Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - DENNY'S Corp | q42019pre-releaseearni.htm |

| 8-K - 8-K - DENNY'S Corp | a011320pre-release8xk.htm |

INVESTOR PRESENTATION 22 nd Annual ICR Conference January 2020

FORWARD-LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES Denny’s Corporation urges caution in considering its current trends and any outlook on earnings disclosed in this presentation. In addition, certain matters discussed may constitute forward-looking statements. These forward-looking statements, which reflect the Company’s best judgment based on factors currently known, are intended to speak only as of the date such statements are made and involve risks, uncertainties, and other factors that may cause the actual performance of Denny’s Corporation, its subsidiaries and underlying restaurants to be materially different from the performance indicated or implied by such statements. Words such as “expects”, “anticipates”, “believes”, “intends”, “plans”, “hopes”, and variations of such words and similar expressions are intended to identify such forward-looking statements. Except as may be required by law, the Company expressly disclaims any obligation to update these forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events. Factors that could cause actual performance to differ materially from the performance indicated by these forward-looking statements include, among others: the competitive pressures from within the restaurant industry; the level of success of the Company’s operating initiatives, advertising and promotional efforts; adverse publicity; health concerns arising from food-related pandemics, outbreaks of flu viruses, such as avian flu, or other diseases; changes in business strategy or development plans; terms and availability of capital; regional weather conditions; overall changes in the general economy, particularly at the retail level; political environment (including acts of war and terrorism); and other factors from time to time set forth in the Company’s SEC reports, including but not limited to the discussion in Management’s Discussion and Analysis and the risks identified in Item 1A. Risk Factors contained in the Company’s Annual Report on Form 10-K for the year ended December 26, 2018 (and in the Company’s subsequent quarterly reports on Form 10-Q). The presentation includes references to the Company’s non-GAAP financials measures. All such measures are designated by an asterisk (*). The Company believes that, in addition to other financial measures, Adjusted EBITDA, Adjusted Free Cash Flow, Adjusted Net Income and Adjusted Net Income Per Share are appropriate indicators to assist in the evaluation of its operating performance on a period-to-period basis. The Company also uses Adjusted EBITDA and Adjusted Free Cash Flow internally as performance measures for planning purposes, including the preparation of annual operating budgets, and for compensation purposes, including bonuses for certain employees. Adjusted EBITDA is also used to evaluate its ability to service debt because the excluded charges do not have an impact on its prospective debt servicing capability and these adjustments are contemplated in its credit facility for the computation of its debt covenant ratios. Adjusted Free Cash Flow, defined as Adjusted EBITDA less cash portion of interest expense net of interest income, capital expenditures, and cash taxes, is used to evaluate operating effectiveness and decisions regarding the allocation of resources. However, Adjusted EBITDA, Adjusted Free Cash Flow, Adjusted Net Income and Adjusted Net Income Per Share should be considered as a supplement to, not a substitute for, operating income, net income or other financial performance measures prepared in accordance with U.S. generally accepted accounting principles. See Appendix for non-GAAP reconciliations. INVESTOR PRESENTATION 2

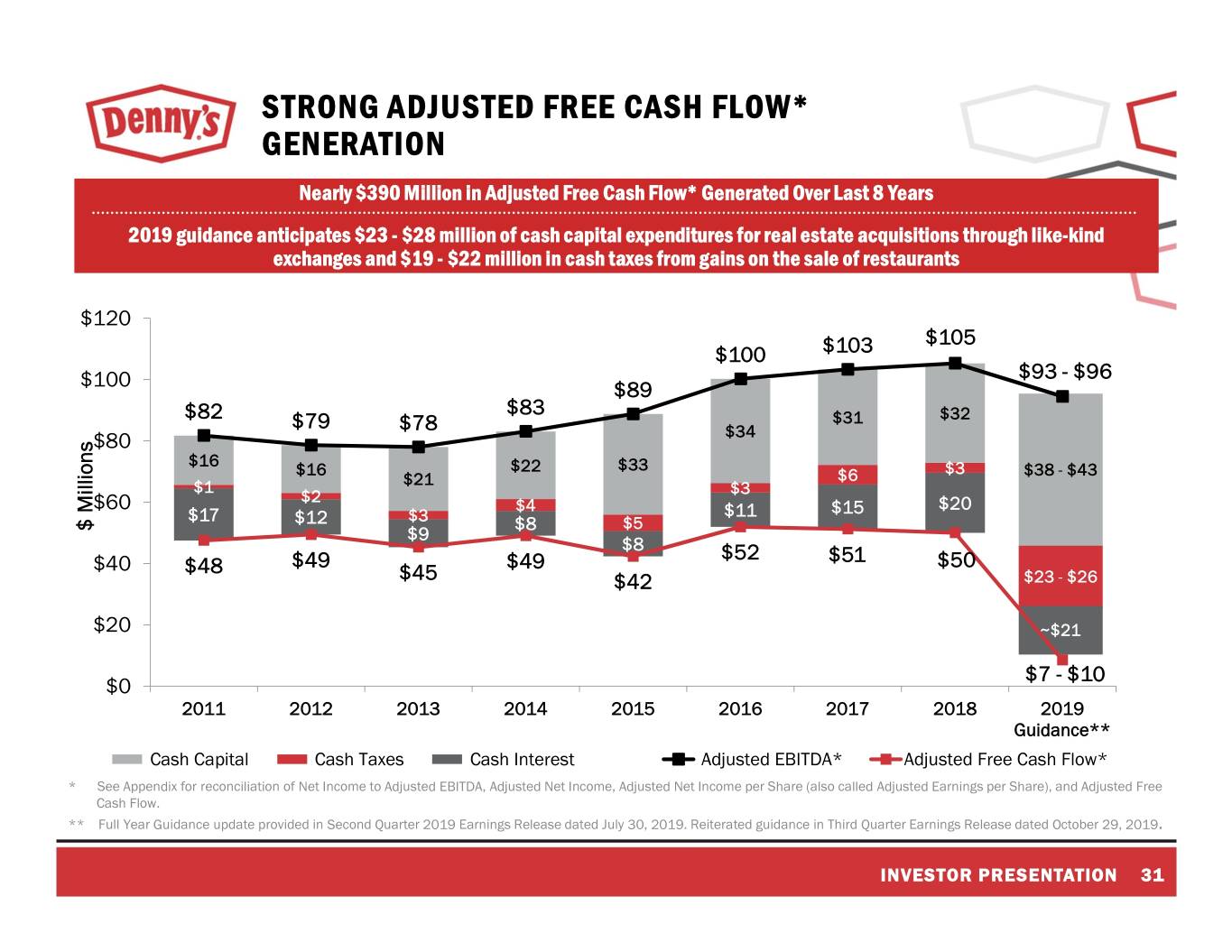

DENNY’S INVESTMENT HIGHLIGHTS • Achieved 9th consecutive year of domestic system-wide same store sales1 CONSISTENTLY GROWING growth2 SAME-STORE SALES 1 • Strong same-store sales1 performance relative to peers • ~380 new restaurants opened since 2011 (over 20% of the system)2 GLOBAL DEVELOPMENT • 74 international locations opened since 20112 • Enhanced international development agreements STRONG ADJUSTED FREE • Generated nearly $390M in Adjusted Free Cash Flow* over the last 8 years3 CASH FLOW * AND • Approximately $520M allocated to share repurchase program since SHAREHOLDER RETURN November 20102 • Transitioning to a lower risk business model expected to have accretive impacts on REFRANCHISING AND REAL Adjusted Earnings per Share* and Adjusted Free Cash Flow* ESTATE STRATEGY • Upgrading the quality of real estate portfolio through a series of like-kind exchanges * See Appendix for reconciliation of Net Income to Adjusted EBITDA, Adjusted Net Income, Adjusted Net Income per Share (also called Adjusted Earnings per Share), and Adjusted Free Cash Flow. 1. Same-store sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open the same period in the prior year. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-store sales and domestic system-wide same-store sales should be considered as a supplement to, not a substitute for, our results as reported under GAAP. 2. Data as of December 25, 2019, the end of Fiscal Fourth Quarter 2019. 3. Data as of December 26, 2018, the end of Fiscal Fourth Quarter 2018. INVESTOR PRESENTATION 3

EXECUTION OF BRAND REVITALIZATION STRATEGY DRIVING RESULTS “Become the World’s Largest, Most Admired and Beloved Family of Local Restaurants” Deliver a Consistently Drive Grow Differentiated Operate Profitable the Global and Relevant Great Growth for All Franchise Brand Restaurants Stakeholders Enabled Through Technology and Training + Close Collaboration with Franchise Partners INVESTOR PRESENTATION 4

DELIVERING A DIFFERENTIATED AND RELEVANT BRAND Welcome to America’s Diner where we serve classic, comforting food at a fair price around the clock for unpretentious, everyday occasions. Food Service Atmosphere INVESTOR PRESENTATION 5

FOCUS ON BETTER QUALITY, MORE CRAVEABLE PRODUCTS Approximately 80% of Core Menu Entrées Changed or Improved Since Our Revitalization Began Leading to Significant Improvement in Taste and Quality Scores and Sales Growth INVESTOR PRESENTATION 6

NEWEST LIMITED TIME ONLY OFFERINGS FEATURED PRODUCTS INCLUDE FEEL GOOD FLAVORS AND SIZZLIN’ SKILLETS INVESTOR PRESENTATION 7

EVERYDAY VALUE HELPING TO DRIVE TRAFFIC High awareness as 1 in 5 guests say they visit Denny’s because of $2468 Value Menu® Utilize local and national media targeting popular products like the Everyday Value Slam® In 2019, total value incidence rate of over 19%, including a $2468 incidence rate of ~14% Positive guest response to new LTO value entrées INVESTOR PRESENTATION 8

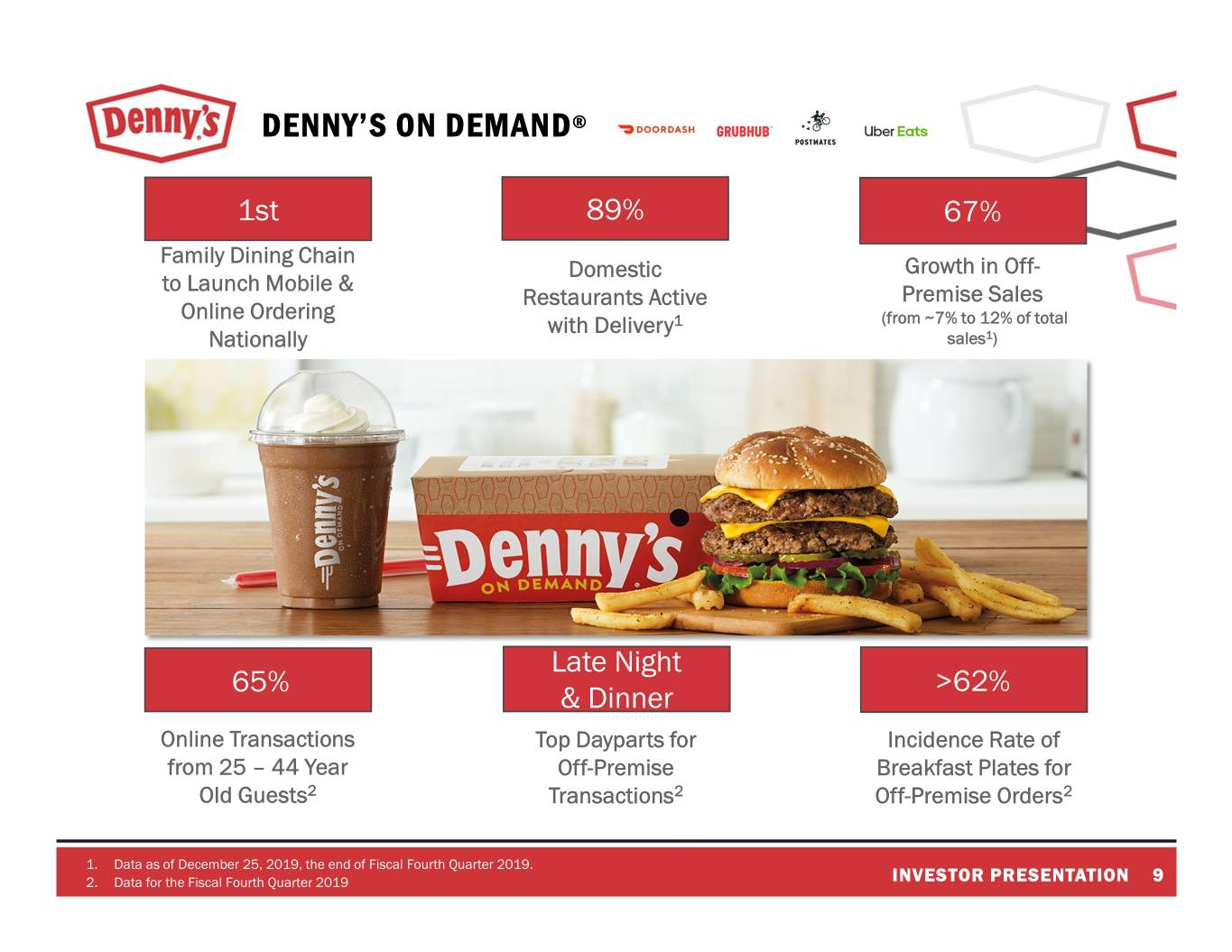

DENNY’S ON DEMAND® 1st 89% 67% Family Dining Chain Domestic Growth in Off- to Launch Mobile & Restaurants Active Premise Sales Online Ordering with Delivery1 (from ~7% to 12% of total Nationally sales1) Late Night 65% >62% & Dinner Online Transactions Top Dayparts for Incidence Rate of from 25 – 44 Year Off-Premise Breakfast Plates for Old Guests2 Transactions2 Off-Premise Orders2 1. Data as of December 25, 2019, the end of Fiscal Fourth Quarter 2019. 2. Data for the Fiscal Fourth Quarter 2019 INVESTOR PRESENTATION 9

THE MODERN AMERICAN FAMILY Who they are: Largely identify as part of the Millennial generation Have a family-first focus and are increasingly becoming multi-generational (especially amongst Hispanics) Are time-pressed, have multiple demands on family schedule Have a multi-screen approach to life, moving to streaming audio and video through mobile devices and Smart TVs How we are connecting with them: TV Digital Video Content Digital & Social Data & Tech Search INVESTOR PRESENTATION 10

REMODELS KEY TO REVITALIZING LEGACY BRAND Heritage 2.0 Heritage Heritage Legacy Denny’s Legacy INVESTOR PRESENTATION 11

FOCUS ON CONSISTENTLY OPERATING GREAT RESTAURANTS LEADING TO SUSTAINED IMPROVEMENT • Investments in training talent, tools, and strategies, such as Ignite E-Learning and our latest Delight & Make It Right service programs, driving improvements in service scores • Denny’s Pride Review Program used to evaluate and share best practices • Close collaboration with franchisees executing remodels, improving speed of service, and growing margins INVESTOR PRESENTATION 12

GLOBAL DEVELOPMENT Growth Initiatives Enabled Approximately 380 New Restaurant Openings Since 2011 With 95% Opened by Franchisees 1 70 61 60 5 50 50 46 45 40 5 14 39 40 38 8 6 6 7 30 30 30 56 9 14 41 20 37 36 34 32 32 21 10 16 0 2011 2012 2013 2014 2015 2016 2017 2018 2019 Domestic Openings International Openings System Openings 1. Data as of December 25, 2019, the end of Fiscal Fourth Quarter 2019. INVESTOR PRESENTATION 13

DOMESTIC FOOTPRINT Over 1,550 Restaurants in the U.S.1 with Strongest Presence in California, Arizona, Texas, and Florida TOP 10 U.S. MARKETS1 DMA UNITS Los Angeles 180 6 Phoenix 66 5 10 8 Houston 62 1 Dallas/Ft. Worth 52 25 2 Sacramento/Stockton 49 San Francisco/Oakland 41 Orlando/Daytona 41 San Diego 38 Chicago 37 6 Miami/Ft. Lauderdale 35 1. Data as of December 25, 2019, the end of Fiscal Fourth Quarter 2019. INVESTOR PRESENTATION 14

INTERNATIONAL FOOTPRINT International Presence of 144 Restaurants in 14 Countries and U.S. Territories has Grown by Over 65% Since Year End 20101 United States 1,559 Canada 77 Puerto Rico 15 Mexico 11 Philippines 10 New Zealand 7 Honduras Guatemala City Honduras 6 United Arab Emirates 6 Costa Rica 3 Guam 2 Guatemala 2 United Kingdom 2 El Salvador 1 Aruba 1 Ontario Philippines Indonesia 1 1. Data as of December 25, 2019, the end of Fiscal Fourth Quarter 2019. INVESTOR PRESENTATION 15

STRONG PARTNERSHIP WITH FRANCHISEES Well Diversified, Experienced, and Energetic Group of 236 Franchisees 1 Ownership of 1,635 Franchisee Restaurants1 • 35 franchisees with more than 10 Number of Number of Total Franchise Franchise Units restaurants each collectively Franchise Units Franchisees Units as % of Total compromise over 60% of the franchise 1 84 84 5% system. 2–5 84 237 15% • Strong support and energy at the 2019 6–10 33 264 16% Annual Denny’s Franchisee Association 11–15 12 145 9% Convention for returns on quality 16–30 13 300 18% investments in food, service, and atmosphere. >30 10 605 37% Total 236 1,635 100% 1. Data as of December 25, 2019, the end of Fiscal Fourth Quarter 2019. INVESTOR PRESENTATION 16

STRONG COLLABORATION WITH FRANCHISEES Denny’s Franchisee Marketing Brand Advisory Operations Brand Advisory Association Council Council Annual Convention Menu Innovation Training Initiatives Steering Committee Meetings Media Support Pride Reviews Joint Board Meetings Product Testing Operations Support Supply Chain Oversight Development Brand Advisory Technology Brand Advisory Committee Council Council Purchase Product for System Successful Heritage Remodels Customer Facing Technology Outperformed PPI by Avg of ~1ppt Prototype Development Denny’s On Demand Each Year Over the Last Decade Lease & Asset Management Common POS Platform INVESTOR PRESENTATION 17

REFRANCHISING STRATEGY Update and Results

REFRANCHISING STRATEGY ADJUSTED FREE CASH FLOW* BENEFIT $9M - $10M Adjusted Free Cash Flow* Benefit of $9M - $10M Lower Maintenance Cash CapEx ($23M - $30M) $9M -$12M $3M -$4M $11M -$13M ~$0 Net Adjusted EBITDA* Impact Estimated Adjusted Incremental Incremental Rent Cost Savings EBITDA* Impact Royalties (@4.5%) 115 – 125 Restaurants to be Refranchised * See Appendix for reconciliation of Net Income to Adjusted EBITDA, Adjusted Net Income, Adjusted Net Income per Share (also called Adjusted Earnings per Share), and Adjusted Free Cash Flow. INVESTOR PRESENTATION 19

REFRANCHISING – STRATEGY TO DATE RESULTS Refranchising Results – Estimates vs. Actuals Metric Estimate Actual1 Restaurants to be Refranchised 115 - 125 113 Percent Franchised 96% - 97% 96% Development Commitments 70 -80 78 Restaurant-Level EBITDA Multiple 4.5x - 5.5x 4.8x Pre-Tax Refranchising Proceeds $125M - $135M $128M 1. Strategy to date results (Strategy announced October 2018). Data as of December 25, 2019, the end of Fiscal Fourth Quarter 2019. INVESTOR PRESENTATION 20

COMPANY FOOTPRINT 68 Company Restaurants in 11 States with a Strong Presence in California, Texas, Florida, and Nevada1 Company Restaurants1 State Units California 25 Texas 13 Florida 9 Nevada 7 South Carolina 3 Hawaii 2 Massachusetts 2 New Hampshire 2 Vermont 2 Virginia 2 Arizona 1 1. Data as of December 25, 2019, the end of Fiscal Fourth Quarter 2019. INVESTOR PRESENTATION 21

REFRANCHISING – EXPECTED COST SAVINGS 25% 40% Total Savings Multi-Year Franchise Support $11M - $13M Cost Sharing Items • Advertising • Information Technology 35% • Procurement Field Support (Operating Margins) Corporate Support (G&A) Franchise Support Cost Sharing (G&A) INVESTOR PRESENTATION 22

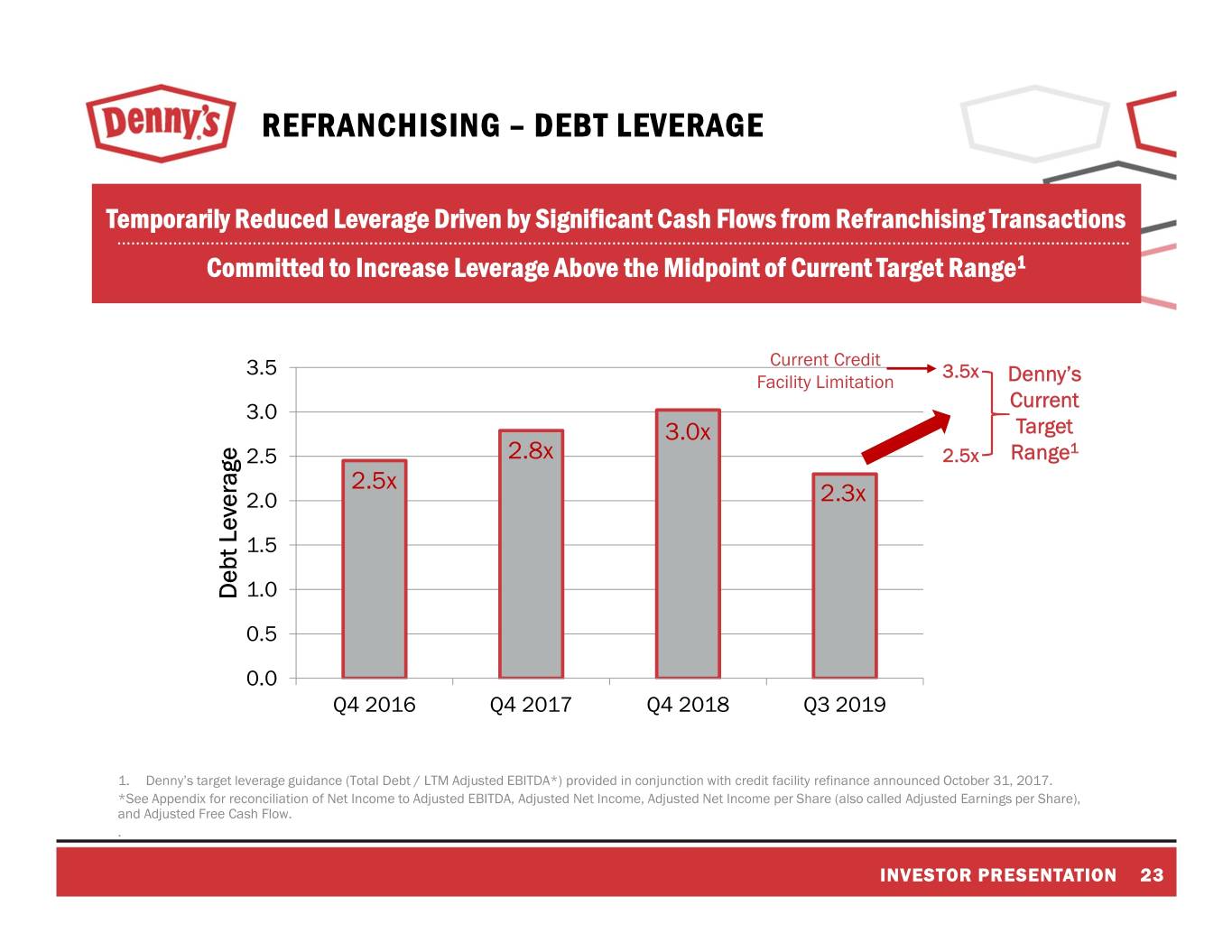

REFRANCHISING – DEBT LEVERAGE Temporarily Reduced Leverage Driven by Significant Cash Flows from Refranchising Transactions Committed to Increase Leverage Above the Midpoint of Current Target Range1 Current Credit 3.5 3.5x Facility Limitation Denny’s Current 3.0 3.0x Target 2.5 2.8x 2.5x Range1 2.5x 2.0 2.3x 1.5 Debt Leverage Debt 1.0 0.5 0.0 Q4 2016 Q4 2017 Q4 2018 Q3 2019 1. Denny’s target leverage guidance (Total Debt / LTM Adjusted EBITDA*) provided in conjunction with credit facility refinance announced October 31, 2017. *See Appendix for reconciliation of Net Income to Adjusted EBITDA, Adjusted Net Income, Adjusted Net Income per Share (also called Adjusted Earnings per Share), and Adjusted Free Cash Flow. . INVESTOR PRESENTATION 23

REAL ESTATE STRATEGY – OBJECTIVES Upgrade Quality of Real Estate Portfolio Through a Series of Like-Kind Exchanges Sell between 25% and 30% of the ~95 properties currently owned1 Generate proceeds of approximately $30 million Redeploy proceeds to acquire higher quality real estate Cash proceeds from the sale of property are not captured in Cash Capital Expenditures while purchases of property are included Sold 6 pieces of real estate and acquired 4 pieces of real estate through a series of like-kind exchange transactions totaling ~$10 million2 YTD 2019 (through Q3) Real Estate Strategy expected to be completed in 2020 1. Data as of December 26, 2018, the end of Fiscal Fourth Quarter 2018. 2. Data as of September 25, 2019, the end of Fiscal Third Quarter 2019. INVESTOR PRESENTATION 24

RECENT PERFORMANCE

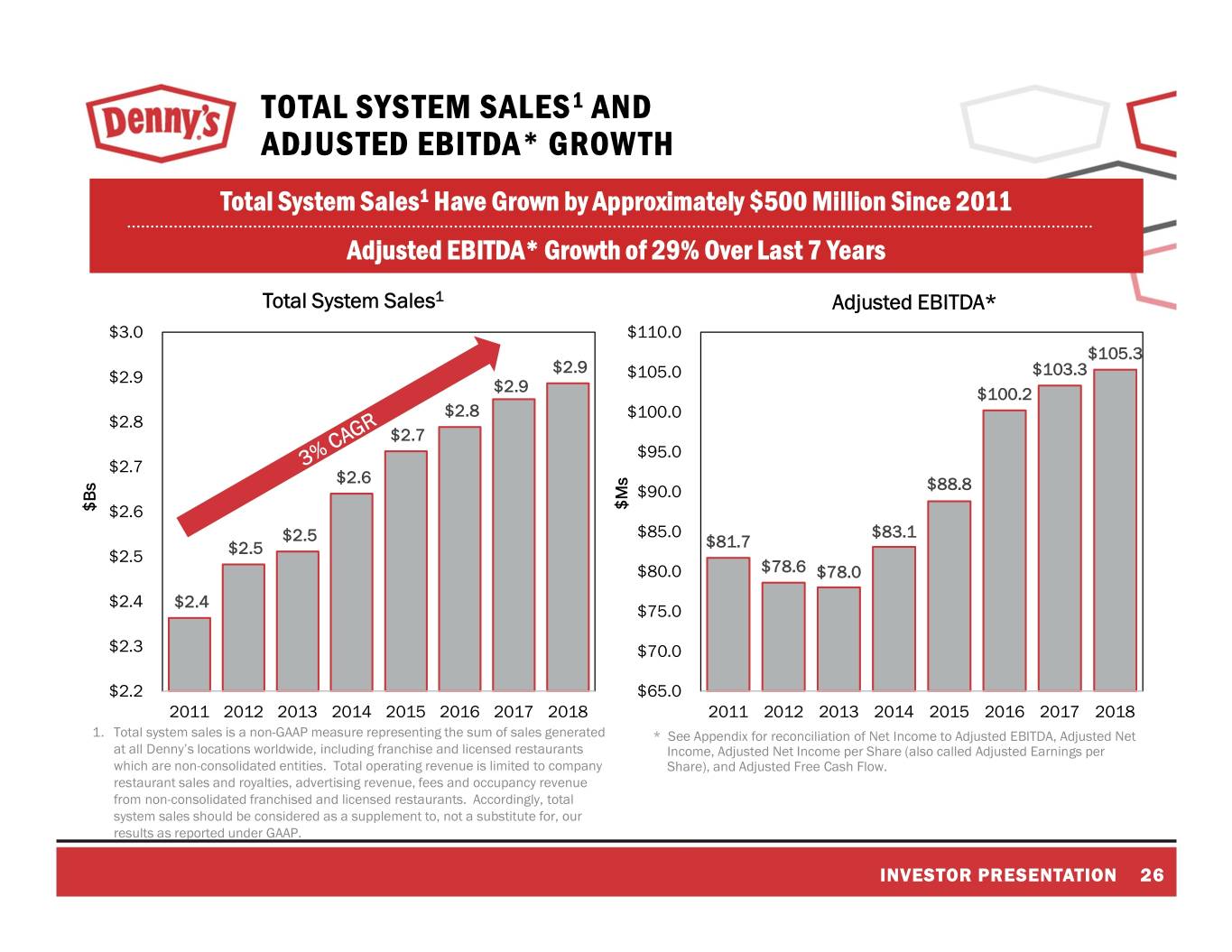

TOTAL SYSTEM SALES1 AND ADJUSTED EBITDA* GROWTH Total System Sales1 Have Grown by Approximately $500 Million Since 2011 Adjusted EBITDA* Growth of 29% Over Last 7 Years Total System Sales1 Adjusted EBITDA* $3.0 $110.0 $105.3 $2.9 $2.9 $105.0 $103.3 $2.9 $100.2 $2.8 $100.0 $2.8 $2.7 $95.0 $2.7 $2.6 $90.0 $88.8 $Ms $Bs $2.6 $85.0 $83.1 $2.5 $81.7 $2.5 $2.5 $80.0 $78.6 $78.0 $2.4 $2.4 $75.0 $2.3 $70.0 $2.2 $65.0 2011 2012 2013 2014 2015 2016 2017 2018 2011 2012 2013 2014 2015 2016 2017 2018 1. Total system sales is a non-GAAP measure representing the sum of sales generated * See Appendix for reconciliation of Net Income to Adjusted EBITDA, Adjusted Net at all Denny’s locations worldwide, including franchise and licensed restaurants Income, Adjusted Net Income per Share (also called Adjusted Earnings per which are non-consolidated entities. Total operating revenue is limited to company Share), and Adjusted Free Cash Flow. restaurant sales and royalties, advertising revenue, fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, total system sales should be considered as a supplement to, not a substitute for, our results as reported under GAAP. INVESTOR PRESENTATION 26

COMPANY SALES AND MARGINS Steady Growth in Company Restaurant Average Unit Volumes Company Margins Grew Over 17% from 2011 Company Restaurant AUVs Company Restaurant Operating Margin (Non-GAAP) $2.50 $70.0 $65.2 $65.6 $2.35 $2.3 $65.0 $63.2 $2.3 $2.3 $2.2 $2.20 $60.0 $58.7 $2.1 $2.05 $2.0 $55.0 $53.8 $51.5 $Ms $1.9 $Ms $1.90 $1.8 $50.0 $45.9 $44.8 $1.75 $45.0 $1.60 $40.0 $1.45 $35.0 2011 2012 2013 2014 2015 2016 2017 2018 2011 2012 2013 2014 2015 2016 2017 2018 INVESTOR PRESENTATION 27

FRANCHISE SALES AND MARGINS Steady Growth in Franchise Restaurant Average Unit Volumes Franchise Operating Margins Grew by ~26% from 2011 Franchise Franchise Restaurant AUVs Operating Margin (Non-GAAP) $1.70 $110.0 $1.65 $104.0 $1.6 $105.0 $1.6 $1.60 $98.8 $99.5 $1.6 $1.6 $100.0 $1.55 $94.9 $1.5 $95.0 $92.9 Ms $Ms $ $1.50 $90.0 $88.0 $88.2 $1.45 $1.4 $1.4 $85.0 $82.6 $1.40 $1.4 $80.0 $1.35 $1.30 $75.0 $1.25 $70.0 2011 2012 2013 2014 2015 2016 2017 2018 2011 2012 2013 2014 2015 2016 2017 2018 INVESTOR PRESENTATION 28

CONSISTENTLY GROWING SAME-STORE SALES1 Ninth Consecutive Year of Positive Domestic System-Wide Same-Store Sales1 Growth 7.0% Domestic System-Wide Same-Store Sales1 6.0% 5.8% 5.0% 4.0% 3.8% 3.0% 2.8% 2.0% 2.0% 1.7% 1.3% 1.3% 1.1% 1.1% 0.9% 1.0% 0.8% 0.7% 0.5% 0.0% 2011 2012 2013 2014 2015 2016 2017 2018 2019 Q1 '19 Q2 '19 Q3 '19 Q4 '19 1. Same-store sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open the same period in the prior year. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-store sales and domestic system-wide same-store sales should be considered as a supplement to, not a substitute for, our results as reported under GAAP. INVESTOR PRESENTATION 29

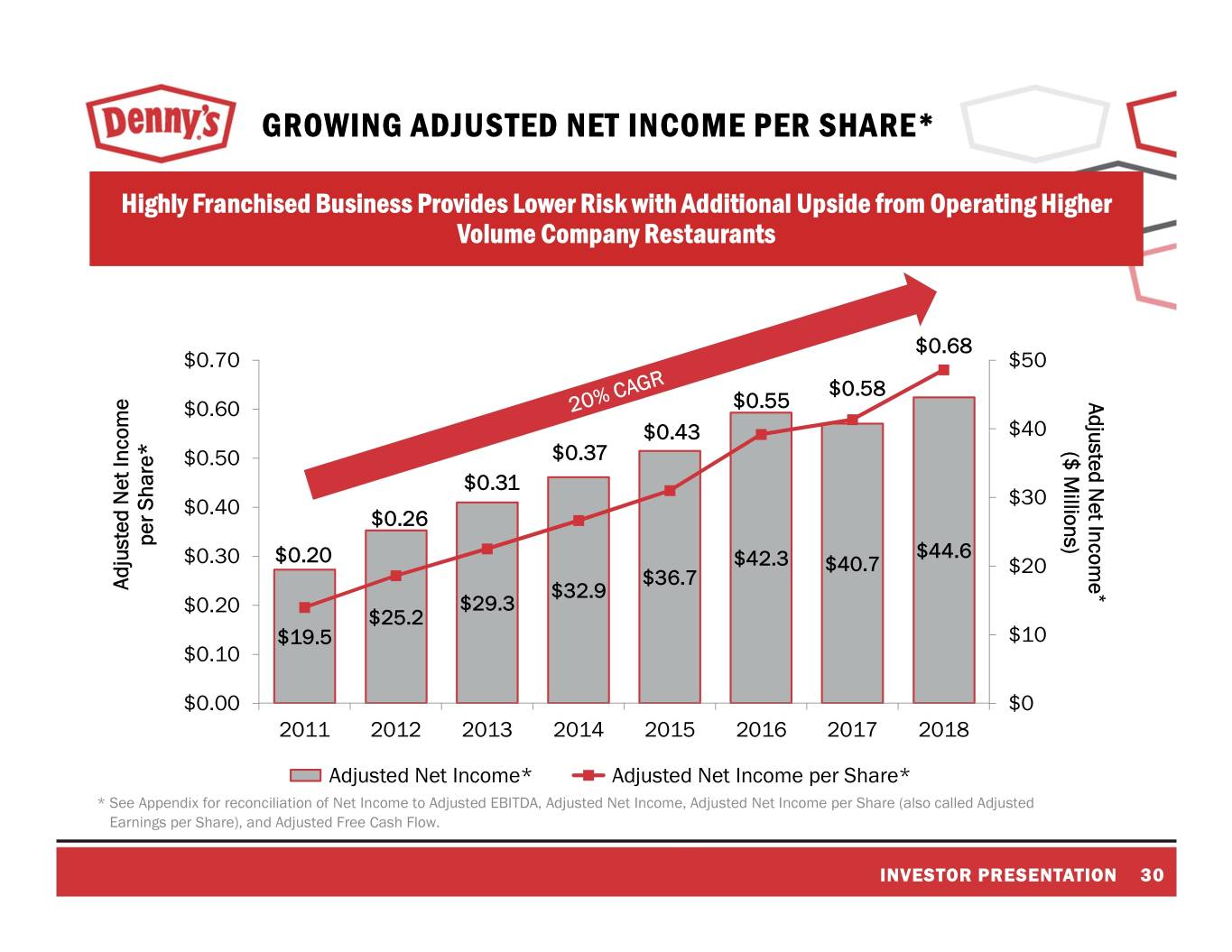

GROWING ADJUSTED NET INCOME PER SHARE* Highly Franchised Business Provides Lower Risk with Additional Upside from Operating Higher Volume Company Restaurants $0.68 $0.70 $50 $0.58 $0.60 $0.55 IncomeNet Adjusted $0.43 $40 $0.50 $0.37 ($Millions) $0.31 $0.40 $30 $0.26 per per Share* $44.6 $0.30 $0.20 $42.3 $40.7 $20 $36.7 Adjusted Net Income $32.9 * $0.20 $29.3 $25.2 $19.5 $10 $0.10 $0.00 $0 2011 2012 2013 2014 2015 2016 2017 2018 Adjusted Net Income* Adjusted Net Income per Share* * See Appendix for reconciliation of Net Income to Adjusted EBITDA, Adjusted Net Income, Adjusted Net Income per Share (also called Adjusted Earnings per Share), and Adjusted Free Cash Flow. INVESTOR PRESENTATION 30

STRONG ADJUSTED FREE CASH FLOW* GENERATION Nearly $390 Million in Adjusted Free Cash Flow* Generated Over Last 8 Years 2019 guidance anticipates $23 - $28 million of cash capital expenditures for real estate acquisitions through like-kind exchanges and $19 - $22 million in cash taxes from gains on the sale of restaurants $120 $105 $100 $103 $93 - $96 $100 $89 $82 $83 $32 $79 $78 $31 $80 $34 $16 $22 $33 $16 $6 $3 $38 - $43 $1 $21 $2 $3 $60 $4 $15 $20 $17 $12 $3 $11 $ Millions $ $8 $5 $9 $8 $52 $51 $40 $48 $49 $49 $50 $45 $42 $23 - $26 $20 ~$21 $7 - $10 $0 2011 2012 2013 2014 2015 2016 2017 2018 2019 Guidance** Cash Capital Cash Taxes Cash Interest Adjusted EBITDA* Adjusted Free Cash Flow* * See Appendix for reconciliation of Net Income to Adjusted EBITDA, Adjusted Net Income, Adjusted Net Income per Share (also called Adjusted Earnings per Share), and Adjusted Free Cash Flow. ** Full Year Guidance update provided in Second Quarter 2019 Earnings Release dated July 30, 2019. Reiterated guidance in Third Quarter Earnings Release dated October 29, 2019. INVESTOR PRESENTATION 31

SOLID BALANCE SHEET WITH FLEXIBILITY Growing Adjusted EBITDA* Enables Higher Leverage while Maintaining Financial Flexibility to Make Investments and Return Capital to Shareholders 3.5x $600 Total Debt Total 3.0x $500 * 2.5x $400 2.0x * $300 ($Millions) 1.5x Total Debt / $200 Adjusted EBITDA 1.0x 0.5x $100 0.0x $0 2010 2011 2012 2013 2014 2015 2016 2017 2018 Total Debt* Total Debt / Adjusted EBITDA* * See Appendix for reconciliation of Net Income to Adjusted EBITDA, Adjusted Net Income, Adjusted Net Income per Share (also called Adjusted Earnings per Share), and Adjusted Free Cash Flow. Total Debt is Gross Debt including Finance Lease Obligations. INVESTOR PRESENTATION 32

CONSISTENTLY RETURNING EXCESS CAPITAL TO SHAREHOLDERS Approximately $520 Million Allocated Towards Share Repurchases Since We Started to Return Excess Capital to Shareholders in Late 20101 SHARE REPURCHASES ($ Millions)1 ASR Total Share Repurchases • During 2019, allocated $96.2 million to $105.8 share repurchases, including $45.4 million $96.2 in Q4 2019 $82.9 $68 $58.7 • Approximately $282 million remaining in authorized share repurchases1 $36.0 $24.7 $22.2 $21.6 $50 $3.9 $25 $25 Q4 2011 2012 2013 2014 2015 2016 2017 2018 2019 2010 1. Data as of December 25, 2019, the end of Fiscal Fourth Quarter 2019. INVESTOR PRESENTATION 33

STOCK PRICE OUTPERFORMANCE Between 2010 and January 9, 2020, Denny’s Stock Price Rose 472%, or 3.3x the S&P Small Cap 600 Index and 1.8x the S&P Small Cap 600 Restaurants Index 600% DENN Up 472% 500% S&P Small Cap 600 Restaurants Index Up 258% S&P Small Cap 600 Index Up 144% Refranchising Announcement 400% 300% 2011 The 200% Beginning of Denny’s Brand Revitalization 100% 0% Mar-11 Jun-11 Mar-12 Jun-12 Mar-13 Jun-13 Mar-14 Jun-14 Mar-15 Jun-15 Mar-16 Jun-16 Mar-17 Jun-17 Mar-18 Jun-18 Mar-19 Jun-19 Dec-10 Sep-11 Dec-11 Sep-12 Dec-12 Sep-13 Dec-13 Sep-14 Dec-14 Sep-15 Dec-15 Sep-16 Dec-16 Sep-17 Dec-17 Sep-18 Dec-18 Sep-19 Dec-19 (100%) INVESTOR PRESENTATION 34

DENNY’S INVESTMENT HIGHLIGHTS • Consistently growing same-store sales1 through brand revitalization strategies to enhance food, service, and atmosphere • Global development supported by commitments from refranchising and enhanced international development agreements • Strong Adjusted Free Cash Flow* and shareholder return supported by solid balance sheet with significant flexibility to support brand investments and highly accretive and shareholder friendly allocations of Adjusted Free Cash Flow* • Transitioning to a lower risk business model expected to have accretive impacts on Adjusted Earnings per Share* and Adjusted Free Cash Flow* 1. Same-store sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open the same period in the prior year. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-store sales and domestic system-wide same-store sales should be considered as a supplement to, not a substitute for, our results as reported under GAAP. *See Appendix for reconciliation of Net Income to Adjusted EBITDA, Adjusted Net Income, Adjusted Net Income per Share (also called Adjusted Earnings per Share), and Adjusted Free Cash Flow. INVESTOR PRESENTATION 35

APPENDIX

EXPERIENCED AND COMMITTED LEADERSHIP TEAM John C. Miller, President and CEO since 2011 with over 30 years experience in restaurant operations and management. Prior to joining Denny’s, served as President of Taco Bueno and spent 17 years with Brinker International where positions held included President of Romano’s Macaroni Grill and President of Brinker’s Mexican Concepts. F. Mark Wolfinger, Executive Vice President, Chief Administrative Officer and Chief Financial Officer since 2005. Previous roles include Chief Financial Officer of Danka Business Systems and senior financial positions with Hollywood Entertainment, Metromedia Restaurant Group (operators of Bennigans, Ponderosa Steakhouse, and Steak & Ale), and the Grand Metropolitan. Christopher D. Bode, Senior Vice President, Chief Operating Officer. Prior to joining Denny’s in 2011, served as Chief Operating Officer of QSR Management, LLC (a franchisee of Dunkin’ Donuts) and Vice President of Development & Construction of Dunkin’ Brands, Inc. Before joining the restaurant industry, served as a United States Navy Communications Specialist. John W. Dillon, Senior Vice President, Chief Brand Officer. Prior to joining Denny’s in 2007, held multiple marketing leadership positions with various organizations, including 10 years with YUM! Brands/Pizza Hut, and was Vice President of Marketing for the National Basketball Association’s Houston Rockets. Stephen C. Dunn, Senior Vice President, Chief Global Development Officer. Prior to joining Denny’s in 2004, held executive-level positions with Church's Chicken, El Pollo Loco, Mr. Gatti's, and TCBY. Earned the distinction of Certified Franchise Executive by the International Franchise Association Educational Foundation. Served as an Infantry Officer in the United States Army. Michael L. Furlow, Senior Vice President, Chief Information Officer. Prior to joining Denny’s in 2017, served as Chief Information Officer and Senior Vice President of IT at Red Robin Gourmet Burgers and CEC Entertainment, Inc. (an operator and franchisor of Chuck E. Cheese’s and Peter Piper Pizza). Jill A. Van Pelt, Senior Vice President, Chief People Officer. Joined Denny's in 2006 as Senior Director of Total Rewards and named Vice President of Human Resources in 2008. Prior experience includes various positions in Accounting, Human Resources Systems, and Human Resources for Maytag, Coastal Corporation, and Dynegy. Robert P. Verostek, Senior Vice President, Finance. Joined Denny’s in 1999 and served in numerous leadership positions across the Finance and Accounting teams. Named Vice President of Financial Planning and Analysis in 2012. Prior experience includes various accounting roles for Insignia Financial Group. INVESTOR PRESENTATION 37

NON-GAAP FINANCIAL RECONCILIATIONS 2019 2011 2012 2013 20141 2015 2016 2017 2018 $ Millions (except per share amounts) Q3 YTD Net Income (loss) $112.3 $22.3 $24.6 $32.7 $36.0 $19.4 $39.6 $43.7 $98.9 Provision for Income Taxes2 (84.0) 12.8 11.5 16.0 17.8 16.5 17.2 8.6 26.7 Operating (Gains) Losses and Other Charges, Net 2.1 0.5 7.1 1.3 2.4 26.9 4.3 2.6 (85.5) Other Non-Operating (Income) Expense, Net 2.6 7.9 1.1 (0.6) 0.1 (1.1) (1.7) 0.6 (2.1) Share‐Based Compensation 4.2 3.5 4.9 5.8 6.6 7.6 8.5 6.0 7.1 Deferred Compensation Plan Valuation Adjustments5 (0.1) 0.7 1.1 0.5 0.0 0.9 1.6 (1.0) 1.8 Interest Expense, Net 20.0 13.4 10.3 9.2 9.3 12.2 15.6 20.7 15.0 Depreciation and Amortization 28.0 22.3 21.5 21.2 21.5 22.2 23.7 27.0 15.6 Cash Payments for Restructuring Charges & Exit Costs (2.7) (3.8) (2.8) (2.0) (1.5) (1.8) (1.7) (1.1) (2.1) Cash Payments for Share‐Based Compensation (0.8) (1.0) (1.2) (1.1) (3.4) (2.5) (3.9) (1.9) (3.6) Adjusted EBITDA5 $81.7 $78.6 $78.0 $83.1 $88.8 $100.2 $103.3 $105.3 $71.9 Adjusted EBITDA Margin % 15.2% 16.1% 16.9% 17.6% 18.1% 19.8% 19.5% 16.7% 16.8% Cash Interest Expense (17.0) (11.6) (9.1) (8.1) (8.3) (11.2) (14.6) (19.6) (14.2) Cash Taxes (1.1) (2.0) (2.8) (3.8) (5.4) (3.0) (6.4) (3.3) (17.9) Capital Expenditures (16.1) (15.6) (20.8) (22.1) (32.8) (34.0) (31.2) (32.4) (22.1) Adjusted Free Cash Flow5 $47.5 $49.4 $45.3 $49.1 $42.3 $51.9 $51.2 $50.0 $17.7 Net Income (loss) $112.3 $22.3 $24.6 $32.7 $36.0 $19.4 $39.6 $43.7 $98.9 Pension Settlement Loss 0.0 0.0 0.0 0.0 0.0 24.3 0.0 0.0 0.0 Losses (Gains) on Sales of Assets and Other, Net (3.2) (7.1) (0.1) (0.1) (0.1) 0.0 3.5 (0.5) (87.5) Impairment Charges 4.1 3.7 5.7 0.4 0.9 1.1 0.3 1.6 0.0 Early Extinguishment of Debt 1.4 7.9 1.2 0.0 0.3 0.0 0.0 0.0 0.0 Tax Reform 0.0 0.0 0.0 0.0 0.0 0.0 (1.6) 0.0 0.0 Tax Effect of Adjustments3 (0.8) (1.6) (2.2) (0.1) (0.4) (2.5) (1.2) (0.2) 22.6 Adjusted Provision for Income Taxes4 (94.3) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Adjusted Net Income $19.5 $25.2 $29.3 $32.9 $36.7 $42.3 $40.7 $44.6 $34.0 Diluted NetIncome Per Share $1.15 $0.23 $0.26 $0.37 $0.42 $0.25 $0.56 $0.67 $1.58 Adjustments Per Share ($0.95) $0.03 $0.05 $0.00 $0.01 $0.30 $0.02 $0.01 ($1.04) Adjusted Net Income Per Share $0.20 $0.26 $0.31 $0.37 $0.43 $0.55 $0.58 $0.68 $0.54 Diluted WeightedAverage Shares Outstanding (000’s) 99,588 96,754 92,903 88,355 84,729 77,206 70,403 65,562 62,370 1. Includes 53 operating weeks. 2. In the fourth quarter of 2011, we recorded an $89 million net deferred tax benefit from the release of a substantial portion of the valuation allowance on certain deferred tax assets. This release was primarily based on our improved historical and projected pre-tax income. 3. Tax adjustments for full year 2013, 2014, 2015, 2017 and 2018 use full year effective tax rates of 31.9%, 32.9%, 33.0%, 30.3% and 16.4%, respectively. Tax adjustments for full year 2011 and 2012 are calculated using the Company's full year 2012 effective tax rate of 36.4%. The tax adjustment for the loss on pension termination for the year ended December 28, 2016 is calculated using an effective tax rate of 8.8%. The remaining tax adjustments for the year ended December 28, 2016 are calculated using the Company's effective tax rate of 30.9%. Tax adjustments for the gains on sales of assets and other, net in 2019 YTD are calculated using an effective rate of 25.8%. 4. Adjusted provision for income taxes based on effective income tax rate of 36.4% for full year ended Dec. 27, 2012 and excludes impact of net deferred tax benefit. 5. Beginning in 2018, historical presentations of Adjusted EBITDA and Adjusted Free Cash Flow have been restated to exclude the impact of market valuation changes in our non-qualified deferred compensation plan liabilities. INVESTOR PRESENTATION 38