Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FULTON FINANCIAL CORP | a8k2-12x20investorpres.htm |

INVESTOR PRESENTATION z Data as of December 31, 2019 - Unless otherwise noted

Forward-Looking Statements This presentation may contain forward-looking statements with respect to the Corporation’s financial condition, results of operations and business. Do not unduly rely on forward-looking statements. Forward-looking statements can be identified by the use of words such as "may," "should," "will," "could," "estimates," "predicts," "potential," "continue," "anticipates," "believes," "plans," "expects," "future," "intends," “projects,” the negative of these terms and other comparable terminology. These forward looking statements may include projections of, or guidance on, the Corporation’s future financial performance, expected levels of future expenses, anticipated growth strategies, descriptions of new business initiatives and anticipated trends in the Corporation’s business or financial results. Management’s 2020 Outlook contained herein is comprised of forward-looking statements. Forward-looking statements are neither historical facts, nor assurance of future performance. Instead, they are based on current beliefs, expectations and assumptions regarding the future of the Corporation’s business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Corporation’s control, and actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not unduly rely on any of these forward-looking statements. Any forward-looking statement is based only on information currently available and speaks only as of the date when made. The Corporation undertakes no obligation, other than as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. A discussion of certain risks and uncertainties affecting the Corporation, and some of the factors that could cause the Corporation’s actual results to differ materially from those described in the forward-looking statements, can be found in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2018 and Quarterly Reports on Form 10-Q for the quarters ended March 31, 2019, June 30, 2019 and September 30, 2019 and other periodic reports, which the Corporation files with the Securities and Exchange Commission and are available in the Investor Relations section of the Corporation’s website (www.fult.com) and on the Securities and Exchange Commission’s website (www.sec.gov). The Corporation uses certain non-GAAP financial measures in this presentation. These non-GAAP financial measures are reconciled to the most comparable GAAP measures at the end of this presentation. 2

Why Fulton? . Deep Executive Bench with Continuity . Valuable Franchise in Attractive Markets . Investing in People to Drive Growth . Relationship Banking Strategy Focused on the Customer Experience . Granular, Well-Diversified Loan Portfolio . Attractive Core Deposit Profile . Solid Asset Quality and Reserves . Prudent Expense Management with Opportunities to Improve . Strong Capital Position 3

Deep Executive Bench With Continuity Years in Financial Prior Name Position Years at Fulton Services Experience Phil Wenger Chairman/CEO 41 41 Various roles since joining in 1979 Curt Myers President/COO 30 30 Various roles since joining in 1990 PwC, Banking and Investment Banking; Joined Mark McCollom (1) Chief Financial Officer 2 32 Fulton in November 2017 Meg Mueller Head of Commercial Banking 24 34 Various roles since joining in 1996 Angela Snyder Head of Consumer Banking 18 34 Various roles since joining in 2002 Angie Sargent Chief Information Officer 28 28 Various roles since joining in 1992 Betsy Chivinski (2) Chief Risk Officer 26 38 Various roles since joining in 1994 (1) Includes years of service in public accounting and investment banking as a financial services industry specialist (2) Includes years of service in public accounting as a financial services industry specialist 4

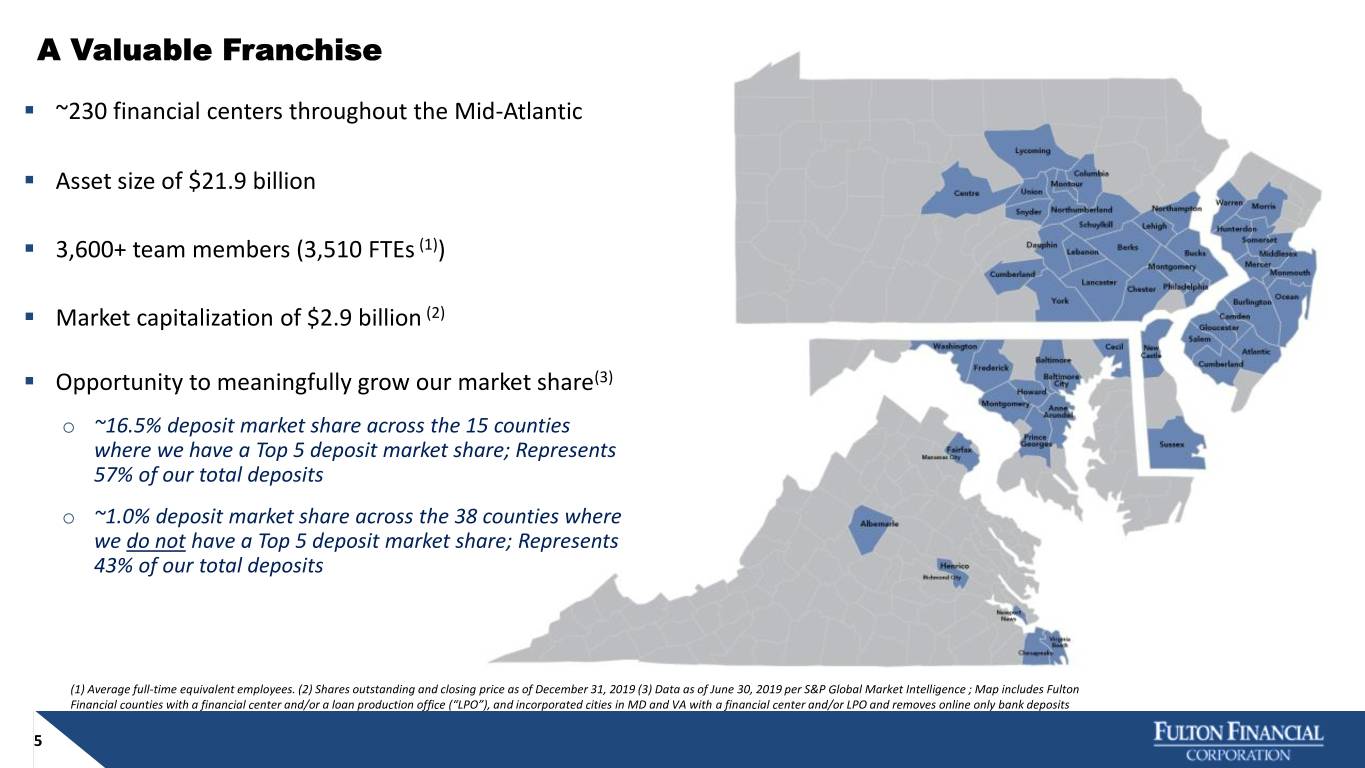

A Valuable Franchise . ~230 financial centers throughout the Mid-Atlantic . Asset size of $21.9 billion . 3,600+ team members (3,510 FTEs (1)) . Market capitalization of $2.9 billion (2) . Opportunity to meaningfully grow our market share(3) o ~16.5% deposit market share across the 15 counties where we have a Top 5 deposit market share; Represents 57% of our total deposits o ~1.0% deposit market share across the 38 counties where we do not have a Top 5 deposit market share; Represents 43% of our total deposits (1) Average full-time equivalent employees. (2) Shares outstanding and closing price as of December 31, 2019 (3) Data as of June 30, 2019 per S&P Global Market Intelligence ; Map includes Fulton Financial counties with a financial center and/or a loan production office (“LPO”), and incorporated cities in MD and VA with a financial center and/or LPO and removes online only bank deposits 5

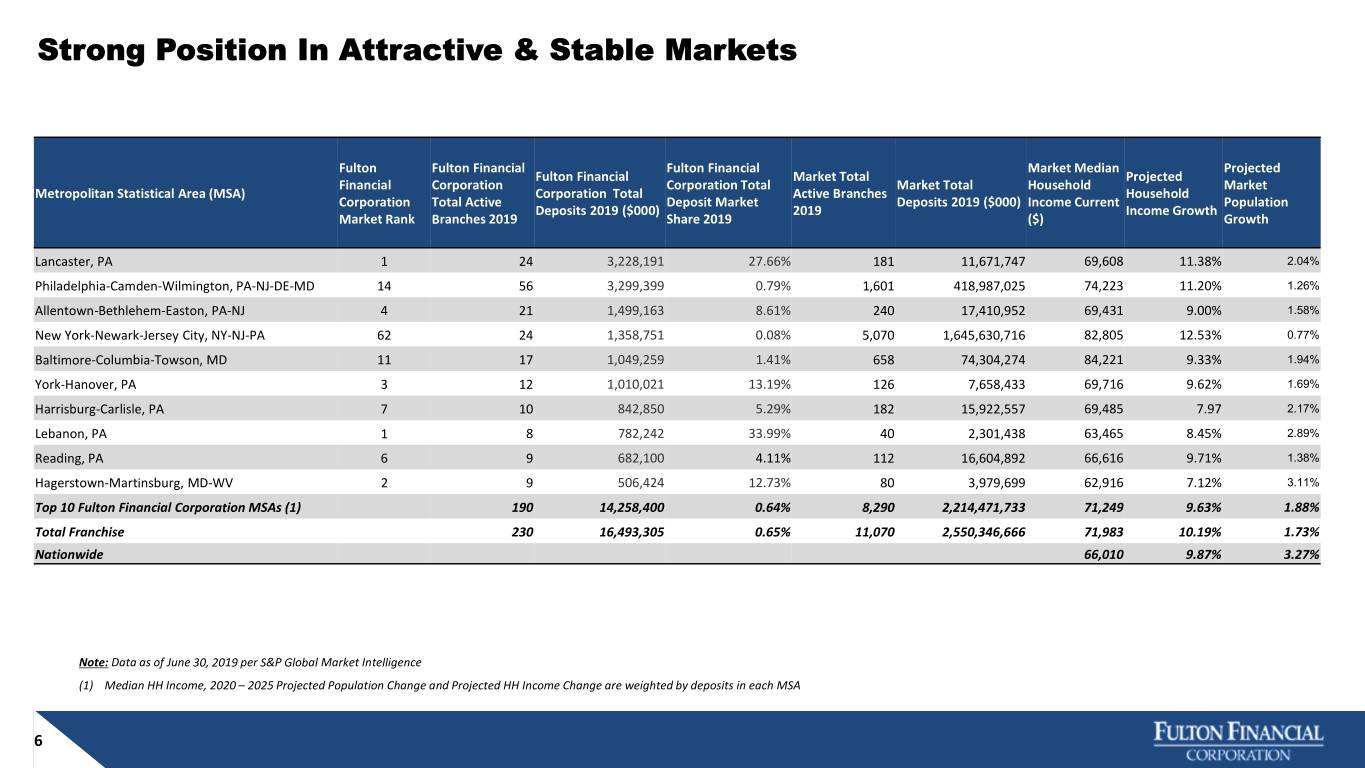

Strong Position In Attractive & Stable Markets Fulton Fulton Financial Fulton Financial Market Median Projected Fulton Financial Market Total Projected Financial Corporation Corporation Total Market Total Household Market Metropolitan Statistical Area (MSA) Corporation Total Active Branches Household Corporation Total Active Deposit Market Deposits 2019 ($000) Income Current Population Deposits 2019 ($000) 2019 Income Growth Market Rank Branches 2019 Share 2019 ($) Growth Lancaster, PA 1 24 3,228,191 27.66% 181 11,671,747 69,608 11.38% 2.04% Philadelphia-Camden-Wilmington, PA-NJ-DE-MD 14 56 3,299,399 0.79% 1,601 418,987,025 74,223 11.20% 1.26% Allentown-Bethlehem-Easton, PA-NJ 4 21 1,499,163 8.61% 240 17,410,952 69,431 9.00% 1.58% New York-Newark-Jersey City, NY-NJ-PA 62 24 1,358,751 0.08% 5,070 1,645,630,716 82,805 12.53% 0.77% Baltimore-Columbia-Towson, MD 11 17 1,049,259 1.41% 658 74,304,274 84,221 9.33% 1.94% York-Hanover, PA 3 12 1,010,021 13.19% 126 7,658,433 69,716 9.62% 1.69% Harrisburg-Carlisle, PA 7 10 842,850 5.29% 182 15,922,557 69,485 7.97 2.17% Lebanon, PA 1 8 782,242 33.99% 40 2,301,438 63,465 8.45% 2.89% Reading, PA 6 9 682,100 4.11% 112 16,604,892 66,616 9.71% 1.38% Hagerstown-Martinsburg, MD-WV 2 9 506,424 12.73% 80 3,979,699 62,916 7.12% 3.11% Top 10 Fulton Financial Corporation MSAs (1) 190 14,258,400 0.64% 8,290 2,214,471,733 71,249 9.63% 1.88% Total Franchise 230 16,493,305 0.65% 11,070 2,550,346,666 71,983 10.19% 1.73% Nationwide 66,010 9.87% 3.27% Note: Data as of June 30, 2019 per S&P Global Market Intelligence (1) Median HH Income, 2020 – 2025 Projected Population Change and Projected HH Income Change are weighted by deposits in each MSA 6

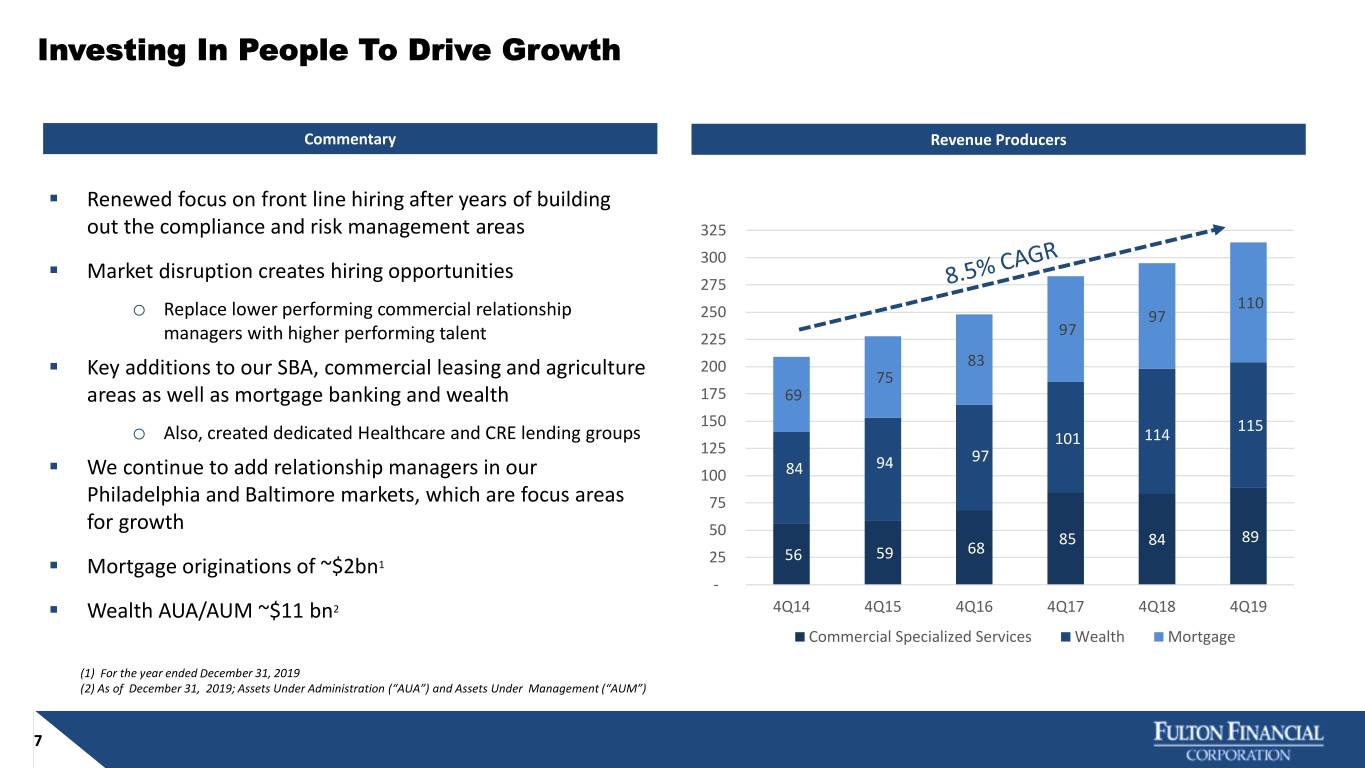

Investing In People To Drive Growth Commentary Revenue Producers . Renewed focus on front line hiring after years of building out the compliance and risk management areas 325 300 . Market disruption creates hiring opportunities 275 110 o Replace lower performing commercial relationship 250 97 97 managers with higher performing talent 225 200 83 . Key additions to our SBA, commercial leasing and agriculture 75 areas as well as mortgage banking and wealth 175 69 150 115 o Also, created dedicated Healthcare and CRE lending groups 101 114 125 94 97 . We continue to add relationship managers in our 100 84 Philadelphia and Baltimore markets, which are focus areas 75 for growth 50 85 84 89 68 25 56 59 . Mortgage originations of ~$2bn1 - . Wealth AUA/AUM ~$11 bn2 4Q14 4Q15 4Q16 4Q17 4Q18 4Q19 Commercial Specialized Services Wealth Mortgage (1) For the year ended December 31, 2019 (2) As of December 31, 2019; Assets Under Administration (“AUA”) and Assets Under Management (“AUM”) 7

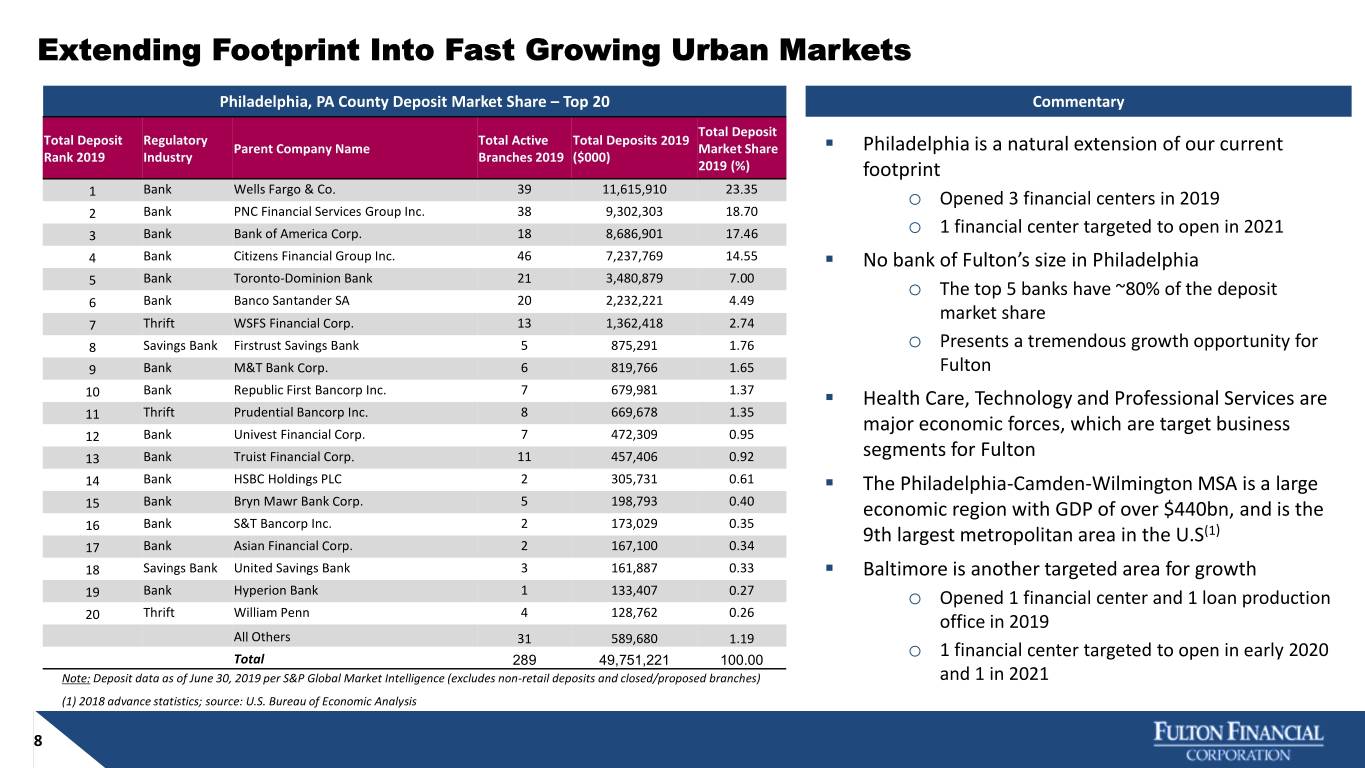

Extending Footprint Into Fast Growing Urban Markets Philadelphia, PA County Deposit Market Share – Top 20 Commentary Total Deposit Total Deposit Regulatory Total Active Total Deposits 2019 Parent Company Name Market Share . Philadelphia is a natural extension of our current Rank 2019 Industry Branches 2019 ($000) 2019 (%) footprint 1 Bank Wells Fargo & Co. 39 11,615,910 23.35 o Opened 3 financial centers in 2019 2 Bank PNC Financial Services Group Inc. 38 9,302,303 18.70 3 Bank Bank of America Corp. 18 8,686,901 17.46 o 1 financial center targeted to open in 2021 4 Bank Citizens Financial Group Inc. 46 7,237,769 14.55 . No bank of Fulton’s size in Philadelphia Bank Toronto-Dominion Bank 21 3,480,879 7.00 5 o The top 5 banks have ~80% of the deposit 6 Bank Banco Santander SA 20 2,232,221 4.49 market share 7 Thrift WSFS Financial Corp. 13 1,362,418 2.74 8 Savings Bank Firstrust Savings Bank 5 875,291 1.76 o Presents a tremendous growth opportunity for 9 Bank M&T Bank Corp. 6 819,766 1.65 Fulton 10 Bank Republic First Bancorp Inc. 7 679,981 1.37 . Health Care, Technology and Professional Services are Thrift Prudential Bancorp Inc. 8 669,678 1.35 11 major economic forces, which are target business 12 Bank Univest Financial Corp. 7 472,309 0.95 13 Bank Truist Financial Corp. 11 457,406 0.92 segments for Fulton 14 Bank HSBC Holdings PLC 2 305,731 0.61 . The Philadelphia-Camden-Wilmington MSA is a large 15 Bank Bryn Mawr Bank Corp. 5 198,793 0.40 economic region with GDP of over $440bn, and is the Bank S&T Bancorp Inc. 2 173,029 0.35 16 9th largest metropolitan area in the U.S(1) 17 Bank Asian Financial Corp. 2 167,100 0.34 18 Savings Bank United Savings Bank 3 161,887 0.33 . Baltimore is another targeted area for growth 19 Bank Hyperion Bank 1 133,407 0.27 o Opened 1 financial center and 1 loan production 20 Thrift William Penn 4 128,762 0.26 office in 2019 All Others 31 589,680 1.19 o Total 289 49,751,221 100.00 1 financial center targeted to open in early 2020 Note: Deposit data as of June 30, 2019 per S&P Global Market Intelligence (excludes non-retail deposits and closed/proposed branches) and 1 in 2021 (1) 2018 advance statistics; source: U.S. Bureau of Economic Analysis 8

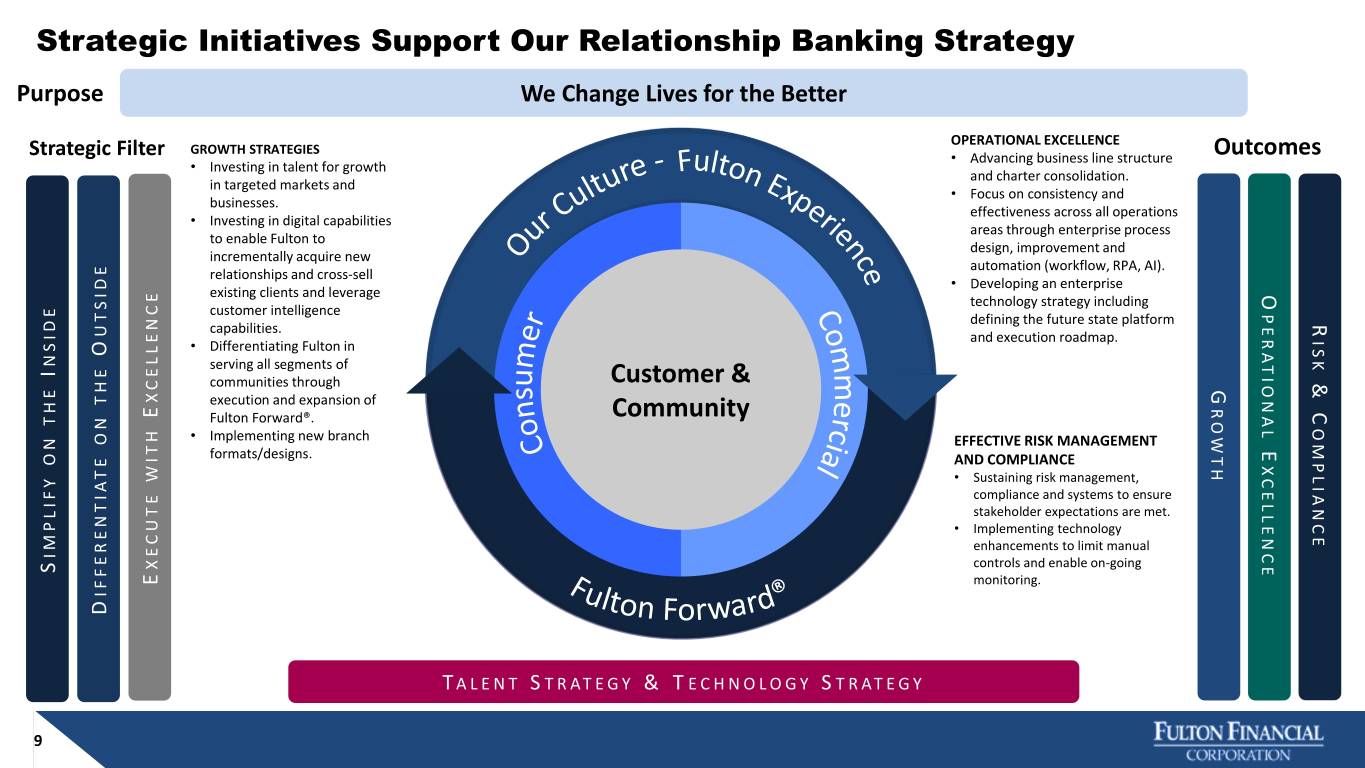

Strategic Initiatives Support Our Relationship Banking Strategy Purpose We Change Lives for the Better OPERATIONAL EXCELLENCE GROWTH STRATEGIES Strategic Filter • Advancing business line structure Outcomes • Investing in talent for growth and charter consolidation. in targeted markets and • Focus on consistency and businesses. effectiveness across all operations • Investing in digital capabilities areas through enterprise process to enable Fulton to design, improvement and incrementally acquire new automation (workflow, RPA, AI). relationships and cross-sell • Developing an enterprise existing clients and leverage O technology strategy including customer intelligence L A N O I AT R E P defining the future state platform R capabilities. UTSIDE and execution roadmap. K S I • Differentiating Fulton in O NSIDE serving all segments of I Customer & C & communities through G XCELLENCE THE execution and expansion of H T W O R E Community THE Fulton Forward®. E C N A I L P M O • Implementing new branch ON EFFECTIVE RISK MANAGEMENT formats/designs. E ON AND COMPLIANCE E C N E L L E C X WITH • Sustaining risk management, compliance and systems to ensure stakeholder expectations are met. • Implementing technology enhancements to limit manual IMPLIFY XECUTE controls and enable on-going S E monitoring. IFFERENTIATE D T ALENT S TRATEGY & T ECHNOLOGY S TRATEGY 9

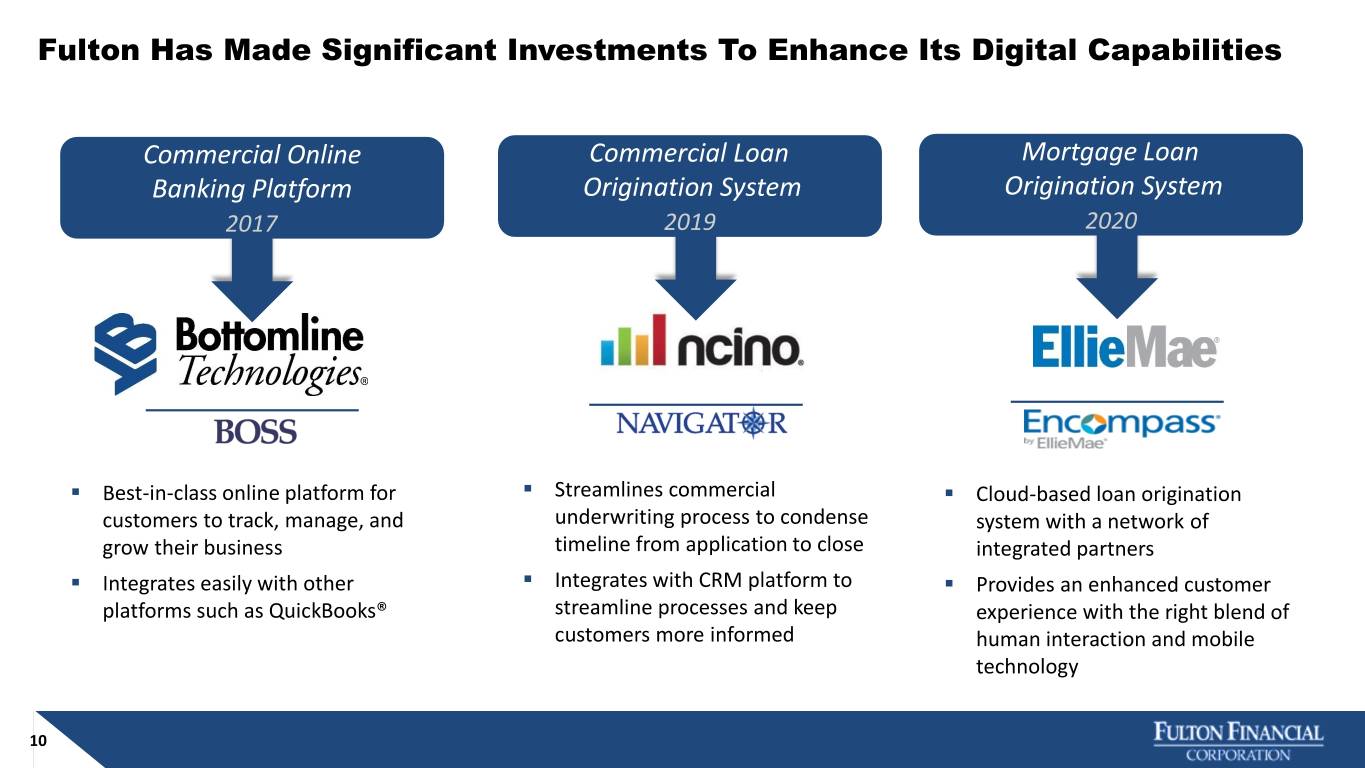

Fulton Has Made Significant Investments To Enhance Its Digital Capabilities Commercial Online Commercial Loan Mortgage Loan NewPurchaseBanking Website Platform Origination System Origination System 2017 2019 2020 . Best-in-class online platform for . Streamlines commercial . Cloud-based loan origination customers to track, manage, and underwriting process to condense system with a network of grow their business timeline from application to close integrated partners . Integrates easily with other . Integrates with CRM platform to . Provides an enhanced customer platforms such as QuickBooks® streamline processes and keep experience with the right blend of customers more informed human interaction and mobile technology 10

Website Recently Recognized As An Innovation Leader Our redesigned customer website allows users to have a cohesive and personalized experience as they explore all of our products, services and capabilities in one place . Leverages data and customer insights to deliver personalized content to customers and prospects while capturing valuable information that can be translated into sales and marketing opportunities Fulton Bank won Sitecore’s 2018 annual award for Best Use of Personalization in North America. 11

Optimizing Our Branch Network Optimizing our financial center network will: . Move us towards multiple financial center types vs. a one-size-fits-all model . Give us greater ability to re-invest in people & digital transactions . Orient the financial center as a primary touchpoint enabling higher- value activities geared towards advice and sales . Create greater focus on customer experience in the financial centers . Closed 37 financial centers and upgraded 56 financial centers to the new format since 2014 Note: Closed financial center information is net of new openings 12

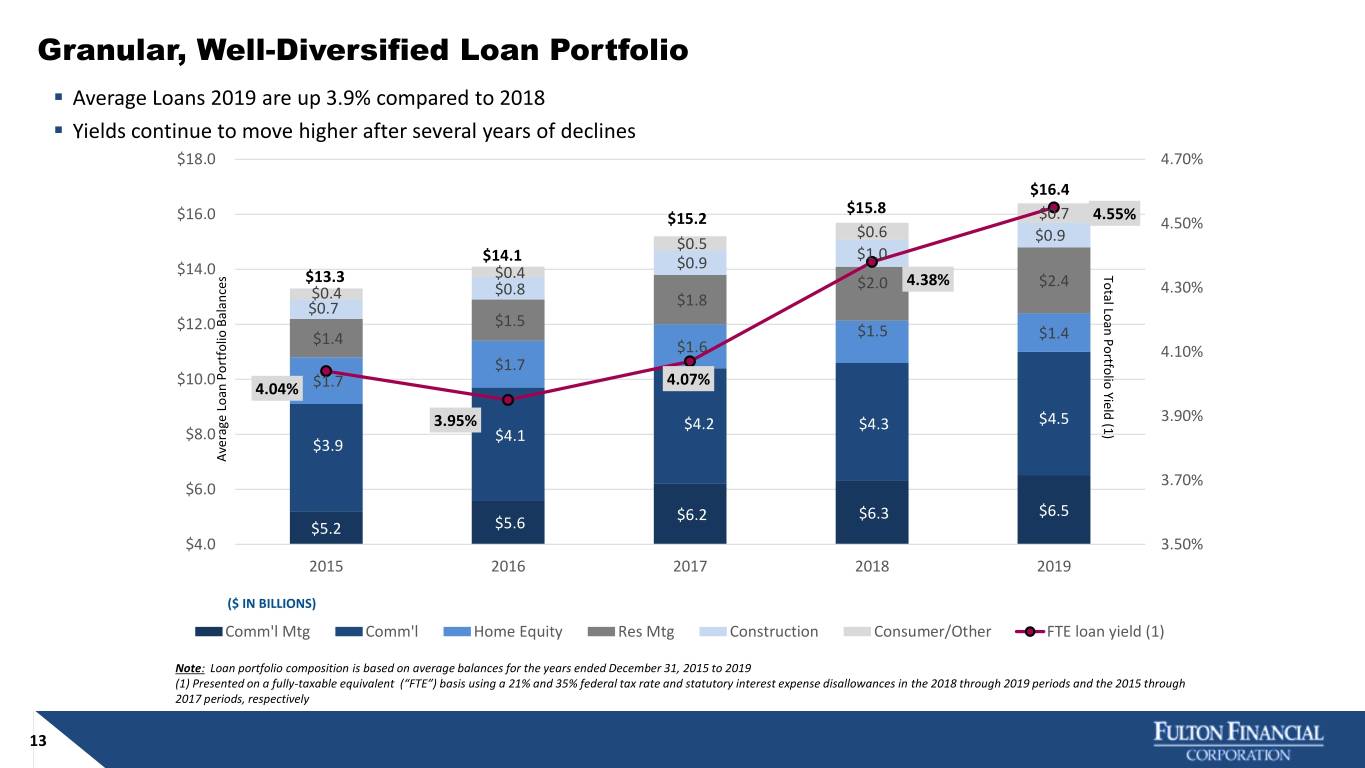

Granular, Well-Diversified Loan Portfolio . Average Loans 2019 are up 3.9% compared to 2018 . Yields continue to move higher after several years of declines $18.0 4.70% $16.4 $16.0 $15.8 $0.7 4.55% $15.2 4.50% $0.6 $0.5 $0.9 $1.0 $14.1 $0.9 $14.0 $0.4 Portfolio Loan Total (1) Yield $13.3 $2.0 4.38% $2.4 $0.4 $0.8 4.30% $0.7 $1.8 $12.0 Balances $1.5 $1.4 $1.5 $1.4 $1.6 4.10% $1.7 $10.0 4.07% 4.04% $1.7 3.95% $4.2 $4.3 $4.5 3.90% $8.0 $4.1 $3.9 Average Average LoanPortfolio 3.70% $6.0 $6.2 $6.3 $6.5 $5.2 $5.6 $4.0 3.50% 2015 2016 2017 2018 2019 ($ IN BILLIONS) Comm'l Mtg Comm'l Home Equity Res Mtg Construction Consumer/Other FTE loan yield (1) Note: Loan portfolio composition is based on average balances for the years ended December 31, 2015 to 2019 (1) Presented on a fully-taxable equivalent (“FTE”) basis using a 21% and 35% federal tax rate and statutory interest expense disallowances in the 2018 through 2019 periods and the 2015 through 2017 periods, respectively 13

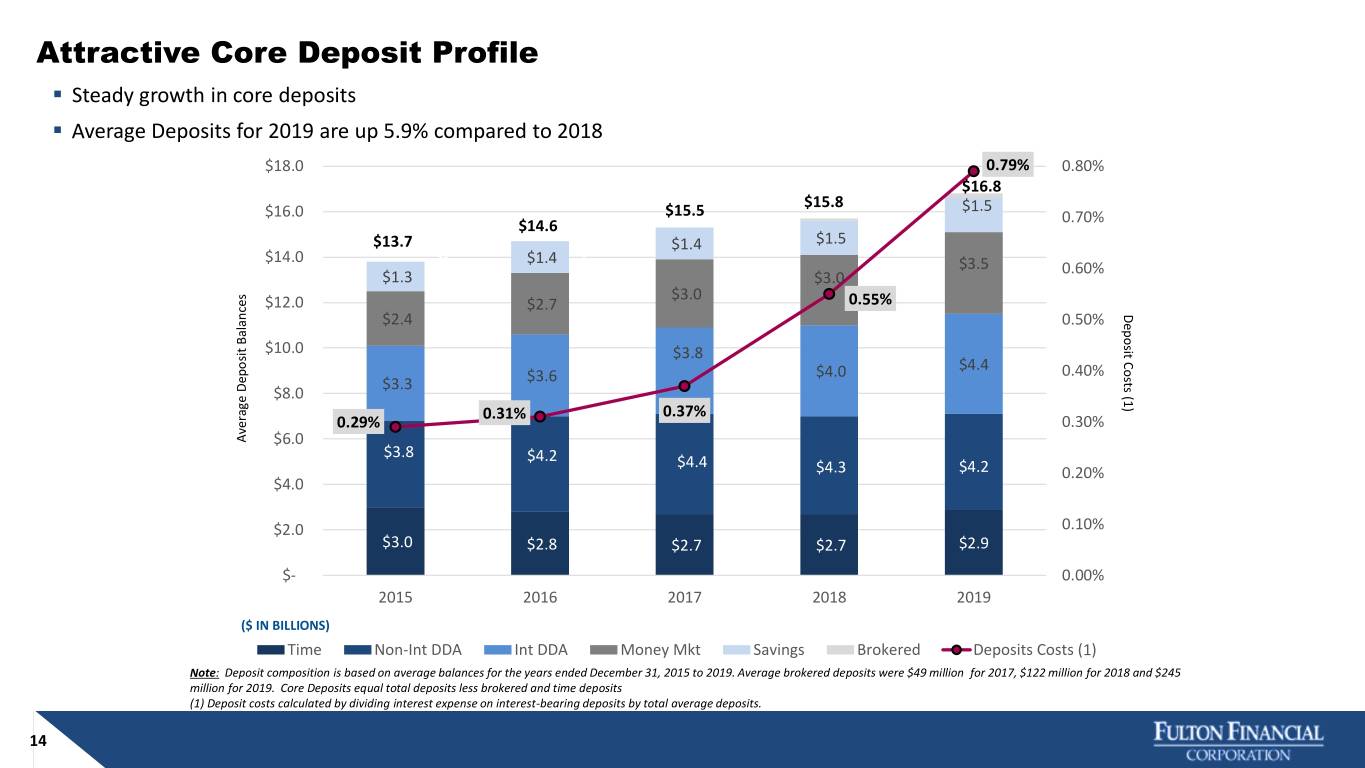

Attractive Core Deposit Profile . Steady growth in core deposits . Average Deposits for 2019 are up 5.9% compared to 2018 $18.0 0.79% 0.80% $16.8 $15.8 $1.5 $16.0 $15.5 0.70% $14.6 $- $ $13.7 $1.4 $1.5 $14.0 $- $1.4 $- $3.5 0.60% $1.3 $3.0 $3.0 $12.0 $2.7 0.55% $2.4 0.50% DepositCosts $10.0 $3.8 $4.0 $4.4 0.40% $3.3 $3.6 $8.0 (1) 0.31% 0.37% 0.29% 0.30% Average Average BalancesDeposit $6.0 $3.8 $4.2 $4.4 $4.3 $4.2 0.20% $4.0 $2.0 0.10% $3.0 $2.8 $2.7 $2.7 $2.9 $- 0.00% 2015 2016 2017 2018 2019 ($ IN BILLIONS) Time Non-Int DDA Int DDA Money Mkt Savings Brokered Deposits Costs (1) Note: Deposit composition is based on average balances for the years ended December 31, 2015 to 2019. Average brokered deposits were $49 million for 2017, $122 million for 2018 and $245 million for 2019. Core Deposits equal total deposits less brokered and time deposits (1) Deposit costs calculated by dividing interest expense on interest-bearing deposits by total average deposits. 14

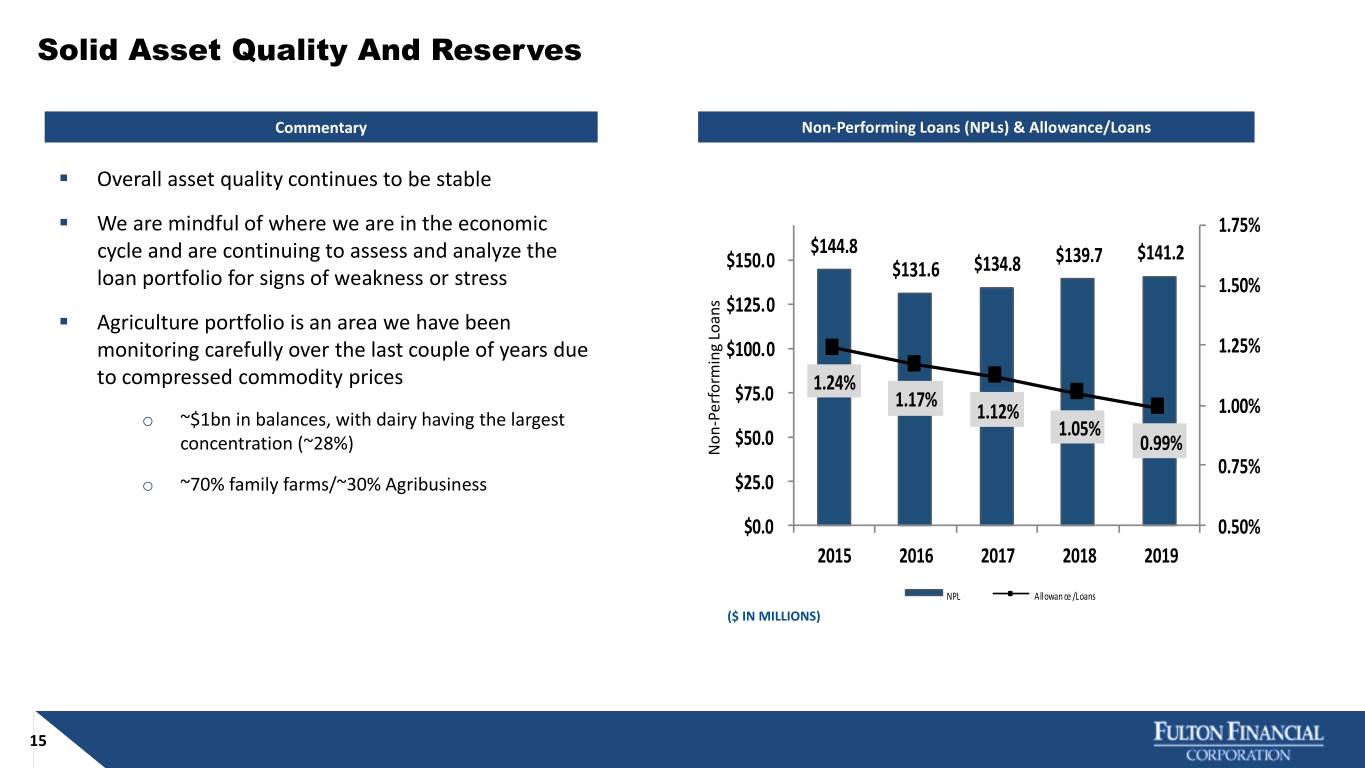

Solid Asset Quality And Reserves Commentary Non-Performing Loans (NPLs) & Allowance/Loans . Overall asset quality continues to be stable . We are mindful of where we are in the economic 1.75% cycle and are continuing to assess and analyze the $144.8 $139.7 $141.2 $150.0 $131.6 $134.8 loan portfolio for signs of weakness or stress 1.50% $125.0 . Agriculture portfolio is an area we have been monitoring carefully over the last couple of years due $100.0 1.25% to compressed commodity prices $75.0 1.24% 1.17% 1.00% Performing Loans Performing 1.12% o ~$1bn in balances, with dairy having the largest - 1.05% concentration (~28%) $50.0 Non 0.99% 0.75% o ~70% family farms/~30% Agribusiness $25.0 $0.0 0.50% 2015 2016 2017 2018 2019 NPL Allowan ce /Loans ($ IN MILLIONS) 15

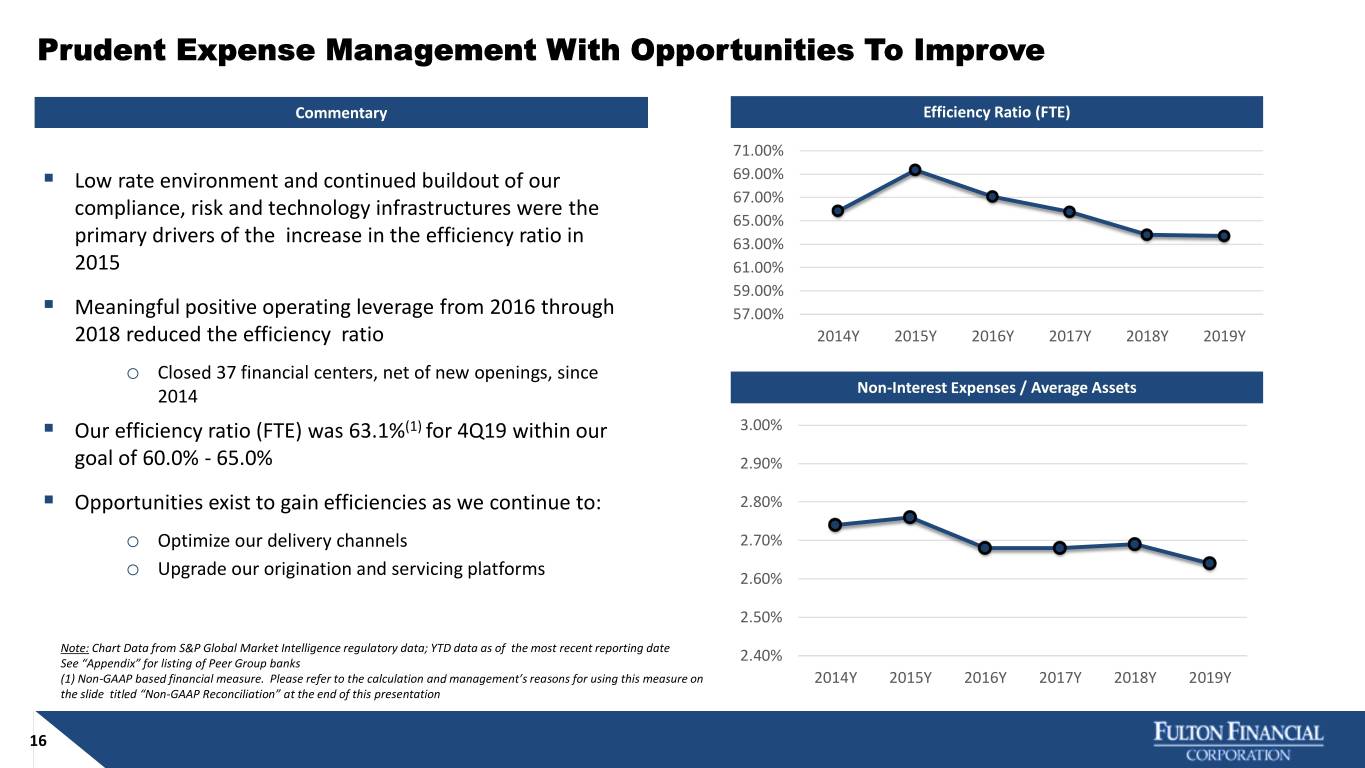

Prudent Expense Management With Opportunities To Improve Commentary Efficiency Ratio (FTE) 71.00% . Low rate environment and continued buildout of our 69.00% compliance, risk and technology infrastructures were the 67.00% 65.00% primary drivers of the increase in the efficiency ratio in 63.00% 2015 61.00% ~ $730 59.00% million . Meaningful positive operating leverage from 2016 through 57.00% ~ $610 2018 reduced the efficiency ratio 2014Y 2015Y 2016Y 2017Y million2018Y 2019Y o Closed 37 financial centers, net of new openings, since 2014 Non-Interest Expenses / Average Assets . Our efficiency ratio (FTE) was 63.1%(1) for 4Q19 within our 3.00% goal of 60.0% - 65.0% 2.90% . Opportunities exist to gain efficiencies as we continue to: 2.80% o Optimize our delivery channels 2.70% o Upgrade our origination and servicing platforms 2.60% 2.50% Note: Chart Data from S&P Global Market Intelligence regulatory data; YTD data as of the most recent reporting date See “Appendix” for listing of Peer Group banks 2.40% (1) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on 2014Y 2015Y 2016Y 2017Y 2018Y 2019Y the slide titled “Non-GAAP Reconciliation” at the end of this presentation 16

Strong Capital Position Commentary Capital Ratios(1) . Capital ratios exceed our internal minimums and regulatory 14.00% requirements 12.00% 11.8% o Opportunity exists to optimize the capital stack . Quarterly cash dividend increased to $0.13 per share in 9.7% 9.7% 10.00% March of 2019 8.5% ~ $730 8.5% o Declared a $0.04 special dividend in the 4th quarter of 2019 8.00% million 1 . Repurchased ~7mn shares or ~$111mn in 2019 ~ $610 million 6.00% o Repurchased ~6mn shares or ~95mn in 2018 . Excess capital needs to earn a return above of our cost of 4.00% capital or that excess should be distributed to shareholders o Targeted dividend payout ratio of 40%-50% 2.00% o Opportunistic share repurchases Tier 1 Leverage Tier 1 Risk Based CE Tier 1 Total Risk-Based TCE(2) Internal Minimum Excess o Strategic M&A . Disciplined approach to M&A – Target Metrics 1) Regulatory capital ratios as of December 31, 2019 are preliminary. 2) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons o Accretive to EPS in year 1 for using this measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation o IRR greater than target’s cost of capital 1 o TBV earn back between 3-5 years 17

RECENT FINANCIAL PERFORMANCE

2019 HIGHLIGHTS Net income of $226 million, or $1.35 per diluted share. Key Accomplishments Record year of revenues and net income Termination of remaining BSA/AML regulatory orders Average loan growth of 4% Successful consolidation of affiliate banks into Fulton Average deposit growth of 6% Bank, N.A. Net income increased 9% and pre-provision net revenue(1) Continuation of organic growth into fast growing increased 4% urban markets (1) Non-GAAP financial measure. Please refer to the calculation and management’s reasons for using this measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation. 19

Quarter Highlights: 4Q19 vs 3Q19 Net income per diluted share: $0.29 in 4Q19, 22% decrease from 3Q19 Loan Growth: 2% increase in average balances driven by C&I, commercial and residential mortgages and construction. Deposit Growth: 3% increase in average balances, largely driven by interest bearing demand deposits. Net Interest Income & Margin: Net interest income decreased 1% from 3Q19, with the impact of a 9 basis point decrease in the net interest margin being partially offset by balance sheet growth. Non-Interest Income(1): Overall flat, with increases in wealth management fees, commercial banking income and other income, offset by decreases in mortgage and consumer banking income. Non-Interest Expense: 5% decrease, as 3Q19 included a $4 million prepayment penalty on certain FHLB advances and $5 million of charter consolidation costs, partially offset by FDIC insurance assessment credits. Asset Quality: Increases in provision for credit losses related to the C&I portfolio. (1) Excluding investment securities gains which were $0 and $4 million in the three months ended December 31, 2019 and September 30, 2019, respectively. 20

Quarter Highlights: 4Q19 vs 4Q18 Net income per diluted share: $0.29 in 4Q19, 12% decrease from 4Q18 Loan Growth: 5% increase in average balances with growth in all categories, except for home equity. Deposit Growth: 6% increase in average balances with growth in all categories. Net Interest Income & Margin: 2% decrease in net interest income, reflecting a 22 basis point decrease in net interest margin, partially offset by the impact of interest-earning asset growth. Non-Interest Income(1): 12% increase realized in all primary fee categories. Non-Interest Expense: 1% decrease, with decreases in professional fees, FDIC insurance and amortization of tax credit investments, largely offset by increases in salaries and benefits, data processing and software and other expense. Asset Quality: Increase in provision for credit losses related to the C&I portfolio. (1) No investment securities gains were recorded for the three months ended December 31, 2019 or 2018. 21

Income Statement Summary (1) ROA is return an average assets determined by dividing net income for the period indicated by average assets. (2) ROE is return on average shareholders’ equity determined by dividing net income for the period indicated by average shareholders’ equity, annualized (3) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation 22

Income Statement Summary Change from 4Q19 3Q19 4Q18 (dollars in thousands, except per-share data) Net Interest Income $ 159,270 $ (1,990) $ (3,674) Provision for Credit Losses 20,530 18,360 12,330 Non-Interest Income 55,281 (40) 5,758 Securities Gains - (4,492) - Non-Interest Expense 138,974 (7,796) (1,711) Income before Income Taxes 55,047 (17,086) (8,535) Income Taxes 7,258 (2,767) 1,759 Net Income $ 47,789 $ (14,319) $ (10,294) Net income per share (diluted) $ 0.29 $ (0.08) $ (0.04) ROA (1) 0.87% (0.28%) (0.25%) ROE (2) 8.10% (2.54%) (2.00%) ROE (tangible) (3) 10.52% (3.51%) (2.65%) Efficiency ratio (3) 63.1% (0.5%) 0.9% (1) ROA is return an average assets determined by dividing net income for the period indicated by average assets, annualized (2) ROE is return on average shareholders’ equity determined by dividing net income for the period indicated by average shareholders’ equity, annualized (3) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation 23

Net Interest Income And Margin AVERAGE INTEREST-EARNING ASSETS & YIELDS NET INTEREST INCOME & NET INTEREST MARGIN ($ IN BILLIONS) ($ IN MILLIONS) $20 5.00% 4.00% $180.0 4.00% $15 4.22% 4.35% 4.37% 4.25% 4.07% 3.00% $10 3.75% $16.0 $16.2 $16.3 $16.4 $16.8 2.00% $164.5 $162.9 $163.3 $5 $161.3 ~ $730 1.00% $159.3 million $160.0 3.50% $3.2 $3.1 $3.2 $3.4 $3.4 $0 0.00% 3.49% 3.44% 4Q18 1Q19 2Q19 3Q19~ $610 4Q19 3.44% 3.25% million 3.31% Securities & Other Loans Earning Asset Yield (FTE) 3.22% $140.0 3.00% AVERAGE LIABILITIES & RATES 2.75% ($ IN BILLIONS) $20 5.00% $1.8 $1.6 $120.0 2.50% $1.5 $1.8 $2.0 4.00% $15 $17.0 $17.4 $16.4 $16.3 $16.4 2.25% 3.00% $10 2.00% 1.29% $100.0 2.00% 1.10% 1.21% 1.29% 1.16% $5 4Q18 1Q19 2Q19 3Q19 4Q19 1.00% Net Interest Income $0 0.00% Net Interest Margin (Fully-taxable equivalent basis, or FTE) 4Q18 1Q19 2Q19 3Q19 4Q19 Deposits Borrowings Cost of Interest-bearing Liabilities (1) Using a 21% federal tax rate and statutory interest expense disallowances 24

Asset Quality PROVISION FOR CREDIT LOSSES NON-PERFORMING LOANS (NPLS) & NPLS TO LOANS ($ IN MILLIONS) 2.00% $30.0 $160.0 $147.7 $139.7 $138.7 $136.0 $141.2 1.50% $20.5 $120.0 $20.0 $80.0 1.00% 0.86% 0.90% $10.0 $8.2 0.85% 0.81% 0.84% $40.0 0.50% $5.1 $5.0 $2.2 $0.0 0.00% $- 4Q18 1Q19 2Q19 3Q19 4Q19 4Q18 1Q19 2Q19 3Q19 4Q19 NPL NPLs/Loans NET CHARGE-OFFS (NCOS) AND NCOS TO AVERAGE LOANS ALLOWANCE FOR CREDIT LOSSES (ALLOWANCE) TO NPLS & LOANS $40.0 127% 0.65% 125.0% 1.00% 123% 1.75% 121% $30.0 $27.1 120% 118% 0.17% 0.50% $20.0 0.10% 0.15% -0.04% 0.00% 1.25% $10.0 $6.6 $6.3 $4.1 $(1.5) $- -0.50% 1.08% 1.05% 1.05% 1.04% 4Q18 1Q19 2Q19 3Q19 4Q19 0.99% $(10.0) -1.00% 100.0% 0.75% 4Q18 1Q19 2Q19 3Q19 4Q19 Allowance/NPLs Allowance/Loans NCOs/(recoveries) NCOs/Average Loans (annualized) 25

Non-Interest Income(1) Three months ended December 31, 2019 (percent of total non-interest income) 4Q19 3Q19 Change (in thousands) n Wealth management $ 14,419 $ 13,867 $ 552 n Mortgage banking 5,076 6,658 (1,582) n Consumer banking 12,426 13,333 (907) n Commercial banking 19,628 18,284 1,344 n Other 3,732 3,179 553 $ 55,281 $ 55,321 (40) Three months ended September 30, 2019 Non-interest income(1) essentially unchanged from 3Q19 (percent of total non-interest income) Increases in: n Brokerage and trust income n Commercial loan interest rate swaps fees n Additional investments in bank-owned life insurance Decreases in: n Seasonally lower mortgage loan volumes n Consumer card income n Merchant and card income (1) Excluding investment securities gains 26

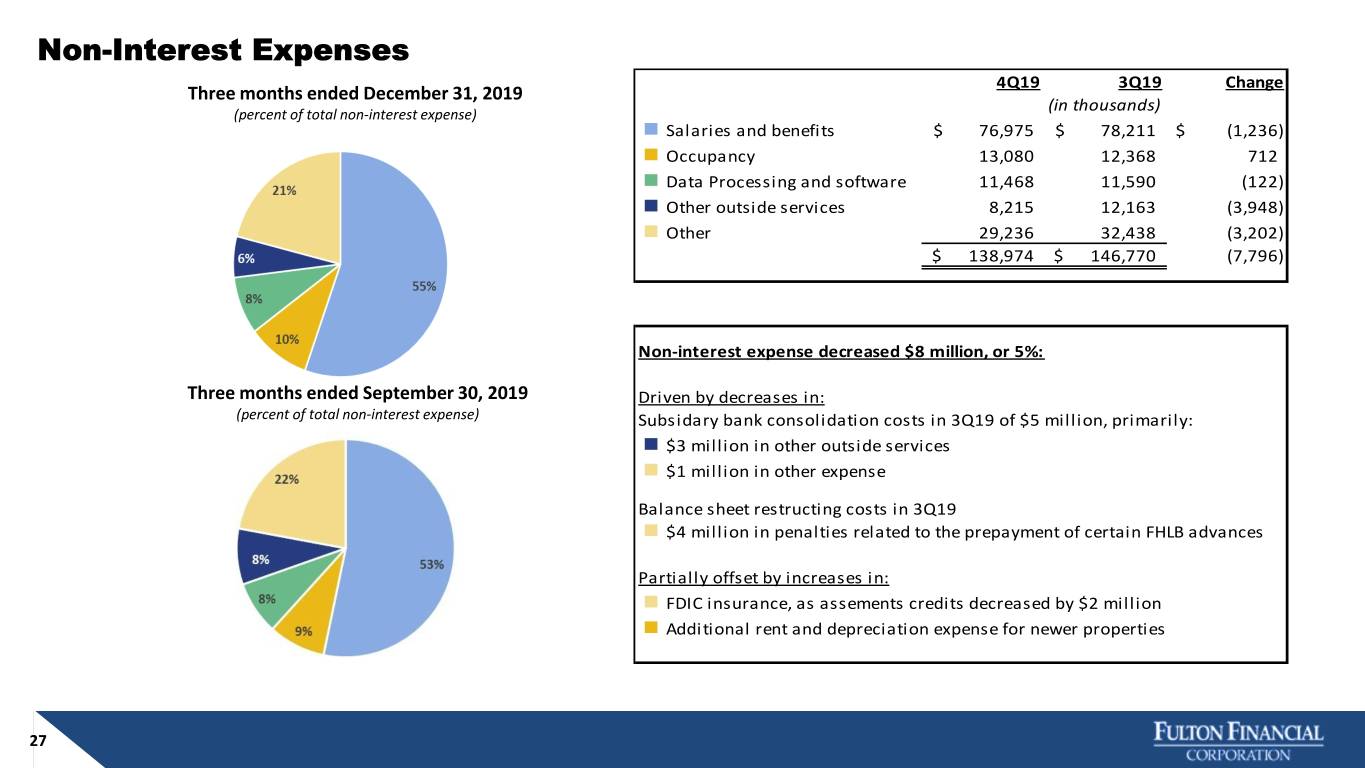

Non-Interest Expenses 4Q19 3Q19 Change Three months ended December 31, 2019 (in thousands) (percent of total non-interest expense) n Salaries and benefits $ 76,975 $ 78,211 $ (1,236) n Occupancy 13,080 12,368 712 n Data Processing and software 11,468 11,590 (122) n Other outside services 8,215 12,163 (3,948) n Other 29,236 32,438 (3,202) $ 138,974 $ 146,770 (7,796) Non-interest expense decreased $8 million, or 5%: Three months ended September 30, 2019 Driven by decreases in: (percent of total non-interest expense) Subsidary bank consolidation costs in 3Q19 of $5 million, primarily: n $3 million in other outside services n $1 million in other expense Balance sheet restructing costs in 3Q19 n $4 million in penalties related to the prepayment of certain FHLB advances Partially offset by increases in: n FDIC insurance, as assements credits decreased by $2 million n Additional rent and depreciation expense for newer properties 27

Profitability & Capital ROA(1) ROE AND ROE (TANGIBLE)(2) 1.40% 16.00% 14.03% 1.20% 1.12% 1.11% 1.14% 1.15% 13.17% 13.28% 13.60% 12.00% 10.42% 10.64% 10.52% 1.00% 0.87% 10.10% 10.15% 8.10% 0.80% 8.00% 0.60% 4.00% 0.40% 0.20% 0.00% 0.00% 4Q18 1Q19 2Q19 3Q19 4Q19 4Q18 1Q19 2Q19 3Q19 4Q19 ROE ROE (tangible) TANGIBLE COMMON EQUITY RATIO(2) NET INCOME PER DILUTED SHARE 12.0% $0.40 $0.37 $0.35 $0.35 $0.33 $0.33 8.8% 8.5% 8.6% 8.5% 8.5% $0.29 $0.30 8.0% $0.25 $0.20 4.0% $0.15 $0.10 $0.05 0.0% $- 4Q18 1Q19 2Q19 3Q19 4Q19 4Q18 1Q19 2Q19 3Q19 4Q19 (1) ROA is return an average assets determined by dividing net income for the period indicated by average assets, annualized (2) Non-GAAP based financial measure. Please refer to the calculation and management’s reasons for using this measure on the slide titled “Non-GAAP Reconciliation” at the end of this presentation 28

Revised 2020 Outlook • Loans & Deposits: Average annual loan and deposit growth rates in the low to mid single-digits • Net Interest Income: Low single digit growth rate • Net Interest Margin: 3.20% to 3.25% for the full year 2020; assumes a stable yield curve and one 25 bp rate cut in 2Q 2020 • Non-Interest Income: Mid single-digit growth rate • Non-Interest Expense: Excluding charter consolidation costs in 2019, low single-digit growth rate • Asset Quality: $25 million to $40 million provision for credit losses for full year 2020. CECL impact – 25% to 35% increase in allowance for credit losses. • Effective Tax Rate: Anticipated to range between 14% and 16% 29

APPENDIX

Average Loan Portfolio And Yields Change in 4Q 2019 Balance From Yield From Balance Yield 3Q 2019 4Q 2018 3Q 2019 4Q 2018 (dollars in millions) Real estate - commercial mortgage $ 6,561 4.34% $ 72 $ 218 (0.23%) (0.23%) Commercial - industrial, financial and agricultural 4,575 4.24% 160 245 (0.32%) (0.27%) Real estate - residential mortgage 2,606 4.00% 93 396 (0.06%) (0.01%) Real estate - home equity 1,331 4.97% (33) (129) (0.30%) (0.22%) Real estate - construction 935 4.37% 30 3 (0.31%) (0.26%) Consumer 465 4.44% 7 59 0.08% (0.13%) Equipment lease financing 281 4.35% 3 7 (0.06%) (0.28%) Other 14 - (1) 3 - % - % - Total Loans $ 16,768 4.31% $ 331 $ 802 (0.24%) (0.23%) Note: Presented on an FTE basis, using a 21% federal tax rate and statutory interest expense disallowances Average loan portfolio and yield are for the three months ended December 31, 2019, September 30, 2019 and December 31, 2018 31

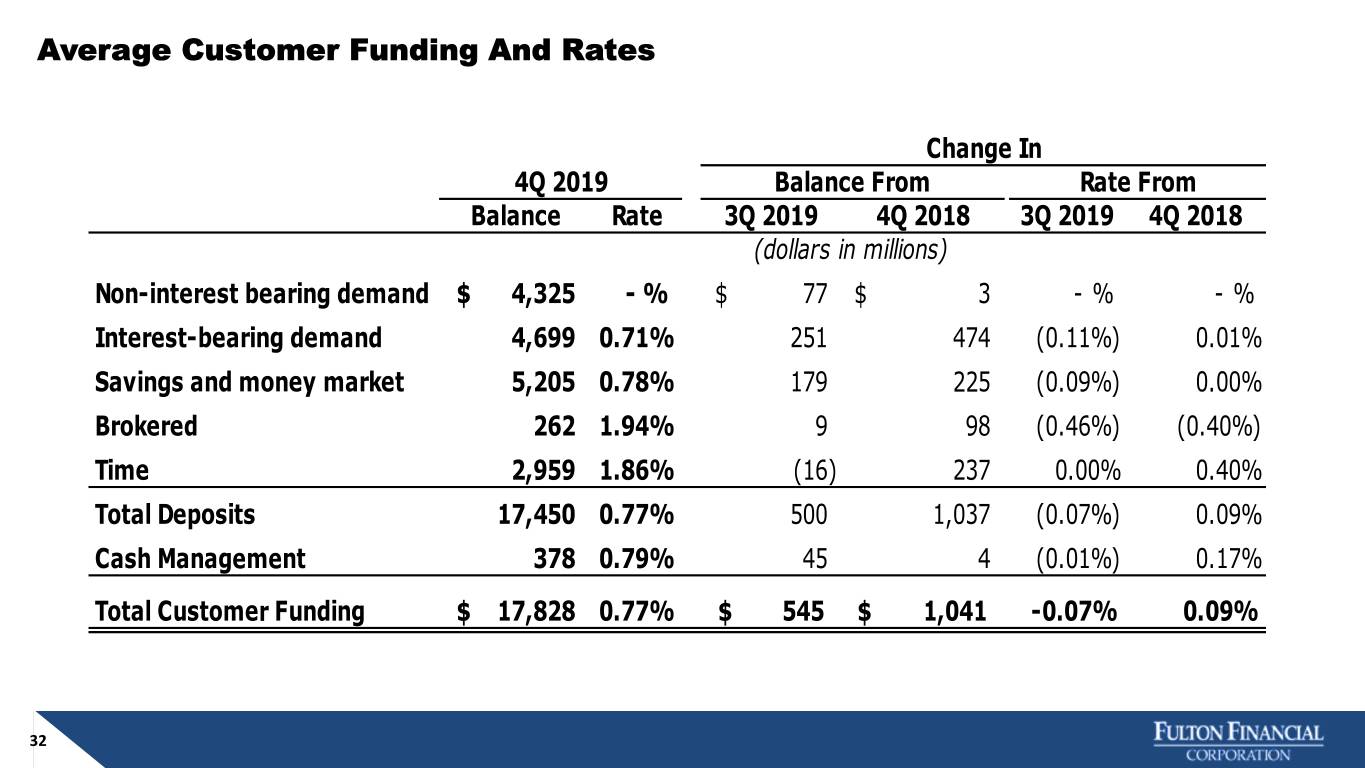

Average Customer Funding And Rates Change In 4Q 2019 Balance From Rate From Balance Rate 3Q 2019 4Q 2018 3Q 2019 4Q 2018 (dollars in millions) Non-interest bearing demand $ 4,325 - % $ 77 $ 3 - % - % Interest-bearing demand 4,699 0.71% 251 474 (0.11%) 0.01% Savings and money market 5,205 0.78% 179 225 (0.09%) 0.00% Brokered 262 1.94% 9 98 (0.46%) (0.40%) Time 2,959 1.86% (16) 237 0.00% 0.40% Total Deposits 17,450 0.77% 500 1,037 (0.07%) 0.09% Cash Management 378 0.79% 45 4 (0.01%) 0.17% Total Customer Funding $ 17,828 0.77% $ 545 $ 1,041 -0.07% 0.09% 32

Non-Interest Income(1) Change From 4Q 2019 3Q 2019 4Q 2018 3Q 2019 4Q 2018 (in thousands) Wealth management $ 14,419 $ 13,867 $ 13,408 $ 552 $ 1,011 Commercial banking: Merchant and card 5,841 6,166 5,656 (325) 185 Cash management 4,697 4,696 4,340 1 357 Commercial loan interest rate swap 5,426 3,944 2,540 1,482 2,886 Other 3,664 3,478 3,466 186 198 Total commercial banking 19,628 18,284 16,002 1,344 3,626 Consumer banking: Card 4,991 5,791 4,966 (800) 25 Overdraft 4,750 4,682 4,653 68 97 Other 2,685 2,860 2,799 (175) (114) Total consumer banking 12,426 13,333 12,418 (907) 8 Mortgage banking: Gains on sales of mortgage loans 4,059 5,520 2,863 (1,461) 1,196 Mortgage servicing 1,017 1,138 1,911 (121) (894) Total mortgage banking 5,076 6,658 4,774 (1,582) 302 Other 3,732 3,179 2,921 553 811 Total Non-Interest Income(1) $ 55,281 $ 55,321 $ 49,523 $ (40) $ 5,758 (1) Excluding securities gains 33

Non-Interest Expense Change From 4Q 2019 3Q 2019 4Q 2018 3Q 2019 4Q 2018 (in thousands) Salaries and employee benefits $ 76,975 $ 78,211 $ 75,745 $ (1,236) $ 1,230 Net occupancy 13,080 12,368 12,708 712 372 Data processing and software 11,468 11,590 10,203 (122) 1,265 Other outside services 8,215 12,163 8,944 (3,948) (729) Equipment 3,475 3,459 3,275 16 200 Professional fees 2,873 3,331 3,546 (458) (673) FDIC insurance 2,177 239 2,563 1,938 (386) Amortization of tax credit investments 1,505 1,533 6,538 (28) (5,033) Marketing 1,503 3,322 1,577 (1,819) (74) Intangible amortization 142 1,071 - (929) 142 Prepayment of FHLB advances - 4,326 - (4,326) - Other 17,561 15,157 15,586 2,404 1,975 Total Non-Interest Expense $ 138,974 $ 146,770 $ 140,685 $ (7,796) $ (1,711) 34

Non-GAAP Reconciliation Years Ended Note: The Corporation has presented the following non-GAAP (Generally Accepted Accounting 2018 2019 Principles) financial measures because it believes that these measures provide useful and Pre-Provision Net Revenue (in thousands) comparative information to assess trends in the Corporation's results of operations and financial Net interest income $ 630,456 $ 648,389 condition. Presentation of these non-GAAP financial measures is consistent with how the Non-interest income 195,525 216,160 Corporation evaluates its performance internally and these non-GAAP financial measures are Less: Investment securities gains (37) (4,733) frequently used by securities analysts, investors and other interested parties in the evaluation of Total Revenue $ 825,944 $ 859,816 companies in the Corporation's industry. Investors should recognize that the Corporation's presentation of these non-GAAP financial measures might not be comparable to similarly-titled Non-interest expense $ 546,104 $ 567,736 measures of other companies. These non-GAAP financial measures should not be considered a Less: Prepayment penalty on FHLB advances - (4,326) substitute for GAAP basis measures and the Corporation strongly encourages a review of its Less: Amortization of tax credit investments (11,449) (6,021) condensed consolidated financial statements in their entirety. Less: Intangible Amortization - (1,427) Total Non-interest expense $ 534,655 $ 555,962 Pre-Provision Net Revenue $ 291,289 $ 303,854 Three Months Ended Dec 31 Mar 31 Jun 30 Sep 30 Dec 31 2018 2019 2019 2019 2019 Tangible Common Equity to Tangible Assets (TCE Ratio) (dollars in thousands) Shareholders' equity $ 2,247,573 $ 2,301,019 $ 2,308,798 $ 2,324,016 $ 2,342,176 Less: Intangible assets (531,556) (535,356) (535,249) (534,178) (535,303) Tangible shareholders' equity (numerator) $ 1,716,017 $ 1,765,663 $ 1,773,549 $ 1,789,838 $ 1,806,873 Total assets $ 20,682,152 $ 20,974,649 $ 21,308,670 $ 21,703,618 $ 21,886,040 Less: Intangible assets (531,556) (535,356) (535,249) (534,178) (535,303) Total tangible assets (denominator) $ 20,150,596 $ 20,439,293 $ 20,773,421 $ 21,169,440 $ 21,350,737 Tangible Common Equity to Tangible Assets 8.5% 8.6% 8.5% 8.5% 8.5% 35

Non-GAAP Reconciliation Years Ended Three Months Ended Dec 31 Mar 31 Jun 30 Sep 30 Dec 31 2018 2019 2018 2019 2019 2019 2019 Efficiency ratio Non-interest expense $ 546,104 $ 567,736 $ 140,685 $ 137,824 $ 144,168 $ 146,770 $ 138,974 Less: Intangible Amortization - (1,427) - (107) (107) (1,071) (142) Less: Amortization of tax credit investments (11,449) (6,021) (6,538) (1,491) (1,492) (1,533) (1,505) Less: Prepeyment penalty on FHLB advances - (4,326) - - - (4,326) - Non-interest expense (numerator) $ 534,655 $ 555,962 $ 134,147 $ 136,226 $ 142,569 $ 139,840 $ 137,327 Net interest income (fully taxable-equivalent) $ 642,577 $ 661,356 $ 166,123 $ 166,564 $ 167,796 $ 164,517 $ 162,479 Plus: Total Non-interest income 195,525 216,160 49,523 46,751 54,315 59,813 55,281 Less: Investment securities gains (37) (4,733) - (65) (176) (4,492) - Net interest income (denominator) $ 838,065 $ 872,783 $ 215,646 $ 213,250 $ 221,935 $ 219,838 $ 217,760 Efficiency ratio 63.8% 63.7% 62.2% 63.9% 64.2% 63.6% 63.1% Years Ended Three Months Ended Dec 31 Mar 31 Jun 30 Sep 30 Dec 31 2018 2019 2018 2019 2019 2019 2019 Return on Average Shareholders' Equity (ROE) (Tangible) Net income $ 208,393 $ 226,339 $ 58,083 $ 56,663 $ 59,779 $ 62,108 $ 47,789 Plus: Intangible amortization, net of tax - 1,127 - 85 85 846 112 Net income (numerator) $ 208,393 $ 227,466 $ 58,083 $ 56,748 $ 59,864 $ 62,954 $ 47,901 Average shareholders' equity $ 2,255,764 $ 2,306,070 $ 2,281,669 $ 2,265,097 $ 2,301,258 $ 2,315,585 $ 2,341,397 Less: Average goodwill and intangible assets (531,556) (534,120) (531,556) (531,767) (535,301) (535,184) (534,190) Average tangible shareholders' equity (denominator) $ 1,724,208 $ 1,771,950 $ 1,750,113 $ 1,733,330 $ 1,765,957 $ 1,780,401 $ 1,807,207 Return on average shareholders' equity (tangible), annualized 12.09% 12.84% 13.17% 13.28% 13.60% 14.03% 10.52% 36

Peer Group . Atlantic Union Bankshares Corporation . Provident Financial Services, Inc. . BancorpSouth Bank . Trustmark Corporation . Commerce Bancshares, Inc. . UMB Financial Corporation . First Midwest Bancorp, Inc. . Umpqua Holdings Corporation . F.N.B. Corporation . United Bankshares, Inc. . Hancock Whitney Corporation . United Community Banks, Inc. . Investors Bancorp, Inc. . Valley National Bancorp . Northwest Bancshares, Inc. . Webster Financial Corporation . Old National Bancorp . Wintrust Financial Corporation . Prosperity Bancshares, Inc. 37

www.fult.com