Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Bank of New York Mellon Corp | ex992financialsuppleme.htm |

| EX-99.1 - EXHIBIT 99.1 - Bank of New York Mellon Corp | ex991earningsrelease1q.htm |

| 8-K - FORM 8-K - Bank of New York Mellon Corp | form8-kearningsapril16.htm |

First Quarter 2020 Financial Highlights April 16, 2020

Management Priorities in Response to Coronavirus Impact » Support well-being of employees and communities during challenging time Employees » Early and successful initiation of our business continuity plans » Significant majority of global workforce working remotely » Operationally resilient Clients » Laser focused on helping clients manage through disruption and uncertainty » Digital capabilities enabling clients to continue operations » Maintaining strong, liquid and lower risk balance sheet Balance Sheet » Supporting our clients and markets 2 First Quarter 2020 – Financial Highlights

Resilient During Volatile Markets » Performs relatively well under stress Attractive » Client base of leading institutional clients, governments, endowments and pension funds business model » Diversified and stable business mix with high percentage of recurring revenue » Lower credit and market risk Lower » High quality loan portfolio supporting broad relationships risk profile » Predominantly AAA/AA and government securities » Controlling expenses during uncertain times Disciplined » Prior investments strengthened technology infrastructure and operations execution » Executing on comprehensive business continuity plans » Continuing to focus on long-term strategic priorities » Capital and liquidity ratios remain comfortably above internal targets and regulatory minimums Strong and liquid » Using our substantial resources to support client activities balance sheet » Consistent returns and proven capital generation 3 First Quarter 2020 – Financial Highlights

1Q20 Financial Results PROFITS RETURNS BALANCE SHEET › Net Income: $944 million › ROE: 10.1% › CET1: 11.3% › Diluted EPS: $1.05 › ROTCE: 20.4% (a) › Tier 1 Leverage: 6.0% › Returned $1.3 billion to shareholders › SLR: 5.6% › LCR: 115% PRE - T A X I N C O M E TOTAL REVENUE ($ millions) ($ millions) › Investment Services revenue primarily +3% 2,965 driven by higher foreign exchange and transaction revenues 1,822 75 3,014 +9% 6570 60 › Investment Management revenue 1,193 1,227 55 Services 3,242 50 Investment 4045 impacted by equity investment losses, 35 including seed capital; investment 38% 2530 31% 30% 20 management and performance fees 15 936 510 were up 2% 1Q19 4Q19 1Q20 971 (4)% Pre-tax operating margin › Expenses flat 898 Investment Investment Ex notable items(a) 4Q19 Management › Provision for credit losses of $169 PTI ($m) 1,218 1Q19 4Q19 1Q20 million; net charge-offs of $1 million Op Margin 31% › Strong capital returns (a) Represents a non-GAAP measure. See page 17 in the Appendix for corresponding reconciliation of notable items and page 18 for corresponding reconciliation of ROTCE. 4 First Quarter 2020 – Financial Highlights

1Q20 Financial Highlights ($ millions, except per share data) 1 Q 2 0 4 Q 1 9 1 Q 1 9 TOTAL REVENUE $4,108 (14)% 5% Fee revenue 3,323 (16) 10 Net interest revenue 814 - (3) Provision for credit losses 169 N/M N/M Noninterest expense 2,712 (9) - Income before income taxes 1,227 (33) 3 Net income applicable to common shareholders $944 (32)% 4% EARNINGS PER COMMON SHARE $1.05 (31)% 12% Operating leverage (a) (552) bps 488 bps Pre-tax operating margin 30% (829) bps (72) bps Return on common equity (annualized) 10.1% (451) bps 13 bps Return on tangible common equity (annualized) (b) 20.4% (891) bps (32) bps NOTABLE ITEMS (C) Increase / (decrease) Revenue Expense EPS 4Q19 includes gain from the sale of an equity investment, partially 4Q19 790 186 $0.50 offset by severance, net securities losses and litigation Note: See page 16 in the Appendix for corresponding footnotes. N/M - not meaningful; bps - basis points 5 First Quarter 2020 – Financial Highlights

Capital and Liquidity 1 Q 20 4 Q 1 9 1 Q19 Consolidated regulatory capital ratios: (a) Common Equity Tier 1 (“CET1”) ratio 11.3% 11.5% 11.1% Tier 1 capital ratio 13.5 13.7 13.2 Total capital ratio 14.3 14.4 14.0 Tier 1 leverage ratio 6.0 6.6 6.8 Supplementary leverage ratio (“SLR”) 5.6 6.1 6.3 Average liquidity coverage ratio (“LCR”) 115% 120% 118% Book value per common share $42.47 $42.12 $39.36 Tangible book value per common share – non-GAAP (b) $21.53 $21.33 $19.74 Cash dividends per common share $0.31 $0.31 $0.28 Common shares outstanding (thousands) 885,443 900,683 957,517 Note: See page 16 in the Appendix for corresponding footnotes. 6 First Quarter 2020 – Financial Highlights

Net Interest Revenue DRIVERS OF SEQUENTIAL NIR CHANGE ($ millions) › Higher deposit balances due to ongoing deposit initiatives and surge in March 815 814 › Increased investment securities and loans › Lower yields on asset portfolios were partially offset by lower deposit rates › Wider spreads between LIBOR and Fed Funds positively impacted 1Q20 4Q19 + Average + Higher – Rate impact − Hedging 1Q20 deposit securities (i.e., interest- (largely balances and loan earning asset offset in FX up ~$26bn balances yield declines and other partially offset trading) by lower deposit and funding cost) 7 First Quarter 2020 – Financial Highlights

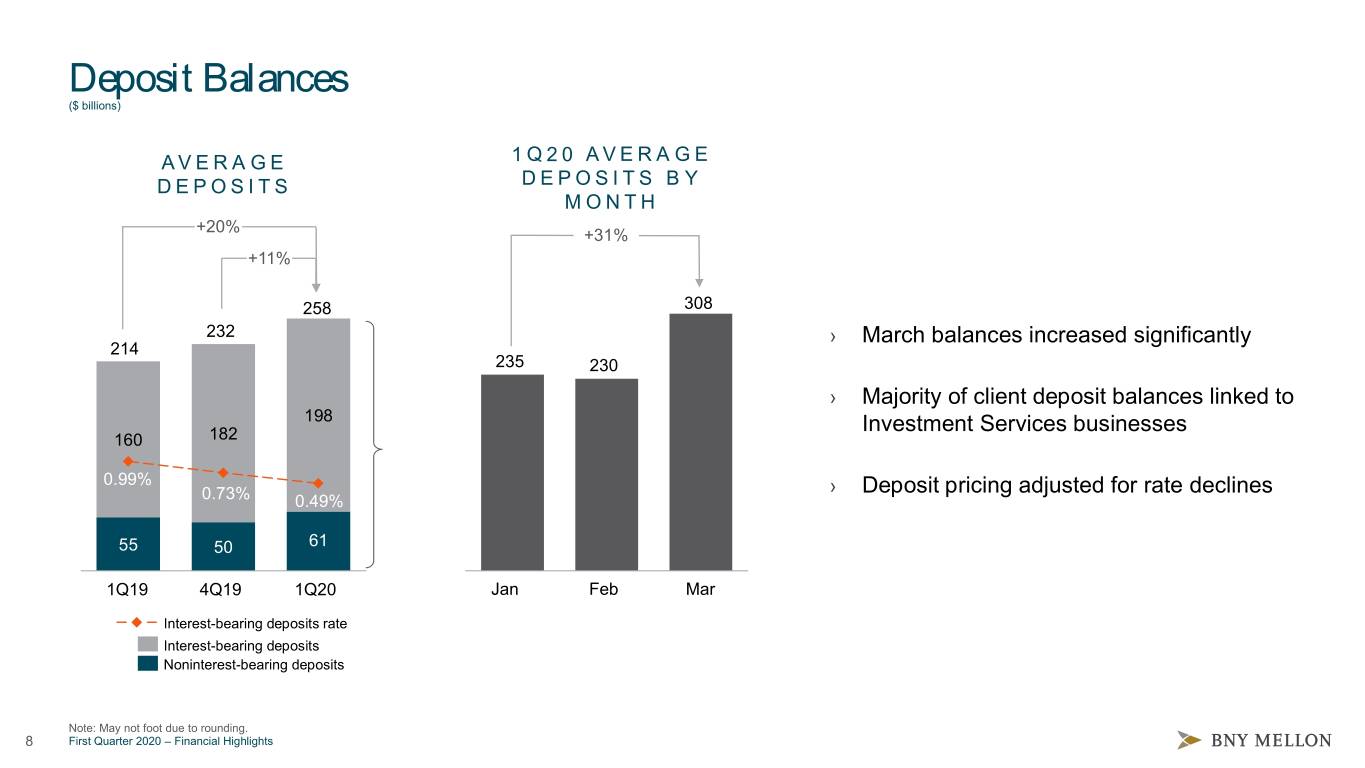

Deposit Balances ($ billions) AV E R A G E 1Q20 AVERAGE DEPOSITS DEPOSITS BY MONTH +20% +31% +11% 258 308 232 › March balances increased significantly 214 235 230 › Majority of client deposit balances linked to 198 Investment Services businesses 160 182 0.99% › Deposit pricing adjusted for rate declines 0.73% 0.49% 55 50 61 1Q19 4Q19 1Q20 Jan Feb Mar Interest-bearing deposits rate Interest-bearing deposits Noninterest-bearing deposits Note: May not foot due to rounding. 8 First Quarter 2020 – Financial Highlights

Credit Risk Profile ($ billions) AVERAGE INTEREST - (a) (a) LOANS SECURITIES EARNING ASSETS +15% +9% Corporates, CLOs, ABS, 324 Munis, CP Overdrafts Non-agency and CDs 298 56 and other Wealth RMBS & CMBS 282 4% 53 14% management 7% 51 26% Commercial 6% U.S. 136 U.S. Agency, 129 Treasuries 18% Agency 124 CRE 10% 52% RMBS and CMBS 132 21% 23% 19% 106 116 Financial Sovereign Margin institutions loans debt/guaranteed, Foreign gov’t agency, 1Q19 4Q19 1Q20 Supranational & Covered bonds Loans Securities Cash/Reverse repo Note: May not foot due to rounding. (a) Data end of period as of 3/31/20. Loan percentages are preliminary. Securities portfolio excludes trading securities. 9 First Quarter 2020 – Financial Highlights

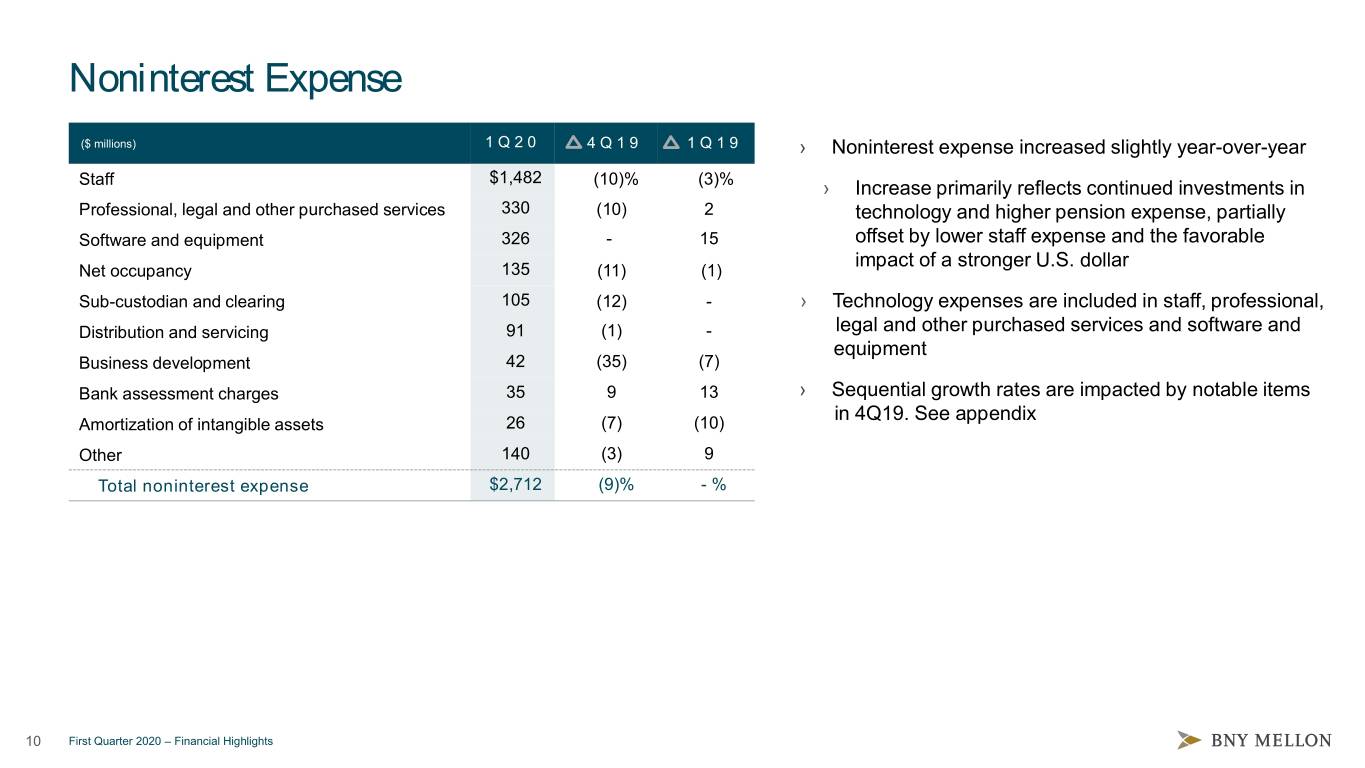

Noninterest Expense ($ millions) 1 Q 2 0 4 Q 1 9 1 Q19 › Noninterest expense increased slightly year-over-year $1,482 Staff (10)% (3)% › Increase primarily reflects continued investments in Professional, legal and other purchased services 330 (10) 2 technology and higher pension expense, partially Software and equipment 326 - 15 offset by lower staff expense and the favorable impact of a stronger U.S. dollar Net occupancy 135 (11) (1) Sub-custodian and clearing 105 (12) - › Technology expenses are included in staff, professional, Distribution and servicing 91 (1) - .legal and other purchased services and software and .equipment Business development 42 (35) (7) Bank assessment charges 35 9 13 › Sequential growth rates are impacted by notable items .in 4Q19. See appendix Amortization of intangible assets 26 (7) (10) Other 140 (3) 9 Total noninterest expense $2,712 (9)% - % 10 First Quarter 2020 – Financial Highlights

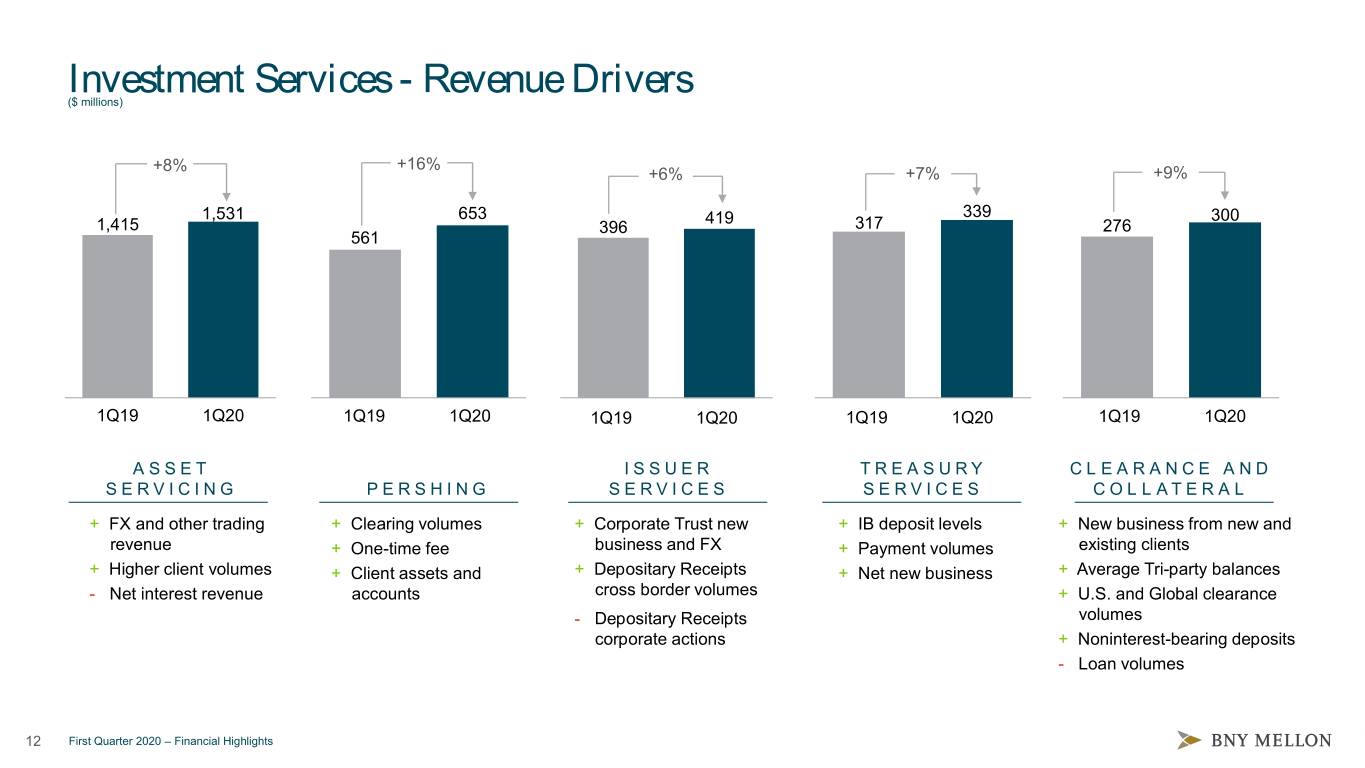

Investment Services FINANCIAL HIGHLIGHTS 1 Q 2 0 ($ millions unless otherwise noted) 4 Q 1 9 1 Q 1 9 › Asset Servicing up year-over-year on higher foreign Total revenue by line of business: exchange and other trading revenue and volumes from Asset Servicing $1,531 9% 8% existing clients, partially offset by lower net interest Pershing 653 13 16 revenue. The decrease in net interest revenue primarily Issuer Services 419 1 6 reflects lower rates, partially offset by higher deposits Treasury Services 339 3 7 and loans Clearance and Collateral Management 300 7 9 Total revenue 3,242 8 9 › Pershing up on higher clearing volumes, a one-time fee Provision for credit losses 149 N/M N/M Noninterest expense 1,987 (9) - and growth in client assets and accounts Income before taxes $1,106 32% 13% Pre-tax operating margin 34% 626 bps 120 bps › Issuer Services up due to higher Corporate Trust and Depositary Receipts fees KEY METRICS › Treasury Services up on higher fees and net interest Foreign exchange and other trading revenue $261 73% 66% revenue. The increase in net interest revenue was Securities lending revenue 46 15 5 driven by deposit growth Average loans 41,789 8 12 Average deposits 242,187 12 24 › Clearance and Collateral Management up primarily AUC/A at period end (tr) (a) 35.2 (5) 2 driven by growth in collateral management and clearance Market value of securities on loan at period end (bn) (b) $389 3% 3% volumes and higher net interest revenue Pershing Net new assets (U.S. platform) (bn) (c) $31 (6) N/M › AUC/A of $35.2 trillion up primarily reflecting higher client Average active clearing accounts (U.S. platform) (thousands) 6,437 2 4 inflows, partially offset by lower market values and the Clearance and Collateral Management unfavorable impact of a stronger U.S. dollar Average tri-party collateral mgmt. balances (tr) $3.7 5% 14% Note: See page 16 in the Appendix for corresponding footnotes. N/M - not meaningful; bps - basis points 11 First Quarter 2020 – Financial Highlights

Investment Services - Revenue Drivers ($ millions) +8% +16% +6% +7% +9% 1,531 653 419 339 300 1,415 396 317 276 561 1Q19 1Q20 1Q19 1Q20 1Q19 1Q20 1Q19 1Q20 1Q19 1Q20 A S S E T I S S U E R T R E A S U R Y CLEARANCE AND SERVICING PERSHING SERVICES SERVICES COLLATERAL + FX and other trading + Clearing volumes + Corporate Trust new + IB deposit levels + New business from new and revenue + One-time fee business and FX + Payment volumes existing clients + Higher client volumes + Client assets and + Depositary Receipts + Net new business + Average Tri-party balances - Net interest revenue accounts cross border volumes + U.S. and Global clearance - Depositary Receipts volumes corporate actions + Noninterest-bearing deposits - Loan volumes 12 First Quarter 2020 – Financial Highlights

Investment Management FINANCIAL HIGHLIGHTS 1 Q 2 0 ($ millions unless otherwise noted) 4 Q 1 9 1 Q 1 9 › Asset Management down year-over-year on equity investment losses, including seed capital, and an Total revenue by line of business: Asset Management $620 (10)% (3)% unfavorable change in the mix of AUM since 1Q19, Wealth Management 278 - (6) partially offset by higher performance fees and market Total revenue 898 (8) (4) Provision for credit losses 9 N/M N/M values Noninterest expense 695 (5) 4 Income before taxes $194 (19)% (27)% › Wealth Management down primarily reflecting lower Pre-tax operating margin 22% (313) bps (666) bps net interest revenue due to lower interest rates, Adjusted pre-tax operating margin – non-GAAP (a) 24% (330) bps (726) bps partially offset by the impact of higher deposits KEY METRICS › Noninterest expense up primarily reflecting higher Average loans $12,124 1% (2)% professional, legal and other purchased services Average deposits 16,144 6 2 Wealth Management client assets (bn) (b) $236 (11)% (7)% › AUM of $1.8 trillion down primarily reflecting the CHANGES IN AUM (bn)(C) 1 Q 2 0 4 Q 1 9 1 Q 1 9 unfavorable impact of a stronger U.S. dollar Beginning balance $1,910 $1,881 $1,722 Equity (2) (6) (4) Fixed income - 5 3 Liability-driven investments (5) (3) 5 Multi-asset and alternatives (1) 3 (4) Index 3 (5) (2) Cash 43 (7) 2 Total net inflows (outflows) 38 (13) - Net market impact (91) (20) 103 Net currency impact (61) 62 16 Ending balance $1,796 $1,910 $1,841 Note: See page 16 in the Appendix for corresponding footnotes. N/M - not meaningful; bps - basis points 13 First Quarter 2020 – Financial Highlights

Other Segment FINANCIAL HIGHLIGHTS 1 Q 2 0 › Total revenue decreased sequentially primarily reflecting ($ millions unless otherwise noted) 4 Q 1 9 1 Q 1 9 the gain on sale of an equity investment recorded in Fee revenue $21 $817 $17 Net securities gains (losses) 9 (23) 1 4Q19 Total fee and other revenue 30 794 18 Net interest (expense) (44) (10) (30) › Net interest expense increased sequentially primarily Total (loss) revenue (14) 784 (12) reflecting corporate treasury activity Provision for credit losses 11 (3) (2) Noninterest expense 30 54 49 › Noninterest expense decreased year-over-year primarily (Loss) income before taxes $(55) $733 $(59) due to lower staff expense Note: Prior periods have been restated. See “Segment Reporting Changes” on page 19 for additional information. 14 First Quarter 2020 – Financial Highlights

Appendix

Footnotes 1Q20 Financial Highlights, Page 5 (a) Operating leverage is the rate of increase (decrease) in total revenue less the rate of increase (decrease) in total noninterest expense. (b) See page 18 for corresponding reconciliation of this non-GAAP measure. (c) Represents a non-GAAP measure. See page 17 in the Appendix for corresponding reconciliation. Capital and Liquidity, Page 6 (a) Regulatory capital ratios for Mar. 31, 2020 are preliminary. For our CET1, Tier 1 capital and Total capital ratios, our effective capital ratios under the U.S. capital rules are the lower of the ratios as calculated under the Standardized and Advanced Approaches, which for Dec. 31, 2019 and Mar. 31, 2019 was the Advanced Approaches, and for Mar. 31, 2020 was the Standardized Approaches for the CET1 and Tier 1 capital ratios and the Advanced Approach for the Total capital ratio. (b) Tangible book value per common share – non-GAAP – excludes goodwill and intangible assets, net of deferred tax liabilities. See page 18 for corresponding reconciliation of this non-GAAP measure. Investment Services, Page 11 Prior periods have been restated. See “Segment Reporting Changes” on page 19 for additional detail. (a) Current period is preliminary. Includes the AUC/A of CIBC Mellon Global Securities Services Company (“CIBC Mellon”), a joint venture with the Canadian Imperial Bank of Commerce, of $1.2 trillion at Mar. 31, 2020, $1.5 trillion at Dec. 31, 2019 and $1.3 trillion at Mar. 31, 2019. (b) Represents the total amount of securities on loan in our agency securities lending program managed by the Investment Services business. Excludes securities for which BNY Mellon acts as agent on behalf of CIBC Mellon clients, which totaled $59 billion at Mar. 31, 2020, $60 billion at Dec. 31, 2019 and $62 billion at Mar. 31, 2019. (c) Net new assets represents net flows of assets (e.g., net cash deposits and net securities transfers) in customer accounts in Pershing LLC, a U.S. broker-dealer. Investment Management, Page 13 Prior periods have been restated. See “Segment Reporting Changes” on page 19 for additional detail. (a) Net of distribution and servicing expense. See page 19 for corresponding reconciliation of this non-GAAP measure. (b) Current period is preliminary. Includes AUM and AUC/A in the Wealth Management business. (c) Current period is preliminary. Excludes securities lending cash management assets and assets managed in the Investment Services business. 16 First Quarter 2020 – Financial Highlights

First Quarter Results – Impact of Sequential Notable Items ($ in millions, except per share data unless otherwise noted) 1 Q 20 4 Q 1 9 1 Q 20 vs 4 Q 1 9 Results – Notable Results – Results – Notable Results – GAAP non- GAAP items non-GAAP GAAP items(a) non-GAAP GAAP Fee revenue $3,323 $ — $3,323 $3,971 $815 $3,156 (16)% 5% Net securities gains (losses) 9 — 9 (25) (25) — N/M N/M Total fee and other revenue 3,332 — 3,332 3,946 790 3,156 (16) 6 (Loss) income from consolidated investment (38) — (38) 17 — 17 N/M N/M management funds Net interest revenue 814 — 814 815 — 815 — — Total revenue 4,108 — 4,108 4,778 790 3,988 (14) 3 Provision for credit losses 169 — 169 (8) — (8) N/M N/M Noninterest expense 2,712 — 2,712 2,964 186 2,778 (9) (2) Income (loss) before income taxes 1,227 — 1,227 1,822 604 1,218 (33) 1 Provision for income taxes 265 — 265 373 144 229 (29) 16 Net income $962 — $962 $1,449 $460 $989 (34)% (3)% Net income applicable to common shareholders $944 — $944 $1,391 $460 $931 (32)% 1% Operating leverage(b) (552) bps 538 bps Diluted earnings per common share(c) $1.05 — $1.05 $1.52 $0.50 $1.01 (31)% 3% Average common shares and equivalents outstanding – diluted (in thousands) 896,689 914,739 Pre-tax operating margin 30% 30% 38% 31% NOTABLE ITEMS BY BUSINESS SEGMENT 4Q19 IS IM Other Total Fee and other revenue $ — $ — $790 $790 Net interest revenue $ — $ — — — Total revenue $ — $ — 790 790 Total noninterest expense 119 16 51 186 Income (loss) before taxes $(119) $(16) $739 $604 (a) Includes a gain on sale of an equity investment, severance, net securities losses and litigation expense. (b) Operating leverage is the rate of increase (decrease) in total revenue less the rate of increase (decrease) in total noninterest expense. (c) Does not foot due to rounding. IS – Investment Services; IM – Investment Management; N/M - not meaningful; bps - basis points 17 First Quarter 2020 – Financial Highlights

Return on Common Equity and Tangible Common Equity Reconciliation ($ millions) 1 Q 20 4 Q 1 9 1 Q19 Net income applicable to common shareholders of The Bank of New York Mellon Corporation – GAAP $944 $1,391 $910 Add: Amortization of intangible assets 26 28 29 Less: Tax impact of amortization of intangible assets 6 7 7 Adjusted net income applicable to common shareholders of The Bank of New York Mellon Corporation, excluding amortization of $964 $1,412 $932 intangible assets – non-GAAP Average common shareholders’ equity $37,664 $37,842 $37,086 Less: Average goodwill 17,311 17,332 17,376 Average intangible assets 3,089 3,119 3,209 Add: Deferred tax liability – tax deductible goodwill 1,109 1,098 1,083 Deferred tax liability – intangible assets 666 670 690 Average tangible common shareholders’ equity – non-GAAP $19,039 $19,159 $18,274 Return on common equity (annualized) – GAAP 10.1% 14.6% 10.0% Return on tangible common equity (annualized) – non-GAAP 20.4% 29.3% 20.7% Book Value and Tangible Book Value Per Common Share Reconciliation ($ millions, except common shares) Mar. 31, 2020 Dec. 31, 2019 Mar. 31, 2019 BNY Mellon shareholders’ equity at period end – GAAP $41,145 $41,483 $41,225 Less: Preferred stock 3,542 3,542 3,542 BNY Mellon common shareholders’ equity at period end – GAAP 37,603 37,941 37,683 Less: Goodwill 17,240 17,386 17,367 Intangible assets 3,070 3,107 3,193 Add: Deferred tax liability – tax deductible goodwill 1,109 1,098 1,083 Deferred tax liability – intangible assets 666 670 690 BNY Mellon tangible common shareholders’ equity at period end – non-GAAP $19,068 $19,216 $18,896 Period-end common shares outstanding (in thousands) 885,443 900,683 957,517 Book value per common share – GAAP $42.47 $42.12 $39.36 Tangible book value per common share – non-GAAP $21.53 $21.33 $19.74 18 First Quarter 2020 – Financial Highlights

Pre-tax Operating Margin Reconciliation – Investment Management Business ($ millions) 1 Q 20 4 Q 1 9 1 Q19 Income before income taxes – GAAP $194 $240 $266 Total revenue – GAAP $898 $971 $936 Less: Distribution and servicing expense 91 93 91 Adjusted total revenue, net of distribution and servicing expense – non-GAAP $807 $878 $845 Pre-tax operating margin – GAAP (a) 22% 25% 28% Adjusted pre-tax operating margin, net of distribution and servicing expense – non-GAAP (a) 24% 27% 31% Segment Reporting Changes In the first quarter of 2020, we reclassified the results of certain services provided between the segments from noninterest expense to fee and other revenue. This activity is offset in the Other segment and relates to services that are also provided to third-parties and provides consistency with the reporting of the revenues. This adjustment had no impact on income before taxes of the businesses. Prior periods have been restated. In the first quarter of 2020, we reclassified the results related to certain lending activities from the Wealth Management business to the Pershing business. These loans were originated by the Wealth Management business as a service to Pershing clients. This resulted in an increase in total revenue, noninterest expense and income before taxes in the Pershing business and corresponding decrease in the Wealth Management business. Prior periods have been restated. For additional information on the segment reporting changes, see “Segment Reporting Changes” in the Financial Supplement available at www.bnymellon.com. (a) Income before income taxes divided by total revenue. 19 First Quarter 2020 – Financial Highlights

Cautionary Statement A number of statements in our presentations, the accompanying slides and the responses to your questions are “forward-looking statements.” Words such as “estimate,” “forecast,” “project,” “anticipate,” “likely,” “target,” “expect,” “intend,” “continue,” “seek,” “believe,” “plan,” “goal,” “could,” “should,” “would,” “may,” “might,” “will,” “strategy,” “synergies,” “opportunities,” “trends,” “future” and words of similar meaning signify forward-looking statements. These statements relate to, among other things, The Bank of New York Mellon Corporation’s (the “Corporation”) expectations regarding: capital plans, strategic priorities, financial goals, organic growth, performance, organizational quality and efficiency, investments, including in technology and product development, capabilities, resiliency, revenue, net interest revenue, fees, expenses, cost discipline, sustainable growth, company management, deposits, interest rates and yield curves, securities portfolio, taxes, business opportunities, divestments, volatility, preliminary business metrics and regulatory capital ratios; and statements regarding the Corporation's aspirations, as well as the Corporation’s overall plans, strategies, goals, objectives, expectations, outlooks, estimates, intentions, targets, opportunities and initiatives, including the potential effects of the coronavirus pandemic on any of the foregoing. These forward-looking statements are based on assumptions that involve risks and uncertainties and that are subject to change based on various important factors (some of which are beyond the Corporation’s control). Actual outcomes may differ materially from those expressed or implied as a result of the factors described under “Forward Looking Statements” and “Risk Factors” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2019 (the “2019 Annual Report”) and in other filings of the Corporation with the Securities and Exchange Commission (the “SEC”). Statements about the effects of the current and near-term market and macroeconomic environment on the Corporation, including on its business, operations, financial performance and prospects, may constitute forward-looking statements, and are based on assumptions that involve risks and uncertainties and that are subject to change based on various important factors (some of which are beyond the Corporation's control), including the scope and duration of the pandemic, actions taken by governmental authorities in response to the pandemic, and the direct and indirect impact of the pandemic on the Corporation, our clients and customers and third parties Preliminary business metrics and regulatory capital ratios are subject to change, possibly materially, as the Corporation completes its Form 10-Q for the first quarter of 2020. All forward-looking statements speak only as of April 16, 2020, and the Corporation undertakes no obligation to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events. For additional information regarding the Corporation, please refer to the Corporation's SEC filings available at www.bnymellon.com/investorrelations. Non-GAAP Measures: In this presentation we discuss some non-GAAP measures in detailing the Corporation’s performance, which exclude certain items or otherwise include components that differ from GAAP. We believe these measures are useful to the investment community in analyzing the financial results and trends of ongoing operations. We believe they facilitate comparisons with prior periods and reflect the principal basis on which our management monitors financial performance. Additional disclosures relating to non-GAAP measures are contained in the Corporation’s reports filed with the SEC, including the 2019 Annual Report, and are available at www.bnymellon.com/investorrelations. 20 First Quarter 2020 – Financial Highlights