Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PROS Holdings, Inc. | form8-k2020q1earningsr.htm |

| EX-99.3 - EXHIBIT 99.3 - PROS Holdings, Inc. | prosirpresentationq12020.htm |

| EX-99.1 - EXHIBIT 99.1 - PROS Holdings, Inc. | a2020q1ex991prosearnin.htm |

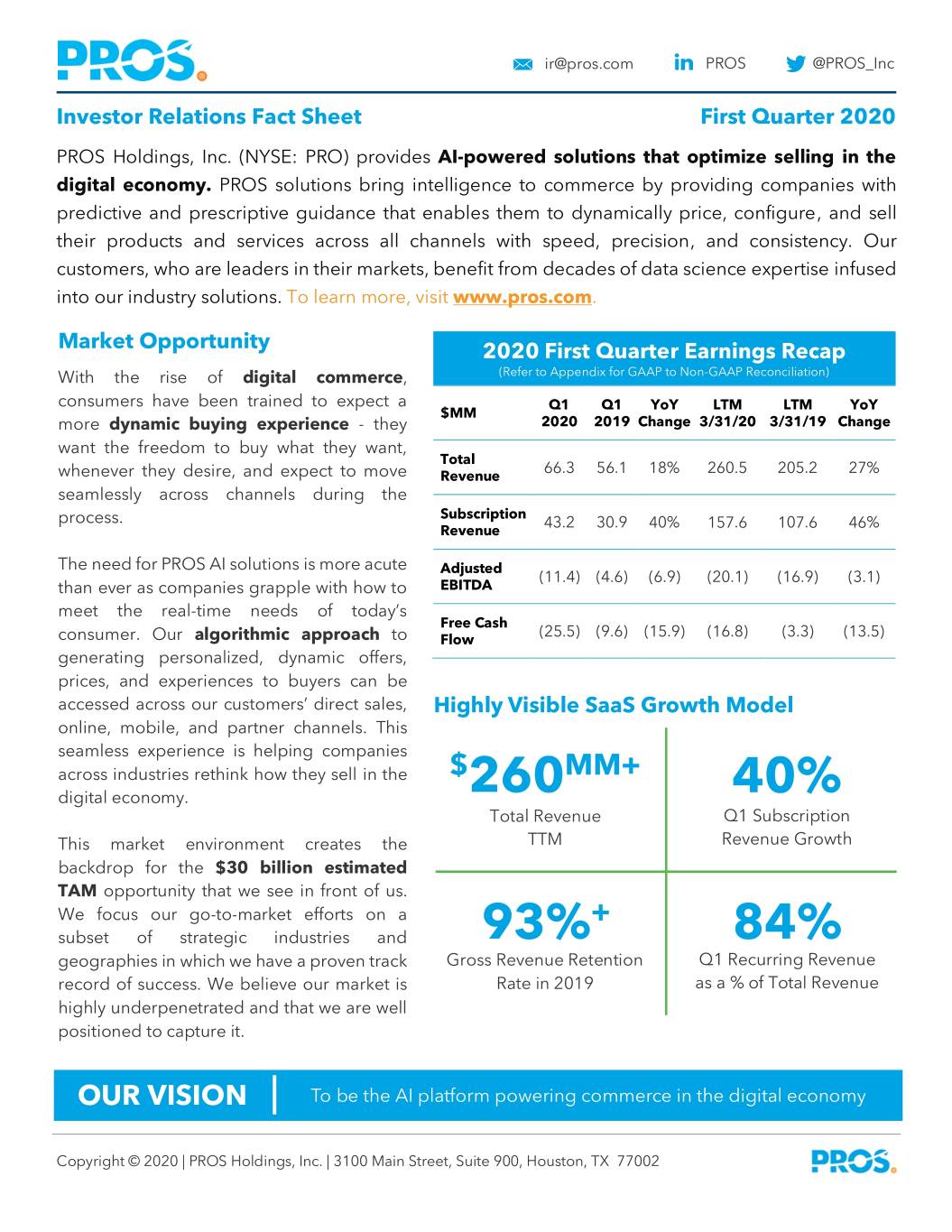

ir@pros.com PROS @PROS_Inc Investor Relations Fact Sheet First Quarter 2020 PROS Holdings, Inc. (NYSE: PRO) provides AI-powered solutions that optimize selling in the digital economy. PROS solutions bring intelligence to commerce by providing companies with predictive and prescriptive guidance that enables them to dynamically price, configure, and sell their products and services across all channels with speed, precision, and consistency. Our customers, who are leaders in their markets, benefit from decades of data science expertise infused into our industry solutions. To learn more, visit www.pros.com. Market Opportunity 2020 First Quarter Earnings Recap With the rise of digital commerce, (Refer to Appendix for GAAP to Non-GAAP Reconciliation) consumers have been trained to expect a Q1 Q1 YoY LTM LTM YoY $MM more dynamic buying experience - they 2020 2019 Change 3/31/20 3/31/19 Change want the freedom to buy what they want, Total whenever they desire, and expect to move 66.3 56.1 18% 260.5 205.2 27% Revenue seamlessly across channels during the Subscription process. 43.2 30.9 40% 157.6 107.6 46% Revenue The need for PROS AI solutions is more acute Adjusted (11.4) (4.6) (6.9) (20.1) (16.9) (3.1) EBITDA than ever as companies grapple with how to meet the real-time needs of today’s Free Cash (25.5) (9.6) (15.9) (16.8) (3.3) (13.5) consumer. Our algorithmic approach to Flow generating personalized, dynamic offers, prices , and experiences to buyers can be access ed across our customers’ direct sales, Highly Visible SaaS Growth Model online, mobile, and partner channels. This seamless experience is helping companies across industries rethink how they sell in the $ MM+ digital economy. 260 40% Total Revenue Q1 Subscription This market environment creates the TTM Revenue Growth backdrop for the $30 billion estimated TAM opportunity that we see in front of us. We focus our go-to-market efforts on a + subset of strategic industries and 93% 84% geographies in which we have a proven track Gross Revenue Retention Q1 Recurring Revenue record of success. We believe our market is Rate in 2019 as a % of Total Revenue highly underpenetrated and that we are well positioned to capture it. OUR VISION To be the AI platform powering commerce in the digital economy Copyright © 2020 | PROS Holdings, Inc. | 3100 Main Street, Suite 900, Houston, TX 77002

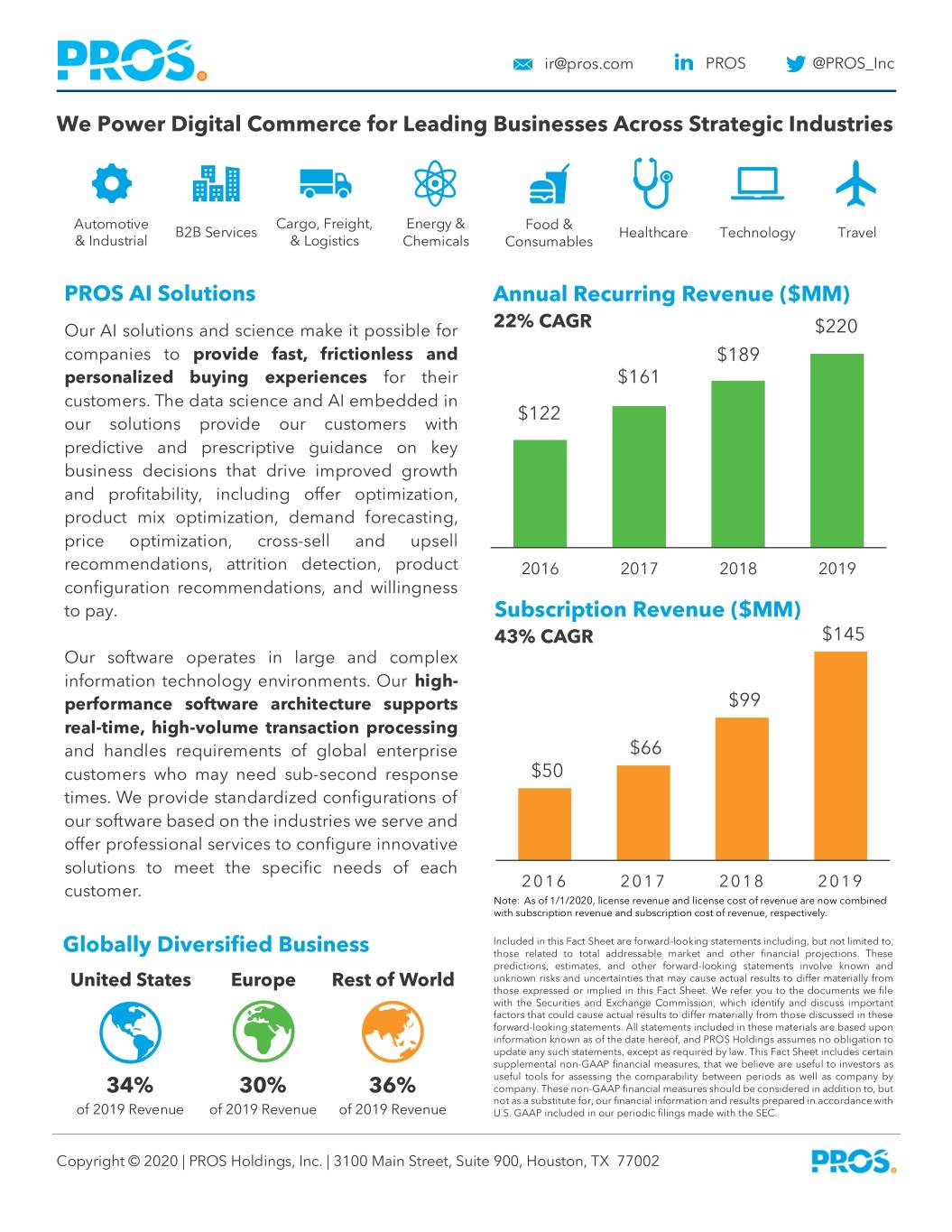

ir@pros.com PROS @PROS_Inc We Power Digital Commerce for Leading Businesses Across Strategic Industries Automotive Cargo, Freight, Energy & Food & B2B Services Healthcare Technology Travel & Industrial & Logistics Chemicals Consumables PROS AI Solutions Annual Recurring Revenue ($MM) 22% CAGR Our AI solutions and science make it possible for $220 companies to provide fast, frictionless and $189 personalized buying experiences for their $161 customers. The data science and AI embedded in $122 our solutions provide our customers with predictive and prescriptive guidance on key business decisions that drive improved growth and profitability, including offer optimization, product mix optimization, demand forecasting, price optimization, cross-sell and upsell recommendations, attrition detection, product 2016 2017 2018 2019 configuration recommendations, and willingness to pay. Subscription Revenue ($MM) 43% CAGR $145 Our software operates in large and complex information technology environments. Our high- performance software architecture supports $99 real-time, high-volume transaction processing and handles requirements of global enterprise $66 customers who may need sub-second response $50 times. We provide standardized configurations of our software based on the industries we serve and offer professional services to configure innovative solutions to meet the specific needs of each 2016 2017 2018 2019 customer. Note: As of 1/1/2020, license revenue and license cost of revenue are now combined with subscription revenue and subscription cost of revenue, respectively. Included in this Fact Sheet are forward-looking statements including, but not limited to, Globally Diversified Business those related to total addressable market and other financial projections. These predictions, estimates, and other forward-looking statements involve known and United States Europe Rest of World unknown risks and uncertainties that may cause actual results to differ materially from those expressed or implied in this Fact Sheet. We refer you to the documents we file with the Securities and Exchange Commission, which identify and discuss important factors that could cause actual results to differ materially from those discussed in these forward-looking statements. All statements included in these materials are based upon information known as of the date hereof, and PROS Holdings assumes no obligation to update any such statements, except as required by law. This Fact Sheet includes certain supplemental non-GAAP financial measures, that we believe are useful to investors as useful tools for assessing the comparability between periods as well as company by 34% 30% 36% company. These non-GAAP financial measures should be considered in addition to, but not as a substitute for, our financial information and results prepared in accordance with of 2019 Revenue of 2019 Revenue of 2019 Revenue U.S. GAAP included in our periodic filings made with the SEC. Copyright © 2020 | PROS Holdings, Inc. | 3100 Main Street, Suite 900, Houston, TX 77002

ir@pros.com PROS @PROS_Inc APPENDIX PROS Holdings, Inc. Supplemental Reconciliation of GAAP to Non-GAAP Financial Measures (In thousands) (Unaudited) Three Months Ended March 31, 2020 2019 GAAP Loss from Operations $ (21,352 ) $ (13,610 ) Amortization of acquisition-related intangibles 1,383 1,583 New headquarters noncash rent expense 555 554 Share-based compensation 6,347 6,046 Depreciation and other amortization 2,037 1,742 Capitalized internal-use software development costs (412 ) (868 ) Adjusted EBITDA $ (11,442 ) $ (4,553 ) Net cash used in operating activities $ (24,173 ) $ (8,095 ) Purchase of property and equipment (excluding new headquarters) (957 ) (611 ) Purchase of intangible asset — (50 ) Capitalized internal-use software development costs (412 ) (868 ) Free Cash Flow $ (25,542 ) $ (9,624 ) Copyright © 2020 | PROS Holdings, Inc. | 3100 Main Street, Suite 900, Houston, TX 77002