Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - Mayville Engineering Company, Inc. | mec-ex311_9.htm |

| EX-21 - EX-21 - Mayville Engineering Company, Inc. | mec-ex21_129.htm |

| EX-32 - EX-32 - Mayville Engineering Company, Inc. | mec-ex32_6.htm |

| EX-31.2 - EX-31.2 - Mayville Engineering Company, Inc. | mec-ex312_8.htm |

| EX-23 - EX-23 - Mayville Engineering Company, Inc. | mec-ex23_167.htm |

| EX-4 - EX-4 - Mayville Engineering Company, Inc. | mec-ex4_131.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 001-38894

Mayville Engineering Company, Inc.

(Exact name of Registrant as specified in its Charter)

|

Wisconsin |

39-0944729 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

715 South Street Mayville, Wisconsin |

53050 |

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (920) 387-4500

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

Common Stock, no par value |

|

MEC |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). YES ☒ NO ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☐ |

|

Emerging growth company |

|

☒ |

|

|

|

|

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

The aggregate market value of the Common Stock held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on the New York Stock Exchange on June 28, 2019, was $272,416,084.

The number of shares of the Registrant’s Common Stock outstanding as of February 15, 2020 was 19,545,689.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this report incorporates information by reference to the Registrant’s proxy statement for its 2020 annual meeting of shareholders, which proxy statement will be filed with the Securities and Exchange Commission no later than 120 days after the close of the year ended December 31, 2019.

|

|

|

Page |

|

PART I |

|

|

|

Item 1. |

1 |

|

|

Item 1A. |

12 |

|

|

Item 1B. |

25 |

|

|

Item 2. |

25 |

|

|

Item 3. |

26 |

|

|

Item 4. |

26 |

|

|

|

|

|

|

PART II |

|

|

|

Item 5. |

27 |

|

|

Item 6. |

28 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

29 |

|

Item 7A. |

40 |

|

|

Item 8. |

41 |

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

65 |

|

Item 9A. |

65 |

|

|

Item 9B. |

66 |

|

|

|

|

|

|

PART III |

|

|

|

Item 10. |

67 |

|

|

Item 11. |

67 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

67 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

67 |

|

Item 14. |

67 |

|

|

|

|

|

|

PART IV |

|

|

|

Item 15. |

68 |

|

|

Item 16. |

70 |

i

Cautionary Statement Regarding Forward-Looking Statements

Certain matters discussed in this Annual Report on Form 10-K contain forward-looking statements that involve risks and uncertainties, such as statements related to future events, business strategy, future performance, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management. All statements other than statements of historical fact may be forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek,” “anticipate,” “plan,” “continue,” “estimate,” “expect,” “may,” “will,” “project,” “predict,” “potential,” “targeting,” “intend,” “could,” “might,” “should,” “believe” and similar expressions or their negative. Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on management’s belief, based on currently available information, as to the outcome and timing of future events. These statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those expressed in such forward-looking statements. Mayville Engineering Company, Inc. (MEC, the Company, we, our, us or similar terms) believes the expectations reflected in the forward-looking statements contained in this Annual Report on Form 10-K are reasonable, but no assurance can be given that these expectations will prove to be correct. Forward-looking statements should not be unduly relied upon.

Important factors that could cause actual results or events to differ materially from those expressed in forward-looking statements include, but are not limited to, those described in “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K, as such may be amended or supplemented in Part II, Item 1A of our subsequently filed Quarterly Reports on Form 10-Q, and the following:

|

|

• |

failure to compete successfully in our markets; |

|

|

• |

risks relating to developments in the industries in which our customers operate; |

|

|

• |

our ability to maintain our manufacturing, engineering and technological expertise; |

|

|

• |

the loss of any of our large customers or the loss of their respective market shares; |

|

|

• |

risks related to scheduling production accurately and maximizing efficiency; |

|

|

• |

our ability to realize net sales represented by our awarded business; |

|

|

• |

our ability to successfully identify or integrate acquisitions; |

|

|

• |

risks related to entering new markets; |

|

|

• |

our ability to develop new and innovative processes and gain customer acceptance of such processes; |

|

|

• |

our ability to recruit and retain our key executive officers, managers and trade-skilled personnel; |

|

|

• |

risks related to our information technology systems and infrastructure; |

|

|

• |

manufacturing risks, including delays and technical problems, issues with third-party suppliers, environmental risks and applicable statutory and regulatory requirements; |

|

|

• |

political and economic developments, including foreign trade relations and associated tariffs; |

|

|

• |

volatility in the prices or availability of raw materials critical to our business; |

|

|

• |

results of legal disputes, including product liability, intellectual property infringement and other claims; |

|

|

• |

risks associated with our capital-intensive industry; |

|

|

• |

risks related to our treatment as an S Corporation prior to the consummation of our initial public offering of common stock (IPO); |

|

|

• |

risks related to our employee stock ownership plan’s treatment as a tax-qualified retirement plan; and |

|

|

• |

our ability to remediate the material weaknesses in internal control over financial reporting identified in preparing our financial statements included in this Annual Report on Form 10-K, and to subsequently maintain effective internal control over financial reporting. |

These factors are not necessarily all of the important factors that could cause actual results or events to differ materially from those expressed in forward-looking statements. Other unknown or unpredictable factors could also cause actual results or events to differ materially from those expressed in the forward-looking statements. All forward-looking statements attributable to us are qualified in their entirety by this cautionary statement. Forward-looking statements speak only as of the date hereof. We undertake no

1

obligation to update or revise any forward-looking statements after the date on which any such statement is made, whether as a result of new information, future events or otherwise, except as required by federal securities laws.

General

MEC is a leading U.S.-based value-added manufacturing partner that provides a broad range of prototyping and tooling, production fabrication, coating, assembly and aftermarket components. Our customers operate in diverse end markets, including heavy- and medium-duty commercial vehicles, construction, powersports, agriculture, military and other end markets. We have developed long-standing relationships with our blue-chip customers based upon a high level of experience, trust and confidence. “We Make Things Simple” by providing a diverse set of process offerings and a “one stop shop” for end-to-end solutions with benefits throughout the entire product lifecycle, including front-end collaboration in design and prototyping, product manufacturing, aftermarket components and ancillary supply chain benefits. Founded as a corporation in 1945 and headquartered in Mayville, Wisconsin, we are a leading Tier I U.S. supplier of highly engineered components to original equipment manufacturer (OEM) customers with leading position in their respective markets. We are focused on producing the highest quality components using complex processes at the lowest cost by working with customers throughout the product design and development process to establish optimal solutions. Our engineering expertise and technical know-how allow us to add value through every product redevelopment cycle (generally every three to five years for our customers). According to The Fabricator, we have been ranked as the largest fabricator in the United States for the past nine years in a row (2011 – 2019). We are more than two times the size of our next largest competitor, based on The Fabricator’s projections for revenue for metal fabricating companies.

Our customers’ complex products require a unique combination of our capabilities that allow us to achieve a customized offering to satisfy our customers’ desired outcomes. Our capabilities, which include, but are not limited to: metal fabrication, metal stamping, tube bending and forming, robotic part forming, robotic welding, resistance welding, five-axis tube and fiber laser cutting and custom coatings, including high heat and chemical agent resistant coating (CARC) painting, are used in a variety of applications and represent the building blocks of what we produce.

Our key customers have globally recognized brands and demand the highest product quality and expertise. Over our nearly 75-year history, we have developed capabilities and provide solutions that result in customer loyalty and long-standing relationships, which we call “Experience You Can Trust”. We have a diverse and market-leading customer base that serves broad end markets representing favorable near- and long-term growth prospects for us. We have a track record of growth and are well-positioned to increase our market share and benefit from growth in customer demand as well as consolidate demand across the end markets that we serve. To help pursue our strategic mission, we have approximately 2,600 employees who are tactically aligned around our core values and will continue to participate in our employee ownership culture. We are led by an experienced management team that has contributed to our growth by establishing deep and long-standing relationships with key customers, and has worked to expand the customer base both organically and through strategic acquisitions.

We maintain an established base of long-standing customers comprised of leading, blue-chip OEM manufactures across the United States. Our broad capabilities offering and track record of producing the highest quality solutions have allowed us to establish, and subsequently deepen, relationships with additional products and platforms over time. For example, our more than 40 year relationship with Deere & Company (John Deere) began with a small order of simple stamped parts for a farm tractor in its agricultural segment that expanded over time and represented 2019 sales in excess of $78.0 million across five market segments, representing over 60 model platforms. We have also been successful in winning customers and rapidly expanding relationships with high-growth customers by utilizing our diversified “one-stop” offering. For instance, our relationship with Volvo Truck began with fuel tanks and has expanded over the last seven years to include exhaust tubing, new sleeper cab and chassis fabrications and other fabrications. Through the expansion of multiple fabricated components from multiple facilities, we have been able to deepen our relationship with this customer and solidify our position as an important strategic sourcing partner.

We serve customers through 20 strategically located U.S. facilities across eight states, with almost three million square feet of manufacturing capacity. Our expansive footprint enables us to service and maintain strong relationships with existing key customers across the United States with a “local” presence, as well as target new customer opportunities. We have a proven track record of improving financial results by thoroughly understanding our capabilities and the markets we serve, and aligning our people and resources to optimize results. Coupled with our focus on market alignment and execution, we constantly strive to improve and refine capabilities, capacities and reduce our carbon footprint. In addition, the ongoing investment in flexible, re-deployable automation allows us to expand output while reducing cost and improving quality, productivity and consistency for margin enhancement and market leading competitiveness.

2

Our leading market position, embedded customer relationships with leading OEMs, unique value proposition and proven acquisition strategy has allowed us to achieve attractive financial performance and has positioned us for further growth. Our historical financial success is a function of our engineering expertise, extensive manufacturing capabilities, limited commodity exposure, investment in automation and embedded relationships with the contractual ability to pass input costs through prices. We believe we are poised to grow though economic cycles due to our:

|

|

• |

market positioning and reputation; |

|

|

• |

product breadth; |

|

|

• |

flexible and re-deployable capital investment in automation and process capabilities; and |

|

|

• |

our geographic, end market and product diversification. |

Our diversified profile today best positions us for stability and leading market performance through all phases of an economic cycle.

Acquisition

On December 14, 2018, we acquired Defiance Metal Products Co., Inc. (DMP), a full-service metal fabricator and contract manufacturer with two facilities in Defiance, OH, one in Heber Springs, AR, and one in Bedford, PA. We acquired DMP for $117.1 million, net of cash received. The DMP acquisition provided us with enhanced product, customer and geographic diversification with minimal customer overlap (i.e. less than $15.0 million).

Our Industry

We compete in the highly fragmented market of contract manufacturers, the majority of which are small local players that are limited in scale, capabilities and technology. Many of these local manufacturers have single or limited production capabilities and provide niche components in specific geographic markets. Accordingly, there are a limited number of competitors in the contract manufacturing market in which we operate with the capacity and expertise to deliver the full range of solutions we offer. For example, our diverse manufacturing capabilities across product lines have contributed to us being the recipient of The Fabricator’s “FAB 40” #1 Largest Fabricator in the attractive U.S. markets for the past nine years in a row (2011 – 2019). While we compete with certain manufacturers across selected product lines, we believe that no single manufacturer directly competes with us across our full offering and end market applications.

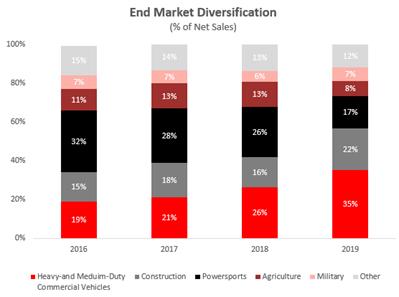

Our end market diversification coupled with our extensive product breadth allows us to maintain financial stability as individual end markets fluctuate. The primary end markets we serve include heavy- and medium-duty commercial vehicles, construction, powersports, agriculture and military, among other machinery markets. As markets strengthen or weaken, our output is redirected and realigned to support ongoing change. Further, as these fluctuations affect the market, we are favorably positioned to benefit from the broader trend of our OEM customers to consolidate to fewer and more sophisticated suppliers in order to improve quality and delivery while lowering the total cost of doing business. This consolidation trend will allow us to grow and protects our cash flow as markets change and shift.

3

We have also experienced, and benefitted from, an OEM trend of seeking to improve their strategy execution and simplify their business through outsourcing. Based on our history, OEMs pursue a strategy that focuses on core component market differentiation, such as structural frames and complete powertrain assemblies, and prefer to outsource the remaining product components to third parties rather than manufacturing them in-house. This is done in order to maintain their strategic focus, drive cost savings and reduce their own investment in manufacturing, thereby allowing them to focus on the most important aspects of their value creation process, namely product design and development, final product assembly and testing, branding, sales, marketing and distribution. While each specific OEM differs in its strategy, we see this trend continuing as customers deal with workforce constraints and look for optimum return on investments and improving cash flow. Moreover, our OEM customers focus on the production of the core components of their products, which leads them to rely on outsourced providers like us for the remaining components of their finished product needs. We believe we will benefit from this continued shift in our customers’ focus and ongoing desire for OEMs to improve efficiencies, reduce costs and simplify supply chains. Our established and embedded relationships, breadth of capabilities and scalability will allow us to simplify the supply chain process for our customers by acting as a single point of contact in the supply chain. In addition, we believe OEMs are increasingly favoring platforms supported by larger, more sophisticated and financially stable suppliers with the ability to serve large national and international operations all while maintaining a local touch. Our extensive manufacturing footprint, competitive cost structure and integrated design, engineering, production planning and quality program management capabilities positions us favorably to take advantage of these opportunities and trends.

Our Competitive Strengths

We believe that customers turn to us for their manufacturing needs because we are the ultimate “ReSource”. ReSource is a dual-purpose acronym we use to describe the breadth of our capabilities and our goal to be the one-stop solution allowing customers to re-source all of their fabrication needs through us. We collaborate with our customers to generate a strategic alignment and position ourselves as an essential part of our customers’ product development and manufacturing process by drawing on our deep product and engineering knowledge to deliver best-in-class solutions. We offer a broad portfolio of end-to-end solutions comprised of advanced and innovative processes and capabilities that enhance quality and simplify supply chains. We are focused on producing the highest quality components using complex processes at the lowest cost by working with customers throughout the product design and development process to establish optimal solutions. Our engineering expertise and technical know-how allows us to add value through every product redevelopment cycle (generally every three to five years for our customers).

Value-Added Supply Chain Partner with Embedded Relationships. Our embedded relationships with our large and diverse customer base are driven by the P.R.I.D.E. (“Personal Responsibility In Daily Excellence”) approach our employees take in their work, which emphasizes the highest quality and performance in all facets of our business, including our ability to partner with our customers and deliver to them complex solutions across a wide range of products. Our unique, end-to-end offering provides solutions throughout the life cycle of a product, including upfront product manufacturability advice and prototyping, production volumes and aftermarket components. We strive to maintain operation alignment (and continuous re-alignment) with our customers’ strategy and production activities as they evolve, allowing us to remain agile in response to market changes, while enabling our customers to be successful, and to remain adaptable to changes in customer needs to retain flexibility to adjust appropriately. Together, these items comprise “The MEC Mission.” Our focus on collaboration with our customers and our breadth of capabilities also generates strategic alignment with our customers, resulting in sticky relationships, driving vendor reduction and providing other ancillary benefits such as optimization of working capital investments. Our track record of engineering expertise has resulted in our consistent inclusion in customer design and prototyping activities, enabling customers to view us as an invaluable extension of their own teams. In turn, this collaboration allows our customers to focus on the development of their core technologies and products. Our position as a deeply embedded supply chain partner of scale allows us to provide a multitude of solutions, driving strong customer relationships with high switching costs.

Leading and Defendable Market Position in Attractive North American Market. According to the Fabricator, we have been ranked as the largest fabricator in the United States for the past nine years in a row (2011 – 2019). The market is highly fragmented and characterized by high barriers to entry given the complex nature of the work, established relationships, and high customer switching costs. While there are numerous competitors in the markets in which we operate, few maintain the product breadth, manufacturing capabilities, scale or engineering expertise that we do. Our depth of capabilities allows us to offer our customers:

|

|

• |

low volume production capability; |

|

|

• |

customized and sophisticated solutions; |

|

|

• |

unique engineering and manufacturing capabilities throughout the product lifecycle; |

|

|

• |

critical scale to service large national and regional customers as well as local customers; and |

|

|

• |

the ability to act as a single point of contact and offer seamless customer service. |

Our position in the market, along with our acquisition experience and reputation as the go-to consolidator, will result in continued organic and acquisitive growth in the future.

4

End Market and Customer Diversification. Our value-added manufacturing focus enables us to remain diversified across a variety of customer end markets, including heavy- and medium-duty commercial vehicles, construction, powersports, agriculture and military, among others. These end markets are representative of our globally recognized customers, which are comprised of large OEM manufacturers. In 2019, our top customer and top ten customers accounted for 15% and 81% of net sales respectively, which collectively represents hundreds of platforms that we serve across a variety of end markets and customer operating segments. Our access to a multitude of end markets allows us to strategically shift focus to sell into current opportunities as end market demand evolves. In addition to customer and end market diversification, our customers themselves are also diversified across multiple end markets. For example, John Deere is one of our leading customers with 2019 net sales accounting for 15% of our total net sales, to whom we provide over 5,000 SKUs across over 60 individual John Deere platforms including the agriculture, forestry, turf care, power systems and construction markets. Our increasingly stable performance is a direct result of our intentional business design of agility and adaptability to realign manufacturing capacities to serve diversified and ever-changing end markets.

Breadth of Capabilities Appealing to a Variety of Applications. We have many manufacturing capabilities that together represent the building blocks for the complex solutions we provide to our customers. We maintain a full spectrum of capabilities across our 20 production facilities to address a wide set of customer needs, including upfront product development advice and prototyping, unique manufacturing processes and capabilities across a variety of products and back-end finishing, assembly and aftermarket components representing a unique end-to-end offering. Our range of capabilities combined with our breadth of components, including fabrications, tubes, tanks, and performance structures, expands the applicable uses and end markets in which we may offer our components. Throughout our history, our capabilities have allowed us to generate growth by expanding into new verticals and by further penetrating existing verticals through cross-selling to increase wallet share, a strategy that has driven sticky relationships with our customers. Further, our unique combination of manufacturing processes allows us to opportunistically target sophisticated, higher margin business. The diversity of our offering has provided our Company with financial stability through various end market and economic cycles.

Technology-Enabled Infrastructure. We continue to invest in a technology-enabled asset base that provides significant flexible and re-deployable capacity to support our planned growth, increases profitability and efficiency, reduces spend on energy and drives a long-term cost advantage over our competitors. We have leveraged our purchasing power to make significant investments in operational infrastructure throughout our history, in items such as flexible and re-deployable automation and capacity improvements to improve throughput, quality and consistency. For example, we were one of the first in our industry to adopt fiber lasers and have continued to invest in this capability. We have implemented 10,000-watt fiber lasers with an automation tower, which are on average three times faster, provide a cleaner, more precise cut and use one-third of the power compared to traditional CO2 lasers, with a payback period of less than two years. Additionally, the implementation of robotic brakes has improved quality through a continued shift towards precision automation. By reducing setup procedures, manual employee lifting requirements and downtime while offering additional capacity, the implementation of robotic brakes has resulted in a payback period of approximately two years. These two examples of investments in technology-enabled infrastructure allow us to reallocate our workforce, as employees can be retrained and redeployed into more technically skilled positions. In today’s ever-changing labor market, the ability to redeploy labor to increase flexibility and capacity for our customers is of utmost importance and interest as part of our strategy. Our investments in continuous improvement and automation have driven operational efficiencies and improved metric tracking allowing our management team to more effectively run the business and improve the value we provide to our customers. We have, from time-to-time, made strategic,

5

customer-driven investments that directly support new product and market expansion which result in further competitive advantages and higher switching costs for our customers.

Cost Structure and Operational Excellence. We have reduced our exposure to commodity price risk by structuring our customer contracts to pass through changes in commodity prices. As such, we have been able to effectively limit any potential impact from recent tariffs and commodity price volatility to our margins. Our scale and profitability have also allowed us the flexibility to implement continuous improvement initiatives in driving efficiencies, such as automation and additional capacity, which will result in long-term efficiency and margin improvements, and expanded capabilities.

Our Strategy

Achieve Sales Growth Through Organic Expansion. We believe there is ample opportunity to achieve deeper penetration of existing customers and to win new customers with our strong one-stop offerings. By leveraging our core product capabilities to expand into new markets, and establishing new offerings in attractive, adjacent or complementary platforms through new product introductions, there is significant opportunity to execute on our organic growth initiatives. Expanding our wallet share with our customers by capturing a wider variety of products and more platforms both solidifies our relationship with customers (because it increases customer switching costs) and attracts potential new customers that seek to simplify supply chains, while also defending our market position from our competitors. These opportunities are enhanced through cross selling between the acquired DMP capabilities and customer base and MEC’s legacy capabilities and customer base. Our expertise allows us to produce higher quality components at cost-effective rates while our volume, equipment and know-how establish competitive advantages. Further, an expanded offering increases our strategic alignment with customers and supports our “We Make Things Simple” value proposition by presenting customers with further vendor consolidation opportunities.

Pursue Opportunistic Acquisitions. Our management team maintains a proven track record of successfully executing and integrating strategic acquisitions. We have completed two significant acquisitions since 2012 (Center Mfg. Co. in 2012 and DMP in December 2018) and four other complementary acquisitions since 2004, which have contributed new capabilities, end markets and technologies to our legacy business, along with significant synergy opportunities that have enhanced our financial position. Our strategy is to continue to identify, and opportunistically execute on, accretive acquisitions that will allow our Company to achieve further growth. We believe that our reputation, scale and track record of performance makes us a “consolidator of choice” among industry participants, which has led to a growing pipeline of actionable acquisition opportunities. Our investment criteria for acquisitions are U.S.-based companies with long-standing customer bases comprised of leading OEMs, and specialized manufacturing capabilities that allows us to enhance our existing expertise or expand into new types of capabilities, among other criteria. It is our view that continued execution of our acquisition strategy provides significant opportunity to generate shareholder value through further consolidation of our fragmented industry. The market environment, comprised mainly of small local and regional players, provides ample add-on acquisition opportunities to bolster our one-stop shop approach to broadly serving our customers. Beyond our existing served markets, we see potential acquisition opportunities within the rail, aerospace, heavy fabrication and food end markets, among others.

Continue Process-Driven Improvement Initiatives. Our process-driven improvement initiatives have resulted in significant savings throughout our history, leading to improved financial results and positive customer outcomes. Our strategy will continue to include a keen focus on continuous improvements in order to maintain a differentiated and defendable market-leading position, as well as ongoing costs and operating improvements. Improvement initiatives in 2019 were focused on strategic investments in automation technology and capacity, which are expected to drive immediate productivity and margin improvements as the integration efforts are completed. For example, we currently have process driven improvement plans that relate to:

|

|

• |

successful integration of new 10,000 watt fiber lasers and automated material handling equipment in Mayville, Wisconsin and Defiance, Ohio; |

|

|

• |

consolidation of shifts through better utilization of automation on paint lines, new laser technology, automated machining centers and optimization of companywide assets; and |

|

|

• |

acquisition synergies between DMP and legacy MEC through centers of competencies driving best practices throughout the organization. |

6

Maintain Alignment with Employee Base and Employee-Driven Results. Our rich history of employee ownership and personal responsibility in daily excellence has cultivated a strategic management-employee alignment and results-driven organization with each employee contributing to a common goal. Our employees maintained a significant ownership stake following our IPO, which we believe benefits the entire organization as our strategic alignment remains in place and continues to generate employee-driven results. As we continue to invest in our business and increasingly implement a more technology-enabled infrastructure, we will strive to redeploy our employees in other, higher-skilled areas of our business and invest in training where needed. Our employees are the foundation of our company; with experience across a diverse range of markets and capabilities, they drive innovation, believe in our process and the outcomes of their work and our success. We and our employees are also highly involved in, and actively support, the communities in which our facilities are located; our 2,600 employees take P.R.I.D.E. in creating value and support for both our customers and communities every day.

We offer a broad portfolio of end-to-end processes and solutions comprised of advanced and innovative capabilities that enhance quality and simplify supply chains for our customers. Through our collaborative approach, we maintain a complete, and growing, set of sophisticated manufacturing capabilities to meet the diverse needs of our customers, including:

|

|

• |

Program Management — We offer our customers a complete solution from concept to launch following the APQP (Advanced Product Quality Planning) process (planning, design for manufacturability and development, process design and improvement, product and process validation and continuous improvement). |

|

|

• |

Engineering — We collaborate with our customers and provide design for manufacturing, off-line programming (lasers, brake press, machining, robot welding, coordinate measuring machines), value engineering and CI (continuous improvement). |

|

|

• |

Tool Design and Build — Our in-house tool design and tool room capability ensures quality from start to finish. We build and service all categories of tooling, including large progressive dies. |

|

|

• |

Laser Cutting — Our programmable fiber and CO2 laser cutting capabilities eliminate expensive hard tooling. Our equipment can cut metal up to 1 inch thick while maintaining tolerances to .002 inches at speeds up to 3,300 per minute. Our tube lasers are state of the art cutting machines that offer exceptional tolerances and through-put. |

|

|

• |

Brake Press — We combine our operator’s expertise with the proper equipment required to offer top versatility to our clients for bending, forming, coining and air bending. Our facilities house the latest press brake press machinery including robotic part manipulation and stacking. |

|

|

• |

Stamping — We provide custom metal stamping capabilities for short, medium or long production runs. For longer runs, our production of sheet metal stamping uses 50 to 1,200-ton manual or automatic feed presses with state-of-the-art feed lines for precision metal stamping. Our small, high-speed presses are ideal for producing intricate high-volume stampings. |

|

|

• |

Machining — We provide a variety of machining capabilities to meet our customer needs by providing in-house machining assistance for parts that are part of larger fabrications and assemblies. |

|

|

• |

Tube Bending — We maintain vast tube bending capabilities, including (i) manufacturing of oval, round and square tubes from .25 inch up through six inch and (ii) leveraging our extensive inventory of equipment including the latest CNC (computer numerical control) benders; and state-of-the-art technologies such as CNC electro-servo-driven bending with multi-task heads. |

|

|

• |

Welding — We have earned our reputation as one of the premier manufacturers of weldments. Our welding departments offer manual and robotic wire welding, including GMAW (Gas Metal Arc Welding and also known as MIG, or Metal Inert Gas), GTAW (Gas Tungsten Arc Welding and also known as TIG (Tungsten Inert Gas), Heliarc), Fluxcore, Metalcore, Aluminum, Plasma Weld, Brazing and Pulse Heliarc. |

|

|

• |

Coatings, Assembly and Logistics — We provide premier full-service coating, assembly and logistics solutions for blue chip OEMs. Our coating capabilities offer a full-range of high technology industrial coating capabilities, including: E-Coat, military certified CARC, commercial and industrial powder and liquid coatings. Our coating systems utilize pre-treatment including acid pickle, zinc phosphate and in-line Alodine for the conversion of aluminum. |

7

We collaborate with our customers to generate a strategic alignment and position ourselves as an essential part of our customers’ product development and manufacturing process by drawing on our deep product and engineering knowledge to deliver best-in-class solutions. Our approach is simple: we view quality as a significant business strategy with a strong return on investment. Our philosophy on quality is based on Continuous Improvement with an IATF (international automotive task force) and ISO (international organization for standardization) foundation. Our skilled and experienced staff is highly trained in areas of quality planning, metrology, geometric dimensioning and tolerancing (ASME Y14.5M 1994), ISO, QS9000, statistical techniques (SPC) and ISO 14001 certifications. Our Quality Management System is comprised of the following:

|

|

• |

IATF 16949:2016 certification (one of the automotive industry’s most widely used international standards for quality management); |

|

|

• |

ISO 9001:2015 registration (international standard for quality management systems); |

|

|

• |

process and assembly line audits with focus on process control; |

|

|

• |

process capability that is proven at validation and monitored during production; and |

|

|

• |

specialized validations for paint and weld operations. |

We periodically enter into joint process improvement efforts with key customers. Such exercises have historically resulted in reduced manufacturing critical path time, cost reductions and quality improvements through effective batch sizes and more repeatable processes. Our continuous improvement initiatives have resulted in the acquisition and application of state-of-the-art technologies and plant improvements that support lean, quick response manufacturing flexibility that put us at the forefront of our market. Moreover, the agility that our quick response manufacturing methodology provides us keeps our purchasing, manufacturing, engineering and quality teams on the cutting edge of flexible manufacturing. This adaptable approach also decreases manufacturing costs, allows for faster order turnaround times, and elimination of excess waste.

We maintain an advanced machinery portfolio in our facilities that allow us to leverage our employee workforce with state-of-the-art capabilities and functionality. We strive to maintain our assets or upgrade capabilities where deterioration has driven obsolescence or better technology is available, reducing our carbon footprint. Most recently, we have invested in two fiber laser systems with automation aimed at reducing labor content and optimizing floor space which allows us to generate more revenue with the same workforce and footprint. We have also recently invested in a machining center with palletizers, robotic brake presses, robotic weld cells and a direct-to-metal paint line.

Our primary end markets include (but are not limited to) the heavy- and medium-duty commercial vehicles, construction, powersports, agriculture and military markets. While our individual end markets may be exposed to cyclical variations, the diversified nature of our end markets affords us the ability to shift production with demand as certain end markets trend lower and others trend higher. In our experience, our diversification has muted the impact of downturns on our business that we have faced in the past. For example, we experienced net sales growth during the 2008 and 2009 recessions due to strong orders, particularly from our customers focused on the military end market. Moreover, as our heavy- and medium-duty commercial vehicles, construction, powersports, and agriculture customers’ revenues fluctuated from 2013 to 2017, with median peak-to-trough sales decline of 23%, our peak-to-trough sales declines were less than that of those respective markets at only 10%. We were able to accomplish this by reallocating our resources to serve our heavy- and medium-duty commercial vehicles and powersports customers, leading to strong double-digit growth in those end markets.

|

|

• |

Heavy- and Medium-Duty Commercial Vehicles: Heavy-duty commercial vehicles include class 8 heavy trucks such as standard semi-trucks. Medium-duty commercial vehicles include classes 3-7 trucks such as box trucks; |

|

|

• |

Construction: Primary applications include wheel loaders, crawlers, skid steer loaders, excavators, motor graders, access equipment and other construction equipment; |

|

|

• |

Powersports: Encompasses our all-terrain (ATV) and multi-utility (MUV) vehicles, as well as marine and motorcycle markets; |

|

|

• |

Agriculture: Primary applications include tractors, combines, sprayers, turf care, implements and other agriculture-related equipment; |

|

|

• |

Military: We provide a variety of components for military vehicle platforms; and |

|

|

• |

Other: We provide components and assemblies to a variety of other industrial and automotive end markets, such as power generation, mining and medical cabinetry. |

8

We are a critical and deeply embedded supply partner with strong strategic alignment and relationships with our customers. We have developed long-standing business relationships with our OEM customers, many of which span decades. Further, we are diversified by customers and end markets with net sales attributed to our top 20 customers accounting for $471 million of 2019 net sales, and no single end market accounting for more than 38% of net sales. For the year ended December 31, 2019, John Deere, AB Volvo and PACCAR Inc. accounted for 15%, 14% and 13% of net sales, respectively. We have not historically experienced customer attrition given high customer switching costs resulting from our embedded relationships driven by our broad capabilities and scale.

Raw Materials and Manufactured Components

Our purchases primarily include steel and aluminum. We maintain a broad and diverse base of over 1,000 suppliers. Our established relationships provide efficient and flexible access to resources and redundancy to ensure support of our customers. We have no history of material supply issues or outages. In 2019, no single supplier represented more than 19% of our total purchases and 98% of the raw materials we purchased were sourced from domestic suppliers. Our suppliers are strategically located in order to maximize efficiencies and minimize shipping costs, although switching costs are minimal and we maintain a multitude of alternative suppliers that we could transfer orders to, if needed. We have structured our customer contracts to pass through commodity price changes, which has allowed us to remain mostly unaffected by the recent raw material price volatility and tariffs. As we continue to grow, we intend to leverage our size and scale to further reduce material costs.

Sales and Marketing

We have a strong sales team comprised of over 50 experienced professionals responsible for managing and expanding client relationships, and proactively pursuing new opportunities. Sales personnel are aligned by market segment and customer, including heavy- and medium-duty commercial vehicles, construction, powersports, agriculture, military and other end markets, and employ a highly technical and collaborative sales process with deep knowledge of our customers and capabilities. Sales personnel have assigned support teams comprised of inside sales, marketing, and sales administration personnel. We are consistently involved in request for proposal processes, where our sales teams with deep process expertise collaborate with customers on optimal designs for manufacturability and manufacturing efficiency. The upfront collaboration drives formalization of product specifications, program lifecycle planning, cost estimates and risk mitigation. The sales process typically takes 3 – 18 months and ultimately ends in the implementation of product lifecycle timelines and purchase orders under long-term customer arrangements. The sales team utilizes systems infrastructure that effectively track and manage backlogs, quotes and bookings information, strategic projects and call reports, all of which are reviewed at weekly sales team meetings.

Information Systems

We utilize standardized information technology systems across all areas of quoting and estimating, enterprise resource planning, materials resource planning, capacity planning and accounting for enhanced procurement of work, project execution and financial controls. We provide information technology oversight and support from our corporate headquarters in Mayville, Wisconsin. The operational information systems we employ throughout our company are industry specific applications that in some cases have been internally or vendor modified and improved to fit our operations. Our enterprise resource planning software is integrated with our operational information systems wherever possible to deliver relevant, real-time operational data to designated personnel. Accounting and operations personnel of acquired companies are trained not only by our information technology support staff, but by long- tenured employees in our organization with extensive experience using our systems. We believe our information systems provide our people with the tools to execute their individual job function and achieve our strategic initiatives.

Our Competition

We participate in a highly fragmented market with competitors in each of the end markets we serve ranging in size from small companies focused on a single capability or end market, to large multi-disciplinary companies. While there can be instances of intense competition from specific end markets, we believe that we have been able to effectively compete, and maintain competitive advantages on the basis of our:

|

|

• |

scale and product offering with the ability to cross-sell and provide our customers with a one-stop solution; |

|

|

• |

broad manufacturing capability and flexibility to fulfill requests that require complex solutions; |

|

|

• |

customer service with our highly skilled and knowledgeable workforce able to provide consultative advice; and |

|

|

• |

regionalized geographic focus provides a defensible position from both foreign and domestic competitors as our customers continue to take a regionalized approach to production, which provides a shorter supply chain with greater flexibility. |

9

We maintain an experienced and skilled workforce. We have been highly focused on attracting and retaining high quality personnel as they represent a critical factor in our continued success. As of December 31, 2019, we had approximately 2,600 full-time employees, none of which are unionized. Despite the recent market challenges in the hiring of trade-skilled employees, our continued investment in newer technologies and capabilities has allowed us to opportunistically re-train and redeploy certain roles that were previously human capital-intensive, and re-train and repurpose employees into other areas of the company. On average, our employees have approximately seven years of service with us. We believe we maintain strong relations with our employees and believe they are aligned with our employee-owned mindset.

Environmental Matters

We are subject to numerous federal, state and local laws and regulations relating to manufacturing, handling and disposal of materials into the environment. We believe that our environmental control procedures are adequate.

Information About Our Executive Officers

The following table sets forth certain information as of February 1, 2020, regarding our executive officers:

|

Name |

|

Age |

|

|

Position |

|

|

Robert D. Kamphuis |

|

|

61 |

|

|

Chairman, President and Chief Executive Officer |

|

Todd M. Butz |

|

|

48 |

|

|

Chief Financial Officer |

|

Ryan F. Raber |

|

|

37 |

|

|

Executive Vice President―Strategy, Sales & Marketing |

|

Steve P. Mance |

|

|

60 |

|

|

Chief Operating Officer |

|

Clifford O. Sanderson |

|

|

62 |

|

|

Vice President―Human Resources |

|

Eric J. Welak |

|

|

44 |

|

|

Executive Vice President―Fabrication |

Robert D. Kamphuis joined our company as President and Chief Executive Officer in 2005 and has served as the Chairman, President and Chief Executive Officer since January 2007. Mr. Kamphuis also serves as a board member and past Chairman of Wisconsin Manufacturers & Commerce, a board member of Brakebush Brothers, Inc. and The Nordic Group of Companies, Ltd., and Subzero Group Inc., and a member of the UW System Business Council, the John Deere Direct Material Supplier Council, the Harley Davidson Supplier Advisory Council and the Mebane Manor Executive Corporate Club. Prior to joining our company, Mr. Kamphuis held various roles with Giddings & Lewis, Inc. including as President and Chief Executive Officer of Gilman Engineering and Manufacturing Co., LLC, a designer and manufacturer of automated assembly systems, and began his career with Ernst & Young. Mr. Kamphuis is a graduate of the Executive International Leadership Program at Stanford University and earned a Bachelor of Business Administration & Accounting from the University of Wisconsin-Whitewater. He is also a licensed certified public accountant.

Todd M. Butz joined our company in 2008 and has served as our Chief Financial Officer since January 2014. Mr. Butz also serves on the Board of Trustees for Marian University. Prior to joining our company, Mr. Butz spent time as the Finance Manager at Mercury Marine, a subsidiary of the Brunswick Corporation, and Audit Supervisor at Schenck Business Solutions. Mr. Butz earned a Bachelor of Science in Accounting and Business Management from Marian University and is a licensed certified public accountant.

Ryan F. Raber joined our company in 2009 and has served as our Executive Vice President – Strategy, Sales & Marketing since June 2019. Prior to serving in his current position, Mr. Raber served as our Executive Vice President – Sales & Marketing beginning in November 2018 and as our Vice President of Sales & Marketing beginning in August 2013. Mr. Raber earned a Masters of Business Administration from the University of Wisconsin-Madison and a Bachelor of Science in Mechanical Engineering from Purdue University.

Steve P. Mance joined our company on December 14, 2018 as part of the DMP acquisition where he served as President for the prior eight years. Mr. Mance became our Chief Operating Officer in June 2019. Prior to joining DMP, Mr. Mance served as Vice President and General Manager of the Charging business at Bendix for eight years, President of the Components Division at Hendrickson International, Vice President of Operations and Six Sigma at AlliedSignal and various engineering and management positions at IBM. Mr. Mance earned a Bachelor of Science in Chemical Engineering from the University of Buffalo.

Clifford O. Sanderson joined our company in October 2013 and has served as our Vice President – Human Resources since that time. Prior to joining our company, Mr. Sanderson served as the Director of Human Resources at Coleman Cable, Inc. from June 1998 to October 2013, the Human Resources Manager at Nypro and the Divisional Director of Human Resources at Wheeling Pittsburgh Steel Corporation. Mr. Sanderson has over 30 years of human resources management experience. Mr. Sanderson earned a Masters in Human Resources and a Masters of Business Administration, Operations and Finance, from the Keller Graduate School of Management at DeVry University and a Bachelor of Science in Business from the University of Illinois Chicago.

10

Eric J. Welak joined our company in 1996 and has served as our Executive Vice President – Fabrication since January 2017. Prior to serving in his current position, Mr. Welak served as our Operations Manager, Plant Manager, Director of Operations and Vice President of Operations. Mr. Welak earned an Associate of Industrial Engineering from Moraine Park Technical College and a Bachelor of Science in Business Administration, Management and Operations from Marian University.

Available Information

Our website address is www.mecinc.com. We are not including the information provided on our website as a part of, or incorporating it by reference into, this Annual Report on Form 10-K. We make available free of charge (other than an investor’s own internet access charges) through our website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, amendments to these reports and our proxy statements, as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the United States Securities and Exchange Commission (the SEC).

11

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this Annual Report on Form 10-K, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes, before making a decision to invest in our common stock. The risks and uncertainties described below may not be the only ones we face. If any of the risks actually occur, our business, financial condition, operating results and prospects could be materially and adversely affected. In that event, the market price of our common stock could decline, and you could lose part or all of your investment.

Risks Related to Our Business

Failure to compete successfully in our markets could materially adversely affect our business, financial condition, results of operations or prospects.

We offer our processes and solutions in highly competitive markets. The competitors in these markets may, among other things:

|

|

• |

respond more quickly to new or emerging technologies; |

|

|

• |

have greater name recognition, critical mass or geographic market presence; |

|

|

• |

be better positioned to take advantage of acquisition opportunities; |

|

|

• |

adapt more quickly to changes in customer requirements; |

|

|

• |

devote greater resources to the development, promotion and sale of their processes and solutions; |

|

|

• |

be better positioned to compete on price due to any combination of low-cost labor, raw materials, components, facilities or other operating items, or willingness to make sales at lower margins than us; |

|

|

• |

consolidate with other competitors in the industry with may create increased pricing and competitive pressures on our business; and |

|

|

• |

be better able to utilize excess capacity which may reduce the cost of their processes and solutions. |

Competitors with lower cost structures may have a competitive advantage over us. We also expect our competitors to continue to improve the performance of their current processes and solutions, to reduce the prices of their existing processes and solutions and to introduce new processes or solutions that may offer greater performance and improved pricing. Additionally, we may face competition from new entrants to the industry in which we operate. Any of these developments could cause a decline in sales and average selling prices, loss of market share or profit margin compression. Maintaining and improving our competitive position will require successful management of these factors, including continued investment by us in research and development, engineering, marketing and customer service and support. Our future growth rate depends upon our agility to compete successfully, which is impacted by a number of factors, including, but not limited to, our ability to (i) identify emerging technological trends in our target end markets, (ii) develop and maintain a wide range of competitive and appropriately priced processes and solutions and defend our market share against an ever-expanding number of competitors including many new and non-traditional competitors, (iii) ensure that our processes and solutions remain cost-competitive and (iv) attract, develop and retain individuals with the requisite technical expertise and understand of customers’ needs to develop and sell new technologies and processes.

We are affected by developments in the industries in which our customers operate.

We derive a large amount of our net sales from customers in the following industry sectors: heavy- and medium-duty commercial vehicles, construction, powersports, agriculture and military. Factors affecting any of these industries in general, or any of our customers in particular, could adversely affect us because our net sales growth largely depends on the continued growth of our customers’ businesses in their respective industries. These factors include:

|

|

• |

seasonality of demand for our customers’ products which may cause our manufacturing capacity to be underutilized for periods of time; |

|

|

• |

our customers’ failure to successfully market their products, to gain or retain widespread commercial acceptance of their products or to compete effectively in their industries; |

|

|

• |

loss of market share for our customers’ products, which may lead our customers to reduce or discontinue purchasing our processes and solutions and to reduce prices, thereby exerting pricing pressure on us; |

|

|

• |

economic conditions in the markets in which our customers operate, in particular, the United States, including recessionary periods such as a global economic downturn; |

12

|

|

• |

our customers’ decision to insource the production of components that has traditionally been outsourced to us; and |

|

|

• |

product design changes or manufacturing process changes that may reduce or eliminate demand for the components we supply. |

We expect that future sales will continue to depend on the success of our customers. If economic conditions and demand for our customers’ products deteriorate, we may experience a material adverse effect on our business, operating results and financial condition.

We may not be able to maintain our manufacturing, engineering and technological expertise.

The markets for our processes and solutions are characterized by changing technology and evolving process development. The continued success of our business will depend upon our ability to:

|

|

• |

hire, retain and expand our pool of qualified engineering and trade-skilled personnel; |

|

|

• |

maintain technological leadership in our industry; |

|

|

• |

implement new and expand upon current robotics, automation and tooling technologies; and |

|

|

• |

anticipate or respond to changes in manufacturing processes in a cost-effective and timely manner. |

We cannot be certain that we will develop the capabilities required by our customers in the future. The emergence of new technologies, industry standards or customer requirements may render our equipment, inventory or processes obsolete or uncompetitive. We may have to acquire new technologies and equipment to remain competitive. The acquisition and implementation of new technologies and equipment may require us to incur significant expense and capital investment, which could reduce our margins and affect our operating results. When we establish or acquire new facilities, we may not be able to maintain or develop our manufacturing, engineering and technological expertise due to a lack of trained personnel, effective training of new staff or technical difficulties with machinery. Failure to anticipate and adapt to customers’ changing technological needs and requirements or to hire and retain a sufficient number of engineers and maintain manufacturing, engineering and technological expertise may have a material adverse effect on our business, operating results and financial condition.

We are dependent on a limited number of large customers for current and future net sales. The loss of any of these customers or the loss of market share by these customers could materially adversely affect our business, financial condition, results of operations and cash flows.

We depend on a limited number of major manufacturers for a majority of our net sales. For example, our largest customers in 2019, including John Deere, AB Volvo and PACCAR Inc. accounted for 15%, 14% and 13% of our net sales, respectively. Our financial performance depends in large part on our ability to continue to arrange for the purchase of our processes and solutions with these customers, and we expect these customers to continue to make up a large portion of our net sales in the foreseeable future. The loss of all or a substantial portion of our sales to any of our large-volume customers could have a material adverse effect on our business, financial condition, results of operations and cash flows by reducing cash flows and by limiting our ability to spread our fixed costs over a larger net sales base. We may make fewer sales to these customers for a variety of reasons, including, but not limited to:

|

|

• |

loss of business relationship; |

|

|

• |

reduced or delayed customer requirements; |

|

|

• |

the insourcing of business that has been traditionally outsourced to us; |

|

|

• |

strikes or other work stoppages affecting production by our customers; or |

|

|

• |

reduced demand for our customers’ products. |

13

Most of our customers do not commit to long-term production schedules, which makes it difficult for us to schedule production accurately and achieve maximum efficiency of our manufacturing capacity.

Most of our customers do not commit to long-term contracts or firm production schedules, and we continue to experience reduced lead-times in customer orders. Additionally, customers may change production quantities or delay production with little lead-time or advance notice. Therefore, we rely on and plan our production and inventory levels based on our customers’ advance orders, commitments and/or forecasts as well as our internal assessments and forecasts of customer demand. The volume and timing of sales to our customers may vary due to, among others:

|

|

• |

variation in demand for or discontinuation of our customers’ products; |

|

|

• |

our customers’ attempts to manage their inventory; |

|

|

• |

design changes; |

|

|

• |

changes in our customers’ manufacturing strategies; |

|

|

• |

disruptive events in the markets in which our customers operate, including natural disasters and epidemics like the coronavirus; and |

|

|

• |

acquisitions of or consolidation among customers. |

The variations in volume and timing of sales make it difficult to schedule production and optimize utilization of manufacturing capacity. This uncertainty may require us to increase staffing and incur other expenses in order to meet an unexpected increase in customer demand, potentially placing a significant burden on our resources. Additionally, an inability to respond to such increases in a timely manner may cause customer dissatisfaction, which may negatively affect our customer relationships.

Further, in order to secure sufficient production scale, we may make capital investments in advance of anticipated customer demand. Such investments may lead to low utilization levels if customer demand forecasts change and we are unable to utilize the additional capacity. Because fixed costs make up a large proportion of our total production costs, a reduction in customer demand can have a significant adverse impact on our gross profits and operating results. Additionally, we order materials and components based on customer forecasts and orders and suppliers may require us to purchase materials and components in minimum quantities that exceed customer requirements, which may have an adverse impact on our gross profits and operating results. In the past, anticipated orders from some of our customers have failed to materialize and delivery schedules have been deferred as a result of changes in our customers’ business needs.

We may be unable to realize net sales represented by our awarded business, which could materially and adversely impact our business, financial condition, results of operations and cash flows.

The realization of future net sales from awarded business is inherently subject to a number of important risks and uncertainties, including a lack of long-term commitments and production schedules with customers. Accordingly, we cannot assure you that we will realize any or all of the future net sales represented by our awarded business. Any failure to realize these net sales could have a material adverse effect on our business, financial condition, results of operations and cash flows.

In addition to not having a commitment from our customers regarding the minimum number of components they must purchase from us if we obtain awarded business, typically the terms and conditions of the agreements with our customers provide that they have the contractual right to unilaterally terminate our contracts with them with no notice or limited notice. In many cases, we must commit substantial resources in preparation for production under awarded customer business well in advance of the customer’s production start date. If such contracts are terminated by our customers, our ability to obtain compensation from our customers for such termination is generally limited to the direct out-of-pocket costs that we incurred for raw materials and work-in-progress. Although we have been successful in recovering these costs under appropriate circumstances in the past, we cannot assure you that our results of operations will not be materially adversely impacted in the future if we are unable to recover these types of pre-production costs related to our customers’ cancellation of awarded business.

Our growth strategy includes acquisitions, and we may not be able to identify attractive acquisition targets or successfully integrate acquired targets without impacting our business.

Acquisitions have played a key role in our growth strategy, and we expect to continue to grow through acquisitions in the future. We expect to continue evaluating potential strategic acquisitions of businesses, assets and product lines. We may not be able to identify suitable candidates, negotiate appropriate or favorable acquisition terms, obtain financing that may be needed to consummate such transactions or complete proposed acquisitions. There is significant competition for acquisition and expansion opportunities in our businesses, which may increase the cost of any acquisition or result in the loss of attractive acquisition targets.

14

In addition, acquisitions involve numerous risks, including (i) incurring the time and expense associated with identifying and evaluating potential acquisitions and negotiating potential transactions, resulting in management’s attention being diverted from the operation of our existing business; (ii) using estimates and judgments to evaluate credit, operations, funding, liquidity, business, management and market risks with respect to the target entity or assets; (iii) litigation relating to an acquisition, particularly in the context of a publicly held acquisition target, could require us to incur significant expenses or result in the delaying or enjoining of the transaction; (iv) failing to properly identify an acquisition candidate’s liabilities, potential liabilities or risks; and (v) not receiving required regulatory approvals or such approvals being delayed or restrictively conditional. In addition, any acquisitions could involve the incurrence of substantial additional indebtedness or dilution to our shareholders. We cannot assure you that we will be able to successfully integrate any acquisitions that we undertake or that such acquisitions will perform as planned or prove to be beneficial to our operations and cash flow. Any such failure could seriously harm our financial condition, results of operations and cash flows.

We routinely evaluate potential acquisition candidates and engage in discussions and negotiations regarding potential acquisitions; however, even if we execute a definitive agreement for an acquisition, there can be no assurance that we will consummate the transaction within the anticipated closing timeframe, or at all. Further, acquisitions typically involve the payment of a premium over book- and market-value for the target business or asset and, therefore, some dilution of our tangible book value and/or earnings per common share may occur in connection with any future transaction.

Entering new markets, either organically or via acquisition, poses new competitive threats and commercial risks.

As we expand into new markets, either organically or via acquisition, we expect to diversify our net sales by leveraging our development, engineering and manufacturing capabilities in order to source necessary parts and components for other industries. Such diversification requires investments and resources that may not be available as needed. Furthermore, even if we sign contracts in new markets, we cannot guarantee that we will be successful in leveraging our capabilities into these new markets and thus in meeting the needs of these customers and competing favorably in these new markets. If these customers experience reduced demand for their products or financial difficulties, our future prospects will be negatively affected as well.

If we fail to develop new and innovative processes or if customers in our market do not accept them, our results would be negatively affected.

Our processes must be kept current to meet our customers’ needs. To remain competitive, we therefore must develop new and innovative processes on an ongoing basis. If we fail to make innovations or the market does not accept our new processes, our sales and results would suffer. We invest significantly in the research and development of new processes; however, these expenditures do not always result in processes that will be accepted by the market. To the extent they do not, whether as a function of the process or the business cycle, we will have increased expenses without significant sales to offset such costs. Failure to develop successful new processes may also cause potential customers to purchase from competitors.

We depend on our key executive officers, managers, and trade-skilled personnel and may have difficulty retaining and recruiting qualified employees. Moreover, we operate in competitive labor markets, which may also impact our ability to hire and retain employees at our facilities.

Our success depends to a large extent upon the continued services of our executive officers, senior management, managers and trade-skilled personnel and our ability to recruit and retain skilled personnel to maintain and expand our operations. We could be affected by the loss of any of our executive officers who are responsible for formulating and implementing our business plan and strategy, and who have been instrumental in our growth and development. In addition, in order to manage our growth, we will need to recruit and retain additional management personnel and other skilled employees at our facilities. However, competition for our trade-skilled labor is high, particularly in some of the geographic locations where our facilities are located. Although we intend to continue to devote significant resources to recruit, train and retain qualified employees, we may not be able to attract, effectively train and retain these employees. Any failure to do so could impair our ability to conduct design, engineering and manufacturing activities, efficiently perform our contractual obligations, develop marketable components, timely meet our customers’ needs and ultimately win new business, all of which could adversely affect our business, financial condition and results of operations. If we are not able to do so, our business and our ability to continue to grow could be negatively affected. In addition, salaries and related costs are a significant portion of the cost of providing our solutions and, accordingly, our ability to efficiently utilize our workforce impacts our profitability. If our employees are under-utilized, our profitability could suffer.

15

We are dependent on information technology and our systems and infrastructure face certain risks, including cyber security risks and data leakage risks.