Notes:

| |

1. |

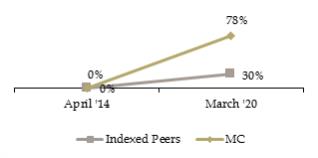

Source: CapIQ, Dividend Adjusted Share Price calculation beginning April 16, 2014 and concluding

March 31, 2020. Calculation starting price modified to reflect IPO price of $25.00 per share vs. closing price of $26.15 per share on April 16, 2014; Indexed peers include Evercore, Greenhill, Houlihan Lokey, Lazard, and PJT.

|

| |

2. |

We pay dividends out of excess cash flow generated during the period. As such, dividends are paid on a quarter

lag. Dividends described include dividends paid in Q2 2018 – Q1 2019, and Q2 2019 - Q1 2020 with respect to performance in the fiscal years ended 2018 and 2019, respectively. |

This letter contains forward-looking statements, which reflect our current views with respect to, among other things, our operations and financial

performance. You can identify these forward-looking statements by the use of words such as “may,” “might,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,”

“estimate,” “intend,” “predict,” “potential” or “continue,” the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to risks, uncertainties,

and assumptions about us, may include projections of our future financial performance, based on our growth strategies and anticipated trends in our business. These statements are only predictions based on our current expectations and projections

about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the

forward-looking statements. In particular, you should consider the numerous risks outlined in our Annual Report on Form 10-K, including under the caption “Risk Factors,” filed with the Securities and

Exchange Commission and available on our website at www.moelis.com. Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements.

Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements.

You

should not rely upon forward-looking statements as a prediction of future events. We are under no duty to and we do not undertake any obligation to update or review any of these forward-looking statements after the date of this letter to conform our

prior statements to actual results or revised expectations whether as a result of new information, future developments or otherwise.