Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Steadfast Apartment REIT, Inc. | ex991cbreconsent123119.htm |

| EX-32.2 - EXHIBIT 32.2 - Steadfast Apartment REIT, Inc. | ex322star12312019.htm |

| EX-32.1 - EXHIBIT 32.1 - Steadfast Apartment REIT, Inc. | ex321star12312019.htm |

| EX-31.2 - EXHIBIT 31.2 - Steadfast Apartment REIT, Inc. | ex312star12312019.htm |

| EX-31.1 - EXHIBIT 31.1 - Steadfast Apartment REIT, Inc. | ex311star12312019.htm |

| EX-23.1 - EXHIBIT 23.1 - Steadfast Apartment REIT, Inc. | ex231star12312019.htm |

| EX-21.1 - EXHIBIT 21.1 - Steadfast Apartment REIT, Inc. | ex211star12312019.htm |

| EX-4.7 - EXHIBIT 4.7 - Steadfast Apartment REIT, Inc. | exhibit47.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2019 | ||

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from _______ to _______ | ||

Commission file number 000-55428

STEADFAST APARTMENT REIT, INC.

(Exact Name of Registrant as Specified in Its Charter)

Maryland | 36-4769184 | |

(State or Other Jurisdiction of | (I.R.S. Employer | |

Incorporation or Organization) | Identification No.) | |

18100 Von Karman Avenue, Suite 500 | ||

Irvine, California | 92612 | |

(Address of Principal Executive Offices) | (Zip Code) | |

(949) 852-0700

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act: None

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

N/A | N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.01 par value per share | ||

(Title of Class) | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated filer o | Accelerated filer o |

Non-Accelerated filer x | Smaller reporting company o |

Emerging growth company x | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period of complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ý

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

There is no established market for the registrant’s shares of common stock. There were approximately 51,850,018 shares of common stock held by non-affiliates as of June 28, 2019, the last business day of the registrant’s most recently completed second fiscal quarter, for an aggregate market value of $821,304,280, assuming an estimated value per share of $15.84.

As of March 5, 2020, there were 52,875,501 shares of the Registrant’s common stock issued and outstanding.

STEADFAST APARTMENT REIT, INC.

INDEX

Page | |||

PART I | |||

PART II | |||

PART III | |||

PART IV | |||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements included in this Annual Report on Form 10-K of Steadfast Apartment REIT, Inc. (which is referred to in this Annual Report on Form 10-K, as context requires, as the “Company,” “we,” “us,” or “our”) that are not historical facts (including any statements concerning investment objectives, other plans and objectives of management for future operations or economic performance, or assumptions or forecasts related thereto) are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements are only predictions. We caution that forward-looking statements are not guarantees. Actual events or our investments and results of operations could differ materially from those expressed or implied in any forward-looking statements. Forward-looking statements are typically identified by the use of terms such as “may,” “should,” “expect,” “could,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “predict,” “potential” or the negative of such terms and other comparable terminology.

The forward-looking statements included herein are based upon our current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements. Factors that could have a material adverse effect on our operations and future prospects include, but are not limited to:

• | the fact that we have had a net loss for each quarterly and annual period since inception; |

• | changes in economic conditions generally and the real estate and debt markets specifically; |

• | our ability to secure resident leases for our multifamily properties at favorable rental rates; |

• | risks inherent in the real estate business, including resident defaults, potential liability relating to environmental matters and the lack of liquidity of real estate investments; |

• | the fact that we pay fees and expenses to our advisor and its affiliates that were not negotiated on an arm’s-length basis and the fact that the payment of these fees and expenses increases the risk that our stockholders will not earn a profit on their investment in us; |

• | our ability to retain our executive officers and other key personnel of our advisor, our property manager and other affiliates of our advisor; |

• | our ability to generate sufficient cash flows to pay distributions for our stockholders; |

• | our level of indebtedness following our mergers with Steadfast Income REIT, Inc. and Steadfast Apartment REIT III, Inc.; |

• | legislative or regulatory changes (including changes to the laws governing the taxation of real estate investment trusts, or REITs); |

• | the availability of capital; |

• | changes in interest rates; and |

• | changes to generally accepted accounting principles, or GAAP. |

Any of the assumptions underlying forward-looking statements could be inaccurate. You are cautioned not to place undue reliance on any forward-looking statements included in this annual report. All forward-looking statements are made as of the date of this annual report and the risk that actual results will differ materially from the expectations expressed in this annual report will increase with the passage of time. Except as otherwise required by the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements after the date of this annual report, whether as a result of new information, future events, changed circumstances or any other reason. In light of the significant uncertainties inherent in the forward-looking statements included in this annual report, the inclusion of such forward-looking statements should not be regarded as a representation by us or any other person that the objectives and plans set forth in this annual report will be achieved. All forward looking statements included herein should be read in connection with the risks identified in Part I. Item 1A. “Risk Factors” of this Annual Report on Form 10-K.

i

PART I

ITEM 1. BUSINESS

Overview

Steadfast Apartment REIT, Inc. (which is referred to in this annual report, as context requires, as the “Company,” “we,” “us,” or “our”) was formed on August 22, 2013, as a Maryland corporation and elected to qualify as a real estate investment trust, or REIT, for U.S. federal income tax purposes commencing with its taxable year ended December 31, 2014. We own and operate a diverse portfolio of real estate investments, primarily in the multifamily sector located throughout the United States. In addition to our focus on multifamily properties, we may also make selective strategic acquisitions of other types of commercial properties. We may also acquire or originate mortgage, mezzanine, bridge and other real estate loans and equity securities of other real estate companies. As of December 31, 2019, we owned 32 multifamily properties comprised of a total of 11,195 apartment homes and one parcel of land held for the development of apartment homes. For more information on our real estate portfolio, see “—Our Real Estate Portfolio” below.

On December 30, 2013, we commenced our initial public offering of up to 66,666,667 shares of common stock at an initial price of $15.00 per share and up to 7,017,544 shares of common stock pursuant to our distribution reinvestment plan, at an initial price of $14.25 per share. On March 24, 2016, we terminated our initial public offering. As of March 24, 2016, we had sold 48,625,651 shares of common stock for gross offering proceeds of $724,849,631, including 1,011,561 shares of common stock issued pursuant to our distribution reinvestment plan for gross offering proceeds of $14,414,752. Following the termination of our initial public offering, we continue to offer shares of our common stock pursuant to our distribution reinvestment plan. As of December 31, 2019, we had sold 54,276,237 shares of common stock for gross offering proceeds of $809,562,356, including 6,662,210 shares of common stock issued pursuant to our distribution reinvestment plan for proceeds of $99,127,477.

On March 14, 2018, our board of directors determined an estimated value per share of our common stock of $15.18 as of December 31, 2017. On March 12, 2019, our board of directors determined an estimated value per share of our common stock of $15.84 as of December 31, 2018. For more information on the determinations of the estimated value per share of our common stock, see Item 5. “Market for Registrant’s Common Equity, Related Stockholder Matters and Purchases of Equity Securities—Estimated Value Per Share.” In connection with the determination of our estimated value per share, our board of directors determined a price per share for the distribution reinvestment plan of $15.18 and $15.84, effective April 1, 2018 and April 1, 2019, respectively. We intend to establish an updated estimated value per share following the completion of the mergers (defined and discussed below) which closed on March 6, 2020. We expect that the estimated value per share will be as of March 6, 2020 and will be reported by us in a Current Report on Form 8-K. In the future, our board of directors may, in its sole discretion and from time to time, change the price at which we offer shares pursuant to our distribution reinvestment plan to reflect changes in our estimated value per share and other factors that our board of directors deems relevant.

We were externally managed by Steadfast Apartment Advisor, LLC, which we refer to as our “advisor,” pursuant to the Advisory Agreement, as amended, or the advisory agreement, dated December 13, 2013, by and between, us and our advisor. In connection with the closing of the mergers, we and our advisor entered into an Amended and Restated Advisory Agreement dated March 6, 2020. The current term of the Advisory Agreement expires on March 6, 2021. Subject to certain restrictions and limitations, our advisor manages our day-to-day operations and our portfolio of properties and real estate-related assets, sources and presents investment opportunities to our board of directors and provides investment management services on our behalf. The advisor has also entered into an Advisory Services Agreement with Crossroads Capital Advisors, LLC, or Crossroads Capital Advisors, whereby Crossroads Capital Advisors provides advisory services to us on behalf of the advisor. Stira Capital Markets Group, LLC (formerly known as Steadfast Capital Markets Group, LLC), or the dealer manager, an affiliate of Steadfast REIT Investments, LLC, our sponsor, served as the dealer manager for our initial public offering. Our advisor, along with the dealer manager, provides marketing, investor relations and other administrative services on our behalf.

Substantially all of our business was conducted through Steadfast Apartment REIT Operating Partnership, L.P., a Delaware limited partnership formed on August 27, 2013, which we refer to as our “operating partnership.” We are the sole general partner of our operating partnership and our wholly-owned subsidiary, Steadfast Apartment REIT Limited Partner, LLC, is the sole limited partner of our operating partnership. Following completion of the mergers on March 6, 2020, we now conduct our business through the operating partnership, Steadfast Income REIT Operating Partnership, L.P. and Steadfast Apartment REIT III Operating Partnership, L.P.

Merger with Steadfast Income REIT, Inc.

On August 5, 2019, we, Steadfast Income REIT, Inc., or SIR, our operating partnership, Steadfast Income REIT Operating Partnership, L.P., the operating partnership of SIR, and SI Subsidiary, LLC, our wholly-owned subsidiary, or SIR Merger Sub, entered into an Agreement and Plan of Merger, or the SIR Merger Agreement.

1

Pursuant to the terms and conditions of the SIR Merger Agreement, on March 6, 2020, SIR merged with and into SIR Merger Sub, or the SIR Merger, with SIR Merger Sub surviving the SIR Merger. Following the SIR Merger, SIR Merger Sub, as the surviving entity, will continue as our wholly-owned subsidiary. In accordance with the applicable provisions of the Maryland General Corporation Law, or MGCL, the separate existence of SIR ceased.

At the effective time of the SIR Merger, each issued and outstanding share of SIR common stock (or a fraction thereof), $0.01 par value per share, or the SIR Common Stock, converted into 0.5934 shares of our common stock.

Merger with Steadfast Apartment REIT III, Inc.

On August 5, 2019, we, Steadfast Apartment REIT III, Inc., or STAR III, our operating partnership, Steadfast Apartment REIT III Operating Partnership, L.P., the operating partnership of STAR III, and SIII Subsidiary, LLC, our wholly-owned subsidiary, or STAR III Merger Sub, entered into an Agreement and Plan of Merger, or the STAR III Merger Agreement.

Pursuant to the terms and conditions of the STAR III Merger Agreement, on March 6, 2020, STAR III merged with and into STAR III Merger Sub, or the STAR III Merger and together with the SIR Merger, the “mergers”, with STAR III Merger Sub surviving the STAR III Merger. Following the STAR III Merger, STAR III Merger Sub, as the surviving entity, will continue as our wholly-owned subsidiary. In accordance with the applicable provisions of the MGCL, the separate existence of STAR III ceased.

At the effective time of the STAR III Merger, each issued and outstanding share of STAR III common stock (or a fraction thereof), $0.01 par value per share, or the STAR III Common Stock, was converted into 1.430 shares of our common stock.

Each of SIR and STAR III were non-listed REITs sponsored by our sponsor and their external advisors were affiliates of our advisor.

Combined Company

The combined company after the mergers retains the name “Steadfast Apartment REIT, Inc.” Each merger is intended to qualify as a “reorganization” under, and within the meaning of, Section 368(a) of the Internal Revenue Code of 1986, as amended, or the Internal Revenue Code.

As of the closing of the mergers, our portfolio (unaudited) consisted of (1) 69 properties (including one property held for development) in 14 states, with an average effective rent of $1,173 and (2) a 10% interest in one unconsolidated joint venture that owned 20 multifamily properties with a total of 4,584 apartment homes. Based on occupancy as of December 31, 2019, our portfolio had an occupancy rate of 94.9%, an average age of 20 years and gross real estate assets value of $3,375,635,000 (unaudited).

As a result of the completion of the mergers, our financial information materially changed; however, the financial information included in this Annual Report on Form 10-K reflects only our stand-alone, historical financial results.

2

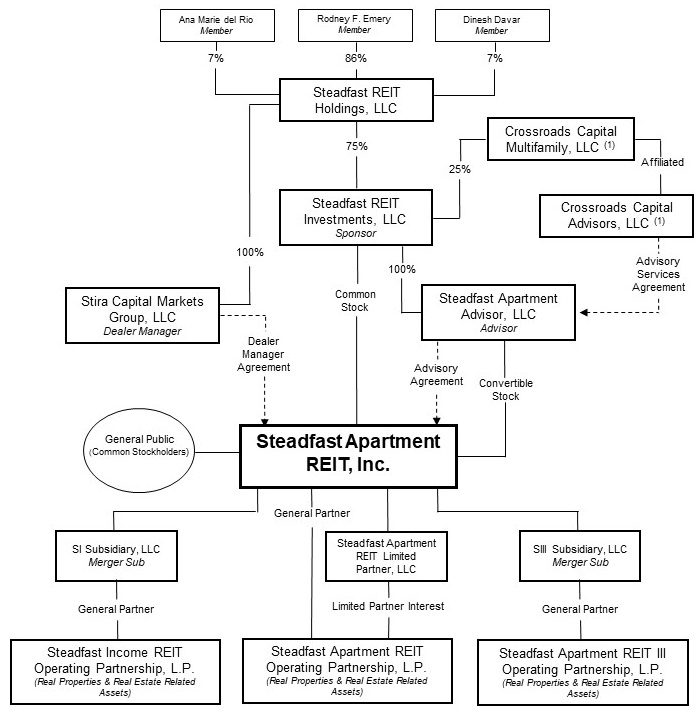

Our Structure

Our sponsor, Steadfast REIT Investments, LLC, a Delaware limited liability company, is indirectly controlled by Rodney F. Emery, the chairman of our board of directors and our chief executive officer. We refer to each of our sponsor, advisor, dealer manager and their affiliates as “a Steadfast Companies affiliate” and collectively as “Steadfast Companies affiliates.” The chart below shows the relationships among our company and various Steadfast Companies affiliates following the SIR Merger and the STAR III Merger.

_______________

_______________(1) | Crossroads Capital Multifamily, LLC and Crossroads Capital Advisors, LLC are affiliated entities, each being wholly-owned subsidiaries of Crossroads Capital Group, LLC. |

3

Objectives and Strategies

Our investment objectives are to:

• | realize capital appreciation in the value of our investments over the long term; and |

• | pay attractive and stable cash distributions to stockholders. |

We intend to use cash flows from operations to continue to invest in and manage our real estate investments located throughout the United States, with the objective of generating stable rental income and maximizing the opportunity for future capital appreciation. We believe that a majority of our portfolio consists of established, well-positioned, institutional-quality apartment communities with high occupancies and consistent rental revenue. Established apartment communities are typically older, more affordable apartments that cater to the middle-class segment of the workforce, with monthly rental rates that accommodate the generally accepted guidelines for housing costs as a percentage of gross income. As a result, we believe the demand for apartment housing at these properties is higher compared to other types of multifamily properties and is generally more consistent in all economic cycles. We continue to implement a value-enhancement strategy on the apartment homes we acquired. Our value-enhancement strategy involves the acquisition of under-managed, stabilized apartment communities in high job and population growth neighborhoods and the investment of additional capital to make strategic upgrades of the interiors of the apartment homes. These opportunities vary in degree based on the specific business plan for each asset, but could include new appliances, better cabinets, countertops and flooring.

2019 Highlights

During 2019, we:

• | entered into merger agreements to combine our company with SIR and STAR III; |

• | invested $26,689,336 in improvements to our real estate investment portfolio; |

• | acquired land for the new development of 176 apartment homes for a purchase price of $2,469,183; |

• | invested $2,920,469 in development and construction to our real estate held for development; |

• | disposed of two multifamily properties, for a gross sales price of $59,100,000, exclusive of closing costs, resulting in a gain on sales of real estate of $11,651,565; |

• | paid cash distributions of $25,681,391 and distributed $21,222,382 in shares of our common stock pursuant to our distribution reinvestment plan, which constituted a 6.0% annualized distribution rate to our stockholders based on our initial public offering price of $15.00 per share; |

• | generated cash flows from operations of $29,078,255, although we incurred a net loss of $38,524,316; |

• | generated net operating income, or NOI, of $96,636,421 (for further information on how we calculate NOI and a reconciliation of NOI to net loss, see Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Net Operating Income”); |

• | generated funds from operations, or FFO, of $23,604,194 (for further information on how we calculate FFO and a reconciliation of FFO to net loss, see Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Funds From Operations and Modified Funds From Operations”); |

• | generated modified funds from operations, or MFFO, of $25,378,778 (for further information on how we calculate MFFO and a reconciliation of MFFO to net loss, see Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Funds from Operations and Modified Funds from Operations”); and |

• | received proceeds of $56,890,038, net of principal payments of $202,728,946, deferred financing costs of $1,573,716 and loan financing deposits of $452,300, related to the refinancing of a portion of our outstanding debt (for further information on the 2019 refinancing transactions, please refer to Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources”). |

4

Our Real Estate Portfolio

As of December 31, 2019, we owned the 32 multifamily properties and one parcel of land held for the development of apartment homes described below.

Property Name | Location | Number of Homes | Average Monthly Occupancy | Average Monthly Rent(1) | Purchase Date | Contract Purchase Price | Mortgage Debt Outstanding(2) | ||||||||||||||||

1 | Villages at Spring Hill Apartments | Spring Hill, TN | 176 | 96.0 | % | $ | 1,120 | 5/22/2014 | $ | 14,200,000 | (3 | ) | |||||||||||

2 | Harrison Place Apartments | Indianapolis, IN | 307 | 94.1 | % | 992 | 6/30/2014 | 27,864,250 | (3 | ) | |||||||||||||

3 | Terrace Cove Apartment Homes | Austin, TX | 304 | 95.1 | % | 966 | 8/28/2014 | 23,500,000 | (3 | ) | |||||||||||||

4 | The Residences on McGinnis Ferry | Suwanee, GA | 696 | 96.0 | % | 1,344 | 10/16/2014 | 98,500,000 | (3 | ) | |||||||||||||

5 | The 1800 at Barrett Lakes | Kennesaw, GA | 500 | 92.4 | % | 1,076 | 11/20/2014 | 49,000,000 | 40,623,442 | ||||||||||||||

6 | The Oasis | Colorado Springs, CO | 252 | 94.8 | % | 1,424 | 12/19/2014 | 40,000,000 | 39,499,673 | ||||||||||||||

7 | Columns on Wetherington | Florence, KY | 192 | 91.7 | % | 1,220 | 2/26/2015 | 25,000,000 | (3 | ) | |||||||||||||

8 | Preston Hills at Mill Creek | Buford, GA | 464 | 91.6 | % | 1,192 | 3/10/2015 | 51,000,000 | (3 | ) | |||||||||||||

9 | Eagle Lake Landing Apartments | Speedway, IN | 277 | 96.8 | % | 905 | 3/27/2015 | 19,200,000 | (3 | ) | |||||||||||||

10 | Reveal on Cumberland | Fishers, IN | 220 | 95.0 | % | 1,144 | 3/30/2015 | 29,500,000 | 20,827,267 | ||||||||||||||

11 | Heritage Place Apartments | Franklin, TN | 105 | 97.1 | % | 1,145 | 4/27/2015 | 9,650,000 | 8,590,932 | ||||||||||||||

12 | Rosemont at East Cobb | Marietta, GA | 180 | 96.7 | % | 1,100 | 5/21/2015 | 16,450,000 | 13,258,252 | ||||||||||||||

13 | Ridge Crossings Apartments | Hoover, AL | 720 | 92.8 | % | 1,012 | 5/28/2015 | 72,000,000 | 57,668,758 | ||||||||||||||

14 | Bella Terra at City Center | Aurora, CO | 304 | 96.1 | % | 1,221 | 6/11/2015 | 37,600,000 | (3 | ) | |||||||||||||

15 | Hearthstone at City Center | Aurora, CO | 360 | 95.0 | % | 1,257 | 6/25/2015 | 53,400,000 | (3 | ) | |||||||||||||

16 | Arbors at Brookfield | Mauldin, SC | 702 | 92.7 | % | 923 | 6/30/2015 | 66,800,000 | (3 | ) | |||||||||||||

17 | Carrington Park | Kansas City, MO | 298 | 95.3 | % | 1,011 | 8/19/2015 | 39,480,000 | (3 | ) | |||||||||||||

18 | Delano at North Richland Hills | North Richland Hills, TX | 263 | 95.8 | % | 1,486 | 8/26/2015 | 38,500,000 | 31,814,165 | ||||||||||||||

19 | Meadows at North Richland Hills | North Richland Hills, TX | 252 | 94.4 | % | 1,392 | 8/26/2015 | 32,600,000 | 26,580,102 | ||||||||||||||

20 | Kensington by the Vineyard | Euless, TX | 259 | 95.8 | % | 1,507 | 8/26/2015 | 46,200,000 | 34,111,658 | ||||||||||||||

21 | Monticello by the Vineyard | Euless, TX | 354 | 96.3 | % | 1,344 | 9/23/2015 | 52,200,000 | 41,229,964 | ||||||||||||||

22 | The Shores | Oklahoma City, OK | 300 | 94.7 | % | 1,016 | 9/29/2015 | 36,250,000 | 23,653,152 | ||||||||||||||

23 | Lakeside at Coppell | Coppell, TX | 315 | 96.8 | % | 1,716 | 10/7/2015 | 60,500,000 | 47,883,143 | ||||||||||||||

24 | Meadows at River Run | Bolingbrook, IL | 374 | 90.1 | % | 1,364 | 10/30/2015 | 58,500,000 | 42,438,707 | ||||||||||||||

25 | PeakView at T-Bone Ranch | Greeley, CO | 224 | 93.3 | % | 1,373 | 12/11/2015 | 40,300,000 | (3 | ) | |||||||||||||

26 | Park Valley Apartments | Smyrna, GA | 496 | 94.4 | % | 1,068 | 12/11/2015 | 51,400,000 | 48,575,513 | ||||||||||||||

27 | PeakView by Horseshoe Lake | Loveland, CO | 222 | 93.7 | % | 1,396 | 12/18/2015 | 44,200,000 | 38,003,137 | ||||||||||||||

28 | Stoneridge Farms | Smyrna, TN | 336 | 95.2 | % | 1,196 | 12/30/2015 | 47,750,000 | 45,340,947 | ||||||||||||||

29 | Fielder’s Creek | Englewood, CO | 217 | 96.3 | % | 1,219 | 3/23/2016 | 32,400,000 | — | ||||||||||||||

30 | Landings of Brentwood | Brentwood, TN | 724 | 96.8 | % | 1,262 | 5/18/2016 | 110,000,000 | (4 | ) | |||||||||||||

31 | 1250 West Apartments | Marietta, GA | 468 | 93.6 | % | 1,061 | 8/12/2016 | 55,772,500 | (3 | ) | |||||||||||||

32 | Sixteen50 @ Lake Ray Hubbard | Rockwall, TX | 334 | 96.4 | % | 1,492 | 9/29/2016 | 66,050,000 | (3 | ) | |||||||||||||

33 | Garrison Station Development(5) | Murfreesboro, TN | — | — | % | — | 5/30/2019 | 5,687,978 | — | ||||||||||||||

11,195 | 94.6%(6) | $ | 1,200 | $ | 1,451,454,728 | $ | 560,098,815 | ||||||||||||||||

________________

(1) | Average monthly rent is based upon the effective rental income for the month of December 2019 after considering the effect of vacancies, concessions and write-offs. |

(2) | Mortgage debt outstanding is net of deferred financing costs associated with the loans for each individual property listed above but excludes the principal balance of $551,669,000 and associated deferred financing costs of $3,208,770 related to the refinancings pursuant to our Master Credit Facility Agreement, or MCFA. |

(3) | Properties secured pursuant to the terms of the MCFA. |

(4) | At December 31, 2018, Landings of Brentwood was pledged as collateral pursuant to our line of credit. On January 9, 2019, we terminated the line of credit. |

(5) | We acquired the Garrison Station property on May 30, 2019, which included unimproved land, currently zoned as a Planned Unit Development, or PUD. The current zoning permits the development of the property into a multifamily community including 176 apartment homes of 1, 2 and 3-bedrooms with a typical mix for this market. |

5

(6) | At December 31, 2019, our portfolio was approximately 96.0% leased, calculated using the number of occupied and contractually leased apartment homes divided by total apartment homes. As of December 31, 2019, no single tenant accounted for greater than 10% of our 2019 gross annualized rental revenues. |

We plan to invest approximately $10 million to $15 million during the year ending December 31, 2020, for the combined company, for interior renovations at certain properties in our portfolio. These renovations are primarily to enhance the interior amenities of the apartment homes and will be performed initially on vacant homes and thereafter on homes vacated from time to time in the ordinary course.

The following information generally applies to all of our properties:

• | we believe all of our properties are adequately covered by insurance and are suitable for their intended purposes; |

• | except as noted above, we have no plans for any material renovations, improvements or developments with respect to any of our properties; and |

• | our properties face competition in attracting new residents and retaining current residents from other multifamily properties in and around their respective submarkets. |

Leverage

We use secured debt, and intend to use in the future secured and unsecured debt, as a means of providing additional funds for the acquisition, development or renovation of our properties. We believe that the careful use of borrowings will help us achieve our diversification goals and potentially enhance the returns on our investments. At December 31, 2019, our debt was approximately 60% of the value of our properties, as determined by the most recent valuations performed by an independent third-party appraiser as of December 31, 2019. Going forward, we expect that our borrowings (after debt amortization) will be approximately 55% to 65% of the value of our properties and other real estate-related assets. Under our Articles of Amendment and Restatement, which we refer to as our “charter,” we are prohibited from borrowing in excess of 300% of the value of our net assets which generally approximates to 75% of the aggregate cost of our assets unless such excess is approved by a majority of the independent directors and disclosed to stockholders, along with a justification for such excess, in our next quarterly report. In such event, we will monitor our debt levels and take action to reduce any such excess as soon as practicable. Our aggregate borrowings are reviewed by our board of directors at least quarterly. At December 31, 2019, our borrowings were not in excess of 300% of the value of our net assets.

Employees

We have no paid employees. The employees of our advisor and its affiliates provide management, acquisition, advisory and certain administrative services for us.

Competition

We are subject to significant competition in seeking real estate investments and residents. We compete with many third parties engaged in real estate investment activities, including other REITs, specialty finance companies, savings and loan associations, banks, mortgage bankers, insurance companies, mutual funds, institutional investors, investment banking firms, lenders, hedge funds, governmental bodies and other entities. Many of our competitors have substantially greater financial and other resources than we have and may have substantially more operating experience than us. They may also enjoy significant competitive advantages that result from, among other things, a lower cost of capital.

The multifamily property market in particular is highly competitive. This competition could reduce occupancy levels and revenues at our multifamily properties, which would adversely affect our operations. We face competition from many sources, including from other multifamily properties in our target markets. In addition, overbuilding of multifamily properties may occur, which would increase the number of multifamily homes available and may decrease occupancy and unit rental rates. Furthermore, multifamily properties we acquire most likely compete, or will compete, with numerous housing alternatives in attracting residents, including owner occupied single- and multifamily homes available to rent or purchase. Competitive housing in a particular area and the increasing affordability of owner occupied single- and multifamily homes available to rent or buy could adversely affect our ability to retain our residents, lease apartment homes and increase or maintain rental rates.

We may also compete with affiliates of our sponsor that have similar investment objectives as us. To the extent that we compete with any other program affiliated with our sponsor for investments, our sponsor will face potential conflicts of interest and there is a risk that our sponsor will select investment opportunities for us that provide lower returns than the investments selected for other such programs, or that certain otherwise attractive investment opportunities will not be available to us.

6

Regulations

Our investments are subject to various federal, state, and local laws, ordinances, and regulations, including, among other things, zoning regulations, land use controls, environmental controls relating to air and water quality, noise pollution, and indirect environmental impacts such as increased motor vehicle activity. We believe that we have all permits and approvals necessary under current law to operate our investments.

Income Taxes

We elected to be taxed as a REIT under the Internal Revenue Code, and operated as such commencing with the taxable year ended December 31, 2014. To continue to qualify as a REIT, we must meet certain organizational and operational requirements, including requirements relating to the nature of our income and assets and the requirement to distribute at least 90% of our annual REIT taxable income to our stockholders (which is computed without regard to the dividends paid deduction or net capital gain and which does not necessarily equal net income as calculated in accordance with GAAP). As a REIT, we generally will not be subject to federal income tax to the extent we distribute qualifying dividends to our stockholders. If we fail to qualify as a REIT in any taxable year, we would be subject to federal income tax on our taxable income at regular corporate income tax rates and generally would not be permitted to qualify for treatment as a REIT for federal income tax purposes for the four taxable years following the year during which qualification is lost unless we are eligible for relief under certain statutory provisions.

Financial Information About Industry Segments

Our current business consists of owning, managing, operating, leasing, acquiring, developing, investing in, and disposing of real estate assets. We internally evaluate all of our real estate assets as one industry segment, and, accordingly, we do not report segment information.

Available Information

We are subject to the reporting requirements of the Exchange Act and, accordingly, we file annual reports, quarterly reports and other information with the Securities and Exchange Commission, or SEC. Access to copies of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the SEC, including amendments to such filings, may be obtained free of charge from our website, http://www.steadfastreits.com. These filings are available promptly after we file them with, or furnish them to, the SEC. We are not incorporating our website or any information from the website into this annual report. The SEC also maintains a website, http://www.sec.gov, that contains our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Report on Form 8-K and other filings with the SEC. Access to these filings is free of charge.

ITEM 1A. RISK FACTORS

The following are some of the risks and uncertainties that could cause our actual results to differ materially from those presented in our forward-looking statements. The risks and uncertainties described below are not the only ones we face but do represent those risks and uncertainties that we believe are material to us. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also harm our business. References to “shares” and “our common stock” refer to the shares of common stock of Steadfast Apartment REIT, Inc.

General Investment Risks

From inception through December 31, 2019, we have experienced annual net losses and may experience similar losses in the future.

From inception through December 31, 2019, we incurred a net loss of $221,552,200. We cannot assure you that we will be profitable in the future or that we will recognize growth in the value of our assets.

There is no public trading market for shares of our common stock and we are not required to effectuate a liquidity event by a certain date. As a result, it will be difficult for you to sell your shares of common stock and, if you are able to sell your shares, you are likely to sell them at a substantial discount. Our stockholders also are limited in their ability to sell shares pursuant to our share repurchase plan and may have to hold their shares for an indefinite period of time.

There is no public market for the shares of our common stock and we have no obligation to list our shares on any public securities market or provide any other type of liquidity to our stockholders by a particular date. It is anticipated that our board of directors will consider a liquidity event within five years after the completion of our offering stage; however, the timing of

7

any such event would be significantly dependent upon economic and market conditions. We terminated our initial public offering on March 24, 2016. Because there is no public trading market for shares of common stock, it will be difficult for you to sell your shares of common stock. Even if you are able to sell your shares of common stock, the absence of a public market may cause the price received for any shares of our common stock sold to be less than what you paid or less than your proportionate value of the assets we own. We have adopted a share repurchase plan but it is limited in terms of the amount of shares that stockholders may sell to us each quarter. Our board of directors can amend, suspend, or terminate our share repurchase plan upon 30 days’ notice. The restrictions of our share repurchase plan limit our stockholders’ ability to sell their shares should they require liquidity and limit our stockholders’ ability to recover the value they invested. See Item 5. “Market for Registrant’s Common Equity, Related Stockholder Matters and Purchases of Equity Securities—Share Repurchase Plan” for more information regarding the limitations of our share repurchase plan. As a result, you should be prepared to hold your shares for an indefinite period of time.

We have paid, and it is likely we will continue to pay, distributions from sources other than our cash flow from operations. To the extent that we pay distributions from sources other than our cash flow from operations, we will have reduced funds available for investment and the overall return to our stockholders may be reduced.

Our organizational documents permit us to pay distributions from any source, including net proceeds from our public offerings, borrowings, advances from our sponsor or advisor and the deferral of fees and expense reimbursements by our advisor, in its sole discretion. To the extent that our cash flow from operations has been or is insufficient to fully cover our distributions, we have paid, and may continue to pay, distributions from sources other than cash flow from operations. We have not established a limit on the amount of proceeds from our public or private securities offerings, or other sources other than cash flow from operations, which we may use to fund distributions.

If we are unable to consistently fund distributions to our stockholders entirely from our cash flow from operations, the value of your shares upon a listing of our common stock, the sale of our assets or any other liquidity event may be reduced. To the extent that we fund distributions from sources other than our cash flow from operations, our funds available for investment will be reduced relative to the funds available for investment if our distributions were funded solely from cash flow from operations, our ability to achieve our investment objectives will be negatively impacted and the overall return to our stockholders may be reduced. In addition, if we make a distribution in excess of our current and accumulated earnings and profits, the distribution will be treated first as a tax-free return of capital, which will reduce the stockholder’s tax basis in its shares of common stock. The amount, if any, of each distribution in excess of a stockholder’s tax basis in its shares of common stock will be taxable as gain realized from the sale or exchange of property.

For the year ended December 31, 2019, we paid aggregate distributions of $46,903,773, including $25,681,391 of distributions paid in cash and 1,354,560 shares of our common stock issued pursuant to our distribution reinvestment plan for $21,222,382. For the year ended December 31, 2019, our net loss was $38,524,316, we had FFO of $23,604,194 and net cash provided by operations of $29,078,255. For the year ended December 31, 2019, we funded $29,078,255, or 62%, and $17,825,518, or 38%, of total distributions paid, including shares issued pursuant to our distribution reinvestment plan, from cash flow from operations and funds equal to amounts reinvested in the STAR DRP, respectively. Since inception, of the $198,592,501 in total distributions paid through December 31, 2019, including shares issued pursuant to our distribution reinvestment plan, we funded $137,568,170 or 70% from cash flow from operations, $40,370,171, or 20%, from funds equal to amounts reinvested in our distribution reinvestment plan and $20,654,160, or 10%, from offering proceeds. For information on how we calculate FFO and the reconciliation of FFO to net loss, see Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Funds from Operations and Modified Funds from Operations.”

Our success is dependent on the performance of our advisor and its affiliates and any adverse change in their financial health could cause our operations to suffer.

Our ability to achieve our investment objectives and to pay distributions is dependent upon the performance of our advisor and its affiliates and any adverse change in their financial health could cause our operations to suffer. Our advisor and its affiliates are sensitive to trends in the general economy, as well as the commercial real estate and credit markets. An economic downturn could result in reductions in overall transaction volume and size of sales and leasing activities, which could put downward pressure on our advisor’s and its affiliates’ revenues and operating results. To the extent that any decline in revenues and operating results impacts the performance of our advisor and its affiliates, our financial condition could suffer.

We have paid substantial fees and expenses to our advisor and its affiliates. These fees were not negotiated at arm’s-length, may be higher than fees payable to unaffiliated third parties and may reduce cash available for investment.

A portion of the offering proceeds from the sale of our shares in our public offering was used to pay fees and expenses to our advisor and its affiliates. These fees were not negotiated at arm’s-length and may be higher than fees payable to unaffiliated third parties. In addition, the full offering price paid by stockholders was not invested in properties. As a result, stockholders will only receive a full return of their invested capital if we either (1) sell our assets or the Company for a sufficient amount in

8

excess of the original purchase price of our assets or (2) the market value of the Company after we list our shares of common stock on a national securities exchange is substantially in excess of the original purchase price of our assets.

The geographic concentration of our portfolio may make us particularly susceptible to adverse economic developments in the real estate markets of those areas.

In addition to general, regional and national economic conditions, our operating results are impacted by the economic conditions of the specific markets in which we have concentrations of properties. As of December 31, 2019, of the $1,451,454,728 contract price of our real estate assets, 22% was located in the Atlanta, Georgia metropolitan statistical area, 20% was located in the Dallas/Fort Worth, Texas metropolitan statistical area and 13% was located in the Nashville, Tennessee metropolitan statistical area. Any adverse economic or real estate developments in these markets, such as business layoffs or downsizing, industry slowdowns, relocations of businesses, changing demographics and other factors, or any decrease in demand for multifamily property space resulting from the local business climate, could adversely affect our property revenue resulting in a lower NOI.

Financial regulatory reforms could have a significant impact on our business, financial condition and results of operations.

On July 21, 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act, was signed into law. The Dodd-Frank Act represents a significant change in the American financial regulatory environment and impacts nearly every aspect of the U.S. financial services industry. The Dodd-Frank Act requires various federal agencies to adopt hundreds of new rules to implement the Dodd-Frank Act and to deliver to Congress numerous studies and reports that may influence future legislation. The Dodd-Frank Act leaves significant discretion to federal agencies as to exactly how to implement the broad provisions of the Dodd-Frank Act. Some provisions of the Dodd-Frank Act are subject to rulemaking and will take effect over several years, making it difficult to anticipate the overall impact on us. The changes resulting from the Dodd-Frank Act may impact the profitability of business activities, require changes to certain business practices, impose more stringent capital, liquidity and leverage requirements or otherwise adversely affect our business.

A cybersecurity incident and other technology disruptions could negatively impact our business.

We use technology in substantially all aspects of our business operations. We also use mobile devices, social networking, outside vendors and other online activities to connect with our residents, suppliers and employees of our affiliates. Such uses give rise to potential cybersecurity risks, including security breach, espionage, system disruption, theft and inadvertent release of information. Our business involves the storage and transmission of numerous classes of sensitive and confidential information and intellectual property, including residents’ and suppliers’ personal information, private information about employees of our affiliates, and financial and strategic information about us. If we fail to assess and identify cybersecurity risks associated with our operations, we may become increasingly vulnerable to such risks. Additionally, the measures we have implemented to prevent security breaches and cyber incidents may not be effective. The theft, destruction, loss, misappropriation, or release of sensitive and/or confidential information or intellectual property, or interference with our information technology systems or the technology systems of third parties on which we rely, could result in business disruption, negative publicity, brand damage, violation of privacy laws, loss of residents, potential liability and competitive disadvantage, any of which could result in a material adverse effect on our financial condition or results of operations.

Our board of directors determined an estimated value per share of $15.84 for our shares of common stock as of December 31, 2018. You should not rely on the estimated value per share as being an accurate measure of the current value of our shares of common stock.

On March 12, 2019, our board of directors determined an estimated value per share of our common stock of $15.84 as of December 31, 2018. Our board of directors’ objective in determining the estimated value per share was to arrive at a value, based on the most recent data available, that it believed was reasonable based on methodologies that it deemed appropriate after consultation with our advisor. However, the market for commercial real estate can fluctuate quickly and substantially and the value of our assets is expected to change in the future and may decrease. Also, our board of directors did not consider certain other factors, such as a liquidity discount to reflect the fact that our shares are not currently traded on a national securities exchange and the limitations on the ability to redeem shares pursuant to our share repurchase plan.

As with any valuation methodology, the methodologies used to determine the estimated value per share were based upon a number of assumptions, estimates and judgments that may not be accurate or complete. Our assets have been valued based upon appraisal standards and the value of our assets using these methodologies are not required to be a reflection of market value under those standards and will not result in a reflection of fair value under GAAP. Further, different parties using different property-specific and general real estate and capital market assumptions, estimates, judgments and standards could derive a different estimated value per share, which could be significantly different from the estimated value per share determined by our board of directors. The estimated value per share does not represent the fair value of our assets less liabilities in accordance with United States GAAP as of December 31, 2018. The estimated value per share is not a representation or indication that: a stockholder would be able to realize the estimated value per share if he or she attempts to sell shares; a

9

stockholder would ultimately realize distributions per share equal to the estimated value per share upon liquidation of assets and settlement of our liabilities or upon a sale of our company; shares of our common stock would trade at the estimated value per share on a national securities exchange; a third party would offer the estimated value per share in an arm’s-length transaction to purchase all or substantially all of our shares of common stock; or the methodologies used to estimate the value per share would be acceptable to FINRA or compliant with the Employee Retirement Income Security Act of 1974, or ERISA, the Internal Revenue Code or other applicable law, or the applicable provisions of a retirement plan or individual retirement plan, or IRA, with respect to their respective requirements. Further, the estimated value per share was calculated as of a moment in time and the value of our shares will fluctuate over time as a result of, among other things, future acquisitions or dispositions of assets (including acquisitions and dispositions of real estate investments since December 31, 2018), developments related to individual assets and changes in the real estate and capital markets. For additional information on the calculation of our estimated value per share as of December 31, 2018, see Item 5. “Market for Registrant’s Common Equity, Related Stockholder Matters and Purchases of Equity Securities—Estimated Value Per Share.”

We intend to establish an updated estimated value per share following the completion of the mergers, which closed on March 6, 2020. We expect that the estimated value per share will be as of March 6, 2020, and will be reported by us in a Current Report on Form 8-K. This updated estimated value per share will be subject to the same risks described above.

If we internalize our management functions, we could incur other significant costs associated with being self-managed.

Our advisor notified us that it intends to present a proposal to our special committee within 60 days of the closing of the mergers regarding a possible internalization of management, whereby our advisor would sell, and we would acquire, our advisor or certain assets of our advisor and its affiliates. Such a transaction, if consummated, likely would include an amendment to the advisory agreement with our advisor to permit our advisor or its affiliates to receive consideration for internalization. We cannot reasonably estimate the form of or amount of consideration that may be paid as consideration in exchange for the sale and the impact it would have on funds available to distribute to our stockholders.

If our board of directors elects to internalize management functions, we may elect to negotiate to acquire our advisor’s assets and hire our advisor’s personnel. Pursuant to our advisory agreement with our advisor, we are not allowed to solicit or hire any of our advisor’s personnel without our advisor’s prior written consent. While we would no longer bear the costs of the various fees and expenses we expect to pay to our advisor under the advisory agreement, our direct expenses would include general and administrative costs, including legal, accounting and other expenses related to asset management fees. We would also be required to employ personnel and would be subject to potential liabilities commonly faced by employers, such as workers’ disability and compensation claims, potential labor disputes and other employee-related liabilities and grievances as well as incur the compensation and benefits costs of our officers and other employees and consultants that are paid by our advisor or its affiliates. We may issue equity awards to officers, employees and consultants, which awards would decrease net income and FFO and may further dilute your investment. We cannot reasonably estimate the amount of fees to our advisor we would save or the costs we would incur if we became self-managed. If the expenses we assume, plus the costs to acquire the advisor and or its assets as a result of an internalization, are higher than the expenses we avoid paying to our advisor, our FFO would be lower as a result of the internalization than they otherwise would have been, potentially decreasing the amount of funds available to distribute to our stockholders.

The outbreak of widespread contagious disease, such as the Coronavirus, could adversely impact the value of our investments, the ability to meet our capital and operating needs or make cash distributions to our stockholders.

The widespread outbreak of infectious or contagious disease, such as H1N1 influenza (swine flu), avian bird flu, SARS, the Coronavirus and Zika virus, could adversely impact our ability to generate income sufficient to meet operating expenses or generate income and capital appreciation, if any, at rates lower than those anticipated or available through investments in comparable real estate or other investments.

We also may depend on access to third-party sources to continue our investing activities and pay distributions to our stockholders. Our access to third-party sources depends on, in part, general market conditions, including conditions that are out of our control, such as the impact of health and safety concerns like the current Coronavirus outbreak.

As of the date of this annual report, the recent outbreak of the Coronavirus appears to be principally concentrated in China, although cases have been confirmed in other countries and regions, including the United States. The extent to which our business may be affected by the Coronavirus will largely depend on future developments with respect to the continued spread and treatment of the virus, which we cannot accurately predict. New information and developments may emerge concerning the severity of the Coronavirus and the actions to contain the Coronavirus or treat its impact. Our business and financial results could be materially and adversely impacted.

10

Disruptions in the financial markets and deteriorating economic conditions could adversely impact our ability to implement our investment strategy and achieve our investment objectives.

United States and global financial markets experienced extreme volatility and disruption from 2008 to 2010. There was a widespread tightening in overall credit markets, devaluation of the assets underlying certain financial contracts, and increased borrowing by governmental entities. The turmoil in the capital markets during the most recent recession resulted in constrained equity and debt capital available for investment in the real estate market, resulting in fewer buyers seeking to acquire properties, increases in capitalization rates and lower property values. During the subsequent economic recovery, capital has been more available and the overall economy has improved. However, the failure of a sustained economic recovery or future disruptions in the financial markets and deteriorating economic conditions could impact the value of our investments in properties. In addition, if potential purchasers of properties have difficulty obtaining capital to finance property acquisitions, capitalization rates could increase and property values could decrease. Current economic conditions greatly increase the risks of our investments. See “—Risks Related to Investments in Real Estate.”

Events in U.S. financial markets have had, and may continue to have, a negative impact on the terms and availability of credit, which could have an adverse effect on our business and our results of operations.

The failure of large U.S. financial institutions in 2009 and the resulting turmoil in the U.S. financial sector had a negative impact on the terms and availability of credit within the United States. The tightening of the U.S. credit markets resulted in a lack of adequate credit. Some lenders continue to impose more stringent restrictions on the terms of credit, including shorter terms and more conservative loan-to-value underwriting than was previously customary. The negative impact of the tightening credit markets may limit our ability to finance the acquisition of properties on favorable terms, if at all, and may result in increased financing costs or financing with increasingly restrictive covenants.

We are uncertain of our sources for funding our future capital needs. If we do not have sufficient funds from operations to cover our expenses or to fund improvements to our real estate and cannot obtain debt or equity financing on acceptable terms, our ability to cover our expenses or to fund improvements to our real estate will be adversely affected.

We terminated our initial public offering on March 24, 2016. In the event that we develop a need for additional capital in the future for the repayment of maturing debt obligations, the improvement of our real properties or for any other reason, sources of funding may not be available to us. If we do not have sufficient funds from cash flow generated by our investments or out of net sale proceeds, or cannot obtain debt or equity financing on acceptable terms, our financial condition and ability to make distributions may be adversely affected.

Risks Relating to Our Organizational Structure

Maryland law and our organizational documents limit your right to bring claims against our officers and directors.

Maryland law provides that a director will not have any liability as a director so long as he or she performs his or her duties in accordance with the applicable standard of conduct. In addition, our charter provides that, subject to the applicable limitations set forth therein or under Maryland law, no director or officer will be liable to us or our stockholders for monetary damages. Our charter also provides that we will generally indemnify our directors, our officers, our advisor and its affiliates for losses they may incur by reason of their service in those capacities unless their act or omission was material to the matter giving rise to the proceeding and was committed in bad faith or was the result of active and deliberate dishonesty, they actually received an improper personal benefit in money, property or services or, in the case of any criminal proceeding, they had reasonable cause to believe the act or omission was unlawful. Moreover, we have entered into separate indemnification agreements with each of our directors and executive officers. As a result, we and our stockholders may have more limited rights against these persons than might otherwise exist under common law. In addition, we may be obligated to fund the defense costs incurred by these persons. However, our charter provides that we may not indemnify our directors, our advisor and its affiliates for loss or liability suffered by them or hold our directors or our advisor and its affiliates harmless for loss or liability suffered by us unless they have determined that the course of conduct that caused the loss or liability was in our best interests, they were acting on our behalf or performing services for us, the liability was not the result of negligence or misconduct by our non-independent directors, our advisor and its affiliates or gross negligence or willful misconduct by our independent directors, and the indemnification or agreement to hold harmless is recoverable only out of our net assets, including the proceeds of insurance, and not from the stockholders. As a result of these limitations on liability and indemnification provisions and agreements, we and our stockholders may be entitled to a more limited right of action than we would otherwise have if indemnification rights were not granted.

The limit on the percentage of shares of our common stock that any person may own may discourage a takeover or business combination that may benefit our stockholders.

Our charter restricts the direct or indirect ownership by one person or entity to no more than 9.8% of the value of our then outstanding capital stock (which includes common stock and any preferred stock we may issue) and no more than 9.8% of the

11

value or number of shares, whichever is more restrictive, of our then outstanding common stock unless exempted (prospectively or retroactively) by our board of directors. These restrictions may discourage a change of control of us and may deter individuals or entities from making tender offers for shares of our common stock on terms that might be financially attractive to stockholders or which may cause a change in our management. In addition to deterring potential transactions that may be favorable to our stockholders, these provisions may also decrease your ability to sell your shares of our common stock.

Our stockholders’ voting interest in us would be diluted if we issue additional shares.

Existing stockholders do not have preemptive rights to any shares issued by us in the future. Under our charter, we have authority to issue a total of 1,100,000,000 shares of capital stock, of which 999,998,000 shares are classified as common stock with a par value of $0.01 per share, 100,000,000 shares are classified as preferred stock with a par value of $0.01 per share, 1,000 shares are classified as convertible stock with a par value of $0.01 per share, and 1,000 shares are classified as Class A convertible stock, with a par value of $0.01 per share. Subject to any limitations set forth under Maryland law, our board of directors may increase the number of authorized shares of stock, increase or decrease the number of shares of any class or series of stock designated, or reclassify any unissued shares without the necessity of obtaining stockholder approval. All such shares may be issued in the discretion of our board of directors. Therefore, existing stockholders would experience dilution of their equity investment in us if we (i) sell additional shares in the future, including those issued pursuant to our distribution reinvestment plan, (2) sell securities that are convertible into shares of our common stock, (3) issue shares of our common stock in a private offering of securities to institutional investors, (4) issue restricted shares of our common stock to our independent directors, (5) issue shares of our common stock in a merger or to sellers of properties acquired by us in connection with an exchange of limited partnership interests of our operating partnership. Because the limited partnership interests of our operating partnership may, in the discretion of our board of directors, be exchanged for shares of our common stock, any merger, exchange or conversion between our operating partnership and another entity ultimately could result in the issuance of a substantial number of shares of our common stock, thereby diluting the percentage ownership interest of other stockholders. Because of these and other reasons, our stockholders may experience substantial dilution in their percentage ownership of our shares.

We may issue preferred stock or other classes of common stock, which issuance could adversely affect the existing holders of our common stock.

Our stockholders do not have preemptive rights to any shares issued by us in the future. We may issue, without stockholder approval, preferred stock or other classes of common stock with rights that could dilute the value of your shares of common stock. However, the issuance of preferred stock must also be approved by a majority of our independent directors not otherwise interested in the transaction, who will have access, at our expense, to our legal counsel or to independent legal counsel. The issuance of preferred stock or other classes of common stock could increase the number of stockholders entitled to distributions without simultaneously increasing the size of our asset base. Under our charter, we have authority to issue a total of 1,100,000,000 shares of capital stock, of which 999,998,000 shares are classified as common stock with a par value of $0.01 per share, 100,000,000 shares are classified as preferred stock with a par value of $0.01 per share, 1,000 shares are classified as convertible stock with a par value of $0.01per share and 1,000 shares are classified as Class A convertible stock with a par value of $0.01 per share. Our board of directors, with the approval of a majority of the entire board of directors and without any action by our stockholders, may amend our charter from time to time to increase or decrease the aggregate number of shares of capital stock or the number of shares of capital stock of any class or series that we have authority to issue. If we ever created and issued preferred stock with a distribution preference over common stock, payment of any distribution preferences of outstanding preferred stock would reduce the amount of funds available for the payment of distributions on our common stock. Further, holders of preferred stock are normally entitled to receive a preference payment in the event we liquidate, dissolve or wind up before any payment is made to our common stockholders, likely reducing the amount common stockholders would otherwise receive upon such an occurrence. In addition, under certain circumstances, the issuance of preferred stock or a separate class or series of common stock may render more difficult or tend to discourage a merger, tender offer or proxy contest, the assumption of control by a holder of a large block of our securities, or the removal of incumbent management.

Your investment will be diluted upon conversion of the Class A convertible stock.

We have issued 1,000 shares of our Class A convertible stock, or the Class A convertible stock, to our advisor for an aggregate purchase price of $1,000. Under limited circumstances, each outstanding share of our Class A convertible stock may be converted into shares of our common stock, which will have a dilutive effect to our stockholders. Our Class A convertible stock will be converted into shares of our common stock if (1) we have made total distributions of money or other property by us, SIR and STAR III to their respective holders of common shares (with respect to SIR and STAR III, in each case prior to the closing of the mergers), which we refer to collectively as the “Class A Distributions,” equal to the original issue price of our shares of common stock, shares of common stock of SIR and shares of common stock of STAR III, or the Common Equity, plus an aggregate 6.0% cumulative, non-compounded, annual return on the original issue price of those shares, (2) we list our common stock for trading on a national securities exchange or enter into a merger whereby holders of our common stock receive listed securities of another issuer or (3) our advisory agreement is terminated or not renewed (other than for “cause” as

12

defined in our advisory agreement), each referred to as a “Triggering Event.” Upon any of these Triggering Events, each share of Class A convertible stock will be converted into a number of shares of our common stock equal to 1/1000 of the quotient of (A) 15% of the amount, if any, by which (i) the “Class A Enterprise Value” plus the aggregate value of the Class A Distributions paid to date on the Common Equity exceeds (ii) the aggregate purchase price paid by stockholders for the Common Equity plus an aggregated 6.0% cumulative, non-compounded, annual return on the original issue price of the Common Equity as of the date of the Triggering Event, divided by (B) the Class A Enterprise Value divided by the number of our outstanding common shares on an as-converted basis as of the date of the Triggering Event. In the event of a termination or non-renewal of our advisory agreement for cause, all of the shares of the convertible stock will be repurchased by us for $1.00. Upon the issuance of our common stock in connection with the conversion of the convertible stock, then-existing stockholders’ interests in us will be diluted.

The conversion of the Class A convertible stock held by our advisor due upon termination of the advisory agreement and the voting rights granted to the holder of our Class A convertible stock may discourage a takeover attempt or prevent us from effecting a merger that otherwise would have been in the best interests of our stockholders.

If we engage in a merger in which we are not the surviving entity or our advisory agreement is terminated without cause, our advisor may be entitled to conversion of the shares of our Class A convertible stock it holds and to require that we purchase all or a portion of the limited partnership interests in our operating partnership that it holds at any time thereafter for cash or our common stock. The existence of this Class A convertible stock may deter a prospective acquirer from bidding on our company, which may limit the opportunity for stockholders to receive a premium for their stock that might otherwise exist if an investor attempted to acquire us through a merger.

The affirmative vote of two-thirds of the outstanding shares of Class A convertible stock, voting as a single class, will be required (1) for any amendment, alteration or repeal of any provision of our charter that materially and adversely changes the rights of the Class A convertible stock and (2) to effect a merger of our company into another entity, or a merger of another entity into our company, unless in each case each share of Class A convertible stock (A) will remain outstanding without a material and adverse change to its terms and rights or (B) will be converted into or exchanged for shares of stock or other ownership interest of the surviving entity having rights identical to that of our Class A convertible stock (except for changes that do not materially and adversely affect the holders of the Class A convertible stock). In the event that we propose to merge with or into another entity, including another REIT, our advisor could, by exercising these voting rights, determine whether or not we are able to complete the proposed transaction. By voting against a proposed merger, our advisor could prevent us from effecting the merger, even if the merger otherwise would have been in the best interests of our stockholders.

Our UPREIT structure may result in potential conflicts of interest with limited partners in our operating partnership whose interests may not be aligned with those of our stockholders.

Limited partners in our operating partnership have the right to vote on certain amendments to the operating partnership agreement, as well as on certain other matters. Persons holding such voting rights may exercise them in a manner that conflicts with the interests of our stockholders. As general partner of our operating partnership, we are obligated to act in a manner that is in the best interest of all partners of our operating partnership. Circumstances may arise in the future when the interests of limited partners in our operating partnership may conflict with the interests of our stockholders. These conflicts may be resolved in a manner stockholders do not believe are in their best interest.

We may change our targeted investments and investment guidelines without our stockholders’ consent.

Our board of directors may change our targeted investments and investment guidelines at any time without the consent of our stockholders, which could result in our making investments that are different from, and possibly riskier than, the investments described in this Annual Report on Form 10-K. A change in our targeted investments or investment guidelines may increase our exposure to interest rate risk, default risk and real estate market fluctuations, all of which could adversely affect the value of our common stock and our ability to make distributions to our stockholders.

Our bylaws designate the Circuit Court for Baltimore City, Maryland as the sole and exclusive forum for certain actions and proceedings that may be initiated by our stockholders.

Our bylaws provide that, unless we consent in writing to the selection of an alternative forum, the Circuit Court for Baltimore City, Maryland, or, if that Court does not have jurisdiction, the U.S. District Court for the District of Maryland, Baltimore Division, will be the sole and exclusive forum for: (1) any derivative action or proceeding brought on our behalf, (2) any action asserting a claim of breach of any duty owed by any of our directors or officers or employees to us or to our stockholders, (3) any action asserting a claim against us or any of our directors or officers or employees arising pursuant to any provision of the MGCL, or our charter or bylaws or (4) any action asserting a claim against us or any of our directors or officers or employees that is governed by the internal affairs doctrine. Any person or entity purchasing or otherwise acquiring or holding any interest in our shares shall be deemed to have notice of and to have consented to these provisions of our bylaws, as they may be amended from time to time. Our board of directors, without stockholder approval, adopted this provision of the

13

bylaws so that we can respond to such litigation more efficiently and reduce the costs associated with our responses to such litigation, particularly litigation that might otherwise be brought in multiple forums. This exclusive forum provision may limit a stockholder’s ability to bring a claim in a judicial forum that the stockholder believes is favorable for disputes with us or our directors, officers, agents or employees, if any, and may discourage lawsuits against us and our directors, officers, agents or employees, if any. Alternatively, if a court were to find this provision of our bylaws inapplicable to, or unenforceable in respect of, one or more of the specified types of actions or proceedings notwithstanding that the MGCL expressly provides that the charter or bylaws of a Maryland corporation may require that any internal corporate claim be brought only in courts sitting in one or more specified jurisdictions, we may incur additional costs that we do not currently anticipate associated with resolving such matters in other jurisdictions, which could adversely affect our business, financial condition and results of operations.

Our stockholders’ investment return may be reduced if we were to be required to register as an investment company under the Investment Company Act of 1940, as amended, or the 1940 Act. If we lose our exemption from registration under the 1940 Act, we would not be able to continue its business unless and until we register under the 1940 Act.

We do not intend to register as an investment company under the 1940 Act. As of December 31, 2019, we owned 32 multifamily properties and one parcel of land held for the development of apartment homes, and investments in real estate will represent the substantial majority of our total asset mix, which would not subject us to the 1940 Act. In order to maintain an exemption from regulation under the 1940 Act, we must engage primarily in the business of buying real estate.

To maintain compliance with our 1940 Act exemption, we may be unable to sell assets we would otherwise want to sell and may need to sell assets we would otherwise wish to retain. In addition, we may be required to acquire additional income- or loss-generating assets that we might not otherwise acquire or forego opportunities to acquire interests in companies that we would otherwise want to acquire. If we are required to register as an investment company but fail to do so, we would be prohibited from engaging in our business, and criminal and civil actions could be brought against us. In addition, our contracts would be unenforceable unless a court required enforcement, and a court could appoint a receiver to take control of us and liquidate our business.

Risks Related To Conflicts of Interest

We depend on our advisor and its key personnel and if any such key personnel were to cease to be affiliated with our advisor, our business could suffer.