Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - MYERS INDUSTRIES INC | mye-ex32_11.htm |

| EX-31.B - EX-31.B - MYERS INDUSTRIES INC | mye-ex31b_10.htm |

| EX-31.A - EX-31.A - MYERS INDUSTRIES INC | mye-ex31a_13.htm |

| EX-23 - EX-23 - MYERS INDUSTRIES INC | mye-ex23_6.htm |

| EX-21 - EX-21 - MYERS INDUSTRIES INC | mye-ex21_9.htm |

| EX-10.AF - EX-10.AF - MYERS INDUSTRIES INC | mye-ex10af_263.htm |

| EX-10.AE - EX-10.AE - MYERS INDUSTRIES INC | mye-ex10ae_262.htm |

| EX-10.AD - EX-10.AD - MYERS INDUSTRIES INC | mye-ex10ad_365.htm |

| EX-10.AC - EX-10.AC - MYERS INDUSTRIES INC | mye-ex10ac_264.htm |

| EX-10.O - EX-10.O - MYERS INDUSTRIES INC | mye-ex10o_363.htm |

| EX-10.M - EX-10.M - MYERS INDUSTRIES INC | mye-ex10m_364.htm |

2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED December 31, 2019

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM ________ TO ________

COMMISSION FILE NUMBER 001-08524

MYERS INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

|

OHIO |

34-0778636 |

|

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification Number) |

|

1293 S. MAIN STREET, AKRON, OHIO (Address of Principal Executive Offices) |

44301 (Zip Code) |

(330) 253-5592 (Telephone Number) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Trading Symbol |

|

Name of Exchange on Which Registered |

|

Common Stock, without par value |

|

MYE |

|

New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☒ |

|

Non-Accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the closing sale price on the New York Stock Exchange as of June 28, 2019: $349,734,506

Indicate the number of shares outstanding of registrant’s common stock as of February 28, 2020: 35,719,817 Shares of Common Stock, without par value.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the Registrant’s Definitive Proxy Statement for its 2020 Annual Meeting of Stockholders are incorporated by reference in Part III of this Form 10-K.

|

|

|

|

|

|

3 |

|

|

|

8 |

|

|

|

14 |

|

|

|

15 |

|

|

|

16 |

|

|

|

|

|

|

|

|

|

|

|

17 |

|

|

|

19 |

|

|

|

ITEM 7. Management’s Discussion and Analysis of Results of Operations and Financial Condition |

20 |

|

|

ITEM 7A. Quantitative and Qualitative Disclosures About Market Risk |

25 |

|

|

26 |

|

|

|

26 |

|

|

|

27 |

|

|

|

28 |

|

|

|

29 |

|

|

|

30 |

|

|

|

31 |

|

|

|

32 |

|

|

|

ITEM 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

57 |

|

|

57 |

|

|

|

59 |

|

|

|

|

|

|

|

|

|

|

|

ITEM 10. Information about our Directors, Executive Officers and Corporate Governance |

59 |

|

|

60 |

|

|

|

60 |

|

|

|

ITEM 13. Certain Relationships and Related Transactions, and Director Independence |

60 |

|

|

60 |

|

|

|

|

|

|

|

|

|

|

|

60 |

|

|

|

|

|

|

63 |

||

|

|

Exhibit 21 |

|

|

|

Exhibit 23 |

|

|

|

Exhibit 31(a) |

|

|

|

Exhibit 31(b) |

|

|

|

Exhibit 32 |

|

|

|

Exhibit 101 |

|

General Development of Business

Myers Industries, Inc. (the “Company”) was founded in Akron, Ohio, in 1933. The terms “Myers Industries,” “Company,” “we,” “us,” or “our” wherever used herein refer to the Company, unless the context indicates to the contrary. Since its founding, the Company has grown from a small storefront distributing tire service supplies into an international manufacturing and distribution enterprise. In 1971, the Company went public, and the stock is traded on the New York Stock Exchange under the ticker symbol MYE.

Headquartered in Akron, Ohio, the Company manufactures a diverse range of polymer products for industrial, agricultural, automotive, commercial, and consumer markets. Myers Industries is a leader in the manufacturing of plastic reusable material handling containers and pallets, and plastic fuel tanks. Other principal product lines include plastic storage and organization containers, rubber tire repair products and custom plastic and rubber products.

The Company is also the largest distributor of tools, equipment and supplies for the tire, wheel and undervehicle service industry in the United States. The distribution products range from tire balancers and alignment systems to valve caps, tire repair tools and other consumable service supplies.

As of December 31, 2019, the Company operated eight manufacturing facilities, 13 sales offices, five distribution centers and three distribution branches located throughout North and Central America; and had approximately 1,640 employees.

Serving customers around the world, Myers Industries’ brands provide safety and efficiency solutions to a wide variety of customers in diverse niche markets. Myers Industries’ diverse products and solutions help customers improve shop productivity with point of use inventory, store and transport products more safely and efficiently, improve sustainability through reuse, lower overall material handling costs, improve ergonomics for their labor force, eliminate waste and ultimately increase profitability. Myers Industries’ employees think and act like owners, implementing long term improvements both internally and for their customers.

The Company’s business strategy is guided by the following key operating principles: 1) niche market focus, 2) flexible operations, and 3) strong cash flow growth. Applying these principles to our business, management emphasizes:

|

|

• |

Customer intimacy - #1 or #2 in each served market; |

|

|

• |

Strong brands; |

|

|

• |

Process driven, simplified, lean operating principles; |

|

|

• |

Manufacturing only value-added components and products; |

|

|

• |

An asset light business model; and |

|

|

• |

Cash return on investment. |

The Company continually reviews its segments and brands for strategic fit and growth potential. The review process is dedicated to furthering innovation and brand leadership in niche markets, building strong customer relationships and positioning the Company for strong financial performance.

Description of Business

The Company conducts its business activities in two distinct business segments, Material Handling and Distribution, consistent with the manner in which the Company’s Chief Operating Decision Maker evaluates performance and makes resource allocation decisions.

In our Material Handling Segment, we design, manufacture, and market a variety of plastic and metal products. These range from plastic reusable material handling containers and small parts storage bins to plastic recreational vehicle (“RV”) tanks and parts, marine tanks and parts, portable plastic fuel tanks and water containers, portable marine fuel containers, ammunition containers, storage totes, bulk shipping containers and metal carts and cabinets. The Material Handling Segment conducts operations in the United States and Canada. Markets served include industrial manufacturing, food processing, retail/wholesale products distribution, agriculture, automotive, recreational vehicles, marine vehicles, healthcare, appliance, bakery, electronics, textiles, consumer, and others. Products are sold both directly to end-users and through distributors.

3

The Distribution Segment is engaged in the distribution of tools, equipment and supplies used for tire, wheel and undervehicle service on passenger, heavy truck and off-road vehicles and the manufacturing of tire repair materials and custom rubber products. The product line includes categories such as tire valves and accessories, lifts and alignment equipment, service equipment and tools, and tire repair/retread supplies. The Distribution Segment also manufactures and sells permanent and temporary reflective highway marking tape. The Distribution Segment operates domestically through its sales offices and five regional distribution centers in the United States, and in certain foreign countries through export sales. In addition, the Distribution Segment operates directly in certain foreign markets, principally Central America, through foreign branch operations. Markets served include retail and truck tire dealers, commercial auto and truck fleets, auto dealers, general service and repair centers, tire retreaders, and government agencies.

On August 26, 2019, the Company acquired the assets of Tuffy Manufacturing Industries, Inc. (“Tuffy”), a warehouse distributor of tire repair equipment and supplies, which is included in the Company’s Distribution Segment. Tuffy’s annual sales are approximately $20 million.

In December 2017, the Company completed the sale of its subsidiaries Myers do Brasil Embalagens Plasticas Ltda. and Plasticos Novel do Nordeste Ltda. (collectively, the “Brazil Business”) to allow the Company to focus resources on its core businesses and additional growth opportunities. The results of the Brazil Business are classified as discontinued operations under Items 6 and 8 of this report.

In 2015, the Company completed the sale of its Lawn and Garden business to an entity controlled by Wingate Partners V, L.P. (“L&G Buyer”), which is now named HC Companies, Inc. (“HC”). The results for the Lawn and Garden business are also classified as discontinued operations in the Consolidated Statements of Operations under Items 6 and 8 of this report; however, certain matters related to financing and lease guarantees provided by the Company in the transaction are included as part of continuing operations. Refer to Notes 6, 12 and 18 to the consolidated financial statements.

4

The following table summarizes the key attributes of the business segments for the year ended December 31, 2019:

|

Material Handling Segment |

|

||||||||

|

Net Sales |

|

Key Product Areas |

|

Product Brands |

|

Key Capabilities & Services |

|

Representative Markets |

|

|

$356.4 |

• |

Plastic Reusable Containers & |

• |

Akro-Mils® |

• |

Product Design |

• |

Agriculture |

|

|

69% |

|

Pallets |

• |

Jamco™ |

• |

Prototyping |

• |

Automotive |

|

|

|

• |

Plastic Storage & |

• |

Buckhorn® |

• |

Product Testing |

• |

Food Processing |

|

|

|

|

Organizational Products |

• |

Ameri-Kart® |

• |

Material Formulation |

• |

Food Distribution |

|

|

|

• |

Plastic and Metal Carts |

• |

Scepter™ |

• |

Injection Molding |

• |

Healthcare |

|

|

|

• |

Metal Cabinets |

|

|

• |

Structural Foam Molding |

• |

Industrial |

|

|

|

• |

Custom Products |

|

|

• |

Material Regrind & Recycling |

• |

Manufacturing |

|

|

|

|

|

|

|

• |

Plastic Blow Molding |

• |

Retail Distribution |

|

|

|

|

|

|

|

• |

Plastic Rotational Molding |

• |

Wholesale Distribution |

|

|

|

|

|

|

|

• |

Thermoforming |

• |

Consumer |

|

|

|

|

|

|

|

• |

Infrared Welding |

• |

Recreational Vehicle |

|

|

|

|

|

|

|

• |

Metal Forming |

• |

Marine |

|

|

|

|

|

|

|

• |

Stainless Steel Forming |

• |

Military |

|

|

|

|

|

|

|

• |

Powder Coating |

• |

Custom |

|

|

|

|

|

|

|

|

|

|

|

|

|

Distribution Segment |

|

||||||||

|

Net Sales |

|

Key Product Areas |

|

Product Brands |

|

Key Capabilities & Services |

|

Representative Markets |

|

|

$159.4 |

• |

Tire Valves & Accessories |

• |

Myers Tire Supply® |

• |

Broad Sales Coverage |

• |

Retail Tire Dealers |

|

|

31% |

• |

Tire Changing & |

• |

Myers Tire Supply |

• |

Local Sales |

• |

Truck Tire Dealers |

|

|

|

|

Balancing Equipment |

|

International |

• |

Five Strategically Placed |

• |

Auto Dealers |

|

|

|

• |

Lifts & Alignment Equipment |

• |

Patch Rubber Company® |

|

Distribution Centers |

• |

Commercial Auto & Truck |

|

|

|

• |

Service Equipment |

• |

Elrick |

• |

International Distribution |

|

Fleets |

|

|

|

• |

Hand Tools |

• |

Fleetline |

• |

Personalized Service |

• |

General Repair & Services |

|

|

|

• |

Tire Repair & Retread |

• |

MTS |

• |

National Accounts |

|

Facilities |

|

|

|

|

Equipment & Supplies |

• |

Phoenix |

• |

Product Training |

• |

Tire Retreaders |

|

|

|

• |

Brake, Transmission & Allied |

• |

Seymoure |

• |

Repair/Service Training |

• |

Tire Repair |

|

|

|

|

Service Equipment & Supplies |

• |

Tuffy |

• |

New Products/Services |

• |

Governmental Agencies |

|

|

|

• |

Highway Markings |

• |

Advance Traffic Markings |

|

“Speed to Market” |

• |

Telecommunications |

|

|

|

• |

Industrial Rubber |

|

|

• |

Rubber Mixing |

• |

Industrial |

|

|

|

• |

General Shop Supplies |

|

|

• |

Rubber Compounding |

• |

Road Construction |

|

|

|

• |

Tire Pressure Monitoring System |

|

|

• |

Rubber Calendaring |

• |

Mining |

|

|

|

|

|

|

|

• |

Tiered Product Offerings |

|

|

|

5

Material Handling Segment

The Material Handling Segment manufactures highly engineered polymer packaging containers, storage and safety products, and specialty molded parts. The brands within this segment include Buckhorn®, Akro-Mils®, Jamco™, Ameri-Kart®, and Scepter™.

Buckhorn’s reusable containers and pallets are used in closed-loop supply chain systems to help customers improve product protection, increase handling efficiencies, reduce freight costs and eliminate solid waste and disposal costs. Buckhorn offers products to replace costly single use cardboard boxes, wooden pallets, and steel containers. The product line is among the broadest in the industry and includes injection-molded and structural foam-molded constructions. Buckhorn’s product lines include hand-held containers used for inventory control, order management and transportation of retail goods; collapsible and fixed-wall bulk transport containers for light and heavy-duty tasks; intermediate bulk containers for the storage and transport of food, liquid, powder, and granular products; plastic pallets; and specialty boxes designed for storage of items such as seed. Buckhorn also produces a wide variety of specialty products for niche applications and custom products designed according to exact customer specifications.

Akro-Mils material handling products provide customers everything they need to store, organize and transport a wide range of goods while increasing overall productivity and profitability. Serving industrial, commercial and consumer markets, Akro-Mils products range from AkroBins® — the industry’s leading small parts bins — to Super-Size AkroBins, metal panel and bin hanging systems, metal storage cabinet and bin systems, wire shelving systems, plastic and metal transport carts and a wide variety of custom storage and transport products. Akro-Mils products deliver storage and organization solutions in a wide variety of applications, from creating assembly line workstations to organizing medical supplies and retail displays. Emphasis is placed on product bundling and customizing systems to create specific storage and organization configurations for customers’ operations.

Jamco Products is well established in industrial and commercial markets with its wide selection of welded steel service carts, platform trucks, mobile work centers, racks and cabinets for plastic bins, safety cabinets, medical cylinder carts and more. Jamco Products’ strong product offering, relationships with industrial distributors and reputation for quality and service complements Myers Industries’ other Material Handling businesses.

Ameri-Kart is an industry leading manufacturer and thermoformer of rotational-molded water, fuel and waste handling tanks, plastic trim and interior parts used in the production of seat components, consoles, and other applications throughout the recreational vehicle, marine, and industrial markets. In addition to standard marine parts, Ameri-Kart is well respected within the marine market for its patented Enviro-Fill® overfill prevention system (“OPS”) technology and is the industry’s only turnkey provider of an integrated, Environmental Protection Agency (“EPA”)-compliant marine fuel tank and patented Enviro-Fill diurnal system.

Scepter is a leading producer of portable plastic fuel containers, portable marine fuel tanks and water containers, ammunition containers and storage totes. Scepter was the first provider of Jerry Cans to North America which offer safe, reliable transportation and storage of fuel for the consumer market. Scepter also manufactures a variety of molded products for military applications from high quality containers to safely store and transport large caliber ammunition, to military specified portable fuel and water canisters. Scepter's in-house product engineering and state of the art mold capabilities complements Myers Industries’ Material Handling Segment through an increased product offering and global reach.

Distribution Segment

Our Distribution Segment includes the Myers Tire Supply®, Myers Tire Supply International, Tuffy Manufacturing and Patch Rubber Company® brands. Within the Distribution Segment we source and manufacture top of the line products for the tire, wheel and undervehicle service industry.

Myers Tire Supply is the largest U.S. distributor and single source for tire, wheel and undervehicle service tools, equipment and supplies. We buy and sell over 10,000 different items — everything that professionals need to service passenger, truck and off-road tires, wheels and related components. Independent tire dealers, mass merchandisers, commercial auto and truck fleets, auto dealerships, tire retreaders and general repair facilities rely on our broad product selection, rapid availability and personal service to be more productive and profitably grow their businesses. Myers Tire Supply International further distributes these product offerings in Central America, through its branch offices, and to other foreign countries, through its U.S. export business.

While the needs and composition of our distribution markets constantly change, we adapt and deliver new products and services that are crucial to our customers’ success. The new product pipeline is driven by a thorough understanding of the market and its customers’ needs. Myers Tire Supply in turn works closely with its suppliers to develop innovative products and services to meet these needs.

6

Patch Rubber Company manufactures one of the most comprehensive lines of tire repair and retreading products in the United States. Service professionals rely on our extensive product selection and quality for safe, cost-effective repairs to passenger, truck and off-road tires. Products include the plug that fills a puncture, the cement that seals the plug, the tire innerliner patch and the final sealing compound. Patch brand repair products maintain a strong position in the tire service markets including sales through the Myers Tire Supply sales network. Patch Rubber also employs its rubber calendering and compounding expertise to create a diverse portfolio of products outside of the tire repair market, such as permanent and temporary reflective highway marking tape. Our rubber-based tape and symbols provide the durability and brightness that construction professionals demand to replace paint for marking road repair, intersections and hazardous areas.

Raw Materials & Suppliers

The Company purchases substantially all of its raw materials from a wide range of third-party suppliers. These materials are primarily polyethylene, polypropylene, and polystyrene plastic resins, all used within the Material Handling Segment, as well as synthetic and natural rubber. Most raw materials are commodity products and available from several domestic suppliers. We believe that the loss of any one supplier or group of suppliers would not have a material adverse effect on our business.

Our Distribution Segment purchases substantially all of its components from third-party suppliers and has multiple sources for its products.

Competition

Competition in our Material Handling Segment is substantial and varied in form and size from manufacturers of similar products to those of other products which can be substituted for products produced by the Company. In general, most direct competitors with the Company’s brands are private entities. Myers Industries maintains strong brand presence and market positions in the niche sectors of the markets it serves. The Company does not command substantial, overall market presence in the broad market sectors.

Competition in our Distribution Segment is generally comprised of small companies, regional players and national auto parts chains where product offerings may overlap. Within the overall tire, wheel and undervehicle service market, Myers Industries is the largest U.S. distributor of tools, equipment and supplies offered based on national coverage.

Customer Dependence

In 2019, 2018 and 2017, there were no customers that accounted for more than ten percent of total net sales from continuing operations. Myers Industries serves thousands of customers who demand value through product selection, innovation, quality, delivery and responsive personal service. Our brands foster satisfied, loyal customers who have recognized our performance through numerous supplier quality awards.

Employees

As of December 31, 2019, Myers Industries had a total of approximately 1,640 full-time and part-time employees. Of these, approximately 1,115 were employed in the Company’s Material Handling Segment while the Distribution Segment employed approximately 475. The Company’s corporate offices had approximately 50 employees.

As of December 31, 2019, the Company had approximately 140 employees represented by a labor union. The collective bargaining agreement between us and the labor union expires June 2022. We consider our relationship with our employees generally to be satisfactory.

Backlog

The backlog of orders for our operations is estimated to have been approximately $23 million at December 31, 2019 and approximately $47 million at December 31, 2018. Generally, our lead time between customer order and product delivery is less than 90 days, and thus our estimated backlog is substantially expected to be delivered within the succeeding three months. During periods of shorter lead times, backlog may not be a meaningful indicator of future sales. Accordingly, we do not believe our backlog data and comparisons thereof, as of different dates, reliably indicate future sales or shipments.

7

Filings with the SEC. As a public company, we regularly file reports and proxy statements with the Securities and Exchange Commission (“SEC”), such as:

|

|

• |

annual reports on Form 10-K; |

|

|

• |

quarterly reports on Form 10-Q; |

|

|

• |

current reports on Form 8-K; and |

|

|

• |

proxy statements on Schedule 14A. |

The SEC maintains an internet website that contains our reports, proxy and information statements, and our other SEC filings; the address of that site is http://www.sec.gov.

We make our SEC filings available free of charge on our own internet site as soon as reasonably practicable after we have filed with the SEC. Our internet address is http://www.myersindustries.com. The content on the Company’s website is available for informational purposes only and is not incorporated by reference into this Form 10-K.

Our website also contains additional information about our corporate governance policies, including the charters of our standing board committees, as described further under Part II, Item 10 of this Form 10-K. Any of these items are available in print to any shareholder who requests them. Requests should be sent to Corporate Secretary, Myers Industries, Inc., 1293 S. Main Street, Akron, Ohio 44301.

This Form 10-K and the information we are incorporating by reference contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, including information regarding the Company’s financial outlook, future plans, objectives, business prospects and anticipated financial performance. You can identify forward-looking statements by words such as “will,” “believe,” “anticipate,” “expect,” “estimate,” “intend,” “plan,” or variations of these words, or similar expressions. These forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, these statements inherently involve a wide range of inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. The Company’s actual actions, results, and financial condition may differ materially from what is expressed or implied by the forward-looking statements. Specific factors that could cause such a difference include those set forth below and other important factors disclosed previously and from time to time in our other filings with the Securities and Exchange Commission. Given these factors, as well as other variables that may affect our operating results, you should not rely on forward-looking statements, assume that past financial performance will be a reliable indicator of future performance, nor use historical trends to anticipate results or trends in future periods. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date thereof. We expressly disclaim any obligation or intention to provide updates to the forward-looking statements and the estimates and assumptions associated with them.

Risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the applicable statements include, but are not limited to:

Significant increase in the cost of raw materials or disruption in the availability of raw materials could adversely affect our financial performance.

Our ability to manage our cost structure can be adversely affected by movements in commodity and other raw material prices. Our primary raw materials include plastic resins, colorants and natural and synthetic rubbers. Plastic resins in particular are subject to substantial short term price fluctuations, including those arising from supply shortages and changes in the prices of natural gas, crude oil and other petrochemical intermediates from which resins are produced, as well as other factors. Over the past several years, we have at times experienced rapidly increasing resin prices. The Company’s revenue and profitability may be materially and adversely affected by these price fluctuations.

Market conditions may limit our ability to raise selling prices to offset increases in our raw material input costs. If we are unsuccessful in developing ways to mitigate raw material cost increases, we may not be able to improve productivity or realize our ongoing cost reduction programs sufficiently to help offset the impact of these increased raw material costs. As a result, higher raw material costs could result in declining margins and operating results.

8

Changes in raw material availability may also occur due to events beyond our control, including natural disasters such as floods, tornadoes and hurricanes. Our specific molding technologies and/or product specifications can limit our ability to timely locate alternative suppliers to produce certain products.

Changes in trade policies could result in new tariffs or other restrictions on products, components or raw materials sourced, directly or indirectly, from foreign countries, which could increase raw material costs and adversely impact profitability. However, as the Company has limited foreign operations and sources the majority of its raw materials domestically, we do not believe new tariffs would have a material impact on our operations. We also believe that adverse impacts can be mitigated over time through increases in price or sourcing through an alternate supply chain.

Our strategic growth initiatives have inherent risks and may not achieve anticipated benefits.

Our growth initiatives include:

|

|

• |

Internal growth driven by strong brands and new product innovation; |

|

|

• |

Development of new, high-growth markets and expansion in existing niche markets; |

|

|

• |

Strengthened customer relationships through value-added initiatives and key product partnerships; |

|

|

• |

Investments in new technology and processes to reinforce market strength and capabilities in key business groups; |

|

|

• |

Consolidation and rationalization activities to further reduce costs and improve productivity within our manufacturing and distribution footprint; |

|

|

• |

An opportunistic and disciplined approach to strategic acquisitions to accelerate growth in our market positions; and |

|

|

• |

Potential divestitures of businesses with non-strategic products or markets. |

While this is a continuous process, all of these activities and initiatives have inherent risks and there remain significant challenges and uncertainties, including economic and general business conditions that could limit our ability to achieve anticipated benefits associated with announced strategic initiatives and affect our financial results. We may not achieve any or all of these goals and are unable to predict whether these initiatives will produce significant revenues or profits.

We may not realize the improved operating results that we anticipate from past acquisitions or from acquisitions we may make in the future and we may experience difficulties in integrating the acquired businesses or may inherit significant liabilities related to such businesses.

We explore opportunities to acquire businesses that we believe are related to the execution of the Company’s long-term strategies, with a focus on, among other things, asset light business models, flexible operations, and penetration of niche markets. Some of these acquisitions may be material to us. We expect such acquisitions will produce operating results consistent with our other operations and our strategic goals; however, we may be unable to achieve the benefits expected to be realized from our acquisitions. In addition, we may incur additional costs and our management’s attention may be diverted because of unforeseen expenses, difficulties, complications, delays and other risks inherent in acquiring businesses, including the following:

|

|

• |

We may have difficulty integrating the acquired businesses as planned, which may include integration of systems of internal controls over financial reporting and other financial and administrative functions; |

|

|

• |

We may have delays in realizing the benefits of our strategies for an acquired business; |

|

|

• |

The increasing demands on our operational systems and integration costs, including diversion of management’s time and attention, may be greater than anticipated; |

|

|

• |

We may not be able to retain key employees necessary to continue the operations of an acquired business; |

|

|

• |

Acquisition costs may be met with cash or debt, increasing the risk that we will be unable to satisfy current financial obligations; and |

|

|

• |

Acquired companies may have unknown liabilities that could require us to spend significant amounts of additional capital. |

9

Our results of operations and financial condition could be adversely affected by a downturn in the United States economy or global markets.

We operate in a wide range of regions, primarily North America and Central America. Additionally, some of our end markets are cyclical, and some of our products are a capital expense for our customers. Worldwide and regional business and political conditions and overall strength of the worldwide, regional and local economies, including changes in the economic conditions of the broader markets and in our individual niche markets, could have an adverse effect on one or both of our operating segments.

We operate in a very competitive business environment, which could affect our financial condition and results of operations.

Both of our segments participate in markets that are highly competitive. We compete primarily on the basis of product quality, product performance, value, and supply chain competency. Our competitive success also depends on our ability to maintain strong brands, customer relationships and the belief that customers will need our products and services to meet their growth requirements. The development and maintenance of such brands requires continuous investment in brand building, marketing initiatives and advertising. The competition that we face in all of our markets — which varies depending on the particular business segment, product lines and customers — may prevent us from achieving sales, product pricing and income goals, which could affect our financial condition and results of operations.

Ongoing industry consolidation continues to create competitors with greater financial and other resources. Competitive pressures may require us to reduce prices and attempt to offset such price reductions with improved operating efficiencies and reduced expenditures, for which options may be limited or unavailable. Additionally, larger competitors may be better positioned to weather prolonged periods of reduced prices, which may incentivize them to reduce prices even when not dictated by market and competitive conditions.

Our operations depend on our ability to maintain continuous, uninterrupted production at our manufacturing facilities, which are subject to physical and other risks that could disrupt production.

We are subject to inherent risks from our diverse manufacturing and distribution activities, including but not limited to product quality, safety, licensing requirements and other regulatory issues, environmental events, loss or impairment of key manufacturing or distribution sites, disruptions in logistics and transportation services, labor disputes and industrial accidents. While we maintain insurance covering our manufacturing and production facilities, including business interruption insurance, a catastrophic loss of the use of all or a portion of our facilities due to accident, fire, explosion, natural disaster or any other reason, whether short or long-term, could have a material adverse effect on our business, financial condition and results of operations.

Unexpected failures of our equipment, machinery and manufacturing processes may also result in production delays, revenue loss and significant repair costs, as well as injuries to our employees. Any interruption in production capability may require us to make large capital expenditures to remedy the situation, which could have a negative impact on our profitability and cash flows. Our business interruption insurance may not be sufficient to offset the lost revenues or increased costs that we may experience during a disruption of our operations. A temporary or long-term business disruption could result in a permanent loss of customers. If this were to occur, our future sales levels, and therefore our profitability, could be materially adversely affected.

We derive a portion of our revenues from direct and indirect sales outside the United States and are subject to the risks of doing business in foreign countries.

We currently operate manufacturing, sales and service facilities outside of the United States, particularly in Canada and Central America. For the year ended December 31, 2019, international net sales accounted for approximately 8% of our total net sales. Accordingly, we are subject to risks associated with operations in foreign countries, including:

|

|

• |

Fluctuations in currency exchange rates; |

|

|

• |

Limitations on the remittance of dividends and other payments by foreign subsidiaries; |

|

|

• |

Limitations on foreign investment; |

|

|

• |

Additional costs of compliance with local regulations; and |

|

|

• |

In certain countries, higher rates of inflation than in the United States. |

In addition, our operations outside the United States are subject to the risk of new and different legal and regulatory requirements in local jurisdictions, potential difficulties in staffing and managing local operations and potentially adverse tax consequences. The costs related to our international operations could adversely affect our operations and financial results in the future.

10

Our future performance depends in part on our ability to develop and market new products if there are changes in technology, regulatory requirements or competitive processes.

Changes in technology, regulatory requirements and competitive processes may render certain of our products obsolete or less attractive. Our performance in the future will depend in part on our ability to develop and market new products that will gain customer acceptance and loyalty, as well as our ability to adapt our product offerings and control our costs to meet changing market conditions. Our operating performance would be adversely affected if we were to incur delays in developing new products or if such products did not gain market acceptance. There can be no assurance that existing or future products will be sufficiently successful to enable us to effectively compete in our markets or, should new product offerings meet with significant customer acceptance, that one or more current or future competitors will not introduce products that render our products noncompetitive.

We may not be successful in protecting our intellectual property rights, including our unpatented proprietary know-how and trade secrets, or in avoiding claims that we infringed on the intellectual property rights of others.

In addition to relying on patent and trademark rights, we rely on unpatented proprietary know-how and trade secrets and employ various methods, including confidentiality agreements with employees and consultants, to protect our know-how and trade secrets. However, these methods and our patents and trademarks may not afford complete protection and there can be no assurance that others will not independently develop the know-how and trade secrets or develop better production methods than us. Further, we may not be able to deter current and former employees, contractors and other parties from breaching confidentiality agreements and misappropriating proprietary information and it is possible that third parties may copy or otherwise obtain and use our information and proprietary technology without authorization or otherwise infringe on our intellectual property rights. Additionally, in the future we may license patents, trademarks, trade secrets and similar proprietary rights to third parties. While we attempt to ensure that our intellectual property and similar proprietary rights are protected when entering into business relationships, third parties may take actions that could materially and adversely affect our rights or the value of our intellectual property, similar proprietary rights or reputation. In the future, we may also rely on litigation to enforce our intellectual property rights and contractual rights and, if not successful, we may not be able to protect the value of our intellectual property. Furthermore, no assurance can be given that we will not be subject to claims asserting the infringement of the intellectual property rights of third parties seeking damages, the payment of royalties or licensing fees and/or injunctions against the sale of our products. Any litigation could be protracted and costly and could have a material adverse effect on our business and results of operations regardless of its outcome.

If we are unable to maintain access to credit financing, our business may be adversely affected.

The Company’s ability to make payments on or refinance our indebtedness, fund planned capital expenditures, finance acquisitions and pay dividends depends on our ability to continue to generate sufficient cash flow and retain access to credit financing. This, to some extent, is subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control.

We cannot provide assurance that our business will continue to generate sufficient cash flow from operating activities or that future borrowings will be available to us in amounts sufficient to enable us to service debt, make necessary capital expenditures or fund other liquidity needs. We may need to refinance all or a portion of our indebtedness, on or before maturity. We cannot ensure that we would be able to refinance any of our indebtedness on commercially reasonable terms or at all.

Our current credit facilities require us to maintain specified financial ratios, and our ability to satisfy those requirements may be affected by events beyond our control. A breach of any of those financial ratio covenants or other covenants could result in a default and upon such a default the lenders could elect to declare the applicable outstanding indebtedness immediately due and payable and terminate all commitments to extend further credit. We cannot be sure that our lenders would waive a default or that we could pay the indebtedness in full if it were accelerated.

If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results. As a result, current and potential shareholders could lose confidence in our financial reporting, which would harm our business and the trading price of our common stock.

Internal control systems are intended to provide reasonable assurance regarding the preparation and fair presentation of published financial statements. Any failure to maintain effective controls or implement required new or improved controls could cause us to fail to meet our periodic reporting obligations or result in material misstatements in our consolidated financial statements, and substantial costs and resources may be required to rectify these internal control deficiencies. If we have an internal control deficiency and our remedial measures are insufficient, material weaknesses or significant deficiencies in our internal control over financial reporting could be discovered or occur in the future, and our consolidated financial statements may contain material misstatements. See Item 9A – Controls and Procedures for further discussion.

11

Our information technology systems may experience an interruption or a breach in security.

We rely on information technology systems to process, transmit and store electronic information and manage and operate our business. Such systems are vulnerable to damage or interruption from natural disasters, power loss, telecommunication failures, computer viruses, computer denial-of-service attacks, unauthorized intrusion, and other events, any of which could interrupt our business operations. While we have implemented security measures designed to prevent and mitigate the risk of breaches, information security risks have generally increased in recent years because of the proliferation of new technologies and the increased sophistication and activities of perpetrators of cybersecurity attacks. A failure in or a breach of security in our information technology systems could expose us, our customers and our suppliers to risks of misuse of confidential information, manipulation and destruction of data, production downtimes and operations disruptions, which in turn could negatively affect our reputation, competitive position, business, results of operations or cash flows. Furthermore, because the techniques used to carry out cybersecurity attacks change frequently and in many instances are not recognized until after they are used against a target, we may be unable to anticipate these changes or implement adequate preventative measures.

Changes in privacy laws, regulations and standards may cause our business to suffer.

Personal privacy and data security have become significant issues in the United States and in many other jurisdictions where we offer our products. The regulatory framework for privacy and security issues worldwide is rapidly evolving and is likely to remain uncertain for the foreseeable future. Federal, state, or foreign government bodies or agencies have in the past adopted and may in the future adopt, laws and regulations affecting data privacy which may require us to incur significant compliance costs. In many jurisdictions, enforcement actions and consequences for noncompliance are rising. Any inability to adequately address privacy and security concerns, even if unfounded, or comply with applicable privacy and data security laws, rules and regulations could result in significant cost and liability to us, damage our reputation, inhibit our sales and adversely affect our business.

Future claims, litigation and regulatory actions could adversely affect our financial condition and our ability to conduct our business.

The nature of our business exposes us, from time to time, to breach of contract, warranty or recall claims, claims for negligence, or product liability, strict liability, personal injury or property damage claims. We strive to ensure that our products comply with applicable government regulatory standards and internal requirements and that our products perform effectively and safely; however, customers from time to time could claim that our products do not meet contractual requirements, and users could be harmed by use or misuse of our products. This could give rise to breach of contract, warranty or recall claims, claims for negligence, product liability, strict liability, personal injury or property damage. Such claims can be expensive to defend or address and may divert the attention of management for significant time periods. While we currently maintain what we believe to be suitable and adequate product liability insurance coverage, such coverage may not be available or adequate in all circumstances and claims may increase the cost of such insurance coverage. In addition, claims may arise related to patent infringement, environmental liabilities, distributor terminations, commercial contracts, antitrust or competition law, employment law and employee benefits issues and other regulatory matters. While we have in place processes and policies to mitigate these risks and to investigate and address such claims as they arise, we cannot predict the underlying costs to defend or resolve such claims.

Current and future environmental and other governmental laws and requirements could adversely affect our financial condition and our ability to conduct our business.

Our operations are subject to federal, state, local and foreign environmental laws and regulations that impose limitations on the discharge of pollutants into the air and water and establish standards for the handling, use, treatment, storage and disposal of, or exposure to, hazardous wastes and other materials and require clean-up of contaminated sites. Some of these laws and regulations require us to obtain permits, which contain terms and conditions that impose limitations on our ability to emit and discharge hazardous materials into the environment and periodically may be subject to modification, renewal and revocation by issuing authorities. Fines, penalties and other civil or criminal sanctions may be imposed for non-compliance with applicable environmental laws and regulations and the failure to have or to comply with the terms and conditions of required permits. Certain environmental laws in the United States, such as the federal Comprehensive Environmental Response, Compensation and Liability act of 1980, as amended, 42 U.S.C. §§ 9601 et seq. (“CERCLA” or “Superfund law”) and similar state laws, impose liability for the cost of investigation or remediation of contaminated sites upon the current or, in some cases, the former site owners or operators (or their predecessor entities) and upon parties who arranged for the disposal of wastes or transported or sent those wastes to an off-site facility for treatment or disposal, regardless of when the release of hazardous substances occurred or the lawfulness of the activities giving rise to the release. Such liability can be imposed without regard to fault and, under certain circumstances, can be joint and several, resulting in one party being held responsible for the entire obligation.

While we have not been required historically to make significant capital expenditures in order to comply with applicable environmental laws and regulations, we cannot predict with any certainty our future capital expenditure requirements because of continually changing compliance standards and environmental technology. Furthermore, violations or contaminated sites that we do not know about, including contamination caused by prior owners and operators of such sites, or at sites formerly owned or operated by us or our predecessors in connection with discontinued operations, could result in additional compliance or remediation costs or other liabilities, which could be material.

12

As more fully described in Note 12 to the consolidated financial statements, we are a potentially responsible party (“PRP”) in an environmental proceeding and remediation matter in which substantial amounts may be involved. It is possible that adjustments to reserved expenses will be necessary as new information is obtained, including after EPA approval of the work plan for the remedial investigation and feasibility study (“RI/FS”), which is anticipated to occur in 2020. Estimates of the Company’s liability are based on current facts, laws, regulations and technology. Estimates of the Company’s environmental liabilities are further subject to uncertainties regarding the nature and extent of site contamination, the range of remediation alternatives available, evolving remediation standards, imprecise engineering evaluation and cost estimates, the extent of remedial actions that may be required, the extent of oversight by the EPA, the number and financial condition of other PRPs that may be named as well as the extent of their responsibility for the remediation, and the availability of insurance coverage for these expenses. At this time, we have not accrued for such remediation costs as we are unable to estimate the liability at this time. Additionally, we are party to a consent decree regarding another location pursuant to which we are required to contribute to the costs of the remediation project.

We have limited insurance coverage for potential environmental liabilities associated with historic and current operations and we do not anticipate increasing such coverage in the future. We may also assume significant environmental liabilities in acquisitions. Such costs or liabilities could adversely affect our financial situation and our ability to conduct our business.

Environmental regulations specific to plastic products and containers could adversely affect our ability to conduct our business.

Federal, state, local and foreign governments could enact laws or regulations concerning environmental matters that increase the cost of producing, or otherwise adversely affect the demand for, plastic products. Legislation that would prohibit, tax or restrict the sale or use of certain types of plastic and other containers, and would require diversion of solid wastes such as packaging materials from disposal in landfills, has been or may be introduced in the U.S. Congress, in state legislatures and other legislative bodies. While container legislation has been adopted in a few jurisdictions, similar legislation has been defeated in public referenda in several states, local elections and many state and local legislative sessions. There can be no assurance that future legislation or regulation would not have a material adverse effect on us. Furthermore, a decline in consumer preference for plastic products due to environmental considerations could have a negative effect on our business.

Our insurance coverage may be inadequate to protect against potential hazardous incidents to our business.

We maintain property, business interruption, product liability and casualty insurance coverage, but such insurance may not provide adequate coverage against potential claims, including losses resulting from war risks, terrorist acts or product liability claims relating to products we manufacture. Consistent with market conditions in the insurance industry, premiums and deductibles for some of our insurance policies have been increasing and may continue to increase in the future. In some instances, some types of insurance may become available only for reduced amounts of coverage, if at all. In addition, there can be no assurance that our insurers would not challenge coverage for certain claims. If we were to incur a significant liability for which we were not fully insured or that our insurers disputed, it could have a material adverse effect on our financial position, results of operations or cash flows.

Our business operations could be adversely affected if we lose key employees or members of our senior management team.

Our success depends to a significant degree upon the continued contributions of our key employees and senior management team. Our senior management team has extensive marketing, sales, manufacturing, finance and engineering experience which we believe is instrumental to our continued success. Our future success will depend, in part, on our ability to attract and retain qualified personnel who have experience in the application of our products and are knowledgeable about our business, markets and products. We cannot assure that we will be able to retain our existing senior management personnel or other key employees or attract additional qualified personnel when needed, and we may modify our management structure from time to time or reduce our overall workforce, which may create marketing, operational and other business risks. The loss of key employees or executive officers in the future could adversely impact our business and operations, including our ability to successfully implement our business strategy, financial plans, expansion of services, marketing and other objectives.

Unforeseen events, including natural disasters, unusual or severe weather events and patterns, public health crises, and other catastrophic events may negatively impact our economic condition.

Future events may occur that would adversely affect our business. Such events may include, but are not limited to, strategic decisions made in response to changes in economic and competitive conditions, the impact of the economic environment on our customer base, a material adverse change in our relationship with significant customers, natural disasters, unusual or severe weather events or patterns, public health crises, or other catastrophic events beyond our control. Any of these events may adversely affect our financial condition and results of operations, whether by disrupting our operations or critical systems, adversely affecting the facilities of our suppliers, or other third-party providers, or customers. Moreover, these types of events could negatively impact customer spending or trends in our end markets in impacted regions or depending upon the severity, globally, which could adversely impact our operating results. For example, in December 2019, a strain of coronavirus first surfaced in Wuhan, China, and has spread to other areas of the world. While the primary regions in which we source and sell are largely unaffected at this point, the extent to which the coronavirus may affect our business is uncertain.

13

Equity Ownership Concentration

Based solely on the Schedule 13D filed on July 19, 2019, by Mario J. Gabelli, Gabelli Funds, LLC, GAMCO Asset Management Inc., MJG Associates, Inc., Teton Advisors, Inc., Gabelli Foundation, Inc., GGCP, Inc., GAMCO Investors, Inc., Associated Capital Group, Inc. and Gabelli & Company Investment Advisors, Inc., (collectively, the “Gamco Group”), for which the Company disclaims any responsibility for accuracy, the Gamco Group beneficially owned 6,857,255 shares of our common stock, which represented approximately 19.2% of the 35,710,934 shares outstanding at December 31, 2019.

Based solely Amendment No. 12 of the Schedule 13G filed on February 4, 2020, by Blackrock, Inc., (“Blackrock”), for which the Company disclaims any responsibility for accuracy, Blackrock beneficially owned 5,587,513 shares of our common stock, which represented approximately 15.6% of the 35,710,934 shares outstanding at December 31, 2019.

Individually or combined, these parties may have sufficient voting power to influence actions requiring the approval of our shareholders.

Changes in laws and regulations may have an adverse impact on our operations.

Changes in laws and regulations and approvals and decisions of courts, regulators, and governmental bodies on any legal claims known or unknown, could have an adverse effect on the Company’s financial results. Additionally, changes in tax laws or new guidance issued by the U.S. Treasury Department, the IRS, and other standard-setting bodies could impact our future effective tax rate and may result in a material adverse effect on our business, financial condition, results of operations, or cash flows.

Exposure to additional tax liabilities could affect our financial performance.

The Company’s 2017. U.S. Federal tax return is currently under audit by the IRS. The Company regularly assesses the likely outcome of the audit in order to determine the appropriateness of its tax provision, however, there can be no assurance that the Company will accurately predict the outcome of the audit and the amounts ultimately paid upon resolution of the audit could be materially different from the amounts previously included in the Company’s income tax expense and therefore could have a material impact on its tax provision, net income and cash flows.

None.

14

The following table sets forth certain information with respect to properties owned by the Company as of December 31, 2019:

|

|

|

Distribution |

|

|

|

|||||

|

Location |

|

Approximate Floor Space (Square Feet) |

|

|

Approximate Land Area (Acres) |

|

|

Use |

||

|

Akron, Ohio |

|

|

129,000 |

|

|

|

8 |

|

|

Headquarters and distribution center |

|

Akron, Ohio |

|

|

67,000 |

|

|

|

5 |

|

|

Administration and warehousing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Manufacturing |

|

|

|

|||||

|

Miami, Oklahoma |

|

|

330,000 |

|

|

|

16 |

|

|

Manufacturing and distribution |

|

Springfield, Missouri |

|

|

227,000 |

|

|

|

19 |

|

|

Manufacturing and distribution |

|

Wadsworth, Ohio |

|

|

197,000 |

|

|

|

23 |

|

|

Manufacturing and distribution |

|

Bristol, Indiana * |

|

|

185,000 |

|

|

|

12 |

|

|

Manufacturing and distribution |

|

Roanoke Rapids, North Carolina |

|

|

172,000 |

|

|

|

20 |

|

|

Manufacturing and distribution |

|

Scarborough, Ontario |

|

|

170,000 |

|

|

|

8 |

|

|

Manufacturing and distribution |

* Classified as held for sale at December 31, 2019 and scheduled for consolidation into a new facility in 2020.

The following table sets forth certain information with respect to facilities leased by the Company as of December 31, 2019:

|

|

|

Manufacturing & Distribution |

|

|

||||

|

Location |

|

Approximate Floor Space (Square Feet) |

|

|

Expiration Date of Lease |

|

Use |

|

|

Cassopolis, Michigan * |

|

|

210,000 |

|

|

December 2020 |

|

Manufacturing and distribution |

|

South Beloit, Illinois |

|

|

160,000 |

|

|

September 2020 |

|

Manufacturing and distribution |

|

Southaven, Mississippi |

|

|

56,000 |

|

|

September 2023 |

|

Distribution center |

|

Cuyahoga Falls, Ohio |

|

|

45,000 |

|

|

August 2020 |

|

Distribution center |

|

Salt Lake City, Utah |

|

|

30,000 |

|

|

October 2023 |

|

Distribution center |

|

Milford, Ohio |

|

|

12,000 |

|

|

December 2023 |

|

Administration and sales |

|

Pomona, California |

|

|

18,000 |

|

|

February 2028 |

|

Sales and distribution center |

* Scheduled for consolidation into a new facility in 2020.

The Company also leases facilities for its sales offices and sales branches in the United States and Central America which, in the aggregate, amount to approximately 31,000 square feet of warehouse and office space. All of these locations are used by the Distribution Segment.

In March 2019, the Company announced plans to consolidate manufacturing operations of its Ameri-Kart Corp. subsidiary, which includes the owned facility in Bristol, Indiana and the leased facility in Cassopolis, Michigan. In December 2019, the Company provided notice to terminate its lease of the Cassopolis, Michigan facility effective December 2020 and signed agreements for the 15-year lease of a new Bristol facility and the sale of its existing Bristol facility. The lease of the new Bristol facility and the sale of the existing Bristol facility both become effective when the new facility is substantially complete, which is expected to be in the second half of 2020. The new Bristol facility is expected to be approximately 233,000 square feet and to be designed to better meet the Company’s manufacturing and distribution needs.

The Company believes that all of its properties, machinery and equipment generally are well maintained and adequate for the purposes for which they are used.

15

The Company is a defendant in various lawsuits and a party to various other legal proceedings arising in the ordinary course of business, some of which are covered in whole or in part by insurance. When a loss arising from these matters is probable and can reasonably be estimated, the most likely amount of the estimated probable loss is recorded, or if a range of probable loss can be estimated and no amount within the range is a better estimate than any other amount, the minimum amount in the range is recorded. As additional information becomes available, any potential liability related to these matters is assessed and the estimates revised, if necessary.

Based on currently available information, management believes that the ultimate outcome of these matters, including those described specifically below, will not have a material adverse effect on our financial position, cash flows or overall trends in our results of operations. However, these matters are subject to inherent uncertainties. If new information becomes available or an unfavorable ruling were to occur, there exists the possibility of a material adverse impact on the financial position and results of operations in the period in which such change in estimate occurs or in future periods.

For information relating to the New Idria Mercury Mine EPA matter, the New Almaden Mine environmental matter, the Lawn and Garden indemnification claim settlement, and the Scepter patent infringement litigation matter, see Note 12, Contingencies, to the Consolidated Financial Statements included in Item 8 of this Annual Report on Form 10-K.

16

|

ITEM 5. |

Market for Registrant’s Common Stock and Related Stockholder Matters and Issuer Purchases of Equity Securities |

The Company’s common stock is traded on the New York Stock Exchange under the symbol MYE. The approximate number of shareholders of record at December 31, 2019 was 966. Dividends for the last two years were:

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

2019 |

|

|

2018 |

|

||

|

March 31 |

|

$ |

0.135 |

|

|

$ |

0.135 |

|

|

June 30 |

|

|

0.135 |

|

|

|

0.135 |

|

|

September 30 |

|

|

0.135 |

|

|

|

0.135 |

|

|

December 31 |

|

|

0.135 |

|

|

|

0.135 |

|

Purchases of equity securities by the issuer

The following table presents information regarding the Company’s stock repurchase plan during the three months ended December 31, 2019.

|

|

|

Total Number of Shares Purchased |

|

|

Average Price Paid per Share |

|

|

Total Number of Shares Purchased as Part of the Publicly Announced Plans or Programs |

|

|

Maximum number of Shares that may yet be Purchased Under the Plans or Programs (1) |

|

||||

|

10/1/2019 to 10/31/2019 |

|

|

— |

|

|

$ |

— |

|

|

|

5,547,665 |

|

|

|

2,452,335 |

|

|

11/1/2019 to 11/30/2019 |

|

|

— |

|

|

|

— |

|

|

|

5,547,665 |

|

|

|

2,452,335 |

|

|

12/1/2019 to 12/31/2019 |

|

|

— |

|

|

|

— |

|

|

|

5,547,665 |

|

|

|

2,452,335 |

|

|

(1) |

On July 11, 2013, the Board authorized the repurchase of up to an additional five million shares of the Company’s common stock. This authorization was in addition to the 2011 Board authorized repurchase of up to five million shares. The Company completed the repurchase of approximately 2.0 million shares in 2011 pursuant to Rule 10b5-1 plans, which were adopted pursuant to the 2011 authorized share repurchase. |

See Item 12 of this Form 10-K for the Equity Compensation Plan Information Table.

17

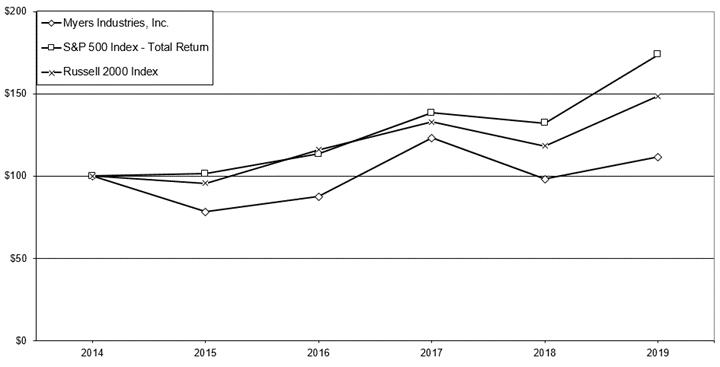

Comparison of 5 Year Cumulative Total Return

Assumes Initial Investment of $100

December 31, 2019

The chart below compares the Company’s cumulative total shareholder return for the five years ended December 31, 2019, to that of the Standard & Poor’s 500 Index – Total Return and the Russell 2000 Index. In all cases, the information is presented on a dividend-reinvested basis and assumes investment of $100 on December 31, 2014.

|

|

2014 |

|

|

2015 |

|

|

2016 |

|

|

2017 |

|

|

2018 |

|

|

2019 |

|

||||||

|

Myers Industries Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Return % |

|

|

|

|

|

(21.65 |

) |

|

|

11.74 |

|

|

|

40.72 |

|

|

|

(20.39 |

) |

|

|

13.84 |

|

|

Cum $ |

|

100.00 |

|

|

|

78.35 |

|

|

|

87.55 |

|

|

|

123.21 |

|

|

|

98.09 |

|

|

|

111.66 |

|

|

S&P 500 Index - Total Return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Return % |

|

|

|

|

|

1.38 |

|

|

|

11.96 |

|

|

|

21.83 |

|

|

|

(4.38 |

) |

|

|

31.49 |

|

|

Cum $ |

|

100.00 |

|

|

|

101.38 |

|

|

|

113.51 |

|

|

|

138.29 |

|

|

|

132.23 |

|

|

|

173.86 |

|

|

Russell 2000 Index |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Return % |

|

|

|

|

|

(4.41 |

) |

|

|

21.31 |

|

|

|

14.65 |

|

|

|

(11.01 |

) |

|

|

25.52 |

|

|

Cum $ |

|

100.00 |

|

|

|

95.59 |

|

|

|

115.95 |

|

|

|

132.94 |

|

|

|

118.30 |

|

|

|

148.49 |

|

18

Thousands of Dollars, Except Per Share Data

|

|

|

2019 |

|

|

2018 |

|

|

2017 |

|

|

2016 |

|

|

2015 |

|

|||||

|

Operations for the Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

515,698 |

|

|

$ |

566,735 |

|

|

$ |

547,043 |

|

|

$ |

534,379 |

|

|

$ |

571,020 |

|

|

Gross profit |

|

|

171,312 |

|

|

|

179,293 |

|

|

|

157,453 |

|

|

|

161,898 |

|

|

|

175,862 |

|

|

Operating income (1) |

|

|

37,266 |

|

|

|

6,327 |

|

|

|

24,888 |

|

|

|

27,362 |

|

|

|

34,517 |

|

|

Income (loss) from continuing operations (1) |

|

|

24,215 |

|

|

|

(1,648 |

) |

|

|

10,844 |

|

|

|

11,324 |

|

|

|

17,471 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Position — At Year End |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

75,527 |

|

|

$ |

58,894 |

|

|

$ |

2,520 |

|

|

$ |

2,404 |

|

|

$ |

2,353 |

|

|

Current assets other than cash |

|

|

109,515 |

|

|

|

123,961 |

|

|

|

147,492 |

|

|

|

138,747 |

|

|

|

152,188 |

|

|

Current liabilities |

|

|

82,625 |

|

|

|

97,423 |

|

|

|

98,653 |

|

|

|

79,312 |

|

|

|

117,045 |

|

|

Working capital |

|

$ |

102,417 |

|

|

$ |

85,432 |

|

|

$ |

51,359 |

|

|

$ |

61,839 |

|

|

$ |

37,496 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|