Attached files

| file | filename |

|---|---|

| EX-21 - FIRST KEYSTONE CORP | v214836_ex21.htm |

| EX-23 - FIRST KEYSTONE CORP | v214836_ex23.htm |

| EX-31.1 - FIRST KEYSTONE CORP | v214836_ex31-1.htm |

| EX-10.2 - FIRST KEYSTONE CORP | v214836_ex10-2.htm |

| EX-32.2 - FIRST KEYSTONE CORP | v214836_ex32-2.htm |

| EX-31.2 - FIRST KEYSTONE CORP | v214836_ex31-2.htm |

| EX-32.1 - FIRST KEYSTONE CORP | v214836_ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

x

|

ANNUAL REPORT UNDER SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

or

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from __________ to __________

Commission file Number: 2-88927

FIRST KEYSTONE CORPORATION

(Exact name of registrant as specified in its Charter)

|

Pennsylvania

|

23-2249083

|

|

|

(State or other jurisdiction of incorporation)

|

(I.R.S. Employer Identification Number)

|

|

|

111 West Front Street Berwick, Pennsylvania

|

18603

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code: (570) 752-3671

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $2.00 per share

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes ¨ No x

Indicate by check mark whether the Registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No ¨

Indicate by check mark if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-K contained in this form, and no disclosure will be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “small reporting company” in Rule 12b-2 of the Exchange Act. Large accelerated filer ¨ Accelerated filer x

Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No x

The aggregate market value of the registrant’s outstanding voting common stock held by non-affiliates on June 30, 2010 determined by using a per share closing price on that date of $15.55 as quoted on the Over the Counter Bulletin Board, was $76,812,957.

At March 11 2011, there were 5,444,292 shares of Common Stock, $2.00 par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's 2011 definitive Proxy Statement are incorporated by reference in Part III of this Report.

FIRST KEYSTONE CORPORATION

FORM 10-K

Table of Contents

|

Page

|

|||

|

Part I

|

|||

|

Item 1.

|

Business

|

1

|

|

|

Item 1A.

|

Risk Factors

|

9

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

12

|

|

|

Item 2.

|

Properties

|

13

|

|

|

Item 3.

|

Legal Proceedings

|

13

|

|

|

Item 4.

|

Removed and Reserved

|

13

|

|

|

Part II

|

|||

|

Item 5.

|

Market for Registrant's Common Equity and Related Shareholder Matters and Issuer Purchases of Equity Securities

|

14

|

|

|

Item 6.

|

Selected Financial Data

|

17

|

|

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

18

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosure About Market Risk

|

36

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

37

|

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

78

|

|

|

Item 9A.

|

Controls and Procedures

|

78

|

|

|

Item 9B.

|

Other Information

|

79

|

|

|

Part III

|

|||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

79

|

|

|

Item 11.

|

Executive Compensation

|

79

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters

|

80

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

80

|

|

|

Item 14.

|

Principal Accountant Fees and Services

|

80

|

|

|

Part IV

|

|||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

80

|

|

|

Signatures

|

82

|

||

|

Exhibit 10.2

|

|

||

|

Exhibit 21

|

|

||

|

Exhibit 23

|

|

||

|

Exhibit 31.1

|

|

||

|

Exhibit 31.2

|

|

||

|

Exhibit 32.1

|

|

||

|

Exhibit 32.2

|

|

ii

FIRST KEYSTONE CORPORATION

FORM 10-K

PART I

Forward Looking Statements

In addition to historical information, this Form 10-K contains forward-looking statements. Examples of forward-looking statements include, but are not limited to (a) projections or statements regarding future earnings, expenses, net interest income, other income, earnings or loss per share, asset mix and quality, growth prospects, capital structure, and other financial terms, (b) statements of plans and objectives of management or the Board of Directors, and (c) statements of assumptions, such as economic conditions in the Corporation’s market areas. Such forward-looking statements can be identified by the use of forward-looking terminology such as “believes”, “expects”, “may”, “intends”, “will”, “should”,

“anticipates”, or the negative of any of the foregoing or other variations thereon or comparable terminology, or by discussion of strategy.

Forward-looking statements are subject to certain risks and uncertainties such as local economic conditions, competitive factors, and regulatory limitations. Actual results may differ materially from those projected in the forward-looking statements. Such risks, uncertainties and other factors that could cause actual results and experience to differ from those projected include, but are not limited to, the following: ineffectiveness of the business strategy due to changes in current or future market conditions; the effects of economic deterioration on current customers, specifically the effect of the economy on loan customers’ ability to repay loans; the effects of competition, changes in laws and regulation, including the Dodd Frank Wall Street Reform and Consumer Protection Act of 2010 and the

regulations promulgated thereunder; interest rate movements; information technology difficulties, and challenges in establishing and maintaining operations in new markets; volatilities in the securities markets; and deteriorating economic conditions.

We caution readers not to place undue reliance on these forward-looking statements. They only reflect management’s analysis as of this date. The Corporation does not revise or update these forward-looking statements to reflect events or changed circumstances. Please carefully review the risk factors described in this document and in other documents the Corporation files from time to time with the Securities and Exchange Commission, including the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and any Current Reports on Form 8-K.

|

ITEM 1.

|

BUSINESS

|

First Keystone Corporation is a Pennsylvania business corporation, and a bank holding company, registered with and supervised by the Board of Governors of the Federal Reserve System. The Corporation was incorporated on July 6, 1983, and commenced operations on July 2, 1984, upon consummation of the acquisition of all of the outstanding stock of First Keystone National Bank (the predecessor to First Keystone Community Bank). The Corporation has one wholly-owned subsidiary, the Bank, which has a commercial banking operation and trust department as its major lines of business. Since commencing operations, the Corporation's business has consisted primarily of managing and supervising the Bank, and its principle source of income has been dividends paid by the Bank. Greater than 98% of

the company's revenue and profit came from the commercial banking department for the years ended December 31, 2010, 2009, and 2008, and was the only reportable segment. At December 31, 2010, the Corporation had total consolidated assets, deposits and stockholders' equity of approximately $797 million, $627 million and $79 million, respectively.

First Keystone Community Bank was originally organized in 1864 as a national banking association. On October 1, 2010, the Bank converted from a national banking association to a Pennsylvania chartered commercial bank under the supervision of the Pennsylvania Department of Banking. Its deposits are insured by the Federal Deposit Insurance Corporation (FDIC) to the maximum extent of the law regulated by the FDIC and the Pennsylvania Department of Banking. The Bank has fifteen branch locations (five branches within Columbia County, five branches within Luzerne County, one branch in Montour County, and four branches within Monroe County, Pennsylvania), and is a full service commercial bank providing a wide range of services to individuals and small to medium sized businesses in its Northeastern and

Central Pennsylvania market area. The Bank's commercial banking activities include accepting time, demand, and savings deposits and making secured and unsecured commercial, real estate and consumer loans. Additionally, the Bank provides personal and corporate trust and agency services to individuals, corporations, and others, including trust investment accounts, investment advisory services, mutual funds, estate planning, and management of pension and profit sharing plans.

1

Acquisition

Effective November 1, 2007, the Corporation completed its acquisition of Pocono Community Bank through the merger of Pocono with and into the Bank. On the acquisition date, Pocono Community Bank had approximately $150 million in assets, $105 million in loans and $110 million in deposits. Headquartered in Stroudsburg, Pennsylvania and organized in 1996, Pocono had 4 banking offices located in Monroe County, Pennsylvania. The acquisition expanded the branch network of the Corporation and provides Pocono customers with a broader array of products and services.

Supervision and Regulation

The Corporation is subject to the jurisdiction of the SEC and of state securities laws for matters relating to the offering and sale of its securities. The Corporation is currently subject to the SEC's rules and regulations relating to company's whose shares are registered under Section 12 of the Securities Exchange Act of 1934, as amended.

The Corporation is also subject to the provisions of the Bank Holding Company Act of 1956, as amended , and to supervision by the Federal Reserve Board. The Bank Holding Company Act requires the Corporation to secure the prior approval of the Federal Reserve Board before it owns or controls, directly or indirectly, more than 5% of the voting shares of substantially all of the assets of any institution, including another bank.

The Bank Holding Company Act also prohibits acquisition of control of a bank holding company, such as the Corporation, without prior notice to the Federal Reserve Board. Control is defined for this purpose as the power, directly or indirectly, to direct the management or policies of a bank holding company or to vote 25% (or 10%, if no other person or persons acting on concert, holds a greater percentage of the Common Stock) or more of the Corporation's Common Stock.

The Corporation is required to file an annual report with the Federal Reserve Board and any additional information that the Federal Reserve Board may require pursuant to the Bank Holding Company Act. The Federal Reserve Board may also make examinations of the Corporation and any or all of its subsidiaries.

The Bank is subject to federal and state statutes applicable to banks chartered under the banking laws of Pennsylvania and to banks whose deposits are insured by the FDIC. The Bank is subject to supervision, regulation and examination by the Pennsylvania Department of Banking and the FDIC.

Federal and state banking laws and regulations govern, among other things, the scope of a bank's business, the investments a bank may make, the reserves against deposits a bank must maintain, loans a bank makes and collateral it takes, and the activities of a bank with respect to mergers and consolidations and the establishment of branches.

As a subsidiary of a bank holding company, the Bank is subject to certain restrictions imposed by the Federal Reserve Act on any extensions of credit to the bank holding company or its subsidiaries, on investments in the stock or other securities of the bank holding company or its subsidiaries and on taking such stock or securities as collateral for loans. The Federal Reserve Act and Federal Reserve Board regulations also place certain limitations and reporting requirements on extensions of credit by a bank to principal shareholders of its parent holding company, among others, and to related interests of such principal shareholders. In addition, such legislation and regulations may affect the terms upon which any person becoming a principal shareholder of a holding company may obtain credit from banks

with which the subsidiary bank maintains a correspondent relationship.

Permitted Non-Banking Activities

The Federal Reserve Board permits bank holding companies to engage in non-banking activities so closely related to banking, managing or controlling banks as to be a proper incident thereto. The Corporation does not at this time engage in any of these non-banking activities, nor does the Corporation have any current plans to engage in any other permissible activities in the foreseeable future.

Legislation and Regulatory Changes

From time to time, various types of federal and state legislation have been proposed that could result in additional regulations of, and restrictions on, the business of the Bank. It cannot be predicted whether any such legislation will be adopted or how such legislation would affect the business of the Bank. As a consequence of the extensive regulation of commercial banking activities in the United States, the Bank's business is particularly susceptible to being affected by federal legislation and regulations that may increase the costs of doing business.

2

From time to time, legislation is enacted which has the effect of increasing the cost of doing business, limiting or expanding permissible activities or affecting the competitive balance between banks and other financial institutions. No prediction can be made as to the likelihood of any major changes or the impact such changes might have on the Corporation and the Bank. Certain changes of potential significance to the Corporation which have been enacted recently and others which are currently under consideration by Congress or various regulatory agencies are discussed below.

Federal Deposit Insurance Corporation Improvement Act of 1991

The FDICIA established five different levels of capitalization of financial institutions, with “prompt corrective actions” and significant operational restrictions imposed on institutions that are capital deficient under the categories. The five categories are:

· well capitalized

· adequately capitalized

· undercapitalized

· significantly undercapitalized, and

· critically undercapitalized.

To be considered well capitalized, an institution must have a total risk-based capital ratio of at least 10%, a Tier 1 risk-based capital ratio of at least 6%, a leverage capital ratio of at least 5%, and must not be subject to any order or directive requiring the institution to improve its capital level. An institution falls within the adequately capitalized category if it has a total risk-based capital ratio of at least 8%, a Tier 1 risk-based capital ratio of at least 4%, and a leverage capital ratio of at least 4%. Institutions with lower capital levels are deemed to be undercapitalized, significantly undercapitalized or critically undercapitalized, depending on their actual capital levels. In addition, the appropriate federal regulatory agency may downgrade an institution to the next lower capital

category upon a determination that the institution is in an unsafe or unsound condition, or is engaged in an unsafe or unsound practice. Institutions are required under FDICIA to closely monitor their capital levels and to notify their appropriate regulatory agency of any basis for a change in capital category. On December 31, 2010 the Corporation and the Bank exceeded the minimum capital levels of the well capitalized category.

Regulatory oversight of an institution becomes more stringent with each lower capital category, with certain “prompt corrective actions” imposed depending on the level of capital deficiency.

Other Provisions of FDICIA

Each depository institution must submit audited financial statements to its primary regulator and the FDIC, which reports are made publicly available. In addition, the audit committee of each depository institution must consist of outside directors and the audit committee at “large institutions” (as defined by FDIC regulation) must include members with banking or financial management expertise. The audit committee at “large institutions” must also have access to independent outside counsel. In addition, an institution must notify the FDIC and the institution's primary regulator of any change in the institution’s independent auditor, and annual management letters must be provided to the FDIC and the depository institution's primary regulator. The regulations define a “large

institution” as one with over $500 million in assets, which does include the Bank. Also, under the rule, an institution's independent public accountant must examine the institution's internal controls over financial reporting and perform agreed-upon procedures to test compliance with laws and regulations concerning safety and soundness.

Under FDICIA, each federal banking agency must prescribe certain safety and soundness standards for depository institutions and their holding companies. Three types of standards must be prescribed:

· asset quality and earnings

· operational and managerial, and

· compensation

3

Such standards would include a ratio of classified assets to capital, minimum earnings, and, to the extent feasible, a minimum ratio of market value to book value for publicly traded securities of such institutions and holding companies. Operational and managerial standards must relate to:

· internal controls, information systems and internal audit systems

· loan documentation

· credit underwriting

· interest rate exposure

· asset growth, and

· compensation, fees and benefits

FDICIA also sets forth Truth in Savings disclosure and advertising requirements applicable to all depository institutions.

Real Estate Lending Standards. Pursuant to the FDICIA, federal banking agencies adopted real estate lending guidelines which would set loan-to-value ratios for different types of real estate loans. The LTV ratio is generally defined as the total loan amount divided by the appraised value of the property at the time the loan is originated. If the institution does not hold a first lien position, the total loan amount would be combined with the amount of all junior liens when calculating the ratio. In addition to establishing the LTV ratios, the guidelines require all real estate loans to be based upon proper loan documentation and a recent appraisal or certificate of inspection of the property.

Regulatory Capital Requirements

The federal banking regulators have adopted certain risk-based capital guidelines to assist in the assessment of the capital adequacy of a banking organization's operations for both transactions reported on the balance sheet as assets and transactions, such as letters of credit, and recourse agreements, which are recorded as off balance sheet items. Under these guidelines, nominal dollar amounts of assets and credit equivalent amounts of off balance sheet items are multiplied by one of several risk adjustment percentages, which range from 0% for assets with low credit risk, such as certain U.S. Treasury securities, to 100% for assets with relatively high credit risk, such as business loans.

The following table presents the Corporation's capital ratios at December 31, 2010.

|

(In Thousands)

|

||||

|

Tier I Capital

|

$ | 60,281 | ||

|

Tier II Capital

|

5,701 | |||

|

Total Capital

|

$ | 65,982 | ||

|

Adjusted Total Average Assets

|

810,120 | |||

|

Total Adjusted Risk-Weighted Assets1

|

555,815 | |||

|

Tier I Risk-Based Capital Ratio2

|

10.85 | % | ||

|

Required Tier I Risk-Based Capital Ratio

|

4.00 | % | ||

|

Excess Tier I Risk-Based Capital Ratio

|

6.85 | % | ||

|

Total Risk-Based Capital Ratio3

|

11.87 | % | ||

|

Required Total Risk-Based Capital Ratio

|

8.00 | % | ||

|

Excess Total Risk-Based Capital Ratio

|

3.87 | % | ||

|

Tier I Leverage Ratio4

|

7.44 | % | ||

|

Required Tier I Leverage Ratio

|

4.00 | % | ||

|

Excess Tier I Leverage Ratio

|

3.44 | % | ||

1Includes off-balance sheet items at credit-equivalent values less intangible assets.

2Tier I Risk-Based Capital Ratio is defined as the ratio of Tier I Capital to Total Adjusted Risk-Weighted Assets.

3Total Risk-Based Capital Ratio is defined as the ratio of Tier I and Tier II Capital to Total Adjusted Risk-Weighted Assets.

4Tier I Leverage Ratio is defined as the ratio of Tier I Capital to Adjusted Total Average Assets.

4

The Corporation's ability to maintain the required levels of capital is substantially dependent upon the success of the Corporation's capital and business plans; the impact of future economic events on the Corporation's loan customers; and the Corporation's ability to manage its interest rate risk and investment portfolio and control its growth and other operating expenses. See also, the information under the caption “Capital Strength” appearing on page 32of this 2010 Annual Report on Form 10-K.

Effect of Government Monetary Policies

The earnings of the Corporation are and will be affected by domestic economic conditions and the monetary and fiscal policies of the United States government and its agencies.

The Federal Reserve Board has had, and will likely continue to have, an important impact on the operating results of commercial banks through its power to implement national monetary policy in order to, among other things, curb inflation or combat a recession. The Federal Reserve Board has a major effect upon the levels of bank loans, investments and deposits through its open market operations in United States government securities and through its regulations of, among other things, the discount rate on borrowings of member banks and the reserve requirements against member bank deposits. It is not possible to predict the nature and impact of future changes in monetary and fiscal policies.

Effects of Inflation

Inflation has some impact on the Bank's operating costs. Unlike industrial companies, however, substantially all of the Bank's assets and liabilities are monetary in nature. As a result, interest rates have a more significant impact on the Bank's performance than the general levels of inflation. Over short periods of time, interest rates may not necessarily move in the same direction or in the same magnitude as prices of goods and services.

Environmental Regulation

There are several federal and state statutes that regulate the obligations and liabilities of financial institutions pertaining to environmental issues. In addition to the potential for attachment of liability resulting from its own actions, a bank may be held liable, under certain circumstances, for the actions of its borrowers, or third parties, when such actions result in environmental problems on properties that collateralize loans held by the bank. Further, the liability has the potential to far exceed the original amount of the loan issued by the Bank. Currently, neither the Corporation nor the Bank is a party to any pending legal proceeding pursuant to any environmental statute, nor are the Corporation and the Bank aware of any circumstances that may give rise to liability under any such statute.

Interest Rate Risk

Federal banking agency regulations specify that the Bank's capital adequacy include an assessment of the Bank's interest rate risk exposure. The standards for measuring the adequacy and effectiveness of a banking organization's Interest Rate Risk (IRR) management includes a measurement of Board of Directors and senior management oversight, and a determination of whether a banking organization's procedures for comprehensive risk management are appropriate to the circumstances of the specific banking organization. First Keystone Community Bank has internal IRR models that are used to measure and monitor IRR. Additionally, the regulatory agencies have been assessing IRR on an informal basis for several years. For these reasons, the Corporation does not expect the addition of IRR evaluation to the agencies'

capital guidelines to result in significant changes in capital requirements for the Bank.

The Gramm-Leach-Bliley Act of 2000

In 2000, the Gramm-Leach-Bliley Act became law, which is also known as the Financial Services Modernization Act. The act repealed some Depression-era banking laws and will permit banks, insurance companies and securities firms to engage in each others' businesses after complying with certain conditions and regulations. The act grants to community banks the power to enter new financial markets as a matter of right that larger institutions have managed to do on an ad hoc basis. At this time, our company has no plans to pursue these additional possibilities.

5

The Sarbanes-Oxley Act

In 2002, the Sarbanes-Oxley Act became law. The Act was in response to public concerns regarding corporate accountability in connection with recent high visibility accounting scandals. The stated goals of the Sarbanes-Oxley Act are:

|

|

·

|

to increase corporate responsibility;

|

|

|

·

|

to provide for enhanced penalties for accounting and auditing improprieties at publicly traded companies; and

|

|

|

·

|

to protect investors by improving the accuracy and reliability of corporate disclosures pursuant to the securities laws.

|

The Sarbanes-Oxley Act generally applies to all companies, both U.S. and non-U.S., that file periodic reports with the SEC under the Securities Exchange Act of 1934. The legislation includes provisions, among other things:

|

|

·

|

governing the services that can be provided by a public company’s independent auditors and the procedures for approving such services;

|

|

|

·

|

requiring the chief executive officer and chief financial officer to certify certain matters relating to the company’s periodic filings under the Exchange Act;

|

|

|

·

|

requiring expedited filings of reports by insiders of their securities transactions and containing other provisions relating to insider conflicts of interest;

|

|

|

·

|

increasing disclosure requirements relating to critical financial accounting policies and their application;

|

|

|

·

|

increasing penalties for securities law violations; and

|

|

|

·

|

creating a public accounting oversight board, a regulatory body subject to SEC jurisdiction with broad powers to set auditing, quality control and ethics standards for accounting firms.

|

Emergency Economic Stabilization Act of 2008 and American Recovery and Reinvestment Act of 2009

In response to the financial crises affecting the banking system and financial markets and going concern threats to investment banks and other financial institutions, on October 3, 2008, the Emergency Economic Stabilization Act of 2008 (the “EESA”) was signed into law and subsequently amended by the American Recovery and Reinvestment Act of 2009 on February 17, 2009. Under the authority of the EESA, as amended, the United States Department of the Treasury (the “Treasury”) created the Troubled Asset Relief Program (“TARP”) Capital Purchase Program and through this program invested in financial institutions by purchasing preferred stock and warrants to purchase either common stock or additional shares of preferred stock. As of December 31, 2009, the Treasury will not make

additional investments under the TARP Capital Purchase Program but is considering continuing a similar program for banks under $10 billion in assets under a different program.

Dodd-Frank Wall Street Reform and Consumer Protection Act

On July 21, 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”) was signed into law. Dodd-Frank is intended to effect a fundamental restructuring of federal banking regulation. Among other things, Dodd-Frank creates a new Financial Stability Oversight Council to identify systemic risks in the financial system and gives federal regulators new authority to take control of and liquidate financial firms. Dodd-Frank additionally creates a new independent federal regulator to administer federal consumer protection laws. Dodd-Frank is expected to have a significant impact on our business operations as its provisions take effect. It is difficult to predict at this time what specific impact Dodd-Frank and the yet to be written implementing rules and regulations will have on

community banks. However, it is expected that at a minimum they will increase our operating and compliance costs and could increase our interest expense. Among the provisions that are likely to affect us are the following:

Holding Company Capital Requirements. Dodd-Frank requires the Federal Reserve to apply consolidated capital requirement to bank holding companies that are no less stringent than those currently applied to depository institutions. Under these standards, trust preferred securities will be excluded from Tier 1 capital unless such securities were issued prior to May 19, 2010 by a bank holding company with less than $15 billion in assets. Dodd-Frank additionally requires that bank regulators issue countercyclical capital requirements so that the required amount of capital increases in times of economic expansion and decreases in times of economic contraction, consistent with safety and soundness.

6

Deposit Insurance. Dodd-Frank permanently increases the maximum deposit insurance amount for banks, savings institutions and credit unions to $250,000 per depositor, and extends unlimited deposit insurance to non-interest bearing transaction accounts through December 31, 2012. Dodd-Frank also broadens the base for FDIC insurance assessments. Assessments will now be based on the average consolidated total assets less tangible equity capital of a financial institution. Dodd-Frank requires the FDIC to increase the reserve ratio of the Deposit Insurance Fund from 1.15% to 1.35% of insured deposits by 2020 and eliminates the requirement that the FDIC pay dividends to insured depository institutions when the reserve ratio exceeds

certain thresholds. Effective one year from the date of enactment, Dodd-Frank eliminates the federal statutory prohibition against the payment of interest on business checking accounts.

Corporate Governance. Dodd-Frank requires publicly traded companies to give stockholders a non-binding vote on executive compensation at least every three years, a non-binding vote regarding the frequency of the vote on executive compensation at least every six years, and a non-binding vote on “golden parachute” payments in connection with approvals of mergers and acquisitions unless previously voted on by shareholders. The SEC has finalized the rules implementing these requirements which took effect on January 21, 2011. Additionally, Dodd-Frank directs the federal banking regulators to promulgate rules prohibiting excessive compensation paid to executives of depository institutions and their holding companies with assets

in excess of $1.0 billion, regardless of whether the company is publicly traded. Dodd-Frank also gives the SEC authority to prohibit broker discretionary voting on elections of directors and executive compensation matters.

Prohibition Against Charter Conversions of Troubled Institutions. Effective one year after enactment, Dodd-Frank prohibits a depository institution from converting from a state to federal charter or vice versa while it is the subject of a cease and desist order or other formal enforcement action or a memorandum of understanding with respect to a significant supervisory matter unless the appropriate federal banking agency gives notice of the conversion to the federal or state authority that issued the enforcement action and that agency does not object within 30 days. The notice must include a plan to address the significant supervisory matter. The converting institution must also file a copy of the conversion application with its

current federal regulator which must notify the resulting federal regulator of any ongoing supervisory or investigative proceedings that are likely to result in an enforcement action and provide access to all supervisory and investigative information relating thereto.

Interstate Branching. Dodd-Frank authorizes national and state banks to establish branches in other states to the same extent as a bank chartered by that state would be permitted. Previously, banks could only establish branches in other states if the host state expressly permitted out-of-state banks to establish branches in that state. Accordingly, banks will be able to enter new markets more freely.

Limits on Interstate Acquisitions and Mergers. Dodd-Frank precludes a bank holding company from engaging in an interstate acquisition — the acquisition of a bank outside its home state — unless the bank holding company is both well capitalized and well managed. Furthermore, a bank may not engage in an interstate merger with another bank headquartered in another state unless the surviving institution will be well capitalized and well managed. The previous standard in both cases was adequately capitalized and adequately managed.

Limits on Interchange Fees. Dodd-Frank amends the Electronic Fund Transfer Act to, among other things, give the Federal reserve the authority to establish rules regarding interchange fees charged for electronic debit transactions by payment card issuers having assets over $10 billion and to enforce a new statutory requirement that such fees be reasonable and proportional to the actual cost of a transaction to the issuer.

Consumer Financial Protection Bureau. Dodd- Frank creates a new, independent federal agency called the Consumer Financial Protection Bureau (“CFPB”), which is granted broad rulemaking, supervisory and enforcement powers under various federal consumer financial protection laws, including the Equal Credit Opportunity Act, Truth in Lending Act, Real Estate Settlement Procedures Act, Fair Credit Reporting Act, Fair Debt Collection Act, the Consumer Financial Privacy provisions of the Gramm-Leach-Bliley Act and certain other statutes. The CFPB will have examination and primary enforcement authority with respect to depository institutions with $10 billion or more in assets. Smaller institutions will be subject to rules

promulgated by the CFPB but will continue to be examined and supervised by federal banking regulators for consumer compliance purposes. The CFPB will have authority to prevent unfair, deceptive or abusive practices in connection with the offering of consumer financial products. Dodd-Frank authorizes the CFPB to establish certain minimum standards for the origination of residential mortgages including a determination of the borrower’s ability to repay. In addition, Dodd-Frank will allow borrowers to raise certain defenses to foreclosure if they receive any loan other than a “qualified mortgage” as defined by the CFPB. Dodd-Frank permits states to adopt consumer protection laws and standards that are more stringent than those adopted at the federal level and, in certain circumstances, permits state attorneys general to enforce compliance with both the state and federal laws and regulations.

7

Small Business Jobs Act

The Small Business Jobs Act was signed into law on September 27, 2010, which creates a $30 billion Small Business Lending Fund (the “Fund”) to provide community banks with capital to increase small business lending. Generally, bank holding companies with assets equal to or less than $10 billion are eligible to apply for and receive a capital investment from the Fund in an amount equal to 3-5% of its risk-weighted assets.

The capital investment will take the form of preferred stock carrying a 5% dividend which has the potential to decrease to as low as 1% if the participant sufficiently increases its small business lending within the first two and one-half years. If the participant does not increase its small business lending at least 2.5% in the first two and one-half years, the dividend rate will increase to 7%. After four and one-half years, the dividend will increase to 9% regardless of the participant’s small business lending. The deadline to apply to receive capital under the fund is March 31, 2011. Whether the Fund will help spur the economy by increasing the small business lending or strengthening the capital position of community banks is uncertain.

History and Business - Bank

The Bank's legal headquarters are located at 111 West Front Street, Berwick, Pennsylvania.

As of December 31, 2010, the Bank had total assets of $796,601,000, total shareholders' equity of $79,060,000 and total deposits and other liabilities of $717,541,000.

The Bank engages in a full-service commercial banking business, including accepting time and demand deposits, and making secured and unsecured commercial and consumer loans. The Bank's business is not seasonal in nature. Its deposits are insured by the FDIC to the extent provided by law. The Bank has no foreign loans or highly leveraged transaction loans, as defined by the Federal Reserve Board. Substantially all of the loans in the Bank’s portfolio have been originated by the Bank. Policies adopted by the Board of Directors are the basis by which the Bank conducts its lending activities.

At December 31, 2010, the Bank had 163 full-time employees and 34 part-time employees. In the opinion of management, the Bank enjoys a satisfactory relationship with its employees. The Bank is not a party to any collective bargaining agreement.

Competition - Bank

The Bank competes actively with other area commercial banks and savings and loan associations, many of which are larger than the Bank, as well as with major regional banking and financial institutions. The Bank's major competitors in Columbia, Luzerne, Montour, and Monroe counties are:

· First Columbia Bank & Trust Co. of Bloomsburg

· PNC Bank, N.A.

· M & T Bank

· FNB Bank, N.A.

· Wachovia Bank

· Sovereign Bank

· Citizens Bank

· ESSA Bank & Trust

· First National Community Bank

· North Penn Bank

· Wayne Bank

Credit unions are also competitors, especially in Luzerne and Montour counties. The Bank is generally competitive with all competing financial institutions in its service area with respect to interest rates paid on time and savings deposits, service charges on deposit accounts and interest rates charged on loans.

8

Concentration

The Corporation and the Bank are not dependent for deposits nor exposed by loan concentrations to a single customer or to a small group of customers, such that the loss of any one or more would not have a materially adverse effect on the financial condition of the Corporation or the Bank.

Available Information

The Corporation’s common stock is registered under Section 12(g) of the Securities Exchange Act of 1934. The Corporation is subject to the informational requirements of the Exchange Act, and, accordingly, files reports, proxy statements and other information with the Securities and Exchange Commission. The reports, proxy statements and other information filed with the SEC are available for inspection and copying at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The Corporation is an electronic filer with the SEC. The SEC maintains an internet site

that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The SEC’s internet site address is www.sec.gov.

A copy of the Corporation’s Annual Report on Form 10-K may be obtained without charge at www.fkyscorp.com or via email at info@fkcbank.com. Information may also be obtained via written request to Investor Relations at First Keystone Corporation, Attention: Cheryl Wynings, 111 West Front Street, P.O. Box 289, Berwick, Pennsylvania 18603.

|

ITEM 1A.

|

RISK FACTORS

|

Investments in First Keystone Corporation common stock involve risk. The market price of First Keystone common stock may fluctuate significantly in response to a number of factors, including:

The Corporation Is Subject To Interest Rate Risk

The Corporation’s earnings and cash flows are largely dependent upon its net interest income. Net interest income is the difference between interest income earned on interest-earning assets such as loans and securities and interest expense paid on interest-bearing liabilities such as deposits and borrowed funds. Interest rates are highly sensitive to many factors that are beyond the Corporation’s control, including general economic conditions and policies of various governmental and regulatory agencies and, in particular, the Board of Governors of the Federal Reserve System. Changes in monetary policy, including changes in interest rates, could influence not only the interest the Corporation receives on loans and securities and the amount of interest it pays on deposits and borrowings,

but such changes could also affect (i) the Corporation’s ability to originate loans and obtain deposits, (ii) the fair value of the Corporation’s financial assets and liabilities, and (iii) the average duration of the Corporation’s mortgage-backed securities portfolio. If the interest rates paid on deposits and other borrowings increase at a faster rate than the interest rates received on loans and other investments, the Corporation’s net interest income, and therefore earnings, could be adversely affected. Earnings could also be adversely affected if the interest rates received on loans and other investments fall more quickly than the interest rates paid on deposits and other borrowings.

Although management believes it has implemented effective asset and liability management strategies to reduce the potential effects of changes in interest rates on the Corporation’s results of operations, any substantial, unexpected, or prolonged change in market interest rates could have a material adverse effect on the Corporation’s financial condition and results of operations.

The Corporation’s Profitability Depends Significantly On Economic Conditions In The Commonwealth of Pennsylvania

The Corporation’s success depends primarily on the general economic conditions of the Commonwealth of Pennsylvania and the specific local markets in which the Corporation operates. Unlike larger national or other regional banks that are more geographically diversified, the Corporation provides banking and financial services to customers primarily in the Columbia, Luzerne, Montour, and Monroe Counties. The local economic conditions in these areas have a significant impact on the demand for the Corporation’s products and services as well as the ability of the Corporation’s customers to repay loans, the value of the collateral securing loans and the stability of the Corporation’s deposit funding sources. Also a significant decline in general economic conditions could impact

the local economic conditions and, in turn, have a material adverse effect on the Corporation’s financial condition and results of operations.

9

The Corporation Operates In A Highly Competitive Industry

The Corporation faces substantial competition in all areas of its operations from a variety of different competitors, many of which are larger and may have more financial resources. Such competitors primarily include national, regional, and community banks within the various markets in which the Corporation operates. Additionally, various out-of-state banks have begun to enter or have announced plans to enter the market areas in which the Corporation currently operates. The Corporation also faces competition from many other types of financial institutions, including, without limitation, savings and loans, credit unions, finance companies, brokerage firms, insurance companies, factoring companies and other financial intermediaries. Also, technology has lowered barriers to entry and made it

possible for non-banks to offer products and services traditionally provided by banks, such as automatic transfer and automatic payment systems. Many of the Corporation’s competitors have fewer regulatory constraints and may have lower cost structures.

The Corporation’s ability to compete successfully depends on a number of factors, including, among other things:

|

|

·

|

The ability to develop, maintain and build upon long-term customer relationships based on top quality service, high ethical standards and safe, sound assets.

|

|

|

·

|

The ability to expand the Corporation’s market position.

|

|

|

·

|

The scope, relevance and pricing of products and services offered to meet customer needs and demands.

|

|

|

·

|

The rate at which the Corporation introduces new products and services relative to its competitors.

|

|

|

·

|

Customer satisfaction with the Corporation’s level of service.

|

|

|

·

|

Industry and general economic trends.

|

Failure to perform in any of these areas could significantly weaken the Corporation’s competitive position, which could adversely affect the Corporation’s growth and profitability, which, in turn, could have a material adverse effect on the Corporation’s financial condition and results of operations.

The Corporation Is Subject To Extensive Government Regulation and Supervision

The Corporation, primarily through the Bank, is subject to extensive federal and state regulation and supervision. Banking regulations are primarily intended to protect depositors’ funds, federal deposit insurance funds and the banking system as a whole, not shareholders. These regulations affect the Corporation’s lending practices, capital structure, investment practices, dividend policy and growth, among other things. Congress and federal regulatory agencies continually review banking laws, regulations and policies for possible changes. Changes to statutes, regulations or regulatory policies could affect the Corporation in substantial and unpredictable ways. Such changes could subject the Corporation to additional costs, limit the types of financial services and products the Corporation may offer

and/or increase the ability of non-banks to offer competing financial services and products, among other things. Failure to comply with laws, regulations or policies could result in sanctions by regulatory agencies, civil money penalties and/or reputation damage, which could have a material adverse effect on the Corporation’s business, financial condition and results of operations.

The Corporation Is Subject To Claims and Litigation Pertaining To Fiduciary Responsibility

From time to time, customers make claims and take legal action pertaining to the Corporation’s performance of its fiduciary responsibilities. Whether customer claims and legal action related to the Corporation’s performance of its fiduciary responsibilities are founded or unfounded, if such claims and legal actions are not resolved in a manner favorable to the Corporation they may result in significant financial liability and/or adversely affect the market perception of the Corporation and its products and services as well as impact customer demand for those products and services. Any financial liability or reputation damage could have a material adverse effect on the Corporation’s financial condition and results of operations.

10

The Trading Volume In The Corporation’s Common Stock Is Less Than That Of Other Larger Financial Services Companies

The Corporation’s common stock is currently not listed, but traded on the Over the Counter Bulletin Board. As a result, trading volume is less than that of other larger financial services companies. A public trading market having the desired characteristics of depth, liquidity and orderliness depends on the presence in the marketplace of willing buyers and sellers of the Corporation’s common stock at any given time. This presence depends on the individual decisions of investors and general economic and market conditions over which the Corporation has no control. Given the lower trading volume of the Corporation’s common stock, significant sales of the Corporation’s common stock, or the expectation of these sales, could cause the Corporation’s stock price to

fall.

The Corporation Is Subject To Lending Risk

As of December 31, 2010, approximately 62.6% of the Corporation’s loan portfolio consisted of commercial and industrial, construction and commercial real estate loans. These types of loans are generally viewed as having more risk of default than residential real estate loans or consumer loans. These types of loans are also typically larger than residential real estate loans and consumer loans. Because the Corporation’s loan portfolio contains a significant number of commercial and industrial, construction and commercial real estate loans with relatively large balances, the deterioration of one or a few of these loans could cause a significant increase in non-performing loans. An increase in non-performing loans could result in a net loss of earnings from these loans, an increase

in the provision for possible loan losses and an increase in loan charge-offs, all of which could have a material adverse effect on the Corporation’s financial condition and results of operations.

The Corporation’s Controls and Procedures May Fail or Be Circumvented.

Management regularly reviews and updates the Corporation’s internal controls, disclosure controls and procedures, and corporate governance policies and procedures. Any system of controls, however well designed and operated, is based in part on certain assumptions and can provide only reasonable, not absolute, assurances that the objectives of the system are met. Any failure or circumvention of the Corporation’s controls and procedures or failure to comply with regulations related to controls and procedures could have a material adverse effect on the Corporation’s business, results of operations and financial condition.

The Corporation May Need or Be Compelled to Raise Additional Capital in the Future, but That Capital May Not Be Available When it Is Needed and on Terms Favorable to Current Shareholders.

Federal banking regulators require the Corporation and Bank to maintain adequate levels of capital to support their operations. These capital levels are determined and dictated by law, regulation and banking regulatory agencies. In addition, capital levels are also determined by the Corporation’s management and board of directors based on capital levels that they believe are necessary to support the Corporation’s business operations. The Corporation is evaluating its present and future capital requirements and needs, is developing a comprehensive capital plan and is analyzing capital raising alternatives, methods and options. Even if the Corporation succeeds in meeting the current regulatory capital requirements, the Corporation may need to raise additional capital in the near

future to support possible loan losses during future periods or to meet future regulatory capital requirements.

Further, the Corporation’s regulators may require it to increase its capital levels. If the Corporation raises capital through the issuance of additional shares of its common stock or other securities, it would likely dilute the ownership interests of current investors and would likely dilute the per-share book value and earnings per share of its common stock. Furthermore, it may have an adverse impact on the Corporation’s stock price. New investors may also have rights, preferences and privileges senior to the Corporation’s current shareholders, which may adversely impact its current shareholders. The Corporation’s ability to raise additional capital will depend on conditions in the capital markets at that time, which are outside its control, and on its financial

performance. Accordingly, the Corporation cannot assure you of its ability to raise additional capital on terms and time frames acceptable to it or to raise additional capital at all. If the Corporation cannot raise additional capital in sufficient amounts when needed, its ability to comply with regulatory capital requirements could be materially impaired. Additionally, the inability to raise capital in sufficient amounts may adversely affect the Corporation’s operations, financial condition and results of operations.

11

If We Conclude That the Decline in Value of Any of Our Investment Securities Is Other than Temporary, We Will Be Required to Write Down the Credit-Related Portion of the Impairment of That Security Through a Charge to Earnings.

We review our investment securities portfolio at each quarter-end reporting period to determine whether the fair value is below the current carrying value. When the fair value of any of our investment securities has declined below its carrying value, we are required to assess whether the decline is other than temporary. If we conclude that the decline is other than temporary, we will be required to write down the credit-related portion of the impairment of that security through a charge to earnings. Due to the complexity of the calculations and assumptions used in determining whether an asset is impaired, the impairment disclosed may not accurately reflect the actual impairment in the future.

If the Corporation’s Allowance For Loan Losses Is Not Sufficient To Cover Actual Loan Losses, Its Earnings Could Decrease

The Corporation’s loan customers may not repay their loans according to the terms of their loans, and the collateral securing the payment of their loans may be insufficient to assure repayment. The Corporation may experience significant credit losses, which could have a material adverse effect on its operating results. In determining the amount of the allowance for loan losses, the Corporation reviews its loans and its loss and delinquency experience, and the Corporation evaluates economic conditions. If its assumptions prove to be incorrect, its allowance for loan losses may not cover inherent losses in its loan portfolio at the date of its financial statements. Material additions to the Corporation’s allowance would materially decrease its net income. At December 31, 2010, its

allowance for loan losses totaled $5.7 million, representing 1.39% of its average total loans.

Although the Corporation believes it has underwriting standards to manage normal lending risks, it is difficult to assess the future performance of its loan portfolio due to the relatively recent origination of many of these loans. The Corporation cannot assure that its non-performing loans will not increase or that its non-performing or delinquent loans will not adversely affect its future performance.

In addition, federal regulators periodically review the Corporation’s allowance for loan losses and may require it to increase its allowance for loan losses or recognize further loan charge-offs. Any increase in its allowance for loan losses or loan charge-offs as required by these regulatory agencies could have a material adverse effect on its results of operations and financial condition.

The Corporation’s Ability To Pay Dividends Is Subject to Limitations

The Corporation is a bank holding company and its operations are conducted by First Keystone Community Bank, which is a separate and distinct legal entity. Substantially all of the Corporation’s assets are held by First Keystone Community Bank.

The Corporation’s ability to pay dividends depends on its receipt of dividends from First Keystone Community Bank, its primary source of dividends. Dividend payments from First Keystone Community Bank are subject to legal and regulatory limitations, generally based on net profits and retained earnings, imposed by the various banking regulatory agencies. The ability of banking subsidiaries to pay dividends is also subject to their profitability, financial condition, capital expenditures and other cash flow requirements. There is no assurance that First Keystone Community Bank will be able to pay dividends in the future or that the Corporation will generate adequate cash flow to pay dividends in the future. The Corporation’s failure to pay dividends on its common stock could have

material adverse effect on the market price of its common stock.

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

None.

12

|

ITEM 2.

|

PROPERTIES

|

The Corporation and its subsidiary occupy sixteen properties in Columbia, Luzerne, Montour, and Monroe counties in Pennsylvania, which are used principally as banking offices.

Properties owned are:

|

|

·

|

Main Office located at 111 West Front Street, Berwick, Pennsylvania 18603;

|

|

|

·

|

Salem Office located at 400 Fowler Avenue, Berwick, Pennsylvania 18603;

|

|

|

·

|

Freas Avenue Office located at 701 Freas Avenue, Berwick, Pennsylvania 18603;

|

|

|

·

|

Scott Township Office located at Central Road and Route 11, Bloomsburg, Pennsylvania 17815;

|

|

|

·

|

Mifflinville Office located at Third and Race Streets, Mifflinville, Pennsylvania 18631;

|

|

|

·

|

Hanover Township Office located at 1540 Sans Souci Highway, Wilkes-Barre, Pennsylvania 18706;

|

|

|

·

|

Danville Office located at 1519 Bloom Road, Danville, Pennsylvania 17821;

|

|

|

·

|

Mountainhome Office located at Route 390 & Price’s Drive, Mountainhome, Pennsylvania 18342;

|

|

|

·

|

Brodheadsville Office located at Route 209, Brodheadsville, Pennsylvania 18322;

|

|

|

·

|

Swiftwater Office located at Route 611, Swiftwater, Pennsylvania 18370;

|

|

|

·

|

Vacant lot held for expansion located at 117-119 West Front Street, Berwick, Pennsylvania 18603;

|

|

|

·

|

Parking lot located at Second and Market Streets, Berwick, Pennsylvania 18603; and

|

|

|

·

|

17 ATM’s located in Columbia, Luzerne, Montour, and Monroe counties.

|

Properties leased are:

|

|

·

|

Briar Creek Office located inside the Giant Market at 50 Briar Creek Plaza, Berwick, Pennsylvania 18603;

|

|

|

·

|

Nescopeck Office located at 437 West Third Street, Nescopeck, Pennsylvania 18635;

|

|

|

·

|

Kingston Office located at 179 South Wyoming Avenue, Kingston, Pennsylvania 18704;

|

|

|

·

|

Stroudsburg Office located at 559 Main Street, Stroudsburg, Pennsylvania 18360;

|

|

|

·

|

Operations Center located at 105 Market Street, Berwick, Pennsylvania 18603; and

|

|

|

·

|

Mountain Top Office located at 18 North Mountain Boulevard, Mountain Top, Pennsylvania 18707 (land only).

|

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

The Corporation and/or the Bank are defendants in various legal proceedings arising in the ordinary course of their business. However, in the opinion of management of the Corporation and the Bank, there are no proceedings pending to which the Corporation and the Bank is a party or to which their property is subject, which, if determined adversely to the Corporation and the Bank, would be material in relation to the Corporation's and Bank's individual profits or financial condition, nor are there any proceedings pending other than ordinary routine litigation incident to the business of the Corporation and the Bank. In addition, no material proceedings are pending or are known to be threatened or contemplated against the Corporation and the Bank by government authorities or others.

|

ITEM 4.

|

REMOVED AND RESERVED

|

13

PART II

|

ITEM 5.

|

MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

The Corporation's Common Stock is traded in the over-the-counter market on the OTC Bulletin Board under the symbol “FKYS.OB”. The following table sets forth:

|

|

·

|

The quarterly high and low prices for a share of the Corporation's Common Stock during the periods indicated as reported to the management of the Corporation and

|

|

|

·

|

Quarterly dividends on a share of the Common Stock with respect to each quarter since January 1, 2009.

|

|

MARKET VALUE OF COMMON STOCK

|

||||||||||||

|

Per Share

|

||||||||||||

|

|

High

|

Low

|

Dividend

|

|||||||||

| 2010: | ||||||||||||

|

First quarter

|

$ | 17.25 | $ | 15.77 | $ | .23 | ||||||

|

Second quarter

|

$ | 17.49 | $ | 15.50 | $ | .23 | ||||||

|

Third quarter

|

$ | 16.75 | $ | 15.50 | $ | .23 | ||||||

|

Fourth quarter

|

$ | 17.50 | $ | 15.90 | $ | .24 | ||||||

|

2009:

|

||||||||||||

|

First quarter

|

$ | 17.50 | $ | 14.01 | $ | .23 | ||||||

|

Second quarter

|

$ | 16.55 | $ | 15.25 | $ | .23 | ||||||

|

Third quarter

|

$ | 16.55 | $ | 15.00 | $ | .23 | ||||||

|

Fourth quarter

|

$ | 17.95 | $ | 14.55 | $ | .23 | ||||||

As of December 31, 2010, the Corporation had approximately 852 shareholders of record.

The Corporation has paid dividends since commencement of business in 1984. It is the present intention of the Corporation's Board of Directors to continue the dividend payment policy; however, further dividends must necessarily depend upon earnings, financial condition, appropriate legal restrictions and other factors relevant at the time the Board of Directors of the Corporation considers dividend policy. Cash available for dividend distributions to shareholders of the Corporation must initially come from dividends paid by the Bank to the Corporation. Therefore, the restrictions on the Bank's dividend payments are directly applicable to the Corporation.

14

Transfer Agent:

|

Registrar and Transfer Company

|

(800) 368-5948

|

10 Commerce Drive

Cranford, NJ 07016-3752

The following brokerage firms make a market in First Keystone Corporation common stock:

|

|

RBC Dain Rauscher

|

(800) 223-4207

|

|

Janney Montgomery Scott LLC

|

(800) 526-6397

|

|

|

Stifel Nicolaus & Co. Inc.

|

(800) 223-6807

|

|

Boenning & Scattergood, Inc.

|

(800) 883-8383

|

Dividend Restrictions on the Bank

Generally, as a Pennsylvania state chartered bank, under Pennsylvania banking law, the Bank may only pay dividends out of accumulated net earnings.

Dividend Restrictions on the Corporation

Under the Pennsylvania Business Corporation Law of 1988, as amended, the Corporation may not pay a dividend if, after giving effect thereto, either:

|

|

·

|

The Corporation would be unable to pay its debts as they become due in the usual course of business, or

|

|

·

|

The Corporation's total assets would be less than its total liabilities.

|

The determination of total assets and liabilities may be based upon:

|

|

·

|

Financial statements prepared on the basis of generally accepted accounting principles,

|

|

|

·

|

Financial statements that are prepared on the basis of other accounting practices and principles that are reasonable under the circumstances, or

|

|

|

·

|

A fair valuation or other method that is reasonable under the circumstances.

|

15

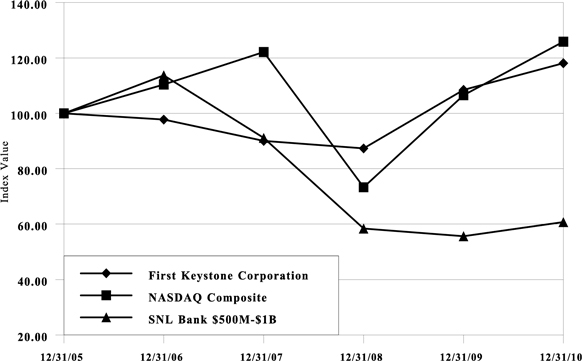

PERFORMANCE GRAPH

The following graph and table compare the cumulative total shareholder return on the Corporation's common stock during the period December 31, 2005, through and including December 31, 2010, with

|

|

·

|

the cumulative total return on the SNL Securities Corporate Performance Index1 for banks $500 million to $1 billion in total assets in the Middle Atlantic area2, and

|

|

|

·

|

the cumulative total return for all United States stocks traded on the NASDAQ Stock Market.

|

The comparison assumes $100 was invested on December 31, 2005, in the Corporation’s common stock and in each of the indices below and assumes further the reinvestment of dividends into the applicable securities. The shareholder return shown on the graph and table below is not necessarily indicative of future performance.

FIRST KEYSTONE CORPORATION

Total Return Performance

|

Period Ending

|

||||||||||||||||||||||||

|

12/31/05

|

12/31/06

|

12/31/07

|

12/31/08

|

12/31/09

|

12/31/10

|

|||||||||||||||||||

|

First Keystone Corporation

|

100.00 | 97.75 | 90.03 | 87.33 | 108.48 | 118.10 | ||||||||||||||||||

|

NASDAQ - Total US

|

100.00 | 110.39 | 122.15 | 73.32 | 106.57 | 125.91 | ||||||||||||||||||

|

SNL $500M- $1B Bank Index

|

100.00 | 113.73 | 91.14 | 58.40 | 55.62 | 60.72 | ||||||||||||||||||

1 SNL Securities is a research and publishing firm specializing in the collection and dissemination of data on the banking, thrift and financial services industries.

2 The Middle Atlantic area comprises the states of Delaware, Pennsylvania, Maryland, New Jersey, New York, the District of Columbia and Puerto Rico.

16

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

(Amounts in thousands, except per share)

|

Year Ended December 31,

|

||||||||||||||||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

||||||||||||||||

|

SELECTED FINANCIAL DATA:

|

||||||||||||||||||||

|

Total Assets

|

$ | 796,601 | $ | 758,330 | $ | 714,898 | $ | 681,207 | $ | 525,920 | ||||||||||

|

Total Investment securities

|

316,531 | 282,798 | 243,165 | 246,059 | 243,938 | |||||||||||||||

|

Net loans

|

403,950 | 401,375 | 403,172 | 371,557 | 248,086 | |||||||||||||||

|

Total Deposits

|

626,895 | 580,569 | 504,633 | 493,041 | 384,020 | |||||||||||||||

|

Stockholders' equity

|

79,060 | 74,167 | 69,147 | 70,924 | 53,387 | |||||||||||||||

|

SELECTED OPERATING DATA:

|

||||||||||||||||||||

|

Interest income

|

$ | 38,154 | $ | 37,726 | $ | 37,638 | $ | 31,899 | $ | 28,577 | ||||||||||

|

Interest expense

|

12,742 | 15,565 | 18,116 | 17,785 | 14,972 | |||||||||||||||

|

Net interest income

|

$ | 25,412 | $ | 22,161 | $ | 19,522 | $ | 14,114 | $ | 13,605 | ||||||||||

|

Provision for loan losses

|

2,575 | 800 | 700 | 150 | 500 | |||||||||||||||

|

Net interest income after provision for loan and lease losses

|

$ | 22,837 | $ | 21,361 | $ | 18,822 | $ | 13,964 | $ | 13,105 | ||||||||||

|

Other income

|

5,758 | 4,299 | 4,046 | 4,199 | 3,788 | |||||||||||||||

|

Other expense

|

17,272 | 16,444 | 13,923 | 10,645 | 9,515 | |||||||||||||||

|

Income before income taxes

|

$ | 11,323 | $ | 9,216 | $ | 8,945 | $ | 7,518 | $ | 7,378 | ||||||||||

|

Income tax expense

|

2,362 | 1,279 | 1,394 | 1,391 | 1,188 | |||||||||||||||

|

Net income

|

$ | 8,961 | $ | 7,937 | $ | 7,551 | $ | 6,127 | $ | 6,190 | ||||||||||

|

PER COMMON SHARE DATA:

|

||||||||||||||||||||

|

Net income

|

$ | 1.65 | $ | 1.46 | $ | 1.39 | $ | 1.31 | $ | 1.35 | ||||||||||

|

Cash dividends

|

.93 | .92 | .89 | .88 | .85 | |||||||||||||||

|

PERFORMANCE RATIOS:

|

||||||||||||||||||||

|

Return on average assets

|

1.09 | % | 1.06 | % | 1.08 | % | 1.09 | % | 1.20 | % | ||||||||||

|

Return on average equity

|

10.98 | % | 10.88 | % | 10.72 | % | 10.48 | % | 11.76 | % | ||||||||||

|

Dividend payout ratio

|

56.47 | % | 63.06 | % | 64.12 | % | 68.25 | % | 62.63 | % | ||||||||||

|

Average equity to average assets ratio

|

9.95 | % | 9.73 | % | 10.00 | % | 10.37 | % | 10.19 | % | ||||||||||

17

|

ITEM 7.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

The purpose of Management’s Discussion and Analysis of First Keystone Corporation, a bank holding company (the Corporation), and its wholly owned subsidiary, First Keystone Community Bank (the Bank), is to assist the reader in reviewing the financial information presented and should be read in conjunction with the consolidated financial statements and other financial data contained herein. Refer to Forward Looking Statements on page 1 for detailed information.

RESULTS OF OPERATIONS

Year Ended December 31, 2010 Versus Year Ended December 31, 2009

Net income increased to $8,961,000 for the year ended December 31, 2010, as compared to $7,937,000 for the prior year, an increase of 12.9%. Earnings per share, both basic and diluted, for 2010 were $1.65 as compared to $1.46 in 2009, an increase of 13.0%. Cash dividends per share increased to $.93 in 2010 from $.92 in 2009, an increase of 1.1%. The Corporation’s return on average assets was 1.09% in 2010 as compared to 1.06% in 2009. Return on average equity increased to 10.98% in 2010 from 10.88% in 2009. An increase in earning asset levels resulted in an overall increase of interest income to $38,154,000, up $428,000 or 1.1% from 2009. There was the accompanying decrease in interest on deposits and borrowings as interest rates declined, which resulted in interest expense of $12,742,000 in 2010, a decrease

of $2,823,000 or 18.1% from 2009.

Net interest income, as indicated below in Table 1, increased by $3,251,000 or 14.7% to $25,412,000 for the year ended December 31, 2010. The Corporation's net interest income on a fully taxable equivalent basis increased by $3,061,000, or 12.7% to $27,234,000 in 2010 as compared to an increase of $2,763,000, or 12.9% to $24,173,000 in 2009.

Year Ended December 31, 2009 Versus Year Ended December 31, 2008

Net income increased to $7,937,000 for the year ended December 31, 2009, as compared to $7,551,000 for the prior year, an increase of 5.1%. Earnings per share, both basic and diluted, for 2009 were $1.46 as compared to $1.39 in 2008, an increase of 5.0%. Cash dividends per share increased to $.92 in 2009 from $.89 in 2008, an increase of 3.4%. The Corporation’s return on average assets was 1.06% in 2009 as compared to 1.08% in 2008. Return on average equity increased to 10.88% in 2009 from 10.72% in 2008. An increase in earning asset levels resulted in an overall increase of interest income to $37,726,000, up $88,000 or 0.2% from 2008. There was the accompanying decrease in interest on deposits and borrowings as interest rates declined, which resulted in interest expense of $15,565,000 in 2009, a decrease of

$2,551,000 or 14.1% from 2008.

Table 1 — Net Interest Income

|

(Amounts in thousands)

|

2010/2009

|

2009/2008

|

||||||||||||||||||||||||||

|

Increase/(Decrease)

|

Increase/(Decrease)

|

|||||||||||||||||||||||||||

|

2010

|

Amount

|

%

|

2009

|

Amount

|

%

|

2008

|

||||||||||||||||||||||

|

Interest Income

|

$ | 38,154 | $ | 428 | 1.1 | $ | 37,726 | $ | 88 | 0.2 | $ | 37,638 | ||||||||||||||||

|

Interest Expense

|

12,742 | (2,823 | ) | (18.1 | ) | 15,565 | (2,551 | ) | (14.1 | ) | 18,116 | |||||||||||||||||

|

Net Interest Income

|

25,412 | 3,251 | 14.7 | 22,161 | 2,639 | 13.5 | 19,522 | |||||||||||||||||||||

|

Tax Equivalent Adjustment

|

1,822 | (190 | ) | (9.4 | ) | 2,012 | 124 | 6.6 | 1,888 | |||||||||||||||||||

|

Net Interest Income (fully tax equivalent)

|

$ | 27,234 | $ | 3,061 | 12.7 | $ | 24,173 | $ | 2,763 | 12.9 | $ | 21,410 | ||||||||||||||||

18

Table 2 — Distribution of Assets, Liabilities and Stockholders' Equity

|

2010

|

2009

|

2008

|

||||||||||||||||||||||||||||||||||

|

Average

|

Revenue/

|

Yield/

|

Average

|

Revenue/

|

Yield/

|

Average

|

Revenue/

|

Yield/

|

||||||||||||||||||||||||||||

|

Balance

|

Expense

|

Rate

|

Balance

|

Expense

|

Rate

|

Balance

|

Expense

|

Rate

|

||||||||||||||||||||||||||||

|

Interest Earning Assets:

|

||||||||||||||||||||||||||||||||||||

|

Loans:

|

||||||||||||||||||||||||||||||||||||

|

Commercial, net1,2

|

$ | 47,027 | $ | 2,307 | 4.91 | % | $ | 48,286 | $ | 2,664 | 5.52 | % | $ | 33,029 | $ | 2,822 | 8.54 | % | ||||||||||||||||||

|

Real Estate1

|

354,700 | 21,163 | 5.97 | % | 347,992 | 21,420 | 6.16 | % | 333,336 | 21,663 | 6.50 | % | ||||||||||||||||||||||||

|

Consumer, Net1,2

|

8,700 | 717 | 8.24 | % | 12,170 | 922 | 7.58 | % | 25,498 | 1,136 | 4.46 | % | ||||||||||||||||||||||||

|

Fees on Loans

|