Attached files

| file | filename |

|---|---|

| EX-99.01 - EARNINGS PRESS RELEASE - EL PASO ELECTRIC CO /TX/ | exh990112-31x2019.htm |

| 8-K - 8-K - EL PASO ELECTRIC CO /TX/ | form8-k12x31x2019.htm |

Fourth Quarter 2019 Investor Presentation February 26, 2020

ThisSafe presentation includes Harbor statements that are forward Statement-looking statements made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the pending acquisition of El Paso Electric Company (“EE” or the “Company”) by an affiliate of the Infrastructure Investments Fund (the “Merger”), regulatory approvals, the expected timetable for completing the pending Merger and for obtaining such regulatory approvals; statements regarding current regulatory filings and anticipated regulatory filings; statements regarding expected capital expenditures; statements regarding expected dividends; and statements regarding the adequacy of our liquidity to meet cash requirements. This information may involve risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These risks and uncertainties include, but are not limited to: the timing to consummate the pending Merger; satisfaction of the conditions to closing of the pending Merger may not be satisfied; the risk that a regulatory approval that may be required for the pending Merger is not obtained or is obtained subject to conditions that are not anticipated; and the diversion of management’s time on Merger-related issues. Additional information concerning factors that could cause actual results to differ materially from those expressed in forward-looking statements is contained in EE’s most recently filed periodic reports and in other filings made by EE with the U.S. Securities and Exchange Commission (the "SEC"), and include, but is not limited to: The impact of changes to U.S. tax laws Increased prices for fuel and purchased power and the possibility that regulators may not permit EE to pass through all such increased costs to customers or to recover previously incurred fuel costs in rates Full and timely recovery of capital investments and operating costs through rates in Texas and New Mexico, and at the Federal Energy Regulatory Commission Uncertainties and instability in the general economy and the resulting impact on EE’s sales and profitability Changes in customers’ demand for electricity as a result of energy efficiency initiatives and emerging competing services and technologies, including distributed generation Unanticipated increased costs associated with scheduled and unscheduled outages of generating plant Unanticipated maintenance, repair, or replacement costs for generation, transmission, or distribution facilities and the recovery of proceeds from insurance policies providing coverage for such costs The size of our construction program, the receipt of necessary permits and approvals and our ability to complete construction on budget and on time Potential delays in our construction and resource contracting schedule due to legal challenges or other reasons Costs at Palo Verde Decisions and actions of EE’s regulators and the resulting impact on EE’s cost of capital, sales, and profitability Deregulation and competition in the electric utility industry Possible increased costs of compliance with environmental or other laws, regulations and policies Possible income tax and interest payments as a result of audit adjustments proposed by the Internal Revenue Service or state taxing authorities Uncertainties and instability in the financial markets and the resulting impact on EE’s ability to access the capital and credit markets Actions by credit rating agencies Possible physical or cyber-attacks, intrusions or other catastrophic events A U.S. Government shutdown and the resulting impact on EE’s sales and profitability Other factors of which EE is currently unaware or deem immaterial EE’s filings are available from the SEC or may be obtained through EE’s website, http://www.epelectric.com. Any such forward-looking statement is qualified by reference to these risks and factors. EE cautions that these risks and factors are not exclusive. Management cautions against putting undue reliance on forward-looking statements or projecting any future results based on such statements or present or prior earnings levels. Forward-looking statements speak only as of the date of this presentation, and EE does not undertake to update any forward-looking statement contained herein. 2

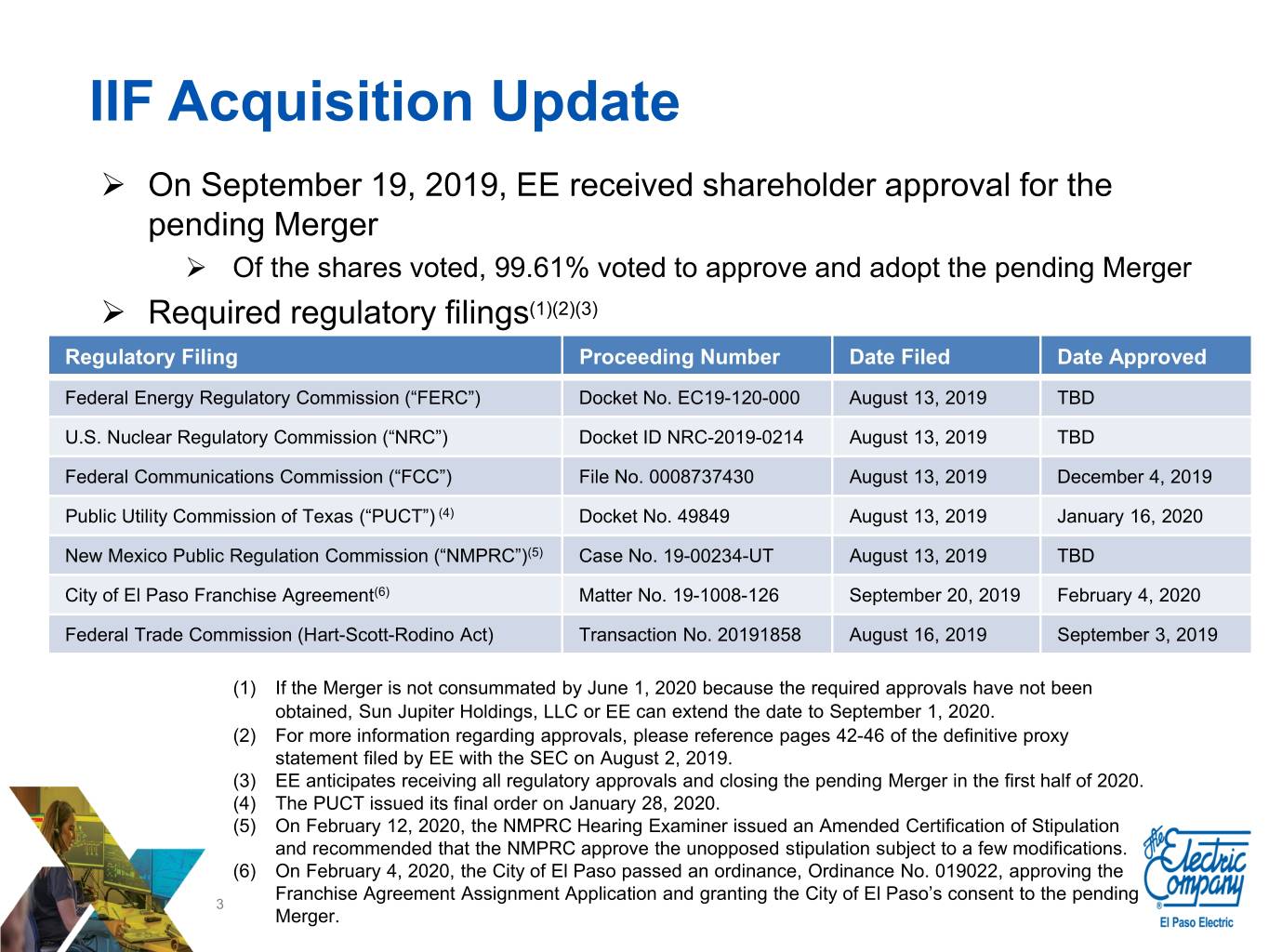

IIF Acquisition Update On September 19, 2019, EE received shareholder approval for the pending Merger Of the shares voted, 99.61% voted to approve and adopt the pending Merger Required regulatory filings(1)(2)(3) Regulatory Filing Proceeding Number Date Filed Date Approved Federal Energy Regulatory Commission (“FERC”) Docket No. EC19-120-000 August 13, 2019 TBD U.S. Nuclear Regulatory Commission (“NRC”) Docket ID NRC-2019-0214 August 13, 2019 TBD Federal Communications Commission (“FCC”) File No. 0008737430 August 13, 2019 December 4, 2019 Public Utility Commission of Texas (“PUCT”) (4) Docket No. 49849 August 13, 2019 January 16, 2020 New Mexico Public Regulation Commission (“NMPRC”)(5) Case No. 19-00234-UT August 13, 2019 TBD City of El Paso Franchise Agreement(6) Matter No. 19-1008-126 September 20, 2019 February 4, 2020 Federal Trade Commission (Hart-Scott-Rodino Act) Transaction No. 20191858 August 16, 2019 September 3, 2019 (1) If the Merger is not consummated by June 1, 2020 because the required approvals have not been obtained, Sun Jupiter Holdings, LLC or EE can extend the date to September 1, 2020. (2) For more information regarding approvals, please reference pages 42-46 of the definitive proxy statement filed by EE with the SEC on August 2, 2019. (3) EE anticipates receiving all regulatory approvals and closing the pending Merger in the first half of 2020. (4) The PUCT issued its final order on January 28, 2020. (5) On February 12, 2020, the NMPRC Hearing Examiner issued an Amended Certification of Stipulation and recommended that the NMPRC approve the unopposed stipulation subject to a few modifications. (6) On February 4, 2020, the City of El Paso passed an ordinance, Ordinance No. 019022, approving the Franchise Agreement Assignment Application and granting the City of El Paso’s consent to the pending 3 Merger.

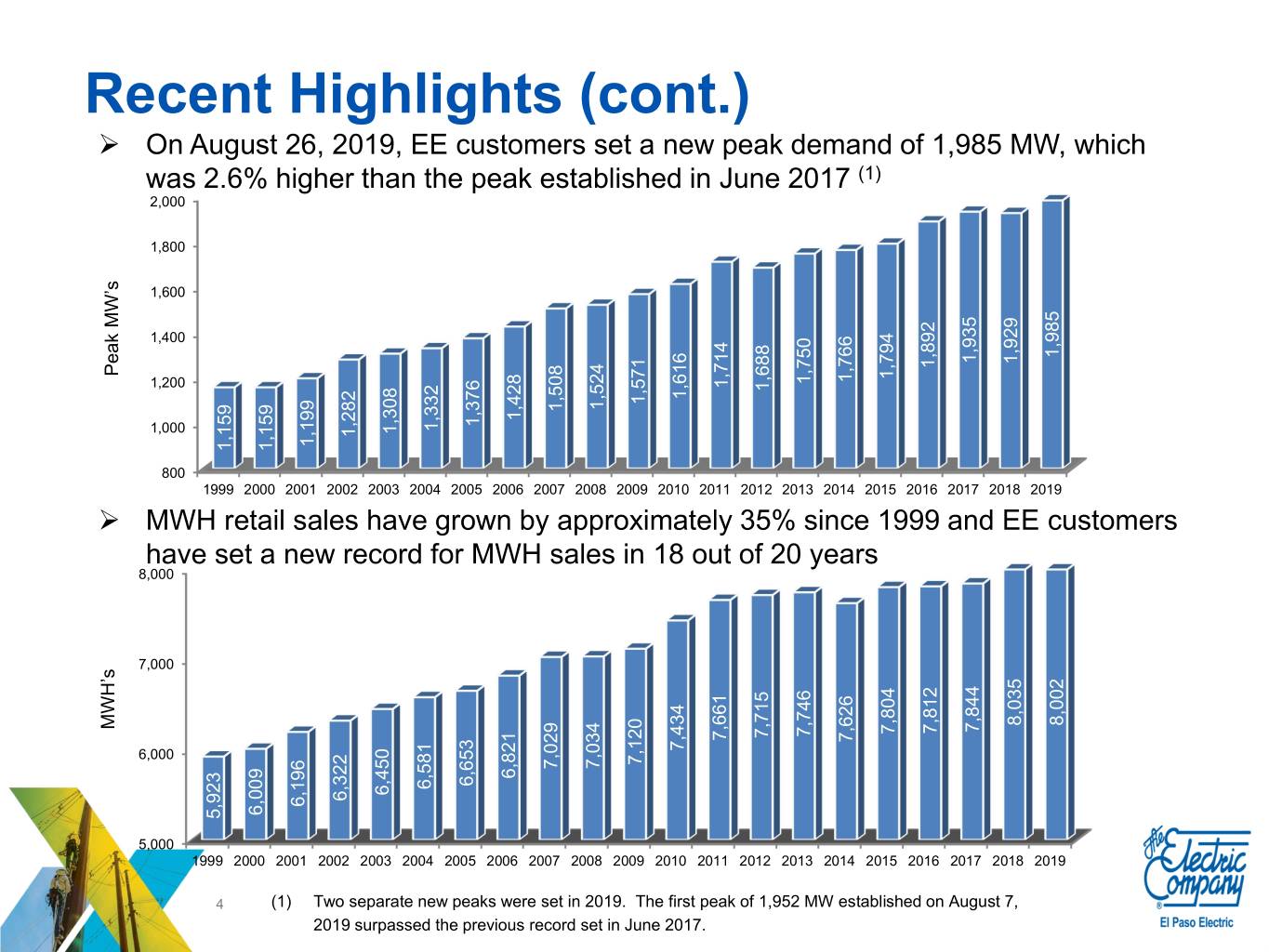

Recent Highlights (cont.) On August 26, 2019, EE customers set a new peak demand of 1,985 MW, which was 2.6% higher than the peak established in June 2017 (1) 2,000 1,800 1,600 1,400 1,985 1,935 1,929 1,892 Peak MW’s 1,794 1,766 1,750 1,714 1,200 1,688 1,616 1,571 1,524 1,508 1,428 1,376 1,332 1,000 1,308 1,282 1,199 1,159 1,159 800 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 MWH retail sales have grown by approximately 35% since 1999 and EE customers have set a new record for MWH sales in 18 out of 20 years 8,000 7,000 8,035 8,002 MWH’s 7,844 7,812 7,804 7,746 7,715 7,661 7,626 6,000 7,434 7,120 7,034 7,029 6,821 6,653 6,581 6,450 6,322 6,196 6,009 5,923 5,000 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 4 (1) Two separate new peaks were set in 2019. The first peak of 1,952 MW established on August 7, 2019 surpassed the previous record set in June 2017.

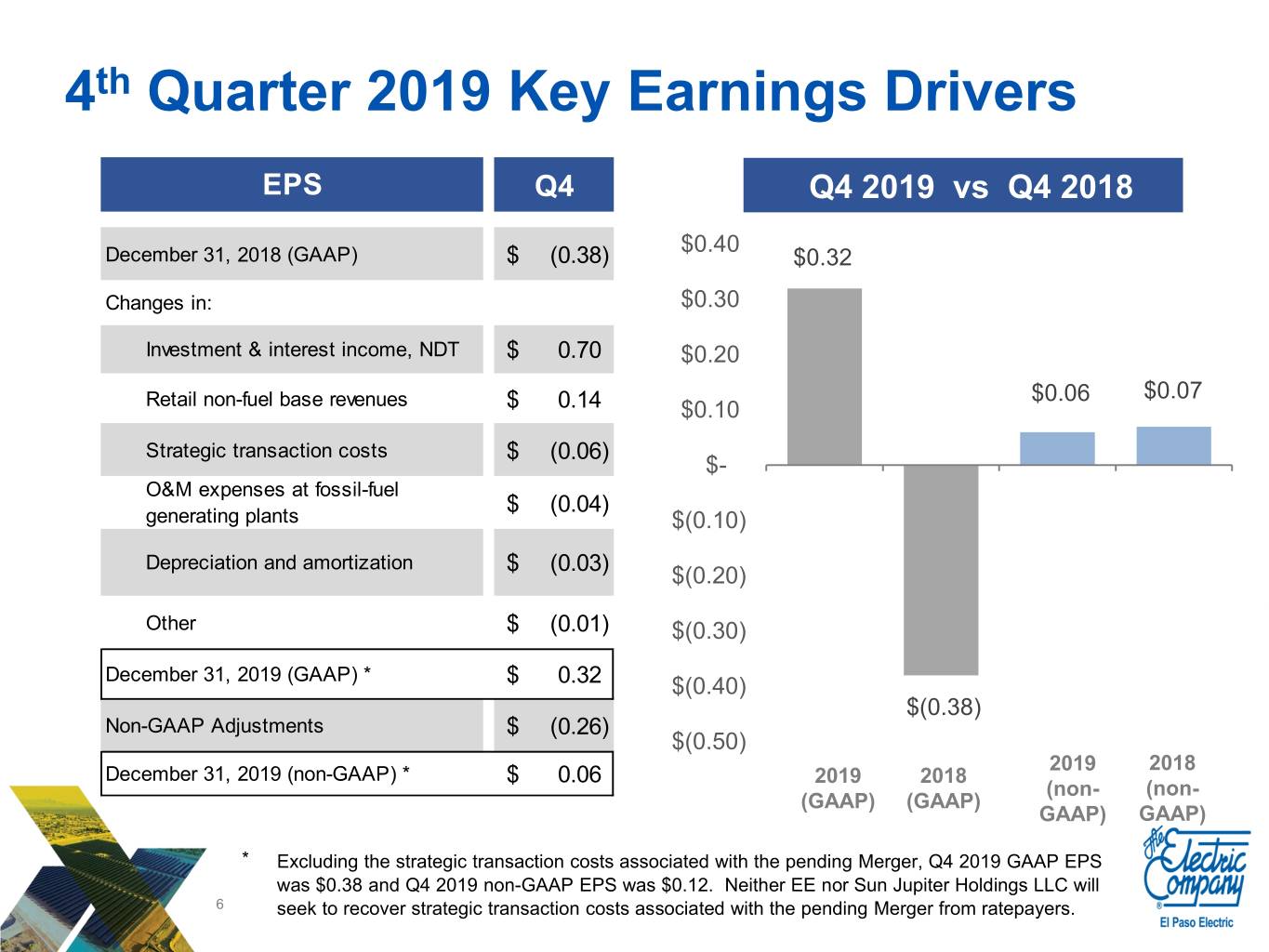

4th Quarter and Fiscal Year (“FY”) Financial Results GAAP – Q4 2019 net income of $12.9 million (or $0.32 per basic share), compared to Q4 2018 net loss of $15.3 million (or $0.38 per basic share) (1) GAAP – FY 2019 net income of $123.0 million (or $3.02 per basic share), compared to FY 2018 net income of $84.3 million (or $2.07 per basic share) (2) Non-GAAP – Q4 2019 adjusted net income of $2.5 million (or $0.06 per basic share), compared to Q4 2018 adjusted net income of $2.8 million (or $0.07 per basic share)(1) (3) Non-GAAP – FY 2019 adjusted net income of $92.2 million (or $2.26 per basic share), compared to FY 2018 adjusted net income of $94.7 million (or $2.33 per basic share) (2) (3) (1) Net income (GAAP) and Adjusted net income (non-GAAP) for Q4 2019 include a pre-tax charge of $2.6 million or $0.06 per share, after-tax, of strategic transaction costs (2) Net income (GAAP) and Adjusted net income (non-GAAP) for FY 2019 include a pre-tax charge of $12.1 million or $0.25 per share, after-tax, of strategic transaction costs (3) Adjusted net income and adjusted basic earnings per share are non-GAAP financial measures that reflect net income and basic earnings per share, respectively (the most comparable GAAP financial measures) adjusted to exclude the impact of changes in fair value of EE’s equity securities and realized gains (losses) from the sale of both equity and fixed income securities held in EE’s Palo Verde nuclear decommissioning trust funds (“NDT”). 5 Refer to slide 12 for a reconciliation of adjusted net income and adjusted basic earnings per share (non-GAAP) to net income and basic earnings per share, respectively (the most comparable GAAP financial measures).

4th Quarter 2019 Key Earnings Drivers EPS Q4 Q4 2019 vs Q4 2018 $0.40 December 31, 2018 (GAAP) $ (0.38) $0.32 Changes in: $0.30 Investment & interest income, NDT $ 0.70 $0.20 $0.06 $0.07 Retail non-fuel base revenues $ 0.14 $0.10 Strategic transaction costs $ (0.06) $- O&M expenses at fossil-fuel $ (0.04) generating plants $(0.10) Depreciation and amortization $ (0.03) $(0.20) Other $ (0.01) $(0.30) December 31, 2019 (GAAP) * $ 0.32 $(0.40) $(0.38) Non-GAAP Adjustments $ (0.26) $(0.50) 2019 2018 December 31, 2019 (non-GAAP) * $ 0.06 2019 2018 (non- (non- (GAAP) (GAAP) GAAP) GAAP) ⃰ Excluding the strategic transaction costs associated with the pending Merger, Q4 2019 GAAP EPS was $0.38 and Q4 2019 non-GAAP EPS was $0.12. Neither EE nor Sun Jupiter Holdings LLC will 6 seek to recover strategic transaction costs associated with the pending Merger from ratepayers.

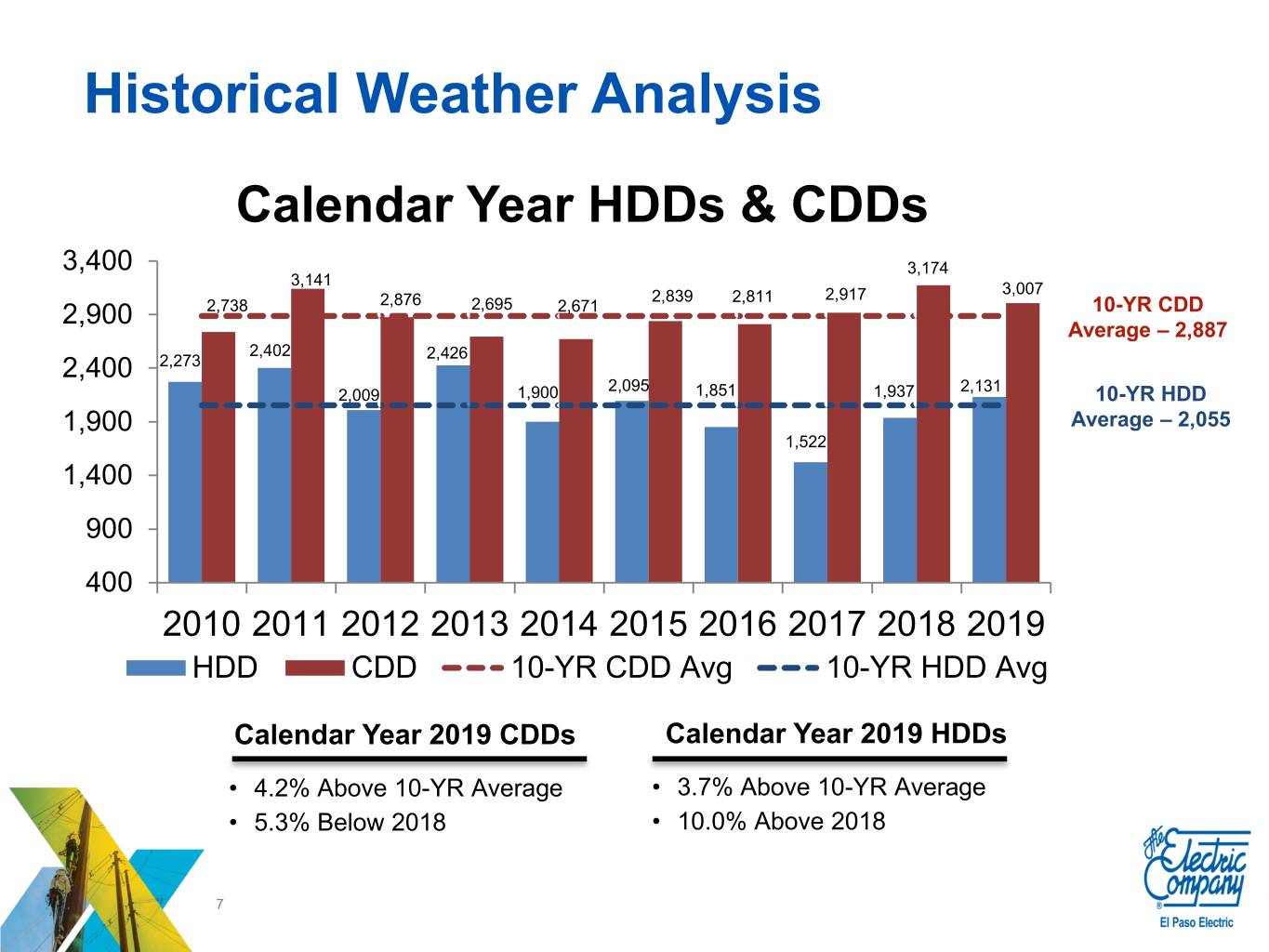

Historical Weather Analysis Calendar Year HDDs & CDDs 3,400 3,174 3,141 3,007 2,876 2,839 2,811 2,917 2,900 2,738 2,695 2,671 10-YR CDD Average – 2,887 2,402 2,426 2,400 2,273 2,095 2,131 2,009 1,900 1,851 1,937 10-YR HDD 1,900 Average – 2,055 1,522 1,400 900 400 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 HDD CDD 10-YR CDD Avg 10-YR HDD Avg Calendar Year 2019 CDDs Calendar Year 2019 HDDs • 4.2% Above 10-YR Average • 3.7% Above 10-YR Average • 5.3% Below 2018 • 10.0% Above 2018 7

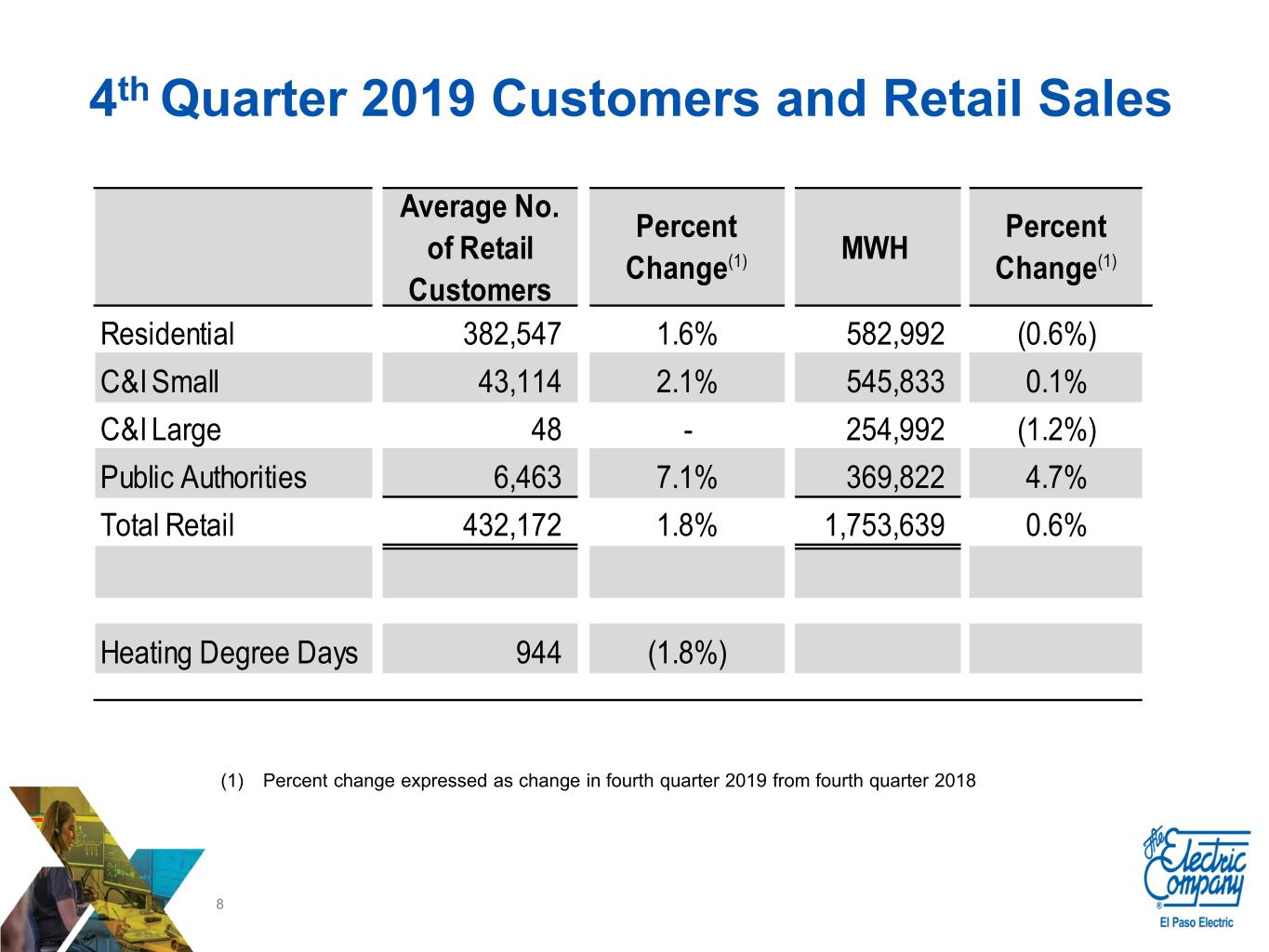

4th Quarter 2019 Customers and Retail Sales Average No. Percent Percent of Retail MWH Change(1) Change(1) Customers Residential 382,547 1.6% 582,992 (0.6%) C&I Small 43,114 2.1% 545,833 0.1% C&I Large 48 - 254,992 (1.2%) Public Authorities 6,463 7.1% 369,822 4.7% Total Retail 432,172 1.8% 1,753,639 0.6% Heating Degree Days 944 (1.8%) (1) Percent change expressed as change in fourth quarter 2019 from fourth quarter 2018 8

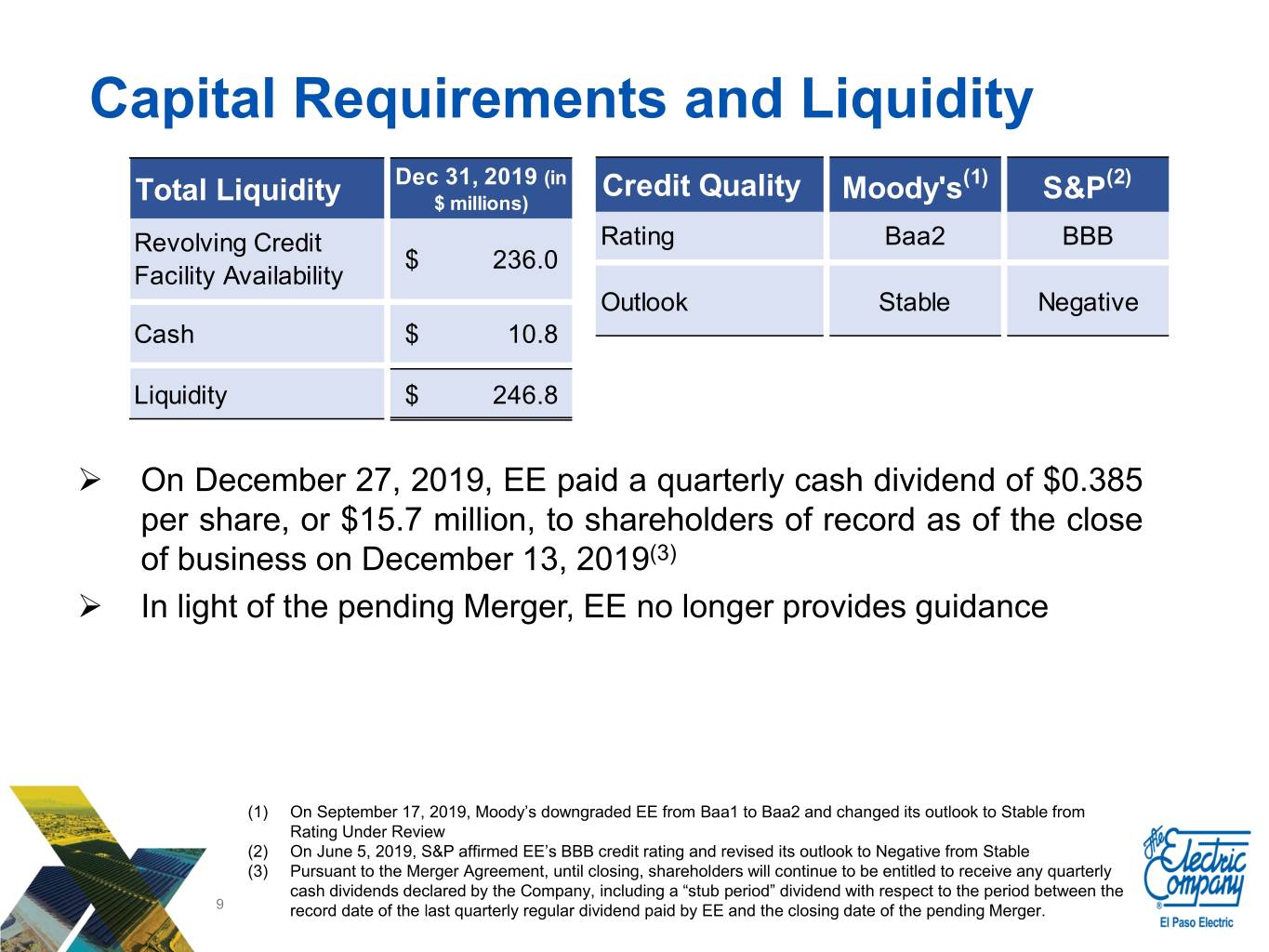

Capital Requirements and Liquidity Dec 31, 2019 (in Credit Quality (1) (2) Total Liquidity $ millions) Moody's S&P Revolving Credit Rating Baa2 BBB $ 236.0 Facility Availability Outlook Stable Negative Cash $ 10.8 Liquidity $ 246.8 On December 27, 2019, EE paid a quarterly cash dividend of $0.385 per share, or $15.7 million, to shareholders of record as of the close of business on December 13, 2019(3) In light of the pending Merger, EE no longer provides guidance (1) On September 17, 2019, Moody’s downgraded EE from Baa1 to Baa2 and changed its outlook to Stable from Rating Under Review (2) On June 5, 2019, S&P affirmed EE’s BBB credit rating and revised its outlook to Negative from Stable (3) Pursuant to the Merger Agreement, until closing, shareholders will continue to be entitled to receive any quarterly cash dividends declared by the Company, including a “stub period” dividend with respect to the period between the 9 record date of the last quarterly regular dividend paid by EE and the closing date of the pending Merger.

Appendix 10

Use of Non-GAAP Financial Measures As required by an accounting standard, changes in the fair value of equity securities are now recognized in EE’s Statements of Operations. The adoption of this standard added the potential for significant volatility to the reported results of operations as changes in the fair value of equity securities may occur. Accordingly, in addition to disclosing financial results that are determined in accordance with U.S. generally accepted accounting principles (“GAAP”), EE has provided adjusted net income and adjusted basic earnings per share, both of which are non-GAAP financial measures. Management believes that providing this additional information is useful to investors in understanding EE’s core operating performance because each measure removes the effects of variances that are not indicative of fundamental changes in the earnings capacity of EE. Adjusted net income and adjusted basic earnings per share are calculated by excluding the impact of changes in fair value from EE’s equity securities and realized gains (losses) from the sale of both equity and fixed income securities in the Company’s Palo Verde nuclear decommissioning trust funds. Adjusted net income and adjusted basic earnings per share are not measures of financial performance under GAAP and should not be considered as an alternative to net income and basic earnings per share, respectively. Furthermore, EE’s presentation of any non-GAAP financial measure may not be comparable to similarly titled measures used by other companies. Please refer to slide 12 of this presentation for a reconciliation of adjusted net income and adjusted basic earnings per share to the most directly comparable financial measures, net income (loss) and basic earnings (loss) per share, respectively, prepared in accordance with GAAP. 11

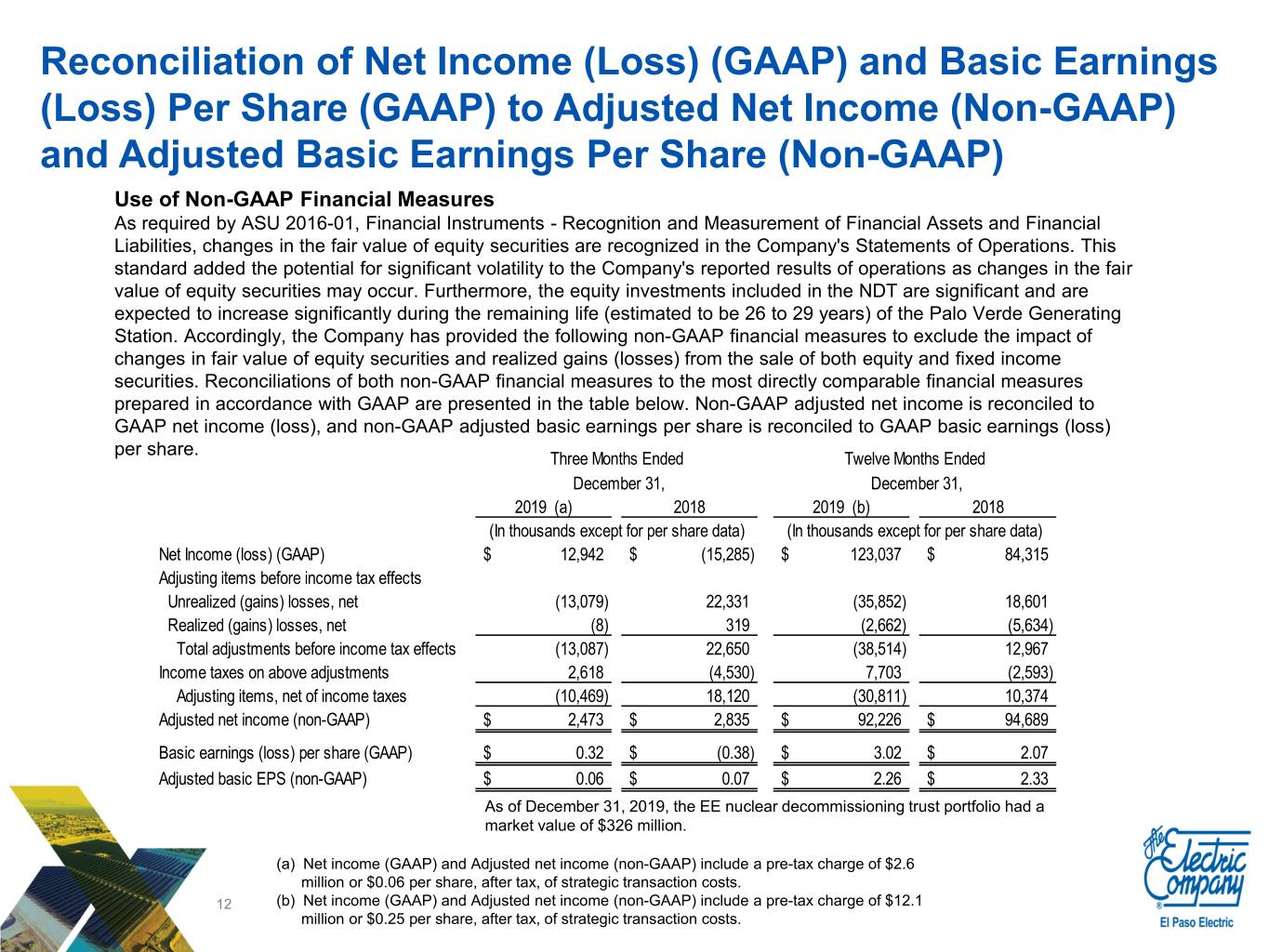

Reconciliation of Net Income (Loss) (GAAP) and Basic Earnings (Loss) Per Share (GAAP) to Adjusted Net Income (Non-GAAP) and Adjusted Basic Earnings Per Share (Non-GAAP) Use of Non-GAAP Financial Measures As required by ASU 2016-01, Financial Instruments - Recognition and Measurement of Financial Assets and Financial Liabilities, changes in the fair value of equity securities are recognized in the Company's Statements of Operations. This standard added the potential for significant volatility to the Company's reported results of operations as changes in the fair value of equity securities may occur. Furthermore, the equity investments included in the NDT are significant and are expected to increase significantly during the remaining life (estimated to be 26 to 29 years) of the Palo Verde Generating Station. Accordingly, the Company has provided the following non-GAAP financial measures to exclude the impact of changes in fair value of equity securities and realized gains (losses) from the sale of both equity and fixed income securities. Reconciliations of both non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with GAAP are presented in the table below. Non-GAAP adjusted net income is reconciled to GAAP net income (loss), and non-GAAP adjusted basic earnings per share is reconciled to GAAP basic earnings (loss) per share. Three Months Ended Twelve Months Ended December 31, December 31, 2019 (a) 2018 2019 (b) 2018 (In thousands except for per share data) (In thousands except for per share data) Net Income (loss) (GAAP) $ 12,942 $ (15,285) $ 123,037 $ 84,315 Adjusting items before income tax effects Unrealized (gains) losses, net (13,079) 22,331 (35,852) 18,601 Realized (gains) losses, net (8) 319 (2,662) (5,634) Total adjustments before income tax effects (13,087) 22,650 (38,514) 12,967 Income taxes on above adjustments 2,618 (4,530) 7,703 (2,593) Adjusting items, net of income taxes (10,469) 18,120 (30,811) 10,374 Adjusted net income (non-GAAP) $ 2,473 $ 2,835 $ 92,226 $ 94,689 Basic earnings (loss) per share (GAAP) $ 0.32 $ (0.38) $ 3.02 $ 2.07 Adjusted basic EPS (non-GAAP) $ 0.06 $ 0.07 $ 2.26 $ 2.33 As of December 31, 2019, the EE nuclear decommissioning trust portfolio had a market value of $326 million. (a) Net income (GAAP) and Adjusted net income (non-GAAP) include a pre-tax charge of $2.6 million or $0.06 per share, after tax, of strategic transaction costs. 12 (b) Net income (GAAP) and Adjusted net income (non-GAAP) include a pre-tax charge of $12.1 million or $0.25 per share, after tax, of strategic transaction costs.

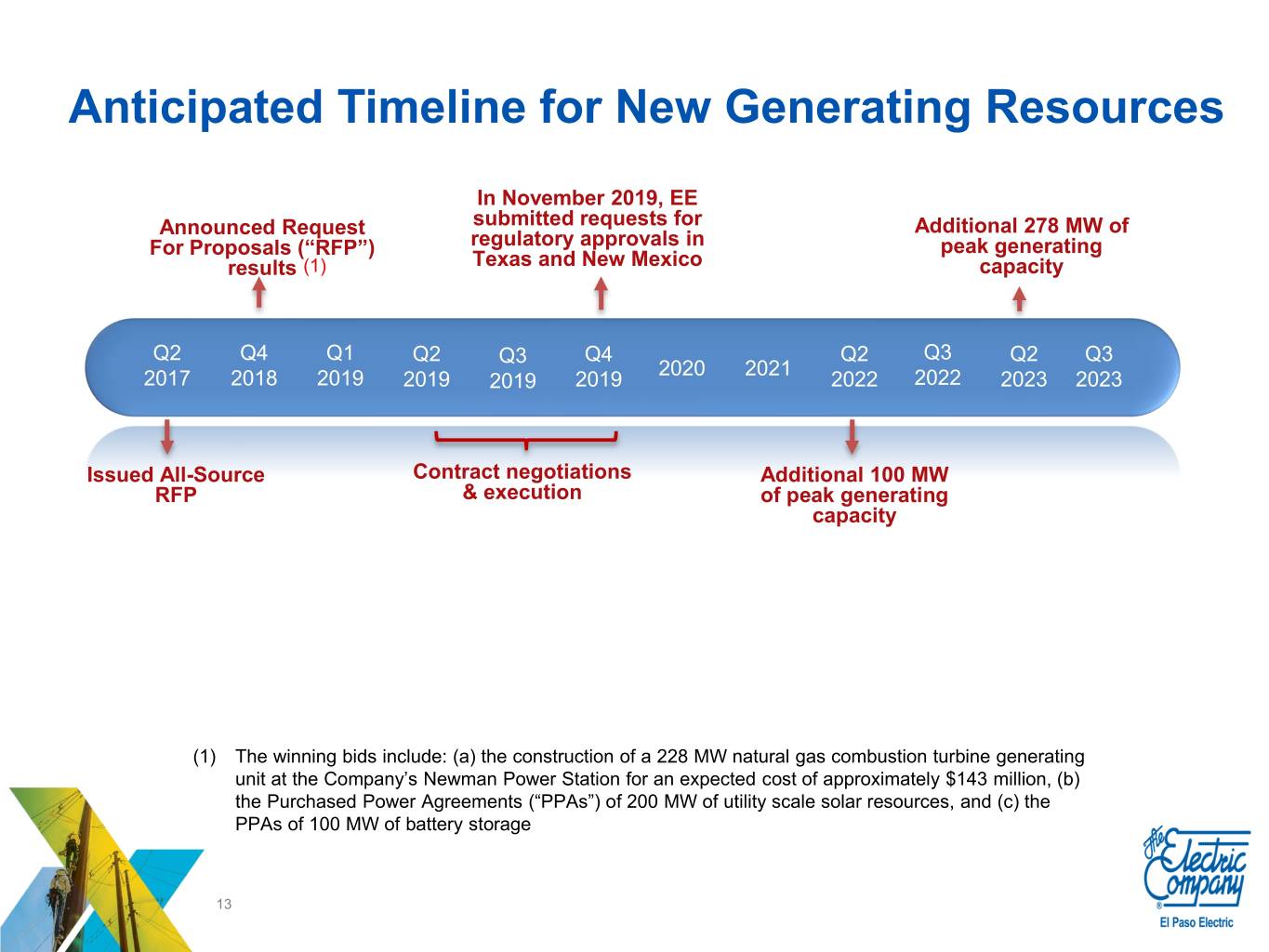

Anticipated Timeline for New Generating Resources In November 2019, EE Announced Request submitted requests for Additional 278 MW of For Proposals (“RFP”) regulatory approvals in peak generating results (1) Texas and New Mexico capacity Q2 Q4 Q1 Q2 Q3 Q4 Q2 Q3 Q2 Q3 2020 2021 2017 2018 2019 2019 2019 2019 2022 2022 2023 2023 Issued All-Source Contract negotiations Additional 100 MW RFP & execution of peak generating capacity (1) The winning bids include: (a) the construction of a 228 MW natural gas combustion turbine generating unit at the Company’s Newman Power Station for an expected cost of approximately $143 million, (b) the Purchased Power Agreements (“PPAs”) of 200 MW of utility scale solar resources, and (c) the PPAs of 100 MW of battery storage 13

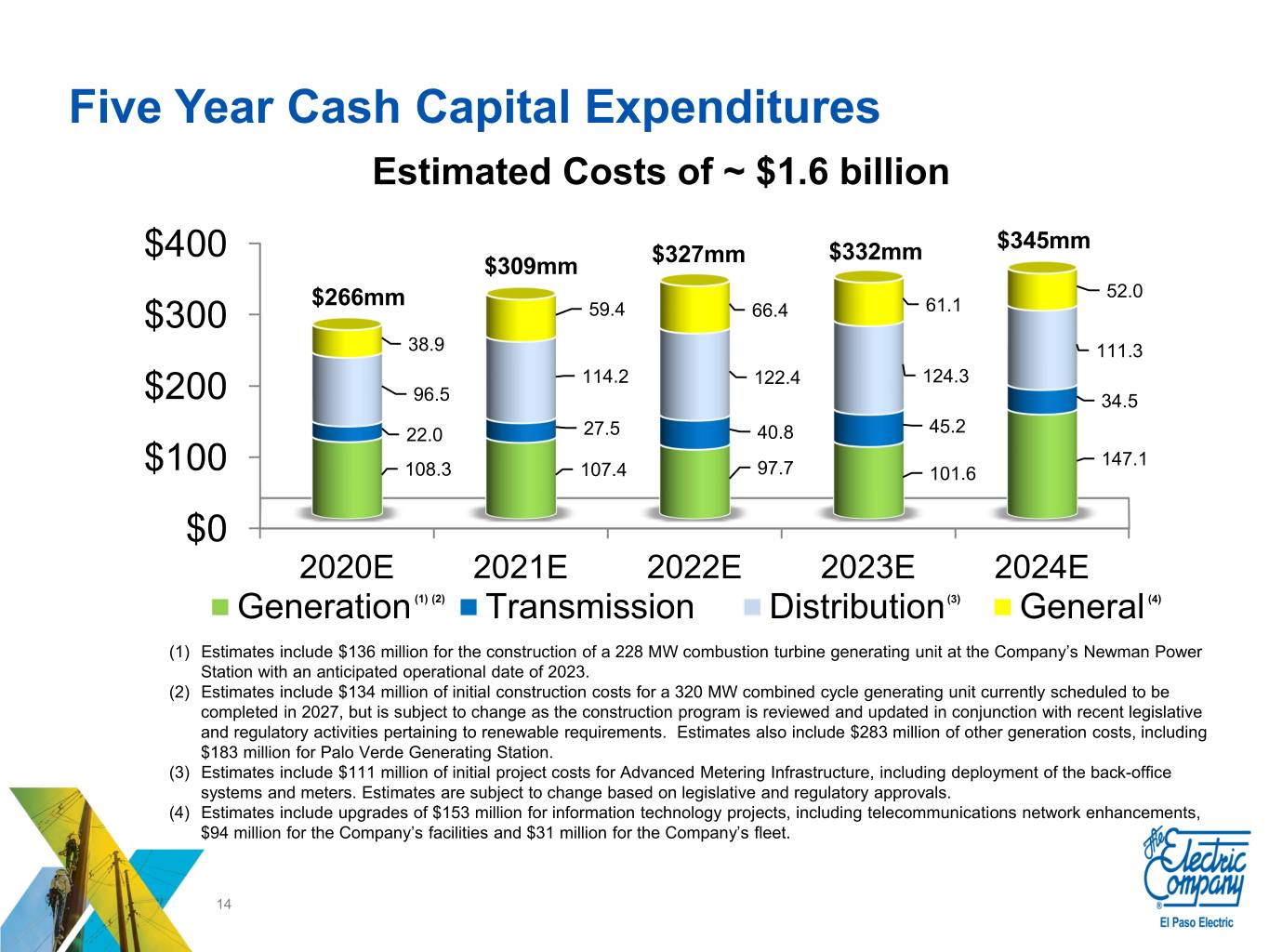

Five Year Cash Capital Expenditures Estimated Costs of ~ $1.6 billion $345mm $400 $327mm $332mm $309mm $266mm 52.0 $300 59.4 66.4 61.1 38.9 111.3 114.2 122.4 124.3 $200 96.5 34.5 22.0 27.5 40.8 45.2 147.1 $100 108.3 107.4 97.7 101.6 $0 2020E 2021E 2022E 2023E 2024E Generation (1) (2) Transmission Distribution (3) General (4) (1) Estimates include $136 million for the construction of a 228 MW combustion turbine generating unit at the Company’s Newman Power Station with an anticipated operational date of 2023. (2) Estimates include $134 million of initial construction costs for a 320 MW combined cycle generating unit currently scheduled to be completed in 2027, but is subject to change as the construction program is reviewed and updated in conjunction with recent legislative and regulatory activities pertaining to renewable requirements. Estimates also include $283 million of other generation costs, including $183 million for Palo Verde Generating Station. (3) Estimates include $111 million of initial project costs for Advanced Metering Infrastructure, including deployment of the back-office systems and meters. Estimates are subject to change based on legislative and regulatory approvals. (4) Estimates include upgrades of $153 million for information technology projects, including telecommunications network enhancements, $94 million for the Company’s facilities and $31 million for the Company’s fleet. 14