Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Ameris Bancorp | tm2014209d1_8k.htm |

Exhibit 99.1

Investor Presentation Update March 30, 2020

Cautionary Statements This presentation contains forward - looking statements, as defined by federal securities laws, including, among other forward - looking statements, certain plans, expectations and goals. Words such as “may,” “believe,” “expect,” “anticipate,” “intend,” “w ill,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential” or the negative of these terms or other comparable termin olo gy, as well as similar expressions, are meant to identify forward - looking statements. The forward - looking statements in this presentati on are based on current expectations of Ameris Bancorp (“Ameris” or the “Company”) and are provided to assist in the understandi ng of potential future performance. Such forward - looking statements involve numerous assumptions, risks and uncertainties that may cause actual results to differ materially from those expressed or implied in any such statements. Factors that could cause or contribute to such differences include, without limitation, general competitive, economic, politi cal and market conditions and fluctuations, including movements in interest rates and the credit exposures of certain loan products t hat could be impacted by the COVID - 19 pandemic. For a discussion of some of the other risks and other factors that may cause such forward - looking statements to differ materially from actual results, please refer to Ameris’s filings with the Securities and Ex change Commission, including Ameris’s Annual Report on Form 10 - K for the year ended December 31, 2019. Forward - looking statements speak only as of the date they are made, and Ameris undertakes no obligation to update or revise forward - looking statements.

Investor Presentation Update Credit Quality Update Given the recent classification of the World Health Organization of the Coronavirus Disease (COVID - 19 ) as a pandemic, and the economic impact that could have on our loan portfolio, we are providing additional information about certain segments of our loan portfolio to our investor presentation previously provided on January 23 , 2020 . We have added information related to the following categories of our loan portfolio, having deemed them to be more susceptible to potential increased credit risk : • Hotels • Restaurants We have not added information related to Energy , because the Company’s exposure to Energy (oil and gas) is limited to $ 151 . 2 million of loans to convenience store operators (both with and without gas) as of 12 / 31 / 19 . Business Continuity Plan Update In addition, we activated our Business Continuity Plans and Incident Response Team, and are taking the following actions within our Company to protect the health of our employees and customers, while continuing to meet the needs of our customers : • All branch locations are drive - thru only, and visitors to the lobby are allowed only by appointment when necessary • Remote work environment for non - essential branch and administrative personnel • Increased communication with employees through internal podcasts, emails and intranet • Increased communications with customers through e - mails and website • Travel restrictions for all employees • Increased janitorial services

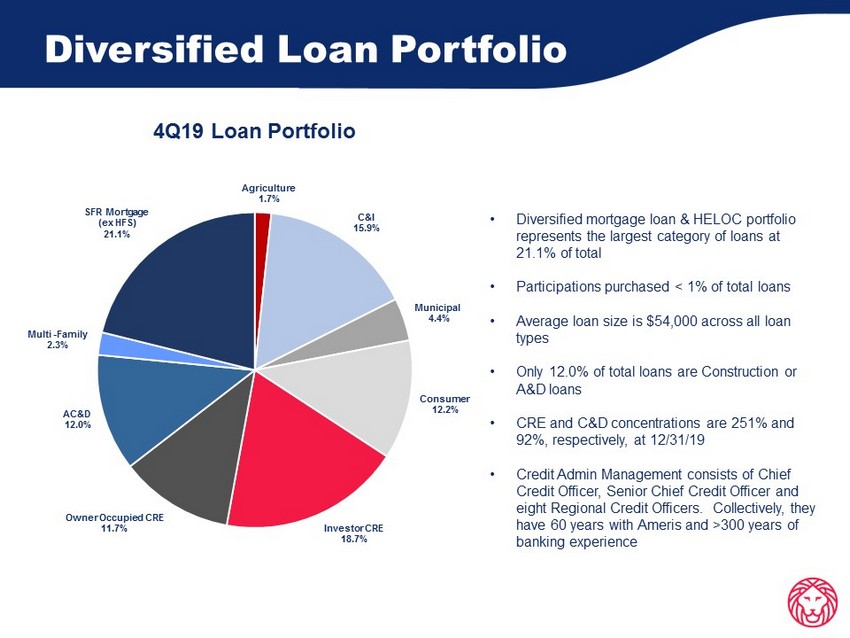

Diversified Loan Portfolio • Diversified mortgage loan & HELOC portfolio represents the largest category of loans at 21.1% of total • Participations purchased < 1% of total loans • Average loan size is $54,000 across all loan types • Only 12.0% of total loans are Construction or A&D loans • CRE and C&D concentrations are 251% and 92%, respectively, at 12/31/ 19 • Credit Admin Management consists of Chief Credit Officer, Senior Chief Credit Officer and eight Regional Credit Officers. Collectively, they have 60 years with Ameris and >300 years of banking experience 4Q19 Loan Portfolio Agriculture 1.7% C&I 15.9% Municipal 4.4% Consumer 12.2% Investor CRE 18.7% Owner Occupied CRE 11.7% AC&D 12.0% Multi - Family 2.3% SFR Mortgage (ex HFS) 21.1%

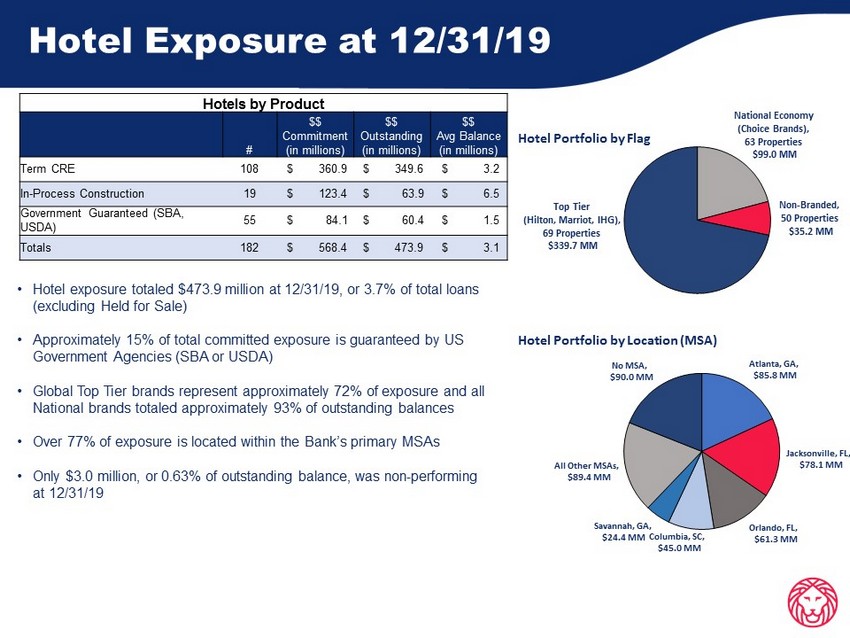

Hotel Exposure at 12/31/19 • Hotel exposure totaled $473.9 million at 12/31/19, or 3.7% of total loans (excluding Held for Sale) • Approximately 15% of total committed exposure is guaranteed by US Government Agencies (SBA or USDA) • Global Top Tier brands represent approximately 72% of exposure and all National brands totaled approximately 93% of outstanding balances • Over 77% of exposure is located within the Bank’s primary MSAs • Only $3.0 million, or 0.63% of outstanding balance, was non - performing at 12/31/19 National Economy (Choice Brands), 63 Properties $99.0 MM Non - Branded , 50 Properties $35.2 MM Top Tier (Hilton, Marriot, IHG), 69 Properties $339.7 MM Hotel Portfolio by Flag Atlanta, GA , $85.8 MM Jacksonville, FL , $78.1 MM Orlando, FL , $61.3 MM Columbia, SC , $45.0 MM Savannah, GA , $24.4 MM All Other MSAs , $89.4 MM No MSA , $90.0 MM Hotel Portfolio by Location (MSA) Hotels by Product # $$ Commitment (in millions) $$ Outstanding (in millions) $$ Avg Balance (in millions) Term CRE 108 $ 360.9 $ 349.6 $ 3.2 In - Process Construction 19 $ 123.4 $ 63.9 $ 6.5 Government Guaranteed (SBA, USDA) 55 $ 84.1 $ 60.4 $ 1.5 Totals 182 $ 568.4 $ 473.9 $ 3.1

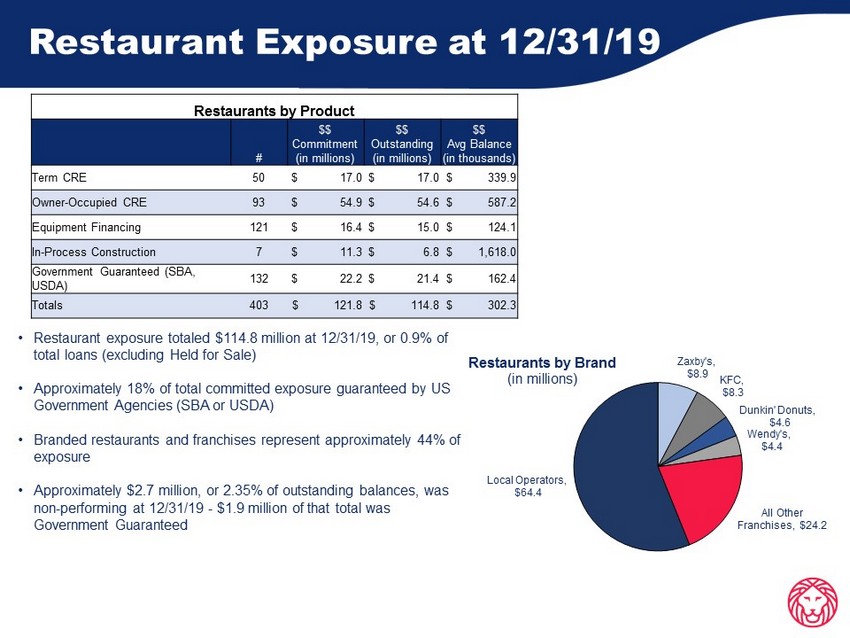

Restaurant Exposure at 12/31/19 • Restaurant exposure totaled $114.8 million at 12/31/19, or 0.9% of total loans (excluding Held for Sale) • Approximately 18% of total committed exposure guaranteed by US Government Agencies (SBA or USDA) • Branded restaurants and franchises represent approximately 44% of exposure • Approximately $2.7 million, or 2.35% of outstanding balances, was non - performing at 12/31/19 - $1.9 million of that total was Government Guaranteed Zaxby's , $8.9 KFC , $8.3 Dunkin' Donuts , $4.6 Wendy's , $4.4 All Other Franchises , $24.2 Local Operators , $64.4 Restaurants by Brand (in millions) Restaurants by Product # $$ Commitment (in millions) $$ Outstanding (in millions) $$ Avg Balance (in thousands) Term CRE 50 $ 17.0 $ 17.0 $ 339.9 Owner - Occupied CRE 93 $ 54.9 $ 54.6 $ 587.2 Equipment Financing 121 $ 16.4 $ 15.0 $ 124.1 In - Process Construction 7 $ 11.3 $ 6.8 $ 1,618.0 Government Guaranteed (SBA, USDA) 132 $ 22.2 $ 21.4 $ 162.4 Totals 403 $ 121.8 $ 114.8 $ 302.3