Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Resource Real Estate Opportunity REIT, Inc. | ck0001466225-ex992_6.htm |

| EX-32.2 - EX-32.2 - Resource Real Estate Opportunity REIT, Inc. | ck0001466225-ex322_8.htm |

| EX-32.1 - EX-32.1 - Resource Real Estate Opportunity REIT, Inc. | ck0001466225-ex321_10.htm |

| EX-31.2 - EX-31.2 - Resource Real Estate Opportunity REIT, Inc. | ck0001466225-ex312_12.htm |

| EX-31.1 - EX-31.1 - Resource Real Estate Opportunity REIT, Inc. | ck0001466225-ex311_11.htm |

| EX-23.1 - EX-23.1 - Resource Real Estate Opportunity REIT, Inc. | ck0001466225-ex231_9.htm |

| EX-21.1 - EX-21.1 - Resource Real Estate Opportunity REIT, Inc. | ck0001466225-ex211_7.htm |

| EX-4.4 - EX-4.4 - Resource Real Estate Opportunity REIT, Inc. | ck0001466225-ex44_310.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission File Number 000-54369

Resource Real Estate Opportunity REIT, Inc.

(Exact name of registrant as specified in its charter)

|

Maryland |

|

27-0331816 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

incorporation or organization) |

|

Identification No.) |

1845 Walnut Street, 18th Floor, Philadelphia, PA 19103

(Address of principal executive offices) (Zip code)

(215) 231-7050

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

None |

|

N/A |

|

N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $.01 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(a) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

|

Accelerated filer |

☐ |

|

Non-accelerated filer |

☑ |

|

|

Smaller reporting company |

☐ |

|

|

|

|

|

Emerging growth company |

☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

There is no established market for the Registrant's shares of common stock. There were approximately 70,041,219 shares of common stock held by non-affiliates at June 30, 2019, the last business day of the registrant's most recently completed second fiscal quarter, for an aggregate market value of $758,546,402, assuming an estimated value per share of $10.83, which was the Registrant’s estimated value per share as determined by its Board of Directors on March 20, 2019. For a full description of the methodologies used to calculate the Registrant’s estimated value per share as of December 31, 2018, see Part II, Item 5, “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities – Market Information” in the Registrant’s Annual Report on Form 10-K for the year ended December 31, 2018.

As of March 13, 2020, there were 69,862,273 outstanding shares of common stock of Resource Real Estate Opportunity REIT, Inc., $.01 per value per share outstanding.

Registrant incorporates by reference portions of the Resource Real Estate Opportunity REIT, Inc. Definitive Proxy Statement for the 2020 Annual Meeting of Stockholders (Items 10, 11, 12, 13, and 14 of Part III).

RESOURCE REAL ESTATE OPPORTUNITY REIT, INC.

INDEX TO ANNUAL REPORT

ON FORM 10-K

|

|

|

PAGE |

|

|

|

|

|

PART 1 |

|

|

|

Item 1. |

4 |

|

|

Item 1A. |

6 |

|

|

Item 1B. |

27 |

|

|

Item 2. |

28 |

|

|

Item 3. |

29 |

|

|

Item 4. |

29 |

|

|

|

|

|

|

PART II |

|

|

|

Item 5. |

30 |

|

|

Item 6 |

38 |

|

|

Item 7. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

39 |

|

Item 7A. |

55 |

|

|

Item 8. |

55 |

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

55 |

|

Item 9A. |

55 |

|

|

Item 9B. |

56 |

|

|

|

|

|

|

PART III |

|

|

|

Item 10. |

57 |

|

|

Item 11. |

57 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholders Matters |

57 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

57 |

|

Item 14. |

57 |

|

|

|

|

|

|

PART IV. |

|

|

|

Item 15. |

58 |

|

|

Item 16. |

58 |

|

|

|

|

|

|

59 |

||

Certain statements included in this Annual Report on Form 10-K are forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expects,” “intend,” “may,” “plan,” “potential,” “project,” “should,” “will” and “would” or the negative of these terms or other comparable terminology. Such statements are subject to the risks and uncertainties more particularly described in Item 1A of this Annual Report on Form 10-K. These risks and uncertainties could cause actual results to differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly revise or update these forward-looking statements to reflect events or circumstances after the date of this report, except as may be required under applicable law.

General

Resource Real Estate Opportunity REIT, Inc. is a Maryland corporation that was formed on June 3, 2009. As used herein, the terms “we,” “our” and “us” refer to Resource Real Estate Opportunity REIT, Inc. and as required by context Resource Real Estate Opportunity OP, LP, a Delaware limited partnership, and its subsidiaries. We elected to be taxed as a real estate investment trust, or REIT, and to operate as a REIT beginning with our taxable year ended December 31, 2010. Our objectives are to preserve stockholder capital, realize growth in the value of our investments, increase cash distributions through increased cash flow from operations or asset sales, and enable stockholders to realize a return on their investments.

As of December 31, 2019, we owned 28 multifamily properties, as described further in “Item 2. Properties” below, and one performing loan.

We are externally managed by Resource Real Estate Opportunity Advisor, LLC, which we refer to as our Advisor, an indirect wholly owned subsidiary of Resource America, Inc. ("RAI"). RAI is a wholly-owned subsidiary of C-III Capital Partners LLC ("C-III"), a leading commercial real estate services company engaged in a broad range of activities. C-III controls both our Advisor and Resource Real Estate Opportunity Manager, LLC, our property manager. C-III also controls all of the shares of common stock held by our Advisor. To provide its services, the Advisor draws upon RAI, C-III, their management teams and their collective investment experience.

Our Offerings

On September 15, 2009, we commenced a private placement offering to accredited investors for the sale of up to 5,000,000 shares of common stock at a price of $10 per share, with discounts available to certain categories of purchasers. The offering, which closed on June 9, 2010, resulted in aggregate gross proceeds of $12.8 million, ($11.3 million, net of syndication costs) and resulted in the issuance of 1,283,727 common shares, including 20,000 shares purchased by our Advisor. Also, in conjunction with the private offering, we offered 5,000 shares of convertible stock at a price of $1 per share. Investors acquired 937 shares of the convertible stock; the Advisor purchased the remaining 4,063 shares.

On June 16, 2010, we commenced our initial primary public offering of up to 75,000,000 shares and a public offering of up to an additional 7,500,000 shares pursuant to our distribution reinvestment plan. An affiliate of our Advisor, Resource Securities LLC, or Resource Securities (formerly known as Resource Securities, Inc.), served as the dealer manager. We offered shares of our common stock in our primary offering for $10 per share, with discounts available to certain categories of investors.

We closed the primary portion of our initial public offering on December 13, 2013, having raised aggregate gross proceeds of $633.1 million through the issuance of 63,647,084 shares of our common stock, including 276,056 shares purchased by our Advisor and 1,161,623 shares sold pursuant to our distribution reinvestment plan. On December 26, 2013, the unsold primary offering shares were deregistered and, on December 30, 2013, the registration of the shares issuable pursuant to the distribution reinvestment plan was continued pursuant to a Registration Statement on Form S-3. A new Registration Statement on Form S-3 was filed in May 2016 to continue the distribution reinvestment plan offering. We continue to offer shares pursuant to our distribution reinvestment plan at a purchase price equal to 95% of our current estimated value per share. During the years ended December 31, 2019, 2018, and 2017, we issued, in total, an additional 7.4 million shares through our distribution reinvestment plan for gross proceeds of $77.5 million.

Our Business Strategy

Our business strategy has a focus on multifamily assets. Our targeted portfolio consists of commercial real estate assets, principally (i) multifamily rental properties purchased as non-performing or distressed loans or as real estate owned by financial institutions and (ii) multifamily rental properties to which we have added value with a capital infusion (referred to as “value add properties”). However, we are not limited in the types of real estate and real estate-related assets in which we may invest or whether we may invest in equity or debt secured by real estate and, accordingly, we may invest in other real estate assets or debt secured by real estate assets. We do not expect to make any significant additional real estate investments and we continually monitor the portfolio of optimized, renovated properties seeking sales opportunities that will maximize our return. We generally expect to distribute gains from such sales to our stockholders in the form of distributions.

Our charter requires that, by December 2019, our Board of Directors consider listing our common stock or liquidating. Our Board has begun the process of considering various liquidity options for our stockholders, including, but not limited to, listing our common stock or liquidating. Pursuant to our charter requirement, the Board of Directors, including all of the independent directors, unanimously determined in September 2019 to continue to evaluate various possible alternatives with the objective of making a recommendation by the end of the second quarter of 2020.

4

Our Operating Policies and Strategies

Our Advisor has the primary responsibility for the selection of investments, the negotiation of the acquisition of these investments, and financing, asset-management and disposition decisions. A majority of our Board of Directors and a majority of the Conflicts Committee, which includes only our three independent directors, approve all proposed real estate property investments and certain significant real estate-related debt investments. Our Board of Directors meets regularly to monitor the execution of our investment strategies and our progress in achieving our investment objectives.

We may use leverage for our acquisitions in the form of both REIT level financing and individual investment financing. Such financing, both at the REIT level and at the individual investment level, may also be obtained from the seller of an investment. Although there is no limit on the amount we can borrow to acquire a single real estate investment, we may not leverage our assets with debt financing such that our total liabilities exceed 75% of the aggregate value of our assets unless a majority of our independent directors finds substantial justification for borrowing a greater amount.

Our Advisor and our Property Manager

Our Advisor manages our day-to-day operations and our portfolio of real estate investments, and provides asset management, marketing, investor relations, and other administrative services on our behalf, all subject to the supervision of our Board of Directors. Our Advisor has invested approximately $2.5 million in us and as of December 31, 2019, it owned 276,056 shares of our common stock and 30,274 shares of our convertible stock. Under certain circumstances, the convertible shares may be converted into shares of our common stock. As of December 31, 2019, our Advisor has granted 21,210 shares of its convertible stock to employees of RAI and its subsidiaries and affiliates. Of these shares, 2,421 have been forfeited and returned to the Advisor as of December 31, 2019. The outstanding shares vest ratably over three years, and 18,789 of these shares have vested as of December 31, 2019.

We have a management agreement with Resource Real Estate Opportunity Manager, LLC, an affiliate of our Advisor, or our Manager, to provide property management services, as applicable, for most of the properties or other real estate related assets, in each case where our Advisor is able to control the operational management of such properties. Our Manager may subcontract with an affiliate or third party to provide day-to-day property management, construction management and/or other property specific functions as applicable for the properties it manages. Our Manager also manages our real estate-related debt investments.

Greystar Management Services, L.P., an unrelated third party, is a property management company that our Manager has subcontracted with to manage most of the real estate assets that we own. The staff of Greystar, acting through our Manager, assist in providing property management as well as construction management services to us.

Competition

We believe that the current market for properties that meet our investment objectives is extremely competitive and many of our competitors have greater resources than we do. We believe that our multifamily communities are suitable for their intended purposes and adequately covered by insurance. There are a number of comparable properties located in the same submarkets that might compete with our properties. We compete with numerous other entities engaged in real estate investment activities, including individuals, corporations, banks and insurance company investment accounts, other REITs, real estate limited partnerships, the U.S. government and other entities, to acquire, manage and sell real estate properties and real estate related assets. Many of our expected competitors enjoy significant competitive advantages that result from, among other things, a lower cost of capital and enhanced operating efficiencies. In addition, the number of entities and the amount of funds competing for suitable investments may increase.

Environmental

As an owner of real estate, we are subject to various environmental laws of federal, state and local governments. Compliance with existing laws has not had a material adverse effect on our financial condition or results of operations, and management does not believe it will have such an impact in the future. However, we cannot predict the impact of unforeseen environmental contingencies or new or changed laws or regulations on properties in which we hold an interest, or on properties that may be acquired directly or indirectly in the future.

Employees and Economic Dependency

We have no paid employees. The employees of our Advisor and its affiliates provide management, acquisition, advisory and certain administrative services for us. We are dependent on our Advisor and its affiliates for certain services that are essential to us, including the identification, evaluation, negotiation, purchase and disposition of properties and other investments; management of the daily operations of our portfolio; and other general and administrative responsibilities. In the

5

event that these affiliated companies are unable to provide the respective services, we will be required to obtain such services from other sources.

Access to Company Information

We electronically file our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, proxy statement, Current Reports on Form 8-K and all amendments to those reports with the United States Securities and Exchange Commission (“SEC”). The SEC maintains an Internet site at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically.

We make available free of charge, the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, proxy statement, Current Reports on Form 8-K and all amendments to those reports on our website, www.resourcereit.com, or by responding to requests addressed to our investor relations group. These reports are available as soon as reasonably practicable after such material is electronically filed or furnished to the SEC.

Below are some of the risks and uncertainties that could cause our actual results to differ materially from those presented in our forward-looking statements. The risks and uncertainties described below are not the only ones we face but do represent those risks and uncertainties that we believe are material to our business, operating results, prospects, and financial condition. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also harm our business.

Risks Related to an Investment in Us

There is no established public trading market for our shares; therefore, it will be difficult for you to sell your shares.

There is no current established public market for our shares and we currently have no plans to list our shares on a national securities exchange. In addition, although our Board of Directors has begun the process of considering various liquidity options for our stockholders, we are not obligated to enter into any transaction and there is no guarantee that our Board of Directors will determine to pursue any liquidity option in the near term or that any liquidity option pursued will be completed successfully. Our charter limits your ability to transfer or sell your shares unless the prospective stockholder meets the applicable suitability and minimum purchase standards. Our charter also prohibits the ownership of more than 9.8% of our stock, unless exempted by our Board of Directors, which may inhibit large investors from desiring to purchase your shares. Moreover, our share redemption program has been suspended except for redemptions sought in connection with a stockholder’s death, qualifying disability, or confinement to a long-term care facility and further includes numerous restrictions that limit your ability to sell your shares to us. In addition, our Board of Directors may amend, suspend or terminate our share redemption program upon 30 days’ notice and without stockholder approval. Therefore, it will be difficult for you to sell your shares promptly or at all. If you are able to sell your shares, you would likely have to sell them at a substantial discount to our estimated value per share. It is also likely that your shares would not be accepted as the primary collateral for a loan. We can provide no assurances as to the timing of a potential liquidity event, and you should expect to hold our shares as a long-term investment because of the illiquid nature of the shares.

Because of the concentration of a significant portion of our assets in three geographic areas, any adverse economic, real estate or business conditions in these areas could affect our operating results and our ability to make distributions to our stockholders.

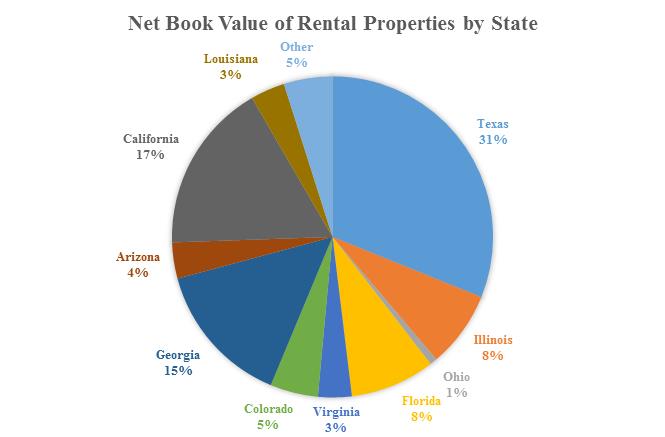

As of December 31, 2019, our real estate investments in Texas, California and Georgia represented approximately 31%, 17% and 15% of the net book value of our rental properties, respectively. As a result, the geographic concentration of our portfolio makes it particularly susceptible to adverse economic developments in the Texas, California and Georgia real estate markets. Any adverse economic or real estate developments in these markets, such as business layoffs or downsizing, industry slowdowns, relocations of businesses, changing demographics and other factors, or any decrease in demand for multifamily rentals resulting from the local business climate, could adversely affect our operating results and our ability to make distributions to stockholders.

Because we are dependent upon our Advisor and its affiliates to conduct our operations, any adverse changes in the financial health of our Advisor or its affiliates or our relationship with them could hinder our operating performance and the return on our stockholders’ investment.

We are dependent on our Advisor to manage our operations and our portfolio of real estate assets. Our Advisor depends largely upon the fees and other compensation that it receives from us in connection with the purchase, management and sale of assets to conduct its operations. Any adverse changes in the financial condition of our Advisor or our relationship with our Advisor could hinder its ability to successfully manage our operations and our portfolio of investments.

Our ability to achieve our investment objectives and to conduct our operations is dependent upon the performance of our Advisor, which is a subsidiary of our sponsor and its parent company, C-III. Our sponsor’s business is sensitive to trends in

6

the general economy, as well as the commercial real estate and credit markets. To the extent that any decline in our sponsor’s or C-III’s revenues and operating results impacts the performance of our Advisor, our results of operations, and financial condition could also suffer.

The loss of or the inability to hire additional or replacement key real estate and debt finance professionals by our Advisor and its affiliates could delay or hinder implementation of our investment strategies, which could limit our ability to make distributions and decrease the value of your investment.

We believe that our future success depends, in large part, upon our Advisor's and its affiliates’ ability to retain highly skilled managerial, operational and marketing professionals. Competition for such professionals is intense, and our Advisor and its affiliates may be unsuccessful in attracting and retaining such skilled individuals. If our Advisor loses or is unable to obtain the services of highly skilled professionals, our ability to implement our investment strategies could be delayed or hindered and the value of your investment may decline.

If we make distributions from sources other than our cash flow from operations, your overall return may be reduced.

We declare distributions when our Board of Directors determines we have sufficient cash flow. We generally expect to fund distributions from interest and rental income on investments, the maturity, payoff or settlement of investments and from strategic sales of loans, properties and other assets. However, we may set distribution rates at levels we believe we will be able to cover with anticipated future cash flows from operating activities. In order to make these cash distributions, we may be required to use alternative funding sources.

Our organizational documents permit us to make distributions from any source. If we fund distributions from sources other than cash flow from operations, your overall return may be reduced. Further, to the extent distributions exceed our cash flow from operations, a stockholder’s basis in our stock will be reduced and, to the extent distributions exceed a stockholder’s basis, the stockholder may recognize capital gain. There is no limit on the amount that we can use to fund distributions from sources other than from cash flows from operations.

During the year ended December 31, 2019, we paid aggregate distributions of $42.0 million including $17.5 million of distributions paid in cash and $24.5 million of distributions reinvested in our shares through our distribution reinvestment plan. Our net loss attributable to common stockholders for the year ended December 31, 2019 was $1.7 million and net cash provided by operating activities was $14.1 million. During 2019, distributions were funded as follows: 39.4% from operating activities, 60.6% from the proceeds of property dispositions and none from debt financing. To the extent that we pay distributions from sources other than our cash flow from operating activities or gains from asset sales, the overall return to our stockholders may be reduced.

Future interest rate increases in response to inflation may inhibit our ability to conduct our business and acquire or dispose of real property or real estate-related debt investments at attractive prices and your overall return may be reduced.

While a significant amount of our leases are short-term multifamily leases that will not be affected by inflation, we will be exposed to inflation risk with respect to income from any long-term leases on real property and from related real estate debt investments as these may constitute a source of our cash flows from operations. Although inflation has been generally low in recent years, high inflation may in the future tighten credit and increase prices. Further, if interest rates rise, such as during an inflationary period, the cost of acquisition capital to purchasers may also rise, which could adversely impact our ability to dispose of our assets at attractive sales prices. Should we be required to acquire, hold or dispose of our assets during a period of inflation, our overall return may be reduced.

7

Our rights and the rights of our stockholders to recover claims against our independent directors are limited, which could reduce your and our recovery against them if they negligently cause us to incur losses.

Maryland law provides that a director has no liability in that capacity if he performs his duties in good faith, in a manner he reasonably believes to be in our best interests and with the care that an ordinarily prudent person in a like position would use under similar circumstances. Our charter provides that no independent director shall be liable to us or our stockholders for monetary damages and that we will generally indemnify them for losses unless they are grossly negligent or engage in willful misconduct. As a result, you and we may have more limited rights against our independent directors than might otherwise exist under common law, which could reduce our and your recovery from these persons if they act in a negligent manner. In addition, we may be obligated to fund the defense costs incurred by our independent directors (as well as by our other directors, officers, employees (if we ever have employees) and agents) in some cases, which would decrease the cash otherwise available for distributions to you. The SEC takes the position that indemnification against liabilities arising under the Securities Act is against public policy and unenforceable.

We may change our policies and our operations without stockholder consent.

Our Board of Directors determines our major policies, including our policies regarding financing, growth, debt capitalization, REIT qualification and distributions. Our Board of Directors may amend or revise these and other policies without a vote of the stockholders. Under Maryland General Corporation Law and our charter, our stockholders have a right to vote only on limited matters. Our Board of Directors’ broad discretion in setting policies and our stockholders’ inability to exert control over those policies increases the uncertainty and risks you face as a stockholder.

The estimated value per share of our common stock may not reflect the value that stockholders will receive for their investment and does not take into account how developments subsequent to the valuation date related to individual assets, the financial or real estate markets or other events may have increased or decreased the value of our portfolio.

On March 19, 2020, our Board of Directors approved an estimated value per share of our common stock of $11.10 based on the estimated market value of the Company’s portfolio of investments as of December 31, 2019. As of the date of this filing, we are not aware of a material change in the value of our investments that would impact the overall estimated value per share; however, the outbreak of COVID-19, together with the resulting restrictions on travel and quarantines imposed, have had a negative impact on the economy and business activity globally, the full impact of which is not yet known and may result in an adverse impact to our investments and our resulting estimated value per share of our common stock.

We provided this estimated value per share to assist broker-dealers that participated in our public offerings in meeting their customer account statement reporting obligations under the Financial Industry Regulatory Authority (“FINRA”) Rule 2231. This valuation was performed in accordance with the provisions of Practice Guideline 2013-01, Valuations of Publicly Registered Non-Listed REITs, issued by the Institute for Portfolio Alternatives (formerly Investment Program Association) (“IPA”) in April 2013 (the “IPA Valuation Guidelines”).

With the approval of the conflicts committee, we engaged Duff & Phelps, LLC (“Duff & Phelps”) to provide a calculation of the range in estimated value per share of our common stock as of December 31, 2019. Duff & Phelps held discussions with senior management of our Advisor and conducted appraisals, investigations, research, review and analysis as it deemed necessary. Duff & Phelps based the range in estimated value per share upon its estimates of the “as is” market values of our interests in 28 multifamily properties and one debt investment. Duff & Phelps made adjustments to the aggregate estimated values of our investments to reflect balance sheet assets and liabilities provided by our management, which are disclosed in this Annual Report on Form 10-K before calculating a range of estimated values based on the number of outstanding shares of our common stock as of December 31, 2019.

As with any valuation methodology, the methodologies used are based upon a number of estimates and assumptions that may not be accurate or complete. Different parties with different assumptions and estimates could derive a different estimated value per share, and these differences could be significant. In particular, due in part to (i) the high concentration of our total assets in real estate, and (ii) the number of shares of our common stock outstanding, even modest changes in key assumptions made in appraising our real estate properties could have a very significant impact on the estimated value of our shares. The estimated value per share is not audited and does not represent the fair value of our assets less the fair value of our liabilities according to U.S. generally accepted accounting principles (“GAAP”), nor does it represent a liquidation value of our assets and liabilities or the amount that our shares of common stock would trade at on a national securities exchange. The estimated value per share does not reflect a discount for the fact that we are externally managed, nor does it reflect a real estate portfolio premium/discount versus the sum of the individual property values. The estimated value per share also does not take into account estimated disposition costs and fees for real estate properties, debt prepayment penalties that could apply upon the

8

prepayment of certain of our debt obligations or the impact of restrictions on the assumption of debt. Accordingly, with respect to the estimated value per share, we can give no assurance that:

|

|

• |

a stockholder would be able to resell his or her shares at the estimated value per share; |

|

|

• |

a stockholder would ultimately realize distributions per share equal to our estimated value per share upon liquidation of our assets and settlement of its liabilities or a sale of our company; |

|

|

• |

our shares of common stock would trade at the estimated value per share on a national securities exchange; |

|

|

• |

a third party would offer the estimated value per share in an arm’s-length transaction to purchase all or substantially all of our shares of common stock; |

|

|

• |

another independent third-party appraiser or third-party valuation firm would agree with the our estimated value per share; or |

|

|

• |

the methodology used to calculate our estimated value per share would be acceptable to FINRA or for compliance with ERISA reporting requirements. |

Further, the estimated value per share as of December 31, 2019 is based on the estimated value of our investments as of December 31, 2019. We did not make any adjustments to the valuation for the impact of other transactions occurring subsequent to December 31, 2019, including, but not limited to, (i) the issuance of common stock under the distribution reinvestment plan, (ii) net operating income earned and distributions declared, (iii) the redemption of shares and (iv) the potential conversion of convertible stock into common stock. The value of our shares will fluctuate over time in response to developments related to individual assets in our portfolio and the management of those assets and in response to the real estate and finance markets. In particular, the outbreak of COVID-19, together with the resulting restrictions on travel and quarantines imposed, have had a negative impact on the economy and business activity globally, the full impact of which is not yet known and may result in an adverse impact to our operations and investments. For a full description of the methodologies and assumptions used to value our assets and liabilities in connection with the calculation of the estimated value per share, see Part II, Item 5, “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities — Market Information.”

We face risks associated with security breaches through cyber-attacks, cyber intrusions or otherwise, as well as other significant disruptions of our information technology, or IT, networks and related systems.

We will face risks associated with security breaches, whether through cyber-attacks or cyber intrusions over the Internet, malware, computer viruses, attachments to e-mails, persons inside our organization or persons with access to systems inside our organization, and other significant disruptions of our IT networks and related systems or the IT systems of our vendors. The risk of a security breach or disruption, particularly through cyber-attack or cyber intrusion, including by computer hackers, foreign governments and cyber terrorists, has generally increased as the number, intensity and sophistication of attempted attacks and intrusions from around the world have increased. Our IT networks and related systems are essential to the operation of our business and our ability to perform day-to-day operations (including the IT systems of our vendors, such as Greystar, our third party manager), and, in some cases, may be critical to the operations of certain of our tenants. There can be no assurance that our efforts to maintain the security and integrity of these types of IT networks and related systems will be effective or that attempted security breaches or disruptions would not be successful or damaging. A security breach or other significant disruption involving our, or our vendors’, IT networks and related systems could adversely impact our financial condition, results of operations, cash flows, and our ability to satisfy our debt service obligations and to pay distributions to our stockholders.

The outbreak of widespread contagious disease, such as the novel coronavirus, COVID-19, could adversely impact our operations and the value of our investments.

In December 2019, a novel strain of coronavirus, COVID-19, was identified in Wuhan, China. This virus continues to spread globally including in the United States and has resulted in restrictions on travel and quarantines imposed. These restrictions have had a negative impact on the economy and business activity globally and may adversely impact the ability of our tenants, many of whom may be restricted in their ability to work, to pay their rent as and when due. In addition, our property managers may be limited in their ability to properly maintain our properties. The extent to which COVID-19 impacts our business will depend on future developments, which are highly uncertain and cannot be predicted, including additional actions taken to contain COVID-19 or treat its impact, among others. Our business and financial results could be materially and adversely impacted.

9

Risks Related to Conflicts of Interest

Our Advisor and its affiliates, including all of our executive officers, our affiliated directors and other key real estate professionals face conflicts of interest caused by their compensation arrangements with us, which could result in actions that are not in the long-term best interests of our stockholders.

All of our executive officers and our affiliated directors are also officers, directors, managers or key professionals of our Advisor, and other affiliated Resource Real Estate and/or C-III entities. Our Advisor and its affiliates receive substantial fees from us. These fees could influence our Advisor’s advice to us as well as the judgment of affiliates of our Advisor. Among other matters, these compensation arrangements could affect their judgment with respect to:

|

|

• |

the continuation, renewal or enforcement of our agreements with our Advisor and its affiliates, including the advisory agreement and the management agreement; |

|

|

• |

sales of properties and other investments, which may entitle our Advisor to disposition fees and the possible issuance to our Advisor of shares of our common stock through the conversion of our convertible stock; |

|

|

• |

acquisitions of properties and investments in loans, which entitle our Advisor to acquisition and asset management fees, and, in the case of acquisitions or investments from other sponsored programs, might entitle affiliates of our Advisor to disposition fees in connection with its services for the seller; |

|

|

• |

borrowings to acquire properties and other investments, which borrowings will increase the acquisition, debt financing, and asset management fees payable to our Advisor; |

|

|

• |

whether and when we seek to list our common stock on a national securities exchange, which listing could entitle our Advisor to the issuance of shares of our common stock through the conversion of our convertible stock; |

|

|

• |

whether we internalize our management, which may entail significant payments to affiliates of our Advisor; and |

|

|

• |

whether and when we seek to sell the company or its assets, which sale could entitle our Advisor to disposition fees and to the issuance of shares of our common stock through the conversion of our convertible stock. |

The fees our Advisor receives in connection with the acquisition and management of assets are based on the cost of the investment, and not based on the quality of the investment or the quality of the services rendered to us. This may influence our Advisor to recommend riskier transactions to us.

Our Advisor will face conflicts of interest relating to the disposition of assets and such conflicts may not be resolved in our favor, which could limit our ability to make distributions and reduce your overall investment return.

We rely on our sponsor and other key real estate professionals at our Advisor to sell our assets. The executive officers and several of the other key real estate professionals at our Advisor are also the key real estate professionals at the advisors to other sponsored programs and joint ventures. As such, sponsored programs and joint ventures rely on many of the same real estate professionals as will future programs. These other sponsored programs and joint ventures may possess properties in similar locations and may be attempting to sell these properties at the same time we are attempting to sell some of our properties. If our Advisor directs potential purchasers to properties owned by another sponsored program when it could direct such purchasers to our properties, we may be unable to sell some or all of our properties at the time or at the price we otherwise would, which could limit our ability to pay distributions and reduce the overall investment return of our stockholders.

Our Advisor will face conflicts of interest relating to joint ventures that we may form with affiliates of our Advisor, which conflicts could result in a disproportionate benefit to the other joint venture partners at our expense.

If approved by our conflicts committee, we may enter into joint venture agreements with other sponsored programs or affiliated entities for the acquisition, development or improvement of properties or other investments. Our Advisor and the advisors to the other Resource Real Estate or C-III sponsored programs have the same executive officers and key employees; and these persons will face conflicts of interest in determining which program or investor should enter into any particular joint venture agreement. These persons may also face a conflict in structuring the terms of the relationship between our interests and the interests of the affiliated co-venturer and in managing the joint venture. Any joint venture agreement or transaction between us and an affiliated co-venturer will not have the benefit of arm’s length negotiation of the type normally conducted between unrelated co-venturers. The affiliated co-venturer may have economic or business interests or goals that are or may become inconsistent with our business interests or goals. These co-venturers may thus benefit to our and your detriment.

Our Advisor, the real estate professionals assembled by our Advisor, their affiliates and our officers face competing demands relating to their time, and this may cause our operations and your investment to suffer.

We rely on our Advisor, the real estate professionals our Advisor has assembled and their affiliates and officers for the day-to-day operation of our business. Our Advisor, its real estate professionals and affiliates, including our officers, have

10

interests in other affiliated programs and engage in other business activities. As a result of their interests in other affiliated programs and the fact that they have engaged in and they will continue to engage in other business activities, they face conflicts of interest in allocating their time among us, our Advisor and other sponsored programs and other business activities in which they are involved. Should our Advisor inappropriately devote insufficient time or resources to our business, the returns on our investments may suffer.

Our executive officers and our affiliated directors face conflicts of interest related to their positions in our Advisor and its affiliates, including our property manager, which could hinder our ability to implement our business strategy and to generate returns to you.

Our executive officers and our affiliated directors are also executive officers, directors, managers and key professionals of our Advisor, our property manager and other affiliated Resource Real Estate and/or C-III entities. Their loyalties to these other entities could result in actions or inactions that are detrimental to our business, which could harm the implementation of our business strategy and our investment and leasing opportunities. If we do not successfully implement our business strategy, we may be unable to generate the cash needed to make distributions to you and to maintain or increase the value of our assets.

Payment of substantial fees and expenses to our Advisor and its affiliates reduces cash available for investment and distribution and increases the risk that you will not be able to recover the amount of your investment in our shares.

Our Advisor and its affiliates perform services for us in connection with the selection and acquisition of our investments, the management and leasing of our properties and the administration of our other investments. We pay them substantial fees for these services, which result in immediate dilution to the value of your investment and reduce the amount of cash available for investment or distribution to stockholders.

We also pay significant fees to our Advisor and its affiliates during our operational stage. Those fees include property management and debt servicing fees, asset management fees and obligations to reimburse our advisor and its affiliates for expenses they incur in connection with their providing services to us, including certain personnel services.

We may also pay significant fees during our listing/liquidation stage. The subordinated incentive fee that we will pay to our Advisor should our investors receive an agreed upon return on their investment is structured in the form of convertible stock. Our Advisor has exchanged 4,500 shares of our common stock for 45,000 shares of our convertible stock. As of December 31, 2019, our Advisor and affiliated persons owned 49,063 shares of our convertible stock, outside investors owned a total of 872 shares of our convertible stock. A total of 50,000 shares of convertible stock were authorized, and 49,935 shares were outstanding at December 31, 2019.

Under limited circumstances, including the listing of our shares on a national securities exchange, these shares may be converted into shares of our common stock satisfying our obligation to pay our Advisor an incentive fee and diluting our stockholders’ interest in us.

Our Advisor can influence whether our common stock is listed for trading on a national securities exchange. Accordingly, our Advisor can influence the conversion of the convertible stock issued to it and the resulting dilution of other stockholders’ interests.

These fees and other potential payments increase the risk that the amount available for distribution to common stockholders upon a liquidation of our portfolio would be less than our estimated net asset value per share. Substantial consideration paid to our Advisor and its affiliates also increases the risk that you will not be able to resell your shares at a profit, even if our shares are listed on a national securities exchange.

11

Risks Related to Our Corporate Structure

Our charter limits the number of shares a person may own, which may discourage a takeover that could otherwise result in a premium price to our stockholders.

Our charter, with certain exceptions, authorizes our directors to take such actions as are necessary and desirable to preserve our qualification as a REIT. To help us comply with the REIT ownership requirements of the Internal Revenue Code, our charter prohibits a person from directly or constructively owning more than 9.8% of our outstanding shares, unless exempted by our Board of Directors. This restriction may have the effect of delaying, deferring or preventing a change in control of us, including an extraordinary transaction (such as a merger, tender offer or sale of all, or substantially all, of our assets) that might provide a premium price for holders of our common stock.

Our charter permits our Board of Directors to issue stock with terms that may subordinate the rights of our common stockholders or discourage a third party from acquiring us in a manner that could result in a premium price to our stockholders.

Our Board of Directors may increase or decrease the aggregate number of shares of stock or the number of shares of stock of any class or series that we have authority to issue and classify or reclassify any unissued common stock or preferred stock and establish the preferences, conversion or other rights, voting powers, restrictions, limitations as to distributions, qualifications and terms or conditions of redemption of any such stock. Our Board of Directors could authorize the issuance of preferred stock with terms and conditions that could have priority as to distributions and amounts payable upon liquidation over the rights of the holders of our common stock. Such preferred stock could also have the effect of delaying, deferring or preventing a change in control of us, including an extraordinary transaction (such as a merger, tender offer or sale of all, or substantially all, of our assets) that might provide a premium price to holders of our common stock. A majority of our independent directors who do not have an interest in the transaction must approve any issuance of preferred stock.

You may not be able to sell your shares under our share redemption program and, if you are able to sell your shares under the program, you may not be able to recover the amount of your investment in our shares.

Our Board of Directors has suspended the share redemption program, except for redemptions submitted in connection with a stockholder’s death, qualifying disability, or confinement to a long-term care facility and may further amend, suspend or terminate our share redemption program upon 30 days’ notice and without stockholder approval. Our Board of Directors may reject any request for redemption of shares. Further, there are many limitations on your ability to sell your shares pursuant to the share redemption program. Any stockholder requesting repurchase of their shares pursuant to our share redemption program will be required to certify to us that such stockholder acquired the shares by either (1) a purchase directly from us or (2) a transfer from the original investor by way of (i) a bona fide gift not for value to, or for the benefit of, a member of the stockholder’s immediate or extended family, (ii) a transfer to a custodian, trustee or other fiduciary for the account of the stockholder or his or her immediate or extended family in connection with an estate planning transaction, including by bequest or inheritance upon death or (iii) operation of law.

In addition, our share redemption program contains other restrictions and limitations. Shares will be redeemed on a quarterly basis, pro rata among all stockholders requesting redemption in such quarter. If the Board of Directors determines to fully resume the share redemption program, priority for redemptions will be given to redemptions upon the death or qualifying disability of a stockholder or redemptions sought upon a stockholder’s confinement to a long-term care facility; next, to stockholders who demonstrate, in the discretion of our Board of Directors, another involuntary, exigent circumstance, such as bankruptcy; next, to stockholders subject to a mandatory distribution requirement under such stockholder’s IRA; and, finally, to other redemption requests. You must hold your shares for at least one year prior to seeking redemption under the share redemption program, except that our Board of Directors may waive this one-year holding requirement with respect to redemptions sought upon the death or qualifying disability of a stockholder or redemptions sought upon a stockholder’s confinement to a long-term care facility or for other exigent circumstances and that if a stockholder is redeeming all of his or her shares the Board of Directors may waive the one-year holding requirement with respect to shares purchased pursuant to the distribution reinvestment plan. We will not redeem more than 5% of the weighted average number of shares outstanding during the twelve-month period immediately prior to the date of redemption. Our Board of Directors will determine from time to time, and at least quarterly, whether we have sufficient excess cash to repurchase shares. Generally, the cash available for redemption will be limited to proceeds from our distribution reinvestment plan plus 1% of the operating cash flow from the previous fiscal year (to the extent positive).

Your interest in us will be diluted if we issue additional shares, which could reduce the overall value of your investment.

Our stockholders do not have preemptive rights to any shares we issue in the future. Our charter authorizes us to issue 1,010,050,000 shares of capital stock, of which 1,000,000,000 shares are designated as common stock, 50,000 shares are designated as convertible stock and 10,000,000 are designated as preferred stock. Our Board of Directors may increase the number of authorized shares of capital stock without stockholder approval. Our Board may also elect to (1) sell additional equity securities in future public or private offerings; (2) issue shares of our common stock upon the exercise of the options we may grant to our independent directors or to our Advisor's or our Manager's employees; (3) issue shares to our Advisor, its

12

successors or assigns, in payment of an outstanding obligation or as consideration in a related-party transaction; (4) issue shares of common stock upon the conversion of our convertible stock; or (5) issue shares of our common stock to sellers of properties we acquire in connection with an exchange of limited partnership interests of our operating partnership. To the extent we issue additional equity interests, your percentage ownership interest in us will be diluted. Further, depending upon the terms of such transactions, most notably the offering price per share, which may be less than the price paid per share in any public offering, and the value of our properties, existing stockholders may also experience a dilution in the book value of their investment in us.

Our Board of Directors could opt into certain provisions of the Maryland General Corporation Law in the future, which may discourage others from trying to acquire control of us and may prevent our stockholders from receiving a premium price for their stock in connection with a business combination.

Under Maryland law, “business combinations” between a Maryland corporation and certain interested stockholders or affiliates of interested stockholders are prohibited for five years after the most recent date on which the interested stockholder becomes an interested stockholder. These business combinations include a merger, consolidation, share exchange, or, in circumstances specified in the statute, an asset transfer or issuance or reclassification of equity securities. Also under Maryland law, control shares of a Maryland corporation acquired in a control share acquisition have no voting rights except to the extent approved by a vote of two-thirds of the votes entitled to be cast on the matter. Shares owned by the acquirer, an officer of the corporation or an employee of the corporation who is also a director of the corporation are excluded from the vote on whether to accord voting rights to the control shares. Should our Board opt into these provisions of Maryland law, it may discourage others from trying to acquire control of us and increase the difficulty of consummating any offer. Similarly, provisions of Title 3, Subtitle 8 of the Maryland General Corporation Law could provide similar anti-takeover protection.

Because Maryland law permits our Board to adopt certain anti-takeover measures without stockholder approval, investors may be less likely to receive a “control premium” for their shares.

In 1999, the State of Maryland enacted legislation that enhances the power of Maryland corporations to protect themselves from unsolicited takeovers. Among other things, the legislation permits our Board, without stockholder approval, to amend our charter to:

|

|

• |

stagger our Board of Directors into three classes; |

|

|

• |

require a two-thirds stockholder vote for removal of directors; |

|

|

• |

provide that only the Board can fix the size of the Board; |

|

|

• |

provide that all vacancies on the Board, however created, may be filled only by the affirmative vote of a majority of the remaining directors in office; and |

|

|

• |

require that special stockholder meetings may only be called by holders of a majority of the voting shares entitled to be cast at the meeting. |

Under Maryland law, a corporation can opt to be governed by some or all of these provisions if it has a class of equity securities registered under the Exchange Act, and has at least three independent directors. Our charter does not prohibit our Board from opting into any of the above provisions permitted under Maryland law. Becoming governed by any of these provisions could discourage an extraordinary transaction (such as a merger, tender offer or sale of all or substantially all of our assets) that might provide a premium price for holders of our securities.

If we internalize our management functions, we could incur significant costs associated with being self-managed and may not be able to retain or replace key personnel; and we may have increased exposure to litigation as a result of internalizing our management functions.

We may internalize management functions provided by our Advisor, our Manager and their respective affiliates by acquiring assets and personnel from our advisor, our property manager or their affiliates. In the event we were to acquire our advisor or our property manager, we cannot be sure of the terms relating to any such acquisition.

If we internalize, we would no longer bear the costs of the various fees and expenses we expect to pay to our Advisor and to our Manager under their respective agreements; however, our direct expenses would increase due to the inclusion of general and administrative costs, including legal, accounting, and other expenses related to corporate governance, SEC reporting and compliance. We would also incur the compensation and benefits costs of our officers and other employees and consultants that are now paid by our Advisor, our Manager or their affiliates. We cannot reasonably estimate the amount of fees to our Advisor, Manager and other affiliates we would save, and the costs we would incur, if we acquired these entities. If the expenses we assume as a result of an internalization are higher than the expenses we avoid paying to our Advisor, our Manager and their affiliates, our net income per share and funds from operations per share would be lower than they otherwise would have been had we not acquired these entities, potentially decreasing the amount of funds available for distribution.

13

Additionally, if we internalize our management functions, we would employ personnel and would be subject to potential liabilities commonly faced by employers, such as workers’ disability and compensation claims, potential labor disputes and other employee-related liabilities and grievances. Also, there can be no assurances that we will be successful in retaining key personnel at our advisor or property manager in the event of an internalization transaction. In addition, we could have difficulty integrating the functions currently performed by our Advisor, our Manager and their affiliates. Currently, the officers and employees of our Advisor, our Manager, and their affiliates perform asset management, property management, and general and administrative functions, including accounting and financial reporting, for multiple entities. We may fail to properly identify the appropriate mix of personnel and capital needs to operate as a stand-alone entity. An inability to manage an internalization transaction effectively could result in our incurring additional costs and/or experiencing deficiencies in our disclosures controls and procedures or our internal control over financial reporting. Such deficiencies could cause us to incur additional costs and our management’s attention could be diverted from effectively managing our properties and overseeing other real estate-related assets.

Internalization transactions have been the subject of stockholder litigation in the past. Stockholder litigation can be costly and time-consuming, and there can be no assurance that any litigation expenses we might incur would not be significant or that the outcome of litigation would be favorable to us. Any amounts we are required to expend defending any such litigation will reduce the amount of funds available for investment by us in properties or other investments.

Risks Related to Investments in Real Estate

Economic and regulatory changes that impact the real estate market generally may decrease the value of our investments and weaken our operating results.

The properties we acquire and their performance are subject to the risks typically associated with real estate, including:

|

|

• |

downturns in national, regional and local economic conditions; |

|

|

• |

competition; |

|

|

• |

adverse local conditions, such as oversupply or reduction in demand and changes in real estate zoning laws that may reduce the desirability of real estate in an area; |

|

|

• |

vacancies, changes in market rental rates and the need to periodically repair, renovate and re-let space; |

|

|

• |

changes in the supply of or the demand for similar or competing properties in an area; |

|

|

• |

changes in interest rates and the availability of permanent mortgage financing, which may render the sale of a property or loan difficult or unattractive; |

|

|

• |

changes in governmental regulations, including those involving tax, real estate usage, environmental and zoning laws; and |

|

|

• |

periods of high interest rates and tight money supply. |

Any of the above factors, or a combination thereof, could result in a decrease in the value of our investments, which would have an adverse effect on our results of operations, reduce the cash available for distributions and the return on your investment.

Residents of multifamily rental properties that have experienced personal financial problems may delay enforcement of our rights, and we may incur substantial costs attempting to protect our investment.

Residents or tenants who have experienced a downturn in their residential or business leases and residents or tenants that have experienced difficulties with their personal financial situations such as a job loss, bankruptcy or bad credit rating, may result in their failure to make timely rental payments or their default under their leases. In the event of any default by residents or tenants at our properties, we may experience delays in enforcing our rights and may incur substantial costs attempting to protect our investment.

The bankruptcy or insolvency of any resident or tenant also may adversely affect the income produced by our properties. If any resident or tenant becomes a debtor in a case under the U.S. Bankruptcy Code, our actions may be restricted by the bankruptcy court and our financial condition and results of operations could be adversely affected.

The operating costs of our properties will not necessarily decrease if our income decreases.

Certain expenses associated with ownership and operation of a property may be intentionally increased to enhance the short- and long-term success of the property in the form of capital gain and current income, such as:

|

|

• |

increased staffing levels; |

14

|

|

• |

increased marketing efforts. |

Certain expenses associated with the ownership and operation of a property are not necessarily reduced by events that adversely affect the income from the property, such as:

|

|

• |

real estate taxes; |

|

|

• |

insurance costs; and |

|

|

• |

maintenance costs. |

For example, if the leased property loses tenants or rents are reduced, then those costs described in the preceding sentence are not necessarily reduced. As a result, our cost of owning and operating leased properties may, in the future, exceed the income the property generates even though the property’s income exceeded its costs at the time it was acquired. This would decrease the amount of cash available to us to distribute to you and could negatively affect your return on investment.

We will compete with third parties in managing and selling properties and other investments, which could reduce our profitability and the return on your investment.

We believe that the current market for properties that meet our investment objectives is extremely competitive and many of our competitors have greater resources than we do. We will compete with numerous other entities engaged in real estate investment activities, including individuals, corporations, banks and insurance company investment accounts, other REITs, real estate limited partnerships, the U.S. government and other entities, to manage and sell real estate and real estate-related assets. Many of our expected competitors enjoy significant competitive advantages that result from, among other things, a lower cost of capital and enhanced operating efficiencies. In addition, the number of entities and the amount of funds competing for suitable investments may increase.

Competition with these entities may result in the following:

|

|

• |

decreased availability of financing to us; or |

|

|

• |

reductions in the size or desirability of the potential tenant base for one or more properties that we lease. |

If such events occur, you may experience a lower return on your investment.

Properties that have significant vacancies, especially discounted real estate assets, may experience delays in leasing up or could be difficult to sell, which could diminish our return on these properties.

A property may incur vacancies either by the expiration of tenant leases or the continued default of tenants under their leases. Further, our potential investments in value-add multifamily rental properties or other types of discounted properties may have significant vacancies at the time of acquisition. If vacancies continue for a prolonged period of time beyond the expected lease-up stage that we anticipate will follow any redevelopment or repositioning efforts, we may suffer reduced revenues resulting in less cash available for distributions. In addition, the resale value of the property could be diminished because the market value of a particular property depends principally upon the value of the cash flow generated by the leases associated with that property. Such a reduction on the resale value of a property could also reduce your return on investment.

Because we rely on our Manager, its affiliates and third parties to manage the day-to-day affairs of any properties we acquire, should the staff of a particular property perform poorly, our operating results for that property will similarly be hindered and our net income may be reduced.

We depend upon the performance of our property managers to effectively manage our properties and real estate-related assets. Poor performance by those sales, leasing and other management staff members operating a particular property will necessarily translate into poor results of operations for that particular property. Should our Manager, its affiliates or third parties fail to identify problems in the day-to-day management of a particular property or fail to take the appropriate corrective action in a timely manner, our operating results may be hindered and our net income reduced.

If we are unable to obtain funding for future capital needs, cash distributions to our stockholders could be reduced and the value of our investments could decline.

If we need additional capital in the future to improve or maintain our properties or for any other reason, we may have to obtain financing from sources beyond our cash flow from operations, such as borrowings, sales of assets or future equity offerings. These sources of funding may not be available on attractive terms or at all. If we cannot procure additional funding for capital improvements, our investments may generate lower cash flows or decline in value, or both, which would limit our ability to make distributions to you and could reduce the value of your investment.

15

If we are unable to sell a property for the price, on the terms or within the time frame we desire, it could limit our ability to pay cash distributions to you.

Many factors that are beyond our control affect the real estate market and could affect our ability to sell properties for the price, on the terms or within the time frame that we desire. These factors include general economic conditions, the availability of financing, interest rates and other factors, including supply and demand. Because real estate investments are relatively illiquid, we have a limited ability to vary our portfolio in response to changes in economic or other conditions. Further, before we can sell a property on the terms we want, it may be necessary to expend funds to correct defects or to make improvements. However, we can give no assurance that we will have the funds available to correct such defects or to make such improvements. We may be unable to sell our properties at a profit. Our inability to sell properties at the time and on the terms we want could reduce our cash flow and limit our ability to make distributions to you and could reduce the value of your investment.

Government entities, community associations and contractors may cause unforeseen delays and increase costs to redevelop and reposition value-add properties that we may acquire, which may reduce our net income and cash available for distributions to you.

We may seek to or be required to incur substantial capital obligations to redevelop or reposition existing properties that we acquire at a discount as a result of neglect of the previous owners or tenants of the properties and to sell the properties. Our Advisor and its key real estate professionals will do their best to acquire properties that do not require excessive redevelopment or modifications and that do not contain hidden defects or problems. There could, however, be unknown and excessive costs, expenses and delays associated with a discounted property’s redevelopment, repositioning or value-add upgrades. We will be subject to risks relating to the uncertainties associated with rezoning for redevelopment and other concerns of governmental entities, community associations and our construction manager’s ability to control costs and to build in conformity with plans and the established timeframe. We will pay a construction management fee to a construction manager, which may be our Manager or its affiliates, if new capital improvements are required.

If we are unable to increase rental rates or sell the redeveloped property at a price consistent with our value-add projections due to local market or economic conditions to offset the cost of the redevelopment or repositioning the property, the return on your investment may suffer. To the extent we acquire discounted properties in major metropolitan areas where the local government has imposed rent controls, we may be prohibited from increasing the rental rates to a level sufficient to cover the particular property’s redevelopment costs and expenses.

Costs of responding to both known and previously undetected environmental contamination and hazardous conditions may decrease our cash flows and limit our ability to make distributions.

Real property and the operations conducted on real property are subject to federal, state and local laws and regulations relating to protection of the environment and human health. We could be subject to liability in the form of fines, penalties or damages for noncompliance with these laws and regulations. These laws and regulations generally govern wastewater discharges, air emissions, the operation and removal of underground and above-ground storage tanks, the use, storage, treatment, transportation and disposal of solid and hazardous materials, the remediation of contamination associated with the release or disposal of solid and hazardous materials, the presence of toxic building materials, and other health and safety-related concerns.

Some of these laws and regulations may impose joint and several liability on the tenants, current or previous owners or operators of real property for the costs to investigate or remediate contaminated properties, whether the contamination occurred prior to purchase, or whether the acts causing the contamination were legal. These costs could be substantial. Such laws often impose liability whether or not the owner or operator knew of, or was responsible for, the presence of such hazardous or toxic substances. Our tenants’ operations, the condition of properties at the time we buy them, operations in the vicinity of our properties, such as the presence of underground storage tanks, or activities of unrelated third parties may affect our properties.

Environmental laws also may impose liens on a property or restrictions on the manner in which a property may be used or businesses may be operated, and these restrictions may require substantial expenditures or prevent us from entering into leases with prospective tenants that may be impacted by such laws. Environmental laws provide for sanctions for noncompliance and may be enforced by governmental agencies or, in certain circumstances, by private parties. Certain environmental laws and common law principles could be used to impose liability for the release of and exposure to hazardous substances, including asbestos-containing materials and lead-based paint. Third parties may seek recovery from real property owners or operators for personal injury or property damage associated with exposure to released hazardous substances.

The presence of hazardous substances, or the failure to properly manage or remediate these substances, may hinder our ability to sell, rent or pledge such property as collateral for future borrowings. Any material expenditures, fines, penalties, or damages we must pay will reduce our ability to make distributions and may reduce the value of your investment.

16

Properties acquired by us may have toxic mold that could result in substantial liabilities to us.

Litigation and concern about indoor exposure to certain types of toxic molds has been increasing as the public becomes aware that exposure to mold can cause a variety of health effects and symptoms, including allergic reactions. It is impossible to eliminate all mold and mold spores in the indoor environment. Although we will attempt to acquire properties and loans secured by properties that do not contain toxic mold, there can be no assurance that none of the properties acquired by us will contain toxic mold. The difficulty in discovering indoor toxic mold growth could lead to an increased risk of lawsuits by affected persons and the risk that the cost to remediate toxic mold will exceed the value of the property. There is a risk that we may acquire properties that contain toxic mold and such properties may negatively affect our performance and your return on investment.

Uninsured losses relating to real property or excessively expensive premiums for insurance coverage could reduce our cash flows and the return on your investment.