Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATIONS - PRIME GLOBAL CAPITAL GROUP Inc | prime_ex3201.htm |

| EX-31.1 - CERTIFICATIONS - PRIME GLOBAL CAPITAL GROUP Inc | prime_ex3101.htm |

| EX-24 - POWER OF ATTORNEY - PRIME GLOBAL CAPITAL GROUP Inc | prime_ex24.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE | ||||

| SECURITIES EXCHANGE ACT OF 1934 | ||||

| For the fiscal year ended October 31, 2019 | ||||

| OR | ||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE | ||||

| SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to ____________

Commission file number: 000-54288

PRIME GLOBAL CAPITAL GROUP INCORPORATED

(Exact name of registrant as specified in its charter)

| NEVADA | 26-4309660 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) | |

|

E-5-2, Megan Avenue 1, Block E Jalan Tun Razak 50400 Kuala Lumpur, Malaysia |

N/A | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: +603 2162 0773

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ | Smaller reporting company ☒ |

| Emerging growth company☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Approximate aggregate market value of the voting stock held by non-affiliates of the registrant as of April 30, 2018, based upon the closing sale price reported by the Over-the-Counter Bulletin Board on that date: $45,787,131.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| Common Stock | Outstanding at January 28, 2020 | |

| Common Stock, $.001 par value per share | 512,682,393 shares |

DOCUMENTS INCORPORATED BY REFERENCE: None

| i |

Forward Looking Statements

This Form 10-K contains “forward-looking” statements including statements regarding our expectations of our future operations. For this purpose, any statements contained in this Form 10-K that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” or “continue” or comparable terminology are intended to identify forward-looking statements. These statements by their nature involve substantial risks and uncertainties, and actual results may differ materially depending on a variety of factors, many of which are not within our control.

These risks and uncertainties include international, national, and local general economic and market conditions; our ability to sustain, manage, or forecast growth, our ability to successfully make and integrate acquisitions, new product development and introduction, existing government regulations and changes in, or the failure to comply with, government regulations, adverse publicity, competition, the loss of significant customers or suppliers, fluctuations and difficulty in forecasting operating results, change in business strategy or development plans, business disruptions, the ability to attract and retain qualified personnel, the ability to protect technology, and the risk of foreign currency exchange rate. Although the forward-looking statements in this report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by them. In light of these risks and uncertainties, you are cautioned not to place undue reliance on these forward-looking statements. Except as required by law, we undertake no obligation to announce publicly revisions we make to these forward-looking statements to reflect the effect of events or circumstances that may arise after the date of this report. All written and oral forward-looking statements made subsequent to the date of this report and attributable to us or persons acting on our behalf are expressly qualified in their entirety by this section.

ITEM 1. DESCRIPTION OF BUSINESS.

History

We were incorporated in the state of Nevada on January 26, 2009, to serve as a holding company for our former smart home business, which was conducted through our former subsidiary, Home Touch Limited, a Hong Kong Special Administrative Region of China corporation, or HTL. On January 26, 2009, we acquired HTL through a share exchange transaction in which we exchanged 40,000,000 shares of our Common Stock for 10,000 shares of HTL common stock. HTL was originally organized under the name Lexing Group Limited in July 2004 and was renamed Home Touch Limited in 2005.

On July 15, 2010, we effectuated a 1-for-20 reverse stock split, or the Reverse Split, of all issued and outstanding shares of the Company's Common Stock in connection with our plans to attract additional financing and potential business opportunities. As a result of the Reverse Split, our issued and outstanding shares decreased from 40,000,000 to 2,000,000.

On September 27, 2010, we filed a report on Form 8-K disclosing the sale to certain accredited investors on September 21, 2010, of an aggregate of 1,500,000 shares of our Common Stock at a per share price of $0.10, or $150,000 in the aggregate, in accordance with the terms and conditions of certain subscription agreements made with such investors. The Company received net proceeds of approximately $145,000 from the sale of the shares which were used for general corporate purposes. The shares were sold pursuant to the exemption provided by Section 4(2) of the Securities Act of 1933, as amended, and Regulation D promulgated thereunder. Weng Kung Wong, who was appointed our Chief Executive Officer and director on November 15, 2010, purchased 375,000 shares of our Common Stock in this transaction.

| 2 |

Change in Control, Disposition of Smart Home Business, Acquisition of UHT and Name Change

On November 15, 2010, we consummated the sale to certain accredited investors of an aggregate of 80,000,000 shares of our Common Stock at a per share price of $0.01, or $800,000 in the aggregate, in accordance with the terms and conditions of certain subscription agreements made with such investors. The Company received net proceeds of approximately $795,000 from the sale of the shares which were used for general corporate purposes. The shares were sold pursuant to the exemption provided by Section 4(2) of the Securities Act of 1933, as amended and Regulation D promulgated thereunder. Weng Kung Wong, our Chief Executive Officer and director, purchased an additional 12,750,000 shares of our Common Stock in this transaction.

A change of control occurred in connection with the sale of such shares. David Ng and Stella Wai Yau resigned from their positions as President and Chief Executive Officer of the Company, and as Chief Financial Officer, Chief Operating Officer and Secretary of the Company effective November 15, 2010. The following individuals were appointed to serve as executive officers and directors of the Company:

| Name | Office | |

| Weng Kung Wong | Chief Executive Officer, Director | |

| Liong Tat Teh | Chief Financial Officer, | |

| Sek Fong Wong | Secretary, |

On December 6, 2010, we consummated a share exchange, or the Share Exchange, pursuant to which Wooi Khang Pua and Kok Wai Chai, or the UHT Shareholders, transferred to us all of the issued and outstanding shares of Union Hub Technology Sdn. Bhd., or UHT, a company organized under the laws of Malaysia and engaged in the design, development and operation of technologies to enable a community of users to engage in social networking, research and e-commerce on a mobile platform, in exchange for the issuance of 16,500,000 shares of our common stock, par value $0.001 per share, or the Common Stock. As a result of our acquisition of UHT, we became involved in the m-commerce business. The Share Exchange was made pursuant to the terms of a Share Exchange Agreement, or the Exchange Agreement, by and among the Company, the UHT Shareholders and UHT. As result of the Share Exchange, UHT became our wholly owned subsidiary. We relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation S promulgated under, the Securities Act of 1933, as amended, or the Securities Act, in issuing the UHT Shares. Mr. Chai is a director of UHT and beneficially owns 4.85% of our issued and outstanding common stock.

Concurrently with the Share Exchange, we sold to Up Pride Investments Limited, a British Virgin Islands limited liability company owned by David Gunawan Ng, and Magicsuccess Investments Limited, a British Virgin Islands limited liability company owned by Stella Wai Yau, all of the issued and outstanding securities of HTL for cash consideration of $20,000. In connection with the sale, Mr. Ng and Ms. Yau, our former founders and executive officers, resigned from their positions on our board of directors. Our smart home business was conducted through HTL, and as result of the sale, we ceased our smart home business operations. The sale of HTL securities was made pursuant to the terms of a Common Stock Purchased Agreement, or the Common Stock Purchase Agreement, by and among the Company, HTL, Up Pride Investments Limited and Magicsuccess Investments Limited. We relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation S promulgated under, the Securities Act of 1933, as amended, or the Securities Act, in selling the HTL securities.

On January 25, 2011, we changed our name to Prime Global Capital Group Incorporated and increased our authorized capital to 1 billion shares of common stock and 100 million shares of preferred stock.

On February 8, 2011, we consummated the sale to 19 of our of existing accredited stockholders of an aggregate of 400,000,000 shares of its common stock, par value $0.001, at a per share price of $0.01, or $4,000,000 in the aggregate, in accordance with the terms and conditions of certain subscription agreements made with such stockholders. Weng Kung Wong, our Chief Executive Officer and director, participated in the transaction and purchased 32,300,000 shares of our common stock on the same terms and conditions as the other stockholders.

| 3 |

The per share closing prices of our common stock and the per share purchase prices paid by our investors on each placement date are described below:

| Subscription Purchase Price | Closing Price | |

| February 8, 2011 | $0.01 | $0.41 |

| November 15, 2010 | $0.01 | $0.55 |

| September 21, 2010 | $0.10 | $0.40 |

The discount on price provided to our investors at the time were attributable to a variety of factors including the significant risks involved in investing in a Company in its early stages of business development, the low revenues and earnings generated by the Company, concerns regarding the Company’s ability to continue as a going concern which was ultimately expressed in the Company’s financial statements as of October 31, 2011, the size of the investment and the illiquidity of the Company’s securities on the open market.

On January 20, 2014, the Company through PGCG Assets sold and issued to an unaffiliated third party 200,000 shares of its Common Stock at a price of RM 100 per share, for aggregate consideration of RM20,000,000, or approximately $6,084,760.72. PGCG Assets received net proceeds of approximately RM20,000,000, or approximately $6,084,760.72 from the sale of its securities and used the net proceeds for general corporate purposes. As a result of the foregoing transactions, 90% of the issued and outstanding securities of PGCG Assets is owned by UHT and 10% by such unaffiliated third party. The sale and issuance was made pursuant to the terms of a subscription agreement containing terms and conditions that are normal and customary for a transaction of this type.

On October 31, 2014, the Company through Virtual Setup Sdn. Bhd., its affiliate, sold and issued to Denvoursuisse Sdn. Bhd. 200,000 shares of its Common Stock at a price of RM 10 per share, for aggregate consideration of RM2,000,000, or approximately $ 611,731. Virtual Setup received net proceeds of approximately RM2,000,000, from the sale of its securities and used the net proceeds for general corporate purposes. As a result of the foregoing transactions, 95% of the issued and outstanding securities of VSSB is owned by PGCG Plantation and 5% by such Denvoursuisse Sdn. Bhd., which also owns 10% of the issued and outstanding securities of PGCG Assets. The sale and issuance was made pursuant to the terms of a subscription agreement containing terms and conditions that are normal and customary for a transaction of this type.

| 4 |

Current Business Operations

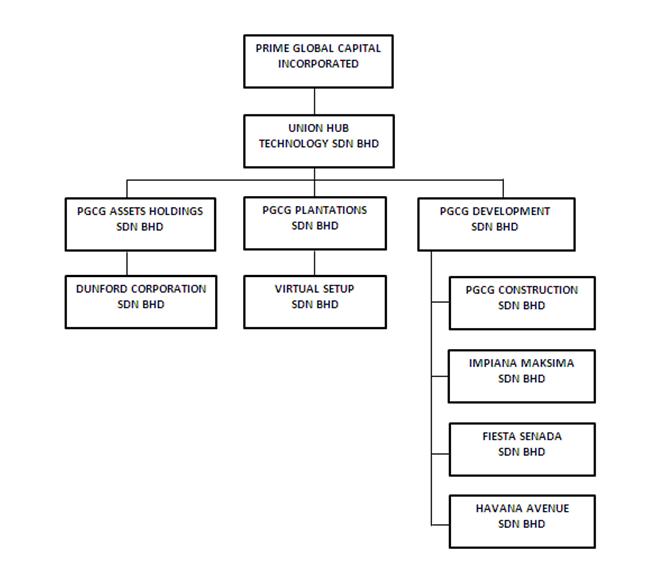

Current Corporate Structure

A chart of our current corporate structure is set forth below:

* Denvoursuisse Sdn. Bhd., an unaffiliated third party, owns 10% of PGCG Assets and 5% of VSSB.

| 5 |

During fiscal year 2019, we operated two business segments: (i) our oil palm and durian plantation business; and (ii) our real estate business. Our oil palm and durian plantation business is operated through Virtual Setup Sdn. Bhd., or VSSB, and our real estate business is primarily operated through PGCG Assets Holdings Sdn. Bhd., or PGCG Assets, and Dunford Corporation Sdn. Bhd.

During the last two fiscal years, each of our business segments accounted for the amount and percentage of net revenue set forth below:

| October 31, 2019 | October 31, 2018 | |||

| Net Revenue | % of Net Revenue | Net Revenue | % of Net Revenue | |

| Plantation | 286,084 | 14.91% | 164,947 | 10.8% |

| Real Estate | 1,632,055 | 85.09% | 1,364,639 | 89.2% |

The business of the Company is engaged entirely in Malaysia. The Chief Executive Officer and executive directors regularly review the Company's business as one geographical segment.

Our initial business plan launched in July 2010 broadly contemplated the development, distribution and operation of mobile and online social networking, ecommerce and search products and services. However, as a result of the challenges we experienced in implementing our m-commerce business plan, we entered the oil palm plantation and real estate businesses in 2012 and in 2014 discontinued our software business. Since the commencement of our new business segments, we (through our subsidiaries):

| · | Acquired an oil palm plantation in Malaysia which is operated through VSSB; |

| · | Acquired 21.8921 hectares (54.10 acres) of vacant development land located in Selangor, Malaysia, which is subject to a 99-year leasehold, expiring July 30, 2100; |

| · | Acquired Dunford Corporation Sdn. Bhd., or Dunford, whose primary assets consist of two parcels of undeveloped land located in Selangor, Malaysia aggregating approximately 31 acres; |

| · | Acquired a 15 story commercial building located at Geran 10010, Lot 238 Section 43, Town and District of Kuala Lumpur, Wilayah Persekutuan, Kuala Lumpur, Malaysia; and |

| · | Acquired a 12 story commercial building located at Megan Avenue 1, No. 189, Jalan Tun Razak, 50400 Kuala Lumpur, Malaysia. |

Description of Our Plantation Business

Oil Palm Cultivation

Oil palm is an edible vegetable oil obtained by crushing the fruit of the oil palm tree, commonly referred to as fresh fruit bunches. Palm oil is one of seventeen major oils traded in the global edible oils and fats market and has broad commercial and industrial uses. According to World Palm Oil, the United States Department of Agriculture (USDA) estimates that the World Palm Oil Production in 2018 will be approximately 73.3 million metric tons with Malaysia contributing 20.5 million metric tons. The estimation of 73.3 million tons production for 2018 represents a decrease of 0.06 million tons in palm oil production around the globe, with Malaysia contributing an increase of 0.637 million metric tons. According to a study by Grand View Research, Inc., global palm oil market demand was 74.01 million tons in 2014 and is expected to reach 128.2 million tons by 2022.

Crude palm oil (CPO) is extracted through a process of sterilizing and pressing of the oil palm tree’s fresh fruit bunches (FFB). Each FFB can contain over a thousand individual fruits. During the extraction process, seeds are separated from the fruit, and upon cracking the seed’s shell, the kernel inside is separated for further processing to yield palm kernel oil (PKO). Derivatives of CPO and PKO are used throughout the world for many food and non-food applications including cooking oil, margarine, ice cream, non dairy creamer, soaps, detergents, animal feed, cosmetics and industrial lubricants.

| 6 |

Oil palm is one of the few perennial crops that is harvested all year round. Oil palm trees require constant rain throughout the year and are limited to tropical environments located in the ten-degree belt around the equator such as South East Asia, West Africa and South America. The largest producers of palm oil are Malaysia and Indonesia, which account for approximately 85 percent of annual global palm oil production.

The commercial life span of an oil palm tree is estimated to be up to 25 years. Palm oil is recognized as being significantly more productive due to its high oil yield per hectare compared to other edible oil sources, such as soybeans and rapeseed. Oil palm, due to its high edible oil productivity per hectare, is one of the world’s most efficient crops for the production of edible oils, which is an important component of the human food supply. Oil palm can yield up to ten to fifteen times more edible oil per hectare than the leading alternatives such as soya, rapeseed, canola or corn.

We believe the palm oil industry is well positioned in the years ahead for the following reasons:

| · | Demand for CPO, in common with other vegetable oils, has remained relatively robust, even through the current global economic turbulence. We believe that this is being driven by growing demand from the food industry which is anticipated to increase in line with expectations of higher GDP growth from the three key consuming/buying markets: China, India and the EU. We believe that demand for vegetable oils is accelerating, due largely to income growth in populous regions and the influence of biodiesel programs. |

| · | We believe that per capita vegetable oil consumption in developing Asian countries remains low relative to other more developed nations. As per capita income increases in these developing nations, we expect that the demand for palm oil will increase, as the population is able to consume more foods that use palm oil (especially packaged foods such as chocolates, creamers and fast food). |

| · | Environmental concerns and the increasing price of crude mineral oils have resulted in a worldwide trend to utilize vegetable oils such as rapeseed oil, soybean oil and palm oil for the production of biofuels and electricity. We believe that the growth in the production of biodiesel will be particularly pronounced in Asia. In addition, biofuel initiatives in Europe, such as the edible oil requirement for food, are causing an increase in demand for vegetable oils, primarily rapeseed, by biofuel producers. In turn, we anticipate that Europe’s demand for palm oil will increase in food processing, as locally produced oil crops are diverted for biofuel usage. |

Management and Operation of Oil Palm Plantation

We cultivate FFBs on our 300 acres oil palm plantation and sell them to third party oil mill processors located within Malaysia. These oil mill processors extract, refine and resell the palm oil. These byproducts of the refinery process are thereafter sold to other manufacturers further downstream to produce various derivative products.

We directly manage our oil palm plantation. The Board expects to monitor its plantation operations in the near future to determine whether the Company will continue with direct operations, enter into another contracting arrangement or sell the oil palm plantation.

Currently, oil palm cultivation comprises 79% of our plantation business. If our cultivation operations expand, we may consider building or acquiring one or more oil mills to extract and sell CPO and PKO from FFB cultivated on our own plantation and on smaller local plantations.

Management believes that the value of its oil palm plantation has increased since its acquisition, and while it has not pursued any discussions or received any formal offers regarding the sale of its plantation, it may also consider selling in the future if a sale would maximize return to its investors.

| 7 |

Oil Palm Pricing

CPO and PKO are commodities traded in a worldwide competitive market with high pricing volatility. Factors affecting pricing of these commodities (which in turn affect the prices for FFBs) include:

| · | Estimated output based on the acreage, weather conditions and pest infestation etc.; |

| · | Shifting cropping patterns in producing countries; |

| · | Leftover stocks from the previous years’ production after meeting the demand; |

| · | Consumption and export pattern; |

| · | Energy prices; and |

| · | Government policies and intervention. |

We believe that prices of our oil palms are linked to prices in the fuel sector. As fuel prices increase, we would expect the prices of our oil palm to also increase. Similarly, we would expect falling crude prices to exercise a downward pressure on oil palm prices. We further believe that the current financial condition and the growing nexus between crude oil prices and vegetable oil prices brought on by the increased reliance on oils for biofuels will exacerbate the pricing volatility and uncertainty already inherent in our industry.

Because we do not exert significant pricing power over our products, we expect margin expansion to occur through more cost effective manufacturing processes or by way of value addition, branding and retail packaging. We do not, however, have any current plans to brand our products or to seek retail customers.

Our Durian Orchard

We commenced planting premium durian, of the “Musang King” variety, in the first quarter of calendar year 2014. The first phase consists of 60 acres, the second and third phase consist of approximately 130 acres and the fourth phase consist of 170 acres. With over 200 varieties, durian is regarded by many people in Southeast Asia as the "king of fruits" with the “Musang King” variety being one of the best. Durian fruit can grow as large as 30 centimeters (12 in) long and 15 centimeters (6 in) in diameter, and it typically weighs one to three kilograms (2 to 7 lbs.). Its shape ranges from oblong to round, the colour of its husk green to brown, and its flesh pale yellow to red, depending on the species. Durian trees have one or two fruiting periods per year, although the timing may vary depending on the species, cultivars, and localities. A typical durian tree can bear fruit after four or five years. The durian fruit can hang from any branch and matures roughly three months after pollination. As of the date of this report, we have replanted approximately 180 acres of our oil palm plantation land with premium durian trees of the “Musang King” variety. We planted approximately 30 trees per acre and anticipate an average production of 35-50 grade A fruits per tree for each of the two harvesting seasons per year. Our premium durian constitutes approximately 21% of our plantation business.

In 2016, we began using our internally developed planting technology, our cutting edge technological bio fertilizers that has reduced the maturity time of the durian tree from 5 years to 3 years. The durian trees planted during the first phase has begun to bear fruits, with our first major harvest occurring in July 2019. We expect the second and third phase plantings to begin bearing fruit by 2021 and the fourth phase planting by 2023, at the latest.

Premium Durian Pricing

Prices of durians are relatively high as compared with other fruits. In Singapore, the strong demand for high quality cultivars such as the D24(Sultan), and Musang King (Mao Shan Wang) has resulted in typical retail prices of between $6 to $12 per kilogram and wholesale prices between $6 to $12 per kilogram of whole fruit. With an average weight of about 1.5 kilograms (3.3 lbs.), a durian fruit would therefore cost about $9 to $18. The edible portion of the fruit, known as the aril and usually referred to as the "flesh" or "pulp", only accounts for about 15–30% of the mass of the entire fruit.

| 8 |

Description of Our Real Estate Business

Our real estate business operations consist of the acquisition, development, management, operation and sale of commercial and residential real estate properties located in Malaysia, primarily in Kuala Lumpur and Selangor. We anticipate generating revenues through sales of developed properties and from rental income from our commercial properties. Developed property sales may include sale of condominium units, individual villas and bungalows at our future Shah Alam 2 Eco Residential Development project located in Selangor, Malaysia. We may also sell properties under development, undeveloped properties or commercial properties, if opportunities arise that we believe will maximize overall asset values.

Real Estate Market Conditions in Malaysia

We believe that Malaysia’s property market has been subdued in 2018 and 2019, and based on industry experts from Malaysia, the same is expected in 2020. However, these industry experts also believe that the recent development of the LRT/MRT train lines which enhances connectivity to Greater Klang Valley including Seremban, Rawang and Klang will bode well for the residential and commercial property markets. We believe that Malaysia has a young demographic, with 80% of Malaysians below the age of 50. We believe that demand for housing will increase as more young adults enter the workforce and begin family formation.

Because our real estate holdings will be concentrated in Selangor and Kuala Lumpur, Malaysia, we expect that the financial condition and results of operations of our real estate segment will be highly dependent upon market conditions for real estate activity in those regions. We expect that our future operating cash flows and, ultimately, our ability to develop our properties and expand our real estate business will be largely dependent on the level of our real estate sales and leasing activities. These activities in turn will be significantly affected by future real estate market conditions in Selangor and Kuala Lumpur, Malaysia, including development costs, interest rate levels, the availability of credit to finance real estate transactions, demand for residential and commercial real estate, and regulatory factors including our use and development entitlements. These market conditions historically move in periodic cycles, and can be volatile in specific regions.

Our Commercial Real Estate Holdings

We generate rental income from our 12 story and 15 story commercial properties and anticipate generating income from the sale of developed properties. As of October 31 2019, we occupy 2 floors of our 12 story commercial building as our corporate headquarters and 6 floors have been leased to tenants at market rates. The remaining 4 floors are currently vacant and we are actively attempting to lease these 4 floors.

In October 18, 2014, PGCG Assets entered into a rental agreement (the “Rental Agreement”) with Le Apple Boutique Hotel (KLCC) Sdn. Bhd. formerly known as Esquire Bayview Sdn. Bhd. (“Le Apple”), pursuant to which Le Apple agreed to lease the entirety of our 15 story commercial building located at No. 160, Jalan Ampang, 50450 Kuala Lumpur, Malaysia to operate a boutique hotel. The Rental Agreement is retroactively effective as of December 1, 2013, and supersedes the prior lease agreement between us and Esquire Bayview Sdn. Bhd. (now Le Apple) dated December 18, 2013, with respect to the same premises.

The Rental Agreement operates on thirty sequential renewable one-year terms, with the current term expiring November 30, 2019. Provided that there are no existing breaches by Le Apple, we will be required to renew the lease for additional one-year terms, for a maximum aggregate term of thirty years. The monthly rental rate shall be increased every three years at an increment rate of 5% to 10% of the current monthly rental rate, or shall be based on the prevailing market rate, whichever is lower. Our current rental rate has increased from RM400,000 to RM550,000 (approximately $131,520) from April 1, 2018.

In the event we elect to sell the premises, we are required to offer Le Apple a right of first refusal to purchase the premises at a mutually agreed upon price in accordance with the terms of the Rental Agreement. If the premises are sold to a third party other than Le Apple, the Rental Agreement shall be assumed by such purchaser.

The foregoing description of the Rental Agreement is qualified in its entirety by reference to the Rental Agreement, which is filed as Exhibit 10.1 to this Annual Report and incorporated herein by reference.

Keen Solution Sdn. Bhd. owns 45% of the shares in Le Apple Boutique Hotel (KLCC) Sdn Bhd. Chai Sook Tieng is a director and owns 55% of the shares of Keen Solution Sdn. Bhd. Chai Sook Tieng is the spouse of Wong Weng Kung, our Chief Executive Officer, Interim Chief Financial Officer, Interim Secretary and Director.

| 9 |

If the business of our tenant is adversely affected, we will be required to seek replacement tenants. There can be no assurance that the business of our tenant will continue for the term of the lease or that we will be able to find a replacement tenant if our tenant is no longer able to meet its lease obligations. If we are unable to lease out the premise, our operating results may be materially and adversely affected. We expect demand for commercial property to remain steady and positive for 2020. As a result, we do not anticipate significant challenges in leasing out our 12 story and 15 story commercial buildings.

Development Activities

We hold a 99-year leasehold interest to 21.8921 hectares (54.10 acres) of vacant development land, or the Land, and two parcels of vacant land aggregating approximately 31 acres, or the Dunford Parcels, all located in Selangor, Malaysia. We intend to develop the Land into the Shah Alam 2 Eco Residential Development project and hope to develop the Dunford Parcels into the Bandar Sungai Long High Grade Villas Community project. For better cash flow planning, we have strategized that the development of our Bandar Sungai Long High Grade Villas Community project will commence once we have successfully sold Phase 1 and Phase 2 of the Shah Alam 2 Eco Residential Development project. If we are not able to successfully develop, market and sell our Shah Alam 2 Eco Residential Development project, our ability to complete all or any portion of our Bandar Sungai Long High Grade Villas Community Project may be affected. As at the date of this report, due to market forces, we plan to begin construction by the end of calendar 2023 to maximize profits.

Shah Alam 2 Eco Residential Development

Shah Alam 2 is an existing third party development sprawled over 1,163 acres of prime land within Bandar Puncak Alam. It is located in Selangor in the burgeoning Klang Valley area in which Malaysia’s capital is also situated. Upon completion, it is anticipated to be an integrated and self-contained township approximately 10 times the size of Subang Jaya, one of Malaysia’s most celebrated suburbs, with a population of approximately 500,000. We believe that Shah Alam 2 may rival even Shah Alam, the Selangor state capital, in terms of size and dynamism.

Our project, the Shah Alam 2 Eco Residential Development, will be located within the Shah Alam 2 development. Encompassing 54.1 acres, the project will feature superlink homes, semi-detached homes, bungalows, high-end condominiums and commercial shop-offices with an environment-friendly theme emphasizing the importance of a sustainable lifestyle. All the residential parcels will be gated and guarded for increased security.

On June 10, 2015, we received approval to develop our leasehold land located in Puncak Alam. Due to challenges in the current Malaysian real property market, in November 2015, we submitted a request to convert some our planned semi-detached and bungalow home parcels into cluster semi-detached homes to improve the marketability of the development. We received approval of our revised development plan on March 4, 2016.

On July 1, 2016, PGCG Assets entered into a memorandum of understanding (“MOU”) with Yong Tai Berhad, a public listed corporation in the main market of Bursa Malaysia Berhad (“YTB”) engaged in the business of commercial and residential property development, to jointly develop our land (the “Land”) located at Puncak Alam (the “Proposed JV”). Under the MOU, the parties agreed to use their best efforts to negotiate exclusively with each other regarding the terms and conditions of the definitive agreement to jointly develop the Land. On February 15, 2017, PGCG Assets and YTB entered into a Mutual Termination of Memorandum of Understanding (the “Termination MOU”) pursuant to which the parties mutually agreed to terminate the MOU as the parties were unable to agree and finalize the terms of the Proposed JV. In light of the termination of the Proposed JV with YTB, we plan to develop, market, promote and complete the construction on our own. As at the date of this report, due to market forces, we plan to begin construction by the end of calendar 2023 to maximize profits. We believe that we will require approximately RM5 to RM10 million in the aggregate to market, promote and complete construction of each phase of our Shah Alam 2 Eco Residential Development Project.

| 10 |

If completed, we expect our Shah Alam 2 Eco Residential Development project to comprise of the following:

| Types of property | Total Block(s) |

Floor(s)/ Units per floor / Land size |

Total Unit(s) | Planned Built-up area (sq. ft.) |

| 2-Story Boulevard Shop offices | 22ft x 75ft / 22ft x 78ft / 20ft x 70ft | 74 | 2,500 to 2,900 | |

| 3-Story Boulevard Shop offices | 30ft x 75ft / 30ft x 77ft | 12 | 6,000 to 6,700 | |

| Stratified Affordable Shops | 20ft x 35ft | 18 | 700 | |

| High Rise Apartments | 2 | 11 floor X 12 units | ||

| Type A | 21 | 1,200 | ||

| Type B | 21 | 1,100 | ||

| Type C | 125 | 1,000 | ||

| Type D | 83 | 800 | ||

| Affordable Apartments (Type B) | 1 | 172 | 750 | |

| Affordable Apartments (Type C) | 1 | 173 | 900 | |

| Landed Homes :- | ||||

| 3 - Story Superlink Homes | - | 22ft x 75ft | 122 | 2,500 |

| 2 - Story Link Homes | - | 20ft x 70ft | 33 | 1,600 |

| 2 - Story Cluster Semi-Detached Homes | - | 30ft x 60ft | 128 | 1,800 |

| 2 - Story Cluster Semi-Detached Homes | - | 30ft x 55ft | 16 | 1,650 |

| 2 - Story Semi-Detached Homes | - | 40ft x 65ft | 24 | 1,900 |

| 3 - Story Bungalow Homes | - | 80ft – 90ft x 60ft | 7 | 3,500 to 5,000 |

| 2 - Story Semi-Detached Homes | - | 42ft x 60ft | 2 | 1,920 |

| 2 - Story Semi-Detached Homes | - | 47ft x 60ft | 2 | 2,220 |

| 2 - Story Semi-Detached Homes | - | 40ft x 60ft | 2 | 1,800 |

Bandar Sungai Long High Grade Villas Community

We do not intend to commence development of our Bandar Sungai Long High Grade Villas Community project until we have successfully sold Phase 1 and Phase 2 of the Shah Alam 2 Eco Residential Development project. If we are able to successfully develop the Bandar Sungai Long High Grade Villas Community project, we anticipate that the project will consist of a high-end gated and guarded community encompassing approximately 31 acres of landscaped areas with the following types of properties:

| Types of property | Total Block(s) |

Floor(s)/ Units per floor / Land size |

Total Unit(s) | Planned Built-up area (sq. ft.) |

| 2 ½ - Story Superlink Homes | 30ft x 80ft | 77 | 3,500 sq.ft. | |

| Condominiums | 4 | – | 508 |

1,000 sq.ft. 1,100 sq.ft. 1,200 sq.ft. 1,300 sq.ft. |

| Low-Cost Apartments | 1 | – | 234 | 700 sq.ft. |

| Low-Medium Cost Apartments | 1 | – | 130 |

750 sq.ft. 900 sq.ft. |

| Medium-Cost Apartments | 1 | – | 226 | 1,000 sq.ft. |

| 11 |

Near-Term Requirements For Additional Capital And Business Strategy

We intend to focus on our near-term goal of developing the Land and the Dunford Parcels through prudent use of available resources and our long-term goal of maximizing the value of our development projects. We believe that Malaysia is a desirable market and we intend to continue exploring acquisitions in Kuala Lumpur and the Selangor region. We believe that our developments will have inherent value given their unique nature and location and that this value should be sustainable in the future.

For the immediate future, we intend to continue financing future real estate acquisitions and development through sales of our securities to existing shareholders and loans from financial institutions. We periodically conduct internal discussions to obtain the necessary financing, however, there can be no assurance that we will be able to obtain sufficient funds on acceptable terms to timely meet our obligations.

As of October 31, 2019, we had cash and cash equivalents of $198,113. We believe that we will need approximately RM5 to RM10 million (equivalent to $1.2 to $2.4 million) in the aggregate to market, promote and complete construction of our Shah Alam 2 Eco Residential Development Project. We hope to finance such costs through the combination of loans, funds from ongoing building sales and operating capital.

Moneylenders License

On September 8, 2016, the Urban Wellbeing, Housing and Local Government Ministry of Malaysia announced the introduction of an initiative that will enable property developers to provide loans to buyers at an annual interest rate between 12 and 18 percent. Developers will be able to begin applying to the ministry on September 8, 2016, for a money lending license. It is our understanding that loans made pursuant to such license will not be restricted to first time homebuyers.

Depending upon the guidelines, we may apply for such moneylender’s license to enable us to provide financing to prospective buyers of our future properties. If we apply and are successful in obtaining such license, we hope that we will be able to boost sales of our properties that we have earmarked for development.

We continue to maintain a cautious but positive outlook for the residential market based upon Malaysia’s stable employment outlook, growth in household income, formation of new households, and increased demand for affordable residential property from first time home buyers. Developers such as us are facing challenges of inconsistent supply and high cost of labour, increased costs of building materials (such as cement and steel bars) and general increased costs of doing business. Our market is also sensitive to changes in lending rates and lending requirements as many homebuyers rely on financing to make purchases. As a result, government or bank policies that result in increased interest rates and or stricter lending requirements may adversely affect the sales of our developed properties.

Distribution

Customers of our oil palm plantation business principally consist of oil palm processors, refineries and oil palm product manufacturers. Our products are distributed in bulk from our plantations directly to our customers’ facilities. We transport our products through third party transportation systems.

As at the date of this report, our durian fruits are primarily sold to and distributed by local wholesalers within Pahang.

Marketing, Sales and Support

Our sales and support staff focus on identifying land for the cultivation of our oil palm, durian and preparation for the marketing activities of our real estate development projects.

We do not and have no immediate plans to engage in marketing activities with respect to our oil palm plantation business as our FFBs are sold in bulk to extractors and processors.

We also do not at the present moment, have any immediate plans to engage in marketing activities with respect to our durian plantation business as our durians fruits are primarily sold to and distributed by local wholesalers in Malaysia.

Once we commence construction of our Shah Alam 2 Eco Residential Development or Bandar Sungai Long High Grade Villas Community projects, we expect to initiate marketing activities directed toward prospective purchasers for the sale of our property units that we are developing.

| 12 |

Major Customers

We generated net revenues of $1,918,139 during the fiscal year ended October 31, 2019. Our real estate business accounted for approximately 85% of our net revenue in Malaysia. We are not a party to any long-term agreements with our customers.

During the fiscal years ended October 31, 2019, and 2018, the following customer accounted for 10% or more of our total net revenues:

| Year ended October 31, 2019 | October 31, 2019 | |||||||||||||

| Business segment | Revenues | Percentage of revenues | Trade accounts receivable | |||||||||||

| Le Apple Boutique Hotel (KLCC) Sdn. Bhd. | Real estate | $ | 1,558,111 | 83% | $ | 4,104 | ||||||||

| Lim Joo Soon Enterprise | Plantation | 286,084 | 15% | 8,852 | ||||||||||

| 1,844,195 | 98% | 12,956 | ||||||||||||

| Year ended October 31, 2018 | October 31, 2018 | |||||||||||||

| Business segment | Revenues | Percentage of revenues | Trade accounts receivable | |||||||||||

| Le Apple Boutique Hotel (KLCC) Sdn. Bhd. | Real estate | $ | 1,289,505 | 89% | $ | 2,398 | ||||||||

All of our customers are located in Malaysia.

Key Vendors

All of our key vendors are located in Malaysia. We are not a party to any long-term agreements with our major vendors. In light of the discontinuation of our software and consumer goods business segments, we do not expect to engage the services of software vendors in the future. We do not anticipate difficulties in locating alternative developers and other vendors as needed.

During the fiscal year ended October 31, 2019, and 2018, no vendor accounted for 10% or more of our purchase.

Competition and Market Position

Oil Palm Plantation

Our oil palm plantation is characterized by intense competition, pricing volatility and foreign currency risks. Our competitors range from small-scale operators to fully integrated multinational enterprises with significant financial, technical, sales, marketing and other resources. In addition to palm oil producers, our competitors for the oil palm plantation business also include producers of alternative vegetable oils such as soybean, rapeseed, cottonseed, peanut, sunflower seed and corn oils.

| 13 |

Market fundamentals that affect supply and demand of our products include land shortages, water constraints, climate change, global warming, low operating margin, inadequate quality control and quality assurance mechanisms leading to adulteration, food laws and poor implementation and low depth liquidity in futures markets. Non-fundamental factors include politics, inflation, investor interest, government policies and liquidity.

Multinational corporations are able to take advantage of economies of scale that allow them to command high quality with lower costs, access cheaper credit, minimize losses and decrease input costs. Multinational corporations also tend to have a greater ability to absorb volatility in production and pricing and respond to uncertainty. We believe that the current financial crisis, global volatility in commodity prices and the growing nexus between crude oil prices and vegetable oil prices brought on by the increased reliance on oils for biofuels have only served to exacerbate the volatility and uncertainty already inherent in our industry.

We believe that our competitive position will depend on our ability to mitigate volatility and uncertainty in our industry. We hope to achieve this by obtaining economies of scale, developing vendor relationships, obtaining and maintaining protection of our intellectual property, recruiting and retaining qualified personnel and securing adequate capital resources. While we expect to compete primarily on the basis of pricing and vendor relationships, we believe that the diversion of palm oil for use as biofuels will offer us an opportunity to achieve and sustain an acceptable margin of return for the foreseeable future.

Durian Orchard Business

Our orchard business is mainly challenged by market fundamentals that affects the supply of durian fruits such as climate change, pests and viruses.

We believe that we will be able to mitigate these challenges through the use of our cutting edge technological bio fertilizers. Furthermore, with the increasing demand for durian fruit in China, south east nations and western countries, over the recent years and with the announcement in May 2019 by the Chinese customs department and the Malaysia’s Deputy Minister of Agriculture and Agro-based Industry that Malaysian companies will be allowed to export frozen whole durians to China, we expect the demand for durian fruits from Malaysia to increase in the coming years.

Real Estate

The real estate development business in Malaysia is highly competitive and fragmented. We compete against numerous public and private developers of varying sizes, ranging from local to national in scope. As a result, we may be competing for investment opportunities, financing, and potential buyers with entities that may possess greater financial, marketing, or other resources than we have. Competition for potential buyers has been intensified by an increase in the number of available properties resulting from the recent boom in the Malaysian real estate market. Our prospective customers generally have a variety of choices of new and existing homes and home sites when considering a purchase. We attempt to differentiate our properties primarily on the basis of community design, quality, uniqueness, amenities, location and developer reputation.

The real estate investment industry in Malaysia is highly fragmented among individuals, partnerships and public and private entities, with no dominant single entity or person. Although we may compete against large sophisticated owners and operators, owners and operators of any size can provide effective competition for prospective tenants. We compete for tenants primarily on the basis of property location, rent charged, and the design and condition of improvements.

| 14 |

Intellectual Property

We intend to protect our investment in the research and development of our products and technologies. We intend to seek the widest possible protection for significant product and process developments in our major markets through a combination of trade secrets, trademarks, copyrights and patents, if applicable. We anticipate that the form of protection will vary depending upon the level of protection afforded by the particular jurisdiction. Currently, our revenue is derived principally from our operations in Malaysia where intellectual property protection may be limited and difficult to enforce. In such instances, we may seek protection of our intellectual property through measures taken to increase the confidentiality of our findings.

We intend to register trademarks as a means of protecting the brand names of our companies and products. We intend protect our trademarks against infringement and also seek to register design protection where appropriate.

We rely on trade secrets and unpatentable know-how that we seek to protect, in part, by confidentiality agreements. Our policy is to require some of our employees to execute confidentiality agreements upon the commencement of employment with us. These agreements provide that all confidential information developed or made known to the individual during the course of the individual’s relationship with us is to be kept confidential and not disclosed to third parties except in specific limited circumstances. The agreements also provide that all inventions conceived by the individual while rendering services to us shall be assigned to us as the exclusive property of our company. There can be no assurance, however, that all persons who we desire to sign such agreements will sign, or if they do, that these agreements will not be breached, that we would have adequate remedies for any breach, or that our trade secrets or unpatentable know-how will not otherwise become known or be independently developed by competitors.

Government Regulation

Malaysia

All of our business segments are subject to the general laws in Malaysia governing businesses including labor, occupational safety and health, general corporations, intellectual property and other similar laws.

Plantation Lands

Our plantation lands are subject to many additional laws addressing land, environmental, labor, wildlife and crop cultivation matters. By way of example, we are subject to the Land Acquisition Act of 1960, which specifies the conditions under which the Malaysian government may acquire by eminent domain private land (including our plantation lands) to pursue its social policies. We are also subject to various environmental laws including the Environmental Quality (Prescribed Activities) (Environmental Impact Assessment) Order 1987 which governs land clearing, air emissions, waste water discharges and other similar matters, the Workers’ Minimum Standard of Housing & Amenities Act 1990 which requires us to provide our plantation workers with reasonable housing and amenities, water, electricity and addresses other sanitation related matters, other labor laws governing minimum wages, wage increases and occupational health and safety, the Pesticides Act 1974 (Pesticides Registration) Rules 1988, Pesticides (Licensing for sale and storage) Rules 1988 and Pesticides (Labeling) Regulations 1984 which govern the registration, use, labeling and storage of pesticides and the Protection of Wildlife Act 1972 which governs the capture and destruction of certain protected wildlife.

We are also subject to taxes, tariffs, duties, subsidies and incentives and import and export restrictions on palm oil products, foreign and domestic policies regarding genetically modified organisms, renewable fuel, and low carbon fuel mandates which can influence the planting of species of crops, the location and size of crop production, and the volume and types of imports and exports. These factors all affect the viability and volume of production of our products, and industry profitability.

International trade disputes can adversely affect the trade flow of our goods by limiting or disrupting trade between countries or regions. Future government policies may adversely affect the supply of, demand for, and prices of our products, restrict our ability to do business in its existing and target markets, and can negatively impact our revenues and operating results.

| 15 |

Real Estate

Our real estate investments are subject to extensive local, city, county and state rules and regulations regarding permitting, zoning, subdivision, utilities and water quality as well as federal rules and regulations regarding air and water quality and protection of endangered species and their habitats. Such regulation may delay development of our properties and result in higher than anticipated developmental and administrative costs.

One of the distinguishing features of our Shah Alam 2 Eco Residential Development and Bandar Sungai Long High Grade Villas Community projects is their emphasis on developing a sustainable green lifestyle to reduce their impact on the environment. Accordingly, we expect to make additional environmental related expenditures in developing these projects as well as other projects with an environmental theme. Based on an analysis of our operations in relation to current and presently anticipated environmental requirements, we currently do not anticipate that these costs will have a material adverse effect on our future operations or financial condition.

Seasonality

Our real estate business is not subject to seasonality.

Our oil palm plantation and durian orchard business is subject to seasonality in the growing cycles, procurement, and transportation. Price variations and availability of raw agricultural commodities may cause fluctuations in our working capital levels. In addition, these seasonal trends will likely cause fluctuations in our quarterly results, including fluctuations in sequential revenue growth rates.

Insurance

We maintain property, business interruption and casualty insurance which we believe is in accordance with customary industry practices in Malaysia, but we cannot predict whether this insurance will be adequate to fully cover all potential hazards incidental to our business.

Employees

As of October 31, 2019, we had 9 employees in Malaysia, all of which are full-time. Our employees are in the following principal areas:

Administrative / Finance – 3

Management– 3

Plantation operations – 3

All of our employees are located in Malaysia and are primarily focused on our real estate businesses. None of our employees are members of a trade union. We believe that we maintain good relationships with our employees, and have not experienced any strikes or shutdowns and have not been involved in any labor disputes.

We are required to make contributions under a defined contribution pension plan for all of our eligible employees in Malaysia. We are required to contribute a specified percentage of the participants’ relevant income based on their ages and wages level. The total contributions made were $21,823 and $23,602, for the years ended October 31, 2019, and 2018, respectively.

Corporation Information

Our principal executive offices are located at E-5-2, Megan Avenue 1, Block E, Jalan Tun Razak, 50400 Kuala Lumpur, Malaysia, telephone at +603 2162 0773, facsimile at +603 2161 0770. Our website is located at www. http://www.pgcg.cc. Copies of our annual report on Form 10-K, quarterly reports on Form 10-Q and amendments to those reports filed or furnished pursuant to the Exchange Act are available on our website. You may request copies of such filings free of charge by writing to our corporate offices.

| 16 |

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 1B. Unresolved Staff Comments.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

We own the following properties:

| Property | Location | Business Segment |

| Vacant land (54.1 acres) for development (1) | Selangor, Malaysia | Real Estate |

| Vacant land (31 acres) for development | Selangor, Malaysia | Real Estate |

| 15 Story Commercial Building | Kuala Lumpur, Malaysia | Real Estate |

| 12 Story Commercial Building | Kuala Lumpur, Malaysia | Real Estate |

| Oil palm and Durian Plantation (643 acres) | Pahang, Malaysia | Plantation |

| (1) | The land is subject to a 99-year leasehold, expiring July 30, 2100. |

Our principal executive offices are located at E-5-2, Megan Avenue 1, Block E, Jalan Tun Razak, 50400 Kuala Lumpur, Malaysia, which is the above referenced 12 story commercial building. We believe that our current facilities are adequate for our current needs. We believe that suitable additional space will be available on commercially reasonable terms as needed to accommodate our operations.

15 Story Bank Loan

Effective July 10, 2018, PGCG Assets accepted the Letter of Offer from the Public Islamic Bank Berhad for a Term Equity Financing-i (the “Loan”) in the amount of RM50,000,000 (approximately $11,956,288). The Loan was used to pay off our existing loan with Bank of China (Malaysia) Berhad on our 15 story commercial building located at No. 160, Jalan Ampang, 50450 Kuala Lumpur, Malaysia and working capital for the Group. The Loan is secured by a charge on the 15-story commercial office building in Kuala Lumpur, Malaysia, deed of assignment of rental proceeds over the rights and interest to the rental of the 15-story commercial office building and is personally guaranteed by Weng Kung Wong, our Chief Executive Officer and Director, and also guaranteed by Union Hub Technology Sdn. Bhd., our wholly owned subsidiary (“UHT”). The loan is also secured by a debenture incorporating fixed and floating charge for RM50 million plus interest thereon over the assets of PGCG Assets.

Outstanding principal amounts due under the Loan accrue interest at a rate of 1.50% per annum below the Base Financing Rate, which is currently at 6.97% per annum. The Loan is repayable in monthly installments of RM407,750.00 (approximately $97,503), including interest, over a period of 180 months and will mature in 2033. As of October 31, 2019, $12 million was outstanding under the Loan.

12 Story Bank Loan

In May 2013, PGCG Assets obtained a loan in the aggregate amount of RM9,840,000 (approximately $2,346,488) from RHB Bank Berhad, a financial institution in Malaysia to finance the acquisition of a twelve story office building property, which bears interest at a rate of 1.90% per annum below the lending rate, with an monthly instalment of RM58,317 (approximately $13,659), including interest, variable rate quoted by the bank, with 288 monthly installments over a period of 24 years and will mature in 2037. The loan is secured by the 12-story commercial office building “Megan Avenue” in Kuala Lumpur, Malaysia and is personally guaranteed by our director and Chief Executive Officer, Weng Kung Wong, the director of UHT, our subsidiary, Kok Wai Chai and UHT.

| 17 |

The foregoing descriptions of the loan agreements with each of Public Islamic Bank Berhad and RHB Bank Berhad are qualified in their entirety by reference to the loan agreements, which are filed as Exhibits 10.2 through and including 10.5 to this Annual Report and incorporated herein by reference.

Financing Loan

In April 2019, the Company, through Virtual Setup Sdn Bhd (“VSSB”) obtained a loan in the aggregate amount of RM5,000,000 from Public Islamic Bank Berhad, a financial institution in Malaysia for working capital purpose, which bears interest at a rate of 1.00% per annum above base financing rate, variable rate quoted by the bank, with 120 monthly instalments of RM60,590 each (including interests) over a period of 10 years and will mature in 2029.

The loan is secured by the first party charge over agricultural lands under Lot 3695, Lot 3696 and Lot 1552 situated at Pahang, Malaysia, and a third-party charge over the 15-story commercial office building registered under PGCG Assets. The loan is also secured by a specific debenture on the oil palm and durian plantation is to be obtained, and personally guaranteed by the director and chief executive officer of the Company, Mr. Weng Kung Wong and subsidiaries of the Company, UHT and PGCG Assets. The cost of funds was 7.97% per annum for the period ended July 31, 2019.

There are no material pending legal proceedings to which we are a party or to which any of our property is subject, nor are there any such proceedings known to be contemplated by governmental authorities. None of our directors, officers or affiliates is involved in a proceeding adverse to our business or has a material interest adverse to our business.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

| 18 |

ITEM 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

(a) Market Information

The following table sets forth the high and low closing sale prices for the periods presented as reported on the Over the Counter Bulletin Board. There is no established public trading market for our securities and a regular trading market may not develop, or if developed, may not be sustained.

| Price Range | ||||||||

| High | Low | |||||||

| Fiscal 2019 | ||||||||

| First quarter | $ | 0.03 | $ | 0.02 | ||||

| Second quarter | 0.87 | 0.02 | ||||||

| Third quarter | 0.39 | 0.15 | ||||||

| Fourth quarter | 0.15 | 0.12 | ||||||

| Fiscal 2018 | ||||||||

| First quarter | $ | 0.10 | $ | 0.10 | ||||

| Second quarter | 0.10 | 0.02 | ||||||

| Third quarter | 0.10 | 0.03 | ||||||

| Fourth quarter | 0.03 | 0.03 | ||||||

Our common stock is quoted on the Over the Counter Bulletin Board under the symbol PGCG. As of January 13, 2020, the closing price of our securities was $0.07.

(b) Approximate Number of Holders of Common Stock

As of January 13, 2020, there were approximately 2285 shareholders of record of our common stock. Such number does not include any shareholders holding shares in nominee or “street name”.

(c) Dividends

Holders of our common stock are entitled to receive such dividends as may be declared by our board of directors. We paid no dividends during the periods reported herein, nor do we anticipate paying any dividends in the foreseeable future.

(d) Equity Compensation Plan Information

There are no options, warrants or convertible securities outstanding.

(e) Recent Sales of Unregistered Securities

The information set forth below describes our issuance of securities without registration under the Securities Act of 1933, as amended, during the year ended October 31, 2019, that were not previously disclosed in a Quarterly Report on Form 10-Q or in a Current Report on Form 8-K: None.

| 19 |

ITEM 6. Selected Financial Data.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

This discussion summarizes the significant factors affecting the operating results, financial condition, liquidity and cash flows of the Company and its subsidiaries for the fiscal years ended October 31, 2019 and 2018. The discussion and analysis that follow should be read together with the section entitled “Forward Looking Statements” and our consolidated financial statements and the notes to the consolidated financial statements included elsewhere in this annual report on Form 10-K.

Except for historical information, the matters discussed in this section are forward looking statements that involve risks and uncertainties and are based upon judgments concerning various factors that are beyond the Company’s control. Consequently, and because forward-looking statements are inherently subject to risks and uncertainties, the actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. You are urged to carefully review and consider the various disclosures made by us in this report.

Currency and exchange rate

Unless otherwise noted, all currency figures quoted as “U.S. dollars”, “dollars” or “$” refer to the legal currency of the United States. References to “MYR” or “RM” are to the Malaysian Ringgit, the legal currency of Malaysia. Throughout this report, assets and liabilities of the Company’s subsidiaries are translated into U.S. dollars using the exchange rate on the balance sheet date. Revenue and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation of financial statements of foreign subsidiaries are recorded as a separate component of accumulated other comprehensive income within the statement of stockholders’ equity.

Overview

During the fiscal year 2019, we operated in two business segments: (i) our oil palm and durian plantation business; and (ii) our real estate business. Our oil palm and durian plantation business is operated through Virtual Setup Sdn. Bhd., or VSSB, and our real estate business is primarily operated through PGCG Assets Holdings Sdn. Bhd., or PGCG Assets, and Dunford Corporation Sdn Bhd. Oil palm and durian comprise approximately 79% and 21% of our plantation business.

Summarized financial information regarding each revenue generating segment for the year ended October 31, 2019 is as follows:

| Year ended October 31, 2019 | ||||||||||||||||

| Plantation Business | Real Estate Business | Corporate | Total | |||||||||||||

| Revenues, net | $ | 286,084 | $ | 1,657,811 | $ | – | $ | 1,943,895 | ||||||||

| Less: inter-company revenues | – | (25,756 | ) | – | (25,756 | ) | ||||||||||

| Revenues from external customers | 286,084 | 1,632,055 | – | 1,918,139 | ||||||||||||

| Cost of revenues | (82,983 | ) | (566,513 | ) | – | (649,496 | ) | |||||||||

| Gross profit | 203,101 | 1,065,542 | – | 1,268,643 | ||||||||||||

| Depreciation | 12,434 | 463,140 | 6,062 | 481,636 | ||||||||||||

| Net income (loss) | 30,933 | 47,123 | (345,377 | ) | (267,321 | ) | ||||||||||

| Total assets | 6,308,836 | 37,943,770 | 220,675 | 44,473,281 | ||||||||||||

| Expenditure for long-lived assets | $ | 33,515 | $ | – | $ | – | $ | 33,515 | ||||||||

| 20 |

Our initial business plan launched in July 2010 broadly contemplated the development, distribution and operation of mobile and online social networking, ecommerce and search products and services. However, as a result of the challenges we experienced in implementing our m-commerce business plan, we entered the oil palm plantation and real estate businesses in 2012 and in 2014 discontinued our software business. Since the commencement of our business segments, we (through our subsidiaries):

| · | Acquired an oil palm plantation in Malaysia which is operated through VSSB; |

| · | Acquired 21.8921 hectares (54.10 acres) of vacant development land located in Selangor, Malaysia, which is subject to a 99-year leasehold, expiring July 30, 2100; |

| · | Acquired Dunford Corporation Sdn. Bhd., or Dunford, whose primary assets consist of two parcels of undeveloped land located in Selangor, Malaysia aggregating approximately 31 acres; |

| · | Acquired a 15 story commercial building located at Geran 10010, Lot 238 Section 43, Town and District of Kuala Lumpur, Wilayah Persekutuan, Kuala Lumpur, Malaysia; and |

| · | Acquired a 12 story commercial building located at Megan Avenue 1, No. 189, Jalan Tun Razak, 50400 Kuala Lumpur, Malaysia. |

As we continue to develop, we may continue to experience significant fluctuations in revenue which may cause our gross profit to fluctuate.

Challenges From Our Oil Palm Planting Operations

The oil palm business is a highly regulated industry with prices subject to wide fluctuations due to factors beyond our control such as weather conditions, competition, global demand and government policies. Management has limited experience operating in this industry and may not be able to successfully navigate all industry specific factors in addition to any geopolitical factors in Malaysia. If we are not able to successfully respond to any of these or other factors, our business operations and financial results may be adversely affected.

We are focused on the maintenance and operation of our oil palm plantation in Malaysia. We believe that the value of our oil palm plantation has increased since its acquisition, and while we have not pursued any discussions or received any formal offers regarding the sale of our plantation, we may consider sales offers in the future if a sale would maximize return to our investors.

Challenges From Our Durian Planting Operations

We commenced planting premium durian, of the “Musang King” variety, in the first quarter of calendar year 2014. As of the date of this report, we have replanted approximately 180 acres of our oil palm with premium durian trees. We planted an average of 30 trees per acre and anticipate an average production of 35-50 grade A fruits per tree for each of the two harvesting seasons per year.

We used the latest planting technology in 2016, which we hope will reduce the maturity time of the durian tree from 5 years to 3 years. The durian trees planted during the first phase has begun to bear fruits, and our first major harvest occurred in July 2019. We expect the second and third phase to begin bearing fruit by 2021 and the fourth phase by 2023, at the latest.

| 21 |

Challenges From Our Real Estate Operations

Commercial Buildings

We generate rental income from our 12 story and 15 story commercial properties and anticipate generating income from the sale of developed properties. As of Oct 31, 2019, we occupy 2 floors of our 12 story commercial building as our corporate headquarters, 6 floors have been leased to tenants at market rate. The remaining 4 floors are currently vacant and we are actively attempting to lease these 4 floors.

Our 15 story building is fully leased to Le Apple Boutique Hotel (KLCC) Sdn Bhd (“Le Apple”) which operates a boutique hotel on the premises. The Rental Agreement has an initial term of one (1) year commencing December 1, 2018 and expiring November 30, 2019. Provided that there are no existing breaches by Le Apple, we will be required to renew the lease for additional one-year terms for a maximum aggregate term of thirty years. The monthly rental rate shall be increased every three years at an increment rate of 5% to 10% of the current monthly rental rate, or shall be based on the prevailing market rate, whichever is lower. Our current rental rate has increased from RM400,000 to RM550,000 (approximately $131,520) from April 1, 2018.

Residential Property Development

On June 10, 2015, we received approval to develop our leasehold land located in Puncak Alam. Due to challenges in the current Malaysian real property market, in November 2015, we submitted a request to convert some of our planned semi-detached and bungalow home parcels into cluster semi-detached homes to improve the marketability of the development. We received approval of our revised development plan on March 4, 2016.

On July 1, 2016, PGCG Assets entered into a memorandum of understanding (“MOU”) with Yong Tai Berhad, a public listed corporation in the main market of Bursa Malaysia Berhad (“YTB”) engaged in the business of commercial and residential property development, to jointly develop our land (the “Land”) located at Puncak Alam (the “Proposed JV”). The MOU was terminated on February 15, 2017, pursuant to the terms of a Mutual Termination of Memorandum of Understanding (the “Termination MOU”). In light of the termination of the Proposed JV with YTB, we intend to develop, market, promote and complete the construction on our own. Due to market forces, we plan to begin construction by the end of calendar 2023, to maximize profits.

We believe that we will require approximately RM5 to RM10 million in the aggregate to market, promote and complete construction of each phase of our Shah Alam 2 Eco Residential Development Project.

On September 8, 2016, the Urban Wellbeing, Housing and Local Government Ministry of Malaysia announced the introduction of an initiative that will enable property developers to provide loans to buyers at an annual interest rate between 12 and 18 percent. Developers will be able to begin applying to the ministry on September 8, 2016, for a moneylending license. It is our understanding that loans made pursuant to such license will not be restricted to first time homebuyers.

We are considering applying for such money lender’s license to enable us to provide financing to prospective buyers of our future properties. If we apply and are successful in obtaining such license, we hope that we will be able to boost sales of our properties that we have earmarked for development.

We continue to maintain a cautious but positive outlook for the residential market based upon Malaysia’s stable employment outlook, growth in household income, formation of new households, and increased demand for affordable residential property for first time home buyers. Developers such as us are facing challenges of inconsistent supply and high cost of labour, increased costs of building materials (such as cement and steel bars) and general increased costs of doing business. Our market is also sensitive to changes in lending rates and lending requirements as many homebuyers rely on financing to make purchases. As a result, government or bank policies that result in increased interest rates and or stricter lending requirements may adversely affect the sales of our developed properties.

Results of Operations

As of October 31, 2019, we suffered from continuous operating loss from prior years and working capital deficit of $1,467,703. Our continuation as a going concern is dependent upon improving our profitability and the continuing financial support from our stockholders or other capital sources. Management believes that the continuing financial support from the existing shareholders and external financing will provide the additional cash to meet our obligations as they become due.

| 22 |

These consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets and liabilities that may result in the Company not being able to continue as a going concern.

The following table sets forth certain operational data for the years indicated:

| Fiscal Years Ended October 31, | ||||||||

| 2019 | 2018 | |||||||

| Total net revenues | $ | 1,918,139 | $ | 1,529,586 | ||||

| Plantation business | 286,084 | 164,947 | ||||||

| Real estate | 1,632,055 | 1,364,639 | ||||||

| Total cost of revenue | (649,496 | ) | (695,040 | ) | ||||

| Plantation business | (82,983 | ) | (79,679 | ) | ||||

| Real estate | (566,513 | ) | (615,361 | ) | ||||

| Gross profit | 1,268,643 | 834,546 | ||||||

| Plantation business | 203,101 | 85,268 | ||||||

| Real estate | 1,065,542 | 749,278 | ||||||

| General and administrative expenses | (667,932 | ) | (352,006 | ) | ||||

| Other income, net (expense) | (690,825 | ) | (823,079 | ) | ||||

| Income tax expense | (177,207 | ) | (213,423 | ) | ||||

| Net loss | (267,321 | ) | (553,962 | ) | ||||

Comparison of the fiscal years ended October 31, 2019 and October 31, 2018

Net Revenue. We generated net revenue of $1,918,139 and $1,529,586 for the fiscal years ended October 31, 2019 and 2018, respectively, with our oil palm and durian plantation and real estate businesses accounting for 15% and 85% of the net revenue, respectively, for the fiscal year ended October 31, 2019. For the fiscal year ended October 31, 2018, our oil palm and durian plantation and real estate businesses accounted for approximately 11% and 89% of net revenue, respectively.

Our plantation business experienced a 73% increase with net revenue increasing from $164,947 for the year ended October 31, 2018, to $286,084 for the same period ended October 31, 2019. The increase is attributable to oil palm and durian plantation.

Our real estate business experienced a 20% increase in revenue from $1,364,639 for the year ended October 31, 2018, to $1,632,055 for the same period ended October 31, 2019. The increase in our real estate revenue is attributable to the increase in rental income from our fifteen story buildings and the decreased vacancies in our twelve story building. The primary increase in real estate revenue is attributable to the recovery of monthly rental rate from RM400,000 to RM550,000 (approximately $131,520) from our tenant of fifteen story building, Le Apple, effective from April 1, 2018. The monthly rental rate on Le Apple was previously decreased from our initial rental rate of RM550,000 to RM400,000 due to unfavourable market conditions.