Attached files

| file | filename |

|---|---|

| EX-10.5.6 - EXHIBIT 10.5.6 - TELEFLEX INC | exhibit1056-ceostockoptagr.htm |

| EX-32.2 - EXHIBIT 32.2 - TELEFLEX INC | tfx-ex322_20151231x10k.htm |

| EX-23 - EXHIBIT 23 - TELEFLEX INC | tfx-ex23_20151231x10k.htm |

| EX-10.5.7 - EXHIBIT 10.5.7 - TELEFLEX INC | exhibit1057-formceorstockr.htm |

| EX-10.20 - EXHIBIT 10.20 - TELEFLEX INC | exhibit1020-chickssevagrmt.htm |

| EX-10.19 - EXHIBIT 10.19 - TELEFLEX INC | exhibit1019-jleydencicagrm.htm |

| EX-31.2 - EXHIBIT 31.2 - TELEFLEX INC | tfx-ex312_20151231x10k.htm |

| EX-32.1 - EXHIBIT 32.1 - TELEFLEX INC | tfx-ex321_20151231x10k.htm |

| EX-10.18 - EXHIBIT 10.18 - TELEFLEX INC | exhibit1018-jleydensevagrmt.htm |

| EX-10.22 - EXHIBIT 10.22 - TELEFLEX INC | exhibit1022-firstamdtdefco.htm |

| EX-21 - EXHIBIT 21 - TELEFLEX INC | exhibit21-subsidiaries.htm |

| EX-10.3.2 - EXHIBIT 10.3.2 - TELEFLEX INC | exhibit1032-specamdto401kp.htm |

| EX-10.21 - EXHIBIT 10.21 - TELEFLEX INC | exhibit1021-chickscicagrmt.htm |

| EX-31.1 - EXHIBIT 31.1 - TELEFLEX INC | tfx-ex311_20151231x10k.htm |

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________________________

FORM 10-K

_________________________________________________

(Mark One) | |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015 or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number 1-5353

_________________________________________________

TELEFLEX INCORPORATED

(Exact name of registrant as specified in its charter)

_________________________________________________

Delaware | 23-1147939 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. employer identification no.) | |

550 East Swedesford Road, Suite 400, Wayne, Pennsylvania | 19087 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (610) 225-6800

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange On Which Registered | |

Common Stock, par value $1 per share | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act:

NONE

_________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨ |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨ |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨ |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. |

Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x | ||||||

The aggregate market value of the Common Stock of the registrant held by non-affiliates of the registrant (30,717,872 shares) on June 28, 2015 (the last business day of the registrant’s most recently completed fiscal second quarter) was $4,200,976,174 (1) . The aggregate market value was computed by reference to the closing price of the Common Stock on such date. | ||||||

The registrant had 41,621,869 Common Shares outstanding as of February 19, 2016. | ||||||

DOCUMENT INCORPORATED BY REFERENCE:

Certain provisions of the registrant’s definitive proxy statement in connection with its 2015 Annual Meeting of Stockholders, to be filed within 120 days of the close of the registrant’s fiscal year, are incorporated by reference in Part III hereof. |

(1) For the purposes of this definition only, the registrant has defined “affiliate” as including executive officers and directors of the registrant and owners of more than five percent of the common stock of the registrant, without conceding that all such persons are “affiliates” for purposes of the federal securities laws. |

TELEFLEX INCORPORATED

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2015

TABLE OF CONTENTS

Page | ||

2

Information Concerning Forward-Looking Statements

All statements made in this Annual Report on Form 10-K, other than statements of historical fact, are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “will,” “would,” “should,” “guidance,” “potential,” “continue,” “project,” “forecast,” “confident,” “prospects” and similar expressions typically are used to identify forward-looking statements. Forward-looking statements are based on the then-current expectations, beliefs, assumptions, estimates and forecasts about our business and the industry and markets in which we operate. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or implied by these forward-looking statements due to a number of factors, including:

• | changes in business relationships with and purchases by or from major customers or suppliers, including delays or cancellations in shipments; |

• | demand for and market acceptance of new and existing products; |

• | our ability to integrate acquired businesses into our operations, realize planned synergies and operate such businesses profitably in accordance with expectations; |

• | our ability to effectively execute our restructuring programs; |

• | our inability to realize savings resulting from restructuring plans and programs at anticipated levels; |

• | the impact of recently passed healthcare reform legislation and changes in Medicare, Medicaid and third-party coverage and reimbursements; |

• | competitive market conditions and resulting effects on revenues and pricing; |

• | increases in raw material costs that cannot be recovered in product pricing; |

• | global economic factors, including currency exchange rates, interest rates and sovereign debt issues; |

• | difficulties entering new markets; and |

• | general economic conditions. |

For a further discussion of the risks relating to our business, see Item 1A “Risk Factors” in this Annual Report on Form 10-K. We expressly disclaim any obligation to update these forward-looking statements, except as otherwise specifically stated by us or as required by law or regulation.

3

PART I

ITEM 1. | BUSINESS |

Teleflex Incorporated is referred to herein as “we,” “us,” “our,” “Teleflex” and the “Company.”

THE COMPANY

Teleflex is a global provider of medical technology products that enhance clinical benefits, improve patient and provider safety and reduce total procedural costs. We primarily design, develop, manufacture and supply single-use medical devices used by hospitals and healthcare providers for common diagnostic and therapeutic procedures in critical care and surgical applications. We market and sell our products to hospitals and healthcare providers worldwide through a combination of our direct sales force and distributors. Because our products are used in numerous markets and for a variety of procedures, we are not dependent upon any one end-market or procedure. We manufacture our products at 25 manufacturing sites, with major manufacturing operations located in the Czech Republic, Germany, Malaysia, Mexico and the United States.

We are focused on achieving consistent, sustainable and profitable growth and improving our financial performance by increasing our market share and improving our operating efficiencies through:

• | development of new products and product line extensions; |

• | investment in new technologies and broadening their applications; |

• | expansion of the use of our products in existing markets and introduction of our products into new geographic markets; |

• | achievement of economies of scale as we continue to expand by leveraging our direct sales force and distribution network for new products, as well as increasing efficiencies in our sales and marketing and research and development structures and our manufacturing and distribution facilities; and |

• | expansion of our product portfolio through select acquisitions, licensing arrangements and business partnerships that enhance, extend or expedite our development initiatives or our ability to increase our market share. During 2015, we completed several acquisitions of businesses that complement our anesthesia, surgical and vascular product portfolios, as well as our Asia segment. See Note 3 to the consolidated financial statements included in this Annual Report on Form 10-K for additional information. |

Our research and development capabilities, commitment to engineering excellence and focus on low-cost manufacturing enable us to bring cost effective, innovative products to market that improve the safety, efficacy and quality of healthcare. Our research and development initiatives focus on developing these products for both existing and new therapeutic applications, as well as enhancements to, and line extensions of, existing products. We introduced 20 new products and line extensions during 2015. Our portfolio of existing products and products under development consists primarily of Class I and Class II devices, which require 510(k) clearance by the United States Food and Drug Administration ("FDA"), for sale in the United States. We believe that 510(k) clearance reduces our research and development costs and risks, and typically results in a shorter timetable for new product introductions as compared to the premarket approval, or PMA, process that would be required for Class III devices. See "Government Regulation" below.

OUR SEGMENTS

Effective April 1, 2015, we reorganized certain of our North American businesses to better leverage our resources. As a result, we realigned our operating segments. Specifically, our Anesthesia/Respiratory North America operating segment was divided into two operating segments, Anesthesia North America and Respiratory North America. Additionally, the businesses comprising our former Specialty operating segment (which was not a reportable segment and, therefore, was included in the "All other" category in our presentation of segment information) were transferred to the Anesthesia North America, Vascular North America and Respiratory North America operating segments.

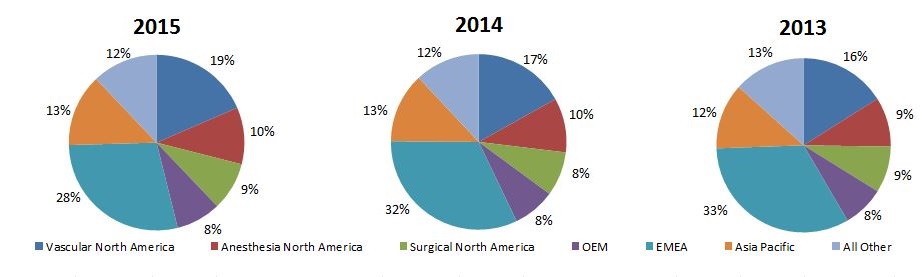

As a result of the operating segment changes described above, we have the following six reportable operating segments: Vascular North America, Anesthesia North America, Surgical North America, EMEA (Europe, Middle East and Africa), Asia and OEM. In connection with the presentation of segment information, we will continue to present in the "All other" category certain operating segments, which, effective April 1, 2015, include, among others, the Respiratory North America operating segment. All prior comparative periods presented in this report have been restated to reflect

4

these changes. The following charts depict our net revenues by reportable operating segment as a percentage of our total consolidated net revenues for the years ended December 31, 2015, 2014 and 2013.

Vascular North America: Our Vascular North America segment is comprised of our North American vascular and interventional access businesses, which offer products that facilitate a variety of critical care therapies and other applications.

Vascular Access Products

Our vascular access products primarily consist of our Arrow branded catheters and related devices that are used in a wide range of procedures, including the administration of intravenous medications and other therapies, the measurement of blood pressure and the withdrawal of blood samples through a single puncture site. The vascular access product portfolio principally consists of the following products:

• | Arrow Central Venous Catheters (CVCs): Arrow CVCs are inserted in the neck or shoulder area and come in multiple lengths and up to four channels, or lumens. The Arrow CVC has a pressure injectable option which gives clinicians who perform contrast-enhanced CT scans the ability to use an indwelling (in the body) pressure injectable Arrow CVC to inject contrast dye for the scan without having to insert a second catheter. |

• | Arrow EZ-IO Intraosseous Vascular Access System: The Arrow EZ-IO system provides vascular access for the delivery of medications and fluids via intraosseous, or in the bone, infusion when traditional vascular access is difficult or impossible. Sales of the Arrow EZ-IO system to our hospital customers are included in our Vascular North America segment results. As discussed below, sales of the Arrow EZ-IO to pre-hospital care customers, such as emergency medical service providers, are included in our Anesthesia North America segment results. |

• | Arrow Peripherally Inserted Central Catheters (PICCs): Arrow PICCs are soft, flexible catheters that are inserted in the upper arm and advanced into a vein that carries blood to the heart to administer various types of intravenous medications and therapies. Arrow PICCs have a pressure injectable option that can withstand the higher pressures required by the injection of contrast media for CT scans. |

• | Arrow Jugular Axillo-subclavian Central Catheters (JACCs): Arrow JACCs are designed to be inserted in the neck or shoulder area and provide an alternative to traditional CVCs and PICCs for acute care. Arrow JACCs may be used short or long term to treat patients who may have poor peripheral circulation. |

• | VPS G4 Vascular Positioning System: Our VPS G4 system is an advanced vascular positioning system designed to facilitate precise placement of central venous catheters within the heart. Indicated as an alternative to chest x-ray confirmation for CVC tip placement confirmation in adult patients, the system analyzes multiple metrics, in real time, to help clinicians navigate through the circulatory system and identify the correct catheter tip placement in the heart. |

• | Arrow Arterial Catheterization Sets: Our Arrow arterial catheterization sets facilitate arterial pressure monitoring and blood withdrawal for glucose, blood-gas and electrolyte measurement in a wide variety of critical care and intensive care settings. |

• | Arrow Percutaneous Sheath Introducers: Our Arrow percutaneous sheath introducers are used to insert cardiovascular and other catheterization devices into the vascular system during critical care procedures. |

5

The large majority of our CVCs are treated with our ARROWg+ard or ARROWg+ard Blue Plus antimicrobial surface treatments, which have been shown to reduce the risk of catheter related bloodstream infection. Our PICCs and JACCs are available with our Chlorag+ard technology, which is an antimicrobial treatment applied to the external surface of the catheter body, as well as the entire fluid pathway of the catheter, that has been shown to be effective in reducing microbial colonization and thrombus accumulation on catheter surfaces.

We also offer many of our vascular access catheters in Maximal Barrier Precautions trays, which are designed to assist healthcare providers in complying with clinical guidelines for reducing catheter-related bloodstream infections. These trays are available for CVCs, PICCs and multi access catheters and include a full body drape, coated or non-coated catheters and other accessories. In addition, our ErgoPACK system offers clinicians a broad range of tray configurations with components packaged in the tray in the order in which they will be needed during the procedure, and incorporates features designed to promote ease of use and patient and provider safety.

Interventional Access Products

Our interventional access products are used in a wide range of applications, including dialysis, oncology and critical care therapies. Our interventional access portfolio also includes several Arrow branded products, such as diagnostic and drainage kits, embolectomy balloons, and reinforced percutaneous sheath introducers. Our interventional access products include:

• | Arrow OnControl® Powered Bone Marrow / Bone Access System: The Arrow OnControl powered bone access system enables access for hematology and oncology diagnostic practices. The system is used to obtain bone marrow, aspirate the bone and access bone lesions. |

• | Arrow Trerotola™ Percutaneous Thrombectomy Device ("PTD"): The Arrow Trerotola PTD is used for declotting of dialysis grafts and fistulas. |

• | Arrow Chronic Hemodialysis Catheters: The Arrow chronic hemodialysis catheters include both antegrade and retrograde insertion options for split, step and symmetrical tip configurations. |

• | Arrow Acute Hemodialysis Catheters: Similar to the Arrow CVC portfolio, the Arrow Acute hemodialysis catheters are offered with or without ARROWg+ard antimicrobial surface treatment |

Anesthesia North America: Our Anesthesia North America segment is comprised of our North American airway management and pain management businesses.

Airway Management Products

Our airway management products and related devices consist principally of the following:

• | LMA Airways: Our LMA laryngeal masks are used by anesthesiologists and emergency responders to establish an airway to channel anesthesia gas or oxygen to a patient's lungs during surgery or trauma. The LMA Protector™ Airway, our latest airway management device, is the first single-use laryngeal mask with a dual gastric drainage channel and pharyngeal chamber designed specifically to channel high volume, high pressure gastric contents away from the airway. It also integrates our Second Seal™ technology to isolate the respiratory tract from the digestive tract, reducing the risk of aspiration of gastric contents. The LMA Protector™ Airway also includes our Cuff Pilot™ technology, which enables clinicians to confirm that the inserted cuff is properly inflated and to monitor pressure levels. |

• | LMA Atomization: Our LMA atomization portfolio includes products designed to facilitate atomized delivery of certain medications. Included in the portfolio is our LMA MAD Nasal™, an intranasal mucosal atomization device that is designed to provide a safe and painless way to deliver medications approved for intranasal delivery to a patient's blood stream without an intravenous line or needle. |

• | RUSCH Endotracheal Tubes and Laryngoscopes: We offer a broad portfolio of products to facilitate and support endotracheal intubation to administer oxygen, and anesthetic gases in multiple settings (surgery, critical care and emergency settings). We also provide a broad range of products for laryngoscopy, a procedure that is primarily used to obtain a view of the airway to facilitate tracheal intubation during general anesthesia or cardiopulmonary resuscitation ("CPR"). Among these products is the RUSCH DispoLED Laryngoscope Handle, a single-use handle |

6

designed to help facilities comply with standards designed to reduce the potential for patient cross-contamination associated with reusable devices during intubation.

Pain Management Products

Our pain management products, which are designed for use in a broad range of surgical and obstetric procedures, consist principally of the following:

• | Arrow Epidural Catheters, Needles and Kits: We offer a broad range of Arrow epidural products, including the Arrow FlexTip Plus epidural catheter, to facilitate epidural analgesia. Epidural analgesia may be used separately for pain management, as an adjunct to general anesthesia, as a sole technique for surgical anesthesia and for post-operative pain management. |

• | Arrow Peripheral Nerve Block ("PNB") Catheters, Pumps, Needles and Kits: Our portfolio of Arrow PNB products, which includes the Arrow Stimucath and FlexBlock catheters, are designed to be used by anesthesiologists to provide localized pain relief by injecting anesthetics to deliberately interrupt the signals traveling along a nerve. Nerve blocks are used in a variety of different procedures, including orthopedics. |

• | AutoFuser Disposable Pain Pumps: Our AutoFuser Disposable Pain Pumps are designed for general infusion use, which includes regional anesthesia and pain management, intra-operative (soft tissue/body cavity) sites, percutaneous, subcutaneous, epidural administration. The AutoFuser offers multiple reservoir sizes and configurations to meet a variety of clinical demands. |

• | Arrow EZ-IO System: The EZ-IO system, as described in the Vascular North America segment summary above, complements our pain management product portfolio when administered in pre-hospital emergency settings. |

Surgical North America: Our surgical products are designed to provide surgeons with a comprehensive range of devices for use in a variety of surgical procedures. Our portfolio, which consists of both single-use and reusable products, include the following:

• | Weck®Ligation Systems: Our Weck Ligation Systems features the Weck Ligating Clips and Hem-o-lok® Ligating Clips. The Weck Ligating Clips are intended for use in procedures involving vessels or anatomic structures and are sold in various sizes, types and materials. Our Hem-o-lok Ligating Clips are intended for use in procedures involving ligation of vessels or tissue structures and are sold in various sizes. |

• | Weck EFx Fascial Closure System: Our Weck EFx endo fascial closure system is a port site closure device used in laparoscopic surgical procedures that is designed to minimize complications and costs associated with port-site herniation. We recently expanded this product line to include the EFx Shield fascial closure system. The Weck Facial Closure Systems are intended to facilitate placement and withdrawal of suture loops to repair port site defects following laparoscopic surgery. |

• | Percutaneous Surgical Systems: Our Mini-Lap surgical instruments, which we added to our product portfolio through our December 2014 acquisition of Mini-Lap Technologies, Inc. ("Mini-Lap"), are designed to be inserted percutaneously (through the skin) to enable surgeons to perform laparoscopic surgery while reducing the need for multiple trocars (access ports). In addition, we have developed our PercuvanceTM percutaneous surgical system with 5 mm attachments, which is indicated for the means to penetrate soft tissue to access certain areas of the human abdomen and used to grasp, hold and manipulate tissue. We received 510(k) clearance for this product in January 2015 and initiated a controlled launch of the product in the United States and Europe in 2015. |

Our other branded surgical products include our Weck Vista bladeless access ports, Deknatel sutures and our Pilling® and Kmedic® surgical instruments.

Europe, the Middle East and Africa (“EMEA”): Our EMEA segment designs, manufactures and distributes medical devices primarily used in critical care, surgical applications and cardiac care and generally serves two end markets: hospitals and healthcare providers, and home health. The products offered by our EMEA segment are most widely used in acute care settings for a range of diagnostic and therapeutic procedures and in general and specialty surgical applications, such as urology.

7

Asia: Our Asia segment, like our EMEA segment, designs, manufactures and distributes medical devices primarily used in critical care, surgical applications and cardiac care and generally serves hospitals and healthcare providers. The products offered by our Asia segment are most widely used in acute care settings for a range of diagnostic and therapeutic procedures and in general and specialty surgical applications.

OEM: Our OEM segment designs, manufactures and supplies devices and instruments for other medical device manufacturers. Our OEM division, which includes the TFX OEM® and Deknatel® OEM brands, provides custom-engineered extrusions, diagnostic and interventional catheters, sheath/dilator sets (introducers) and kits, sutures, performance fibers, and bioresorbable resins and fibers. We offer an extensive portfolio of integrated capabilities, including engineering, material selection, regulatory affairs, prototyping, testing and validation, manufacturing, assembly and packing. As a result of our acquisition of Trintris Medical, Inc. in 2015, the OEM segment expanded its product portfolio to include balloons and balloon catheters.

All other businesses: Our other operating segments do not meet the threshold for separate disclosure under applicable accounting guidance and are therefore included in the “All other” line item in tabular presentations of segment information. Products offered by these operating segments include single-use respiratory, urology and cardiac care products, as well as capital equipment, which are provided to hospitals and other alternative channels of care. Also included in the "All other" line item is our Latin American business.

Respiratory/Urology Product Portfolio

As a result of the business reorganization discussed previously, we combined our respiratory and urology businesses. Our respiratory products are used in a variety of care settings and include oxygen therapy products, aerosol therapy products, spirometry products, and ventilation management products. Our Hudson RCI brand has been a prominent name in respiratory care for over 65 years.

Our urology product portfolio provides bladder management for patients in the hospital and individuals in the home care markets. The product portfolio consists principally of a wide range of catheters (including Foley, intermittent, external and suprapubic), urine collectors, catheterization accessories and products for operative endourology marketed under the Rusch brand name.

Cardiac Care Product Portfolio

Products in this portfolio include diagnostic and intra-aortic balloon catheters and capital equipment. Our diagnostic catheters include thermodilution and wedge pressure catheters; specialized catheters used during the x-ray examination of blood vessels, such as Berman and Reverse Berman catheters; therapeutic delivery catheters, such as temporary pacing catheters; sheaths for femoral and trans-radial aortic access used in diagnostic and therapeutic procedures; and intra-aortic balloon, or IAB, catheters. Capital equipment includes our intra-aortic balloon pump, or IABP, consoles. IABP products are used to augment oxygen delivery to the cardiac muscle and reduce the oxygen demand after cardiac surgery, serious heart attack or interventional procedures. We market our cardiac care products under the Arrow brand name.

Latin America

Our Latin America business generally engages in the same type of operations, and serves the same type of end markets, as the EMEA and Asia segments.

OUR MARKETS

We generally serve three end-markets: hospitals and healthcare providers, medical device manufacturers and home care. These markets are affected by a number of factors, including demographics, utilization and reimbursement patterns. The following charts depict the percentage of net revenues for the years ended December 31, 2015, 2014 and 2013 derived from each of our end markets.

8

HISTORY AND RECENT DEVELOPMENTS

Teleflex was founded in 1943 as a manufacturer of precision mechanical push/pull controls for military aircraft. From this original single market, single product orientation, we expanded and evolved through entries into new businesses, development of new products, introduction of products into new geographic or end-markets and acquisitions and dispositions of businesses. Throughout our history, we have continually focused on providing innovative, technology-driven, specialty-engineered products that help our customers meet their business requirements.

Beginning in 2007, we significantly changed the composition of our portfolio of businesses, expanding our presence in the medical device industry, while divesting all of our other businesses, which served the aerospace, automotive, industrial and marine markets. Following the divestitures of our marine business and cargo container and systems businesses in 2011, we became exclusively a medical device company.

We expect to continue to increase the size of our business through a combination of acquisitions and organic growth initiatives. In recent years, we expanded our product portfolio through select acquisitions, including our 2012 acquisition of substantially all of the assets of LMA International N.V, a global provider of laryngeal masks whose products are used in anesthesia and emergency care, which complements our anesthesia product portfolio, and our 2013 acquisition of Vidacare Corporation ("Vidacare"), a provider of intraosseous, or inside the bone, access devices, which complements our vascular access and anesthesia product portfolios. We continue to complete conversions from distributor sales to direct sales ("distributor-to-direct sales conversions") in certain countries, including Australia, Korea and Japan. Additionally, we continue to execute restructuring programs to improve efficiencies in our sales and marketing and research and development structures and in our manufacturing and distribution facilities.

GOVERNMENT REGULATION

We are subject to comprehensive government regulation both within and outside the United States relating to the development, manufacture, sale and distribution of our products.

Regulation of Medical Devices in the United States

All of our medical devices manufactured or sold in the United States are subject to the Federal Food, Drug, and Cosmetic Act (“FDC Act”), as implemented and enforced by the FDA. The FDA and, in some cases, other government agencies administer requirements for the design, testing, safety, effectiveness, manufacturing, labeling, storage, record keeping, clearance, approval, advertising and promotion, distribution, post-market surveillance, import and export of our medical devices.

Unless an exemption or pre-amendment grandfather status applies, each medical device that we market must first receive either clearance as a Class I or Class II device (by submitting a premarket notification (“510(k)”) or approval as a Class III device (by filing a premarket approval application (“PMA”)) from the FDA pursuant to the FDC Act. To obtain 510(k) clearance, a manufacturer must demonstrate that the proposed device is substantially equivalent to a legally marketed 510(k)-cleared device (or pre-amendment device for which FDA has not called for PMAs), referred to as the "predicate device." Substantial equivalence is established by the applicant showing that the proposed device has the same intended use as the predicate device, and it either has the same technological characteristics or has

9

been shown to be equally safe and effective and does not raise different questions of safety and effectiveness as compared to the predicate device. The FDA’s 510(k) clearance process usually takes from four to twelve months, but it can last longer. A device that is not eligible for the 510(k) process because there is no predicate device may be reviewed through the de novo process (the process for approval when no substantially equivalent device exists) if the FDA agrees it is a low to moderate risk device eligible for Class I or Class II designation. A device not eligible for 510(k) clearance or de novo clearance is categorized as Class III and must follow the PMA approval pathway, which requires proof of the safety and effectiveness of the device to the FDA’s satisfaction. The process of obtaining PMA approval is much more costly, lengthy and uncertain than the 510(k) process. It generally takes from one to three years or even longer. Our portfolio of existing products and pipeline of potential new products consist primarily of Class I and Class II devices that require 510(k) clearance. In addition, modifications made to devices after they receive clearance or approval may require a new 510(k) clearance or approval of a PMA or PMA supplement. We cannot be sure that 510(k) clearance or PMA approval will be obtained for any device that we propose to market.

A clinical trial is almost always required to support a PMA application and is sometimes required for a 510(k) clearance. The sponsor of a clinical study must comply with and conduct the study in accordance with the applicable federal regulations, including FDA’s investigational device exemption (“IDE”) requirements, and good clinical practice (“GCP”). Clinical trials must also be approved by an institutional review board ("IRB"), which is an appropriately constituted group that has been formally designated to review and monitor biomedical research involving human subjects and which has the authority to approve, require modifications in, or disapprove research to protect the rights, safety, and welfare of the human research subject. The FDA may order the temporary, or permanent, discontinuation of a clinical trial at any time, or impose other sanctions, if it believes that the clinical trial either is not being conducted in accordance with FDA requirements or presents an unacceptable risk to the clinical trial patients. An IRB may also require the clinical trial at the site to be halted for failure to comply with the IRB’s requirements, or may impose other conditions.

After a device is placed on the market, numerous regulatory requirements continue to apply. Those regulatory requirements include the following:

• | device listing and establishment registration; |

• | adherence to the Quality System Regulation (“QSR”) which requires stringent design, testing, control, documentation, complaint handling and other quality assurance procedures; |

• | labeling requirements; |

• | FDA prohibitions against the promotion of off-label uses or indications; |

• | adverse event and malfunction reporting; |

• | post-approval restrictions or conditions, including post-approval clinical trials or other required testing; |

• | post-market surveillance requirements; |

• | the FDA’s recall authority, whereby it can require or ask for the recall of products from the market; and |

• | voluntary corrections or removals reporting and documentation. |

In September 2013, the FDA issued final regulations and draft guidance documents regarding the Unique Device Identification (“UDI”) System, which will require manufacturers to mark certain medical devices with unique identifiers. While the FDA expects that the UDI System will help track products during recalls and improve patient safety, it will require us to make changes to our manufacturing and labeling, which could increase our costs. The UDI System is being implemented in stages based on device risk, with the first requirements having taken effect in September 2014 and the last taking effect in September 2020.

Certain of our medical devices are sold in convenience kits that include a drug component, such as lidocaine. These types of kits are generally regulated as combination products within the Center for Devices and Radiological Health under the device regulations because the device generates the primary mode of action of the kit. Although the kit as a whole is regulated as a medical device, it may be subject to certain drug requirements such as current good manufacturing practices (“cGMPs”) to the extent applicable to the drug-component repackaging activities and subject to inspection to verify compliance with cGMPs as well as other regulatory requirements.

Our manufacturing facilities, as well as those of certain of our suppliers, are subject to periodic and for-cause inspections to verify compliance with the QSR as well as other regulatory requirements. If the FDA were to find that

10

we or certain of our suppliers have failed to comply with applicable regulations, it could institute a wide variety of enforcement actions, ranging from issuance of a warning or untitled letter to more severe sanctions, such as product recalls or seizures, civil penalties, consent decrees, injunctions, criminal prosecution, operating restrictions, partial suspension or total shutdown of production, refusal to permit importation or exportation, refusal to grant, or delays in granting, clearances or approvals or withdrawal or suspension of existing clearances or approvals. The FDA also has the authority to request repair, replacement or refund of the cost of any medical device manufactured or distributed by us. Any of these actions could have an adverse effect on our business.

Regulation of Medical Devices Outside of the United States

Medical device laws also are in effect in many of the markets outside of the United States in which we do business. These laws range from comprehensive device approval requirements for some or all of our products to requests for product data or certifications. Inspection of and controls over manufacturing, as well as monitoring of device-related adverse events, are components of most of these regulatory systems.

Healthcare Laws

We are subject to various federal, state and local laws in the United States targeting fraud and abuse in the healthcare industry. These laws prohibit us from, among other things, soliciting, offering, receiving or paying any remuneration to induce the referral or use of any item or service reimbursable under Medicare, Medicaid or other federally or state financed healthcare programs. Violations of these laws are punishable by imprisonment, criminal fines, civil monetary penalties and exclusion from participation in federal healthcare programs. In addition, we are subject to federal and state false claims laws in the United States that prohibit the submission of false payment claims under Medicare, Medicaid or other federally or state funded programs. Certain marketing practices, such as off-label promotion, and violations of federal anti-kickback laws may also constitute violations of these laws.

We are also subject to various federal and state reporting and disclosure requirements related to the healthcare industry. Recent rules issued by the Centers for Medicare & Medicaid Services ("CMS") require us to collect and report information on payments or transfers of value to physicians and teaching hospitals, as well as investment interests held by physicians and their immediate family members. The reported data is available to the public on the CMS website. Failure to submit required information may result in civil monetary penalties. In addition, several states now require medical device companies to report expenses relating to the marketing and promotion of device products and to report gifts and payments to individual physicians in these states. Other states prohibit various other marketing-related activities. The federal government and still other states require the posting of information relating to clinical studies and their outcomes. The shifting commercial compliance environment and the need to build and maintain robust and expandable systems to comply with the different compliance and/or reporting requirements among a number of jurisdictions increases the possibility that a healthcare company may violate one or more of the requirements, resulting in increased compliance costs that could adversely impact our results of operations.

Other Regulatory Requirements

We are also subject to the United States Foreign Corrupt Practices Act and similar anti-bribery laws applicable in jurisdictions outside the United State that generally prohibit companies and their intermediaries from improperly offering or paying anything of value to non-United States government officials for the purpose of obtaining or retaining business. Because of the predominance of government-sponsored healthcare systems around the world, most of our customer relationships outside of the United States are with governmental entities and are therefore subject to such anti-bribery laws. Our policies mandate compliance with these anti-bribery laws. We operate in many parts of the world that have experienced governmental corruption to some degree, and in certain circumstances strict compliance with anti-bribery laws may conflict with local customs and practices. In the sale, delivery and servicing of our medical devices and software outside of the United States, we must also comply with various export control and trade embargo laws and regulations, including those administered by the Department of Treasury’s Office of Foreign Assets Control (“OFAC”) and the Department of Commerce’s Bureau of Industry and Security (“BIS”) which may require licenses or other authorizations for transactions relating to certain countries and/or with certain individuals identified by the United States government. Despite our global trade and compliance program, our internal control policies and procedures may not always protect us from reckless or criminal acts committed by our employees, distributors or other agents. Violations of these requirements are punishable by criminal or civil sanctions, including substantial fines and imprisonment.

11

COMPETITION

The medical device industry is highly competitive. We compete with many companies, ranging from small start-up enterprises to companies that are larger and more established than us and have access to significantly greater financial resources. Furthermore, extensive product research and development and rapid technological advances characterize the market in which we compete. We must continue to develop and acquire new products and technologies for our businesses to remain competitive. We believe that we compete primarily on the basis of clinical superiority and innovative features that enhance patient benefit, product reliability, performance, customer and sales support, and cost-effectiveness. Our major competitors include C. R. Bard, Inc., Medtronic plc and Becton, Dickinson and Company.

SALES AND MARKETING

Our product sales are made directly to hospitals, healthcare providers, distributors and to original equipment manufacturers of medical devices through our own sales forces, independent representatives and independent distributor networks.

BACKLOG

Most of our products are sold to hospitals or healthcare providers on orders calling for delivery within a few days or weeks, with longer order times for products sold to medical device manufacturers. Therefore, our backlog of orders is not indicative of revenues to be anticipated in any future 12-month period.

PATENTS AND TRADEMARKS

We own a portfolio of patents, patents pending and trademarks. We also license various patents and trademarks. Patents for individual products extend for varying periods according to the date of patent filing or grant and the legal term of patents in the various countries where patent protection is obtained. Trademark rights may potentially extend for longer periods of time and are dependent upon national laws and use of the marks. All product names throughout this document are trademarks owned by, or licensed to, us or our subsidiaries. Although these have been of value and are expected to continue to be of value in the future, we do not consider any single patent or trademark, except for the Teleflex and Arrow brands, to be essential to the operation of our business.

SUPPLIERS AND MATERIALS

Materials used in the manufacture of our products are purchased from a large number of suppliers in diverse geographic locations. We are not dependent on any single supplier for a substantial amount of the materials used or components supplied for our overall operations. Most of the materials and components we use are available from multiple sources, and where practical, we attempt to identify alternative suppliers. Volatility in commodity markets, particularly aluminum, steel and plastic resins, can have a significant impact on the cost of producing certain of our products. We may not be able to successfully pass cost increases through to all of our customers, particularly original equipment manufacturers.

RESEARCH AND DEVELOPMENT

We are engaged in both internal and external research and development. Our research and development costs principally relate to our efforts to bring innovative new products to the markets we serve, and our efforts to enhance the clinical value, ease of use, safety and reliability of our existing product lines. Our research and development efforts support our strategic objectives to provide safe and effective products that reduce infections, improve patient and clinician safety, enhance patient outcomes and enable less invasive procedures. Our research and development expenditures were $52.1 million, $61.0 million and $65.0 million for the years ended December 31, 2015, 2014 and 2013, respectively.

We also acquire or license products and technologies that are consistent with our strategic objectives and enhance our ability to provide a full range of product and service options to our customers.

12

SEASONALITY

Portions of our revenues are subject to seasonal fluctuations. Incidence of flu and other disease patterns as well as the frequency of elective medical procedures affect revenues related to single-use products. Historically, we have experienced higher sales in the fourth quarter as a result of these factors.

EMPLOYEES

We employed approximately 12,200 full-time and temporary employees at December 31, 2015. Of these employees, approximately 2,900 were employed in the United States and 9,300 in countries other than the United States. Approximately 4% percent of our employees in the United States and in other countries were covered by union contracts or collective-bargaining arrangements. We believe we have good relationships with our employees.

ENVIRONMENTAL

We are subject to various environmental laws and regulations both within and outside the United States. Our operations, like those of other medical device companies, involve the use of substances regulated under environmental laws, primarily in manufacturing and sterilization processes. While we continue to make capital and operational expenditures relating to compliance with existing environmental laws and regulations, we cannot ensure that our costs of complying with current or future environmental protection, health and safety laws and regulations will not exceed our estimates or will not have a material adverse effect on our business, financial condition, results of operations and cash flows. Further, we cannot ensure that we will not be subject to additional environmental claims for personal injury or cleanup in the future based on our past, present or future business activities.

INVESTOR INFORMATION

We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Therefore, we file reports, proxy statements and other information with the Securities and Exchange Commission (SEC). Copies of these reports, proxy statements, and other information may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, NE, Washington, DC 20549 or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains a website (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

You can access financial and other information about us in the Investors section of our website, which can be accessed at www.teleflex.com. We make available through our website, free of charge, copies of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed with or furnished to the SEC under Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after electronically filing or furnishing such material to the SEC. The information on our website is not part of this Annual Report on Form 10-K. The reference to our website address is intended to be an inactive textual reference only.

We are a Delaware corporation incorporated in 1943. Our executive offices are located at 550 East Swedesford Road, Suite 400, Wayne, PA 19087.

EXECUTIVE OFFICERS

The names and ages of our executive officers and the positions and offices held by each such officer are as follows:

Name | Age | Positions and Offices with Company | |||

Benson F. Smith | 68 | Chairman, President, Chief Executive Officer and Director | |||

Liam J. Kelly | 49 | Executive Vice President and Chief Operating Officer | |||

Thomas E. Powell | 54 | Executive Vice President and Chief Financial Officer | |||

Thomas A. Kennedy | 53 | Senior Vice President, Global Operations | |||

Karen T. Boylan | 44 | Vice President, Global RA/QA | |||

Cameron P. Hicks | 51 | Vice President, Global Human Resources | |||

James J. Leyden | 49 | Vice President, General Counsel and Secretary | |||

13

Mr. Smith has been our Chairman, President and Chief Executive Officer since January 2011, and has served as a Director since April 2005. Prior to January 2011, Mr. Smith was the managing partner of Sales Research Group, a research and consulting organization. From 1999 to January 2011, he also served as the Chief Executive Officer of BFS & Associates LLC, which specialized in strategic planning and venture investing. From 2000 until 2005, Mr. Smith also served as a speaker and author at The Gallup Organization, a global research-based consultancy firm. Previously, Mr. Smith worked for C.R. Bard, Inc., a company specializing in medical devices, for approximately 25 years, where he held various executive and senior level positions, most recently as President and Chief Operating Officer from 1994 to 1998.

Mr. Kelly has been our Executive Vice President and Chief Operating Officer since April 2015. From April 2014 to April 2015, Mr. Kelly served as Executive Vice President and President, Americas. From June 2012 to April 2014 Mr. Kelly served as Executive Vice President and President, International. He also has held several positions with regard to our EMEA segment, including President from June 2011 to June 2012, Executive Vice President from November 2009 to June 2011, and Vice President of Marketing from April 2009 to November 2009. Prior to joining Teleflex, Mr. Kelly held various senior level positions with Hill-Rom Holdings, Inc., a medical device company, from October 2002 to April 2009, serving as its Vice President of International Marketing and R&D from August 2006 to February 2009.

Mr. Powell has been our Executive Vice President and Chief Financial Officer since February 2013. From March 2012 to February 2013, Mr. Powell was Senior Vice President and Chief Financial Officer. He joined Teleflex in August 2011 as Senior Vice President, Global Finance. Prior to joining Teleflex, Mr. Powell served as Chief Financial Officer and Treasurer of Tomotherapy Incorporated, a medical device company, from June 2009 until June 2011. In 2008, he served as Chief Financial Officer of Textura Corporation, a software provider. From April 2001 until January 2008, Mr. Powell was employed by Midway Games, Inc., a software provider, serving as its Executive Vice President, Chief Financial Officer and Treasurer from September 2001 until January 2008. Mr. Powell has also held leadership positions with Dade Behring, Inc. (now Siemens Healthcare Diagnostics), PepsiCo, Bain & Company, Tenneco Inc. and Arthur Andersen & Company.

Mr. Kennedy has been our Senior Vice President, Global Operations since May 2013. He previously held the position of Vice President, International Operations from December 2012 to May 2013. From July 2007 to December 2012, he held the position of Vice President, EMEA Operations. Prior to joining Teleflex, Mr. Kennedy was a managing director for Saint Gobain Performance Plastics, a producer of engineered, high-performance polymer products, from September 2004 to May 2007. Mr. Kennedy also has held leadership positions with Bio-Medical Research Limited, Marconi Plc, Fore Systems, Inc. and American Power Conversion Corporation.

Ms. Boylan has been our Vice President, Global RA/QA since August 2014. She joined Teleflex in January 2013 as Vice President, International RA/QA. Prior to joining Teleflex, Ms. Boylan served as QA Vice President, Corporate Quality Systems for Boston Scientific Corporation, a developer, manufacturer and marketer of medical devices, from April 1996 to December 2012.

Mr. Hicks has been our Vice President, Global Human Resources since April 2013. Prior to joining Teleflex, Mr. Hicks served as Executive Vice President of Human Resources & Organizational Effectiveness for Harlan Laboratories, Inc., a private global provider of pre-clinical and non-clinical research services, from July 2010 to March 2013. From April 1990 to January 2010, Mr. Hicks held various leadership roles with MDS Inc., a provider of products and services for the development of drugs and the diagnosis and treatment of disease, including Senior Vice President of Human Resources for MDS’ global Pharma Services division from November 2000 to January 2010.

Mr. Leyden has been our Vice President, General Counsel and Secretary since February 2014. He previously held the positions of Acting General Counsel from November 2013 to February 2014, Deputy General Counsel from February 2013 to November 2013 and Associate General Counsel from December 2004 to February 2013. Prior to joining Teleflex, Mr. Leyden served as general counsel of InfraSource Services, Inc., a utility infrastructure construction company, from April 2004 to December 2004. From February 2002 to April 2004, he served as Associate General Counsel of Aramark Corporation, a provider of food, facility and uniform services.

Our officers are elected annually by our board of directors. Each officer serves at the discretion of the board.

14

ITEM 1A. | RISK FACTORS |

In addition to the other information set forth in this Annual Report on Form 10-K, you should carefully consider the following factors which could have a material adverse effect on our business, financial condition, results of operations or stock price. The risks below are not the only risks we face. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also adversely affect our business, financial condition, results of operations or stock price.

We face strong competition. Our failure to successfully develop and market new products could adversely affect our business.

The medical device industry is highly competitive. We compete with many domestic and foreign medical device companies ranging from small start-up enterprises that might sell only a single or limited number of competitive products or compete only in a specific market segment, to companies that are larger and more established than us, have a broad range of competitive products, participate in numerous markets and have access to significantly greater financial and marketing resources than we do.

In addition, the medical device industry is characterized by extensive product research and development and rapid technological advances. The future success of our business will depend, in part, on our ability to design and manufacture new competitive products and enhance existing products. Our product development efforts may require us to make substantial investments. There can be no assurance that we will be able to successfully develop new products, enhance existing products or achieve market acceptance of our products, due to, among other things, our inability to:

• | identify viable new products; |

• | obtain adequate intellectual property protection; |

• | gain market acceptance of new products; or |

• | successfully obtain regulatory approvals. |

In addition, our competitors currently may be developing, or may develop in the future, products that provide better features, clinical outcomes or economic value than those that we currently offer or subsequently develop. Our failure to successfully develop and market new products or enhance existing products could have a material adverse effect on our business, financial condition and results of operations.

Our customers depend on third party coverage and reimbursements and the failure of healthcare programs to provide coverage and reimbursement, or the reduction in reimbursement levels, for our medical products could adversely affect us.

The ability of our customers to obtain coverage and reimbursement for our products is important to our business. Demand for many of our existing and new medical products is, and will continue to be, affected by the extent to which government healthcare programs and private health insurers reimburse our customers for patients’ medical expenses in the countries where we do business. Even when we develop or acquire a promising new product, demand for the product may be limited unless reimbursement approval is obtained from private and governmental third party payors. Internationally, healthcare reimbursement systems vary significantly. In some countries, medical centers are constrained by fixed budgets, regardless of the extent of their patient treatment. Other countries require application for, and approval of, government or third party reimbursement. Without both favorable coverage determinations by, and the financial support of, government and third party insurers, the market for many of our medical products would be adversely affected. We cannot be sure that third party payors will maintain the current level of coverage and reimbursement to our customers for use of our existing products. Adverse coverage determinations or any reduction in the amount of reimbursement could harm our business by reducing customers’ selection of our products and the prices they are willing to pay.

In addition, as a result of their purchasing power, third party payors are implementing cost cutting measures such as seeking discounts, price reductions or other incentives from medical products suppliers and imposing limitations on coverage and reimbursement for medical technologies and procedures. These trends could compel us to reduce prices for our products and could cause a decrease in the size of the market or a potential increase in competition that could negatively affect our business, financial condition and results of operations.

15

We may not be successful in achieving expected operating efficiencies and sustaining or improving operating expense reductions, and may experience business disruptions associated with restructuring, facility consolidations, realignment, cost reduction and other strategic initiatives.

Over the past several years we have implemented a number of restructuring, realignment and cost reduction initiatives, including facility consolidations, organizational realignments and reductions in our workforce. While we have realized some efficiencies from these actions, we may not realize the benefits of these initiatives to the extent we anticipated. Further, such benefits may be realized later than expected, and the ongoing difficulties in implementing these measures may be greater than anticipated, which could cause us to incur additional costs or result in business disruptions. In addition, if these measures are not successful or sustainable, we may be compelled to undertake additional realignment and cost reduction efforts, which could result in significant additional charges. Moreover, if our restructuring and realignment efforts prove ineffective, our ability to achieve our other strategic and business plan goals may be adversely affected.

In addition, as part of our efforts to increase operating efficiencies, we have implemented a number of initiatives over the past several years to consolidate our enterprise resource planning, or ERP, systems. For example, between 2012 and 2013, we migrated our Arrow business from a separate ERP system to our principal ERP system. To date, we have not experienced any significant disruptions to our business or operations in connection with these initiatives. However, as we continue our efforts to further consolidate our ERP systems, we could experience business disruptions, which could adversely affect customer relationships and divert the attention of management away from daily operations. In addition, any delays in the implementation of these initiatives could cause us to incur additional unexpected costs. Should we experience such difficulties, our business, cash flows and results of operations could be adversely affected.

We are subject to extensive government regulation, which may require us to incur significant expenses to ensure compliance. Our failure to comply with those regulations could have a material adverse effect on our business, results of operations, financial condition and cash flows.

Our products are classified as medical devices and are subject to extensive regulation in the United States by the FDA and by comparable government agencies in other countries. The regulations govern, among other things, the development, design, approval, manufacturing, labeling, importing and exporting and sale and marketing of many of our products. Moreover, these regulations are subject to future change.

In the United States, before we can market a new medical device, or a new use of, or claim for, or significant modification to, an existing product, we generally must first receive either 510(k) or de novo clearance or approval of a premarket approval application, or PMA, from the FDA. Similarly, most major markets for medical devices outside the United States also require clearance, approval or compliance with certain standards before a product can be commercially marketed. The process of obtaining regulatory clearances and approvals to market a medical device, particularly from the FDA and certain foreign governmental authorities, can be costly and time consuming, and clearances and approvals might not be granted for new products on a timely basis, if at all. In addition, once a device has been cleared or approved, a new clearance or approval may be required before the device may be modified or its labeling changed. Furthermore, the FDA or a foreign governmental authority may make its review and clearance or approval process more rigorous, which could require us to generate additional clinical or other data, and expend more time and effort, in obtaining future product clearances or approvals. The regulatory clearance and approval process may result in, among other things, delayed realization of product revenues, substantial additional costs or limitations on indicated uses of products, any one of which could have a material adverse effect on our financial condition and results of operations. Even after a product has received marketing approval or clearance, such product approval or clearance can be withdrawn or limited due to unforeseen problems with the device or issues relating to its application.

Failure to comply with applicable regulations could lead to adverse effects on our business, which could include:

• | partial suspension or total shutdown of manufacturing; |

• | product shortages; |

• | delays in product manufacturing; |

• | warning or untitled letters; |

• | fines or civil penalties; |

• | delays in obtaining new regulatory clearances or approvals; |

16

• | withdrawal or suspension of required clearances, approvals or licenses; |

• | product seizures or recalls; |

• | injunctions; |

• | criminal prosecution; |

• | advisories or other field actions; |

• | operating restrictions; and |

• | prohibitions against exporting of products to, or importing products from, countries outside the United States. |

We could be required to expend significant financial and human resources to remediate failures to comply with applicable regulations and quality assurance guidelines. In addition, civil and criminal penalties, including exclusion under Medicaid or Medicare, could result from regulatory violations. Any one or more of these events could have a material adverse effect on our business, financial condition and results of operations.

Medical devices are cleared or approved for one or more specific intended uses and performance claims must be adequately substantiated. Promoting a device for an off-label use or making misleading or unsubstantiated claims could result in government enforcement action.

Furthermore, our facilities are subject to periodic inspection by the FDA and other federal, state and foreign government authorities, which require manufacturers of medical devices to adhere to certain regulations, including the FDA’s Quality System Regulation, which requires periodic audits, design controls, quality control testing and documentation procedures, as well as complaint evaluations and investigation. In addition, any facilities assembling convenience kits that include drug components and are registered as drug repackaging establishments are also subject to current good manufacturing practices requirements for drugs. The FDA also requires the reporting of certain adverse events and product malfunctions and may require the reporting of recalls or other field safety corrective actions. Issues identified through such inspections and reports may result in FDA enforcement action through any of the actions discussed above. Moreover, issues identified through such inspections and reports may require significant resources to resolve.

We are subject to healthcare fraud and abuse laws, regulation and enforcement; our failure to comply with those laws could have a material adverse effect on our results of operations and financial condition.

We are subject to healthcare fraud and abuse regulation and enforcement by the federal government and the governments of those states and foreign countries in which we conduct our business. The laws that may affect our ability to operate include:

• | the federal healthcare anti-kickback statute, which, among other things, prohibits persons from knowingly and willfully offering or paying remuneration to induce either the referral of an individual for, or the purchase, order or recommendation of, any good or service for which payment may be made under federal healthcare programs such as Medicare and Medicaid, or soliciting payment for such referrals, purchases, orders and recommendations; |

• | federal false claims laws which, among other things, prohibit individuals or entities from knowingly presenting, or causing to be presented, false or fraudulent claims for payment from the federal government, including Medicare, Medicaid or other third-party payors; |

• | the federal Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), which prohibits schemes to defraud any healthcare benefit program and false statements relating to healthcare matters; and |

• | state law equivalents of each of the above federal laws, such as anti-kickback and false claims laws which may apply to items or services reimbursed by any third-party payor, including commercial insurers. |

If our operations are found to be in violation of any of these laws or any other government regulations, we may be subject to penalties, including civil and criminal penalties, damages, fines, the curtailment or restructuring of our operations, the exclusion from participation in federal and state healthcare programs and imprisonment of personnel, any of which could adversely affect our ability to operate our business and our financial results. The risk of our being found to have violated these laws is increased by the fact that many of them have not been fully interpreted by the regulatory authorities or the courts, and their provisions are open to a variety of interpretations.

17

Further, the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act (collectively, the “Affordable Care Act”), imposed annual reporting and disclosure requirements on device manufacturers for any “transfer of value” made or distributed to physicians or teaching hospitals. Our first report was submitted in 2014, and the reported information was made publicly available in a searchable format in September 2014. In addition, device manufacturers are required to report and disclose any investment interests held by physicians and their immediate family members during the preceding calendar year. Failure to submit required information may result in civil monetary penalties for each payment, transfer of value or ownership or investment interests not reported in an annual submission, up to an aggregate of $150,000 per year (and up to an aggregate of $1 million per year for “knowing failures”).

In addition, there has been a recent trend of increased federal and state regulation of payments made to healthcare providers. Some states, such as California, Connecticut, Nevada and Massachusetts, mandate implementation of compliance programs that include the tracking and reporting of gifts, compensation for consulting and other services, and other remuneration to healthcare providers. The shifting commercial compliance environment and the need to build and maintain robust and expandable systems to comply with the different compliance and/or reporting requirements among a number of jurisdictions increases the possibility that we may inadvertently violate one or more of the requirements, resulting in increased compliance costs that could adversely impact our results of operations.

We may incur material losses and costs as a result of product liability and warranty claims, as well as product recalls, any of which may adversely affect our results of operations and financial condition. Furthermore, as a medical device company, our reputation may be damaged if one or more of our products are, or are alleged to be, defective.

Our businesses expose us to potential product liability risks that are inherent in the design, manufacture and marketing of our products. In particular, our medical device products are often used in surgical and intensive care settings with seriously ill patients. In addition, many of our products are designed to be implanted in the human body for varying periods of time. Product defects or inadequate disclosure of product-related risks with respect to products we manufacture or sell could result in patient injury or death. In addition, in connection with the divestitures of our former non-medical businesses, we agreed to retain certain liabilities related to those businesses, which include, among other things, liability for products manufactured prior to the date on which we completed the sale of the business. Product liability and warranty claims often involve very large or indeterminate amounts, including punitive damages. The magnitude of potential losses from product liability lawsuits may remain unknown for substantial periods of time, and the related legal defense costs may be significant. We could experience material warranty or product liability losses in the future and incur significant costs to defend these claims.

In addition, if any of our products are, or are alleged to be, defective, we may voluntarily participate, or be required by regulatory authorities to participate, in a recall of that product. In the event of a recall, we may lose sales and be exposed to individual or class-action litigation claims. Moreover, negative publicity regarding a quality or safety issue, whether accurate or inaccurate, could harm our reputation, decrease demand for our products, lead to product withdrawals or impair our ability to successfully launch and market our products in the future. Product liability, warranty and recall costs may have a material adverse effect on our business, financial condition, results of operations and cash flows.

The ongoing volatility in the domestic and global financial markets, combined with a continuation of constrained global credit markets could adversely impact our results of operations, financial condition and liquidity.

We are subject to risks arising from adverse changes in general domestic and global economic conditions. The economic slowdown and disruption of credit markets that occurred in recent years led to recessionary conditions and depressed levels of consumer and commercial spending, resulting in reductions, delays or cancellations of purchases of our products and services and continues to cause disruption in the financial markets, including diminished liquidity and credit availability. We cannot predict the duration or extent of any economic recovery or the extent to which our customers will return to more typical spending behaviors. The continuation of the present broad economic trends of weak economic growth, constricted credit, public sector austerity measures in response to public budget deficits and foreign currency volatility, particularly the euro, could have a material adverse effect on our results of operations, financial condition and liquidity.

Additionally, our customers, particularly in the European region, have extended or delayed payments for products and services already provided, which has increased our focus on collectability with respect to our accounts receivable

18

from these customers. To date, we have not experienced an inordinate amount of payment defaults by our customers, and we have sufficient lending commitments in place to enable us to fund our foreseeable additional operating needs. However, the ongoing uncertainty in the European financial markets, combined with a continuation of constrained European credit markets creates a risk that some of our European customers and suppliers may be unable to access liquidity. As of December 31, 2015 and 2014, our net current and long term accounts receivable in Italy, Spain, Portugal and Greece were $62.3 million and $76.2 million, respectively. In 2015, 2014 and 2013, net revenues from these countries were approximately 7%, 8% and 8% of total net revenues, respectively, and average days that accounts receivable from these countries were outstanding were 204, 223 and 260 days, respectively. Although we maintain allowances for doubtful accounts to cover the estimated losses which may occur when customers cannot make their required payments, we cannot be assured that we will continue to experience the same loss rate in the future given the volatility in the worldwide economy. If our allowance for doubtful accounts is insufficient to address receivables we ultimately determine are uncollectible, we would be required to incur additional charges, which could materially adversely affect our results of operations. Moreover, our inability to collect outstanding receivables could adversely affect our financial condition and cash flow from operations.

In addition, adverse economic and financial market conditions may result in future impairment charges with respect to our goodwill and other intangible assets, which would not directly affect our liquidity but could have a material adverse effect on our reported financial results.

Our strategic initiatives, including acquisitions, may not produce the intended growth in revenue and operating income.

Our strategic initiatives include making significant investments designed to achieve revenue growth and margin improvement targets. If we do not achieve the expected benefits from these investments or otherwise fail to execute on our strategic initiatives, we may not achieve the growth improvement we are targeting and our results of operations may be adversely affected.