Attached files

| file | filename |

|---|---|

| 10-K - 10-K - STEVEN MADDEN, LTD. | shoo-20191231x10k.htm |

| EX-32.02 - EXHIBIT 32.02 - STEVEN MADDEN, LTD. | shoo-20191231xex322.htm |

| EX-32.01 - EXHIBIT 32.01 - STEVEN MADDEN, LTD. | shoo-20191231xex321.htm |

| EX-31.02 - EXHIBIT 31.02 - STEVEN MADDEN, LTD. | shoo-20191231xex312.htm |

| EX-31.01 - EXHIBIT 31.01 - STEVEN MADDEN, LTD. | shoo-20191231xex311.htm |

| EX-23.01 - EXHIBIT 23.01 - STEVEN MADDEN, LTD. | shoo-20191231xex2301.htm |

| EX-21.01 - EXHIBIT 21.01 - STEVEN MADDEN, LTD. | shoo-20191231xex2101.htm |

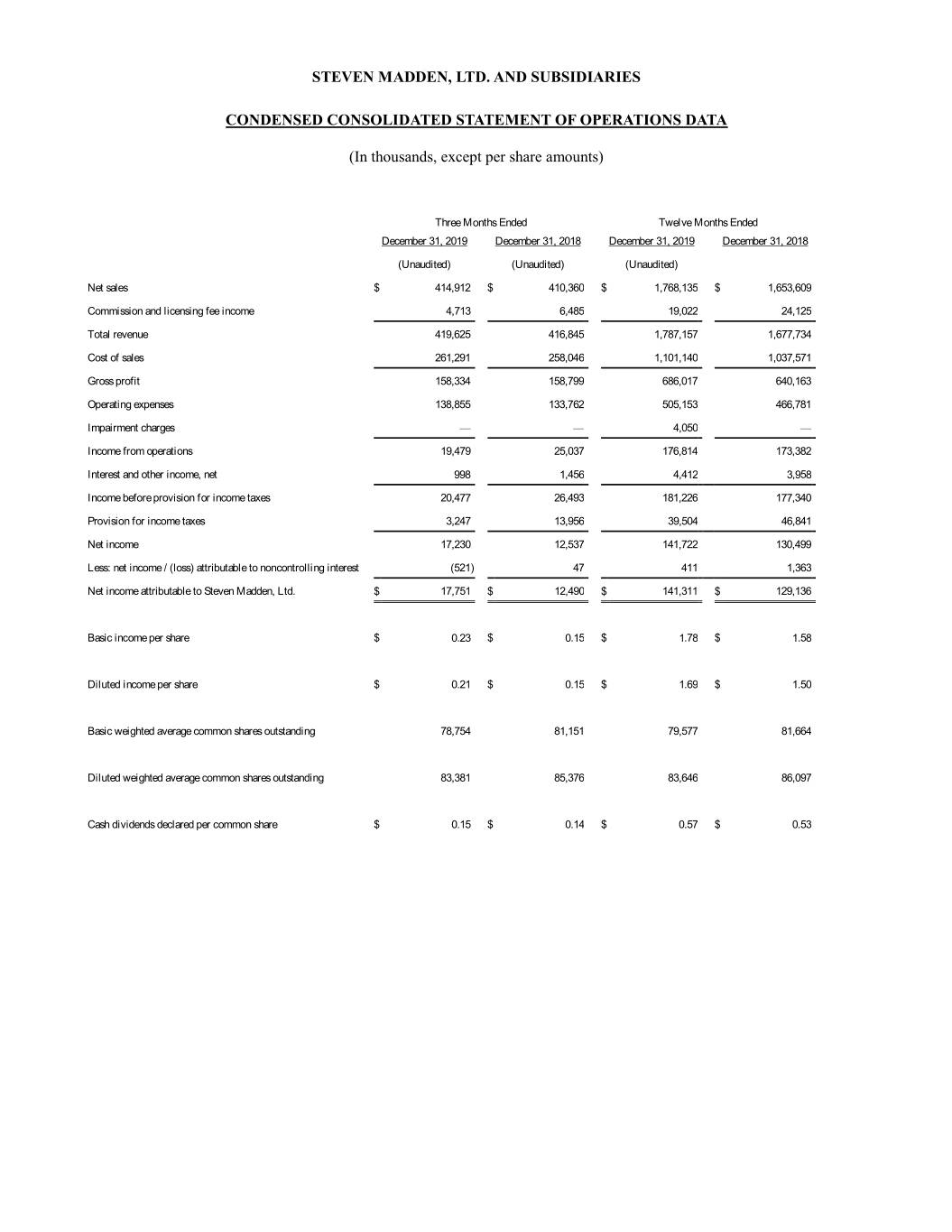

Exhibit 99.01 Steve Madden Announces Fourth Quarter and Full Year 2019 Results and Provides Initial Fiscal Year 2020 Revenue and EPS Guidance LONG ISLAND CITY, N.Y., February 27, 2020 – Steve Madden (Nasdaq: SHOO), a leading designer and marketer of fashion-forward footwear, accessories and apparel for women, men and children, today announced financial results for the fourth quarter and full year ended December 31, 2019, and provided initial fiscal year 2020 revenue and EPS guidance. Amounts referred to as “Adjusted” exclude the items that are described under the heading “Non-GAAP Adjustments.” The Company reclassed commission and licensing fee income to Total Revenue and reclassed its respective expenses into Operating Expenses from previously labeled Commission and Licensing Fee Income - Net on the Company's Consolidated Statement of Operations for each period provided. For the Fourth Quarter 2019: • Revenue increased 0.7% to $419.6 million compared to $416.8 million in the same period of 2018. • Gross margin was 37.7% compared to 38.1% in the same period last year. Adjusted gross margin was 37.8% in 2019. • Operating expenses as a percentage of revenue were 33.1% compared to 32.1% in the same period of 2018. Adjusted operating expenses as a percentage of revenue were 30.0% compared to 29.0% in the same period of 2018. • Income from operations totaled $19.5 million, or 4.6% of revenue, compared to $25.0 million, or 6.0% of revenue, in the same period of 2018. Adjusted income from operations was $33.0 million, or 7.9% of revenue, compared to Adjusted income from operations of $37.9 million, or 9.1% of revenue, in the same period of 2018. • Net income attributable to Steven Madden, Ltd. was $17.8 million, or $0.21 per diluted share, compared to $12.5 million, or $0.15 per diluted share, in the prior year’s fourth quarter. Adjusted net income attributable to Steven Madden, Ltd. was $32.2 million, or $0.39 per diluted share, compared to $35.7 million, or $0.42 per diluted share, in the prior year’s fourth quarter. Edward Rosenfeld, Chairman and Chief Executive Officer, commented, “We are pleased to have achieved Adjusted diluted EPS at the high end of our guidance range for the fourth quarter and full year 2019. Fiscal year 2019 was a strong year for the Company, with revenue and Adjusted diluted EPS increasing mid-single digits on a percentage basis compared to the prior year despite significant headwinds from the bankruptcy of Payless ShoeSource and the tariffs implemented on accessories, footwear and apparel from China. “Looking ahead, while we are cautious on the near-term outlook due to additional headwinds from the coronavirus outbreak, China tariffs and the termination of the Kate Spade footwear license, we are confident that the strength of our brands and our business model will enable us to drive earnings growth and shareholder value creation over the long term.”

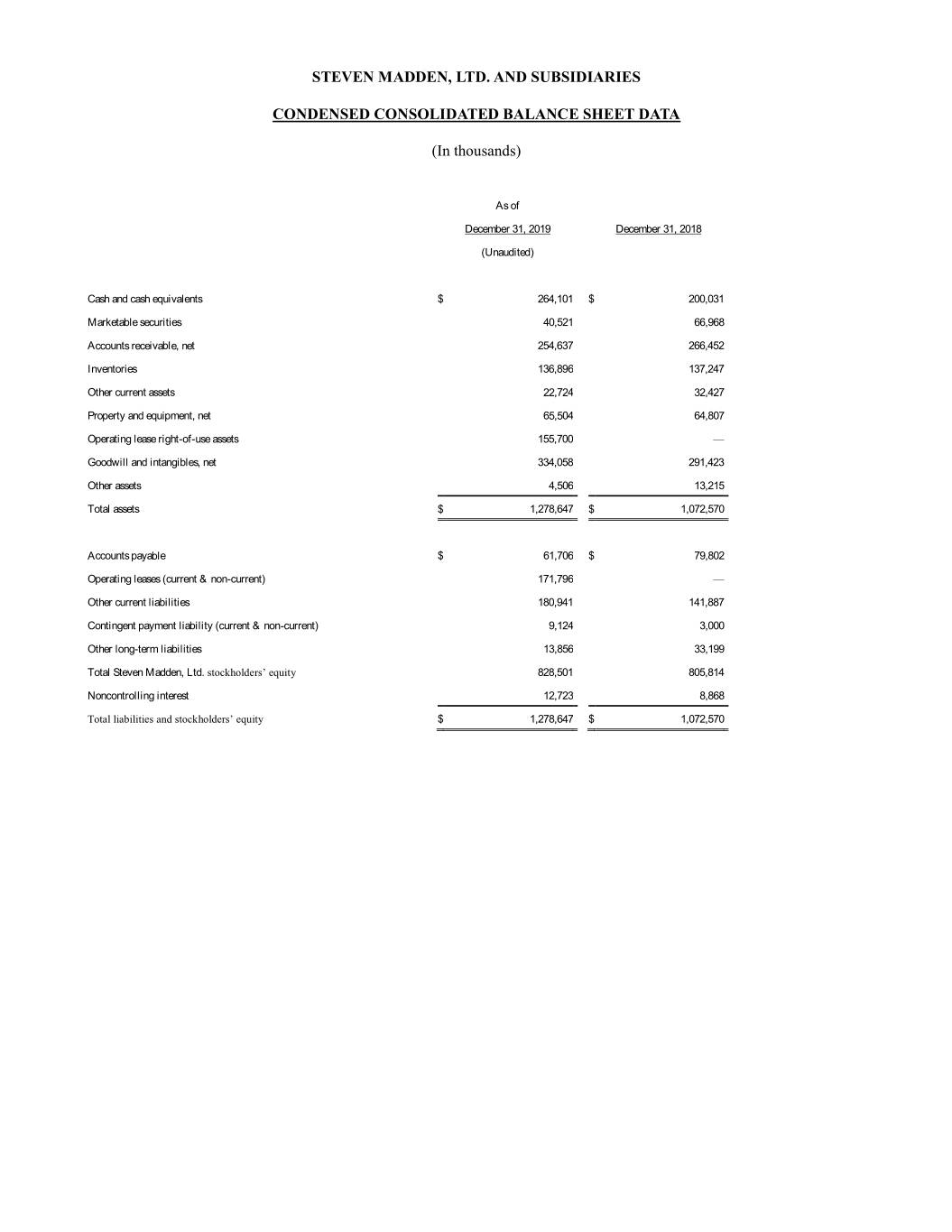

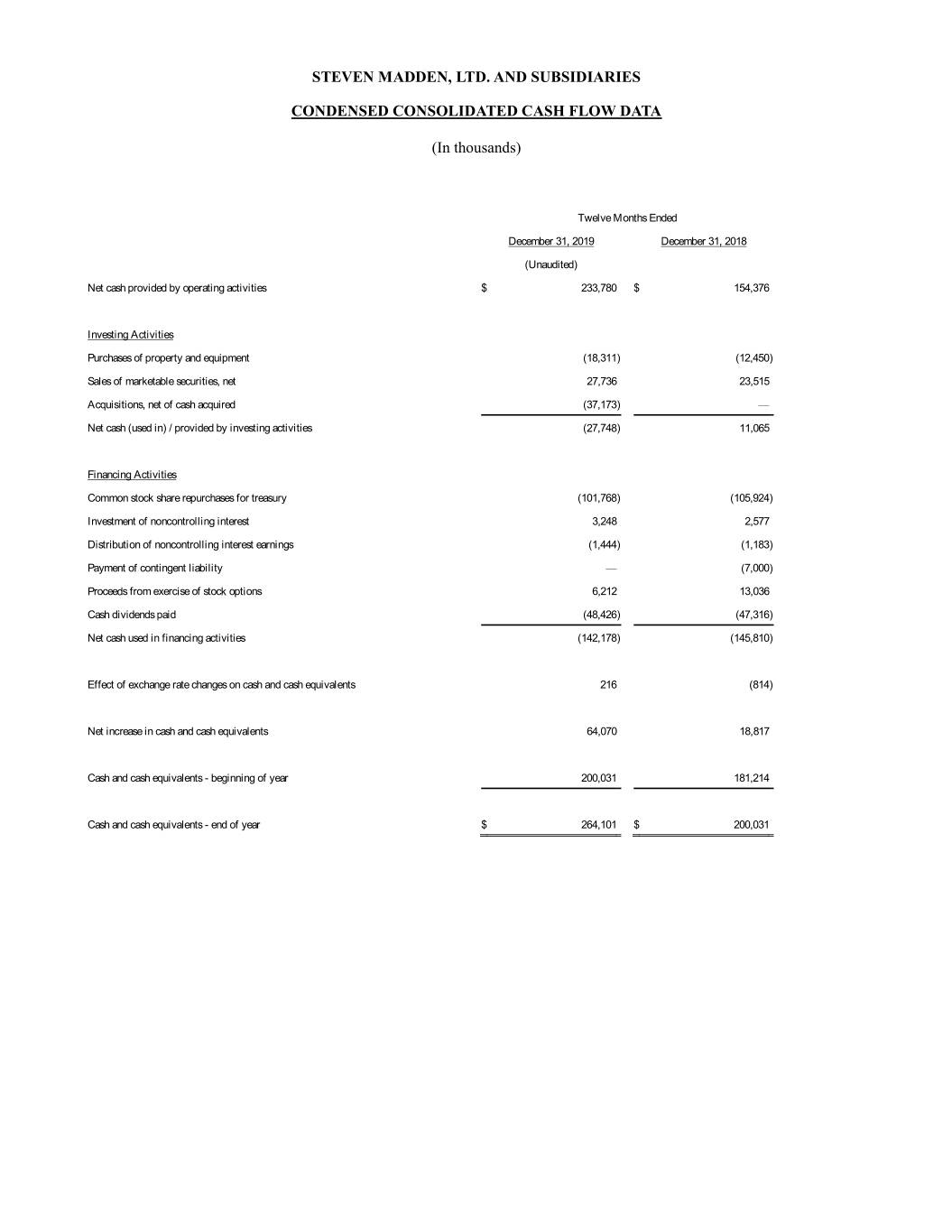

Fourth Quarter 2019 Segment Results Revenue for the wholesale business decreased 1.1% to $313.8 million in the fourth quarter of 2019 due primarily to a decrease in wholesale accessories/apparel revenue. Wholesale footwear revenue declined 0.2% with a decline in the branded business offset by a gain in private label. Wholesale accessories/apparel revenue decreased 3.6% driven by declines in private label handbags and cold weather accessories, partially offset by the addition of the BB Dakota apparel business. Gross margin in the wholesale business decreased to 29.2% compared to 30.1% in last year’s fourth quarter driven by tariffs on goods imported from China. Retail revenue in the fourth quarter rose 8.7% to $101.1 million compared to $93.0 million in the fourth quarter of the prior year. Same store sales increased 6.7% in the quarter driven by strong performance in the Company’s e-commerce business. Retail gross margin was 61.2% in the fourth quarter of 2019 compared to 61.0% in last year's fourth quarter. Adjusted gross margin in the retail segment increased to 61.6% in the fourth quarter of 2019 compared to 61.0% in the fourth quarter of the prior year due to a reduction in promotional activity. The Company ended the quarter with 227 company-operated retail locations, including eight Internet stores, as well as 31 company-operated concessions in international markets. The Company’s effective tax rate for the fourth quarter of 2019 was 15.9% compared to 52.7% in the fourth quarter of 2018. On an Adjusted basis, the effective tax rate was 6.3% compared to 9.2% in the fourth quarter of the prior year due to the impact of the year-over-year benefit resulting from the exercising and vesting of share-based awards. Full Year Ended December 31, 2019 For the full year ended December 31, 2019, revenue increased 6.5% to $1.8 billion from $1.7 billion in the prior year. Net income attributable to Steven Madden, Ltd. was $141.3 million, or $1.69 per diluted share, for the year ended December 31, 2019 compared to net income of $129.1 million, or $1.50 per diluted share, for the year ended December 31, 2018. On an Adjusted basis, net income attributable to Steven Madden, Ltd. was $162.8 million, or $1.95 per diluted share, for the year ended December 31, 2019 compared to net income of $157.7 million, or $1.83 per diluted share, for the year ended December 31, 2018. Balance Sheet and Cash Flow During the fourth quarter of 2019, the Company repurchased 589,809 shares of the Company’s common stock for approximately $25.3 million, which includes shares acquired through the net settlement of employee stock awards. For the full year ended December 31, 2019, the Company repurchased 3.0 million shares of the Company's common stock for approximately $101.8 million, which includes shares acquired through the net settlement of employee stock awards. As of December 31, 2019, cash, cash equivalents and current marketable securities totaled $304.6 million.

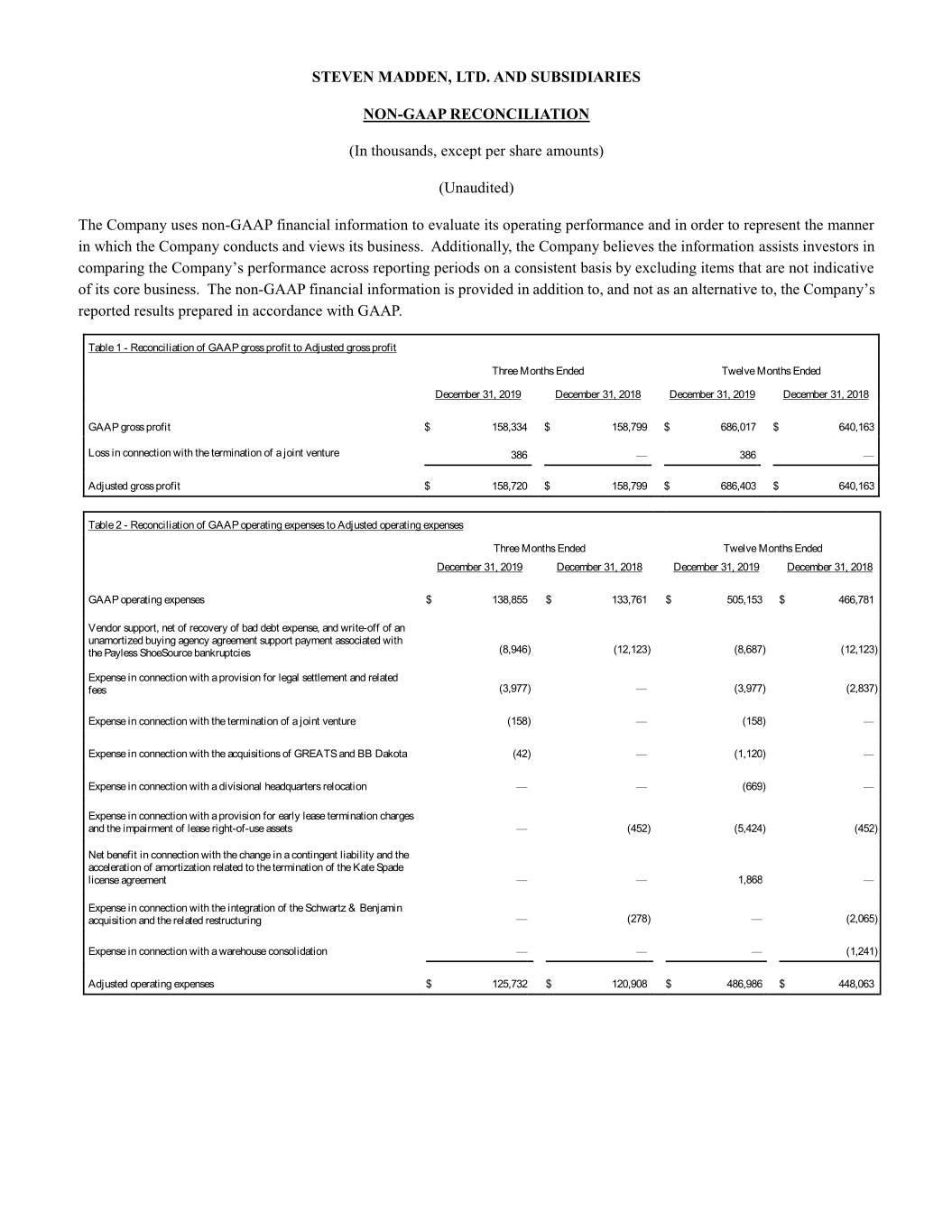

Quarterly Dividend The Company’s Board of Directors approved a quarterly cash dividend of $0.15 per share. The dividend will be paid on March 27, 2020, to stockholders of record at the close of business on March 17, 2020. Fiscal Year 2020 Outlook For fiscal year 2020, the Company expects revenue will increase 0% to 1% over revenue in 2019. The Company expects diluted EPS for fiscal year 2020 will be in the range of $1.70 to $1.80. Compared to the prior year, the diluted EPS range reflects an adverse impact of approximately $0.35 from the combined impact of the coronavirus, tariffs on goods from China, the termination of the Kate Spade footwear license and a higher anticipated tax rate. Non-GAAP Adjustments Amounts referred to as “Adjusted” exclude the items below. For the fourth quarter 2019: • $8.9 million pre-tax ($8.9 million after-tax) vendor support associated with the Payless ShoeSource bankruptcy, included in operating expenses. • $4.0 million pre-tax ($3.0 million after-tax) expense in connection with a provision for a legal settlement and related fees, included in operating expenses. • $0.4 million pre-tax ($0.3 million after-tax) expense in connection with the termination of a joint venture, included in cost of goods sold; $0.2 million pre-tax ($0.1 million after-tax) expense in connection with the termination of a joint venture, included in operating expenses; and $0.2 million after-tax income in connection with the termination of a joint venture, included in net loss attributable to noncontrolling interest. • $0.04 million pre-tax ($0.03 million after-tax) expense in connection with the acquisitions of GREATS and BB Dakota, included in operating expenses. • $2.2 million tax expense in connection with deferred tax and other tax adjustments. For the fourth quarter 2018: • $12.1 million pre-tax ($11.5 million after-tax) in bad debt expense and write-off of an unamortized buying agency agreement support payment associated with the Payless ShoeSource bankruptcy, included in operating expenses. • $0.5 million pre-tax ($0.3 million after-tax) expense in connection with a provision for early lease termination charges, included in operating expenses. • $0.3 million pre-tax ($0.2 million after-tax) expense in connection with the integration of the Schwartz & Benjamin acquisition and the related restructuring, included in operating expenses. • $11.1 million tax expense resulting from the Tax Cuts and Jobs Act transition tax and prepaid tax adjustments related to prior years.

For the fiscal year 2019: • $8.7 million pre-tax ($8.6 million after-tax) vendor support, net of recovery of bad debt expense associated with the Payless ShoeSource bankruptcy, included in operating expenses. • $5.4 million pre-tax ($4.1 million after-tax) expense in connection with early lease termination charges and the impairment of lease right-of-use assets. • $4.1 million pre-tax ($3.0 million after-tax) non-cash expense associated with the impairment of the Brian Atwood trademark. • $4.0 million pre-tax ($3.0 million after-tax) expense in connection with provision for a legal settlement and related fees, included in operating expenses. • $1.9 million pre-tax ($1.4 million after-tax) net benefit associated with the change in a contingent liability and the acceleration of amortization related to the termination of the Kate Spade license agreement as of December 31, 2019. • $1.1 million pre-tax ($0.8 million after-tax) expense in connection with the acquisitions of GREATS and BB Dakota, included in operating expenses. • $0.7 million pre-tax ($0.5 million after-tax) expense in connection with a divisional headquarters relocation. • $0.4 million pre-tax ($0.3 million after-tax) expense in connection with the termination of a joint venture, included in cost of goods sold; $0.2 million pre-tax ($0.1 million after-tax) expense in connection with the termination of a joint venture, included in operating expenses; and $0.2 million after-tax income in connection with the termination of a joint venture, included in net income attributable to noncontrolling interest. • $2.6 million tax expense in connection with deferred tax and other tax adjustments. For the fiscal year 2018: • $12.1 million pre-tax ($11.5 million after-tax) in bad debt expense and write-off of an unamortized buying agency agreement support payment associated with the Payless ShoeSource bankruptcy, included in operating expenses. • $2.8 million pre-tax ($2.1 million after-tax) expense in connection with a provision for a settlement, included in operating expenses. • $2.1 million pre-tax ($1.5 million after-tax) expense in connection with the integration of the Schwartz & Benjamin acquisition and the related restructuring, included in operating expenses. • $1.2 million pre-tax ($0.9 million after-tax) expense in connection with a warehouse consolidation, included in operating expenses. • $1.0 million tax expense in connection with the impairment of the preferred interest investment in Brian Atwood Italia Holding, LLC recorded in fourth quarter 2017. • $0.5 million pre-tax ($0.3 million after-tax) expense in connection with a provision for early lease termination charges, included in operating expenses. • $11.1 million tax expense resulting from the Tax Cuts and Jobs Act transition tax and prepaid tax adjustments related to prior years.

Reconciliations of amounts on a GAAP basis to Adjusted amounts are presented in the Non-GAAP Reconciliation tables at the end of this release and identify and quantify all excluded items. Conference Call Information Interested stockholders are invited to listen to the fourth quarter and fiscal year 2019 earnings conference call scheduled for today, February 27, 2020 at 8:30 a.m. Eastern Time. The call will be broadcast live over the Internet and can be accessed by logging onto http://stevemadden.gcs-web.com. An online archive of the broadcast will be available within two hours of the conclusion of the call and will be accessible for a period of 30 days following the call. About Steve Madden Steve Madden designs, sources and markets fashion-forward footwear, accessories and apparel for women, men and children. In addition to marketing products under its own brands including Steve Madden®, Dolce Vita®, Betsey Johnson®, Blondo®, Report®, Brian Atwood®, Cejon®, GREATS®, BB Dakota®, Mad Love® and Big Buddha®, Steve Madden is a licensee of various brands, including Anne Klein®, Superga® and DKNY®. Steve Madden also designs and sources products under private label brand names for various retailers. Steve Madden’s wholesale distribution includes department stores, specialty stores, luxury retailers, national chains and mass merchants. Steve Madden also operates 227 retail stores (including eight Internet stores). Steve Madden licenses certain of its brands to third parties for the marketing and sale of certain products, including ready-to-wear, outerwear, eyewear, hosiery, jewelry, fragrance, luggage and bedding and bath products. For local store information and the latest Steve Madden booties, pumps, men’s and women’s boots, fashion sneakers, dress shoes, sandals and more, visit http://www.stevemadden.com. Safe Harbor Statement Under the U.S. Private Securities Litigation Reform Act of 1995 This press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include, among others, statements regarding revenue and earnings guidance, plans, strategies, objectives, expectations and intentions. Forward-looking statements can be identified by words such as: “may”, “will”, “expect”, “believe”, “should”, “anticipate”, “project”, “predict”, “plan”, “intend”, or “estimate”, and similar expressions or the negative of these expressions. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they represent the Company’s current beliefs, expectations and assumptions regarding anticipated events and trends affecting its business and industry based on information available as of the time such statements are made. Investors are cautioned that such forward- looking statements are inherently subject to risks and uncertainties, many of which cannot be predicted with accuracy and some of which may be outside of the Company’s control. The Company’s actual results and financial condition may differ materially from those indicated in these forward-looking statements. As such, investors should not rely upon them. Important risk factors include: • the Company’s ability to accurately anticipate fashion trends and promptly respond to consumer demand;

• the Company’s ability to compete effectively in a highly competitive market; • the Company’s ability to adapt its business model to rapid changes in the retail industry; • the Company’s dependence on the retention and hiring of key personnel; • the Company’s ability to successfully implement growth strategies and integrate acquired businesses; • the Company’s reliance on independent manufacturers to produce and deliver products in a timely manner, especially when faced with adversities such as work stoppages, transportation delays, public health emergencies, social unrest, changes in local economic conditions, and political upheavals as well as meet the Company’s quality standards; • changes in trade policies and tariffs imposed by the United States government and the governments of other nations in which the Company manufactures and sells products; • disruptions to product delivery systems and the Company’s ability to properly manage inventory; • the Company’s ability to adequately protect its trademarks and other intellectual property rights; • legal, regulatory, political and economic risks that may affect the Company’s sales in international markets; • changes in U.S. and foreign tax laws that could have an adverse effect on the Company’s financial results; • additional tax liabilities resulting from audits by various taxing authorities; • the Company’s ability to achieve operating results that are consistent with prior financial guidance; and • other risks and uncertainties indicated from time to time in the Company’s filings with the Securities and Exchange Commission. The Company does not undertake any obligation to publicly update any forward-looking statement, including, without limitation, any guidance regarding revenue or earnings, whether as a result of new information, future developments or otherwise.

STEVEN MADDEN, LTD. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS DATA (In thousands, except per share amounts) Three Months Ended Twelve Months Ended December 31, 2019 December 31, 2018 December 31, 2019 December 31, 2018 (Unaudited) (Unaudited) (Unaudited) Net sales $ 414,912 $ 410,360 $ 1,768,135 $ 1,653,609 Commission and licensing fee income 4,713 6,485 19,022 24,125 Total revenue 419,625 416,845 1,787,157 1,677,734 Cost of sales 261,291 258,046 1,101,140 1,037,571 Gross profit 158,334 158,799 686,017 640,163 Operating expenses 138,855 133,762 505,153 466,781 Impairment charges — — 4,050 — Income from operations 19,479 25,037 176,814 173,382 Interest and other income, net 998 1,456 4,412 3,958 Income before provision for income taxes 20,477 26,493 181,226 177,340 Provision for income taxes 3,247 13,956 39,504 46,841 Net income 17,230 12,537 141,722 130,499 Less: net income / (loss) attributable to noncontrolling interest (521 ) 47 411 1,363 Net income attributable to Steven Madden, Ltd. $ 17,751 $ 12,490 $ 141,311 $ 129,136 Basic income per share $ 0.23 $ 0.15 $ 1.78 $ 1.58 Diluted income per share $ 0.21 $ 0.15 $ 1.69 $ 1.50 Basic weighted average common shares outstanding 78,754 81,151 79,577 81,664 Diluted weighted average common shares outstanding 83,381 85,376 83,646 86,097 Cash dividends declared per common share $ 0.15 $ 0.14 $ 0.57 $ 0.53

STEVEN MADDEN, LTD. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEET DATA (In thousands) As of December 31, 2019 December 31, 2018 (Unaudited) Cash and cash equivalents $ 264,101 $ 200,031 Marketable securities 40,521 66,968 Accounts receivable, net 254,637 266,452 Inventories 136,896 137,247 Other current assets 22,724 32,427 Property and equipment, net 65,504 64,807 Operating lease right-of-use assets 155,700 — Goodwill and intangibles, net 334,058 291,423 Other assets 4,506 13,215 Total assets $ 1,278,647 $ 1,072,570 Accounts payable $ 61,706 $ 79,802 Operating leases (current & non-current) 171,796 — Other current liabilities 180,941 141,887 Contingent payment liability (current & non-current) 9,124 3,000 Other long-term liabilities 13,856 33,199 Total Steven Madden, Ltd. stockholders’ equity 828,501 805,814 Noncontrolling interest 12,723 8,868 Total liabilities and stockholders’ equity $ 1,278,647 $ 1,072,570

STEVEN MADDEN, LTD. AND SUBSIDIARIES CONDENSED CONSOLIDATED CASH FLOW DATA (In thousands) Twelve Months Ended December 31, 2019 December 31, 2018 (Unaudited) Net cash provided by operating activities $ 233,780 $ 154,376 Investing Activities Purchases of property and equipment (18,311 ) (12,450 ) Sales of marketable securities, net 27,736 23,515 Acquisitions, net of cash acquired (37,173 ) — Net cash (used in) / provided by investing activities (27,748 ) 11,065 Financing Activities Common stock share repurchases for treasury (101,768 ) (105,924 ) Investment of noncontrolling interest 3,248 2,577 Distribution of noncontrolling interest earnings (1,444 ) (1,183 ) Payment of contingent liability — (7,000 ) Proceeds from exercise of stock options 6,212 13,036 Cash dividends paid (48,426 ) (47,316 ) Net cash used in financing activities (142,178 ) (145,810 ) Effect of exchange rate changes on cash and cash equivalents 216 (814 ) Net increase in cash and cash equivalents 64,070 18,817 Cash and cash equivalents - beginning of year 200,031 181,214 Cash and cash equivalents - end of year $ 264,101 $ 200,031

STEVEN MADDEN, LTD. AND SUBSIDIARIES NON-GAAP RECONCILIATION (In thousands, except per share amounts) (Unaudited) The Company uses non-GAAP financial information to evaluate its operating performance and in order to represent the manner in which the Company conducts and views its business. Additionally, the Company believes the information assists investors in comparing the Company’s performance across reporting periods on a consistent basis by excluding items that are not indicative of its core business. The non-GAAP financial information is provided in addition to, and not as an alternative to, the Company’s reported results prepared in accordance with GAAP. Table 1 - Reconciliation of GAAP gross profit to Adjusted gross profit Three Months Ended Twelve Months Ended December 31, 2019 December 31, 2018 December 31, 2019 December 31, 2018 GAAP gross profit $ 158,334 $ 158,799 $ 686,017 $ 640,163 Loss in connection with the termination of a joint venture 386 — 386 — Adjusted gross profit $ 158,720 $ 158,799 $ 686,403 $ 640,163 Table 2 - Reconciliation of GAAP operating expenses to Adjusted operating expenses Three Months Ended Twelve Months Ended December 31, 2019 December 31, 2018 December 31, 2019 December 31, 2018 GAAP operating expenses $ 138,855 $ 133,761 $ 505,153 $ 466,781 Vendor support, net of recovery of bad debt expense, and write-off of an unamortized buying agency agreement support payment associated with the Payless ShoeSource bankruptcies (8,946 ) (12,123 ) (8,687) (12,123) Expense in connection with a provision for legal settlement and related fees (3,977 ) — (3,977) (2,837) Expense in connection with the termination of a joint venture (158 ) — (158) — Expense in connection with the acquisitions of GREATS and BB Dakota (42 ) — (1,120) — Expense in connection with a divisional headquarters relocation — — (669) — Expense in connection with a provision for early lease termination charges and the impairment of lease right-of-use assets — (452 ) (5,424) (452) Net benefit in connection with the change in a contingent liability and the acceleration of amortization related to the termination of the Kate Spade license agreement — — 1,868 — Expense in connection with the integration of the Schwartz & Benjamin acquisition and the related restructuring — (278 ) — (2,065) Expense in connection with a warehouse consolidation — — — (1,241) Adjusted operating expenses $ 125,732 $ 120,908 $ 486,986 $ 448,063

Table 3 - Reconciliation of GAAP income from operations to Adjusted income from operations Three Months Ended Twelve Months Ended December 31, 2019 December 31, 2018 December 31, 2019 December 31, 2018 GAAP income from operations $ 19,479 $ 25,037 $ 176,814 $ 173,382 Vendor support, net of recovery of bad debt expense, and write-off of an unamortized buying agency agreement support payment associated with the Payless ShoeSource bankruptcies 8,946 12,123 8,687 12,123 Expense in connection with a provision for legal settlement and related fees 3,977 — 3,977 2,837 Loss in connection with the termination of a joint venture 544 — 544 — Expense in connection with the acquisitions of GREATS and BB Dakota 42 — 1,120 — Expense in connection with a divisional headquarters relocation — — 669 — Expense in connection with a provision for early lease termination charges and the impairment of lease right-of-use assets — 452 5,424 452 Net benefit in connection with the change in a contingent liability and the acceleration of amortization related to the termination of the Kate Spade license agreement — — (1,868) — Expense in connection with the integration of the Schwartz & Benjamin acquisition and the related restructuring — 278 — 2,065 Expense in connection with a warehouse consolidation — — — 1,241 Impairment of the Brian Atwood trademark — — 4,050 — Adjusted income from operations $ 32,988 $ 37,890 $ 199,417 $ 192,100

Table 4 - Reconciliation of GAAP provision for income taxes to Adjusted provision for income taxes Three Months Ended Twelve Months Ended December 31, 2019 December 31, 2018 December 31, 2019 December 31, 2018 GAAP provision for income taxes $ 3,247 $ 13,956 $ 39,504 $ 46,841 Tax effect of vendor support, net of recovery of bad debt expense, and write- off of an unamortized buying agency agreement support payment associated with the Payless ShoeSource bankruptcies — 642 85 642 Tax effect of expense in connection with a provision for legal settlement and related fees 961 — 961 702 Tax effect of the loss in connection with the termination of a joint venture 136 — 136 — Tax effect of expense in connection with the acquisitions of GREATS and BB Dakota 10 — 281 — Tax effect of expense in connection with a divisional headquarters relocation — — 168 — Tax effect of expense in connection with a provision for early lease termination charges and the impairment of lease right-of-use assets — 109 1,361 109 Tax effect of the net benefit in connection with the change in a contingent liability and the acceleration of amortization related to the termination of the Kate Spade license agreement — — (469) — Tax effect of expense in connection with the integration of the Schwartz & Benjamin acquisition and the related restructuring — 67 — 529 Tax effect of expense in connection with a warehouse consolidation — — — 327 Tax effect in connection with the impairment of the Brian Atwood trademark — — 1,017 — Tax expense in connection with the impairment of the preferred interest investment in Brian Atwood Italia Holding, LLC recorded in fourth quarter 2017 — — — (1,028 ) Tax expense in connection with deferred tax and other tax adjustments (2,207 ) — (2,590) — Tax expense resulting from the Tax Cuts and Jobs Act transition tax and taxing authorities audit and prepaid tax adjustment related to prior years — (11,136 ) — (11,136 ) Adjusted provision for income taxes $ 2,147 $ 3,637 40,454 $ 36,985 Table 5 - Reconciliation of GAAP net income / (loss) attributable to noncontrolling interest to Adjusted net income / (loss) attributable to noncontrolling interest Three Months Ended Twelve Months Ended December 31, 2019 December 31, 2018 December 31, 2019 December 31, 2018 GAAP net income / (loss) attributable to noncontrolling interest $ (521 ) $ 47 $ 411 $ 1,363 Net loss attributable to noncontrolling interest related to the termination of a joint venture 204 — 204 — Adjusted net income / (loss) attributable to noncontrolling interest $ (317 ) $ 47 $ 615 $ 1,363

Table 6 - Reconciliation of GAAP net income attributable to Steve Madden, Ltd. to Adjusted net income attributable to Steve Madden, Ltd. Three Months Ended Twelve Months Ended December 31, 2019 December 31, 2018 December 31, 2019 December 31, 2018 GAAP net income attributable to Steven Madden, Ltd. $ 17,751 $ 12,490 $ 141,311 $ 129,136 After -tax impact of vendor support, net of recovery of bad debt expense, and write-off of an unamortized buying agency agreement support payment associated with the Payless ShoeSource bankruptcies 8,946 11,481 8,602 11,481 After -tax impact of expense in connection with a provision for legal settlement and related fees 3,016 — 3,016 2,135 After-tax impact of loss in connection with the termination of a joint venture 204 — 204 — After -tax impact of expense in connection with the acquisitions of GREATS and BB Dakota 32 — 839 — After -tax impact of expense in connection with a divisional headquarters relocation — — 501 — After -tax impact of expense in connection with early lease termination charges and the impairment of lease right-of-use assets — 343 4,063 343 After-tax impact of the net benefit in connection with the change in a contingent liability and the acceleration of amortization related to the termination of the Kate Spade license agreement — — (1,399 ) — After -tax impact of expense in connection with the integration of the Schwartz & Benjamin acquisition and the related restructuring — 211 — 1,536 After-tax impact of expense in connection with a warehouse consolidation — — — 914 After -tax impact associated with the impairment related to the Brian Atwood trademark — — 3,033 — Tax expense in connection with the impairment of the preferred interest investment in Brian Atwood Italia Holding, LLC recorded in fourth quarter 2017 — — — 1,028 Tax expense in connection with deferred tax and other tax adjustments 2,207 — 2,590 — Tax expense resulting from the Tax Cuts and Jobs Act transition tax and taxing authorities audit and prepaid tax adjustment related to prior years — 11,136 — 11,136 Adjusted net income attributable to Steven Madden, Ltd. $ 32,156 $ 35,661 $ 162,760 $ 157,710 GAAP diluted income per share $ 0.21 $ 0.15 $ 1.69 $ 1.50 Adjusted diluted income per share $ 0.39 $ 0.42 $ 1.95 $ 1.83 Contact Steven Madden, Ltd. Director of Corporate Development & Investor Relations Danielle McCoy 718-308-2611 InvestorRelations@stevemadden.com