Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Santander Consumer USA Holdings Inc. | a2020q1scusa8-kearning.htm |

| EX-99.1 - EX-99.1 - Santander Consumer USA Holdings Inc. | a2020q1exhibit991.htm |

Exhibit 99.2 First Quarter 2020 April 28, 2020

Forward-Looking Statements Among the factors that could cause the forward-looking statements in this press release and/or our financial performance to differ materially from that suggested by the forward-looking statements are (a) the adverse impact of COVID-19 on our business, financial condition, liquidity and results of operations; (b) the inherent limitations in internal IMPORTANT control over financial reporting; (c) our ability to remediate any material weaknesses in internal controls over financial reporting completely and in a timely manner; (d) continually changing federal, state, and local laws INFORMATION and regulations could materially adversely affect our business; (e) adverse economic conditions in the United States and worldwide may negatively impact our results; (f) our business could suffer if our access to funding is reduced; (g) significant risks we face implementing our growth strategy, some of which are outside our control; (h) unexpected costs and delays in connection with exiting our personal lending business; (i) our agreement with FCA US LLC may not result in currently anticipated levels of growth and is subject to certain conditions that could result in termination of the agreement; (j) our business could suffer if we are unsuccessful in developing and maintaining relationships with automobile dealerships; (k) our financial condition, liquidity, and results of operations depend on the credit performance of our loans; (l) loss of our key management or other personnel, or an inability to attract such management and personnel; (m) certain regulations, including but not limited to oversight by the Office of the Comptroller of the Currency, the Consumer Financial Protection Bureau, the European Central Bank, and This presentation contains forward-looking statements within the the Federal Reserve, whose oversight and regulation may limit certain of meaning of the Private Securities Litigation Reform Act of 1995. Any our activities, including the timing and amount of dividends and other statements about our expectations, beliefs, plans, predictions, forecasts, limitations on our business; and (n) future changes in our relationship objectives, assumptions, or future events or performance are not with SHUSA and Banco Santander that could adversely affect our historical facts and may be forward-looking. These statements are often, operations. If one or more of the factors affecting our forward-looking but not always, made through the use of words or phrases such as information and statements proves incorrect, our actual results, anticipates, believes, can, could, may, predicts, potential, should, will, performance or achievements could differ materially from those estimates, plans, projects, continuing, ongoing, expects, intends, and expressed in, or implied by, forward-looking information and statements. similar words or phrases. Although we believe that the expectations Therefore, we caution the reader not to place undue reliance on any reflected in these forward-looking statements are reasonable, these forward-looking information or statements. The effect of these factors is statements are not guarantees of future performance and involve risks difficult to predict. Factors other than these also could adversely affect and uncertainties that are subject to change based on various important our results, and the reader should not consider these factors to be a factors, some of which are beyond our control. For additional discussion complete set of all potential risks or uncertainties as new factors emerge of these risks, refer to the section entitled Risk Factors and elsewhere in from time to time. Any forward-looking statements only speak as of the our Annual Report on Form 10-K for the year ended December 31, 2019, date of this document, and we undertake no obligation to update any our subsequent Quarterly Reports on Form 10-Q or Current Reports on forward-looking information or statements, whether written or oral, to Form 8-K, or other applicable documents that are filed or furnished with reflect any change, except as required by law. All forward-looking the U.S. Securities and Exchange Commission (collectively, our “SEC statements attributable to us are expressly qualified by these cautionary filings”). statements. 2

COVID-19 Santander Consumer COVID-19 Relief Efforts ► 95%+ employees working from home Employees ► Temporary Emergency Paid Leave Program ► Premium compensation to frontline employees ► Expanded payment deferrals Customers ► Waiving late charges and providing lease extensions ► Temporarily suspended involuntary repossessions ► Extensions for lessees unable to return their vehicles ► First payment deferred 90 days on select new FCA models FCA/Dealers ► 0% Annual Percentage Rate for 84 months on select new FCA models ► Relief programs for dealers through Santander Bank, N.A. ► Santander US will provide $25M in financing to Community Development Financial Institutions Communities ► SC donated $3M to organizations serving vulnerable populations hardest hit by the crisis 3

Earnings Highlights 1Q20 Earnings Impacted by Reserves ► $442M of incremental reserves due to macroeconomic factors, primarily driven by COVID-19, CECL approximately $0.81 per diluted common share ► Allowance ratio of 17.8%, up ~800bps from Q4 2019 allowance ratio ► Total auto originations of ~$7.0B in Q1 2020, down 1% versus prior year quarter Results ► Through Santander Bank, originated $1.1B in auto loans in Q1 2020 ► FCA penetration rate of 39%, up from 31% in Q1 2019 ► Early stage delinquency ratio of 8.3%, down 10 bps YoY Credit ► Late stage delinquency ratio of 4.6%, up 40 bps YoY Performance ► Gross charge-off ratio of 15.5%, down 400 bps YoY ► Net charge-off ratio of 7.7%, down 90 bps YoY ► $2.1B in ABS issued in Q1 2020, an additional $965M in April 2020 Liquidity & ► Completed $455M of the $1B tender offer Capital ► CET1 Ratio of 13.8%, down from 15.8% as of March 31, 2019 4

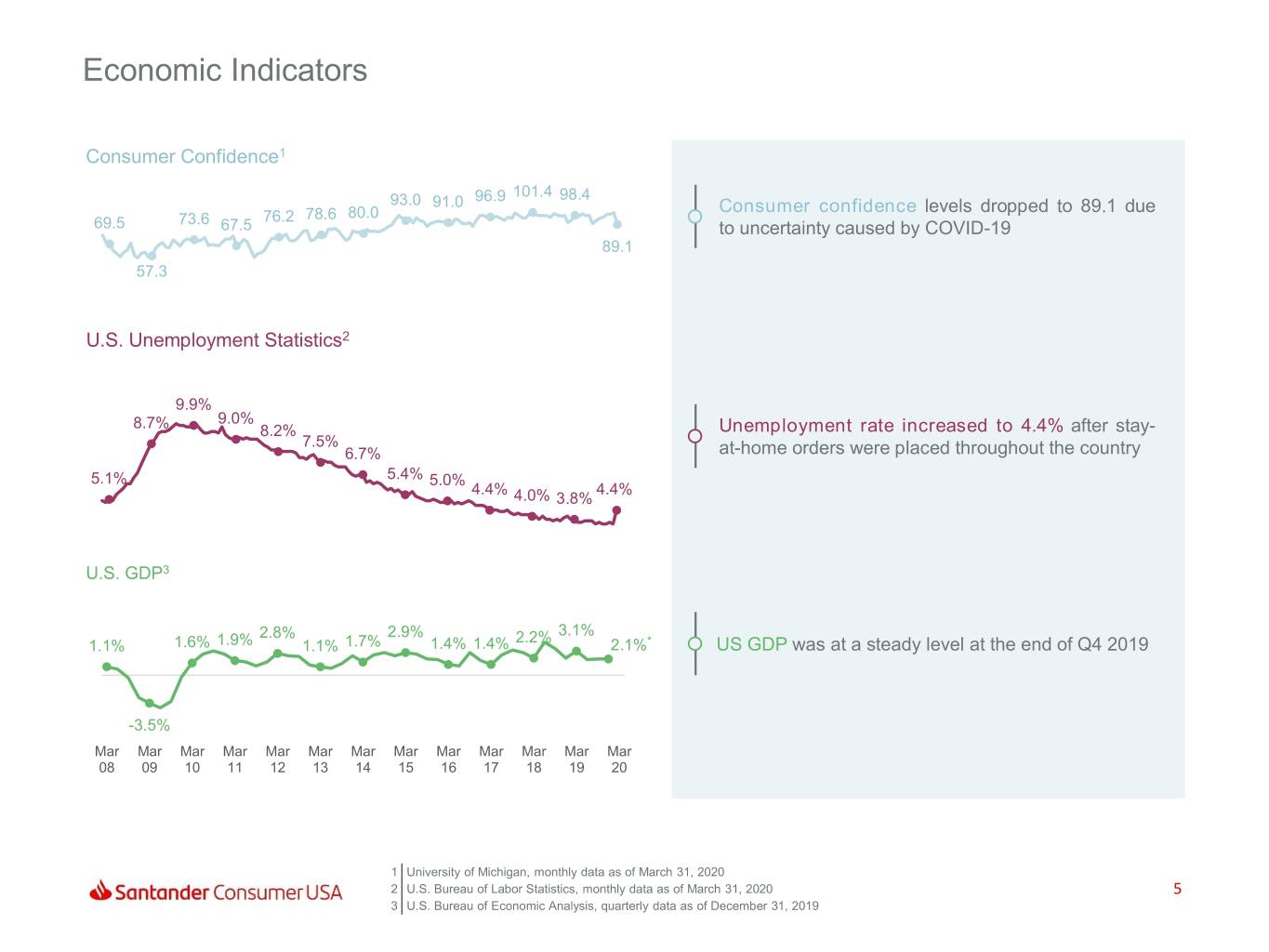

Economic Indicators Consumer Confidence1 96.9 101.4 98.4 93.0 91.0 Consumer confidence levels dropped to 89.1 due 76.2 78.6 80.0 69.5 73.6 67.5 to uncertainty caused by COVID-19 89.1 57.3 U.S. Unemployment Statistics2 9.9% 9.0% 8.7% 8.2% Unemployment rate increased to 4.4% after stay- 7.5% 6.7% at-home orders were placed throughout the country 5.1% 5.4% 5.0% 4.4% 4.4% 4.0% 3.8% U.S. GDP3 2.8% 2.9% 2.2% 3.1% 1.1% 1.6% 1.9% 1.1% 1.7% 1.4% 1.4% 2.1%* US GDP was at a steady level at the end of Q4 2019 -3.5% Mar Mar Mar Mar Mar Mar Mar Mar Mar Mar Mar Mar Mar 08 09 10 11 12 13 14 15 16 17 18 19 20 1 University of Michigan, monthly data as of March 31, 2020 2 U.S. Bureau of Labor Statistics, monthly data as of March 31, 2020 5 3 U.S. Bureau of Economic Analysis, quarterly data as of December 31, 2019

Auto Industry Analysis U.S. Auto Sales1 17.4 17.3 17.2 17.1 16.6 Auto sales of 11.4M, down 31% QoQ due to dealership and manufacturer shutdowns caused by COVID-19 11.4 Used Vehicle Indices2 Manheim 141.9 140.5 139.9 141.1 137.6 136.0 Used vehicle prices were strong during the beginning of Q1 before deteriorating during March due to COVID-19 JDP 122.0 121.8 121.6 117.2 118.4 117.9 SC Recovery Rates3 60.3% 55.9% 55.9% SC’s recovery rate reflects the resilient used car 52.2% 50.1% 47.3% market at the beginning of Q1, offset by COVID-19 impacts during March Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 1 U.S. Bureau of Economic Analysis, Light Weight Vehicle Sales: Autos and Light Trucks, monthly data as of March 31, 2020 2 Manheim, Inc.; Indexed to a basis of 100 at 1995 levels; JD Power Used-Vehicle Price Index (not seasonally adjusted), both monthly, quarter end 3 Recovery Rate – Per the financial statements includes insurance proceeds, bankruptcy/deficiency sales, and timing impacts 6

Diversified Underwriting Across the Credit Spectrum Three Months Ended Originations % Variance ($ in Millions) Q1 2020 Q4 2019 Q1 2019 QoQ YoY Total Core Retail Auto $ 2,306 $ 2,427 $ 2,620 (5%) (12%) Chrysler Capital Loans (<640)1 1,190 1,313 1,331 (9%) (11%) Chrysler Capital Loans (≥640)1 1,432 1,935 1,112 (26%) 29% Total Chrysler Capital Retail 2,622 3,248 2,443 (19%) 7% Total Leases 2 2,024 1,816 1,967 11% 3% Total Auto Originations3 $ 6,952 $ 7,491 $ 7,030 (7%) (1%) SBNA Originations 4 $ 1,081 $ 1,895 $ 1,036 (43%) 4% 1 Approximate FICOs 2 Includes nominal capital lease originations 7 3 Includes SBNA Originations 4 SBNA Originations remain off of SC’s balance sheet in the Service For Others portfolio

Fiat Chrysler (FCA) Relationship SC continues to support FCA, recently through incentivized programs on select new FCA models • First payment deferred 90 days on select new FCA models • 0% Annual Percentage Rate for 84 months on select new FCA models FCA Sales1 (units in ‘000s) Chrysler Penetration Rate2 598 565 543 38.9% 498 36.1% 35.7% 447 31.1% 31.9% 1Q19 2Q19 3Q19 4Q19 1Q20 1Q19 2Q19 3Q19 4Q19 1Q20 1 FCA filings; sales as reported on 01/03/2020 2 Auto loans and leases financed by Chrysler Capital 8

Serviced for Others (SFO) Platform Stable balances Serviced for Others Balances, End of Period ($ in Millions) $10,414 $10,331 QoQ $9,979 $9,282 15% 15% $8,744 20% Recent serviced for others balance growth driven by prime originations from the 26% SBNA originations program 34% Previously announced TCF conversion executed during Q1 85% 85% 80% 74% 66% 1Q19 2Q19 3Q19 4Q19 1Q20 Related Party 3rd Party 9

Funding and Liquidity $50B in liquidity Funding and Liquidity ($ in Billions) $51.1 $49.5 Executed $965M SDART subsequent to 1.9 1.1 quarter end $45.5 SBNA • One of the first ABS transactions to 1.0 9.2 8.7 Originations re-open the securitization markets since the COVID-19 pandemic 7.0 • Significant investor support allowing Santander for upsize and better than expected Holdings pricing USA 18.8 18.2 ABS Executed $1.1B of new third party 18.5 financings at the end of March Extended and renewed an existing 3rd party Bank Term $1.25B third party revolving warehouse 9.3 9.9 Financing line 8.6 3rd party 45% available warehouse capacity from Bank 13 bank partners Warehouse $10.3 11.9 11.8 Lines $3.0B unused related party liquidity Q1 2019 Q4 2019 Q1 2020 10

Q1 2020 Financial Results Three Months Ended (Unaudited, Dollars in Thousands, except per share) March 31, 2020 December 31, 2019 March 31, 2019 Interest on finance receivables and loans $ 1,273,819 $ 1,262,266 $ 1,253,580 Net leased vehicle income 195,067 214,693 205,541 Other finance and interest income 7,551 10,624 10,247 Interest expense 328,834 332,171 334,382 Net finance and other interest income $ 1,147,603 $ 1,155,412 $ 1,134,986 Provision for credit losses 907,887 545,345 550,879 Profit sharing 14,295 14,293 6,968 Total other income 50,807 (64,023) 51,085 Total operating expenses 282,673 309,475 290,957 Income before tax $ (6,445) $ 222,276 $ 337,267 Income tax expense (2,458) 76,214 89,764 Net income $ (3,987) $ 146,062 $ 247,503 Diluted EPS ($) $ (0.01) $ 0.43 $ 0.70 Average total assets $ 47,690,751 $ 47,875,073 $ 44,488,868 Average managed assets $ 60,207,338 $ 58,909,208 $ 54,433,129 11

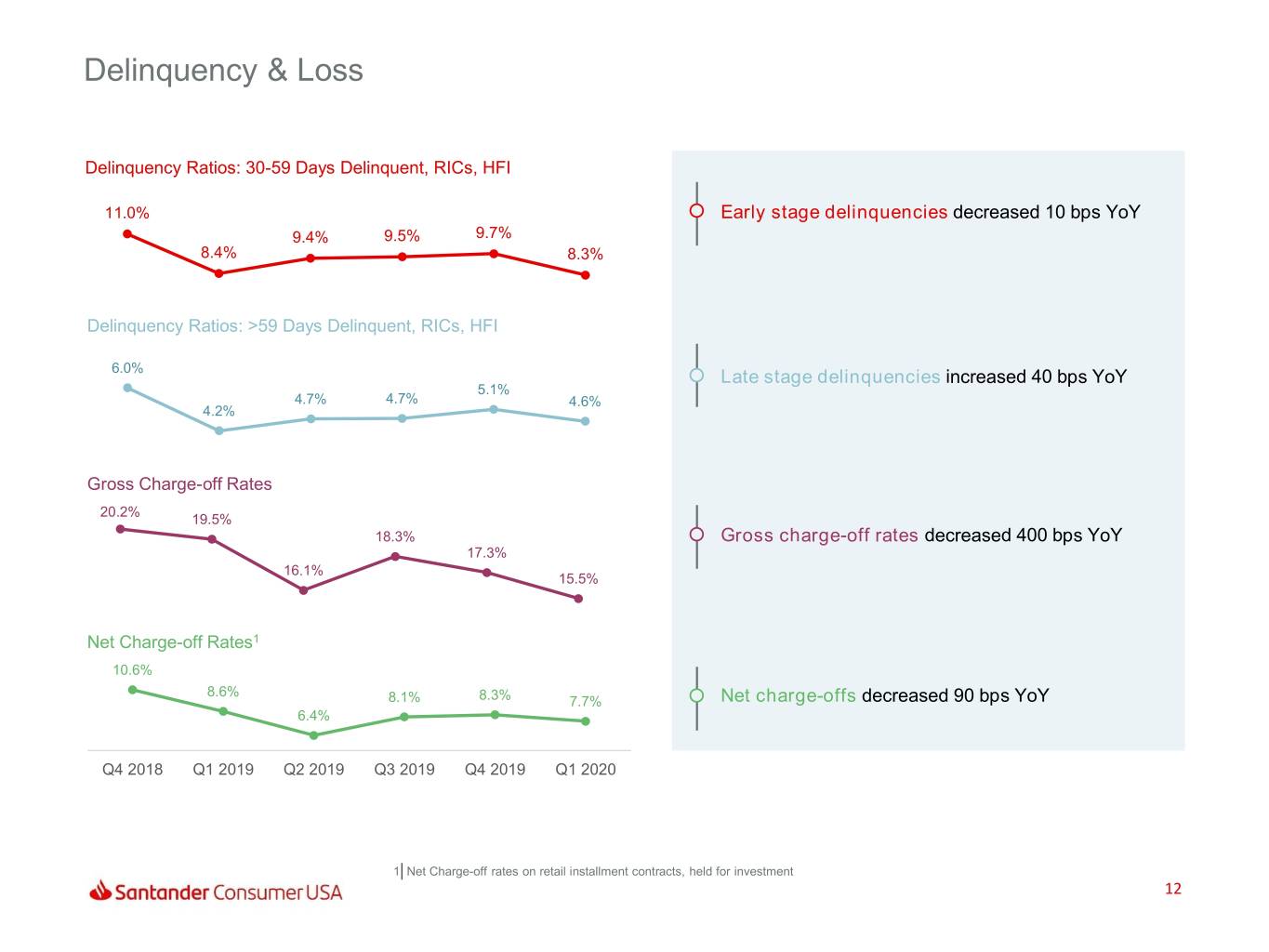

Delinquency & Loss Delinquency Ratios: 30-59 Days Delinquent, RICs, HFI 11.0% Early stage delinquencies decreased 10 bps YoY 9.4% 9.5% 9.7% 8.4% 8.3% Delinquency Ratios: >59 Days Delinquent, RICs, HFI 6.0% Late stage delinquencies increased 40 bps YoY 5.1% 4.7% 4.7% 4.6% 4.2% Gross Charge-off Rates 20.2% 19.5% 18.3% Gross charge-off rates decreased 400 bps YoY 17.3% 16.1% 15.5% Net Charge-off Rates1 10.6% 8.6% 8.1% 8.3% 7.7% Net charge-offs decreased 90 bps YoY 6.4% Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 1 Net Charge-off rates on retail installment contracts, held for investment 12

Loss Detail Q1 2019 to Q1 2020: Net Charge-off Walk, ($ in millions) Net charge-offs for RICs decreased $22M versus prior year quarter to $593M $96 ($124) $615 $48 ($41) $593 $48M increase in losses due to lower recoveries YoY and $96M increase due to higher loan balance $124M decrease due to a lower gross charge-off rate YoY and $41M lower due to other impacts Q1 2019 Recoveries Balance Gross Loss Other Q1 2020 Performance 13

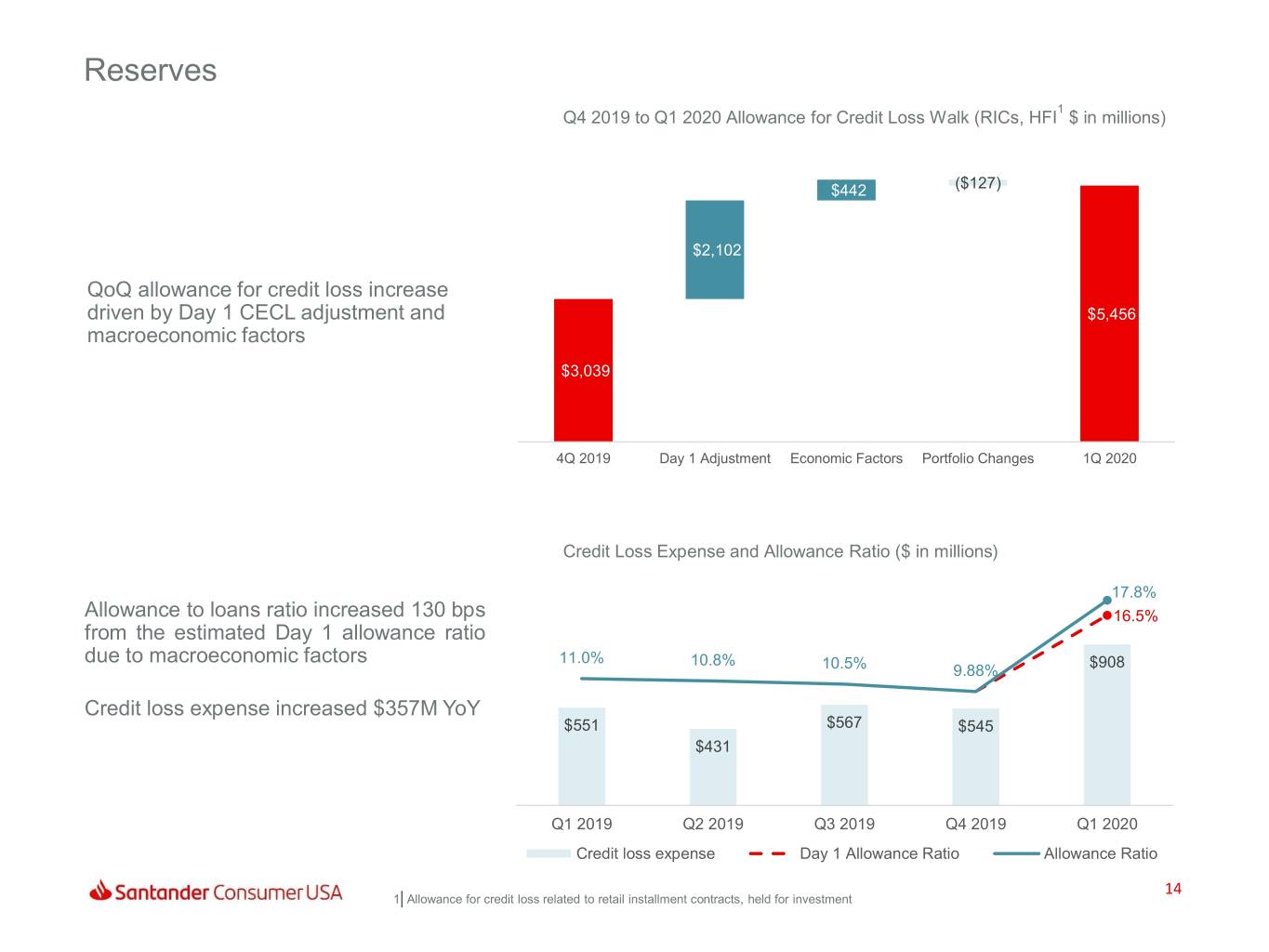

Reserves 1 Q4 2019 to Q1 2020 Allowance for Credit Loss Walk (RICs, HFI $ in millions) $442 ($127) $2,102 QoQ allowance for credit loss increase driven by Day 1 CECL adjustment and $5,141 $5,456 $5,456 macroeconomic factors $3,039 $3,039 4Q 2019 Day 1 Adjustment Economic Factors Portfolio Changes 1Q 2020 (Primarily COVID) Credit Loss Expense and Allowance Ratio ($ in millions) Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 0.2 $1,200 17.8% 0.18 Allowance to loans ratio increased 130 bps 16.5% 0.16 from the estimated Day 1 allowance ratio$1,000 0.14 due to macroeconomic factors 11.0% $800 10.8% $908 0.12 10.5% 9.88% 0.1 $600 Credit loss expense increased $357M YoY 0.08 $551 $567 $545 $400 0.06 $431 0.04 $200 0.02 $0 0 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Credit loss expense Day 1 Allowance Ratio Allowance Ratio 14 1 Allowance for credit loss related to retail installment contracts, held for investment

Current Expected Credit Losses (“CECL”) CECL Impact Dollars in Millions (Unaudited) (Estimated)1 (Audited) Previously estimated Day 1 CECL impact increased allowance for credit loss (ACL) Allowance Ratios March 31, 2020 January 1, 2020 December 31, 2019 by ~$2B compared to Q4 2019, primarily because of expected credit losses over the TDR- Unpaid principal balance $3,560 $3,859 $3,859 full expected life of the non-TDR loans TDR – Impairment $973 ~$950 $915 • Non-TDR coverage ratio approximately TDR- Allowance ratio 28.1% ~24.6% 23.7% doubles, reflecting lifetime reserve coverage Non-TDR – Unpaid principal $27,262 $26,896 $26,896 As of the end of Q1 2020, total allowance balance increased $0.4B compared to 1/1/2020, Non-TDR – Allowance $4,483 ~$4,150 $2,124 primarily driven by macroeconomic factors and COVID-19 reserves Non-TDR Allowance ratio 16.4% ~15.4% 7.9% • Total allowance coverage ratio increased to 17.8% Total – Unpaid principal balance $30,722 $30,755 $30,755 • SC is electing to defer CECL’s effect on Total – Allowance $5,456 ~$5,100 $3,039 regulatory capital for two years followed by a three-year phase-in period per Total – Allowance ratio 17.8% ~16.5% 9.9% regulatory guidance 1 Estimated as of December 31, 2019 15

Expense Management Operating expenses Operating Expenses ($ in Millions) totaled $283M, $400 7.0% $350 $329 $309 6.0% $291 expense ratio down $300 $281 $283 5.0% 20bps YoY $250 4.0% $200 2.3% 3.0% $150 2.1% 2.1% Operating expenses decreased $8M 2.0% 1.9% 2.0% YoY primarily driven by lower $100 repossession expense. Involuntary 1.0% repossessions have been temporarily $50 suspended due to COVID-19. $0 0.0% 1Q19 2Q19 3Q19 4Q19 1Q20 Expense ratio decreased 20bps YoY Operating Expense Expense Ratio 16

Consistent Capital Generation 1 Common Equity Tier 1 Capital Ratio $120,000 18.0% Strong capital 15.8% 15.7% 15.4% 16.0% 14.8% $110,000 base 13.8% 14.0% Lower CET1 due to share repurchases $100,000 12.0% SC maintains strong capital levels in addition to its loan loss reserves 10.0% $90,000 8.0% $80,000 6.0% 4.0% $70,000 2.0% $60,000 0.0% Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Tier 1 common capital $6,982 $7,207 $7,226 $7,193 $6,726 Risk weighted assets 2 $44,261 $45,850 $46,870 $48,762 $48,830 CET1 15.8% 15.7% 15.4% 14.8% 13.8% 1 CET1 is calculated under Basel III regulations required as of January 1, 2015. Please see Slide 22 for further details related to CECL phase-in impact. 2 Under the banking agencies' risk-based capital guidelines, assets and credit equivalent amounts of derivatives and off-balance sheet exposures are assigned 17 to .broad risk .categories. The aggregate dollar amount in each risk category is multiplied by the associated risk weight of the category. The resulting weighted values are added together with the measure for market risk, resulting in the Company's and the Bank's total Risk weighted assets

Appendix

Diversified Underwriting Across Full Credit Spectrum Originations by Credit (RICs)1 $6,192 $5,867 $5,674 $5,063 $4,927 41% 41% 40% 31% 36% 16% 14% 15% 14% 15% 26% 22% 23% 21% 24% 13% 9% 9% 10% 11% 12% 11% 11% 12% 11% 2% 2% 2% 3% 3% 1Q19 2Q19 3Q19 4Q19 1Q20 Commercial 2 No FICO <540 540-599 600-639 >640 Average Loan Balance in Dollars $23,274 $25,565 $25,627 $25,706 $24,776 New/Used Originations $6,192 $5,867 $5,674 $5,063 $4,927 39% 38% 39% 48% 45% 62% 61% 61% 52% 55% 1Q19 2Q19 3Q19 4Q19 1Q20 New Used 1 RIC; Retail Installment Contract 2 Loans to commercial borrowers; no FICO score obtained 19

Heldfor Investment Credit Trends Retail Installment RetailInstallment Contracts 1.9% Commercial 2.1% Q1 2019 2.2% 2.4% 2.5% 1 10.9% Unknown 10.9% 10.6% 1 Held for investment; excludes assets held for sale forheld assets excludes investment; Held for Q2 2019 10.0% 12.4% 19.4% 18.8% <540 17.9% 16.9% Q3 2019 16.7% 33.0% 540-599 33.2% 32.9% 31.9% 31.9% Q4 2019 18.4% 600-639 18.9% 19.0% 19.0% 18.9% Q1 2020 16.4% >=640 16.1% 17.4% 19.8% 17.5% 20

Excluding Personal Lending Detail Personal lending earned $68M before operating expenses and taxes in Q1 2020 Three Months Ended, (Unaudited, Dollars in Thousands) March 31, 2020 December 31, 2019 March 31, 2019 Excluding Excluding Excluding Personal Personal Personal Total Personal Total Personal Total Personal Lending Lending Lending Lending Lending Lending Interest on finance receivables and loans $ 1,273,819 $ 93,541 $ 1,180,278 $ 1,262,266 $ 87,842 $ 1,174,424 $ 1,253,580 $ 96,022 $ 1,157,558 Net leased vehicle income 195,067 - 195,067 214,693 - 214,693 205,541 - 205,541 Other finance and interest income 7,551 - 7,551 10,624 - 10,624 10,247 - 10,247 Interest expense 328,834 12,205 316,629 332,171 10,423 321,748 334,382 12,561 321,821 Net finance and other interest income $ 1,147,603 $ 81,336 $ 1,066,267 $ 1,155,412 $ 77,419 $ 1,077,993 $ 1,134,986 $ 83,461 $ 1,051,525 Provision for credit losses $ 907,887 $ - $ 907,887 $ 545,345 $ - $ 545,345 $ 550,879 $ 83 $ 550,796 Profit sharing 14,295 (93) 14,388 14,293 1,388 12,905 6,968 (2,057) 9,025 Investment gains (losses), net1 $ (63,426) $ (62,958) $ (468) $ (168,406) $ (169,534) $ 1,128 $ (67,097) $ (67,691) $ 594 Servicing fee income 19,103 - 19,103 21,079 - 21,079 23,806 - 23,806 Fees, commissions and other 95,130 49,522 45,608 83,304 47,063 36,241 94,376 50,535 43,841 Total other income $ 50,807 $ (13,436) $ 64,243 $ (64,023) $ (122,471) $ 58,448 $ 51,085 $ (17,156) $ 68,241 Average gross individually acquired retail installment $ 30,768,423 - $ 29,936,775 - $ 28,595,315 - contracts, held for investment and held for sale Average gross personal loans - $ 1,413,021 - $ 1,364,877 - $ 1,466,300 Average gross operating leases $ 17,735,640 $ - $ 17,395,639 $ - $ 15,425,190 $ - 1 The current period losses were primarily driven by $63 million of lower of cost or market adjustments related to the held for sale personal lending portfolio, comprised of $110 million in customer default activity, and a $47 million decrease in market discount, consistent with 21 typical seasonal patterns.

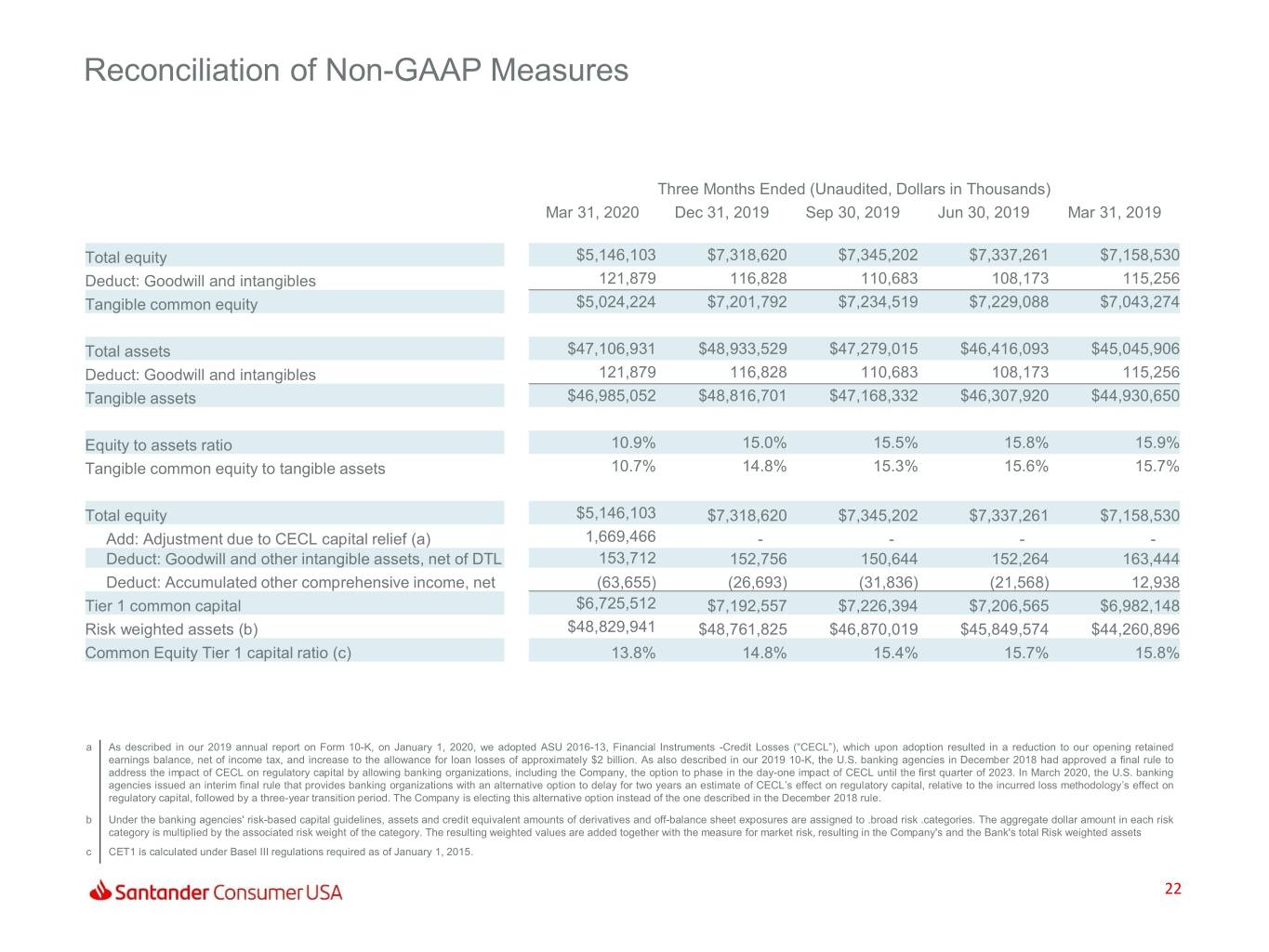

Reconciliation of Non-GAAP Measures Three Months Ended (Unaudited, Dollars in Thousands) Mar 31, 2020 Dec 31, 2019 Sep 30, 2019 Jun 30, 2019 Mar 31, 2019 Total equity $5,146,103 $7,318,620 $7,345,202 $7,337,261 $7,158,530 Deduct: Goodwill and intangibles 121,879 116,828 110,683 108,173 115,256 Tangible common equity $5,024,224 $7,201,792 $7,234,519 $7,229,088 $7,043,274 Total assets $47,106,931 $48,933,529 $47,279,015 $46,416,093 $45,045,906 Deduct: Goodwill and intangibles 121,879 116,828 110,683 108,173 115,256 Tangible assets $46,985,052 $48,816,701 $47,168,332 $46,307,920 $44,930,650 Equity to assets ratio 10.9% 15.0% 15.5% 15.8% 15.9% Tangible common equity to tangible assets 10.7% 14.8% 15.3% 15.6% 15.7% Total equity $5,146,103 $7,318,620 $7,345,202 $7,337,261 $7,158,530 Add: Adjustment due to CECL capital relief (a) 1,669,466 - - - - Deduct: Goodwill and other intangible assets, net of DTL 153,712 152,756 150,644 152,264 163,444 Deduct: Accumulated other comprehensive income, net (63,655) (26,693) (31,836) (21,568) 12,938 Tier 1 common capital $6,725,512 $7,192,557 $7,226,394 $7,206,565 $6,982,148 Risk weighted assets (b) $48,829,941 $48,761,825 $46,870,019 $45,849,574 $44,260,896 Common Equity Tier 1 capital ratio (c) 13.8% 14.8% 15.4% 15.7% 15.8% a As described in our 2019 annual report on Form 10-K, on January 1, 2020, we adopted ASU 2016-13, Financial Instruments -Credit Losses (“CECL”), which upon adoption resulted in a reduction to our opening retained earnings balance, net of income tax, and increase to the allowance for loan losses of approximately $2 billion. As also described in our 2019 10-K, the U.S. banking agencies in December 2018 had approved a final rule to address the impact of CECL on regulatory capital by allowing banking organizations, including the Company, the option to phase in the day-one impact of CECL until the first quarter of 2023. In March 2020, the U.S. banking agencies issued an interim final rule that provides banking organizations with an alternative option to delay for two years an estimate of CECL’s effect on regulatory capital, relative to the incurred loss methodology’s effect on regulatory capital, followed by a three-year transition period. The Company is electing this alternative option instead of the one described in the December 2018 rule. b Under the banking agencies' risk-based capital guidelines, assets and credit equivalent amounts of derivatives and off-balance sheet exposures are assigned to .broad risk .categories. The aggregate dollar amount in each risk category is multiplied by the associated risk weight of the category. The resulting weighted values are added together with the measure for market risk, resulting in the Company's and the Bank's total Risk weighted assets c CET1 is calculated under Basel III regulations required as of January 1, 2015. 22

Thank You Our purpose is to help people and business prosper. Our culture is based on believing that everything we do should be: