Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - Gofba, Inc. | gofba_ex322.htm |

| EX-32.1 - CERTIFICATION - Gofba, Inc. | gofba_ex321.htm |

| EX-31.2 - CERTIFICATION - Gofba, Inc. | gofba_ex312.htm |

| EX-31.1 - CERTIFICATION - Gofba, Inc. | gofba_ex311.htm |

| EX-10.11 - PROMISSORY NOTE - Gofba, Inc. | gofba_ex1011.htm |

| EX-10.10 - COMPUTER TOWER LEASE AGREEMENT - Gofba, Inc. | gofba_ex1010.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10‑K

x ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

OR

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from_____________ to _____________.

Commission file number: 000-53316

| GOFBA, INC. |

| (Exact name of registrant as specified in its charter) |

| California |

| 94-3453342 |

| (State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

|

|

|

|

| 3281 E. Guasti Road, Suite 700 Ontario, CA |

|

91761 |

| (Address of principal executive offices) |

| (Zip Code) |

Registrant’s telephone number, including area code (909) 212-7989

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

| Name of each exchange on which registered |

| None |

| None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, no par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S‑K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10‑K or any amendment to this Form 10‑K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

|

|

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

Aggregate market value of the voting and non-voting stock held by non-affiliates as of June 30, 2019: $14,000,050 as based on last sales price of such stock ($2.50) on June 30, 2019 (in a private transaction). The voting stock held by non-affiliates on that date consisted of 5,600,020 shares of common stock.

Applicable Only to Registrants Involved in Bankruptcy Proceedings During the Preceding Five Years:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of April 13, 2020, there were 51,233,998 shares of common stock, no par value, issued and outstanding.

Documents Incorporated by Reference

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to rule 424(b) or (c) of the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). None.

|

|

TABLE OF CONTENTS

| 2 |

|

|

| Table of Contents |

Special Note Regarding Forward Looking Statements

This Annual Report includes forward‑looking statements within the meaning of the Securities Exchange Act of 1934 (the “Exchange Act”). These statements are based on management’s beliefs and assumptions, and on information currently available to management. Forward‑looking statements include the information concerning possible or assumed future results of operations of the Company set forth under the heading “Management's Discussion and Analysis of Financial Condition or Plan of Operation.” Forward‑looking statements also include statements in which words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” “consider,” or similar expressions are used.

Forward‑looking statements are not guarantees of future performance. They involve risks, uncertainties, and assumptions. The Company's future results and shareholder values may differ materially from those expressed in these forward‑looking statements. Readers are cautioned not to put undue reliance on any forward‑looking statements.

Corporate History

We were incorporated in the State of California as Gofba, Inc. on November 6, 2008.

Business Overview

Gofba, Inc., was formed to create a safe haven for users of the internet. To that end, we have created an internet “supersite”, consisting of search, chat, email, and offsite file transfer and storage modules, in order to address dangerous, pressing issues not adequately addressed by our competitors. We see two primary threats to the average user of the internet. The first is unrestricted, free access to inappropriate material, including, but not limited to, pornographic material. To address this we have developed a “clean” database from scratch that does not contain inappropriate material and we use proprietary search algorithms which automatically eliminate, or make scarce, inappropriate material from search results. The second is security. To address this, we have developed proprietary security algorithms which provide an enhanced level of protection for users. Put simply, Gofba is the online solution to these problems; providing users with a safe haven on the internet. With limited promotional activity and no advertising, we currently enjoy over 40 million users worldwide.[1] Our user base has been consistently expanding since we launched Gofba Search in 2008, and we expect it to continue to increase. A number of our users are located in conservative countries and we discuss the unique nature of having users based in conservative countries below.

______________

1 Due to our strict privacy policy, we can only see how many accounts are created and whether that person logs into their account. In order to comply with our privacy policy, we do not track how a person uses their account. It is one of the ways we separate ourselves from our competitors. However, since we can tell if users have logged-in, we do occasionally delete accounts that have not been logged into in a number of years. As a result, the 40 million user number is a cumulative number of users, but does not include approximately 10 million accounts we have deleted due to non-use. We are not able to see how active the user is with their account once logged-in.

| 3 |

|

|

| Table of Contents |

Internet Problems Identified

In order to best understand Gofba’s suite of products and services, and what makes them unique, it is helpful to understand what they were created to combat. As noted above, Gofba has identified a number of serious issues encountered by everyday users of the internet.

The first problem identified was inappropriate content. These days, pornography, violence, and vulgarity, are freely accessible by any internet user without regard to age, social situation, or intent. Internet pornography sites are freely accessible to children, thus destroying their innocence. These same sites are accessed by millions in the workplace limiting productivity. Family dynamics and relationships can be greatly impacted as well.

Software and firewalls meant to filter out inappropriate content have been developed to address this issue, but over time have proven to be ineffective. The filters are simply too easy to circumvent. As a result, there has been no search engine that has been able to effectively eliminate this inappropriate material for those that are underage or desire this protection. Gofba has developed proprietary technology which eliminates or makes scarce this inappropriate content. Our search algorithms are written so that inappropriate content is not returned, or made scarce, as a result from web search queries. We accomplish this with a two-step approach. First, we built our database from scratch and did not include inappropriate content in our database. As a result, certain known inappropriate terms do not exist in our database. This is drastically different than other search engines, which have the inappropriate content in their databases, but they simply try and scrub out the content on a search-by-search basis utilizing filters. Unfortunately, history has shown that filtering search results this way is not very effective and the inappropriate content ends up being easily accessible by appearing in the search results of the user. By not having the terms in our database the use of inappropriate content search terms simply returns no results or only results that contain benign content. Second, we built proprietary “search crawlers” to weed out any inappropriate content that is returned from a search result. This is necessary since the internet does not remain static. Purveyors of inappropriate content constantly create new words, or use existing words in an inappropriate way, to try and have their content appear in search results. Gofba’s “search crawlers”, and some of its personnel, are constantly scanning search results to determine when inappropriate content is returned from an internet search and work to immediately delete that content from the Gofba database.

The second issue that Gofba addresses is security. Unsuspecting internet users have little idea that their demographic information and browsing habits are secretly collected by search engines and other sites. This information is then used for marketing purposes and sold for profit, leaving users betrayed and deceived. Additionally, much of the information that these same users transmit over the internet is poorly encrypted and can be easily hacked. Gofba will never track users' experiences or sell their information. Gofba uses secure algorithms which include 256 bit encryption thus mitigating the risk of predatory hacking.

A third problem is ease and speed of large file transfers. Traditionally it has been difficult to transfer large amounts of information in a speedy, user-friendly, and secure manner. Files can be transferred through both Gofba Chat and Gofba Vault, Gofba's offsite storage module. Both are easily accessible and allow for secure transfer of files of 5 Gigabytes at internal speeds 10 Gigabits per second (Gbps).

There are plans to periodically release additional modules, detailed below, as we grow and expand.

Proudly, Gofba's core business is rooted in making the world a better place. Gofba is committed to providing users with the safest internet experience. We achieve this not only by providing online tools that are wholesome, useful, and helpful, but also by providing a strong sense of security for users.

| 4 |

|

|

| Table of Contents |

Current Gofba Products and Solutions

In response to the multitude of issues facing users of the internet every day, Gofba has created a number of unique services to address these concerns and significantly improve a user’s internet experience, namely Gofba Search, Gofba Vault, Gofba Chat and Gofba Email. We also have a number of additional services we plan to rollout in the future, which are also detailed below. We believe that users are much more likely to return to a search engine and other services that previously provided them with a positive experience.

Gofba Chat: A secure messaging service that allows users to communicate with ease. Gofba Chat enables users to instantly transfer files up to 5GB at 10 Gbps internal transfer speed with a simple 'drag & drop' with the same 256-bit encryption. Users can also send chat messages via SMS. Soon Gofba Chat will instantly translate almost all of the world's most frequently used languages, as well as offer international keyboards, audio & video chatting, SMS messaging response, and include an additional 10 GB of storage in its own secure “vault”. Gofba Chat is a module that will play an integral role in Gofba Circle, our social network, in the future.

In late 2018 and early 2019, we completed the initial and Phase Two Beta testing of our Android and iPhone mobile Chat applications, and received excellent reviews from our 100+ beta testers. We rolled out the first iteration of the Gofba Apps in the 2nd quarter of 2019. We plan to continue to work on the development of these apps and plan updated version releases as necessary.

Gofba Search: Current web search options offer a staggeringly homogenous experience with little differentiating one site from the other. Gofba offers a unique search product, one that excludes objectionable material and provides unparalleled security. Gofba has developed proprietary phrase recognition and image scanning technology that ensures this inappropriate content is made scarce or not returned as a result from web search queries. These two factors, cleanliness and security, provide a competitive advantage which will open markets to us and allow us to penetrate a niche market that has never before been filled. Our unique database solution also allows us to tailor our search engine based on geography to disallow certain search results that may be objectionable to a certain country or society. For instance, conservative countries like China and certain middle-eastern countries do not want certain content returned with search results, even content that seems benign to western countries. Our technology allows us to scrub our database of those objectionable search results and, therefore, provide a clean search engine option to certain countries that currently disallow many of our competitors, such as Google. Additionally, we do not allow “smart cookies” in our search results. “Smart cookies” are executable files that create programs designed to gather information on the infected computer, including, but not limited to, search results and search habits. Many of our competitors plant these cookies in their search engine resulting in your searches being shared and spread across many websites, which results in ads for those products and services appearing on other websites you visit. We consider this to be an invasion of privacy and offensive to the user.

Gofba Vault: Gofba Vault is a secure offsite storage service. Many companies refer to their offsite storage as "cloud storage", however we have named ours "Vault". We did this to convey that we do not put users' information into a public "cloud", instead keeping users' information safely stored in their personal vault. Gofba Vault offers competitively priced offsite storage all encrypted with our 256-bit security algorithm. All transfers can be done at 10 Gbps internal transfer speed. The enhanced security hones in on Gofba's core principal of creating the fastest and safest online experience for users.

| 5 |

|

|

| Table of Contents |

Gofba Email: Our new email platform, which we plan to rollout in the latter part of 2020, will be the most innovative email product on the market. It is virus free, junk mail free, and hacker free and offers a unique user experience. Gofba email will change the way people and businesses communicate. With up to 5 GB attachments, along with embedded audio and video, we believe Gofba Email will revolutionize the way emails will be sent and received.

The next steps and budget to bring Gofba Email to market are as follows:

Development – 2nd quarter 2020 - $45,000

Beta testing – 3rd quarter 2020 - $20,000

Future Gofba Products and Solutions

Gofba continues to invest in product development to add to this array of modules. In addition to the above products and services, we plan to launch Gofba Business Listing, Gofba Media, Gofba Marketplace, Gofba Concierge, Gofba Circle, Gofba University and Gofba Medical, along with several others.

Gofba Business Listing: We intend to roll out a business listing service that costs businesses very little to list their company, around $19.00 per month. Our plan is for our business listing service to also act as a rating system, similar to Yelp, except our business listings will start with a 5-star rating, and we plan to assist the listed companies with maintaining their 5-star rating and also, hopefully, utilize our suite of products and services. We plan to launch this service on an international level on or about the 2nd quarter of 2020 and we do not believe the service will involve any additional capital above what we already have allocated to the launch of our other products and services.

Gofba Media: This module, along with Gofba Chat, acts as the groundwork for Gofba Circle, our social networking platform. Currently, Gofba Media features location-based news content and is a viable source for advertisers to gain exposure. We plan to rollout Gofba Media in the fourth quarter of 2020.

The next steps and budget to bring Gofba Media to market are as follows:

Development – 2nd quarter 2020 - $30,000

Beta testing – 3rd quarter 2020 - $15,000

Gofba Marketplace: Gofba Marketplace is our e-commerce platform which will demonstrate a combination of retail, wholesale, and bidding. The first phase of Gofba Marketplace will be rolled out in early 2021.

The next steps and budget to bring Gofba Marketplace to market are as follows:

Development – 3rd quarter 2020 through 4th quarter 2020 - $30,000

Beta testing – 2nd quarter 2021 - $15,000

Gofba Concierge: This module will act as users' personal assistant with the ability to schedule appointments, manage calendars, and help with many more tasks. We plan to rollout Gofba Concierge in the third quarter of 2020. Due to the anticipated rollout date over six months away, we have not finalized a development and beta testing schedule for Gofba Concierge or an anticipated budget.

| 6 |

|

|

| Table of Contents |

Gofba Circle: This is our social media module which will segregate by age group on a secure and accountable platform. We plan to rollout Gofba Circle in the first quarter of 2021. Due to the anticipated rollout date being about one year away, we have not finalized a development and beta testing schedule for Gofba Circle or an anticipated budget.

Gofba University: GU is an aggregator of online classes offered first in the United States, then the world. It will allow anyone to go to college, keep track of your studies and show your expected graduation date, and the first two years of college are free. We plan to rollout Gofba University in the third quarter of 2021. Due to the anticipated rollout date being over one year away, we have not finalized a development and beta testing schedule for Gofba University or an anticipated budget.

Gofba Medical: Gofba medical is a comprehensive medical app, designed to keep track of a patient’s medical records and have secure chats with medical personnel including your doctor or specialists referred by your doctor. Our plan is to give an accurate diagnosis using a world-wide database, combined with one of the fastest computer systems in the world. We plan to rollout Gofba Medical in the third quarter of 2020. Due to the anticipated rollout date being about six months away, we have not finalized a development and beta testing schedule for Gofba Medical or an anticipated budget.

The HIPAA Opportunity

As noted herein, we have spent thousands of man hours working on secure processes and networks for the transfer of confidential and private information related to our customers, including, but not limited to, credit card information, social security numbers, addresses, and other very personal information. As a result, we believe we have developed one of the most secure networks in existence, utilizing a level of encryption beyond what is the industry norm.

In 2019, a local hospital approached us regarding whether our systems could assist them with meeting the requirements of the Health Insurance Portability and Accountability Act (HIPAA) in order to make them compliant so they could protect patient data and avoid possible fines, etc. Although this was not one of the uses of Gofba’s systems we were concentrating on at the time, we immediately began researching the standards mandated by HIPAA and determining how our systems met, or could meet, those standards.

Passed in 1996, HIPAA required the U.S. Department of Health & Human Services (HHS) to adopt national standards for electronic health transactions and code sets, unique health identifiers, and security. HIPAA is a complicated statute and a good description of the standards it places on health industry companies and professionals is located here: http://www.hhs.gov/hipaa/for-professionals/index.html. HIPAA has been amended through the years to keep up with modern technology and the challenges presented. For our purposes, we are primarily focused on the requirement that requires companies in the health field and health care professionals to utilize systems that have at least 128-bit encryption when transmitting patient information. These requirements make our secure communication platform that utilizes 256-bit encryption, which exceeds current HIPAA standards, perfect for this application.

As a result of Gofba’s HIPAA-compliant electronic communication capabilities, we are in discussions with hospitals, medical groups and insurance companies regarding those entities potentially utilizing Gofba for the transmission of patient information in order to be HIPAA-compliant. We have not yet signed any agreements with any of these entities but are hopeful we will do so in the near future.

Financing for our Operations

As noted above, and elsewhere herein, we need to raise substantial investment capital in order to complete the planned build-out and expansion of our products and services. From January 1, 2020 through April 13, 2020, we sold subscriptions to issue 320,500 shares of our common stock to 14 non-affiliated investors in exchange for $1,602,500 of cash proceeds. All sales were made pursuant to our primary offering in our effective Registration Statement on Form S-1. We believe these proceeds will be sufficient to cover our cash needs through the remainder of 2020 based on our current projections.

| 7 |

|

|

| Table of Contents |

Strategic Overview

Our business goal is to become THE safe haven for users of the internet that want to avoid the known and unknown pitfalls of internet use, either for businesses, schools, colleges, universities, government offices and countries around the world. Our first step was the creation of Gofba Search, outlined above. Moving forward our goal is to create and launch a number of related modules in addition to those outlined above. We plan to achieve this by launching these modules strategically, as many as one or two per year.

Competitive Strengths

We believe that our competitive strengths advantageously position us to expand our products and services and pursue strategic opportunities in various internet spaces both domestically and abroad. Our key competitive strengths are summarized below.

| • | Exclusive Focus on Clean Content. Our business goal is to become the safe haven for internet users that desire a “pure” internet experience, one devoid of unwanted material. To date, this has led to over 40 million users worldwide who trust us to effectively exclude or make scarce inappropriate results. Most other web search providers have clearly established their position on filtering content – being unwilling or unable to effectively eliminate inappropriate search content from queries. We built our database from scratch and did not include inappropriate content in our database. As a result, certain known inappropriate terms do not exist in our database. This is drastically different than other search engines, which have the inappropriate content in their databases, but they simply try and scrub out the content on a search-by-search basis utilizing filters. Additionally, our unique database solution also allows us to tailor our search engine based on geography to disallow certain search results that may be objectionable to a certain country or society. For instance, conservative countries like China and certain middle-eastern countries do not want certain content returned with search results, even content that seems benign to western countries. Our technology allows us to scrub our database of those objectionable search results and, therefore, provide a clean search engine option to certain countries that currently disallow many of our competitors, such as Google. We believe this provides us with a distinct advantage in many countries that our competitors have been disallowed access due to their inability to filter out the undesirable content. |

|

| |

| • | Proprietary Technology. Our sophisticated, proprietary technology that supports our search engine and platform took years of research and development, as well as significant capital expenditures. This research resulted in our proprietary phrase recognition and image scanning technology that ensures that inappropriate content is made scarce or not returned as a result from web search queries. |

|

| |

| • | Provide a Private Internet Experience. Unlike most of our competitors, we do not track a user’s browsing experiences and do not sell or exploit their searches or personal data. As noted above, we do not allow “smart cookies” in our search results. “Smart cookies” are executable files that create programs designed to gather information on the infected computer, including, but not limited to, search results and search habits. Many of our competitors plant these cookies in their search engine resulting in your searches being shared and spread across many websites, which results in ads for those products and services appearing on other websites you visit. We consider this to be an invasion of privacy and offensive to the user. We believe there is a viable market of users that do not want their search criteria shared and used to place ads in their future searches and believe that type of internet user will grow in the future as internet ads become more obtrusive. |

|

| |

| • | Gofba Vault. Rather than storing valuable, confidential information for our users in the “cloud” our Gofba Vault is a secure offsite storage service. Gofba Vault keeps users’ information safely stored in their personal vault, encrypted with our 256-bit security algorithm. Gofba Vault allows up to 10 GB’s of free storage space, with options to increase the size up to 10 TB’s. Gofba Vault also gives members the ability to send files to any email account up to 5 GB’s in size. |

|

| |

| • | Strong and Experienced Management Team. We have an experienced project management team that continues to focus on our core competencies and to draw upon our significant domestic and international development and operating experience. |

| 8 |

|

|

| Table of Contents |

Sources of Revenue

Our business plan is to generate revenues, primarily from the following sources:

| • | Advertising. In the second quarter of 2020, we plan to formally offer advertising on our primary products and services. To that end, our team has connected with enterprises which have indicated they would be willing to enter into year-long advertising contracts, but we do not have any signed agreements at this time. Gofba will continue to aggressively pursue advertising revenues. We have received interest from large, globally recognized enterprises, including Fortune 500 companies and large political organizations and hope to capitalize on that interest. |

|

| |

| • | Gofba Vault. We expect to generate revenue from providing storage through Gofba Vault, our unique offsite storage system, encrypted with our 256-bit security algorithm. We plan to charge reasonable, or lower amounts than the current market, with more security than our competitors. |

| • | Gofba Marketplace. A platform that, when launched, will provide a suite of combined services that are not currently available, including advertising, shipping, handling and warehouse storage. |

|

| |

| • | Paid Placement Revenue. Internet search engines implement a paid placement strategy, where some content providers are given prominent positioning in return for a placement fee. The optimal placement strategy depends on the relative benefits to the users of paid placement. We compute the optimal placement fee, characterize the optimal bias level, and analyze sensitivity of the placement strategy to various factors. In the optimal paid placement strategy, the placement maximizes revenues and is set below the monopoly level to complement our advertising revenues. By optimizing our search engine’s quality of service, we will be able to maximize revenues from paid placement as well as our other advertising models. |

|

| |

| • | HIPAA. As noted above, we are in discussions with hospitals, medical groups and insurance companies regarding those entities potentially utilizing Gofba’s HIPAA-compliant electronic communication capabilities for the transmission of patient information in order to be HIPAA-compliant. We have not yet signed any agreements with any of these entities but are hopeful we will do so in the near future. In the event we are successful in signing up these entities we believe they will be a strong source of revenue.

|

| • | Gofba Business Listings. For our business listing service we plan to charge businesses around $19.00 per month in order to list their business in our business directory. Although we will be charging businesses for this service, we do not anticipate this will be a big revenue-generator for us, but we hope it will lead some of those businesses to pay us to place advertising on our website. |

Source of Computer Storage and Processing

Since inception, we have leased computer storage and processing space from Sunray Trust, a trust for which Anna Chin, one of our officers and directors, is a trustee. Under the terms of a Computer Towers Lease Agreement, Sunray Trust provides us with sufficient space to store the data used in our operations, as well as the processors and other technology equipment to run our programs and applications in exchange for a monthly rate based on the number of server towers, super computers and virtual servers our business operations require, with the amount modified annually. We first became obligated to pay for these services on January 1, 2009, when the monthly lease payment was $43,758, or $525,096 for the year, which allowed us to utilize 6 towers, 30 super computers and 600 virtual servers. Each year we sign an amendment to the Computer Towers Lease Agreement for our use for the upcoming year. From 2010 to 2014, our lease payments were $910,224 per year. Since 2015, our lease payments have been $1,085,256 per year. We anticipate this will increase in future years as we need additional resources. The current Computer Towers Lease Agreement is set to terminate on October 30, 2020.

| 9 |

|

|

| Table of Contents |

Unique Challenges Presented by Having Users in China

We have a number of users in China, believed to be in the millions. We can identify this by being able to locate their access location through IP Geo Data. As noted herein, one of the unique attributes of our technology is that it allows us to scrub our search engine database of objectionable search results and, therefore, provide a clean search engine option to certain countries that currently disallow many of our competitors. One of these countries is China.

Having users in China creates a unique challenge. First, we don’t “operate” in China. We do not have servers in China. Access to our products and services by persons in China is web-based with the functionality of those services being provided by servers not located in China. All of our servers are located in the United States. Although Chinese law states that all websites and like platforms must have an Internet Content Provider (ICP) License, the reality is they only place the requirement on companies that have servers based in China to provide their products and services. We have attempted to obtain an ICP License through Alibaba Cloud (a local Chinese company), but they have informed us that we don’t qualify for an ICP License since we don’t have any servers in China. Eventually, we plan to put servers in China and apply for an ICP License.

China has not banned our products and services like they have other providers such as Google and Yahoo. We believe this is in large part due to the fact our search engine is scrubbed to almost entirely remove objectionable content. However, part of the risk of operating in China is that the government can block access to products and services without recourse, and, as a result, we are always subject to the discretion of the Chinese government to have users in China.

Market Overview

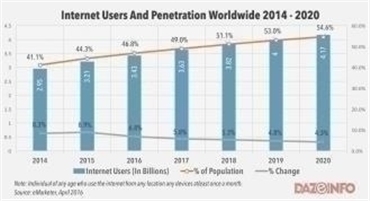

Internet search and related services is a rapidly expanding and influential market as the global landscape of internet users continues to grow. According to eMartketer, in 2016 approximately 46.8% of the world’s 7.3 billion population used the internet, with that penetration expected to increase to over 50% of the world’s population by 2019 as the world welcomes another 200 million people online.

| 10 |

|

|

| Table of Contents |

Web search has been dominated for years by one major player in U.S. and global markets, Google. Google’s U.S. search market share, however, has decreased by about 3% in the past two years, suggesting an openness to alternative search providers. Taking into account all search providers, there are well over 5 billion search queries performed daily all over the world.

Google, and other large internet giants, including Microsoft, Yahoo, Amazon, and Facebook, each provide a range of integrated services which include search, email, chat, cloud-based storage, and e-commerce.

Gofba is well poised to enter this market due to its proprietary technology that allows it to eliminate or make scarce inappropriate content from searches. Its unparalleled security measures, and range of internet services will create an inclusive and safe internet experience. Gofba’s diverse set of modules places it within this megasite sphere. Uniquely, Gofba is well-positioned as the only site that successfully protects its users from inappropriate content and is steadfast in making security a priority. Increased awareness of the many dangers that threaten internet users presents a high-growth opportunity for Gofba’s services.

Market Leader Analysis

Presently, Gofba is entering the internet market for search, chat, email, e-commerce, and offsite storage.

The chart below details the 2019 revenues, percentage of U.S. market share, and market caps for each dominant player in the respective markets.

| Name |

| Market |

| 2019 Revenue |

| % U.S. Market Share(1) |

|

| Market Cap(2) | ||

| |

| Search |

| $136.36 billion |

|

| 63 | % |

| $1 trillion | |

| Amazon |

| E-commerce |

| $232.88 billion |

|

| 44 | % |

| $737 billion | |

| Dropbox |

| Offsite Storage |

| $1.6 billion |

|

| 47 | % |

| $7 billion | |

| |

| Social Media |

| $70.7 billion |

|

| 39 | % |

| $630 billion | |

_____

(1) Estimated as of December 31, 2019.

(2) Estimated as of December 31, 2019.

| 11 |

|

|

| Table of Contents |

Further market analysis reveals:

| • | Each company reported a higher revenue in 2019 than in 2018, representing growth in each market segment. |

| • | Advertising is a major contributor to the revenue of each of these companies. Each of Gofba’s 32 modules either available or planned for development presents advertising revenue opportunities. |

| • | Other revenue streams include e-commerce and cloud based storage. Both are avenues that Gofba is pursuing. Gaining a fraction of markets will present significant revenue opportunities for Gofba. |

| • | Although each company has been categorized within a specific market, it is important to note that each company has many diversified yet integrated product lines and services, positioning Gofba competitively. |

| • | Each of these companies has achieved massive brand awareness which has undoubtedly contributed to their success in highly competitive markets. |

Global Internet Use

According to eMartker, 3.9 billion people use the internet. In 2019 alone, 200 million more people have gained access to the internet.

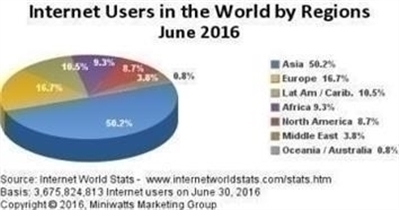

Of Gofba’s 40 million users, the majority have been attracted from two of the three largest markets of internet users worldwide, China and the United States. This has been done through grassroots word of mouth and without promotion. The majority of Gofba’s users are in China with the U.S. close behind. According to Internet World Stats by Miniwatts Marketing Group, China alone accounts for over 19% of the world's internet users with 721 million users. The United States is home to 286 million internet users. The second largest market is India with 462 million internet users.

As more people gain access to the internet, education on internet safety and security will become increasingly important. Gofba’s branding as the safe and secure online platform will make our product extremely attractive to internet users and we believe it will continue to generate new users at an exponential rate.

| 12 |

|

|

| Table of Contents |

Internet Safety

There is an extensive list of potential dangers that threaten internet users. These include inappropriate content making its way to unsuspecting users’ screens, malware infection, identity theft, privacy invasion through tracking, and a slew of others. Just as useful technology is advancing, so is technology used to hack and harm. These threats are increasing in number and severity. Many present industry leaders have shown to be unwilling or incapable of addressing these threats.

Due to increasing online threats, we believe Gofba enjoys a high-growth opportunity in its position as the safe and clean search engine and megasite alternative.

Gofba targets people that want safe internet experiences.

Some insight into why internet users of all ages can benefit from Gofba’s protection.

| • | Children are largely unable to recognize most online threats and are susceptible to harm from disguised predators. Children also face developmental risk from exposure to inappropriate content. |

|

| |

| • | Studies show that people aged 45 and above are more cautious about sharing information online, but lack the knowledge on how to spot potential danger. With over 80% of baby boomers now using the internet, the population that is in need of education of safe online practices is growing. |

|

| |

| • | Research shows that those aged 24 and under reveal more information on the web, but can recognize threats more easily. The reports say younger people’s less restrained online behavior means they’re more likely to be hit by a malware infection. |

We believe our products are very attractive to businesses, schools, universities, colleges, and government offices. Gofba’s search results have also been well received in countries where internet usage is restricted, primarily for religious or political reasons. Gofba’s platform is well-suited for settings undertaking the responsibility for children’s use of the internet.

Below are some statistics to show the vast academic and organizational markets that Gofba intends to tap into:

|

| • | According to the National Center for Education Statistics, in the U.S., in fall 2019, an estimated 56.7 million students attended public elementary and secondary schools. Public school systems employed close to 3.2 million full-time teachers. |

|

| • | According to the National Center for Education Statistics, In fall 2019, some 22.5 million students attended American colleges and universities, an increase of about 7.5 million since fall 2000. |

|

| • | According to Governing magazine, U.S. state and local governments employ over 19.4 million employees and the Federal government employees another 2.8 million employees. |

In the past, we have not invested in advertising. Our user base has grown steadily since 2008 to over 40 million users. We believe this speaks to the need and desire for a safe internet product.

| 13 |

|

|

| Table of Contents |

Competition

The search engine, e-mail providers and instant messaging sectors are highly competitive and continually evolving as participants strive to distinguish themselves within their markets and compete within the internet industry. We face intense competition from companies much larger than ours, and, as a result, we could struggle to attract users and gain market share. Many of our existing or future competitors have greater financial resources and greater brand name recognition than we do and, as a result, may be better positioned to adapt to changes in the industry or the economy as a whole.

We also face competition from other internet providers, search engine providers (such as Google and Yahoo!), instant messaging services, social network companies (such as Facebook), and internet storage companies. We will strive to advance our technology in each of these sectors ahead of our competitors to gain market share.

We also face intense competition in attracting and retaining qualified employees, including, but not limited to, software developers. Our ability to continue to compete effectively will depend upon our ability to attract new employees, retain and motivate our existing employees and continue to compensate employees competitively.

Intellectual Property

Currently, we do not have any patents, but consider certain elements of our products and services to be trade secrets and we protect it as our intellectual property. Most of our products and services are based on “open-source” code (meaning it is freely available computer code for anyone to use) and, as a result, we cannot get patents to protect our products and services. Additionally, due to the nature of our business the constant upgrades occurring to our types of products and services, patent filings are not really practical. In the future, if we have products or services or processes that are patentable, we plan to apply for such patents to protect our products and services.

We do own the trademark to “Gofba” under Goods and Services Class IC042 “Providing computer searching services, namely, searching and retrieving information at the customer's request via the Internet; and provision of Internet search engines.”

Staffing

As of December 31, 2019, we contract with 16 consultants and we have employment agreements with our Chief Executive Officer and President.

Available Information

We are a fully reporting issuer, subject to the Securities Exchange Act of 1934. Our Quarterly Reports, Annual Reports, and other filings can be obtained from the SEC’s Public Reference Room at 100 F Street, NE., Washington, DC 20549, on official business days during the hours of 10 a.m. to 3 p.m. You may also obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. The Commission maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Commission at http://www.sec.gov.

| 14 |

|

|

| Table of Contents |

As a smaller reporting company, we are not required to provide the information required by this Item. However, we believe this information may be valuable to our shareholders for this filing. We reserve the right to not provide risk factors in our future filings. Our primary risk factors and other considerations include:

Risks Related to the Company

We are a development stage company with limited operating history and, accordingly, you will have no basis upon which to evaluate our ability to achieve our business objective.

We are a development stage company with limited operating results to date. Our business is subject to the risks inherent in the establishment and development of a new business enterprise. As a result, we cannot provide our shareholders with the type of information that would be available from a company with a more substantial history of operations. We cannot assure investors that it will ever operate profitably.

Financial projections are highly speculative.

Any financial projections included in this Annual Report and all other materials or documents supplied by us should be considered speculative and are qualified in their entirety by the assumptions, information and risks disclosed therein and in this Annual Report. The financial projections have not been prepared based upon certified public accounting standards and have not been reviewed by an independent accountant. The assumptions and facts upon which such projections are based are subject to variations that may arise as future events actually occur. The financial projections included herein are based on assumptions made by us regarding future events. There is no assurance that actual events will correspond with these assumptions. Actual results for any period may or may not approximate such financial projections.

The Company’s common stock lacks liquidity and marketability.

There is no public market for the common stock and we are not sure when we will apply to be a publicly-traded company. Furthermore, we cannot assure shareholders that even if we become a publicly-traded company that a vibrant market will develop for our common stock.

We are subject to the significant influence of our current officers and directors, and their interests may not always coincide with those of our other stockholders.

Anna Chin, one of our officers and directors, and Chairperson of the Board of Directors, beneficially owns approximately 80% of our outstanding Common Stock. As a result, Ms. Chin is able to significantly influence all matters requiring approval by our stockholders, including the election of directors and the approval of mergers or other business combination transactions. Because the interests of Ms. Chin may not always coincide with those of our other stockholders, such stockholder may influence or cause us to take actions with which our other stockholders disagree.

Our management has discretion as to how to use any proceeds from the sale of securities.

Any money raised by us through the sale of our securities will be spent at the discretion of our management based on that they deem to be in the best interests of the company and our stockholders. As a result of the foregoing, our success will be substantially dependent upon the discretion and judgment of management with respect to application and allocation of any proceeds from any offerings of our securities.

| 15 |

|

|

| Table of Contents |

This Annual Report contains forward-looking statements that are based on our current expectations, estimates and projections but are not guarantees of future performance and are subject to risks and uncertainties.

This Annual Report contains forward-looking statements. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about our industry, our beliefs and our assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” and “estimates,” and variations of these words and similar expressions, are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. These risks and uncertainties include those described in “Risk Factors” and elsewhere in this Annual Report. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect our management’s view only as of the date of this Annual Report. Except as required by law, we undertake no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

We may not be able to obtain financing required to maintain and grow our business.

We will need additional funding to execute our business plan. However, there can be no assurance that we will be successful in obtaining such funding on acceptable terms or at all. Additional financing will increase risks of an investment in our company. For example, outside debt financing could constrain our cash flow, and additional equity financing would dilute current shareholders.

Current economic conditions and capital markets are in a period of disruption and instability which could adversely affect our ability to access the capital markets, and thus adversely affect our business and liquidity.

The current economic conditions largely caused by the coronavirus pandemic have had, and likely will continue to have for the foreseeable future, a negative impact on our ability to access the capital markets, and thus have a negative impact on our business and liquidity. The recent, substantial losses in worldwide equity markets, significantly restricted global business activities, and quickly increasing unemployment rates could lead to an extended worldwide recession. We may face significant challenges if conditions in the capital markets do not improve. Our ability to access the capital markets has been and continues to be severely restricted at a time when we need to access such markets, which could have a negative impact on our business plans. Even if we are able to raise capital, it may not be at a price or on terms that are favorable to us. We cannot predict the occurrence of future disruptions or how long the current conditions may continue.

The coronavirus pandemic is causing disruptions in the workplace, which will have negative repercussions on our business if they continue for an extended period time.

We are closely monitoring the coronavirus pandemic and the directives from federal and local authorities regarding not only our workforce, but how it impacts companies we work with for the development of our suite of products and services. As more states and localities implement social distancing and “work from home” regulations more and more companies will be forced to either shut down, slow down or alter their work routines. Since the development and testing of our suite of products can be a “hands on” process these alternative work arrangements could significantly slow down our anticipated schedules for the development, marketing and launch of our products and services, which could have a negative impact our business.

| 16 |

|

|

| Table of Contents |

Our shareholders will likely experience dilution of your ownership interests due to the future issuance of additional shares of our common stock.

We do not currently have sufficient funds to finance the growth of our business or to support our projected future capital expenditures. As a result, we will require additional funds from further financings, including equity financing transactions or sales of common or preferred stock, or other securities that are convertible into or exercisable for our common or preferred stock, to complete the development of new projects, develop revenue-generating opportunities, and pay the general and administrative costs of our business. We may also issue such securities in connection with hiring or retaining employees and consultants (including stock options issued under our equity incentive plans), as payment to providers of goods and services, in connection with future acquisitions or for other business purposes. Our Board of Directors may at any time authorize the issuance of additional common stock without common stockholder approval, subject only to the total number of authorized common stock set forth in our articles of incorporation. The terms of equity securities issued by us in future transactions may be more favorable to new investors, and may include dividend and/or liquidation preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have a further dilutive effect. Any such future issuances of such additional shares of common stock or other securities may be at a price (have an exercise price) below the price our current shareholders paid for your shares.

Sales of shares of our common stock by broker – dealers may not be permitted.

Our common stock is not presently included for trading on any exchange, and there can be no assurances that our common stock will ultimately be listed on any exchange. As a result, our common stock is covered by a Securities and Exchange Commission rule that imposes additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors. For transactions covered by the rule, the broker-dealer must make a special suitability determination for the purchaser and receive the purchaser’s written agreement to the transaction prior to the sale. Consequently, the rule may affect the ability of broker-dealers to sell our securities and may also affect the ability of stockholders to sell their shares in any secondary market.

Our election to not opt out of the extended accounting transition period under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, may make our financial statements difficult to compare to other companies.

Under the JOBS Act, as an emerging growth company, we can elect to opt out of the extended transition period for any new or revised accounting standards that may be issued by the Financial Accounting Standards Board (“FASB”) or the U.S. Securities and Exchange Commission (the “SEC”). We have elected not to opt out of such extended transition period. This means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, are permitted to use any extended transition period for adoption that is provided in the new or revised accounting standard having different application dates for public and private companies. This may make the comparison of our financial statements with any other public company, which is not either an emerging growth company nor an emerging growth company which has opted out of using the extended transition period, difficult or impossible as possible different or revised standards may be used.

If we are unable to implement and maintain effective internal control over financial reporting in the future, the accuracy and timeliness of our financial reporting may be adversely affected. In addition, because of our status as an emerging growth company, you will not be able to depend on any attestation from our independent registered public accounting firm as to our internal control over financial reporting for the foreseeable future.

| 17 |

|

|

| Table of Contents |

As a reporting company, the Sarbanes-Oxley Act requires, among other things, that we assess disclosure controls and procedures and internal control over financial reporting. In particular, as a public company, we will be required to perform system and process evaluations and testing of our internal control over financial reporting to allow management to report on the effectiveness of our internal controls over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act. We will be required to furnish a report by management on, among other things, the effectiveness of our internal control over financial reporting for the first fiscal year beginning after the effective date of our offering, which is the year beginning January 1, 2020. However, our independent registered public accounting firm will not be required to attest to the effectiveness of our internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act until the later of the year following our first annual report required to be filed with the SEC or the date we are no longer an “emerging growth company” as defined in the JOBS Act. Accordingly, you will not be able to depend on any attestation concerning our internal control over financial reporting from our independent registered public accounting firm for the foreseeable future.

We have identified material weaknesses in our internal control over financial reporting. If we fail to remedy these material weaknesses and develop and maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud. As a result, stockholders could lose confidence in our financial and other public reporting, which would harm our business and the trading price of our common shares.

We have identified material weaknesses in our internal control over financial reporting as of December 31, 2019. As defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, a “material weakness” is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. Specifically:

|

| (i) | we did not have sufficient segregation of duties within our accounting functions; |

|

| (ii) | our financial reporting closing process did not effectively determine all period-end adjustments; and |

|

| (iii) | our corporate governance and U.S. GAAP and SEC accounting resources were not commensurate with those required of a public company. |

Effective internal control over financial reporting is necessary for us to provide reliable financial reports and, together with adequate disclosure controls and procedures, are designed to prevent fraud. Any failure to implement required new or improved controls, or difficulties encountered in their implementations could cause us to fail to meet our reporting obligations. In addition, any testing by us conducted in connection with Section 404 of the Sarbanes-Oxley Act or any subsequent testing by our independent registered public accounting firm may reveal additional deficiencies in our internal control over financial reporting that are deemed to be material weaknesses or significant deficiencies, or that may require prospective or retroactive changes to our financial statements or identify other areas for further attention or improvement. Inferior internal control over financial reporting could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our common stock.

| 18 |

|

|

| Table of Contents |

We have a Computer Towers Lease Agreement with Sunray Trust. In the event we are unable to pay the lease amount, Sunray Trust could prohibit us from utilizing the server towers, super computers and virtual servers necessary to store the data used in our operations as well as the processors to run our programs and applications.

Under the terms of a Computer Towers Lease Agreement that expires on October 30, 2020, Sunray Trust provides us with sufficient space to store the data used in our operations, as well as the processors and other technology equipment to run our programs and applications in exchange for a monthly rate based on the number of server towers, super computers and virtual servers our business operations require, with the amount modified annually. We first became obligated to pay for these services on January 1, 2009, when the monthly lease payment was $43,758, or $525,096 for the year, which allowed us to utilize 6 towers, 30 super computers and 600 virtual servers. Each year we sign an amendment to the Computer Towers Lease Agreement for our projected use for the upcoming year, with each such amendment being approved by the non-interested members of our Board of Directors. From 2010 to 2014 our lease payments were $910,224 per year. Since 2015 our lease payments have been $1,085,256 per year. Since we have not been able to pay the entire cost for the use of this computer storage and processing space, the amounts we owe Sunray Trust have been accrued through December 31, 2019. We will need to raise funds from the sale of our securities and/or generate revenues from our operations to be able pay Sunray Trust the past and future amounts owed under this agreement. In the event we are unable to pay, Sunray Trust could prohibit us from utilizing the server towers, super computers and virtual servers necessary to store the data used in our operations as well as the processors to run our programs and applications, which would have a material adverse effect on our ability to operate our business. Anna Chin, our President, is a trustee of Sunray Trust. Excluding amounts owed under a separate promissory note, the total amounts owed, including other amounts received from and paid to our Chairperson, President and majority shareholder, totaled $4,470,000 as of December 31, 2019.

As of December 31, 2019, we owed Sunray Trust $1,284,697 under a Promissory Note that matures on January 1, 2022. In the event we are unable to repay this amount on the maturity date we will be in default under the terms of the note.

Under the terms of a Promissory Note we owe Sunray Trust $1,284,697. We will need to raise funds from the sale of our securities and/or generate revenues from our operations to be able to repay this obligation. In the event we are unable to repay this amount on the maturity date we will be in default under the terms of the note, which could subject us to legal action regarding the amounts we owe Sunray Trust. Anna Chin, our President, is a trustee of Sunray Trust. As of December 31, 2019, we also owe accrued interest on this note of $107,000.

From inception of the company through January 9, 2017 we received cash proceeds from individuals we call pre-subscribers herein. We do not believe such pre-subscriptions were an offer of securities, and if they were, that we complied the offering exemption provided for in Section 4(a)(2) of the Securities Act of 1933, as amended. If those assumptions proved incorrect we could be made to refund the pre-subscribers funds and/or be forced to pay penalties and fines to federal and/or state securities regulators.

From inception of the company through January 9, 2017, we received cash proceeds as deposits from individuals who indicated an interest in purchasing shares of our common stock. At the time of these transactions, management does not believe that the Company offered securities for sale, as defined by the Securities Act of 1933, as amended. However, if such transactions were deemed to be an offering of securities, management believes we complied with Section 4(a)(2) of the Securities Act of 1933, as amended, including the requirement that each purchaser be an accredited investor (as defined) or a sophisticated investor (as defined). In the event that we were deemed to have offered securities for sale and did not comply with Section 4(a)(2) of the Securities Act of 1933, as amended, we could be required to refund amounts received and/or be subject to penalties from security regulators.

Risks Related to Our Operations

We face significant competition for users, advertisers, publishers, developers, and distributors.

We face significant competition from online search engines, sites offering integrated internet products and services, social media and networking sites, e-commerce sites, companies providing analytics, monetization and marketing tools for mobile and desktop developers, and digital, broadcast and print media. A number of these competitors are significantly larger than we are and have access to vastly greater financial resources. Additionally, in a number of international markets, especially those in Asia, Europe, the Middle East and Latin America, we face substantial competition from local Internet service providers and other entities that offer search, communications, and other commercial services.

| 19 |

|

|

| Table of Contents |

Several of our competitors offer an integrated variety of Internet products, online services and content in a manner similar to Gofba. We compete against these and other companies to attract and retain users and developers. We also compete with social media and networking sites which are increasingly used to communicate and share information, and which are attracting a substantial and increasing share of users, users’ online time, and online advertising dollars.

A number of our competitors offer products, services and apps that directly compete for users of our product offerings, including e-mail, search, and messaging. Further, emerging start-ups may be able to innovate and provide new products, services and apps faster than we can. In addition, competitors may consolidate or collaborate with each other, and new competitors may enter the market. Some of our competitors in international markets have a substantial competitive advantage over us because they have dominant market share in their territories, have greater local brand recognition, are focused on a single market, are more familiar with local tastes and preferences, or have greater regulatory and operational flexibility due to the fact that we may be subject to both U.S. and foreign regulatory requirements.

If our competitors are more successful than we are in developing and deploying compelling products or in attracting and retaining users, developers, or distributors, our users and growth rates could decline.

Although all our user data is encrypted, our security measures may be breached and user data accessed, which may cause users and customers to curtail or stop using our products and services, and may cause us significant legal and financial exposure.

Our products and services involve the storage and transmission of our users’ and customers’ personal and proprietary information in our facilities and on our equipment, networks, and corporate systems. As a result, we may be targeted by outside third parties, including technically sophisticated and well-resourced state-sponsored actors, attempting to access or steal our user and customer data or otherwise compromise user accounts. Security breaches or other unauthorized access or actions expose us to a risk of theft of user data, regulatory actions, litigation, investigations, remediation costs, damage to our reputation and brand, loss of user and partner confidence in the security of our products and services and resulting fees, costs, and expenses, loss of revenue, damage to our reputation, and potential liability. Outside parties may attempt to fraudulently induce employees, users, partners, or customers to disclose sensitive information or take other actions to gain access to our data or our users’ or customers’ data. In addition, hardware, software, or applications we procure from third parties may contain defects in design or manufacture or other problems that could unexpectedly compromise network and data security. Additionally, some third parties, such as our distribution partners, service providers, vendors, and app developers, may receive or store information provided by us or by our users through applications that are integrated with our properties and services. If these third parties fail to adopt or adhere to adequate data security practices, or in the event of a breach of their networks, our data or our users’ data may be improperly accessed, used, or disclosed. Security breaches or other unauthorized access may in the future result in a combination of significant legal and financial exposure, increased remediation and other costs, damage to our reputation, and a loss of confidence in the security of our products, services, and networks that could have a significantly adverse effect on our business. We take steps to prevent unauthorized access to our corporate systems, however, because the techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems change frequently or may be disguised or difficult to detect, or designed to remain dormant until a triggering event, we may be unable to anticipate these techniques or implement adequate preventative measures. Breaches of our security measures, or perceived breaches, may cause the market perception of the effectiveness of our security measures to be harmed and cause us to lose users and customers.

| 20 |

|

|

| Table of Contents |

Changes in regulations or user concerns regarding privacy and protection of user data, or any failure to comply with such laws, could adversely affect our business.

Federal, state, and international laws and regulations govern the collection, use, retention, disclosure, sharing and security of data that we receive from and about our users. The use of consumer data by online service providers is a topic of active interest among federal, state, and international regulatory bodies, and the regulatory environment is unsettled. Many states have passed laws requiring notification to users where there is a security breach for personal data, such as California’s Information Practices Act. We face similar risks in international markets where our products and services are offered. Any failure, or perceived failure, by us to comply with or make effective modifications to our policies, or to comply with any applicable federal, state, or international privacy, data-retention or data-protection-related laws, regulations, orders or industry self-regulatory principles could result in proceedings or actions against us by governmental entities or others, a loss of user confidence, damage to our business and brand, and a loss of users, which could potentially have an adverse effect on our business.

In addition, various federal, state and foreign legislative or regulatory bodies may enact new or additional laws and regulations concerning privacy, data retention, data transfer and data protection issues, including laws or regulations mandating disclosure to domestic or international law enforcement bodies, which could adversely impact our business, our brand or our reputation with users. For example, some countries are considering or have enacted laws mandating that user data regarding users in their country be maintained in their country. In addition, there currently is a data protection regulation applicable to member states of the European Union that includes operational and compliance requirements that are different than those currently in place and that also includes significant penalties for non-compliance.

The interpretation and application of privacy, data protection, data transfer and data retention laws and regulations are often uncertain and in flux in the United States and internationally. These laws may be interpreted and applied inconsistently from country to country and inconsistently with our current policies and practices, complicating long-range business planning decisions. If privacy, data protection, data transfer or data retention laws are interpreted and applied in a manner that is inconsistent with our current policies and practices, we may be fined or ordered to change our business practices in a manner that adversely impacts our operating results. Complying with these varying international requirements could cause us to incur substantial costs or require us to change our business practices in a manner adverse to our business and operating results.

If we are unable to protect the confidentiality of our trade secrets, our business and competitive position would be harmed.

We consider trade secrets, including confidential and unpatented know-how and programs important to the maintenance of our competitive position. We protect trade secrets and confidential and unpatented know-how, in part, by customarily entering into non-disclosure and confidentiality agreements with parties who have access to such knowledge, such as our employees, outside technical and commercial collaborators, consultants, advisors and other third parties. We plan to enter into confidentiality and invention assignment agreements with our employees and consultants that obligate them to maintain confidentiality and assign their inventions to us. Despite these efforts, any of these parties may breach the agreements and disclose our proprietary information, including our trade secrets, and we may not be able to obtain adequate remedies for such breaches.

| 21 |

|

|

| Table of Contents |

If we are unable to provide innovative search experiences and other products and services that differentiate our services and generate significant traffic to our websites, our business could be harmed, causing our revenue to decline.

Internet search is characterized by rapidly changing technology, significant competition, evolving industry standards, and frequent product and service enhancements. We need to innovate to improve our users’ search experience to continue to differentiate our services and attract, retain, and expand our user base. The research and development of new, technologically advanced products is a complex process that requires significant levels of innovation and investment, as well as accurate anticipation of technology, market and consumer trends.

If we are unable to provide innovative search experiences and other products and services which differentiate our services, gain user acceptance and generate significant traffic to our websites, or if we are unable to effectively monetize the traffic from such products and services, our business could be harmed, causing our revenue to decline.

Interruptions, delays, or failures in the provision of our services could damage our reputation and harm our operating results.

Delays or disruptions to our service, or the loss or compromise of data, could result from a variety of causes, including the following:

|

| • | Our operations are susceptible to outages and interruptions due to fire, flood, earthquake, tsunami, other natural disasters, power loss, equipment or telecommunications failures, cyber-attacks, terrorist attacks, political or social unrest, and other events over which we have little or no control. We do not have multiple site capacity for all of our services and some of our systems are not fully redundant. In the event of delays or disruptions to service, some data or systems may not be fully recoverable. |

|

| • | The systems through which we provide our products and services are highly technical, complex, and interdependent. Design errors might exist in these systems, or might be introduced when we make modifications, which might cause service malfunctions or require services to be taken offline while corrective responses are developed. |

|

| • | Despite our implementation of network security measures, our servers are vulnerable to computer viruses, malware, worms, hacking, physical and electronic break-ins, router disruption, sabotage or espionage, and other disruptions from unauthorized access and tampering, as well as coordinated denial-of-service attacks. We may not be in a position to promptly address attacks or to implement adequate preventative measures if we are unable to immediately detect such attacks. Such events could result in large expenditures to investigate or remediate, to recover data, to repair or replace networks or information systems, including changes to security measures, to deploy additional personnel, to defend litigation or to protect against similar future events, and may cause damage to our reputation or loss of revenue. |

|