Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DIXIE GROUP INC | a8kmarchinvpres.htm |

Exhibit 99.1 March 2020 Investor Presentation Contact: Allen Danzey CFO The Dixie Group Phone: 706-876-5865 allen.danzey@dixiegroup.com

Forward Looking Statements The Dixie Group, Inc. • Statements in this presentation which relate to the future, are subject to risk factors and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements. Such factors include the levels of demand for the products produced by the Company. Other factors that could affect the Company’s results include, but are not limited to, raw material and transportation costs related to petroleum prices, the cost and availability of capital, and general economic and competitive conditions related to the Company’s business. Issues related to the availability and price of energy may adversely affect the Company’s operations. Additional information regarding these and other factors and uncertainties may be found in the Company’s filings with the Securities and Exchange Commission. • General information set forth in this presentation concerning market conditions, sales data and trends in the U.S. carpet and rug markets are derived from various public and, in some cases, non-public sources. Although we believe such data and information to be accurate, we have not attempted to independently verify such information. 2

Dixie History • 1920 Began as Dixie Mercerizing in Chattanooga, TN • 1990’s Transitioned from textiles to floorcovering • 2003 Refined focus on upper- end floorcovering market • 2003 Launched Dixie Home - upper end residential line • 2005 Launched modular tile carpet line – new product category • 2012 Purchased Colormaster dye house and Crown Rugs • 2013 Purchased Robertex - wool carpet manufacturing • 2014 Purchased Atlas Carpet Mills – high-end commercial business • 2014 Purchased Burtco - computerized yarn placement for hospitality • 2016 Launched Calibré luxury vinyl flooring in Masland Contract • 2017 Launched Stainmaster® LVF in Masland and Dixie Home • 2018 Launched engineered wood in our Fabrica brand • 2018 Unified Atlas and Masland Contract into single business unit • 2019 Launched TRUCOR™ and TRUCOR Prime™ LVF in Dixie Home and Masland 3

Dixie Today • Commitment to brands in the upper- end market with strong growth potential. • Diversified between Commercial and Residential markets. • Diversified customer base (TTM Basis) – Top 10 carpet customers • 16% of sales – Top 100 carpet customers • 31% of sales 4

Dixie Group Drivers What affects our business? The market dynamics: • Residentially • The market is driven by home sales and remodeling. • New construction is a smaller effect. • Dixie is driven by the wealth effect. • The stock market and consumer confidence. • Commercially • The market is driven by remodeling of offices, schools, retail and hospitality as demonstrated by the investment in non-residential fixed structures. • Dixie is driven by upper-end remodeling in offices, retail remodeling, higher education, and upper-end hospitality that primarily involves a designer. 5

New and Existing Home Sales Seasonally Adjusted Annual Rate • “I view 2019 as a neutral New 1,000 Existing 1,000 year for housing in terms of 800 6,000 sales,” Yun said. “Home sellers are positioned well, 750 but prospective buyers aren’t as fortunate. Low 700 5,500 inventory remains a problem, with first-time 650 buyers affected the most. 600 5,000 • Price appreciation has rapidly accelerated, and 550 areas that are relatively unaffordable or declining in 500 4,500 affordability are starting to experience slower job 450 growth. The hope is for price appreciation to slow in 400 4,000 line with wage growth, which is about 3%.” 350 Lawrence Yun Chief Economist 300 3,500 National Association of Jan '13 Jan '14 Jan '15 Jan '16 Jan '17 Jan '18 Jan '19 Realtors January 22, 2020 6 Source: National Association of Realtors (existing) and census.gov/newhomesales

7

Household Formations Year Over Year Growth 8

Residential and Commercial Fixed Investment 9

The Industry as compared to The Dixie Group Source: U.S. Bureau of Economic Analysis and Company estimates 10

2018 U.S. Flooring Manufacturers Flooring $ in Flooring Market Flooring Manufacturers millions % Shaw (Berkshire Hathaway) 5,142 21.7% Mohawk (MHK) 5,213 22.0% Engineered Floors (Private) 1,015 4.3% Interface (TILE) 601 2.5% Dixie (DXYN) 405 1.7% Imports & All Others 11,304 47.7% U.S. Carpet & Rug Market 23,680 100.0% Source: Floor Focus - Flooring includes sales of carpet, rugs, ceramic floor tile, wood, laminate, resilient and rubber 11

Dixie versus the Industry 2019 2019 U.S. Carpet & Rug Market of Dixie sales $10.6 billion High End Commercial, 25% Commercial, 44% High End Residential, 56% Residential, 75% Source: Floor Covering Weekly and Dixie Group estimate 12

Carpet Growth Dixie Market Share in Dollars and Units 13

Industry Positioning The Dixie Group • Strategically our residential and commercial businesses are driven by our relationship to the upper-end consumer and the design community • This leads us to: – Have a sales force that is attuned to design and customer solutions – Be a “product driven company” with emphasis on the most beautiful and up-to-date styling and design – Be quality focused with excellent reputation for building excellent products and standing behind what we make – And, unlike much of the industry, not manufacturing driven 14

Residential Brand Positioning The Dixie Group ESTIMATED WHOLESALE MARKET PRICE FOR CARPETS AND RUGS: VOLUME AND PRICE POINTS OR SALES DOLLARS Masland TOTAL MARKET: SQUARE YARDS SQUAREMARKET: YARDS TOTAL Dixie Home Fabrica $0 $8 $14 $21 $28 $35 $42 $49 INDUSTRY AVERAGE PRICE / SQ YD FOR CARPETS AND RUGS Note: Market share data based on internal company estimates – Industry average price based on sales reported through industry sources 15

Dixie Group High-End Residential Sales All Residential Brands Sales by Brand for 2019 Fabrica Masland Dixie Home 16

Dixie Group High-End Residential Sales All Brands Sales by Channel for 2019 Specialty - OEM Commercial Builder Mass Merchant Retailer Designer The company believes that a significant portion of retail sales also involve a designer. 17

• Well-styled moderate to upper priced residential broadloom line – Known for differentiated pattern and color selection • Dixie Home provides a “full line” to retailers – Sells specialty and mass merchant retailers • Growth initiatives – TRUCOR™ SPC and TRUCOR Prime™ WPC Luxury Vinyl Flooring – Stainmaster® PetProtect ® Fiber Technology 18

• Leading high-end brand with reputation for innovative styling, design and color • High-end retail / designer driven – Approximately 21% of sales directly involve a designer – Hand crafted and imported rugs • Growth initiative – TRUCOR Prime™ WPC Luxury Vinyl Flooring – Stainmaster® PetProtect ® Fiber Technology – Wool products in both tufted and woven constructions 19

• Premium high-end brand – “Quality without Compromise” • Designer focused – Approximately 30% of sales directly involve a designer – Hand crafted and imported rugs • Growth initiatives – Fabrica Fine Wood Flooring, a sophisticated collection of refined “best in class” wood flooring products. 20

Commercial Market Positioning The Dixie Group • We focus on the “high-end specified soft floorcovering contract market” • Our Atlas | Masland products – Designer driven focused on the fashion oriented market space – Broad product line for diverse commercial markets • Our Masland eNergy products – Sells “main street commercial” through retailers • Our Masland Residential and Atlas | Masland sales forces – Commercial design firms and select commercial retailers 21

• The consolidation of Atlas and Masland Contract provides an exciting opportunity for us to become a greater resource to our customers in the hyper competitive commercial flooring market. • Atlas | Masland has become a comprehensive resource to the commercial flooring customer. Whether a project calls for broadloom carpet, modular carpet tile, area rugs, walk off material or luxury vinyl flooring, we have the product and expertise to service any market segment. 22

• Upper-end brand in the specified commercial marketplace – Corporate, End User, Store Planning, Hospitality, Health Care, Government and Education markets • Designer focused • Strong national account base • Growth initiatives – Sustaina™ cushion modular carpet backing with the ability to install in high relative humidity environments – The Crafted Collection with Sustaina™ cushion modular carpet backing, both PVC and polyeurathane free – over 80% recycled content – Calibré Luxury Vinyl Tile 23

Sales by Channel for 2019 Other Health Care Gov't Hospitality Store Planning Education Corporate Channels: Interior Design Specifier and Commercial End User 24

Dixie Group Sales $ in millions Net Sales 450 422 412 407 397 405 400 375 345 350 331 321 300 283 270 266 250 231 205 200 150 100 50 0 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 *2016 had 53 weeks. 25

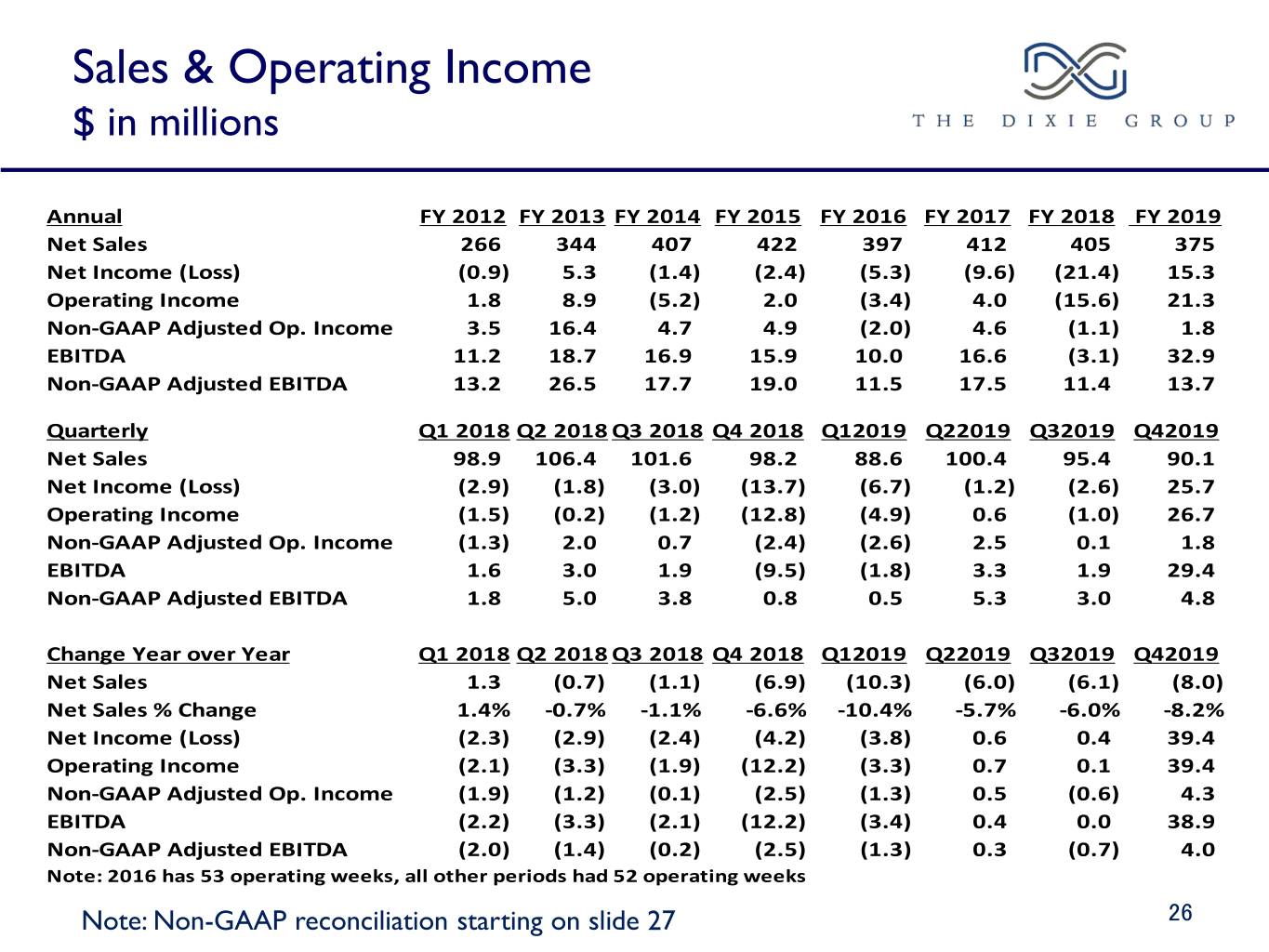

Sales & Operating Income $ in millions Annual FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 Net Sales 266 344 407 422 397 412 405 375 Net Income (Loss) (0.9) 5.3 (1.4) (2.4) (5.3) (9.6) (21.4) 15.3 Operating Income 1.8 8.9 (5.2) 2.0 (3.4) 4.0 (15.6) 21.3 Non-GAAP Adjusted Op. Income 3.5 16.4 4.7 4.9 (2.0) 4.6 (1.1) 1.8 EBITDA 11.2 18.7 16.9 15.9 10.0 16.6 (3.1) 32.9 Non-GAAP Adjusted EBITDA 13.2 26.5 17.7 19.0 11.5 17.5 11.4 13.7 Quarterly Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q12019 Q22019 Q32019 Q42019 Net Sales 98.9 106.4 101.6 98.2 88.6 100.4 95.4 90.1 Net Income (Loss) (2.9) (1.8) (3.0) (13.7) (6.7) (1.2) (2.6) 25.7 Operating Income (1.5) (0.2) (1.2) (12.8) (4.9) 0.6 (1.0) 26.7 Non-GAAP Adjusted Op. Income (1.3) 2.0 0.7 (2.4) (2.6) 2.5 0.1 1.8 EBITDA 1.6 3.0 1.9 (9.5) (1.8) 3.3 1.9 29.4 Non-GAAP Adjusted EBITDA 1.8 5.0 3.8 0.8 0.5 5.3 3.0 4.8 Change Year over Year Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q12019 Q22019 Q32019 Q42019 Net Sales 1.3 (0.7) (1.1) (6.9) (10.3) (6.0) (6.1) (8.0) Net Sales % Change 1.4% -0.7% -1.1% -6.6% -10.4% -5.7% -6.0% -8.2% Net Income (Loss) (2.3) (2.9) (2.4) (4.2) (3.8) 0.6 0.4 39.4 Operating Income (2.1) (3.3) (1.9) (12.2) (3.3) 0.7 0.1 39.4 Non-GAAP Adjusted Op. Income (1.9) (1.2) (0.1) (2.5) (1.3) 0.5 (0.6) 4.3 EBITDA (2.2) (3.3) (2.1) (12.2) (3.4) 0.4 0.0 38.9 Non-GAAP Adjusted EBITDA (2.0) (1.4) (0.2) (2.5) (1.3) 0.3 (0.7) 4.0 Note: 2016 has 53 operating weeks, all other periods had 52 operating weeks Note: Non-GAAP reconciliation starting on slide 27 26

Current Business Conditions 2019 Accomplishments and 2020 Outlook • We have consolidated our two commercial brands into Atlas | Masland Contract. • We launched Sustaina™, our 95% post-consumer recycled material, PVC free and polyurethane free, cushion modular carpet tile backing. • We launched TRUCOR™ and TRUCOR Prime™ luxury vinyl flooring. • We are growing the number of items in our TRUCOR™ family of luxury vinyl flooring products by over 40%. We are featuring, “Integrated Grout Technology” where the locking system is engineered to simulate a real grout line. We are launching our new oversized planks in contemporary, clean visuals. • Since the third quarter of 2018, we have paid down over $50 million in debt. • Since the third quarter of 2019, we increased our equity by over 50%. • We returned to operating profitability in the fourth quarter of 2019. • We launched around 50 new styles in soft surface, including STAINMASTER®, EnVision 6,6™, and Strongwool in 2020. • As the year began, business activity was slow and behind the levels of last year. Sales and orders in February have improved significantly and are above the level of last year. We have experienced improvement in both the residential retail and commercial business, however, our mass merchant sales continue to underperform. For the quarter to date, excluding our mass merchant sales, our sales are slightly behind this same period in 2019. 27

Non-GAAP Information Use of Non-GAAP Financial Information: The Company believes that non-GAAP performance measures, which management uses in evaluating the Company's business, may provide users of the Company's financial information with additional meaningful bases for comparing the Company's current results and results in a prior period, as these measures reflect factors that are unique to one period relative to the comparable period. However, the non-GAAP performance measures should be viewed in addition to, not as an alternative for, the Company's reported results under accounting principles generally accepted in the United States. The Company defines Adjusted Gross Profit as Gross Profit plus manufacturing integration expenses of new or expanded operations, plus acquisition expense related to the fair market write up of inventories, plus one time items so defined (Note 1) The Company defines Adjusted S,G&A as S,G&A less manufacturing integration expenses included in selling, general and administrative, less direct acquisition expenses, less one time items so defined. (Note 2) The Company defines Adjusted Operating Income as Operating Income plus manufacturing integration expenses of new or expanded operations, plus acquisition expense related to the fair market write up of inventories, plus facility consolidation and severance expenses, plus acquisition related expenses, plus impairment of assets, plus impairment of goodwill, plus one time items so defined. (Note 3) The company defines Adjusted Income from Continuing Operations as net income plus loss from discontinued operations net of tax, plus manufacturing integration expenses of new or expanded operations, plus facility consolidation and severance expenses, plus acquisition related expenses, plus impairment of assets, plus impairment of goodwill, plus one time items so defined , all tax effected. (Note 4) The Company defines Adjusted EBIT as net income plus taxes and plus interest. The Company defines Adjusted EBITDA as Adjusted EBIT plus depreciation and amortization, plus manufacturing in integration expenses of new or expanded operations, plus facility consolidation and severance expenses, plus acquisition related expenses, plus impairment of assets, plus impairment of goodwill, plus one time items so defined. (Note 5) The company defines Free Cash Flow as Net Income plus interest plus depreciation plus non-cash impairment of assets and goodwill minus the net change in working capital minus the tax shield on interest minus capital expenditures. The change in net working capital is the change in current assets less current liabilities between periods. (Note 6) The company defines Non-GAAP Earnings per Share (EPS) as the adjusted operating income less Interest and other expense, tax adjusted at a 35% rate, and divided by the number of fully diluted shares. (Note 7) The Company defines Net Sales as Adjusted as net sales less the last week of sales in a 53 week fiscal year. (Note 8) The Company defines Non-GAAP earnings per Share (EPS) for the Jobs Cut and Tax Act of 2017 as Net Income less discontinued operations minus the effect of the tax act and divided by the number of fully diluted shares. (Note 9) 29

Non-GAAP Information Twelve Months Ended Non-GAAP Gross Profit 2011 2012 2013 2014 2015 2016 2017 2018 2019 Net Sales 270,110 266,372 344,374 406,588 422,484 397,453 412,462 405,033 374,581 Gross Profit 65,506 65,372 85,569 95,497 106,231 95,425 101,213 86,991 86,205 Plus: Unusual Workers Comp - - - - - - - 450 - Plus: Inventory write off for PIP - - - - - - - 2,701 572 Plus: Business integration expense - 1,383 4,738 445 - - - - - Plus: Amortization of inventory step up - - 367 606 - - - - - Non-GAAP Adj. Gross Profit (Note 1) 65,506 66,755 90,674 96,548 106,231 95,425 101,213 90,142 86,778 Gross Profit as % of Net Sales 24.3% 24.5% 24.8% 23.5% 25.1% 24.0% 24.5% 21.5% 23.0% Non-GAAP Adj. Gross Profit % of Net Sales 24.3% 25.1% 26.3% 23.7% 25.1% 24.0% 24.5% 22.3% 23.2% Non-GAAP S,G&A 2011 2012 2013 2014 2015 2016 2017 2018 2019 Net Sales 270,110 266,372 344,374 406,588 422,484 397,453 412,462 405,033 374,581 Selling and Administrative Expense 60,667 63,489 76,221 93,182 100,422 96,983 96,171 92,472 83,825 Plus: Business integration expense - - (1,706) (1,429) - - - - - Less: Acquisition expenses - (318) (350) (789) - - - - - Non-GAAP Adj. Selling and Admin. Expense 60,667 63,171 74,164 90,964 100,422 96,983 96,171 92,472 83,825 S,G&A as % of Net Sales 22.5% 23.8% 22.1% 22.9% 23.8% 24.4% 23.3% 22.8% 22.4% Non-GAAP S,G&A as % of Net Sales (Note 2) 22.5% 23.7% 21.5% 22.4% 23.8% 24.4% 23.3% 22.8% 22.4% 30

Non-GAAP Operating Income 2011 2012 2013 2014 2015 2016 2017 2018 2019 Net Sales 270,110 266,372 344,374 406,588 422,484 397,453 412,462 405,033 374,581 Operating income (loss) 5,668 1,815 8,855 (5,236) 1,990 (3,415) 3,965 (15,624) 21,350 Plus: Acquisition expenses - 318 350 789 - - - - - Plus: Amortization of inventory step up - - 367 606 - - - - - Plus: Business integration expense - 1,383 6,616 1,874 - - - - - Plus: Unusual Workers Comp - - - - - - - 450 - Plus: Legal Settlement - - - - - - - 1,514 - Plus: Inventory write off for PIP - - - - - - - 2,701 572 Plus: Profit improvement plans (563) - - 5,514 2,946 1,456 636 3,167 5,019 Plus: Impairment of assets - - 195 1,133 - - - 1,164 (25,111) Plus: Impairment of goodwill and intangibles - - - - - - - 5,545 - Non-GAAP Adj. Operating Income (Loss) (Note 3) 5,105 3,516 16,384 4,681 4,936 (1,959) 4,601 (1,083) 1,830 Operating income as % of net sales 2.1% 0.7% 2.6% -1.3% 0.5% -0.9% 1.0% -3.9% 5.7% Adjusted operating income as a % of net sales 1.9% 1.3% 4.8% 1.2% 1.2% -0.5% 1.1% -0.3% 0.5% Non-GAAP Income from Continuing Operations 2011 2012 2013 2014 2015 2016 2017 2018 2019 Net income (loss) as reported 986 (927) 5,291 (1,402) (2,426) (5,278) (9,555) (21,384) 15,270 Less: (Loss) from discontinued, net tax (286) (275) (266) (2,075) (148) (71) (233) 95 (348) Income (loss) from Continuing Operations 1,272 (653) 5,557 673 (2,278) (5,207) (9,323) (21,479) 15,619 Plus: Acquisition expenses - 318 350 789 - - - - - Plus: Amortization of inventory step up - - 367 606 - - - - - Less: Gain on purchase of business - - - (11,110) - - - - - Plus: Business integration expense - 1,383 6,616 1,874 - - - - - Plus: Unusual Workers Comp - - - - - - - 450 - Plus: Legal Settlement - - - - - - - 1,514 - Plus: Inventory write off for PIP - - - - - - - 2,701 572 Plus: Profit improvement plans (563) - - 5,514 2,946 1,456 636 3,167 5,019 Plus: Impairment of assets - - 195 1,133 - - - 1,164 (25,111) Plus: Impairment of goodwill and intangibles - - - - - - - 5,545 - Plus: Tax effect of above 214 (646) (2,861) 453 (1,119) (553) (242) - - Plus: Tax credits, rate change and valuation allowance - - (1,847) - - - 8,169 - (14) Non-GAAP Adj. (Loss) / Inc from Cont. Op's (Note 4) 923 402 8,377 (68) (451) (4,304) (759) (6,938) (3,915) Adj diluted EPS from Cont. Op's 0.07 0.03 0.65 (0.00) (0.03) (0.28) (0.05) (0.44) (0.25) Wt'd avg. common shares outstanding - diluted 12,623 12,638 12,852 14,382 15,536 15,638 15,699 15,764 15,772 31

Non-GAAP EBIT and EBITDA 2011 2012 2013 2014 2015 2016 2017 2018 2019 Net income (loss) as reported 986 (927) 5,291 (1,402) (2,426) (5,278) (9,555) (21,384) 15,270 Less: (Loss) from discontinued, net tax (286) (275) (266) (2,075) (148) (71) (233) 95 (348) Plus: Taxes 684 (401) (576) 1,055 (714) (3,622) 7,510 (831) (657) Plus: Interest 3,470 3,146 3,756 4,301 4,935 5,392 5,740 6,490 6,444 Non-GAAP Adjusted EBIT (Note 5) 5,426 2,092 8,737 6,029 1,943 (3,437) 3,927 (15,820) 21,405 Plus: Depreciation and amortization 9,650 9,396 10,263 12,908 14,120 13,515 12,947 12,653 11,803 Non-GAAP EBITDA from Cont Op 15,075 11,488 18,999 18,937 16,063 10,078 16,874 (3,167) 33,208 Plus: Acquisition expenses - 318 350 789 - - - - - Plus: Amortization of inventory step up - - 367 606 - - - - - Less: Gain on purchase of business - - - (11,110) - - - - - Plus: Business integration expense - 1,383 6,616 1,874 - - - - - Plus: Unusual Workers Comp - - - - - - - 450 - Plus: Legal Settlement - - - - - - - 1,514 - Plus: Inventory write off for PIP - - - - - - - 2,701 572 Plus: Profit improvement plans (563) - - 5,514 2,946 1,456 636 3,167 5,019 Plus: Impairment of assets - - 195 1,133 - - - 1,164 (25,111) Plus: Impairment of goodwill and intangibles - - - - - - - 5,545 - Non-GAAP Adj. EBITDA (Note 5) 14,512 13,189 26,528 17,743 19,009 11,534 17,510 11,374 13,689 Non-GAAP Adj. EBITDA as % of Net Sales 5.4% 5.0% 7.7% 4.4% 4.5% 2.9% 4.2% 2.8% 3.7% Management estimate of severe weather (not in above) - - - 1,054 - - - - - Non-GAAP Free Cash Flow 2011 2012 2013 2014 2015 2016 2017 2018 2019 Non-GAAP Adjusted EBIT (from above) 5,426 2,092 8,737 6,029 1,943 (3,437) 3,927 (15,820) 21,405 Times: 1 - Tax Rate = EBIAT 3,364 1,297 5,417 3,738 1,205 (2,131) 2,435 (15,820) 21,405 Plus: Depreciation and amortization 9,650 9,396 10,263 12,908 14,120 13,515 12,947 12,653 11,803 Plus: Non Cash Impairment of Assets, Goodwill - - 195 1,133 - - - 6,709 (25,111) Minus: Net change in Working Capital 9,589 10,786 17,714 11,546 (1,970) (16,905) 23,386 (8,578) (8,298) Non-GAAP Cash from Operations 3,425 (93) (1,839) 6,234 17,295 28,289 (8,004) 12,120 16,395 Minus: Capital Expenditures 6,735 4,052 13,257 32,825 12,230 5,331 13,582 4,441 1,416 Minus: Business / Capital acquisitions - 6,961 1,863 9,331 - - - - - Non-GAAP Free Cash Flow (Note 6) (3,310) (11,106) (16,959) (35,922) 5,065 22,958 (21,586) 7,679 14,979 32