Attached files

| file | filename |

|---|---|

| EX-23.4 - EX-23.4 - AdaptHealth Corp. | a2240949zex-23_4.htm |

| EX-23.3 - EX-23.3 - AdaptHealth Corp. | a2240949zex-23_3.htm |

| EX-23.2 - EX-23.2 - AdaptHealth Corp. | a2240949zex-23_2.htm |

| EX-23.1 - EX-23.1 - AdaptHealth Corp. | a2240949zex-23_1.htm |

| EX-5.1 - EX-5.1 - AdaptHealth Corp. | a2240949zex-5_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on March 9, 2020

Registration No. 333-236011

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Pre-Effective Amendment No. 2 to FORM S-3

on

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ADAPTHEALTH CORP.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

8082 (Primary Standard Industrial Classification Code Number) |

82-3677704 (I.R.S. Employer Identification Number) |

220 West Germantown Pike, Suite 250

Plymouth Meeting, PA 19462

(610) 630-6357

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

Christopher Joyce

General Counsel

220 West Germantown Pike, Suite 250

Plymouth Meeting, PA 19462

(610) 630-6357

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

Steven Gartner

Michael Brandt

Danielle Scalzo

Willkie Farr & Gallagher LLP

787 Seventh Avenue

New York, New York 10019

Telephone: (212) 728-8000

Facsimile: (212) 718-8111

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o |

Smaller reporting company ý Emerging growth company ý |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Security |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee |

||||

|---|---|---|---|---|---|---|---|---|

Primary Offering |

||||||||

Class A Common Stock, par value $0.0001 per share ("Class A Common Stock"), issuable upon the exercise of warrants issued in the registrant's initial public offering ("public warrants") |

5,268,576 | $11.50(2) | $60,588,624.00(2) | $7,864.40(2) | ||||

Class A Common Stock, issuable upon the exercise of warrants issued in private placements ("private placement warrants") |

4,333,333 | $11.50(2) | $49,833,329.50(2) | $6,468.37(2) | ||||

Secondary Offering |

||||||||

Class A Common Stock |

75,053,512 | $11.63(3) | $872,872,344.56(3) | $113,298.83(3) | ||||

Private placement warrants |

4,333,333 | (4) | (4) | (4) | ||||

Total |

$127,631.60(5) | |||||||

|

||||||||

- (1)

- Pursuant

to Rule 416 under the Securities Act of 1933 (the "Securities Act"), the Registrant is also registering hereunder an indeterminate number of

additional shares of common stock that shall be issuable to prevent dilution resulting from stock splits, stock dividends or similar transactions.

- (2)

- Calculated

pursuant to Rule 457(g) under the Securities Act based on the fixed conversion or exercise price of the security.

- (3)

- Estimated

solely for the purpose of calculating the registration fee in accordance with Rule 457(c) of the Securities Act based on the average of the high and

low sales prices of the Registrant's common stock on January 17, 2020, as reported on the Nasdaq Capital Market.

- (4)

- Pursuant

to Rule 457(g) of the Securities Act, no separate registration fee is required with respect to these securities.

- (5)

- An aggregate registration fee of $132,206.37 was previously paid.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 9, 2020

PRELIMINARY PROSPECTUS

AdaptHealth Corp.

Primary Offering of

9,601,909 shares of Class A Common Stock

Issuable Upon Exercise of Warrants

Secondary Offering of

75,053,512 shares of Class A Common Stock and

4,333,333 Warrants to Purchase Class A Common Stock

This prospectus relates to the issuance by us of up to 9,601,909 shares of our Class A Common Stock, par value $0.0001 per share ("Class A Common Stock"). Of these shares:

- •

- 5,268,576 shares are issuable upon the exercise of warrants that were issued in our initial public offering pursuant to the registration

statement declared effective on February 15, 2018 (the "public warrants"); and

- •

- 4,333,333 shares are issuable upon the exercise of warrants initially issued to Deerfield/RAB Ventures LLC (our "Sponsor") in a private placement that occurred simultaneously with our initial public offering (the "private placement warrants" and collectively with the public warrants, the "warrants"), which private placement warrants have been distributed from the Sponsor to its members.

Each warrant entitles the holder thereof to purchase one share of our Class A Common Stock at a price of $11.50 per share. We will receive the proceeds from the exercise of the warrants, but not from the sale of the underlying shares of Class A Common Stock.

In addition, the selling securityholders identified in this prospectus may, from time to time in one or more offerings, offer and sell up to 75,053,512 shares of our Class A Common Stock, of which:

- •

- 6,250,000 shares were issued to our Sponsor in a private placement prior to our initial public offering ("founder shares"), which founder shares

have been distributed from the Sponsor to its members;

- •

- 2,500,000 shares were acquired by Deerfield Management Company, L.P. in connection with our initial public offering;

- •

- 17,356,380 shares were issued as partial consideration in connection with our business combination with AdaptHealth Holdings LLC

("AdaptHealth Holdings"), which we completed on November 8, 2019 (the "Business Combination");

- •

- 30,563,799 shares are issuable upon the exchange of an equal number of units (the "AdaptHealth Units") representing limited liability company

interests in AdaptHealth Holdings, our direct subsidiary, together with a corresponding number of shares of our Class B Common Stock, par value $0.0001 per share (the "Class B Common

Stock");

- •

- 1,550,000 shares were issued upon the exchange of an equal number of AdaptHealth Units, together with a corresponding number of shares of our

Class B Common Stock;

- •

- 12,500,000 shares were issued in private placements in connection with the Business Combination; and

- •

- 4,333,333 shares are issuable upon the exercise of private placement warrants.

The selling securityholders may also, from time to time in one or more offerings, offer and sell up to 4,333,333 private placement warrants.

We will not receive any proceeds from the sale of our Class A Common Stock or private placement warrants by selling securityholders, but we are required to pay certain offering fees and expenses in connection with the registration of the selling securityholders' securities and to indemnify certain selling securityholders against certain liabilities.

This prospectus describes the general manner in which these securities may be offered and sold. If necessary, the specific manner in which these securities may be offered and sold will be described in one or more supplements to this prospectus. Any prospectus supplement may add, update or change information contained in this prospectus. You should carefully read this prospectus, and any applicable prospectus supplement, before you invest in any of our securities.

The selling securityholders may offer and sell our Class A Common Stock or private placement warrants to or through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed basis. In addition, certain selling securityholders may offer and sell these securities from time to time, together or separately. If the selling securityholders use underwriters, dealers or agents to sell such securities, we will name them and describe their compensation in a prospectus supplement. The price to the public of those securities and the net proceeds any selling securityholders expect to receive from that sale will also be set forth in a prospectus supplement.

Our Class A Common Stock is listed on the Nasdaq Capital Market ("Nasdaq") and trades under the symbol "AHCO". On March 6, 2020, the closing price of our Class A Common Stock was $16.54. Our public warrants were formerly listed on Nasdaq under the symbol "AHCOW" and were suspended from trading on Nasdaq on December 6, 2019 because the public warrants did not satisfy the minimum 300 round lot holder requirement for listing, at which time the warrants became eligible to trade "over-the-counter" under the trading symbol "AHCOW". A Form 25-NSE with respect to the public warrants was filed by Nasdaq on January 21, 2020, and the formal delisting of the public warrants became effective ten days thereafter. The private placement warrants are not listed on any exchange.

See the section entitled "Risk Factors" beginning on page 5 of this prospectus and any similar section contained in any applicable prospectus supplement to read about factors you should consider before buying our securities.

We are an "emerging growth company" as defined in Section 2(a) of the Securities Act and are subject to reduced public company reporting requirements. We are also a "smaller reporting company" as defined by Rule 12b-2 of the Exchange Act and are subject to reduced public company reporting requirements. See "Risk Factors."

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2020

You should rely only on the information contained in this prospectus or any supplement to this prospectus. We have not authorized anyone to provide you with different information. Neither we nor the selling securityholders are making an offer to sell or soliciting an offer to buy these securities in any jurisdiction where the offer is not permitted. You should not assume that the information contained in this prospectus or any supplement to this prospectus is accurate as of any date other than the date on the front cover of those documents.

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the "SEC") using a "shelf" registration process. Under this shelf process, we may issue up to an aggregate of 9,601,909 shares of our Class A Common Stock upon the exercise of our public warrants and our private placement warrants and the selling securityholders may sell from time to time in one or more offerings up to an aggregate of 75,053,512 shares of our Class A Common Stock and up to an aggregate of 4,333,333 private placement warrants.

This prospectus describes the general manner in which the securities may be offered and sold. If necessary, the specific manner in which these securities may be offered and sold will be described in one or more supplements to this prospectus. Any prospectus supplement may add, update or change information contained in this prospectus. You should carefully read this prospectus, and any applicable prospectus supplement, before you invest in any of our securities.

Unless the context requires otherwise, references in this prospectus to "AdaptHealth," the "Company," "we," "us," "our" and similar terms refer to AdaptHealth Corp. and its consolidated subsidiaries on and after the consummation of the Business Combination, and references to "DFB" refer to us prior to the consummation of the Business Combination.

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

We make forward-looking statements in this prospectus within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to expectations for future financial performance, business strategies or expectations for our business. These statements may be preceded by, followed by or include the words "may," "might," "will," "will likely result," "should," "estimate," "plan," "project," "forecast," "intend," "expect," "anticipate," "believe," "seek," "continue," "target" or similar expressions.

These forward-looking statements are based on information available to us as of the date they were made, and involve a number of risks and uncertainties which may cause them to turn out to be wrong. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward- looking statements. Some factors that could cause actual results to differ include:

- •

- the ability to maintain the listing of our Class A Common Stock on Nasdaq;

- •

- the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition and

the ability of our business to grow and manage growth profitably;

- •

- changes in applicable laws or regulations;

- •

- fluctuations in the U.S. and/or global stock markets;

- •

- the possibility that we may be adversely affected by other economic, business, and/or competitive factors; and

- •

- other risks and uncertainties set forth in this prospectus or in any applicable prospectus supplement.

ii

"A Blocker" means Access Point Medical, Inc., a Delaware corporation;

"A Blocker Seller" means Clifton Bay Offshore Investments L.P., a British Virgin Islands limited partnership;

"A&R AdaptHealth Holdings LLC Agreement" means the Fifth Amended and Restated Limited Liability Company Agreement of AdaptHealth Holdings, dated as of November 8, 2019;

"AdaptHealth Holdings" means AdaptHealth Holdings LLC, a Delaware limited liability company;

"AdaptHealth Holdings Unitholders' Representative" means AH Representative LLC;

"Blocker Companies" means A Blocker and BM Blocker;

"Blocker Sellers" means A Blocker Seller and the BlueMountain Entities;

"BlueMountain Entities" means BM AH Holdings, LLC, BlueMountain Summit Opportunities Fund II (US) L.P., BMSP L.P., BlueMountain Foinaven Master Fund L.P. and BlueMountain Fursan Fund L.P., collectively;

"BM Blocker" means BM AH Holdings, LLC, a Delaware limited liability company;

"Class A Common Stock" means our Class A Common Stock, par value $0.0001 per share, created on the Closing;

"Class B Common Stock" means our Class B Common Stock, par value $0.0001 per share, created on the Closing;

"Closing" means the closing of the Business Combination;

"Common Stock" means our Class A Common Stock and our Class B Common Stock, collectively;

"Deerfield" means Deerfield Private Design Fund IV, L.P.;

"Exchange Agreement" means the Exchange Agreement, dated as of November 8, 2019, by and among AdaptHealth, AdaptHealth Holdings, and holders of AdaptHealth Units;

"Lock-Up Agreements" means the Lock-Up Agreements, dated as of July 8, 2019, among DFB, AdaptHealth Holdings and certain members of AdaptHealth Holdings;

"Merger Agreement" means the Merger Agreement, dated as of July 8, 2019, among DFB, Merger Sub, AdaptHealth Holdings, the Blocker Companies, the AdaptHealth Holdings Unitholders' Representative and, solely for the purposes specified therein, the Blocker Sellers, as amended by the Merger Agreement Amendment;

"Merger Agreement Amendment" means the Amendment No. 1 to the Merger Agreement, dated as of October 15, 2019, by and among DFB, Merger Sub, AdaptHealth Holdings, the Blocker Companies, the AdaptHealth Holdings Unitholders' Representative and, solely for the purposes specified therein, the Blocker Sellers;

"Merger Sub" means DFB Merger Sub LLC, a wholly-owned subsidiary of DFB prior to the Closing, which merged with and into AdaptHealth Holdings at the Closing;

"Non-Blocker AdaptHealth Members" means the owners of AdaptHealth Units immediately prior to the Closing, other than the Blocker Companies;

"RAB Ventures" means RAB Ventures (DFB) LLC;

"Registration Rights Agreement" means the Registration Rights Agreement, dated as of November 8, 2019, by and among AdaptHealth, AdaptHealth Holdings, and certain investors party thereto;

"Subscription Agreement" means the Amended and Restated Subscription Agreement, dated as of October 15, 2019, among DFB, Deerfield and RAB Ventures; and

"Tax Receivable Agreement" means the Tax Receivable Agreement, dated as of November 8, 2019, by and among AdaptHealth, AdaptHealth Holdings, and holders of AdaptHealth Units.

iii

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including our consolidated financial statements and the related notes included in this prospectus and the information set forth under the headings "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations."

Company History

We were originally formed in November 2017 as a special purpose acquisition company under the name DFB Healthcare Acquisitions Corp. for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combination involving one or more businesses. Until the consummation of the Business Combination, our shares of Class A Common Stock, Public Warrants and units, consisting of one share of Common Stock and one-third of one redeemable warrant, were traded on Nasdaq under the symbols "DFB", "DFBW" and "DFBU," respectively.

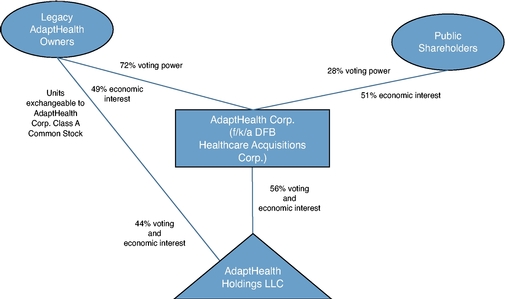

On November 8, 2019, we completed our initial business combination with AdaptHealth Holdings pursuant to that certain Agreement and Plan of Merger, dated as of July 8, 2019, by and among the Company, the Blocker Companies, Merger Sub, AdaptHealth Holdings, AdaptHealth Holdings Unitholders' Representative, solely for purposes of Section 7.20 thereof, the BlueMountain Entities and, solely for purposes of Section 7.21 thereof, A Blocker Seller, pursuant to which the Company acquired 56% of the economic and voting interests of AdaptHealth Holdings through a series of transactions, including: (i) the merger of each of the Blockers with and into the Company, with the Company surviving; (ii) the merger of Merger Sub with and into AdaptHealth Holdings, with AdaptHealth Holdings surviving (the "AdaptHealth Merger"); and (iii) the contribution by the Company to AdaptHealth Holdings of all its available funds (other than cash used to pay certain transaction expenses of the Company) in exchange for equity interests in AdaptHealth Holdings. The transactions contemplated by the Merger Agreement are collectively referred to in this prospectus as the "Business Combination." As part of the Business Combination, we changed our name from DFB Healthcare Acquisitions Corp. to AdaptHealth Corp.

Business Overview

Following the completion of the Business Combination (the "Closing"), substantially all of the Company's assets and operations are held and conducted by AdaptHealth Holdings and its subsidiaries, and the Company's only assets are equity interests in AdaptHealth Holdings. The Company owns a majority of the economic and voting interests of AdaptHealth Holdings and is the sole manager of AdaptHealth Holdings.

We are a leading provider of home healthcare equipment, supplies and related services in the United States. We focus primarily on providing (i) sleep therapy equipment, supplies and related services (including CPAP and bi-PAP services) to individuals suffering from obstructive sleep apnea ("OSA"), (ii) home medical equipment ("HME") to patients discharged from acute care and other facilities, (iii) oxygen and related chronic therapy services in the home and (iv) other HME medical devices and supplies on behalf of chronically ill patients with diabetes care, wound care, urological, ostomy and nutritional supply needs. We service beneficiaries of Medicare, Medicaid and commercial insurance payors. As of December 31, 2019, we serviced approximately 1.2 million patients annually in 49 states through our network of 173 locations in 35 states. Following our acquisition of the Patient Care Solutions business from McKesson Corporation in January 2020, we service approximately 1.4 million patients annually in all 50 states through our network of 187 locations in 38 states.

1

Recent Developments

On January 1, 2020, the Company purchased 100% of the equity interests of NRE Holding Corporation ("NRE"), a subsidiary of McKesson Corporation ("McKesson"). In connection with the transaction, AdaptHealth Corp. acquired the Patient Care Solutions business ("PCS") from McKesson. PCS provides wound care supplies, ostomy supplies, urological supplies, incontinence supplies, diabetic care supplies, and breast pumps directly to patients across the United States. The total cash paid at closing was approximately $15 million. In addition, the Company may be required to make an additional payment of $1.5 million to McKesson after the closing of the transaction pursuant to the terms and conditions of a Transition Services Agreement executed in connection with the transaction. The total investment of AdaptHealth in PCS, including restructuring costs, is expected to be approximately $30.0 million.

On March 2, 2020, the Company purchased certain assets relating to the durable medical equipment business of Advanced Home Care, Inc. ("Advanced"). Advanced is a durable medical equipment company headquartered in North Carolina. The total consideration was $67.5 million, inclusive of an initial cash payment of $52.5 million, an escrow payment of $6.0 million, and a potential deferred payment up to $9.0 million to be paid within six months subsequent to closing based on certain required conditions after closing.

On February 28, 2020, the Company purchased 100% of the membership interests of Healthline Medical Equipment, LLC ("Healthline"). Healthline is headquartered in Texas and provides durable medical equipment and supplies to its customers. The total consideration was $38.4 million inclusive of an initial cash payment of $29.4 million, an escrow payment of $3.0 million, and shares of Class A Common Stock with a value of $6.0 million.

Our Emerging Growth Company Status

As a company with less than $1.0 billion in revenue during its last fiscal year, we qualify as an "emerging growth company" as defined in the JOBS Act. As an emerging growth company, we are eligible for certain exemptions from various reporting requirements applicable to other public companies that are not emerging growth companies for as long as we continue to be an emerging growth company, including (i) the exemption from the auditor attestation requirements with respect to internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002 (the "Sarbanes-Oxley Act"), (ii) the exemptions from say-on-pay, say-on-frequency and say-on-golden parachute voting requirements and (iii) reduced disclosure obligations regarding executive compensation in its periodic reports and proxy statements.

We may take advantage of these provisions until we are no longer an emerging growth company, which will occur on the earliest of (i) the last day of the fiscal year in which the market value of our Class A Common Stock that is held by non-affiliates exceeds $700 million as of June 30 of that fiscal year, (ii) the last day of the fiscal year in which we have total annual gross revenue of $1 billion or more during such fiscal year, (iii) the date on which we have issued more than $1.07 billion in non-convertible debt in the prior three-year period or (iv) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock in the IPO, which would be December 31, 2023.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the exemption from complying with new or revised accounting standards provided in Section 7(a)(2)(B) of the Securities Act as long as we are an emerging growth company. An emerging growth company can therefore delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of such extended transition period, which means that when a standard is issued or revised and it has different application

2

dates for public or private companies, we, as an emerging growth company, can adopt the new or revised standard at the same time private companies adopt the new or revised standard.

Our Smaller Reporting Company Status

Notwithstanding the above, we are also currently a "smaller reporting company," meaning that we have a public float of less than $250 million and annual revenues of less than $100 million. In the event that we are still considered a "smaller reporting company," at such time as we cease being an "emerging growth company," the disclosure we will be required to provide in our SEC filings will increase, but will still be less than it would be if we were not considered either an "emerging growth company" or a "smaller reporting company." Specifically, similar to "emerging growth companies," "smaller reporting companies" are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings.

Accordingly, the information that we provide you may be different than what you may receive from other public companies in which you hold equity interests.

Additional Information

Our principal executive office is located at 220 West Germantown Pike, Suite 250, Plymouth Meeting, Pennsylvania 19462, and its telephone number is (610) 630-6357. Our website is https://www.adapthealth.com. The information on our website does not constitute part of, and is not incorporated by reference in, this prospectus or any accompanying prospectus supplement, and you should not rely on our website or such information in making a decision to invest in our Common Stock.

3

Shares Offered by the Selling Securityholders |

75,053,512 shares of Class A Common Stock held by the selling securityholders named herein or issuable upon exchange of shares of Class B Common Stock. | |

|

5,268,576 shares of Class A Common Stock issuable upon exercise of the public warrants. |

|

|

4,333,333 shares of Class A Common Stock issuable upon exercise of the private placement warrants. |

|

Warrants Offered by the Selling Securityholders |

4,333,333 warrants to purchase shares of Class A Common Stock that are the private placement warrants issued to the Sponsor in a private placement concurrent with our IPO. |

|

Terms of the Offering |

The selling securityholders will determine when and how they will dispose of the shares of Class A Common Stock and private placement warrants registered under this prospectus for resale. |

|

Shares of Common Stock Outstanding |

As of March 6, 2020 we had issued and outstanding (i) 42,751,419 shares of Class A Common Stock and (ii) 30,563,799 shares of Class B Common Stock. |

|

Use of Proceeds |

We will not receive any proceeds from the sale of our securities offered by the selling securityholders under this prospectus (the "Securities"). We will receive up to an aggregate of approximately $110,421,953.50 from the exercise of the warrants, assuming the exercise in full of all of the warrants for cash. We expect to use the net proceeds from the exercise of the warrants for general corporate purposes, including acquisitions and other business opportunities, capital expenditures and working capital. See the section titled "Use of Proceeds." |

|

Risk Factors |

See the section titled "Risk Factors" and other information included in this prospectus for a discussion of factors that you should consider carefully before deciding to invest in our securities. |

|

Trading Markets and Ticker Symbols |

Our Class A Common Stock is listed on Nasdaq under the symbol "AHCO." Our warrants are quoted on the OTC Pink marketplace operated by OTC Markets Group, Inc. under the symbol "AHCOW." |

The number of issued and outstanding shares of Class A Common Stock does not include (i) the 3,682,084 shares of Class A Common Stock available for future issuance as of December 31, 2019 under the AdaptHealth Corp. 2019 Stock Incentive Plan or (ii) the 9,601,909 shares of Class A Common Stock issuable upon the exercise of the public warrants or the private placement warrants.

For additional information concerning the offering, see the section titled "Plan of Distribution."

4

Investing in our securities involves risks. Before you make a decision to buy our securities, in addition to the risks and uncertainties discussed above under "Cautionary Note Regarding Forward-Looking Statements" and the risks described below, you should carefully consider the specific risks set forth under the caption "Risk Factors" in any applicable prospectus supplement, as well as in our definitive proxy statement on Schedule 14A filed in connection with the Business Combination, our most recent Annual Report on Form 10-K and any subsequently filed Quarterly Reports on Form 10-Q, and our Current Reports on Form 8-K (other than, in each case, information furnished rather than filed). If any of these risks actually occur, it may materially harm our business, financial condition, liquidity and results of operations. As a result, the market price of our securities could decline, and you could lose all or part of your investment.

Additionally, the risks and uncertainties described in this prospectus or any prospectus supplement are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business.

Risks Related to Our Business and Industry

AdaptHealth's revenue could be impacted by federal and state changes to reimbursement and other aspects of Medicaid and Medicare.

AdaptHealth derived approximately 32% of its revenue for the year ended December 31, 2019 from Medicare and various state-based Medicaid programs. These programs are subject to statutory and regulatory changes affecting overall spending, base rates or basis of payment, retroactive rate adjustments, annual caps that limit the amount that can be paid (including deductible and coinsurance amounts) for rehabilitation therapy services rendered to Medicare beneficiaries, administrative or executive orders and government funding restrictions, all of which may materially adversely affect the rates and frequency at which these programs reimburse AdaptHealth. For example, the Medicaid Integrity Contractor program is increasing the scrutiny placed on Medicaid payments and could result in recoupments of alleged overpayments in an effort to rein in Medicaid spending. Recent budget proposals and legislation at both the federal and state levels have called for cuts in reimbursement for healthcare providers participating in the Medicare and Medicaid programs. Enactment and implementation of measures to reduce or delay reimbursement or overall Medicare or Medicaid spending could result in substantial reductions in AdaptHealth's revenue and profitability. Payors may disallow AdaptHealth's requests for reimbursement based on determinations that certain costs are not reimbursable or reasonable because either adequate or additional documentation was not provided or because certain services were not covered or considered reasonably necessary. Additionally, revenue from these payors can be retroactively adjusted after a new examination during the claims settlement process or as a result of post-payment audits.

AdaptHealth's business may be adversely impacted by healthcare reform efforts, including repeal of or significant modifications to the ACA.

In recent years, the U.S. Congress and certain state legislatures have considered and passed a number of laws that are intended to result in significant changes to the healthcare industry. However, there is significant uncertainty regarding the future of the Patient Protection and Affordable Care Act ("ACA"), the most prominent of these reform efforts. The law has been subject to legislative and regulatory changes and court challenges, and the current presidential administration and certain members of Congress have stated their intent to repeal or make additional significant changes to the ACA, its implementation or its interpretation. In 2017, the Tax Cuts and Jobs Acts was enacted, which, effective January 1, 2019, among other things, removed penalties for not complying with ACA's individual mandate to carry health insurance. In addition, President Trump has signed an executive

5

order that directs agencies to minimize "economic and regulatory burdens" of the ACA. Because the penalty associated with the individual mandate was eliminated, a federal judge in Texas ruled in December 2018 that the entire ACA was unconstitutional. The presidential administration and the Centers for Medicare and Medicaid Services have both stated that the ruling will have no immediate effect, and on December 18, 2019, the Fifth Circuit U.S. Court of Appeals upheld the lower court's finding that the individual mandate is unconstitutional and remanded the case back to the lower court to reconsider its earlier invalidation of the full ACA. Pending review, the law remains in effect, but it is unclear at this time what effect the latest ruling will have on the status of the ACA.These changes and court challenges may impact the number of individuals that elect to obtain public or private health insurance or the scope of such coverage, if purchased. The presidential administration and the U.S. Congress may take further action regarding the ACA, including, but not limited to, repeal or replacement. Additionally, all or a portion of the ACA and related subsequent legislation may be modified, repealed or otherwise invalidated through further legislation or judicial challenge, which could result in reduced funding for state Medicaid programs, lower numbers of insured individuals, and reduced coverage for insured individuals. There is uncertainty regarding whether, when, and how the ACA will be further changed, what alternative provisions, if any, will be enacted, and the impact of alternative provisions on providers and other healthcare industry participants. Government efforts to repeal or change the ACA or to implement alternative reform measures could cause AdaptHealth's revenues to decrease to the extent such legislation reduces Medicaid and/or Medicare reimbursement rates.

AdaptHealth is affected by continuing efforts by private third-party payors to control their costs. If AdaptHealth agrees to lower its reimbursement rates due to pricing pressures from private third-party payors, AdaptHealth's financial condition and results of operations would likely deteriorate.

AdaptHealth derived approximately 57% of its revenue for the year ended December 31, 2019 from third-party private payors. Such payors continually seek to control the cost of providing healthcare services through direct contracts with healthcare providers, increased oversight and greater enrollment of patients in managed care programs and preferred provider organizations. These private payors are increasingly demanding discounted fee structures, including setting reimbursement rates based on Medicare fee schedules and the assumption by the healthcare provider of all or a portion of the financial risk. Reimbursement payments under private payor programs may not remain at current levels and may not be sufficient to cover the costs allocable to patients eligible for reimbursement pursuant to such programs, and AdaptHealth may suffer deterioration in pricing flexibility, changes in payor mix and growth in operating expenses in excess of increases in payments by private third-party payors. AdaptHealth may be compelled to lower its prices due to increased pricing pressures, which could adversely impact AdaptHealth's financial condition and results of operations.

Changes in governmental or private payor supply replenishment schedules could adversely affect AdaptHealth.

AdaptHealth generated approximately 42% of its revenue for the year ended December 31, 2019 through the sale of masks, tubing and other ancillary products related to patients utilizing CPAP devices. Medicare, Medicaid and private payors limit the number of times per year that patients may purchase such supplies. To the extent that any governmental or private payor revises their resupply guidelines to reduce the number of times such supplies can be purchased, such reductions could adversely impact AdaptHealth's revenue, financial condition and results of operations.

AdaptHealth generates a significant portion of its revenue from the provision of sleep therapy equipment and supplies to patients, and AdaptHealth is therefore highly dependent on it for its success.

Approximately 58% of AdaptHealth's revenue for the year ended December 31, 2019 was generated from the provision of sleep therapy equipment and supplies to patients. AdaptHealth's ability

6

to execute its growth strategy therefore depends upon the adoption by patients, physicians and sleep centers, among others, of AdaptHealth's sleep therapy equipment and supplies to treat their patients suffering from OSA. There can be no assurance that AdaptHealth will continue to maintain broad acceptance among physicians and patients. Any failure by AdaptHealth to satisfy physician or patient demand or to maintain meaningful market acceptance will harm its business and future prospects.

AdaptHealth may be adversely affected by consolidation among health insurers and other industry participants.

In recent years, a number of health insurers have merged or increased efforts to consolidate with other non-governmental payors. Insurers are also increasingly pursuing alignment initiatives with healthcare providers. Consolidation within the health insurance industry may result in insurers having increased negotiating leverage and competitive advantages, such as greater access to performance and pricing data. AdaptHealth's ability to negotiate prices and favorable terms with health insurers in certain markets could be affected negatively as a result of this consolidation. In addition, the shift toward value-based payment models could be accelerated if larger insurers, including those engaging in consolidation activities, find these models to be financially beneficial. There can be no assurance that AdaptHealth will be able to negotiate favorable terms with payors and otherwise respond effectively to the impact of increased consolidation in the payor industry or vertical integration efforts.

AdaptHealth's payor contracts are subject to renegotiation or termination, which could result in a decrease in AdaptHealth's revenue or profits.

The majority of AdaptHealth's payor contracts are subject to unilateral termination by either party on between 30 and 90 days' prior written notice. Such contracts are routinely amended (sometimes by unilateral action by payors regarding payment policy), renegotiated, subjected to a bidding process with AdaptHealth's competitors, or terminated altogether. Sometimes in the renegotiation process, certain lines of business may not be renewed or a payor may enlarge its provider network or otherwise adversely change the way it conducts its business with AdaptHealth. In other cases, a payor may reduce its provider network in exchange for lower payment rates. AdaptHealth's revenue from a payor may also be adversely affected if the payor alters its utilization management expectations and/or administrative procedures for payments and audits, changes its order of preference among the providers to which it refers business or imposes a third-party administrator, network manager or other intermediary. Any reduction in AdaptHealth's projected home respiratory therapy/home medical equipment revenues as a result of these or other factors could lead to a reduction in AdaptHealth's revenues. There can be no assurance that AdaptHealth's payor contracts will not be terminated or altered in ways that are unfavorable to AdaptHealth as a result of renegotiation or such administrative changes. Payors may decide to refer business to their owned provider subsidiaries, such as specialty pharmaceuticals and/or HME networks owned by such payors or by third-party management companies. These activities could materially reduce AdaptHealth's revenue from these payors.

If AdaptHealth fails to manage the complex and lengthy reimbursement process, its revenue, financial condition and results of operations could suffer.

Because AdaptHealth depends upon reimbursement from Medicare, Medicaid and third-party payors for a significant majority of its revenues, AdaptHealth's revenue, financial condition and results of operations may be affected by the reimbursement process, which in the healthcare industry is complex and can involve lengthy delays between the time that services are rendered and the time that the reimbursement amounts are settled. Depending on the payor, AdaptHealth may be required to obtain certain payor-specific documentation from physicians and other healthcare providers before submitting claims for reimbursement. Certain payors have filing deadlines and will not pay claims submitted after such time. AdaptHealth cannot ensure that it will be able to effectively manage the reimbursement process and collect payments for its equipment and services promptly.

7

If the Centers for Medicare and Medicaid Services ("CMS") require prior authorization or implement changes in documentation necessary for AdaptHealth's products, AdaptHealth's revenue, financial condition and results of operations could be negatively impacted.

CMS has established and maintains a Master List of Items Frequently Subject to Unnecessary Utilization of certain DMEPOS that the Secretary determined, based on prior payment experience, are frequently subject to unnecessary utilization. This list identifies items that CMS has determined could potentially be subject to Prior Authorization as a condition of Medicare payment. Since 2012, CMS has also mainted a list of categories of DMEPOS items to include face-to-face encounters with practitioners and written orders before furnishing the items to beneficiaries. On November 8, 2019, CMS combined and harmonized the two lists to create a single unified Master List of DMEPOS Items Potentially Subject to Face-To-Face Encounter and Written Order Prior to Delivery and/or Prior Authorization Requirements ("Master List"). In November 2019, CMS also reduced the financial threshold for inclusion on the Master List. With certain exceptions for reductions in Payment Threshold, items remain on the Master List for 10 years from the date the item was added to the Master List. The presence of an item on the Master List does not automatically mean that a prior authorization is required. Currently, CMS selects items from the Master List for inclusion on the "Required Prior Authorization List." The expanded Master List would increase the number of DMEPOS items potentially eligible to be selected for prior authorization, face-to-face encounter and written order prior to delivery requirements as a condition of payment. On April 22, 2019, CMS has added items that are a part of AdaptHealth's product lines to the Master List of Items Frequently Subject to Unnecessary Utilization. If CMS adds additional products to the Master List, expands Prior Authorization requirements, or expands Face-to-Face Encounter and Written Order Prior to Delivery requirments to products in AdaptHealth's product line, such Prior Authorization requirements may adversely impact AdaptHealth's revenue, financial condition and results from operations.

Reimbursement claims are subject to audits by various governmental and private payor entities from time to time and such audits may negatively affect AdaptHealth's revenue, financial condition and results of operations.

AdaptHealth receives a substantial portion of its revenues from the Medicare program. Medicare reimbursement claims made by healthcare providers, including HME providers, are subject to audit from time to time by governmental payors and their agents, such as Medicare Administrative Contractors ("MACs") that act as fiscal intermediaries for all Medicare billings, auditors contracted by CMS, and insurance carriers, as well as HHS-OIG, CMS and state Medicaid programs. These include specific requirements imposed by the Durable Medical Equipment Medicare Administrative Contractor ("DME MAC") Supplier Manuals. To ensure compliance with Medicare, Medicaid and other regulations, government agencies or their contractors, including MACs, Recovery Audit Contractors and Zone Program Integrity Contractors, often conduct audits and request customer records and other documents to support our claims submitted for payment of services rendered. In many instances, there are only limited publicly-available guidelines and methodologies for determining errors with certain audits. As a result, there can be a significant lack of clarity regarding required documentation and audit methodology. The clarity and completeness of each patient medical file, some of which is the work product of physicians not employed by AdaptHealth, is essential to successfully challenging any payment denials. For example, the DME MAC Supplier Manuals provide that clinical information from the "patient's medical record" is required to justify the initial and ongoing medical necessity for the provision of DME. Some DME MACs, CMS staff and government subcontractors have taken the position, that the "patient's medical record" refers not to documentation maintained by the Durable Medical Equipment ("DME") supplier but instead to documentation maintained by the patient's physician, healthcare facility or other clinician, and that clinical information created by the DME supplier's personnel and confirmed by the patient's physician is not sufficient to establish medical necessity. If the physicians working with AdaptHealth's patients do not adequately document, among

8

other things, their diagnoses and plans of care, AdaptHealth's risks related to audits and payment denials in general are greater. Depending on the nature of the conduct found in such audits and whether the underlying conduct could be considered systemic, the resolution of these audits could adversely impact AdaptHealth's revenue, financial condition and results of operations.

CMS has developed and instituted various audit programs under which CMS contracts with private companies to conduct claims and medical record audits. These audits are in addition to those conducted by existing MACs. Some contractors are paid a percentage of the overpayments recovered. One type of audit contractor, the Recovery Audit Contractors ("RACs"), receive claims data directly from MACs on a monthly or quarterly basis and are authorized to review previously paid claims. It is unclear whether CMS intends to conduct RAC prepayment reviews in the future and if so, what providers and claims would be the focus of those reviews.

Moreover, the ACA now requires that overpayments be reported and returned within 60 days of identification of the overpayment. Any overpayment retained after this deadline will now be considered an "obligation" for purposes of the False Claims Act and subject to fines and penalties. CMS currently has a six-year "lookback period," for reporting and returning the "identified" overpayment. Private payors also reserve rights to conduct audits and make monetary adjustments.

AdaptHealth's third-party payors may also, from time to time, request audits of the amounts paid, or to be paid, to AdaptHealth. AdaptHealth could be adversely affected in some of the markets in which it operates if the auditing payor alleges substantial overpayments were made to AdaptHealth due to coding errors or lack of documentation to support medical necessity determinations.

AdaptHealth cannot currently predict the adverse impact, if any, that these audits, methodologies and interpretations might have on its financial condition and results of operations.

Significant reimbursement reductions and/or exclusion from markets or product lines could adversely affect AdaptHealth.

All Medicare Durable Medical Equipment, Prosthetics, Orthotics, & Supplies ("DMEPOS") Competitive Bidding Program contracts expired on December 31, 2018, and, as a result, there is a temporary gap in the entire DMEPOS Competitive Bidding Program that CMS expects will last until December 31, 2020.

On March 7, 2019, CMS announced plans to consolidate the competitive bidding areas ("CBAs") included in the Round 1 2017 and Round 2 Recompete DMEPOS Competitive Bidding Programs into a single round of competition named "Round 2021." Round 2021 contracts are scheduled to become effective on January 1, 2021, and extend through December 31, 2023. The bid window for the Round 2021 DMEPOS Competitive Bidding Program closed on September 18, 2019.

For each CBA, providers will submit bids to CMS offering to supply certain covered items of DME in the CBA at certain prices. A number of products in AdaptHealth's product lines are included on the list of products subject to Round 2021. For the year ended December 31, 2019, AdaptHealth estimates that approximately $145.0 million of revenue was generated with respect to covered items in competitive bidding areas subject to Round 2021. The $145.0 million estimate excludes amounts generated in non-rural and rural non-bid areas, as well as products not currently part of Competitive Bidding Programs. As part of the competitive bidding process, single payment amounts ("SPAs") replace the current Medicare durable medical equipment fee schedule payment amounts for selected items in certain areas of the country. The SPAs are determined by using bids submitted by DME suppliers. CMS will select winning bidders based upon the CMS-determined demand in each CBA, and the price assigned to the winning bidders shall be the price submitted by the final bidder accepted to meet such CBA's volume demand. Successful bidders are expected to meet certain program quality standards in order to be awarded a contract and only successful bidders can supply the covered items

9

to Medicare beneficiaries in the acquisition area (there are, however, regulations in place that allow non-contracted providers to continue to provide equipment and services to their existing customers at the new prices determined through the bidding process). The contracts are expected to be re-bid at least every three years. CMS is required to award contracts to multiple entities submitting bids in each area for an item or service, but has the authority to limit the number of contractors in a competitive acquisition area to the number it determines to be necessary to meet projected demand. AdaptHealth's exclusion from certain markets or product lines could materially adversely affect its financial condition and results of operations.

The competitive bidding process has historically put pressure on the amount AdaptHealth is reimbursed in the markets in which it exists, as well as in areas that are not subject to the Competitive Bidding Program. The rates required to win future competitive bids could continue to compress reimbursement rates. AdaptHealth will continue to monitor developments regarding the competitive bidding program. While AdaptHealth cannot predict the outcome of the competitive bidding program on its business in the future nor the Medicare payment rates that will be in effect in future years for the items subjected to competitive bidding, the program may materially adversely affect its financial condition and results of operations.

Failure by AdaptHealth to maintain controls and processes over billing and collections or the deterioration of the financial condition of AdaptHealth's payors or disputes with third parties could have a significant negative impact on its financial condition and results of operations.

The collection of accounts receivable requires constant focus and involvement by management and ongoing enhancements to information systems and billing center operating procedures. There can be no assurance that AdaptHealth will be able to improve upon or maintain its current levels of collectability and days sales outstanding in future periods. Further, some of AdaptHealth's payors and/or patients may experience financial difficulties, or may otherwise not pay accounts receivable when due, resulting in increased write-offs. If AdaptHealth is unable to properly bill and collect its accounts receivable, its financial condition and results of operations will be adversely affected. In addition, from time to time AdaptHealth is involved in disputes with various parties, including its payors and their intermediaries regarding their performance of various contractual or regulatory obligations. These disputes sometimes lead to legal and other proceedings and cause AdaptHealth to incur costs or experience delays in collections, increases in its accounts receivable or loss of revenue. In addition, in the event such disputes are not resolved in AdaptHealth's favor or cause AdaptHealth to terminate its relationships with such parties, there may be an adverse impact on its financial condition and results of operations.

If AdaptHealth is unable to maintain or develop relationships with patient referral sources, its growth and profitability could be adversely affected.

AdaptHealth's success depends in large part on referrals from acute care hospitals, sleep laboratories, pulmonologist offices, skilled nursing facilities, hospice operators and other patient referral sources in the communities served by AdaptHealth. By law, referral sources cannot be contractually obligated to refer patients to any specific provider. However, there can be no assurance that other market participants will not attempt to steer patients to competing post-acute providers or otherwise limit AdaptHealth's access to potential referrals. The establishment of joint ventures or networks between referral sources, such as acute care hospitals, and other post-acute providers may hinder patient referrals to AdaptHealth. AdaptHealth's growth and profitability depend on its ability to establish and maintain close working relationships with patient referral sources and to increase awareness and acceptance of the benefits of inpatient rehabilitation, home health, and hospice care by its referral sources and their patients. There can be no assurance that AdaptHealth will be able to maintain its existing referral source relationships or that it will be able to develop and maintain new relationships in existing or new markets. AdaptHealth's loss of, or failure to maintain, existing relationships or its failure to develop new relationships could adversely affect its ability to grow its business and operate profitably.

10

Failure by AdaptHealth to successfully design, modify and implement technology-based and other process changes to maximize productivity and ensure compliance could ultimately have a significant negative impact on AdaptHealth's financial condition and results of operations.

AdaptHealth has identified a number of areas throughout its operations, including revenue cycle management and fulfilment logistics, where it intends to centralize and/or modify current processes or systems in order to attain a higher level of productivity or ensure compliance. Failure to achieve the cost savings or enhanced quality control expected from the successful design and implementation of such initiatives may adversely impact AdaptHealth's financial condition and results of operations. Additionally, Medicare and Medicaid often change their documentation requirements with respect to claims submissions. The standards and rules for healthcare transactions, code sets and unique identifiers also continue to evolve, such as ICD 10 and HIPAA 5010 and other data security requirements. Moreover, government programs and/or commercial payors may have difficulties administering new standards and rules for healthcare transactions and this may adversely affect timelines of payment or payment error rates. The DMEPOS competitive bidding program also imposes new reporting requirements on contracted providers. Failure by AdaptHealth to successfully design and implement system or process modifications could have a significant impact on its operations and financial condition. From time to time, AdaptHealth's outsourced contractors for certain information systems functions, such as Brightree LLC and Parachute Health LLC, may make operational, leadership or other changes that could impact AdaptHealth's plans and cost-savings goals. The implementation of many of the new standards and rules will require AdaptHealth to make substantial investments. Further, the implementation of these system or process changes could have a disruptive effect on related transaction processing and operations. If AdaptHealth's implementation efforts related to systems development are unsuccessful, AdaptHealth may need to write off amounts that it has capitalized related to systems development projects. Additionally, if systems development implementations do not occur, AdaptHealth may need to incur additional costs to support its existing systems.

AdaptHealth's business depends on its information systems, including software licensed from third parties. AdaptHealth's information systems and those of AdaptHealth's third-party software providers are subject to security breaches and other cybersecurity incidents, which may disrupt AdaptHealth's operations.

AdaptHealth's business depends on the proper functioning and availability of its computer systems and networks. AdaptHealth relies on an external service provider to provide continual maintenance, upgrading and enhancement of AdaptHealth's primary information systems used for its operational needs. AdaptHealth licenses third-party software that supports intake, personnel scheduling and other human resources functions, office clinical and centralized billing and receivables management in an integrated database, enabling AdaptHealth to standardize the care delivered across its network of locations and monitor its performance and consumer outcomes. AdaptHealth also uses a third-party software provider for its order processing and inventory management platform. To the extent that its third-party providers fail to support, maintain and upgrade such software or systems, or if AdaptHealth loses its licenses with third-party providers, the efficiency of AdaptHealth's operations could be disrupted or reduced.

If AdaptHealth experiences a reduction in the performance, reliability, or availability of its information systems, its operations and ability to process transactions and produce timely and accurate reports could be adversely affected. If AdaptHealth experiences difficulties with the transition and integration of information systems or is unable to implement, maintain, or expand its systems properly, AdaptHealth could suffer from, among other things, operational disruptions, regulatory problems, and increases in administrative expenses.

There can be no assurance that AdaptHealth's and its third-party software providers' safety and security measures and disaster recovery plan will prevent damage, interruption or breach of its

11

information systems and operations. Because the techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems change frequently and may be difficult to detect, AdaptHealth may be unable to anticipate these techniques or implement adequate preventive measures. In addition, hardware, software or applications AdaptHealth develops or procures from third parties may contain defects in design or manufacture or other problems that could unexpectedly compromise the security of its information systems. Unauthorized parties may attempt to gain access to AdaptHealth's systems or facilities, or those of third parties with whom AdaptHealth does business, through fraud or other forms of deceiving its employees or contractors. On occasion, AdaptHealth has acquired additional information systems through its business acquisitions. AdaptHealth has upgraded and expanded its information system capabilities and has committed significant resources to maintain, protect, enhance existing systems and develop new systems to keep pace with continuing changes in technology, evolving industry and regulatory standards, and changing customer preferences. In addition, costs and potential problems and interruptions associated with the implementation of new or upgraded systems and technology or with maintenance or adequate support of existing systems also could disrupt or reduce the efficiency of AdaptHealth's operations. A cyber security attack or other incident that bypasses AdaptHealth's information systems security could cause a security breach which may lead to a material disruption to its information systems infrastructure or business and may involve a significant loss of business or patient health information. If a cyber security attack or other unauthorized attempt to access AdaptHealth's systems or facilities were to be successful, it could result in the theft, destruction, loss, misappropriation or release of confidential information or intellectual property, and could cause operational or business delays that may materially impact AdaptHealth's ability to provide various healthcare services. Any successful cyber security attack or other unauthorized attempt to access AdaptHealth's systems or facilities also could result in negative publicity which could damage its reputation or brand with its patients, referral sources, payors or other third parties and could subject AdaptHealth to substantial penalties under HIPAA and other federal and state privacy laws, in addition to private litigation with those affected. Failure to maintain the security and functionality of AdaptHealth's information systems and related software, or a failure to defend a cyber security attack or other attempt to gain unauthorized access to AdaptHealth's systems, facilities or patient health information, could expose AdaptHealth to a number of adverse consequences, the vast majority of which are not insurable, including but not limited to disruptions in AdaptHealth's operations, regulatory and other civil and criminal penalties, fines, investigations and enforcement actions (including, but not limited to, those arising from the SEC, Federal Trade Commission, the OIG or state attorneys general), private litigation with those affected by the data breach, loss of customers, disputes with payors and increased operating expense, which could adversely impact AdaptHealth's financial condition and results of operations.

AdaptHealth experiences competition from numerous other home respiratory and mobility equipment providers, and this competition could adversely affect its revenues and its business.

The home respiratory and mobility equipment markets are highly competitive and include a large number of providers, some of which are national providers, but most of which are either regional or local providers, including hospital systems, physician specialists and sleep labs. The primary competitive factors are quality considerations such as responsiveness, access to payor contracts, the technical ability of the professional staff and the ability to provide comprehensive services. These markets are very fragmented. Some of AdaptHealth's competitors may now or in the future have greater financial or marketing resources than AdaptHealth. In addition, in certain markets, competitors may have more effective sales and marketing activities. AdaptHealth's largest national home respiratory/home medical equipment provider competitors include AeroCare Holdings, Inc., Apria Healthcare Group Inc., Lincare Holdings Inc. and Rotech Healthcare Inc. The rest of the homecare market in the United States consists of regional providers and product-specific providers, as well as numerous local organizations. Hospitals and health systems are routinely looking to provide coverage and better control

12

of post-acute healthcare services, including homecare services of the types AdaptHealth provides. These trends may continue as new payment models evolve, including bundled payment models, shared savings programs, value based purchasing and other payment systems.

There are relatively few barriers to entry in local home healthcare markets, and new entrants to the home respiratory/home medical equipment markets could have a material adverse effect on AdaptHealth's business, results of operations and financial condition. A number of manufacturers of home respiratory equipment currently provide equipment directly to patients on a limited basis. Such manufacturers have the ability to provide their equipment at prices below those charged by AdaptHealth, and there can be no assurance that such direct-to-patient sales efforts will not increase in the future or that such manufacturers will not seek reimbursement contracts directly with AdaptHealth's third-party payors, who could seek to provide equipment directly to patients from the manufacturer. In addition, pharmacy benefit managers (known as "PBMs"), including CVS Health Corporation and the OptumRx business of UnitedHealth Group Incorporated, could enter the HME market and compete with AdaptHealth. Large technology companies, such as Amazon.com, Inc. and Alphabet Inc., have disrupted other supply businesses and have publicly stated an interest in the entering the healthcare market. In the event such companies enter the HME market, AdaptHealth may experience a loss of referrals or revenue.

Changes in medical equipment technology and development of new treatments may cause AdaptHealth's current equipment or services to become obsolete.

AdaptHealth evaluates changes in home medical equipment technology and treatments on an ongoing basis for purposes of determining the feasibility of replacing or supplementing items currently included in the patient service equipment inventory and services that AdaptHealth offers patients. AdaptHealth's selection of medical equipment and services is formulated on the basis of a variety of factors, including overall quality, functional reliability, availability of supply, payor reimbursement policies, product features, labor costs associated with the technology, acquisition, repair and ownership costs and overall patient and referral source demand, as well as patient therapeutic and lifestyle benefits. Manufacturers continue to invest in research and development to introduce new products to the marketplace. It is possible that major changes in available technology, payor benefit or coverage policies related to those changes or the preferences of patients and referral sources may cause AdaptHealth's current product offerings to become less competitive or obsolete, and it will be necessary to adapt to those changes. Unanticipated changes could cause AdaptHealth to incur increased capital expenditures and accelerated equipment write-offs, and could force AdaptHealth to alter its sales, operations and marketing strategies.

AdaptHealth's operations involve the transport of compressed and liquid oxygen, which carries an inherent risk of rupture or other accidents with the potential to cause substantial loss.

AdaptHealth's operations are subject to the many hazards inherent in the transportation of medical gas products and compressed and liquid oxygen, including ruptures, leaks and fires. These risks could result in substantial losses due to personal injury or loss of life, severe damage to and destruction of property and equipment and pollution or other environmental damage and may result in curtailment or suspension of AdaptHealth's related operations. If a significant accident or event occurs, it could adversely affect AdaptHealth's business, financial position and results of operations. Additionally, corrective action plans, fines or other sanctions may be levied by government regulators who oversee transportation of hazardous materials such as compressed or liquid oxygen.

AdaptHealth provides a significant number of patients with oxygen-based therapy, and from time to time, AdaptHealth has operated medical gas facilities in several states subject to federal and state regulatory requirements. AdaptHealth's medical gas facilities and operations are subject to extensive regulation by the Food and Drug Administration ("FDA") and other federal and state authorities. The

13

FDA regulates medical gases, including medical oxygen, pursuant to its authority under the federal Food, Drug and Cosmetic Act. Among other requirements, the FDA's current Good Manufacturing Practice ("cGMP") regulations impose certain quality control, documentation and recordkeeping requirements on the receipt, processing and distribution of medical gas. Further, in each such state, its medical gas facilities would be subject to regulation under state health and safety laws, which vary from state to state. The FDA and state authorities conduct periodic, unannounced inspections at medical gas facilities to assess compliance with the cGMP and other regulations, and AdaptHealth expends significant time, money and resources in an effort to achieve substantial compliance with the cGMP regulations and other federal and state law requirements at each of its medical gas facilities. AdaptHealth also complies with the FDA's requirement for medical gas providers to register their sites with the agency. There can be no assurance, however, that these efforts will be successful and that AdaptHealth's medical gas facilities will maintain compliance with federal and state law regulations. Failure by AdaptHealth to maintain regulatory compliance at its medical gas facilities could result in enforcement action, including warning letters, fines, product recalls or seizures, temporary or permanent injunctions, or suspensions in operations at one or more locations, and civil or criminal penalties which would materially harm its business, financial condition, results of operations, cash flow, capital resources and liquidity.

AdaptHealth is subject, directly or indirectly, to United States federal and state healthcare fraud and abuse and false claims laws and regulations. Prosecutions under such laws have increased in recent years and AdaptHealth may become subject to such litigation. If AdaptHealth is unable to or has not fully complied with such laws, it could face substantial penalties.

AdaptHealth's operations are subject to various state and federal fraud and abuse laws, including, without limitation, the federal Anti-Kickback Statute, the federal Stark Law and the federal False Claims Act. These laws may impact, among other things, AdaptHealth's sales, marketing and education programs.

The federal Anti-Kickback Statute prohibits persons from knowingly and willfully soliciting, offering, receiving or providing remuneration, directly or indirectly, in exchange for or to induce either the referral of an individual, or the furnishing or arranging for a good or service, for which payment may be made under a federal healthcare program such as the Medicare and Medicaid programs. Several courts have interpreted the statute's intent requirement to mean that if any one purpose of an arrangement involving remuneration is to induce referrals of federal healthcare covered business, the statute has been violated. The Anti-Kickback Statute is broad and, despite a series of narrow safe harbors, prohibits many arrangements and practices that are lawful in businesses outside of the healthcare industry. Penalties for violations of the federal Anti-Kickback Statute include criminal penalties and civil sanctions such as fines, imprisonment and possible exclusion from Medicare, Medicaid and other federal healthcare programs. Many states have also adopted laws similar to the federal Anti-Kickback Statute, some of which apply to the referral of patients for healthcare items or services reimbursed by any source, not only the Medicare and Medicaid programs.

The federal Ethics in Patient Referrals Act of 1989, commonly known as the "Stark Law," prohibits, subject to certain exceptions, physician referrals of Medicare and Medicaid patients to an entity providing certain "designated health services" if the physician or an immediate family member has any financial relationship with the entity. The Stark Law also prohibits the entity receiving the referral from billing any good or service furnished pursuant to an unlawful referral. Various states have corollary laws to the Stark Law, including laws that require physicians to disclose any financial interest they may have with a healthcare provider to their patients when referring patients to that provider. Both the scope and exceptions for such laws vary from state to state.

The federal False Claims Act prohibits persons from knowingly filing, or causing to be filed, a false claim to, or the knowing use of false statements to obtain payment from the federal government. Suits

14

filed under the False Claims Act, known as qui tam actions, can be brought by any individual on behalf of the government and such individuals, commonly known as "whistleblowers," may share in any amounts paid by the entity to the government in fines or settlement. The frequency of filing qui tam actions has increased significantly in recent years, causing greater numbers of medical device, pharmaceutical and healthcare companies to have to defend a False Claim Act action. When an entity is determined to have violated the federal False Claims Act, it may be required to pay up to three times the actual damages sustained by the government, plus civil penalties for each separate false claim. Various states have also enacted laws modeled after the federal False Claims Act.