Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - FIRST KEYSTONE CORP | tm2019165d1_ex99-2.htm |

| 8-K - FORM 8-K - FIRST KEYSTONE CORP | tm2019165d1_8k.htm |

Exhibit 99.1

Annual Shareholders’ Meeting May 7, 2020

ANNUAL MEETING OF SHAREHOLDERS I. Introduction – Robert A. Bull, Chairman II. Call to Order III. Welcome IV. Ascertain Presence of a Quorum – David R. Saracino , Secretary V. Proposal No. 1 – Election of Directors VI. Proposal No. 2 – Ratification of Independent Auditors VII. Proposal No. 3 – Advisory Vote on Executive Compensation VIII. Management Presentations I. Diane Rosler II. Elaine Woodland IX. Questions X. Results of Voting XI. Closing Comments / Adjournment

• COVID - 19 , and the resulting guidance for Social Distancing, has created the necessity of holding our first ever Virtual Annual Shareholders Meeting. We appreciate your understanding of the required change and we miss being with you in person. • Due to this change, our presentation today will be an abbreviated version of what had been " normal.“ There will be a shortened presentation on our results for 2019 & 1 st quarter 2020 made by our CFO, Diane Rosler. • Our President and CEO's presentation will address COVID - 19 actions we have taken to protect our customers and employees and will address our preparation plans for the future. • We WILL conduct the normal business portion of the meeting. • To supplement today's annual meeting, we will release a more detailed presentation of today's meeting as part of the investor presentation on Form 8(K). • Unlike our typical previous Annual Meetings, we will not be spending much time focusing on the past. You may find our results for 2019 in our 10(K) filing and 1st Quarter 2020 in our 10(Q) filing. These documents provide very detailed information. Introduction

First Keystone Corporation Board of Directors

First Keystone Corporation Director Emeriti

Diane C. A. Rosler This presentation contains certain forward - looking statements, which are included pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 , and reflect management’s beliefs and expectations based on information currently available . These forward - looking statements are inherently subject to significant risks and uncertainties, including changes in general economic and financial market conditions, the Corporation’s ability to effectively carry out its business plans and changes in regulatory or legislative requirements . Other factors that could cause or contribute to such differences are changes in competitive conditions, and pending or threatened litigation . Although management believes the expectations reflected in such forward - looking statements are reasonable, actual results may differ materially . Senior Vice President, Chief Financial Officer

FIRST KEYSTONE CORPORATION

FIRST KEYSTONE CORPORATION RETURN ON ASSETS

FIRST KEYSTONE CORPORATION

FIRST KEYSTONE CORPORATION

$200,000 $250,000 $300,000 $350,000 $400,000 $450,000 $500,000 $550,000 $600,000 $650,000 $700,000 2015 2016 2017 2018 2019 $509,605 $518,145 $536,054 $584,960 $621,598 $370,061 $389,176 $388,488 $341,826 $306,810 Loans Investments Average Loan and Investment Balances (amounts in thousands)

2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 2015 2016 2017 2018 2019 4.35% 4.33% 4.30% 4.49% 4.78% 3.14% 2.97% 3.11% 3.47% 3.45% Loan Yields Investment Yields Loan and Investment Yields (tax equivalent)

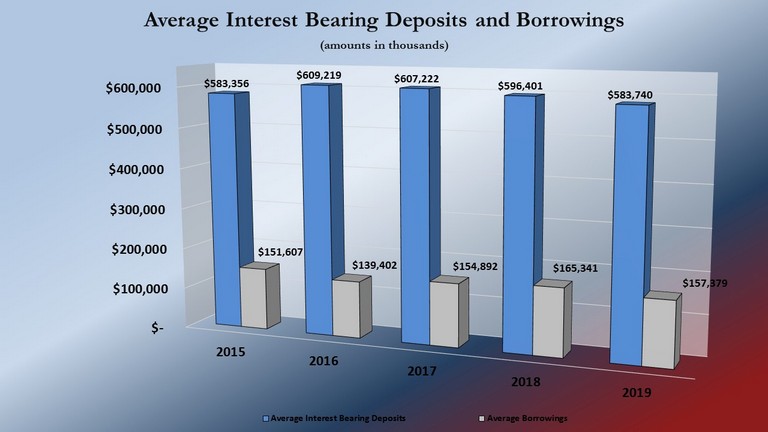

$- $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 2015 2016 2017 2018 2019 $583,356 $609,219 $607,222 $596,401 $583,740 $151,607 $139,402 $154,892 $165,341 $157,379 Average Interest Bearing Deposits Average Borrowings Average Interest Bearing Deposits and Borrowings (amounts in thousands)

0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 2015 2016 2017 2018 2019 0.54% 0.56% 0.70% 0.87% 1.14% 1.19% 1.33% 1.50% 2.07% 2.28% Deposits Borrowings Liability Costs | Deposit and Borrowing Costs

2.50% 2.60% 2.70% 2.80% 2.90% 3.00% 3.10% 3.20% 3.30% 3.40% 3.50% 2015 2016 2017 2018 2019 3.15% 3.03% 2.93% 2.98% 2.95% 3.27% 3.16% 3.09% 3.18% 3.23% Net Interest Spread Net Interest Margin Net Interest Spread and Net Interest Margin (tax equivalent )

$(2,000) $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 2015 2016 2017 2018 2019 $9,172 $9,472 $8,648 $9,211 $10,227 $1,971 $1,845 $1,455 $459 $1,114 $2,131 $1,764 $938 $(65) $911 Net Income After Taxes Tax Expense Net Securities Gain/Loss Net Income After Taxes, Tax Expense & Net Securities Gains/(Losses) (amounts in thousands)

3 Months Ended March 31, 2020 3 Months Ended March 31, 2019 % Change Net Interest Income 7,376$ 6,821$ 8.1% Plus Non-Interest Income* 983 1,507 -34.8% Equals Operating Revenue 8,359 8,328 0.4% Less Loan Loss Provision 194 92 110.9% Less Non-Interest Expense 5,915 5,855 1.0% Equals Pre-Tax Income 2,250 2,381 -5.5% Less Income Tax Expense 197 138 42.8% Equals Net Income 2,053$ 2,243$ -8.5% Earnings Per Share 0.35$ 0.39$ -10.3% Return on Assets 0.81% 0.88% -8.0% Return on Equity 6.21% 7.54% -17.6% Income Statement (amounts in thousands, except per share data) *Includes $538,000 of recognized losses on the holding company's equity securities portfolio for the mark to market adjustment for the current quarter. These are not realized losses due to sales of the stocks. Unaudited

March 31, 2020 March 31, 2019 % Change Cash & Cash Equivalents & Restricted Stocks 9,045$ 13,440$ -32.7% Securites 291,797 292,208 -0.1% Net Loans 654,437 611,221 7.1% Premises & Equipment, Net 19,244 19,906 -3.3% Other Assets 52,684 53,993 -2.4% Total Assets 1,027,207$ 990,768$ 3.7% Non-Interest Bearing Deposits 153,029$ 142,184$ 7.6% Interest Bearing Deposits 581,768 555,236 4.8% Total Deposits 734,797 697,420 5.4% Borrowings 156,379 166,479 -6.1% Other Liabilities 5,881 5,507 6.8% Stockholders' Equity 130,150 121,362 7.2% Liabilities and Stockholders' Equity 1,027,207$ 990,768$ 3.7% Balance Sheet (amounts in thousands) Unaudited

FKC’s Franchise Value • History of solid investor returns – Dividend Yield of 4.36% at 12/31/19 & 6.75% at 3/31/20 • Historically strong capital position • Investor - focused dividend policy • Consistent financial performance – Efficiency Ratio of 64.91% at 12/31/19 & 64.41% at 3/31/20 • Community banking strategy • Economic diversity in the markets we serve • Strong experienced management team and over 200 dedicated employees • Our shareholders

Marketing strategy during pandemic crisis » Via Bank website, Direct email, Social Media, Print media, Billboards, Radio and TV – » COVID - 19 Customer communications of bank operational changes » Bank existing and newly developed products & services » Community appreciation & involvement messages » Lock down tips on Financial education, Fun activities, Free resources, Banking tools

Elaine A. Woodland This presentation contains certain forward - looking statements, which are included pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 , and reflect management’s beliefs and expectations based on information currently available . These forward - looking statements are inherently subject to significant risks and uncertainties, including changes in general economic and financial market conditions, the Corporation’s ability to effectively carry out its business plans and changes in regulatory or legislative requirements . Other factors that could cause or contribute to such differences are changes in competitive conditions, and pending or threatened litigation . Although management believes the expectations reflected in such forward - looking statements are reasonable, actual results may differ materially . President and CEO

“Unprecedented Times” » Prime Lending Rate dropped 1.50% in two decreases: March 4 and March 16 » March 9, 2020 DOW dropped 2200 points » “Stay at Home” order issued by Governor Wolf on March 23, 2020 Covid - 19 Impact

Were we Ready? – YES » First Keystone Community Bank has prepared and regularly updates a full Business Continuity Plan (BCP) and Pandemic Plan » Plans are reviewed , tested , and approved by the Board of Directors annually » Customer and Employee Safety are #1 concerns Covid - 19 Impact

TEAMWORK » BCP Team met regularly to address PA Government, PA Department of Health and CDC guidelines and regulation as events unfolded » BCP Team consisted of: Covid - 19 Impact Elaine A Woodland Diane Rosler Mark McDonald Jeff Wozniak Rebecca Hooper Kevin Krieger Kim Heller June George Chris Zlobik President CEO Acting Director of Lending Sr VP CFO Sr VP Chief Credit Officer Sr VP IT Manager & ISO VP Sr Trust Officer VP Compliance & CRA Officer VP HR Manager VP Branch Administrator VP Deposit Ops Officer

TEAMWORK » Disinfectant supplies inventoried, common high traffic areas identified , measures put in place to help keep employees and customers safe » Pa Bankers CEO Peer exchange conference calls regularly attended. Industry experts in attendance included: PA Dept. of Banking and Securities, Federal Reserve, U.S. Sec. of Treasury, FDIC, Small Business Administration and Federal Home Loan Bank. Covid - 19 Impact

Change in Business Model » Online Account Opening increased 200% since February » Mobile Remote Deposits increased 50% in volume to $356 thousand in April 2020 » Automated Telephone Banking handled 29,000 calls in April compared to an average of 16,400 in previous months Covid - 19 Impact

Future » Knowledge gained will be used to enhance and improve BCP Plan » Created a library of Federal guidelines, First Keystone Community Bank documentation , loan modification and stimulus check information, core system documentation for future reference Covid - 19 Impact

Customer Impact » 16 of 18 branches remain open via drive - thru only (open Sat. as well and Main branch open Sun.) » Marketing and Social Media initiatives implemented to provide customer updates and education » Provided Fraud and Scams Education via social media » Launched Chat Box on our Website to enable customers to ask questions and receive immediate response » Increase in automated Telephone Banking service calls » Reallocated resources and increased the number of employees responding to customer phone calls » Increased Mobile Remote Deposit Limits & waived Telephone Transfer Fees » Waived early close - out fee for Christmas Clubs Covid - 19 Impact

Customer Impact » Waived early withdrawal penalties for CDs » Increased Loan Authority of Officers' Loan Committee to handle Payment Deferral requests quickly » Introduced new consumer unsecured Line of Credit "Keystone Quick Cash" » Continue to serve our customers through drive - thru, ATMs, night deposit as well as Online Banking, Mobile, Telephone Banking » Continuing to serve customers in person on an appointment basis » Approving consumer, residential mortgage and commercial loan payment deferrals and modification requests » Processed $16,264,000 in Stimulus ACH Deposits through May 1, 2020 » Processed and obtained approval for 449 loans through the SBA Payroll Protection Program (“PPP”) for $ 32,462,000 Covid - 19 Impact

As we prepare to re - open our lobbies you will see changes: » Continue to follow employee and customer mask wearing mandate of PA Dept. of Health guidelines and social distancing » Sneeze Shields for Teller and Customer Service areas » Floor distance markers Covid - 19 Impact

Community » Opened parking lots at Shickshinny and Mifflinville for school lunch distribution programs » Donated funds to Central Susquehanna Community Foundation Disaster Relief Fund » Participate in the # LightItBlue initiative honoring Healthcare Workers, First Responders, Essential Workers » Providing $4,000 donation to local Food Banks » Co - Sponsored Berwick United Way mask giveaway Covid - 19 Impact

Employee » Managers reviewed personnel, split and divided staff for employee and Bank safety and security » Work from home alternative made available for employees - following Gov. Wolf and Dept. of Health guidance » Provided a Telecommuting agreement for all employees working from home and travel letter for all employees » Encryption and Data Loss prevention controls maintained » Currently have 35 employees working from home » All Social Distancing guidelines implemented and followed Covid - 19 Impact

Employee » Mandatory Mask mandate of April 20, 2020 strictly adhered to by 100% of our employees » Feel ill, fever above 103.1 - stay home » Strictly adhering to PA Dept of Health guidelines, FMLA, HIPAA » Meetings held virtually. No in - person meetings exceeding 10 people, each 6 feet apart. » Vendor visitation restricted » Eliminated unnecessary employee travel » Focus on Morale – “Denim Days”, Business Casual, CONNECT Covid - 19 Impact

Shareholder » Annual meeting held virtually - first time in our history » We remain true to our mission s tatement and goals upon which we were founded over 150 years ago » Thank you for your understanding , and attendance Covid - 19 Impact

Name/Title Overall Banking Experience Number of years with First Keystone Community Bank Prior Positions held at First Keystone Community Bank Prior Experience Elaine A. Woodland President and CEO 39 years 27 years Teller, CSR, Acctg Clerk, Commercial Loan Officer, Director of Lending, COO Credit Analyst, Credit Dept Manager, Commercial Lender Diane C.A. Rosler Sr VP, CFO, Cashier 29 years 29 years Purchasing Agent, Acctg Manager, Primary Financial Officer Has worked her entire career at First Keystone Community Bank Mark J. McDonald Sr VP, Chief Credit Officer 34 Years 14 ½ years Commercial Services Officer, Credit Admn . Manager Branch Manager, Mortgage Loan Officer, Mortgage Loan Underwriter, Mortgage Loan Dept. Mgr., Credit Analyst, Relationship Mgmt Development Trainee, Underwriting Analyst, Commercial Lender, Loan Workout Officer Jeffrey T. Wozniak Sr VP, Sr IT Manager and Info Security Officer 18 years 18 years It Specialist, Network Specialist, Network Admin., IT Manager Has worked his entire career at First Keystone Community Bank Rebecca A. Hooper VP, Sr Trust Officer 17 Years 17 Years Trust Clerk, Trust Admin., Asst Trust Officer, Trust Officer Has worked her entire career at First Keystone Community Bank Kevin Krieger VP, Compliance Officer and CRA Officer 41 years Full Time plus 2 years Part Time 12 years BSA Officer Compliance Consultant, Training Manager, Teller, Teller Supervisor, Bookkeeping Clerk, Proof Clerk, Control Department Clerk, Fed Funds Desk Manager, Branch Manager/Loan Officer, Microfilm Clerk (PT) June George VP, Branch Administrator 34 Years 23 Years Consumer Loan Underwriter, Regional Manager (PCB) Mellon Bank, Pocono Community Bank Chris Zlobik VP, Deposit Operations Officer 9 Years 9 Years Computer Applications Analyst, Asst IT Manager Served in the Navy 1992 - 1994, worked in other industries and started his banking career in Nov 2010 Senior Management Depth of Bench

Keys to our Success are expressed in our Mission Statement Our mission is to be the financial provider of choice of a broad selection of quality banking and related financial services, including trust services, to individuals, businesses, and households in the Bank’s service area and thereby deliver superior financial performance and value to our shareholders. We will be a leading community bank that offers high quality service in response to the needs of the consumers within our market area. We focus on strong customer relationships and compete on the basis of value, convenience, and delivery of high quality services. The delivery of these services will be done by skilled, sales - oriented, customer service personnel, supported by a broad - based, experienced organization employing “state - of - the - art” technological resources. First Keystone Community Bank intends to be a good corporate citizen committing its resources (financial and human) for the betterment of the communities we serve. First Keystone Community Bank recognizes and values the contribution of our employees. To them, we pledge to provide opportunity for a high level of job satisfaction and an equitable exchange for their services.

Thank you!