Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Accel Entertainment, Inc. | accel1q20resultspresenta.htm |

| 8-K - 8-K - Accel Entertainment, Inc. | accel-20200511x8kearnings.htm |

Accel Entertainment Announces Q1 2020 Operating Results May 11, 2020 07:30 AM Eastern Daylight Time CHICAGO--(BUSINESS WIRE)--Accel Entertainment, Inc. (NYSE: ACEL) today announced certain financial and operating results for the three-months ended March 31, 2020. Accel Q1 2020 Highlights: Ended Q1 2020 with 2,353 locations; an increase of 35% compared to Q1 2019 (9% excluding the impact of the Grand River acquisition) Ended Q1 2020 with 11,164 video gaming terminals (“VGTs”); an increase of 41% compared to Q1 2019 (16% excluding the impact of the Grand River acquisition) Q1 2020 Total net revenues of $105 million, an increase of 8% compared to Q1 2019 Q1 2020 Adjusted EBITDA of $15 million, a decrease of 25% compared to Q1 2019 In response to the COVID-19 pandemic, the Illinois Gaming Board shut down all VGTs across the state of Illinois starting on March 16th On March 20th, Illinois’ Governor instituted a stay at home order to limit the spread of COVID-19; the stay at home order was subsequently extended to May 30th Accel Entertainment CEO Andy Rubenstein commented, “These are truly unprecedented times, but I have been extremely proud of how the Accel team has responded to the current environment in our industry. Accel remains fully committed to providing the same great customer service that has become our hallmark. We are confident that our financial discipline, combined with our strong balance sheet and asset-lite business model, positions us well to successfully maintain our leadership position in the industry.” /

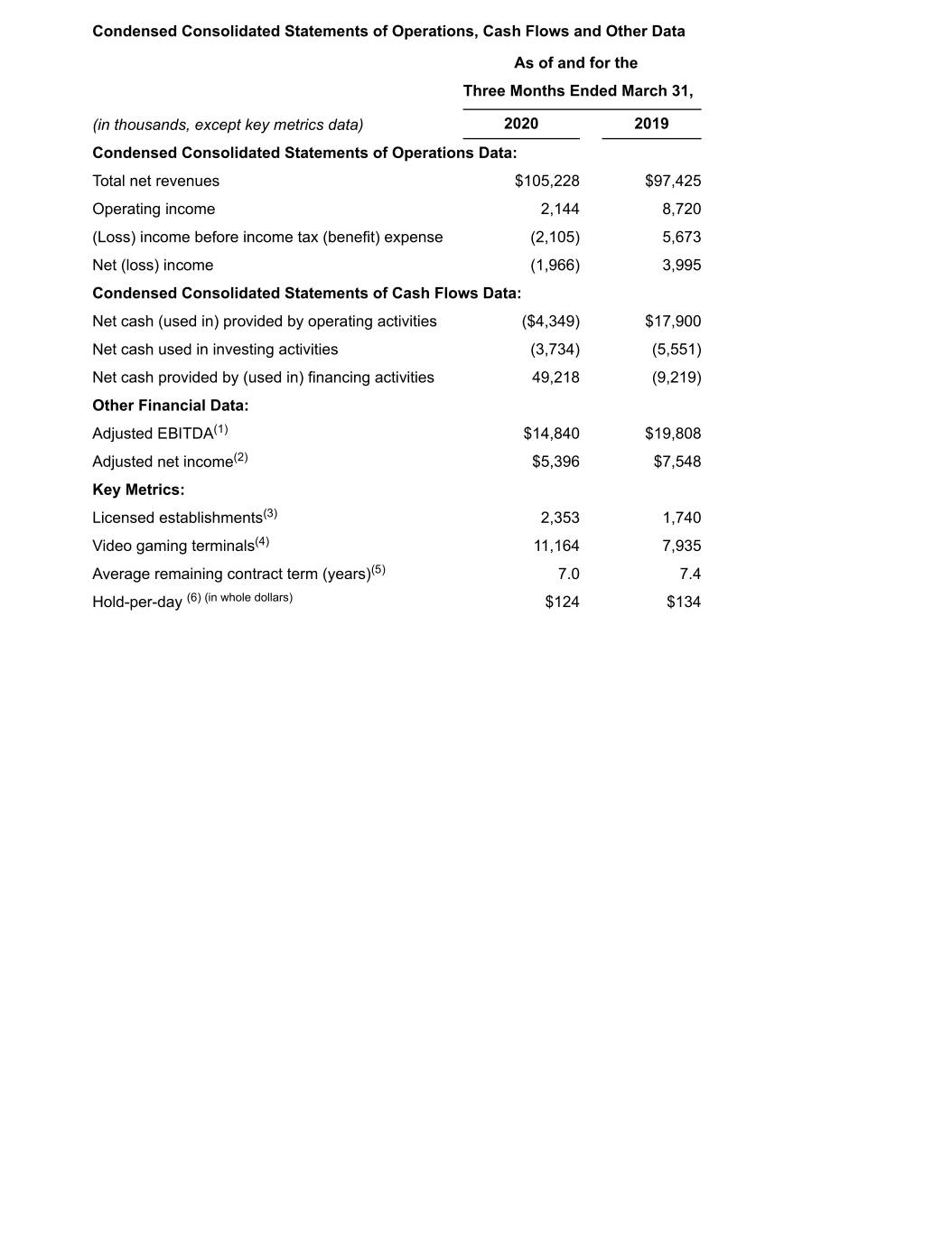

Condensed Consolidated Statements of Operations, Cash Flows and Other Data As of and for the Three Months Ended March 31, (in thousands, except key metrics data) 2020 2019 Condensed Consolidated Statements of Operations Data: Total net revenues $105,228 $97,425 Operating income 2,144 8,720 (Loss) income before income tax (benefit) expense (2,105) 5,673 Net (loss) income (1,966) 3,995 Condensed Consolidated Statements of Cash Flows Data: Net cash (used in) provided by operating activities ($4,349) $17,900 Net cash used in investing activities (3,734) (5,551) Net cash provided by (used in) financing activities 49,218 (9,219) Other Financial Data: Adjusted EBITDA(1) $14,840 $19,808 Adjusted net income(2) $5,396 $7,548 Key Metrics: Licensed establishments(3) 2,353 1,740 Video gaming terminals(4) 11,164 7,935 Average remaining contract term (years)(5) 7.0 7.4 Hold-per-day (6) (in whole dollars) $124 $134 /

(1) Adjusted EBITDA is defined as net (loss) income plus amortization of route and customer acquisition costs and location contracts acquired; stock-based compensation expense; other expenses, net; tax effect of adjustments; depreciation and amortization of property and equipment; interest expense; and provision for income taxes. For additional information on Adjusted EBITDA and a reconciliation of net (loss) income to Adjusted EBITDA, see “Non-GAAP Financial Measures—Adjusted EBITDA and Adjusted net income.” (2) Adjusted Net income is defined as net (loss) income plus amortization of route and customer acquisition costs and location contracts acquired; stock-based compensation expense; other expenses, net; and tax effect of adjustments. For additional information on Adjusted net income and a reconciliation of net (loss) income to Adjusted net income, see "Non-GAAP Financial Measures— Adjusted EBITDA and Adjusted net income.” (3) Based on Scientific Games International third-party terminal operator portal data which is updated at the end of each gaming day and includes licensed establishments that may be temporarily closed but still connected to the central system. This metric is utilized by Accel to continually monitor growth from existing locations, organic openings, acquired locations, and competitor conversions. (4) Based on Scientific Games International third-party terminal operator portal data which is updated at the end of each gaming day and includes VGTs that may be temporarily shut off but still connected to the central system. This metric is utilized by Accel to continually monitor growth from existing locations, organic openings, acquired locations, and competitor conversions. (5) Calculated by determining the average expiration date of all outstanding contracts, and then subtracting the applicable measurement date. The IGB limited the length of contracts entered into after February 2, 2018 to a maximum of eight years with no automatic renewals. (6) Calculated by dividing the difference between cash deposited in all VGTs and tickets issued to players by the average number of VGTs in operation during the period being measured, and then further dividing such quotient by the number of open days in such period. Hold per day for the three months ended March 31, 2020 is computed based on 76-eligible days of gaming (excludes 15 non-gaming days due to the IGB mandated COVID-19 shutdown). /

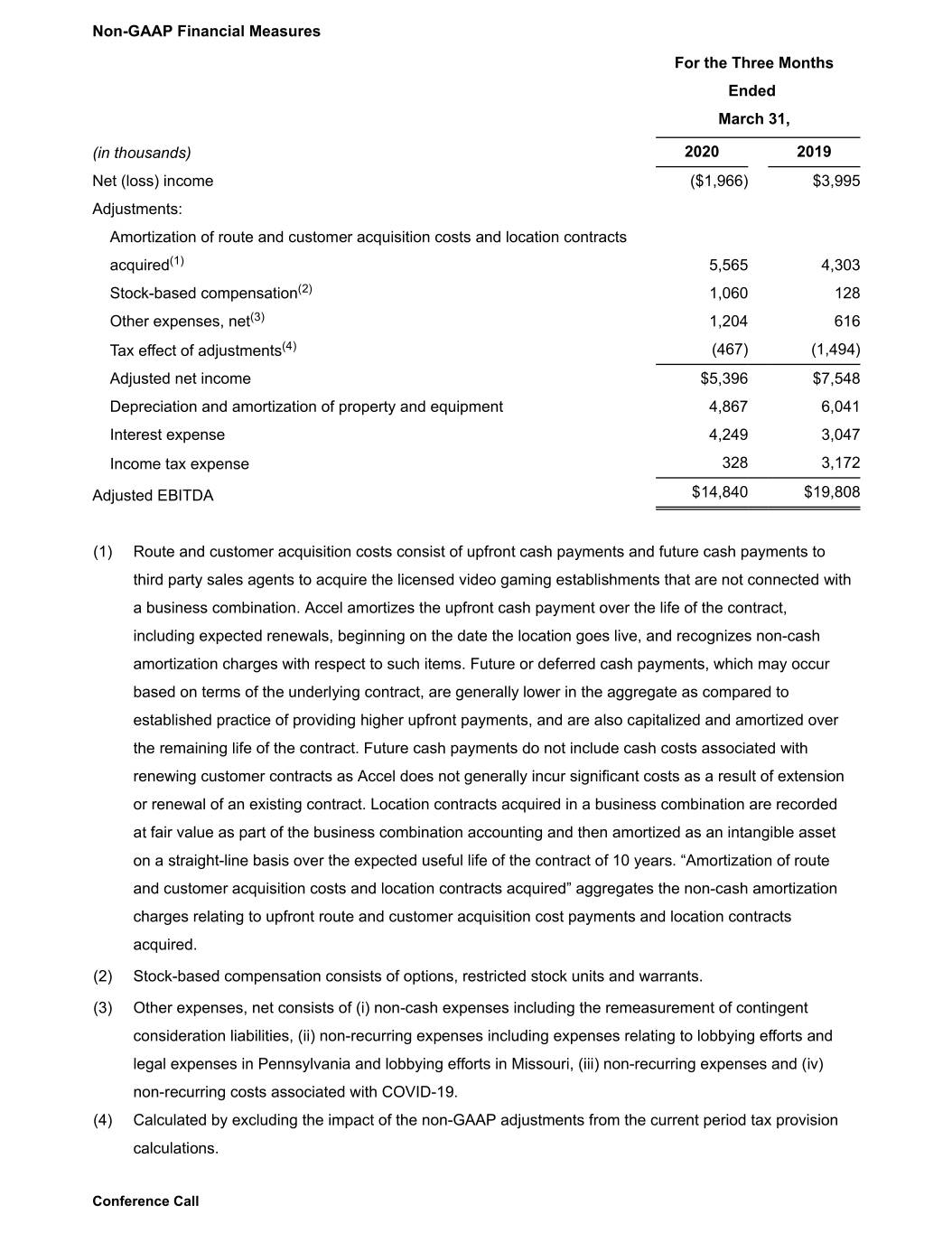

Non-GAAP Financial Measures For the Three Months Ended March 31, (in thousands) 2020 2019 Net (loss) income ($1,966) $3,995 Adjustments: Amortization of route and customer acquisition costs and location contracts acquired(1) 5,565 4,303 Stock-based compensation(2) 1,060 128 Other expenses, net(3) 1,204 616 Tax effect of adjustments(4) (467) (1,494) Adjusted net income $5,396 $7,548 Depreciation and amortization of property and equipment 4,867 6,041 Interest expense 4,249 3,047 Income tax expense 328 3,172 Adjusted EBITDA $14,840 $19,808 (1) Route and customer acquisition costs consist of upfront cash payments and future cash payments to third party sales agents to acquire the licensed video gaming establishments that are not connected with a business combination. Accel amortizes the upfront cash payment over the life of the contract, including expected renewals, beginning on the date the location goes live, and recognizes non-cash amortization charges with respect to such items. Future or deferred cash payments, which may occur based on terms of the underlying contract, are generally lower in the aggregate as compared to established practice of providing higher upfront payments, and are also capitalized and amortized over the remaining life of the contract. Future cash payments do not include cash costs associated with renewing customer contracts as Accel does not generally incur significant costs as a result of extension or renewal of an existing contract. Location contracts acquired in a business combination are recorded at fair value as part of the business combination accounting and then amortized as an intangible asset on a straight-line basis over the expected useful life of the contract of 10 years. “Amortization of route and customer acquisition costs and location contracts acquired” aggregates the non-cash amortization charges relating to upfront route and customer acquisition cost payments and location contracts acquired. (2) Stock-based compensation consists of options, restricted stock units and warrants. (3) Other expenses, net consists of (i) non-cash expenses including the remeasurement of contingent consideration liabilities, (ii) non-recurring expenses including expenses relating to lobbying efforts and legal expenses in Pennsylvania and lobbying efforts in Missouri, (iii) non-recurring expenses and (iv) non-recurring costs associated with COVID-19. (4) Calculated by excluding the impact of the non-GAAP adjustments from the current period tax provision calculations. Conference Call /

Accel will host an investor conference call on May 11, 2020 at 11 a.m. Central (12 p.m. Eastern) to discuss these operating and financial results. Interested parties may join the webcast by dialing (833) 502 0490, Event ID: 8481609#. Following completion of the call, a replay of the webcast will be posted on Accel’s investor relations website. About Accel Accel is a leading distributed gaming operator in the United States on an Adjusted EBITDA basis, and a preferred partner for local business owners in the Illinois market. Accel’s business consists of the installation, maintenance and operation of VGTs, redemption devices that disburse winnings and contain ATM functionality, and other amusement devices in authorized non-casino locations such as restaurants, bars, taverns, convenience stores, liquor stores, truck stops, and grocery stores. Forward Looking Statements This press release may include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact included in this press release are forward-looking statements. When used in this press release, words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “target,” “plan,” “outlook” and similar expressions, as they relate to us or our management team, identify forward-looking statements. Such forward-looking statements are based on the beliefs of management, as well as assumptions made by, and information currently available to, the Company’s management. Actual results could differ materially from those contemplated by the forward-looking statements as a result of certain factors detailed in the Company’s filings with the Securities and Exchange Commission (“SEC”). All subsequent written or oral forward-looking statements attributable to us or persons acting on our behalf are qualified in their entirety by this paragraph. Forward-looking statements are subject to numerous conditions, many of which are beyond the control of the Company. The Company undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law. Non-GAAP Financial Information This press release includes certain financial information not prepared in accordance with Generally Accepted Accounting Principles in the United States (“GAAP”), including Adjusted EBITDA. Adjusted EBITDA is a non-GAAP financial measure and is a key metric used to monitor ongoing core operations. Management of Accel believes Adjusted EBITDA enhances the understanding of Accel’s underlying drivers of profitability and trends in Accel’s business and facilitate company-to- company and period-to-period comparisons, because this non-GAAP financial measure excludes the effects of certain non- cash items or represent certain nonrecurring items that are unrelated to core performance. Management of Accel also believes that this non-GAAP financial measure is used by investors, analysts and other interested parties as measures of financial performance. Although Accel excludes amortization of route and customer acquisition costs and location contracts acquired from Adjusted EBITDA, Accel believes that it is important for investors to understand that these route, customer and location contract acquisitions contribute to revenue generation. Any future acquisitions may result in amortization of route and customer acquisition costs and location contracts acquired. Adjusted EBITDA is not a recognized term under GAAP. This non-GAAP financial measure excludes some, but not all, items that affect net income, and this measure may vary among companies. This non-GAAP financial measure is unaudited and has important limitations as an analytical tool, should not be viewed in isolation and does not purport to be an alternative to net income as indicators of operating performance. Contacts Media: Eric Bonach Abernathy MacGregor /

212-371-5999 ejb@abmac.com /