Attached files

| file | filename |

|---|---|

| EX-14.1 - EX-14.1 - Moelis & Co | a2223245zex-14_1.htm |

| EX-23.1 - EX-23.1 - Moelis & Co | a2223245zex-23_1.htm |

| EX-10.6 - EX-10.6 - Moelis & Co | a2223245zex-10_6.htm |

| EX-31.1 - EX-31.1 - Moelis & Co | a2223245zex-31_1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Moelis & Co | Financial_Report.xls |

| EX-31.2 - EX-31.2 - Moelis & Co | a2223245zex-31_2.htm |

| EX-32.1 - EX-32.1 - Moelis & Co | a2223245zex-32_1.htm |

| EX-32.2 - EX-32.2 - Moelis & Co | a2223245zex-32_2.htm |

| EX-21.1 - EX-21.1 - Moelis & Co | a2223245zex-21_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

Item 8. Financial Statements and Supplementary Data

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2014 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission File Number: 001-36418

Moelis & Company

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

46-4500216 (I.R.S. Employer Identification No.) |

|

399 Park Avenue, 5th Floor, New York NY (Address of principal executive offices) |

10022 (Zip Code) |

(212) 883-3800

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Class A common stock, par value $0.01 | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, non-accelerated filer or a smaller reporting company. See definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the voting and nonvoting common equity held by non-affiliates of the Registrant as of June 30, 2014 was $432 million.

As of February 19, 2015, there were 19,727,048 shares of Class A common stock, par value $0.01 per share, and 31,617,704 shares of Class B common stock, par value $0.01 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's definitive proxy statement for its 2015 annual meeting of stockholders are incorporated by reference in Part III of this Form 10-K.

2

When we use the terms "Company," "we," "our," or "us," we mean Moelis & Company, a Delaware corporation (incorporated in January 2014), and its consolidated subsidiaries. "Old Holdings" refers solely to Moelis Asset Management LP (formerly Moelis & Company Holdings LP). References to the "IPO" refer to our initial public offering in April 2014 where Old Holdings reorganized its business in connection with the offering of 7,475,000 shares of Moelis & Company Class A common stock. Following the reorganization, the advisory business is now held under Moelis & Company Group LP ("Group LP"), a Delaware limited partnership, and Group LP is controlled by Moelis & Company.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 10-K contains forward-looking statements, which reflect our current views with respect to, among other things, our operations and financial performance. You can identify these forward-looking statements by the use of words such as "may," "might," "will," "should," "expect," "plan," "anticipate," "believe," "estimate," "intend," "predict," "potential" or "continue," the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to risks, uncertainties, and assumptions about us, may include projections of our future financial performance, based on our growth strategies and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. In particular, you should consider the numerous risks outlined in Item 1A.

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as a prediction of future events. We are under no duty to and we do not undertake any obligation to update or review any of these forward-looking statements after the date of this filing to conform our prior statements to actual results or revised expectations whether as a result of new information, future developments or otherwise.

Moelis & Company is a leading global independent investment bank that provides innovative strategic and financial advice to a diverse client base, including corporations, governments and financial sponsors. We assist our clients in achieving their strategic goals by offering comprehensive, globally integrated financial advisory services across all major industry sectors. Our team of experienced professionals advises clients on their most critical decisions, including mergers and acquisitions ("M&A"), recapitalizations and restructurings and other corporate finance matters.

Moelis & Company was founded in 2007 by veteran investment bankers to create a global independent investment bank that offers multi-disciplinary solutions and exceptional transaction execution combined with the highest standard of confidentiality and discretion. We create lasting client relationships by providing focused innovative advice through a highly collaborative and global approach not limited to specific products or access to particular regions. Our compensation model fosters our holistic approach to clients by emphasizing quality of advice and is not a commission-based structure where employees are compensated on a defined percentage of the revenues they generate. We believe our discretionary approach to compensation leads to exceptional advice, strong client impact and enhanced internal collaboration.

Since our inception, we have achieved rapid growth by hiring high-caliber professionals, expanding the scope and geographic reach of our advisory services, developing new client relationships and

3

cultivating our professionals through training and mentoring. Today we serve our clients with almost 400 advisory professionals, including 99 Managing Directors, based in 17 offices around the world. We have demonstrated strong financial performance, achieving revenues of $519 million in 2014, our seventh full year of operations, and have advised on over $1 trillion of transactions since inception.

Our Market Opportunity

We believe that we will continue to grow revenues and gain market share as a result of being well positioned to benefit from the following market forces:

Growing Demand for Independent Advice: The demand for independent advice has increased dramatically in recent years. In 2014, independent advisors generated over 21% of the total advisory fee pool, up from less than 15% in 2009. Of the advisory revenue generated by independent advisors, Moelis & Company was responsible for 19% in 2014, up from less than 11% in 2009. We believe the shift toward independent advice has been driven largely by the actual or perceived conflicts at the large financial conglomerates where sizable sales and trading, underwriting and lending businesses coexist with an advisory business that comprises only a small portion of revenues and profits. We expect the momentum of the independent firms to continue as clients seek uncompromised confidential advice free of conflicts. We believe we are well positioned amongst the independent investment banks to deliver this advice given our global reach and product and industry depth.

Ongoing Dislocation at Large Financial Conglomerates: We will seek to continue to take advantage of growth opportunities arising from the ongoing dislocation at large financial conglomerates. These firms face increasing regulation and the pressure of managing large disparate business divisions, leading to confidentiality challenges, higher operating costs, compensation limitations and increased capital constraints, all of which we believe adversely affect their ability to serve clients and compete for talented professionals. As these firms continue to struggle with these issues, we see tremendous opportunities to enhance our industry coverage, expand our geographic reach and add new advisory expertise.

Steady Improvement in Mergers & Acquisitions Activity: While announced M&A volume was relatively restrained from the global financial crisis through 2013, we are seeing a steady improvement in the M&A environment driven by a stabilizing global macroeconomic environment, strong corporate balance sheets, attractive financing markets, a trend toward global consolidation and increased financial sponsor activity. In addition to these typical ingredients for a healthy M&A market, companies are pursuing M&A opportunities in the current low growth environment to drive greater efficiencies by reducing costs and upgrading cash flows and balance sheets. Given these trends, we expect a steady improvement in M&A, which we believe will continue to increase our deal flow and enhance our growth. In addition, the recovery in Europe since the global financial crisis has lagged that of the U.S. We have made substantial investments in Europe, with almost 70 advisory professionals, including 19 Managing Directors, in the region and believe we will be well positioned when the European M&A market rebounds.

Continued Activity in Recapitalization and Restructuring Market: We believe that, given the amount of leverage (including floating rate instruments) that companies have issued in recent years, a steady recapitalization and restructuring market will exist if interest rates rise or credit markets become more difficult to access, even with an improving macroeconomic environment and a steady improvement in M&A activity. In 2012 through 2014 leveraged finance issuance in the U.S. reached record levels, as companies took advantage of historically low borrowing costs to leverage their capital structures. We believe we are well positioned to assist companies through our holistic approach, which combines sector expertise with M&A, recapitalization and restructuring and other

4

advisory capabilities, to provide solutions to clients in both robust and challenging economic environments.

Our Key Competitive Strengths

With 17 offices located around the world, capabilities in all major industries and deep advisory expertise, we believe we are well positioned to take advantage of the strong market opportunity for independent investment banks. Furthermore, we believe our business is differentiated from that of our competitors in the following respects:

Globally Integrated Firm with Innovative Advisory Solutions: We provide the high-touch and conflict free benefits of an independent investment bank with the global reach, sector depth and product expertise more commonly found at larger financial institutions. With 17 offices located in North and South America, Europe, the Middle East, Asia and Australia, we combine local and regional expertise with international market knowledge to provide our clients with highly integrated information flow and strong cross-border capabilities. We harness the deep industry expertise and broad corporate finance experience of our 99 global Managing Directors, which include 60 former sector and product heads from major investment banks. We reinforce our model with a discretionary compensation structure that encourages a high degree of collaboration and our "One Firm" mentality.

Advisory Focus with Strong Intellectual Capital: We primarily focus on advising clients, unlike most of our major competitors who derive a large percentage of their revenues from lending, trading and underwriting securities. We believe this independence allows us to offer advice free from the actual or perceived conflicts associated with lending to clients or trading in their securities. In addition, our focus on advisory services frees us from the pressure of cross-selling products, which we believe can distract from the dialogue with clients around their long-term strategy, compromising the advice. We provide intellectual capital based on our judgment, expertise and relationships combined with intense senior level attention to all transactions. The business of delivering intellectual capital allows us to operate a low risk and capital light model with attractive profit margins. We are not exposed to the financial risk and regulatory requirements that arise from, or the capital investments required in, balance sheet lending and trading activities.

Fast Growing Global Independent Investment Bank: Since our inception in 2007, we have achieved rapid growth, earning revenues of $519 million in 2014. During this time however, the global financial crisis contributed to a 42% decrease in global completed M&A volume from the peak levels of 2007. We took advantage of the dislocation in the financial services industry following the global financial crisis and capitalized on the unique opportunity to hire Managing Directors who have on average 20 years of investment banking experience. We believe the quality and scale of our global franchise and the speed at which it has been achieved would be a challenge to replicate today.

Strong Financial Discipline: We have remained financially disciplined with an intense focus on managing growth in a profitable manner. We hired aggressively during the global financial crisis to take advantage of the dislocation among our competitors and recently have taken a more measured approach to hiring as the markets and compensation levels have stabilized. We incentivize our bankers as owners by awarding equity compensation in order to align the interests of our employees and equity holders, and our employees currently own a majority of our Company. Additionally, we have focused on entering new regions and sectors through creative and cost efficient strategies. We intend to maintain our financial discipline as we continue to grow our revenues, expand into new markets and increase our areas of expertise.

Significant Organic Growth Opportunities: We have made significant investments in our intellectual capital with the hiring of 57 Managing Directors since 2010. In addition, we have invested time

5

and resources in our recruiting and training and development programs. We established a meaningful presence at the top undergraduate programs in our first year of operations, which has resulted in the hiring of over 250 analysts from campus since our inception. We are poised to continue realizing meaningful organic growth from these investments. We have achieved critical size in key industry sectors and regions around the globe, as well as recognition for advising on innovative transactions, which have enhanced our brand globally. We are positioned to continue to grow revenues as a result of increased individual productivity as our investments in people mature and as we continue to leverage our global platform through enhanced connectivity and idea generation and expanded brand recognition.

High Standard of Confidentiality and Discretion: Due to the highly sensitive nature of M&A discussions where confidentiality is of paramount importance to clients, the M&A business is most effectively operated on a "need to know" basis. We believe that large financial conglomerates with multiple divisions, "Chinese Walls" and layers of management have a significantly greater number of employees who have access to sensitive client information, which can increase the risk of confidential information leaking. Such leaks can materially impair the viability of transactions and other strategic decisions. We have established a high standard of confidentiality and discretion, as well as instituted procedures designed to protect our clients and minimize the risk of sensitive information leaking to the market.

Diversified Advisory Platform: Our business is highly diversified across sectors, types of advisory services and clients. Our broad corporate finance expertise positions us to advise clients through any phase of their life cycle and in any economic environment. We focus on a wide range of clients from large public multinational corporations to middle market private companies to individual entrepreneurs, and we deliver the full resources of our firm and the highest level of senior attention to every client, regardless of size or situation. In addition, we have no meaningful client concentration, with our top 10 transactions representing only 23% of our revenues in 2014. Our holistic "One Firm" approach also reduces dependence on any one product or banker and allows us to leverage our intellectual capital across the firm as necessary to offer multiple solutions to our clients, increase our client penetration and adapt to changing circumstances.

Partnership Culture: We believe that our momentum and commitment to excellence have created an environment that attracts and retains high quality talent. Our people are our most valuable asset and our goal is to attract, retain and develop the best and brightest talent in our industry across all levels. We strive to foster a collaborative environment, and we seek individuals who are passionate about our business and are a fit with our culture. We have established a compensation philosophy that reinforces our long-term vision and values by rewarding collaboration, client impact and lasting relationships and encourages employees to put the interests of our clients and our Company first. Above all, our core values nurture a culture of partnership, passion, optimism and hard work, inspiring the highest level of quality and integrity in every interaction with our clients and each other.

Our Growth Strategy

Our growth strategy is to continue to take advantage of what we believe are attractive market opportunities to enhance our leadership position as a global independent investment bank, advising our clients on important mergers and acquisitions, recapitalization and restructuring transactions and other strategic matters. We seek to achieve these objectives through the following two primary strategies:

Deepen and Expand our Client Relationships: We seek to continue to deepen and expand our client relationships, which are the foundation of our business. We are tireless in our pursuit of offering the highest quality integrated advice and most innovative solutions that lead to the long-term success of our clients. We believe this approach has enhanced our reputation as a trusted advisor

6

to our clients, and we intend to leverage this approach further as we increase our touch points with our clients and develop new client relationships.

Broaden our Areas of Expertise Based on Client Needs: We intend to pursue further industry and geographic expansion and introduce new product expertise based on client needs. In addition to hiring high quality professionals who will expand our market share, we will seek to grow through increasing the tenure of our Managing Directors, investing in and training our next generation of Managing Directors and continuing to hire analysts and associates from leading undergraduate and graduate programs. We believe that developing talent internally creates a more sustainable franchise and reinforces the culture of our firm.

Our Advisory Offering

We offer holistic advisory solutions to clients by integrating our bankers' deep industry knowledge and broad corporate finance experience with our global capabilities. With 17 offices located in North and South America, Europe, the Middle East, Asia and Australia, we combine local and regional expertise with international market knowledge to provide highly integrated information flow and strong cross-border capabilities. Since our founding, we have rapidly scaled our global platform, as we believe clients value our ability to be relevant in their local market as well as to provide valuable global insights.

We combine our global capabilities with expertise in all major industries including Consumer, Retail & Restaurants; Financial Institutions; Financial Sponsors; General Industrials; Healthcare; Natural Resources; Real Estate, Gaming, Lodging & Leisure and Technology, Media & Telecommunications. We collaborate globally to bring our deep industry knowledge to the local markets where our clients operate.

We focus on a wide range of clients from large public multinational corporations to middle market private companies to individual entrepreneurs, and we deliver the full resources of our firm and the highest level of senior attention to every client, regardless of size or situation.

We advise our clients through all phases of the business cycle using our strong capabilities in M&A, recapitalization and restructuring and other advisory services.

We have established a premier M&A franchise advising clients on mergers, acquisitions, sales and divestitures. We counsel our clients through all stages of the process as we evaluate strategic alternatives, assess potential acquirers and targets, provide valuation analyses and advise on transaction terms including valuation, structuring, timing and potential financing. Additionally, we have an exclusive sales franchise with a strong track record in achieving maximum value for clients in their sale processes.

Moelis & Company has substantial expertise in guiding special committees of boards of directors to evaluate strategies and negotiate proposals by leveraging decades of transaction experience. We execute a rigorous process to help special committees synthesize alternatives and develop an appropriate course of action. In addition, we bring a strong understanding of key deal points and the interplay between deal terms, value and the various stakeholders involved.

For our clients in financial distress, we partner senior recapitalization and restructuring professionals with our industry, M&A and capital markets experts to provide holistic advice. We advise both companies and creditors, utilizing our strong relationship network to access capital, identify potential partners and drive support for our transactions. Since our inception, approximately 60% of our recapitalization and restructuring engagements have been on the company or debtor side of a transaction. We understand that during times of financial distress, having a true partner as an advisor is of critical importance, and our partnership and collaboration with our clients during these times has helped us develop long-lasting company relationships. In addition, our deep relationships throughout the creditor and recapitalization and restructuring communities provide multiple creditor side

7

origination opportunities and allow us to develop a comprehensive perspective from all constituents. We understand that in distressed situations, many creditors become temporary equityholders of businesses, and we help these clients realize value which leads to further M&A activity for us.

As part of our holistic approach to client service, we have substantial experience in advising clients on complex risk exposures. Our team consists of experts in structured products, securitization, derivatives and risk management who are highly qualified to value complex assets and advise on repositioning and divesting underperforming portfolios. These capabilities have been particularly relevant to our financial institutions clients since the global financial crisis.

We also advise clients on capital markets matters, providing comprehensive capital structure advice and developing financing solutions tailored to the specific needs of issuers. Our independence and objectivity, coupled with our direct and long-standing institutional buy-side relationships, inform our market views and enhance the likelihood of a successful transaction. We advise clients on all aspects of public and private debt and equity transactions.

We provide capital raising, secondary transaction and other advisory services to private fund sponsors and limited partners. Our team's extensive experience raising capital for a wide variety of fund sponsors located in North America, Europe, Asia and the emerging markets is fully integrated with our global platform, ensuring the broadest possible marketing efforts for our clients. We specialize in private equity fund structures across a wide range of strategies, including buyout, growth capital, distressed, special situations, venture and sector-specific strategies.

In addition, we provide a broad range of other financial advisory services tailored to the specific circumstances and needs of our clients. For example, we act as defense advisor to boards of directors responding to unsolicited proposals, we act as expert witness for clients in major litigation and we assist private clients and governments in negotiations of significant commercial matters.

We seek to generate repeat business from our clients by becoming long-term partners with them as opposed to being solely transaction focused. We are also committed to developing new client relationships, and we maintain an active dialogue with a large number of potential clients, as well as with their financial and legal advisors, on an ongoing basis. We continue to penetrate new relationships through our business development initiatives, growing our senior team with professionals who bring additional client relationships and through introductions from our strong network of relationships with senior executives, board members, attorneys and other third parties.

Our People

We believe that our people are our most valuable asset. Our goal is to attract, retain and develop the best and brightest talent in our industry across all levels. We strive to foster a collaborative environment, and we seek individuals who are passionate about our business and fit our culture. Our Managing Directors are compensated based on the quality of advice and execution provided to a client, which is predicated on delivering our full suite of advisory services through a high degree of collaboration across different industries, products and regions. This collaborative approach is demonstrated by the fact that on almost all of our transactions, at least two Managing Directors support the client. We reinforce our long-term vision and values by rewarding for client impact and lasting relationships. Our year-end evaluation process measures both performance and alignment with our core value system, ensuring that we continue to integrate our expertise to meaningfully enhance the quality of our advice and strengthen our client relationships. We do not compensate on a commission-based pay model and do not manage our business based on industry, product or regional silos. Our compensation structure for junior bankers is based on a system of meritocracy whereby bankers are rewarded for top performance.

8

We recruit our junior bankers from the world's leading undergraduate and graduate programs. Since our inception we have had a dedicated campus recruiting effort through which we have hired over 250 analysts from these undergraduate programs. We devote significant time and resources to training and mentoring our employees and have implemented a generalist program in which our junior professionals receive significant transaction experience across a wide range of products and industries. We believe this exposure enhances the investment banking experience and allows our junior professionals to develop and refine their proficiency in a broad variety of corporate finance matters at an early stage in their career. We are committed to talent retention and our goal is to develop our brightest and most ambitious junior professionals into successful Managing Directors. As of December 31, 2014, we had 550 employees globally, including 381 advisory professionals and 94 Managing Directors.

Our Australian Joint Venture

In 2009, we opened our sixth global office in Sydney to provide investment banking services in Australia and expand our coverage of the Asia-Pacific region. Following the establishment of this office and the hiring of what we believe is a strong executive team, we entered into a joint venture with this team (the "Australian JV"). Our Australian JV has been responsible for providing our investment banking services in this region since April 1, 2010. Our Australian JV's primary business is offering advisory services. In addition, it has an equity capital markets and research, sales and trading business covering Australian public equity securities and also engages in certain asset management activities. We and the Australian executives each own a 50% economic interest in the Australian JV. The Australian JV expanded into Melbourne in 2014. As of December 31, 2014, the Australian JV had 59 employees, including 30 advisory bankers.

Our Strategic Alliance with Sumitomo Mitsui Banking Corporation and its Subsidiary, SMBC Nikko Securities Inc.

Effective January 1, 2012, we entered into a strategic alliance with Sumitomo Mitsui Banking Corporation ("SMBC") and its subsidiary, SMBC Nikko Securities Inc. ("Nikko") to provide advisory services, including advising on mergers, acquisitions, divestitures, restructurings and other corporate finance matters, to Japanese companies in regions where our firms conduct business. On February 17, 2012, SMBC invested approximately $93 million in our Company in connection with the strategic alliance. The alliance has provided us and our clients with access to the Japanese market as well as provided us with opportunities to advise Japanese clients on the full suite of our advisory services, with a particular focus on cross-border M&A. Established in 1876 as Mitsui Bank, SMBC is the second largest bank in Japan based on market capitalization. Nikko is one of the five major securities companies in Japan. Our strategic alliance agreement had an initial term of three years which expired on December 31, 2014. The arrangement automatically renewed for one year according to its terms, which call for automatic one-year renewals, unless written notice is provided at least six months prior to the end of the term by either party.

Competition

The financial services industry is intensely competitive, and we expect it to remain so. Our competitors are other investment banking and financial advisory firms. We compete on both a global and a regional basis, and on the basis of a number of factors, including depth of client relationships, industry knowledge, transaction execution skills, our range of products and services, innovation, reputation and price.

We believe our primary competitors in securing advisory engagements include the investment banking businesses of Bank of America Corporation, The Blackstone Group L.P., Citigroup Inc., Credit Suisse Group AG, The Goldman Sachs Group, Inc., JPMorgan Chase & Co., Morgan Stanley and

9

other large investment banking firms as well as independent investment banking firms such as Evercore Partners Inc., Greenhill & Co., Inc., Houlihan Lokey, Inc., Lazard Ltd and NM Rothschild & Sons Limited.

We compete to attract and retain qualified employees. Our ability to continue to compete effectively in our business will depend upon our ability to attract new employees and retain and motivate our existing employees.

In past years there has been substantial consolidation in the financial services industry. In particular, a number of large commercial banks and other broad-based financial services firms have established or acquired broker-dealers or have merged with other financial institutions. Many of these firms have the ability to offer a wider range of products, from loans, deposit-taking and insurance to brokerage, asset management and investment banking services, which may enhance their competitive position. They also have the ability to support investment banking and securities products with commercial lending and other financial services revenues in an effort to gain market share, which could result in pricing pressure in our business or loss of opportunities for us. In addition, we may be at a competitive disadvantage relative to certain of our competitors who are able to, and regularly do, provide financing or market making services that are often instrumental in effecting transactions. The trend toward consolidation has significantly increased the capital base and geographic reach of our competitors as well as the potential for actual or perceived conflicts of these firms.

Regulation

Our business, as well as the financial services industry generally, is subject to extensive regulation in the U.S. and across the globe. As a matter of public policy, regulatory bodies in the U.S. and the rest of the world are charged with safeguarding the integrity of the securities and other financial markets and with protecting the interests of customers participating in those markets, not with protecting the interests of our stockholders or creditors. In the U.S., the SEC is the federal agency responsible for the administration of the federal securities laws. Moelis & Company LLC, our wholly-owned subsidiary through which we conduct our financial advisory business in the U.S., is registered as a broker-dealer with the SEC. Moelis & Company LLC is subject to regulation and oversight by the SEC. In addition, the Financial Industry Regulatory Authority, Inc. ("FINRA"), a self-regulatory organization that is subject to oversight by the SEC, adopts and enforces rules governing the conduct, and examines the activities, of its member firms, including Moelis & Company LLC. State securities regulators also have regulatory or oversight authority over Moelis & Company LLC.

Broker-dealers are subject to regulations that cover all aspects of the securities business, including capital structure, record-keeping and the conduct and qualifications of directors, officers and employees. In particular, as a registered broker-dealer and member of a self-regulatory organization, we are subject to the SEC's uniform net capital rule, Rule 15c3-1. Rule 15c3-1 specifies the minimum level of net capital a broker-dealer must maintain and also requires that a significant part of a broker-dealer's assets be kept in relatively liquid form. The SEC and various self-regulatory organizations impose rules that require notification when net capital falls below certain predefined criteria, limit the ratio of subordinated debt to equity in the regulatory capital composition of a broker-dealer and constrain the ability of a broker-dealer to expand its business under certain circumstances. Additionally, the SEC's uniform net capital rule imposes certain requirements that may have the effect of prohibiting a broker-dealer from distributing or withdrawing capital and requiring prior notice to the SEC for certain withdrawals of capital.

In addition to the regulation we are subject to in the United States, we are also subject to regulation internationally by the Financial Conduct Authority in the United Kingdom, the Securities and Futures Commission in Hong Kong, the Australian Securities and Investments Commission and the Dubai Financial Services Authority.

10

Certain parts of our business are subject to compliance with laws and regulations of U.S. federal and state governments, non-U.S. governments, their respective agencies and/or various self-regulatory organizations or exchanges relating to, among other things, the privacy of client information, and any failure to comply with these regulations could expose us to liability and/or reputational damage.

The U.S. and non-U.S. government agencies and self-regulatory organizations, as well as state securities commissions in the United States, are empowered to conduct periodic examinations and initiate administrative proceedings that can result in censure, fines, the issuance of cease-and-desist orders or the suspension or expulsion of a broker-dealer or its directors, officers or employees.

Federal anti-money-laundering laws make it a criminal offense to own or operate a money transmitting business without the appropriate state licenses, which we maintain, and registration with the U.S. Department of the Treasury's Financial Crimes Enforcement Network (FinCEN). In addition, the USA PATRIOT Act of 2001 and the Treasury Department's implementing federal regulations require us, as a "financial institution," to establish and maintain an anti-money-laundering program.

In connection with its administration and enforcement of economic and trade sanctions based on U.S. foreign policy and national security goals, the Treasury Department's Office of Foreign Assets Control, or OFAC, publishes a list of individuals and companies owned or controlled by, or acting for or on behalf of, targeted countries. It also lists individuals, groups and entities, such as terrorists and narcotics traffickers, designated under programs that are not country-specific. Collectively, such individuals and companies are called "Specially Designated Nationals," or SDNs. Assets of SDNs are blocked, and we are generally prohibited from dealing with them. In addition, OFAC administers a number of comprehensive sanctions and embargoes that target certain countries, governments and geographic regions. We are generally prohibited from engaging in transactions involving any country, region or government that is subject to such comprehensive sanctions.

The Foreign Corrupt Practices Act (the "FCPA") and the UK 2010 Bribery Act (the "UK Bribery Act") prohibit the payment of bribes to foreign government officials and political figures. The FCPA has a broad reach, covering all U.S. companies and citizens doing business abroad, among others, and defining a foreign official to include not only those holding public office but also local citizens acting in an official capacity for or on behalf of foreign government-run or -owned organizations or public international organizations. The FCPA also requires maintenance of appropriate books and records and maintenance of adequate internal controls to prevent and detect possible FCPA violations. Similarly, the UK Bribery Act prohibits us from bribing, being bribed or making other prohibited payments to government officials or other persons to obtain or retain business or gain some other business advantage.

11

Executive Officers and Directors

Board of Directors

Kenneth

Moelis,

Chairman and Chief Executive Officer of the Company

Eric

Cantor,

Managing Director and Vice Chairman of the Company

J.

Richard Leaman III,

Managing Partner of the Company

Navid

Mahmoodzadegan,

Co-Founder and Managing Director of the Company

Jeffrey

Raich,

Co-Founder and Managing Director of the Company

Stephen

F. Bollenbach,

Former Co-Chairman and CEO, Hilton Hotels Corporation

Yvonne

Greenstreet,

Former Senior Vice President and Head of Medicines Development, Pfizer Inc.

Kenneth

L. Shropshire

David W. Hauck Professor, Wharton School, University of Pennsylvania and Faculty Director of Wharton Sports Business Initiative

Other Executive Officers

Elizabeth

Crain

Chief Operating Officer

Joseph

Simon

Chief Financial Officer

Osamu

R. Watanabe

General Counsel and Secretary

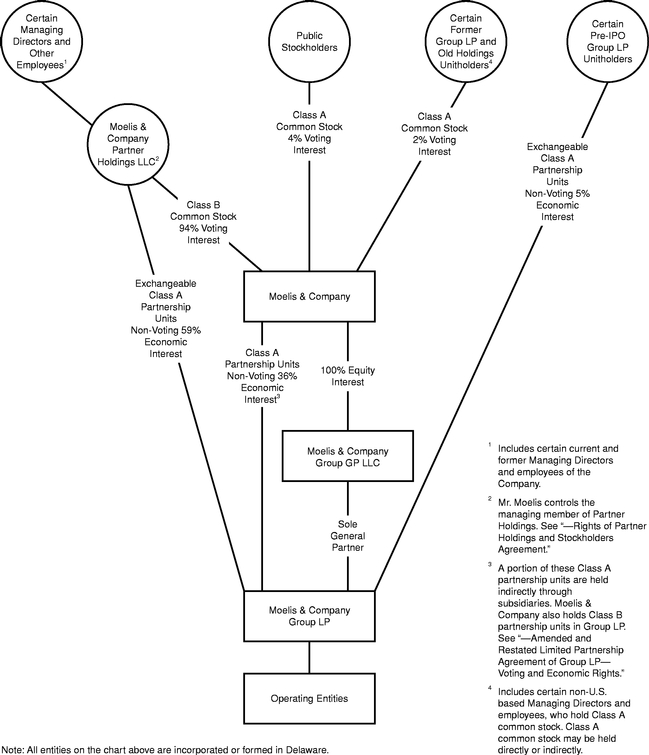

Organizational Structure

Overview

Moelis & Company is a holding company and its only assets are its partnership interests in Group LP, its equity interest in the sole general partner of Group LP, Moelis & Company Group GP LLC, and its interests in its subsidiaries. Moelis & Company operates and controls all of the business and affairs of Group LP and its operating entity subsidiaries indirectly through its equity interest in Moelis & Company Group GP LLC.

The simplified diagram below depicts our organizational structure (percentages are as of December 31, 2014).

12

The Reorganization

Prior to our initial public offering, our business was owned by Old Holdings. In connection with the consummation of our initial public offering, a reorganization of the existing businesses of Old Holdings was effected pursuant to which the advisory business was transferred to Group LP. Old Holdings retained its asset management business, which includes managers of direct lending funds, hedge funds, private equity funds, collateralized loan obligation funds and certain other asset management businesses. Moelis & Company generally does not engage in these activities.

13

Amended and Restated Limited Partnership Agreement of Group LP

We operate our business through Group LP and its subsidiaries. The provisions governing the operations of Group LP and the rights and obligations of its partners are set forth in the amended and restated limited partnership agreement of Group LP, the material terms of which are described below. The amended and restated limited partnership agreement of Group LP is filed as an exhibit to this Form 10-K.

Through our control of the general partner of Group LP, we have unilateral control (subject to the consent of Partner Holdings on various matters) over the affairs and decisions of Group LP. As such, we, through our officers and directors, are responsible for all operational and administrative decisions of Group LP and the day-to-day management of Group LP's business.

Voting and Economic Rights

Group LP issued Class A partnership units to Moelis & Company and to the holders of Old Holdings units at the time of the reorganization. In addition, Group LP issued Class B partnership units to Moelis & Company. The Group LP Class B partnership units correspond with the economic rights of shares of Moelis & Company's Class B common stock. Group LP Class A unitholders have no voting rights by virtue of their ownership of Group LP partnership units, except for the right to approve certain amendments to the amended and restated limited partnership agreement of Group LP, certain changes to the capital accounts of the limited partners of Group LP and any conversion of Group LP to a corporation other than for purposes of a sale transaction. Partner Holdings holds all shares of Moelis & Company Class B common stock, enabling it to exercise majority voting control over Moelis & Company and, indirectly, over Group LP.

Pursuant to the Group LP amended and restated limited partnership agreement, we have the right to determine when distributions will be made to the partners of Group LP and the amount of any such distributions. If we authorize a distribution, such distribution will be made, except as required under applicable tax law, to the partners of Group LP (i) in the case of a tax distribution, generally to the holders of partnership units in proportion to the amount of taxable income of Group LP allocated to such holder and (ii) in the case of other distributions, pro rata in accordance with the percentages of their respective partnership units.

Coordination of Moelis & Company and Group LP

At any time we issue a share of Class A common stock for cash, unless we use the proceeds for certain specified permitted purposes (including the acquisition Group LP Class A partnership units or other property), the proceeds received by us will be promptly transferred to Group LP, and Group LP will issue to us one of its Group LP Class A partnership units. At any time we issue a share of Class A common stock pursuant to our equity incentive plan we will contribute to Group LP all of the proceeds that we receive (if any), and Group LP will issue to us one of its Group LP Class A partnership units, having the same restrictions, if any, attached to the shares of Class A common stock issued under the equity incentive plan. Conversely, if we redeem or repurchase any of our shares of Class A common stock, Group LP will, immediately prior to our redemption or repurchase, redeem or repurchase an equal number of Group LP Class A partnership units held by us, upon the same terms and for the same price, as the shares of Class A common stock are redeemed or repurchased. We can only redeem or repurchase shares of Class A common stock if Group LP first redeems or repurchases an equivalent amount of Group LP Class A partnership units that we hold.

Exchange Rights

Subject to the terms and conditions of the Group LP amended and restated limited partnership agreement and the lock-up restrictions described below, each Group LP Class A unitholder (except for

14

Moelis & Company) has the right to exchange Group LP Class A partnership units, either for shares of our Class A common stock on a one-for-one basis, or cash (based on the market price of the shares of Class A common stock), at Group LP's option. If Group LP chooses to exchange such units for our Class A common stock, Moelis & Company will deliver an equivalent number of shares of Class A common stock to Group LP for further delivery to the exchanging holder and receive a corresponding number of newly issued Group LP Class A partnership units. The exchanging holder's surrendered Group LP Class A partnership units will be cancelled by Group LP. As Group LP Class A unitholders exchange their Group LP Class A partnership units, Moelis & Company's percentage of economic ownership of Group LP will be correspondingly increased. Following each such exchange, Partner Holdings will be required to surrender to Moelis & Company a corresponding number of shares of Class B common stock, and each such share will be converted into approximately 0.00055 shares of Class A common stock, which will be delivered to Partner Holdings. Group LP will also convert an equivalent number of Class B partnership units held by Moelis & Company into Class A partnership units based on the same conversion rate.

Group LP Class A partnership units and Moelis & Company Class A common stock held by our Managing Directors (including through Partner Holdings) are subject to lock-up agreements for four years from the date of our initial public offering. After this period, Group LP Class A partnership units held by a Managing Director will become exchangeable into Class A common stock or cash as described above and Moelis & Company Class A common stock held by a Managing Director will become transferable, in each case in three equal installments on each of the fourth, fifth and sixth anniversary of our initial public offering. If a Managing Director terminates his or her employment with the Company prior to the end of the lock-up period, the Company will be entitled to extend the lock-up period until up to the tenth anniversary of our initial public offering. We may waive the transfer and exchange restrictions set forth in the Group LP amended and restated limited partnership agreement, including in connection with an offering of shares of our Class A common stock by our Managing Directors. In addition, these restrictions cease to apply upon the death or termination of employment by us due to disability of the applicable Managing Director with respect to such Managing Director's Group LP Class A partnership units.

Restrictive Covenants of our Managing Directors

Prior to the expiration of the Managing Director lock-up, our Managing Directors are generally subject to forfeiting their interests in vested Group LP partnership units and Moelis & Company Class A common stock they held as of the initial public offering if they terminate their employment without good reason and compete with the Company within 12 months thereafter, except for a certain limited number of designated units and stock which were awarded to replace equity of a former employer forfeited upon joining. Our Managing Directors have agreed not to solicit our employees during the term of their employment and for 12 months thereafter.

Registration Rights

Moelis & Company has granted certain registration rights in the the amended and restated limited partnership agreement of Group LP, the stockholders agreement with Partners Holdings and the strategic alliance agreement with SMBC, each filed as exhibits to this Form 10-K.

Rights of Partner Holdings and Stockholders Agreement

Moelis & Company is party to a stockholders agreement with Partner Holdings pursuant to which, for so long as the Class B Condition (as defined in our amended and restated certificate of incorporation) is satisfied, Partner Holdings has approval rights over significant corporate actions by Moelis & Company. Our board of directors will nominate individuals designated by Partner Holdings equal to a majority of the board of directors, for so long as the Class B Condition is satisfied.

15

After the Class B Condition ceases to be satisfied, for so long as the Secondary Class B Condition (as defined in the stockholders agreement with Partners Holdings) is satisfied, Partner Holdings will have certain approval rights (including, among others, over the appointment or termination of the Chief Executive Officer) and our board of directors will nominate individuals designated by Partner Holdings equal to one quarter of the board of directors.

The industry, market and competitive position data referenced throughout this Form 10-K are based on research, industry and general publications, including surveys and studies conducted by third parties. Industry publications, surveys and studies generally state that they have been obtained from sources believed to be reliable. We have not independently verified such third party information. While we are not aware of any misstatements regarding any industry, market or similar data presented herein, such data involve uncertainties and are subject to change based on various factors, including those discussed under the headings "Special Note Regarding Forward-Looking Statements" and "Risk Factors" in this Form 10-K. The M&A market data for announced and completed transactions in 2014 and 2013 referenced throughout this Form 10-K was obtained from Thomson Financial as of January 5, 2015 and January 5, 2014, respectively.

In this Form 10-K, we use the term "independent investment banks" or "independent advisors" to refer to investment banks primarily focused on advisory services and that conduct limited or no commercial banking or sales and trading activities. We use the term "global independent investment banks" to refer to independent investment banks with global coverage capabilities across all major industries and regions. We consider the global independent investment banks to be our publicly traded peers, Evercore Partners Inc., Greenhill & Co., Inc., Lazard Ltd, and us.

Our website address is www.moelis.com. We make available free of charge on the Investor Relations section of our website (http://investors.moelis.com) this Annual Report on Form 10-K ("Form 10-K"), Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed or furnished with the Securities and Exchange Commission (the "SEC") pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934; as amended (the "Exchange Act"). We also make available through our website other reports filed with or furnished to the SEC under the Exchange Act, including our Proxy Statements and reports filed by officers and directors under Section 16(a) of that Act, as well as our Code of Business Conduct and Ethics. From time to time we may use our website as a channel of distribution of material company information. Financial and other material information regarding the Company is routinely posted on and accessible at http://investors.moelis.com. In addition, you may automatically receive email alerts and other information about us by enrolling your email by visiting the "Contact Us" section at http://investors.moelis.com. We do not intend for information contained in our website to be part of this Form 10-K. The inclusion of our website in this Form 10-K does not include or incorporate by reference the information on our website into this Form 10-K.

Any materials we file with the SEC may be inspected without charge at the public reference facilities maintained by the SEC at 100 F. Street, N.E., Washington, D.C. 20549, and copies of all or any part of this Form 10-K may be obtained from the SEC upon payment of the prescribed fee. Information on the operation of the public reference facilities may be obtained by calling the SEC at 1-800-SEC-0330. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding registrants that file electronically with the SEC. The address of the site is http://www.sec.gov.

16

Risks Related to Our Business

Our future growth will depend on, among other things, our ability to successfully identify, recruit and develop talent and will require us to commit additional resources.

We have experienced rapid growth over the past several years, which may be difficult to sustain at the same rate. Our future growth will depend on, among other things, our ability to successfully identify and recruit individuals and teams to join our firm. It typically takes time for these professionals to become profitable and effective. During that time, we may incur significant expenses and expend significant time and resources toward training, integration and business development aimed at developing this new talent. If we are unable to recruit and develop profitable professionals, we will not be able to implement our growth strategy and our financial results could be materially adversely affected.

In addition, sustaining growth will require us to commit additional management, operational and financial resources and to maintain appropriate operational and financial systems to adequately support expansion, especially in instances where we open new offices that may require additional resources before they become profitable. See "—Our growth strategy may involve opening or acquiring new offices and expanding internationally and would involve hiring new Managing Directors and other senior professionals for these offices, which would require substantial investment by us and could materially and adversely affect our operating results." There can be no assurance that we will be able to manage our expanding operations effectively, and any failure to do so could materially adversely affect our ability to grow revenue and control our expenses.

Changing market conditions can adversely affect our business in many ways, including by reducing the volume of the transactions involving our business, which could materially reduce our revenue.

As a financial services firm, we are materially affected by conditions in the global financial markets and economic conditions throughout the world. For example, our revenue is directly related to the volume and value of the transactions in which we are involved. During periods of unfavorable market or economic conditions, the volume and value of M&A transactions may decrease, thereby reducing the demand for our M&A advisory services and increasing price competition among financial services companies seeking such engagements. In addition, during periods of strong market and economic conditions, the volume and value of recapitalization and restructuring transactions may decrease, thereby reducing the demand for our recapitalization and restructuring advisory services and increasing price competition among financial services companies seeking such engagements. Our results of operations would be adversely affected by any such reduction in the volume or value of such advisory transactions. Further, in the period following an economic downturn, the volume and value of M&A transactions typically takes time to recover and lags a recovery in market and economic conditions.

Our profitability may also be adversely affected by our fixed costs and the possibility that we would be unable to scale back other costs within a time frame sufficient to match any decreases in revenue relating to changes in market and economic conditions. The future market and economic climate may deteriorate because of many factors beyond our control, including rising interest rates or inflation, terrorism or political uncertainty.

Our revenue in any given period is dependent on the number of fee-paying clients in such period, and a significant reduction in the number of fee-paying clients in any given period could reduce our revenue and adversely affect our operating results in such period.

Our revenue in any given period is dependent on the number of fee-paying clients in such period. We had 130 clients and 109 clients paying fees equal to or greater than $1 million in 2014 and 2013,

17

respectively. We may lose clients as a result of the sale or merger of a client, a change in a client's senior management, competition from other financial advisors and financial institutions and other causes. A significant reduction in the number of fee-paying clients in any given period could reduce our revenue and adversely affect our operating results in such period.

Our ability to retain our Managing Directors and our other professionals, including our executive officers, is critical to the success of our business.

Our future success depends to a substantial degree on our ability to retain qualified professionals within our organization, including our Managing Directors. However, we may not be successful in our efforts to retain the required personnel as the market for qualified investment bankers is extremely competitive. Our investment bankers possess substantial experience and expertise and have strong relationships with our advisory clients. As a result, the loss of these professionals could jeopardize our relationships with clients and result in the loss of client engagements. For example, if any of our Managing Directors or other senior professionals, including our executive officers, or groups of professionals, were to join or form a competing firm, some of our current clients could choose to use the services of that competitor rather than our services. There is no guarantee that our compensation and non-competition arrangements with our Managing Directors provide sufficient incentives or protections to prevent our Managing Directors from resigning to join our competitors. In addition, some of our competitors have more resources than us which may allow them to attract some of our existing employees through compensation or otherwise. The departure of a number of Managing Directors or groups of professionals could have a material adverse effect on our business and our profitability.

We depend on the efforts and reputations of Mr. Moelis and our other executive officers. Our senior leadership team's reputations and relationships with clients and potential clients are critical elements in the success of our business. The loss of the services of any of them, in particular Mr. Moelis, could have a material adverse effect on our business, including our ability to attract clients.

Substantially all of our revenue is derived from advisory fees. As a result, our revenue and profits are highly volatile on a quarterly basis and may cause the price of our Class A common stock to fluctuate and decline.

Our revenue and profits are highly volatile. We derive substantially all of our revenue from advisory fees, generally from a limited number of engagements that generate significant fees at key transaction milestones, such as closing, the timing of which is outside of our control. We expect that we will continue to rely on advisory fees for most of our revenue for the foreseeable future. Accordingly, a decline in our advisory engagements or the market for advisory services would adversely affect our business. In addition, our financial results will likely fluctuate from quarter to quarter based on the timing of when fees are earned, and high levels of revenue in one quarter will not necessarily be predictive of continued high levels of revenue in future periods. Because we lack other, more stable, sources of revenue, which could moderate some of the volatility in our advisory revenue, we may experience greater variations in our revenue and profits than other larger, more diversified competitors in the financial services industry. Fluctuations in our quarterly financial results could, in turn, lead to large adverse movements in the price of our Class A common stock or increased volatility in our stock price generally.

Because in many cases we are not paid until the successful consummation of the underlying transaction, our revenue is highly dependent on market conditions and the decisions and actions of our clients, interested third parties and governmental authorities. For example, we may be engaged by a client in connection with a sale or divestiture, but the transaction may not occur or be consummated because, among other things, anticipated bidders may not materialize, no bidder is prepared to pay our client's price or because our client's business experiences unexpected operating or financial problems. We may be engaged by a client in connection with an acquisition, but the transaction may not occur or

18

be consummated for a number of reasons, including because our client may not be the winning bidder, failure to agree upon final terms with the counterparty, failure to obtain necessary regulatory consents or board or stockholder approvals, failure to secure necessary financing, adverse market conditions or because the target's business experiences unexpected operating or financial problems. In these circumstances, we often do not receive significant advisory fees, despite the fact that we have devoted considerable resources to these transactions.

In addition, we face the risk that certain clients may not have the financial resources to pay our agreed-upon advisory fees. Certain clients may also be unwilling to pay our advisory fees in whole or in part, in which case we may have to incur significant costs to bring legal action to enforce our engagement agreement to obtain our advisory fees.

Our joint ventures, strategic investments and acquisitions may result in additional risks and uncertainties in our business.

In addition to recruiting and internal expansion, we may grow our core business through joint ventures, strategic investments or acquisitions.

In the case of joint ventures, such as our 50% investment in our Australian JV, we are subject to additional risks and uncertainties relating to governance and controls, in that we may be dependent upon, and subject to, liability, losses or reputational damage relating to personnel, controls and systems that are not fully under our control. In addition, disagreements between us and our joint venture partners may negatively impact our business. Although our Australian JV must abide by certain market risk limits approved by us with respect to its trading activities, there is a risk that such limits will be insufficient to protect us against significant losses. In addition, investments made by our Australian JV could be unprofitable.

With respect to our Australian JV, in the event of the departure of the key senior Australian executive, unless we agree to the remaining Australian executives' proposal for revised Australian JV terms, a call/put option arrangement is triggered. Under this arrangement, we have a right to acquire the Australian executives' interests in the Australian JV and, depending on the terms of the departure, the key senior Australian executive has the right to require us to purchase his interests, in each case for the fair market value (calculated assuming the goodwill associated with the Moelis & Company brand belongs to us and not the Australian JV).

In the event we make further strategic investments or acquisitions, we would face numerous risks and would be presented with financial, managerial and operational challenges, including the difficulty of integrating personnel, financial, accounting, technology and other systems and management controls.

If the number of debt defaults, bankruptcies or other factors affecting demand for our recapitalization and restructuring advisory services declines, our recapitalization and restructuring business could suffer.

We provide various financial recapitalization and restructuring and related advice to companies in financial distress or to their creditors or other stakeholders. A number of factors affect demand for these advisory services, including general economic conditions, the availability and cost of debt and equity financing, governmental policy and changes to laws, rules and regulations, including those that protect creditors. In addition, providing recapitalization and restructuring advisory services entails the risk that the transaction will be unsuccessful or take considerable time and can be subject to a bankruptcy court's authority to disallow or discount our fees in certain circumstances. If the number of debt defaults, bankruptcies or other factors affecting demand for our recapitalization and restructuring advisory services declines, our recapitalization and restructuring business would be adversely affected.

19

Our failure to deal appropriately with actual, potential or perceived conflicts of interest could damage our reputation and materially adversely affect our business.

We confront actual, potential or perceived conflicts of interest in our business. For instance, we face the possibility of an actual, potential or perceived conflict of interest where we represent a client on a transaction in which an existing client is a party. We may be asked by two potential clients to act on their behalf on the same transaction, including two clients as potential buyers in the same acquisition transaction, and we may act for both clients if both clients agree to us doing so. In each of these situations, we face the risk that our current policies, controls and procedures do not timely identify or appropriately manage such conflicts of interest.

It is possible that actual, potential or perceived conflicts could give rise to client dissatisfaction, litigation or regulatory enforcement actions. Appropriately identifying and managing actual or perceived conflicts of interest is complex and difficult, and our reputation could be damaged if we fail, or appear to fail, to deal appropriately with one or more potential or actual conflicts of interest. Regulatory scrutiny of, or litigation in connection with, conflicts of interest could have a material adverse effect on our reputation which could materially adversely affect our business in a number of ways, including a reluctance of some potential clients and counterparties to do business with us.

Employee misconduct, which is difficult to detect and deter, could harm us by impairing our ability to attract and retain clients and by subjecting us to legal liability and reputational harm.

There is a risk that our employees could engage in misconduct that would adversely affect our business. For example, our business often requires that we deal with confidential matters of great significance to our clients. If our employees were to improperly use or disclose confidential information provided by our clients, we could be subject to regulatory sanctions and suffer serious harm to our reputation, financial position, current client relationships and ability to attract future clients. It is not always possible to deter employee misconduct, and the precautions we take to detect and prevent misconduct may not be effective in all cases. If our employees engage in misconduct, our business could be materially adversely affected.

We may face damage to our professional reputation if our services are not regarded as satisfactory or for other reasons.

As an advisory service firm, we depend to a large extent on our relationships with our clients and reputation for integrity and high-caliber professional services to attract and retain clients. As a result, if a client is not satisfied with our services, it may be more damaging in our business than in other businesses.

We face strong competition from other financial advisory firms, many of which have the ability to offer clients a wider range of products and services than those we can offer, which could cause us to fail to win advisory mandates and subject us to pricing pressures that could materially adversely affect our revenue and profitability.

The financial services industry is intensely competitive, and we expect it to remain so. Our competitors are other investment banking and financial advisory firms. We compete on both a global and a regional basis, and on the basis of a number of factors, including depth of client relationships, industry knowledge, transaction execution skills, our range of products and services, innovation, reputation and price. In addition, in our business there are usually no long-term contracted sources of revenue. Each revenue-generating engagement typically is separately solicited, awarded and negotiated.

We have experienced intense competition over obtaining advisory mandates in recent years, and we may experience further pricing pressures in our business in the future as some of our competitors may seek to obtain increased market share by reducing fees.

20

Our primary competitors are large financial institutions, many of which have far greater financial and other resources than us and, unlike us, have the ability to offer a wider range of products, from loans, deposit taking and insurance to brokerage and trading, which may enhance their competitive position. They also regularly support investment banking, including financial advisory services, with commercial lending and other financial services and products in an effort to gain market share, which puts us at a competitive disadvantage and could result in pricing pressures or loss of opportunities, which could materially adversely affect our revenue and profitability. In addition, we may be at a competitive disadvantage with regard to certain of our competitors who are able to and often do, provide financing or market making services that are often a crucial component of the types of transactions on which we advise.

In addition to our larger competitors, over the last few years a number of independent investment banks that offer independent advisory services have emerged, with several showing rapid growth. As these independent firms or new entrants into the market seek to gain market share there could be pricing pressures, which would adversely affect our revenues and earnings.

As a member of the financial services industry, we face substantial litigation risks.

Our role as advisor to our clients on important transactions involves complex analysis and the exercise of professional judgment, including rendering "fairness opinions" in connection with mergers and other transactions. Our activities may subject us to the risk of significant legal liabilities to our clients and affected third parties, including shareholders of our clients who could bring securities class actions against us. In recent years, the volume of claims and amount of damages claimed in litigation and regulatory proceedings against financial services companies have been increasing. These risks often may be difficult to assess or quantify and their existence and magnitude often remain unknown for substantial periods of time. Our engagements typically include broad indemnities from our clients and provisions to limit our exposure to legal claims relating to our services, but these provisions may not protect us in all cases, including when a client does not have the financial capacity to pay under the indemnity. As a result, we may incur significant legal expenses in defending against or settling litigation. In addition, we may have to spend a significant amount to adequately insure against these potential claims. Substantial legal liability or significant regulatory action against us could have material adverse financial effects or cause significant reputational harm to us, which could seriously harm our business prospects.

Prior to our initial public offering in April 2014, our management had not previously managed a public company.

Prior to our initial public offering in April 2014, our management team had operated our business as a privately-owned company. The individuals who constitute our management had not previously managed a publicly traded company.

Compliance with public company requirements has placed significant additional demands on our management and has required us to enhance our investor relations, legal, financial reporting and corporate communications functions. These additional efforts may strain our resources and divert management's attention from other business concerns, which could adversely affect our business and profitability.

In addition, the reorganization that took place in connection with the consummation of our initial public offering involved separating our advisory business from the asset management business of Old Holdings. These two businesses had historically utilized common management and operational structures, including facilities and technology platforms as well as legal, compliance, marketing and other support personnel and senior management oversight. The process of separating these businesses, and of operating our advisory business on a stand-alone basis, may result in increased costs and

21

inefficiencies and other impediments to the regular operations of our business, the occurrence of any of which could adversely affect our business and profitability.

Extensive and evolving regulation of our business and the business of our clients exposes us to the potential for significant penalties and fines due to compliance failures, increases our costs and may result in limitations on the manner in which our business is conducted.

As a participant in the financial services industry, we are subject to extensive regulation in the U.S. and internationally. We are subject to regulation by governmental and self-regulatory organizations in the jurisdictions in which we operate. As a result of market volatility and disruption in recent years, the U.S. and other governments have taken unprecedented steps to try to stabilize the financial system including providing assistance to financial institutions and taking certain regulatory actions. The full extent of the effects of these actions and of legislative and regulatory initiatives (including the Dodd-Frank Wall Street Reform and Consumer Protection Act) effected in connection with, and as a result of, such extraordinary disruption and volatility is uncertain, both as to the financial markets and participants in general, and as to us in particular.

Our ability to conduct business and our operating results, including compliance costs, may be adversely affected as a result of any new requirements imposed by the Securities and Exchange Commission ("SEC"), FINRA or other U.S. or foreign governmental regulatory authorities or self-regulatory organizations that regulate financial services firms or supervise financial markets. We may be adversely affected by changes in the interpretation or enforcement of existing laws and rules by these governmental authorities and self-regulatory organizations. In addition, some of our clients or prospective clients may adopt policies that exceed regulatory requirements and impose additional restrictions affecting their dealings with us. Accordingly, we may incur significant costs to comply with U.S. and international regulation. In addition, new laws or regulations or changes in enforcement of existing laws or regulations applicable to our clients may adversely affect our business. For example, changes in antitrust enforcement could affect the level of M&A activity and changes in applicable regulations could restrict the activities of our clients and their need for the types of advisory services that we provide to them.