Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - Green Thumb Industries Inc. | d853417dex322.htm |

| EX-32.1 - EX-32.1 - Green Thumb Industries Inc. | d853417dex321.htm |

| EX-31.2 - EX-31.2 - Green Thumb Industries Inc. | d853417dex312.htm |

| EX-31.1 - EX-31.1 - Green Thumb Industries Inc. | d853417dex311.htm |

| EX-23.2 - EX-23.2 - Green Thumb Industries Inc. | d853417dex232.htm |

| EX-23.1 - EX-23.1 - Green Thumb Industries Inc. | d853417dex231.htm |

| EX-16.1 - EX-16.1 - Green Thumb Industries Inc. | d853417dex161.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-56132

GREEN THUMB INDUSTRIES INC.

(Exact name of registrant as specified in its charter)

| British Columbia | 98-1437430 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. employer identification no.) | |

| 325 West Huron Street, Suite 412 Chicago, Illinois |

60654 | |

| (Address of principal executive offices) | (zip code) | |

Registrant’s telephone number, including area code - (312) 471-6720

Securities registered pursuant to Section 12(g) of the Act:

Subordinate Voting Shares

Multiple Voting Shares

Super Voting Shares

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of March 31, 2020, there were 144,810,322 shares of the registrant’s Subordinate Voting Shares, 23,850,400 shares of the registrant’s Multiple Voting Shares (on an as converted basis) and 39,081,400 of the registrant’s Super Voting Shares (on an as converted basis). Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the Subordinate Voting Shares, and Multiple Voting Shares and Super Voting Shares (on an as converted basis, based on the closing price of these shares on the Canadian Stock Exchange) on June 30, 2019, the last business day of the registrant’s most recently completed second fiscal quarter, held by nonaffiliates was $1,455,373,948

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates certain information by reference from the definitive proxy statement to be filed by the registrant in connection with the 2020 Annual Meeting of Stockholders (the “2020 Proxy Statement”). The 2020 Proxy Statement will be filed by the registrant with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the year ended December 31, 2019.

Table of Contents

Table of Contents

Use of Names

In this Annual Report on Form 10-K, unless the context otherwise requires, the terms “we,” “us,” “our,” “Company,” “Corporation” or “GTI” refer to Green Thumb Industries Inc. together with its wholly-owned subsidiaries. References to “Bayswater” refer to the Company prior to completion of the Transaction (as hereinafter defined).

Currency

Unless otherwise indicated, all references to “$” or “US$” in this document refer to United States dollars, and all references to “C$” refer to Canadian dollars.

Disclosure Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains statements that we believe are, or may be considered to be, “forward-looking statements.” All statements other than statements of historical fact included in this document regarding the prospects of our industry or our prospects, plans, financial position or business strategy may constitute forward-looking statements. In addition, forward-looking statements generally can be identified by the use of forward-looking words such as “may,” “will,” “expect,” “intend,” “estimate,” “foresee,” “project,” “anticipate,” “believe,” “plan,” “forecast,” “continue” or “could” or the negative of these terms or variations of them or similar terms. Furthermore, forward-looking statements may be included in various filings that we make with the Securities and Exchange Commission (the “SEC”) or press releases or oral statements made by or with the approval of one of our authorized executive officers. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot assure you that these expectations will prove to be correct. These forward-looking statements are subject to certain known and unknown risks and uncertainties, as well as assumptions that could cause actual results to differ materially from those reflected in these forward-looking statements. Readers are cautioned not to place undue reliance on any forward-looking statements contained in this document, which reflect management’s opinions only as of the date hereof. Except as required by law, we undertake no obligation to revise or publicly release the results of any revision to any forward-looking statements. You are advised, however, to consult any additional disclosures we make in our reports to the SEC. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained in this document.

1

Table of Contents

PART I

Background

Green Thumb Industries Inc. is a reporting issuer in Canada listed for trading on the Canadian Securities Exchange (“CSE”) under the symbol “GTII.” The Company’s Subordinate Voting Shares (as hereinafter defined) are also traded in the United States on the OTCQX Best Market (the “OTCQX”) under the symbol “GTBIF.”

Originally founded in 2014, GTI began operations in 2015 upon the award of a medical marijuana license for cultivation/processing and retail in Illinois. The Company has since expanded its operational footprint to 11 additional U.S. markets, including California, Colorado, Connecticut, Florida, Maryland, Massachusetts, Nevada, New Jersey, New York, Ohio and Pennsylvania. Currently, GTI owns, manufactures, and distributes a portfolio of cannabis consumer packaged goods brands (which we refer to as our consumer packaged goods business), including Beboe, Dogwalkers, Dr. Solomon’s, incredibles, Rythm and The Feel Collection, primarily to third-party licensed retail cannabis stores across the United States as well as to GTI-owned retail stores. The Company also owns and operates a rapidly growing national chain of retail cannabis stores called Rise and, in the Las Vegas, Nevada area, a chain of stores called Essence, which both sell GTI and third-party products (which we refer to as our retail business).

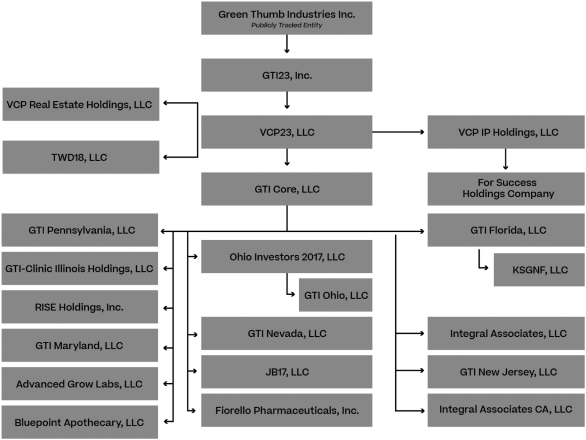

The Company, through its subsidiaries, owns interests in several state-licensed medical and/or adult use marijuana businesses in Connecticut, Florida, Illinois, Maryland, Massachusetts, Nevada, New Jersey, New York, Ohio and Pennsylvania. The Company also licenses its intellectual property and certain brands to licensees in California and Colorado. The following organizational chart describes the organizational structure of the Company as of December 31, 2019. See Exhibit 21.1 to this document for a list of subsidiaries of the Company. All lines represent 100% ownership of outstanding securities of the applicable subsidiary unless otherwise noted in Exhibit 21.1. In part, the complexity of our organization structure is due to state licensing requirements that mandate that we maintain the corporate identity of our operating license holders.

2

Table of Contents

The registered office of GTI is located at 250 Howe Street, 20th Floor, Vancouver, British Columbia V6C 3R8. The head office is located at 325 W. Huron Street, Suite 412, Chicago, Illinois 60654.

History of the Company

The Company was incorporated under the Company Act (British Columbia) on June 26, 1979 under the name “Dalmatian Resources Ltd.” On February 18, 2002, the Company changed its name to “Enwest Ventures Corp.” Further, on February 25, 2003, the Company changed its name to “Bayswater Ventures Corp.” In August 2006, the Company changed its name from Bayswater Ventures Corp. to “Bayswater Uranium Corporation” following a Canadian amalgamation transaction with Pathfinder Resources Ltd.

On July 18, 2007, under a plan of arrangement, the Company amalgamated with Kilgore Minerals Ltd., a company incorporated under the Canada Business Corporations Act (the “CBCA”) on June 21, 2002 and continued into the Province of British Columbia under the Business Corporations Act (British Columbia) (the “BCBCA”) on December 7, 2006. Following the plan of arrangement, Kilgore Minerals Ltd. changed its name to “Bayswater Uranium Corporation” on July 24, 2007.

Subsequent to the Company’s financial year ended February 28, 2018, the Company completed the Transaction (as hereinafter defined), filed Articles of Amendment in the Province of British Columbia to effect the name change from “Bayswater Uranium Corporation” to “Green Thumb Industries Inc.” and continued the business of VCP23, LLC (“VCP”). VCP was formed in the State of Delaware on November 27, 2017. The entity had no activity or financials in 2017.

3

Table of Contents

General Development of the Business

The Transaction

On January 1, 2018, the Corporation completed a restructuring to consolidate its organizational structure. RCP23, LLC, which had operations in Maryland, Massachusetts, Nevada and Pennsylvania, and GTI-Clinic Illinois Holdings, LLC, which had operations in Illinois, restructured and each entity contributed certain assets and real estate to VCP or its subsidiaries. Simultaneously, GTI-Clinic Illinois Holdings, LLC transferred its membership interests in the Illinois licensed medical businesses to GTI Core, LLC. Prior to the closing of the Transaction, VCP was acquired by GTI23, Inc. (“GTI23”) and the members of VCP exchanged their membership interests in VCP in exchange for shares of GTI23. The transaction did not include outside parties that were not previously members of RCP23, LLC or GTI clinic Illinois Holdings, LLC. The transaction did involve certain current directors and officers of the Corporation that, at the time, were members of RCP23, LLC and/or GTI Clinic Illinois Holdings, LLC.

On June 12, 2018, the Company, 1165318 B.C. Ltd. a wholly-owned subsidiary of Bayswater (“Subco”), VCP, GTI23 and GTI Finco Inc. (“GTI Finco”) entered into a Business Combination Agreement whereby the Company, Subco, VCP, GTI23 and GTI Finco combined their respective businesses (the “Transaction”). The Transaction was structured as a series of transactions, including a Canadian three-cornered amalgamation transaction and a series of U.S. reorganization steps for the purpose of raising capital from third-party investors simultaneously with the closing of the Transaction. The Company (formerly Bayswater) had no active business operations leading up to completion of the Transaction.

In connection with the Transaction, the Company disposed of its uranium-based assets, changed its name from “Bayswater Uranium Corporation” to “Green Thumb Industries Inc.” and consolidated its existing common shares on the basis of one Subordinate Voting Share for each 368 existing common shares of the Company.

At a meeting of the Company’s shareholders on June 11, 2018, the shareholders approved a resolution to restructure the Company’s share capital to, among other things, re-designate its existing common shares as subordinate voting shares (“Subordinate Voting Shares”) and create a class of multiple voting shares (“Multiple Voting Shares”) and super voting shares (“Super Voting Shares”).

The Company, Subco and GTI Finco were parties to a Canadian three-cornered amalgamation (the “Amalgamation”) whereby:

| (i) | GTI Finco shareholders received Subordinate Voting Shares of the Company on a one-for-one basis; |

| (ii) | members of VCP contributed their membership interests to GTI23 for shares of GTI23; and |

| (iii) | members of VCP then contributed their shares of GTI23 to GTI in exchange for Super Voting Shares and Multiple Voting Shares of GTI. |

The SR Offering

Prior to the Transaction, GTI Finco (a special purpose corporation wholly-owned by VCP), completed a brokered and a non-brokered subscription receipt financing at a price of C$7.75 per subscription receipt for aggregate gross proceeds of approximately C$87 million (the “SR Offering”). As part of closing the Transaction, the investors in the SR Offering received Subordinate Voting Shares of GTI on an economically equivalent basis. The brokered portion of the SR Offering was co-led by GMP Securities L.P. and Canaccord Genuity Corp., with a syndicate that included Beacon Securities Limited, Echelon Wealth Partners Inc. and Eight Capital Corp. In connection with the Transaction and pursuant to the SR Offering, a total of 11,245,434 Subordinate Voting

4

Table of Contents

Shares were issued and outstanding after completion of the Transaction, including Subordinate Voting Shares issued to former holders of GTI Finco subscription receipts issued in the SR Offering.

The Subordinate Voting Shares began trading on the CSE on June 13, 2018 under the symbol “GTII.”

Financing Activities

On March 6, 2020, the Company closed on a sale and lease back transaction to sell its Oglesby, Illinois cultivation and processing facility to an unrelated third party, Innovative Industrial Properties (“IIP”). Under a long-term agreement, the Company will lease back the facility and continue to operate and manage it. The purchase price for the property was $9.0 million, excluding transaction costs. The Company is also expected to make certain improvements to the property that will significantly enhance production capacity, for which IIP has agreed to provide reimbursement of up to $41 million. Assuming full reimbursement for such improvements, IIPs total investment in the property will be $50 million.

On January 31, 2020, the Corporation closed on a sale and leaseback transaction to sell its Toledo, Ohio processing facility to IIP. Under a long-term agreement, the Corporation will lease back the facility and continue to operate the space and manage it. The purchase price for the property was $2.9 million, excluding transaction costs. The Corporation is also expected to make certain improvements to the property that will significantly enhance production capacity, for which IIP has agreed to provide reimbursement of up to $4.3 million. Assuming full reimbursement for such improvements, IIP’s total investment in the property will be $7.2 million.

On November 12, 2019, the Company closed on a sale and lease back transaction to sell its Danville, Pennsylvania cultivation and processing facility to IIP. Under a long-term agreement, the Company will lease back the facility and continue to operate and manage it. The purchase price for the property was $20.3 million, excluding transaction costs. The Company is also expected to make certain improvements to the property that will significantly enhance production capacity, for which IIP has agreed to provide reimbursement of up to $19.3 million. Assuming full reimbursement for such improvements, IIP’s total investment in the property will be $39.6 million.

On May 22, 2019, the Company closed a $105 million senior secured non-brokered private placement financing through the issuance of three-year senior secured notes (the “Notes”) pursuant to the Note Purchase Agreement (the “Note Purchase Agreement”). The financing generated funds for general working capital purposes and various growth initiatives and to retire the Company’s existing debt, including the Bridge Notes (as hereinafter defined). The Notes have a maturity date of May 22, 2022 and will bear interest from the date of issue at 12% per annum, payable quarterly, with an option, at the discretion of the Company, to extend an additional 12 months. Upon the execution of the Note Purchase Agreement, the Purchasers of the Notes received warrants to purchase 1,822,771 Subordinate Voting Shares at an exercise price of C$19.39 per share, which can be exercised for 60 months from the date of issuance. The Company entered into the First Amendment to the Note Purchase Agreement (the “Note Purchase Agreement Amendment”) on November 9, 2019. The Note Purchase Agreement Amendment reduced the borrowing capacity from $150 million to $130 million, which allows the Company to borrow an additional $24.5 million over a period of 12 months from the closing date of the Note Purchase Agreement. Upon the execution of the Note Purchase Agreement Amendment, the Purchasers of the Notes received warrants to purchase 365,076 Subordinate Voting Shares at an exercise price of C$12.04 per share, which can be exercised for 60 months from the date of issuance.

On April 12, 2019, the Company closed on a private placement of $12.5 million in six-month senior secured promissory notes (the “Bridge Notes”). The Bridge Notes accrue interest at an annual rate of 10.5% payable on a monthly basis, commencing June 1, 2019. The Bridge Notes included warrants to purchase 218,964 Subordinate Voting Shares at an exercise price of C$22.90 per share, which can be exercised for 42 months from the closing date of the transaction. On May 22, 2019, the Company repaid the full principal amount and accrued interest for the Bridge Notes with the proceeds from the private placement financing discussed above.

5

Table of Contents

On October 17, 2018, the Company closed a $78.6 million (C$101.7 million) bought deal financing, which included proceeds from the sale of Subordinate Voting Shares following the full exercise by the underwriters, namely GMP Securities L.P. (as lead underwriter and sole bookrunner), Beacon Securities Limited, Cormark Securities Inc., Echelon Wealth Partners Inc. and Eight Capital Corp., of an over-allotment option. The financing generated funds for the Company’s continued growth, including wholesale capacity, strategic initiatives and general corporate purposes.

On August 2, 2018, the Company closed a $61.7 million (C$80.3 million) bought deal financing, co-led by Canaccord Genuity Corp. and GMP Securities L.P., and including Beacon Securities Limited, Echelon Wealth Partners Inc. and Eight Capital Corp., to fund the Company’s continued growth, including the acquisition of one of ten licenses in the regulated New York cannabis market and the buildout of five dispensaries in Ohio pursuant to licenses awarded by the Ohio State Board of Pharmacy in June 2018, and for working capital purposes.

On June 12, 2018, GTI Finco (a special purpose corporation wholly-owned by VCP), completed the SR Offering, a brokered and a non-brokered subscription receipt financing at a price of C$7.75 per subscription receipt for aggregate gross proceeds of approximately $64.1 million (C$87 million). The investors received 11,245,434 Subordinate Voting Shares on an economically equivalent basis. The brokered portion of the financing was co-led by GMP Securities L.P. and Canaccord Genuity Corp., with a syndicate that included Beacon Securities Limited, Echelon Wealth Partners Inc. and Eight Capital Corp.

On April 30, 2018, the Company closed a private placement offering to sell $45 million in a convertible promissory note (“Convertible Promissory Note”) to VCP Convert, LLC, a Delaware limited liability company owned by accredited investors. The Convertible Promissory Note was converted into common units of VCP immediately prior to the Transaction.

On December 31, 2017, RCP23, LLC, closed a $67 million private placement offering to sell investor member units (“RCP Investor Member Units”) in RCP23, LLC to fund growth opportunities and working capital of the Company.

Certain Recent Developments

On March 11, 2020, the World Health Organization declared COVID-19 a global pandemic and recommended containment and mitigation measures worldwide. The Company is monitoring this closely, and although operations have not been materially affected by the COVID-19 outbreak to date, the ultimate severity of the outbreak and its impact on the economic environment is uncertain. Operations of the Company are currently ongoing as the cultivation, processing and sale of cannabis products is currently considered an essential business by the states in which we operate with respect to all customers (or medical patients only in Massachusetts). The uncertain nature of the spread of COVID-19 globally may impact our business operations for reasons including the potential quarantine of our employees, customers, and third-party service providers. At this time, the Company is unable to estimate the impact of this event on its operations.

On August 23, 2019, the Company closed on its acquisition of Fiorello Pharmaceuticals, Inc. (“Fiorello”). Fiorello is one of only ten companies in New York licensed to grow, process and dispense medical cannabis. Fiorello has one cultivation/processing facility and four dispensing locations, with three of such dispensing locations currently operating.

On June 5, 2019, the Company closed on its acquisition of Integral Associates, LLC (“Integral Nevada”), a leading cannabis operator in Nevada, and Integral Associates CA, LLC (“Integral California,” together with Integral Nevada, “Integral Associates”). In addition to the initial consideration paid at closing, the membership interest purchase agreement (the “Membership Interest Purchase Agreement”) provides for the payment by the Company of additional consideration upon the achievement of certain performance targets (including a potential EBITDA earn-out payment) and regulatory license awards. Milestone payments for each

6

Table of Contents

license won are 50% payable at the initial license award, and the remaining 50% will be paid once the final licenses are issued. The transaction consideration included $52.8 million paid in cash and approximately 20.8 million in Subordinate Voting Shares which were valued at $235.4 million, and an additional 3.3 million milestone shares with a fair value of $37.7 million, for a total value of $273.1 million in share issuances. The acquisition includes: (i) Integral Associates’ three Essence retail stores located across the Las Vegas, Nevada area; (ii) eight additional adult use retail licenses in Nevada, five in the Las Vegas area and three in Northern Nevada; (iii) West Hollywood, California retail license, one of only five with a consumption lounge and delivery service; (iv) Pasadena, California and Culver City, California retail licenses; (v) Desert Grown Farms, a 54,000 square foot state-of-the-art cultivation and processing facility with an award-winning genetics library of 100+ strains; and (vi) Cannabiotix NV, a 41,000 square foot cultivation and processing facility which has been a recognized High Times Cannabis Cup award winner.

On February 21, 2019, the Company closed on its acquisition of For Success Holding Company, the Los Angeles-based creator of the lifestyle suite of Beboe branded cannabis products. Beboe is best known for, among other things, the thoughtfully designed aesthetic of its iconic rose gold vaporizing pens and edible pastilles, with each product curated using a unique blend of socially dosed THC (as hereinafter defined) and CBD (as hereinafter defined). The acquisition was an all-stock transaction, and consideration was satisfied through the issuance of Subordinate Voting Shares. The purchase agreement also includes additional consideration based on future performance targets.

On February 12, 2019, the Company closed on its acquisition of Connecticut-based Advanced Grow Labs LLC (“AGL”). AGL is one of four companies in Connecticut licensed to grow and process cannabis. AGL operates a 41,000 square foot manufacturing facility in West Haven, Connecticut, with expansion potential. AGL also has an ownership stake in a dispensary that is located in Westport, Connecticut. AGL produces and distributes a wide range of cannabis products to the operating stores in the state. The transaction consideration included $15.5 million in cash and approximately 7.3 million Subordinate Voting Shares. The purchase agreement also includes additional consideration based on future performance targets.

On November 8, 2018, the Company acquired KSGNF, LLC, the holder of a license to operate a vertically-integrated medical marijuana treatment center in Florida, in exchange for approximately $48.6 million in cash and Subordinate Voting shares valued at approximately $49.6 million. KSGNF, LLC operates a cultivation/processing facility in Homestead, Florida with six open and operating dispensaries across the state.

Description of the Business

Overview of the Company

Established in 2014 and headquartered in Chicago, Illinois, GTI is promoting well-being through the power of cannabis, while being committed to community and sustainable profitable growth. As of March 31, 2020, GTI has operations across 12 U.S. markets, employs approximately 1,700 people and serves hundreds of thousands of patients and customers annually.

GTI’s core business is manufacturing, distributing and marketing a portfolio of owned cannabis consumer packaged goods brands (which we refer to as our consumer packaged goods business), including Beboe, Dogwalkers, Dr. Solomon’s, incredibles, Rythm and The Feel Collection, primarily to third-party licensed retail cannabis stores across the United States as well as to GTI-owned retail stores.

The Company’s consumer packaged goods portfolio is produced in 13 owned and operated manufacturing facilities and consists of stock keeping units (“SKUs”) across a range of product categories, including flower, pre-rolls, concentrates, vape, capsules, tinctures, edibles, topicals and other cannabis-related products.

GTI also owns and operates a national cannabis retail chain called Rise, and in the Las Vegas, Nevada area, a chain of stores called Essence, which are relationship-centric retail experiences aimed to deliver a superior level of customer service through high-engagement consumer interaction, a consultative, transparent and education-forward selling approach and a consistently available assortment of cannabis products. In addition, we own stores under other names, primarily where we co-own the stores or naming is subject to licensing or similar restrictions. (We refer to the operation of these retail stores as our retail business.) The income from our retail

7

Table of Contents

stores is primarily from the sale of cannabis-related products, which includes the sale of GTI produced products as well as those produced by third parties, with an immaterial (under 10%) portion of this income resulting from the sale of other merchandise (such as t-shirts and accessories for cannabis use). Our Rise stores currently are located in eight of the states in which we operate (including Nevada). Our Essence stores were acquired in connection with the 2019 acquisition of Integral Associates and are located in Nevada. The Essence stores differ from the Rise stores mainly in geographic location. As of December 31, 2019, the Company had 39 open and operating retail locations, with state licensed permission to open a total of 96 stores. Our new store opening plans will remain fluid depending on market conditions, obtaining local licensing, construction and other permissions and subject to our capital allocation plans and the evolving situation with respect to the Coronavirus.

Financial Highlights and Revenue Streams

The Company has consolidated financial statements across its operating businesses with revenue from the manufacture, sale and distribution of branded cannabis products to third-party licensed retail customers as well as the sale of finished products to consumers in its retail stores.

The percentage of total revenue contributed by operations of consumer package goods was, 36%, 33% and 40% for the years ended December 31, 2019, 2018 and 2017 respectively. The percentage of total revenue contributed by retail operations was, 64%, 67% and 60% for the years ended December 31, 2019, 2018 and 2017, respectively. See Item 7—“Management Discussion and Analysis” for details on key financial highlights.

As of the year ended December 31, 2019, GTI has operating revenue in 12 markets (California, Colorado, Connecticut, Florida, Illinois, Maryland, Massachusetts, Nevada, New York, New Jersey, Ohio and Pennsylvania).

Geographic Information

GTI operates in 12 U.S. states: California, Colorado, Connecticut, Florida, Illinois, Maryland, Massachusetts, Nevada, New Jersey, New York, Ohio and Pennsylvania.

Product Research, Design and Development

The Company’s branded products portfolio includes stock keeping units (“SKUs”) across a range of product categories, including flower, pre-rolls, concentrates, vape, capsules, tinctures, edibles, topicals and other cannabis-related products.

8

Table of Contents

GTI engages in research and development activities focused on developing new extracted or infused cannabis consumer packaged products.

Manufacturing

Our branded products are produced in manufacturing facilities across 12 U.S. states in which the primary activity is the cultivation, processing and manufacture of cannabis consumer packaged goods.

The majority of our finished goods production is manufactured by our owned production facilities. However, we also have entered into manufacturing agreements with third parties, primarily for our cannabidiol (“CBD”) business lines, none of which account for more than 1% of finished goods production.

We aim to maintain strict brand and quality assurance standards and have implemented standard operating procedures across all production facilities to ensure continuity of product and consistent consumer experience across all operating markets.

Sources and Availability of Materials

Almost all of the raw material input, except packaging materials, used by the Company to produce finished cannabis consumer packaged goods are cultivated or processed internally for further use in the manufacturing process.

Significant Customers

Customers of our consumer packaged goods business include legal state-licensed cannabis dispensaries within each U.S. state in which we operate, as well as national retail channels, including department stores and specialty boutiques. The majority of our branded consumer packaged goods are distributed to unrelated third-party licensed retail cannabis stores. GTI is not dependent upon a single customer, or a few customers, the loss of any one or more of which would have a material adverse effect on the business. No customer accounted for 10% or more of our consolidated net revenue during fiscal 2019, 2018 or 2017.

Merchandise

To meet the array of unique customer needs, we offer a variety of cannabis products at each of our Rise and Essence stores, totaling thousands of SKUs in managed inventory, comprehensive of product categories including flower, concentrates, topicals (bath and beauty products) and edibles (confection, beverages, snacks).

We leverage our owned retail channel, Rise, Essence and our other stores to distribute our branded product portfolio, such as Beboe, Dogwalkers, Dr. Solomon’s, incredibles, Rythm and The Feel Collection, among others.

All products sold have passed state-mandated third-party testing as required by applicable law to help assure that they do not contain impermissible levels of toxins, microbials and other harmful substances, are inventoried in comprehensive seed-to-sale tracking software to minimize product slippage and deviated inventory and meet the Company’s vendor requirements for quality assurance and reliability.

Omnichannel Distribution

Products sold at Rise and Essence are delivered directly to our stores primarily by our manufacturing and distribution vendor partners.

Our primary retail presence is traditional brick and mortar. However, as regulations allow, we will continue to expand our e-commerce, in-store guest pick-up and direct to consumer delivery capabilities as part of our commitment to providing a consistent retail brand experience no matter where the consumer might be.

9

Table of Contents

Intellectual Property – Patents and Trademarks

We believe that brand protection is critical to our business strategy. We regularly seek to protect our intellectual property rights in connection with our operating names (e.g., Green Thumb and Rise), our consumer packaged goods (e.g., Dogwalkers and Rythm) and certain patentable goods and services. The U.S. trademark statute, The Lanham Act, allows for the protection of trademarks and service marks on products and services used, or intended for use, lawfully. Because cannabis-related products and services remain illegal at the federal level under the Controlled Substances Act (21 U.S.C. § 811) (the “CSA”), we are not able to fully protect our intellectual property at the federal level; therefore, we currently seek trademark protections at the state level where commercially feasible. Nonetheless, our success depends upon other areas of our business such as product development and design, production and marketing and not exclusively upon trademarks, patents and trade secrets.

From the time the Company became licensed to cultivate marijuana, we have developed proprietary cultivation techniques. The Company has also developed certain proprietary intellectual property for operating butane extraction, carbon dioxide extraction and ethanol extraction machinery, including production best practices, procedures and methods. This requires specialized skills in cultivation, extraction and refining.

The Company relies on non-disclosure/confidentiality agreements to protect its intellectual property rights. To the extent the Company describes or discloses its proprietary cultivation or extraction techniques in its applications for cultivation or processing licenses, the Company redacts or requests redaction of such information prior to public disclosure.

GTI has sought U.S. patent protection for certain of its Dr. Solomon’s products, namely a utility patent for compositions and methods for treating skin and neuropathic conditions and disorders. Where commercially reasonable, we will seek further U.S. patent protection on other eligible products and services. The Company owns several website domains, including www.gtigrows.com, numerous social media accounts across all major platforms and various phone and web application platforms.

GTI has successfully registered over 20 trademarks across three countries and nine states for brands offered within those jurisdictions and has additional trademark applications pending. GTI is in the process of registering several brands for state trademark protection at the Canadian federal level, U.S. federal level and/or in the states in which the brands are offered, including Beboe, Dogwalkers, Dr. Solomon’s, incredibles, Rythm and The Feel Collection. GTI anticipates feedback on outstanding submitted applications on a rolling basis. As such, GTI will continue to rely on common law protection for these brands during the trademark registration process. Moreover, GTI will proactively seek intellectual property protection for brand expansions in current markets as well as any new market expansion. For additional details on the risks associated with the lack of trademark protection, see Item 1A—“Risk Factors” with respect to intellectual property.

For incredibles and Beboe branded cannabis products, the Company has entered into licensing and distribution contracts with third parties that hold licenses to engage in the sale of cannabis in the states of California and Colorado, where the Company does not currently have permission to operate cultivation and processing facilities. Such third parties directly engage in or arrange for the sourcing, manufacturing, laboratory testing, quality assurance, storage, marketing, sales, distribution and delivery of products containing cannabis and remit licensing fees to the Company.

Joint Ventures

We utilize joint ventures when necessary to comply with state regulatory requirements in certain states. Partnering with one or more non-affiliated third parties provides the Company with the opportunity to mitigate certain operational and financial risks while ensuring continued compliance with the applicable regulatory guidelines. Currently, the Company has joint ventures for a vertically integrated license in Ohio and for the

10

Table of Contents

operation of (i) a medical marijuana dispensary in Effingham, Illinois (Illinois Disp, LLC) of which the Company holds a 50% interest, (ii) a medical marijuana dispensary in Westport, Connecticut (Bluepoint Wellness of Westport, LLC) of which the Company holds a 46% interest, and (iii) a registered marijuana dispensary and a cultivation and processing facility in Chicopee, Massachusetts (Cal Funding, LLC) of which the Company holds less than a 10% interest. See additional discussion of the Company’s investments in Note 13—Investment in Associates, Note 19—Variable Interest Entities and Note 14—Share Capital.

Working Capital

Effective inventory management is critical to the Company’s ongoing success and the Company uses a variety of demand and supply forecasting, planning and replenishment techniques. The Company strives to maintain sufficient levels of inventory of core product categories, maintain positive vendor and customer relationships and carefully plan to minimize markdowns and inventory write-offs.

For additional details on liquidity and Capital Resources, see Item 7—“Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Number of Employees

As of March 31, 2020 GTI employs approximately 1,700 team members nationwide including corporate, retail, manufacturing and part-time employees, including but not limited to: finance and accounting, legal and compliance, supply chain and operations, sales and marketing, commercial and cannabis agriculture, chemists, customer service, construction and project management, real estate and human resources. We offer a comprehensive package of company-sponsored benefits to our team. Eligibility depends on the full-time or part-time status, location and other factors, and benefits include 401(k), medical and dental plans, disability insurance, employee assistance programs and life insurance. Additionally, we believe in aligned incentives and utilize employee stock and incentive plans for a competitive total rewards program.

The Company began executing furloughs mainly in the Nevada market where its Retail operations have been impacted by COVID-19. The total furloughed workforce represents less than 8% of the Company’s total employee base with approximately 74% of those impacted being part time employees. The Company continues to closely monitor and assess each and every market accordingly.

Environmental Compliance

Expenditures for compliance with federal, state and local environmental laws and regulations are consistent from year to year and are not material to the Company’s financials. The Company is compliant with all applicable regulations and does not use materials that would pose any known risk under normal conditions.

Competitive Conditions and the Company’s Position in the Industry

Competition

The markets in which the Company’s products are distributed and its retail stores are operated are highly competitive markets. The Company’s operations exist in markets with relatively high barriers to entry given the licensed nature of the cannabis industry. The Company competes directly with cannabis producers and retailers within single-state operating markets, as well as those that operate across several U.S. markets. More broadly, GTI views manufacturers of other consumer products, such as those in the pharmaceuticals, alcohol, tobacco, health and beauty and functional wellness industries, as potential competitors. Product quality, performance, new product innovation and development, packaging, customer experience and consumer price/value are important differentiating factors.

The Company faces intense competition from other companies that may have a longer operating history, a higher capitalization, additional financial resources, more manufacturing and marketing experience, greater access to public equity and debt markets and more experienced management than the Company. Increased competition by larger and better financed competitors could materially affect the business, financial condition and results of operations of the Company. The vast majority of both manufacturing and retail competitors in our markets consist of localized businesses (i.e. doing business in only a single state market).

11

Table of Contents

There are a few multistate operators with whom the Company competes directly in several of the Company’s operating markets. Aside from this direct competition, out-of-state operators that are capitalized well enough to enter those markets through acquisitions are also part of the competitive landscape. Similarly, as the Company executes its national U.S. growth strategy, operators in our future state markets will inevitably become direct competitors.

Because of the early stage of the industry in which the Company operates, the Company faces additional competition from new entrants. If the number of consumers of medical and adult use cannabis in the states in which the Company operates its business increases, the demand for products will increase and the Company expects that competition will become more intense, as current and future competitors begin to offer an increasing number of diversified products. To remain competitive, the Company will require a continued high level of investment in research and development, marketing, sales and client support. The Company may not have sufficient resources to maintain research and development, marketing, sales and client support efforts on a competitive basis, which could materially and adversely affect the business, financial condition and results of its operations.

See Item 1A—“Risk Factors” with respect to competition.

Medical-Only Markets

All of the medical-only markets that the Company does business in (Illinois until January 1, 2020, Connecticut, Florida, Maryland, New Jersey, New York, Ohio and Pennsylvania) have written regulations that impose limitations on the number of cannabis business licenses that can be awarded. In each of these markets, the Company has a proven track record of: (i) entering the market through state-granted awards based on the merit of its application and business plans; and/or (ii) expanding market reach through accretive mergers, acquisitions and partnership ventures.

Adult Use Markets

The adult use markets in which the Company operates (Illinois as of January 1, 2020, California, Colorado, Massachusetts and Nevada) have fewer barriers to entry and more closely reflect free market dynamics typically seen in mature retail and manufacturing industries. The growth of these markets poses a risk of increased competition. However, given the Company’s additional growth opportunities as an original operator in these states, which have historically been limited supply markets, management views the Company’s market share as less at risk than operators without a current operating footprint.

Overview of Government Regulation

Below is a discussion of the federal and state-level regulatory regimes in those jurisdictions where the Company is currently directly involved through its subsidiaries. The Company’s subsidiaries are directly engaged in the manufacture, possession, sale or distribution of cannabis in the adult use and/or medicinal cannabis marketplace in the states of California, Colorado, Connecticut, Florida, Illinois, Maryland, Massachusetts, Nevada, New Jersey, New York, Ohio and Pennsylvania.

Federal Regulation of Cannabis

In 2005, the U.S. Supreme Court ruled that Congress has the power to regulate cannabis.

The U.S. federal government regulates drugs through the Controlled Substances Act (21 U.S.C. § 811) (the “CSA”), which places controlled substances, including cannabis, in a schedule. Cannabis is classified as a Schedule I controlled substance. A Schedule I controlled substance is defined as a substance that has no currently accepted medical use in the United States, a lack of safety for use under medical supervision and a high potential

12

Table of Contents

for abuse. The Department of Justice (the “DOJ”) defines Schedule I drugs, substances or chemicals as “drugs with no currently accepted medical use and a high potential for abuse.” However, the Food and Drug Administration (the “FDA”) has approved Epidiolex, which contains a purified form of the drug CBD, a non-psychoactive ingredient in the cannabis plant, for the treatment of seizures associated with two epilepsy conditions. The FDA has not approved cannabis or cannabis compounds as a safe and effective drug for any other condition. Moreover, under the 2018 Farm Bill or Agriculture Improvement Act of 2018 (the “Farm Bill”), CBD remains a Schedule I controlled substance under the CSA, with a narrow exception for CBD derived from hemp with a tetrahydrocannabinol (“THC”) concentration of less than 0.3%.

Marijuana is largely regulated at the state level.

State laws that permit and regulate the production, distribution and use of cannabis for adult use or medical purposes are in direct conflict with the CSA, which makes cannabis use and possession federally illegal. Although certain states and territories of the U.S. authorize medical and/or adult use cannabis production and distribution by licensed or registered entities, under U.S. federal law, the possession, use, cultivation and transfer of cannabis and any related drug paraphernalia is illegal and any such acts are criminal acts under federal law under any and all circumstances under the CSA. Although the Company’s activities are believed to be compliant with applicable state and local laws, strict compliance with state and local laws with respect to cannabis may neither absolve the Company of liability under U.S. federal law, nor may it provide a defense to any federal proceeding which may be brought against the Company.

As of December 31, 2019, 33 states, plus the District of Columbia (and the territories of Guam, Puerto Rico, the U.S. Virgin Islands and the Northern Mariana Islands), have legalized the cultivation and sale of cannabis for medical purposes. In 11 states, the sale and possession of cannabis is legal for both medical and adult use, and the District of Columbia has legalized adult use but not commercial sale.

The risk of federal enforcement and other risks associated with the Company’s business are described in Item 1A—“Risk Factors.”

Regulation of the Cannabis Market at State and Local Level

Following the thesis that distributing brands at scale will win, the Company enters markets where it believes that it can profitably and sustainably operate and command significant market share, and thus maximize consumer and brand awareness. The regulatory frameworks installed by the states, which are similar to the limited and controlled issuance of gaming or alcohol distributorship licenses, provide macro-level indication of whether certain state markets will be sustainable and profitable.

Below is a summary overview of the regulatory and competitive frameworks in each of the Company’s operating markets. See Appendix A to this Annual Report on Form 10-K for a state-by-state list of the licenses and permits held by the Company.

California

In 1996, California was the first state to legalize medical marijuana through Proposition 215, the Compassionate Use Act of 1996. This legalized the use, possession and cultivation of medical marijuana by patients with a physician recommendation for treatment of cancer, anorexia, AIDS, chronic pain, spasticity, glaucoma, arthritis, migraine or any other illness for which marijuana provides relief. In 2003, Senate Bill 420 was signed into law establishing an optional identification card system for medical marijuana patients.

In September 2015, the California legislature passed three bills collectively known as the Medical Cannabis Regulation and Safety Act (“MCRSA”). The MCRSA established a licensing and regulatory framework for medical marijuana businesses in California. In November 2016, voters in California overwhelmingly passed

13

Table of Contents

Proposition 64, the Adult Use of Marijuana Act (“AUMA”) creating an adult use marijuana program for adults 21 years of age or older. Some provisions of AUMA conflicted with MCRSA, so the California State Legislature passed Senate Bill No. 94, known as Medicinal and Adult Use Cannabis Regulation and Safety Act (“MAUCRSA”) in June 2017, amalgamating MCRSA and AUMA to provide a single set of regulations to govern a medical and adult use licensing regime for cannabis businesses in the State of California. MAUCRSA went into effect on January 1, 2018.

The three agencies that regulate cannabis at the state level are: (a) the California Department of Food and Agriculture, via CalCannabis, which issues licenses to cannabis cultivators; (b) the California Department of Public Health, via the Manufactured Cannabis Safety Branch, which issues licenses to cannabis manufacturers; and (c) the California Department of Consumer Affairs, via the Bureau of Cannabis Control, which issues licenses to cannabis distributors, testing laboratories, retailers and micro-businesses.

On June 6, 2018, a proposal by the California Department of Consumer Affairs, the California Department of Public Health and the California Department of Food and Agriculture to re-adopt their emergency cannabis regulations went into effect. Among the changes, applicants may now complete one license application, allowing for both medical and adult use cannabis activity. On January 16, 2019, California’s three state cannabis licensing authorities announced that the Office of Administrative Law officially approved state regulations for cannabis businesses. The final cannabis regulations took effect immediately and superseded the previous emergency regulations.

In order to legally operate a medical or adult use cannabis business in California, the operator must have both a local and state license. This requires license holders to operate in cities with cannabis licensing programs. Municipalities in California are allowed to determine the number of licenses they will issue to cannabis operators or can choose to ban cannabis businesses outright.

California License and Regulations

There are three principal license categories in California: (1) cultivation, (2) processing and (3) retailer. A license holder that does not submit a completed license renewal application to the state within 30 calendar days after the expiration of a current license forfeits their eligibility to apply for a license renewal and, instead, would be required to submit a new license application.

Currently, the Company does not have any operational licenses in the State of California. GTI has been granted conditional licenses, permitting the Company to retail medical and adult use cannabis and cannabis related products.

Cultivation licenses permit commercial cannabis cultivation activity involving the planting, growing, harvesting, drying, curing, grading or trimming of cannabis. Such licenses further permit the production, labeling and packaging of a limited number of non-manufactured cannabis products and permit the licensee to sell cannabis to certain licensed entities (both medical and adult use licensees) within the State of California for resale or manufacturing purposes.

Processing licenses authorize manufacturers to process marijuana biomass into certain value-added products with the use of volatile or non-volatile solvents, depending on the license type.

Retailer licenses permit the sale of cannabis and cannabis products to both medical patients and adult use customers. Only certified physicians may provide medicinal marijuana recommendations. An adult use retailer license permits the sale of cannabis and cannabis products to any adult 21 years of age or older. It does not require the individual to possess a physician’s recommendation. Under the terms of such licenses, the holder is permitted to sell adult use cannabis and cannabis products to any person, provided the local jurisdiction permits the sale of adult use cannabis and the person presents a valid government-issued photo identification demonstrating that they are 21 years of age or older.

14

Table of Contents

See Appendix A to this Annual Report for a list of the licenses issued to the Company with respect to its operations in California.

California Reporting Requirements

The California Cannabis Track-and-Trace (“CCTT”) system is the T&T system used statewide to record the inventory and movement of cannabis and cannabis products through the commercial cannabis supply chain from seed to sale. The CCTT system must be used by all annual and provisional cannabis licensees, including those with licenses for cannabis cultivation, manufacturing, retail, distribution, testing labs and microbusinesses. The state’s contracted service provider for the CCTT system is METRC. Licensees are required to maintain records for at least seven years from the date a record is created.

Colorado

On November 7, 2000, Colorado voters approved Amendment 20, which amended the state constitution to allow the use of marijuana in the state by approved patients with written medical consent. Conditions recognized for medical marijuana in Colorado include: cancer, chronic pain, epilepsy, HIV/AIDS, multiple sclerosis and nausea.

Amendment 64 passed on November 6, 2012, which amended the state constitution to establish a cannabis program in Colorado and permit the commercial cultivation, manufacture and sale of marijuana to adults 21 years of age or older. The commercial sale of marijuana for adult use to the general public began on January 1, 2014 at cannabis businesses licensed under the regulatory framework.

In Colorado, cannabis businesses must comply with local licensing requirements in addition to state licensing requirements in order to operate. Colorado localities are allowed to limit or prohibit the operation of marijuana cultivation facilities, product manufacturing facilities or retail dispensary facilities.

Colorado License and Regulations

There are three principal license categories in Colorado: (1) cultivation, (2) product manufacturer and (3) medical center/retail store. Each facility is authorized to engage only in the type of activity for which it is licensed. A licensee must apply for renewal before the expiration date of a license.

The Company does not have any licenses in the State of Colorado. The Company has entered into licensing and distribution contracts with third parties that hold licenses to engage in the sale of cannabis in Colorado for incredibles and Beboe branded cannabis products. Such third parties directly engage in or arrange for the sourcing, manufacturing, laboratory testing, quality assurance, storage, marketing, sales, distribution and delivery of products containing cannabis and remit licensing fees to GTI. See Item 1—“Intellectual Property – Patents and Trademarks” for details on licenses with respect to operations in Colorado.

Regulations for the production and sale of marijuana in Colorado are published through the Marijuana Enforcement Division of the Department of Revenue (the “MED”).

See Appendix A to this Annual Report for a list of the licenses issued to the Company with respect to its operations in Colorado.

Colorado Reporting Requirements

Colorado uses METRC as the MED’s marijuana inventory tracking system for all medical and adult use licensees. Marijuana is required to be tracked and reported with specific data points from seed to sale through METRC for compliance purposes under Colorado marijuana laws and regulations.

15

Table of Contents

Connecticut

The State of Connecticut has authorized cultivation, possession and distribution of marijuana for medical purposes by certain licensed Connecticut marijuana businesses. The Medical Marijuana Program in Connecticut (the “CT Program”) registers qualifying patients, primary caregivers, Dispensary Facilities (“DFs”) and Dispensary Facility Employees (“DFEs”). The CT Program was established by Connecticut General Statutes §§ 21a-408–21a-429. DFs and production facilities are separately licensed.

Connecticut’s medical cannabis program was introduced in May 2012 when the General Assembly passed legislation PA 12-55 “An Act Concerning the Palliative Use of Marijuana.”

The program launched with six dispensary licensees and four producer licensees. The first dispensaries sold to patients in September 2014.

In January 2016, the Connecticut Department of Consumer Protection (“CTDCP”), the agency that oversees and administers the program, approved three additional dispensary licenses. In December 2018, the CTDCP issued nine additional dispensary licenses, bringing the total to 18 licensed dispensaries in the state. As of December 31, 2019, 15 of these dispensaries were operational.

Connecticut Licenses and Regulations

There are two principal license categories in Connecticut: (1) cultivation/processing and (2) dispensary. The Company is licensed to operate one medical marijuana cultivation/processing facility and two medical marijuana dispensaries. All licenses are, as of the date hereof, active with the State of Connecticut. The licenses are independently issued for each approved activity for use at the Company’s facilities in Connecticut.

The CTDCP has issued regulations regarding the CT Program. Patients with certain debilitating medical conditions qualify to participate in the CT Program. A physician or advanced practice registered nurse must issue a written certification for a CT Program patient, and the qualifying patient or caregiver must choose one designated DF where the patient’s marijuana will be obtained. Under the CT Program, dispensary licenses are renewed annually. Renewal applications must be submitted 45 days prior to license expiration and any renewal submitted more than 30 days after expiration will not be renewed.

Medical marijuana cultivation/processing licenses permit the Company to operate a secure, indoor facility to cultivate and process medical marijuana and wholesale to dispensaries.

Medical marijuana dispensary facility licenses qualify a dispensary to purchase medical cannabis from licensed medical cannabis producers and to dispense cannabis to qualifying patients or primary caregivers that are registered under the CT Program. Dispensaries must have a pharmacist on staff.

See Appendix A to this Annual Report for a list of the licenses issued to the Company with respect to its operations in Connecticut.

Connecticut Reporting Requirements

Connecticut does not mandate the use of a particular unified T&T system by which all dispensary license holders submit data directly to the state. However, the CT Program does provide strict guidelines for reporting via the license holder’s T&T program. Every cannabis sale must be documented at the point of sale, including recording the date. At least once per day, all sales must be uploaded via the T&T system to the Connecticut Prescription Monitoring Program which accumulates and tracks medical cannabis purchases across all Connecticut dispensaries.

16

Table of Contents

Florida

In 2014, the Florida Legislature passed the Compassionate Use Act, which was the first legal medical cannabis program in the state’s history. The original Compassionate Use Act only allowed for low-THC cannabis to be dispensed and purchased by patients suffering from cancer and epilepsy. In 2016, the Legislature passed the Right To Try Act which allowed for full potency cannabis to be dispensed to patients suffering from a diagnosed terminal condition. Also, in 2016, the Florida Medical Marijuana Legalization Initiative was introduced by citizen referendum and passed on November 8. This language, known as “Amendment 2,” amended the state constitution and mandated an expansion of the state’s medical cannabis program.

Amendment 2, and the resulting expansion of qualifying medical conditions, became effective on January 3, 2017. The Florida Department of Health, physicians, dispensing organizations and patients are bound by Article X Section 29 of the Florida Constitution and Florida Statutes Section 381.986. On June 9, 2017, the Florida House of Representatives and Florida Senate passed respective legislation to implement the expanded program by replacing large portions of the existing Compassionate Use Act, which officially became law on June 23, 2017.

The State of Florida Statutes Section 381.986(8)(a) provides a regulatory framework that requires licensed producers, which are statutorily defined as “Medical Marijuana Treatment Centers” (the “MMTC”), to cultivate, process and dispense medical cannabis in a vertically-integrated marketplace.

Florida Licenses and Regulations

There is one principal license category in Florida: vertically-integrated MMTC license. The Company is licensed to operate one medical cannabis cultivation/processing facility and up to 35 medical dispensaries. All licenses are, as of the date hereof, active with the State of Florida. The licenses are independently issued for each approved activity for use at the Company’s facilities in Florida.

Licenses are issued by the Florida Department of Health and must be renewed biennially, provided the license meets the requirements under Florida law and the license holder pays a renewal fee. License holders can only own one license. Currently, the dispensaries can be in any geographic location within the state, provided that the local municipality’s zoning regulations authorize such a use, the proposed site is zoned for a pharmacy and the site is not within 500 feet of a church or school.

The MMTC license permits the Company to sell medical cannabis to qualified patients to treat certain medical conditions in Florida, which are delineated in Florida Statutes Section 386.981. As the Company’s operations in Florida are vertically-integrated, the Company is able to cultivate, harvest, process and sell/dispense/deliver its own medical cannabis products. Under the terms of its Florida license, the Company is permitted to sell medical cannabis only to qualified medical patients that are registered with the State. Only certified physicians who have successfully completed a medical cannabis educational program can register patients on the Florida Office of Compassionate Use Registry.

See Appendix A to this Annual Report for a list of the licenses issued to the Company with respect to its operations in Florida.

Florida Reporting Requirements

The Florida Department of Health requires that any licensee establish, maintain and control a computer software tracking system that traces cannabis from seed to sale and allows real-time, 24-hour access by the Florida Department of Health to this data. The tracking system must allow for integration of other seed-to-sale systems and, at minimum, include notification of when marijuana seeds are planted, when marijuana plants are harvested and destroyed and when cannabis is transported, sold, stolen, diverted or lost. Additionally, the Florida Department of Health maintains a patient and physician registry, and the Company must comply with all requirements and regulations related to providing required data or proof of key events to the tracking system.

17

Table of Contents

Illinois

The Compassionate Use of Medical Cannabis Program Act, which allows individuals diagnosed with a debilitating medical condition access to medical marijuana, became effective January 1, 2014 and is now permanent. There are more than 40 qualifying conditions as part of the medical program, including chronic pain, migraines, epilepsy, traumatic brain injury and post-traumatic stress disorder (“PTSD”). Licenses were awarded based on merit in a highly competitive application process to applicants who demonstrated strong operational expertise and financial backing.

On May 31, 2019, Illinois lawmakers passed a bill legalizing adult use marijuana. The bill permits adult use sales to adults 21 years of age or older which began in the state of Illinois on January 1, 2020. Governor J.B. Pritzker signed the bill into law, making Illinois the 11th state to legalize the adult use and commercial sale of cannabis to adults.

Illinois Licenses and Regulations

There are two principal license categories in Illinois: (1) cultivation/processing and (2) dispensary. The Company is licensed to grow cannabis for medical and adult use sales at the Company’s two cultivation/processing facilities. The Company has applied for and received state approval for its five existing medical dispensary retail locations in Illinois to also make sales to adult use customers, subject to local zoning approval. The Company applied for and received five “secondary” adult use dispensary licenses, subject to local zoning approval, which by law will serve only adult use customers, not medical patients. That will bring the Company to a total of ten dispensary licenses in Illinois, which is the statutory cap. All licenses are, as of the date hereof, active with the State of Illinois. The licenses are independently issued for each approved activity for use at the Company’s facilities in Illinois.

All cultivation/processing establishments must register with Illinois Department of Agriculture. All dispensaries must register with the Illinois Department of Financial and Professional Regulation. If applications contain all required information, establishments are issued a marijuana establishment registration certificate. Registration certificates are valid for a period of one year and are subject to annual renewals after required fees are paid and the business remains in good standing. Pursuant to Illinois law, registration renewal applications must be received 45 days prior to expiration and may be denied if the license has a history of non-compliance and penalties.

The cultivation/processing licenses permit the Company to acquire, possess, cultivate, manufacture/process into edible marijuana products and/or marijuana-infused products, deliver, transfer, have tested, transport, supply or sell marijuana and related supplies to marijuana dispensaries.

The retail dispensary licenses permit the Company to purchase marijuana and marijuana products from cultivation/processing facilities, as well as allow the sale of marijuana and marijuana products.

See Appendix A to this Annual Report for a list of the licenses issued to the Company with respect to its operations in Illinois.

Illinois Reporting Requirements

The state of Illinois uses BioTrack as the state’s computerized track-and-trace (“T&T”) system for seed-to-sale reporting. Individual licensees, whether directly or through third-party integration systems, are required to push data to the state to meet all reporting requirements. The Company uses an in-house computerized seed-to-sale software, which integrates with the state’s BioTrack program and captures the necessary data points as required in the Illinois Compassionate Use of Medical Cannabis Program Act.

18

Table of Contents

Maryland

In 2012, a state law was enacted in Maryland to establish a state-regulated medical marijuana program. Legislation was signed in May 2013 and the program became operational on December 1, 2017. The Maryland Medical Cannabis Commission (the “MMCC”) regulates the state program and awarded operational licenses in a highly competitive application process. 102 dispensary licenses were awarded out of a pool of over 800 applicants, while an original 15 cultivation licenses were awarded out of a pool of over 150 applicants. In April 2018, Maryland lawmakers agreed to expand the state’s medical marijuana industry by authorizing an additional 20 licenses, seven for cultivation and 13 for processing. The state program was written to allow access to medical marijuana for patients with any condition that is considered “severe” for which other medical treatments have proven ineffective, including: chronic pain, nausea, seizures, glaucoma and PTSD.

Maryland Licenses and Regulations

There are three principal license categories in Maryland: (1) cultivation, (2) processing and (3) dispensary. The Company has control and/or ownership over one cultivation license, one processing license and three retail dispensaries. All licenses are, as of the date hereof, active with the State of Maryland. The licenses are independently issued for each approved activity for use at the Company facilities in Maryland.

All cultivation, processing and dispensary establishments must register with the MMCC under the provisions of the Maryland Medical Cannabis Law, Section 13-3301 et seq. If applications contain all required information, establishments are issued a medical marijuana establishment registration certificate. Registration certificates are valid for a period of six years and are subject to annual renewals after required fees are paid and the business remains in good standing. After the first expiration of the approved license, the dispensary, cultivation and processing licensee is required to renew every two years. Licensees are required to submit a renewal application per the guidelines published by the MMCC. 90 days prior to the expiration of a license, the MMCC notifies the licensee of the date on which the license expires and provides the instructions and fee required to renew the license along with the consequences of failure to renew. At least 30 business days before a license expires, the licensee must submit the renewal application as provided by the MMCC.

The medical cultivation licenses permit the Company to acquire, possess, cultivate, deliver, transfer, have tested, transport, supply or sell marijuana and related supplies to medical marijuana dispensaries, facilities for the production of medical marijuana products and/or medical marijuana-infused products or other medical marijuana cultivation facilities.

The medical processing license permits the Company to acquire, possess, manufacture, deliver, transfer, transport, supply, or sell marijuana products or marijuana infused products to other medical marijuana production facilities or medical marijuana dispensaries.

The retail dispensary licenses permit the Company to purchase marijuana from cultivation facilities, marijuana and marijuana products from product manufacturing facilities and marijuana from other medical marijuana dispensaries, as well as allow the sale of marijuana and marijuana products.

See Appendix A to this Annual Report for a list of the licenses issued to the Company with respect to its operations in Maryland.

Maryland Reporting Requirements

The state of Maryland uses METRC as the state’s computerized T&T system for seed-to-sale reporting. Individual licensees, whether directly or through third-party integration systems, are required to push data to the state to meet all reporting requirements. The Company uses an in-house computerized seed-to-sale software, which integrates with the state’s METRC program and captures the required data points for retail as required in the Maryland Medical Cannabis Law. The Company uses METRC directly for cultivation and manufacturing.

19

Table of Contents

Massachusetts

Massachusetts legalized medical marijuana when voters passed a ballot initiative in 2012. The Massachusetts Medical Use of Marijuana Program was formed pursuant to the Act for the Humanitarian Medical Use of Marijuana. Adult use marijuana became legal in Massachusetts as of December 15, 2016, following a ballot initiative in November 2016. Dispensaries for the adult use of cannabis in Massachusetts began operating in July 2018.

In Massachusetts, Registered Marijuana Dispensaries (“RMDs”) are “vertically-integrated,” which means RMDs grow, process and dispense their own marijuana. An RMD must have a retail facility, as well as cultivation and processing operations. Some RMDs elect to conduct cultivation, processing and retail operations all in one location, which is commonly referred to as a “co-located” operation. An RMD may also choose to have a retail dispensary in one location and grow marijuana at a remote cultivation location. An RMD may process marijuana at either a retail dispensary location or a remote cultivation location. The remote cultivation location need not be in the same municipality, or the same county, as the retail dispensary.

Massachusetts Licenses and Regulations

There is one principal license category in Massachusetts: vertically-integrated RMD license. The Company is licensed to operate one medical and adult use cultivation/processing facility and up to two medical and adult use retail dispensaries. All licenses are, as of the date hereof, active with the State of Massachusetts. The licenses are independently issued for each approved activity for use at the Company’s facilities in Massachusetts.

The Massachusetts Department of Public Health was the regulatory body that oversaw the original Massachusetts medical program, including all cultivation, processing and dispensary facilities. The Cannabis Control Commission (the “CCC”), a regulatory body created in 2018, now oversees the medical and adult use programs, including licensing of cultivation, processing and dispensary facilities. Licensed medical dispensaries are given priority status in adult use licensing.

Each Massachusetts dispensary, cultivator and processor license is valid for one year and must be renewed no later than 60 calendar days prior to expiration. The CCC can deny or revoke licenses and renewals for multiple reasons, including (a) submission of materially inaccurate, incomplete or fraudulent information, (b) failure to comply with any applicable law or regulation, including laws relating to taxes, child support, workers compensation and insurance coverage, (c) failure to submit or implement a plan of correction, (d) attempting to assign registration to another entity, (e) insufficient financial resources, (f) committing, permitting, aiding or abetting of any illegal practices in the operation of the RMD, (g) failure to cooperate or give information to relevant law enforcement related to any matter arising out of conduct at an RMD and (h) lack of responsible RMD operations, as evidenced by negligence, disorderly or unsanitary facilities or permitting a person to use a registration card belonging to another person.

The RMD license permits the Company to cultivate, process and dispense medical and adult use cannabis.

See Appendix A to this Annual Report for a list of the licenses issued to the Company with respect to its operations in Massachusetts.

Massachusetts Reporting Requirements

The Commonwealth of Massachusetts uses the MMJ Online system through the Virtual Gateway portal as the state’s computerized T&T system for seed-to-sale reporting. Individual licensees, whether directly or through third-party integration systems, are required to push data to the state to meet all reporting requirements.

20

Table of Contents

The Company uses an in-house computerized seed-to-sale software, which integrates with the state’s program and captures the required data points for cultivation, manufacturing and retail as required in the Massachusetts marijuana laws and regulations.

Nevada

Nevada became a medical marijuana state in 2001. In 2013, the Nevada legislature passed SB374, providing for state licensing of medical marijuana establishments. On November 8, 2016, Nevada voters passed NRS 435D by ballot initiative allowing for the sale of marijuana for adult use starting on July 1, 2017. In 2018, the Nevada Department of Taxation (the “DOT”) opened up applications for additional adult use marijuana dispensary licenses. Only those companies that held medical marijuana licenses in the state could apply. In December 2018, 61 additional marijuana dispensary licenses were issued by the DOT.

Nevada Licenses and Regulations