Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - LMP Automotive Holdings, Inc. | f10k2019ex32-2_lmpauto.htm |

| EX-32.1 - CERTIFICATION - LMP Automotive Holdings, Inc. | f10k2019ex32-1_lmpauto.htm |

| EX-31.2 - CERTIFICATION - LMP Automotive Holdings, Inc. | f10k2019ex31-2_lmpauto.htm |

| EX-31.1 - CERTIFICATION - LMP Automotive Holdings, Inc. | f10k2019ex31-1_lmpauto.htm |

| EX-10.10 - EMPLOYMENT AGREEMENT, DATED AS OF AUGUST 31, 2018, BY AND BETWEEN LMP MOTORS.COM - LMP Automotive Holdings, Inc. | f10k2019ex10-10_lmpauto.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to ______

Commission File Number: 333-232172

LMP Automotive Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 82-3829328 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 601 N. State Rd. 7, Plantation, FL | 33317 | |

| (Address of principal executive offices) | (Zip Code) |

(954) 895-0352

(Registrant’s telephone number, including area code)

| Securities registered pursuant to Section 12(b) of the Act: | ||

| Title of each class | Name of each exchange on which registered | |

| Common Stock, Par Value $0.0001 Per Share | The Nasdaq Capital Market | |

| Securities registered pursuant to Section 12(g) of the Act: None | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☐ Yes ☒ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ | Smaller reporting company ☒ |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2019 (the last business day of the registrant’s most recently completed second fiscal quarter) cannot be provided because the registrant’s common stock was not traded on any market as of June 30, 2019.

As of January 27, 2020, there were 8,691,323 shares of the registrant’s common stock outstanding.

LMP AUTOMOTIVE HOLDINGS, INC.

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2019

INDEX

i

In this Annual Report on Form 10-K, “we,” “our,” “us,” “LMP” and “the Company” refer to LMP Automotive Holdings, Inc. and its consolidated subsidiaries, unless the context requires otherwise.

Forward-Looking and Cautionary Statements

This Annual Report on Form 10-K, as well as information included in oral statements or other written statements made or to be made by us, contain statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, and other future conditions. Forward-looking statements can be identified by words such as “anticipate,” “believe,” “envision,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” “ongoing,” “contemplate” and other similar expressions, although not all forward-looking statements contain these identifying words. Examples of forward-looking statements include, among others, statements we make regarding:

| ● | future financial position; |

| ● | business strategy; |

| ● | budgets, projected costs and plans; |

| ● | future industry growth; |

| ● | financing sources; |

| ● | the impact of litigation, government inquiries and investigations; and |

| ● | all other statements regarding our intent, plans, beliefs or expectations or those of our directors or officers. |

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. Important factors that could cause actual results and events to differ materially from those indicated in the forward-looking statements include, among others, the following:

| ● | our history of losses and ability to maintain profitability in the future; |

| ● | our ability to effectively manage our rapid growth; |

| ● | our ability to maintain customer service quality and reputational integrity and enhance our brand; |

| ● | our limited operating history; |

| ● | the seasonal and other fluctuations in our quarterly operating results; |

| ● | our management’s accounting judgments and estimates, as well as changes to accounting policies; |

| ● | our ability to compete in the highly competitive industry in which we participate; |

1

| ● | the changes in prices of new and used vehicles; |

| ● | our ability to acquire desirable inventory; |

| ● | our ability to sell our inventory expeditiously; |

| ● | our ability to sell and generate gains on the sale of automotive finance receivables; |

| ● | our dependence on the sale of automotive finance receivables for a substantial portion of our gross profits; |

| ● | our reliance on credit data for the automotive finance receivables we sell; |

| ● | our ability to successfully market and brand our business; |

| ● | our reliance on internet searches to drive traffic to our website; |

| ● | our ability to comply with the laws and regulations to which we are subject; |

| ● | the changes in the laws and regulations to which we are subject; |

| ● | our ability to comply with the Telephone Consumer Protection Act of 1991; |

| ● | the evolution of regulation of the internet and e-commerce; |

| ● | our ability to grow complementary product and service offerings; |

| ● | our ability to address the shift to mobile device technology by our customers; |

| ● | risks related to the larger automotive ecosystem; |

| ● | the geographic concentration where we provide services and recondition and store vehicle inventory; |

| ● | our ability to obtain affordable inventory insurance; |

| ● | our ability to raise additional capital; |

| ● | our ability to maintain adequate relationships with the lenders that finance our vehicle inventory purchases; |

| ● | the representations we make in the finance receivables we sell; |

| ● | our reliance on our proprietary credit scoring model in the forecasting of loss rates; |

| ● | our reliance on internal and external logistics to transport our vehicle inventory; |

| ● | the risks associated with the construction and operation of our inspection and reconditioning centers, hubs and vending machines, including our dependence on one supplier for construction and maintenance for our vending machines; |

| ● | our ability to finance vending machines and inspection and reconditioning centers; |

| ● | our ability to protect the personal information and other data that we collect, process and store; |

2

| ● | disruptions in availability and functionality of our website; |

| ● | our ability to protect our intellectual property, technology and confidential information; |

| ● | our ability to defend against claims that our employees, consultants or advisors have wrongfully used or disclosed trade secrets or intellectual property; |

| ● | our ability to defend against intellectual property disputes; |

| ● | our ability to comply with the terms of open source licenses; |

| ● | conditions affecting vehicle manufacturers, including manufacturer recalls; |

| ● | our reliance on third party technology to complete critical business functions; |

| ● | our dependence on key personnel to operate our business; |

| ● | the resources required to comply with public company obligations; |

| ● | the diversion of management’s attention and other disruptions associated with potential future acquisitions; |

| ● | the restrictions that could limit the flexibility in operating our business imposed by the covenants contained in the indenture governing our senior unsecured notes; |

| ● | the legal proceedings to which we may be subject in the ordinary course of business; and |

| ● | risks relating to our corporate structure and tax receivable agreements. |

The forward-looking statements in this Annual Report on Form 10-K represent our views as of the date of this Report. We undertake no obligation to publicly update any forward-looking statements whether as a result of new information, future developments or otherwise.

Market and Industry Data

Some of the market and industry data contained in this Annual Report on Form 10-K are based on independent industry publications or other publicly available information. Although we believe that these independent sources are reliable, we have not independently verified and cannot assure you as to the accuracy or completeness of this information. As a result, you should be aware that the market and industry data contained herein, and our beliefs and estimates based on such data, may not be reliable.

LMP Automotive Holdings, Inc. is a holding company that was formed as a Delaware corporation on December 15, 2017. LMP Class A common stock trades on the NASDAQ Capital Market under the symbol “LMPX.”

On December 9, 2019, we completed our initial public offering (“IPO”) of 2.645 million shares of common stock at a public offering price of $5.00 per share. We received approximately $12 million in proceeds, net of underwriting discounts and commissions and offering expenses, which we plan to use for strategic acquisitions, to build our vehicle inventory, for working capital and other general corporate purposes. Total equity from the IPO after deducting deferred offering expenses of $1.5 million was approximately $10.5 million. See Note 1 to the consolidated financial statements included in Part II, Item 8 for additional information about our IPO. Unless the context requires otherwise, references in this report to “LMP,” the “Company,” “we,” “us” and “our” refer to both LMP Automotive Holdings, Inc. and its consolidated subsidiaries prior to the IPO described in this report and to LMP and its consolidated subsidiaries following the IPO.

3

Our Company

LMP, through our wholly owned subsidiaries, currently offers our customers the opportunity to buy, sell, rent and subscribe for, and obtain financing for automobiles both online and in person.

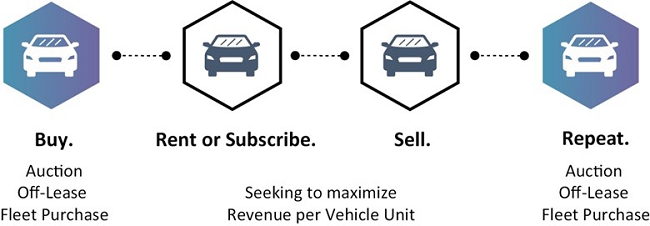

We describe our business model as “Buy, Rent or Subscribe, Sell and Repeat.” This means that we “Buy” pre-owned automobiles primarily through auctions or directly from other automobile dealers, and new automobiles from manufacturers and manufacturer distributors at fleet rates. We “Rent or Subscribe” by either renting automobiles to our customers or allowing them to enter into our subscription plan for automobiles in which customers have use of an automobile for a minimum of thirty (30) days. We “Sell” our inventory, including automobiles previously included in our rental and subscription programs, to customers, and then we hope to “Repeat” the whole process.

We believe we offer a stress-free and user-friendly experience, either directly or through arrangements with third parties, that enables consumers to efficiently:

| – | Browse and purchase a vehicle | – | Subscribe for a vehicle | |||

| – | Rent a vehicle | – | Sell or trade-in vehicle | |||

| – | Obtain pre-approval for financing (through third parties) | – | Buy extended warranties (through third parties) | |||

| – | Schedule pick-ups for all programs at the originating location and deliveries for all programs are typically scheduled through third parties |

Our platform is designed to streamline the automobile transaction value chain by digitizing a substantial part of the sales and transaction process. We believe this will enhance the consumer experience by creating operational efficiencies that are designed to improve our financial and business performance. We also intend to centralize sales, title, tag, finance, insurance and logistics operations, in order to create additional financial and operational benefits, as well as a positive consumer experience. We believe that bringing more of the vehicle shopping and transaction experience online will provide consumers with a broader range of purchase, rental and subscription options while eliminating time spent in negotiation and haggling.

We commenced our operations in the first quarter of 2017. Currently, we only offer sales of pre-owned automobiles, and rentals and subscriptions for both pre-owned and new automobiles. As of December 31, 2019, our inventory consisted of 316 automobiles in total. Of those, 206 were subscribed and in use by customers, 15 were out on rent in use by customers, 67 were on premise and available for subscription and rental consumers and 28 were held for sale on premise. Our current facility is approximately 8,771 square feet on 1.25 acres of land. Our facility contains storage for ten vehicles on the interior and up to 90 on the exterior. We believe over 90% of our fleet will be rented and subscribed and in use by customers and we can facilitate over 1,000 subscribers using our current facility.

Industry Overview

The automotive retail industry is highly competitive and fragmented. Consumers use a variety of online and offline sources to research vehicle information, obtain vehicle pricing information and identify dealers. In addition, dealers use a variety of marketing channels to promote themselves to consumers.

4

We believe that the following are the current key drivers of growth for the automobile industry:

| ● | Economic Drivers. Consumer confidence and employment are currently at a 17-year high1, which we believe will lead to continued growth in consumer spending, including increased spending on automobiles. |

| ● | Emerging Technologies and Disruptive Business Models. We believe the U.S. automobile industry is rapidly evolving through the adoption of new technologies and disruptive business models, which we believe is driven primarily by consumer expectations and demands for a better purchasing experience. |

| ● | Off-Lease Vehicles. The number of off-lease vehicles has grown from 2.0 million in 2014 to 3.4 million in 20183. We believe that the off-lease vehicle market can provide a steady supply of high-quality automobiles that will offer consumers a viable alternative to the new-vehicle market. We expect that this will result in increased competition with the new vehicle market. |

| ● | Subscription Market. We believe the subscription model has been widely adopted in several different sectors, such as consumer goods, streaming media and data cloud services. Driven by consumer demand, the automobile industry has begun adopting a subscription model as an alternative to ownership and leasing. Although we believe that vehicle ownership will continue to dominate the industry, we expect that the auto subscription segment will grow steadily. |

| ● | Pre-Owned Automobile Sales Market. America’s automobile industry is one of the most powerful engines driving the U.S. economy4. According to Edmunds Used Vehicle Outlook 2019, approximately 40.2 million pre-owned vehicles were sold in 2018, up from 39.3 million pre-owned vehicles sold in 2017. |

Reorganization and Securities Issuances

The Company was incorporated under the laws of Delaware in December 2017. Samer Tawfik, our founder, Chairman, President and Chief Executive Officer, contributed one hundred percent (100%) of the equity interests in each of LMP Motors.com, LLC and LMP Finance, LLC to the Company in December 2017, and in January 2018, 601 NSR, LLC and LMP Automotive Holdings, LLC made the Company their sole member. We refer to these transactions as the reorganization. As a result of the reorganization, the Company now owns one hundred percent (100%) of the equity in each of these four entities. LMP Motors.com, LLC currently operates our automobile sales business. LMP Finance, LLC currently operates our rental and subscription business. 601 NSR, LLC and LMP Automotive Holdings, LLC were formed to enter into future potential strategic acquisitions, but are currently inactive. As a result of the reorganization, Mr. Tawfik was issued 15,750,000 shares of common stock and ST RXR Investments, LLC, or ST RXR, a company wholly owned and controlled by Mr. Tawfik, was issued 5,250,000 shares of common stock.

In February 2018, we completed an offering exempt from the registration requirements of the Securities Act, or a private placement offering, pursuant to which we sold 2,858,030 shares of our common stock, at a purchase price of $3.33 per share, for an aggregate purchase price of $9,517,239.

From June 2018 through October 2018, we sold an aggregate of 787,264 shares of our common stock, in a private placement offering, at a purchase price of $4.75 per share, for an aggregate purchase price of $3,739,505.

During the second and third quarters of 2018, we issued convertible promissory notes in an aggregate principal amount of $1,448,965, or the 6-month notes, pursuant to a private placement offering. The 6-month notes bear interest at 4% per annum and mature six (6) months from the date of issuance, at which time the principal and any accrued but unpaid interest shall be due and payable. The holders of the 6-month notes may, at any time prior to the maturity date, convert the 6-month notes (and accrued interest) into shares of our common stock by dividing (a) the outstanding principal balance and unpaid accrued interest under the applicable 6-month note on the date of conversion by (b) $4.75 (subject to adjustment as provided in the 6-month notes). Based on the terms of the conversion rights, we did not recognize a beneficial conversion discount.

During the year ended December 31, 2019, we repaid eight of the 6-month notes in the principal amount of $962,000, and converted the remaining seven 6-Month Notes to 44,684 shares of common stock with a principal and accrued interest value of $212,249.

During 2019, our CEO retired 18,500,000 beneficially owned shares of common stock for no value. In addition, four non-accredited investors were refunded a total of $20,430, which cancelled 5,055 shares of common stock. Total outstanding shares of common stock prior to our IPO, after the share retirements and refunds, were 6,001,639.

On December 9, 2019, we completed our IPO, selling 2,645,000 shares of common stock at an offering price of $5.00 per share, and warrants to purchase shares of common stock. Aggregate gross proceeds from the IPO, which included the exercise in full of the representative’s over-allotment option, were approximately $13,200,000, and net proceeds received after underwriting fees and offering expenses were approximately $12,000,000. Total equity from the IPO after deducting deferred offering expenses of $1,500,000 was approximately $10,500,000.

5

Employees

As of December 31, 2019, we had 14 full-time employees. Certain employees are subject to contractual agreements that specify requirements for confidentiality, ownership of newly developed intellectual property and restrictions on working for competitors, as well as other matters. None of our employees is represented by a labor union or covered by a collective bargaining agreement. We consider our relationship with our employees to be strong.

Intellectual Property

We own or have rights to service marks or trade names that we use in connection with the operation of our business, including our corporate names, logos and website names. In addition, we own or have the rights to trade secrets and other proprietary rights that protect the services that we offer. This annual report on Form 10-K may also contain trademarks, service marks and trade names of other companies, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this annual report on Form 10-K is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, some of the trade names and service marks referred to in this annual report on Form 10-K are listed without their SM symbols, but we will assert, to the fullest extent under applicable law, our rights to our trade names and service marks. All other trademarks, service marks and trade names are the property of their respective owners.

At this time we do not have trademark registrations or copyrights.

We are the registered holder of a variety of domestic and international domain names, including “lmpmotors.com”, “lmpsubscriptions.com” and “lmprentals.com.”

In addition to the protection provided by our intellectual property rights, we generally enter into confidentiality and proprietary rights agreements with our employees, consultants, contractors and business partners.

Our Internet website is www.lmpmotors.com.

Investing in our common stock involves a high degree of risk. You should carefully consider each of the following risks, together with all other information set forth in this Annual Report on Form 10-K, including the financial statements and the related notes and “Management’s Discussion and Analysis of Financial Conditions and Results of Operations”, before making a decision to purchase, hold or sell our common stock. The occurrence of any of the following risks could harm our business, financial condition, results of operations and/or growth prospects or cause our actual results to differ materially from those contained in forward-looking statements we have made in this report and those we may make from time to time. If any of the following risks actually occurs, our business, financial condition, results of operations and future growth prospects would likely be materially and adversely affected. In these circumstances, the market price of our common stock would likely decline and you may lose all or part of your investments. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations.

Risks Related to Our Business

Our limited operating history makes it difficult for us to evaluate our future business prospects and make decisions based on those estimates of our future performance.

We are a recently formed holding company with a limited operating history. The Company was incorporated under the laws of Delaware in December 2017. Samer Tawfik, our founder, Chairman, President and Chief Executive Officer, contributed one hundred percent (100%) of the equity interests in each of LMP Motors.com, LLC and LMP Finance, LLC into the Company in December 2017, and in January 2018, 601 NSR, LLC and LMP Automotive Holdings, LLC made the Company their sole member. Currently, LMP Motors.com, LLC, which operates our automobile sales business, and LMP Finance, LLC, which operates our rental and subscription business, are the only subsidiaries that generate revenues. 601 NSR, LLC and LMP Automotive Holdings, LLC were formed to enter into future potential strategic acquisitions, but are currently inactive. Because of the uncertainties related to our limited historical operations, including the limited historical operations of LMP Motors.com, LLC, we may be hindered in our ability to anticipate and timely adapt to increases or decreases in revenues or expenses, which may materially and adversely affect our business, financial condition, results of operations and the value of an investment in our common stock.

6

We have a history of net losses.

We expect to continue to incur losses at least in the near term as we invest in and strive to grow our business. We may incur significant losses in the future for a number of reasons, including a decrease in demand for automobiles and our related products and services, losses associated with our strategic acquisitions, increased competition, weakness in the automotive industry generally, as well as other risks described in this annual report on Form 10-K, and we may encounter unforeseen expenses, difficulties, complications and delays in generating revenue or profitability. If our revenues decrease, we may not be able to reduce costs in a timely manner because many of our costs are fixed at least, in the short term. In addition, if we reduce variable costs to respond to losses, this may limit our ability to acquire customers and grow our revenues. Accordingly, we may not achieve or maintain profitability and we may continue to incur significant losses in the future, which may materially and adversely affect our business, financial condition, results of operations and the value of an investment in our common stock.

We depend on key personnel to operate our business, and if we are unable to retain, attract and integrate qualified personnel, our ability to develop and successfully grow our business could be harmed.

We believe our initial success has depended, and continues to depend, on the efforts and talents of our executives and employees. Our future success depends on our continuing ability to attract, develop, motivate and retain highly qualified and skilled employees. Qualified individuals are in high demand, and we may incur significant costs to attract and retain them. In addition, the loss of any of our key employees or senior management, including our founder, Chairman, President and Chief Executive Officer, Samer Tawfik, could have a materially adverse effect on our ability to execute our business plan and strategy, and we may not be able to find adequate replacements on a timely basis, or at all. Our executive officers and other employees are at-will employees, which means they may terminate their employment relationship with us at any time, and their knowledge of our business and industry would be extremely difficult to replace. We may not be able to retain the services of any members of our senior management or other key employees. If we do not succeed in attracting well-qualified employees or retaining and motivating existing employees, our business could be materially and adversely affected.

We intend to acquire other companies and/or technologies, which could divert our management’s attention, result in additional dilution to our stockholders and otherwise disrupt our operations and harm our operating results.

Our success will depend, in part, on our ability to grow our business in response to the demands of consumers and other constituents within the automotive industry, as well as our ability to respond to competitive pressures. Part of our strategy is to do so through the strategic acquisition of complementary businesses, such as independent and franchised dealerships and vehicle rental companies clustered in key metropolitan areas, and technologies, in addition to our own internal development efforts. The identification of suitable acquisition candidates can be difficult, time-consuming and costly, and we may not be able to successfully complete identified acquisitions. The risks we face in connection with acquisitions include:

| ● | diversion of management time and focus from operating our business to addressing acquisition integration challenges; |

| ● | coordination of technology, research and development, and sales and marketing functions; |

| ● | transition of the acquired company’s users to our website and mobile applications; |

| ● | retention of employees from the acquired company; |

| ● | cultural challenges associated with integrating employees from the acquired company into our organization; |

| ● | integration of the acquired company’s accounting, management information, human resources and other administrative systems; |

| ● | the need to implement or improve controls, policies and procedures at a business that, prior to the acquisition, may have lacked effective controls, policies and procedures; |

7

| ● | potential write-offs of intangibles or other assets acquired in such transactions that may have an adverse effect on our operating results; |

| ● | liability for activities of the acquired company before the acquisition, including patent and trademark infringement claims, violations of laws, commercial disputes, tax liabilities, and other known and unknown liabilities; and |

| ● | litigation or other claims in connection with the acquired company, including claims from terminated employees, consumers, former stockholders, or other third parties. |

Our failure to address these risks or other problems encountered in connection with our planned acquisitions and investments could cause us to fail to realize the anticipated benefits of these acquisitions or investments, cause us to incur unanticipated liabilities and otherwise harm our business. Future acquisitions could also result in dilutive issuances of our equity securities, the incurrence of debt, contingent liabilities, amortization expenses, or the write-off of goodwill, any of which could harm our financial condition. Also, the anticipated benefits of any acquisitions may not materialize. Any of these risks, if realized, could materially and adversely affect our business and results of operations.

We expect that we will require additional capital to pursue our business objectives and respond to business opportunities, challenges and/or unforeseen circumstances. If such capital is not available to us, or is not available on favorable terms, our business, operating results and financial condition may be harmed.

While we intend to use the proceeds from our IPO for our strategic acquisitions, to build our vehicle inventory, for working capital and other general corporate purposes, we expect that we will require additional capital to pursue our business objectives and respond to business opportunities, challenges and/or unforeseen circumstances, including to increase our marketing expenditures in order to improve our brand awareness, build and maintain our inventory of quality pre-owned vehicles, develop new products or services or further improve existing services, enhance our operating infrastructure and acquire complementary businesses and technologies. Accordingly, we may need to engage in equity, debt or other types of financings to secure additional funds. Additional funds may not be available when we need them on terms that are acceptable to us, or at all. In addition, any debt financing that we secure in the future could involve restrictive covenants which may make it more difficult for us to obtain additional capital and to pursue business opportunities.

Volatility in the credit markets may also have an adverse effect on our ability to obtain debt financing. If we raise additional funds through further issuances of equity or convertible debt securities, our existing stockholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences and privileges superior to those of our common stock. If we are unable to obtain adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to pursue our business objectives and to respond to business opportunities, challenges or unforeseen circumstances could be significantly limited, and our business, operating results, financial condition and prospects could be adversely affected.

Our business is subject to risks related to the larger automotive ecosystem, including consumer demand, global supply chain challenges and other macroeconomic issues.

Decreases in consumer demand could adversely affect the market for vehicle purchases and, as a result, reduce the number of consumers using our platform. Consumer purchases of vehicles generally decline during recessionary periods and other periods in which disposable income is adversely affected. Purchases of vehicles are typically discretionary for consumers and have been, and may continue to be, affected by negative trends in the economy and other factors, including rising interest rates, the cost of energy and gasoline, the availability and cost of credit, reductions in business and consumer confidence, stock market volatility, increased regulation and increased unemployment. Increased environmental regulation has made, and may in the future make, used vehicles more expensive and less desirable for consumers. In addition, our business may be negatively affected by challenges to the larger automotive ecosystem, including urbanization, global supply chain challenges and other macroeconomic issues. For example, vehicle rideshare services, such as Uber, Juno, Lyft, and Via, vehicle sharing, and other services that allow people to supplement transit trips and share vehicles are becoming increasingly popular as a means of transportation and may decrease consumer demand for the pre-owned vehicles we sell, particularly as urbanization increases. Additionally, new technologies such as autonomous or self-driving vehicles have the potential to change the dynamics of vehicle ownership in the future. Any of the foregoing could have a material adverse effect on our business, results of operations and financial condition.

8

We participate in a highly competitive industry, and pressure from existing and new companies may adversely affect our business and operating results.

We face significant competition from existing and new companies that provide, among other things, automobile listings, information, lead generation, and vehicle buying, rental and subscription services.

Our current and future competitors may include:

| ● | traditional automotive dealerships that could increase investment in technology and infrastructure to compete directly with our online platform; |

| ● | Internet and online automotive sites that could change their models to directly compete with us, such as Google, Amazon, AutoTrader.com, eBay Motors, Edmunds.com, KBB.com, Autobytel.com, TrueCar.com and Cars.com; |

| ● | providers of offline, membership-based vehicle buying services such as the Costco Auto Program; |

| ● | used vehicle dealers or marketplaces with e-commerce business or online platforms such as Carvana, Vroom and Shift; |

| ● | national rental car companies such as Sixt Rent A Car, Hertz, Avis, Budget and Enterprise, as well as local and regional car rental services; |

| ● | vehicle subscription services, and other pay-as-you-go services, such as ZipCar and Flexdrive, and similar services offered by large automobile manufacturers such as Volvo and BMW; |

| ● | other automobile manufacturers that could change their sales models through technology and infrastructure investment; and |

| ● | Peer-to-peer ride-sharing companies. |

We also expect that new competitors will continue to enter the online and traditional automotive retail, rental and subscription market with competing brands, business models, products and services, which could have an adverse effect on our revenue, business and financial results. Some of these companies have significantly greater resources than we do and may be able to provide consumers access to a greater inventory of vehicles at lower prices while delivering a competitive online experience.

Our current and potential competitors may also develop and market new technologies that may adversely affect our business and operating results.

Our current and potential competitors may also develop and market new technologies that render our existing or future business model, products and services less competitive, unmarketable or obsolete. For example, manufacturers are beginning to develop automated, driverless vehicles that could eventually reduce the demand for, or replace, traditional vehicles, including the vehicles that we currently sell. Additionally, vehicle rideshare services, such as Uber, Juno, Lyft, and Via, vehicle sharing, and other services that allow people to supplement transit trips and share vehicles, are becoming increasingly popular as a means of transportation and may decrease consumer demand for vehicle ownership. In addition, if our competitors develop business models, products or services with similar or superior functionality to our solutions, it may adversely impact our business.

Our competitors may also impede our ability to reach consumers or commence operations in certain jurisdictions. For example, our competitors may increase their search engine optimization efforts and outbid us for search terms on various search engines. Additionally, our competitors could use their political influence and increase lobbying efforts resulting in new regulations or interpretations of existing regulations that could prevent us from operating in certain jurisdictions.

Our current and potential competitors may have significantly greater resources than we do.

Our current and potential competitors may have significantly greater financial, technical, marketing and other resources than we have, and the ability to devote greater resources to the development, promotion and support of their business. Additionally, they may have more extensive automotive industry relationships, longer operating histories and greater name recognition than we have. As a result, these competitors may be able to respond to changes in the automotive industry more quickly with new technologies and undertake more extensive marketing or promotional campaigns. If we are unable to compete with these companies, the demand for our automobiles, products and services could substantially decline. In addition, if one or more of our competitors were to merge or partner with another one of our competitors, the change in the competitive landscape could adversely affect our ability to compete effectively. Our competitors may also establish or strengthen cooperative relationships with our current or future providers and suppliers, or other parties with whom we have relationships, thereby limiting our ability to develop, improve and grow our business. We may not be able to compete successfully against current or future competitors, and competitive pressures may harm our revenue, business and financial results.

9

Our business is dependent upon access to a desirable vehicle inventory. Obstacles to acquiring attractive inventory, whether because of supply, competition, or other factors, may have a material adverse effect on our business, sales and results of operations.

Our business requires that we have access to a large number of quality vehicles. We acquire vehicles for sale through numerous sources, including wholesale auction, agreements with manufacturers, independent and franchise dealerships, trade-ins and directly from consumers. The sources from which we can acquire vehicles of a quality and in a quantity acceptable to us are limited, and there is substantial competition to acquire the vehicles we purchase. There can be no assurance that the supply of desirable vehicles will be sufficient to meet our needs. A reduction in the availability of or access to sources of inventory, including an increase in competition for quality vehicles, could diminish our ability to obtain sufficient inventory at a price that we can reflect in retail market prices and would have a material adverse effect on our business, sales and results of operations. Additionally, we evaluate potential vehicles regularly using third-party systems to predict mechanical soundness, consumer desirability and relative value of prospective inventory. If we fail to adjust appraisal offers to stay in line with broader market trade-in offer trends, or fail to recognize those trends, it could adversely affect our ability to acquire inventory effectively. Our ability to source vehicles through our appraisal process could also be affected by competition, both from new and used vehicle dealers directly and through third party websites driving appraisal traffic to those dealers.

Our business is dependent upon our ability to expeditiously sell inventory. Failure to expeditiously sell our inventory could have a material adverse effect on our business, sales and results of operations.

Our purchases of vehicles are based in large part on projected demand. If actual sales are materially less than our forecasts, we would experience an over-supply of vehicle inventory. An over-supply of vehicle inventory will generally cause downward pressure on our product sales prices and margins and increase our average days to sale.

Pre-owned vehicle inventory has typically represented, and will continue to represent, a significant portion of our total assets. Having such a large portion of our total assets in the form of pre-owned vehicle inventory for an extended period of time subjects us to depreciation and other risks that may affect our results of operations. Accordingly, if we have excess inventory or our average days-to-sale increases, we may be unable to liquidate such inventory in a timely manner, or do so at prices that would allow us to meet margin targets or to recover our costs, which could have a material adverse effect on our results of operations.

Our business is sensitive to changes in the prices of new and pre-owned vehicles.

Any significant changes in retail prices for new or pre-owned vehicles could have a material adverse effect on our revenues and results of operations. For example, if retail prices for pre-owned vehicles rise relative to retail prices for new vehicles, it could make buying a new vehicle more attractive to consumers than buying a used vehicle, which could have a material adverse effect on our results of operations and could result in reduced used vehicle sales and lower revenue. Additionally, manufacturer incentives could contribute to narrowing the price gap between new and pre-owned vehicles. Pre-owned vehicle prices may also decline due to an increased number of new vehicle lease returns over the next several years. While lower prices of pre-owned vehicles reduce our cost of acquiring new inventory, lower prices could also lead to reductions in the value of inventory that we currently hold, which could have a negative impact on gross profit. Furthermore, any significant changes in wholesale prices for pre-owned vehicles could have a material adverse effect on our results of operations by reducing our profit margins.

If our inventory or other costs of operations increase and we are unable to pass along these costs to our customers, we may be unable to maintain or grow our sales margins.

Our inventory and other costs are variable and dependent upon various factors, many of which are outside of our control. A rise in vehicle acquisition costs could erode our sales margins and negatively affect our results of operations. If we incur cost increases, we may seek to pass those increases along to our customers. However, our consumers typically have limits on the maximum amount they can afford, and we may be unable to pass these costs along to them in the form of higher sales prices, which would adversely affect our ability to maintain or increase margins.

10

We rely heavily on logistics in transporting vehicles for delivery from point of purchase to our facilities, and finally to the customers, via third parties. Our ability to manage this process both internally and through our network of transportation partners could cause a rise in inventory costs and a disruption in our inventory supply chain and distribution. Further, any disruption in the vehicle transport industry or an increase in the cost of transport could adversely affect our results of operations.

We could be negatively affected if losses for which we do not have third-party insurance coverage increase or our insurance coverages prove to be inadequate.

We have third-party insurance coverage, subject to limits, for bodily injury and property damage resulting from accidents involving our vehicles that are rented or subscribed for. We self-insure (that is, we do not have third-party insurance coverage) for other risks, such as theft and damages to vehicles that are rented or subscribed for and are not otherwise covered by renters’ or subscribers’ insurance, and theft and damage to vehicles in our inventory. We account for vehicle damage or total loss at the time such damage or loss is incurred. As a result, we are responsible for damage to our vehicles. A deterioration in claims management, whether by our management or by a third-party claims administrator, could lead to delays in settling claims, thereby increasing claim costs. In the future, we may be exposed to liability for which we self-insure at levels in excess of our historical levels and to liabilities for which we are insured that exceed the level of our insurance. Claims filed against us in excess of insurance limits, or for which we are otherwise self-insured, or the inability of our insurance carriers to pay otherwise-insured claims, could have an adverse effect on our financial condition. For example, damages resulting from a significant natural disaster, such as a hurricane, fire or flood, or judgment against us for liability for damages resulting from our rental program could have a material adverse impact on our business, operating results and financial condition, and our insurance coverage may be insufficient to compensate us for losses that may occur. Should we be unable to renew our commercial insurance policies at competitive rates, this loss could have an adverse effect on our financial condition and results of operations.

The success of our business relies heavily on our marketing and branding efforts and these efforts may not be successful.

We believe that an important component of our growth will be to successfully attract new visitors to our physical locations and our online platform. Because we are a consumer brand, we rely heavily on marketing and advertising to increase brand visibility with potential customers. We intend to execute our sales and marketing efforts by utilizing a multi-channel approach that utilizes brand building, as well as direct response channels in order to efficiently establish and grow both locally and nationally and to increase the strength, recognition and trust in the LMP brand.

Our business model relies on our ability to scale rapidly and to decrease incremental customer acquisition costs as we grow. If we are unable to recover our marketing costs through increases in customer traffic and in the number of transactions by users of our platform, or if our broad marketing campaigns are not successful or are terminated, it could have a material adverse effect on our growth, results of operations and financial condition.

We rely on Internet search engines and social networking sites to help drive traffic to our website and our facilities, and if we fail to appear prominently in the search results or fail to drive traffic through paid advertising, our traffic would decline and our business would be adversely affected.

We depend in part on Internet search engines, such as Google, Bing and Yahoo!, and social networking sites, such as Facebook, to drive traffic to our website and our facilities. Our ability to maintain and increase the number of visitors directed to our website is not entirely within our control. Our competitors may increase their search engine optimization efforts and outbid us for search terms on various search engines, resulting in their websites receiving a higher search result page ranking than ours. Additionally, Internet search engines could revise their methodologies in a way that would adversely affect our search result rankings. If Internet search engines modify their search algorithms in ways that are detrimental to us, or if our competitors’ efforts are more successful than ours, overall growth in our customer base could decrease or our customer base could decline. Further, Internet search engine providers could provide automotive dealer and pricing information directly in search results, align with our competitors or choose to develop competing services. Any reduction in the number of users directed to our website and/or our facilities through Internet search engines could harm our business and operating results.

11

The traffic to our websites and mobile applications may decline and our business may be adversely affected if other companies copy information from our websites and publish or aggregate it with other information for their own benefit.

From time to time, other companies copy information from our websites through website scraping, robots or other means, and publish, or aggregate it with other information for their own benefit. When third parties copy, publish, or aggregate content from our websites, it makes them more competitive, and decreases the likelihood that consumers will visit our websites or use our mobile applications to find the information they seek. While we may try to prevent or limit these activities, we cannot guarantee that we will be successful in preventing or properly detecting such activities in the future. We may not be able to detect such third-party conduct in a timely manner and, even if we could, we may not be able to prevent it. In some cases, particularly in the case of third parties that operate outside of the United States, our available remedies may be inadequate to protect us against such activities. In addition, we may be required to expend significant financial or other resources to successfully enforce our rights. If any of these activities were to occur, it could adversely affect our business, results of operations and financial condition.

We depend on our e-commerce business and failure to successfully manage this business and deliver a seamless online experience to our customers could have an adverse effect on our growth strategy, business, financial condition, operating results and prospects.

We believe that sales from our e-commerce platform will account for a meaningful portion of our revenues. Our business, financial condition, operating results and prospects are, and we believe will continue to be, dependent on maintaining our e-commerce business. Dependence on our e-commerce business and the continued growth of our direct and retail channels subjects us to certain risks, including:

| ● | the failure to successfully implement new systems, system enhancements and Internet platforms; |

| ● | the failure of our technology infrastructure or the computer systems that operate our website and their related support systems, causing, among other things, website downtimes, telecommunications issues or other technical failures; |

| ● | the reliance on third-party computer hardware/software providers; |

| ● | rapid technological change; |

| ● | liability for online content; |

| ● | violations of federal, state, foreign or other applicable laws, including those relating to data protection; |

| ● | credit card fraud; |

| ● | cyber security and vulnerability to electronic break-ins and other similar disruptions; and |

| ● | diversion of traffic and sales from our stores. |

Our failure to successfully address and respond to these risks and uncertainties could negatively impact sales, increase costs, diminish our growth prospects and damage the reputation of our brand, each of which could have a material adverse effect on our business, financial condition, operating results and prospects.

Vehicle subscription is a relatively new business model, and may not be widely adopted.

We expect to derive a portion of our revenue from our vehicle subscription service, which is a relatively new and rapidly evolving market. If the market for vehicle subscription fails to grow or grows more slowly than we currently anticipate, our business could be negatively affected. We currently only offer vehicle subscription services in Florida. We intend to expand into markets that we believe are the most likely to adopt vehicle subscription services. However, our efforts to expand within and beyond our existing market may not be successful.

We face risks related to liabilities resulting from the use of our vehicles by our rental and subscription customers.

Our business can expose us to claims for personal injury, death and property damage resulting from the use of vehicles by our rental and subscription customers. For example, a rental or subscription customer may be using a vehicle that has worn tires, a mechanical issue or some other problem, including a manufacturing defect, which could contribute to a motor vehicle accident resulting in serious bodily injury, death or significant property damage for which we may be liable. In addition, since we cannot physically inspect our vehicles after they are delivered to our customers, we depend on our rental and subscription customers and third-party service providers to inspect the vehicles prior to driving in order to identify any potential damage or safety concern with the vehicle. To the extent that we are found at fault or otherwise responsible for an accident, our insurance coverage would only cover losses up to a maximum amount.

12

In addition, in certain jurisdictions, as the owner of the vehicle, there is the potential that we may have vicarious liability for any damages caused by our renters or subscribers, even if we are not found to be negligent. Any such liability may have a material adverse impact on our business.

We anticipate that our business will be highly seasonal and any occurrence that disrupts our activity during our peak periods could materially adversely affect our results of operations, financial condition, liquidity and cash flows.

Certain significant components of our expenses are fixed, including real estate taxes, rent, insurance, utilities, maintenance and other facility-related expenses, the costs of operating our information technology systems and staffing costs. We anticipate that seasonal changes in our revenues will not affect those fixed expenses, which typically result in higher profitability in periods when our revenues are higher, and lower profitability in periods when our revenues are lower. Any circumstance, occurrence or situation that disrupts our activity during these periods could have a disproportionately material adverse effect on our results of operations, financial condition, liquidity and cash flows due to a significant change in revenue.

We operate in a highly regulated industry and are subject to a wide range of federal, state and local laws and regulations. Failure to comply with these laws and regulations could have a material adverse effect on our business, results of operations and financial condition.

We are subject to a wide range of federal, state and local laws and regulations. Our sales, rental and subscription services, and related activities, including the sale of complementary products and services, are, or may potentially be, subject to state and local licensing requirements, federal and state (or local) laws regulating vehicle advertising, state or local laws related to sales tax, title and registration, state or local laws regulating vehicle sales and service, and state laws regulating vehicle rentals and subscriptions. For example, a number of state legislatures are proposing to regulate vehicle subscription programs, and in August 2018, the State of Indiana issued a moratorium on vehicle subscription programs until May 1, 2019.

Our facilities and business operations are subject to laws and regulations relating to environmental protection and health and safety. In addition to these laws and regulations that apply specifically to our business, upon the completion of the IPO, we are also subject to laws and regulations affecting public companies, including securities laws and NASDAQ listing rules. The violation of any of these laws or regulations could result in administrative, civil or criminal penalties or in a cease-and-desist order against our business operations, any of which could damage our reputation and have a material adverse effect on our business, sales and results of operations. We have incurred and will continue to incur capital and operating expenses and other costs in order to comply with these laws and regulations.

Our business is subject to the state and local licensing requirements of the jurisdictions in which we operate and in which our customers reside. Regulators of jurisdictions in which our customers reside, but for which we do not have an applicable dealer license, could require that we obtain a license or otherwise comply with various state regulations. Regulators may seek to impose punitive fines for operating without a license or demand we seek a license in those jurisdictions, any of which may inhibit our ability to do business in those jurisdictions, increase our operating expenses and adversely affect our financial condition and results of operations.

With respect to our advertising, private plaintiffs, as well as federal, state and local regulatory and law enforcement authorities, continue to scrutinize advertising, sales, financing and insurance activities in the sale and leasing of pre-owned vehicles. If, as a result, other automotive retailers adopt more transparent, consumer-oriented business practices, it may be difficult for us to differentiate ourselves from other retailers.

The foregoing description of laws and regulations to which we are or may be subject is not exhaustive, and the regulatory framework governing our operations is subject to continuous change.

13

Changes in government regulation affecting the communications industry could harm our prospects and operating results.

The Federal Communications Commission, or the FCC, has jurisdiction over the U.S. communications industry. Under current rules, the FCC regulates broadband Internet service providers as telecommunications service carriers under Title II of the Telecommunications Act and enforces net neutrality regulations that prohibit blocking, degrading or prioritizing certain types of internet traffic.

On February 26, 2015, the FCC reclassified broadband Internet access services in the United States as a telecommunications service subject to some elements of common carrier regulation, including the obligation to provide service on just and reasonable terms, and adopted specific net neutrality rules prohibiting the blocking, throttling or “paid prioritization” of content or services. However, in May 2017, the FCC issued a notice of proposed rulemaking to roll back net neutrality rules and return to a “light touch” regulatory framework. Consistent with this notice, on December 14, 2017, the FCC once again classified broadband Internet access service as an unregulated information service and repealed the specific rules against blocking, throttling or “paid prioritization” of content or services. It retained a rule requiring Internet service providers to disclose their practices to consumers, entrepreneurs and the FCC. A number of parties have already stated they would appeal this order and it is possible Congress may adopt legislation restoring some net neutrality requirements.

The elimination of net neutrality rules and any changes to the rules could affect the market for broadband Internet access service in a way that affects our business. For example, any actions taken by Internet access providers to provide better Internet access to our competitors’ websites or limit the bandwidth and speed for the transmission of data from our websites, could adversely affect our business, operating results, and financial condition.

We are subject to environmental laws and may be subject to environmental liabilities that could have a material adverse effect on us in the future.

We are subject to various federal, state and local environmental laws and governmental regulations relating to the operation of our business, including those governing the handling, storage and disposal of hazardous substances such as motor oil, gasoline, solvents, lubricants, paints and other substances at our facilities. We face potentially significant costs relating to claims, penalties and remediation efforts in the event of non-compliance with existing and future laws and regulations. A failure by us to comply with environmental laws and regulations could have a material adverse effect on our business financial condition and results of operations.

Changes in the laws and regulations to which our business and industry is subject could have a material adverse effect on our business, sales, results of operations and financial condition.

Recent federal legislative and regulatory initiatives and reforms may result in an increase in expenses or a decrease in revenues, which could have a material adverse effect on our results of operations. For example, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, or the Dodd-Frank Act, regulates, among other things, the provision of consumer financing. The Dodd-Frank Act established the Consumer Financial Protection Bureau, or the CFPB, a consumer financial protection agency with broad regulatory powers. The CFPB is responsible for administering and enforcing laws and regulations related to consumer financial products and services, including our provision of vehicle financing and our receivables sale facilities. The evolving regulatory environment in the wake of the Dodd-Frank Act and the creation of the CFPB may increase the cost of regulatory compliance or result in changes to business practices that could have a material adverse effect on our results of operations.

The enactment of new laws and regulations or the interpretation of existing laws and regulations in an unfavorable way may affect the operation of our business, directly or indirectly, which could result in substantial regulatory compliance costs, civil or criminal penalties, including fines, adverse publicity, decreased revenues and increased expenses.

If we fail to comply with the Telephone Consumer Protection Act, or the TCPA, we may face significant damages, which could harm our business, financial condition, results of operations and cash flows.

We utilize telephone calls and intend to utilize text messaging as a means of responding to customer interest in purchasing, renting or subscribing for vehicles. We generate leads from our website by prompting potential customers to provide their phone numbers so that we may contact them in response to their interest in specific vehicles. We also intend to engage and pay third parties to provide us with leads. A portion of our revenue comes from sales that involve calls made by our internal call centers to these potential customers.

14

The TCPA, as interpreted and implemented by the FCC, imposes significant restrictions on utilization of telephone calls and text messages to residential and mobile telephone numbers as a means of communication, when the prior consent of the person being contacted has not been obtained. Violations of the TCPA may be enforced by the FCC or by individuals through litigation, including class actions and statutory penalties for TCPA violations ranging from $500 to $1,500 per violation, which is often interpreted to mean per phone call.

While we intend to implement processes and procedures to comply with the TCPA, any failure by us or the third parties on which we rely for data to adhere to, or successfully implement, appropriate processes and procedures in response to existing or future regulations could result in legal and monetary liability, fines and penalties, or damage to our reputation in the marketplace, any of which could have a material adverse effect on our business, financial condition and results of operations. Additionally, any changes to the TCPA or its interpretation that further restrict the way we contact and communicate with our potential customers or generate leads, or any governmental or private enforcement actions related thereto, could adversely affect our ability to attract customers and harm our business, financial condition, results of operations and cash flows.

Government regulation of the Internet and e-commerce is evolving, and unfavorable changes or failure by us to comply with these regulations could substantially harm our business and results of operations.

We are subject to general business regulations and laws as well as regulations and laws specifically governing the Internet and e-commerce. Existing and future regulations and laws could impede the growth of the Internet, e-commerce or mobile commerce. These regulations and laws may involve taxes, tariffs, privacy and data security, anti-spam, content protection, electronic contracts and communications, consumer protection, Internet neutrality and gift cards. It is not clear how existing laws governing issues such as property ownership, sales and other taxes and consumer privacy apply to the Internet as the vast majority of these laws were adopted prior to the advent of the Internet and do not contemplate or address the unique issues raised by the Internet or e-commerce. It is possible that general business regulations and laws, or those specifically governing the Internet or e-commerce, may be interpreted and applied in a manner that is inconsistent from one jurisdiction to another and may conflict with other rules or our practices.

Though we seek at all times to be in full compliance with all such laws, we cannot be sure that our practices have complied, comply or will comply fully with all such laws and regulations. Any failure, or perceived failure, by us to comply with any of these laws or regulations could result in damage to our reputation, a loss in business and proceedings or actions against us by governmental entities or others. Any such proceeding or action could damage our reputation and brand, force us to spend significant amounts in defense of these proceedings, distract our management, increase our costs of doing business, decrease the use of our website by consumers and result in the imposition of monetary liability. We may also be contractually liable to indemnify and hold harmless third parties from the costs or consequences of non-compliance with any such laws or regulations.

We collect, process, store, share, disclose and use personal information and other data, and our actual or perceived failure to protect such information and data could damage our reputation and brand and harm our business and operating results.

We collect, process, store, share, disclose and use personal information and other data provided by consumers. We rely on encryption and authentication technology licensed from third parties to effect secure transmission of such information. We may need to expend significant resources to protect against security breaches or to address problems caused by breaches. Any failure or perceived failure to maintain the security of personal and other data that is provided to us by consumers and vendors could harm our reputation and brand and expose us to a risk of loss or litigation and possible liability, any of which could adversely affect our business and operating results.

Additionally, concerns about our practices with regard to the collection, use or disclosure of personal information or other privacy related matters, even if unfounded, could harm our business and operating results. There are numerous federal, state and local laws regarding privacy and the collection, processing, storing, sharing, disclosing, using and protecting of personal information and other data, the scope of which are changing, subject to differing interpretations, and which may be costly to comply with and may be inconsistent between jurisdictions or conflict with other rules. We generally comply with industry standards and are subject to the terms of our privacy policies and privacy-related obligations to third parties. We strive to comply with applicable laws, policies, legal obligations and industry codes of conduct relating to privacy and data protection, to the extent possible. However, it is possible that these obligations may be interpreted and applied in new ways or in a manner that is inconsistent from one jurisdiction to another and may conflict with other rules, our practices, or new regulations that could be enacted. Any failure or perceived failure by us to comply with our privacy policies, our privacy-related obligations to consumers or other third parties, or our privacy-related legal obligations, or any compromise of security that results in the unauthorized release or transfer of sensitive information, which may include personally identifiable information or other customer data, may result in governmental enforcement actions, litigation or public statements against us by consumer advocacy groups or others. This also could cause consumers and vendors to lose trust in us, which could have an adverse effect on our business. Additionally, if vendors, developers or other third parties that we work with violate applicable laws or our policies, such violations may also put consumer and vendor information at risk and could in turn harm our reputation, business and operating results.

15

A significant disruption in service on our website could damage our reputation and result in a loss of consumers, which could harm our business, brand, operating results and financial condition.

Our brand, reputation and ability to attract customers depend on the reliable performance of our website and the supporting systems, technology and infrastructure. We may experience significant interruptions with our systems in the future. Interruptions in these systems, whether due to system failures, programming or configuration errors, computer viruses, or physical or electronic break-ins, could affect the availability of our inventory on our website and prevent or inhibit the ability of customers to access our website. Problems with the reliability or security of our systems could harm our reputation, result in a loss of customers and result in additional costs.

We utilize cloud computing, or the practice of using shared processing resources at third party locations, to operate our website and e-commerce platform. We do not own or control the operation of these third party locations. These third party systems, software and operations are vulnerable to damage or interruption from fire, flood, power loss, telecommunications failure, terrorist attacks, acts of war, electronic and physical break-ins, computer viruses, earthquakes, and similar events. The occurrence of any of these events could damage our systems and hardware or could cause them to fail.

Problems faced by our third party web hosting providers could adversely affect the experience of our customers. For example, our third party web hosting providers could close their facilities without adequate notice. Any financial difficulties, up to and including bankruptcy, faced by our third party web hosting providers or any of the service providers with whom they contract may have negative effects on our business, the nature and extent of which are difficult to predict. If our third party web hosting providers are unable to keep up with our growing capacity needs, our business could be harmed.

Any errors, defects, disruptions, or other performance or reliability problems with our network operations could interrupt our customers’ access to our inventory and our access to data that drives our inventory purchase operations as well as cause delays and additional expenses in arranging access to new facilities and services, any of which could harm our reputation, business, operating results and financial condition.

We rely on internal and external logistics to transport our vehicle inventory throughout the United States. Thus, we are subject to business risks and costs associated with the transportation industry. Many of these risks and costs are out of our control, and any of them could have a material adverse effect on our business, financial condition and results of operations.

We rely on a combination of internal and external logistics for third parties to transport vehicles from point of purchase to our facilities, and finally to the customers. As a result, we are exposed to risks associated with the transportation industry such as weather, traffic patterns, gasoline prices, recalls affecting our vehicle fleet, local and federal regulations, vehicular crashes, insufficient internal capacity, rising prices of external transportation vendors, fuel prices and taxes, license and registration fees, insurance premiums, self-insurance levels, difficulty in recruiting and retaining qualified drivers, disruption of our technology systems, and increasing equipment and operational costs. Failure to successfully manage our logistics and fulfillment process could cause a disruption in our inventory supply chain and distribution, which may adversely affect our operating results and financial condition.

Our failure to maintain a reputation of integrity and to otherwise maintain and enhance our brand could adversely affect our business, sales and results of operations.

Our business model is based on our ability to provide customers with a transparent and simplified solution to vehicle buying, renting and subscribing that we believe will save them time and money. If we fail to build and maintain a positive reputation, or if an event occurs that damages this reputation, it could adversely affect consumer demand and have a material adverse effect on our business, sales and results of operations. Even the perception of a decrease in the quality of our brand could negatively impact results.

16

Complaints or negative publicity about our business practices, marketing and advertising campaigns, compliance with applicable laws and regulations, the integrity of the data that we provide to users, data privacy and security issues, and other aspects of our business, especially on industry-specific blogs and social media websites, and irrespective of their validity, could diminish consumer confidence in our platform and adversely affect our brand. The growing use of social media increases the speed with which information and opinions can be shared and, thus, the speed with which reputation can be affected. If we fail to correct or mitigate misinformation or negative information, including information spread through social media or traditional media channels, about us, the vehicles we offer, our customer experience, or any aspect of our brand, it could have a material adverse effect on our business, sales and results of operations.

Our ability to grow our complementary product and service offerings may be limited, which could negatively impact our growth rate, revenues and financial performance.

If we introduce or expand additional product and service offerings for our platform, such as services or products involving other vehicles, sales of new vehicles, or vehicle trade-ins, we may incur losses or otherwise fail to enter these markets successfully. Our expansion into these markets would place us in competitive and regulatory environments with which we are unfamiliar and involve various risks, including the need to invest significant resources and the possibility that returns on such investments will not be achieved for several years, if at all. In attempting to establish new service or product offerings, we expect to incur significant expenses and face various other challenges, such as expanding our customer service personnel and management personnel to cover these markets and complying with complicated regulations that apply to these markets. In addition, we may not successfully demonstrate the value of these complementary products and services to consumers, and failure to do so would compromise our ability to successfully expand into these additional revenue streams. Any of these risks, if realized, could adversely affect our business and results of operations.

If we do not adequately address our customers’ shift to mobile device technology, operating results could be harmed and our growth could be negatively affected.