Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - PROVIDENT FINANCIAL SERVICES INC | d859004dex992.htm |

| 8-K - 8-K - PROVIDENT FINANCIAL SERVICES INC | d859004d8k.htm |

Acquisition of SB One Bancorp (NASDAQ: SBBX) March 12, 2020 Exhibit 99.1

Forward Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about (i) the benefits of a merger (the “Merger”) between SB One Bancorp (“SB One”) and Provident Financial Services, Inc. (“Provident”), including future financial and operating results, cost savings, enhancements to revenue and accretion to reported earnings that may be realized from the Merger; (ii) Provident’s and SB One’s plans, objectives, expectations and intentions and other statements contained in this press release that are not historical facts; and (iii) other statements identified by words such as “expects” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “projects,” or words of similar meaning generally intended to identify forward-looking statements. These forward-looking statements are based upon the current beliefs and expectations of the respective managements of Provident and SB One and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control of Provident and SB One. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements because of possible uncertainties. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) the businesses of Provident and SB One may not be combined successfully, or such combination may take longer, be more difficult, time-consuming or costly to accomplish than expected; (2) the expected growth opportunities or cost savings from the Merger may not be fully realized or may take longer to realize than expected; (3) deposit attrition, operating costs, customer losses and business disruption following the Merger, including adverse effects on relationships with employees and customers, may be greater than expected; (4) the regulatory approvals required for the Merger may not be obtained on the proposed terms or on the anticipated schedule; (5) the shareholders of SB One may fail to approve the Merger; (6) legislative or regulatory changes, including changes in accounting standards, may adversely affect the businesses in which Provident and SB One are engaged; (7) the interest rate environment may further compress margins and adversely affect net interest income; (8) results may be adversely affected by continued diversification of assets and adverse changes to credit quality; (9) competition from other financial services companies in Provident’s and SB One’s markets could adversely affect operations; and (10) an economic slowdown could adversely affect credit quality and loan originations. Additional factors, that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in SB One’s and Provident’s reports (such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the Securities and Exchange Commission (the “SEC”) and available on the SEC's Internet site (http://www.sec.gov). Provident and SB One caution that the foregoing list of factors is not exclusive. All subsequent written and oral forward-looking statements concerning the proposed transaction or other matters attributable to Provident or SB One or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Provident and SB One do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statements are made.

Additional Information Important Additional Information and Where to Find It This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to the Merger. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which such offer, solicitation or sale would be unlawful. In connection with the Merger, Provident will file with the SEC a registration statement on Form S-4 (the “Registration Statement”) that will include a proxy statement of SB One and a prospectus of Provident (the “Proxy Statement/Prospectus”), and each of Provident and SB One may file with the SEC other relevant documents concerning the Merger. The definitive Proxy Statement/Prospectus will be mailed to shareholders of SB One. Shareholders and investors are urged to read the Registration Statement and the Proxy Statement/Prospectus regarding the Merger carefully and in their entirety when they become available and any other relevant documents filed with the SEC by Provident and SB One, as well as any amendments or supplements to those documents, because they will contain important information about Provident, SB One and the Merger. Free copies of the Proxy Statement/Prospectus, as well as other filings containing information about Provident and SB One, may be obtained at the SEC’s website, www.sec.gov, when they are filed. You will also be able to obtain these documents, when they are filed, free of charge, by directing a request to Provident Financial Services, Inc., 100 Wood Avenue South, P.O. Box 1001, Iselin, New Jersey 08830, Attention: Corporate Secretary, Telephone: (732) 590-9200 or to SB One Bancorp, 95 State Route 17, Paramus, New Jersey 07652, Attention: Corporate Secretary, Telephone: (844) 256-7328, or by accessing Provident’s website at www.provident.bank under the tab “Investor Relations” and then under the heading “SEC Filings” or by accessing SB One’s website at www.sbone.bank under the tab “Investor Relations” and then under the heading “SEC Filings”. The information on Provident’s and SB One’s websites is not, and shall not be deemed to be, a part of this presentation or incorporated into other filings either company makes with the SEC. Participants in the Solicitation Provident, SB One and their respective directors, and certain of their executive officers and employees may be deemed to be participants in the solicitation of proxies from the shareholders of SB One in connection with the Merger. Information about Provident’s directors and executive officers is available in its proxy statement for its 2019 annual meeting of stockholders, which was filed with the SEC on March 15, 2019, and information about SB One’s directors and executive officers is available in its proxy statement for its 2019 annual meeting of shareholders, which was filed with the SEC on March 25, 2019. Information regarding all of the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement/Prospectus regarding the Merger and other relevant materials to be filed with the SEC when they become available. Free copies of these documents may be obtained as described in the preceding paragraph.

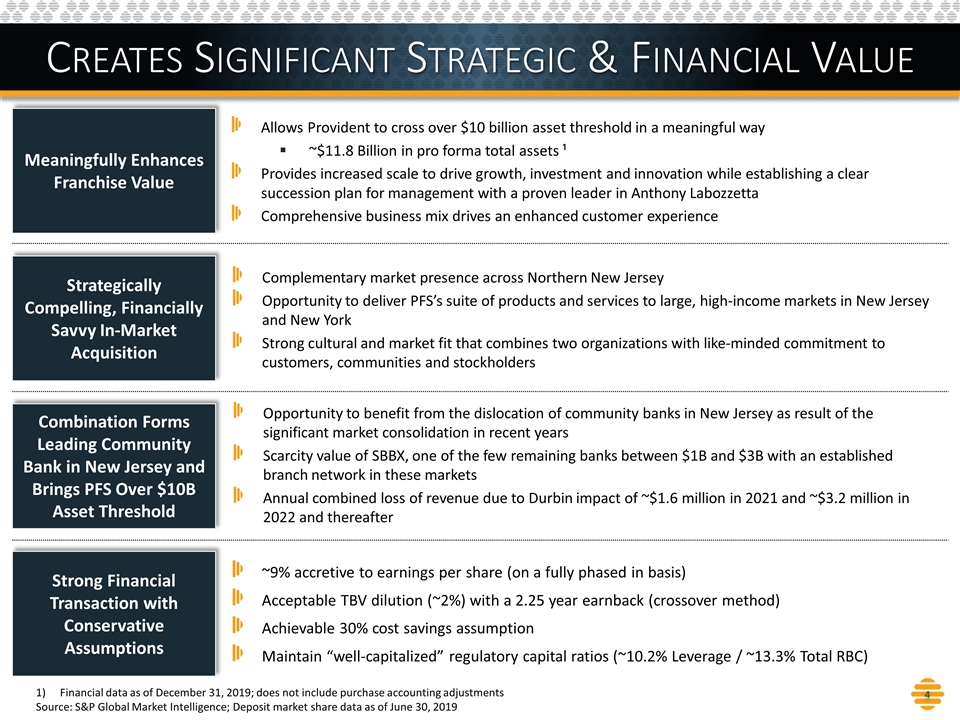

Creates Significant Strategic & Financial Value ~9% accretive to earnings per share (on a fully phased in basis) Acceptable TBV dilution (~2%) with a 2.25 year earnback (crossover method) Achievable 30% cost savings assumption Maintain “well-capitalized” regulatory capital ratios (~10.2% Leverage / ~13.3% Total RBC) Strong Financial Transaction with Conservative Assumptions Combination Forms Leading Community Bank in New Jersey and Brings PFS Over $10B Asset Threshold Allows Provident to cross over $10 billion asset threshold in a meaningful way ~$11.8 Billion in pro forma total assets ¹ Provides increased scale to drive growth, investment and innovation while establishing a clear succession plan for management with a proven leader in Anthony Labozzetta Comprehensive business mix drives an enhanced customer experience Meaningfully Enhances Franchise Value Strategically Compelling, Financially Savvy In-Market Acquisition Financial data as of December 31, 2019; does not include purchase accounting adjustments Source: S&P Global Market Intelligence; Deposit market share data as of June 30, 2019 Complementary market presence across Northern New Jersey Opportunity to deliver PFS’s suite of products and services to large, high-income markets in New Jersey and New York Strong cultural and market fit that combines two organizations with like-minded commitment to customers, communities and stockholders Opportunity to benefit from the dislocation of community banks in New Jersey as result of the significant market consolidation in recent years Scarcity value of SBBX, one of the few remaining banks between $1B and $3B with an established branch network in these markets Annual combined loss of revenue due to Durbin impact of ~$1.6 million in 2021 and ~$3.2 million in 2022 and thereafter

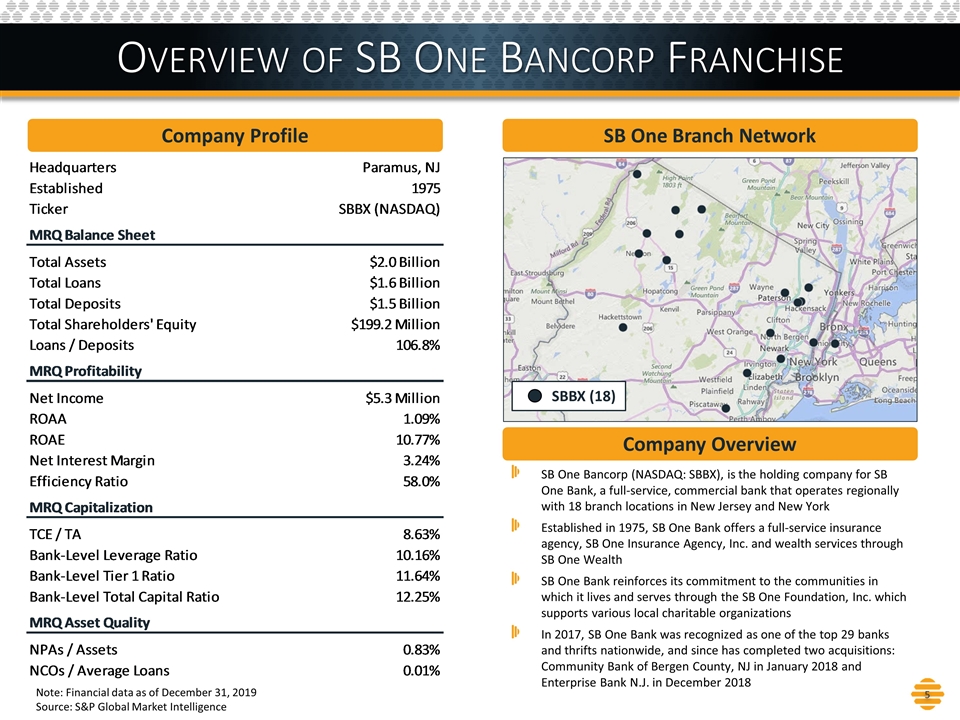

Overview of SB One Bancorp Franchise Company Profile Company Overview SB One Branch Network SB One Bancorp (NASDAQ: SBBX), is the holding company for SB One Bank, a full-service, commercial bank that operates regionally with 18 branch locations in New Jersey and New York Established in 1975, SB One Bank offers a full-service insurance agency, SB One Insurance Agency, Inc. and wealth services through SB One Wealth SB One Bank reinforces its commitment to the communities in which it lives and serves through the SB One Foundation, Inc. which supports various local charitable organizations In 2017, SB One Bank was recognized as one of the top 29 banks and thrifts nationwide, and since has completed two acquisitions: Community Bank of Bergen County, NJ in January 2018 and Enterprise Bank N.J. in December 2018 Note: Financial data as of December 31, 2019 Source: S&P Global Market Intelligence SBBX (18)

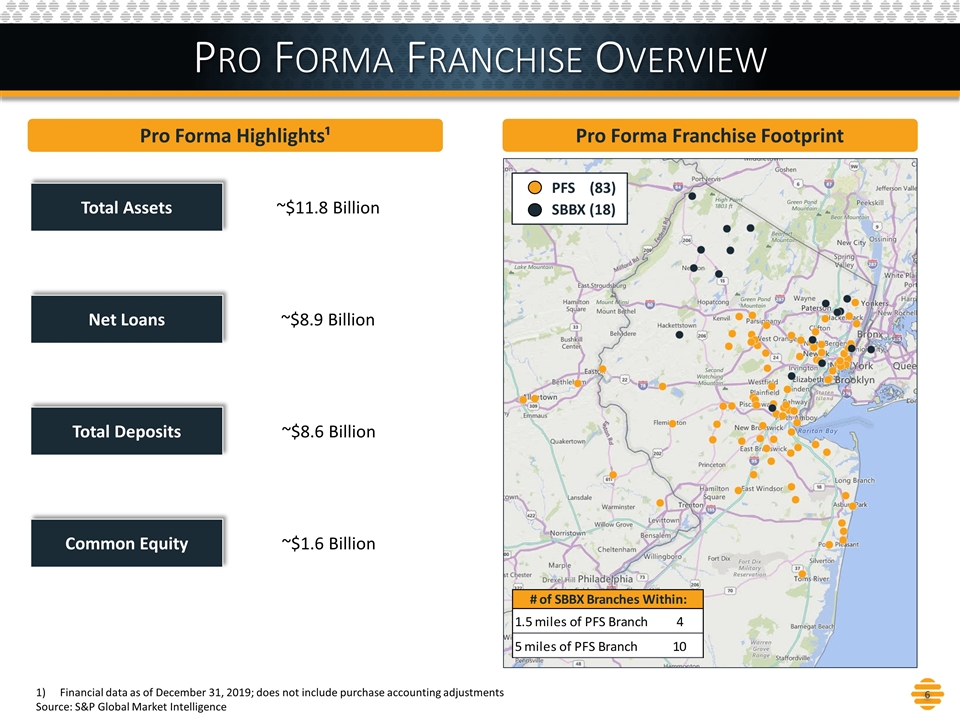

Pro Forma Franchise Overview Pro Forma Highlights¹ Pro Forma Franchise Footprint Financial data as of December 31, 2019; does not include purchase accounting adjustments Source: S&P Global Market Intelligence PFS (83) SBBX (18) Total Deposits Total Assets Net Loans Common Equity ~$8.6 Billion ~$11.8 Billion ~$8.9 Billion ~$1.6 Billion

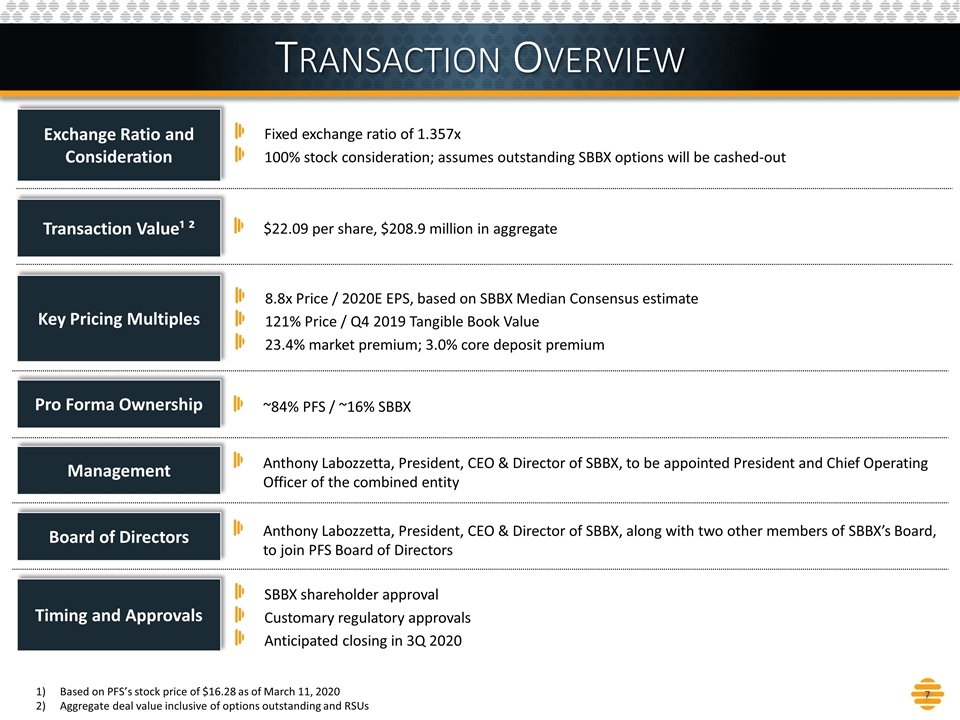

Transaction Overview Fixed exchange ratio of 1.357x 100% stock consideration; assumes outstanding SBBX options will be cashed-out Exchange Ratio and Consideration SBBX shareholder approval Customary regulatory approvals Anticipated closing in 3Q 2020 Timing and Approvals Transaction Value¹ ² $22.09 per share, $208.9 million in aggregate 8.8x Price / 2020E EPS, based on SBBX Median Consensus estimate 121% Price / Q4 2019 Tangible Book Value 23.4% market premium; 3.0% core deposit premium Key Pricing Multiples ~84% PFS / ~16% SBBX Pro Forma Ownership Anthony Labozzetta, President, CEO & Director of SBBX, to be appointed President and Chief Operating Officer of the combined entity Management Anthony Labozzetta, President, CEO & Director of SBBX, along with two other members of SBBX’s Board, to join PFS Board of Directors Board of Directors Based on PFS’s stock price of $16.28 as of March 11, 2020 Aggregate deal value inclusive of options outstanding and RSUs

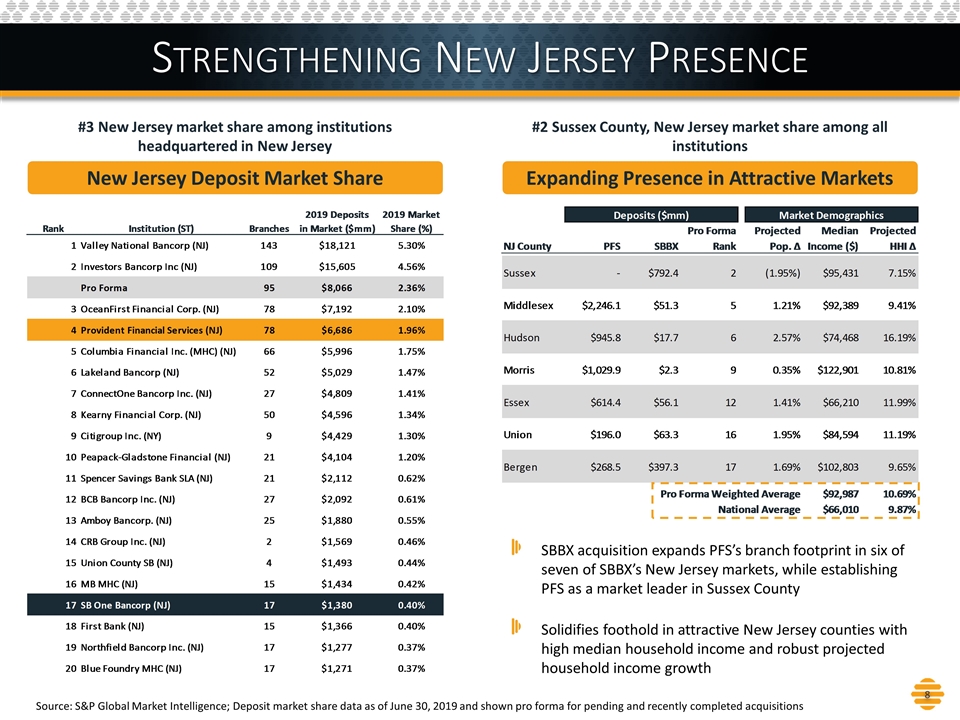

Strengthening New Jersey Presence New Jersey Deposit Market Share Expanding Presence in Attractive Markets Source: S&P Global Market Intelligence; Deposit market share data as of June 30, 2019 and shown pro forma for pending and recently completed acquisitions #3 New Jersey market share among institutions headquartered in New Jersey #2 Sussex County, New Jersey market share among all institutions SBBX acquisition expands PFS’s branch footprint in six of seven of SBBX’s New Jersey markets, while establishing PFS as a market leader in Sussex County Solidifies foothold in attractive New Jersey counties with high median household income and robust projected household income growth

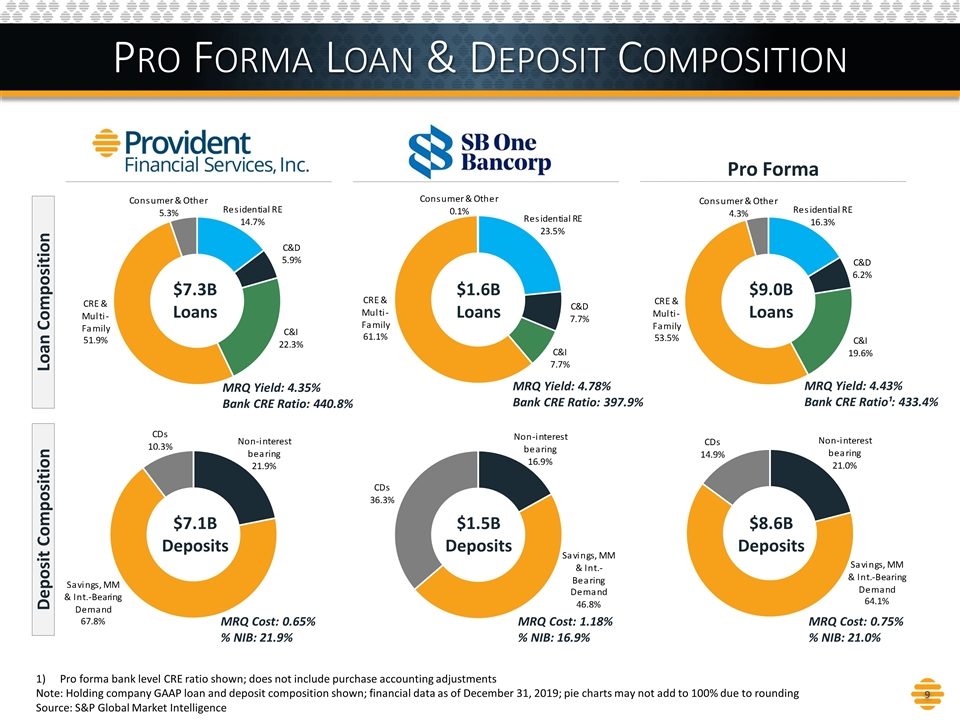

Pro Forma Loan & Deposit Composition Loan Composition Deposit Composition Pro Forma $9.0B Loans $1.6B Loans $7.3B Loans MRQ Yield: 4.35% Bank CRE Ratio: 440.8% MRQ Yield: 4.78% Bank CRE Ratio: 397.9% MRQ Yield: 4.43% Bank CRE Ratio¹: 433.4% MRQ Cost: 0.65% % NIB: 21.9% MRQ Cost: 1.18% % NIB: 16.9% MRQ Cost: 0.75% % NIB: 21.0% $8.6B Deposits $1.5B Deposits $7.1B Deposits Pro forma bank level CRE ratio shown; does not include purchase accounting adjustments Note: Holding company GAAP loan and deposit composition shown; financial data as of December 31, 2019; pie charts may not add to 100% due to rounding Source: S&P Global Market Intelligence

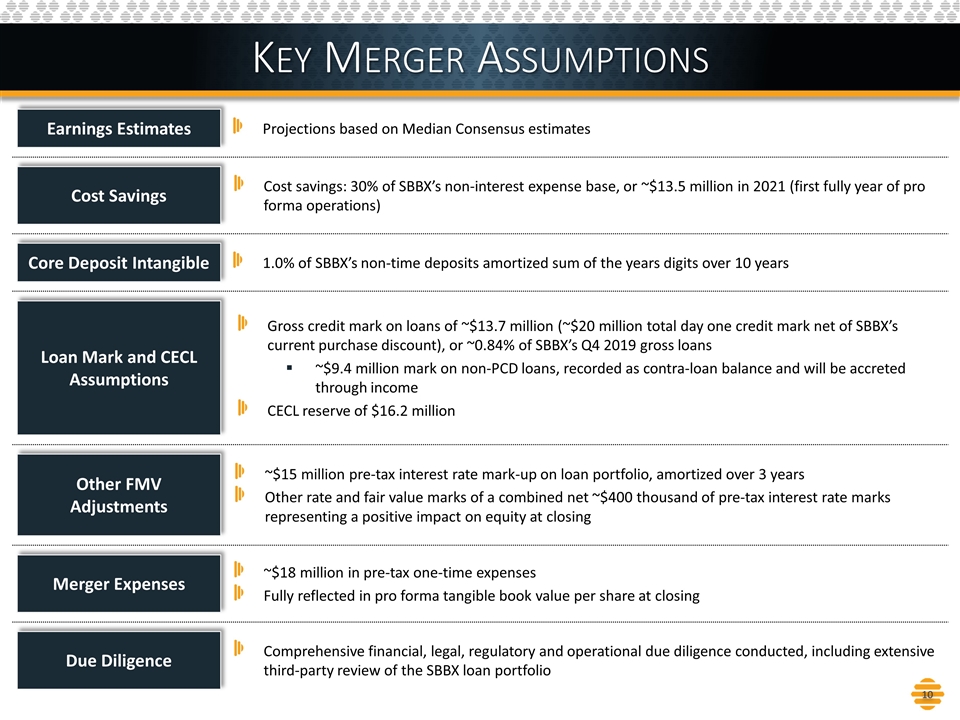

1.0% of SBBX’s non-time deposits amortized sum of the years digits over 10 years Core Deposit Intangible ~$18 million in pre-tax one-time expenses Fully reflected in pro forma tangible book value per share at closing Merger Expenses ~$15 million pre-tax interest rate mark-up on loan portfolio, amortized over 3 years Other rate and fair value marks of a combined net ~$400 thousand of pre-tax interest rate marks representing a positive impact on equity at closing Other FMV Adjustments Key Merger Assumptions Projections based on Median Consensus estimates Earnings Estimates Comprehensive financial, legal, regulatory and operational due diligence conducted, including extensive third-party review of the SBBX loan portfolio Due Diligence Cost Savings Cost savings: 30% of SBBX’s non-interest expense base, or ~$13.5 million in 2021 (first fully year of pro forma operations) Gross credit mark on loans of ~$13.7 million (~$20 million total day one credit mark net of SBBX’s current purchase discount), or ~0.84% of SBBX’s Q4 2019 gross loans ~$9.4 million mark on non-PCD loans, recorded as contra-loan balance and will be accreted through income CECL reserve of $16.2 million Loan Mark and CECL Assumptions

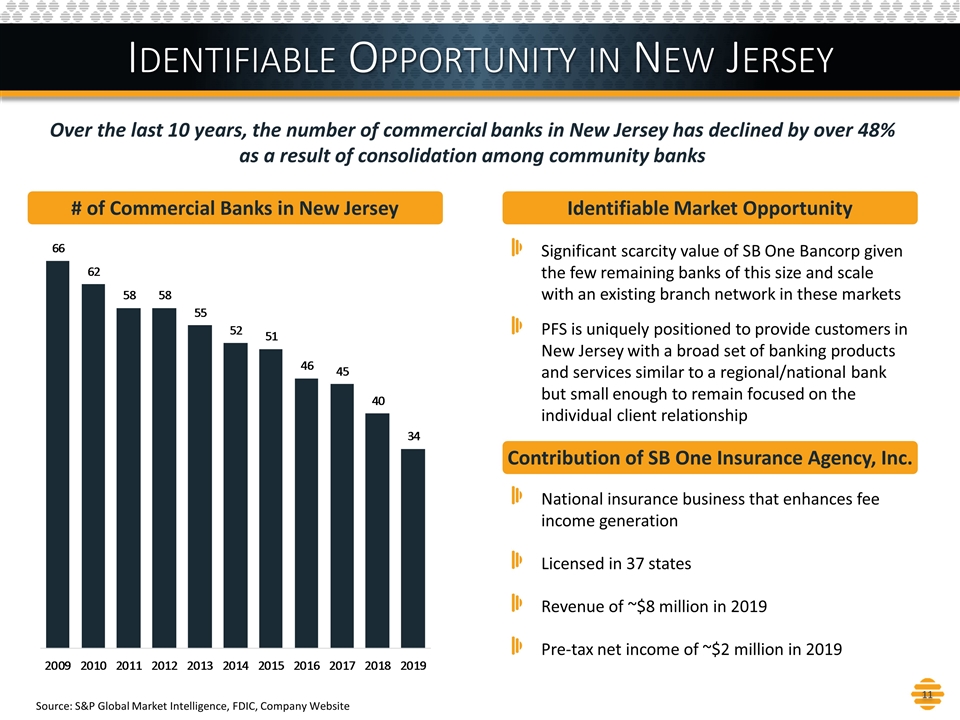

Identifiable Opportunity in New Jersey # of Commercial Banks in New Jersey Identifiable Market Opportunity Source: S&P Global Market Intelligence, FDIC, Company Website Over the last 10 years, the number of commercial banks in New Jersey has declined by over 48% as a result of consolidation among community banks Contribution of SB One Insurance Agency, Inc. Significant scarcity value of SB One Bancorp given the few remaining banks of this size and scale with an existing branch network in these markets PFS is uniquely positioned to provide customers in New Jersey with a broad set of banking products and services similar to a regional/national bank but small enough to remain focused on the individual client relationship National insurance business that enhances fee income generation Licensed in 37 states Revenue of ~$8 million in 2019 Pre-tax net income of ~$2 million in 2019

Transaction Highlights Acquisition of a high-performing bank that provides a natural extension of existing footprint ü Positioned to cross $10B asset threshold while combining compatible operating cultures ü Conservative assumptions produce a financially compelling transaction ü Pro forma #3 New Jersey deposit market share among institutions headquartered in the state ü Potential for significant efficiencies through infrastructure optimization & branch consolidation ü Solidifies a clear succession plan for management with a proven leader in Anthony Labozzetta ü