Attached files

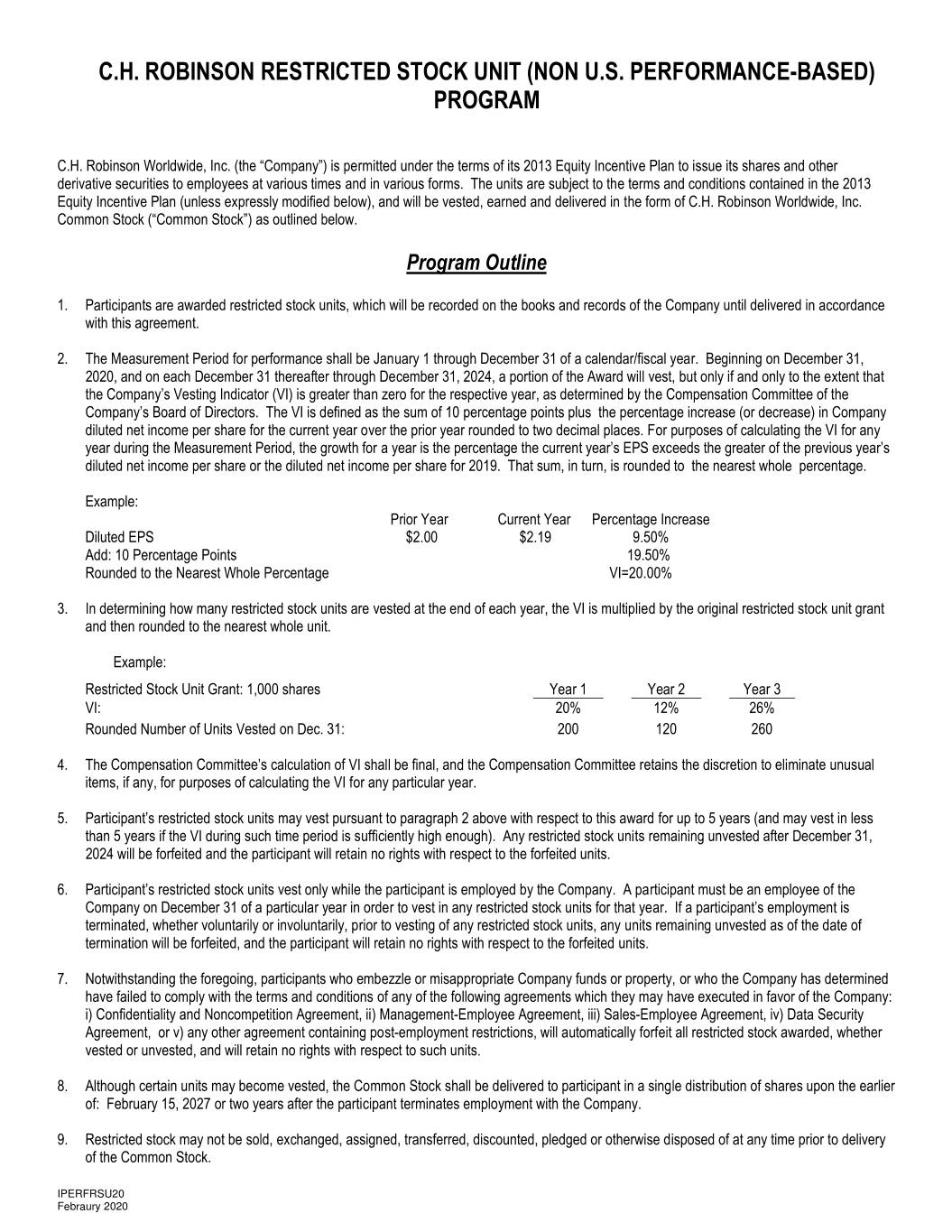

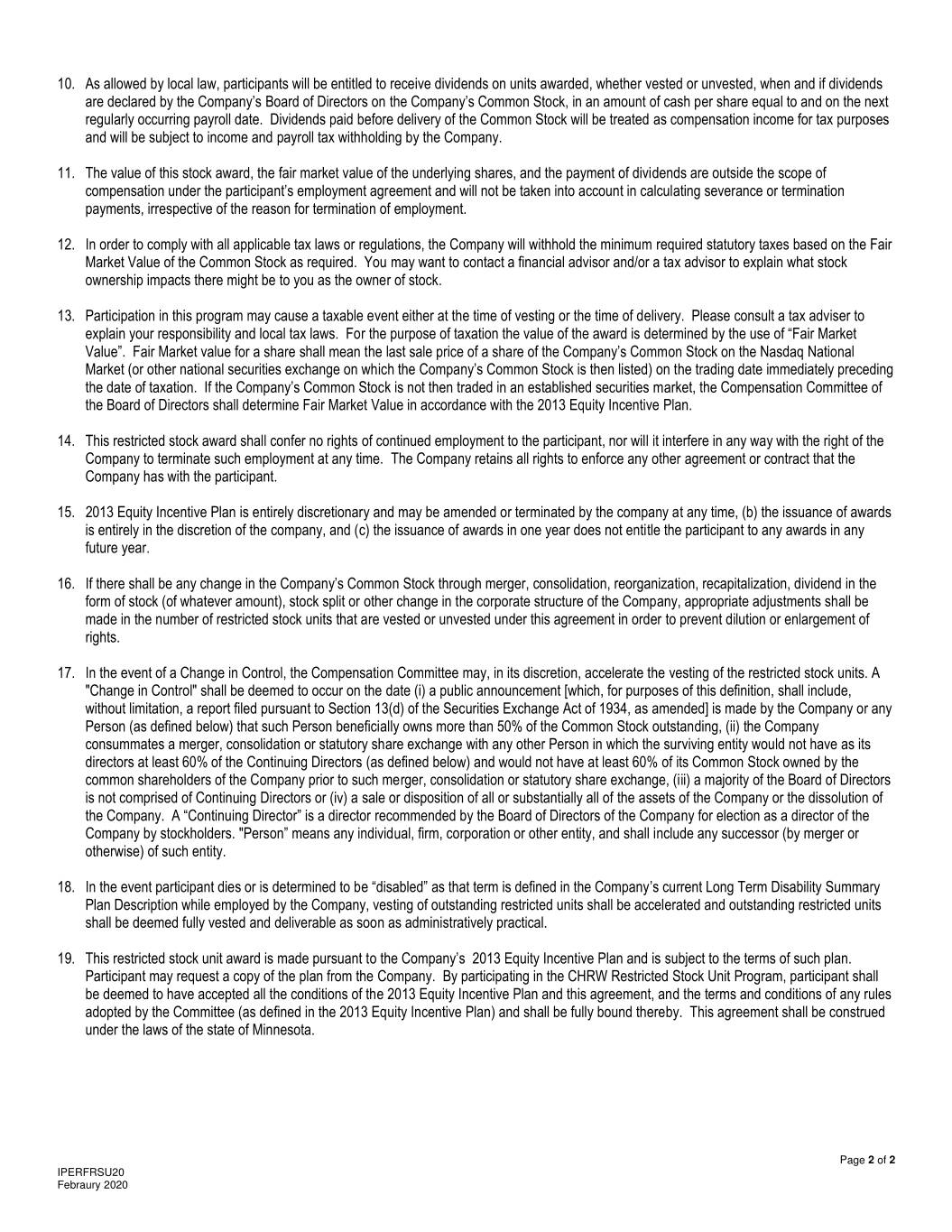

C.H. ROBINSON RESTRICTED STOCK UNIT (NON U.S. PERFORMANCE-BASED) PROGRAM C.H. Robinson Worldwide, Inc. (the “Company”) is permitted under the terms of its 2013 Equity Incentive Plan to issue its shares and other derivative securities to employees at various times and in various forms. The units are subject to the terms and conditions contained in the 2013 Equity Incentive Plan (unless expressly modified below), and will be vested, earned and delivered in the form of C.H. Robinson Worldwide, Inc. Common Stock (“Common Stock”) as outlined below. Program Outline 1. Participants are awarded restricted stock units, which will be recorded on the books and records of the Company until delivered in accordance with this agreement. 2. The Measurement Period for performance shall be January 1 through December 31 of a calendar/fiscal year. Beginning on December 31, 2020, and on each December 31 thereafter through December 31, 2024, a portion of the Award will vest, but only if and only to the extent that the Company’s Vesting Indicator (VI) is greater than zero for the respective year, as determined by the Compensation Committee of the Company’s Board of Directors. The VI is defined as the sum of 10 percentage points plus the percentage increase (or decrease) in Company diluted net income per share for the current year over the prior year rounded to two decimal places. For purposes of calculating the VI for any year during the Measurement Period, the growth for a year is the percentage the current year’s EPS exceeds the greater of the previous year’s diluted net income per share or the diluted net income per share for 2019. That sum, in turn, is rounded to the nearest whole percentage. Example: Prior Year Current Year Percentage Increase Diluted EPS $2.00 $2.19 9.50% Add: 10 Percentage Points 19.50% Rounded to the Nearest Whole Percentage VI=20.00% 3. In determining how many restricted stock units are vested at the end of each year, the VI is multiplied by the original restricted stock unit grant and then rounded to the nearest whole unit. Example : Restricted Stock Unit Grant: 1,000 shares Year 1 Year 2 Year 3 VI: 20% 12% 26% Rounded Number of Units Vested on Dec. 31: 200 120 260 4. The Compensation Committee’s calculation of VI shall be final, and the Compensation Committee retains the discretion to eliminate unusual items, if any, for purposes of calculating the VI for any particular year. 5. Participant’s restricted stock units may vest pursuant to paragraph 2 above with respect to this award for up to 5 years (and may vest in less than 5 years if the VI during such time period is sufficiently high enough). Any restricted stock units remaining unvested after December 31, 2024 will be forfeited and the participant will retain no rights with respect to the forfeited units. 6. Participant’s restricted stock units vest only while the participant is employed by the Company. A participant must be an employee of the Company on December 31 of a particular year in order to vest in any restricted stock units for that year. If a participant’s employment is terminated, whether voluntarily or involuntarily, prior to vesting of any restricted stock units, any units remaining unvested as of the date of termination will be forfeited, and the participant will retain no rights with respect to the forfeited units. 7. Notwithstanding the foregoing, participants who embezzle or misappropriate Company funds or property, or who the Company has determined have failed to comply with the terms and conditions of any of the following agreements which they may have executed in favor of the Company: i) Confidentiality and Noncompetition Agreement, ii) Management-Employee Agreement, iii) Sales-Employee Agreement, iv) Data Security Agreement, or v) any other agreement containing post-employment restrictions, will automatically forfeit all restricted stock awarded, whether vested or unvested, and will retain no rights with respect to such units. 8. Although certain units may become vested, the Common Stock shall be delivered to participant in a single distribution of shares upon the earlier of: February 15, 2027 or two years after the participant terminates employment with the Company. 9. Restricted stock may not be sold, exchanged, assigned, transferred, discounted, pledged or otherwise disposed of at any time prior to delivery of the Common Stock. IPERFRSU20 Febraury 2020

10. As allowed by local law, participants will be entitled to receive dividends on units awarded, whether vested or unvested, when and if dividends are declared by the Company’s Board of Directors on the Company’s Common Stock, in an amount of cash per share equal to and on the next regularly occurring payroll date. Dividends paid before delivery of the Common Stock will be treated as compensation income for tax purposes and will be subject to income and payroll tax withholding by the Company. 11. The value of this stock award, the fair market value of the underlying shares, and the payment of dividends are outside the scope of compensation under the participant’s employment agreement and will not be taken into account in calculating severance or termination payments, irrespective of the reason for termination of employment. 12. In order to comply with all applicable tax laws or regulations, the Company will withhold the minimum required statutory taxes based on the Fair Market Value of the Common Stock as required. You may want to contact a financial advisor and/or a tax advisor to explain what stock ownership impacts there might be to you as the owner of stock. 13. Participation in this program may cause a taxable event either at the time of vesting or the time of delivery. Please consult a tax adviser to explain your responsibility and local tax laws. For the purpose of taxation the value of the award is determined by the use of “Fair Market Value”. Fair Market value for a share shall mean the last sale price of a share of the Company’s Common Stock on the Nasdaq National Market (or other national securities exchange on which the Company’s Common Stock is then listed) on the trading date immediately preceding the date of taxation. If the Company’s Common Stock is not then traded in an established securities market, the Compensation Committee of the Board of Directors shall determine Fair Market Value in accordance with the 2013 Equity Incentive Plan. 14. This restricted stock award shall confer no rights of continued employment to the participant, nor will it interfere in any way with the right of the Company to terminate such employment at any time. The Company retains all rights to enforce any other agreement or contract that the Company has with the participant. 15. 2013 Equity Incentive Plan is entirely discretionary and may be amended or terminated by the company at any time, (b) the issuance of awards is entirely in the discretion of the company, and (c) the issuance of awards in one year does not entitle the participant to any awards in any future year. 16. If there shall be any change in the Company’s Common Stock through merger, consolidation, reorganization, recapitalization, dividend in the form of stock (of whatever amount), stock split or other change in the corporate structure of the Company, appropriate adjustments shall be made in the number of restricted stock units that are vested or unvested under this agreement in order to prevent dilution or enlargement of rights. 17. In the event of a Change in Control, the Compensation Committee may, in its discretion, accelerate the vesting of the restricted stock units. A "Change in Control" shall be deemed to occur on the date (i) a public announcement [which, for purposes of this definition, shall include, without limitation, a report filed pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended] is made by the Company or any Person (as defined below) that such Person beneficially owns more than 50% of the Common Stock outstanding, (ii) the Company consummates a merger, consolidation or statutory share exchange with any other Person in which the surviving entity would not have as its directors at least 60% of the Continuing Directors (as defined below) and would not have at least 60% of its Common Stock owned by the common shareholders of the Company prior to such merger, consolidation or statutory share exchange, (iii) a majority of the Board of Directors is not comprised of Continuing Directors or (iv) a sale or disposition of all or substantially all of the assets of the Company or the dissolution of the Company. A “Continuing Director” is a director recommended by the Board of Directors of the Company for election as a director of the Company by stockholders. "Person” means any individual, firm, corporation or other entity, and shall include any successor (by merger or otherwise) of such entity. 18. In the event participant dies or is determined to be “disabled” as that term is defined in the Company’s current Long Term Disability Summary Plan Description while employed by the Company, vesting of outstanding restricted units shall be accelerated and outstanding restricted units shall be deemed fully vested and deliverable as soon as administratively practical. 19. This restricted stock unit award is made pursuant to the Company’s 2013 Equity Incentive Plan and is subject to the terms of such plan. Participant may request a copy of the plan from the Company. By participating in the CHRW Restricted Stock Unit Program, participant shall be deemed to have accepted all the conditions of the 2013 Equity Incentive Plan and this agreement, and the terms and conditions of any rules adopted by the Committee (as defined in the 2013 Equity Incentive Plan) and shall be fully bound thereby. This agreement shall be construed under the laws of the state of Minnesota. Page 2 of 2 IPERFRSU20 Febraury 2020