Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - SYNAPTICS Inc | d927977dex991.htm |

| 8-K - 8-K - SYNAPTICS Inc | d927977d8k.htm |

Third Quarter Fiscal 2020 Earnings Supplemental Slides May 7, 2020 Exhibit 99.2

This presentation contains forward-looking statements that are subject to the safe harbors created under the Securities Act of 1933, as amended (the “Securities Act”), and the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business, including our expectations regarding the potential impacts on our business of the COVID-19 pandemic and can be identified by the fact that they do not relate strictly to historical or current facts. Such forward-looking statements may include words such as ”expect,” “anticipate,” “intend,” “believe,” “estimate,” “plan,” “target,” “strategy,” “continue,” “may,” “will,” “should,” variations of such words, or other words and terms of similar meaning. All forward-looking statements reflect our best judgment and are based on several factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control. Such factors include, but are not limited to: the risk that our business, results of operations and financial condition and prospects may be materially and adversely affected by the COVID-19 pandemic and that significant uncertainties remain related to the impact of COVID-19 on our business operations and future results, including our fourth quarter fiscal 2020 business outlook; the risks as identified in the “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” sections of our Annual Report on Form 10-K for the fiscal year ended June 29, 2019 (including that the impact of the COVID-19 pandemic may also exacerbate the risks discussed therein); and other risks as identified from time to time in our Securities and Exchange Commission reports. Forward-looking statements are based on information available to us on the date hereof, and we do not have, and expressly disclaim, any obligation to publicly release any updates or any changes in our expectations, or any change in events, conditions, or circumstances on which any forward-looking statement is based. Our actual results and the timing of certain events could differ materially from the forward-looking statements. These forward-looking statements do not reflect the potential impact of any mergers, acquisitions, or other business combinations that had not been completed as of the date of this presentation. Safe Harbor Statement

Non-GAAP Results •In evaluating our business, we consider and use non-GAAP net income, which we define as net income excluding share-based compensation, acquisition related costs, and certain other non-cash or recurring and non-recurring items we do not believe are indicative of our core operating performance as a supplemental measure of operating performance. •Non-GAAP net income is not a measurement of our financial performance under GAAP and should not be considered as an alternative to GAAP net income. We present non-GAAP net income because we consider it an important supplemental measure of our performance since it facilitates operating performance comparisons from period to period by eliminating potential differences in net income caused by the existence and timing of share-based compensation charges, acquisition related costs, and certain other non-cash or recurring and non-recurring items. •Non-GAAP net income has limitations as an analytical tool and should not be considered in isolation or as a substitute for our GAAP net income. The principal limitations of this measure are that it does not reflect our actual expenses and may thus have the effect of inflating our net income and net income per share as compared to our operating results reported under GAAP. •Please see our third quarter fiscal 2020 press release for additional discussion of our use of non-GAAP financial measures, and the tables attached to the end of this presentation for a complete reconciliation of GAAP to non-GAAP financial measures used in this presentation.

Q3FY20 Highlights Financial Highlights Better than expected profitability despite revenue slightly below guidance range due to COVID-19 impact Non-GAAP gross margin exceeded the high-end of guidance range Highest non-GAAP gross margins in more than five years; three sequential quarters of non-GAAP gross margin improvement Non-GAAP OPEX spend was below the low-end of guidance range $48 million cash flow generated from operations Adjusted cash position of $711 million on the balance sheet Quarter-end cash balance of $472 million plus cash received from mobile LCD TDDI divestiture on April 16, 2020 of approximately $139 million and the addition of $100 million from revolver draw on April 2, 2020 Business Highlights After quarter end, completed divestiture of mobile LCD TDDI Business for $120 million plus payment of approximately $19.4 million for closing inventory Huawei P40 Pro and Pro Plus smartphones with flexible on-cell OLED panel launch with Synaptics touch controller

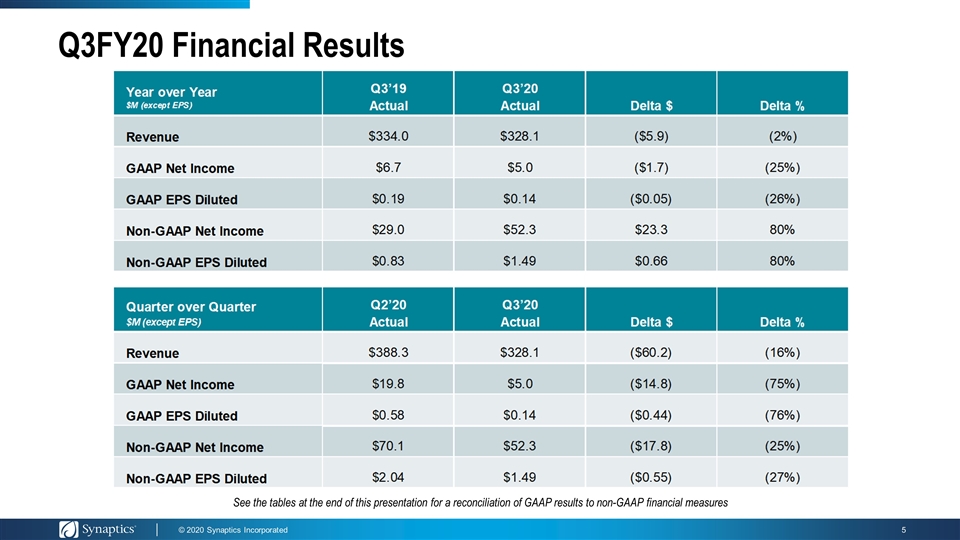

Q3FY20 Financial Results See the tables at the end of this presentation for a reconciliation of GAAP results to non-GAAP financial measures Year over Year Q1’19 Actual Q1’18 Actual Delta $ Delta %

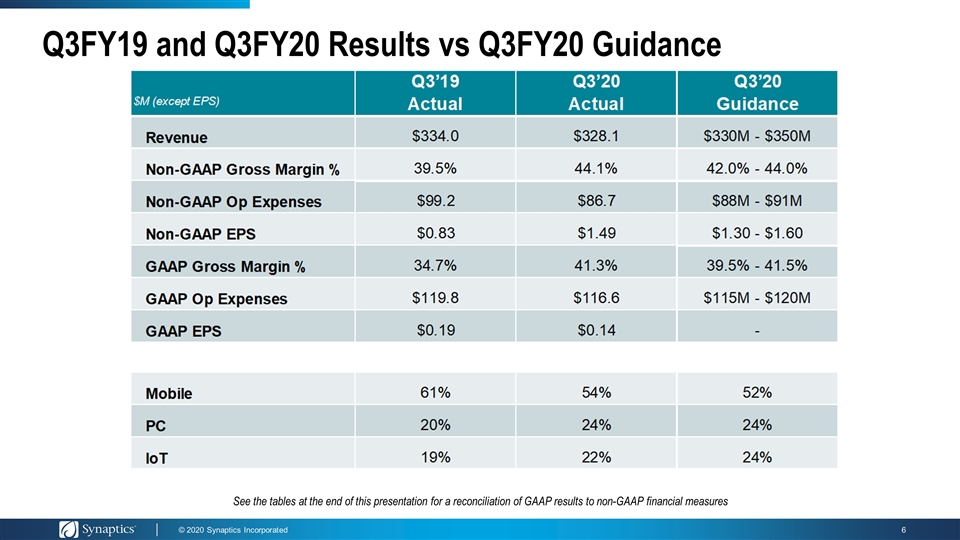

Q3FY19 and Q3FY20 Results vs Q3FY20 Guidance See the tables at the end of this presentation for a reconciliation of GAAP results to non-GAAP financial measures

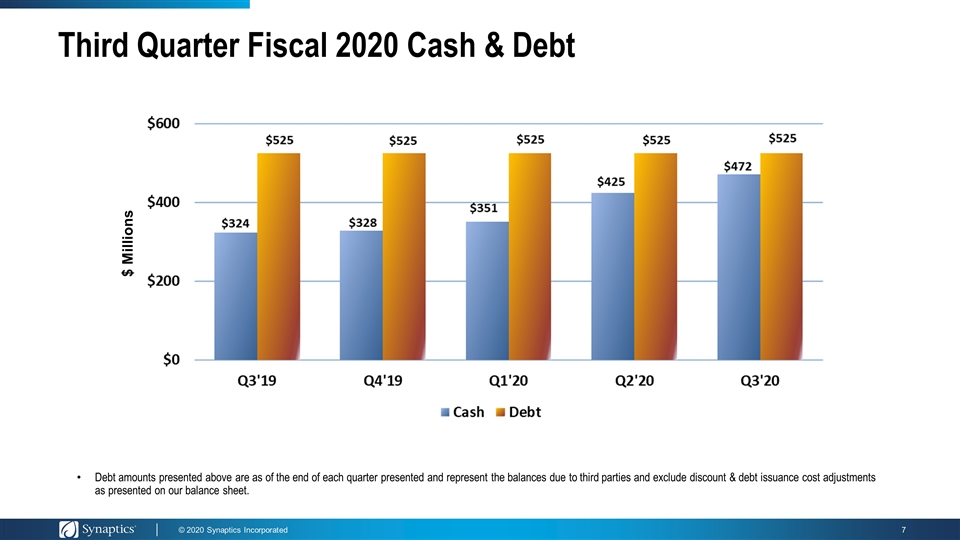

Third Quarter Fiscal 2020 Cash & Debt Debt amounts presented above are as of the end of each quarter presented and represent the balances due to third parties and exclude discount & debt issuance cost adjustments as presented on our balance sheet. $ Millions

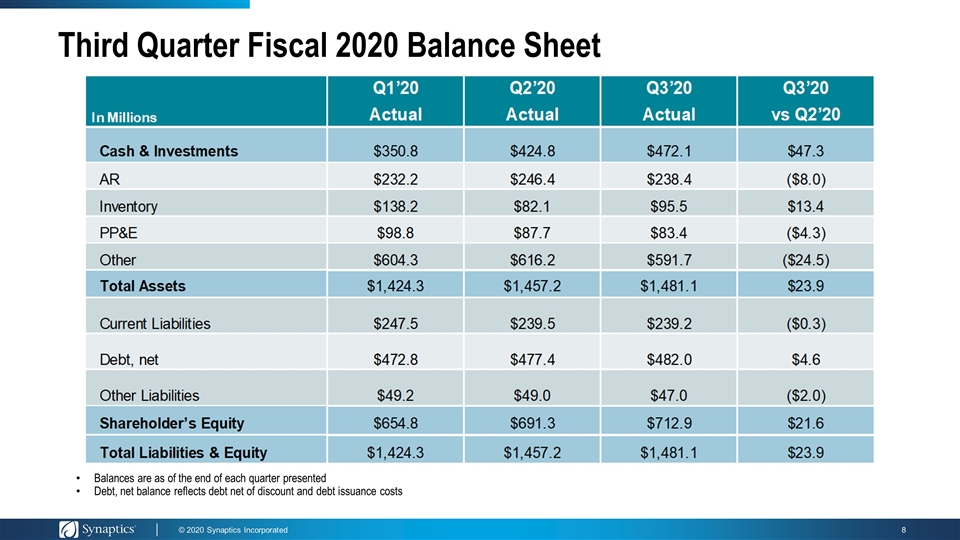

Third Quarter Fiscal 2020 Balance Sheet Balances are as of the end of each quarter presented Debt, net balance reflects debt net of discount and debt issuance costs

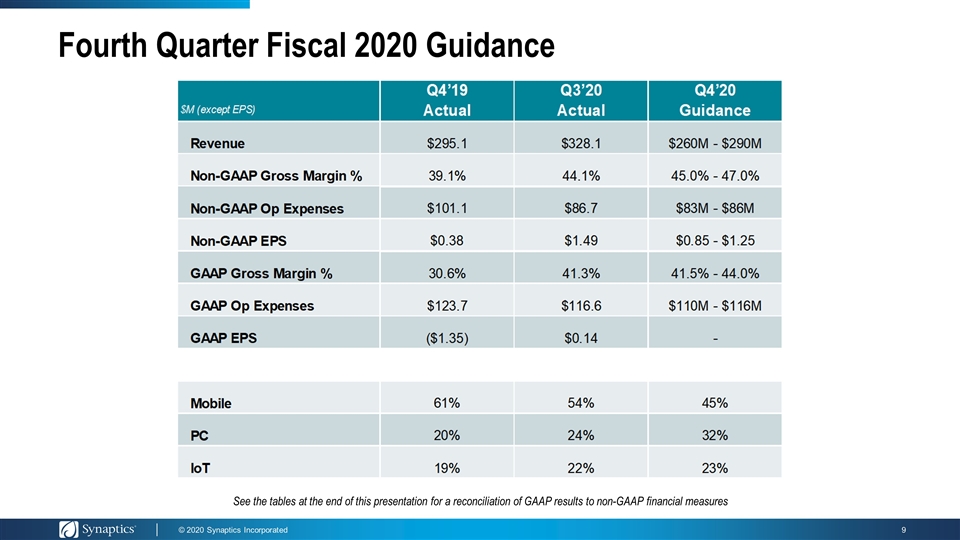

Fourth Quarter Fiscal 2020 Guidance See the tables at the end of this presentation for a reconciliation of GAAP results to non-GAAP financial measures

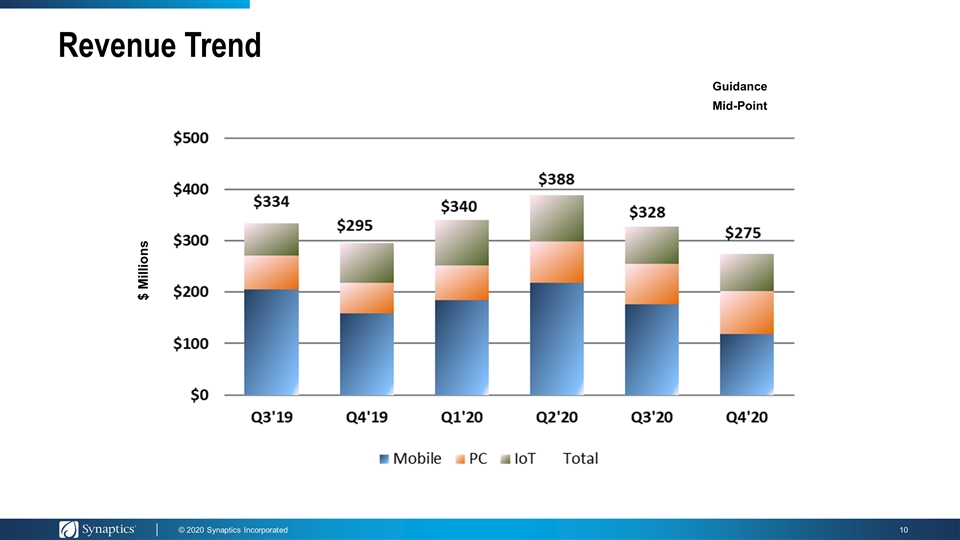

Revenue Trend $ Millions Mid-Point Guidance

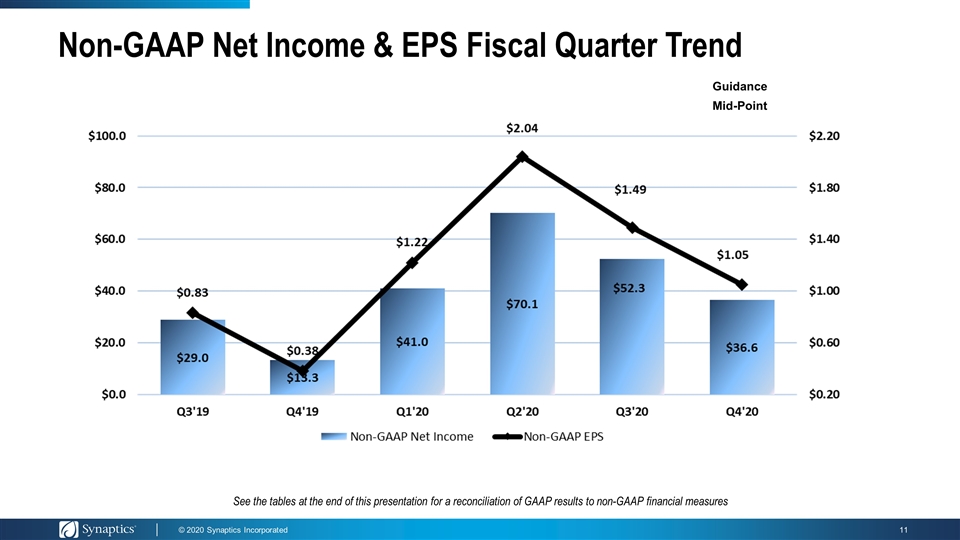

Non-GAAP Net Income & EPS Fiscal Quarter Trend See the tables at the end of this presentation for a reconciliation of GAAP results to non-GAAP financial measures Mid-Point Guidance

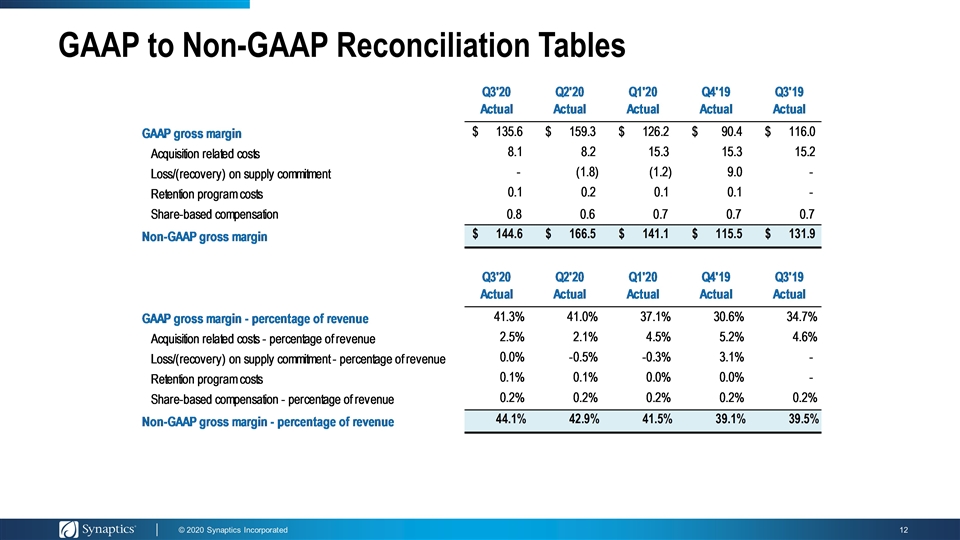

GAAP to Non-GAAP Reconciliation Tables

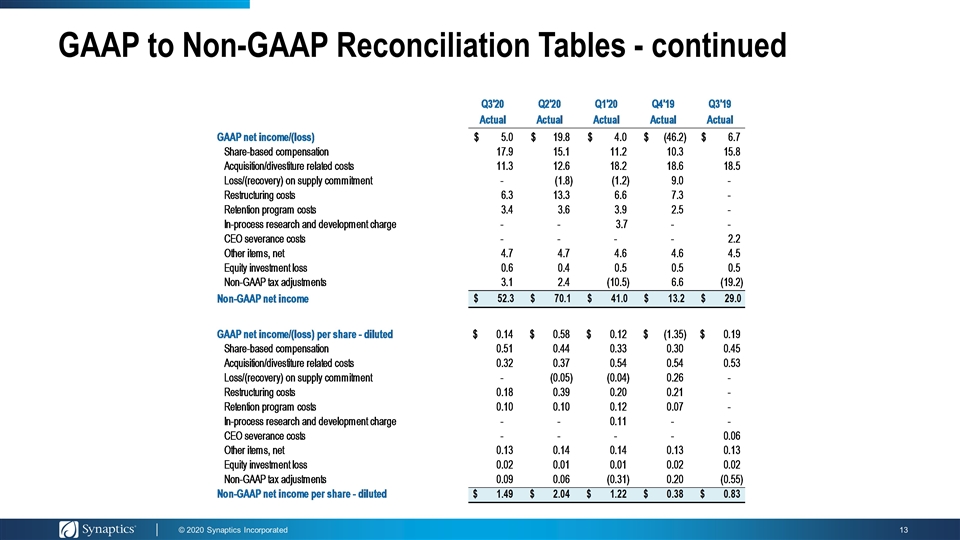

GAAP to Non-GAAP Reconciliation Tables - continued