Attached files

| file | filename |

|---|---|

| EX-21.1 - EX-21.1 - CONTANGO OIL & GAS CO | mcf-20191231ex211b8d224.htm |

| EX-99.1 - EX-99.1 - CONTANGO OIL & GAS CO | mcf-20191231ex9913d1de3.htm |

| EX-32.2 - EX-32.2 - CONTANGO OIL & GAS CO | mcf-20191231ex322494a23.htm |

| EX-32.1 - EX-32.1 - CONTANGO OIL & GAS CO | mcf-20191231ex32134b534.htm |

| EX-31.2 - EX-31.2 - CONTANGO OIL & GAS CO | mcf-20191231ex31252f448.htm |

| EX-31.1 - EX-31.1 - CONTANGO OIL & GAS CO | mcf-20191231ex311ec6d07.htm |

| EX-23.3 - EX-23.3 - CONTANGO OIL & GAS CO | mcf-20191231ex233c79dbd.htm |

| EX-23.2 - EX-23.2 - CONTANGO OIL & GAS CO | mcf-20191231ex2328ea8b7.htm |

| EX-23.1 - EX-23.1 - CONTANGO OIL & GAS CO | mcf-20191231ex2310941ea.htm |

| EX-21.2 - EX-21.2 - CONTANGO OIL & GAS CO | mcf-20191231ex212d2bac6.htm |

| EX-4.5 - EX-4.5 - CONTANGO OIL & GAS CO | mcf-20191231ex45d4e218a.htm |

| 10-K - 10-K - CONTANGO OIL & GAS CO | mcf-20191231x10k.htm |

Exhibit 99.2

February 17, 2020

Mr. John P. Atwood

Senior Vice President

Exaro Energy III, LLC

5850 San Felipe, Suite 500

Houston, Texas 77057

|

|

Re: Engineering Evaluation |

|

|

Estimate of Reserves & Revenues |

|

|

Year End 2019 SEC Pricing |

|

|

“As of” January 1, 2020 |

Dear Mr. Atwood:

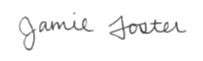

At your request, W.D. Von Gonten & Co. has estimated future reserves and projected net revenues attributable to certain oil and gas interests currently owned by Exaro Energy III, LLC (Exaro). The properties represented herein are located in the Jonah field of Sublette County, Wyoming. A summary of the discounted future net revenue attributable to Exaro’s Proven reserves, “As of” January 1, 2020, is as follows:

Report Preparation

Purpose of Report – The purpose of this report is to provide Exaro with a projection of future reserves and revenues attributable to certain Proved oil and gas interests presently owned.

Scope of Report – W.D. Von Gonten & Co. was engaged by Exaro to estimate the reserves and revenues associated with the properties included in this report. Once reserves were estimated, future revenue projections were generated utilizing SEC pricing guidelines.

Reporting Requirements – The Society of Petroleum Engineers (SPE) requires Reserves to be economically recoverable with prices and costs in effect on the “as of” date of the report. In conjunction with World Petroleum Council (WPC), American Association of Petroleum Geologists (AAPG), Society of Petroleum Evaluation Engineers (SPEE), Society of Exploration Geophysicists (SEG), Society of Petrophysicists and Well Log Analysts (SPWLA), and the European Associated of Geoscientists and Engineers (EAGE), the SPE has issued Petroleum Resources Management System (2018 ed.), which sets forth the definitions and requirements associated with the determination and classification of both Reserves and Resources. In addition, the SPE has issued Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserve Information (2019 ed.), which sets requirements for the qualifications and independence of qualified reserves evaluators and auditors.

Securities and Exchange Commission (SEC) Regulation S-K, Item 102 and Regulation S-X, Rule 4-10, and Financial Accounting Standards Board (FASB) Statement No. 69 requires oil and gas reserve information to be reported by publicly held companies as supplemental financial information. These regulations and standards provide for estimates of Proved reserves and revenues discounted at 10% and based on constant prices and costs.

The estimated Proved Reserves herein have been prepared in conformance with all SPE definitions and requirements in the above referenced publications.

Projections – The attached reserve and revenue projections are on a calendar year basis with the first time period being January 1 through December 31, 2020.

Property Discussion

Exaro signed an Earning and Development Agreement (EDA) with Encana Oil & Gas (Encana) in April 2012 that allowed them to gradually obtain increasing levels of ownership in the Jonah field. As part of the EDA, Exaro’s interest in each well drilled prior to the April 2012 agreement (old Proved Developed Producing (PDP) wells) continued to increase as Encana drilled additional wells (new wells) within the field. Exaro’s interest in the new wells stayed constant for the life of the well. For each new well drilled within the EDA, Exaro paid for 100% of the capital costs and earned 32.5% of Encana’s interest in the new wellbore until Exaro was fully earned into their devoted interest. In addition, for each new well drilled, Exaro earned 0.40% interest in the old PDP wells and related leasehold if Encana’s working interest in the new well location was 100% and a proportional share if not.

As of the date of this report, Encana has sold its ownership to Jonah Energy, LLC (Jonah Energy). Exaro notified Jonah Energy of its intent to terminate the EDA effective May 12, 2014, and thereafter participate under the existing Joint Operating Agreements (JOA’s) going forward. Exaro currently has no locations left under the EDA. All wells are proposed under the JOA and Exaro has the right to participate for its working interest in each well. At the current time, there are no rigs running within Exaro’s acreage.

Production in this area is primarily from the Lance sand which can range from 8,000’ to 11,000’ in depth and approach 3000’ in interval thickness.

Beginning in 2014, Jonah Energy began drilling horizontal wells across the eastern sections of Exaro’s acreage. To date, there are six horizontal wells currently producing.

Exaro Energy III, LLC – Reserves and Revenues – SEC Pricing – February 17, 2020 - Page 2

Starting in February 2015, Jonah Energy began line pressure reduction projects in the field on varying groups of wells. They started by lowering the pressure from 200 psi to 50 psi in seventeen wells located in section 35. Lowering the pressure caused an increase in the production rate and reserves on most of the connected wells. Based on provided daily production data, W.D. Von Gonten & Co. was able to give these wells a brief uplift in the production projections. Jonah Energy has since begun and maintained several similar projects throughout Exaro’s acreage.

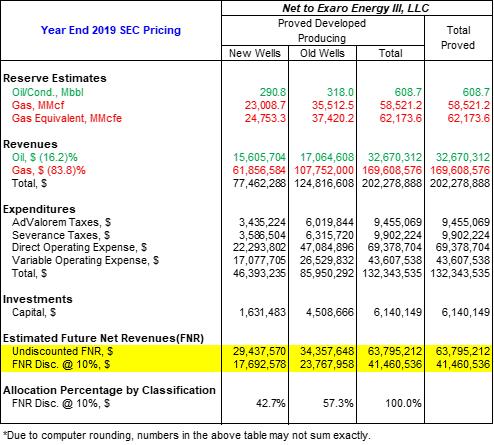

Figure 1 displays the comparison of Exaro’s historical monthly net production and W.D. Von Gonten & Co.’s forecasted net monthly production beginning January 1, 2020.

Figure 1: Historical Net Production and PDP Reserves Forecast as of January 1, 2020

Exaro Energy III, LLC – Reserves and Revenues – SEC Pricing – February 17, 2020 - Page 3

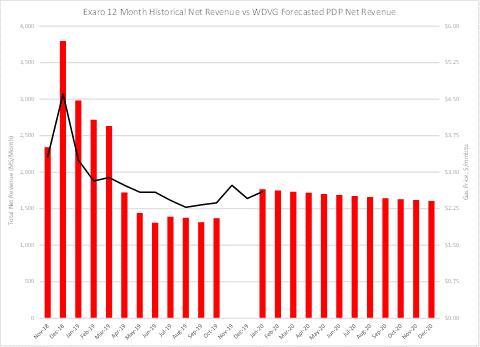

Figure 2 below is a graphical comparison of Exaro’s November 2018 through October 2019 historical net revenue and W.D. Von Gonten & Co.’s forecasted net revenue beginning January 1, 2020.

Figure 2: Historical Net Revenue and Forecasted Net Revenue as of January 1, 2020

Reserves Discussion

Reserves estimates represented herein were generally determined through the implementation of various methods including, but not limited to, performance decline, analogy, and type curve analysis. Based on the amount of available data, one or more of the above methods was utilized as deemed appropriate.

Reserves and schedules of production included in this report are only estimates. The amount of available data, reservoir and geological complexity, reservoir drive mechanism, and mechanical aspects can have a material effect on the accuracy of these reserve estimates. Due to inherent uncertainties in future production rates, commodity prices, and geologic conditions, it should be realized that the reserve estimates, the reserves actually recovered, the revenue derived therefrom, and/or the actual costs incurred could be more or less than the estimated amounts.

Product Prices Discussion

SEC pricing is determined by averaging the first day of each month’s closing price for the previous calendar year using published benchmark oil and gas prices. This method, as applied for the purposes of this report, renders a price of $55.65 per barrel of oil and $2.60 per MMBtu of gas. These prices were held constant throughout the life of the properties as per SEC guidelines.

Pricing differentials were applied on a field basis to reflect the actual prices received at the wellhead. Differentials typically account for transportation costs, geographical differentials, marketing bonuses or deductions, and any other factors that may affect the price actually received at the wellhead. W.D. Von Gonten & Co. determined the historical pricing differentials from lease operating data provided by Exaro representing the time period November 2018 through October 2019.

Exaro Energy III, LLC – Reserves and Revenues – SEC Pricing – February 17, 2020 - Page 4

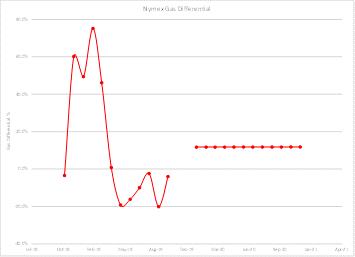

Figures 3 and 4 illustrate the comparison between historical differentials versus those projected.

Figure 3: Historical and Forecasted Oil Differential

Figure 4: Historical and Forecasted Gas Differential

W.D. Von Gonten & Co. has included the historical NGL revenue and processing fees within the gas price differential for the new wells only. Due to existing and new contracts, the old wells do not include any NGL revenues or fees.

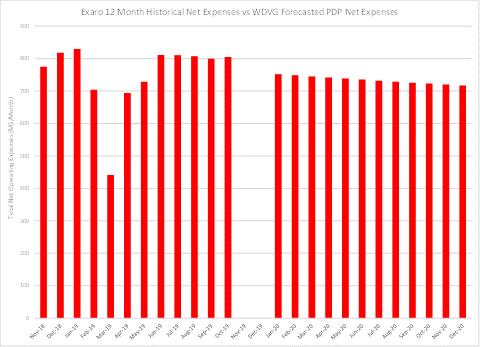

Operating Expenses and Capital Costs Discussion

Projected monthly operating expenses associated with the Jonah properties were based on the review of lease operating data provided by Exaro for the time period November 2018 through October 2019. Using the supplied data, W.D. Von Gonten & Co. applied a gross direct expense to each well on an individual basis. The horizontal wells have an increased monthly expense compared to vertical wells based on historical observations. A gross variable deduct of $0.48 per Mcf, which covers gathering fees, has been applied to all wells. In addition, a gross $3.84 per barrel salt water disposal (SWD) expense has been applied to each well. All direct and variable operating expenses were held constant for the economic life of each property.

Exaro Energy III, LLC – Reserves and Revenues – SEC Pricing – February 17, 2020 - Page 5

Figure 5 below is a graphical comparison of historical net lease operating expenses for November 2018 through October 2019 versus comparable forecasted expenses for the subsequent twelve months.

Figure 5: Historical and Forecasted Lease Operating Expense

There are no capital costs associated with any of the properties included herein. Currently, Exaro has no knowledge of anticipated work efforts scheduled by the operator.

Other Considerations

Abandonment Costs – Cost estimates regarding future plugging and abandonment liabilities associated with these properties were supplied by Exaro for the purposes of this report. As we have not inspected the properties personally, W.D. Von Gonten & Co. expresses no warranties as to the accuracy or reasonableness of these assumptions. A third party study would be necessary in order to accurately estimate all future abandonment liabilities.

Data Sources – Data furnished by Exaro included basic well information, lease operating statements, ownership, pricing, and production information on certain leases. IHS Energy archives was utilized to view the monthly production for some of the wells included in this report.

Context – We specifically advise that any particular reserve estimate for a specific property not be used out of context with the overall report. The revenues and present worth of future net revenues are not represented to be market value either for individual properties or on a total property basis.

While the oil and gas industry may be subject to regulatory changes from time to time that could affect an industry participant’s ability to recover its oil and gas reserves, we are not aware of any such governmental actions which would restrict the recovery of the January 1, 2020 estimated oil and gas volumes. The reserves in this report can be produced under current regulatory guidelines. Actual future commodity prices may differ substantially from the utilized pricing scenario which may or may not extend or limit the estimated reserves and revenue quantities presented in this report.

Exaro Energy III, LLC – Reserves and Revenues – SEC Pricing – February 17, 2020 - Page 6

We have not inspected the properties included in this report, nor have we conducted independent well tests. W.D. Von Gonten & Co. and our employees have no direct ownership in any of the properties included in this report. Our fees are based on hourly expenses, and are not related to the reserve and revenue estimates produced in this report. The responsible technical personnel referenced below have obtained the qualifications and meet the requirements of objectivity for Qualified Reserves Evaluator employed internally by W.D. Von Gonten & Co. as set forth in the Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserve Information (2019 ed.) promulgated by the SPE.

Thank you for the opportunity to assist Exaro Energy III, LLC with this project.

|

|

Respectfully submitted, |

|

|

|

|

Phillip Hunter, P.E.

|

|

|

|

Jamie Foster |

|

|

|

Reviewed by:

W.D. Von Gonten, Jr., P.E.

TX #73244

Exaro Energy III, LLC – Reserves and Revenues – SEC Pricing – February 17, 2020 - Page 7