Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - C. H. ROBINSON WORLDWIDE, INC. | ex991earningsreleaseq1.htm |

| 8-K - 8-K - C. H. ROBINSON WORLDWIDE, INC. | chrw-20200428.htm |

Earnings Conference Call – First Quarter 2020 April 29, 2020 Bob Biesterfeld, CEO Mike Zechmeister, CFO Bob Houghton, VP of Corporate Finance 1

Safe Harbor Statement Except for the historical information contained herein, the matters set forth in this presentation and the accompanying earnings release are forward-looking statements that represent our expectations, beliefs, intentions or strategies concerning future events. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience or our present expectations, including, but not limited to such factors as changes in economic conditions, including uncertain consumer demand; changes in market demand and pressures on the pricing for our services; competition and growth rates within the third party logistics industry; freight levels and increasing costs and availability of truck capacity or alternative means of transporting freight; changes in relationships with existing contracted truck, rail, ocean, and air carriers; changes in our customer base due to possible consolidation among our customers; our ability to successfully integrate the operations of acquired companies with our historic operations; risks associated with litigation, including contingent auto liability and insurance coverage; risks associated with operations outside of the United States; risks associated with the potential impact of changes in government regulations; risks associated with the produce industry, including food safety and contamination issues; fuel price increases or decreases, or fuel shortages; cyber-security related risks; the impact of war on the economy; changes to our capital structure; risks related to the elimination of LIBOR; changes due to catastrophic events including pandemics such as COVID-19; and other risks and uncertainties detailed in our Annual and Quarterly Reports. 2 2

Q1 2020 Opening Remarks ▪ Three key pillars as guideposts for our decision-making: ▪ Ensuring the health and safety of our employees ▪ Providing supply chain continuity for our customers and carriers ▪ Protecting the economic security of our people to the greatest extent possible ▪ High-single-digit truckload volume increase in Q1 while industry volumes were down high-single digits ▪ Over $1.2 billion of liquidity 3 3

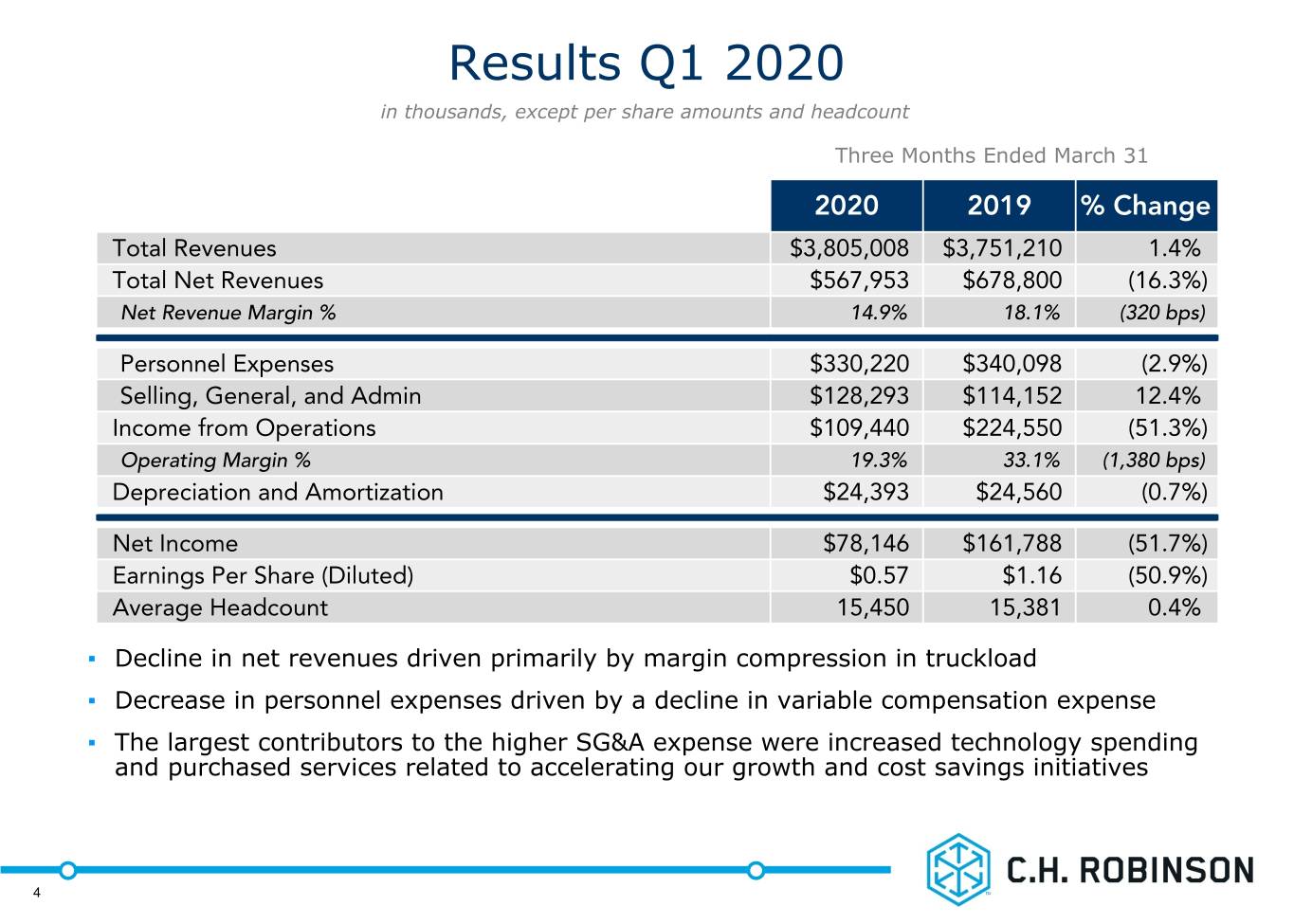

Results Q1 2020 in thousands, except per share amounts and headcount Three Months Ended March 31 2020 2019 % Change Total Revenues $3,805,008 $3,751,210 1.4% Total Net Revenues $567,953 $678,800 (16.3%) Net Revenue Margin % 14.9% 18.1% (320 bps) Personnel Expenses $330,220 $340,098 (2.9%) Selling, General, and Admin $128,293 $114,152 12.4% Income from Operations $109,440 $224,550 (51.3%) Operating Margin % 19.3% 33.1% (1,380 bps) Depreciation and Amortization $24,393 $24,560 (0.7%) Net Income $78,146 $161,788 (51.7%) Earnings Per Share (Diluted) $0.57 $1.16 (50.9%) Average Headcount 15,450 15,381 0.4% ▪ Decline in net revenues driven primarily by margin compression in truckload ▪ Decrease in personnel expenses driven by a decline in variable compensation expense ▪ The largest contributors to the higher SG&A expense were increased technology spending and purchased services related to accelerating our growth and cost savings initiatives 4 4

Q1 2020 Other Income Statement Items ▪ Q1 effective tax rate of 17.1% vs. 22.0% in Q1 2019 ▪ Lower tax rate due to benefit from stock-based compensation ▪ Expect full-year 2020 effective tax rate to be on the lower end of the 22.0-24.0% range ▪ $2.9 million unfavorable impact from currency revaluation, versus a $5.0 million unfavorable impact in Q1 2019 ▪ Interest expense declined by $1.1 million versus Q1 2019 due to lower average debt balance ‹#› 5

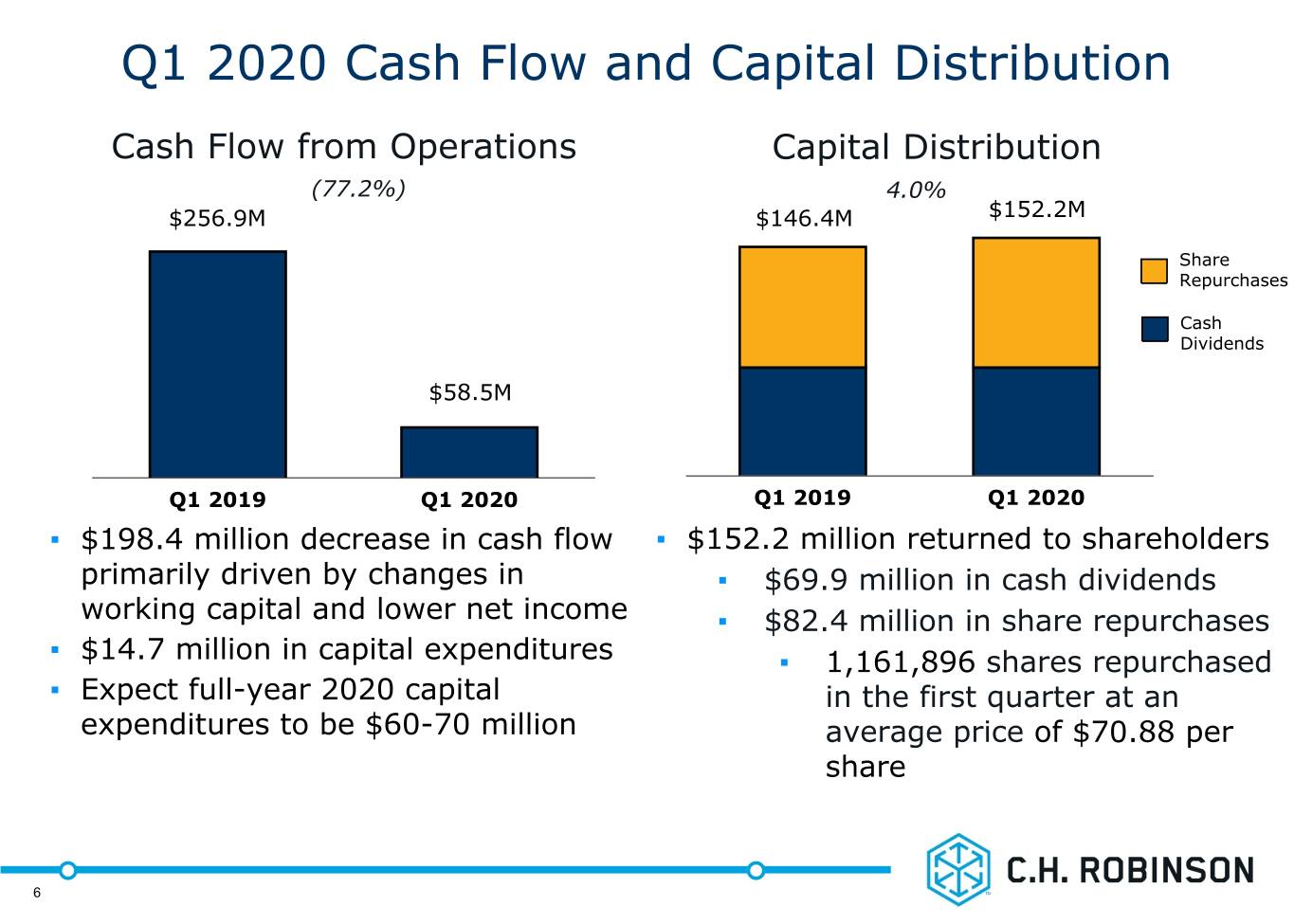

Q1 2020 Cash Flow and Capital Distribution Cash Flow from Operations Capital Distribution (77.2%) 4.0% $256.9M $146.4M $152.2M Share Repurchases Cash Dividends $58.5M Q1 2019 Q1 2020 Q1 2019 Q1 2020 ▪ $198.4 million decrease in cash flow ▪ $152.2 million returned to shareholders primarily driven by changes in ▪ $69.9 million in cash dividends working capital and lower net income ▪ $82.4 million in share repurchases ▪ $14.7 million in capital expenditures ▪ 1,161,896 shares repurchased ▪ Expect full-year 2020 capital in the first quarter at an expenditures to be $60-70 million average price of $70.88 per share ‹#› 6 ◦ Dividend payout ratio of

Q1 2020 Balance Sheet in thousands March 31, March 31, 2020 2019 % Change Accounts Receivable, Net(1) $2,216,171 $2,223,487 (0.3%) Accounts Payable(2) $1,244,454 $1,186,658 4.9% Net Operating Working Capital(3) $971,717 $1,036,829 (6.3%) ▪ Total debt balance $1.41 billion ▪ $600 million senior unsecured notes maturing April 2028, 4.20% coupon ▪ $500 million private placement debt, 4.28% average coupon ▪ $175M maturing in August 2023, $150M maturing in August 2028 and $175M maturing in August 2033 ▪ $250 million accounts receivable securitization debt facility maturing December 2020, 2.06% average interest rate (one-month LIBOR + 65 bps) ▪ $71 million drawn on credit facility maturing October 2023, 2.39% average interest rate (one-month LIBOR + 113 bps) ▪ 3.9% weighted average interest rate in the quarter (1) Accounts receivable amount includes contract assets. (2) Accounts payable amount includes outstanding checks and accrued transportation expense. ‹#› (3) Net operating working capital is defined as net accounts receivable less accounts payable. 7

NAST Truckload Cost and Price Change(1)(2) 25% 20% 15% 10% 5% 0% -5% -10% YoY Price Change YoY Cost Change -15% YO Y % CHANGE IN COST AND PRICE -20% 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 NAST Q1 Truckload ▪ 65% / 35% truckload contractual to transactional volume mix Volume(2) 7.5% ▪ Average routing guide depth from Managed Services business Pricing(2)(3)(4) (8.5%) of 1.2 for the fifth consecutive quarter Cost(2)(3)(4) (2.5%) Net Revenue (1) North American Surface Transportation ("NAST") truckload cost and price change chart represents Margin truckload shipments in North America. (2) Growth rates are rounded to the nearest 0.5 percent. ‹#› 8 (3) Pricing and cost measures exclude the estimated impact of the change in fuel prices. (4) Represents price and cost YoY change for North America shipments across all segments.

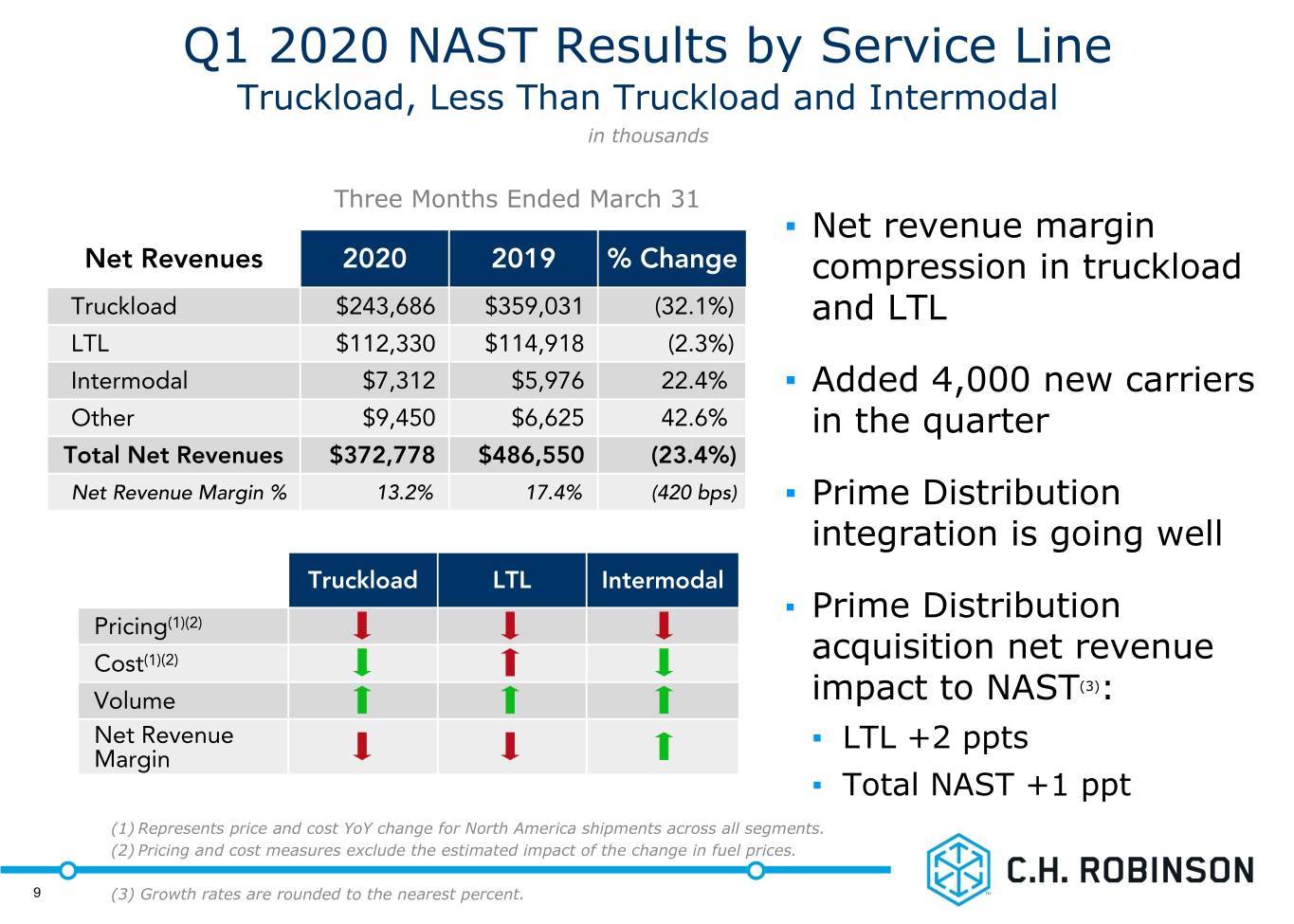

Q1 2020 NAST Results by Service Line Truckload, Less Than Truckload and Intermodal in thousands Three Months Ended March 31 ▪ Net revenue margin Net Revenues 2020 2019 % Change compression in truckload Truckload $243,686 $359,031 (32.1%) and LTL LTL $112,330 $114,918 (2.3%) Intermodal $7,312 $5,976 22.4% ▪ Added 4,000 new carriers Other $9,450 $6,625 42.6% in the quarter Total Net Revenues $372,778 $486,550 (23.4%) Net Revenue Margin % 13.2% 17.4% (420 bps) ▪ Prime Distribution integration is going well Truckload LTL Intermodal ▪ Prime Distribution Pricing(1)(2) Cost(1)(2) acquisition net revenue (3) Volume impact to NAST : Net Revenue ▪ LTL +2 ppts Margin ▪ Total NAST +1 ppt (1) Represents price and cost YoY change for North America shipments across all segments. (2) Pricing and cost measures exclude the estimated impact of the change in fuel prices. ‹#› 9 (3) Growth rates are rounded to the nearest percent.

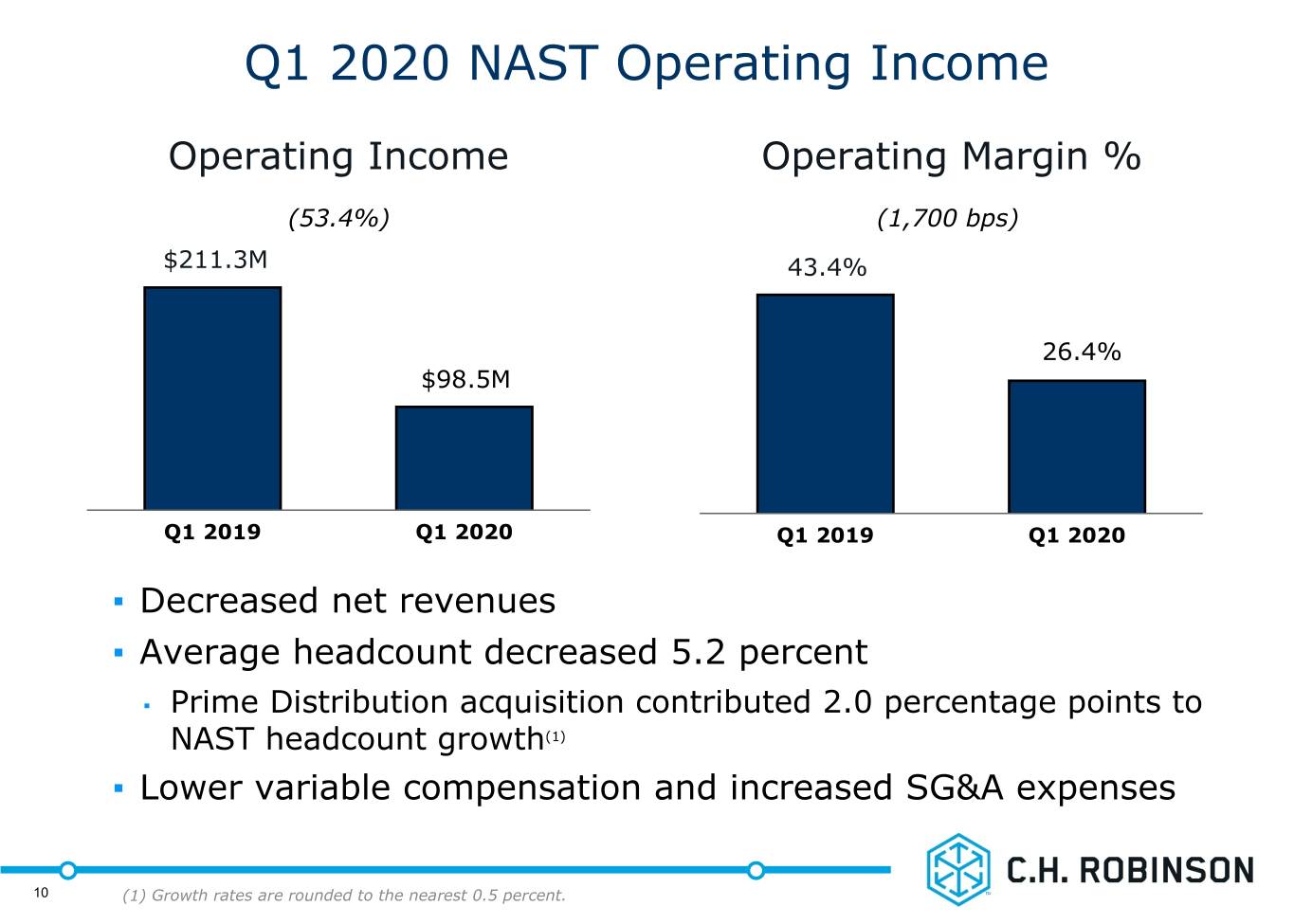

Q1 2020 NAST Operating Income Operating Income Operating Margin % (53.4%) (1,700 bps) $211.3M 43.4% 26.4% $98.5M Q1 2019 Q1 2020 Q1 2019 Q1 2020 ▪ Decreased net revenues ▪ Average headcount decreased 5.2 percent ▪ Prime Distribution acquisition contributed 2.0 percentage points to NAST headcount growth(1) ▪ Lower variable compensation and increased SG&A expenses ‹#› 10 (1) Growth rates are rounded to the nearest 0.5 percent.

Q1 2020 Global Forwarding Results by Service Line Ocean, Air and Customs in thousands Three Months Ended March 31 ▪ Ocean and customs net Net Revenues 2020 2019 % Change revenue declines due to Ocean $69,810 $71,457 (2.3%) lower pricing and volume Air $26,877 $26,136 2.8% ▪ Air net revenue increase Customs $21,193 $21,877 (3.1%) due to higher pricing Other $10,434 $7,766 34.4% ▪ Space Cargo acquisition net Total Net Revenues $128,314 $127,236 0.8% revenue impact to Global (1) Net Revenue Margin % 24.2% 23.7% 50 bps Forwarding : ▪ Ocean +2 ppts Ocean Air ▪ Air +3 ppts Pricing ▪ Customs +1 ppt Volume ▪ Total GF +2 ppts Net Revenue Margin (1) Growth rates are rounded to the nearest percent. ‹#› 11

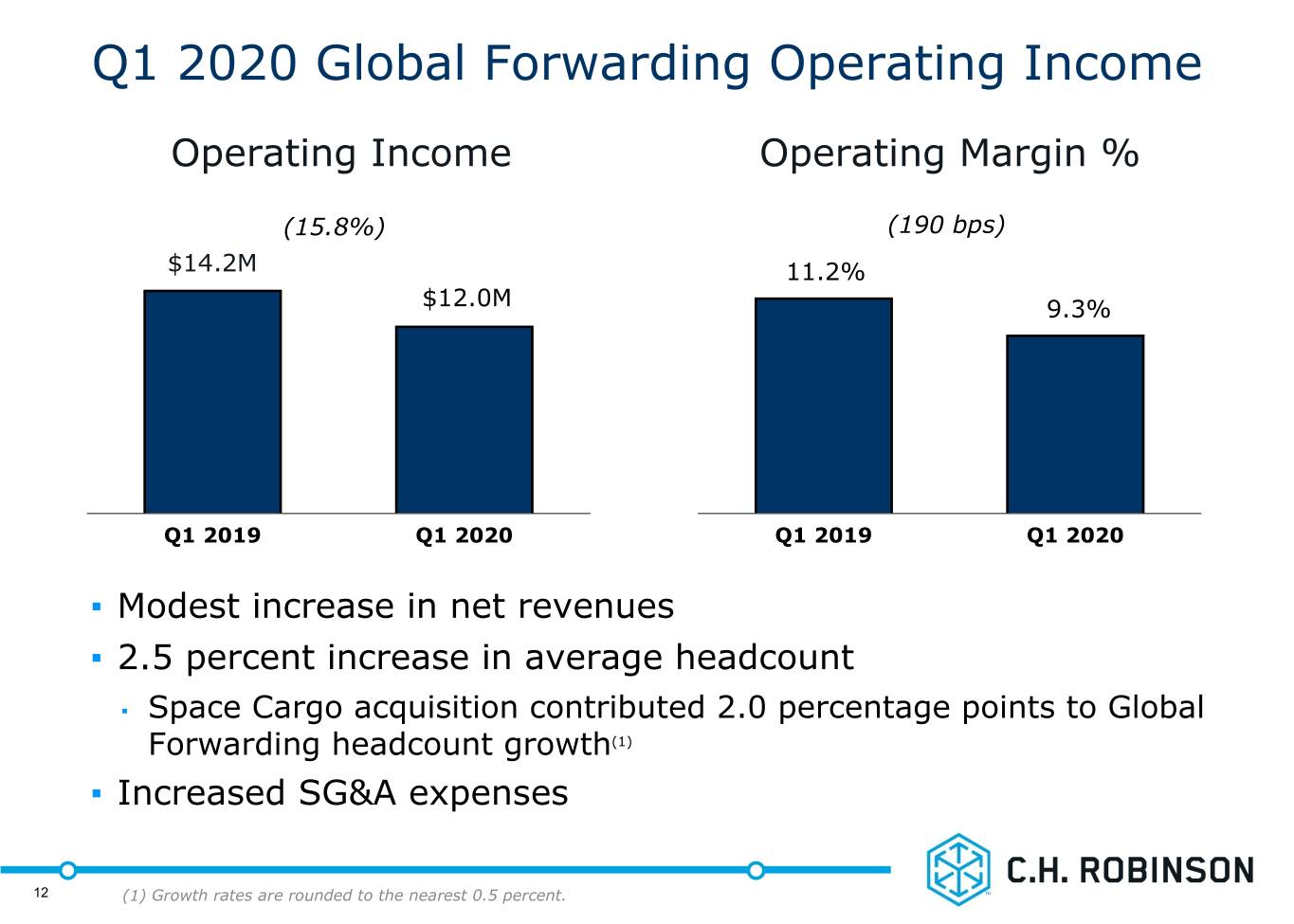

Q1 2020 Global Forwarding Operating Income Operating Income Operating Margin % (15.8%) (190 bps) $14.2M 11.2% $12.0M 9.3% Q1 2019 Q1 2020 Q1 2019 Q1 2020 ▪ Modest increase in net revenues ▪ 2.5 percent increase in average headcount ▪ Space Cargo acquisition contributed 2.0 percentage points to Global Forwarding headcount growth(1) ▪ Increased SG&A expenses ‹#› 12 (1) Growth rates are rounded to the nearest 0.5 percent.

Q1 2020 All Other and Corporate Results Robinson Fresh, Managed Services and Other Surface Transportation in thousands Three Months Ended March 31 Net Revenues 2020 2019 % Change Robinson Fresh $27,458 $28,658 (4.2%) Managed Services $22,527 $20,312 10.9% Other Surface Transportation $16,876 $16,044 5.2% Total $66,861 $65,014 2.8% Robinson Fresh ▪ Case volume decline of 2.5 percent(1) Managed Services ▪ Over $4 billion in annual freight under management Other Surface Transportation ▪ Dema Service acquisition added 8.5 percentage points of net revenue growth(1) ▪ 13 percent increase in Europe truckload volume ‹#› 13 (1) Growth rates are rounded to the nearest 0.5 percent.

Final Comments ▪ Continue to monitor impacts of COVID-19 ▪ Balancing cost reductions with continued investment in technology ▪ Committed to our vital role in the global supply chain, especially in this time of crisis ‹#› 14

Appendix 15

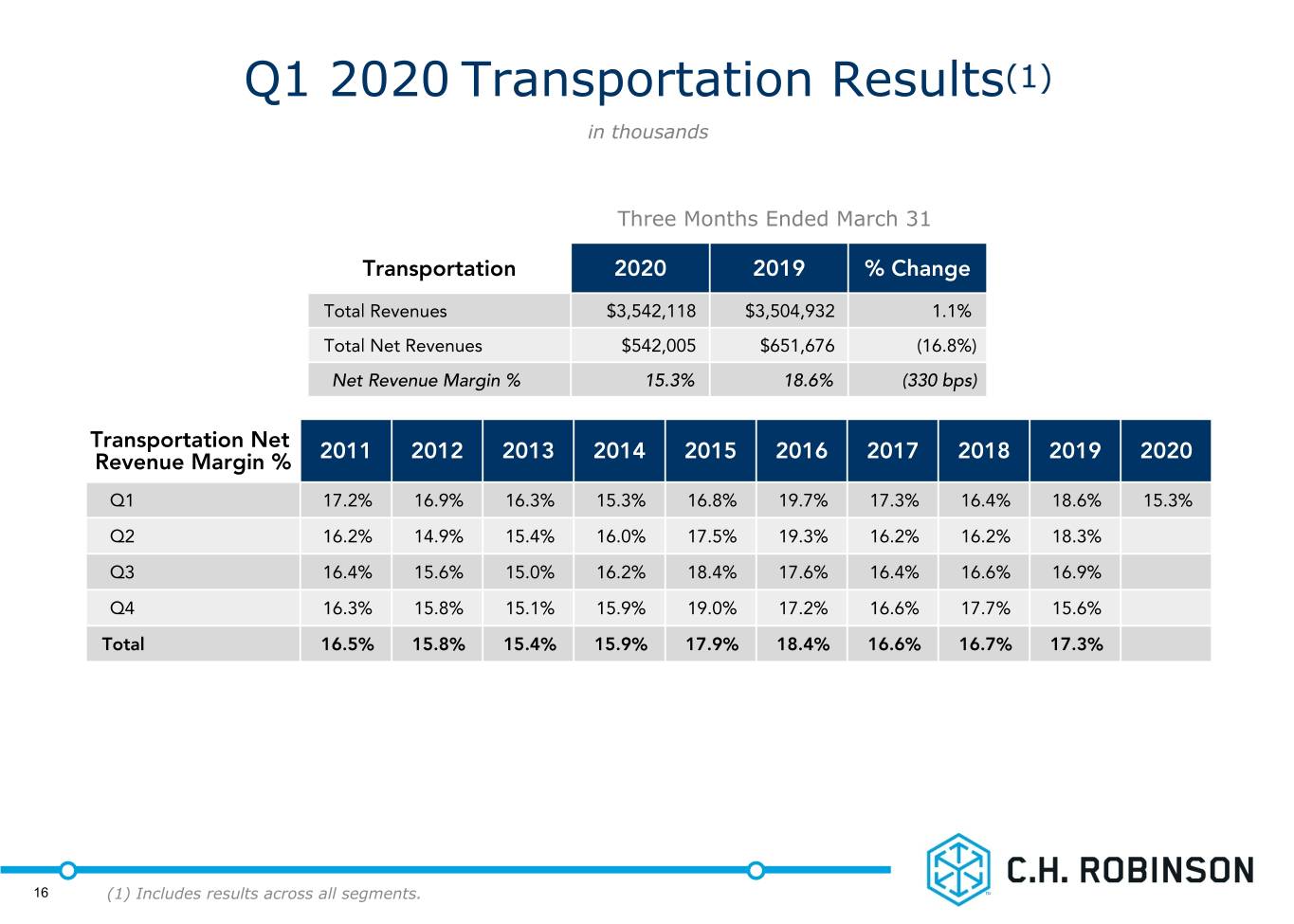

Q1 2020 Transportation Results(1) in thousands Three Months Ended March 31 Transportation 2020 2019 % Change Total Revenues $3,542,118 $3,504,932 1.1% Total Net Revenues $542,005 $651,676 (16.8%) Net Revenue Margin % 15.3% 18.6% (330 bps) Transportation Net Revenue Margin % 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Q1 17.2% 16.9% 16.3% 15.3% 16.8% 19.7% 17.3% 16.4% 18.6% 15.3% Q2 16.2% 14.9% 15.4% 16.0% 17.5% 19.3% 16.2% 16.2% 18.3% Q3 16.4% 15.6% 15.0% 16.2% 18.4% 17.6% 16.4% 16.6% 16.9% Q4 16.3% 15.8% 15.1% 15.9% 19.0% 17.2% 16.6% 17.7% 15.6% Total 16.5% 15.8% 15.4% 15.9% 17.9% 18.4% 16.6% 16.7% 17.3% ‹#› 16 (1) Includes results across all segments.

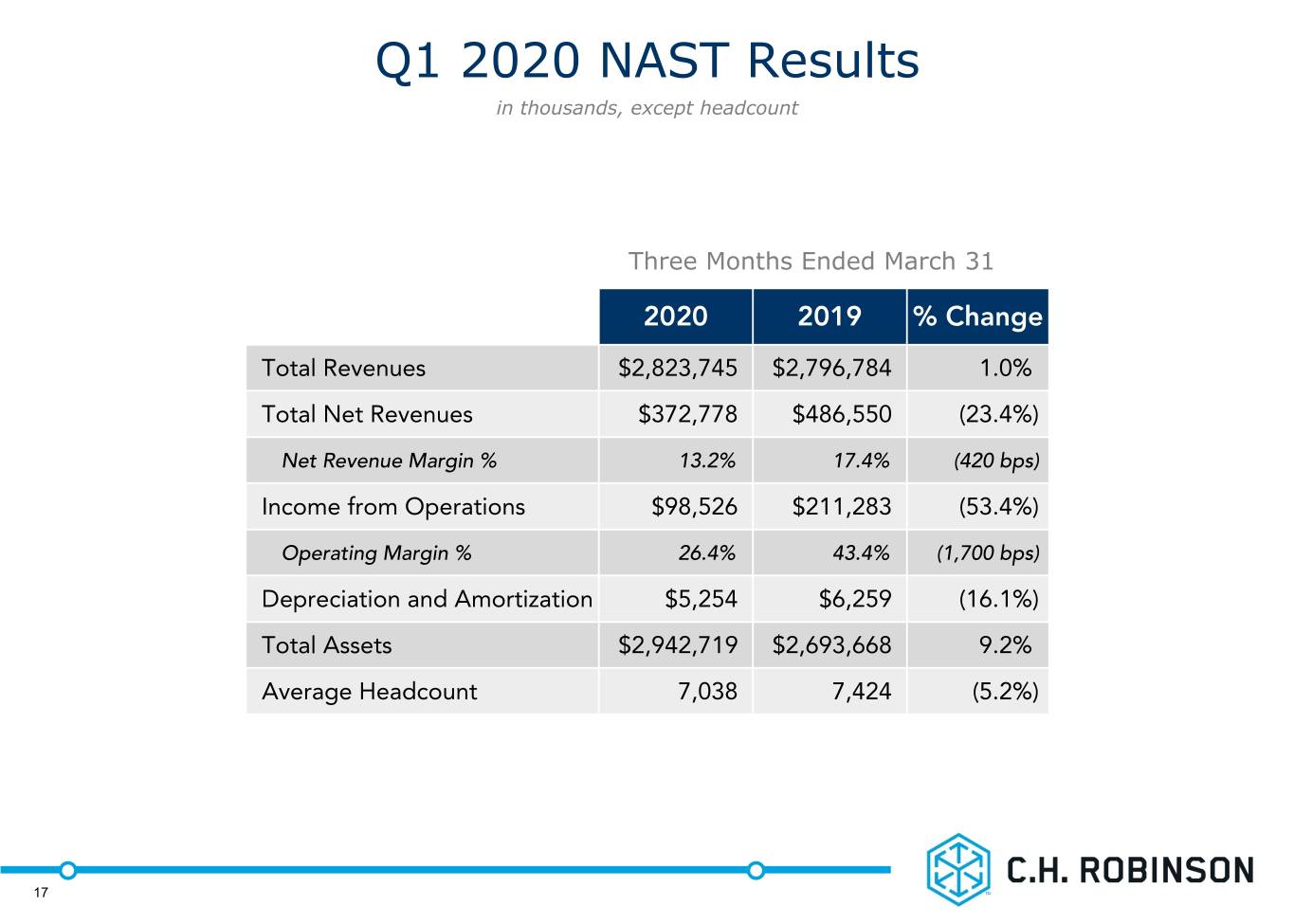

Q1 2020 NAST Results in thousands, except headcount Three Months Ended March 31 2020 2019 % Change Total Revenues $2,823,745 $2,796,784 1.0% Total Net Revenues $372,778 $486,550 (23.4%) Net Revenue Margin % 13.2% 17.4% (420 bps) Income from Operations $98,526 $211,283 (53.4%) Operating Margin % 26.4% 43.4% (1,700 bps) Depreciation and Amortization $5,254 $6,259 (16.1%) Total Assets $2,942,719 $2,693,668 9.2% Average Headcount 7,038 7,424 (5.2%) ‹#› 17

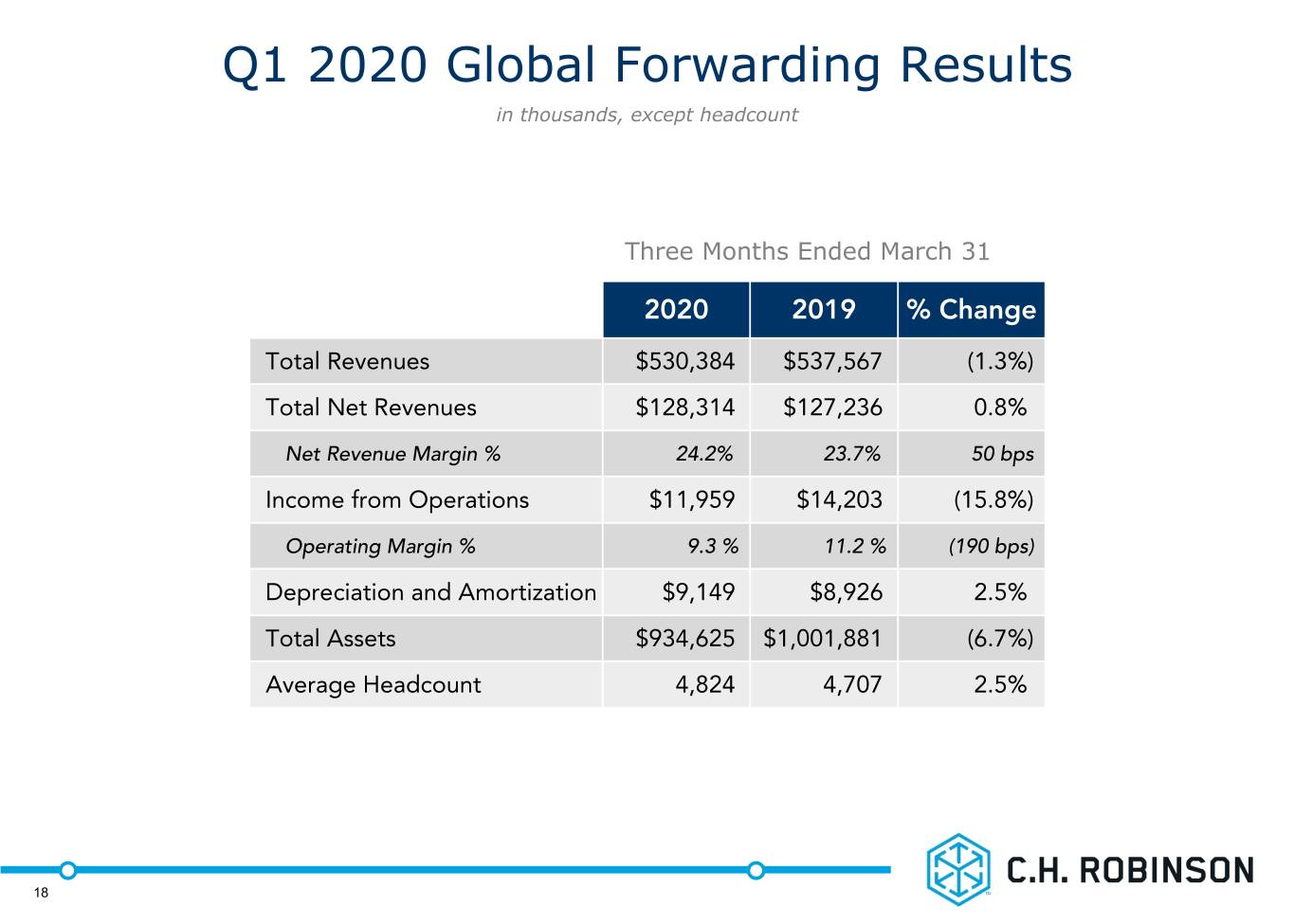

Q1 2020 Global Forwarding Results in thousands, except headcount Three Months Ended March 31 2020 2019 % Change Total Revenues $530,384 $537,567 (1.3%) Total Net Revenues $128,314 $127,236 0.8% Net Revenue Margin % 24.2% 23.7% 50 bps Income from Operations $11,959 $14,203 (15.8%) Operating Margin % 9.3 % 11.2 % (190 bps) Depreciation and Amortization $9,149 $8,926 2.5% Total Assets $934,625 $1,001,881 (6.7%) Average Headcount 4,824 4,707 2.5% ‹#› 18

Q1 2020 All Other and Corporate Results in thousands, except headcount Three Months Ended March 31 2020 2019 % Change Total Revenues $450,879 $416,859 8.2% Total Net Revenues $66,861 $65,014 2.8% Income from Operations ($1,045) ($936) NM Depreciation and Amortization $9,990 $9,375 6.6% Total Assets $970,976 $1,001,895 (3.1%) Average Headcount 3,588 3,250 10.4% ‹#› 19

20