Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Accel Entertainment, Inc. | q12020resultspressreleas.htm |

| 8-K - 8-K - Accel Entertainment, Inc. | accel-20200511x8kearnings.htm |

Accel Entertainment First Quarter 2020 Earnings Presentation May 2020 1

Important Information Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, contained in this presentation are forward-looking statements, including, but not limited to, statements regarding our strategy, prospects, plans, objectives, future operations, future revenue and earnings, projected margins and expenses, markets for our services, potential acquisitions or strategic alliances, financial position, and liquidity and anticipated cash needs and availability. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would,” and similar expressions or the negatives thereof are intended to identify forward-looking statements. However, not all forward-looking statements contain these identifying words. These forward-looking statements represent our current reasonable expectations and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance and achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. We cannot guarantee the accuracy of the forward-looking statements, and you should be aware that results and events could differ materially and adversely from those contained in the forward-looking statements due to a number of factors including, but not limited to: the existing and potential future adverse impact of the COVID-19 pandemic on Accel’s business, operations and financial condition, including as a result the suspension of all video gaming terminal operations by the Illinois Gaming Board starting on March 16, 2020, which suspension remains in effect; Accel’s ability to operate in existing markets or expand into new jurisdictions; Accel’s ability to manage its growth effectively; Accel’s ability to offer new and innovative products and services that fulfill the needs of licensed establishment partners and create strong and sustained player appeal; Accel’s dependence on relationships with key manufacturers, developers and third parties to obtain VGTs, amusement machines, and related supplies, programs, and technologies for its business on acceptable terms; the negative impact on Accel’s future results of operations by the slow growth in demand for VGTs and by the slow growth of new gaming jurisdictions; Accel’s heavy dependency on its ability to win, maintain and renew contracts with licensed establishment partners; unfavorable economic conditions or decreased discretionary spending due to other factors such as epidemics or other public health issues (including COVID-19), terrorist activity or threat thereof, , civil unrest or other economic or political uncertainties, that could adversely affect Accel’s business, results of operations, cash flows and financial conditions and other risks and uncertainties indicated from time to time in documents filed or to be filed with the Securities and Exchange Commission ("SEC"). Accordingly, forward-looking statements, including any projections or analysis, should not be viewed as factual and should not be relied upon as an accurate prediction of future results. The forward-looking statements contained in this presentation are based on our current expectations and beliefs concerning future developments and their potential effects on the Accel. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control), or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the sections entitled “Risk Factors” in the Quarterly Report on Form 10-Q and in the Annual Report on Form 10-K filed by Accel with the SEC, as well as Accel’s other filings with the SEC. Except as required by law, we do not undertake publicly to update or revise these statements, even if experience or future changes make it clear that any projected results expressed in this presentation or future quarterly reports, press releases or company statements will not be realized. In addition, the inclusion of any statement in this presentation does not constitute an admission by us that the events or circumstances described in such statement are material. We qualify all of our forward-looking statements by these cautionary statements. In addition, the industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors including those described in the section entitled “Risk Factors.” These and other factors could cause our results to differ materially from those expressed in this presentation. Industry and Market Data Unless otherwise indicated, information contained in this presentation concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity, and market size, is based on information from various sources, on assumptions that we have made that are based on those data and other similar sources, and on our knowledge of the markets for our services. This information includes a number of assumptions and limitations, and you are cautioned not to give undue weight to such information. In addition, projections, assumptions, and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the Quarterly Report on Form 10-Q and in the Annual Report on Form 10-K filed by Accel with the SEC, as well as Accel’s other filings with the SEC. These and other factors could cause results to differ materially from those expressed in the estimates made by third parties and by us. Use of Non-GAAP Financial Measures This presentation includes non-GAAP financial measures, including Adjusted EBITDA. Adjusted EBITDA is defined as net (loss) income plus amortization of route and customer acquisition costs and location contracts acquired; stock-based compensation expense; other expenses, net; tax effect of adjustments; depreciation and amortization of property and equipment; interest expense; and provision for income taxes.. Management believes that these non-GAAP measures of financial results enhance the understanding of Accel’s underlying drivers of profitability and trends in Accel’s business and facilitate company-to-company and period-to period comparisons, because these non-GAAP financial measures exclude the effects of certain non-cash items or represent certain nonrecurring items that are unrelated to core performance. Management of Accel also believes that these non-GAAP financial measures are used by investors, analysts and other interested parties as measures of financial performance and to evaluate Accel’s ability to fund capital expenditures, service debt obligations and meet working capital requirements. See the slide entitled “Non-GAAP to GAAP Reconciliation” on page 12 for additional information. 2

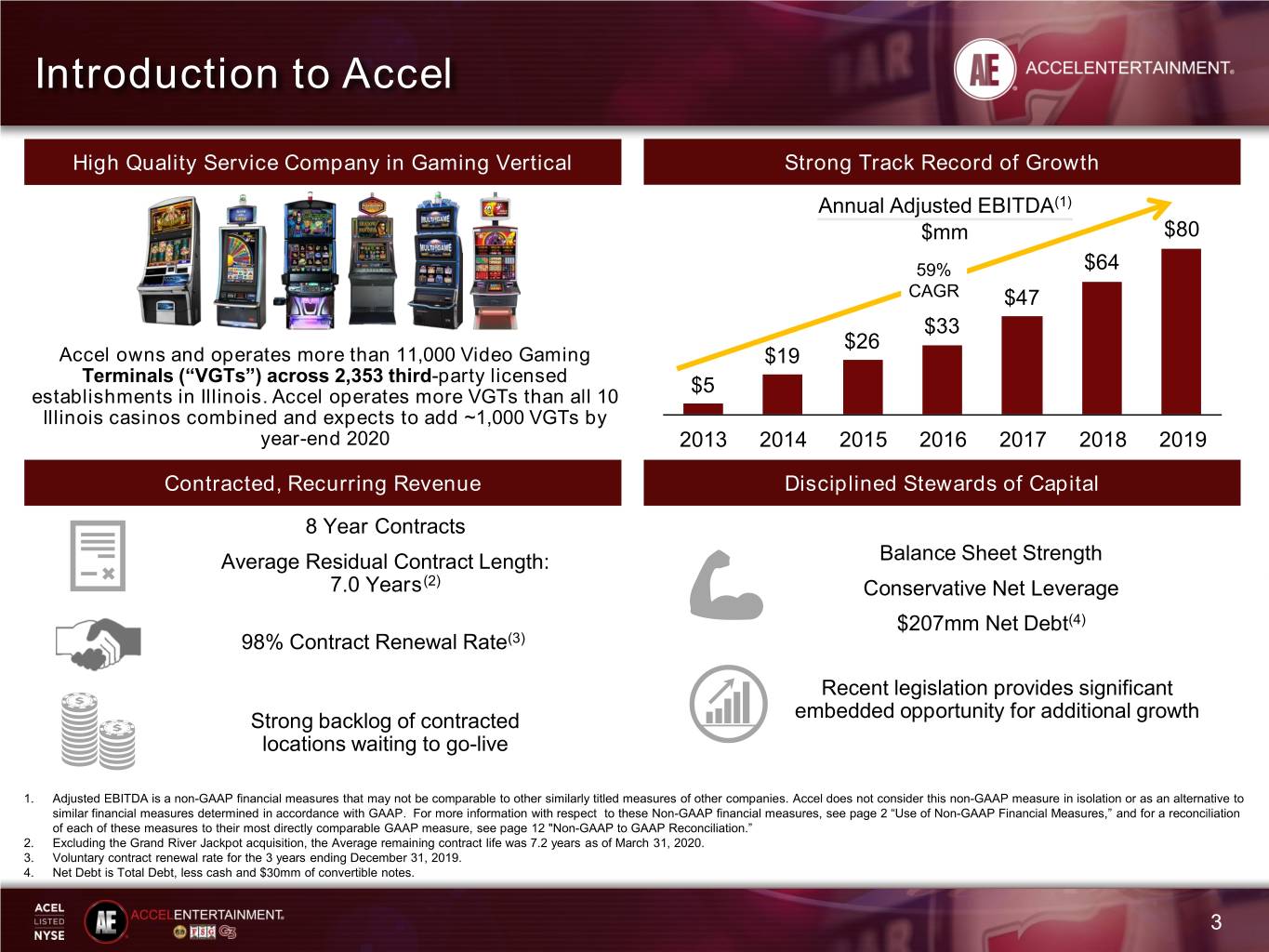

Introduction to Accel High Quality Service Company in Gaming Vertical Strong Track Record of Growth Annual Adjusted EBITDA(1) $mm $80 59% $64 CAGR $47 $33 $26 Accel owns and operates more than 11,000 Video Gaming $19 Terminals (“VGTs”) across 2,353 third-party licensed $5 establishments in Illinois. Accel operates more VGTs than all 10 Illinois casinos combined and expects to add ~1,000 VGTs by year-end 2020 2013 2014 2015 2016 2017 2018 2019 Contracted, Recurring Revenue Disciplined Stewards of Capital 8 Year Contracts Average Residual Contract Length: Balance Sheet Strength 7.0 Years(2) Conservative Net Leverage $207mm Net Debt(4) 98% Contract Renewal Rate(3) Recent legislation provides significant Strong backlog of contracted embedded opportunity for additional growth locations waiting to go-live 1. Adjusted EBITDA is a non-GAAP financial measures that may not be comparable to other similarly titled measures of other companies. Accel does not consider this non-GAAP measure in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to these Non-GAAP financial measures, see page 2 “Use of Non-GAAP Financial Measures,” and for a reconciliation of each of these measures to their most directly comparable GAAP measure, see page 12 "Non-GAAP to GAAP Reconciliation.” 2. Excluding the Grand River Jackpot acquisition, the Average remaining contract life was 7.2 years as of March 31, 2020. 3. Voluntary contract renewal rate for the 3 years ending December 31, 2019. 4. Net Debt is Total Debt, less cash and $30mm of convertible notes. 3

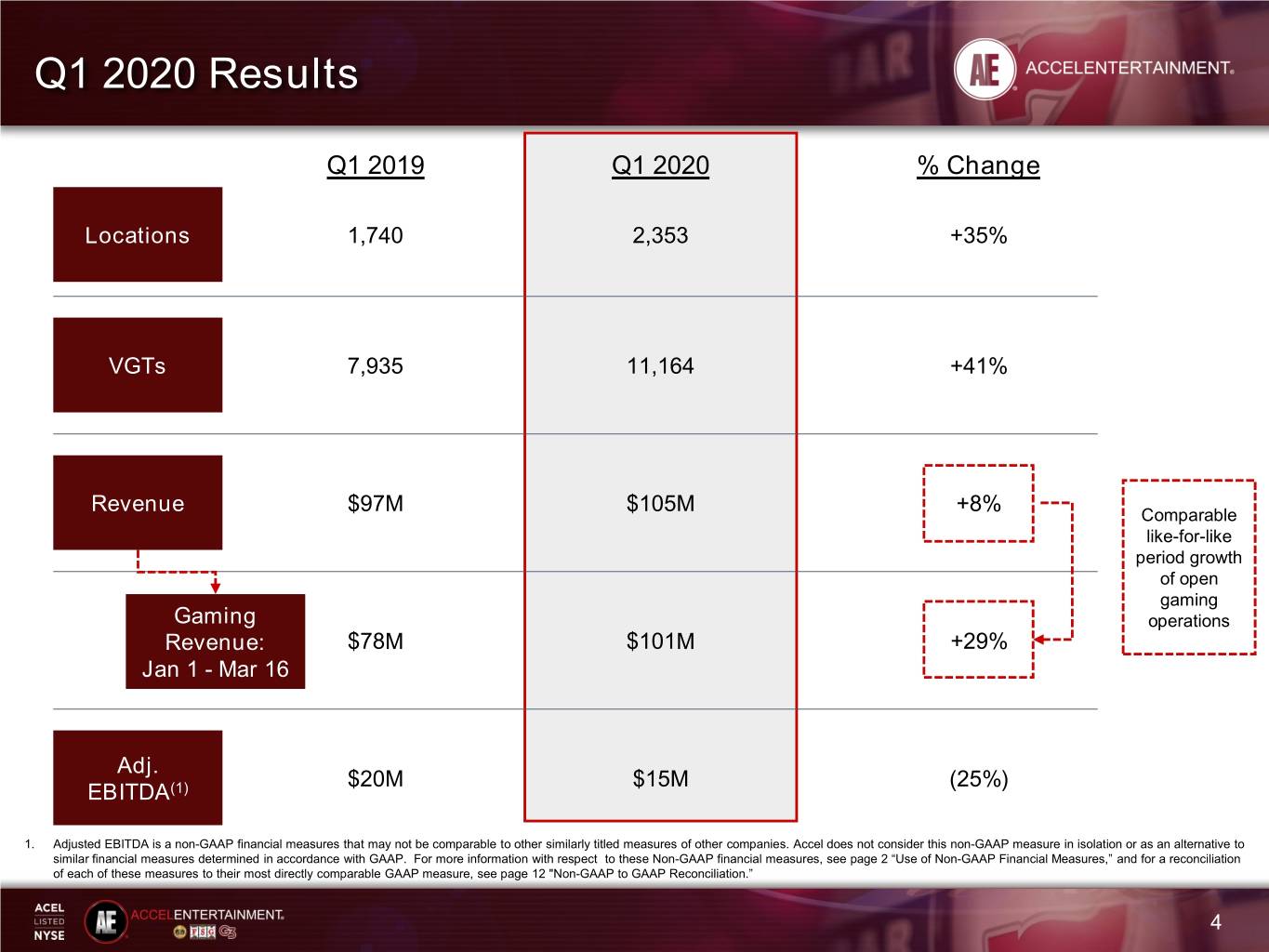

Q1 2020 Results Q1 2019 Q1 2020 % Change Locations 1,740 2,353 +35% VGTs 7,935 11,164 +41% Revenue $97M $105M +8% Comparable like-for-like period growth of open gaming Gaming operations Revenue: $78M $101M +29% Jan 1 - Mar 16 Adj. $20M $15M (25%) EBITDA(1) 1. Adjusted EBITDA is a non-GAAP financial measures that may not be comparable to other similarly titled measures of other companies. Accel does not consider this non-GAAP measure in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to these Non-GAAP financial measures, see page 2 “Use of Non-GAAP Financial Measures,” and for a reconciliation of each of these measures to their most directly comparable GAAP measure, see page 12 "Non-GAAP to GAAP Reconciliation.” 4

COVID-19 Update • In response to the COVID-19 pandemic, the Illinois Gaming Board shut down all VGTs across the state of Illinois starting at 9PM on Monday March 16th • On March 20th, Illinois’ Governor instituted a stay at home order to limit the spread of COVID-19. The stay at home order, and suspension of VGT activities, was subsequently extended to May 30th • In late-March Accel took actions to significantly reduce projected cash expenses to $2 - 3 million per month of which interest and insurance make up over 50% of the expense • In these reductions most all of Accel’s senior management, including its CEO, CFO, and General Counsel, agreed to forego 100% of their respective base salaries until the company resumes video gaming operations • Accel has worked with our location partners to help them apply for relief under the CARES Act • Accel has developed a plan to safely and rapidly resume operations once the “stay-at- home” order is lifted • Last week, Illinois’ Governor announced a regional and phased based reopening plan for Illinois. We are waiting for more information on how and when each region will progress through the phases and its effect on the relaunch of video gaming 5

Liquidity Update • Immediately following the suspension of video gaming activities on March 16th, Accel began expedited cash collections from our location partners. All field cash was collected within 72 hours • On March 18th Accel drew down $65 million on its delayed-draw term loan • As of March 31st Accel had total liquidity of $216 million, consisting of $167 million of cash and cash equivalents plus $50 million of revolver availability • Given Accel’s substantial cash balance and current level of cash expenses, in a shut- down scenario we believe we have multiple years of liquidity without needing to raise outside capital 6

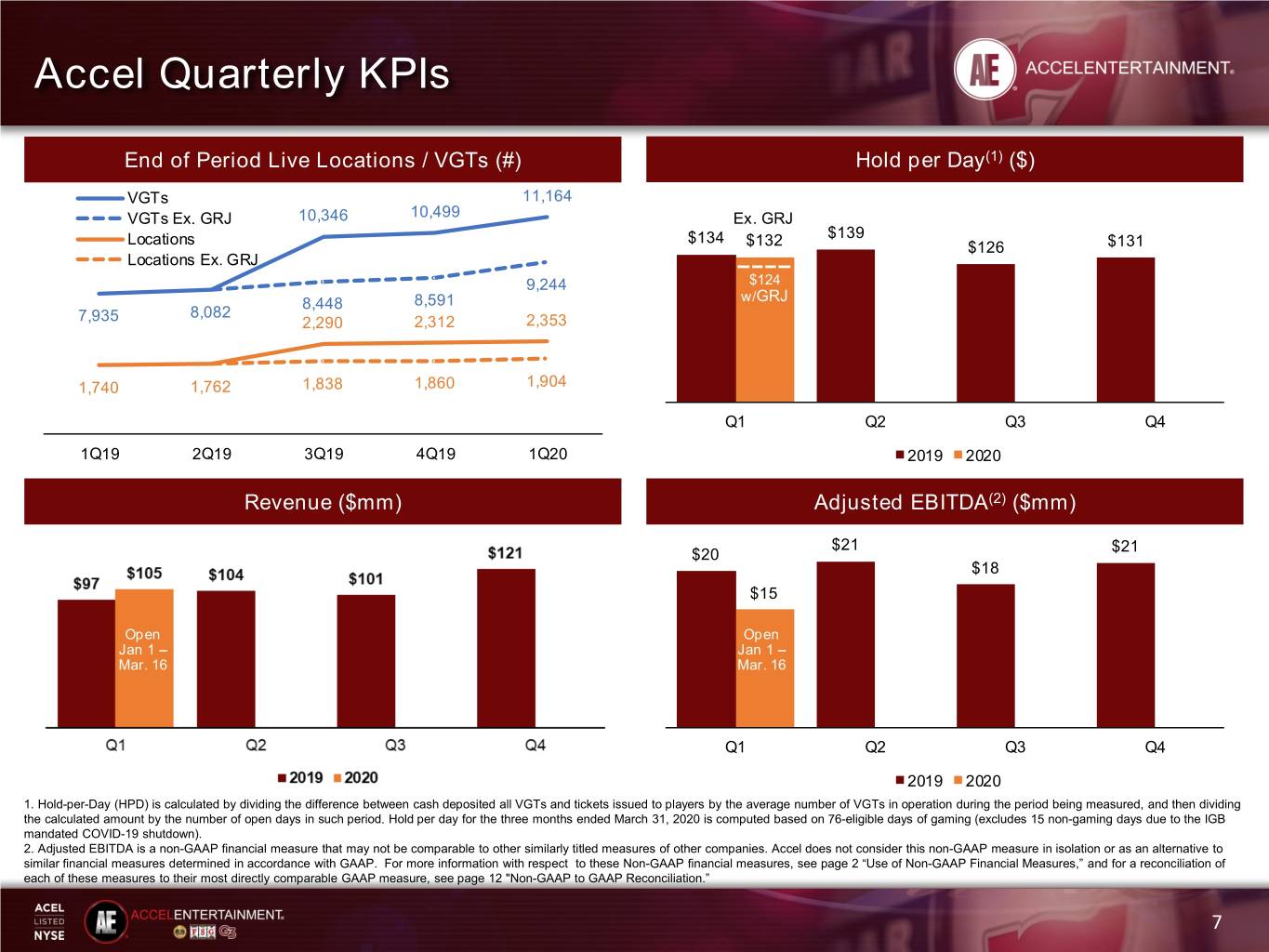

Accel Quarterly KPIs End of Period Live Locations / VGTs (#) Hold per Day(1) ($) VGTs 11,164 VGTs Ex. GRJ 10,346 10,499 Ex. GRJ Locations $134 $139 $132 $126 $131 Locations Ex. GRJ 9,244 $124 8,448 8,591 w/GRJ 8,082 7,935 2,290 2,312 2,353 1,740 1,762 1,838 1,860 1,904 Q1 Q2 Q3 Q4 1Q19 2Q19 3Q19 4Q19 1Q20 2019 2020 Revenue ($mm) Adjusted EBITDA(2) ($mm) $21 $21 $20 $18 $15 Open Open Jan 1 – Jan 1 – Mar. 16 Mar. 16 Q1 Q2 Q3 Q4 2019 2020 1. Hold-per-Day (HPD) is calculated by dividing the difference between cash deposited all VGTs and tickets issued to players by the average number of VGTs in operation during the period being measured, and then dividing the calculated amount by the number of open days in such period. Hold per day for the three months ended March 31, 2020 is computed based on 76-eligible days of gaming (excludes 15 non-gaming days due to the IGB mandated COVID-19 shutdown). 2. Adjusted EBITDA is a non-GAAP financial measure that may not be comparable to other similarly titled measures of other companies. Accel does not consider this non-GAAP measure in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to these Non-GAAP financial measures, see page 2 “Use of Non-GAAP Financial Measures,” and for a reconciliation of each of these measures to their most directly comparable GAAP measure, see page 12 "Non-GAAP to GAAP Reconciliation.” 7

Regulatory Update • Illinois VGT operations have been suspended since March 16th due to COVID-19 related restrictions. Current restrictions are in place until May 30th • The vast majority of our location partners are eligible for PPP loans under CARES act, and based off a COVID-19 survey of our location partners we expect that ~75% applied for assistance • Governor Pritzker announced a regional and phased based reopening plan for Illinois. We are waiting for more information on what phase each region is in and which phase will allow video gaming to relaunch • Illinois Legislation allows for the addition of a 6th machine at each location, and up to 10 total machines at certain qualified truck stops 6th VGT • The IGB gave approval to start installing 6th machines on January 13th • Accel has installed more than 480 6th machines and expects to install a total of 1,000 by year-end • Legislation increases the max bet from $2 to $4, and increases the max payout from $500 to $1,199 • Higher bet/win limits require a software update to be developed by each VGT manufacturer, which are Increased Bet at varying levels of readiness Limits / New • Remote updates are being deployed during the shutdown Software • ~50% of VGTs will require a site visit to complete the update • Expect to complete update by year-end • Missouri House Bill (“HB”) 2088 would allow VGTs and sports betting in certain areas of the state. Bars would be allowed to operate 5 VGTs per location, while truck stops and fraternal organizations would Missouri be allowed 10 VGTs per location. HB 2088 was recently approved by the Missouri House Special Legislation Committee • Accel’s strong position in southwestern Illinois (reinforced by the acquisition of Grand River Jackpot) can act as a staging point to enter Missouri in the event legislation is passed Georgia • Georgia currently allows coin-operated skill based games, primarily in convenience stores Expansion • Accel is evaluating ways to enter the Georgia market and expand gaming to higher quality locations 8

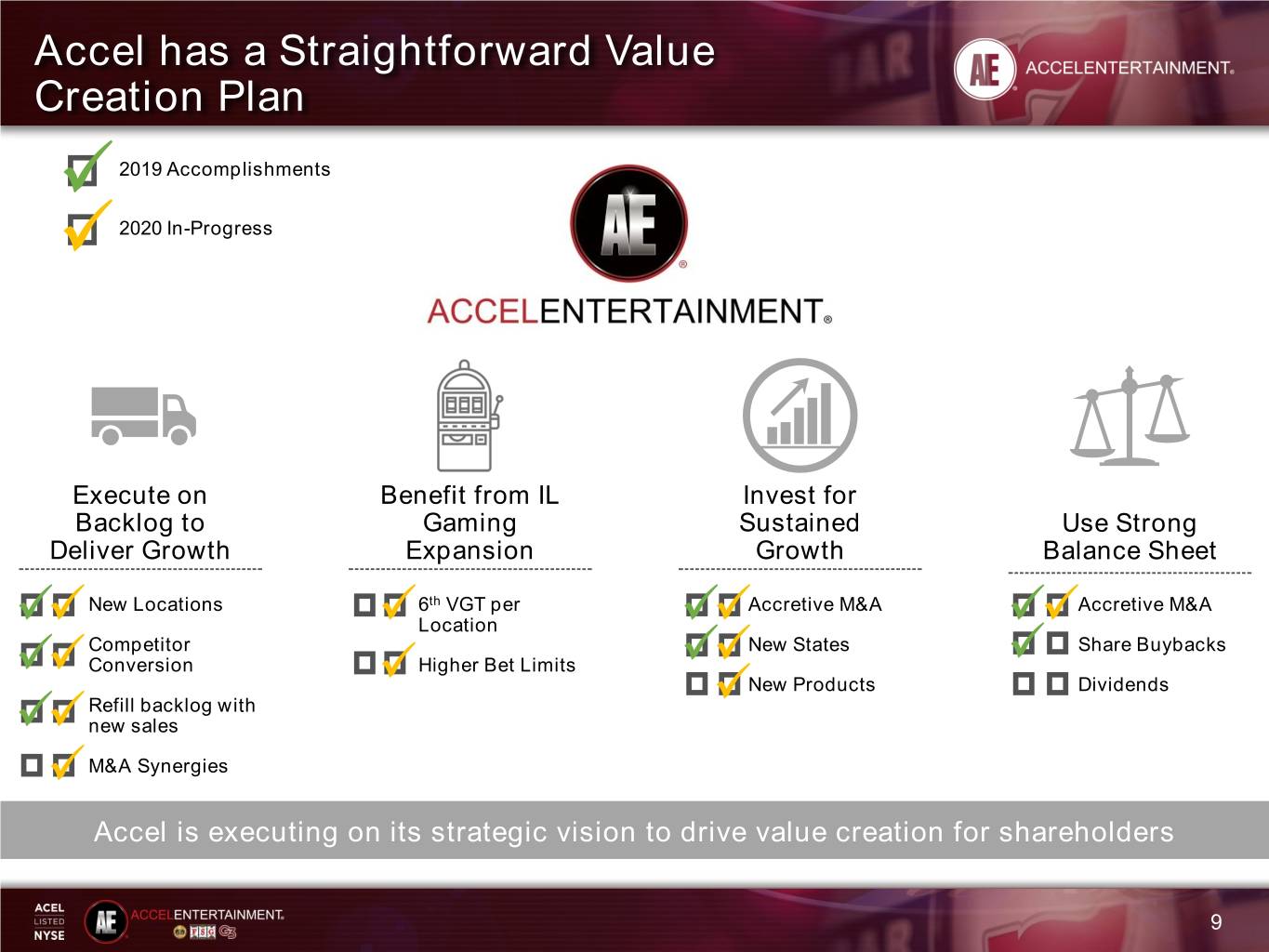

Accel has a Straightforward Value Creation Plan 2019 Accomplishments 2020 In-Progress Execute on Benefit from IL Invest for Backlog to Gaming Sustained Use Strong Deliver Growth Expansion Growth Balance Sheet New Locations 6th VGT per Accretive M&A Accretive M&A Location Competitor New States Share Buybacks Conversion Higher Bet Limits New Products Dividends Refill backlog with new sales M&A Synergies Accel is executing on its strategic vision to drive value creation for shareholders 9

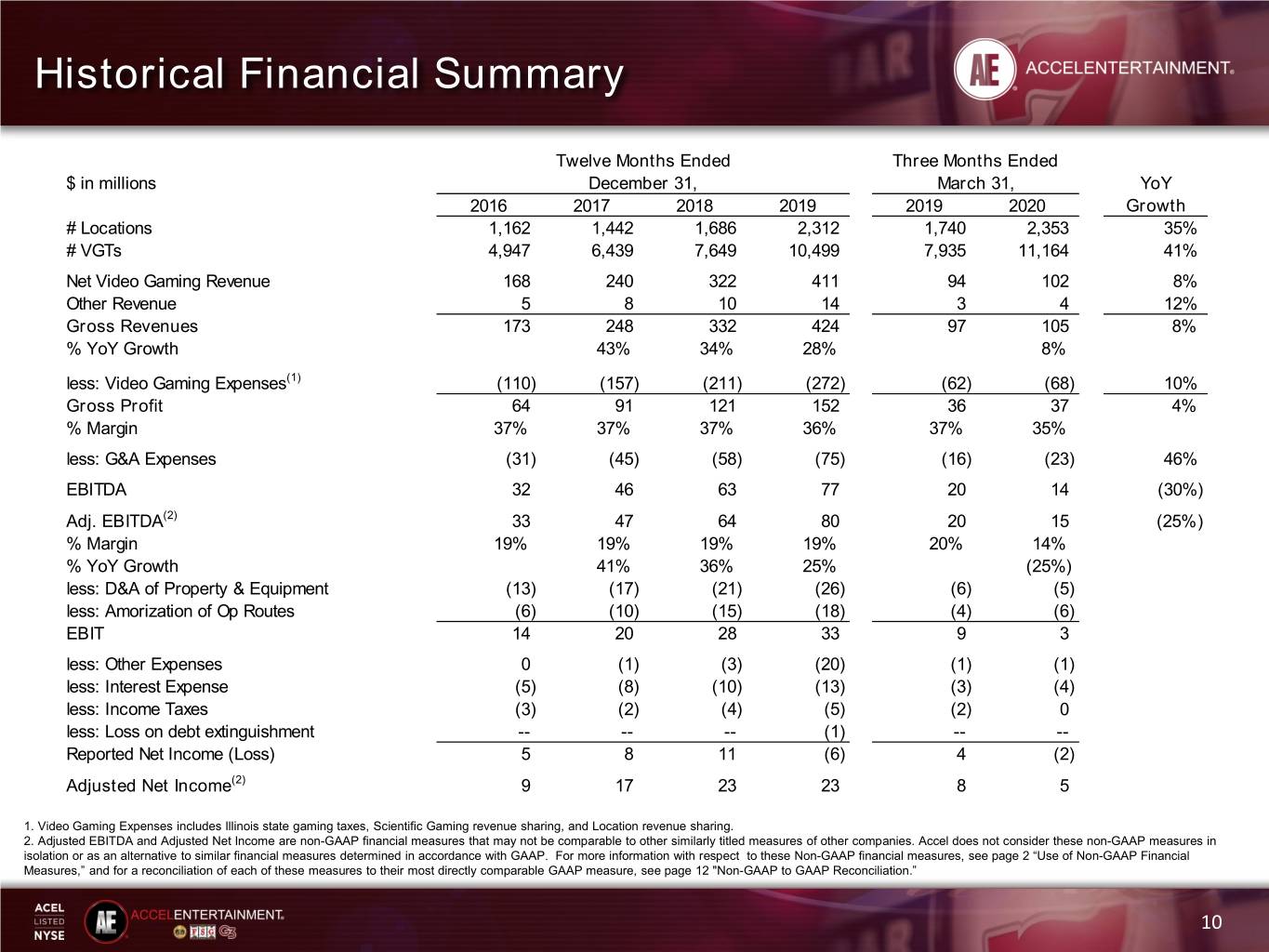

Historical Financial Summary Twelve Months Ended Three Months Ended $ in millions December 31, March 31, YoY 2016 2017 2018 2019 2019 2020 Growth # Locations 1,162 1,442 1,686 2,312 1,740 2,353 35% # VGTs 4,947 6,439 7,649 10,499 7,935 11,164 41% Net Video Gaming Revenue 168 240 322 411 94 102 8% Other Revenue 5 8 10 14 3 4 12% Gross Revenues 173 248 332 424 97 105 8% % YoY Growth 43% 34% 28% 8% less: Video Gaming Expenses(1) (110) (157) (211) (272) (62) (68) 10% Gross Profit 64 91 121 152 36 37 4% % Margin 37% 37% 37% 36% 37% 35% less: G&A Expenses (31) (45) (58) (75) (16) (23) 46% EBITDA 32 46 63 77 20 14 (30%) Adj. EBITDA(2) 33 47 64 80 20 15 (25%) % Margin 19% 19% 19% 19% 20% 14% % YoY Growth 41% 36% 25% (25%) less: D&A of Property & Equipment (13) (17) (21) (26) (6) (5) less: Amorization of Op Routes (6) (10) (15) (18) (4) (6) EBIT 14 20 28 33 9 3 less: Other Expenses 0 (1) (3) (20) (1) (1) less: Interest Expense (5) (8) (10) (13) (3) (4) less: Income Taxes (3) (2) (4) (5) (2) 0 less: Loss on debt extinguishment -- -- -- (1) -- -- Reported Net Income (Loss) 5 8 11 (6) 4 (2) Adjusted Net Income(2) 9 17 23 23 8 5 1. Video Gaming Expenses includes Illinois state gaming taxes, Scientific Gaming revenue sharing, and Location revenue sharing. 2. Adjusted EBITDA and Adjusted Net Income are non-GAAP financial measures that may not be comparable to other similarly titled measures of other companies. Accel does not consider these non-GAAP measures in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to these Non-GAAP financial measures, see page 2 “Use of Non-GAAP Financial Measures,” and for a reconciliation of each of these measures to their most directly comparable GAAP measure, see page 12 "Non-GAAP to GAAP Reconciliation.” 10

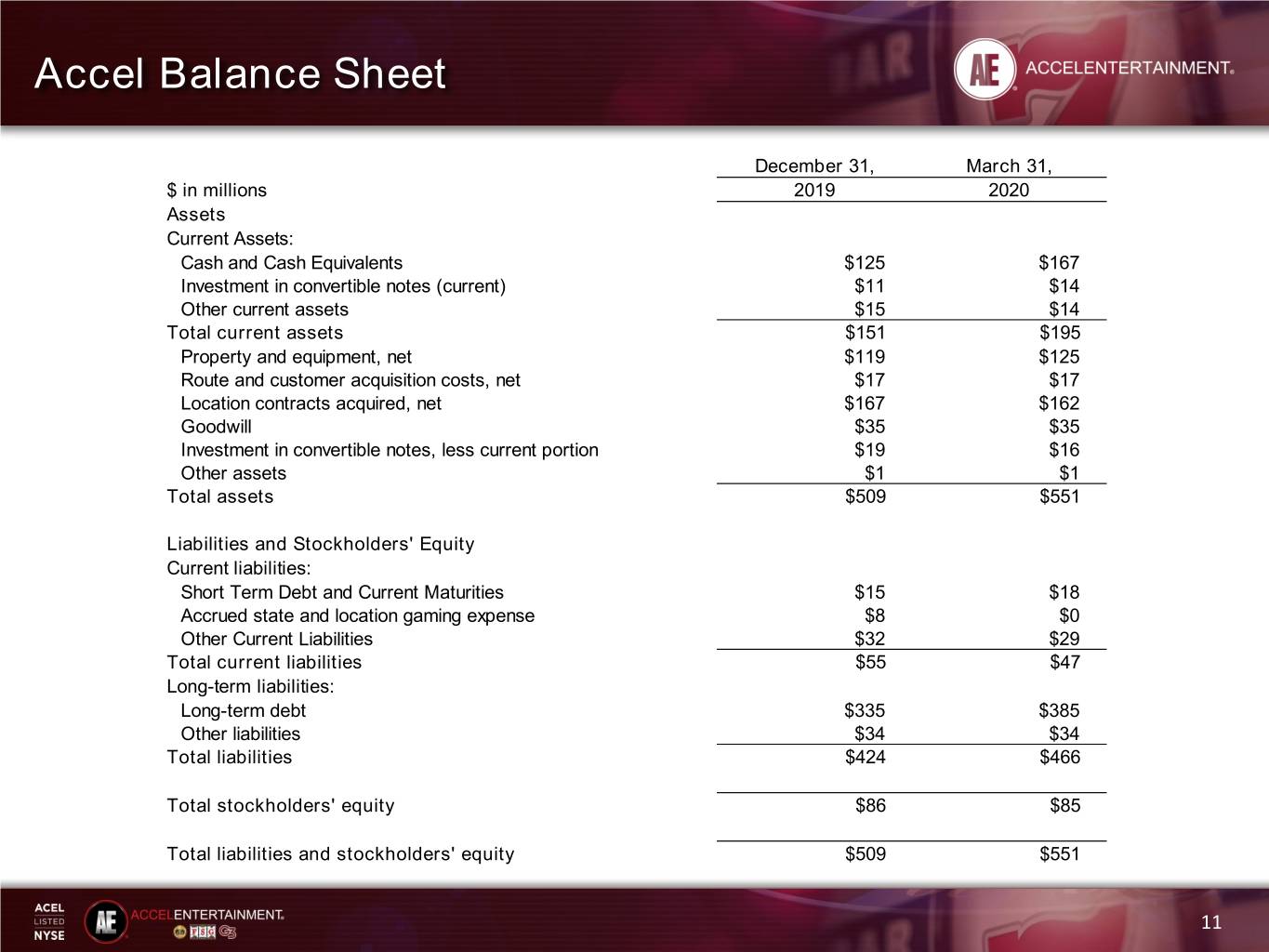

Accel Balance Sheet December 31, March 31, $ in millions 2019 2020 Assets Current Assets: Cash and Cash Equivalents $125 $167 Investment in convertible notes (current) $11 $14 Other current assets $15 $14 Total current assets $151 $195 Property and equipment, net $119 $125 Route and customer acquisition costs, net $17 $17 Location contracts acquired, net $167 $162 Goodwill $35 $35 Investment in convertible notes, less current portion $19 $16 Other assets $1 $1 Total assets $509 $551 Liabilities and Stockholders' Equity Current liabilities: Short Term Debt and Current Maturities $15 $18 Accrued state and location gaming expense $8 $0 Other Current Liabilities $32 $29 Total current liabilities $55 $47 Long-term liabilities: Long-term debt $335 $385 Other liabilities $34 $34 Total liabilities $424 $466 Total stockholders' equity $86 $85 Total liabilities and stockholders' equity $509 $551 11

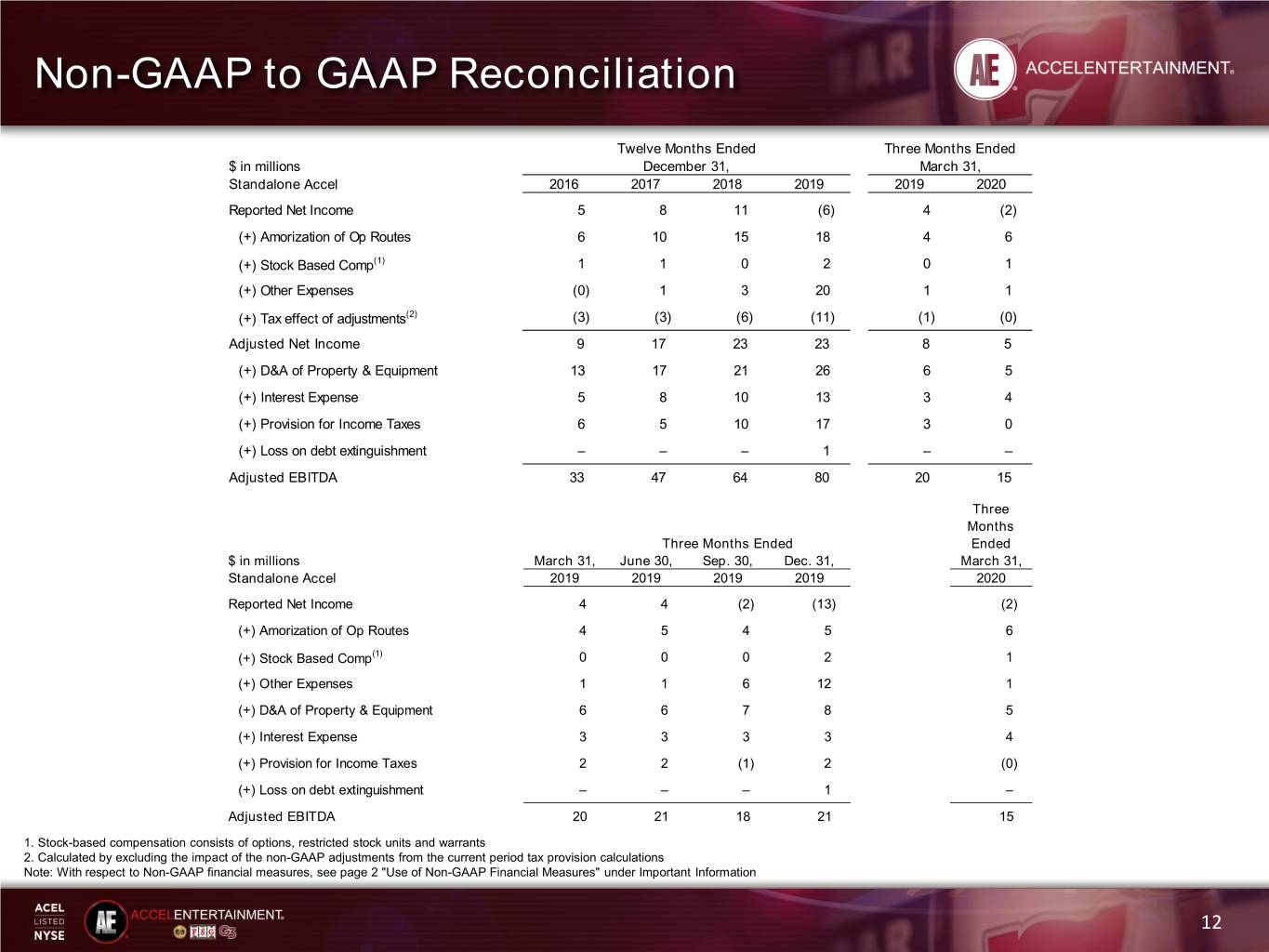

Non-GAAP to GAAP Reconciliation Twelve Months Ended Three Months Ended $ in millions December 31, March 31, Standalone Accel 2016 2017 2018 2019 2019 2020 Reported Net Income 5 8 11 (6) 4 (2) (+) Amorization of Op Routes 6 10 15 18 4 6 (+) Stock Based Comp(1) 1 1 0 2 0 1 (+) Other Expenses (0) 1 3 20 1 1 (+) Tax effect of adjustments(2) (3) (3) (6) (11) (1) (0) Adjusted Net Income 9 17 23 23 8 5 (+) D&A of Property & Equipment 13 17 21 26 6 5 (+) Interest Expense 5 8 10 13 3 4 (+) Provision for Income Taxes 6 5 10 17 3 0 (+) Loss on debt extinguishment – – – 1 – – Adjusted EBITDA 33 47 64 80 20 15 Three Months Three Months Ended Ended $ in millions March 31, June 30, Sep. 30, Dec. 31, March 31, Standalone Accel 2019 2019 2019 2019 2020 Reported Net Income 4 4 (2) (13) (2) (+) Amorization of Op Routes 4 5 4 5 6 (+) Stock Based Comp(1) 0 0 0 2 1 (+) Other Expenses 1 1 6 12 1 (+) D&A of Property & Equipment 6 6 7 8 5 (+) Interest Expense 3 3 3 3 4 (+) Provision for Income Taxes 2 2 (1) 2 (0) (+) Loss on debt extinguishment – – – 1 – Adjusted EBITDA 20 21 18 21 15 1. Stock-based compensation consists of options, restricted stock units and warrants 2. Calculated by excluding the impact of the non-GAAP adjustments from the current period tax provision calculations Note: With respect to Non-GAAP financial measures, see page 2 "Use of Non-GAAP Financial Measures" under Important Information 12