Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Premier, Inc. | d921826dex992.htm |

| EX-99.1 - EX-99.1 - Premier, Inc. | d921826dex991.htm |

| 8-K - 8-K - Premier, Inc. | d921826d8k.htm |

Third-Quarter Fiscal 2020 Financial Results and Update May 5, 2020 Exhibit 99.3

Forward-looking statements and non-GAAP financial measures Forward-looking statements – Statements made in this presentation that are not statements of historical or current facts, such as those related to the expected financial and operational impacts of the COVID-19 pandemic on our business segments, our ability to manage expenses during the COVID-19 pandemic, current market environment and uncertainties, expected financial performance, non-GAAP free cash flow generation, the statements related to fiscal 2020 outlook and guidance and the assumptions underlying such guidance, and the anticipated financial and operational impact of the acquisition of Health Design Plus are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Premier to be materially different from historical results or from any future results or projections expressed or implied by such forward-looking statements. Accordingly, readers should not place undue reliance on any forward-looking statements. In addition to statements that explicitly describe such risks and uncertainties, readers are urged to consider statements in the conditional or future tenses or that include terms such as “believes,” “belief,” “expects,” “estimates,” “intends,” “anticipates” or “plans” to be uncertain and forward-looking. Forward-looking statements may include comments as to Premier’s beliefs and expectations as to future events and trends affecting its business and are necessarily subject to uncertainties, many of which are outside Premier’s control. More information on potential factors that could affect Premier’s financial results is included from time to time in the “Cautionary Note Regarding Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Premier’s periodic and current filings with the SEC, including those discussed under the “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” section of Premier’s Form 10-K for the year ended June 30, 2019 as well as the Form 10-Q for the quarter ended March 31, 2020, expected to be filed with the SEC shortly after the date of this presentation, and also made available on Premier’s website at investors.premierinc.com. Forward-looking statements speak only as of the date they are made, and Premier undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events that occur after that date, or otherwise. Non-GAAP financial measures – This presentation and accompanying webcast includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial measures included in this presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. You should carefully read Premier’s periodic and current filings with the SEC for definitions and further explanation and disclosure regarding our use of non-GAAP financial measures and such filings should be read in conjunction with this presentation.

Q3 Overview and Business Update Susan DeVore Chief Executive Officer Premier, Inc.

Premier’s COVID-19 response strategies Key Supply Chain Initiatives: Accelerating provider access to much-needed products Align with other critical stakeholders to share information and more effectively coordinate response efforts Monitoring supply in the system, conserving supply on hand, and advising our members on non-traditional supply channels, including the gray market Key Technology Initiatives: Clinical surveillance technology now includes COVID-19 specific alerts and patient flags for tracking and analysis Clinical decision support technology is using natural language processing and machine learning to flag suspected or confirmed COVID-19 patient cases directly in the EMR, at the point of care Use technology to predict surges and hot spots, serving as an early warning system for future waves of COVID-19

Operations Review Mike Alkire President Premier, Inc.

Premier is helping members manage through recovery Major Objectives: Build confidence with patients to resume typical healthcare procedures, while continuing to care for patients with COVID-19 Prepare for another COVID-19 surge in their community Find ways to become more efficient for both procedural and infrastructure costs Improve their revenue

Update on Contigo Health, direct-to-employer, high value care network initiative Acquired Health Design Plus (HDP) to help accelerate Contigo Health initiative HDP is third-party administrator (TPA) and care management company specializing in the development and administration of customized health benefits solutions for employer clients and health system partners HDP offers both TPA services and a nationally recognized Centers of Excellence program for many innovative employers, including well-known Fortune 25 brands, who operate their own self-funded insurance plans HDP will provide specialized TPA services supporting Contigo Health as it expands its product pilots in multiple markets with multiple employers

Financial Review Craig McKasson Chief Administrative and Financial Officer Premier, Inc.

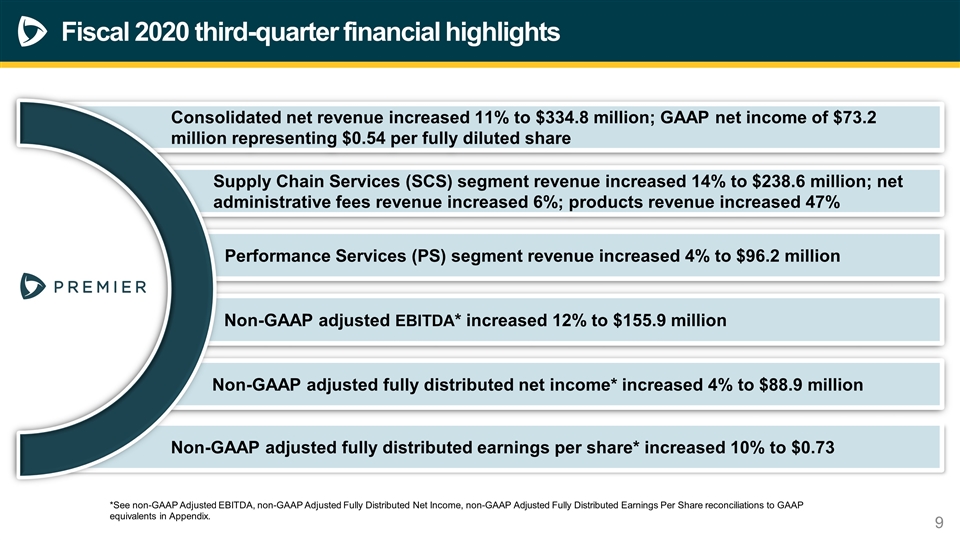

Fiscal 2020 third-quarter financial highlights *See non-GAAP Adjusted EBITDA, non-GAAP Adjusted Fully Distributed Earnings Per Share and non-GAAP Free Cash Flow reconciliations to GAAP equivalents in Appendix. Performance Services (PS) segment revenue increased 4% to $96.2 million Supply Chain Services (SCS) segment revenue increased 14% to $238.6 million; net administrative fees revenue increased 6%; products revenue increased 47% Non-GAAP adjusted EBITDA* increased 12% to $155.9 million Non-GAAP adjusted fully distributed net income* increased 4% to $88.9 million Non-GAAP adjusted fully distributed earnings per share* increased 10% to $0.73 Consolidated net revenue increased 11% to $334.8 million; GAAP net income of $73.2 million representing $0.54 per fully diluted share *See non-GAAP Adjusted EBITDA, non-GAAP Adjusted Fully Distributed Net Income, non-GAAP Adjusted Fully Distributed Earnings Per Share reconciliations to GAAP equivalents in Appendix.

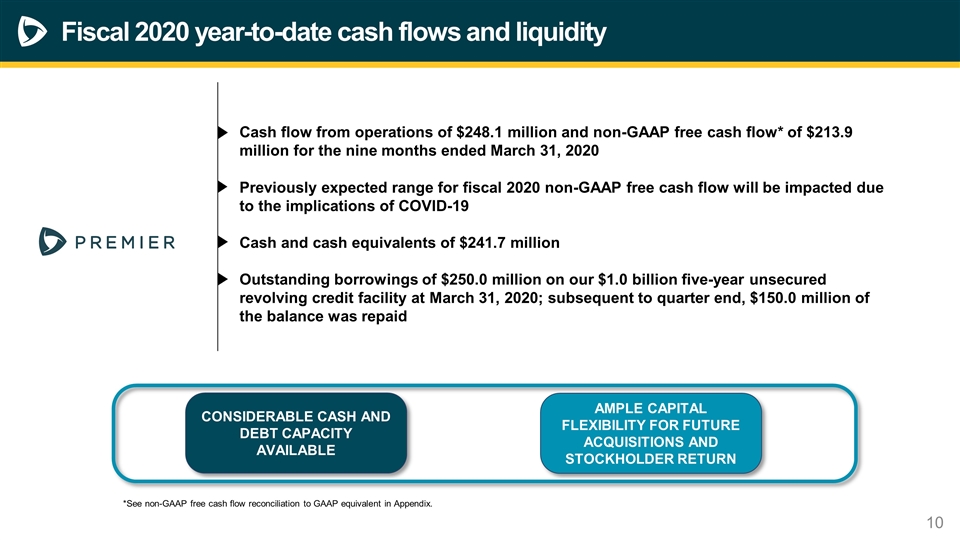

Fiscal 2020 year-to-date cash flows and liquidity Cash flow from operations of $248.1 million and non-GAAP free cash flow* of $213.9 million for the nine months ended March 31, 2020 Previously expected range for fiscal 2020 non-GAAP free cash flow will be impacted due to the implications of COVID-19 Cash and cash equivalents of $241.7 million Outstanding borrowings of $250.0 million on our $1.0 billion five-year unsecured revolving credit facility at March 31, 2020; subsequent to quarter end, $150.0 million of the balance was repaid CONSIDERABLE CASH AND DEBT CAPACITY AVAILABLE AMPLE CAPITAL FLEXIBILITY FOR FUTURE ACQUISITIONS AND STOCKHOLDER RETURN *See non-GAAP free cash flow reconciliation to GAAP equivalent in Appendix.

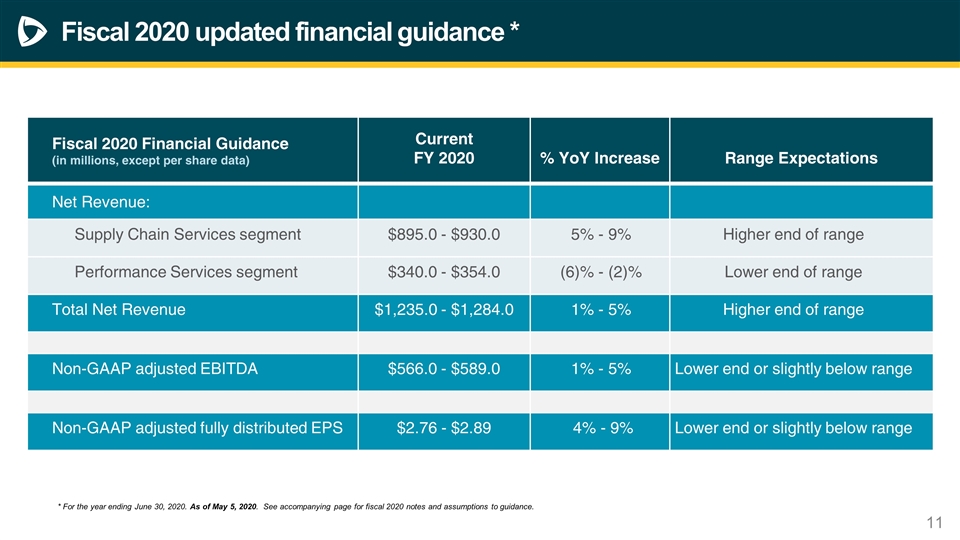

Fiscal 2020 updated financial guidance * Fiscal 2020 Financial Guidance (in millions, except per share data) Current FY 2020 % YoY Increase Range Expectations Net Revenue: Supply Chain Services segment $895.0 - $930.0 5% - 9% Higher end of range Performance Services segment $340.0 - $354.0 (6)% - (2)% Lower end of range Total Net Revenue $1,235.0 - $1,284.0 1% - 5% Higher end of range Non-GAAP adjusted EBITDA $566.0 - $589.0 1% - 5% Lower end or slightly below range Non-GAAP adjusted fully distributed EPS $2.76 - $2.89 4% - 9% Lower end or slightly below range * For the year ending June 30, 2020. As of May 5, 2020. See accompanying page for fiscal 2020 notes and assumptions to guidance.

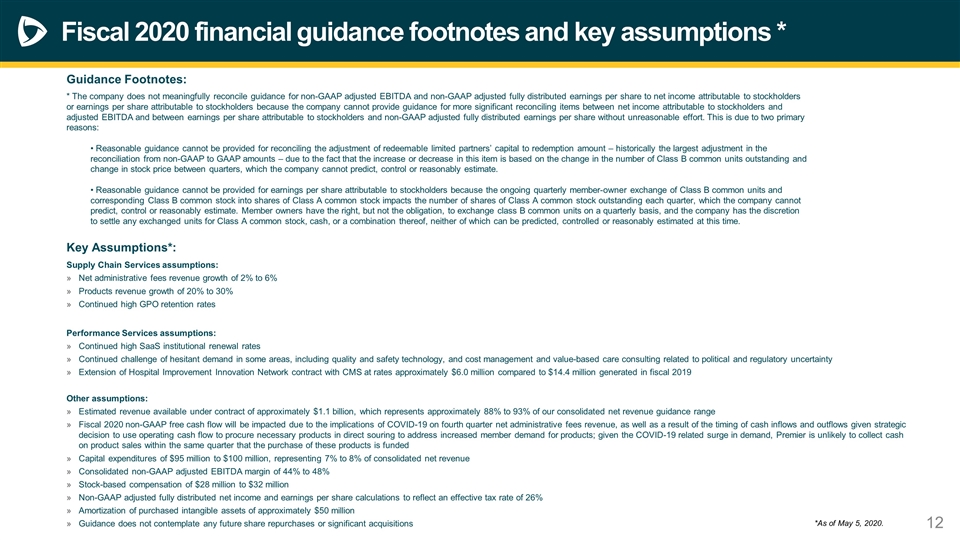

Fiscal 2020 financial guidance footnotes and key assumptions * Guidance Footnotes: * The company does not meaningfully reconcile guidance for non-GAAP adjusted EBITDA and non-GAAP adjusted fully distributed earnings per share to net income attributable to stockholders or earnings per share attributable to stockholders because the company cannot provide guidance for more significant reconciling items between net income attributable to stockholders and adjusted EBITDA and between earnings per share attributable to stockholders and non-GAAP adjusted fully distributed earnings per share without unreasonable effort. This is due to two primary reasons: • Reasonable guidance cannot be provided for reconciling the adjustment of redeemable limited partners’ capital to redemption amount – historically the largest adjustment in the reconciliation from non-GAAP to GAAP amounts – due to the fact that the increase or decrease in this item is based on the change in the number of Class B common units outstanding and change in stock price between quarters, which the company cannot predict, control or reasonably estimate. • Reasonable guidance cannot be provided for earnings per share attributable to stockholders because the ongoing quarterly member-owner exchange of Class B common units and corresponding Class B common stock into shares of Class A common stock impacts the number of shares of Class A common stock outstanding each quarter, which the company cannot predict, control or reasonably estimate. Member owners have the right, but not the obligation, to exchange class B common units on a quarterly basis, and the company has the discretion to settle any exchanged units for Class A common stock, cash, or a combination thereof, neither of which can be predicted, controlled or reasonably estimated at this time. Key Assumptions*: Supply Chain Services assumptions: Net administrative fees revenue growth of 2% to 6% Products revenue growth of 20% to 30% Continued high GPO retention rates Performance Services assumptions: Continued high SaaS institutional renewal rates Continued challenge of hesitant demand in some areas, including quality and safety technology, and cost management and value-based care consulting related to political and regulatory uncertainty Extension of Hospital Improvement Innovation Network contract with CMS at rates approximately $6.0 million compared to $14.4 million generated in fiscal 2019 Other assumptions: Estimated revenue available under contract of approximately $1.1 billion, which represents approximately 88% to 93% of our consolidated net revenue guidance range Fiscal 2020 non-GAAP free cash flow will be impacted due to the implications of COVID-19 on fourth quarter net administrative fees revenue, as well as a result of the timing of cash inflows and outflows given strategic decision to use operating cash flow to procure necessary products in direct souring to address increased member demand for products; given the COVID-19 related surge in demand, Premier is unlikely to collect cash on product sales within the same quarter that the purchase of these products is funded Capital expenditures of $95 million to $100 million, representing 7% to 8% of consolidated net revenue Consolidated non-GAAP adjusted EBITDA margin of 44% to 48% Stock-based compensation of $28 million to $32 million Non-GAAP adjusted fully distributed net income and earnings per share calculations to reflect an effective tax rate of 26% Amortization of purchased intangible assets of approximately $50 million Guidance does not contemplate any future share repurchases or significant acquisitions *As of May 5, 2020.

Questions

Appendix

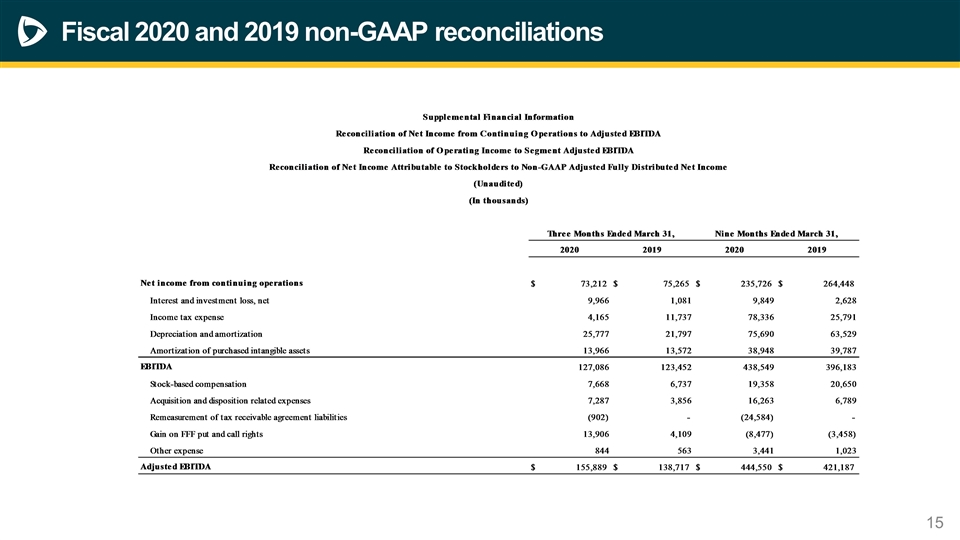

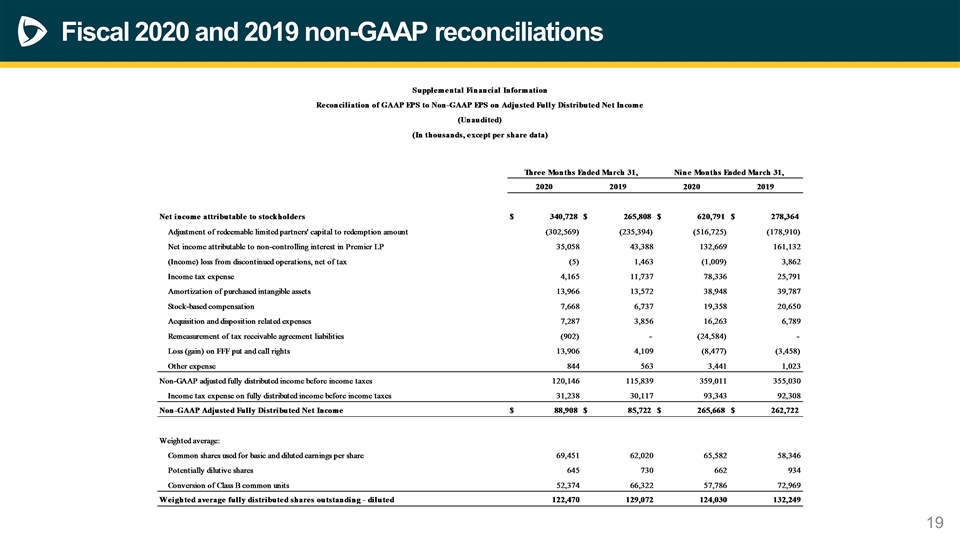

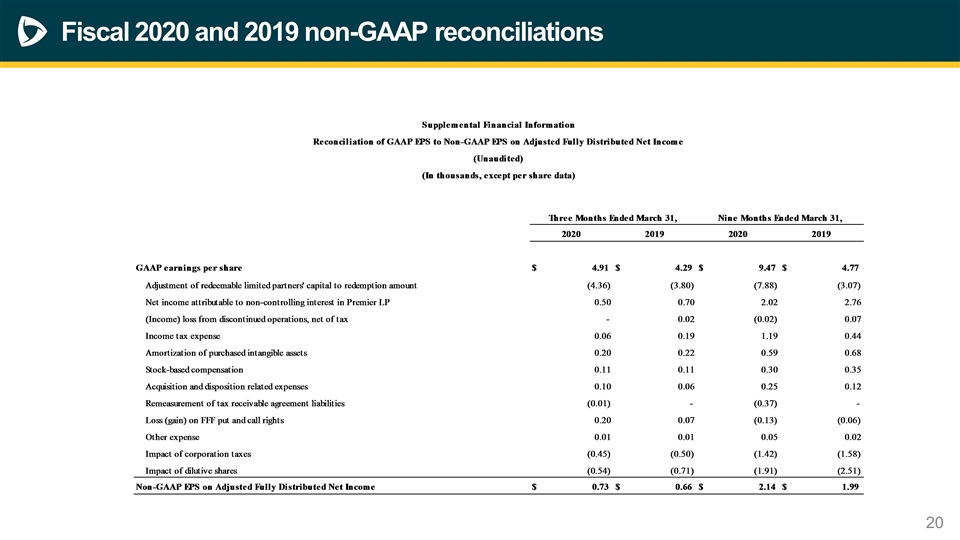

Fiscal 2020 and 2019 non-GAAP reconciliations

Fiscal 2020 and 2019 non-GAAP reconciliations

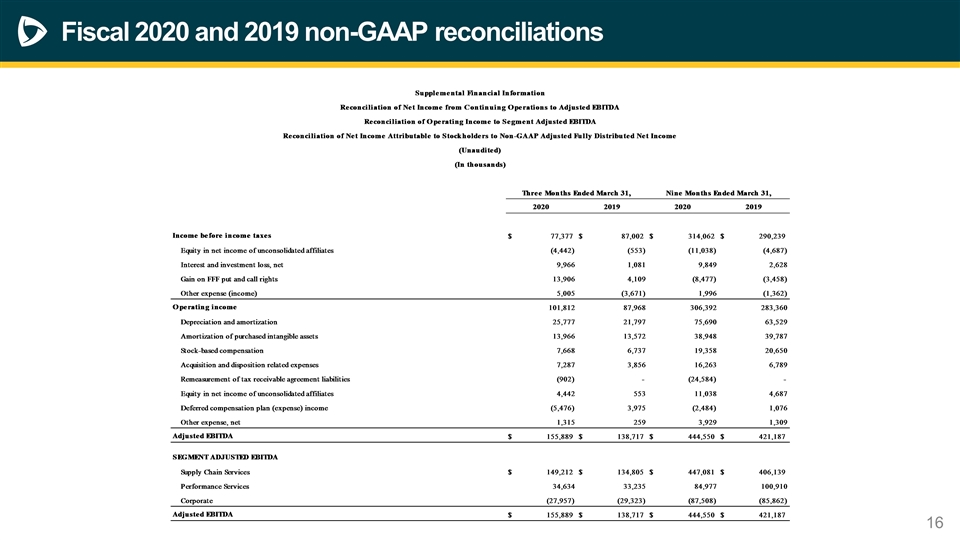

Fiscal 2020 and 2019 non-GAAP reconciliations

Fiscal 2020 and 2019 non-GAAP reconciliations

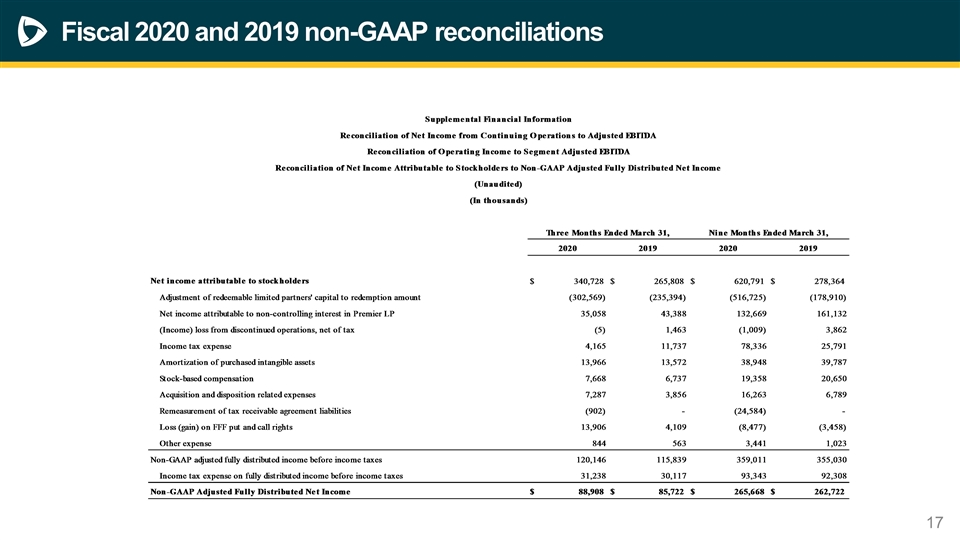

Fiscal 2020 and 2019 non-GAAP reconciliations

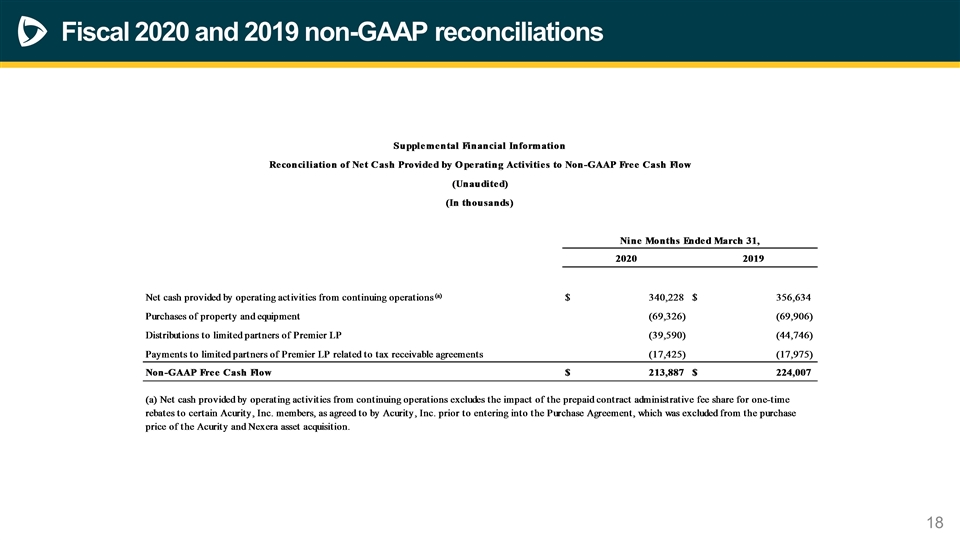

Fiscal 2020 and 2019 non-GAAP reconciliations