Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - BROADWIND, INC. | exh_991.htm |

| 8-K - FORM 8-K - BROADWIND, INC. | f8k_022620.htm |

EXHIBIT 99.2

4Q19 / Full - Year 2019 Results Conference Call Investor Presentation

SAFE - HARBOR STATEMENT 2 | Investor Presentation Broadwind obtained the industry and market data used throughout this presentation from our own research, internal surveys and studies conducted by third parties, independent industry associations or general publications and other publicly available information . Independent industry publications and surveys generally state that they have obtained information from sources believed to be reliable, but do not guarantee the accuracy or completeness of such information . Forecasts are particularly likely to be inaccurate, especially over long periods of time . We are not aware of any misstatements in the industry data we have presented herein, but estimates involve risks and uncertainties and are subject to change based on various factors beyond our control . Our forward - looking statements may include or relate to our beliefs, expectations, plans and/or assumptions with respect to the following : (i) state, local and federal regulatory frameworks affecting the industries in which we compete, including the wind energy industry, and the related extension, continuation or renewal of federal tax incentives and grants and state renewable portfolio standards as well as new or continuing tariffs on steel or other products imported into the United States ; (ii) our customer relationships and our substantial dependency on a few significant customers and our efforts to diversify our customer base and sector focus and leverage relationships across business units ; (iii) our ability to continue to grow our business organically and through acquisitions ; (iv) the production, sales, collections, customer deposits and revenues generated by new customer orders and our ability to realize the resulting cash flows ; (v) the sufficiency of our liquidity and alternate sources of funding, if necessary ; (vi) our ability to realize revenue from customer orders and backlog ; (vii) our ability to operate our business efficiently, comply with our debt obligations, manage capital expenditures and costs effectively, and generate cash flow ; (viii) the economy and the potential impact it may have on our business, including our customers ; (ix) the state of the wind energy market and other energy and industrial markets generally and the impact of competition and economic volatility in those markets ; (x) the effects of market disruptions and regular market volatility, including fluctuations in the price of oil, gas and other commodities ; [(xi) competition from new or existing industry participants including, in particular, increased competition from foreign tower manufacturers with access to lower cost steel] ; (xii) the effects of the change of administrations in the U . S . federal government ; (xiii) our ability to successfully integrate and operate companies and to identify, negotiate and execute future acquisitions ; (xiv) the potential loss of tax benefits if we experience an “ownership change” under Section 382 of the IRC ; (xv) the limited trading market for our securities and the volatility of market price for our securities ; and (xvi) the impact of future sales of our common stock or securities convertible into our common stock on our stock price . These statements are based on information currently available to us and are subject to various risks, uncertainties and other factors . We are under no duty to update any of these statements . You should not consider any list of such factors to be an exhaustive statement of all of the risks, uncertainties or other factors that could cause our current beliefs, expectations, plans and/or assumptions to change . This presentation contains non - GAAP financial information . We believe that certain non - GAAP financial measures may provide users of this financial information with meaningful comparisons between current results and results in prior operating periods . We believe that these non - GAAP financial measures can provide additional meaningful reflection of underlying trends of the business because they provide a comparison of historical information that excludes certain infrequently occurring or non - operational items that impact the overall comparability . Non - GAAP financial measures should be viewed in addition to, and not as an alternative to, our reported results prepared in accordance with GAAP . Please see our earnings release dated February 27 , 2020 for a reconciliation of certain non - GAAP measures presented in this presentation .

PERFORMANCE OVERVIEW

4Q19 EXECUTIVE SUMMARY 4 | Investor Presentation 1. Total backlog +48% y/y to $142.3 million: Driven by growth in Heavy Fabrications and Diversification > Total Heavy Fabrications backlog +$53.6 million y/y, significant growth in towers sold, expansion of industrial fabrications 2. Total Revenue + 81% y/y to $49.3 million: Highest quarterly revenue since 1Q17 > Growth driven by recovery in tower demand 3. Heavy Fabrications revenue +210% y/y; Seeing accelerated demand for wind towers > Tower plants operating at 75% capacity 4. Gearing revenue - 30% y/y: Impacted by lower oil/gas activity > Richer product mix provides earnings resilience; record full year operating profit of $3.2M 5. Industrial Solutions revenue flat y/y: First solar kitting order received during 4Q19; y/y growth in EBITDA > Lower NGT - related deliveries offset by first solar kitting order; generated third consecutive quarter of positive EBITDA

4Q19 EXECUTIVE SUMMARY (Continued) 5 | Investor Presentation 7. Total cash and availability of $19.0 million as of 12/31/19 > Working capital management initiatives successful; working capital declines to 3% of sales 8. Production Tax Credit (PTC) extension provides uplift in wind tower demand into 2024 and beyond > December legislation provides 60% PTC for projects commenced during 2020 9. Favorable preliminary outcome on trade litigation > Limits wind tower producers in Indonesia, Canada, Vietnam and Korea from participating in unfair trade practices in the U.S. 10. BWEN leadership transition underway, effective March 1, 2020 > Current CEO Kushner will retire as CEO and become Chairman of the Board; current COO Blashford named CEO 6. Total Adjusted EBITDA $1.8 million in 4Q19 vs. ($1.7) million in 4Q18 > Y/Y growth in Heavy Fabrications and Industrial Solutions Adj. EBITDA more than offset y/y decline in Gearing

FIVE - YEAR HISTORICAL TREND DATA Significant Y/Y Increase In Orders and Backlog Exiting 2019 6 | Investor Presentation Total Annual Orders ($MM) Backlog ($MM) $94.0 $275.0 $87.6 $83.2 $221.5 2015 2016 2017 2018 2019 $93.9 $188.7 $138.2 $96.5 $142.3 YE 2015 YE 2016 YE 2017 YE 2018 YE 2019 Surge of Tower orders to support scheduled PTC installations Significant Tower customer adds in ’19; Positive ’20 outlook $21 MM of Industrial fabrication orders booked in 2019 2 3 1

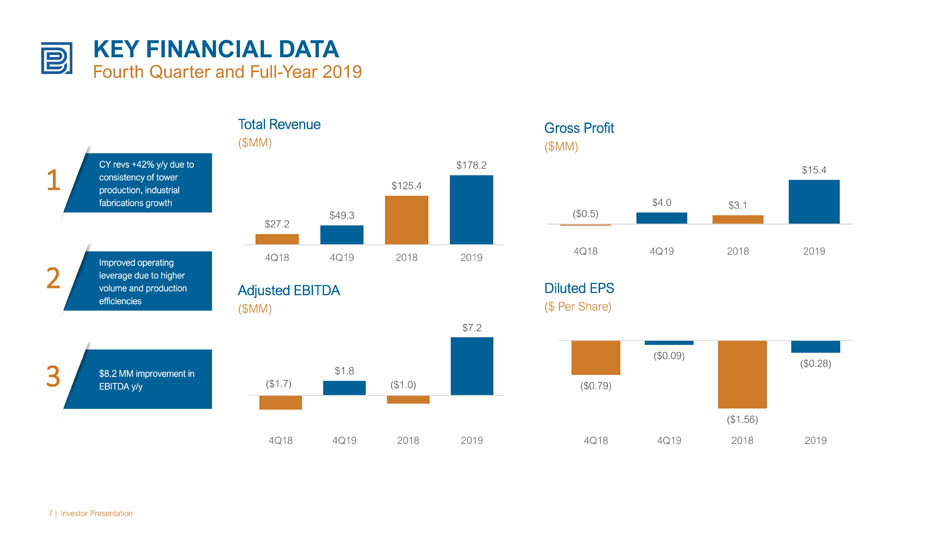

KEY FINANCIAL DATA Fourth Quarter and Full - Year 2019 7 | Investor Presentation Total Revenue ($MM) Gross Profit ($MM) Adjusted EBITDA ($MM) Diluted EPS ($ Per Share) $27.2 $49.3 $125.4 $178.2 4Q18 4Q19 2018 2019 ($0.5) $4.0 $3.1 $15.4 4Q18 4Q19 2018 2019 ($1.7) $1.8 ($1.0) $7.2 4Q18 4Q19 2018 2019 CY revs +42% y/y due to consistency of tower production, industrial fabrications growth Improved operating leverage due to higher volume and production efficiencies $8.2 MM improvement in EBITDA y/y 2 3 1 ($0.79) ($0.09) ($1.56) ($0.28) 4Q18 4Q19 2018 2019

HEAVY FABRICATIONS SEGMENT Positive Commercial Momentum Leading to Improved Operating Performance 8 | Investor Presentation Revenue ($MM) Adjusted EBITDA ($MM) Orders ($MM) Backlog ($MM) ($1.3) $2.4 $1.1 $6.7 4Q18 4Q19 2018 2019 $4.3 $5.3 $28.6 $179.7 4Q18 4Q19 2018 2019 Tower sections sold up to ~300 in Q4; 75% plant utilization Margin pressure during ’19 due to tower imports and supply chain challenges 37% y/y increase in full - year Industrial Fabrications orders 2 3 1 ~65% of 2020 tower production in 12/31 backlog 4 $66.7 $152.6 $120.3 Dec. 31, 2018 Sept. 30, 2019 Dec. 31, 2019 12/31/18 9/30/19 12/31/19 $12.1 $37.6 $74.7 $128.7 4Q18 4Q19 2018 2019

HEAVY FABRICATIONS SEGMENT PTC - Driven Demand For Tower Sections 9 | Investor Presentation Total Tower Sections Sold (Number of Sections) 143 188 201 201 132 243 64 302 1Q18 1Q19 2Q18 2Q19 3Q18 3Q19 4Q18 4Q19 +31% y/y Flat y/y +84% y/y +372% y/y Note: In December 2019, the United States production tax credit for renewable wind projects was extended for one - year, pursuant to a year - end 2019 appropriations bill, from January 1, 2020 to January 1, 2021. As a result of the new legislation, the PTC will subsidize wind projects commenced as late as 2020 and completed by 2024, or later, if continuous construction can be demonstrated. The extension of the PTC is expected to result in a material, near - term increase in wind tower orders during c alendar 2020, as producers seek to capture the ratable economic benefit associated with the PTC extension.

GEARING SEGMENT Higher - Value Sales Mix Contributes To Improved EBITDA Generation 10 | Investor Presentation Revenue ($MM) Adjusted EBITDA ($MM) Orders ($MM) Backlog ($MM) $10.9 $7.6 $38.4 $34.9 4Q18 4Q19 2018 2019 $1.6 $1.0 $2.6 $5.6 4Q18 4Q19 2018 2019 $8.5 $6.9 $41.6 $25.5 4Q18 4Q19 2018 2019 Generated record operating income of $3.2 MM, EBITDA margin of 16.1% Improved margins in Mining, Steel and Wind Frac gear demand off 2018 highs 2 3 1 Custom gearbox revenue doubled y/y in 2019 4 $23.6 $14.6 $14.3 Dec. 31, 2018 Sept. 30, 2019 Dec. 31, 2019 12/31/18 9/30/19 12/31/19

INDUSTRIAL SOLUTIONS SEGMENT Benefited From First Solar Kitting Order In The Fourth Quarter 2019 11 | Investor Presentation Revenue ($MM) Adjusted EBITDA ($MM) Orders ($MM) Backlog ($MM) 3 rd consecutive quarter of positive EBITDA – orders increased 25% y/y Increased market share gains, seeing positive momentum – orders for NGT content +90% y/y 1 2 Recorded $0.8 MM of accelerated amortization in 4Q19 due to rebranding initiative 3 $3.9 $4.3 $13.1 $16.4 4Q18 4Q19 2018 2019 $6.2 $7.4 $7.7 Dec. 31, 2018 Sept. 30, 2019 Dec. 31, 2019 12/31/18 9/30/19 12/31/19 $4.2 $4.1 $12.5 $14.7 4Q18 4Q19 2018 2019 ($0.7) $0.1 ($1.2) $0.4 4Q18 4Q19 2018 2019

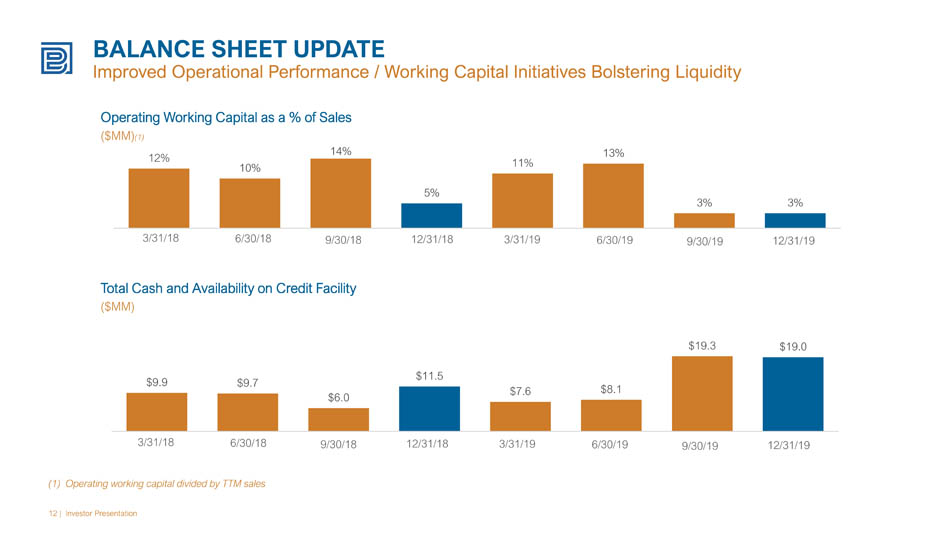

BALANCE SHEET UPDATE Improved Operational Performance / Working Capital Initiatives Bolstering Liquidity 12 | Investor Presentation Total Cash and Availability on Credit Facility ($MM) Operating Working Capital as a % of Sales ($MM) (1) $9.9 $9.7 $6.0 $11.5 $7.6 $8.1 $19.3 $19.0 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 3/31/18 6/30/18 9/30/18 12/31/18 3/31/19 6/30/19 9/30/19 12/31/19 (1) Operating working capital divided by TTM sales 12% 10% 14% 5% 11% 13% 3% 3% 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 3/31/18 6/30/18 9/30/18 12/31/18 3/31/19 6/30/19 9/30/19 12/31/19

MANAGEMENT OUTLOOK

FINANCIAL GUIDANCE Current as of February 27, 2020 14 | Investor Presentation Revenue Guidance ($MM) > Total Company 1Q20 Forecast Full - Year 2020 Forecast > Heavy Fabrications > Gearing > Industrial Solutions > Corporate/Other $48.0 to $52.0 $37.0 to $40.0 $7.0 to $7.5 Adjusted EBITDA Guidance ($MM) 1Q20 Forecast Full - Year 2020 Forecast $4.0 to $4.5 $2.8 to $3.5 $4.0 to $4.5 $0.5 to $0.7 $0.0 to $0.2 ($1.6) to ($1.9) $200 to $220 $12 to $14

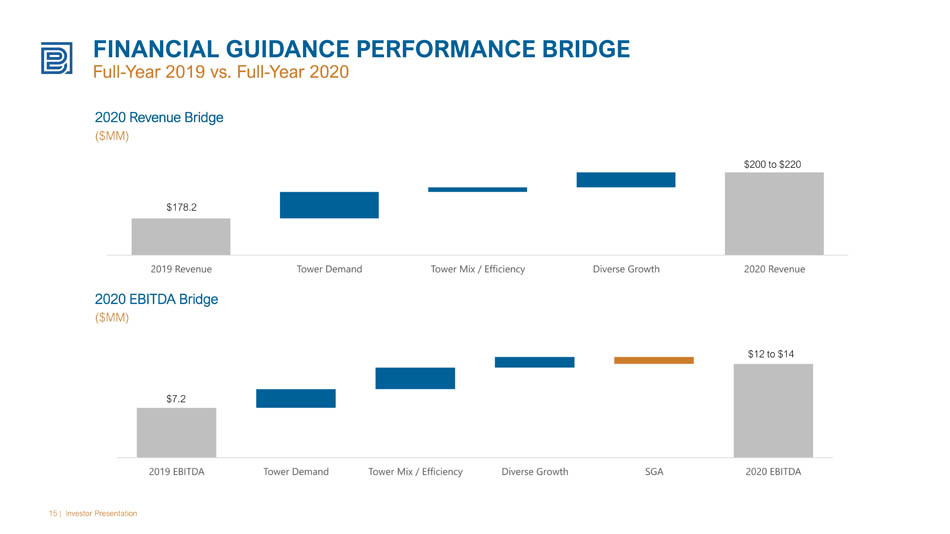

FINANCIAL GUIDANCE PERFORMANCE BRIDGE Full - Year 2019 vs. Full - Year 2020 15 | Investor Presentation 2020 EBITDA Bridge ($MM) 2020 Revenue Bridge ($MM) $7.2 $178.2 $200 to $220 $12 to $14

BROADWIND OVERVIEW Positioned For Profitable Growth 16 | Investor Presentation About Us > We are a precision manufacturer of structures, equipment and components for clean tech and other specialized industrial applications Unique Value Proposition > Proven technical capabilities > Complete turnkey solutions > Large scale complex fabrications & precision products > Stringent quality standards > Multi - industry focus Key Strategic Priorities > Diversify customer and product line concentrations beyond the wind energy sector > Maintain elevated capacity utilization levels, while broadening our manufacturing capabilities > Continuously enhance production technology and operational efficiency > Acquire assets that complement our geographic presence and/or product/service offering > Maintain balance sheet optionality to pursue growth investments

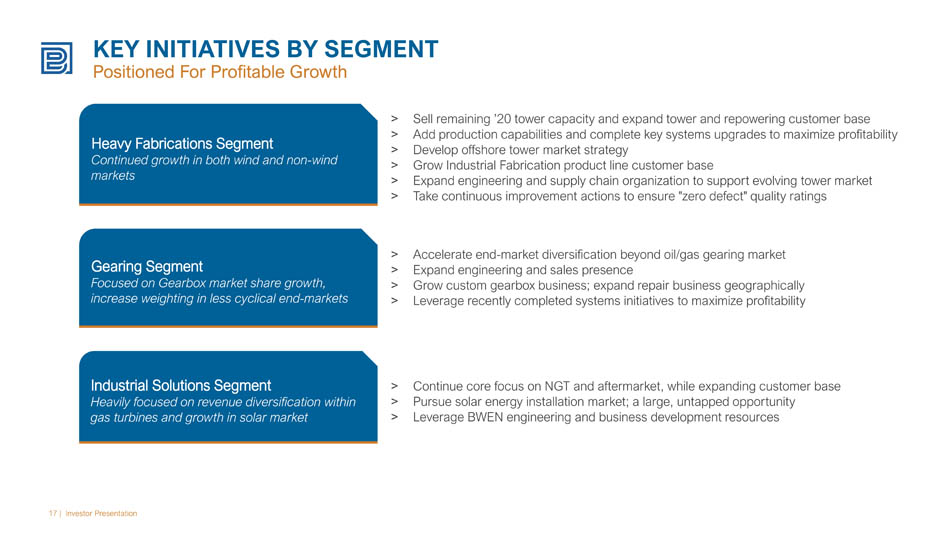

KEY INITIATIVES BY SEGMENT Positioned For Profitable Growth 17 | Investor Presentation > Sell remaining ’20 tower capacity and expand tower and repowering customer base > Add production capabilities and complete key systems upgrades to maximize profitability > Develop offshore tower market strategy > Grow Industrial Fabrication product line customer base > Expand engineering and supply chain organization to support evolving tower market > Take continuous improvement actions to ensure "zero defect" quality ratings Heavy Fabrications Segment Continued growth in both wind and non - wind markets > Accelerate end - market diversification beyond oil/gas gearing market > Expand engineering and sales presence > Grow custom gearbox business; expand repair business geographically > Leverage recently completed systems initiatives to maximize profitability Gearing Segment Focused on Gearbox market share growth, increase weighting in less cyclical end - markets > Continue core focus on NGT and aftermarket, while expanding customer base > Pursue solar energy installation market; a large, untapped opportunity > Leverage BWEN engineering and business development resources Industrial Solutions Segment Heavily focused on revenue diversification within gas turbines and growth in solar market

CUSTOMER DIVERSIFICATION INITIATIVE Applying Precision Manufacturing Expertise Beyond Wind Energy 18 | Investor Presentation Continued to execute on customer diversification initiative Non - wind revenue ~1/3 of total revenue exiting 2019 Continue to experienced significant growth in most non - wind markets 2 3 1 Customer Concentration 2016 vs. 2019 (as % of total revenue) 91% 94% 79% 87% Top 5 Customers Top 10 Customers 2016 2019 Wind vs. Non - Wind Revenue Concentration 2016 - 2019 ($MM) (1) Non - Wind Revenue By Sector 2016 vs. 2019 (as % of total revenue) (1) Wind energy figures shown above exclude repair/replacement demand $156.2 $100.6 $61.8 $110.9 $24.7 $46.2 $63.7 $67.4 2016 2017 2018 2019 Wind - New Installations Non-Wind 0% 2.4% 7.2% 1.5% 0% 2.5% 2.9% 4.3% 5.4% 6.8% 8.2% 10.2% Construction Industrial Other Oil & Gas Power Generation Mining 2016 2019

U.S. WIND SECTOR OUTLOOK On - Shore Ramp Occurring; Off - Shore Ramp Beginning In 2023 19 | Investor Presentation U.S. Wind Power On - Shore and Off - Shore Capacity Installations (Annual On - Shore GW Installed) (1) Source: Wood MacKenzie ; wind values include new build and repowering Who We Serve > Wind turbine OEMs > Wind farm operators > Wind farm developers Sector Outlook > Positive Outlook > PTC extension > Positive preliminary outcome on trade case Our Products > Tower sections > Repowering adapters > Aftermarket gearing CY18 CY19 CY20 E CY21 E CY22 E CY23 E CY24 E CY25 E CY26 E CY27 E CY28 E United States On-Shore Wind Energy (GW) United States Off-Shore Wind Energy (GW) 8.3 9.1 15.2 12.5 6.4 6.1 6.8 7.3 6.9 7.8 7.5

KEY NON - WIND SECTOR OPPORTUNITIES Growth Forecasts By Sectors 20 | Investor Presentation Mining activity levels continue to be strong Focus on Industrial/Material handling markets O&G Fracking headwinds, uncertainty remains 2 3 1 U.S Industrial Machinery Sector Y/Y Sector Production Growth (1) U.S. Mining, Oil & Gas, Field Equipment Sector Y/Y Sector Production Growth (1) Turbines and Power Transmission Sector Y/Y Sector Production Growth (1) Construction Sector Y/Y Sector Production Growth (1) NGT customer base expanding; key customer regaining share 4 Source: IHS Markit, AGMA 2020 Forecast (Jan - 20) - 5.6% - 1.4% 2.7% 3.0% 2.0% 1.5% CY19 CY20 E CY21 E CY22 E CY23 E CY24 E 4.9% - 4.3% - 0.6% 1.6% 2.6% 2.2% CY19 CY20 E CY21 E CY22 E CY23 E CY24 E 2.0% 7.0% 1.1% 3.3% 2.3% 1.2% CY19 CY20 E CY21 E CY22 E CY23 E CY24 E - 0.2% - 9.0% 0.7% 2.2% 2.5% 2.2% CY19 CY20 E CY21 E CY22 E CY23 E CY24 E

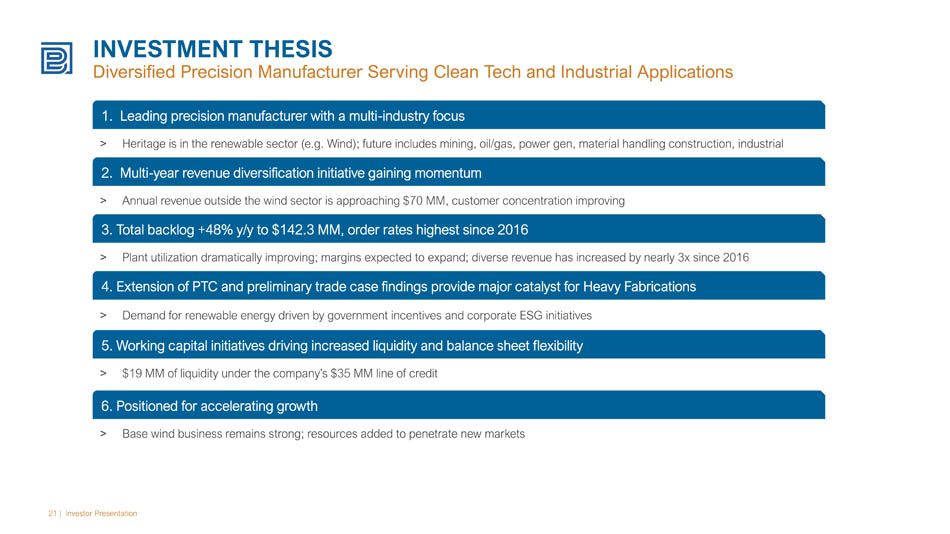

INVESTMENT THESIS Diversified Precision Manufacturer Serving Clean Tech and Industrial Applications 21 | Investor Presentation 1. Leading precision manufacturer with a multi - industry focus > Heritage is in the renewable sector (e.g. Wind); future includes mining, oil/gas, power gen, material handling construction, ind ustrial 2. Multi - year revenue diversification initiative gaining momentum > Annual revenue outside the wind sector is approaching $70 MM, customer concentration improving 3. Total backlog +48% y/y to $142.3 MM, order rates highest since 2016 > Plant utilization dramatically improving; margins expected to expand; diverse revenue has increased by nearly 3x since 2016 4. Extension of PTC and preliminary trade case findings provide major catalyst for Heavy Fabrications > Demand for renewable energy driven by government incentives and corporate ESG initiatives 5. Working capital initiatives driving increased liquidity and balance sheet flexibility > $19 MM of liquidity under the company’s $35 MM line of credit 6. Positioned for accelerating growth > Base wind business remains strong; resources added to penetrate new markets

APPENDIX

EXHIBIT A Orders, Revenues and Operating Income (Loss) By Segment 23 | Investor Presentation Three Months Ended Twelve Months Ended 2019 2018 2019 2018 ORDERS: Heavy Fabrications………………………………………………………………5,260$ 4,288$ 179,657$ 28,604$ Gearing………………………………………………………………6,880 8,532 25,466 41,576 Industrial Solutions………………………………………………………………4,273 3,906 16,426 13,061 Total orders………………………………...………………16,413$ 16,726$ 221,549$ 83,241$ REVENUES: Heavy Fabrications………………………………………………………………37,590$ 12,111$ 128,686$ 74,667$ Gearing………………………………………………………………7,594 10,882 34,877 38,376 Industrial Solutions………………………………………………………………4,075 4,204 14,664 12,467 Corporate and Other……………………………………………………………(6) (10) (7) (130) Total revenues…………………………………..……………………49,253$ 27,187$ 178,220$ 125,380$ OPERATING (LOSS)/PROFIT: Heavy Fabrications………………………………………………………………1,074$ (2,999)$ 1,861$ (5,440)$ Gearing………………………………………………………………440 992 3,237 51 Industrial Solutions………………………………………………………………(944) (8,672) (1,059) (15,348) Corporate and Other……………………………………………………………(1,969) (1,502) (6,396) (4,329) Total operating loss…………………………………… (1,399)$ (12,181)$ (2,357)$ (25,066)$ December 31, December 31,

EXHIBIT B GAAP to Non - GAAP Consolidated Adjusted EBITDA Reconciliation 24 | Investor Presentation Consolidated 2019 2018 2019 2018 Loss from Continuing Operations…………………………...…………. (1,625)$ (12,358)$ (4,585)$ (24,000)$ Interest Expense…………………….……………………………………. 390 475 2,309 1,494 Income Tax Provision/(Benefit)…………………...…………………… (24) (184) 38 (204) Depreciation and Amortization………………………………………………………………2,491 2,193 7,497 9,183 Share-based Compensation and Other Stock Payments………………………………………………………………530 290 1,955 1,504 Restructuring Costs…………………………………...……………………. - 243 12 668 Impairment Charges…………………………………………………. - 7,592 - 12,585 NMTC Extinguishment Gain……………………………………. - - - (2,249) Adjusted EBITDA (Non-GAAP)…………………………. 1,762$ (1,749)$ 7,226$ (1,019)$ Three Months Ended December 31, Twelve Months Ended December 31,

EXHIBIT C GAAP to Non - GAAP Adjusted EBITDA Reconciliation By Segment 25 | Investor Presentation Heavy Fabrications Segment 2019 2018 2019 2018 Net Income/(Loss)……………………...……………………………. 847$ (2,387)$ 1,275$ (4,372)$ Interest Expense……………………………..……………………. 106 69 296 199 Income Tax Provision/(Benefit)…………………...…………………… 235 (567) 392 (1,154) Depreciation……………………………………………………………… 953 1,227 3,976 5,145 Share-based Compensation and Other Stock Payments………………………………………………………………214 152 780 648 Restructuring Expense………………………………………...…………… - 243 12 668 Adjusted EBITDA (Non-GAAP)…………………………….. 2,355$ (1,263)$ 6,731$ 1,134$ Three Months Ended December 31, Twelve Months Ended December 31, Gearing Segment 2019 2018 2019 2018 Net Income/(Loss)……………………...……………………………. 421$ 915$ 2,953$ (34)$ Interest Expense………………………...……………………………… 24 67 281 74 Income Tax (Benefit) Provision…………………...…………………… (5) 10 3 11 Depreciation and Amortization………………………………………………………………509 513 1,981 2,255 Share-based Compensation and Other Stock Payments………………………………………………………………86 66 390 286 Adjusted EBITDA (Non-GAAP)……………………….. 1,035$ 1,571$ 5,608$ 2,592$ Three Months Ended December 31, Twelve Months Ended December 31, Industrial Solutions 2019 2018 2019 2018 Net Loss……………………...……………………………. (931)$ (8,309)$ (1,071)$ (14,904)$ Interest Expense……………………………………………………. 1 - 2 1 Income Tax (Benefit)/Provision…………………...…………………… (15) (365) 3 (453) Depreciation and Amortization……………………………………. 995 391 1,362 1,550 Share-based Compensation and Other Stock Payments………… 81 7 122 47 Impairment Expense………………………………………………… - 7,592 - 12,585 Adjusted EBITDA (Non-GAAP)……………………………… 131$ (684)$ 418$ (1,174)$ Three Months Ended December 31, Twelve Months Ended December 31,

EXHIBIT C (Continued) GAAP to Non - GAAP Adjusted EBITDA Reconciliation By Segment 26 | Investor Presentation Corporate and Other 2019 2018 2019 2018 Loss from continuing operations…………………………...…………. (1,962)$ (2,577)$ (7,742)$ (4,690)$ Interest Expense……………….…………………………………… 259 339 1,730 1,220 Income Tax Provision/(Benefit)……………………..…………… (239) 738 (360) 1,392 Depreciation and Amortization………………………………………………………………34 62 178 233 Share-based Compensation and Other Stock Payments………………………………………………………………149 65 663 523 NMTC Extinguishment Gain………………………………….………………. - - - (2,249) Adjusted EBITDA (Non-GAAP)……………………..……………. (1,759)$ (1,373)$ (5,531)$ (3,571)$ Three Months Ended December 31, Twelve Months Ended December 31,

Please contact our investor relations team at 720.334.0195 IR CONTACT