Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TELEFLEX INC | a2-20x20208xkreq42019e.htm |

| EX-99.1 - EXHIBIT 99.1 - TELEFLEX INC | ex991to2-20x20208xkreq.htm |

Teleflex Incorporated Fourth Quarter 2019 Earnings Conference Call 1

Conference Call Logistics The release, accompanying slides, and replay webcast are available online at www.teleflex.com (click on “Investors”) Telephone replay available by dialing (855) 859-2056 or for international calls, (404) 537-3406, pass code number 5857007 2

Today’s Speakers Liam Kelly President and CEO Thomas Powell Executive Vice President and CFO Jake Elguicze Treasurer and Vice President, Investor Relations 3

Note on Forward-Looking Statements This presentation contains forward-looking statements, including, but not limited to, our expectation with respect to the impact of our acquisition of IWG High Performance Conductors, Inc. on our average revenue growth and operating margin profile; forecasted 2020 GAAP and constant currency revenue growth, GAAP and adjusted gross and operating profit and margins and GAAP and adjusted diluted earnings per share and the items that are expected to impact each of those forecasted results; our assumptions with respect to the euro to U.S. dollar exchange rate for 2020 and our adjusted weighted average shares for 2020; estimated pre-tax charges we expect to incur in connection with our ongoing restructuring programs; estimated annualized pre-tax savings we expect to realize in connection with our ongoing restructuring programs and a similar initiative within our OEM segment (the “OEM initiative”); our expectations with respect to when we will begin to realize savings from our ongoing restructuring programs and the OEM initiative and when those programs will be substantially completed; and other matters which inherently involve risks and uncertainties which could cause actual results to differ from those projected or implied in the forward–looking statements. These risks and uncertainties are addressed in our SEC filings, including our most recent Form 10-K. We expressly disclaim any obligation to update forward-looking statements, except as otherwise specifically stated by us or as required by law or regulation. Note on Non-GAAP Financial Measures This presentation refers to certain non-GAAP financial measures, including, but not limited to, constant currency revenue growth, adjusted diluted earnings per share, adjusted gross and operating margins and adjusted tax rate. These non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP financial measures. Tables reconciling these non-GAAP financial measures to the most comparable GAAP financial measures are contained within this presentation and the appendices at the end of this presentation. Additional Notes This document contains certain highlights with respect to our 2019 performance and developments and does not purport to be a complete summary thereof. Accordingly, we encourage you to read our Earnings Release for the quarter ended December 31, 2019 located in the investor section of our website at www.teleflex.com and our Annual Report on Form 10-K for the year ended December 31, 2019 filed with the Securities and Exchange Commission. Unless otherwise noted, the following slides reflect continuing operations. 4

4Q19 and FY19 Highlights Revenue Highlights • 4Q19 as-reported revenue increased 6.1% versus 4Q18 • 4Q19 constant currency revenue increased 7.1% versus 4Q18 • FY19 as-reported revenue increased 6.0% versus FY18 • FY19 constant currency revenue increased 8.1% versus FY18 Broad Based Product Category Performance1 • FY19 Interventional Urology revenue of $290.5 million, up 47.8% vs FY18, as UroLift® continues strong momentum • FY19 Interventional revenue of $427.6 million, up 9.8% vs FY18, driven by complex catheters, On-Control®, biologics, intra-aortic balloon and Manta large-bore closure products • FY19 OEM revenue of $220.7 million, up 8.2% vs FY18, led by increased sales of catheter and suture products • FY19 Vascular Access revenue of $600.9 million, up 6.3% vs FY18, driven by PICCs and CVCs • FY19 Surgical revenue of $370.1 million, up 5.7% vs FY18, led by ligation and surgical instrument products Continued Adjusted Margin Expansion and Adjusted EPS Growth • Adjusted gross and operating margins of 59.2% and 27.1%, respectively, attained in 4Q19; represent increase of 160 bps and 60 bps, respectively, as compared to the prior year period • FY19 adjusted gross and operating margins reach 58.1% and 25.8%, respectively; represent increase of 100 bps and 10 bps, respectively, as compared to prior year • Achieved 4Q19 adjusted EPS of $3.28, up 18.4% as compared to prior year period • Achieved FY19 adjusted EPS of $11.15, up 12.6% as compared to prior year 1. All global product family revenue growth provided is on a constant currency basis 5 Note: Tables reconciling non-GAAP financial measures to the most comparable GAAP financial measures are included within this presentation and the appendices to this presentation.

4Q19 Segment Revenue Review As-Reported Constant Dollars Q4’19 Q4’18 Currency Revenue Currency in Millions Revenue Revenue Impact Growth Growth Americas $400.0 $358.2 11.6% (0.1%) 11.7% EMEA $145.9 $150.9 (3.3%) (2.7%) (0.6%) Asia $80.5 $79.8 1.0% (1.7%) 2.7% OEM $54.6 $52.7 3.6% (0.7%) 4.3% TOTAL $681.0 $641.6 6.1% (1.0%) 7.1% 6

4Q19 Global Product Category Revenue Review As-Reported Constant Dollars Q4’19 Q4’18 Currency Revenue Currency in Millions Revenue Revenue Impact Growth Growth Vascular Access $154.6 $149.1 3.7% (0.9%) 4.6% Interventional $112.7 $107.1 5.2% (0.8%) 6.0% Anesthesia $85.3 $87.6 (2.6%) (1.3%) (1.3%) Surgical $95.2 $92.7 2.7% (1.2%) 3.9% Interventional Urology $89.1 $57.8 54.3% (0.1%) 54.4% OEM $54.6 $52.7 3.6% (0.7%) 4.3% Other1 $89.4 $94.7 (5.6%) (1.4%) (4.2%) TOTAL $681.0 $641.6 6.1% (1.0%) 7.1% 1. Includes revenues generated from sales of the Company’s respiratory and urology products (other than interventional urology products). 7

Product and Clinical Updates UroLift® System KEY TAKEAWAYS • U.S. Food and Drug Administration (FDA) has granted the company an expanded indication for the use of its UroLift® System to treat larger prostates, between 80cc and100cc. • The collection of data presented to the FDA demonstrates that the UroLift System treatment is safe and effective in men with prostate sizes between 80cc and 100cc, with outcomes similar to the L.I.F.T. randomized controlled trial.1 • This new indication marks another exciting milestone for UroLift® System UroLift® System Teleflex and an opportunity for hundreds of thousands Permanent Implant Delivery Device more men to benefit from the UroLift System and the durable and lasting relief it can provide from burdensome BPH symptoms • Treated over 175,000 patients globally for enlarged prostate 8 1. Roehrborn, J Urology 2013 LIFT Study

Acquisition Update Acquires IWG High Performance Conductors, Inc. KEY TAKEAWAYS • Market Leader in Insulated Ultra Fine Wires and Polyimide and Polymer Micro-Diameter Tubing Components • Provides two highly complementary, differentiated capability platforms, including: ➢ Ultra-fine wire and polyimide tubing components for therapeutic applications in fast growing markets such as Electrophysiology, Peripheral Management, and Pain Management ➢ Ultra-fine wire components for conducting electricity in healthcare applications • Acquisition is expected to be accretive to Teleflex’s average revenue growth and operating margin profile END MARKET APPLICATIONS Embolic Protection for TAVR EP Mapping Catheters Radiofrequency Probes Pacemaker Leads Hearing Aids PICC Catheters 9

4Q19 Financial Review Revenue of $681.0 million • Up 6.1% vs. prior year period on an as-reported basis • Up 7.1% vs. prior year period on a constant currency basis Gross Margin • GAAP gross margin of 58.5%, up 150 bps vs. prior year period • Adjusted gross margin of 59.2%, up 160 bps vs. prior year period Operating Margin • GAAP operating margin of 18.6%, flat vs. prior year period • Adjusted operating margin of 27.1%, up 60 bps vs. prior year period Tax Rate • GAAP tax rate of (6.4%), compared to 9.0% in prior year period • Adjusted tax rate of 7.7%, down 400 bps vs. prior year period Earnings per Share • GAAP EPS of $2.28, up 21.9% vs. prior year period • Adjusted EPS of $3.28, up 18.4% vs. prior year period 10 Note: See appendices for reconciliations of non-GAAP information

2020 Revenue Guidance 2020 constant currency revenue growth expected to be driven by Interventional Urology, Vascular Access, Interventional Access, and OEM 2020 Guidance 2019 Low High Actual GAAP Revenue Growth 6.5% 7.5% 6.0% Impact of Foreign Exchange Rate Fluctuations -0.7% -0.7% -2.1% Constant Currency Revenue Growth 7.2% 8.2% 8.1% 11

2020 Adjusted Gross Margin Guidance 60% +65 bps to +115 bps 58.75% 2020 Adj. Gross Margin Drivers +100 bps to Gross margin expansion in 2020 as 59.25% compared to 2019 expected to be driven by: 58% +130 bps 58.1% • Higher margin Interventional Urology, Interventional Access, and Vascular Access 57.1% product mix • Manufacturing productivity improvement programs 55% 55.8% • Benefits from previously announced restructuring plans Near-term gross margin expansion offset by: • Inflation 53% 2017 2018 2019 2020E 12 Note: See appendices for reconciliations of non-GAAP information

2020 Adjusted Operating Margin Guidance +145 bps to +195 bps 28% 2020 Adj. Operating Margin Drivers 27.25% to Operating margin expansion in 2020 as 27.75% compared to 2019 expected to be driven by: +60 bps +10 bps • Gross margin expansion 25.8% 25% • Operating expense leverage 25.7% ➢ UroLift ➢ Base business 25.1% • HPC acquisition 23% 2017 2018 2019 2020E 13 Note: See appendices for reconciliations of non-GAAP information

2020 Adjusted EPS Guidance 2020 adjusted EPS growth is expected to be between 12.1% and 13.9%, or approximately double the level of as-reported revenue growth 2020 Guidance Low High 2019 Adjusted Earnings per Share $11.15 $11.15 Operations $1.99 $1.92 Interest Expense $0.09 $0.16 Taxes ($0.42) ($0.27) Weighted average shares ($0.11) ($0.11) Foreign currency exchange rates ($0.10) ($0.10) Coronavirus ($0.10) ($0.05) 2020 Adjusted Earnings per Share $12.50 $12.70 14 Note: See appendices for reconciliations of non-GAAP information

Question and Answer Section 15

THANK YOU 16

Appendices 17

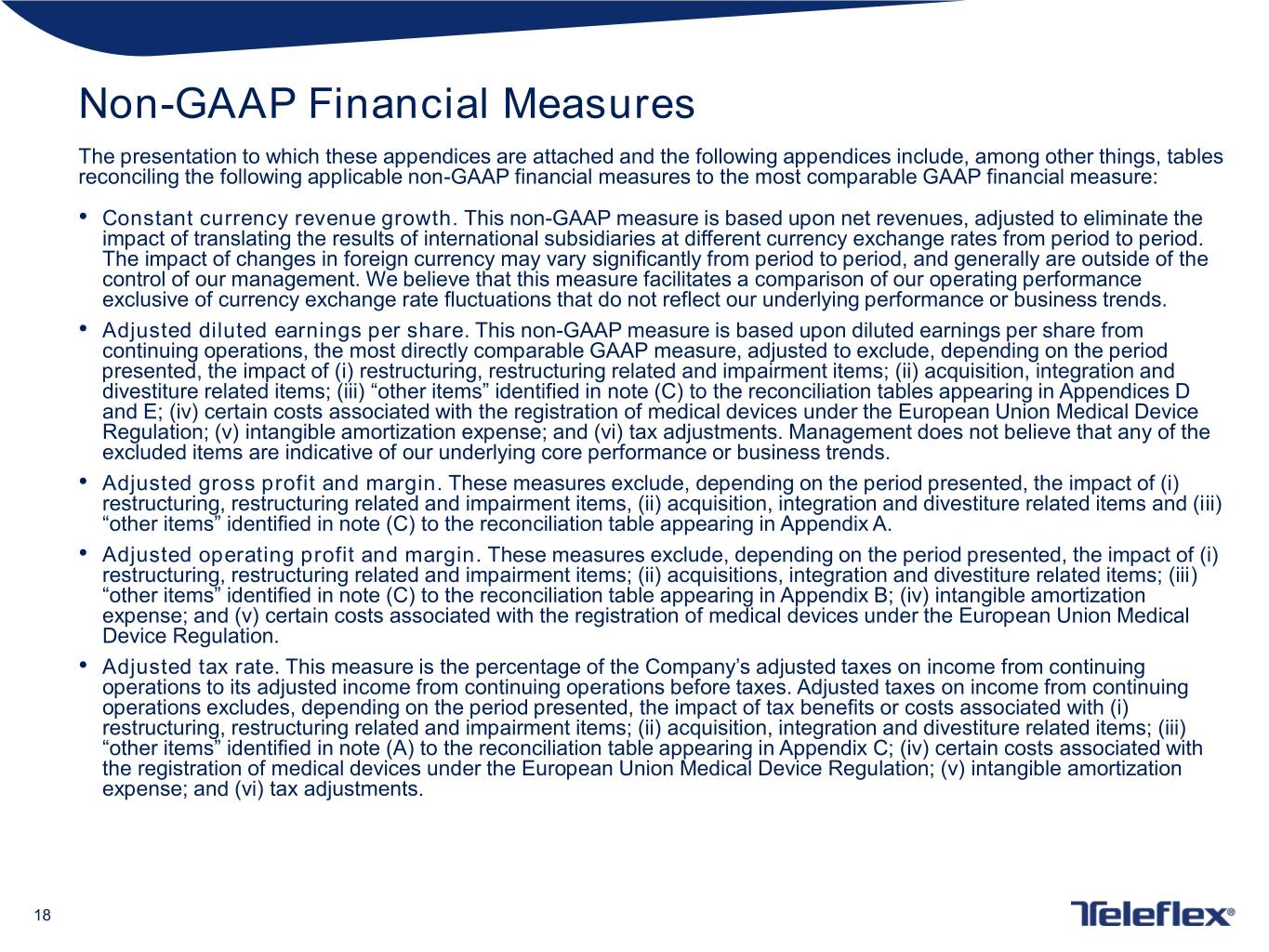

Non-GAAP Financial Measures The presentation to which these appendices are attached and the following appendices include, among other things, tables reconciling the following applicable non-GAAP financial measures to the most comparable GAAP financial measure: • Constant currency revenue growth. This non-GAAP measure is based upon net revenues, adjusted to eliminate the impact of translating the results of international subsidiaries at different currency exchange rates from period to period. The impact of changes in foreign currency may vary significantly from period to period, and generally are outside of the control of our management. We believe that this measure facilitates a comparison of our operating performance exclusive of currency exchange rate fluctuations that do not reflect our underlying performance or business trends. • Adjusted diluted earnings per share. This non-GAAP measure is based upon diluted earnings per share from continuing operations, the most directly comparable GAAP measure, adjusted to exclude, depending on the period presented, the impact of (i) restructuring, restructuring related and impairment items; (ii) acquisition, integration and divestiture related items; (iii) “other items” identified in note (C) to the reconciliation tables appearing in Appendices D and E; (iv) certain costs associated with the registration of medical devices under the European Union Medical Device Regulation; (v) intangible amortization expense; and (vi) tax adjustments. Management does not believe that any of the excluded items are indicative of our underlying core performance or business trends. • Adjusted gross profit and margin. These measures exclude, depending on the period presented, the impact of (i) restructuring, restructuring related and impairment items, (ii) acquisition, integration and divestiture related items and (iii) “other items” identified in note (C) to the reconciliation table appearing in Appendix A. • Adjusted operating profit and margin. These measures exclude, depending on the period presented, the impact of (i) restructuring, restructuring related and impairment items; (ii) acquisitions, integration and divestiture related items; (iii) “other items” identified in note (C) to the reconciliation table appearing in Appendix B; (iv) intangible amortization expense; and (v) certain costs associated with the registration of medical devices under the European Union Medical Device Regulation. • Adjusted tax rate. This measure is the percentage of the Company’s adjusted taxes on income from continuing operations to its adjusted income from continuing operations before taxes. Adjusted taxes on income from continuing operations excludes, depending on the period presented, the impact of tax benefits or costs associated with (i) restructuring, restructuring related and impairment items; (ii) acquisition, integration and divestiture related items; (iii) “other items” identified in note (A) to the reconciliation table appearing in Appendix C; (iv) certain costs associated with the registration of medical devices under the European Union Medical Device Regulation; (v) intangible amortization expense; and (vi) tax adjustments. 18

Non-GAAP Adjustments The following is an explanation of certain of the adjustments that are applied with respect to one or more of the non-GAAP financial measures that appear in the presentation to which these appendices are attached: Restructuring, restructuring related and impairment items - Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities, outsource distribution operations, improve operating efficiencies and integrate acquired businesses. Depending on the specific restructuring program involved, our restructuring charges may include employee termination, contract termination, facility closure, employee relocation, equipment relocation, outplacement and other exit costs associated with the restructuring program. Restructuring related charges are directly related to our restructuring programs and consist of facility consolidation costs, including accelerated depreciation expense related to facility closures, costs to transfer manufacturing operations between locations, and retention bonuses offered to certain employees as an incentive for them to remain with our company after completion of the restructuring program. Impairment charges occur if, due to events or changes in circumstances, we determine that the carrying value of an asset exceeds its fair value. Impairment charges do not directly affect our liquidity, but could have a material adverse effect on our reported financial results. Acquisition, integration and divestiture related items - Acquisition and integration expenses are incremental charges, other than restructuring or restructuring related expenses, that are directly related to specific business or asset acquisition transactions. These charges may include, among other things, professional, consulting and other fees; systems integration costs; legal entity restructuring expense; inventory step-up amortization (amortization, through cost of goods sold, of the increase in fair value of inventory resulting from a fair value calculation as of the acquisition date); fair value adjustments to contingent consideration liabilities; and bridge loan facility and backstop financing fees in connection with loan facilities that ultimately were not utilized. Divestiture related activities involve specific business or asset sales. Depending primarily on the terms of a divestiture transaction, the carrying value of the divested business or assets on our financial statements and other costs we incur as a direct result of the divestiture transaction, we may recognize a gain or loss in connection with the divestiture related activities. Other items - These are discrete items that occur sporadically and can affect period-to-period comparisons. See footnote C to the reconciliation tables set forth below. European medical device regulation - The European Union (“EU”) has adopted the EU Medical Device Regulation (“MDR”), which replaces the existing Medical Devices Directive (“MDD”) and imposes more stringent requirements for the marketing and sale of medical devices in the EU, including requirements affecting clinical evaluations, quality systems and post-market surveillance. Manufacturers of currently marketed medical devices will have until May 2020 to meet the MDR requirements, although certain devices that previously satisfied MDD requirements can continue to be placed on the EU market until May 2024, subject to certain limitations. Significantly, the MDR will require the re-registration of previously approved medical devices. As a result, Teleflex will incur expenditures in connection with the new registration of medical devices that previously had been registered under the MDD. Therefore, these expenditures are not considered to be ordinary course expenditures in connection with regulatory matters (in contrast, no adjustment has been made to exclude expenditures related to the registration of medical devices that were not registered previously under the MDD). Intangible amortization expense - Certain intangible assets, including customer relationships, intellectual property, distribution rights, trade names and non- competition agreements, initially are recorded at historical cost and then amortized over their respective estimated useful lives. The amount of such amortization can vary from period to period as a result of, among other things, business or asset acquisitions or dispositions. Tax adjustments - These adjustments represent the impact of the expiration of applicable statutes of limitations for prior year returns, the resolution of audits, the filing of amended returns with respect to prior tax years and/or tax law or certain other discrete changes affecting our deferred tax liability. 19

Appendix A – Reconciliation of Adjusted Gross Profit and Margin (Dollars in Thousands) Three Months Ended Twelve Months Ended December 31, 2019 December 31, 2018 December 31, 2019 December 31, 2018 Teleflex gross profit as-reported $ 398,266 $ 365,821 $ 1,491,612 $ 1,384,442 Teleflex gross margin as-reported 58.5% 57.0% 57.5% 56.5% Restructuring, restructuring related and impairment items (A) 4,963 3,525 15,874 13,441 Acquisition, integration and divestiture related items (B) - - 97 1,058 Other items (C) - - - (1,347) Adjusted Teleflex gross profit $ 403,229 $ 369,346 $ 1,507,583 $ 1,397,594 Adjusted Teleflex gross margin 59.2% 57.6% 58.1% 57.1% Teleflex revenue as-reported $ 680,952 $ 641,615 $ 2,595,362 $ 2,448,383 (A) Restructuring, restructuring related and impairment items – The charges for all periods presented are for restructuring-related activities. (B) Acquisition, integration and divestiture related items – For the twelve months ended December 31, 2018, these charges primarily related to our acquisition of NeoTract. (C) Other items – For the twelve months ended December 31, 2018, other items included the reversal of previously recognized income due to distributor acquisitions related to Vascular Solutions. 20 See slide titled Non-GAAP Adjustments included at the beginning of the appendices to this presentation for Non-GAAP definitions.

Appendix B – Reconciliation of Adjusted Operating Profit and Margin (Dollars in Thousands) Three Months Ended Twelve Months Ended December 31, 2019 December 31, 2018 December 31, 2019 December 31, 2018 Teleflex income from continuing operations before interest and taxes $ 126,932 $ 119,266 $ 427,254 $ 321,704 Teleflex income from continuing operations before interest and taxes margin 18.6% 18.6% 16.5% 13.1% Restructuring, restructuring related and impairment items (A) 7,148 6,004 38,490 93,957 Acquisition, integration and divestiture related items (B) 11,219 5,382 49,299 60,321 Other items (C) 276 1,762 1,814 2,907 Medical Device Regulation (MDR) Costs (D) 1,566 - 3,194 - Intangible amortization expense 37,313 37,512 149,974 149,486 Adjusted Teleflex income from continuing operations before interest and taxes $ 184,454 $ 169,926 $ 670,025 $ 628,376 Adjusted Teleflex income from continuing operations 27.1% 26.5% 25.8% 25.7% Teleflex revenue as-reported $ 680,952 $ 641,615 $ 2,595,362 $ 2,448,383 (A) Restructuring, restructuring related and impairment items – For the three months ended December 31, 2019 pre-tax restructuring charges were $1.8 million, pre-tax restructuring related charges were $5.3 million, and pre-tax impairment charges were $0.1 million. For the three months ended December 31, 2018, pre-tax restructuring charges were $1.6 million, pre-tax restructuring related charges were $4.4 million, and there were no pre-tax impairment charges. For the twelve months ended December 31, 2019 pre-tax restructuring charges were $15.2 million, pre-tax restructuring related charges were $16.3 million, and pre-tax impairment charges were $7.0 million. For the twelve months ended December 31, 2018, pre-tax restructuring charges were $60.1 million, pre-tax restructuring related charges were $14.7 million, and pre-tax impairment charges were $19.1 million. (B) Acquisition, integration and divestiture related items – For the three months ended December 31, 2019, these charges primarily related to contingent consideration liabilities and our acquisition of IWG High Performance Conductors, Inc., partially offset by the gain on sale of an asset. For the three months ended December 31, 2018, these charges primarily related to contingent consideration liabilities and our acquisition of Essential Medical, Inc., and acquisitions related to our surgical and interventional product portfolios, partially offset by the gain on sale of an asset. For the twelve months ended December 31, 2019, these charges primarily related to contingent consideration liabilities and our acquisition of Essential Medical, somewhat offset by the gain on sale of a business and two assets. For the twelve months ended December 31, 2018, these charges primarily related to contingent consideration liabilities and our acquisition of NeoTract, Inc., partially offset by the gain on sale of an asset. (C) Other items – For the three months ended December 31, 2019, other items included debt modification expenses, and relabeling costs. For the three months ended December 31, 2018, other items included losses associated with settlement of litigation related to an intellectual property matter, expenses associated with a franchise tax audit, and relabeling costs. For the twelve months ended December 31, 2019, other items included debt modification expenses, expenses associated with a franchise tax audit, and relabeling costs, somewhat offset by a credit associated with an insurance settlement. Other items for the twelve months ended December 31, 2018 included the reversal of previously recognized income due to distributor acquisitions related to Vascular Solutions, losses associated with settlement of ligation relating to an intellectual property matter, expenses associated with a franchise tax audit, and relabeling costs. In addition, these items included a charge we incurred as a result of our continuing evaluation of the impact of the Tax Cuts and Jobs Act ("TCJA") on our consolidated operations. During the second quarter of 2018, we identified provisions of the TCJA that could have adverse consequences due to our organization structure. We implemented certain changes in our organization structure (with, pursuant to tax law, retroactive impact back to 2017), and as a result of which we incurred a $1.9 million net worth tax in a foreign jurisdiction with respect to the 2017 tax year. Because the decision to make the change resulting in the net worth tax occurred in the second quarter of 2018, and as permitted under GAAP, we recorded the net worth tax charge in 2018, and the adjustment eliminating the charge is included in the table above among "Other Items" for the 2018 period. (D) MDR – For the three and twelve months ended December 31, 2019, these costs are associated with our efforts to comply with the European Medical Device Regulation initiatives. For the twelve months ended December 31, 2019, the costs associated with the European Medical Device Regulation initiative include $0.3 million that were a component of the "Other items" line item in the reconciliation table for the three months ended March 31, 2019 included in our first quarter 2019 earnings release. 21 See slide titled Non-GAAP Adjustments included at the beginning of the appendices to this presentation for Non-GAAP definitions.

Appendix C – Reconciliation of Adjusted Tax Rate (Dollars in Thousands) Three Months Ended Twelve Months Ended Income from Taxes on Income from Taxes on continuing income from continuing income from operations continuing operations continuing before taxes operations Tax rate before taxes operations Tax rate December 31, 2019 GAAP basis $101,295 ($6,511) -6.4% $339,903 ($122,078) -35.9% Restructuring, restructuring related and impairment charges $7,148 $1,051 $38,490 $5,115 Acquisition, integration and divestiture related items $11,219 ($894) $49,299 ($2,808) Other items (A) $9,098 $2,116 $10,636 $2,474 Medical Device Regulation (MDR) Costs (B) $1,566 $0 $3,194 $0 Intangible amortization expense $37,313 $5,040 $149,974 $28,054 Tax adjustment $0 $12,111 $0 $155,752 December 31, 2019 Adjusted basis $167,639 $12,913 7.7% $591,496 $66,509 11.2% December 31, 2018 GAAP basis $96,177 $8,664 9.0% $219,628 $23,196 10.6% Restructuring, restructuring related and impairment charges $6,004 $1,021 $93,957 $11,608 Acquisition, integration and divestiture related items $5,382 ($212) $60,321 $801 Other items (A) $1,762 $122 $2,907 $72 Intangible amortization expense $37,512 $6,495 $149,486 $26,540 Loss on extinguishment of Debt $0 $0 $0 $0 Tax adjustment $0 $1,094 $0 $570 December 31, 2018 Adjusted basis $146,837 $17,184 11.7% $526,299 $62,787 11.9% (A) Other items – For the three months ended December 31, 2019, other items included debt modification expenses, and relabeling costs. For the three months ended December 31, 2018, other items included losses associated with settlement of litigation related to an intellectual property matter, expenses associated with a franchise tax audit, and relabeling costs. For the twelve months ended December 31, 2019, other items included debt modification expenses, expenses associated with a franchise tax audit, and relabeling costs, somewhat offset by a credit associated with an insurance settlement. Other items for the twelve months ended December 31, 2018 included the reversal of previously recognized income due to distributor acquisitions related to Vascular Solutions, losses associated with settlement of ligation relating to an intellectual property matter, expenses associated with a franchise tax audit, and relabeling costs. In addition, these items included a charge we incurred as a result of our continuing evaluation of the impact of the Tax Cuts and Jobs Act ("TCJA") on our consolidated operations. During the second quarter of 2018, we identified provisions of the TCJA that could have adverse consequences due to our organization structure. We implemented certain changes in our organization structure (with, pursuant to tax law, retroactive impact back to 2017), and as a result of which we incurred a $1.9 million net worth tax in a foreign jurisdiction with respect to the 2017 tax year. Because the decision to make the change resulting in the net worth tax occurred in the second quarter of 2018, and as permitted under GAAP, we recorded the net worth tax charge in 2018, and the adjustment eliminating the charge is included in the table above among "Other Items" for the 2018 period. (B) MDR – For the three and twelve months ended December 31, 2019, these costs are associated with our efforts to comply with the European Medical Device Regulation initiatives. For the twelve months ended December 31, 2019, the costs associated with the European Medical Device Regulation initiative include $0.3 million that were a component of the "Other items" line item in the reconciliation table for the three months ended March 31, 2019 included in our first quarter 2019 earnings release. 22 See slide titled Non-GAAP Adjustments included at the beginning of the appendices to this presentation for Non-GAAP definitions.

Appendix D – Reconciliation of Adjusted EPS from Continuing Operations Three Months Ended– December 31, 2019 (Dollars in Millions, except per share data) Selling, general Restructuring Diluted earnings Cost of goods sold, Research and (Gain) loss on Loss on and and Income Income (loss) from per share from excluding intangible development sale of business extinguishment administrative impairment taxes continuing operations continuing asset amortization expenses and assets of debt, net expenses charges operations GAAP Basis $282.7 $240.6 $31.1 $1.9 ($2.2) $8.8 ($6.5) $107.8 $2.28 Adjustments Restructuring, restructuring related and 5.0 0.3 (0.0) 1.9 — — 1.1 6.1 $0.13 impairment items (A) Acquisition, integration and divestiture related — 13.5 — — (2.2) — (0.9) 12.1 $0.26 items (B) Other items (C) — 0.3 — — — 8.8 2.1 7.0 $0.15 MDR Costs (D) — — 1.6 — — — — 1.6 $0.03 Intangible amortization — 37.2 0.1 — — — 5.0 32.3 $0.68 expense Tax adjustments — — — — — — 12.1 (12.1) ($0.26) Adjusted basis $277.7 $189.3 $29.5 — — — $12.9 $154.7 $3.28 23 See slide titled Non-GAAP Adjustments included at the beginning of the appendices to this presentation for Non-GAAP definitions.

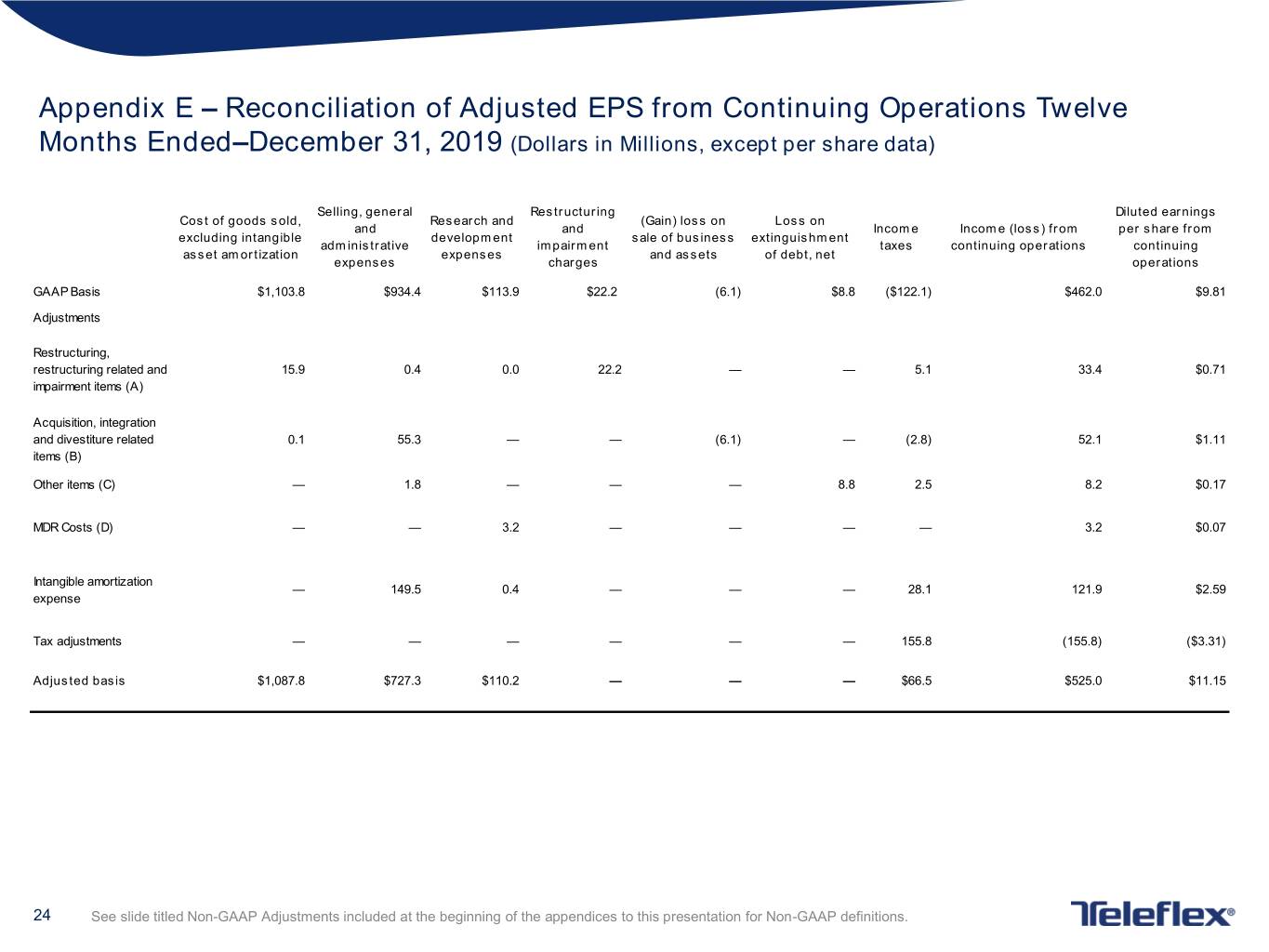

Appendix E – Reconciliation of Adjusted EPS from Continuing Operations Twelve Months Ended–December 31, 2019 (Dollars in Millions, except per share data) Selling, general Restructuring Diluted earnings Cost of goods sold, Research and (Gain) loss on Loss on and and Income Income (loss) from per share from excluding intangible development sale of business extinguishment administrative impairment taxes continuing operations continuing asset amortization expenses and assets of debt, net expenses charges operations GAAP Basis $1,103.8 $934.4 $113.9 $22.2 (6.1) $8.8 ($122.1) $462.0 $9.81 Adjustments Restructuring, restructuring related and 15.9 0.4 0.0 22.2 — — 5.1 33.4 $0.71 impairment items (A) Acquisition, integration and divestiture related 0.1 55.3 — — (6.1) — (2.8) 52.1 $1.11 items (B) Other items (C) — 1.8 — — — 8.8 2.5 8.2 $0.17 MDR Costs (D) — — 3.2 — — — — 3.2 $0.07 Intangible amortization — 149.5 0.4 — — — 28.1 121.9 $2.59 expense Tax adjustments — — — — — — 155.8 (155.8) ($3.31) Adjusted basis $1,087.8 $727.3 $110.2 — — — $66.5 $525.0 $11.15 24 See slide titled Non-GAAP Adjustments included at the beginning of the appendices to this presentation for Non-GAAP definitions.

Appendix F – Reconciliation of Adjusted EPS from Continuing Operations Three Months Ended –December 31, 2018 (Dollars in Millions, except per share data) Selling, general Restructuring Diluted earnings Cost of goods sold, Research and (Gain) loss on and and Income Income (loss) from per share from excluding intangible development sale of business administrative impairment taxes continuing operations continuing asset amortization expenses and assets expenses charges operations GAAP Basis $275.8 $218.5 $27.8 $1.6 ($1.4) $8.7 $87.5 $1.87 Adjustments Restructuring, restructuring related and 3.5 0.8 0.1 1.6 — 1.0 5.0 $0.11 impairment items (A) Acquisition, integration and divestiture related — 6.8 — — (1.4) (0.2) 5.6 $0.12 items (B) Other items (C) — 1.8 — — — 0.1 1.6 $0.04 MDR Costs (D) — — — — — — — — Intangible amortization — 37.4 0.1 — — 6.5 31.0 $0.66 expense Tax adjustments — — — — — 1.1 (1.1) ($0.02) Adjusted basis $272.3 $171.8 $27.6 — — $17.2 $129.7 $2.77 25 See slide titled Non-GAAP Adjustments included at the beginning of the appendices to this presentation for Non-GAAP definitions.

Appendix G – Reconciliation of Adjusted EPS from Continuing Operations Twelve Months Ended –December 31, 2018 (Dollars in Millions, except per share data) Selling, general Restructuring Diluted earnings Cost of goods sold, Research and (Gain) loss on and and Income Income (loss) from per share from excluding intangible development sale of business administrative impairment taxes continuing operations continuing asset amortization expenses and assets expenses charges operations GAAP Basis $1,063.9 $878.7 $106.2 $79.2 (1.4) $23.2 $196.4 $4.20 Adjustments Restructuring, restructuring related and 13.4 1.0 0.3 79.2 — 11.6 82.3 $1.76 impairment items (A) Acquisition, integration and divestiture related 1.1 60.1 0.5 — (1.4) 0.8 59.5 $1.27 items (B) Other items (C) (1.3) 4.3 — — — 0.1 2.8 $0.06 Intangible amortization — 149.1 0.4 — — 26.5 122.9 $2.63 expense Tax adjustments — — — — — 0.6 (0.6) ($0.01) Shares due to Teleflex — — — — — — — — under note hedge Adjusted basis $1,050.8 $664.3 $104.9 — — $62.8 $463.5 $9.90 26 See slide titled Non-GAAP Adjustments included at the beginning of the appendices to this presentation for Non-GAAP definitions.

Appendices D, E, F and G – tickmarks (A) Restructuring, restructuring related and impairment items – For the three months ended December 31, 2019 pre-tax restructuring charges were $1.8 million, pre-tax restructuring related charges were $5.3 million, and pre-tax impairment charges were $0.1 million. For the three months ended December 31, 2018, pre-tax restructuring charges were $1.6 million, pre-tax restructuring related charges were $4.4 million, and there were no pre-tax impairment charges. For the twelve months ended December 31, 2019 pre-tax restructuring charges were $15.2 million, pre-tax restructuring related charges were $16.3 million, and pre-tax impairment charges were $7.0 million. For the twelve months ended December 31, 2018, pre-tax restructuring charges were $60.1 million, pre-tax restructuring related charges were $14.7 million, and pre-tax impairment charges were $19.1 million. (B) Acquisition, integration and divestiture related items – For the three months ended December 31, 2019, these charges primarily related to contingent consideration liabilities and our acquisition of IWG High Performance Conductors, Inc., partially offset by the gain on sale of a asset. For the three months ended December 31, 2018, these charges primarily related to contingent consideration liabilities and our acquisition of Essential Medical, Inc., and acquisitions related to our surgical and interventional portfolios, partially offset by the gain on sale of an asset. For the twelve months ended December 31, 2019, these charges primarily related to contingent consideration liabilities and our acquisition of Essential Medical, Inc., partially offset by the gain on sale of a business and two assets. For the twelve months ended December 31, 2018, these charges primarily related to contingent consideration liabilities and our acquisition of NeoTract, Inc., partially offset by the gain on sale of an asset. (C) Other items – For the three months ended December 31, 2019, other items included debt modification expenses, and relabeling costs. For the three months ended December 31, 2018, other items included losses associated with settlement of litigation related to an intellectual property matter, expenses associated with a franchise tax audit, and relabeling costs. For the twelve months ended December 31, 2019, other items included debt modification expenses, expenses associated with a franchise tax audit, and relabeling costs, somewhat offset by a credit associated with an insurance settlement. Other items for the twelve months ended December 31, 2018 included the reversal of previously recognized income due to distributor acquisitions related to Vascular Solutions, losses associated with settlement of ligation relating to an intellectual property matter, expenses associated with a franchise tax audit, and relabeling costs. In addition, these items included a charge we incurred as a result of our continuing evaluation of the impact of the Tax Cuts and Jobs Act ("TCJA") on our consolidated operations. During the second quarter of 2018, we identified provisions of the TCJA that could have adverse consequences due to our organization structure. We implemented certain changes in our organization structure (with, pursuant to tax law, retroactive impact back to 2017), and as a result of which we incurred a $1.9 million net worth tax in a foreign jurisdiction with respect to the 2017 tax year. Because the decision to make the change resulting in the net worth tax occurred in the second quarter of 2018, and as permitted under GAAP, we recorded the net worth tax charge in 2018, and the adjustment eliminating the charge is included in the table above among "Other Items" for the 2018 period. (D) MDR – For the three and twelve months ended December 31, 2019, these costs are associated with our efforts to comply with the European Medical Device Regulation initiatives. For the twelve months ended December 31, 2019, the costs associated with the European Medical Device Regulation initiative include $0.3 million that were a component of the "Other items" line item in the reconciliation table for the three months ended March 31, 2019 included in our first quarter 2019 earnings release. 27 See slide titled Non-GAAP Adjustments included at the beginning of the appendices to this presentation for Non-GAAP definitions.

Appendix H – Reconciliation of 2017 Adjusted Gross and Operating Profit and Margin (Dollars in Thousands) Twelve Months Ended Twelve Months Ended December 31, 2017 December 31, 2017 Teleflex gross profit as-reported $ 1,171,802 Teleflex income from continuing operations before interest and taxes $ 372,279 Teleflex gross margin as-reported 54.6% Teleflex income from continuing operations before interest and taxes margin 17.3% Restructuring, restructuring related and impairment items (A) 12,730 Restructuring, restructuring related and impairment items (A) 29,371 Acquisition, integration and divestiture related items (B) 10,795 Acquisition, integration and divestiture related items (B) 38,802 Other items (C) (551) Other items (C) 1,347 Intangible amortization expense 98,766 Adjusted Teleflex income from continuing operations Adjusted Teleflex gross profit $ 1,196,674 before interest and taxes $ 538,667 Adjusted Teleflex gross margin 55.8% Adjusted Teleflex income from continuing operations before interest and taxes margin 25.1% Teleflex revenue as-reported $ 2,146,303 Teleflex revenue as-reported $ 2,146,303 Adjusted Gross Margin: (A) Restructuring, restructuring related and impairment items – In 2017, these charges were related to restructuring related activity. (B) Acquisition, integration and divestiture related items – In 2017, these charges were primarily related to our acquisitions of Vascular Solutions and NeoTract. (C) Other items – In 2017, other items included the reversal of previously recognized income due to distributor acquisitions related to Vascular Solutions. Adjusted Operating Margin: (A) Restructuring, restructuring related and impairment items – In 2017, These charges were for restructuring-related activities (B) Acquisition, integration and divestiture related items – In 2017, these charges were primarily related to our acquisitions of Vascular Solutions and NeoTract, as well as contingent consideration liabilities. (C) Other items – In 2017, other items included both gains and losses associated with litigation settlements, the reversal of previously recognized income due to distributor acquisitions related to Vascular Solutions, the reversal of previously recognized income due to our distributor to direct sales conversion in China, and relabeling costs. 28 See slide titled Non-GAAP Adjustments included at the beginning of the appendices to this presentation for Non-GAAP definitions.

Appendix I – Reconciliation of 2020 Adjusted Gross and Operating Margin Guidance 2020 Guidance Low High Forecasted GAAP Gross Margin 57.65% 58.25% Estimated restructuring, restructuring related and impairment items 1.05% 1.00% Estimated acquisition, integration and divestiture related items 0.05% - Estimated other items - - Forecasted Adjusted Gross Margin 58.75% 59.25% 2020 Guidance Low High Forecasted GAAP Operating Margin 18.55% 19.25% Estimated restructuring, restructuring related and impairment items 1.25% 1.20% Estimated acquisition, integration and divestiture related items 0.85% 0.80% Estimated other items - - Estimated MDR 0.60% 0.55% Estimated intangible amortization expense 6.00% 5.95% Forecasted Adjusted Operating Margin 27.25% 27.75% 29

Appendix J – Reconciliation of 2020 Adjusted Earnings Per Share Guidance 2020 Guidance Low High Forecasted GAAP Diluted Earnings Per Share from continuing operations $7.70 $7.85 Estimated Restructuring, restructuring related and impairment items, net of tax $0.65 $0.67 Estimated acquisition, integration and divestiture related items, net of tax $0.44 $0.45 Estimated other items, net of tax - - Estimated MDR, net of tax $0.34 $0.35 Estimated intangible amortization expense, net of tax $2.93 $2.94 Tax adjustments $0.44 $0.44 Forecasted Adjusted Diluted Earnings Per Share from continuing operations $12.50 $12.70 30

Appendix K – 2020 Financial Outlook Assumptions Euro to U.S. Dollar exchange rate assumed to be approximately 1.11 for full year 2020 Adjusted weighted average shares expected to be approximately 47.5 million for full year 2020 2020 Calendar of shipping days: Q1’20 vs. Q1’19: 1 less day Q2’20 vs. Q2’19: no difference Q3’20 vs. Q3’19: no difference Q4’20 vs. Q4’19: 2 additional days FY’20 vs. FY’19: 1 additional day 31

Appendix L – Teleflex Restructuring and Similar Cost Savings Initiatives Summary In February 2019, we initiated a restructuring plan primarily involving the relocation of certain manufacturing operations to existing lower-cost locations and related workforce reductions (the “2019 Footprint realignment plan"). These actions are expected to be substantially completed during 2022. We estimate that we will incur aggregate pre-tax restructuring and restructuring related charges in connection with the 2019 Footprint realignment plan of $56 million to $70 million, of which we estimate that $53 million to $66 million of these charges will result in future cash outlays. Additionally, we expect to incur $29 million to $35 million in aggregate capital expenditures under the plan, most of which we expect to be incurred by the end of 2021. We expect to begin realizing plan-related savings in 2021 and expect to achieve annual pre-tax savings of $12 million to $14 million once the plan is fully implemented. We have ongoing restructuring programs primarily related to the consolidation of our manufacturing operations (referred to as our 2019, 2018 and 2014 Footprint realignment plans). We also have similar ongoing activities to relocate certain manufacturing operations within our OEM segment (the "OEM initiative") that do not meet the criteria for a restructuring program under applicable accounting guidance; nevertheless, the activities should result in cost savings (we expect only minimal costs to be incurred in connection with the OEM initiative). With respect to our currently ongoing restructuring programs and the OEM initiative, the table below summarizes charges incurred or estimated to be incurred and estimated annual pre-tax savings to be realized as follows: (1) with respect to charges (a) the estimated total charges that will have been incurred once the restructuring programs and OEM initiative are completed; (b) the charges incurred through December 31, 2019; and (c) the estimated charges to be incurred from January 1, 2020 through the last anticipated completion date of the restructuring programs and OEM initiative, December 31, 2026 and (2) with respect to estimated annual pre-tax savings, (a) the estimated total annual pre-tax savings to be realized once the restructuring programs and OEM initiative are completed; (b) the estimated annual pre-tax savings realized based on the progress of the restructuring programs and OEM initiative through December 31, 2019; and (c) the estimated additional annual pre-tax savings to be realized from January 1, 2020 through the last anticipated completion date of the restructuring programs and the OEM initiative, December 31, 2026. Estimated charges and pre-tax savings are subject to change based on, among other things, the nature and timing of restructuring activities and similar activities, changes in the scope of restructuring programs and the OEM initiative, unanticipated expenditures and other developments, the effect of additional acquisitions or dispositions, the failure to realize anticipated savings from a supply contract related to a component included in certain kits sold by our Americas segment and other factors that were not reflected in the assumptions made by management in previously estimating restructuring and restructuring related charges and estimated pre-tax savings. Moreover, estimated pre-tax savings constituting efficiencies with respect to increased costs that otherwise would have resulted from business acquisitions involve, among other things, assumptions regarding the cost structure and integration of businesses that previously were not administered by our management, which are subject to a particularly high degree of risk and uncertainty. It is likely that estimates of charges and pre-tax savings will change from time to time, and the table below may reflect changes from amounts previously estimated. In addition, the table below does not include estimated charges and pre-tax savings related to substantially completed programs such as the 2017 Vascular Solutions integration program, the 2017 EMEA program, the 2016 Footprint realignment plan and other 2016 restructuring programs, which were substantially completed prior to or during 2019. Pre-tax savings can also be affected by increases or decreases in sales volumes generated by the businesses impacted by the consolidation of manufacturing operations; such variations in revenues can increase or decrease pre-tax savings generated by the consolidation of manufacturing operations. For example, an increase in sales volumes generated by the impacted businesses, although likely to increase manufacturing costs, may generate additional savings with respect to costs that otherwise would have been incurred if the manufacturing operations were not consolidated. Through Estimated remaining from January 1, 2020 through Dollars in Millions Estimated Total December 31, 2019 December 31, 2026 Restructuring charges $95 to $114 $83 $12 to $31 Restructuring related charges 1 $110 to $141 $46 $64 to $95 Total charges $205 to $255 $129 $76 to $126 OEM initiative pre-tax savings $6 to $7 $1 $5 to $6 Pre-tax savings 2 $63 to $73 $25 $38 to $48 Total pre-tax savings $69 to $80 $26 $43 to $54 1. Restructuring related charges represent costs that are directly related to the programs and principally constitute costs to transfer manufacturing operations to the new locations, project management costs and accelerated depreciation, as well as a charge associated with our exit from facilities that is expected to be imposed by the taxing authority in the affected jurisdiction. Most of these changes (other than the tax charge) are expected to be recognized in cost of goods sold. 2. Substantially all of the pre-tax savings are expected to result in reductions to cost of goods sold. 32

Appendix M – 4Q 2019 and Full Year 2019 GPO and IDN Review Group Purchasing Organization Update 4Q19 FY19 Renewed agreements 4 21 New agreements 1 3 Existing agreements lost 0 1 IDN Update 4Q19 FY19 Renewed agreements 12 37 New agreements 14 28 Existing agreements lost 1 2 33

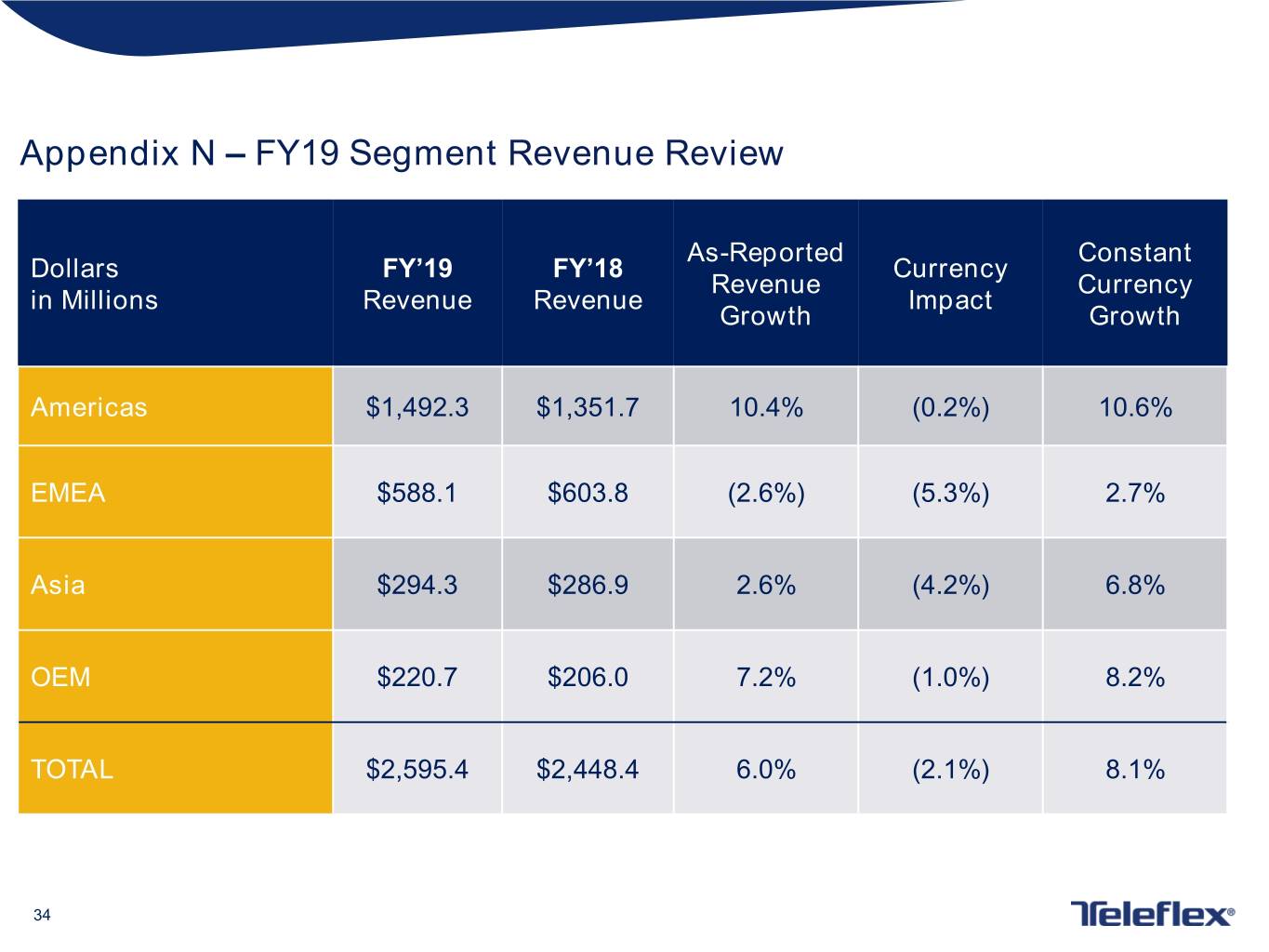

Appendix N – FY19 Segment Revenue Review As-Reported Constant Dollars FY’19 FY’18 Currency Revenue Currency in Millions Revenue Revenue Impact Growth Growth Americas $1,492.3 $1,351.7 10.4% (0.2%) 10.6% EMEA $588.1 $603.8 (2.6%) (5.3%) 2.7% Asia $294.3 $286.9 2.6% (4.2%) 6.8% OEM $220.7 $206.0 7.2% (1.0%) 8.2% TOTAL $2,595.4 $2,448.4 6.0% (2.1%) 8.1% 34

Appendix O – FY19 Global Product Category Revenue Review As-Reported Constant Dollars FY’19 FY’18 Currency Revenue Currency in Millions Revenue Revenue Impact Growth Growth Vascular Access $600.9 $575.3 4.4% (1.9%) 6.3% Interventional $427.6 $395.4 8.1% (1.7%) 9.8% Anesthesia $338.4 $349.4 (3.1%) (2.6%) (0.5%) Surgical $370.1 $358.7 3.2% (2.5%) 5.7% Interventional Urology $290.5 $196.7 47.6% (0.2%) 47.8% OEM $220.7 $206.0 7.2% (1.0%) 8.2% Other1 $347.3 $366.9 (5.3%) (2.9%) (2.4%) TOTAL $2,595.4 $2,448.4 6.0% (2.1%) 8.1% 1. Includes revenues generated from sales of the Company’s respiratory and urology products (other than interventional urology products). 35

Appendix P – FY19 Financial Review Revenue of $2,595.4 million • Up 6.0% vs. prior year on an as-reported basis • Up 8.1% vs. prior year on a constant currency basis Gross Margin • GAAP gross margin of 57.5%, up 100 bps vs. prior year • Adjusted gross margin of 58.1%, up 100 bps vs. prior year Operating Margin • GAAP operating margin of 16.5%, up 340 bps vs. prior year • Adjusted operating margin of 25.8%, up 10 bps vs. prior year Tax Rate • GAAP tax rate of (35.9%), compared to 10.6% in prior year • Adjusted tax rate of 11.2%, down 70 bps vs. prior year Earnings per Share • GAAP EPS of $9.81, up 133.6% vs. prior year • Adjusted EPS of $11.15, up 12.6% vs. prior year 36 Note: See appendices for reconciliations of non-GAAP information