Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Univar Solutions Inc. | unvr-20200228.htm |

2019 Fourth Quarter and Full Year Performance Revised as of February 28, 2020

Forward-Looking Statements This slide presentation should be reviewed in conjunction with the Fourth Quarter 2019 earnings release of Univar Solutions. This presentation includes certain statements relating to future events and our intentions, beliefs, expectations, and predictions for the future which are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond our control. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from the expectations and assumptions. A detailed discussion of these factors and uncertainties is contained in the company's filings with the Securities and Exchange Commission. Potential factors that could affect such forward-looking statements include, among others: fluctuations in general economic conditions, particularly in industrial production and the demands of our customers; significant changes in the business strategies of producers or in the operations of our customers; increased competitive pressures, including as a result of competitor consolidation; significant changes in the pricing, demand and availability of chemicals; our substantial indebtedness, the restrictions imposed by our debt instruments, and our ability to obtain additional financing; the broad spectrum of laws and regulations that we are subject to, including extensive environmental, health and safety laws and regulations; an inability to integrate the business and systems of companies we acquire, including of Nexeo Solutions, Inc., or to realize the anticipated benefits of such acquisitions; potential business disruptions and security breaches, including cybersecurity incidents; an inability to generate sufficient working capital; increases in transportation and fuel costs and changes in our relationship with third party providers; accidents, safety failures, environmental damage, product quality and liability issues and recalls; major or systemic delivery failures involving our distribution network or the products we carry; operational risks for which we may not be adequately insured; ongoing litigation and other legal and regulatory risks; challenges associated with international operations; exposure to interest rate and currency fluctuations; potential impairment of goodwill; liabilities associated with acquisitions, ventures and strategic investments; negative developments affecting our pension plans and multi-employer pensions; labor disruptions associated with the unionized portion of our workforce; loss of key personnel; and the other factors described in the Company's filings with the Securities and Exchange Commission. We caution you that the forward-looking information presented in this presentation is not a guarantee of future events or results, and that actual events or results may differ materially from those made in or suggested by the forward-looking information contained in this presentation. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “plan,” “seek, “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe” or “continue” or the negative thereof or variations thereon or similar terminology. Any forward-looking information presented herein is made only as of the date of this presentation, and we do not undertake any obligation to update or revise any forward-looking information to reflect changes in assumptions, the occurrence of unanticipated events, or otherwise. Non-GAAP Measures This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Furthermore, the non-GAAP financial measures presented herein may not be consistent with similar measures provided by other companies. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in the Appendix at the end of the presentation. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided in the Appendix. This data should be read in conjunction with Univar Solutions' periodic reports previously filed with the SEC. 2 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

Agenda • Fourth quarter summary & integration update - David Jukes • Financial results and outlook - Nick Alexos • Concluding remarks - David Jukes • Q&A 3 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

2019 Fourth Quarter Summary • Solid fourth quarter results ◦ Disciplined execution in challenging demand environment with chemical price deflation ◦ Ended 2019 with $30M of Legacy Nexeo integration value capture ◦ Strong margin improvement ◦ Significantly higher cash flow used to lower our leverage ratio to 3.3x vs. 3.9x prior quarter ◦ Refinanced $900M of debt, reducing interest expense 4 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

Driving long-term value creation Progress driving long-term value creation • Successful, seamless first wave system migration; Wave two in process • Roll-out of new scoreboard with KPI's for U.S. sales force • Site consolidation program: ◦ In Q4 we closed eight branches and sold four properties for $53M ◦ In 2019 we closed twelve branches and sold seven properties for $55M • Completed strategic divestiture of Environmental Sciences business • Continued investments in digitization • Hosted successful Customer and Supplier Innovation Day 5 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

Q4-2019 Financial Highlights (1) • GAAP diluted EPS: $(0.33), compared to $0.01 in the prior year ◦ Increase in earnings from Nexeo, better operating performance, and divestiture gain more than offset by taxes, lower global demand, loss on extinguishment of debt, and pension mark to market • Adjusted diluted EPS(1): $0.29 vs. $0.33 in the prior year ◦ Increase in earnings from Nexeo and better operating performance, more than offset by lower global demand, higher share count and higher D&A • Gross Profit (exclusive of depreciation)(1) up 17.5%: $522.2M vs $444.3M prior year • Adjusted Gross Profit(1): $512.5M vs $444.3M prior year ◦ Driven by contribution from Nexeo, improving sales force execution and favorable mix • Net income (loss): $(55.1)M vs $1.2M prior year • Adjusted EBITDA(1) up 10.3%: $158.8M vs. $144.0M prior year ◦ Nexeo contribution, improved sales force execution and product mix, and realization of synergies from integration program • Net Cash Provided by Operating Activities of $329.7M compared to $292.5M prior year • Return on Invested Capital (ROIC)(1) of 10.1% • Leverage ratio(1) of 3.3x: down from Q4-2018 and Q3-2019 (1) Non-GAAP financial measures; see Appendix for definitions and reconciliation to the most comparable GAAP financial measure. 6 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

Q4-2019 – Consolidated Highlights ($ in millions) KEY METRICS Three months ended 2019 2018 Y/Y Higher margins in a challenging December 31, industrial demand environment Net Sales (2) $2,155.0 $1,971.2 9.3% Constant Currency (1) -- -- 9.8% • Top line growth from Nexeo acquisition Gross Profit (exclusive $522.2 $444.3 17.5% partially offset by lower global demand of depreciation) (1)(2) from industrial end markets and chemical (1) price deflation Gross Margin 24.2% 22.5% +170 bps Outbound freight and • Gross margin expansion driven by sales handling $89.7 $79.8 12.4% force execution and favorable mix Delivered Gross Profit (1) $432.5 $364.5 18.7% • Cost synergies from Nexeo integration program Adjusted EBITDA (1) $158.8 $144.0 10.3% Constant Currency (1) -- -- 11.3% Adjusted EBITDA 7.4% 7.3% +10 bps Margin (1) Conversion Ratio (1) 30.4% 32.4% -200bps (1) Non-GAAP financial measures; see Appendix for definitions page and reconciliation to the most comparable GAAP financial measure. (2) Included in net sales, gross profit (exclusive of depreciation) and gross margin is a $9.7 million benefit in LATAM related to a Brazil VAT recovery for the three months ended December 31, 2019. Excluding this impact, net sales, adjusted gross profit (exclusive of depreciation) and gross margin was $2,145.3 million, $512.5 million and 23.9%, respectively for the three months ended December 31, 2019. Adjusted EBITDA margin excluding the impact from the Brazil VAT recovery remained unchanged. 7 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

USA – Highlights ($ in millions) KEY METRICS Three months ended Growth driven by Nexeo December 31, 2019 2018 Y/Y acquisition and margin Segment External Sales $1,353.9 $1,161.5 16.6% improvement Gross Profit (exclusive of (1) $330.3 $268.2 23.2% • Top line growth from Nexeo acquisition depreciation) partially offset by lower global demand Gross Margin (1) 24.4% 23.1% +130 bps from industrial end markets and Outbound freight and chemical price deflation handling $62.9 $52.9 18.9% • Gross margin expansion, sales force Delivered Gross Profit (1) $267.4 $215.3 24.2% execution and favorable change in mix Adjusted EBITDA (1) $102.4 $88.6 15.6% • Cost synergies from Nexeo integration Adjusted EBITDA program Margin (1) 7.6% 7.6% 0 bps (1) Non-GAAP financial measures; see Appendix for definitions page and reconciliation to the most comparable GAAP financial measure. 8 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

CANADA – Highlights ($ in millions) KEY METRICS Three months ended Solid performance in industrial December 31, 2019 2018 Y/Y end markets and focused Segment External Sales $256.2 $264.5 (3.1)% Industries Constant Currency (1) -- -- (4.0)% • Sales decreased due to chemical price Gross Profit (exclusive $55.9 $51.5 8.5% deflation and lower demand in energy market of depreciation) (1) • Growth in industrial end markets, contribution Constant Currency (1) -- -- 8.2% from legacy Nexeo as well as Agriculture Gross Margin (1) 21.8% 19.5% +230 bps • Growth in gross profit dollars, gross margins Outbound freight and and EBITDA margins despite revenue handling $10.1 $10.0 1.0% headwinds Delivered Gross Profit (1) $45.8 $41.5 10.4% Adjusted EBITDA (1) $22.5 $21.4 5.1% Constant Currency (1) -- -- 4.7% Adjusted EBITDA 8.8% 8.1% +70 bps Margin (1) (1) Non-GAAP financial measures; see Appendix for definitions page and reconciliation to the most comparable GAAP financial measure. 9 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

EMEA – Highlights ($ in millions) KEY METRICS Solid performance in a sluggish Three months ended 2019 2018 Y/Y trading environment December 31, Segment External Sales $418.9 $452.8 (7.5)% • Sales decreased due to chemical price deflation Constant Currency (1) -- -- (5.3)% • Improved performance in chemical Gross Profit (exclusive $100.3 $104.0 (3.6)% of depreciation) (1) distribution offset weakness in finished pharmaceutical Constant Currency (1) -- -- (1.1)% • Gross Profit and EBITDA margin expansion Gross Margin (1) 23.9% 23.0% +90 bps despite revenue headwinds Outbound freight and handling $14.3 $15.0 (4.7)% Delivered Gross Profit (1) $86.0 $89.0 (3.4)% Adjusted EBITDA (1) $31.1 $30.8 1.0% Constant Currency (1) -- -- 2.9% Adjusted EBITDA 7.4% 6.8% +60 bps Margin (1) (1) Non-GAAP financial measures; see Appendix for definitions page and reconciliation to the most comparable GAAP financial measure. 10 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

LATAM – Highlights ($ in millions) KEY METRICS Three months ended 2019 2018 Y/Y Solid performance in Mexico December 31, energy markets and Brazil Segment External Sales (2) $126.0 $92.4 36.4% agriculture sector Constant Currency (1) -- -- 39.0% • Mexico energy markets and Brazil agriculture Gross Profit (exclusive of $35.7 $20.6 73.3% depreciation) (1)(2) sector, along with contributions from legacy Nexeo and Brazil VAT recovery benefited Constant Currency (1) -- -- 80.1% results Gross Margin (1) 28.3% 22.3% +600 bps • Weakness in Brazil industrial demand Outbound freight and $2.4 $1.9 26.3% • Gross Profit and EBITDA margin expansion handling Delivered Gross Profit (1) $33.3 $18.7 78.1% Adjusted EBITDA (1) $10.8 $7.3 47.9% Constant Currency (1) -- -- 63.0% Adjusted EBITDA 8.6% 7.9% +70 bps Margin (1) (1) Non-GAAP financial measures; see Appendix for definitions page and reconciliation to the most comparable GAAP financial measure. (2) Included in segment external sales, gross profit (exclusive of depreciation) and gross margin is a $9.7 million benefit related to a Brazil VAT recovery for the three months ended December 31, 2019. Excluding this impact, segment external sales, adjusted gross profit (exclusive of depreciation) and gross margin was $116.3 million, $26.0 million and 22.4%, respectively, for the three months ended December 31, 2019. Adjusted EBITDA margin excluding the impact from the Brazil VAT recovery was 11 9.3%, increasing 140 bps. © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

Cash Flow Highlights Three months ended December 31, Year ended December 31, ($ in millions) 2019 2018 2019 2018 Net cash provided by operating activities $ 329.7 $ 292.5 $ 363.9 $ 289.9 Capital expenditures (1) (50.4) (34.7) (122.5) (94.6) Transaction related costs (2) — 0.2 65.0 4.9 Integration costs (3) 24.8 14.5 116.2 14.5 Free cash flow $ 304.1 $ 272.5 $ 422.6 $ 214.7 Net cash provided (used) by investing activities $ 173.4 $ (27.7) $ (433.1) $ (99.0) Net cash (used) provided by financing activities $ (316.1) $ (228.2) $ 295.2 $ (518.3) Cash interest (net) $ (35.6) $ (25.5) $ (143.3) $ (125.1) Cash taxes (net) $ 1.6 $ (16.0) $ (30.0) $ (63.4) Pension contribution $ (4.5) $ (14.3) $ (27.4) $ (38.7) Saccharin legal settlement $ — $ — $ (62.5) $ — (1) Excludes additions from finance leases. (2) Includes the incremental cost from the appraisal litigation settlement in 2019. (3) Includes severance, facility exit and other integration related expenses. 12 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

OUTLOOK EXPECTATIONS* 2020 2020 Full Year 2020 Flat industrial production Adjusted EBITDA (1) of U.S. energy and EMEA finished pharma headwinds $700 - $740 million Commodity chemical price deflation Free Cash Flow (1) $120 - $170 million New supplier authorizations Normalized Free Cash Flow (1) Realization of sales force realignment $325 - $375 million Execute on integration and value capture-$40M incremental savings Q1 2020 Divested Environmental Sciences in 2019 Adjusted EBITDA (1) of $150 - $160 million (1) Non-GAAP financial measures; see Appendix for definitions page and reconciliation to the most comparable GAAP financial measure. (•) Excludes any impact from the Coronavirus outbreak. 13 * © 2019 Univar, Inc. All rights reserved. Confidential and content* subject to change.

Full Year 2020 Guidance Year ended December 31, ($ in millions) 2020 2019 (Actuals) Adjusted EBITDA (1) $700-$740 $704.2 Cash Interest (net) ($115-$125) ($143.3) Tax Rate on Adjusted Diluted EPS (1) 28%-30% 29.2% Pension Contribution ($25-$30) ($27.4) Change in Net Working Capital ($100-$150) $195.1 Capital Expenditures ($120-$130) ($122.5) Cash Taxes (net) ($60-$75) ($30.0) Diluted Weighted Avg. Shares Outstanding 175 M 164.1M (1) Non-GAAP financial measures; see Appendix for definitions page and reconciliation to the most comparable GAAP financial measure. Note: Cash inflow +/ Cash outflow - 14 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

2019 Accomplishments: Creating a Sustainable Competitive Advantage • $30M integration cost • ERP Migration/ • Redesigned sales synergies Digitization Investment territories • Network optimization • Advanced Sustainability • Supplier authorizations agenda • Nexeo Plastics and • Increase global footprint Environmental Services • Created new company: Divestitures Univar Solutions Controlling the controllables, while delivering margin expansion, net working capital efficiency, and reduced leverage 15 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

Appendix 16 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

Appendix - Definitions • Adjusted EBITDA – Adjusted EBITDA is defined as consolidated net (loss) income, plus the sum of net (income) loss from discontinued operations, net interest expense, income tax expense, depreciation, amortization, other operating expenses, net (which primarily consists of employee stock-based compensation expense, restructuring charges, litigation settlements, other employee termination costs, other facility exit costs, acquisition and integration related expenses and other unusual or non-recurring expenses), loss on extinguishment of debt and other (expense) income, net (which consists of gains and losses on foreign currency transactions and undesignated derivative instruments, non-operating retirement benefits, and other non-operating activity), and in 2019, inventory step-up adjustment and Brazil VAT recovery. • Adjusted EBITDA Margin – Adjusted EBITDA divided by net sales on a consolidated level and by external sales on a segment level. • Constant Currency – Excludes the impact of fluctuations in foreign currency exchange rates. Currency impacts on consolidated and segment results have been derived by translating current period financial results in local currency using the average exchange rate for the prior period to which the financial information is being compared. • Conversion Ratio – Adjusted EBITDA divided by gross profit (exclusive of depreciation). • Delivered Gross Profit – Gross profit (exclusive of depreciation) less outbound freight and handling. • Free Cash Flow – GAAP net cash provided (used) by operating activities less capital expenditures, before integration and transaction related costs. • Gross Profit (exclusive of depreciation) – Net sales less cost of goods sold (exclusive of depreciation). • Gross Margin – Gross profit (exclusive of depreciation) divided by net sales on a consolidated level and by external sales on a segment level. • Net Assets Deployed – Average net working capital (trade accounts receivable plus inventory less trade accounts payable) plus average net property, plant & equipment. • Normalized Free Cash Flow – Management has calculated Normalized Free Cash Flow guidance assuming an Adjusted EBITDA for 2020 in the range of $700-$740 million, and taking into consideration the following: • Working capital levels consistent with flat to low single-digit sales growth; • Capital expenditures required to support post-integration operations; • The exclusion of tax payments for unusual 2019 transactions that are payable in future years; • Consistent levels of agriculture prepayments; • A reduction in cash outflows from lower other operating expenses, exclusive of integration costs; and, • Neutralization of timing differences flowing through other assets and liabilities. • Return on Invested Capital – Last twelve months (LTM) Adjusted net income divided by net assets deployed. 17 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

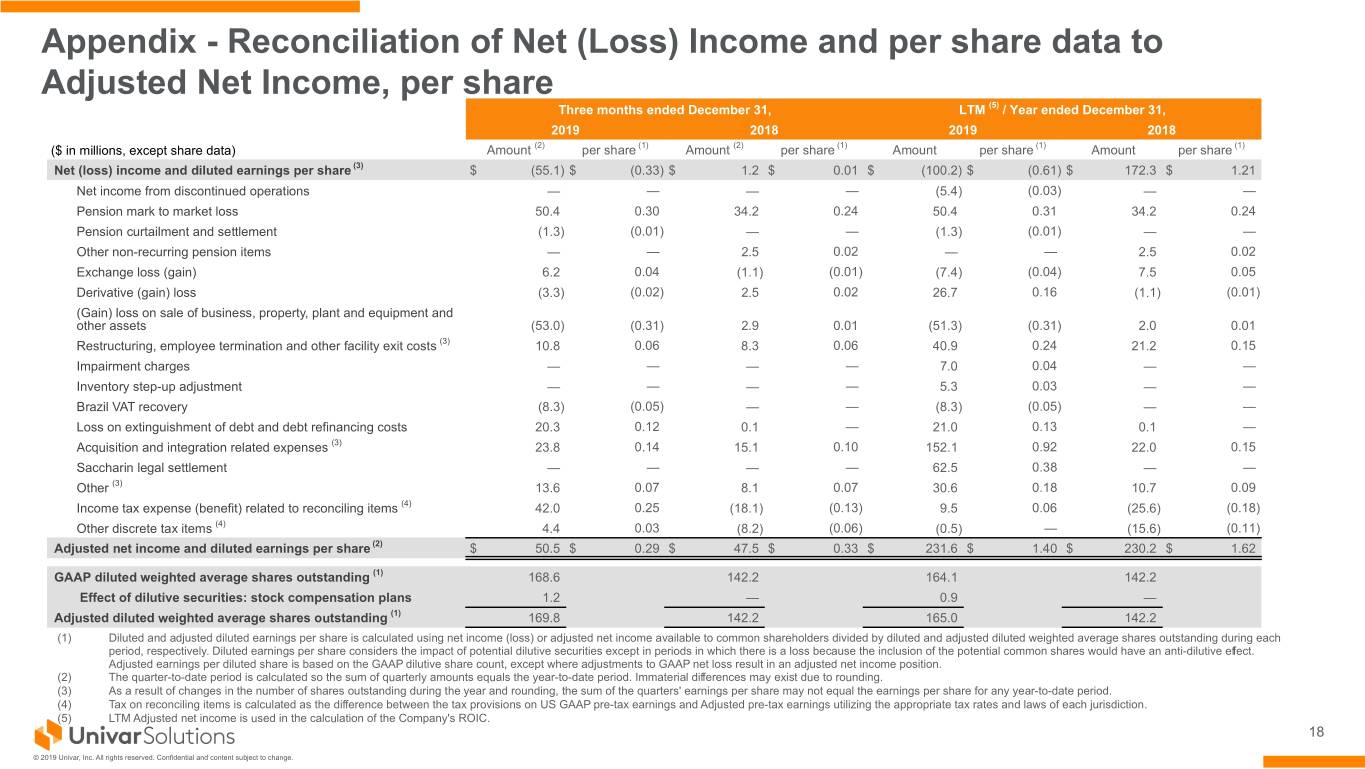

Appendix - Reconciliation of Net (Loss) Income and per share data to Adjusted Net Income, per share Three months ended December 31, LTM (5) / Year ended December 31, 2019 2018 2019 2018 ($ in millions, except share data) Amount (2) per share (1) Amount (2) per share (1) Amount per share (1) Amount per share (1) Net (loss) income and diluted earnings per share (3) $ (55.1) $ (0.33) $ 1.2 $ 0.01 $ (100.2) $ (0.61) $ 172.3 $ 1.21 Net income from discontinued operations — — — — (5.4) (0.03) — — Pension mark to market loss 50.4 0.30 34.2 0.24 50.4 0.31 34.2 0.24 Pension curtailment and settlement (1.3) (0.01) — — (1.3) (0.01) — — Other non-recurring pension items — — 2.5 0.02 — — 2.5 0.02 Exchange loss (gain) 6.2 0.04 (1.1) (0.01) (7.4) (0.04) 7.5 0.05 Derivative (gain) loss (3.3) (0.02) 2.5 0.02 26.7 0.16 (1.1) (0.01) (Gain) loss on sale of business, property, plant and equipment and other assets (53.0) (0.31) 2.9 0.01 (51.3) (0.31) 2.0 0.01 Restructuring, employee termination and other facility exit costs (3) 10.8 0.06 8.3 0.06 40.9 0.24 21.2 0.15 Impairment charges — — — — 7.0 0.04 — — Inventory step-up adjustment — — — — 5.3 0.03 — — Brazil VAT recovery (8.3) (0.05) — — (8.3) (0.05) — — Loss on extinguishment of debt and debt refinancing costs 20.3 0.12 0.1 — 21.0 0.13 0.1 — Acquisition and integration related expenses (3) 23.8 0.14 15.1 0.10 152.1 0.92 22.0 0.15 Saccharin legal settlement — — — — 62.5 0.38 — — Other (3) 13.6 0.07 8.1 0.07 30.6 0.18 10.7 0.09 Income tax expense (benefit) related to reconciling items (4) 42.0 0.25 (18.1) (0.13) 9.5 0.06 (25.6) (0.18) Other discrete tax items (4) 4.4 0.03 (8.2) (0.06) (0.5) — (15.6) (0.11) Adjusted net income and diluted earnings per share (2) $ 50.5 $ 0.29 $ 47.5 $ 0.33 $ 231.6 $ 1.40 $ 230.2 $ 1.62 GAAP diluted weighted average shares outstanding (1) 168.6 142.2 164.1 142.2 Effect of dilutive securities: stock compensation plans 1.2 — 0.9 — Adjusted diluted weighted average shares outstanding (1) 169.8 142.2 165.0 142.2 (1) Diluted and adjusted diluted earnings per share is calculated using net income (loss) or adjusted net income available to common shareholders divided by diluted and adjusted diluted weighted average shares outstanding during each period, respectively. Diluted earnings per share considers the impact of potential dilutive securities except in periods in which there is a loss because the inclusion of the potential common shares would have an anti-dilutive effect. Adjusted earnings per diluted share is based on the GAAP dilutive share count, except where adjustments to GAAP net loss result in an adjusted net income position. (2) The quarter-to-date period is calculated so the sum of quarterly amounts equals the year-to-date period. Immaterial differences may exist due to rounding. (3) As a result of changes in the number of shares outstanding during the year and rounding, the sum of the quarters' earnings per share may not equal the earnings per share for any year-to-date period. (4) Tax on reconciling items is calculated as the difference between the tax provisions on US GAAP pre-tax earnings and Adjusted pre-tax earnings utilizing the appropriate tax rates and laws of each jurisdiction. (5) LTM Adjusted net income is used in the calculation of the Company's ROIC. 18 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

Appendix - GAAP Net Income (Loss) to Adjusted EBITDA Reconciliation LTM (1) LTM (1) LTM (1) LTM (1) ($ in millions) Q4'17 Q1'18 Q2'18 Q3'18 Q4'18 Q1'19 Q2'19 Q3'19 Q4'19 Q3'18 Q4'18 Q3'19 Q4'19 Net income (loss) $ 27.0 $ 65.4 $ 56.1 $ 49.6 $ 1.2 $ (63.9) $ 16.3 $ 2.5 $ (55.1) $ 198.1 $ 172.3 $ (43.9) $ (100.2) Net (income) loss from discontinued operations — — — — — (6.1) 0.7 — — — — (5.4) (5.4) Depreciation 32.5 31.4 30.9 31.5 31.4 33.2 39.7 41.6 40.5 126.3 125.2 145.9 155.0 Amortization 15.4 13.4 13.8 13.5 13.6 14.4 18.6 12.1 14.6 56.1 54.3 58.7 59.7 Interest expense, net 38.0 34.9 32.0 32.2 33.3 34.2 37.9 36.8 30.6 137.1 132.4 142.2 139.5 Income tax expense (benefit) 33.6 10.2 27.2 20.3 (7.8) (23.3) 18.5 43.2 66.1 91.3 49.9 30.6 104.5 EBITDA $ 146.5 $ 155.3 $ 160.0 $ 147.1 $ 71.7 $ (11.5) $ 131.7 $ 136.2 $ 96.7 608.9 534.1 328.1 353.1 Other operating (income) expenses, net (0.4) 13.6 11.0 12.4 36.5 164.8 63.8 30.2 39.4 36.6 73.5 295.3 298.2 Other (income) expense, net (3.0) (2.6) 2.1 (2.5) 35.7 6.1 5.6 5.5 53.3 (6.0) 32.7 52.9 70.5 Inventory step-up adjustment — — — — — — — 5.3 — — — 5.3 5.3 Brazil VAT recovery — — — — — — — — (8.3) — — — (8.3) Impairment charges — — — — — — — 7.0 — — — 7.0 7.0 Gain on sale of business — — — — — — — — (41.4) — — — (41.4) Loss on extinguishment of debt 3.0 — — — 0.1 0.7 — — 19.1 3.0 0.1 0.8 19.8 Adjusted EBITDA $ 146.1 $ 166.3 $ 173.1 $ 157.0 $ 144.0 $ 160.1 $ 201.1 $ 184.2 $ 158.8 $ 642.5 $ 640.4 $ 689.4 $ 704.2 (1) LTM Adjusted EBITDA is used in the calculation of the Company's leverage ratio. 19 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

Appendix - Gross Profit, Adjusted Gross Profit and Delivered Gross Profit (all exclusive of depreciation) Other/ USA Canada EMEA LATAM Eliminations (1) Consolidated ($ in millions) Three months ended December 31, 2019 Net sales $ 1,376.3 $ 257.9 $ 419.6 $ 126.0 $ (24.8) $ 2,155.0 Cost of goods sold (exclusive of depreciation) 1,046.0 202.0 319.3 90.3 (24.8) 1,632.8 Gross Profit (exclusive of depreciation) $ 330.3 $ 55.9 $ 100.3 $ 35.7 $ — $ 522.2 Brazil VAT recovery — — — (9.7) — (9.7) Adjusted gross profit (exclusive of depreciation) (2) $ 330.3 $ 55.9 $ 100.3 $ 26.0 $ — $ 512.5 Outbound freight and handling 62.9 10.1 14.3 2.4 — 89.7 Delivered gross profit (3) $ 267.4 $ 45.8 $ 86.0 $ 33.3 $ — $ 432.5 Other/ USA Canada EMEA LATAM Eliminations (1) Consolidated ($ in millions) Three months ended December 31, 2018 Net sales $ 1,186.5 $ 266.6 $ 453.3 $ 92.4 $ (27.6) $ 1,971.2 Cost of goods sold (exclusive of depreciation) 918.3 215.1 349.3 71.8 (27.6) 1,526.9 Gross Profit (exclusive of depreciation) $ 268.2 $ 51.5 $ 104.0 $ 20.6 $ — $ 444.3 Outbound freight and handling 52.9 10.0 15.0 1.9 — 79.8 Delivered gross profit (3) $ 215.3 $ 41.5 $ 89.0 $ 18.7 $ — $ 364.5 (1) Other/Eliminations represents the elimination of intersegment transactions as well as unallocated corporate costs consisting of costs specifically related to parent company operations that do not directly benefit segments, either individually or collectively. (2) Adjusted gross profit (exclusive of depreciation) excludes the impact related to the Brazil VAT recovery in the LATAM segment. Adjusted gross profit (exclusive of depreciation) is equal to gross profit (exclusive of depreciation) for USA, EMEA and Canada segments. (3) Gross profit (exclusive of depreciation) less outbound freight and handling. 20 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

Appendix - GAAP Debt to Net Debt Reconciliation December 31, September 30, ($ in millions) 2019 2018 2019 2018 Total short-term and long-term debt $ 2,713.8 $ 2,372.1 $ 2,996.1 $ 2,601.0 Add: Short-term financing 0.7 8.1 2.9 8.7 Less: Cash and cash equivalents (330.3) (121.6) (134.6) (85.9) Total net debt $ 2,384.2 $ 2,258.6 $ 2,864.4 $ 2,523.8 LTM Adjusted EBITDA (1)(2) $ 725.4 $ 640.4 $ 742.3 $ 642.5 Leverage ratio (Total net debt/LTM Adjusted EBITDA) (2) 3.3x 3.5x 3.9x 3.9x (1) LTM Adjusted EBITDA, as defined by the Company's credit agreements, excluding the impact of synergies not yet realized, includes two and five months of Nexeo Chemicals Adjusted EBITDA for December 31 and September 30, 2019, respectively, based on the 2018 full year estimate of $127 million for the periods prior to the acquisition on February 28, 2019. LTM Adjusted EBITDA in 2018 does not include an estimate of Nexeo Chemicals Adjusted EBITDA. (2) Refer to “Appendix - GAAP Net Income (Loss) to Adjusted EBITDA Reconciliation.” 21 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

Appendix - GAAP Net (Loss) Income to Adjusted EBITDA Guidance Reconciliation Q1 2020 Full Year 2020 ($ in millions) Low High Low High Net (loss) income (1) $ (9.0) $ 14.3 $ 87.8 $ 186.1 Depreciation (1) 45.0 40.0 175.0 145.0 Amortization (1) 17.5 12.5 70.0 50.0 Interest expense, net (1) 32.5 27.5 125.0 115.0 Other operating expenses, net (1)(2) 50.0 40.0 175.0 125.0 Other income, net (1)(3) (1.5) — (5.0) — Income tax expense (1) 15.5 25.7 72.2 118.9 Adjusted EBITDA $ 150.0 $ 160.0 $ 700.0 $ 740.0 (1) Adjusted EBITDA excludes from forecasted net income the impact of gains and losses of foreign currency and on divestitures, refinancing costs, potential impairments, discrete tax items and other unusual or nonrecurring items that might materially impact GAAP net income. We have not provided a further reconciliation of Adjusted EBITDA to GAAP net income as such reconciliation is not available without unreasonable efforts because the additional components in deriving Adjusted EBITDA are evaluated on an ongoing basis, can be highly variable and cannot reasonably be predicted and should not be viewed as guidance. In addition, forecasted net income presented within this reconciliation is provided for informational purposes only and should not be viewed as guidance, as reported GAAP net income may differ materially from forecasted net income due to the impact of the items of the type identified above. (2) Other operating expenses, net, primarily consists of the following: acquisition and integration related expenses, stock-based compensation expense, restructuring charges, litigation settlements, other employee termination costs, other facility exit costs and other unusual or infrequent expenses. (3) Other expense (income), net, primarily consists of the following: foreign currency transaction gains and losses, changes in fair value on undesignated derivative instruments and non-operating retirement benefits. 22 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

Appendix - GAAP Cash Flow from Operations to Free Cash Flow and Normalized Free Cash Flow Guidance Reconciliation Full Year 2020 ($ in millions) Low High Net cash provided by operating activities (1) $ 140 $ 210 Capital expenditures (1)(2) (130) (120) Integration costs (1)(3) 110 80 Free cash flow guidance (4)(5) $ 120 $ 170 Changes in capital expenditures and operating assets and liabilities (4) 205 205 Normalized free cash flow guidance (4)(5) $ 325 $ 375 Net cash used by investing activities (1) $ (130) $ (120) Net cash provided by financing activities (1) $ (35) $ (15) (1) Management does not provide guidance on GAAP financial measures, including net cash provided by operating and financing activities and used by investing activities as we are unable to predict with certainty unusual or infrequent items impacting GAAP financial metrics. As such, we have included above the impact of only those items about which we are aware and are reasonably likely to occur during the guidance period covered. These financial measures are included within this reconciliation for informational purposes only and should not be viewed as guidance, as reported GAAP measures may differ materially from such forecasted amounts. (2) Excludes additions from finance leases. (3) Includes severance, facility exit and other integration related expenses. (4) Non-GAAP financial measures; see Appendix for definitions of Free Cash Flow and Normalized Free Cash Flow. (5) Management believes that Normalized Free Cash Flow provides meaningful supplemental information relative to the Company’s Free Cash Flow guidance for 2020. Normalized Free Cash Flow further adjusts for fluctuations in other operating assets and liabilities that occur in any given period due to the timing of payments and cash receipts and therefore provides investors with supplemental information regarding the underlying cash flow of the business as well as additional visibility into the performance and prospects of the business. Free Cash Flow and Normalized Free Cash Flow should be used as supplemental measures and should not be considered as alternatives to cash flow from operating activities (calculated in accordance with GAAP). In addition, neither Free Cash Flow nor Normalized Free Cash Flow is indicative of funds available to fund our liquidity needs, including our ability to service or incur debt. Management also notes that Free Cash Flow and Normalized Free Cash Flow may be calculated differently by other companies thereby limiting their usefulness as comparative measures. 23 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.