Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CANTEL MEDICAL LLC | a8kinvestorpresentatio.htm |

Investor Presentation January 2020

Cantel is focused on providing solutions for complex reprocessing workflows to prevent healthcare related infections Providing comprehensive education Unique portfolio of products Leading Global Brands and clinical support to dental that deliver a “complete circle in our markets: schools, dental offices and of protection” in the endoscopy Medivators ● Hu-Friedy ● Crosstex suite and dental office healthcare professionals 2

Healthcare-Associated Infections are a Major Issue with Significant Costs to the System • IFU conflicts • Old equipment • Adherence • Lack of • Costs of documentation 40M patients and $150 • High staff to changing guidelines and technology turnover limiting best in • Lack of Billion annual spend on system standardization • Lean staff priorities class adoption Medical and Dental infections globally1 People Policies Products Processes Partnering with healthcare providers, offering comprehensive • IP&C • Education Partnership • Market • Workflow solutions • Training • Workflow Leading Solutions and assessments Technology Process Improvements 1. 2016 Infection Control Market –Global Forecasts to 2021 (Freedonia) 3

Cantel by the Numbers Organic ~$1.2B ~20% Financial snapshot: GrowthTargets: Net Adjusted Medical: 8-10% Sales1 EBITDAS Rate1 Dental: 5-7% Life Sciences: Flat Unique portfolio and 75-80% Approx. 1/3 ~5% Recurring Avg. Annual M&A Net operational foundation Revenue OUS1 Revenue1 Sales Contribution2 Historically unlevered balance ~120% $861.8 3.75x sheet now includes Hu-Friedy Operating Net Net Cash % of Net Income3 Debt4 Leverage5 1. Pro Forma including the October, 2019 acquisition of Hu-Friedy 2. Average historical contribution from FY14 – FY19 3. Estimated cash generation as a percent of net income post integration of Hu-Friedy 4. Actual as of 10/31/19 driven by the acquisition of Hu-Friedy 5. Net debt/Pro Forma LTM EBITDAS including the October, 2019 acquisition of Hu-Friedy 4

Path to Value Creation Positioning the Medical segment as the premier infection prevention solutions provider in GI and expand into strategic adjacencies Drive continued growth in Dental with comprehensive infection prevention and compliance solutions that include consumables, instruments, and instrument management Disciplined investment in new products and technologies Continued operating improvements driven by disciplined operating model and processes Accelerate growth profile and strategic position with continued M&A execution 5

MEDICAL: Endoscopy focused business in a ~$4.5B global TAM growing 4-5% Endoscopy Market Opportunity Cantel’s Strategic Position Over 100M endoscopy procedures in our direct markets GI Endoscopy reprocessing leader in North America and Europe growing at low-single digits1 with large installed base and leading market share Comprehensive Product Portfolio of capital, chemistry, Colorectal, stomach, and liver cancers continue to be among the top 5 consumables, and service offering complete solutions for infection causes of cancer related death2 prevention and reprocessing workflows Cancer detection in younger patients and aging population are driving Provide differentiated education and training for our customers to increase in screening population3 drive consistent system-wide execution of IP&C processes Enhanced focus on reprocessing, cleaning, documentation, and Drive continued growth through new product development and single-use procedural products to mitigate cross-contamination technological innovation KOL partnerships and clinical trials create thought leadership in Healthcare systems seeking to create value-based partnerships with infection prevention selected vendors Medical Organic Growth Outlook: 8-10% 1. Market Report for GI Endoscopy. iData Research. 2018. https://www.cancer.org/cancer/colon-rectal-cancer/detection-diagnosis-staging/acs- 2. Cancer: Key Facts. World Health Organization. 2018.ww.who.int/news-room/fact-sheets/detail/cancer recommendations.html 3. American Cancer Society Guideline for Colorectal Cancer Screening. American Cancer Society. 2018.. 6

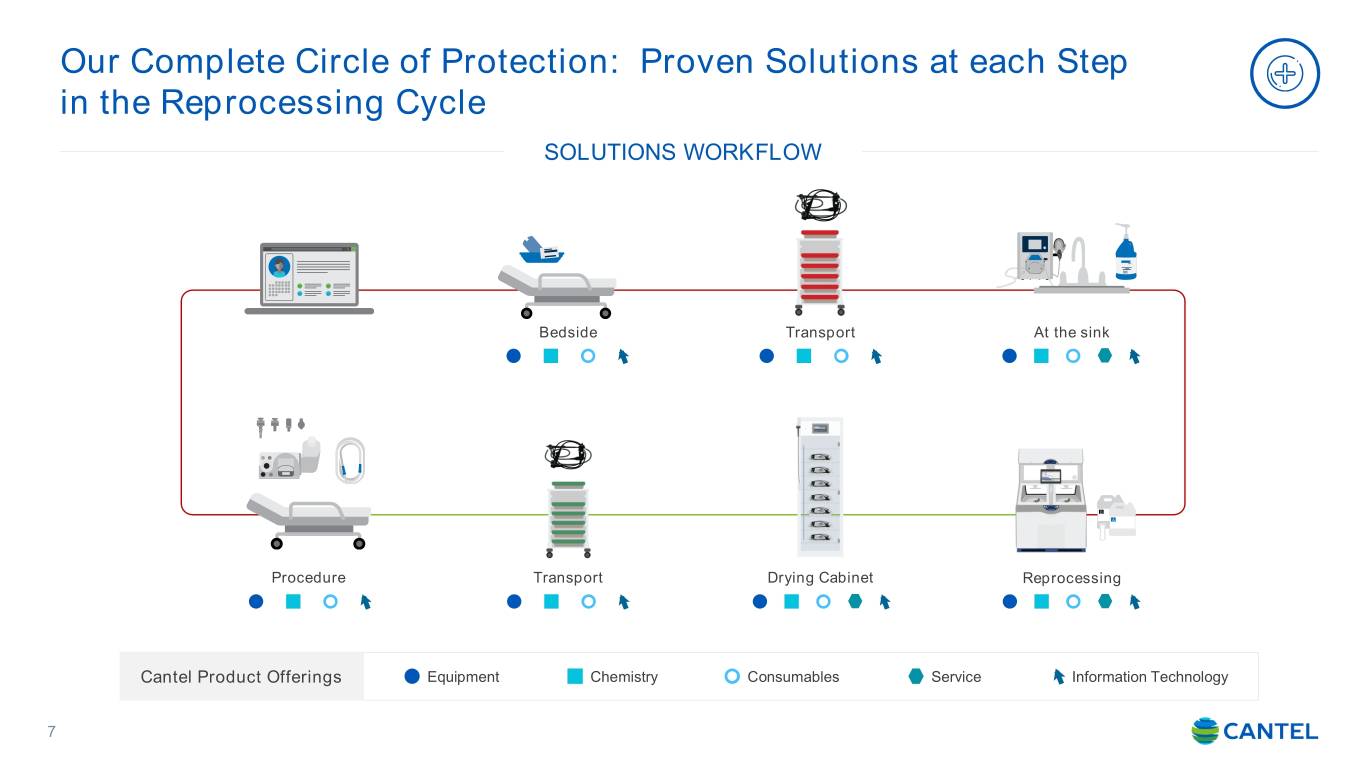

Our Complete Circle of Protection: Proven Solutions at each Step in the Reprocessing Cycle SOLUTIONS WORKFLOW Bedside Transport At the sink Procedure Transport Drying Cabinet Reprocessing Cantel Product Offerings Equipment Chemistry Consumables Service Information Technology 7

DENTAL: Diverse dental instrument and consumables business in a ~$2.0B global TAM growing 2% Dental Market Opportunity Cantel’s Strategic Position Approx. 200,000 dental professionals in the US in 20191 Global leading dental brands of Hu-Friedy & Crosstex with enduring customer relationships based on a foundation of quality, innovation, protection, and safety 213 million annual US dental visits growing at 2-3%2 Comprehensive offering of instruments, consumables, Infection prevention and higher compliance standards remains chemistries and instrument management systems focused a headline risk for dental practitioners globally on performance, protection, and productivity Key relationships with dental and hygiene schools and US: Instrument reprocessing is expected to grow at 6%, comprehensive education and training programs create Dental Instruments expected growth is at 2-3%3 strong end user relationships with dentists and hygienists Dental Service Organizations (DSOs) estimated to have ~20% Continued innovation and consistent new share of dental practices today and will continue to expand product introductions driving demand for comprehensive value add solutions Leading compliance, education and monitoring Enhanced government funding of dental Community Health technologies such as ConFirm and Greenlight™ drives centers represents new expanded opportunity for growth leadership and partnership with DSOs and practitioners Dental Organic Growth Outlook: 5-7% 1. Dental Markets Model. William Blair. 2019. https://www.cancer.org/cancer/colon-rectal-cancer/detection-diagnosis-staging/ 8 2. American Dental Association New. 2014.w. 3. Markets and Markets/L.E.K. research and analysis.o.int/news-room/fact-sheets/detail/cancer

Hu-Friedy Acquisition Company Overview Product Portfolio • Leading global provider of comprehensive portfolio of premium dental Infection Control Single-use products used to prevent instruments, proprietary Instrument Management System, and compliance Consumables cross-contamination in dental suites education and training General Hand Instruments utilized for the setting of braces and other structural • Iconic, highly recognized dental brand Instruments dental procedures • Strong recurring revenue model driven by healthy replacement cycle Specialty Hand Instruments utilized in dental of instrumentation surgeries and manipulation of dental Instruments structures and tissues • Headquartered in Chicago with ~1,000 employees globally Instruments utilizing ultrasonic • ~$220M in Revenue and ~$50M Adj. EBITDA General Power vibrations for the removal of hard Instruments deposits on teeth Strategic Rationale Transaction Details • Accelerates Cantel’s strategy to be a leading global provider of innovative • Total consideration of up to $775M, or $675M net of anticipated tax infection prevention and reprocessing workflow solutions and education in benefit - $725M upfront and up to $50M in contingent consideration both medical and dental • Transaction expected to generate anticipated tax benefit of $100M+ • Creates a comprehensive portfolio of infection prevention consumables, on a present value basis instrumentation, and instrument management solutions • Significant non-GAAP earnings accretion of ~10% in FY20 • Enhances scale, competitive position, and commercial capabilities in dental • Pro-Forma leverage of 3.75x at Close with a target to de-lever • Expected run-rate cost synergies of $10+ million by Year 3 to the mid-2x in FY21 9

Our Complete Circle of Protection: Comprehensive Solutions Drive Performance, Protection and Efficiency from Patient to Patient SOLUTIONS WORKFLOW Chairside Cleaning Storage Sterilization Cantel Dental Product Equipment Chemistry Consumables Services Categories 10

Hemodialysis Water - Strategic Review Update Strategic Review Process Key Business Highlights Completed comprehensive strategic review of Multi year supply agreements now secured for top hemodialysis water business including a sale process two customers accounting for ~40% of revenue1 Best path to maximize shareholder value creation is to retain the business Business right sized and stabilized to support its unique national service footprint Financial Profile & Performance Expectations1 • FY19 ~$200M sales and ~15% EBITDA margins • FY20: New RO portable machine scheduled for launch in 4Q20 • 1H20 sales down low single digits • 2H20 sales flat to up low single digits • FY21: Flat Revenue and Margin profile Next generation, “two pass” central RO unit • Free Cash Flow: low teens % of revenue anticipated for launch in FY22 11 1. Life Sciences segment. Hemodialysis water is part of this reportable segment for Cantels-room/fact- https://www.cancer.org/cancer/colon-rectal-cancer/detection-diagnosis-staging/ sheets/detail/cancer

Accelerating Growth Profile with Disciplined M&A Execution Healthy track record of disciplined approach to M&A provides the roadmap to building Cantel's suite of products, providing an end-to-end solution in infection prevention FY14-FY19 Key M&A Metrics1 M&A Strategy STRATEGIC FIT • Align with strategy of being leading provider of innovative infection prevention and reprocessing workflow solutions, education, and training $1.1 BN • Seek scale, differentiated products, and durable competitive position that 20 expands Complete Circle of Protection Total capital Acquisitions • Attractive end-markets with strong Fundamentals and addressable TAMs deployed FINANCIAL FIT • Significant recurring revenue models • Healthy organic growth profiles • Accretive gross margin and synergized EBITDA profiles • Leverage sales channels and combined portfolios to drive revenue synergies • Market expansion opportunities 1.10x 4.9% • Target ROIC exceeding WACC by Year 5 Average Net Debt/ Average annual M&A revenue OPERATING FIT LTM EBITDAS growth contribution • Clear plan for realizing synergies • Leverage existing sales and commercial capabilities • Streamlined back-office infrastructure to absorb acquisitions more seamlessly 1. Includes Hu-Friedy acquisition 12

Financial Performance—Track Record of Success $1,000 10 Yr. $900 CAGR ~13% $800 $700 $600 $500 $400 $ in in millions $ $300 $200 ~15% $100 $0 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 2,3 1,2 Net Sales Adj. EBITDAS 1. Earnings before Interest, Taxes, Depreciation, Amortization, Stock compensation expense, (Gain)/Loss on Disposal of Fixed Asset, Acquisition-related items and Atypical items. 2. See Appendix for GAAP to Non-GAAP reconciliation 13

Capital Allocation Priorities 1 2 3 Invest in Organic Growth Debt Paydown M&A Strong cash flow generation Enhanced R&D and product Pursue continued acquisitions supports commitment to significantly innovation investment in the infection prevention space de-lever to mid-2x by end of FY21 Ongoing strategic Investment in Maintain strong and flexible Focus on scale and market commercial initiatives balance sheet expansion opportunities 14

FY20 Guidance including Hu-Friedy Sales Growth* FY20 Earnings per Share* FY20 Sales Growth – Reported ~25.0% to 28.0% GAAP EPS $1.85 to $1.90 Sales Growth – FX ~(1.0%) GAAP EPS V% ~40% to 44% Sales Growth – Acquisitions ~20.0% to ~22.0% Non-GAAP EPS* $2.78 to $2.83 Sales Growth – Organic ~6.0% to 7.0% Non-GAAP EPS V% ~17% to 19% KEY ASSUMPTIONS Medical – high single digit growth Interest Expense ~$34M to ~$35M Life Sciences – 1st half decline/ 2nd half growth Tax Rate ~25% / CAPEX ~$45M Dental (legacy) – at the high end of the traditional *Hu-Friedy anticipated to add ~10% growth to core 4-6% range Non-GAAP EPS range of $2.53 to $2.58 15

Key Takeaways Leading Market Positions with established Global Brands Circle of Infection Prevention driving comprehensive workflow solutions Disciplined investment in new technologies to drive future growth Responsible growth company leveraging operating improvements to enhance margins Accelerate growth profile with disciplined M&A execution 16

Appendix

APPENDIX A – Select Products

Selected Medical Product Portfolio 01 02 03 04 05 06 07 08 1. Advantage Plus® Pass-Thru AER 5. DEFENDOTM Single Use Valves 2. No touch cassette and Hookup for Advantage System 6. Procedure Kits 3. ENDODRYTM Storage and Drying System 7. Rinse and Irrigation Tubing 4. Cleanascope® Transport System 8. Rapicide PA High Level Disinfectant and Sterilant 19

Selected Dental Product Portfolio 01 02 03 04 05 06 07 08 09 10 1. IMS® Cassettes 6. Ultrasonic Inserts 2. IMS® Cassette Wrap 7. IMS® Cassette Wrap Tape 3. Sure-Check™ Pouches 8. ConFirm™ 10 In-office Biological Monitoring System 4. VistaPure™ Water Purification System 9. Safe-Flo™ Saliva Ejectors and Valves 5. Perma Sharp® Sutures 10. Enzymax™ Ultrasonic Detergent and Spray Gel 20

Selected Dental Product Portfolio 11 12 13 14 15 16 17 18 19 11. Hand Essentials™ Skin Repair Cream and Hand Soap 16. DentaPure™ Cartridges 12. Team Vista™ Dental Waterline Cleaner 17. ClearView™ Nasal Masks 13. SteamPlus™ Type 5 Integrators 18. Digital Ultra™ Flushmount Flowmeter 14. Secure Fit™ Masks 19. Axess™ Nasal Masks 15. Liquid Ultra™ Solution 21

APPENDIX B – GAAP to Non-GAAP Reconciliations

GAAP to Non-GAAP EPS Disclosure Non-GAAP financial measures contained herein supplement information previously reported in filings on Form 10-Q and Form 10-K as well as in presentations by Company management to investors, analysts and others. The information below will not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or incorporated by reference in any filing under the Securities Act of 1933, as amended. Non-GAAP Financial Measures In evaluating our operating performance, we supplement the reporting of our financial information determined under generally accepted accounting principles in the United States (“G P”) with certain non-GAAP financial measures including (i) non-GAAP net income, (ii) non-GAAP earnings per diluted share (“EPS”), (iii) earnings before interest, taxes, depreciation, amortization, loss on disposal of fixed assets, and stock-based compensation expense (“E ITD S”), (iv) adjusted EBITDAS, (v) net debt and (vi) organic sales. These non-GAAP financial measures are indicators of our performance that are not required by, or presented in accordance with, GAAP. They are presented with the intent of providing greater transparency to financial information used by us in our financial analysis and operational decision-making. We believe that these non-GAAP measures provide meaningful information to assist investors, stockholders and other readers of our consolidated financial statements in making comparisons to our historical operating results and analyzing the underlying performance of our results of operations. These non-GAAP financial measures are not intended to be, and should not be, considered separately from, or as an alternative to, the most directly comparable GAAP financial measures. (a) Organic Sales We define organic sales as net sales less (i) the impact of foreign currency translation, (ii) net sales related to acquired businesses during the first twelve months of ownership and (iii) divestitures during the periods being compared. We believe that reporting organic sales provides useful information to investors by helping identify underlying growth trends in our business and facilitating easier comparisons of our revenue performance with prior periods. We exclude the effect of foreign currency translation from organic sales because foreign currency translation is not under management’s control, is subject to volatility and can obscure underlying business trends. We exclude the effect of acquisitions and divestitures because the nature, size, and number of acquisitions and divestitures can vary dramatically from period to period and can obscure underlying business trends and make comparisons of financial performance difficult. 23

GAAP to Non-GAAP EPS Disclosure (continued) (b) Non-GAAP Gross Profit Rate We define non-GAAP gross profit rate, adjusted to exclude acquisition-related and restructuring-related items as management deems these items to be irregular or non-operating in nature. For the three months ended July 31, 2019 we made adjustments to Non-GAAP gross profit rate to exclude acquisition-related items and restructuring-related items, and for the three months ended July 31, 2018, we made adjustments to non-GAAP gross profit rate to exclude restructuring-related items, as further explained below. For the fiscal year ended July 31, 2019 we made adjustments to Non-GAAP gross profit rate to exclude acquisition-related items and restructuring-related items, and for the fiscal year ended July 31, 2018 we made adjustments to Non-GAAP gross profit rate to exclude acquisition-related items and restructuring-related items, as further explained below. In addition, we have supplemented our reported GAAP and non-GAAP gross profit rate to reflect the presentation of our gross profit rate, on a comparable basis, to adjust for the reclassification of certain salary and benefit related costs that had previously been recorded in operating expenses into costs of good sold for the three months and fiscal year ended July 31, 2018. (c) Non-GAAP Income from Operations, Non-GAAP Net Income and Non-GAAP Diluted EPS We define non-GAAP income from operations, as income from operations adjusted to exclude (i) amortization of purchased intangible assets, (ii) acquisition-related items, (iii) business optimization and restructuring-related charges and (iv) other significant items management deems irregular or non-operating in nature. We define non-GAAP net income and non-GAAP diluted EPS as net income and diluted EPS, respectively, adjusted to exclude (i) amortization of purchased intangible assets, (ii) acquisition-related items, (iii) business optimization and restructuring-related charges, (iv) certain significant and discrete tax matters and (v) other significant items management deems irregular or non-operating in nature. Amortization expense of purchased intangible assets: Amortization expense of purchased intangible assets is a non-cash expense related to intangibles that were primarily the result of business acquisitions. Our history of acquiring businesses has resulted in significant increases in amortization of intangible assets that reduce our net income. The removal of amortization from our overall operating performance helps in assessing our cash generated from operations including our return on invested capital, which we believe is an important analysis for measuring our ability to generate cash and invest in our continued growth. 24

GAAP to Non-GAAP EPS Disclosure (continued) Acquisition-related Items Acquisition-related items consist of (i) fair value adjustments to contingent consideration and other contingent liabilities resulting from acquisitions, (ii) due diligence, integration, legal fees and other transaction costs associated with our acquisition program and (iii) acquisition accounting charges for the amortization of the initial fair value adjustments of acquired inventory and deferred revenue. The adjustments of contingent consideration and other contingent liabilities are periodic adjustments to record such amounts at fair value at each balance sheet date. Given the subjective nature of the assumptions used in the determination of fair value calculations, fair value adjustments may potentially cause significant earnings volatility that are not representative of our operating results. Similarly, due diligence, integration, legal and other acquisition costs associated with our acquisition program, including accounting charges relating to recording acquired inventory and deferred revenue at fair market value, can be significant and also adversely impact our effective tax rate as certain costs are often not tax-deductible. Since these acquisition-related items are irregular and often mask underlying operating performance, we exclude these amounts for purposes of calculating these non-GAAP financial measures to facilitate an evaluation of our current operating performance and a comparison to past operating performance. Excess tax benefits (expense) Excess tax benefits (expense) resulting from stock compensation are recorded as an adjustment to income tax expense. The magnitude of the impact of excess tax benefits generated in the future, which may be favorable or unfavorable, are dependent upon our future grants of equity awards, our future share price on the date awards vest in relation to the fair value of awards on grant date and the exercise behavior of our stock award holders. Since these tax benefits are largely unrelated to our results and unrepresentative of our normal effective tax rate, we excluded their impact on net income and diluted EPS to arrive at our non-GAAP financial measures. Other Adjustments During fiscal 2019, we recorded specific discrete tax items associated with our international operations that were unrelated to fiscal 2019. As these items are unrepresentative of our normal effective tax rate, we excluded their impact on net income and diluted EPS for fiscal 2019 to arrive at our non-GAAP financial measures. During fiscal 2019, we completed the disposition of our high purity water business in Canada. This resulted in a pre-tax gain of $1,305 through other income. Since this gain was irregular, we made an adjustment to our net income and diluted EPS for fiscal 2019 to exclude this gain to arrive at our non-GAAP financial measures. 25

GAAP to Non-GAAP EPS Disclosure (continued) Other Adjustments (continued) During fiscal 2019, we recorded an adjustment to a minor litigation matter in our consolidated financial statements. Since these costs are irregular and mask our underlying operating performance, we made an adjustment to our net income and diluted EPS for fiscal 2019 to exclude such costs to arrive at our non-GAAP financial measures. The 2017 Tax Act significantly revised U.S. tax law by, among other provisions, (a) lowering the applicable U.S. federal statutory income tax rate from 35% to 21%, (b) creating a partial territorial tax system that includes imposing a mandatory one-time transition tax on previously deferred foreign earnings, (c) creating provisions regarding the (1) Global Intangible Low Tax Income, (2) the Foreign Derived Intangible Income deduction, and (3) the Base Erosion Anti-Abuse Tax and (d) eliminating or reducing certain income tax deductions, such as interest expense, executive compensation expenses and certain employee expenses. During fiscal 2018, we recorded a one-time net benefit as a provisional estimate of the net accounting impact of the 2017 Tax Act in accordance with SAB 118. Since the net favorable tax benefit is largely unrelated to our results and unrepresentative of our normal effective tax rate, we excluded its impact on net income and diluted EPS for fiscal 2018 to arrive at our non-GAAP financial measures. During fiscal 2018, the Israeli Government notified us that they would forgive any future amounts due under a contingent obligation payable from a previous acquisition. As a result of this formal notification, we reduced the $1,138 contingent obligation payable to $0 during fiscal 2018, resulting in a gain through other income. Since this gain was irregular, we made an adjustment to our net income and diluted EPS for fiscal 2018 to exclude this gain to arrive at our non-GAAP financial measures. During fiscal 2018, we settled a patent infringement matter and also recorded an adjustment to another minor litigation matter in our consolidated financial statements. Since these costs are irregular and mask our underlying operating performance, we made an adjustment to our net income and diluted EPS for fiscal 2018 to exclude such costs to arrive at our non-GAAP financial measures. During fiscal 2018, we recorded a $2,785 valuation allowance on deferred tax assets related to a prior acquisition. Since this tax adjustment is related to acquired net operating losses and is not representative of our normal effective tax rate, we excluded its impact on net income and diluted EPS for fiscal 2018 to arrive at our non-GAAP financial measures. 26

Historical P&L Reveals Success of Growth Programs Fiscal Year Ending 7/31/2019 ($ in millions, except per share data) CAGR: FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 ’12 -’19 Net Sales $386.5 $425.0 $488.7 $565.0 $665.0 $770.2 $871.9 $918.2 13% Gross Profit $164.2 $183.5 $213.3 $253.5 $309.2 $367.2 $413.9 $427.5 15% Gross Margin 42.5% 43.2% 43.6% 44.9% 46.5% 47.7% 47.5% 46.6% Adjusted EBITDAS1, 2 $71.9 $83.7 $97.5 $113.8 $137.9 $161.5 $178.3 $174.8 16% % of sales 18.6% 17.3% 20.0% 20.1% 20.8% 21.0% 20.5% 19.0% Op. Profit $52.1 $63.2 $70.9 $80.8 $97.3 $110.4 $121.7 $83.6 7% Net Income $31.3 $39.2 $43.3 $48.0 $60.0 $71.4 $91.0 $55.1 8% Diluted GAAP EPS3 $0.77 $0.95 $1.04 $1.15 $1.44 $1.71 $2.18 $1.32 8% Non-GAAP Diluted EPS2,3 $0.90 $1.10 $1.24 $1.44 $1.75 $2.08 $2.51 $2.37 18% 1. Earnings before Interest, Taxes, Depreciation, Amortization, Stock compensation expense, (Gain)/Loss on Disposal of Fixed Asset, Acquisition-related items and Atypical items. 2. See appendix for GAAP to Non-GAAP reconciliation. 3. Retroactively applies the 3:2 stock splits effective February 2012 and July 2013. 27

Strong Balance Sheet & Cash Flow Generation Fiscal Year 2019 Ending 7/31/2019 ($ and shares in millions) FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 Total Assets $277.9 $280.7 $321.4 $434.8 $487.7 $536.1 $584.0 $694.5 $786.4 $963.7 $1,070.4 Current Ratio 2.3:1 2.3:1 2.6:1 2.4:1 2.5:1 2.5:1 2.7:1 2.3:1 2.4:1 2.5:1 2.2:1 Equity $187.1 $209.4 $234.3 $275.9 $321.1 $365.2 $406.6 $454.4 $523.9 $608.9 $661.5 Operating Cash Flow $31.0 $29.0 $28.2 $50.6 $51.5 $64.3 $59.1 $80.3 $108.2 $125.9 $66.8 Net Debt1,2 / Adjusted 0.5x 0.0x 2.1x 0.8x 0.7x 0.5x 0.4x 0.6x 0.6x 0.6x 1.1x EBITDAS2,3 # of Diluted Shares3,4 37.3 38.2 39.0 40.8 41.2 41.5 41.6 41.7 41.8 41.7 41.8 1. Net Debt calculated as Gross Debt minus cash on balance sheet. 2. See appendix for GAAP to Non-GAAP reconciliation. 3. Earnings before Interest, Taxes, Depreciation, Amortization, Stock compensation expense, (Gain)/Loss on Disposal of Fixed Asset, Acquisition-related items and Atypical items. 4. Retroactively reflects 3:2 stock splits effective February, 2012 and July, 2013. 28

GAAP to Non-GAAP EPS Reconciliation Fiscal Year 2019 Ending 7/31/2019 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 GAAP Diluted EPS1 $0.77 $0.95 $1.04 $1.15 $1.44 $1.71 $2.18 $1.32 + Intangible amortization $0.14 $0.16 $0.16 $0.21 $0.22 $0.30 $0.32 $0.39 + Acquisition related items ($0.02) ($0.02) $0.02 $0.02 $0.06 $0.04 $0.07 $0.21 + Restructuring Related/Other $0.01 $0.01 $0.01 $0.06 $0.03 $0.03 ($0.06) $0.45 Non-GAAP Diluted EPS1 $0.90 $1.10 $1.24 $1.44 $1.75 $2.08 $2.51 $2.37 1. Retroactively applies the 3:2 stock splits effective February 2012 and July 2013. The effect of rounding may create minor data variances. 29

Income to Adjusted EBITDAS Reconciliation Fiscal Year 2019 Ending 7/31/2019 ($ in millions) FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 Net Income $15.6 $19.9 $20.4 $31.3 $39.2 $43.3 $48.0 $60.0 $71.4 $91.0 $55.0 + Income taxes 9.4 11.6 10.0 16.5 21.1 25.3 28.2 34.0 34.9 26.5 20.3 + Net Interest expense 2.4 1.3 0.9 3.8 2.9 2.3 2.4 3.3 4.3 5.3 9.5 + D&A 11.4 11.4 12.4 15.9 17.3 18.9 24.0 25.1 33.5 34.8 42.4 + Loss on disposal of fixed 0.1 0.2 - 0.1 0.2 0.5 0.4 0.5 1.0 0.8 1.6 asset + Stock-based comp 3.2 3.1 3.4 3.8 3.7 5.4 5.9 8.4 8.8 9.6 15.6 + Acquisition-related items - - 1.4 (1.2) (1.4) 1.1 1.6 3.2 2.4 4.1 13.1 + Loss on sale of business - - - - - - 2.2 - - - (1.3) + Other atypical items - - - 1.7 0.8 0.6 1.3 3.5 5.2 6.2 18.7 Adjusted EBITDAS $42.1 $47.5 $48.5 $71.9 $83.7 $97.5 $113.8 $137.9 $161.5 $178.3 $174.8 1. *The effect of rounding may create minor data variances. 30

Gross Debt to Net Debt Reconciliation Fiscal Year 2019 Ending 7/31/2019 ($ in millions) FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 Gross Debt $43.3 $21.0 $122.0 $90.0 $95.0 $80.5 $78.5 $116.0 $126.0 $200.0 $233.0 - Cash (23.4) (22.6) (18.4) (30.2) (34.1) (31.8) (31.7) (28.4) (36.6) (94.1) (44.5) Net Debt $19.9 ($1.6) $103.6 $59.8 $60.9 $48.7 $46.8 $87.6 $89.4 $105.9 $188.5 1. FY11 Net Debt includes $98M in debt assumed on the first day of fiscal year 2012 upon closing of the Byrne Medical acquisition. 31