Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WELLTOWER INC. | a4q198-k.htm |

| EX-99.1 - EXHIBIT 99.1 - WELLTOWER INC. | a4q19earningsrelease991.htm |

Table of Contents | |

Overview | |

(dollars in thousands, at Welltower pro rata ownership) | |||||||||||||||||

Portfolio Composition | Beds/Unit Mix | ||||||||||||||||

Average Age | Properties | Total | Independent Living | Assisted Living | Memory Care | Long-Term/ Post-Acute Care | |||||||||||

Seniors Housing Operating | 16 | 612 | 73,058 | 35,267 | 26,051 | 11,200 | 540 | ||||||||||

Seniors Housing Triple-net | 14 | 341 | 27,774 | 4,970 | 16,207 | 6,227 | 370 | ||||||||||

Outpatient Medical | 14 | 392 | 23,608,411 | (1) | n/a | n/a | n/a | n/a | |||||||||

Health System | 31 | 218 | 26,212 | 201 | 723 | 3,051 | 22,237 | ||||||||||

Long-Term/Post-Acute Care | 18 | 138 | 16,204 | 40 | 873 | — | 15,291 | ||||||||||

Total | 16 | 1,701 | |||||||||||||||

NOI Performance | Same Store(2) | In-Place Portfolio(3) | ||||||||||||||||||||

Properties | 4Q18 NOI | 4Q19 NOI | % Change | Properties | Annualized In-Place NOI | % of Total | ||||||||||||||||

Seniors Housing Operating | 409 | $ | 191,170 | $ | 194,101 | 1.5 | % | 561 | $ | 904,136 | 43.0 | % | ||||||||||

Seniors Housing Triple-net(4) | 293 | 88,530 | 91,091 | 2.9 | % | 320 | 411,968 | 19.6 | % | |||||||||||||

Outpatient Medical | 236 | 73,031 | 74,677 | 2.3 | % | 370 | 464,820 | 22.1 | % | |||||||||||||

Health System | 215 | 35,307 | 35,795 | 1.4 | % | 215 | 143,168 | 6.8 | % | |||||||||||||

Long-Term/Post-Acute Care(4) | 124 | 41,144 | 42,932 | 4.3 | % | 135 | 179,780 | 8.5 | % | |||||||||||||

Total | 1,277 | $ | 429,182 | $ | 438,596 | 2.2 | % | 1,601 | $ | 2,103,872 | 100.0 | % | ||||||||||

Portfolio Performance | Facility Revenue Mix | |||||||||||||||||

Stable Portfolio(5) | Occupancy | EBITDAR Coverage(6) | EBITDARM Coverage(6) | Private Pay | Medicaid | Medicare | Other Government(7) | |||||||||||

Seniors Housing Operating | 87.2 | % | n/a | n/a | 97.3 | % | 0.8 | % | 0.5 | % | 1.4 | % | ||||||

Seniors Housing Triple-net | 86.1 | % | 1.03 | 1.20 | 93.0 | % | 3.1 | % | 0.4 | % | 3.5 | % | ||||||

Outpatient Medical | 93.9 | % | n/a | n/a | 99.7 | % | — | — | 0.3 | % | ||||||||

Health System(8) | 83.3 | % | 2.06 | 2.77 | 36.2 | % | 43.1 | % | 20.7 | % | — | |||||||

Long-Term/Post-Acute Care | 83.1 | % | 1.20 | 1.50 | 29.2 | % | 43.3 | % | 27.5 | % | — | |||||||

Total | 1.30 | 1.62 | 92.7 | % | 3.9 | % | 2.1 | % | 1.3 | % | ||||||||

Notes:

(1) Indicates the total square footage of Outpatient Medical.

(2) See pages 22 and 23 for reconciliation.

(3) Excludes land parcels, loans, developments and investments held for sale. See page 22 for reconciliation.

(4) Same store NOI for these property types represents cash rent excluding the impact of expansions.

(5) Data as of December 31, 2019 for Seniors Housing Operating and Outpatient Medical and September 30, 2019 for remaining asset types.

(6) Represents trailing twelve month coverage metrics.

(7) Represents various federal and local reimbursement programs in the United Kingdom and Canada.

(8) EBITDAR and EBITDARM coverage as reported by ProMedica inclusive of the three held for sale properties.

1

Portfolio | |

(dollars in thousands at Welltower pro rata ownership) | ||||||||||||||||||||||||||||

In-Place NOI Diversification(1) | ||||||||||||||||||||||||||||

By Partner: | Total Properties | Seniors Housing Operating | Seniors Housing Triple-net | Outpatient Medical | Health System | Long-Term/ Post-Acute Care | Total | % of Total | ||||||||||||||||||||

Sunrise Senior Living North America | 126 | $ | 253,762 | $ | — | $ | — | $ | — | $ | — | $ | 253,762 | 12.1 | % | |||||||||||||

Sunrise Senior Living United Kingdom | 45 | 73,548 | — | — | — | — | 73,548 | 3.5 | % | |||||||||||||||||||

ProMedica | 215 | — | — | — | 143,168 | — | 143,168 | 6.8 | % | |||||||||||||||||||

Revera | 94 | 109,270 | — | — | — | — | 109,270 | 5.2 | % | |||||||||||||||||||

Genesis HealthCare | 76 | — | — | — | — | 84,667 | 84,667 | 4.0 | % | |||||||||||||||||||

Senior Resource Group | 24 | 67,400 | — | — | — | — | 67,400 | 3.2 | % | |||||||||||||||||||

Avery Healthcare | 54 | 5,626 | 61,223 | — | — | — | 66,849 | 3.2 | % | |||||||||||||||||||

Sagora Senior Living | 31 | 37,764 | 25,806 | — | — | — | 63,570 | 3.0 | % | |||||||||||||||||||

Belmont Village | 21 | 63,259 | — | — | — | — | 63,259 | 3.0 | % | |||||||||||||||||||

Brandywine Living | 27 | 61,578 | — | — | — | — | 61,578 | 2.9 | % | |||||||||||||||||||

Brookdale Senior Living | 84 | — | 58,254 | — | — | — | 58,254 | 2.8 | % | |||||||||||||||||||

Brookdale Senior Living - Transitions(2) | 3 | 3,132 | — | — | — | — | 3,132 | 0.1 | % | |||||||||||||||||||

Remaining | 801 | 228,797 | 266,685 | 464,820 | — | 95,113 | 1,055,415 | 50.2 | % | |||||||||||||||||||

Total | 1,601 | $ | 904,136 | $ | 411,968 | $ | 464,820 | $ | 143,168 | $ | 179,780 | $ | 2,103,872 | 100.0 | % | |||||||||||||

By Country: | ||||||||||||||||||||||||||||

United States | 1,337 | $ | 658,846 | $ | 323,513 | $ | 444,484 | $ | 143,168 | $ | 173,173 | $ | 1,743,184 | 82.9 | % | |||||||||||||

United Kingdom | 116 | 81,918 | 85,078 | 20,336 | — | — | 187,332 | 8.9 | % | |||||||||||||||||||

Canada | 148 | 163,372 | 3,377 | — | — | 6,607 | 173,356 | 8.2 | % | |||||||||||||||||||

Total | 1,601 | 904,136 | 411,968 | 464,820 | 143,168 | 179,780 | 2,103,872 | 100.0 | % | |||||||||||||||||||

By MSA: | ||||||||||||||||||||||||||||

New York | 79 | $ | 90,134 | $ | 30,301 | $ | 30,936 | $ | 3,512 | $ | 11,860 | $ | 166,743 | 7.9 | % | |||||||||||||

Los Angeles | 68 | 85,535 | 18,082 | 28,039 | 422 | — | 132,078 | 6.3 | % | |||||||||||||||||||

Greater London | 50 | 52,977 | 35,617 | 20,336 | — | — | 108,930 | 5.2 | % | |||||||||||||||||||

Dallas | 57 | 26,410 | 19,019 | 32,343 | 740 | 3,891 | 82,403 | 3.9 | % | |||||||||||||||||||

Philadelphia | 50 | 17,204 | 1,343 | 22,624 | 12,134 | 23,006 | 76,311 | 3.6 | % | |||||||||||||||||||

Washington D.C. | 38 | 40,086 | 756 | 6,911 | 9,090 | 2,998 | 59,841 | 2.8 | % | |||||||||||||||||||

Houston | 29 | 15,328 | 4,469 | 29,826 | — | — | 49,623 | 2.4 | % | |||||||||||||||||||

San Francisco | 20 | 34,146 | 9,677 | — | 4,268 | — | 48,091 | 2.3 | % | |||||||||||||||||||

Chicago | 37 | 19,672 | 9,453 | 2,765 | 9,538 | — | 41,428 | 2.0 | % | |||||||||||||||||||

Toronto | 25 | 39,336 | — | — | — | — | 39,336 | 1.9 | % | |||||||||||||||||||

San Diego | 17 | 22,729 | 6,251 | 6,075 | — | 2,697 | 37,752 | 1.8 | % | |||||||||||||||||||

Miami | 35 | 5,606 | — | 22,341 | 5,078 | — | 33,025 | 1.6 | % | |||||||||||||||||||

Minneapolis | 20 | 1,765 | 14,892 | 15,618 | — | — | 32,275 | 1.5 | % | |||||||||||||||||||

Seattle | 26 | 11,882 | 3,063 | 14,828 | 1,586 | — | 31,359 | 1.5 | % | |||||||||||||||||||

Montréal | 19 | 28,346 | — | — | — | — | 28,346 | 1.3 | % | |||||||||||||||||||

Boston | 16 | 21,437 | — | 2,625 | — | 2,773 | 26,835 | 1.3 | % | |||||||||||||||||||

Raleigh | 12 | 7,115 | 17,408 | 854 | — | — | 25,377 | 1.2 | % | |||||||||||||||||||

Atlanta | 23 | 4,211 | — | 19,326 | 1,759 | — | 25,296 | 1.2 | % | |||||||||||||||||||

Denver | 11 | 10,528 | 4,636 | 1,525 | 2,002 | 4,960 | 23,651 | 1.1 | % | |||||||||||||||||||

Charlotte | 22 | — | 8,546 | 14,529 | — | — | 23,075 | 1.1 | % | |||||||||||||||||||

Remaining | 947 | 369,689 | 228,455 | 193,319 | 93,039 | 127,595 | 1,012,097 | 48.1 | % | |||||||||||||||||||

Total | 1,601 | $ | 904,136 | $ | 411,968 | $ | 464,820 | $ | 143,168 | $ | 179,780 | $ | 2,103,872 | 100.0 | % | |||||||||||||

(1) Represents current quarter annualized In-Place NOI. See page 22 for reconciliation.

(2) Represents the three properties to be transitioned to other operators as announced in our June 27, 2018 press release.

2

Portfolio | |

(dollars in thousands at Welltower pro rata ownership) | |||||||||||||||||||||

Seniors Housing Operating | |||||||||||||||||||||

Total Portfolio Performance(1) | 4Q18 | 1Q19 | 2Q19 | 3Q19 | 4Q19 | ||||||||||||||||

Properties | 554 | 582 | 619 | 566 | 578 | ||||||||||||||||

Units | 66,002 | 69,209 | 74,145 | 68,918 | 70,144 | ||||||||||||||||

Total occupancy | 87.2 | % | 86.2 | % | 85.7 | % | 86.0 | % | 86.1 | % | |||||||||||

Total revenues | $ | 834,356 | $ | 841,938 | $ | 880,320 | $ | 805,251 | $ | 804,403 | |||||||||||

Operating expenses | 582,412 | 580,917 | 607,836 | 554,782 | 564,895 | ||||||||||||||||

NOI | $ | 251,944 | $ | 261,021 | $ | 272,484 | $ | 250,469 | $ | 239,508 | |||||||||||

NOI margin | 30.2 | % | 31.0 | % | 31.0 | % | 31.1 | % | 29.8 | % | |||||||||||

Recurring cap-ex | $ | 22,569 | $ | 15,226 | $ | 20,275 | $ | 27,306 | $ | 38,756 | |||||||||||

Other cap-ex | $ | 49,813 | $ | 27,366 | $ | 30,320 | $ | 40,117 | $ | 55,536 | |||||||||||

Same Store Performance(2) | 4Q18 | 1Q19 | 2Q19 | 3Q19 | 4Q19 | ||||||||||||||||

Properties | 409 | 409 | 409 | 409 | 409 | ||||||||||||||||

Occupancy | 87.9 | % | 87.5 | % | 87.1 | % | 87.3 | % | 87.6 | % | |||||||||||

Same store revenues | $ | 600,350 | $ | 604,772 | $ | 607,565 | $ | 616,605 | $ | 618,400 | |||||||||||

Compensation | 254,691 | 254,964 | 258,761 | 262,924 | 263,716 | ||||||||||||||||

Utilities | 22,579 | 24,137 | 20,023 | 22,205 | 22,592 | ||||||||||||||||

Food | 22,821 | 21,875 | 21,938 | 22,534 | 23,021 | ||||||||||||||||

Repairs and maintenance | 13,994 | 13,841 | 14,481 | 15,093 | 15,138 | ||||||||||||||||

Property taxes | 17,760 | 19,262 | 19,232 | 18,273 | 18,126 | ||||||||||||||||

All other | 77,335 | 77,094 | 78,947 | 77,159 | 81,706 | ||||||||||||||||

Same store operating expenses | 409,180 | 411,173 | 413,382 | 418,188 | 424,299 | ||||||||||||||||

Same store NOI | $ | 191,170 | $ | 193,599 | $ | 194,183 | $ | 198,417 | $ | 194,101 | |||||||||||

Year over year growth rate | 1.5 | % | |||||||||||||||||||

Partners | Properties(3) | Units(3) | Welltower Ownership %(4) | Core Markets | 4Q19 NOI | % of Total | ||||||||||||

Sunrise Senior Living | 171 | 14,548 | 98.4 | % | Southern California | $ | 31,440 | 13.1 | % | |||||||||

Revera | 94 | 11,823 | 75.0 | % | New York / New Jersey | 22,269 | 9.3 | % | ||||||||||

Senior Resource Group | 24 | 4,656 | 66.3 | % | Northern California | 19,271 | 8.0 | % | ||||||||||

Belmont Village | 21 | 2,952 | 95.0 | % | Greater London | 12,966 | 5.4 | % | ||||||||||

Brandywine Living | 27 | 2,599 | 99.3 | % | Washington D.C. | 11,418 | 4.8 | % | ||||||||||

Chartwell Retirement Residences | 39 | 7,726 | 51.9 | % | Toronto | 9,803 | 4.1 | % | ||||||||||

Sagora Senior Living | 14 | 2,697 | 92.7 | % | Boston | 7,446 | 3.1 | % | ||||||||||

Cogir | 18 | 3,269 | 88.5 | % | Montréal | 7,104 | 3.0 | % | ||||||||||

Senior Star Living | 11 | 2,064 | 90.0 | % | Seattle | 6,460 | 2.7 | % | ||||||||||

Frontier Management | 28 | 1,574 | 96.3 | % | Ottawa | 4,890 | 2.0 | % | ||||||||||

Clover Management | 30 | 3,679 | 89.2 | % | Vancouver | 2,635 | 1.1 | % | ||||||||||

Pegasus Senior Living | 35 | 3,812 | 98.0 | % | Birmingham, UK | 1,999 | 0.8 | % | ||||||||||

Oakmont Senior Living | 8 | 623 | 85.3 | % | Manchester, UK | 1,873 | 0.8 | % | ||||||||||

Discovery Senior Living | 12 | 3,065 | 55.9 | % | Core Markets | 139,574 | 58.2 | % | ||||||||||

Remaining | 29 | 3,043 | All Other | 99,934 | 41.8 | % | ||||||||||||

Total | 561 | 68,130 | Total | $ | 239,508 | 100.0 | % | |||||||||||

Notes:

(1) Properties, units and occupancy exclude all land parcels and properties under development.

(2) See pages 22 and 23 for reconciliation.

(3) Represents In-Place Portfolio.

(4) Welltower ownership percentage weighted based on In-Place NOI. See page 22 for reconciliation.

3

Portfolio | |

(dollars in thousands at Welltower pro rata ownership)

New Supply in Our US Seniors Housing Operating Portfolio

We have strategically acquired and developed properties in major US metro markets that benefit from population growth and density, affluence, job growth, and higher barriers to entry. New supply in a 3-mile ring around our properties potentially impacts just 3.7% of our total annualized In-Place NOI (IPNOI).

3-Mile Ring(1) | ||||||||||||||||||||||||||||||

Welltower | Welltower | |||||||||||||||||||||||||||||

MSA | Prop. / Units | Annualized IPNOI(2) | % of US SHO Portfolio | Prop. / Units Under Construction(3) | Prop. / Units Potentially Impacted | IPNOI Potentially Impacted(4) | 5 Year Total Pop. Growth(5) | 5 Year 75+ Pop. Growth(5) | Avg. Pop. Density(6) | Household Income(7) | Housing Value(7) | Est. Net Annual Inventory Growth(8) | Est. Annual Job Growth(9) | |||||||||||||||||

New York | 30 / 2,598 | $ | 90,134 | 13.7 | % | 6 / 653 | 6 / 480 | $ | 13,626 | 0.4 | % | 5.9 | % | 4,096 | $ | 115,527 | $ | 544,686 | 4.2 | % | 1.0 | % | ||||||||

Los Angeles | 31 / 3,676 | 85,535 | 13.0 | % | 6 / 867 | 6 / 652 | 10,834 | 2.6 | % | 12.4 | % | 6,868 | 98,398 | 961,970 | 2.2 | % | 1.5 | % | ||||||||||||

Washington D.C. | 12 / 1,358 | 40,086 | 6.1 | % | 4 / 457 | 4 / 342 | 6,983 | 3.7 | % | 13.9 | % | 5,554 | 132,150 | 717,057 | 3.4 | % | 1.6 | % | ||||||||||||

San Francisco | 13 / 1,623 | 34,146 | 5.2 | % | — | — | — | 4.0 | % | 13.0 | % | 9,068 | 130,962 | 1,150,229 | (0.7 | )% | 2.4 | % | ||||||||||||

Dallas | 15 / 2,180 | 26,410 | 4.0 | % | 1 / 83 | 1 / 52 | 54 | 7.4 | % | 28.8 | % | 3,366 | 87,897 | 328,031 | 4.0 | % | 3.2 | % | ||||||||||||

San Diego | 7 / 922 | 22,729 | 3.4 | % | — | — | — | 3.1 | % | 17.0 | % | 4,596 | 108,247 | 883,745 | 0.0 | % | 2.3 | % | ||||||||||||

Boston | 11 / 751 | 21,437 | 3.3 | % | — | — | — | 3.3 | % | 8.4 | % | 2,613 | 133,887 | 747,660 | 3.4 | % | 1.4 | % | ||||||||||||

Chicago | 16 / 1,724 | 19,672 | 3.0 | % | 2 / 188 | 3 / 257 | 1,685 | -0.1 | % | 10.3 | % | 3,416 | 91,777 | 338,681 | 1.6 | % | 0.6 | % | ||||||||||||

Philadelphia | 11 / 885 | 17,204 | 2.6 | % | 4 / 671 | 2 / 146 | 3,237 | 0.9 | % | 5.0 | % | 2,143 | 109,780 | 368,024 | 2.4 | % | 1.0 | % | ||||||||||||

Houston | 9 / 878 | 15,328 | 2.3 | % | 3 / 539 | 3 / 317 | 3,285 | 7.3 | % | 27.4 | % | 3,637 | 84,122 | 412,627 | 3.9 | % | 2.7 | % | ||||||||||||

Sacramento | 7 / 598 | 14,754 | 2.2 | % | 4 / 664 | 4 / 381 | 7,060 | 4.1 | % | 14.4 | % | 3,697 | 86,880 | 493,179 | 8.1 | % | 1.6 | % | ||||||||||||

San Antonio | 4 / 1,075 | 11,956 | 1.8 | % | 2 / 367 | 2 / 512 | 2,320 | 8.8 | % | 30.5 | % | 2,370 | 75,155 | 263,010 | 2.2 | % | 3.2 | % | ||||||||||||

Boulder, CO | 6 / 518 | 11,949 | 1.8 | % | — | — | — | 6.0 | % | 31.4 | % | 2,029 | 103,497 | 678,582 | N/A | 2.2 | % | |||||||||||||

Seattle | 12 / 1,292 | 11,882 | 1.8 | % | 3 / 305 | 3 / 339 | 2,394 | 6.5 | % | 21.7 | % | 5,093 | 95,498 | 581,211 | 1.8 | % | 2.9 | % | ||||||||||||

San Jose | 4 / 480 | 11,384 | 1.7 | % | — | — | — | 3.9 | % | 13.0 | % | 6,841 | 141,812 | 1,493,978 | (1.9 | )% | 2.8 | % | ||||||||||||

Denver | 4 / 661 | 10,528 | 1.6 | % | 3 / 458 | 1 / 163 | 312 | 7.0 | % | 25.3 | % | 5,056 | 85,940 | 587,061 | 0.8 | % | 2.4 | % | ||||||||||||

Phoenix | 7 / 767 | 8,929 | 1.4 | % | 2 / 212 | 2 / 191 | 1,919 | 6.7 | % | 13.6 | % | 3,659 | 74,812 | 360,104 | 3.2 | % | 2.6 | % | ||||||||||||

Cincinnati | 4 / 662 | 8,412 | 1.3 | % | — | — | — | 1.2 | % | 9.4 | % | 1,981 | 71,194 | 192,119 | (0.1 | )% | 1.8 | % | ||||||||||||

Buffalo | 10 / 1,254 | 7,851 | 1.2 | % | — | — | — | 0.4 | % | 3.5 | % | 2,799 | 70,551 | 183,220 | 6.2 | % | 0.7 | % | ||||||||||||

Pittsburgh | 4 / 434 | 7,633 | 1.2 | % | 2 / 298 | 1 / 101 | 2,876 | 0.2 | % | 6.6 | % | 1,899 | 90,209 | 239,590 | 2.9 | % | (0.4 | )% | ||||||||||||

Trenton, NJ | 2 / 207 | 7,408 | 1.1 | % | — | — | — | 2.2 | % | 9.9 | % | 819 | 137,888 | 495,307 | N/A | 1.3 | % | |||||||||||||

Columbus | 4 / 463 | 7,319 | 1.1 | % | 2 / 229 | 1 / 199 | 750 | 5.7 | % | 29.5 | % | 2,280 | 97,976 | 332,078 | 4.0 | % | (0.4 | )% | ||||||||||||

Raleigh | 2 / 250 | 7,115 | 1.1 | % | 2 / 471 | 2 / 250 | 6,659 | 6.5 | % | 26.1 | % | 3,148 | 90,852 | 308,868 | (1.1 | )% | 3.8 | % | ||||||||||||

Santa Rosa, CA | 4 / 511 | 6,932 | 1.1 | % | — | — | — | 2.1 | % | 8.1 | % | 2,060 | 87,571 | 758,680 | N/A | 1.8 | % | |||||||||||||

Austin | 5 / 427 | 6,618 | 1.0 | % | — | — | — | 8.8 | % | 43.0 | % | 2,338 | 129,948 | 669,430 | 9.7 | % | 2.7 | % | ||||||||||||

Total - Top 25 | 234 / 26,194 | $ | 513,351 | 77.9 | % | 46 / 6,462 | 41 / 4,382 | $ | 63,994 | 3.4 | % | 14.8 | % | 4,316 | $ | 106,470 | $ | 658,154 | 2.7 | % | 1.7 | % | ||||||||

All Other US SHO Markets | 132 / 16,505 | 145,495 | 22.1 | % | 19 / 2,658 | 18 / 1,892 | 13,164 | 3.6 | % | 11.9 | % | 2,385 | 76,946 | 356,806 | ||||||||||||||||

Total US SHO | 366 / 42,699 | $ | 658,846 | 100.0 | % | 65 / 9,120 | 59 / 6,274 | $ | 77,158 | 3.5 | % | 13.8 | % | 3,627 | $ | 99,321 | $ | 585,183 | ||||||||||||

% of Total IPNOI | 3.7 | % | ||||||||||||||||||||||||||||

US National Average | 3.3 | % | 11.7 | % | 94 | $ | 66,010 | $ | 245,219 | 2.5 | % | (10) | 1.4 | % | ||||||||||||||||

Notes:

(1) Based on historical drawing patterns in our portfolio, a 3-mile ring is appropriate for most urban markets, which accounts for the vast majority of our portfolio. A 5-mile ring is appropriate for most suburban markets. A larger ring is appropriate for rural markets. Each market is unique due to population density, town lines, geographic barriers, and roads/infrastructure. In the interest of simplicity, we have applied a 3-mile competitive ring to all of our properties given the preponderance of urban locations. We have also included a sensitivity with a 5-mile ring.

(2) Represents annualized IPNOI. See pages 2 and 22 for a reconciliation.

(3) Construction data provided by NIC, reflects competitive seniors housing properties within 3 miles of Welltower SHO properties for US markets.

(4) Reflects annualized IPNOI for Welltower SHO properties within 3 miles of new construction for the component of our project that potentially competes with the project under construction.

(5) Total population and 75+ population growth data represents simple averages of Claritas estimates for 2020-2025.

(6) Average population density data represents average population per square mile within a 3-mile ring based on 2020 Claritas estimates.

(7) Household income and household value data are medians weighted by IPNOI.

(8) NIC MAP Data and Analysis Service, 4Q19. Net inventory growth is calculated at the MSA level based on historical deletions from inventory and a 5-6 quarter construction period to reflect our urban locations. Total - Top 25 Net Inventory Growth weighted by IPNOI.

(9) Annual job growth data represents MSA level growth from November 2018-November 2019 per Bureau of Labor Statistics. Total - Top 25 Estimated Annual Job Growth weighted by IPNOI

(10) Reflects net inventory growth for NIC Top 99 Markets.

4

Portfolio | |

(dollars in thousands at Welltower pro rata ownership)

New Supply in Our US Seniors Housing Operating Portfolio

We have strategically acquired and developed properties in major US metro markets that benefit from population growth and density, affluence, job growth, and higher barriers to entry. New supply in a 5-mile ring around our properties potentially impacts just 7.0% of our total annualized In-Place NOI (IPNOI).

5-Mile Ring(1) | ||||||||||||||||||||||||||||||

Welltower | Welltower | |||||||||||||||||||||||||||||

MSA | Prop. / Units | Annualized IPNOI(2) | % of US SHO Portfolio | Prop. / Units Under Construction(3) | Prop. / Units Potentially Impacted | IPNOI Potentially Impacted(4) | 5 Year Total Pop. Growth(5) | 5 Year 75+ Pop. Growth(5) | Avg. Pop. Density(6) | Household Income(7) | Housing Value(7) | Est. Net Annual Inventory Growth(8) | Est. Annual Job Growth(9) | |||||||||||||||||

New York | 30 / 2,598 | $ | 90,134 | 13.7 | % | 12 / 1,578 | 15 / 1,254 | $ | 28,272 | 0.6 | % | 5.8 | % | 4,022 | $ | 110,413 | $ | 511,493 | 4.2 | % | 1.0 | % | ||||||||

Los Angeles | 31 / 3,676 | 85,535 | 13.0 | % | 9 / 1,243 | 16 / 1,877 | 24,093 | 2.6 | % | 13.0 | % | 6,666 | 91,780 | 887,302 | 2.2 | % | 1.5 | % | ||||||||||||

Washington D.C. | 12 / 1,358 | 40,086 | 6.1 | % | 8 / 959 | 9 / 1,073 | 13,460 | 4.1 | % | 14.6 | % | 5,489 | 125,255 | 687,399 | 3.4 | % | 1.6 | % | ||||||||||||

San Francisco | 13 / 1,623 | 34,146 | 5.2 | % | — | — | — | 4.0 | % | 13.2 | % | 7,723 | 128,824 | 1,122,144 | (0.7 | )% | 2.4 | % | ||||||||||||

Dallas | 15 / 2,180 | 26,410 | 4.0 | % | 5 / 1,075 | 4 / 392 | 3,709 | 7.3 | % | 27.8 | % | 3,209 | 80,263 | 313,731 | 4.0 | % | 3.2 | % | ||||||||||||

San Diego | 7 / 922 | 22,729 | 3.4 | % | 1 / 200 | 2 / 249 | 3,654 | 3.5 | % | 16.0 | % | 4,480 | 104,821 | 796,347 | 0.0 | % | 2.3 | % | ||||||||||||

Boston | 11 / 751 | 21,437 | 3.3 | % | 3 / 365 | 3 / 261 | 2,892 | 3.3 | % | 8.4 | % | 2,551 | 121,587 | 671,870 | 3.4 | % | 1.4 | % | ||||||||||||

Chicago | 16 / 1,724 | 19,672 | 3.0 | % | 7 / 1,074 | 7 / 701 | 6,296 | -0.2 | % | 11.0 | % | 3,283 | 95,415 | 348,612 | 1.6 | % | 0.6 | % | ||||||||||||

Philadelphia | 11 / 885 | 17,204 | 2.6 | % | 7 / 943 | 4 / 316 | 6,536 | 1.0 | % | 5.4 | % | 2,330 | 99,971 | 334,617 | 2.4 | % | 1.0 | % | ||||||||||||

Houston | 9 / 878 | 15,328 | 2.3 | % | 4 / 719 | 4 / 614 | 7,060 | 7.5 | % | 30.5 | % | 3,689 | 80,907 | 315,465 | 3.9 | % | 2.7 | % | ||||||||||||

Sacramento | 7 / 598 | 14,754 | 2.2 | % | 7 / 946 | 6 / 532 | 8,693 | 4.0 | % | 15.0 | % | 3,464 | 83,737 | 468,588 | 8.1 | % | 1.6 | % | ||||||||||||

San Antonio | 4 / 1,075 | 11,956 | 1.8 | % | 2 / 367 | 2 / 512 | 2,320 | 8.6 | % | 29.4 | % | 2,254 | 70,551 | 245,989 | 2.2 | % | 3.2 | % | ||||||||||||

Boulder, CO | 6 / 518 | 11,949 | 1.8 | % | — | — | — | 6.4 | % | 28.7 | % | 1,406 | 110,296 | 666,694 | N/A | 2.2 | % | |||||||||||||

Seattle | 12 / 1,292 | 11,882 | 1.8 | % | 3 / 305 | 3 / 339 | 2,394 | 6.5 | % | 23.4 | % | 4,565 | 97,711 | 588,639 | 1.8 | % | 2.9 | % | ||||||||||||

San Jose | 4 / 480 | 11,384 | 1.7 | % | — | — | — | 3.9 | % | 13.1 | % | 5,832 | 138,526 | 1,480,463 | (1.9 | )% | 2.8 | % | ||||||||||||

Denver | 4 / 661 | 10,528 | 1.6 | % | 5 / 708 | 2 / 252 | 347 | 6.7 | % | 25.0 | % | 4,589 | 85,066 | 485,453 | 0.8 | % | 2.4 | % | ||||||||||||

Phoenix | 7 / 767 | 8,929 | 1.4 | % | 7 / 912 | 4 / 500 | 4,498 | 7.1 | % | 15.1 | % | 3,463 | 73,589 | 331,491 | 3.2 | % | 2.6 | % | ||||||||||||

Cincinnati | 4 / 662 | 8,412 | 1.3 | % | — | — | — | 1.3 | % | 10.4 | % | 1,662 | 69,575 | 191,981 | (0.1 | )% | 1.8 | % | ||||||||||||

Buffalo | 10 / 1,254 | 7,851 | 1.2 | % | — | — | — | 0.2 | % | 3.5 | % | 2,522 | 67,042 | 174,118 | 6.2 | % | 0.7 | % | ||||||||||||

Pittsburgh | 4 / 434 | 7,633 | 1.2 | % | 3 / 426 | 2 / 236 | 3,814 | 0.6 | % | 5.7 | % | 1,730 | 84,286 | 222,530 | 2.9 | % | (0.4 | )% | ||||||||||||

Trenton, NJ | 2 / 207 | 7,408 | 1.1 | % | — | — | — | 1.4 | % | 9.8 | % | 1,079 | 125,586 | 453,041 | N/A | 1.3 | % | |||||||||||||

Columbus | 4 / 463 | 7,319 | 1.1 | % | 2 / 229 | 1 / 199 | 750 | 5.5 | % | 27.2 | % | 2,104 | 88,079 | 305,948 | 4.0 | % | (0.4 | )% | ||||||||||||

Raleigh | 2 / 250 | 7,115 | 1.1 | % | 2 / 471 | 2 / 250 | 7,050 | 7.6 | % | 32.7 | % | 2,640 | 98,414 | 363,283 | (1.1 | )% | 3.8 | % | ||||||||||||

Santa Rosa, CA | 4 / 511 | 6,932 | 1.1 | % | — | — | — | 2.3 | % | 9.2 | % | 1,144 | 89,757 | 762,152 | N/A | 1.8 | % | |||||||||||||

Austin | 5 / 427 | 6,618 | 1.0 | % | 2 / 118 | 2 / 170 | 731 | 8.6 | % | 40.9 | % | 2,371 | 104,466 | 570,204 | 9.7 | % | 2.7 | % | ||||||||||||

Total - Top 25 | 234 / 26,194 | $ | 513,351 | 77.9 | % | 89 / 12,638 | 88 / 9,727 | $ | 126,569 | 3.5 | % | 15.0 | % | 4,067 | $ | 101,661 | $ | 618,382 | 2.7 | % | 1.7 | % | ||||||||

All Other US SHO Markets | 132 / 16,505 | 145,495 | 22.1 | % | 31 / 4,309 | 32 / 4,465 | 21,539 | 3.5 | % | 12.2 | % | 2,061 | 73,196 | 345,791 | ||||||||||||||||

Total US SHO | 366 / 42,699 | $ | 658,846 | 100.0 | % | 120 / 16,947 | 120 / 14,192 | $ | 148,108 | 3.5 | % | 14.0 | % | 3,351 | $ | 94,768 | $ | 552,374 | ||||||||||||

% of Total IPNOI | 7.0 | % | ||||||||||||||||||||||||||||

US National Average | 3.3 | % | 11.7 | % | 94 | $ | 66,010 | $ | 245,219 | 2.5 | % | (10) | 1.4 | % | ||||||||||||||||

Notes:

(1) Based on historical drawing patterns in our portfolio, a 3-mile ring is appropriate for most urban markets, which accounts for the vast majority of our portfolio. A 5-mile ring is appropriate for most suburban markets. A larger ring is appropriate for rural markets. Each market is unique due to population density, town lines, geographic barriers, and roads/infrastructure. In the interest of simplicity, we have applied a 3-mile competitive ring to all of our properties given the preponderance of urban locations. We have also included a sensitivity with a 5-mile ring.

(2) Represents annualized IPNOI. See pages 2 and 22 for a reconciliation.

(3) Construction data provided by NIC, reflects competitive seniors housing properties within 5 miles of Welltower SHO properties for US markets.

(4) Reflects annualized IPNOI for Welltower SHO properties within 5 miles of new construction for the component of our project that potentially competes with the project under construction.

(5) Total population and 75+ population growth data represents simple averages of Claritas estimates for 2020-2025.

(6) Average population density data represents average population per square mile within a 5-mile ring based on 2020 Claritas estimates.

(7) Household income and household value data are medians weighted by IPNOI.

(8) NIC MAP Data and Analysis Service, 4Q19. Net inventory growth is calculated at the MSA level based on historical deletions from inventory and a 5-6 quarter construction period to reflect our urban locations. Total - Top 25 Net Inventory Growth weighted by IPNOI.

(9) Annual job growth data represents MSA level growth from November 2018-November 2019 per Bureau of Labor Statistics. Total -Top 25 Estimated Annual Job Growth weighted by IPNOI.

(10) Reflects net inventory growth for NIC Top 99 Markets.

5

Portfolio | |

(Currency amounts in thousands, except per unit and REVPOR. Company amounts at Welltower pro rata ownership. DNA = data not available.)

Seniors Housing Operating Quality Indicators | ||||||||

US Portfolio(1,3,4) | Industry Benchmarks(2) | |||||||

Property age | 15 | 20 | ||||||

5 year total population growth | 3.5 | % | 3.3 | % | ||||

5 year 75+ population growth | 13.8 | % | 11.7 | % | ||||

Housing value | $ | 585,183 | $ | 245,219 | ||||

Household income | $ | 99,321 | $ | 66,010 | ||||

REVPOR | $ | 6,272 | $ | 4,997 | ||||

SS REVPOR growth | 3.4 | % | 2.5 | % | ||||

SSNOI per unit | $ | 23,657 | $ | 18,307 | ||||

SSNOI growth | 1.0 | % | DNA | |||||

UK Portfolio(1,3,4) | Industry Benchmarks(5) | |||||||

Property age | 10 | 21 | ||||||

Units per property | 96 | 41 | ||||||

5 year total population growth | 3.1 | % | 2.7 | % | ||||

5 year 75+ population growth | 13.0 | % | 14.7 | % | ||||

Housing value | £ | 396,020 | £ | 229,352 | ||||

REVPOR | £ | 6,592 | £ | 3,720 | ||||

SS REVPOR growth | 3.9 | % | 3.3 | % | ||||

SSNOI per unit | £ | 16,694 | £ | 9,544 | ||||

SSNOI growth | 8.8 | % | DNA | |||||

Canadian Portfolio(1,3,4) | Industry Benchmarks(6) | |||||||

5 year total population growth | 5.6 | % | 5.5 | % | ||||

5 year 75+ population growth | 19.0 | % | 22.2 | % | ||||

Housing value | C$ | 571,142 | C$ | 456,053 | ||||

Household income | C$ | 112,369 | C$ | 102,231 | ||||

REVPOR | C$ | 3,664 | C$ | 2,469 | ||||

SS REVPOR growth | 2.1 | % | 3.4 | % | ||||

SSNOI per unit | C$ | 14,830 | DNA | |||||

SSNOI growth | 0.5 | % | DNA | |||||

Notes:

(1) Property age, housing value and household income are NOI weighted as of December 31, 2019. The median housing value and household income is used for the US, and the average housing value and household income is used for the UK and Canada. Housing value, household income and population growth are based on a 3-mile radius. Growth figures represent performance of Welltower's same store portfolio for current quarter. See page 24 for reconciliations.

(2) Property age, REVPOR and REVPOR growth per 4Q19 NIC MAP for Majority AL Properties in the primary and secondary markets; AMR is used as a proxy for REVPOR; population growth reflects 2020-2025 Claritas projections; housing value and household income are the US median per Claritas 2020; NOI per unit per The State of Seniors Housing 2019 and represents 2018 results.

(3) REVPOR is based on total 4Q19 results. See page 24 for reconciliation.

(4) SSNOI per unit represents the SSNOI per unit available based on trailing four quarters for those properties in the portfolio for 15 months preceding the end of the current portfolio performance period. SSNOI per unit for UK portfolio in GBP calculated by taking SSNOI per unit in USD divided by a standardized GBP/USD rate of 1.31. SSNOI per unit for Canadian portfolio in CAD calculated by taking SSNOI per unit in USD divided by a standardized USD/CAD rate of 1.32. See page 24 for reconciliation.

(5) Property age, units per property, REVPOR, REVPOR growth and NOI per Unit derived from LaingBuisson, Care of Older People UK Market Report 29th Edition; population growth reflects 2018-2023 Experian projections; housing value represents UK average per Experian 2018.

(6) Population growth reflects 2019-2024 Environics projection; housing value and household income represents Canadian average per Environics WealthScapes 2019; REVPOR and REVPOR growth are calculated weighted averages from 2019 CMHC Seniors Housing reports from each province.

6

Portfolio | |

(dollars in thousands at Welltower pro rata ownership) | |||||||||||||||||||||||||

Payment Coverage Stratification | |||||||||||||||||||||||||

EBITDARM Coverage(1) | EBITDAR Coverage(1) | ||||||||||||||||||||||||

% of In-Place NOI | Seniors Housing Triple-net | Long-Term/ Post- Acute Care | Total | Weighted Average Maturity | Number of Leases | Seniors Housing Triple-net | Long-Term/ Post- Acute Care | Total | Weighted Average Maturity | Number of Leases | |||||||||||||||

<0.85x | 0.4 | % | 0.1 | % | 0.5 | % | 6 | 5 | 3.0 | % | 1.1 | % | 4.1 | % | 6 | 12 | |||||||||

0.85x - 0.95x | 1.7 | % | — | % | 1.7 | % | 6 | 2 | 2.0 | % | — | % | 2.0 | % | 11 | 3 | |||||||||

0.95x - 1.05x | 0.9 | % | 0.5 | % | 1.4 | % | 8 | 4 | 1.5 | % | — | % | 1.5 | % | 16 | 6 | |||||||||

1.05x - 1.15x | 3.2 | % | 0.4 | % | 3.6 | % | 11 | 8 | 5.8 | % | 1.9 | % | 7.7 | % | 10 | 6 | |||||||||

1.15x - 1.25x | 1.9 | % | — | % | 1.9 | % | 12 | 3 | 1.6 | % | 3.7 | % | 5.3 | % | 13 | 3 | |||||||||

1.25x - 1.35x | 4.5 | % | 1.0 | % | 5.5 | % | 8 | 5 | 4.1 | % | — | % | 4.1 | % | 12 | 2 | |||||||||

>1.35x | 5.4 | % | 5.7 | % | 11.1 | % | 13 | 8 | — | % | 1.0 | % | 1.0 | % | 8 | 3 | |||||||||

Total | 18.0 | % | 7.7 | % | 25.7 | % | 11 | 35 | 18.0 | % | 7.7 | % | 25.7 | % | 11 | 35 | |||||||||

Revenue and Lease Maturity(2) | |||||||||||||||||||||||||||

Rental Income | |||||||||||||||||||||||||||

Year | Seniors Housing Triple-net | Outpatient Medical | Health System | Long-Term / Post-Acute Care | Interest Income | Total Rental and Interest Income | % of Total | ||||||||||||||||||||

2020 | $ | — | $ | 41,593 | $ | — | $ | — | $ | 9,148 | $ | 50,741 | 3.8 | % | |||||||||||||

2021 | 3,543 | 54,198 | — | 8,749 | 19,419 | 85,909 | 6.4 | % | |||||||||||||||||||

2022 | 3,195 | 54,786 | — | 5,695 | 20,305 | 83,981 | 6.2 | % | |||||||||||||||||||

2023 | — | 55,185 | — | 840 | 579 | 56,604 | 4.2 | % | |||||||||||||||||||

2024 | 11,262 | 62,618 | — | — | 1,154 | 75,034 | 5.5 | % | |||||||||||||||||||

2025 | 51,069 | 33,102 | — | — | 214 | 84,385 | 6.2 | % | |||||||||||||||||||

2026 | 86,353 | 41,324 | — | 16,826 | — | 144,503 | 10.7 | % | |||||||||||||||||||

2027 | 31,249 | 23,669 | — | 1,041 | 221 | 56,180 | 4.2 | % | |||||||||||||||||||

2028 | 6,849 | 26,030 | — | 19,571 | 177 | 52,627 | 3.9 | % | |||||||||||||||||||

2029 | 33,619 | 28,212 | — | — | 213 | 62,044 | 4.6 | % | |||||||||||||||||||

Thereafter | 187,198 | 139,376 | 144,524 | 127,247 | 2,254 | 600,599 | 44.4 | % | |||||||||||||||||||

$ | 414,337 | $ | 560,093 | $ | 144,524 | $ | 179,969 | $ | 53,684 | $ | 1,352,607 | 100.0 | % | ||||||||||||||

Weighted avg. maturity years | 10 | 7 | 13 | 12 | 3 | 9 | |||||||||||||||||||||

Notes:

(1) Represents trailing twelve month coverage metrics as of September 30, 2019 for stable portfolio only. Agreements included represent 91% of total Seniors Housing Triple-net and Long-Term/Post-Acute Care In-Place NOI. See page 22 for a reconciliation. Agreements with mixed units use the predominant type based on investment balance.

(2) Excludes all land parcels, developments and investments held for sale. Rental income represents annualized cash base rent for effective lease agreements. The amounts are derived from the current contracted monthly cash base rent, net of collectability reserves, if applicable. Rental income does not include common area maintenance charges, the amortization of above/below market lease intangibles, or other non cash income. Interest income represents contractual rate of interest for loans, net of collectability reserves if applicable.

7

Portfolio | |

(dollars in thousands at Welltower pro rata ownership) | ||||||||||||||||||||

Outpatient Medical | ||||||||||||||||||||

Total Portfolio Performance(1) | 4Q18 | 1Q19 | 2Q19 | 3Q19 | 4Q19 | |||||||||||||||

Properties | 274 | 283 | 340 | 348 | 378 | |||||||||||||||

Square feet | 17,292,516 | 17,649,227 | 21,098,926 | 21,472,874 | 23,044,140 | |||||||||||||||

Occupancy | 93.1 | % | 92.9 | % | 93.3 | % | 93.6 | % | 94.0 | % | ||||||||||

Total revenues | $ | 134,844 | $ | 139,735 | $ | 154,443 | $ | 175,000 | $ | 180,101 | ||||||||||

Operating expenses | 40,136 | 44,868 | 47,894 | 57,272 | 55,915 | |||||||||||||||

NOI | $ | 94,708 | $ | 94,867 | $ | 106,549 | $ | 117,728 | $ | 124,186 | ||||||||||

NOI margin | 70.2 | % | 67.9 | % | 69.0 | % | 67.3 | % | 69.0 | % | ||||||||||

Revenues per square foot | $ | 32.73 | $ | 33.20 | $ | 30.45 | $ | 33.90 | $ | 32.49 | ||||||||||

NOI per square foot | $ | 22.99 | $ | 22.54 | $ | 21.01 | $ | 22.80 | $ | 22.41 | ||||||||||

Recurring cap-ex | $ | 9,095 | $ | 6,400 | $ | 8,528 | $ | 7,296 | $ | 7,794 | ||||||||||

Other cap-ex | $ | 4,852 | $ | 2,860 | $ | 2,374 | $ | 5,989 | $ | 8,618 | ||||||||||

Same Store Performance(2) | 4Q18 | 1Q19 | 2Q19 | 3Q19 | 4Q19 | |||||||||||||||

Properties | 236 | 236 | 236 | 236 | 236 | |||||||||||||||

Occupancy | 93.4 | % | 93.4 | % | 93.4 | % | 93.8 | % | 94.0 | % | ||||||||||

Same store revenues | $ | 104,215 | $ | 105,860 | $ | 106,198 | $ | 109,010 | $ | 108,476 | ||||||||||

Same store operating expenses | 31,184 | 32,807 | 32,284 | 35,350 | 33,799 | |||||||||||||||

Same store NOI | $ | 73,031 | $ | 73,053 | $ | 73,914 | $ | 73,660 | $ | 74,677 | ||||||||||

Year over year growth rate | 2.3 | % | ||||||||||||||||||

Portfolio Diversification by Tenant(3) | Rental Income | % of Total | Quality Indicators | ||||||||

Kelsey-Seybold | $ | 22,430 | 4.0 | % | Health system affiliated properties as % of NOI(3) | 93.5 | % | ||||

NMC Health | 20,944 | 3.7 | % | Health system affiliated tenants as % of rental income(3) | 68.3 | % | |||||

CommonSpirit Health | 18,534 | 3.3 | % | Retention (trailing twelve months)(3) | 82.2 | % | |||||

Virtua | 16,298 | 2.9 | % | In-house managed properties as % of square feet(3,4) | 80.3 | % | |||||

Novant Health | 14,908 | 2.7 | % | Average remaining lease term (years)(3) | 6.7 | ||||||

Remaining portfolio | 466,979 | 83.4 | % | Average building size (square feet)(3) | 61,040 | ||||||

Total | $ | 560,093 | 100.0 | % | Average age (years) | 14 | |||||

Expirations(3) | 2020 | 2021 | 2022 | 2023 | 2024 | Thereafter | ||||||||||||

Occupied square feet | 1,630,888 | 2,054,463 | 2,165,074 | 2,162,280 | 2,263,819 | 11,220,640 | ||||||||||||

% of occupied square feet | 7.6 | % | 9.6 | % | 10.1 | % | 10.1 | % | 10.5 | % | 52.1 | % | ||||||

Notes:

(1) Property count, occupancy, square feet and per square foot metrics exclude properties under development and all land parcels. Per square foot amounts are annualized.

(2) Includes 236 same store properties representing 15,224,636 square feet. See pages 22 and 23 for reconciliation.

(3) Excludes all land parcels, developments and investments held for sale. Rental income represents annualized cash base rent for effective lease agreements. The amounts are derived from the current contracted monthly cash base rent, net of collectability reserves, if applicable. Rental income does not include common area maintenance charges, the amortization of above/below market lease intangibles, or other non cash income.

(4) Excludes tenant managed properties.

8

Investment | |

(dollars in thousands at Welltower pro rata ownership)

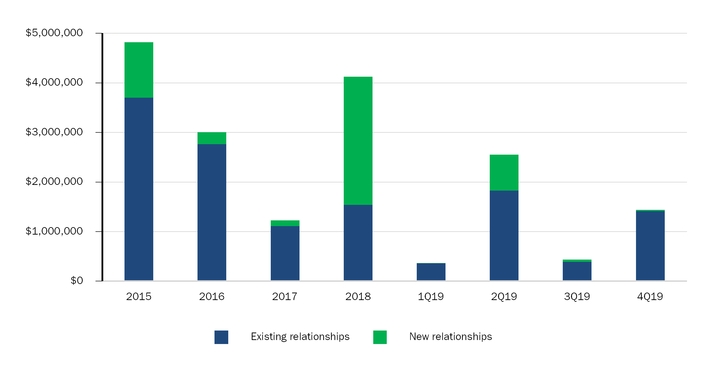

Relationship Investment History

Detail of Acquisitions/JVs(1) | ||||||||||||||||||||||||||||||||||||

2015 | 2016 | 2017 | 2018 | 1Q19 | 2Q19 | 3Q19 | 4Q19 | 15-19 Total | ||||||||||||||||||||||||||||

Count | 44 | 22 | 18 | 15 | 5 | 8 | 7 | 7 | 126 | |||||||||||||||||||||||||||

Total | $ | 3,765,912 | $ | 2,287,973 | $ | 742,020 | $ | 3,788,261 | $ | 258,771 | $ | 2,402,549 | $ | 294,193 | $ | 1,118,041 | $ | 14,657,720 | ||||||||||||||||||

Low | 6,080 | 10,618 | 7,310 | 4,950 | 8,300 | 22,800 | 7,550 | 18,000 | 4,950 | |||||||||||||||||||||||||||

Median | 33,513 | 27,402 | 24,025 | 73,727 | 56,812 | 214,371 | 30,638 | 38,800 | 35,385 | |||||||||||||||||||||||||||

High | 437,472 | 1,150,000 | 149,400 | 2,481,723 | 79,544 | 1,250,000 | 140,000 | 786,835 | 2,481,723 | |||||||||||||||||||||||||||

Investment Timing | ||||||||||||||||||||||||

Acquisitions/Joint Ventures(2) | Yield | Loan Advances(3) | Yield | Construction Conversions | Yield | Dispositions | Yield | |||||||||||||||||

October | $ | 81,609 | 3.8 | % | $ | — | — | % | $ | 23,063 | 9.8 | % | $ | 31,137 | 6.7 | % | ||||||||

November | 79,723 | 6.4 | % | 5,000 | 1.6 | % | 112,812 | 7.7 | % | 8,500 | 10.5 | % | ||||||||||||

December | 956,709 | 5.4 | % | 5,800 | 6.0 | % | 73,629 | 5.6 | % | — | — | % | ||||||||||||

Total | $ | 1,118,041 | 5.3 | % | $ | 10,800 | 4.0 | % | $ | 209,504 | 7.2 | % | $ | 39,637 | 7.6 | % | ||||||||

Notes:

(1) Includes non-yielding asset acquisitions.

(2) Excludes land acquisitions.

(3) Includes advances for non-real estate loans and excludes advances for development loans.

9

Investment | |

(dollars in thousands at Welltower pro rata ownership, except per bed/unit/square foot) | |||||||||||||

Gross Investment Activity | |||||||||||||

Fourth Quarter 2019 | |||||||||||||

Properties | Beds/Units/Square Feet | Pro Rata Amount | Investment Per Bed/Unit /SqFt | Yield | |||||||||

Acquisitions/Joint Ventures(1) | |||||||||||||

Seniors Housing Operating | 9 | 767 | units | $ | 233,483 | 532,851 | 5.0 | % | |||||

Seniors Housing Triple-net | 4 | 319 | units | 79,723 | 268,471 | 6.4 | % | ||||||

Outpatient Medical | 30 | 1,533,152 | sf | 804,835 | 525 | 5.3 | % | ||||||

Total acquisitions | 43 | 1,118,041 | 5.3 | % | |||||||||

Development(2) | |||||||||||||

Development projects: | |||||||||||||

Seniors Housing Operating | 31 | 3,451 | units | 216,933 | |||||||||

Seniors Housing Triple-net | 9 | 855 | units | 29,768 | |||||||||

Outpatient Medical | 8 | 742,271 | sf | 52,952 | |||||||||

Total development projects | 48 | 299,653 | |||||||||||

Expansion projects: | |||||||||||||

Seniors Housing Operating | 3 | 114 | units | 8,654 | |||||||||

Total development | 51 | 308,307 | 7.9 | % | |||||||||

Loan advances(3) | 10,800 | 4.0 | % | ||||||||||

Total gross investments | 1,437,148 | 5.8 | % | ||||||||||

Dispositions(4) | |||||||||||||

Seniors Housing Operating | 4 | 334 | units | 31,137 | 124,298 | 6.7 | % | ||||||

Outpatient Medical | 1 | 45,000 | sf | 8,500 | 189 | 10.5 | % | ||||||

Real property dispositions | 5 | 39,637 | 7.6 | % | |||||||||

Loan payoffs | 115,971 | 7.8 | % | ||||||||||

Total dispositions | 5 | 155,608 | 7.7 | % | |||||||||

Net investments | $ | 1,281,540 | |||||||||||

Notes:

(1) Amounts represent purchase price excluding accounting adjustments pursuant to U.S. GAAP for all consolidated and unconsolidated property acquisitions. Yield represents annualized contractual or projected cash rent/NOI to be generated divided by investment amount, excluding land parcels.

(2) Amounts represent cash funded and capitalized interest for all developments/expansions including construction in progress, loans and in-substance real estate. Yield represents projected annualized cash rent/NOI to be generated upon conversion/stabilization divided by commitment amount.

(3) Amounts represent cash funded to operators for real estate and non-real estate loans, excluding development loans. Yield represents annualized contractual interest divided by investment amount.

(4) Amounts represent proceeds received for loan payoffs and consolidated and unconsolidated property sales. Yield represents annualized cash rent/interest/NOI that was being generated pre-disposition divided by proceeds.

10

Investment | |

(dollars in thousands at Welltower pro rata ownership, except per bed/unit/square foot) | |||||||||||||

Gross Investment Activity | |||||||||||||

Year-To-Date 2019 | |||||||||||||

Properties | Beds/Units/Square Feet | Pro Rata Amount | Investment Per Bed/Unit/SqFt | Yield | |||||||||

Acquisitions/Joint Ventures(1) | |||||||||||||

Seniors Housing Operating | 62 | 7,106 | units | $ | 1,459,254 | 245,735 | 5.1 | % | |||||

Seniors Housing Triple-net | 10 | 859 | units | 217,658 | 263,834 | 6.5 | % | ||||||

Outpatient Medical | 105 | 5,774,484 | sf | 2,396,642 | 416 | 5.6 | % | ||||||

Total acquisitions | 177 | 4,073,554 | 5.4 | % | |||||||||

Development(2) | |||||||||||||

Development projects: | |||||||||||||

Seniors Housing Operating | 34 | 4,040 | units | 396,942 | |||||||||

Seniors Housing Triple-net | 10 | 1,008 | units | 101,077 | |||||||||

Outpatient Medical | 8 | 742,271 | sf | 154,628 | |||||||||

Total development projects | 52 | 652,647 | |||||||||||

Expansion projects: | |||||||||||||

Seniors Housing Operating | 3 | 114 | units | 28,963 | |||||||||

Total development | 55 | 681,610 | 7.8 | % | |||||||||

Loan advances(3) | 38,460 | 6.9 | % | ||||||||||

Total gross investments | 4,793,624 | 5.8 | % | ||||||||||

Dispositions(4) | |||||||||||||

Seniors Housing Operating | 55 | 4,619 | units | 1,803,413 | 413,232 | 5.4 | % | ||||||

Seniors Housing Triple-net | 9 | 1,344 | units | 344,340 | 256,205 | 5.1 | % | ||||||

Outpatient Medical | 1 | 45,000 | sf | 8,500 | 189 | 10.5 | % | ||||||

Long-Term/Post-Acute Care | 48 | 5,841 | beds | 558,391 | 95,599 | 9.6 | % | ||||||

Real property dispositions | 113 | 2,714,644 | 6.3 | % | |||||||||

Loan payoffs | 192,399 | 8.7 | % | ||||||||||

Total dispositions | 113 | 2,907,043 | 6.5 | % | |||||||||

Net investments | $ | 1,886,581 | |||||||||||

Notes:

(1) Amounts represent purchase price excluding accounting adjustments pursuant to U.S. GAAP for all consolidated and unconsolidated property acquisitions. Yield represents annualized contractual or projected cash rent/NOI to be generated divided by investment amount, excluding land parcels.

(2) Amounts represent cash funded and capitalized interest for all developments/expansions including construction in progress, loans and in-substance real estate. Yield represents projected annualized cash rent/NOI to be generated upon conversion/stabilization divided by commitment amount.

(3) Amounts represent cash funded to operators for real estate and non-real estate loans, excluding development loans. Yield represents annualized contractual interest divided by investment amount.

(4) Amounts represent proceeds received for loan payoffs and consolidated and unconsolidated property sales. Yield represents annualized cash rent/interest/NOI that was being generated pre-disposition divided by proceeds.

11

Investment | |

Property Acquisitions/Joint Ventures Detail | ||||||||||

Operator | Units | Location | MSA | |||||||

Seniors Housing Operating | ||||||||||

Frontier Management | 116 | 10250 W Smoke Ranch Drive | Boise | Idaho | US | Boise | ||||

Frontier Management | 81 | 3791 Crowell Road | Turlock | California | US | Modesto | ||||

Sunrise Senior Living | 92 | 1450 Post Street | San Francisco | California | US | San Francisco | ||||

Oakmont Senior Living | 71 | 4717 Engle Road | Carmichael | California | US | Sacramento | ||||

Oakmont Senior Living | 79 | 5605 North Gates Avenue | Fresno | California | US | Fresno | ||||

Oakmont Senior Living | 98 | 630 The City Drive South | Orange | California | US | Los Angeles | ||||

Oakmont Senior Living | 86 | 2150 Bechelli Lane | Redding | California | US | Redding | ||||

Oakmont Senior Living | 64 | 955 Grand Ave | San Diego | California | US | San Diego | ||||

Oakmont Senior Living | 80 | 2020 Town Center West Way | El Dorado Hills | California | US | Sacramento | ||||

Total | 767 | |||||||||

Seniors Housing Triple-Net | ||||||||||

Encore Care Homes | 80 | Poole Lane | Bournemouth | United Kingdom | UK | Bournemouth | ||||

Encore Care Homes | 84 | Kingsmill Road | Poole | United Kingdom | UK | Poole | ||||

Legend Senior Living | 95 | 3605 NW 83rd Street | Gainesville | Florida | US | Gainesville | ||||

Legend Senior Living | 60 | 2800 SW 131st Street | Oklahoma City | Oklahoma | US | Oklahoma City | ||||

Total | 319 | |||||||||

Outpatient Medical | ||||||||||

Health System | Square Feet | Location | MSA | |||||||

University of Arkansas for Medical Sciences | 67,144 | 6119 Midtown Avenue | Little Rock | Arkansas | US | Little Rock | ||||

Hammes Properties (1) | 1,466,008 | |||||||||

Total | 1,533,152 | |||||||||

(1) Please refer to the 4Q19 Welltower Facility Address List in the Investors section of our website for further details.

12

Investment | |

(dollars in thousands at Welltower pro rata ownership) | |||||||||||||||||||

Development Summary(1) | |||||||||||||||||||

Unit Mix | |||||||||||||||||||

Facility | Property Type | Total | Independent Living | Assisted Living | Memory Care | Commitment Amount | Balance at 12/31/19 | Estimated Conversion | |||||||||||

Wandsworth, UK | SHO | 97 | — | 77 | 20 | $ | 58,666 | $ | 52,408 | 1Q20 | |||||||||

Union, KY | NNN | 162 | 162 | — | — | 34,600 | 25,649 | 1Q20 | |||||||||||

Westerville, OH | NNN | 102 | — | 82 | 20 | 22,800 | 19,922 | 1Q20 | |||||||||||

Taylor, PA | SHO | 113 | 113 | — | — | 13,209 | 11,481 | 1Q20 | |||||||||||

Shrewsbury, NJ | SHO | 81 | — | 52 | 29 | 11,696 | 10,287 | 1Q20 | |||||||||||

Beavercreek, OH | SHO | 100 | 100 | — | — | 11,136 | 10,700 | 1Q20 | |||||||||||

New York, NY | SHO | 151 | — | 69 | 82 | 89,054 | 85,424 | 2Q20 | |||||||||||

Apex, NC | NNN | 152 | 98 | 30 | 24 | 30,883 | 16,494 | 2Q20 | |||||||||||

Edenbridge, UK | NNN | 85 | — | 51 | 34 | 19,876 | 13,966 | 2Q20 | |||||||||||

Droitwich, UK | NNN | 70 | — | 45 | 25 | 16,805 | 11,730 | 2Q20 | |||||||||||

Newton, MA | SHO | 85 | — | 43 | 42 | 15,169 | 3,844 | 3Q20 | |||||||||||

Potomac, MD | SHO | 120 | — | 90 | 30 | 55,302 | 22,566 | 4Q20 | |||||||||||

Thousand Oaks, CA | NNN | 82 | — | — | 82 | 24,763 | 9,971 | 4Q20 | |||||||||||

Medina, OH | SHO | 166 | 166 | — | — | 20,520 | 10,712 | 4Q20 | |||||||||||

Collierville, TN | SHO | 164 | 164 | — | — | 18,949 | 9,858 | 4Q20 | |||||||||||

Redhill, UK | NNN | 76 | — | 46 | 30 | 21,098 | 6,287 | 1Q21 | |||||||||||

Staten Island, NY | SHO | 95 | — | 45 | 50 | 19,444 | 5,357 | 1Q21 | |||||||||||

Franklin Lakes, NY | SHO | 88 | — | 51 | 37 | 16,921 | 2,962 | 1Q21 | |||||||||||

Fairfax, VA | SHO | 84 | — | 51 | 33 | 16,658 | 3,328 | 1Q21 | |||||||||||

Redwood City, CA | SHO | 90 | — | 56 | 34 | 16,065 | 2,351 | 1Q21 | |||||||||||

Mountain Lakes, NJ | SHO | 90 | — | 57 | 33 | 15,266 | 2,576 | 1Q21 | |||||||||||

Leicester, UK | NNN | 60 | — | 36 | 24 | 14,861 | 3,505 | 1Q21 | |||||||||||

Scarborough, ON | SHO | 172 | 141 | — | 31 | 33,871 | 8,884 | 2Q21 | |||||||||||

Wombourne, UK | NNN | 66 | — | 41 | 25 | 15,923 | 3,515 | 2Q21 | |||||||||||

Boynton Beach, FL | SHO | 82 | — | 52 | 30 | 11,465 | 5,966 | 2Q21 | |||||||||||

Bellevue, WA | SHO | 110 | — | 110 | — | 9,518 | 2,730 | 2Q21 | |||||||||||

White Plains, NY | SHO | 132 | 132 | — | — | 59,913 | 8,898 | 3Q21 | |||||||||||

Beckenham, UK | SHO | 100 | — | 76 | 24 | 46,873 | 20,567 | 3Q21 | |||||||||||

Orange, CA | SHO | 91 | — | 49 | 42 | 18,564 | 2,963 | 3Q21 | |||||||||||

Livingston, NJ | SHO | 103 | — | 77 | 26 | 17,375 | 2,043 | 3Q21 | |||||||||||

Hendon, UK | SHO | 102 | — | 78 | 24 | 55,531 | 25,274 | 4Q21 | |||||||||||

Barnet, UK | SHO | 100 | — | 76 | 24 | 51,252 | 21,374 | 4Q21 | |||||||||||

Coral Gables, FL | SHO | 91 | — | 55 | 36 | 18,224 | 3,380 | 4Q21 | |||||||||||

San Francisco, CA | SHO | 214 | 11 | 170 | 33 | 110,905 | 68,147 | 1Q22 | |||||||||||

Alexandria, VA | SHO | 93 | — | 66 | 27 | 20,624 | 8,396 | 1Q22 | |||||||||||

Subtotal | 3,769 | 1,087 | 1,731 | 951 | $ | 1,033,779 | $ | 523,515 | |||||||||||

Rentable Square Ft | Preleased % | Health System Affiliation | Commitment Amount | Balance at 12/31/19 | Estimated Conversion | ||||||||||||||

Porter, TX | OM | 55,000 | 100 | % | Yes | $ | 20,800 | $ | 16,124 | 1Q20 | |||||||||

Lowell, MA | OM | 50,668 | 100 | % | Yes | 11,900 | 10,288 | 1Q20 | |||||||||||

Charlotte, NC | OM | 176,640 | 100 | % | Yes | 95,703 | 57,666 | 2Q20 | |||||||||||

Katy, TX | OM | 36,500 | 100 | % | Yes | 12,028 | 3,251 | 2Q20 | |||||||||||

Brooklyn, NY | OM | 140,955 | 100 | % | Yes | 105,306 | 80,799 | 3Q20 | |||||||||||

Charlotte, NC | OM | 104,508 | 100 | % | Yes | 52,255 | 20,558 | 3Q20 | |||||||||||

Subtotal | 564,271 | $ | 297,992 | $ | 188,686 | ||||||||||||||

Total Development Projects | $ | 1,331,771 | $ | 712,201 | |||||||||||||||

Note:

(1) Includes development projects (construction in progress, development loans and in-substance real estate) and excludes redevelopments and expansion projects. Commitment amount represents current balances plus unfunded commitments to complete development.

13

Investment | |

(dollars in thousands at Welltower pro rata ownership) | ||||||||||||||||||||||||

Development Funding Projections(1) | ||||||||||||||||||||||||

Projected Future Funding | ||||||||||||||||||||||||

Projects | Beds / Units / Square Feet | Projected Yields(2) | 2020 Funding | Funding Thereafter | Total Unfunded Commitments | Committed Balances | ||||||||||||||||||

Seniors Housing Operating | 26 | 2,914 | 8.4 | % | $ | 277,290 | $ | 142,404 | $ | 419,694 | $ | 832,170 | ||||||||||||

Seniors Housing Triple-net | 9 | 855 | 5.7 | % | 81,179 | 9,391 | 90,570 | 201,609 | ||||||||||||||||

Outpatient Medical | 6 | 564,271 | 6.5 | % | 109,306 | — | 109,306 | 297,992 | ||||||||||||||||

Total | 41 | 7.7 | % | $ | 467,775 | $ | 151,795 | $ | 619,570 | $ | 1,331,771 | |||||||||||||

Development Project Conversion Estimates(1) | ||||||||||||||||

Quarterly Conversions | Annual Conversions | |||||||||||||||

Amount | Projected Yields(2) | Amount | Projected Yields(2) | |||||||||||||

1Q19 actual | $ | 34,389 | 7.6 | % | 2019 actual | $ | 302,589 | 7.2 | % | |||||||

2Q19 actual | 36,240 | 7.8 | % | 2020 estimate | 741,420 | 7.5 | % | |||||||||

3Q19 actual | 22,456 | 6.1 | % | 2021 estimate | 458,822 | 8.6 | % | |||||||||

4Q19 actual | 209,504 | 7.2 | % | 2022 estimate | 131,529 | 6.8 | % | |||||||||

1Q20 estimate | 184,807 | 8.5 | % | Total | $ | 1,634,360 | 7.7 | % | ||||||||

2Q20 estimate | 264,349 | 6.5 | % | |||||||||||||

3Q20 estimate | 172,730 | 7.2 | % | |||||||||||||

4Q20 estimate | 119,534 | 8.8 | % | |||||||||||||

1Q21 estimate | 120,313 | 8.6 | % | |||||||||||||

2Q21 estimate | 70,777 | 8.0 | % | |||||||||||||

3Q21 estimate | 142,725 | 8.4 | % | |||||||||||||

4Q21 estimate | 125,007 | 9.0 | % | |||||||||||||

1Q22 estimate | 131,529 | 6.8 | % | |||||||||||||

Total | $ | 1,634,360 | 7.7 | % | ||||||||||||

Unstabilized Properties | |||||||||||||||||

9/30/2019 Properties | Stabilizations | Construction Conversions(3) | Acquisitions/ Dispositions | 12/31/2019 Properties | Beds / Units | ||||||||||||

Seniors Housing Operating | 27 | (4 | ) | 5 | 1 | 29 | 3,689 | ||||||||||

Seniors Housing Triple-net | 9 | — | — | 1 | 10 | 994 | |||||||||||

Long-Term/Post-Acute Care | 2 | (1 | ) | — | — | 1 | 120 | ||||||||||

Total | 38 | (5 | ) | 5 | 2 | 40 | 4,803 | ||||||||||

Occupancy | 9/30/2019 Properties | Stabilizations | Construction Conversions(3) | Acquisitions/ Dispositions | Progressions | 12/31/2019 Properties | |||||||||||||

0% - 50% | 12 | — | 5 | 1 | (5 | ) | 13 | ||||||||||||

50% - 70% | 14 | (2 | ) | — | — | (1 | ) | 11 | |||||||||||

70% + | 12 | (3 | ) | — | 1 | 6 | 16 | ||||||||||||

Total | 38 | (5 | ) | 5 | 2 | — | 40 | ||||||||||||

Occupancy | 12/31/2019 Properties | Months In Operation | Revenues | % of Total Revenues(4) | Gross Investment Balance | % of Total Gross Investment | |||||||||||||

0% - 50% | 13 | 5 | $ | 25,064 | 0.5 | % | $ | 343,694 | 1.0 | % | |||||||||

50% - 70% | 11 | 19 | 48,387 | 1.0 | % | 461,344 | 1.3 | % | |||||||||||

70% + | 16 | 19 | 72,690 | 1.5 | % | 481,818 | 1.3 | % | |||||||||||

Total | 40 | 15 | $ | 146,141 | 3.0 | % | $ | 1,286,856 | 3.6 | % | |||||||||

Notes:

(1) Includes development projects (construction in progress, development loans, and in-substance real estate) and excludes expansion projects.

(2) Actual yields may vary.

(3) Includes expansion and development loan conversions.

(4) Percent of total revenues based on current quarter annualized pro rata total revenues on page 16.

14

Financial | |

(dollars in thousands at Welltower pro rata ownership) | ||||||||

Components of NAV | ||||||||

Stabilized NOI | Pro rata beds/units/square feet | |||||||

Seniors Housing Operating(1) | $ | 904,136 | 55,792 | units | ||||

Seniors Housing Triple-net | 411,968 | 24,029 | units | |||||

Outpatient Medical | 464,820 | 19,416,665 | square feet | |||||

Health System | 143,168 | 20,602 | units/beds | |||||

Long-Term/Post-Acute Care | 179,780 | 13,596 | beds | |||||

Total In-Place NOI(2) | 2,103,872 | |||||||

Incremental stabilized NOI(3) | 52,632 | |||||||

Total stabilized NOI | $ | 2,156,504 | ||||||

Obligations | ||||||||

Lines of credit and commercial paper(4) | $ | 1,588,600 | ||||||

Senior unsecured notes(4) | 10,427,562 | |||||||

Secured debt(4) | 3,176,749 | |||||||

Financing lease liabilities | 108,890 | |||||||

Total debt | $ | 15,301,801 | ||||||

Add (Subtract): | ||||||||

Other liabilities (assets), net(5) | $ | 266,419 | ||||||

Cash and cash equivalents and restricted cash | (385,766 | ) | ||||||

Net obligations | $ | 15,182,454 | ||||||

Other Assets | ||||||||

Land parcels | $ | 129,749 | Effective Interest Rate(8) | |||||

Real estate loans receivable(6) | 245,690 | 7.7% | ||||||

Non real estate loans receivable(7) | 336,854 | 8.2% | ||||||

Joint venture real estate loans receivables(9) | 337,298 | 5.2% | ||||||

Other investments(10) | 15,685 | |||||||

Investments held for sale(11) | 1,709,979 | |||||||

Development properties:(12) | ||||||||

Current balance | $ | 729,481 | ||||||

Unfunded commitments | 624,413 | |||||||

Committed balances | $ | 1,353,894 | ||||||

Projected yield | 7.7 | % | ||||||

Projected NOI | $ | 104,250 | ||||||

Common Shares Outstanding | 410,257 | |||||||

Notes:

(1) Includes $5,559,000 attributable to our proportional share of income from unconsolidated management company investments.

(2) See page 22 for reconciliation.

(3) Represents incremental NOI from Seniors Housing Operating lease-up properties.

(4) Represents pro rata principal amounts due and do not include unamortized premiums/discounts, deferred loan expenses or other fair value adjustments as reflected on the balance sheet. Includes $1,228,128,000 of foreign secured debt.

(5) Includes liabilities/(assets) that impact cash or NOI and excludes non-real estate loans and non-cash items such as the following:

Unearned revenues | $ | 183,011 | ||

Below market tenant lease intangibles, net | 49,645 | |||

Deferred taxes, net | (22,284 | ) | ||

Available-for-sale equity investments | (15,686 | ) | ||

In place lease intangibles, net | (47,012 | ) | ||

Other non-cash liabilities / (assets), net | 2,862 | |||

Total non-cash liabilities/(assets), net | $ | 150,536 | ||

(6) Represents $288,066,000 of real estate loans excluding development loans and net of $42,376,000 of allowance for loan losses.

(7) Represents $362,850,000 of non real estate loans and net of $25,996,000 of allowance for loan losses.

(8) Average cash-pay interest rates are 7.7% and 5.8% for real estate and non real estate loans, respectively. Rates exclude non-accrual/interest-free loans.

(9) Represents partners' share of Welltower loans made to our partners in select joint ventures, secured by their interest in the joint venture properties.

(10) Represents the fair value of Genesis HealthCare stock investment based on closing stock price.

(11) Represents expected proceeds from assets held for sale.

(12) See pages 13-14. Also includes expansion projects.

15

Financial | |

(dollars in thousands at Welltower pro rata ownership) | ||||||||||||||||||||

Net Operating Income(1) | ||||||||||||||||||||

4Q18 | 1Q19 | 2Q19 | 3Q19 | 4Q19 | ||||||||||||||||

Revenues: | ||||||||||||||||||||

Seniors Housing Operating | ||||||||||||||||||||

Resident fees and services | $ | 833,134 | $ | 837,866 | $ | 878,933 | $ | 803,904 | $ | 802,452 | ||||||||||

Interest income | 157 | — | — | — | 36 | |||||||||||||||

Other income | 1,065 | 4,072 | 1,387 | 1,347 | 1,915 | |||||||||||||||

Total revenues | 834,356 | 841,938 | 880,320 | 805,251 | 804,403 | |||||||||||||||

Seniors Housing Triple-net | ||||||||||||||||||||

Rental income | 104,431 | 113,874 | 107,220 | 114,419 | 115,717 | |||||||||||||||

Interest income | 5,749 | 5,660 | 7,701 | 5,910 | 6,303 | |||||||||||||||

Other income | 637 | 945 | 1,105 | 1,312 | 1,403 | |||||||||||||||

Total revenues | 110,817 | 120,479 | 116,026 | 121,641 | 123,423 | |||||||||||||||

Outpatient Medical | ||||||||||||||||||||

Rental income | 130,076 | 139,295 | 154,044 | 174,330 | 177,840 | |||||||||||||||

Interest income | 170 | 173 | 238 | 358 | 426 | |||||||||||||||

Other income | 4,598 | 267 | 161 | 312 | 1,835 | |||||||||||||||

Total revenues | 134,844 | 139,735 | 154,443 | 175,000 | 180,101 | |||||||||||||||

Health System | ||||||||||||||||||||

Rental income | 43,033 | 43,036 | 43,036 | 43,036 | 43,036 | |||||||||||||||

Total revenues | 43,033 | 43,036 | 43,036 | 43,036 | 43,036 | |||||||||||||||

Long-Term/Post-Acute Care | ||||||||||||||||||||

Rental income | 64,216 | 65,456 | 62,640 | 60,479 | 53,422 | |||||||||||||||

Interest income | 7,006 | 9,286 | 9,417 | 9,369 | 8,953 | |||||||||||||||

Other income | 201 | 375 | 173 | 517 | 473 | |||||||||||||||

Total revenues | 71,423 | 75,117 | 72,230 | 70,365 | 62,848 | |||||||||||||||

Corporate | ||||||||||||||||||||

Other income | 591 | 2,031 | 327 | 712 | 385 | |||||||||||||||

Total revenues | 591 | 2,031 | 327 | 712 | 385 | |||||||||||||||

Total | ||||||||||||||||||||

Rental income | 341,756 | 361,661 | 366,940 | 392,264 | 390,015 | |||||||||||||||

Resident fees and services | 833,134 | 837,866 | 878,933 | 803,904 | 802,452 | |||||||||||||||

Interest income | 13,082 | 15,119 | 17,356 | 15,637 | 15,718 | |||||||||||||||

Other income | 7,092 | 7,690 | 3,153 | 4,200 | 6,011 | |||||||||||||||

Total revenues | $ | 1,195,064 | $ | 1,222,336 | $ | 1,266,382 | $ | 1,216,005 | $ | 1,214,196 | ||||||||||

Property operating expenses: | ||||||||||||||||||||

Seniors Housing Operating | $ | 582,412 | $ | 580,917 | $ | 607,836 | $ | 554,782 | $ | 564,895 | ||||||||||

Seniors Housing Triple-net | 21 | 8,935 | 7,219 | 8,282 | 7,473 | |||||||||||||||

Outpatient Medical | 40,136 | 44,868 | 47,894 | 57,272 | 55,915 | |||||||||||||||

Health System | 17 | 20 | 20 | 20 | 20 | |||||||||||||||

Long-Term/Post-Acute Care | 287 | 5,905 | 5,475 | 5,503 | 4,595 | |||||||||||||||

Total property operating expenses | $ | 622,873 | $ | 640,645 | $ | 668,444 | $ | 625,859 | $ | 632,898 | ||||||||||

Net operating income: | ||||||||||||||||||||

Seniors Housing Operating | $ | 251,944 | $ | 261,021 | $ | 272,484 | $ | 250,469 | $ | 239,508 | ||||||||||

Seniors Housing Triple-net | 110,796 | 111,544 | 108,807 | 113,359 | 115,950 | |||||||||||||||

Outpatient Medical | 94,708 | 94,867 | 106,549 | 117,728 | 124,186 | |||||||||||||||

Health System | 43,016 | 43,016 | 43,016 | 43,016 | 43,016 | |||||||||||||||

Long-Term/Post-Acute Care | 71,136 | 69,212 | 66,755 | 64,862 | 58,253 | |||||||||||||||

Corporate | 591 | 2,031 | 327 | 712 | 385 | |||||||||||||||

Net operating income | $ | 572,191 | $ | 581,691 | $ | 597,938 | $ | 590,146 | $ | 581,298 | ||||||||||

Note:

(1) Please see discussion of Supplemental Reporting Measures on page 21. Includes amounts from investments sold or held for sale.

16

Financial | |

(dollars in thousands) | ||||||||

Leverage and EBITDA Reconciliations(1) | ||||||||

Twelve Months Ended | Three Months Ended | |||||||

12/31/2019 | 12/31/2019 | |||||||

Net income (loss) | $ | 1,330,410 | $ | 240,136 | ||||

Interest expense | 555,559 | 131,648 | ||||||

Income tax expense (benefit) | 2,957 | (4,832 | ) | |||||

Depreciation and amortization | 1,027,073 | 262,644 | ||||||

EBITDA | $ | 2,915,999 | $ | 629,596 | ||||

Loss (income) from unconsolidated entities | (42,434 | ) | (57,420 | ) | ||||

Stock-based compensation(2) | 25,047 | 4,547 | ||||||

Loss (gain) on extinguishment of debt, net | 84,155 | 2,612 | ||||||

Loss (gain) on real estate dispositions, net | (748,041 | ) | (12,064 | ) | ||||

Impairment of assets | 28,133 | 98 | ||||||

Provision for loan losses | 18,690 | — | ||||||

Loss (gain) on derivatives and financial instruments, net | (4,399 | ) | (5,069 | ) | ||||

Other expenses(2) | 51,052 | 16,042 | ||||||

Total adjustments | (587,797 | ) | (51,254 | ) | ||||

Adjusted EBITDA | $ | 2,328,202 | $ | 578,342 | ||||

Interest Coverage Ratios | ||||||||

Interest expense | $ | 555,559 | $ | 131,648 | ||||

Capitalized interest | 15,272 | 4,868 | ||||||

Non-cash interest expense | (8,645 | ) | (734 | ) | ||||

Total interest | $ | 562,186 | $ | 135,782 | ||||

EBITDA | $ | 2,915,999 | $ | 629,596 | ||||

Interest coverage ratio | 5.19 | x | 4.64 | x | ||||

Adjusted EBITDA | $ | 2,328,202 | $ | 578,342 | ||||

Adjusted Interest coverage ratio | 4.14 | x | 4.26 | x | ||||

Fixed Charge Coverage Ratios | ||||||||

Total interest | $ | 562,186 | $ | 135,782 | ||||

Secured debt principal amortization | 54,325 | 13,977 | ||||||

Total fixed charges | $ | 616,511 | $ | 149,759 | ||||

EBITDA | $ | 2,915,999 | $ | 629,596 | ||||

Fixed charge coverage ratio | 4.73 | x | 4.20 | x | ||||

Adjusted EBITDA | $ | 2,328,202 | $ | 578,342 | ||||

Adjusted Fixed charge coverage ratio | 3.78 | x | 3.86 | x | ||||

Net Debt to EBITDA Ratios | ||||||||

Total debt(3) | $ | 15,023,962 | ||||||

Less: cash and cash equivalents(4) | (284,917 | ) | ||||||

Net debt | $ | 14,739,045 | ||||||

EBITDA Annualized | $ | 2,518,384 | ||||||

Net debt to EBITDA ratio | 5.85 | x | ||||||

Adjusted EBITDA Annualized | $ | 2,313,368 | ||||||

Net debt to Adjusted EBITDA ratio | 6.37 | x | ||||||

Notes:

(1) Please see discussion of Supplemental Reporting Measures on page 21.

(2) Certain severance-related costs are included in stock-based compensation and excluded from other expenses.

(3) Amounts include unamortized premiums/discounts, fair value adjustments and lease liabilities related to financing leases. Operating lease liabilities related to ASC 842 adoption are excluded.

(4) Includes IRC Section 1031 deposits, if any.

17

Financial | |

(in thousands except share price) | |||||||||

Leverage and Current Capitalization(1) | |||||||||

% of Total | |||||||||

Book Capitalization | |||||||||

Lines of credit and commercial paper(2) | $ | 1,587,597 | 5.00 | % | |||||

Long-term debt obligations(2) | 13,436,365 | 42.36 | % | ||||||

Cash and cash equivalents(3) | (284,917 | ) | (0.90 | )% | |||||

Net debt to consolidated book capitalization | $ | 14,739,045 | 46.46 | % | |||||

Total equity(4) | 16,982,504 | 53.54 | % | ||||||

Consolidated book capitalization | $ | 31,721,549 | 100.00 | % | |||||

Joint venture debt, net(5) | 183,407 | ||||||||

Total book capitalization | $ | 31,904,956 | |||||||

Undepreciated Book Capitalization | |||||||||

Lines of credit and commercial paper(2) | $ | 1,587,597 | 4.24 | % | |||||

Long-term debt obligations(2) | 13,436,365 | 35.89 | % | ||||||

Cash and cash equivalents(3) | (284,917 | ) | (0.76 | )% | |||||

Net debt to consolidated undepreciated book capitalization | $ | 14,739,045 | 39.37 | % | |||||

Accumulated depreciation and amortization | 5,715,459 | 15.27 | % | ||||||

Total equity(4) | 16,982,504 | 45.36 | % | ||||||

Consolidated undepreciated book capitalization | $ | 37,437,008 | 100.00 | % | |||||

Joint venture debt, net(5) | 183,407 | 186.271 | |||||||

Total undepreciated book capitalization | $ | 37,620,415 | |||||||

Enterprise Value | |||||||||

Lines of credit and commercial paper(2) | $ | 1,587,597 | 3.19 | % | |||||

Long-term debt obligations(2) | 13,436,365 | 27.02 | % | ||||||

Cash and cash equivalents(3) | (284,917 | ) | (0.57 | )% | |||||

Net debt to consolidated enterprise value | $ | 14,739,045 | 29.64 | % | |||||

Common shares outstanding | 410,257 | ||||||||

Period end share price | 81.78 | ||||||||

Common equity market capitalization | $ | 33,550,817 | 67.46 | % | |||||

Noncontrolling interests(4) | 1,442,060 | 2.90 | % | ||||||

Consolidated enterprise value | $ | 49,731,922 | 100.00 | % | |||||

Joint venture debt, net(5) | 183,407 | ||||||||

Total enterprise value | $ | 49,915,329 | |||||||

Secured Debt as % of Total Assets | |||||||||

Secured debt(2) | $ | 2,990,962 | 8.96 | % | |||||

Total assets | $ | 33,380,751 | |||||||

Total Debt as % of Total Assets | |||||||||

Total debt(2) | $ | 15,023,962 | 45.01 | % | |||||

Total assets | $ | 33,380,751 | |||||||

Unsecured Debt as % of Unencumbered Assets | |||||||||

Unsecured debt(2) | $ | 11,924,109 | 39.65 | % | |||||

Unencumbered assets | $ | 30,075,557 | |||||||

Notes:

(1) Please see discussion of Supplemental Reporting Measures on page 21.

(2) Amounts include unamortized premiums/discounts, fair value adjustments and lease liabilities related to financing leases. Operating lease liabilities related to ASC 842 adoption are excluded.

(3) Inclusive of IRC Section 1031 deposits, if any.

(4) Includes all noncontrolling interests (redeemable and permanent) as reflected on our balance sheet.

(5) Net of Welltower's share of unconsolidated debt and minority partners' share of Welltower consolidated debt.

18

Financial | |

(dollars in thousands) | |||||||||||||||||||||||||||||

Debt Maturities and Principal Payments(1) | |||||||||||||||||||||||||||||

Year | Lines of Credit and Commercial Paper(2) | Senior Unsecured Notes(3,4,5,6) | Consolidated Secured Debt | Share of Unconsolidated Secured Debt | Noncontrolling Interests' Share of Consolidated Secured Debt | Combined Debt(7) | % of Total | Wtd. Avg. Interest Rate | |||||||||||||||||||||

2020 | $ | 643,600 | $ | — | $ | 354,329 | $ | 57,728 | $ | (84,716 | ) | $ | 970,941 | 6.39 | % | 2.56 | % | ||||||||||||

2021 | — | — | 439,176 | 20,454 | (133,881 | ) | 325,749 | 2.14 | % | 3.81 | % | ||||||||||||||||||

2022 | — | 10,000 | 421,876 | 31,718 | (58,958 | ) | 404,636 | 2.66 | % | 3.79 | % | ||||||||||||||||||

2023 | 945,000 | 1,792,871 | 467,378 | 53,739 | (106,181 | ) | 3,152,807 | 20.75 | % | 3.24 | % | ||||||||||||||||||

2024 | — | 1,350,000 | 304,533 | 42,044 | (81,685 | ) | 1,614,892 | 10.63 | % | 3.89 | % | ||||||||||||||||||

2025 | — | 1,250,000 | 204,764 | 406,388 | (36,099 | ) | 1,825,053 | 12.01 | % | 3.96 | % | ||||||||||||||||||

2026 | — | 700,000 | 63,712 | 17,500 | (19,611 | ) | 761,601 | 5.01 | % | 4.17 | % | ||||||||||||||||||

2027 | — | 731,446 | 162,644 | 62,242 | (45,140 | ) | 911,192 | 6.00 | % | 2.96 | % | ||||||||||||||||||

2028 | — | 1,479,795 | 81,222 | 23,223 | (14,413 | ) | 1,569,827 | 10.33 | % | 4.48 | % | ||||||||||||||||||

2029 | — | 550,000 | 249,574 | 29,461 | (2,518 | ) | 826,517 | 5.44 | % | 3.86 | % | ||||||||||||||||||

Thereafter | — | 2,563,450 | 244,134 | 81,899 | (59,787 | ) | 2,829,696 | 18.64 | % | 4.42 | % | ||||||||||||||||||

Totals | $ | 1,588,600 | $ | 10,427,562 | $ | 2,993,342 | $ | 826,396 | $ | (642,989 | ) | $ | 15,192,911 | 100.00 | % | ||||||||||||||

Weighted Avg Interest Rate(8) | 2.40 | % | 4.03 | % | 3.63 | % | 3.76 | % | 3.37 | % | 3.80 | % | |||||||||||||||||

Weighted Avg Maturity Years | 2.1 | (2) | 8.8 | 5.3 | 8.7 | 4.3 | 7.6 | (2) | |||||||||||||||||||||

% Floating Rate Debt | 100.00 | % | 6.74 | % | 39.39 | % | 9.75 | % | 52.65 | % | 21.15 | % | |||||||||||||||||

Debt by Local Currency(1) | ||||||||||||||||||||||||||||||

Lines of Credit and Commercial Paper | Senior Unsecured Notes | Consolidated Secured Debt | Share of Unconsolidated Secured Debt | Noncontrolling Interests' Share of Consolidated Secured Debt | Combined Debt(7) | Investment Hedges(9) | ||||||||||||||||||||||||

United States | $ | 1,588,600 | $ | 8,610,000 | $ | 1,690,390 | $ | 603,882 | $ | (345,651 | ) | $ | 12,147,221 | $ | — | |||||||||||||||

United Kingdom | — | 1,393,245 | 178,707 | — | (44,677 | ) | 1,527,275 | 1,778,985 | ||||||||||||||||||||||

Canada | — | 424,317 | 1,124,245 | 222,514 | — | (252,661 | ) | 1,518,415 | 559,327 | |||||||||||||||||||||

Totals | $ | 1,588,600 | $ | 10,427,562 | $ | 2,993,342 | $ | 826,396 | $ | (642,989 | ) | $ | 15,192,911 | $ | 2,338,312 | |||||||||||||||

Notes:

(1) Represents principal amounts due excluding unamortized premiums/discounts or other fair value adjustments as reflected on the balance sheet.

(2) The 2020 maturity reflects the $643,600,000 in principal outstanding on our unsecured commercial paper program as of December 31, 2019. The 2023 maturity reflects the $945,000,000 in principal outstanding on our unsecured revolving credit facility that matures on July 19, 2022 (with an option to extend for two successive terms of six months each at our discretion). These borrowings reduce the available borrowing capacity of our unsecured revolving credit facility to $1,411,400,000. If the commercial paper was refinanced using the unsecured revolving credit facility, the weighted average years to maturity of our combined debt would be 7.8 years with extensions.

(3) 2023 includes a $500,000,000 term loan and a CAD $250,000,000 unsecured term loan (approximately $192,871,000 USD at December 31, 2019). The loans mature on July 19, 2023. The interest rates on the loans are LIBOR + 0.9% for USD and CDOR + 0.9% for CAD.

(4) 2027 includes CAD $300,000,000 of 2.95% senior unsecured notes (approximately $231,446,000 USD at December 31, 2019) that matures on January 15, 2027.

(5) 2028 includes £550,000,000 of 4.80% senior unsecured notes (approximately $729,795,000 USD at December 31, 2019). The notes mature on November 20, 2028.

(6) Thereafter includes £500,000,000 of 4.50% senior unsecured notes (approximately $663,450,000 USD at December 31, 2019). The notes mature on December 1, 2034.

(7) Excludes operating lease liabilities of $364,803,000 and finance lease liabilities of $108,890,000 related to ASC 842 adoption.

(8) The interest rate on the unsecured revolving credit facility is 1-month LIBOR + 0.825%. Commercial paper, senior notes and secured debt average interest rate represents the face value note rate.

(9) Represents notional value of foreign currency derivative contracts at end of period spot FX rates. The fair market value of the gains (losses) of these contracts is currently USD $(26,767,000), as represented in other assets (liabilities) on the balance sheet. We supplement our local currency debt with foreign currency derivative contracts to offset the translation and economic exposures related to our international investments. Currently, our foreign currency derivatives are comprised of forward contracts and cross-currency swaps.

19

Glossary | |

Age: Current year, less the year built, adjusted for major renovations. Average age is weighted by pro rata NOI.

Cap-ex, Tenant Improvements, Leasing Commissions: Represents amounts paid in cash for: 1) recurring and non-recurring capital expenditures required to maintain and re-tenant our properties; 2) second generation tenant improvements; and 3) leasing commissions paid to third party leasing agents to secure new tenants.

Construction Conversion: Represents completed construction projects that were placed into service and began generating NOI.

EBITDAR: Earnings before interest, taxes, depreciation, amortization and rent. The company uses unaudited, periodic financial information provided solely by tenants/borrowers to calculate EBITDAR and has not independently verified the information.

EBITDAR Coverage: Represents the ratio of EBITDAR to contractual rent for leases or interest and principal payments for loans. EBITDAR coverage is a measure of a property’s ability to generate sufficient cash flows for the operator/borrower to pay rent and meet other obligations. The coverage shown excludes properties that are unstabilized, closed or for which data is not available or meaningful.

EBITDARM: Earnings before interest, taxes, depreciation, amortization, rent and management fees. The company uses unaudited, periodic financial information provided solely by tenants/borrowers to calculate EBITDARM and has not independently verified the information.

EBITDARM Coverage: Represents the ratio of EBITDARM to contractual rent for leases or interest and principal payments for loans. EBITDARM coverage is a measure of a property’s ability to generate sufficient cash flows for the operator/borrower to pay rent and meet other obligations, assuming that management fees are not paid. The coverage shown excludes properties that are unstabilized, closed or for which data is not available or meaningful.

Health System: Includes independent, assisted living, dementia care and long-term post-acute care properties subject to triple-net operating leases to or guaranteed by investment-grade health systems.

Health System - Affiliated: Outpatient medical properties are considered affiliated with a health system if one or more of the following conditions are met: 1) the land parcel is contained within the physical boundaries of a hospital campus; 2) the land parcel is located adjacent to the campus; 3) the building is physically connected to the hospital regardless of the land ownership structure; 4) a ground lease is maintained with a health system entity; 5) a master lease is maintained with a health system entity; 6) significant square footage is leased to a health system entity; 7) the property includes an ambulatory surgery center with a hospital partnership interest; or (8) a significant square footage is leased to a physician group that is either employed, directly or indirectly by a health system, or has a significant clinical and financial affiliation with the health system.