South Street, Suite 230 Waltham, MA 02453 Phone: +1 (617) 375-3006 investorrelations@greatelmcap.com © 2020 Great Elm Capital Corp.