Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SELECT BANCORP, INC. | tm1928448d1_8k.htm |

Exhibit 99.1

Investor Presentation Strategic Branch Acquisition January 2020 Exhibit 99.1

2 Statements included in this presentation which are not historical in nature are intended to be, and are hereby identified as, forward looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995 . These statements generally relate to our financial condition, results of operations, plans, objectives, future performance, or business . They usually can be identified by the use of forward - looking terminology, such as “believes,” “expects,” or “are expected to,” “plans,” “projects,” “proposes,” “goals,” “estimates,” “will,” “may,” “should,” “could,” “would,” “continues,” “intends to,” “outlook,” “pending,” or “anticipates,” or variations of these and similar words, or by discussions of strategies that involve risks and uncertainties . These statements are not guarantees of future performance and are subject to certain risks, uncertainties, and other factors, some of which remain beyond our control, are difficult to predict, and could cause actual results to differ materially from those expressed or forecasted in the forward - looking statements . Risk factors relating both to the strategic branch acquisition described in this presentation and the integration of the branch customers into Select Bank & Trust Company after the completion of the transaction include the following, without limitation : • Completion of the transaction is dependent on, among other things, the ability of the parties to satisfy the conditions set forth in the Branch Purchase and Assumption Agreement dated as of December 20 , 2019 and to secure applicable regulatory approvals, the timing of which cannot be predicted with precision and may not be satisfied or received at all . • The transaction may be more expensive to complete and the anticipated benefits may be significantly harder or take longer to achieve than expected or may not be achieved at all as a result of unexpected events . • The integration of customers and operations, which will include conversion of data and information from the seller’s operating systems to our operating systems, may take longer or be more costly than anticipated . • Our ability to achieve anticipated results from the transaction is dependent on the sate of the economy and financial markets going forward . Specifically, we may incur more credit losses from the acquired loan portfolio than expected, and deposit costs or attrition may be greater than expected . Additional risks and uncertainties that could cause our actual results to differ from those expressed in the forward - looking statements are identified in Select Bancorp, Inc . ’s reports filed with the Securities and Exchange Commission, including Annual Reports on Form 10 - K, Quarterly Reports on Form 10 - Q, and Current Reports on Form 8 - K . We caution you not to place undue reliance on these forward - looking statements, which reflect management’s view only as of the date of this presentation . We are not obligated to update these statements or publicly release the result of any revisions to them to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events . Caution Regarding Forward - Looking Statements

3 Certain financial measures we use to evaluate our performance and discuss in this presentation are identified as being “non - GAAP financial measures . ” In accordance with the rules of the SEC, we classify a financial measure as being a non - GAAP (generally accepted accounting principles) financial measure if that financial measure excludes or includes amounts, or is subject to adjustments that have the effect of excluding or including amounts, that are included or excluded, as the case may be, in the most directly comparable measure calculated and presented in accordance with GAAP as in effect from time to time in the United States in our statements of operations, balance sheet or statements of cash flows . Non - GAAP financial measures do not include operating and other statistical measures or ratios or statistical measures calculated using exclusively either financial measures calculated in accordance with GAAP, operating measures or other measures that are not non - GAAP financial measures or both . The non - GAAP financial measures that we discuss in this presentation should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP . Moreover, the manner in which we calculate the non - GAAP financial measures that we discuss in this presentation may differ from that of other companies reporting measures with similar names . You should understand how such other banking organizations calculate their financial measures similar or with names similar to the non - GAAP financial measures we have discussed in this presentation when comparing such non - GAAP financial measures . Tangible common equity, tangible assets, and tangible book value per share are non - GAAP measures generally used by financial analysts and investment bankers to evaluate financial institutions . We calculate : (a) tangible common equity as shareholders’ equity less goodwill and core deposit intangibles, (b) tangible assets as total assets less goodwill and core deposit intangibles, and (c) tangible book value per share as tangible common equity (as described in clause (a)) divided by shares of common stock outstanding . We believe that these measures are important to many investors in the marketplace who are interested in changes from period to period in common equity, total assets, and book value per common share exclusive of changes in intangible assets . Non - GAAP Financial Measures

Branch Purchase ▪ Select is acquiring three Entegra Bank (“ Entegra ”) 1 branches located in Franklin, Highlands and Sylva, NC • $179 million in deposits • Approximately $110 million in loans acquired at par value • Premises and equipment acquired at fair market value ▪ Deposit premium of 8.00% (excluding brokered deposits); Implied premium of $14.1 million as of October 31, 2019 ▪ Subject to regulatory approval; closing expected early in the second quarter of 2020 Strategic Rationale ▪ Further positions Select as a premier community banking franchise in North Carolina ▪ Enter new markets in western North Carolina with meaningful market share ▪ Transaction in line with Select’s strategic plan: organic growth in rural and metro markets and strategic acquisitions ▪ High quality, low cost deposits Anticipated Financial Impact ▪ Immediately accretive to earnings per share (> 20% EPS accretion in second year) ▪ Manageable TBV 2 dilution in an all cash transaction (7.5%); TBV payback of 3.5 years ▪ Internal rate of return expected to be 15% ▪ Select Bank remains well - capitalized Strategic Expansion in New Markets Transaction Summary 1. Branches are being divested as required under agreements with the U.S. Department of Justice, Antitrust Division, and the Fed era l Reserve in connection with the proposed merger of Entegra Financial Corp. and its wholly owned subsidiary, Entegra , with First - Citizens Bank & Trust Company (“First Citizens”). The branches will be acquired by First Citizens upon close of the merger, but will not be converted to First Citizens’ systems 2. Tangible book value, a non - GAAP financial measure 4

5 Pro Forma Franchise Footprint * Including the three Entegra branches Striving to be The Bank of Choice in the Communities We Serve Wilmington Virginia Beach Dunn Mt. Pleasant Savannah Johnson City Norfolk Elizabeth City 21 Branches* ● 3 Loan Production Offices ● Over 200 Employees Branch Locations Loan Production Office Entegra Branches

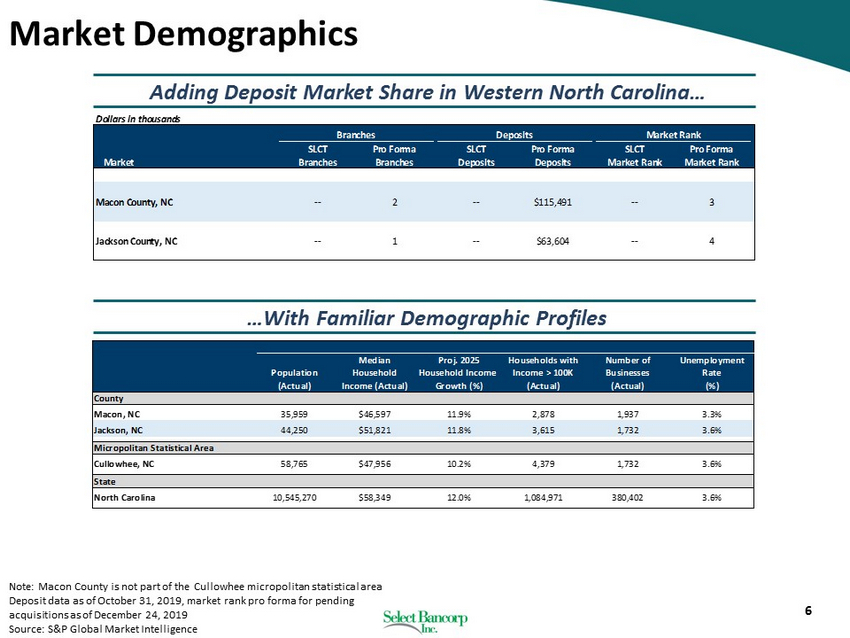

Note: Macon County is not part of the Cullowhee micropolitan statistical area Deposit data as of October 31, 2019, market rank pro forma for pending acquisitions as of December 24, 2019 Source: S&P Global Market Intelligence Adding Deposit Market Share in Western North Carolina… …With Familiar Demographic Profiles Market Demographics Median Proj. 2025 Households with Number of Unemployment Population Household Household Income Income > 100K Businesses Rate (Actual) Income (Actual) Growth (%) (Actual) (Actual) (%) County Macon, NC 35,959 $46,597 11.9% 2,878 1,937 3.3% Jackson, NC 44,250 $51,821 11.8% 3,615 1,732 3.6% Micropolitan Statistical Area Cullowhee, NC 58,765 $47,956 10.2% 4,379 1,732 3.6% State North Carolina 10,545,270 $58,349 12.0% 1,084,971 380,402 3.6% Dollars in thousands SLCT Pro Forma SLCT Pro Forma SLCT Pro Forma Market Branches Branches Deposits Deposits Market Rank Market Rank Macon County, NC -- 2 -- $115,491 -- 3 Jackson County, NC -- 1 -- $63,604 -- 4 Market RankDepositsBranches 6

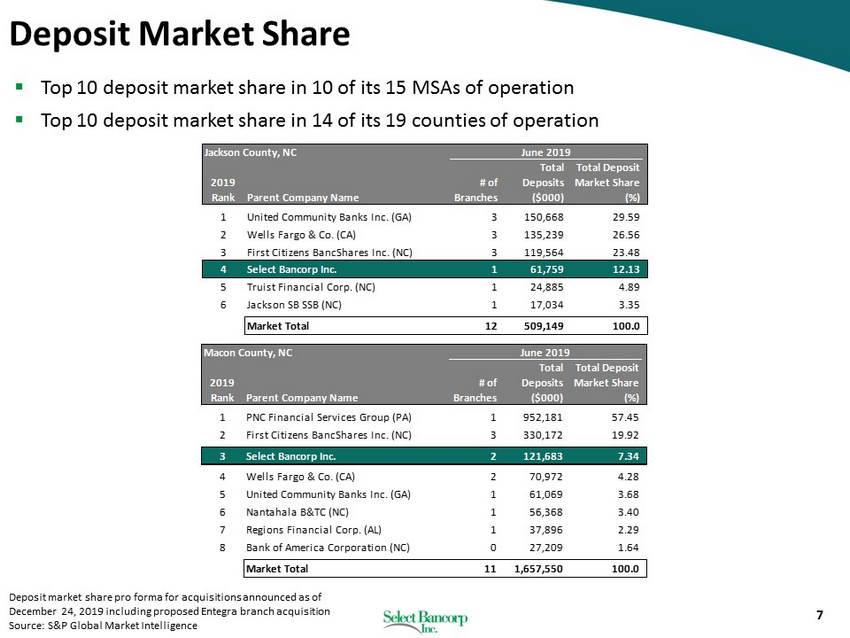

7 Deposit Market Share Deposit market share pro forma for acquisitions announced as of December 24, 2019 including proposed Entegra branch acquisition Source: S&P Global Market Intelligence ▪ Top 10 deposit market share in 10 of its 15 MSAs of operation ▪ Top 10 deposit market share in 14 of its 19 counties of operation Jackson County, NC 2019 Rank Parent Company Name # of Branches Total Deposits ($000) Total Deposit Market Share (%) 1 United Community Banks Inc. (GA) 3 150,668 29.59 2 Wells Fargo & Co. (CA) 3 135,239 26.56 3 First Citizens BancShares Inc. (NC) 3 119,564 23.48 4 Select Bancorp Inc. 1 61,759 12.13 5 Truist Financial Corp. (NC) 1 24,885 4.89 6 Jackson SB SSB (NC) 1 17,034 3.35 Market Total 12 509,149 100.0 June 2019 Macon County, NC 2019 Rank Parent Company Name # of Branches Total Deposits ($000) Total Deposit Market Share (%) 1 PNC Financial Services Group (PA) 1 952,181 57.45 2 First Citizens BancShares Inc. (NC) 3 330,172 19.92 3 Select Bancorp Inc. 2 121,683 7.34 4 Wells Fargo & Co. (CA) 2 70,972 4.28 5 United Community Banks Inc. (GA) 1 61,069 3.68 6 Nantahala B&TC (NC) 1 56,368 3.40 7 Regions Financial Corp. (AL) 1 37,896 2.29 8 Bank of America Corporation (NC) 0 27,209 1.64 Market Total 11 1,657,550 100.0 June 2019

Dollars in Millions SLCT ENFC Branches Pro Forma Total Assets $1,270 $179 $1,449 Total Loans $1,017 $110 $1,127 Total Deposits $988 $179 $1,167 Total Equity $212 $0 $212 Meaningful balance sheet growth providing additional liquidity Balance Sheet Impact 8

Deposit Premium ▪ 8.00% deposit premium ▪ Excluding brokered deposits Core Deposit (1) Intangible ▪ 2.00% of core deposits (1) ▪ Amortized 7 - year straight line Estimated Transaction Expenses ▪ $500 thousand Branch Closures ▪ No branch closures expected Expected Transaction Closing ▪ 2 nd quarter 2020 Financing ▪ No external financing necessary (1) Core deposits defined as total deposits less time deposits (2) Assumes a mid - April 2020 closing K EY A SSUMPTIONS TBV Dilution ▪ 7.5% estimated at expected close TBV Earnback ▪ 3.5 years EPS Accretion ▪ 11% EPS accretion expected in 2019 (2) ▪ 24% EPS accretion expected in 2020 Capital ▪ Select Bank remains well - capitalized E STIMATED P RO F ORMA I MPACTS Key Assumptions & Impacts 9

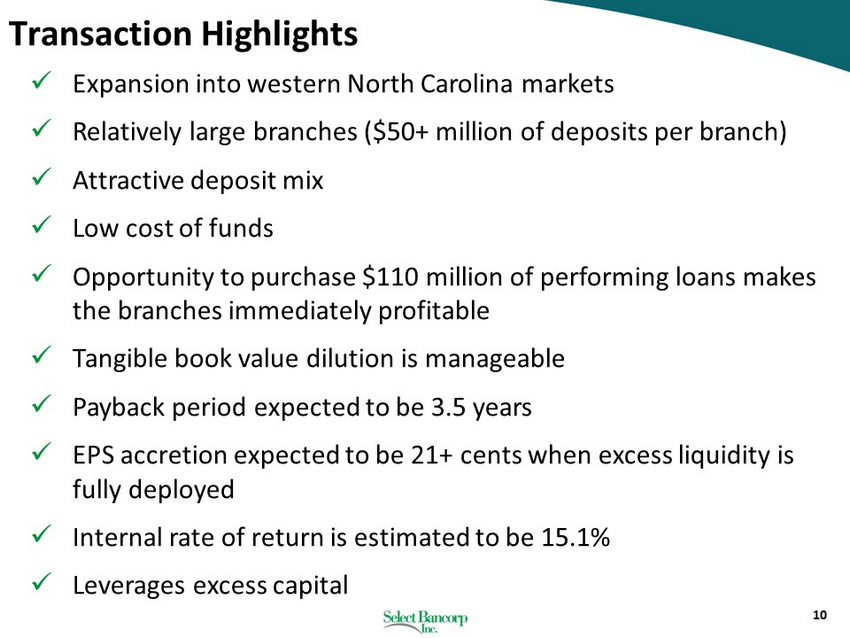

10 Transaction Highlights x Expansion into western North Carolina markets x Relatively large branches ($50+ million of deposits per branch) x Attractive deposit mix x Low cost of funds x Opportunity to purchase $110 million of performing loans makes the branches immediately profitable x Tangible book value dilution is manageable x Payback period expected to be 3.5 years x EPS accretion expected to be 21+ cents when excess liquidity is fully deployed x Internal rate of return is estimated to be 15.1% x Leverages excess capital

11