Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Rosehill Resources Inc. | exhibit991123119.htm |

| EX-32.2 - EXHIBIT 32.2 - Rosehill Resources Inc. | exhibit322123119.htm |

| EX-32.1 - EXHIBIT 32.1 - Rosehill Resources Inc. | exhibit321123119.htm |

| EX-31.2 - EXHIBIT 31.2 - Rosehill Resources Inc. | exhibit312123119.htm |

| EX-31.1 - EXHIBIT 31.1 - Rosehill Resources Inc. | exhibit311123119.htm |

| EX-23.2 - EXHIBIT 23.2 - Rosehill Resources Inc. | exhibit232consentofnsai.htm |

| EX-23.1 - EXHIBIT 23.1 - Rosehill Resources Inc. | exhibit231consentofbdo.htm |

| EX-10.27 - EXHIBIT 10.27 - Rosehill Resources Inc. | exhibit1027123119.htm |

| EX-10.23 - EXHIBIT 10.23 - Rosehill Resources Inc. | exhibit1023123119.htm |

| EX-10.5 - EXHIBIT 10.5 - Rosehill Resources Inc. | exhibit105123119.htm |

| EX-4.6 - EXHIBIT 4.6 - Rosehill Resources Inc. | exhibit46123119.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-37712

ROSEHILL RESOURCES INC. |

(Exact Name of Registrant as Specified in its Charter) |

Delaware | 90-1184262 | |

(State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) | |

16200 Park Row, Suite 300 |

Houston, Texas 77084 |

(Address of principal executive offices) |

(281) 675-3400 |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Class A Common Stock | ROSE | The Nasdaq Capital Market |

Class A Common Stock Public Warrants | ROSEW | The Nasdaq Capital Market |

Class A Common Stock Public Units | ROSEU | The Nasdaq Capital Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ý | Smaller reporting company | ý |

Emerging growth company | ý | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes ☐ No ý

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2019, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $39.9 million based on the last sales price of the shares as reported on the Nasdaq market on that date.

As of March 27, 2020, 28,811,078 shares of Class A common stock, par value $0.0001 per share, and 15,707,692 shares of Class B common stock, par value $0.0001 per share, were issued and outstanding.

Documents Incorporated by Reference

Portions of the Definitive Proxy Statement for the registrant’s 2020 Annual Meeting of Stockholders, filed with the commission on April 7, 2020, are incorporated by reference into Part III of this report.

ROSEHILL RESOURCES INC.

FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2019

TABLE OF CONTENTS

Page | ||

PART I | ||

ITEM 1. | ||

ITEM 1A. | ||

ITEM 1B. | ||

ITEM 2. | ||

ITEM 3. | ||

ITEM 4. | ||

PART II | ||

ITEM 5. | ||

ITEM 6. | ||

ITEM 7. | ||

ITEM 7A. | ||

ITEM 8. | ||

ITEM 9. | ||

ITEM 9A. | ||

ITEM 9B. | ||

PART III | ||

ITEM 10. | ||

ITEM 11. | ||

ITEM 12. | ||

ITEM 13. | ||

ITEM 14. | ||

PART IV | ||

ITEM 15. | ||

ITEM 16. | ||

1

GLOSSARY OF TERMS

The following are abbreviations and definitions of certain terms commonly used in the oil and natural gas industry and in this Annual Report on Form 10-K.

3-D seismic. Geophysical data that depict the subsurface strata in three dimensions. 3-D seismic typically provides a more detailed and accurate interpretation of the subsurface strata than 2-D, or two-dimensional, seismic.

Acquisition of properties. Costs incurred to purchase, lease or otherwise acquire a property, including costs of lease bonuses and options to purchase or lease properties, the portion of costs applicable to minerals when land including mineral rights is purchased in fee, brokers’ fees, recording fees, legal costs and other costs incurred in acquiring properties.

Basin. A large depression on the earth’s surface in which sediments accumulate.

Bbl. One stock tank barrel or 42 U.S. gallons liquid volume used in reference to crude oil or other liquid hydrocarbons.

Bbls/d. Barrels per day.

Boe. One barrel of oil equivalent determined using a ratio of six thousand cubic feet (Mcf) of natural gas being equivalent to one Bbl of crude oil, condensate or natural gas liquids.

Boe/d. Barrels of oil equivalent per day.

Btu. British thermal unit, which is the heat required to raise the temperature of a one-pound mass of water from 58.5 to 59.5 degrees Fahrenheit.

Completion. The process of treating a drilled well followed by the installation of permanent equipment for the production of natural gas or oil, or in the case of a dry hole, the reporting of abandonment to the appropriate agency.

Condensate. Condensate is a mixture of hydrocarbons that exists in the gaseous phase at original reservoir temperature and pressure, but that, when produced, is in the liquid phase at surface pressure and temperature. For additional information, see the SEC’s definition in Rule 4-10(a)(4) of Regulation S-X, a link for which is available at the SEC’s website.

Crude oil. Liquid hydrocarbons retrieved from geological structures underground to be refined into fuel sources.

Developed acreage. The number of acres that are allocated or assignable to productive wells or wells capable of production.

Development costs. Costs incurred to obtain access to proved reserves and to provide facilities for extracting, treating, gathering and storing the oil and gas.

Development project. A development project is the means by which petroleum resources are brought to the status of economically producible. As examples, the development of a single reservoir or field, an incremental development in a producing field, or the integrated development of a group of several fields and associated facilities with a common ownership may constitute a development project.

Development well. A well drilled within the proved area of an oil or natural gas reservoir to the depth of a stratigraphic horizon known to be productive.

Differential. An adjustment to the price of oil or natural gas from an established spot market price to reflect differences in the quality or location of oil or natural gas.

Dry hole or well. A well found to be incapable of producing hydrocarbons in sufficient quantities such that proceeds from the sale of such production would exceed production expenses and taxes.

Economically producible. The term economically producible, as it relates to a resource, means a resource which generates revenue that exceeds, or is reasonably expected to exceed, the costs of the operation.

Exploitation. A development or other project which may target proven or unproven reserves (such as probable or possible reserves), but which generally has a lower risk than that associated with exploration projects.

2

Exploratory well. A well drilled to find and produce oil or natural gas reserves not classified as proved, to find a new reservoir in a field previously found to be productive of natural gas or oil in another reservoir or to extend a known reservoir.

Field. An area consisting of a single reservoir or multiple reservoirs all grouped on or related to the same individual geological structural feature or stratigraphic condition.

Formation. A layer of rock that has distinct characteristics that differs from nearby rock.

Fracturing. The process of creating and preserving a fracture or system of fractures in a reservoir rock typically by injecting a fluid under pressure through a wellbore and into the targeted formation.

Gross acres or gross wells. The total acres or wells, as the case may be, in which a working interest is owned.

Henry Hub. A distribution hub of natural gas pipelines used as a benchmark in natural gas pricing and the underlying commodity of NYMEX natural gas futures contracts.

Horizontal drilling. A drilling technique used in certain formations where a well is drilled vertically to a certain depth and then drilled at a right angle with a specified interval.

Horizontal wells. Wells drilled directionally horizontal to allow for development of structures not reachable through traditional vertical drilling mechanisms.

Hydrocarbons. Oil, NGLs and natural gas are all collectively considered hydrocarbons.

Liquids. Natural gas that contains significant heavy hydrocarbons, such as ethane, propane, butane, pentane and isobutane.

MBbls. One thousand barrels of crude oil or other liquid hydrocarbons.

MBoe. One thousand barrels of crude oil equivalent, using a ratio of six Mcf of natural gas to one Bbl of crude oil, condensate or natural gas liquids.

Mcf. One thousand cubic feet.

Mcf/d. One thousand cubic feet of natural gas per day.

Mineral interests. The interests in ownership of the resource and mineral rights, giving an owner the right to profit from the extracted resources.

MMBbls. One million barrels of crude oil or other liquid hydrocarbons.

MMBoe. One million barrels of crude oil equivalent, using a ratio of six Mcf of natural gas to one Bbl of crude oil, condensate or NGLs.

MMBtu. One million British thermal units.

MMcf/d. One million cubic feet of natural gas per day

Net acres. The sum of the fractional working interest owned in gross acres.

Net production. Production that is owned by the Company less royalties and production due others.

Net revenue interest. An owner’s interest in the revenues of a well after deducting proceeds allocated to royalty and overriding interests.

Net wells. The sum of the fractional working interest owned in gross wells.

NGLs. The combination of ethane, propane, butane, pentane and isobutane that when removed from natural gas become liquid under various levels of higher pressure and lower temperature.

3

NYMEX. New York Mercantile Exchange.

Oil. Crude oil and condensate.

Oil and natural gas properties. Tracts of land consisting of properties to be developed for oil and natural gas resource extraction.

Operating interest. An interest in natural gas and oil that is burdened with the cost of development and operation of the property.

Operator. The individual or company responsible for the exploration or production of an oil or natural gas well or lease.

Play. A set of discovered or prospective oil or natural gas accumulations sharing similar geologic, geographic and temporal properties, such as source rock, reservoir structure, timing, trapping mechanism and hydrocarbon type.

Plugging and abandonment. Refers to the sealing off of fluids in the strata penetrated by a well so that the fluids from one stratum will not escape into another or to the surface. Regulations of all states require plugging of abandoned wells.

Productive well. A well that is found to be capable of producing hydrocarbons in sufficient quantities such that proceeds from the sale of such production exceed production expenses and taxes.

Proved developed reserves. Reserves that can be expected to be recovered through: (i) existing wells with existing equipment and operating methods or in which the cost of the required equipment is relatively minor compared to the cost of a new well; and (ii) through installed extraction equipment and infrastructure operational at the time of the reserves estimate if the extraction is by means not involving a well.

Proved developed non-producing. Proved oil and natural gas reserves that are developed behind pipe or shut-in or that can be recovered through improved recovery only after the necessary equipment has been installed, or when the costs to do so are relatively minor. Shut-in reserves are expected to be recovered from (1) completion intervals which are open at the time of the estimate but which have not started producing, (2) wells that were shut-in for market conditions or pipeline connections, or (3) wells not capable of production for mechanical reasons. Behind-pipe reserves are expected to be recovered from zones in existing wells that will require additional completion work or future recompletion prior to the start of production.

Proved reserves. Proved oil and natural gas reserves are those quantities of oil and gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible—from a given date forward, from known reservoirs and under existing economic conditions, operating methods and government regulations—prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation.

Proved undeveloped reserves (“PUDs”). Proved undeveloped oil and gas reserves that are expected to be recovered from new wells on undrilled acreage, or from existing wells where a relatively major expenditure is required for recompletion.

(i) Proved reserves on undrilled acreage shall be limited to those directly offsetting development spacing areas that are reasonably certain of production when drilled, unless evidence using reliable technology exists that establishes reasonable certainty of economic producibility at greater distances.

(ii) Proved undrilled locations can be classified as having undeveloped reserves only if a development plan has been adopted indicating that they are scheduled to be drilled within five years, unless the specific circumstances, justify a longer time.

(iii) Under no circumstances shall estimates for proved undeveloped reserves be attributable to any acreage for which an application of fluid injection or other improved recovery technique is contemplated, unless such techniques have been proved effective by actual projects in the same reservoir or an analogous reservoir or by other evidence using reliable technology establishing reasonable certainty.

PV-10. When used with respect to natural gas, oil and NGL reserves, PV-10 means the present value of the estimated future net revenue to be generated from the production of proved reserves, net of estimated production and future development costs, using prices and costs in effect as of the date of the report or estimate, without giving effect to non-property related expenses such as general and administrative expenses, debt service and future income tax expense or to depreciation, depletion and amortization, discounted using an annual discount rate of 10%. Also referred to as “present value.” After-tax PV-10 is also referred to as “standardized measure” and is net of future income tax expense.

4

Realized price. The cash market price less all expected quality, transportation and demand adjustments.

Recompletion. The completion for production of an existing wellbore in another formation from that which the well has been previously completed.

Reserves. Reserves are estimated remaining quantities of oil and natural gas and related substances anticipated to be economically producible, as of a given date, by application of development projects to known accumulations. In addition, there must exist, or there must be a reasonable expectation that there will exist, the legal right to produce or a revenue interest in the production, installed means of delivering oil and natural gas or related substances to the market and all permits and financing required to implement the project. Reserves should not be assigned to adjacent reservoirs isolated by major, potentially sealing, faults until those reservoirs are penetrated and evaluated as economically producible. Reserves should not be assigned to areas that are clearly separated from a known accumulation by a non-productive reservoir (i.e., absence of reservoir, structurally low reservoir or negative test results). Such areas may contain prospective resources (i.e., potentially recoverable resources from undiscovered accumulations).

Reservoir. A porous and permeable underground formation containing a natural accumulation of producible oil or natural gas that is confined by impermeable rock or water barriers and is individual and separate from other reserves.

Royalty interest. An interest that gives an owner the right to receive a portion of the resources or revenues without having to carry any costs of development or operations.

SEC. United States Securities and Exchange Commission.

Spacing. The distance between wells producing from the same reservoir. Spacing is often expressed in terms of acres (e.g., 40-acre spacing) and is often established by regulatory agencies.

Standardized measure. The present value of estimated future net revenues to be generated from the production of proved reserves, determined in accordance with assumptions required by the Financial Accounting Standards Board and the Securities and Exchange Commission (using current costs and the average annual prices based on the unweighted arithmetic average of the first-day-of-the-month price for each month) without giving effect to non-property related expenses such as general and administrative expenses, debt service and future income tax expenses or to depreciation, depletion and amortization, and discounted using an annual discount rate of 10%. Federal income taxes have not been deducted from future production revenues in the calculation of standardized measure. In addition, Texas margin taxes and the federal income taxes associated with a corporate subsidiary have not been deducted from future production revenues in the calculation of the standardized measure as the impact of these taxes would not have a significant effect on the calculated standardized measure. Standardized measure does not give effect to commodity derivative transactions.

Tight formation. A formation with low permeability that produces natural gas with very low flow rates for long periods of time.

Undeveloped acreage. Lease acreage on which wells have not been drilled or completed to a point that would permit the production of commercial quantities of oil and natural gas regardless of whether such acreage contains proved reserves.

Undeveloped oil, natural gas and NGL reserves. Undeveloped oil, natural gas and NGL reserves are reserves of any category that are expected to be recovered from new wells on undrilled acreage, or from existing wells where a relatively major expenditure is required for recompletion. Also referred to as “undeveloped reserves.”

Working interest. The operating interest that gives the owner the right to drill, produce and conduct operating activities on the property and the right to a share of production.

Workover. Operations on a producing well to restore or increase production.

West Texas Intermediate (“WTI”). A type of crude oil used as a benchmark in oil pricing and the underlying commodity of NYMEX oil futures contracts.

5

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical fact included in this report, including those regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management, are forward-looking statements. When used in this Annual Report on Form 10-K, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements described under “Risk Factors” in Item 1A of Part 1 of this Annual Report on Form 10-K. Such statements speak only as of the date of this report.

Forward-looking statements may include statements about:

• | our future financial performance; |

• | our ability to realize the anticipated benefits of acquired mineral rights and other associated assets and interests in the Southern Delaware Basin in December 2017 (the “White Wolf Acquisition”); |

• | our business strategy; |

• | our reserves; |

• | our liquidity and capital resources; |

• | our ability to comply with covenants and obligations under our financing agreements; |

• | the future of our operations; |

• | our drilling prospects, inventories, projects and programs; |

• | our ability to replace the reserves we produce through drilling and property acquisitions; |

• | our financial strategy, liquidity and capital required for our development program; |

• | our realized oil, natural gas and NGL prices; |

• | the timing and amount of our future production of oil, natural gas and NGLs; |

• | our hedging strategy and results; |

• | our future drilling plans; |

• | our expansion plans and future opportunities; |

• | our competition and government regulations; |

• | our ability to obtain permits and governmental approvals; |

• | our pending legal or environmental matters; |

• | our marketing of oil, natural gas and NGLs; |

• | our leasehold or business acquisitions; |

• | our costs of developing our properties; |

• | general economic conditions; |

• | credit markets; |

• | the impact of the COVID-19 pandemic; |

• | our ability to continue as a going concern; |

• | our ability to successfully complete strategic initiatives, including potential refinancings, restructuring or deleveraging; |

• | uncertainty regarding our future operating results; and |

• | our plans, objectives, expectations and intentions contained in the Annual Report on Form 10-K that are not historical. |

You should not place undue reliance on these forward-looking statements. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including but not limited to those risks described under “Risk Factors” in Item 1A of Part 1 of this Annual Report on Form 10-K. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make.

Reserve engineering is a process of estimating underground accumulations of oil and natural gas that cannot be measured in an exact way. The accuracy of any reserve estimate depends on the quality of available data, the interpretation of such data and price and cost assumptions made by reserve engineers. In addition, the results of drilling, testing and production activities may justify revisions of estimates that were made previously. If significant, such revisions would change the schedule of any further production and development drilling. Accordingly, reserve estimates may differ significantly from the quantities of oil and natural gas that are ultimately recovered.

6

Although we believe that our plans, intentions and expectations reflected in or suggested by the forward-looking statements we make in this Annual Report on Form 10-K are reasonable, we can give no assurance that these plans, intentions or expectations will be achieved or occur, and actual results could differ materially and adversely from those anticipated or implied by the forward-looking statements.

All forward-looking statements, expressed or implied, included in this Annual Report on Form 10-K are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue.

Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this Annual Report on Form 10-K.

7

PART I

ITEM 1. BUSINESS

Overview

Rosehill Resources Inc. (the “Company,” “Rosehill Resources,” “we,” “us,” or “our”) is an independent oil and natural gas company focused on the acquisition, exploration, development and production of unconventional oil and associated liquids-rich natural gas reserves in the Permian Basin. Our assets are concentrated in the Delaware Basin, a sub-basin of the Permian Basin, and we divide our operations into two core areas: Northern Delaware Basin and the Southern Delaware Basin.

Our goal is to build a premier development and acquisition company focused on horizontal drilling in the Delaware Basin. Our objective is to be a returns-oriented pure-play Delaware Basin company focusing on (i) acreage with reduced development risk as a result of being in proven areas within the vicinity of other successful wells, (ii) stacked pay zones, including Brushy Canyon, Upper Avalon, LowerAvalon/1st Bone Spring, 2nd Bone Spring Shale, 2nd Bone Spring Sand, 3rd Bone Spring Shale, 3rd Bone Spring Sand, Upper Wolfcamp A (X/Y), Lower Wolfcamp A and Wolfcamp B and (iii) application of geology, optimizing well process improvements and well returns. We believe these characteristics have the potential to enhance our horizontal production capabilities, recoveries and economic results.

We have no direct operations and no significant assets other than our ownership interest in Rosehill Operating Company, LLC (“Rosehill Operating”), an entity for which we act as the sole managing member and of whose common units we currently own approximately 64.5% (or 70.6% assuming the conversion of Rosehill Operating Series A preferred units into Rosehill Operating common units). As the sole managing member of Rosehill Operating, we, through our officers and directors, are responsible for all operational, management and administrative decisions relating to Rosehill Operating’s business without the approval of any other member, unless otherwise specified in the Second Amended and Restated Limited Liability Company Agreement of Rosehill Operating (the “Second Amended LLC Agreement”).

Presentation of Financial and Operating Data

On April 27, 2017, KLR Energy Acquisition Corporation (“KLRE”) acquired a portion of the equity interests of Rosehill Operating, an entity into which Tema Oil & Gas Company (“Tema”), a wholly owned subsidiary of Rosemore, Inc. (“Rosemore”), contributed certain assets and liabilities (the “Transaction”). Following the Transaction, KLRE changed its name to Rosehill Resources Inc. and became the sole managing member of Rosehill Operating. The consolidated financial statements included in this report were derived from the audited carve-out historical financial statements of Tema and reflects the operating results of Rosehill Operating for the periods up to the Transaction and the combined results of the Company and Rosehill Operating following the Transaction.

8

Organizational Structure

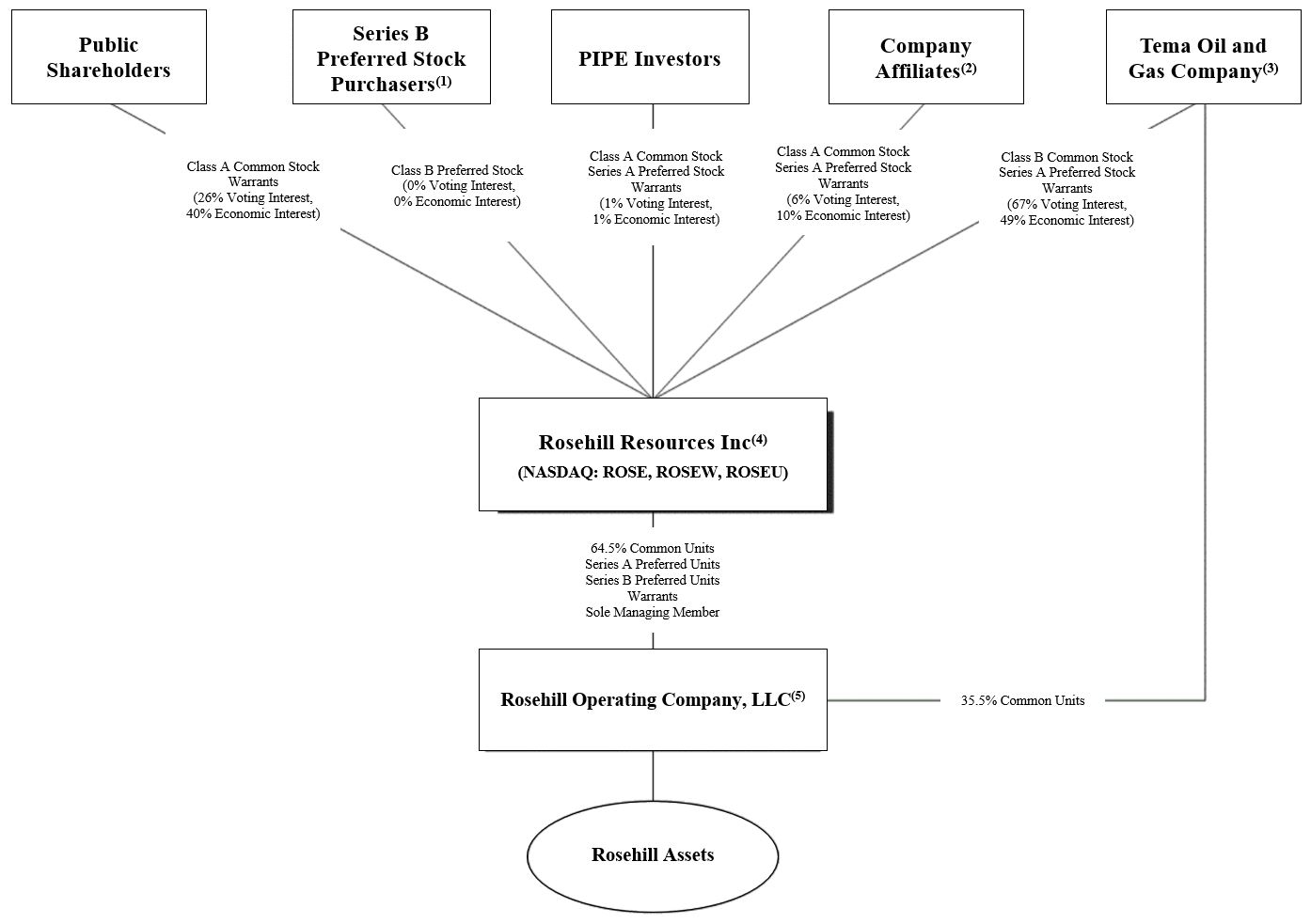

The following diagram illustrates the ownership structure of the company as of December 31, 2019:

(1) | “Series B Preferred Stock Purchasers” refers to certain private funds and accounts managed by EIG Global Energy Partners, LLC. |

(2) | “Company Affiliates” refers to KLR Energy Sponsor, LLC, KLR Group Investments, LLC and our current directors and officers. |

(3) | Includes Class B Common Stock, Class A Common Stock, Series A Preferred Stock and warrants held by Tema. |

(4) | The economic and voting interests set forth above do not take into account (i) the exercise of outstanding warrants for shares of Class A Common Stock, (ii) the future issuance of shares of Class A Common Stock under the Amended and Restated 2017 Long-Term Incentive Plan or (iii) the conversion of Series A Preferred Stock into shares of Class A Common Stock or the redemption of Rosehill Operating Common Units (and corresponding shares of Class B Common Stock) for shares of Class A Common Stock. |

(5) | In connection with the conversion of our remaining Series A Preferred Stock into Class A Common Stock, the Rosehill Operating Series A Preferred Units owned by us will convert into Rosehill Operating Common Units and, on an as-converted basis, we will own approximately 71% of the Rosehill Operating Common Units. |

Our Operations

We operate in one industry segment, which is the exploration, development and production of oil and natural gas, and all of our operations are conducted in the United States. Consequently, we currently report a single reportable segment. See the notes to our consolidated financial statements for financial information about this reportable segment. Our future development will be focused predominately on horizontal development drilling in our core acreage areas in the Delaware Basin.

9

Since 2012, we have drilled 89 gross horizontal wells in the Northern Delaware Basin and 17 gross horizontal wells in the Southern Delaware Basin. In 2019, our production was approximately 20,786 net Boe/d. As of December 31, 2019, our portfolio included 83 gross operated producing horizontal wells in the Northern Delaware Basin and 17 gross operated producing horizontal wells in the Southern Delaware Basin, as well as working interests in approximately 4,625 gross acres in the Northern Delaware Basin and 11,160 gross acres in the Southern Delaware Basin.

As of December 31, 2019, we have identified 605 gross operated potential horizontal drilling locations in the Northern and Southern Delaware Basin, including 48 locations associated with proved undeveloped reserves, in up to ten formations from Brushy Canyon down through the Wolfcamp B. As of December 31, 2019, we had 5 drilled uncompleted wells (“DUCs”).

Our locations

Historically, our horizontal drilling has been widespread across the majority of our lease acreage. We have established commercial production in eight distinct formations in the Northern Delaware Basin in the Upper Avalon, Lower Avalon, 2nd Bone Spring Shale, 2nd Bone Spring Sand, 3rd Bone Spring Sand, Upper Wolfcamp A (X/Y), Lower Wolfcamp A and Wolfcamp B. In addition, offset operators have drilled and are producing in all ten formations, from Brushy Canyon down through the Wolfcamp B, enabling us to evaluate our acreage across various geographic areas and stratigraphic formations. As of December 31, 2019, approximately 77.7% of our total net operated acreage was either held by production or under continuous drilling provisions. Offset operator activity within the 2nd and 3rd Bone Spring Sands and the Wolfcamp formations as well as our recent successful Bone Spring and Wolfcamp drilling program has been a catalyst for our development program focused on the 2nd and 3rd Bone Spring Sands, Upper Wolfcamp A (X/Y), Lower Wolfcamp A and Wolfcamp B formations in the Northern Delaware. If our development program recommences, our near-term development program in the Southern Delaware will focus largely on the 2nd Bone Spring and Wolfcamp A formations. We will closely monitor this offset activity and adjust our future development plans with information and best practices learned from other operators.

Based on our evaluation of applicable geologic and engineering data, we currently have approximately 605 gross (569 net) identified potential operated horizontal drilling locations in multiple horizons on our acreage. If we recommence our drilling program, we intend to continue to develop our reserves through development drilling and exploitation and exploration activities on this multi-year project inventory of identified potential drilling locations and through additional acquisitions that meet our strategic and financial objectives, targeting oil-weighted reserves.

Operational facilities

Historically, our development plan included the development of necessary infrastructure to lower our costs and support our drilling schedule. We expect to accomplish this goal primarily through contractual arrangements with third-party service providers. Our facilities are generally in close proximity to our well locations and include storage tank batteries, oil/natural gas/water separation equipment and artificial lift equipment. We have sufficient gathering systems and pipeline takeaway capacity to continue ongoing and planned operations. We have agreements in place with third-party natural gas and crude oil purchasers and processors to benefit from existing downstream infrastructure. We expect to continue to evaluate the marketplace to obtain additional transportation and gathering options and capacity in the form of new pipeline tie-ins.

10

Major customers

We sell our production to a relatively small number of customers, as is customary in the industry. We sell all of our natural gas and NGLs under contracts with terms generally greater than twelve months and all of our oil under contracts with terms generally less than twelve months. The following table shows the percentage of sales to each of our major customers that accounted for 10% or more of our total oil, natural gas and NGL sales for each year presented.

Year Ended December 31, | ||||||||

2019 | 2018 | 2017 | ||||||

Customer | ||||||||

Major customer #1 | 63 | % | 17 | % | — | % | ||

Major customer #2 | 19 | 13 | — | |||||

Major customer #3 | 12 | — | — | |||||

Major customer #4 | — | 60 | 80 | |||||

Major customer #5 | — | — | 10 | |||||

Other | 6 | 10 | 10 | |||||

Total | 100 | % | 100 | % | 100 | % | ||

The loss of any one or all of our significant customers as a purchaser could materially and adversely affect our revenues.

The typical oil and natural gas lease agreement covering our properties provides for the payment of royalties to the mineral owner for all oil, NGLs and natural gas produced from any wells drilled on the leased premises. The lessor royalties and other leasehold burdens on our properties generally range from 12.5% to 25.0%, resulting in a net revenue interest to us generally ranging from 75.0% to 87.5%.

Gathering and Transportation

The majority of our crude oil production is sold at or near the lease as it enters third-party gathering pipelines and revenue is recognized based upon an index price less any applicable differentials. Because the majority of the purchasers of our crude oil production either owns or controls our crude oil production through the third-party pipelines used to transport our crude oil production, transportation costs related to moving our crude oil production are deducted from the price received.

Our natural gas production is sold at various delivery points to midstream processors and revenue is recognized based upon an appropriate index pricing for the extracted NGLs and remaining residue natural gas less applicable fees and differentials. If the midstream processor owns or controls our natural gas production through the gas gathering system that transports our natural gas production from the wellhead to the inlet of the midstream processor, transportation costs related to moving our natural gas production are deducted from the price received for our NGLs and residue gas. If the midstream processor takes possession of our natural gas production at the inlet to the midstream processor, transportation costs related to moving our natural gas production from the wellhead to the inlet of the midstream processor is recognized as transportation expense. We have long-term contracts in place to transport our natural gas production from the wellhead to various delivery points.

Competition

The oil and natural gas industry is intensely competitive and we compete with other companies that have greater resources. Many of these companies not only explore for and produce oil and natural gas, but also carry on midstream and refining operations and market petroleum and other products on a regional, national or worldwide basis. These companies may be able to pay more for productive oil and natural gas properties and exploratory prospects or to define, evaluate, bid for and purchase a greater number of properties and prospects than our financial or human resources permit. In addition, these companies may have a greater ability to continue exploration activities during periods of low oil and natural gas market prices. Our larger or more integrated competitors may be able to absorb the burden of existing, and any changes to, federal, state and local laws and regulations more easily than we can, which would adversely affect our competitive position. Our ability to acquire additional properties and to discover reserves in the future will be dependent upon our ability to evaluate and select suitable properties and to consummate transactions in a highly competitive environment. In addition, because we have fewer financial and human resources than many companies in our industry, we may be at a disadvantage in bidding for exploratory prospects and producing oil and natural gas properties.

11

There is also competition between oil and natural gas producers and other industries producing energy and fuel, primarily based on price. Changes in the availability or price of oil and natural gas or other forms of energy, as well as business conditions, conservation and the ability to convert to alternate fuels and other forms of energy may affect the demand for oil and natural gas. Furthermore, competitive conditions may be substantially affected by various forms of energy legislation or regulation considered from time to time by the governments of the United States and the jurisdictions in which we operate. It is not possible to predict the nature of any such legislation or regulation that may ultimately be adopted or its effects upon our future operations. Such laws and regulations may substantially increase the costs of developing oil and natural gas and may prevent or delay the commencement or continuation of a given operation. Our larger competitors may be able to absorb the burden of existing and future federal, state and local laws and regulations more easily than we can, which would adversely affect our competitive position. Please see “Risk Factors - Risks Related to Our Operations - Competition in the oil and natural gas industry is intense, making it more difficult for us to acquire properties, market oil or natural gas and secure trained personnel.”

Seasonality of business

Demand for oil and natural gas generally decreases during the spring and fall months and increases during the summer and winter months. However, seasonal anomalies such as mild winters or mild summers sometimes lessen this fluctuation. Weather conditions affect the demand for and prices of, oil, natural gas and NGLs. Due to these and other seasonal fluctuations, results of operations for quarterly periods may not be indicative of the results that may be realized on an annual basis. Such seasonal anomalies can also pose challenges for meeting our well drilling objectives and may increase competition for equipment, supplies and personnel during the spring and summer months, which could lead to shortages and increase costs or delay or temporarily halt our operations.

Operational hazards and insurance

The oil and natural gas industry involves a variety of operating risks, including, but not limited to, the risk of fire, explosions, blow outs, pipe failures and, in some cases, abnormally high-pressure formations which could lead to environmental hazards such as oil spills, natural gas leaks and the discharge of toxic gases. If any of these should occur, we could incur legal defense costs and could be required to pay amounts due to injury, loss of life, damage or destruction to property, natural resources and equipment, pollution or environmental damage, regulatory investigation and penalties and suspension of operations.

In accordance with what we believe to be industry practice, we maintain insurance against some, but not all, of the operating risks to which our business is exposed. We currently have insurance policies for certain property damages, control of well protection, commercial general liability, business automobile liability, workers compensation, excess umbrella liability and other coverages.

Our insurance is subject to exclusion and limitations, and there is no assurance that such coverage will fully or adequately protect us against liability from all potential consequences, damages and losses. Any of these operational hazards could cause a significant disruption to our business. A loss not fully covered by insurance could have a material adverse effect on our financial position, results of operations and cash flows. See Item 1A. “Risk Factors - Risks Related to Our Operations - We may incur substantial losses and be subject to substantial liability claims as a result of our operations. Additionally, we may not be insured for, or the insurance may be inadequate to protect us against, these risks.”

We reevaluate the purchase of insurance, policy terms and limits annually. Future insurance coverage for our industry could increase in cost and may include higher deductibles or retentions. In addition, some forms of insurance may become unavailable in the future or unavailable on terms that we believe are economically acceptable. No assurance can be given that we will be able to maintain insurance in the future at rates that we consider reasonable and we may elect to maintain minimal or no insurance coverage. We may not be able to secure additional insurance or bonding that might be required by new governmental regulations. This may cause us to restrict our operations, which might severely impact our financial position. The occurrence of a significant event, not fully insured against, could have a material adverse effect on our financial condition and results of operations.

Generally, we also require our third-party vendors to sign master service agreements in which they agree to indemnify us for injuries and deaths of the service provider’s employees as well as contractors and subcontractors hired by the service provider.

12

Regulation of the Oil and Natural Gas Industry

Our operations are substantially affected by federal, state and local laws and regulations. Failure to comply with these laws and regulations can result in substantial penalties. The regulatory burden on the industry increases the cost of doing business and affects profitability. Although we believe we are in substantial compliance with all applicable laws and regulations, and that continued substantial compliance with existing requirements will not have a material adverse effect on our financial position, cash flows or results of operations, such laws and regulations are frequently amended or reinterpreted. Therefore, we are unable to predict the future costs or impacts of compliance. Proposals and proceedings that could affect the oil and natural gas industry are regularly considered by the United States Congress (“Congress”), the states, the Federal Energy Regulatory Commission (“FERC”), the U.S. Environmental Protection Agency (“EPA”), other federal agencies and the courts. We cannot predict when or whether any such proposals may become effective. However, we do not believe that we would be affected by any such action materially differently than similarly situated competitors.

Regulation of oil and natural gas production

The production of oil and natural gas is subject to regulation under a wide range of local, state and federal statutes, rules, orders and regulations. We own property interests in jurisdictions that regulate drilling and operating activities by requiring, among other things, permits for the drilling of wells, bonding requirements to drill or operate wells, reports concerning operations and regulating the location of wells, the method of drilling and casing wells, the source and disposal of water used in the drilling and completion process, and the surface use and restoration of properties upon which wells are drilled and the plugging and abandonment of wells. Our operations are also subject to various conservation laws and regulations, including the size of drilling and spacing units or proration units, the number of wells which may be drilled in an area and the unitization or pooling of crude oil or natural gas wells, as well as regulations that limit or prohibit the venting or flaring of natural gas and impose certain requirements regarding the ratability or fair apportionment of production from fields and individual wells. These laws also govern various conservation matters, including provisions for the unitization or pooling of oil and natural gas properties, the establishment of maximum allowable rates of production from oil and natural gas wells, the regulation of well spacing or density and plugging and abandonment of wells. The effect of these regulations may limit the amount of oil and natural gas that we can produce from our wells and limit the number of wells or the locations at which we can drill, although we can apply for exceptions to such regulations or to have reductions in well spacing or density. Moreover, many jurisdictions impose a production or severance tax with respect to the production and sale of oil, natural gas and NGLs within its jurisdiction. The failure to comply with these rules and regulations can result in substantial penalties. Our competitors in the oil and natural gas industry are subject to the same regulatory requirements and restrictions that affect our operations.

Regulation of oil sales and transportation

Sales of oil, condensate and NGLs are not currently regulated and are made at negotiated prices. Nevertheless, Congress could reenact price controls in the future. Our sales of oil are affected by the availability, terms and cost of transportation. The transportation of oil in common carrier pipelines is also subject to rate and access regulation. FERC regulates interstate oil pipeline transportation rates under the Interstate Commerce Act. In general, interstate oil pipeline rates must be cost‑based, although settlement rates agreed to by all shippers are permitted and market based rates may be permitted in certain circumstances. Intrastate oil pipeline transportation rates are subject to regulation by state regulatory commissions. The basis for intrastate oil pipeline regulation, and the degree of regulatory oversight and scrutiny given to intrastate oil pipeline rates, varies from state to state. Insofar as effective interstate and intrastate rates and regulations regarding access are equally applicable to all comparable shippers, we believe that the regulation of oil transportation will not affect our operations in any way that is of material difference from those of our competitors who are similarly situated. In December 2015, H.R. 2029 was signed into law which lifted a ban on the export of crude oil from the United States. This will enable U.S. oil producers the flexibility to seek new markets and export oil into the global marketplace.

Regulation of natural gas sales and transportation

In the past, the federal government has regulated the prices at which natural gas could be sold. While sales by producers of natural gas can currently be made at uncontrolled market prices, Congress could reenact price controls in the future.

The transportation and sale for resale of natural gas in interstate commerce is regulated by FERC primarily under the Natural Gas Act of 1938, as amended (“NGA”) and by regulations and orders promulgated under the NGA by FERC. In certain limited circumstances, intrastate transportation and wholesale sales of natural gas may also be affected directly or indirectly by laws enacted by Congress and by FERC regulations.

13

The Energy Policy Act of 2005 (“EP Act of 2005”) amended the NGA to add an anti-market manipulation provision that makes it unlawful for any entity to engage in prohibited behavior prescribed by FERC Pursuant to the EP Act of 2005, FERC promulgated regulations that make it unlawful to: (i) in connection with the purchase or sale of natural gas subject to the jurisdiction of FERC, or the purchase or sale of transportation services subject to the jurisdiction of FERC, for any entity, directly or indirectly, use, or employ any device, scheme, or artifice to defraud; (ii) make any untrue statement of material fact or omit to make any such statement necessary to make the statements made not misleading; or (iii) engage in any act or practice that operates as a fraud or deceit upon any person. The anti-market manipulation rule does not apply to activities that relate only to intrastate or other non-jurisdictional sales or gathering, but does apply to activities of gas pipelines and storage companies that provide interstate services, as well as otherwise non-jurisdictional entities to the extent the activities are conducted “in connection with” gas sales, purchases or transportation subject to FERC jurisdiction, which now includes the Annual Reporting requirements described below.

The EP Act of 2005 also provided FERC with the power to assess civil penalties of up to $1,000,000 per day for violations of the NGA and increased FERC’s civil penalty authority under the NGA from $5,000 per violation per day to $1,000,000 per violation per day. Effective February 2019, to account for inflation, FERC’s civil penalty authority was increased to $1,269,500 per violation per day. The civil penalty provisions are applicable to entities that engage in the sale of natural gas for resale in interstate commerce. Under FERC’s regulations, wholesale buyers and sellers of more than 2.2 million MMBtus of physical natural gas in the previous calendar year, including natural gas producers, gatherers and marketers, are now required to report, on May 1 of each year, aggregate volumes of natural gas purchased or sold at wholesale in the prior calendar year to the extent such transactions utilize, contribute to or may contribute to the formation of price indices, and whether they report prices to any index publishers, and if so, whether their reporting complies with FERC’s policy statement on price reporting.

Gathering service, which occurs upstream of jurisdictional transmission services, is regulated by the states onshore and in state waters. Section 1(b) of the NGA exempts natural gas gathering facilities from regulation by FERC under the NGA. Although FERC has set forth a general test for determining whether facilities perform a non-jurisdictional gathering function or a jurisdictional transmission function, FERC’s determinations as to the classification of facilities are done on a case-by-case basis. To the extent that FERC issues an order that reclassifies certain non-jurisdictional gathering facilities as jurisdictional transmission facilities, our costs of transporting gas to point of sale locations could increase. We believe that the third-party natural gas pipelines on which our gas is gathered meet the traditional tests FERC has used to establish a pipeline’s status as a gatherer not subject to regulation under the NGA. However, the distinction between FERC-regulated transmission services and federally unregulated gathering services is the subject of ongoing litigation, so the classification and regulation of those gathering facilities are subject to change based on future determinations by FERC, the courts or Congress. State regulation of natural gas gathering facilities generally includes various occupational safety, environmental and, in some circumstances, nondiscriminatory-take requirements. Although such regulation has not generally been affirmatively applied by state agencies, natural gas gathering may receive greater regulatory scrutiny in the future.

For physical sales of these energy commodities, we are required to observe anti-market manipulation laws and related regulations enforced by FERC under the EP Act of 2005 and under the Commodity Exchange Act (“CEA”) and regulations promulgated thereunder by the U.S. Commodity Futures Trading Commission. The CEA prohibits any person from manipulating or attempting to manipulate the price of any commodity in interstate commerce or futures or derivative contracts on such commodity. The CEA also prohibits knowingly delivering or causing to be delivered false or misleading or knowingly inaccurate reports concerning market information or conditions that affect or tend to affect the price of a commodity, as well as any manipulative or deceptive device or contrivance in connection with any contract of sale of any commodity in interstate commerce or futures or derivative contract on such commodity. Should we violate the anti-market manipulation laws and regulations, they could also be subject to related third-party damage claims by, among others, sellers, royalty owners and taxing authorities.

Intrastate natural gas transportation is also subject to regulation by state regulatory agencies. The basis for intrastate regulation of natural gas transportation and the degree of regulatory oversight and scrutiny given to intrastate natural gas pipeline rates and services varies from state to state. Insofar as such regulation within a particular state will generally affect all intrastate natural gas shippers within the state on a comparable basis, we believe that the regulation of similarly situated intrastate natural gas transportation in any states in which we operate and ship our natural gas on an intrastate basis will not affect our operations in any way that is of material difference from those of our competitors. Like the regulation of interstate transportation rates, the regulation of intrastate transportation rates affects the marketing of natural gas that we produce, as well as the revenue we receive for sales of our natural gas.

Changes in law and to FERC or state policies and regulations may adversely affect the availability and reliability of firm or interruptible transportation service on interstate and intrastate pipelines, and we cannot predict what future action FERC or state regulatory bodies will take. We do not believe, however, that any regulatory changes will affect our operations in a way that materially differs from the way they will affect other natural gas producers and marketers with which we compete.

14

Regulation of Environmental and Occupational Safety and Health Matters

Our oil and natural gas exploration, development and production operations are subject to stringent federal, regional, state and local laws and regulations governing the discharge of materials into the environment or otherwise relating to occupational health and safety, or the protection of the environment and natural resources. Numerous federal, state and local governmental agencies, such as the EPA, issue regulations that often require difficult and costly compliance measures that carry substantial administrative, civil and criminal penalties and may result in injunctive obligations for non-compliance. These laws and regulations may require the acquisition of a permit before drilling commences, restrict the types, quantities and concentrations of various substances that can be released into the environment in connection with drilling and production activities, limit or prohibit construction or drilling activities on certain lands lying within wilderness, wetlands, ecologically or seismically sensitive areas and other protected areas, require action to prevent or remediate pollution from current or former operations, such as plugging abandoned wells or closing pits, result in the suspension or revocation of necessary permits, licenses and authorizations, require that additional pollution controls be installed and impose substantial liabilities for pollution resulting from our operations or related to our owned or operated facilities. Liability under such laws and regulations is often strict (i.e., no showing of “fault” is required) and can be joint and several. Moreover, it is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the release of hazardous substances, hydrocarbons or other waste products into the environment. Changes in environmental laws and regulations occur frequently, and any changes that result in more stringent and costly pollution control or waste handling, storage, transport, disposal or cleanup requirements could materially adversely affect our operations and financial position, as well as the oil and natural gas industry in general. Our management believes that we are in substantial compliance with applicable environmental laws and regulations and we have not experienced any material adverse effect from compliance with these environmental requirements. This trend, however, may not continue in the future.

Regulation of hazardous substances and waste handling

The Comprehensive Environmental Response, Compensation, and Liability Act of 1980 (“CERCLA”), also known as the “Superfund” law, and comparable state laws, impose liability without regard to fault or the legality of the original conduct, on certain classes of persons that are considered to have contributed to the release of a “hazardous substance” into the environment. These persons include the current and past owner or operator of the disposal site or the site where the release occurred and companies that disposed or arranged for the disposal of the hazardous substances at the site where the release occurred. Under CERCLA, such persons may be subject to joint and several strict liability for the costs of cleaning up the hazardous substances that have been released into the environment and for damages to natural resources. Although petroleum substances such as crude oil and natural gas are excluded from the definition of hazardous substances under CERCLA, various substances used in drilling and production operations are not covered by this exclusion and releases of these non-excluded substances or petroleum substances could give rise to CERCLA liability. In addition, it is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the hazardous substances or petroleum released into the environment. We are only able to directly control the operation of those wells for which we act as operator. Notwithstanding our lack of direct control over wells operated by others, the liability of an operator other than us for releases may, in certain circumstances, be attributed to us. We generate materials in the course of our operations that may be regulated as hazardous substances, but we are unaware of any liabilities for which we may be held responsible that would materially and adversely affect us.

The Resource Conservation and Recovery Act (“RCRA”) and analogous state laws impose detailed requirements for the generation, handling, storage, treatment and disposal of nonhazardous and hazardous solid wastes. RCRA specifically excludes drilling fluids, produced waters and other wastes associated with the development or production of crude oil, natural gas or geothermal energy from regulation as hazardous wastes. However, in the course of our operations, we may generate some amounts of ordinary industrial wastes, such as paint wastes, waste solvents, laboratory wastes and waste compressor oils that may be regulated as hazardous wastes if such wastes have hazardous characteristics or are listed hazardous wastes. In addition, even wastes excluded from the definition of hazardous waste may be regulated by the EPA or state agencies under state laws or other federal laws. Moreover, it is possible that those particular oil and natural gas development and production wastes now excluded from the definition of hazardous wastes could be classified as hazardous wastes in the future. For example, from time to time various environmental groups have challenged the EPA’s exclusion of certain oil and gas wastes from regulations RCRA. In one such challenge, the U.S. District Court for the District of Columbia entered a consent decree requiring EPA to evaluate the exclusion of oil and gas wastes, and by March 2019, to either sign a notice of proposed rulemaking revising the regulations excluding oil and gas wastes or sign a determination that revision of the exclusion is not necessary. In April 2019, the EPA concluded that revisions to RCRA was not necessary the time. A loss of the RCRA exclusion for drilling fluids, produced waters and related wastes, if the EPA were to eliminate the exclusion, could result in an increase in our costs to manage and dispose of generated wastes, which could have a material adverse effect on our results of operations and financial position. Although the costs of managing hazardous waste may be significant, we do not believe that our costs in this regard are materially more burdensome than those for similarly situated companies.

15

We currently own, lease, or operate numerous properties that have been used for oil and natural gas development and production activities for many years. Although we believe that we have utilized operating and waste disposal practices that were standard in the industry at the time, hazardous substances, wastes or petroleum hydrocarbons may have been released on, under or from the properties owned or leased by us, or on, under or from other locations, including off-site locations, where such substances have been taken for recycling or disposal. In addition, some of our properties have been operated by third parties or by previous owners or operators whose treatment and disposal of hazardous substances, wastes or petroleum hydrocarbons was not under our control. These properties and the substances disposed or released on, under or from them may be subject to CERCLA, RCRA and analogous state laws. Under such laws, we could be required to undertake response or corrective measures, which could include removal of previously disposed substances and wastes, cleanup of contaminated property, or performance of remedial plugging or pit closure operations to prevent future contamination.

Regulation of water discharges

The Clean Water Act and comparable state laws impose restrictions and strict controls regarding the discharge of pollutants, including produced waters and other oil and natural gas wastes, into or near navigable waters. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by the EPA or the state. The discharge of dredge and fill material into regulated waters, including wetlands, is also prohibited, unless authorized by a permit issued by the U.S. Army Corps of Engineers (the “Corps”). In September 2015, the EPA and the Corps issued new rules defining the scope of the EPA’s and the Corps’ jurisdiction under the Clean Water Act with respect to certain types of waterbodies and classifying these waterbodies as regulated wetlands. However, in October 2019, the EPA and the Corps published a final rule to repeal the 2015 rule and recodified the jurisdiction to that which existed under the Clean Water Act prior to the 2015 rule; this final rule became effective in December and is currently subject to litigation which challenges the repeal. In January 2020, the EPA finalized a replacement rule clarifying the scope of regulated waters which widely is viewed as less expansive then the 2015 rule; the rule will be effective 60 days after publication in the Federal Register and is likely to be subject to legal challenges. As a result of these recent developments, the final determination of the scope of the EPA’s and the Corp’s jurisdiction is uncertain. To the extent any revised rule expands the scope of the Clean Water Act’s jurisdiction, we could face increased costs and delays with respect to obtaining permits for dredge and fill activities in wetland areas. Obtaining permits has the potential to delay the development of oil and natural gas projects. These laws and any implementing regulations provide for administrative, civil and criminal penalties for any unauthorized discharges of pollutants in reportable quantities and may impose substantial potential liability for the costs of removal, remediation and damages.

In addition, pursuant to these laws and regulations, we may be required to obtain and maintain approvals or permits for the discharge of wastewater or storm water and are required to develop and implement spill prevention, control and countermeasure plans, also referred to as “SPCC plans,” for on-site storage of significant quantities of oil. We believe that we maintain all required discharge permits necessary to conduct our operations and further believe we are in substantial compliance with the terms thereof.

The primary federal law related specifically to oil spill liability is the Oil Pollution Act of 1990 (“OPA”), which amends and augments the oil spill provisions of the Clean Water Act and imposes certain duties and liabilities on certain “responsible parties” related to the prevention of oil spills and damages resulting from such spills in or threatening waters of the United States or adjoining shorelines. For example, operators of certain oil and natural gas facilities must develop, implement and maintain facility response plans, conduct annual spill training for certain employees and provide varying degrees of financial assurance. Owners or operators of a facility, vessel or pipeline that is a source of an oil discharge or that poses the substantial threat of discharge is one type of “responsible party” who is liable. The OPA applies joint and several liability, without regard to fault, to each liable party for oil removal costs and a variety of public and private damages. Although defenses exist, they are limited. As such, a violation of the OPA has the potential to adversely affect our operations.

Regulation of air emissions

The federal Clean Air Act and comparable state laws restrict the emission of air pollutants from many sources, such as, for example, compressor stations, through air emissions standards, construction and operating permitting programs and the imposition of other compliance requirements. These laws and regulations may require us to obtain pre-approval for the construction or modification of certain projects or facilities expected to produce or significantly increase air emissions, obtain and strictly comply with stringent air permit requirements or utilize specific equipment or technologies to control emissions of certain pollutants. Over the next several years, we may be required to incur certain capital expenditures for air pollution control equipment or other air emissions related issues. For example, in October 2015, the EPA lowered the National Ambient Air Quality Standards (“NAAQS”) for ozone from 75 to 70 parts per billion. In November 2017, the EPA published a list of areas that are in compliance with the new ozone standard and, separately in December 2017, issued responses to state recommendations for designating non-attainment areas. States had the opportunity to submit new air quality monitoring to the EPA prior to the EPA finalizing its non-attainment designations. The EPA issued final attainment status designations in April 2018 and July 2018. State implementation of the revised

16

NAAQS could result in stricter permitting requirements or could delay or limit our ability to obtain such permits and result in increased expenditures for pollution control equipment, the costs of which could be significant.

In addition, the EPA has adopted new rules under the Clean Air Act that require the reduction of volatile organic compound emissions from certain fractured and refractured natural gas wells for which well completion operations are conducted and further require that most wells use reduced emission completions, also known as “green completions.” These regulations also establish specific new requirements regarding emissions from production-related wet seal and reciprocating compressors, and from pneumatic controllers and storage vessels. More recently, in June 2016, the EPA finalized rules regarding criteria for aggregating multiple small surface sites into a single source for air-quality permitting purposes applicable to the oil and gas industry. This rule could cause small facilities, on an aggregate basis, to be deemed a major source, thereby triggering more stringent air permitting processes and requirements. Compliance with these and other air pollution control and permitting requirements has the potential to delay the development of oil and natural gas projects and increase our costs of development, which costs could be significant. However, we do not believe that compliance with such requirements will have a material adverse effect on our operations.

Regulation of greenhouse gas emissions (“GHG”)

In response to findings that emissions of carbon dioxide, methane and other GHG present an endangerment to public health and the environment, the EPA has adopted regulations pursuant to the federal Clean Air Act that, among other things, require preconstruction and operating permits for GHG emissions from certain large stationary sources that otherwise require such permits for non-GHG emissions. Facilities required to obtain preconstruction permits for their GHG emissions are also required to meet “best available control technology” standards that are being established by the states or, in some cases, by the EPA on a case-by-case basis. These regulatory requirements could adversely affect our operations and restrict or delay our ability to obtain air permits for new or modified sources. In addition, the EPA has adopted rules requiring the monitoring and reporting of GHG emissions from specified onshore and offshore oil and natural gas production sources in the United States on an annual basis, which include certain of our operations. Furthermore, in June 2016, the EPA finalized rules that establish new controls for emissions of methane from new, modified or reconstructed sources in the oil and natural gas source category (the “2016 NSPS Rules”), including production, processing, transmission and storage activities. The rule includes first-time standards to address emissions of methane from equipment and processes across the source category, including hydraulically fractured oil and natural gas well completions. In September 2018, the EPA proposed amendments to the 2016 rules that would reduce the 2016 rules’ fugitive emissions monitoring requirements and expand exceptions to controlling methane emissions from pneumatic pumps, among other changes and is in

the process of finalizing the targeted amendments. Separately, on August 28, 2019, the EPA proposed amendments to the NSPS Rules which would remove all sources in the transmission and storage segment of the oil and natural gas industry from regulation under the rules and rescind the methane requirements in the 2016 rules that apply to sources in the production and processing segments of the industry. As an alternative, EPA also is proposing to rescind the methane requirements that apply to all sources in the oil and natural gas industry, without removing any sources from the current source category. Various industry and environmental groups have separately challenged the 2016 NSPS rules and the proposed revisions to the rules will likely be subject to legal challenge after finalization. As a result of these developments, future implementation of the standards is uncertain at this time. To the extent implemented, compliance with these rules would require enhanced record-keeping practices, the purchase of new equipment such as optical gas imaging instruments to detect leaks and increased frequency of maintenance and repair activities to address emissions leakage. The rules would also likely require hiring additional personnel to support these activities or the engagement of third-party contractors to assist with and verify compliance. New rules related to the reduction of methane and other GHG emissions could result in increased compliance costs on our operations.

There have not been significant legislative proposals to reduce GHG emissions at the federal level in recent years. In the absence of such federal climate legislation, a number of state and regional programs and initiatives have been enacted or are being considered that are aimed at tracking or reducing GHG emissions by means of cap and trade programs, direct taxation of carbon emissions, or that promote the use of less carbon-intensive fuels. These programs typically require major sources of GHG emissions to acquire and surrender emission allowances in return for emitting those GHGs. At the international level, the United States joined the international community at the 21st Conference of the Parties of the United Nations Framework Convention on Climate Change in Paris, France (“Paris Agreement”) that requires member countries to review and “represent a progression” in their intended nationally determined contributions, which set GHG emission reduction goals every five years beginning in 2020. The Paris Agreement entered into force in November 2016. Although this agreement does not create any binding obligations for nations to limit their GHG emissions, it does include pledges from participating nations to voluntarily limit or reduce future emissions. In June 2017, President Trump stated that the United States would withdraw from the Paris Agreement, but may enter into a future international agreement related to GHGs. The Paris Agreement provides for a four-year exit process beginning when it took effect in November 2016 and a formal withdrawal could not begin until three years after the Paris Agreement went into effect. In November 2019, the United States began the process to withdraw from the Paris Agreement by submitting formal notifications to the United Nations but the withdrawal will not take effect until one year from delivery of the notification,which would result in an effective

17

exit date of November 2020. The United States’ adherence to the exit process is uncertain or the terms on which the United States may reenter the Paris Agreement or a separately negotiated agreement are unclear at this time.

Although it is not possible at this time to predict how legislation or new regulations that may be adopted to address GHG emissions would impact our business, any such future laws and regulations imposing reporting obligations on, or limiting emissions of GHGs from, our equipment and operations could require us to incur costs to reduce emissions of GHGs associated with our operations. Substantial limitations on GHG emissions could adversely affect demand for the oil and natural gas we produce and lower the value of our reserves. Recently, activists concerned about the potential effects of climate change have directed their attention at sources of funding for fossil-fuel energy companies, which has resulted in certain financial institutions, funds and other sources of capital restricting or eliminating their investment in oil and natural gas activities. Ultimately, this could make it more difficult to secure funding for exploration and production activities. Notwithstanding potential risks related to climate change, the International Energy Agency estimates that global energy demand will continue to rise and will not peak until after 2040 and that oil and gas will continue to represent a substantial percentage of global energy use over that time. Finally, it should be noted that some scientists have concluded that increasing concentrations of GHGs in the Earth’s atmosphere may produce climate changes that have significant physical effects, such as increased frequency and severity of storms, floods, droughts and other climatic events. Our operations are onshore and not located in coastal or flood-prone regions of the United States, but if any such effects were to occur at our locations, these effects have the potential to cause physical damage to our assets or affect the availability of water for our operations and thus could have a material adverse effect on our operations.

Regulation of hydraulic fracturing