Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Sunstone Hotel Investors, Inc. | sho-20200508xex99d1.htm |

| 8-K - 8-K - Sunstone Hotel Investors, Inc. | sho-20200508x8k.htm |

Exhibit 99.2

|

|

Supplemental Financial Information |

|

|

|

|||||||

|

|

|

|||||||

|

Supplemental Financial Information For the quarter ended March 31, 2020 May 8, 2020

|

|

|||||||

|

|

Supplemental Financial Information |

Table of Contents

|

|

Supplemental Financial Information |

CORPORATE PROFILE, FINANCIAL DISCLOSURES,

AND SAFE HARBOR

|

CORPORATE PROFILE, FINANCIAL DISCLOSURES, AND SAFE HARBOR |

|

Page 2 |

||||||

|

|

|

|

||||||

|

|

Supplemental Financial Information |

Sunstone Hotel Investors, Inc. (the “Company,” “we,” and “our”) (NYSE: SHO) is a lodging real estate investment trust (“REIT”) that as of May 8, 2020 has interests in 20 hotels comprised of 10,610 rooms. Sunstone is the premier steward of Long-Term Relevant Real Estate® (“LTRR®”) in the lodging industry. Sunstone’s business is to acquire, own, asset manage and renovate or reposition hotels that the Company considers to be LTRR® in the United States, specifically hotels in urban and resort locations that benefit from barriers to entry and diverse economic drivers. The majority of Sunstone’s hotels are operated under nationally recognized brands, such as Marriott, Hilton and Hyatt.

As demand for lodging generally fluctuates with the overall economy, the Company seeks to own Long-Term Relevant Real Estate® that will maintain a high appeal with lodging travelers over long periods of time and will generate superior economic earnings materially in excess of recurring capital requirements. Sunstone’s strategy is to maximize stockholder value through focused asset management and disciplined capital recycling, which is likely to include selective acquisitions and dispositions, while maintaining balance sheet flexibility and strength. Sunstone’s goal is to maintain appropriate leverage and financial flexibility to position the Company to create value throughout all phases of the operating and financial cycles.

Corporate Headquarters

200 Spectrum Center Drive, 21st Floor

Irvine, CA 92618

(949) 330-4000

Company Contacts

John Arabia

President and Chief Executive Officer

(949) 382-3008

Bryan Giglia

Executive Vice President and Chief Financial Officer

(949) 382-3036

Aaron Reyes

Vice President, Corporate Finance

(949) 382-3018

|

CORPORATE PROFILE, FINANCIAL DISCLOSURES, AND SAFE HARBOR |

|

Page 3 |

||||||

|

|

|

|

||||||

|

|

Supplemental Financial Information |

This presentation contains forward-looking statements within the meaning of federal securities laws and regulations. These forward-looking statements are identified by their use of terms and phrases such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will” and other similar terms and phrases, including opinions, references to assumptions and forecasts of future results. Forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors that may cause the actual results to differ materially from those anticipated at the time the forward-looking statements are made. These risks include, but are not limited to: the short-term and long-term impact on the Company’s business of the COVID-19 global pandemic and the response of governments and the Company to the outbreak; general economic and business conditions, including a U.S. recession, trade conflicts and tariffs between the U.S. and its trading partners, changes in the European Union or global economic slowdown, which may diminish the desire for leisure travel or the need for business travel, as well as any type of flu or disease-related pandemic or the adverse effects of climate change, affecting the lodging and travel industry, internationally, nationally and locally; the Company’s need to operate as a REIT and comply with other applicable laws and regulations, including new laws, interpretations or court decisions that may change the federal or state tax laws or the federal or state income tax consequences of the Company’s qualification as a REIT; rising hotel operating costs due to labor costs, workers’ compensation and health-care related costs, including the impact of the Patient Protection and Affordable Care Act or its potential replacement, utility costs, insurance and unanticipated costs such as acts of nature and their consequences and other factors that may not be offset by increased room rates; relationships with, and the requirements and reputation of, the Company’s franchisors and hotel brands; relationships with, and the requirements, performance and reputation of, the managers of the Company’s hotels; the ground, building or airspace leases for four of the 20 Hotels the Company has interests in as of the date of this presentation; competition for the acquisition of hotels, and the Company’s ability to complete acquisitions and dispositions; performance of hotels after they are acquired; new hotel supply, or alternative lodging options such as timeshare, vacation rentals or sharing services such as Airbnb, in the Company’s markets, which could harm its occupancy levels and revenue at its hotels; competition from hotels not owned by the Company; the need for renovations, repositionings and other capital expenditures for the Company’s hotels; the impact, including any delays, of renovations and repositionings on hotel operations; changes in the Company’s business strategy or acquisition or disposition plans; the Company’s level of debt, including secured, unsecured, fixed and variable rate debt; financial and other covenants in the Company’s debt and preferred stock; the Company’s hotels may become impaired, or its hotels which have previously become impaired may become further impaired in the future, which may adversely affect its financial condition and results of operations; volatility in the capital markets and the effect on lodging demand or the Company’s ability to obtain capital on favorable terms or at all; potential adverse tax consequences in the event that the Company’s operating leases with its taxable REIT subsidiaries are not held to have been made on an arm’s-length basis; system security risks, data protection breaches, cyber-attacks, including those impacting the Company’s hotel managers or other third parties, and systems integration issues; other events beyond the Company’s control, including natural disasters, terrorist attacks or civil unrest; and other risks and uncertainties associated with our business described in the Company’s filings with the Securities and Exchange Commission. Although the Company believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that the expectations will be attained or that any deviation will not be material. All forward-looking information provided herein is as of the date of this presentation, and the Company undertakes no obligation to update any forward-looking statement to conform the statement to actual results or changes in the Company’s expectations.

This presentation contains unaudited information, and should be read together with the consolidated financial statements and notes thereto included in our most recent reports on Form 10-K and Form 10-Q. Copies of these reports are available on our website at www.sunstonehotels.com and through the SEC’s Electronic Data Gathering Analysis and Retrieval System (“EDGAR”) at www.sec.gov.

|

CORPORATE PROFILE, FINANCIAL DISCLOSURES, AND SAFE HARBOR |

|

Page 4 |

||||||

|

|

|

|

||||||

|

|

Supplemental Financial Information |

We present the following non-GAAP financial measures that we believe are useful to investors as key supplemental measures of our operating performance: earnings before interest expense, taxes, depreciation and amortization for real estate, or EBITDAre; Adjusted EBITDAre, excluding noncontrolling interest (as defined below); funds from operations attributable to common stockholders, or FFO attributable to common stockholders; Adjusted FFO attributable to common stockholders (as defined below); hotel Adjusted EBITDAre; and hotel Adjusted EBITDAre margin. These measures should not be considered in isolation or as a substitute for measures of performance in accordance with GAAP. In addition, our calculation of these measures may not be comparable to other companies that do not define such terms exactly the same as the Company. These non-GAAP measures are used in addition to and in conjunction with results presented in accordance with GAAP. They should not be considered as alternatives to net income (loss), cash flow from operations, or any other operating performance measure prescribed by GAAP. These non-GAAP financial measures reflect additional ways of viewing our operations that we believe, when viewed with our GAAP results and the reconciliations to the corresponding GAAP financial measures, provide a more complete understanding of factors and trends affecting our business than could be obtained absent this disclosure. We strongly encourage investors to review our financial information in its entirety and not to rely on a single financial measure.

We present EBITDAre in accordance with guidelines established by the National Association of Real Estate Investment Trusts (“NAREIT”), as defined in its September 2017 white paper “Earnings Before Interest, Taxes, Depreciation and Amortization for Real Estate.” We believe EBITDAre is a useful performance measure to help investors evaluate and compare the results of our operations from period to period in comparison to our peers. NAREIT defines EBITDAre as net income (calculated in accordance with GAAP) plus interest expense, income tax expense, depreciation and amortization, gains or losses on the disposition of depreciated property (including gains or losses on change in control), impairment write-downs of depreciated property and of investments in unconsolidated affiliates caused by a decrease in the value of depreciated property in the affiliate, and adjustments to reflect the entity’s share of EBITDAre of unconsolidated affiliates.

We make additional adjustments to EBITDAre when evaluating our performance because we believe that the exclusion of certain additional items described below provides useful information to investors regarding our operating performance, and that the presentation of Adjusted EBITDAre, excluding noncontrolling interest, when combined with the primary GAAP presentation of net income, is beneficial to an investor’s complete understanding of our operating performance. In addition, we use both EBITDAre and Adjusted EBITDAre, excluding noncontrolling interest as measures in determining the value of hotel acquisitions and dispositions.

We believe that the presentation of FFO attributable to common stockholders provides useful information to investors regarding our operating performance because it is a measure of our operations without regard to specified noncash items such as real estate depreciation and amortization, any real estate impairment loss and any gain or loss on sale of real estate assets, all of which are based on historical cost accounting and may be of lesser significance in evaluating our current performance. Our presentation of FFO attributable to common stockholders conforms to the NAREIT definition of “FFO applicable to common shares.” Our presentation may not be comparable to FFO reported by other REITs that do not define the terms in accordance with the current NAREIT definition, or that interpret the current NAREIT definition differently that we do.

|

CORPORATE PROFILE, FINANCIAL DISCLOSURES, AND SAFE HARBOR |

|

Page 5 |

||||||

|

|

|

|

||||||

|

|

Supplemental Financial Information |

We also present Adjusted FFO attributable to common stockholders when evaluating our operating performance because we believe that the exclusion of certain additional items described below provides useful supplemental information to investors regarding our ongoing operating performance, and may facilitate comparisons of operating performance between periods and our peer companies.

We adjust EBITDAre and FFO attributable to common stockholders for the following items, which may occur in any period, and refer to these measures as either Adjusted EBITDAre, excluding noncontrolling interest or Adjusted FFO attributable to common stockholders:

|

· |

Amortization of favorable and unfavorable contracts: we exclude the noncash amortization of the favorable management contract asset recorded in conjunction with our acquisition of the Hilton Garden Inn Chicago Downtown/Magnificent Mile, along with the favorable and unfavorable tenant lease contracts, as applicable, recorded in conjunction with our acquisitions of the Boston Park Plaza, the Hilton Garden Inn Chicago Downtown/Magnificent Mile, the Hyatt Regency San Francisco and the Wailea Beach Resort. We exclude the noncash amortization of favorable and unfavorable contracts because it is based on historical cost accounting and is of lesser significance in evaluating our actual performance for the current period. |

|

· |

Gains or losses from debt transactions: we exclude the effect of finance charges and premiums associated with the extinguishment of debt, including the acceleration of deferred financing costs from the original issuance of the debt being redeemed or retired because, like interest expense, their removal helps investors evaluate and compare the results of our operations from period to period by removing the impact of our capital structure. |

|

· |

Acquisition costs: under GAAP, costs associated with completed acquisitions that meet the definition of a business are expensed in the year incurred. We exclude the effect of these costs because we believe they are not reflective of the ongoing performance of the Company or our hotels. |

|

· |

Cumulative effect of a change in accounting principle: from time to time, the FASB promulgates new accounting standards that require the consolidated statement of operations to reflect the cumulative effect of a change in accounting principle. We exclude these one-time adjustments, which include the accounting impact from prior periods, because they do not reflect our actual performance for that period. |

|

· |

Other adjustments: we exclude other adjustments that we believe are outside the ordinary course of business because we do not believe these costs reflect our actual performance for the period and/or the ongoing operations of our hotels. Such items may include: lawsuit settlement costs; prior year property tax assessments or credits; the write-off of development costs associated with abandoned projects; property-level restructuring, severance and management transition costs; lease terminations; and property insurance proceeds or uninsured losses. |

In addition, to derive Adjusted EBITDAre, excluding noncontrolling interest we exclude the noncontrolling partner’s pro rata share of the net (income) loss allocated to the Hilton San Diego Bayfront partnership, as well as the noncontrolling partner’s pro rata share of any EBITDAre and Adjusted EBITDAre components. We also exclude the noncash expense incurred with the amortization of deferred stock compensation as this expense is based on historical stock prices at the date of grant to our corporate employees and does not reflect the underlying performance of our hotels. In addition, we exclude the amortization of our right-of-use assets and liabilities as these expenses are based on historical cost accounting and do not reflect the actual rent amounts due to the respective lessors or the underlying performance of our hotels. Additionally, we include an adjustment for the cash

|

CORPORATE PROFILE, FINANCIAL DISCLOSURES, AND SAFE HARBOR |

|

Page 6 |

||||||

|

|

|

|

||||||

|

|

Supplemental Financial Information |

finance lease expenses recorded on the ground lease at the Courtyard by Marriott Los Angeles (prior to the hotel’s sale in October 2019) and the building lease at the Hyatt Centric Chicago Magnificent Mile. We determined that both of these leases are finance leases, and, therefore, we include a portion of the lease payments each month in interest expense. We adjust EBITDAre for these two finance leases in order to more accurately reflect the actual rent due to both hotels’ lessors in the current period, as well as the operating performance of both hotels. We also exclude the effect of gains and losses on the disposition of undepreciated assets because we believe that including them in Adjusted EBITDAre, excluding noncontrolling interest is not consistent with reflecting the ongoing performance of our assets.

To derive Adjusted FFO attributable to common stockholders, we also exclude the noncash interest on our derivatives and finance lease obligations as we believe that these items are not reflective of our ongoing finance costs. Additionally, we exclude the noncontrolling partner’s pro rata share of any FFO adjustments related to our consolidated Hilton San Diego Bayfront partnership. We also exclude the real estate amortization of our right-of-use assets and liabilities, which includes the amortization of both our finance and operating lease intangibles (with the exception of our corporate operating lease), as these expenses are based on historical cost accounting and do not reflect the actual rent amounts due to the respective lessors or the underlying performance of our hotels. In addition, we exclude changes to deferred tax assets, liabilities or valuation allowances, and income tax benefits or provisions associated with the application of net operating loss carryforwards, uncertain tax positions or with the sale of assets other than real estate investments.

In presenting hotel Adjusted EBITDAre and hotel Adjusted EBITDAre margins, miscellaneous non-hotel items have been excluded. We believe the calculation of hotel Adjusted EBITDAre results in a more accurate presentation of the hotel Adjusted EBITDAre margins for our hotels, and that these non-GAAP financial measures are useful to investors in evaluating our property-level operating performance.

Reconciliations of net (loss) income to EBITDAre, Adjusted EBITDAre, excluding noncontrolling interest, FFO attributable to common stockholders, Adjusted FFO attributable to common stockholders, hotel Adjusted EBITDAre and hotel Adjusted EBITDAre margins are set forth in the following pages of this supplemental package.

|

CORPORATE PROFILE, FINANCIAL DISCLOSURES, AND SAFE HARBOR |

|

Page 7 |

||||||

|

|

|

|

||||||

|

|

Supplemental Financial Information |

CORPORATE FINANCIAL INFORMATION

|

CORPORATE FINANCIAL INFORMATION |

|

Page 8 |

||||||

|

|

|

|

||||||

|

|

Supplemental Financial Information |

Condensed Consolidated Balance Sheets

Q1 2020 – Q1 2019

|

(In thousands) |

|

March 31, 2020 (1) |

|

December 31, 2019 (2) |

|

September 30, 2019 (3) |

|

June 30, 2019 (4) |

|

March 31, 2019 (5) |

|

|||||

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Investment in hotel properties: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Land |

|

$ |

600,649 |

|

$ |

601,181 |

|

$ |

605,581 |

|

$ |

605,581 |

|

$ |

605,388 |

|

|

Buildings & improvements |

|

|

2,800,187 |

|

|

2,950,534 |

|

|

2,968,241 |

|

|

2,957,631 |

|

|

2,950,723 |

|

|

Furniture, fixtures, & equipment |

|

|

496,312 |

|

|

506,754 |

|

|

512,333 |

|

|

497,082 |

|

|

492,317 |

|

|

Other |

|

|

71,327 |

|

|

73,992 |

|

|

68,677 |

|

|

102,125 |

|

|

88,305 |

|

|

|

|

|

3,968,475 |

|

|

4,132,461 |

|

|

4,154,832 |

|

|

4,162,419 |

|

|

4,136,733 |

|

|

Less accumulated depreciation & amortization |

|

|

(1,212,063) |

|

|

(1,260,108) |

|

|

(1,243,980) |

|

|

(1,225,741) |

|

|

(1,189,937) |

|

|

|

|

|

2,756,412 |

|

|

2,872,353 |

|

|

2,910,852 |

|

|

2,936,678 |

|

|

2,946,796 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance lease right-of-use assets, net |

|

|

47,284 |

|

|

47,652 |

|

|

48,019 |

|

|

54,991 |

|

|

55,359 |

|

|

Operating lease right-of-use assets, net |

|

|

41,198 |

|

|

60,629 |

|

|

61,512 |

|

|

62,380 |

|

|

63,235 |

|

|

Other noncurrent assets, net |

|

|

16,390 |

|

|

24,608 |

|

|

25,348 |

|

|

27,029 |

|

|

32,878 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

847,445 |

|

|

816,857 |

|

|

730,039 |

|

|

741,503 |

|

|

683,995 |

|

|

Restricted cash |

|

|

53,485 |

|

|

48,116 |

|

|

46,206 |

|

|

46,199 |

|

|

50,746 |

|

|

Other current assets, net |

|

|

37,326 |

|

|

48,759 |

|

|

58,380 |

|

|

56,960 |

|

|

57,648 |

|

|

Assets held for sale, net |

|

|

— |

|

|

— |

|

|

18,481 |

|

|

— |

|

|

— |

|

|

Total assets |

|

$ |

3,799,540 |

|

$ |

3,918,974 |

|

$ |

3,898,837 |

|

$ |

3,925,740 |

|

$ |

3,890,657 |

|

*Footnotes on following page

|

CORPORATE FINANCIAL INFORMATION |

|

Page 9 |

||||||

|

|

|

|

||||||

|

|

Supplemental Financial Information |

Condensed Consolidated Balance Sheets

Q1 2020– Q1 2019 (cont.)

|

(In thousands) |

|

March 31, 2020 (1) |

|

December 31, 2019 (2) |

|

September 30, 2019 (3) |

|

June 30, 2019 (4) |

|

March 31, 2019 (5) |

|

||||||

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current portion of notes payable, net |

|

$ |

82,189 |

|

$ |

82,109 |

|

$ |

6,271 |

|

$ |

6,167 |

|

$ |

6,064 |

|

|

|

Other current liabilities |

|

|

104,029 |

|

|

243,443 |

|

|

114,805 |

|

|

115,024 |

|

|

106,318 |

|

|

|

Liabilities of assets held for sale |

|

|

— |

|

|

— |

|

|

12,446 |

|

|

— |

|

|

— |

|

|

|

Total current liabilities |

|

|

186,218 |

|

|

325,552 |

|

|

133,522 |

|

|

121,191 |

|

|

112,382 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes payable, less current portion, net |

|

|

1,187,468 |

|

|

888,954 |

|

|

966,496 |

|

|

968,090 |

|

|

969,657 |

|

|

|

Finance lease obligations, less current portion |

|

|

15,570 |

|

|

15,570 |

|

|

15,571 |

|

|

27,120 |

|

|

27,064 |

|

|

|

Operating lease obligations, less current portion |

|

|

48,460 |

|

|

49,691 |

|

|

50,905 |

|

|

52,097 |

|

|

53,276 |

|

|

|

Other liabilities |

|

|

24,818 |

|

|

18,136 |

|

|

19,824 |

|

|

19,176 |

|

|

17,991 |

|

|

|

Total liabilities |

|

|

1,462,534 |

|

|

1,297,903 |

|

|

1,186,318 |

|

|

1,187,674 |

|

|

1,180,370 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.95% Series E cumulative redeemable preferred stock |

|

|

115,000 |

|

|

115,000 |

|

|

115,000 |

|

|

115,000 |

|

|

115,000 |

|

|

|

6.45% Series F cumulative redeemable preferred stock |

|

|

75,000 |

|

|

75,000 |

|

|

75,000 |

|

|

75,000 |

|

|

75,000 |

|

|

|

Common stock, $0.01 par value, 500,000,000 shares authorized |

|

|

2,155 |

|

|

2,249 |

|

|

2,249 |

|

|

2,282 |

|

|

2,286 |

|

|

|

Additional paid in capital |

|

|

2,578,445 |

|

|

2,683,913 |

|

|

2,681,754 |

|

|

2,723,737 |

|

|

2,726,466 |

|

|

|

Retained earnings |

|

|

1,156,394 |

|

|

1,318,455 |

|

|

1,274,039 |

|

|

1,243,002 |

|

|

1,199,039 |

|

|

|

Cumulative dividends and distributions |

|

|

(1,633,763) |

|

|

(1,619,779) |

|

|

(1,483,907) |

|

|

(1,469,456) |

|

|

(1,454,838) |

|

|

|

Total stockholders' equity |

|

|

2,293,231 |

|

|

2,574,838 |

|

|

2,664,135 |

|

|

2,689,565 |

|

|

2,662,953 |

|

|

|

Noncontrolling interest in consolidated joint venture |

|

|

43,775 |

|

|

46,233 |

|

|

48,384 |

|

|

48,501 |

|

|

47,334 |

|

|

|

Total equity |

|

|

2,337,006 |

|

|

2,621,071 |

|

|

2,712,519 |

|

|

2,738,066 |

|

|

2,710,287 |

|

|

|

Total liabilities and equity |

|

$ |

3,799,540 |

|

$ |

3,918,974 |

|

$ |

3,898,837 |

|

$ |

3,925,740 |

|

$ |

3,890,657 |

|

|

|

(1) |

As presented on Form 10-Q to be filed in May 2020. |

|

(2) |

As presented on Form 10-K filed on February 19, 2020. |

|

(3) |

As presented on Form 10-Q filed on November 5, 2019. |

|

(4) |

As presented on Form 10-Q filed on August 5, 2019. |

|

(5) |

As presented on Form 10-Q filed on May 8, 2019. |

|

CORPORATE FINANCIAL INFORMATION |

|

Page 10 |

||||||

|

|

|

|

||||||

|

|

Supplemental Financial Information |

Consolidated Statements of Operations

Q1 2020/2019

|

|

|

Three Months Ended March 31, |

||||

|

(In thousands, except per share data) |

|

2020 |

|

2019 |

||

|

Revenues |

|

|

|

|

|

|

|

Room |

|

$ |

127,400 |

|

$ |

171,858 |

|

Food and beverage |

|

|

47,990 |

|

|

69,113 |

|

Other operating |

|

|

15,822 |

|

|

16,709 |

|

Total revenues |

|

|

191,212 |

|

|

257,680 |

|

Operating expenses |

|

|

|

|

|

|

|

Room |

|

|

44,245 |

|

|

48,246 |

|

Food and beverage |

|

|

41,760 |

|

|

46,822 |

|

Other operating |

|

|

3,764 |

|

|

3,965 |

|

Advertising and promotion |

|

|

12,462 |

|

|

13,564 |

|

Repairs and maintenance |

|

|

10,049 |

|

|

10,282 |

|

Utilities |

|

|

5,842 |

|

|

6,665 |

|

Franchise costs |

|

|

5,336 |

|

|

6,839 |

|

Property tax, ground lease and insurance |

|

|

20,051 |

|

|

20,348 |

|

Other property-level expenses |

|

|

28,845 |

|

|

32,840 |

|

Corporate overhead |

|

|

7,394 |

|

|

7,516 |

|

Depreciation and amortization |

|

|

36,746 |

|

|

36,387 |

|

Impairment losses |

|

|

115,366 |

|

|

— |

|

Total operating expenses |

|

|

331,860 |

|

|

233,474 |

|

|

|

|

|

|

|

|

|

Interest and other income |

|

|

2,306 |

|

|

4,924 |

|

Interest expense |

|

|

(17,507) |

|

|

(14,326) |

|

(Loss) income before income taxes |

|

|

(155,849) |

|

|

14,804 |

|

Income tax (provision) benefit, net |

|

|

(6,670) |

|

|

3,112 |

|

Net (loss) income |

|

|

(162,519) |

|

|

17,916 |

|

Loss (income) from consolidated joint venture attributable to noncontrolling interest |

|

|

458 |

|

|

(1,599) |

|

Preferred stock dividends |

|

|

(3,207) |

|

|

(3,207) |

|

(Loss) income attributable to common stockholders |

|

$ |

(165,268) |

|

$ |

13,110 |

|

|

|

|

|

|

|

|

|

Basic and diluted per share amounts: |

|

|

|

|

|

|

|

Basic and diluted (loss) income attributable to common stockholders per common share |

|

$ |

(0.75) |

|

$ |

0.06 |

|

|

|

|

|

|

|

|

|

Basic and diluted weighted average common shares outstanding |

|

|

221,036 |

|

|

227,219 |

|

|

|

|

|

|

|

|

|

Distributions declared per common share |

|

$ |

0.05 |

|

$ |

0.05 |

|

CORPORATE FINANCIAL INFORMATION |

|

Page 11 |

||||||

|

|

|

|

||||||

|

|

Supplemental Financial Information |

Reconciliation of Net (Loss) Income to EBITDAre and Adjusted EBITDAre, Excluding Noncontrolling Interest

Q1 2020/2019

|

|

|

Three Months Ended March 31, |

||||

|

(In thousands) |

|

|

2020 |

|

|

2019 |

|

Net (loss) income |

|

$ |

(162,519) |

|

$ |

17,916 |

|

Operations held for investment: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

36,746 |

|

|

36,387 |

|

Interest expense |

|

|

17,507 |

|

|

14,326 |

|

Income tax provision (benefit), net |

|

|

6,670 |

|

|

(3,112) |

|

Impairment loss - hotel properties |

|

|

113,064 |

|

|

— |

|

EBITDAre |

|

|

11,468 |

|

|

65,517 |

|

|

|

|

|

|

|

|

|

Operations held for investment: |

|

|

|

|

|

|

|

Amortization of deferred stock compensation |

|

|

2,207 |

|

|

2,122 |

|

Amortization of right-of-use assets and liabilities |

|

|

(261) |

|

|

(19) |

|

Finance lease obligation interest - cash ground rent |

|

|

(351) |

|

|

(589) |

|

Prior year property tax adjustments, net |

|

|

(81) |

|

|

189 |

|

Impairment loss - abandoned development costs |

|

|

2,302 |

|

|

— |

|

Noncontrolling interest: |

|

|

|

|

|

|

|

Loss (income) from consolidated joint venture attributable to noncontrolling interest |

|

|

458 |

|

|

(1,599) |

|

Depreciation and amortization |

|

|

(804) |

|

|

(639) |

|

Interest expense |

|

|

(420) |

|

|

(560) |

|

Amortization of right-of-use asset and liability |

|

|

72 |

|

|

72 |

|

Impairment loss - abandoned development costs |

|

|

(449) |

|

|

— |

|

Adjustments to EBITDAre, net |

|

|

2,673 |

|

|

(1,023) |

|

Adjusted EBITDAre, excluding noncontrolling interest |

|

$ |

14,141 |

|

$ |

64,494 |

|

CORPORATE FINANCIAL INFORMATION |

|

Page 12 |

||||||

|

|

|

|

||||||

|

|

Supplemental Financial Information |

Reconciliation of Net (Loss) Income to FFO and Adjusted FFO Attributable to Common Stockholders

Q1 2020/2019

|

|

|

Three Months Ended March 31, |

||||

|

(In thousands, except per share data) |

|

|

2020 |

|

|

2019 |

|

Net (loss) income |

|

$ |

(162,519) |

|

$ |

17,916 |

|

Preferred stock dividends |

|

|

(3,207) |

|

|

(3,207) |

|

Operations held for investment: |

|

|

|

|

|

|

|

Real estate depreciation and amortization |

|

|

36,122 |

|

|

35,770 |

|

Impairment loss - hotel properties |

|

|

113,064 |

|

|

— |

|

Noncontrolling interest: |

|

|

|

|

|

|

|

Loss (income) from consolidated joint venture attributable to noncontrolling interest |

|

|

458 |

|

|

(1,599) |

|

Real estate depreciation and amortization |

|

|

(804) |

|

|

(639) |

|

FFO attributable to common stockholders |

|

|

(16,886) |

|

|

48,241 |

|

|

|

|

|

|

|

|

|

Operations held for investment: |

|

|

|

|

|

|

|

Real estate amortization of right-of-use assets and liabilities |

|

|

146 |

|

|

151 |

|

Noncash interest on derivatives and finance lease obligations, net |

|

|

6,080 |

|

|

2,119 |

|

Prior year property tax adjustments, net |

|

|

(81) |

|

|

189 |

|

Impairment loss - abandoned development costs |

|

|

2,302 |

|

|

— |

|

Noncash income tax provision (benefit), net |

|

|

7,415 |

|

|

(3,284) |

|

Noncontrolling interest: |

|

|

|

|

|

|

|

Real estate amortization of right-of-use asset and liability |

|

|

72 |

|

|

72 |

|

Impairment loss - abandoned development costs |

|

|

(449) |

|

|

— |

|

Adjustments to FFO attributable to common stockholders, net |

|

|

15,485 |

|

|

(753) |

|

Adjusted FFO attributable to common stockholders |

|

$ |

(1,401) |

|

$ |

47,488 |

|

FFO attributable to common stockholders per diluted share |

|

$ |

(0.08) |

|

$ |

0.21 |

|

Adjusted FFO attributable to common stockholders per diluted share |

|

$ |

(0.01) |

|

$ |

0.21 |

|

|

|

|

|

|

|

|

|

Basic weighted average shares outstanding |

|

|

221,036 |

|

|

227,219 |

|

Shares associated with unvested restricted stock awards |

|

|

— |

|

|

260 |

|

Diluted weighted average shares outstanding |

|

|

221,036 |

|

|

227,479 |

|

CORPORATE FINANCIAL INFORMATION |

|

Page 13 |

||||||

|

|

|

|

||||||

|

|

Supplemental Financial Information |

Comparative Capitalization

Q1 2020 – Q1 2019

|

|

|

March 31, |

|

December 31, |

|

September 30, |

|

June 30, |

|

March 31, |

|

|||||

|

(In thousands, except per share data) |

|

2020 |

|

2019 |

|

2019 |

|

2019 |

|

2019 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Share Price & Dividends |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At the end of the quarter |

|

$ |

8.71 |

|

$ |

13.92 |

|

$ |

13.74 |

|

$ |

13.71 |

|

$ |

14.40 |

|

|

High during quarter ended |

|

$ |

13.81 |

|

$ |

14.41 |

|

$ |

13.92 |

|

$ |

14.94 |

|

$ |

15.44 |

|

|

Low during quarter ended |

|

$ |

6.99 |

|

$ |

13.25 |

|

$ |

12.85 |

|

$ |

13.19 |

|

$ |

12.86 |

|

|

Common dividends per share |

|

$ |

0.05 |

|

$ |

0.59 |

|

$ |

0.05 |

|

$ |

0.05 |

|

$ |

0.05 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares & Units |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common shares outstanding |

|

|

215,541 |

|

|

224,855 |

|

|

224,862 |

|

|

228,207 |

|

|

228,587 |

|

|

Units outstanding |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Total common shares and units outstanding |

|

|

215,541 |

|

|

224,855 |

|

|

224,862 |

|

|

228,207 |

|

|

228,587 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capitalization |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market value of common equity |

|

$ |

1,877,363 |

|

$ |

3,129,986 |

|

$ |

3,089,604 |

|

$ |

3,128,716 |

|

$ |

3,291,659 |

|

|

Liquidation value of preferred equity - Series E |

|

|

115,000 |

|

|

115,000 |

|

|

115,000 |

|

|

115,000 |

|

|

115,000 |

|

|

Liquidation value of preferred equity - Series F |

|

|

75,000 |

|

|

75,000 |

|

|

75,000 |

|

|

75,000 |

|

|

75,000 |

|

|

Consolidated debt |

|

|

1,272,965 |

|

|

974,863 |

|

|

977,058 |

|

|

979,040 |

|

|

980,996 |

|

|

Consolidated total capitalization |

|

|

3,340,328 |

|

|

4,294,849 |

|

|

4,256,662 |

|

|

4,297,756 |

|

|

4,462,655 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noncontrolling interest in consolidated debt |

|

|

(55,000) |

|

|

(55,000) |

|

|

(55,000) |

|

|

(55,000) |

|

|

(55,000) |

|

|

Pro rata total capitalization |

|

$ |

3,285,328 |

|

$ |

4,239,849 |

|

$ |

4,201,662 |

|

$ |

4,242,756 |

|

$ |

4,407,655 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated debt to consolidated total capitalization |

|

|

38.1 |

% |

|

22.7 |

% |

|

23.0 |

% |

|

22.8 |

% |

|

22.0 |

% |

|

Pro rata debt to pro rata total capitalization |

|

|

37.1 |

% |

|

21.7 |

% |

|

21.9 |

% |

|

21.8 |

% |

|

21.0 |

% |

|

Consolidated debt and preferred equity to consolidated total capitalization |

|

|

43.8 |

% |

|

27.1 |

% |

|

27.4 |

% |

|

27.2 |

% |

|

26.2 |

% |

|

Pro rata debt and preferred equity to pro rata total capitalization |

|

|

42.9 |

% |

|

26.2 |

% |

|

26.5 |

% |

|

26.3 |

% |

|

25.3 |

% |

|

CAPITALIZATION |

|

Page 15 |

||||||

|

|

|

|

||||||

|

|

Supplemental Financial Information |

Consolidated Debt Summary Schedule

|

(In thousands) |

|

|

|

Interest Rate / |

|

Maturity |

|

|

March 31, 2020 |

|

|

Balance At |

|

Debt |

|

Collateral |

|

Spread |

|

Date |

|

|

Balance |

|

|

Maturity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed Rate Debt |

|

|

|

|

|

|

|

|

|

|

|

|

|

Secured Mortgage Debt |

|

Hilton Times Square |

|

4.97% |

|

11/01/2020 |

|

$ |

77,339 |

|

$ |

76,145 |

|

Secured Mortgage Debt |

|

Renaissance Washington DC |

|

5.95% |

|

05/01/2021 |

|

|

110,312 |

|

|

106,855 |

|

Term Loan Facility |

|

Unsecured |

|

2.94% |

|

09/03/2022 |

|

|

85,000 |

|

|

85,000 |

|

Term Loan Facility |

|

Unsecured |

|

3.20% |

|

01/31/2023 |

|

|

100,000 |

|

|

100,000 |

|

Secured Mortgage Debt |

|

JW Marriott New Orleans |

|

4.15% |

|

12/11/2024 |

|

|

81,430 |

|

|

72,071 |

|

Secured Mortgage Debt |

|

Embassy Suites La Jolla |

|

4.12% |

|

01/06/2025 |

|

|

58,884 |

|

|

51,987 |

|

Series A Senior Notes |

|

Unsecured |

|

4.69% |

|

01/10/2026 |

|

|

120,000 |

|

|

120,000 |

|

Series B Senior Notes |

|

Unsecured |

|

4.79% |

|

01/10/2028 |

|

|

120,000 |

|

|

120,000 |

|

Total Fixed Rate Debt |

|

|

|

|

|

|

|

|

752,965 |

|

|

732,058 |

|

Secured Mortgage Debt |

|

Hilton San Diego Bayfront |

|

L + 1.05% |

|

12/09/2023 (1) |

|

|

220,000 |

|

|

220,000 |

|

Credit Facility |

|

Unsecured |

|

L + 1.40% |

|

04/14/2023 |

|

|

300,000 |

|

|

300,000 |

|

Total Variable Rate Debt |

|

|

|

|

|

|

|

|

520,000 |

|

|

520,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL CONSOLIDATED DEBT |

|

|

|

|

|

|

|

$ |

1,272,965 |

|

$ |

1,252,058 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

Series E cumulative redeemable preferred |

|

|

|

6.95% |

|

perpetual |

|

$ |

115,000 |

|

|

|

|

Series F cumulative redeemable preferred |

|

|

|

6.45% |

|

perpetual |

|

|

75,000 |

|

|

|

|

Total Preferred Stock |

|

|

|

|

|

|

|

$ |

190,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt Statistics |

|

|

|

|

|

|

|

|

|

|

|

|

|

% Fixed Rate Debt |

|

|

|

|

|

|

|

|

59.2 |

% |

|

|

|

% Floating Rate Debt |

|

|

|

|

|

|

|

|

40.8 |

% |

|

|

|

Average Interest Rate (2) |

|

|

|

|

|

|

|

|

3.63 |

% |

|

|

|

Weighted Average Maturity of Debt (1) |

|

|

|

|

|

|

|

|

3.7 years |

|

|

|

|

(1) |

At this time, the Company intends to exercise all three of its available one-year options to extend the maturity date of the $220.0 million loan secured by the Hilton San Diego Bayfront from December 2020 to December 2023. By extending this loan, the Company's weighted average maturity of debt increases from 3.2 years to 3.7 years. |

|

(2) |

Average Interest Rate on the variable-rate debt obligations is calculated based on the variable rates at March 31, 2020, and includes the effect of the Company's interest rate derivative agreement. |

|

CAPITALIZATION |

|

Page 16 |

||||||

|

|

|

|

||||||

|

|

Supplemental Financial Information |

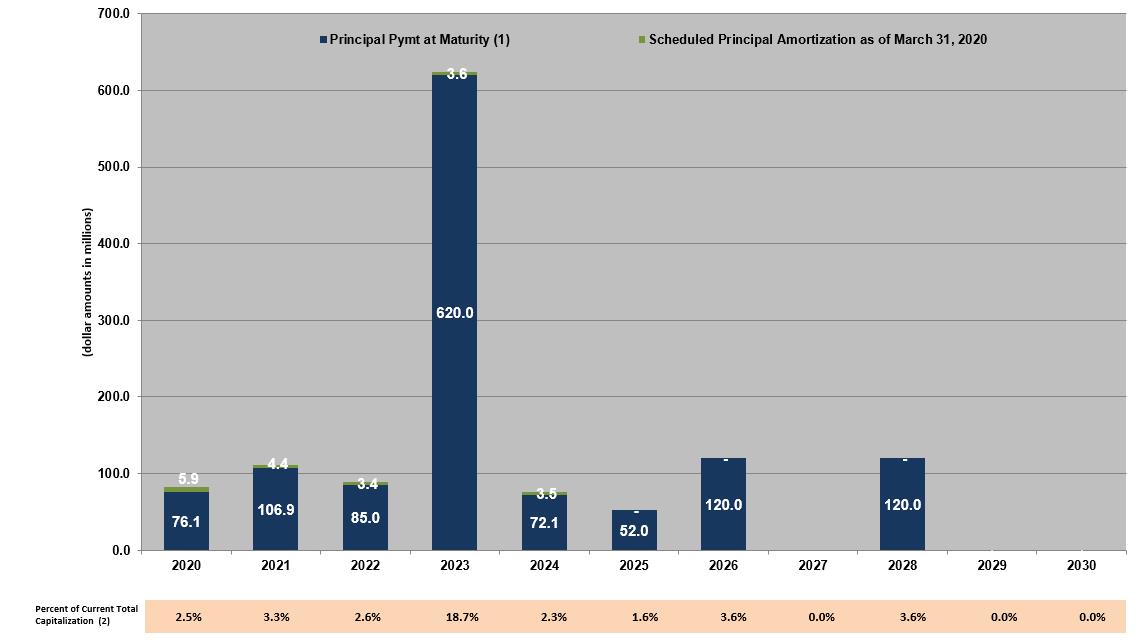

Consolidated Amortization and Debt Maturity Schedule

As of March 31, 2020

|

(1) |

At this time, the Company intends to exercise all three of its available one-year options to extend the maturity date of the $220.0 million loan secured by the Hilton San Diego Bayfront from December 2020 to December 2023. |

|

(2) |

Percent of Current Total Capitalization is calculated by dividing the sum of scheduled principal amortization and maturity payments by the March 31, 2020 consolidated total capitalization as presented on page 15. |

|

CAPITALIZATION |

|

Page 17 |

||||||

|

|

|

|

||||||

|

|

Supplemental Financial Information |

Hotel Information as of May 8, 2020

|

Hotel |

|

Location |

|

Brand |

|

Number of |

|

% of Total |

|

Open / Date Operations Temporarily Suspended (1) |

|

Interest |

|

Leasehold |

|

Year Acquired |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1 |

|

Hilton San Diego Bayfront (3) |

|

California |

|

Hilton |

|

1,190 |

|

11.22% |

|

March 23, 2020 |

|

Leasehold |

|

2071 |

|

2011 |

| 2 |

|

Boston Park Plaza |

|

Massachusetts |

|

Independent |

|

1,060 |

|

9.99% |

|

Open |

|

Fee Simple |

|

|

|

2013 |

| 3 |

|

Hyatt Regency San Francisco |

|

California |

|

Hyatt |

|

821 |

|

7.74% |

|

March 22, 2020 |

|

Fee Simple |

|

|

|

2013 |

| 4 |

|

Renaissance Washington DC |

|

Washington DC |

|

Marriott |

|

807 |

|

7.61% |

|

March 26, 2020 |

|

Fee Simple |

|

|

|

2005 |

| 5 |

|

Renaissance Orlando at SeaWorld® |

|

Florida |

|

Marriott |

|

781 |

|

7.36% |

|

March 20, 2020 |

|

Fee Simple |

|

|

|

2005 |

| 6 |

|

Renaissance Harborplace |

|

Maryland |

|

Marriott |

|

622 |

|

5.86% |

|

Open |

|

Fee Simple |

|

|

|

2005 |

| 7 |

|

Wailea Beach Resort |

|

Hawaii |

|

Marriott |

|

547 |

|

5.16% |

|

March 25, 2020 |

|

Fee Simple |

|

|

|

2014 |

| 8 |

|

Renaissance Los Angeles Airport |

|

California |

|

Marriott |

|

502 |

|

4.73% |

|

Open |

|

Fee Simple |

|

|

|

2007 |

| 9 |

|

JW Marriott New Orleans (4) |

|

Louisiana |

|

Marriott |

|

501 |

|

4.72% |

|

March 28, 2020 |

|

Fee Simple |

|

|

|

2011 |

| 10 |

|

Hilton Times Square |

|

New York |

|

Hilton |

|

478 |

|

4.51% |

|

Open |

|

Leasehold |

|

2091 |

|

2006 |

| 11 |

|

Hyatt Centric Chicago Magnificent Mile |

|

Illinois |

|

Hyatt |

|

419 |

|

3.95% |

|

April 6, 2020 |

|

Leasehold |

|

2097 |

|

2012 |

| 12 |

|

Marriott Boston Long Wharf |

|

Massachusetts |

|

Marriott |

|

415 |

|

3.91% |

|

March 12, 2020 |

|

Fee Simple |

|

|

|

2007 |

| 13 |

|

Renaissance Long Beach |

|

California |

|

Marriott |

|

374 |

|

3.52% |

|

Open |

|

Fee Simple |

|

|

|

2005 |

| 14 |

|

Embassy Suites Chicago |

|

Illinois |

|

Hilton |

|

368 |

|

3.47% |

|

April 1, 2020 |

|

Fee Simple |

|

|

|

2002 |

| 15 |

|

Hilton Garden Inn Chicago Downtown/Magnificent Mile |

|

Illinois |

|

Hilton |

|

361 |

|

3.40% |

|

March 27, 2020 |

|

Fee Simple |

|

|

|

2012 |

| 16 |

|

Renaissance Westchester |

|

New York |

|

Marriott |

|

348 |

|

3.28% |

|

April 4, 2020 |

|

Fee Simple |

|

|

|

2010 |

| 17 |

|

Embassy Suites La Jolla |

|

California |

|

Hilton |

|

340 |

|

3.20% |

|

Open |

|

Fee Simple |

|

|

|

2006 |

| 18 |

|

Hilton New Orleans St. Charles |

|

Louisiana |

|

Hilton |

|

252 |

|

2.38% |

|

March 28, 2020 |

|

Fee Simple |

|

|

|

2013 |

| 19 |

|

Marriott Portland |

|

Oregon |

|

Marriott |

|

249 |

|

2.35% |

|

March 27, 2020 |

|

Fee Simple |

|

|

|

2000 |

| 20 |

|

Oceans Edge Resort & Marina |

|

Florida |

|

Independent |

|

175 |

|

1.65% |

|

March 22, 2020 |

|

Fee Simple |

|

|

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 Hotel Portfolio |

|

|

|

|

|

10,610 |

|

100% |

|

|

|

|

|

|

|

|

|

(1) |

As of May 8, 2020, the Company has termporarily suspended operations at 14 of its hotels due to the COVID-19 pandemic. Operations for the remaining 6 hotels have been significantly reduced. |

|

(2) |

Assumes the full exercise of all lease extensions. |

|

(3) |

The Company owns 75% of the joint venture that owns the Hilton San Diego Bayfront. |

|

(4) |

Hotel is subject to a municipal airspace lease that matures in 2044 and applies only to certain balcony space that is not integral to the hotel operation. |

|

PROPERTY-LEVEL DATA |

|

Page 19 |

||||||

|

|

|

|

||||||

|

|

Supplemental Financial Information |

PROPERTY-LEVEL OPERATING STATISTICS

|

PROPERTY-LEVEL OPERATING STATISTICS |

|

Page 20 |

||||||

|

|

|

|

||||||

|

|

Supplemental Financial Information |

Property-Level Operating Statistics

|

|

|

Hotels sorted by number of rooms |

|

ADR |

|

Occupancy |

|

RevPAR |

||||||||||||||||

|

|

|

|

|

January |

|

January |

|

January |

||||||||||||||||

|

|

|

|

|

2020 |

|

2019 |

|

Variance |

|

2020 |

|

2019 |

|

Variance |

|

2020 |

|

2019 |

|

Variance |

||||

| 1 |

|

Hilton San Diego Bayfront (1) |

|

$ |

221.94 |

|

$ |

231.72 |

|

-4.2% |

|

77.2% |

|

68.2% |

|

13.2% |

|

$ |

171.34 |

|

$ |

158.03 |

|

8.4% |

| 2 |

|

Boston Park Plaza |

|

$ |

138.41 |

|

$ |

142.16 |

|

-2.6% |

|

66.8% |

|

75.6% |

|

-11.6% |

|

$ |

92.46 |

|

$ |

107.47 |

|

-14.0% |

| 3 |

|

Hyatt Regency San Francisco |

|

$ |

351.67 |

|

$ |

396.40 |

|

-11.3% |

|

77.6% |

|

77.0% |

|

0.8% |

|

$ |

272.90 |

|

$ |

305.23 |

|

-10.6% |

| 4 |

|

Renaissance Washington DC |

|

$ |

180.18 |

|

$ |

185.07 |

|

-2.6% |

|

62.6% |

|

61.0% |

|

2.6% |

|

$ |

112.79 |

|

$ |

112.89 |

|

-0.1% |

| 5 |

|

Renaissance Orlando at SeaWorld ® |

|

$ |

196.55 |

|

$ |

194.14 |

|

1.2% |

|

68.8% |

|

78.9% |

|

-12.8% |

|

$ |

135.23 |

|

$ |

153.18 |

|

-11.7% |

| 6 |

|

Renaissance Harborplace (1) |

|

$ |

145.65 |

|

$ |

143.86 |

|

1.2% |

|

53.7% |

|

37.0% |

|

45.1% |

|

$ |

78.21 |

|

$ |

53.23 |

|

46.9% |

| 7 |

|

Wailea Beach Resort |

|

$ |

556.25 |

|

$ |

491.86 |

|

13.1% |

|

88.0% |

|

91.0% |

|

-3.3% |

|

$ |

489.50 |

|

$ |

447.59 |

|

9.4% |

| 8 |

|

Renaissance Los Angeles Airport |

|

$ |

140.45 |

|

$ |

143.32 |

|

-2.0% |

|

85.2% |

|

86.0% |

|

-0.9% |

|

$ |

119.66 |

|

$ |

123.26 |

|

-2.9% |

| 9 |

|

JW Marriott New Orleans |

|

$ |

219.30 |

|

$ |

196.26 |

|

11.7% |

|

79.8% |

|

84.9% |

|

-6.0% |

|

$ |

175.00 |

|

$ |

166.62 |

|

5.0% |

| 10 |

|

Hilton Times Square |

|

$ |

173.06 |

|

$ |

189.32 |

|

-8.6% |

|

95.2% |

|

98.6% |

|

-3.4% |

|

$ |

164.75 |

|

$ |

186.67 |

|

-11.7% |

| 11 |

|

Hyatt Centric Chicago Magnificent Mile |

|

$ |

117.17 |

|

$ |

106.52 |

|

10.0% |

|

62.0% |

|

55.7% |

|

11.3% |

|

$ |

72.65 |

|

$ |

59.33 |

|

22.5% |

| 12 |

|

Marriott Boston Long Wharf |

|

$ |

216.35 |

|

$ |

209.78 |

|

3.1% |

|

74.7% |

|

68.5% |

|

9.1% |

|

$ |

161.61 |

|

$ |

143.70 |

|

12.5% |

| 13 |

|

Renaissance Long Beach |

|

$ |

182.47 |

|

$ |

183.97 |

|

-0.8% |

|

80.6% |

|

71.7% |

|

12.4% |

|

$ |

147.07 |

|

$ |

131.91 |

|

11.5% |

| 14 |

|

Embassy Suites Chicago |

|

$ |

111.74 |

|

$ |

101.67 |

|

9.9% |

|

73.7% |

|

66.0% |

|

11.7% |

|

$ |

82.35 |

|

$ |

67.10 |

|

22.7% |

| 15 |

|

Hilton Garden Inn Chicago Downtown/Magnificent Mile |

|

$ |

96.94 |

|

$ |

81.32 |

|

19.2% |

|

53.7% |

|

54.6% |

|

-1.6% |

|

$ |

52.06 |

|

$ |

44.40 |

|

17.3% |

| 16 |

|

Renaissance Westchester |

|

$ |

149.50 |

|

$ |

145.29 |

|

2.9% |

|

64.9% |

|

65.8% |

|

-1.4% |

|

$ |

97.03 |

|

$ |

95.60 |

|

1.5% |

| 17 |

|

Embassy Suites La Jolla |

|

$ |

188.27 |

|

$ |

189.14 |

|

-0.5% |

|

83.1% |

|

85.2% |

|

-2.5% |

|

$ |

156.45 |

|

$ |

161.15 |

|

-2.9% |

| 18 |

|

Hilton New Orleans St. Charles |

|

$ |

171.82 |

|

$ |

161.66 |

|

6.3% |

|

79.5% |

|

74.2% |

|

7.1% |

|

$ |

136.60 |

|

$ |

119.95 |

|

13.9% |

| 19 |

|

Marriott Portland (1) |

|

$ |

143.32 |

|

$ |

153.75 |

|

-6.8% |

|

47.0% |

|

72.4% |

|

-35.1% |

|

$ |

67.36 |

|

$ |

111.32 |

|

-39.5% |

| 20 |

|

Oceans Edge Resort & Marina |

|

$ |

304.52 |

|

$ |

252.45 |

|

20.6% |

|

89.7% |

|

94.0% |

|

-4.6% |

|

$ |

273.15 |

|

$ |

237.30 |

|

15.1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 Hotel Portfolio (2) |

|

$ |

214.02 |

|

$ |

212.79 |

|

0.6% |

|

72.8% |

|

72.4% |

|

0.6% |

|

$ |

155.81 |

|

$ |

154.06 |

|

1.1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

Operating statistics for January 2020 are impacted by a room renovation at the Marriott Portland. Operating statistics for January 2019 are impacted by room renovations at the Hilton San Diego Bayfront and the Renaissance Harborplace. |

|

(2) |

20 Hotel Portfolio includes all hotels owned by the Company as of March 31, 2020. |

|

PROPERTY-LEVEL OPERATING STATISTICS |

|

Page 21 |

||||||

|

|

|

|

||||||

|

|

Supplemental Financial Information |

Property-Level Operating Statistics

February 2020/2019

|

|

|

Hotels sorted by number of rooms |

ADR |

|

Occupancy |

|

RevPAR |

||||||||||||||||

|

|

|

|

February |

|

February |

|

February |

||||||||||||||||

|

|

|

|

2020 |

|

2019 |

|

Variance |

|

2020 |

|

2019 |

|

Variance |

|

2020 |

|

2019 |

|

Variance |

||||

| 1 |

|

Hilton San Diego Bayfront (1) |

$ |

261.15 |

|

$ |

279.63 |

|

-6.6% |

|

83.9% |

|

79.8% |

|

5.1% |

|

$ |

219.10 |

|

$ |

223.14 |

|

-1.8% |

| 2 |

|

Boston Park Plaza |

$ |

145.74 |

|

$ |

136.62 |

|

6.7% |

|

69.5% |

|

75.7% |

|

-8.2% |

|

$ |

101.29 |

|

$ |

103.42 |

|

-2.1% |

| 3 |

|

Hyatt Regency San Francisco |

$ |

301.04 |

|

$ |

340.71 |

|

-11.6% |

|

82.6% |

|

87.2% |

|

-5.3% |

|

$ |

248.66 |

|

$ |

297.10 |

|

-16.3% |

| 4 |

|

Renaissance Washington DC |

$ |

232.97 |

|

$ |

229.44 |

|

1.5% |

|

75.8% |

|

71.7% |

|

5.7% |

|

$ |

176.59 |

|

$ |

164.51 |

|

7.3% |

| 5 |

|

Renaissance Orlando at SeaWorld ® |

$ |

192.31 |

|

$ |

205.95 |

|

-6.6% |

|

87.7% |

|

85.2% |

|

2.9% |

|

$ |

168.66 |

|

$ |

175.47 |

|

-3.9% |

| 6 |

|

Renaissance Harborplace (1) |

$ |

136.74 |

|

$ |

145.31 |

|

-5.9% |

|

56.1% |

|

43.3% |

|

29.6% |

|

$ |

76.71 |

|

$ |

62.92 |

|

21.9% |

| 7 |

|

Wailea Beach Resort |

$ |

580.48 |

|

$ |

518.96 |

|

11.9% |

|

92.1% |

|

93.3% |

|

-1.3% |

|

$ |

534.62 |

|

$ |

484.19 |

|

10.4% |

| 8 |

|

Renaissance Los Angeles Airport |

$ |

145.24 |

|

$ |

152.51 |

|

-4.8% |

|

93.3% |

|

89.5% |

|

4.2% |

|

$ |

135.51 |

|

$ |

136.50 |

|

-0.7% |

| 9 |

|

JW Marriott New Orleans |

$ |

240.41 |

|

$ |

234.70 |

|

2.4% |

|

82.2% |

|

82.5% |

|

-0.4% |

|

$ |

197.62 |

|

$ |

193.63 |

|

2.1% |

| 10 |

|

Hilton Times Square |

$ |

165.20 |

|

$ |

189.04 |

|

-12.6% |

|

97.0% |

|

99.2% |

|

-2.2% |

|

$ |

160.24 |

|

$ |

187.53 |

|

-14.5% |

| 11 |

|

Hyatt Centric Chicago Magnificent Mile |

$ |

132.27 |

|

$ |

118.87 |

|

11.3% |

|

61.1% |

|

71.1% |

|

-14.1% |

|

$ |

80.82 |

|

$ |

84.52 |

|

-4.4% |

| 12 |

|

Marriott Boston Long Wharf |

$ |

229.82 |

|

$ |

213.35 |

|

7.7% |

|

84.9% |

|

81.1% |

|

4.7% |

|

$ |

195.12 |

|

$ |

173.03 |

|

12.8% |

| 13 |

|

Renaissance Long Beach |

$ |

191.70 |

|

$ |

198.49 |

|

-3.4% |

|

84.9% |

|

86.5% |

|

-1.8% |

|

$ |

162.75 |

|

$ |

171.69 |

|

-5.2% |

| 14 |

|

Embassy Suites Chicago |

$ |

123.88 |

|

$ |

116.27 |

|

6.5% |

|

73.9% |

|

81.6% |

|

-9.4% |

|

$ |

91.55 |

|

$ |

94.88 |

|

-3.5% |

| 15 |

|

Hilton Garden Inn Chicago Downtown/Magnificent Mile |

$ |

95.00 |

|

$ |

92.30 |

|

2.9% |

|

65.9% |

|

66.2% |

|

-0.5% |

|

$ |

62.61 |

|

$ |

61.10 |

|

2.5% |

| 16 |

|

Renaissance Westchester |

$ |

145.99 |

|

$ |

151.93 |

|

-3.9% |

|

66.0% |

|

66.0% |

|

0.0% |

|

$ |

96.35 |

|

$ |

100.27 |

|

-3.9% |

| 17 |

|

Embassy Suites La Jolla |

$ |

197.95 |

|

$ |

199.90 |

|

-1.0% |

|

85.8% |

|

85.8% |

|

0.0% |

|

$ |

169.84 |

|

$ |

171.51 |

|

-1.0% |

| 18 |

|

Hilton New Orleans St. Charles |

$ |

195.75 |

|

$ |

200.35 |

|

-2.3% |

|

84.3% |

|

74.0% |

|

13.9% |

|

$ |

165.02 |

|

$ |

148.26 |

|

11.3% |

| 19 |

|

Marriott Portland (1) |

$ |

143.86 |

|

$ |

159.01 |

|

-9.5% |

|

48.8% |

|

85.5% |

|

-42.9% |

|

$ |

70.20 |

|

$ |

135.95 |

|

-48.4% |

| 20 |

|

Oceans Edge Resort & Marina |

$ |

362.28 |

|

$ |

341.63 |

|

6.0% |

|

91.6% |

|

95.8% |

|

-4.4% |

|

$ |

331.85 |

|

$ |

327.28 |

|

1.4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 Hotel Portfolio (2) |

$ |

223.83 |

|

$ |

225.39 |

|

-0.7% |

|

78.8% |

|

79.3% |

|

-0.6% |

|

$ |

176.38 |

|

$ |

178.73 |

|

-1.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

Operating statistics for February 2020 are impacted by a room renovation at the Marriott Portland. Operating statistics for February 2019 are impacted by room renovations at the Hilton San Diego Bayfront and the Renaissance Harborplace. |

|

(2) |

20 Hotel Portfolio includes all hotels owned by the Company as of March 31, 2020. |

|

PROPERTY-LEVEL OPERATING STATISTICS |

|

Page 22 |

||||||

|

|

|

|

||||||

|

|

Supplemental Financial Information |

Property-Level Operating Statistics

March 2020/2019

|

|

|

Hotels sorted by number of rooms |

ADR |

|

Occupancy |

|

RevPAR |

||||||||||||||||

|

|

|

|

March |

|

March |

|

March |

||||||||||||||||

|

|

|

|

2020 |

|

2019 |

|

Variance |

|

2020 |

|

2019 |

|

Variance |

|

2020 |

|

2019 |

|

Variance |

||||

| 1 |

|

Boston Park Plaza |

$ |

171.07 |

|

$ |

180.55 |

|

-5.3% |

|

32.1% |

|

90.5% |

|

-64.5% |

|

$ |

54.91 |

|

$ |

163.40 |

|

-66.4% |

| 2 |

|

Renaissance Harborplace (1) |

$ |

152.42 |

|

$ |

177.80 |

|

-14.3% |

|

23.8% |

|

47.1% |

|

-49.5% |

|

$ |

36.28 |

|

$ |

83.74 |

|

-56.7% |

| 3 |

|

Renaissance Los Angeles Airport |

$ |

136.46 |

|

$ |

148.63 |

|

-8.2% |

|

45.4% |

|

88.8% |

|

-48.9% |

|

$ |

61.95 |

|

$ |

131.98 |

|

-53.1% |

| 4 |

|

Hilton Times Square |

$ |