Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FRANKLIN FINANCIAL SERVICES CORP /PA/ | fraf-20200427x8k.htm |

Exhibit 99.1

COVID-19 Response & 2020 Financial Updates F&M TRUST Franklin Financial Services Corporation 1

Forward Looking Statements Certain statements appearing herein which are not historical in nature are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements refer to a future period or periods, reflecting management’s current views as to likely future developments, and use words “may,” “will,” “expect,” “believe,” “estimate,” “anticipate,” or similar terms. Because forward-looking statements involve certain risks, uncertainties and other factors over which Franklin Financial Services Corporation has no direct control, actual results could differ materially from those contemplated in such statements. These factors include (but are not limited to) the following: general economic conditions, changes in interest rates, changes in the Corporation’s cost of funds, changes in government monetary policy, changes in government regulation and taxation of financial institutions, changes in the rate of inflation, changes in technology, the intensification of competition within the Corporation’s market area, and other similar factors. We caution readers not to place undue reliance on these forward-looking statements. They only reflect management’s analysis as of this date. The Corporation does not revise or update these forward-looking statements to reflect events or changed circumstances. Please carefully review the risk factors described in other documents the Corporation files from time to time with the SEC, including the Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and any Current Reports on Form 8-K. F&M TRUST Franklin Financial Services Corporation 2

CEO Comments On April 28, 2020 at 9:00 AM the Franklin Financial Services Corporation will hold its annual shareholders meeting. Unlike any previous year this meeting will be held virtually as the Company’s response to the COVID-19 pandemic and in compliance with the laws and regulations of the Commonwealth of Pennsylvania. Due to the change in how the Annual Meeting will be conducted many of the comments and presentations typical and customary of our annual meetings will be suspended. This year your Chairman’s remarks will be shortened, there will not be a guest speaker and there will not be comments from our Chief Financial Officer. Your company’s CEO / President will make some specific comments and together the CEO and CFO will answer questions but otherwise the actions of the annual meeting will be taken in a direct business only manner. We hope that in 2021 we can return to the format you are accustomed to, perhaps running in tandem with a virtual presentation. To supplement the annual meeting, we are releasing the following investor presentation on Form 8(k). The information enclosed in the presentation will inform the reader of the Company’s actions in the face of the pandemic to protect and help our employees, our customers and the communities we serve. Unlike typical annual meetings when the results from the previous fiscal year and the most recent quarter are discussed we will not be spending much time to focus on the past. The 2019 annual results and the results of the first quarter of 2020 are thoroughly discussed in the Company’s Form 10(k) and 2020 first quarter earnings release, respectively. Suffice it to say 2019 was a record year for your company and the results from the first quarter of 2020, before consideration of the extra provision for loan loss, would have placed it as one of the best quarters in the Company’s history. F&M TRUST Franklin Financial Services Corporation 3

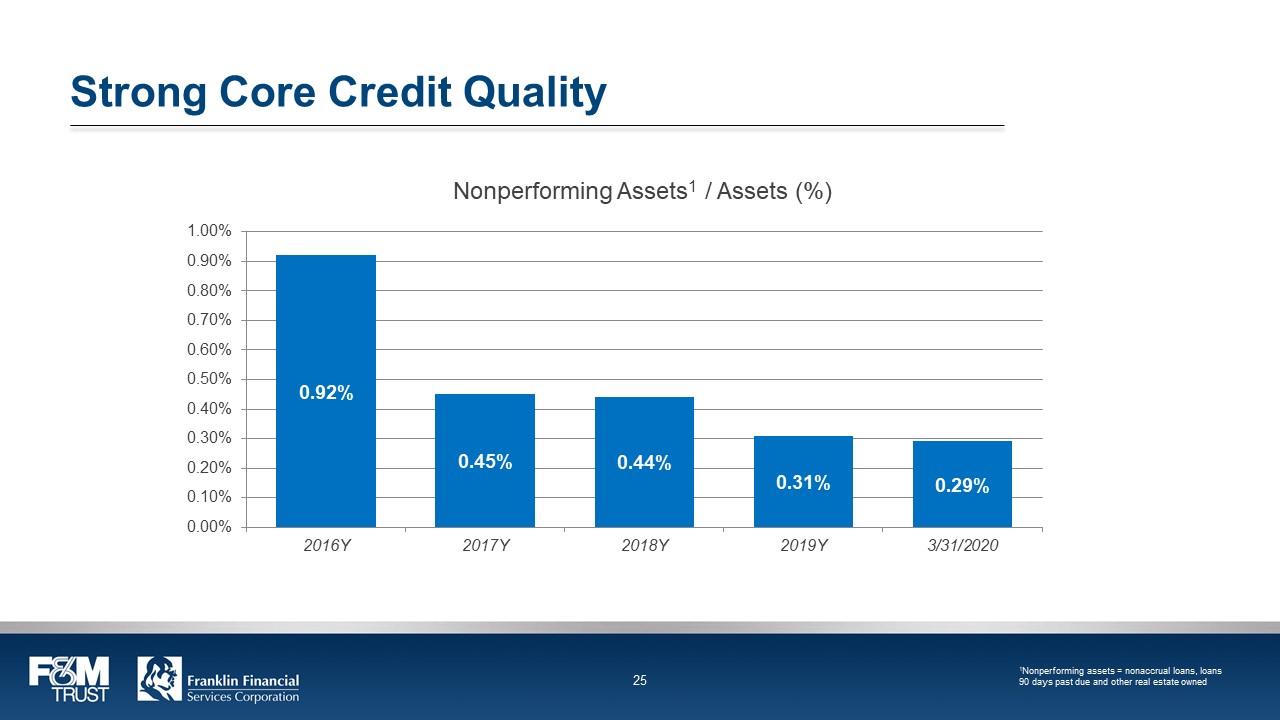

CEO Comments We must all recognize that this is not a typical year. The real value of our performance in 2019 and at the beginning of this year was to further financially strengthen your Company so we can face the probable economic challenges the pandemic is bringing with an ability to support our customers and communities. Ultimately all of this brings value to you, our shareholders. While our credit quality today is excellent, we recognize that the Qualitative Factors underlying our loan portfolio are changing and that future economic pain as a result of the pandemic and the steps taken to control the pandemic are felt by all of us. Recognizing the potential challenges ahead we believe it is prudent to set aside additional funds in the loan loss provision now, when we can, so we can operate effectively over the next year in helping our customers and communities reestablish themselves. We believe this is an important role and responsibility of your company and we intend to prepare for and honor that role. You will see that your Board decided, unanimously, to maintain the quarterly cash dividend at $0.30 per share. We are able to do so because our capital and earnings are strong. Over the next 90 days we hope to have a clearer picture of the challenges that lie ahead, and we will continue to adapt so as to be effective in the new environment. We have made a lot of changes to the bank over the last several years and those changes have now positioned us to move confidently forward into the new challenges that wait for us. We appreciate the support of our shareholders and I am available to you at anytime to listen to your concerns and ideas and answer your questions to the best of my ability. Be safe, F&M TRUST Franklin Financial Services Corporation 4

Response to COVID-19 Pandemic Operational Response Customer Assistance Communication and Marketing Community Support F&M TRUST Franklin Financial Services Corporation 5

Operational Response Closed lobby access to all F&M Trust Community Offices effective March 20, 2020 to ensure the safety of all employees and customers Community Office drive-up services and access to banking services that require an appointment remain available Modified operations at the bank’s Camp Hill and Brookview Community Offices based on specific circumstances at those locations All F&M Trust employees started a work from home rotation schedule on March 20, 2020 Bank personnel are now equipped with technology solutions that allow sustained performance through remote working arrangements F&M TRUST Franklin Financial Services Corporation 6

Operational Response Established COVID-19 Response Team consisting of the following senior leaders: Timothy G. Henry – President and Chief Executive Officer Lorie Heckman – Senior Vice President, Chief Risk Officer Karen K. Carmack, DM – Senior Vice President, Chief Human Resources Officer The bank’s COVID-19 Response Team and additional senior leaders listed below started and continue to conduct daily virtual briefings to coordinate operations and monitor issues related to the COVID-19 pandemic Mark R. Hollar – Senior Vice President, Chief Financial Officer & Treasurer Steven D. Butz – Senior Vice President, Chief Commercial Services Officer Susan L. Rosenberg, JD – Senior Vice President, Chief Investment & Trust Services Officer Patricia A. Hanks – Senior Vice President, Chief Retail Services Officer Ronald L. Cekovich – Senior Vice President, Chief Information & Operations Officer Matthew D. Weaver – Senior Vice President, Chief Marketing Officer F&M TRUST Franklin Financial Services Corporation 7

Customer Assistance Directed customers to the bank’s convenience services including online banking, the F&M Trust mobile banking app, Freedom Access Center (telephone banking) and call center Introduced an Emergency Personal Line of Credit for existing and non-customers who are experiencing a financial hardship Responded to requests from commercial and retail customers to provide loan modifications including three to six month interest-only or full payment deferrals due to economic conditions Posted content on social media channels and the bank’s blog, Money Moves, educating our customers and communities of fraud and scams related to COVID-19 F&M TRUST Franklin Financial Services Corporation 8

Customer Assistance Participated in the Paycheck Protection Program (PPP), under the Coronavirus Aid, Relief and Economic Security (CARES) Act, to offer economic relief for local businesses Allocated bank-wide resources to support the program and processed 512 PPP applications resulting in $50.2 million in approved loans for F&M Trust customers during the initial round of funding which was available on April 3, 2020 99.6% of the bank’s applicants were successfully funded during the first round of the program and loan amounts ranged from $1,855 to $2,516,147 F&M Trust continues to support PPP loan applications for customers and non-customers during the additional round of funding made available on April 24, 2020 To date, the Paycheck Protection Program loans impacted 512 small businesses with nearly 6,500 employees within the F&M Trust marketplace Anticipate $2.0 million in fee income will be generated from the Paycheck Protection Program which will likely be realized over the second and third quarters of 2020 F&M TRUST Franklin Financial Services Corporation 9

Communication and Marketing Published content on the bank’s website, fmtrust. bank, with updates and resources related to COVID-19, the Paycheck Protection Program and the CARES Act federal stimulus payments Provided timely and valuable information to customers through multiple channels including email, social media, online and mobile banking and office drive-up windows Launched “We Got This” campaign on television, radio, outdoor, digital and direct mail to promote a relevant message during the challenging times COVID-19 Information and Updates HOME COVID-I9 WE GOT THIS, CENTRAL PA Here when you need us... then, now, always. F&M TRUST F&M Trust was founded for farmers and merchants in 1906. Since then, we've also helped first responders and electricians Nurses, retail specialists and truck drivers. Customers. Neighbors. Friends. We got this Central PA. Together. And were here for you. Community Office Updates As an essential business. F&M Trust remains open and stands ready to assist you with your financial needs. Rest assured, your money is safe. In fact the safest place for your money is «i the bank because it is FDIC-insured. F&M Trust will continue to maintain operations, protect your deposits and provide ongoing access to your funds Community Office drive-up services are available. Please Click Her# for information on locations and hours Lobby access to all F&M Trust Community Offices is closed until further notice to ensure the safety of our customers and employees. Our offices will provide access to safe deposit boxes and banking services that require an in-person meeting by appointment only. Lobby access and drive-up services at our Camp Hill Office are closed at this time. Customers in this community can access drive-up services and banking services that require an in-person meeting at our Mechanicsburg Office, located at 6375 Carlisle Pike Please call 717.697 0444 or 717.264 6116 for assistance or to schedule an appointment. F&M TRUST Franklin Financial Services Corporation 10

Community Support F&M Trust committed a $100,000 public investment to be distributed across the bank’s marketplace for COVID-19 relief efforts The funds for this effort were reallocated from budgeted business development activities, bank events and sponsorships that were cancelled due to COVID-19 Organizations receiving the investment include the United Way of Franklin County, the United Way of the Capital Region, the United Way of Carlisle & Cumberland County, the United Way of the Shippensburg area, the Fulton County Family Partnership and numerous fire companies and emergency rescue services that support the bank’s community office network F&M TRUST Franklin Financial Services Corporation 11

YTD Financial Updates Reduced deposit rates in February and March in response to market conditions Recorded a provision for loan loss expense of $3 million for the first quarter of 2020 due to changing Qualitative Factors related to the COVID-19 pandemic Provided payment modifications on 206 loans totaling approximately $165 million Capital position remained strong with a total risk-based capital ratio of 15.80% and a leverage ratio of 9.45% Maintained the dividend at $0.30 per share for the second quarter of 2020 Liquidity remained strong both on the balance sheet and with resources available if needed including Paycheck Protection Program Liquidity Facility (PPPLF) funding F&M TRUST Franklin Financial Services Corporation 12

YTD Financial Updates Profitability from 2019 and the first quarter of 2020 positioned the company to increase the allowance for loan losses and strengthen capital levels as the company heads into a time of economic uncertainty Loan-to-deposit ratio of 84% enhances liquidity position and allows for quality lending opportunities Significant reduction in participation loans has improved overall portfolio credit quality 54 new mortgage originations for $11.1 million, an increase of 39.4% from the first quarter of 2019 Fee income from new mortgages originated for sale in the secondary market increased $67,000 over the same period in 2019 F&M TRUST Franklin Financial Services Corporation 13

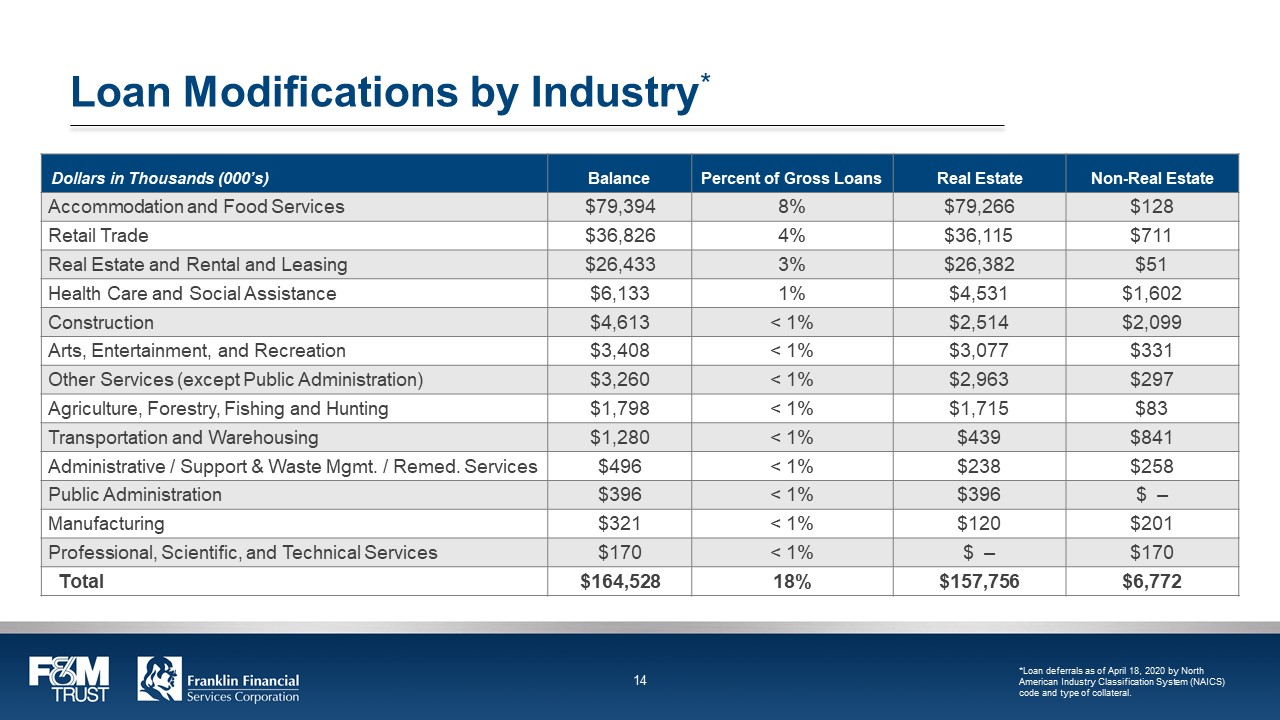

Loan Modifications by Industry*Dollars in Thousands (000’s) Balance Percent of Gross Loans Real Estate Non-Real Estate Accommodation and Food Services$79,394 8% $79,266 $128 Retail Trade$36,826 4% $36,115 $711 Real Estate and Rental and Leasing$26,433 3% $26,382 $51 Health Care and Social Assistance $6,133 1% $4,531 $1,602 Construction $4,613 < 1% $2,514 $2,099 Arts, Entertainment, and Recreation$3,408< 1%$3,077 $331 Other Services (except Public Administration) $3,260 < 1% $2,963 $297 Agriculture, Forestry, Fishing and Hunting $1,798 < 1% $1,715 $83 Transportation and Warehousing $1,280 < 1% $439 $841 Administrative / Support & Waste Mgmt. / Remed. Services $496 < 1% $238 $258 Public Administration $396 < 1% $396 $– Manufacturing $321 < 1% $120 $201 Professional, Scientific, and Technical Services $170 < 1% $– $170Total $164,528 18% $157,756 $6,772 *Loan deferrals as of April 18, 2020 by North American Industry Classification System (NAICS) code and type of collateral. F&M TRUST Franklin Financial Services Corporation 14

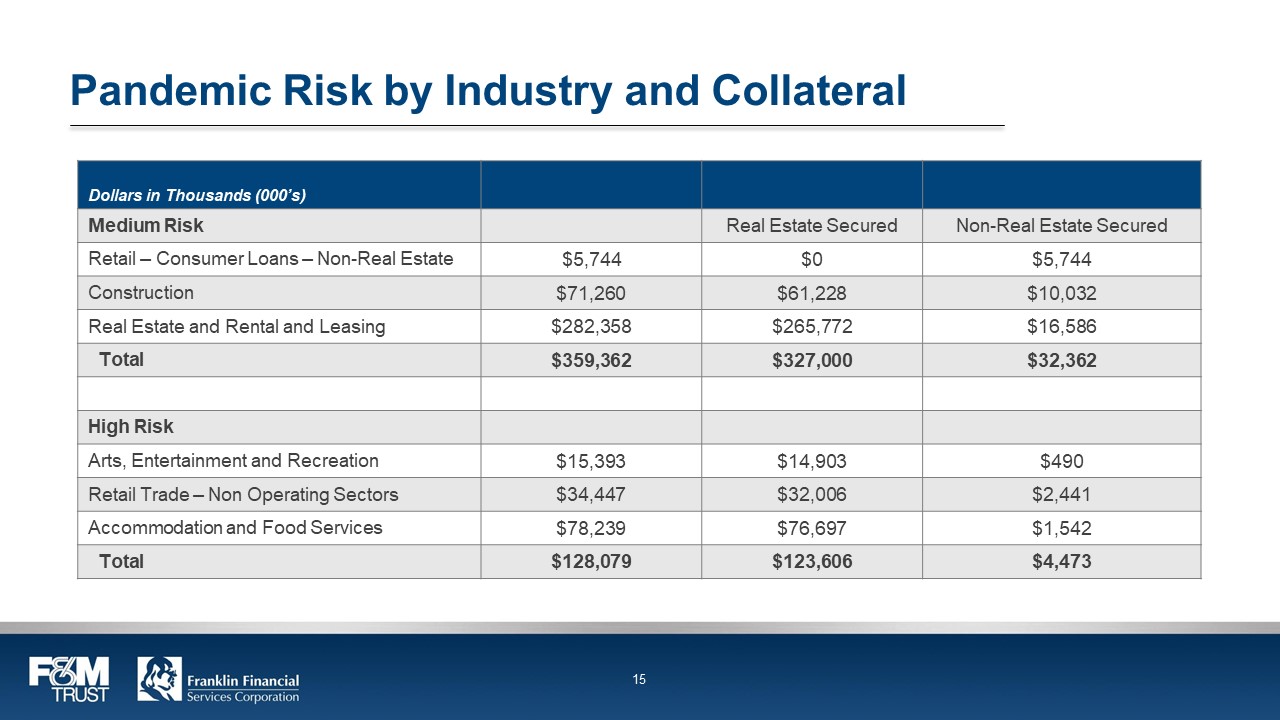

Pandemic Risk by Industry and Collateral Dollars in Thousands (000’s) Medium Risk Real Estate Secured Non-Real Estate Secured Retail – Consumer Loans – Non-Real Estate $5,744 $0 $5,744 Construction $71,260 $61,228 $10,032 Real Estate and Rental and Leasing $282,358 $265,772 $16,586 Total $359,362 $327,000 $32,362 High Risk Arts, Entertainment and Recreation $15,393 $14,903 $490 Retail Trade – Non Operating Sectors $34,447 $32,006 $2,441 Accommodation and Food Services $78,239 $76,697 $1,542 Total $128,079 $123,606 $4,473 F&M TRUST Franklin Financial Services Corporation 15

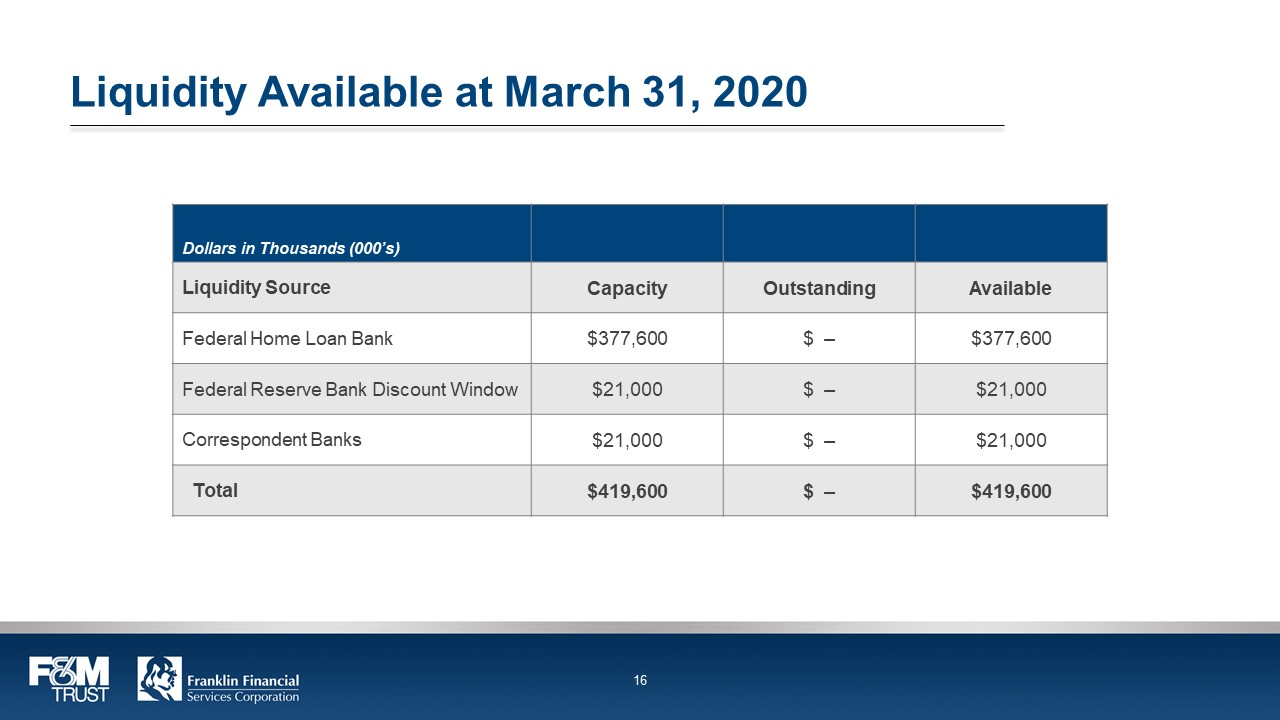

Liquidity Available at March 31, 2020 Dollars in Thousands (000’s) Liquidity Source Capacity Outstanding Available Federal Home Loan Bank $377,600 $– $377,600 Federal Reserve Bank Discount Window $21,000 $– $21,000 Correspondent Banks $21,000 $– $21,000 Total $419,600 $– $419,600 F&M TRUST Franklin Financial Services Corporation 16

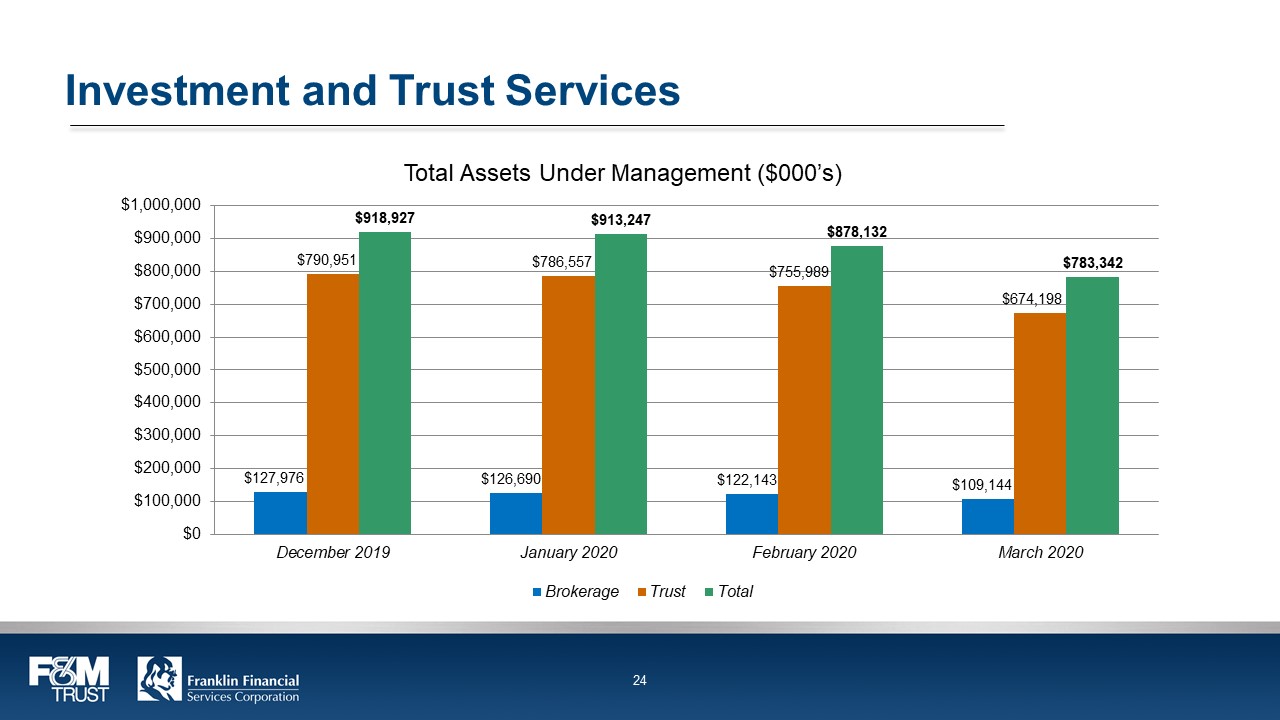

Outlook for 2020 Additional provision for loan losses expected for the second quarter of 2020 Anticipating a challenging environment and slow economic recovery in the second half of 2020 and into 2021 Lower interest rate environment will continue to put pressure on net interest margin Moderate loan demand through 2020 and strong competition to meet that demand Deposit growth likely as depositors look for safety for their funds Lower fee income in Investment & Trust Services business line primarily due to equity market performance Use of the Paycheck Protection Program Liquidity Facility (PPPLF) to fund PPP loans to protect current liquidity resources F&M TRUST Franklin Financial Services Corporation 17

Financial Updates First Quarter Ended March 31, 2020 F&M TRUST Franklin Financial Services Corporation 18

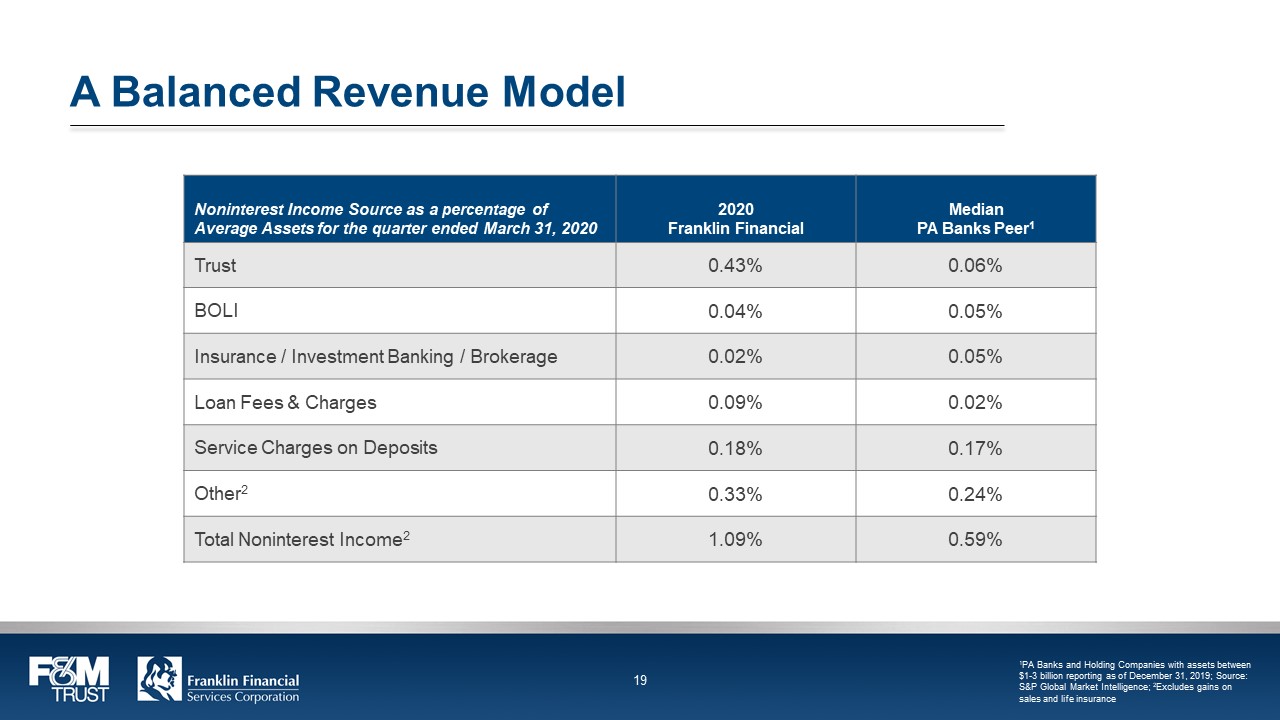

A Balanced Revenue Model Noninterest Income Source as a percentage of Average Assets for the quarter ended March 31, 2020 2020 Franklin Financial Median PA Banks Peer 1 Trust 0.43% 0.06% BOLI 0.04% 0.05% Insurance / Investment Banking / Brokerage 0.02% 0.05% Loan Fees & Charges 0.09% 0.02% Service Charges on Deposits 0.18% 0.17% Other 2 0.33% 0.24% Total Noninterest Income 2 1.09% 0.59% F&M TRUST 1PA Banks and Holding Companies with assets between $1-3 billion reporting as of December 31, 2019; Source: S&P Global Market Intelligence; 2Excludes gains on sales and life insurance F&M TRUST Franklin Financial Services Corporation 19

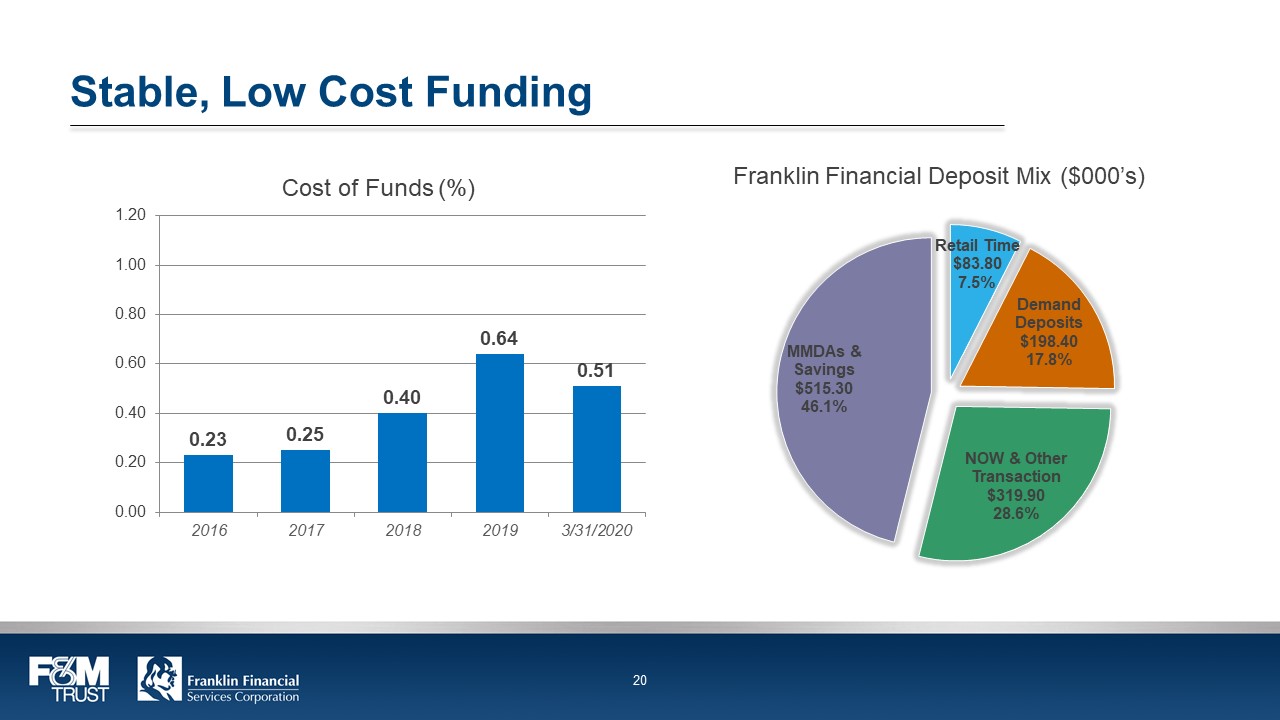

Stable, Low Cost Funding Cost of Funds (%) 0.00 0.20 0.40 0.60 0.80 0.80 1.00 1.20 2016 0.23 2017 0.25 2018 0.40 2019 3/31/2020 Franklin Financial Deposit Mix ($000’s) MMDAs & Savings $515.30 46.1% NOW & Other Transaction $319.90 28.6% F&M TRUST Franklin Financial Services Corporation 20

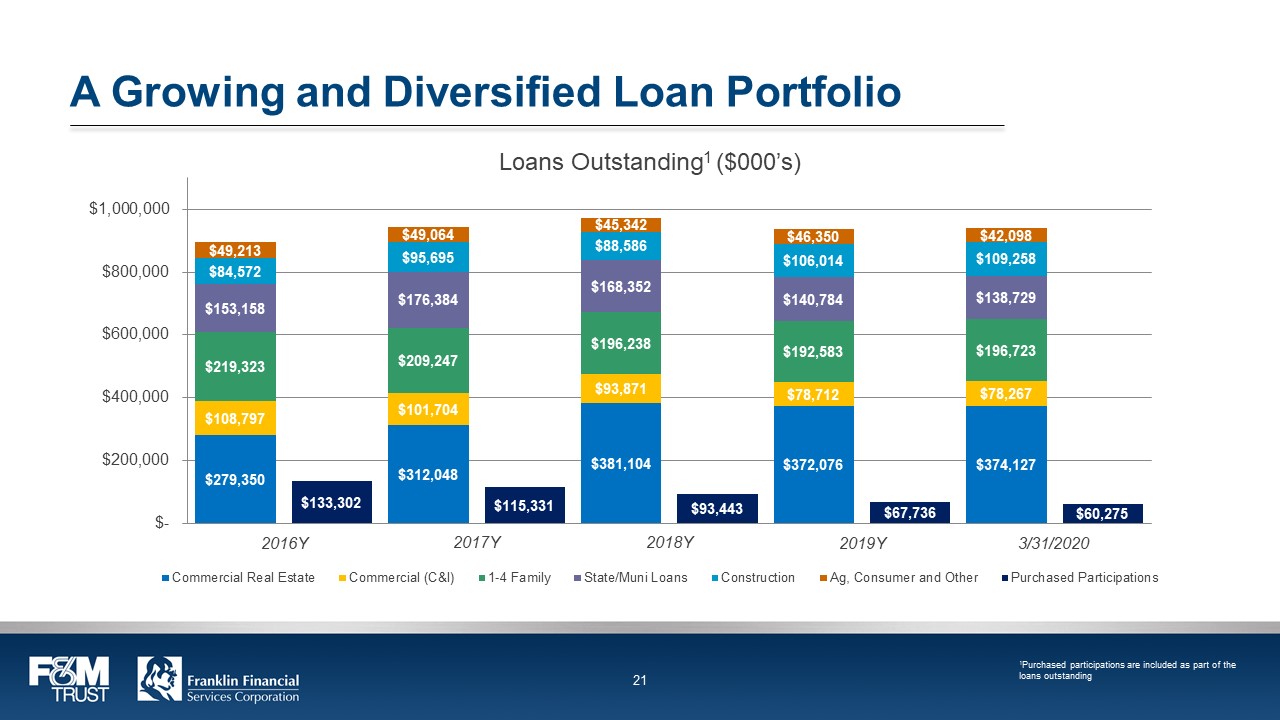

A Growing and Diversified Loan Portfolio Loans Outstanding 1 ($000’s) $ $200,000 $400,000 $600,000 $800,00 $1,000,000 2016Y $279,350 $108,797 $219,323 $153,158 $84,572 $49,213 $133,302 2017Y $312,048 $101,704 $209,247 $176,384 $95,695 $49,064 $115,331 2018Y $381,104 $93,871 $196,238 $168,352 $88,586 $45,342 $93,443 2019Y $372,076 $78,712 $192,583 $140,784 $106,014 $46,350 $67,736 3/31/2020 $374,127 $78,267 $196,723 $138,729 $109,258 $42,098 $60,275 Commercial Real Estate Commercial (C&I) 1-4 Family State/Muni Loans Construction Ag, Consumer and other Purchased Participations 1Purchased participations are included as part of the loans outstanding F&M TRUST Franklin Financial Services Corporation 21

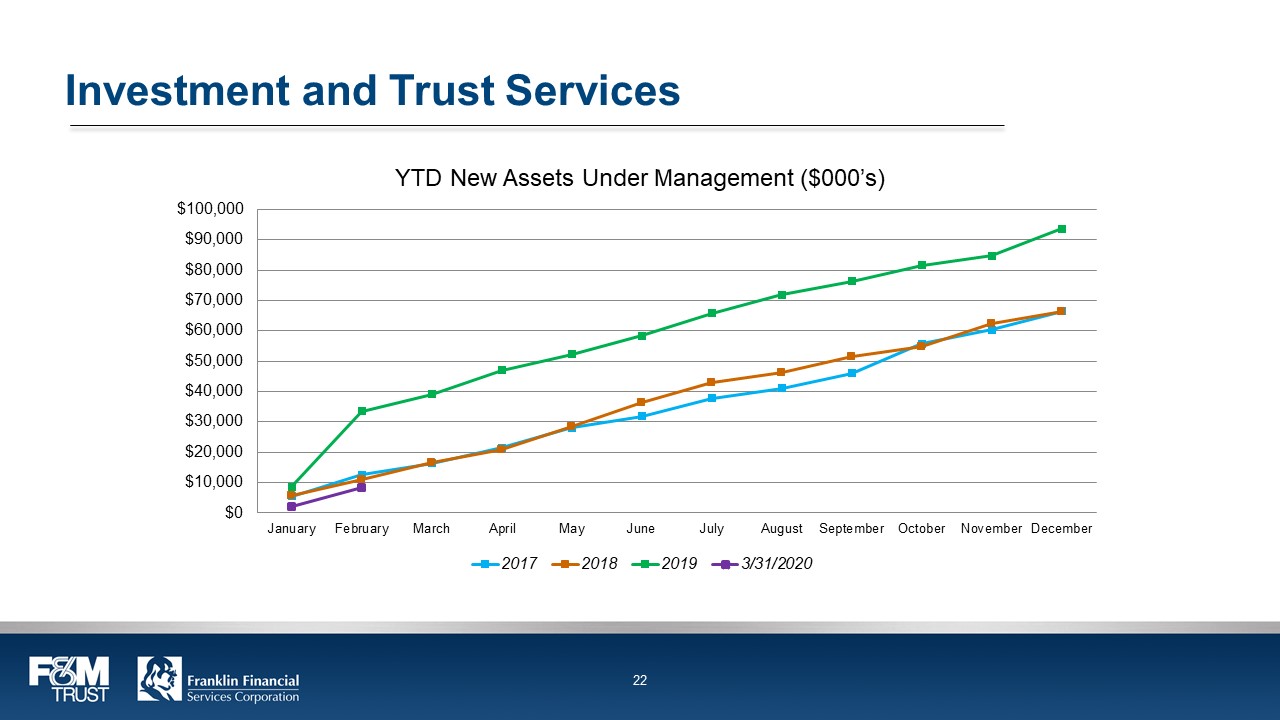

Investment and Trust Services YTD New Assets Under Management ($000’s) $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 $100,000 January February March April May June July August September October November December 2017 2018 2019 3/31/2020 F&M TRUST Franklin Financial Services Corporation 22

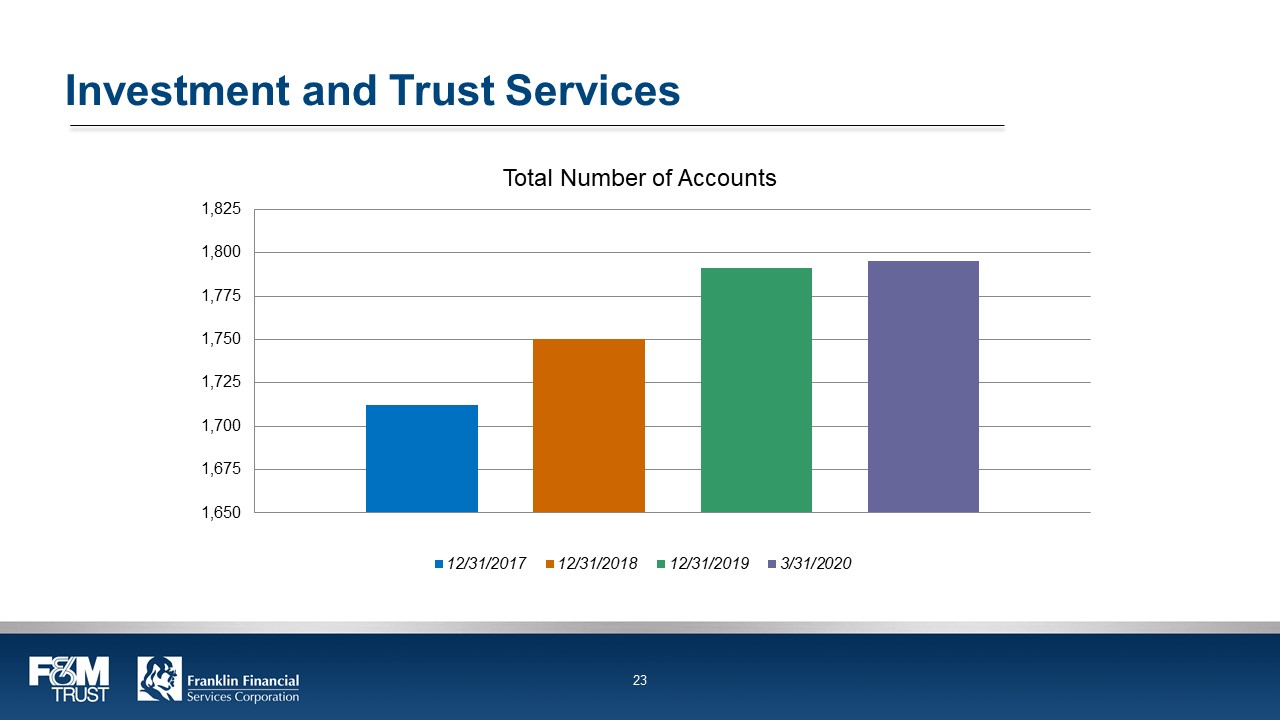

Investment and Trust Services Total Number of Accounts 1,650 1,675 1,700 1,725 1,750 1,775 1,800 1,825 12/31/2017 12/31/2018 12/31/2019 3/31/2020 F&M TRUST Franklin Financial Services Corporation 23

Investment and Trust Services Total Assets Under Management ($000’s) $0 $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 $800,000 $900,000 $1,000,000 December 2019 $127,976 $790,951 $918,927 January 2020 $126,690 $786,557 $913,247 $122,143 $755,989 $878,132 March 2020 $109,144 $674,198 $783,342 Brokerage Trust Total F&M TRUST Franklin Financial Services Corporation 24

Strong Core Credit Quality Nonperforming Assets 1 / Assets (%) 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 0.70% 0.80% 0.90% 1.00% 2016Y 0.92% 2017Y 0.45% 2018Y 0.44% 2019 0.31% 3/31/2020 0.29% 1Nonperforming assets = nonaccrual loans, loans 90 days past due and other real estate owned F&M TRUST Franklin Financial Services Corporation 25

Balance Sheet Highlights Dollars in Thousands (000’s) 2016Y 2017Y 2018Y 2019Y 3/31/2020 Total Assets $1,127,443 $1,179,813 $1,209,587 $1,270,923 $1,262,126 Cash and Cash Equiv. $36,665 $58,603 $52,957 $83,828 $53,350 Investments $145,925 $127,336 $131,846 $197,084 $218,818 Net Loans $883,338 $932,350 $960,960 $922,609 $921,656 Deposits $982,120 $1,047,181 $1,082,629 $1,125,392 $1,117,433 Shareholders’ Equity $116,493 $115,144 $118,396 $127,528 $129,005 F&M TRUST Franklin Financial Services Corporation 26

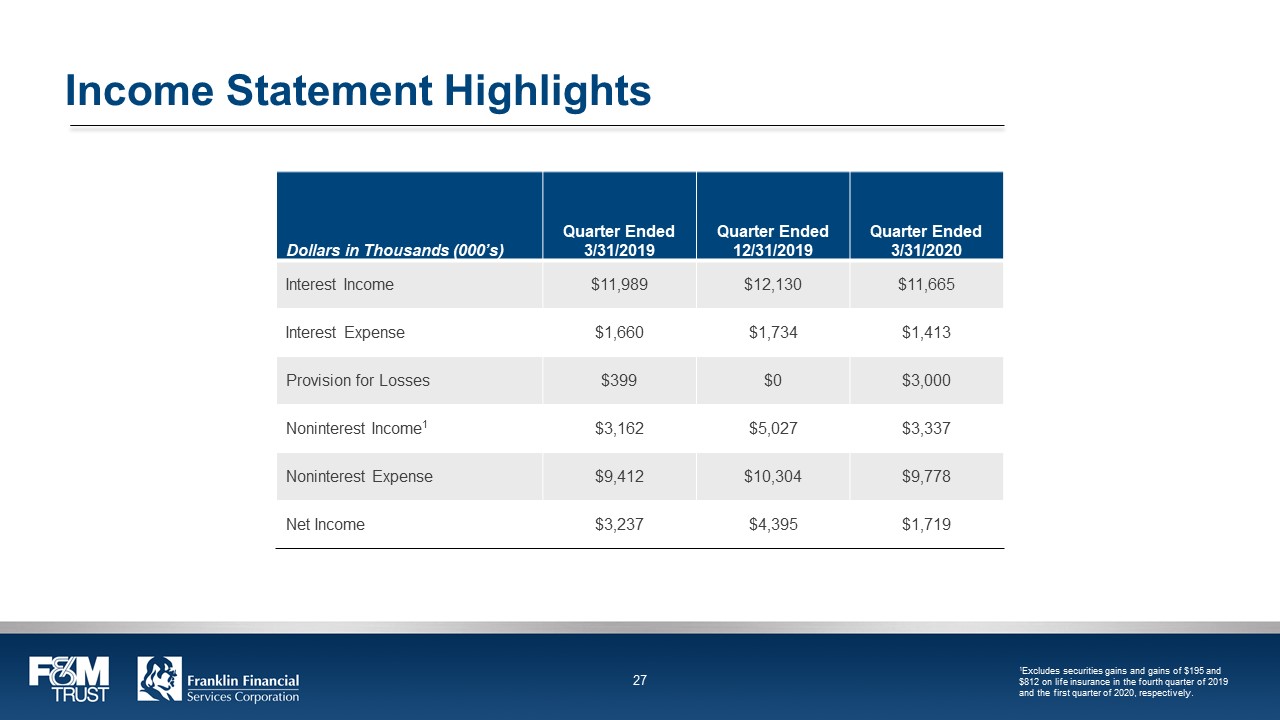

Income Statement Highlights Dollars in Thousands (000’s) Quarter Ended 3/31/2019 Quarter Ended 12/31/2019 Quarter Ended 3/31/2020 Interest Income $11,989 $12,130 $11,665 Interest Expense $1,660 $1,734 $1,413 Provision for Losses $399 $0 $3,000 Noninterest Income 1 $3,162 $5,027 $3,337 Noninterest Expense $9,412 $10,304 $9,778 Net Income $3,237 $4,395 $1,719 1 Excludes securities gains and gains of $195 and $812 on life insurance in the fourth quarter of 2019 and the first quarter of 2020, respectively. F&M TRUST Franklin Financial Services Corporation 27

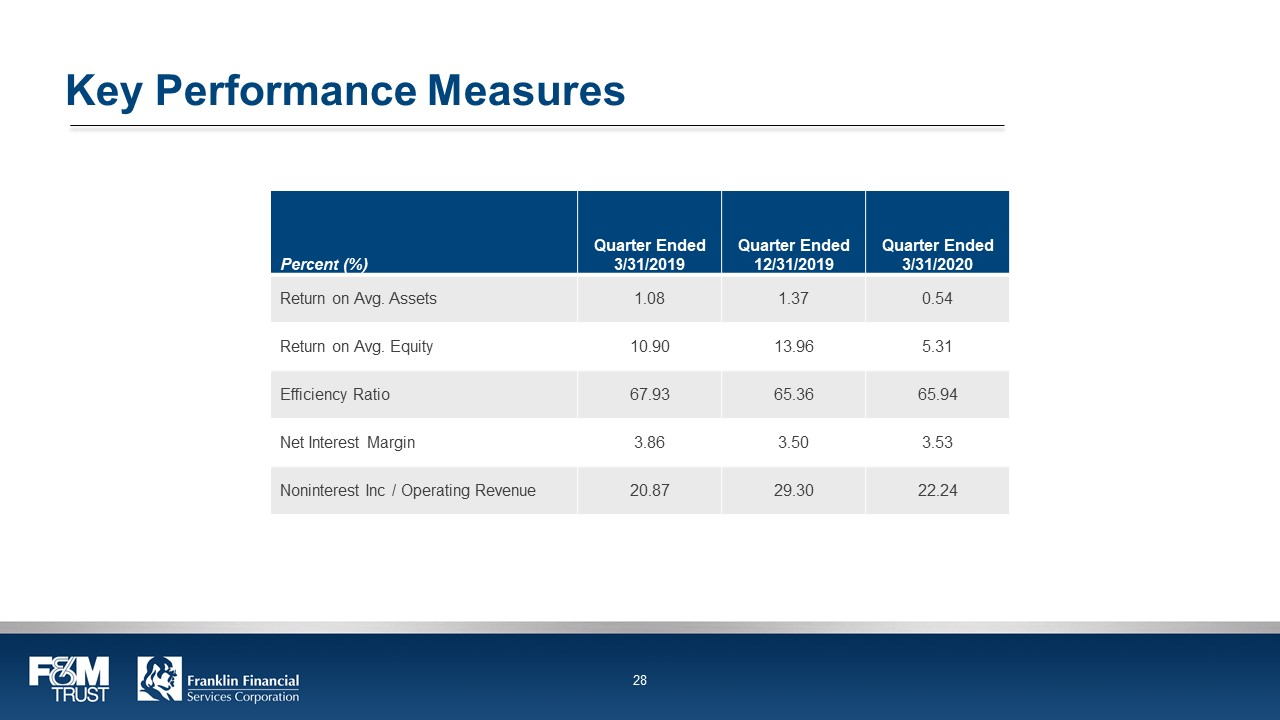

Key Performance Measures Percent (%) Quarter Ended 3/31/2019 Quarter Ended 12/31/2019 Quarter Ended 3/31/2020 Return on Avg. Assets 1.08 1.37 0.54 Return on Avg. Equity 10.90 13.96 5.31 Efficiency Ratio 67.93 65.36 65.94 Net Interest Margin 3.86 3.50 3.53 Noninterest Inc / Operating Revenue 20.87 29.30 22.24 F&M TRUST Franklin Financial Services Corporation 28

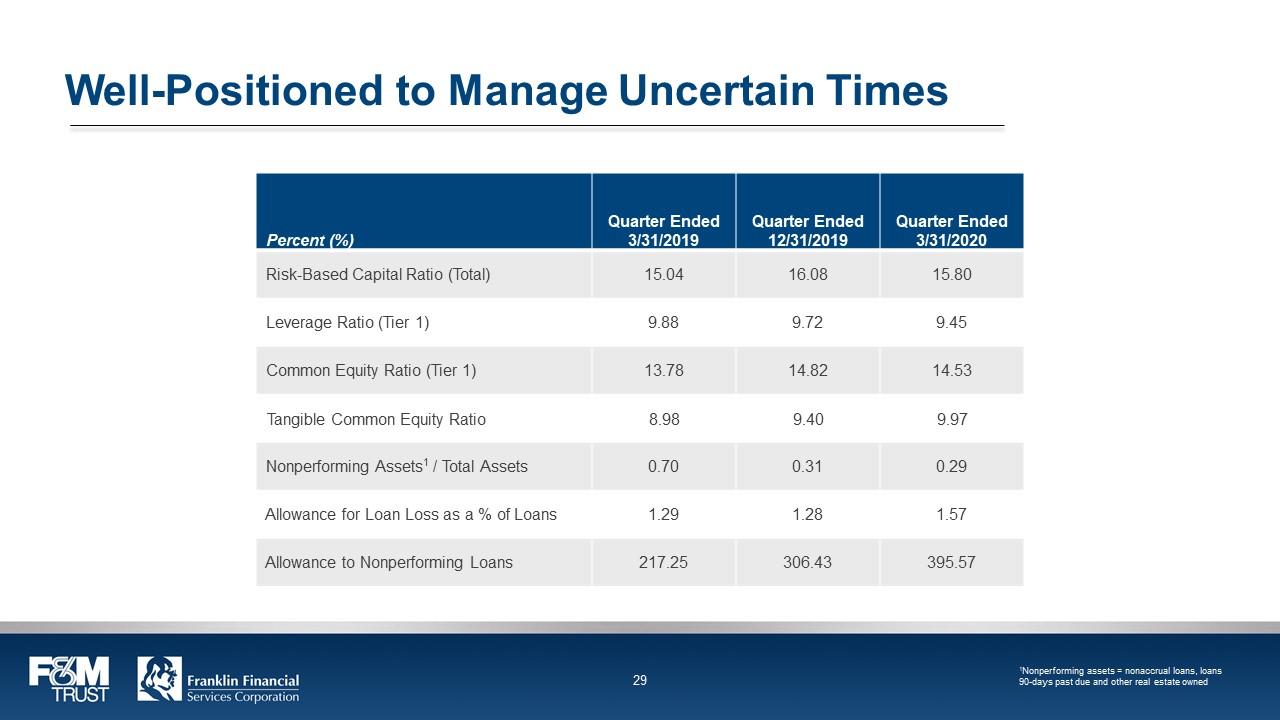

Well-Positioned to Manage Uncertain Times Percent (%) Quarter Ended 3/31/2019 Quarter Ended 12/31/2019 Quarter Ended 3/31/2020 Risk-Based Capital Ratio (Total) 15.04 16.08 15.80 Leverage Ratio (Tier 1) 9.88 9.72 9.45 Common Equity Ratio (Tier 1) 13.78 14.82 14.53 Tangible Common Equity Ratio 8.98 9.40 9.97 Nonperforming Assets 1 / Total Assets 0.70 0.31 0.29 Allowance for Loan Loss as a % of Loans 1.29 1.28 1.57 Allowance to Nonperforming Loans 217.25 306.43 395.57 1 Nonperforming assets = nonaccrual loans, loans 90-days past due and other real estate owned F&M TRUST Franklin Financial Services Corporation 29

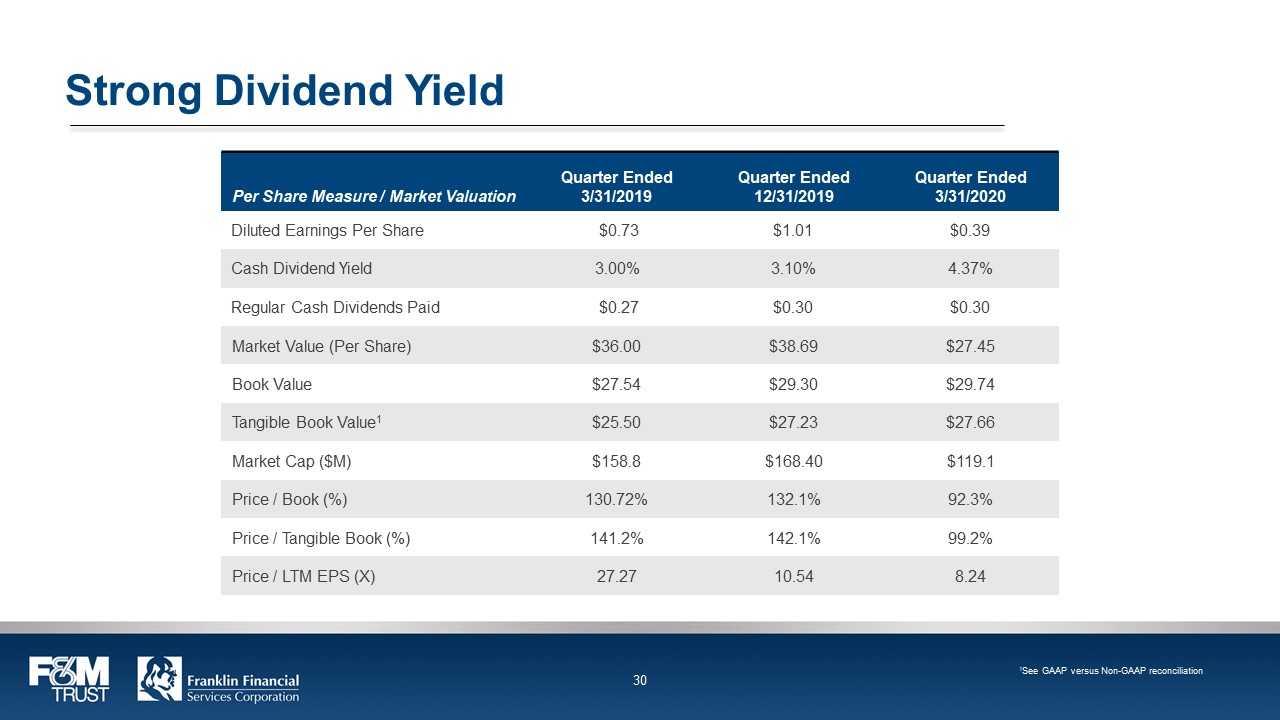

Strong Dividend Yield Per Share Measure / Market Valuation Quarter Ended 3/31/2019 Quarter Ended 12/31/2019 Quarter Ended 3/31/2020 Diluted Earnings Per Share $0.73 $1.01 $0.39 Cash Dividend Yield 3.00% 3.10% 4.37% Regular Cash Dividends Paid $0.27 $0.30 $0.30 Market Value (Per Share) $36.00 $38.69 $27.45 Book Value $27.54 $29.30 $29.74 Tangible Book Value 1 $25.50 $27.23 $27.66 Market Cap ($M) $158.8 $168.40 $119.1 Price / Book (%) 130.72% 132.1% 92.3% Price / Tangible Book (%) 141.2% 142.1% 99.2% Price / LTM EPS (X) 27.27 10.54 8.24 1 See GAAP versus Non-GAAP reconciliation F&M TRUST Franklin Financial Services Corporation 30

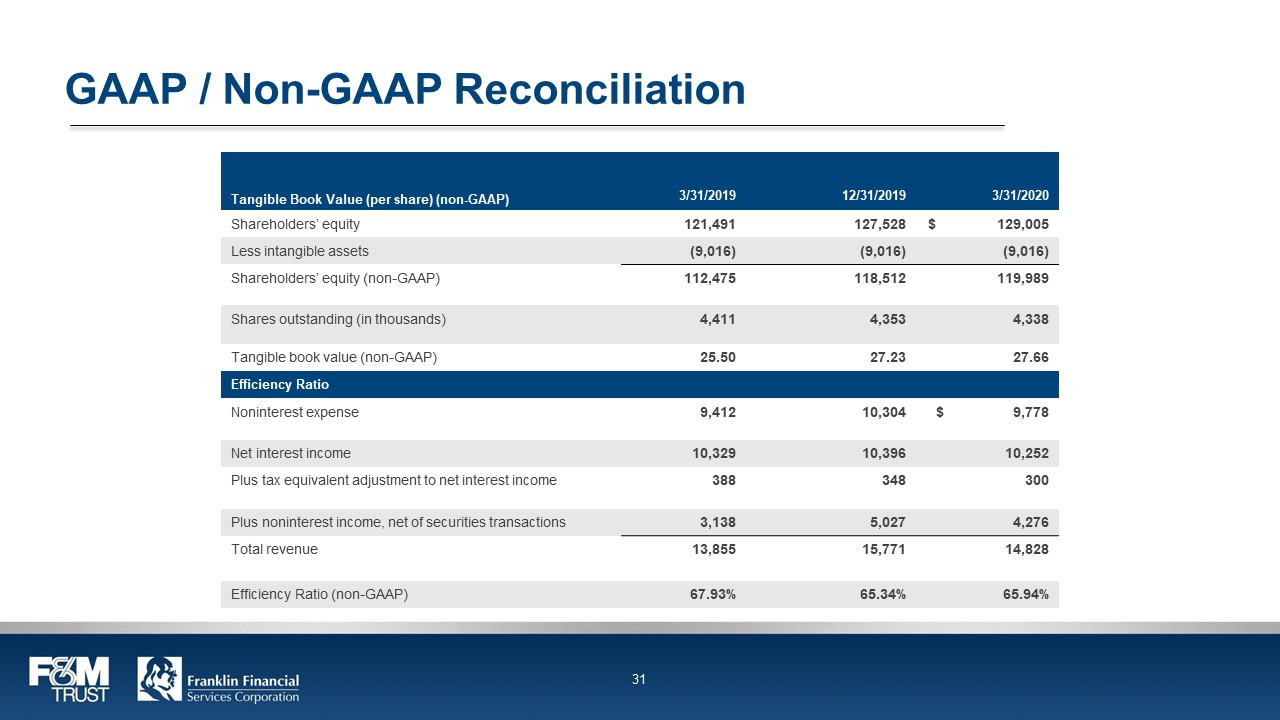

GAAP / Non-GAAP Reconciliation Tangible Book Value (per share) (non-GAAP) 3/31/2019 12/31/2019 3/31/2020 Shareholders’ equity 121,491 127,528 $ 129,005 Less intangible assets (9,016) (9,016) (9,016) Shareholders’ equity (non-GAAP) 112,475 118,512 119,989 Shares outstanding (in thousands) 4,411 4,353 4,338 Tangible book value (non-GAAP) 25.50 27.23 27.66 Efficiency Ratio Noninterest expense 9,412 10,304 $ 9,778 Net interest income 10,329 10,396 10,252 Plus tax equivalent adjustment to net interest income 388 348 300 Plus noninterest income, net of securities transactions 3,138 5,027 4,276 Total revenue 13,855 15,771 14,828 Efficiency Ratio (non-GAAP) 67.93% 65.34% 65.94% F&M TRUST Franklin Financial Services Corporation 31

Summary The Company is well capitalized which provides the ability to assist customers and communities through a challenging time Asset quality is good due to significantly lower dependence on participation loans Seasoned and experienced senior management team has previously worked through difficult economic conditions Earnings performance leading into uncertain times allows for additional provision for loan losses Liquidity remains strong with resources available if needed F&M TRUST Franklin Financial Services Corporation 32

Thank You Stock Symbol: FRAF (Nasdaq) www.franklinfin.com www.fmtrust.bank F&M TRUST Franklin Financial Services Corporation 33