Attached files

| file | filename |

|---|---|

| 8-K - 8-K - R1 RCM INC. | a12-27x198xk.htm |

Exhibit 99.1 Investor Presentation December 27, 2019

Forward-Looking Statements and Non-GAAP Financial Measures This presentation includes information that may constitute “forward-looking statements,” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements relate to future, not past, events and often address our expected future growth, plans and performance or forecasts. These forward-looking statements are often identified by the use of words such as “anticipate,” “believe,” “designed,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “will,” or “would,” and similar expressions or variations, although not all forward-looking statements contain these identifying words. Such forward-looking statements are based on management’s current expectations about future events as of the date hereof and involve many risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Subsequent events and developments, including actual results or changes in our assumptions, may cause our views to change. We do not undertake to update our forward-looking statements except to the extent required by applicable law. Readers are cautioned not to place undue reliance on such forward-looking statements. All forward-looking statements included herein are expressly qualified in their entirety by these cautionary statements. Our actual results and outcomes could differ materially from those included in these forward-looking statements as a result of various factors, including but not limited to, our ability to integrate the Intermedix business as planned and to realize the expected benefits from the acquisition, our ability to successfully deliver on our commitments to our customers, our ability to deploy new business as planned, our ability to successfully implement new technologies, fluctuations in our results of operations and cash flows, and the factors discussed under the heading “Risk Factors” in our most recent Annual Report on Form 10-K and any other periodic reports that the Company files with the Securities and Exchange Commission. This presentation includes the following non-GAAP financial measure: Adjusted EBITDA. Please refer to the Appendix located at the end of this presentation for a reconciliation of the non-GAAP financial measure to the most directly comparable GAAP financial measure. 2

R1 Investment Highlights Leading end-to-end revenue cycle platform with highly compelling financial model DIFFERENTIATED LARGE HIGH RECURRING STRONG VALUE UNDERPENETRATED REVENUE AND GROWTH PROPOSITION MARKET Adj. EBITDA TRAJECTORY Operating $235-260M $100B 14% Model 2020 Adj. EBITDA Acute and Average Quarterly Outlook Robust and Physician RCM Revenue Growth From $57M Proven Market since 2016 in 2018 3

We Drive Financial Improvement and a Better Patient Experience for Integrated Health Systems NEED VALUE ADD RESULT Growing We plug into health Lower costs, pressure to run providers’ existing IT faster collections revenue cycle systems and higher more efficiently revenue OPERATING MODEL + ▪Proprietary Technology + ▪Experienced Talent + ▪Analytics + ▪Global Shared Services + ▪Demonstrated Results 4

Comprehensive Revenue Cycle Capabilities for Healthcare Providers Care Setting Emergency Physician Acute Post-Acute Revenue Cycle Phases Order to Intake Care to Claim Claim to Payment Payment Models Fee-for-service Value-based Patient Self-pay We Transform Revenue Cycle Performance Across Care Settings and Payment Models 5

Demonstrated Revenue Momentum Quarterly Revenue – $Millions $295 $301 $276 $263 $250 $208 $140 $147 $123 $87 $99 Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Q3'18 Q4'18 Q1'19 Q2'19 Q3'19 6

Financial Outlook $m 2019 2020 Revenue 1,175 – 1,200 1,250 – 1,400 GAAP Operating Income 55 – 70 140 – 170 Adjusted EBITDA 165 – 170 235 – 260 $m Contracted Growth1 Revenue 1,250 – 1,300 1,300 – 1,400 Adjusted EBITDA 245 – 260 235 – 245 Expected 2019 EBITDA Improvement of ~$100M Positions us well for 2020 Note: Adjusted EBITDA is a non-GAAP measure, please refer to the Appendix for a reconciliation of non-GAAP financial measures. 7 Note1: Growth scenario assumes addition of new $3B in NPR under management in mid-2019 and mid-2020.

Investment Highlights 1 Large, Underpenetrated Market R1 2 Differentiated Value Proposition Investment Thesis 3 Multiple Growth & Profit Drivers 8

Market Dynamics Play to Our Strengths Hospital Market Implication for Need for Dynamics Hospitals Sustainable Solutions ▪ Financial ▪ Sub-optimal pressures collections rate Best value proposition ▪ Increasing ▪ Weakening complexity margins ▪ Infrastructure = ▪ Industry not delivering consolidation scale advantages ▪ Capital ▪ Falling behind in constraints technology ▪ Consumer ▪ Transform from a demands wholesale to retail mindset 9

Large, Growing and Underpenetrated Market $100B Market External RCM Spend …R1 Revenue Expected for RCM Services1 Growing Steadily2… to Grow Faster External 25% Spend Projected CAGR from ~$30B 2018 to 2020 Internal 12% Projected CAGR Spend through 2020 ~$70B $60B Acute-Care $40B Physician Target Market $100B Total TAM R1 Contracted Business Yields Growth 2x Market… Market Dynamics Support Strong Incremental Growth Note1: CMS NHE Projections and R1 estimates. Note2: Research and Markets Global Forecast to 2022, published January 2018. 10

Investment Highlights 1 Large, Underpenetrated Market R1 2 Differentiated Value Proposition Investment Thesis 3 Multiple Growth & Profit Drivers 11

Comprehensive Approach to Transform Revenue Cycle WORKFLOW R1 PERFORMANCE STACKSM PATIENT ACCESS UTILIZATION, CHARGE & CODE CLAIMS & REIMBURSEMENT 1 2 3 4 5 6 7 8 9 10 11 12 13 Phys. Pre-Reg. / Financial Check-in Level of Case Charge Coding & Billing & Denials Customer Patient Pay Under- Order & Financial Counseling /Arrival Care Mgmt. / Optimization Acuity Follow-up Mgmt. Service / Pre- payments Scheduling Clearance Utilization Capture Collect Review ANALYTICS VISIBILITY + ACTIONABLE INTELLIGENCE + PERFORMANCE MANAGEMENT DELIVERY DEPLOYMENT + CENTRALIZED & CUSTOMER OPERATIONS + TALENT + GLOBAL NETWORK TECHNOLOGY EXTENSIVE & FLEXIBLE PLATFORM + RPA & DIGITAL SOLUTIONS + INFRASTRUCTURE + SECURITY OPERATING SYSTEM PROVEN METHODS + STANDARDIZATION + OPERATING RHYTHM + QUALITY + COMPLIANCE Improved Healthcare UP TO 5% 20% 30% Provider Economics increase in reduction in reduction in net revenue A/R days cost to collect 12

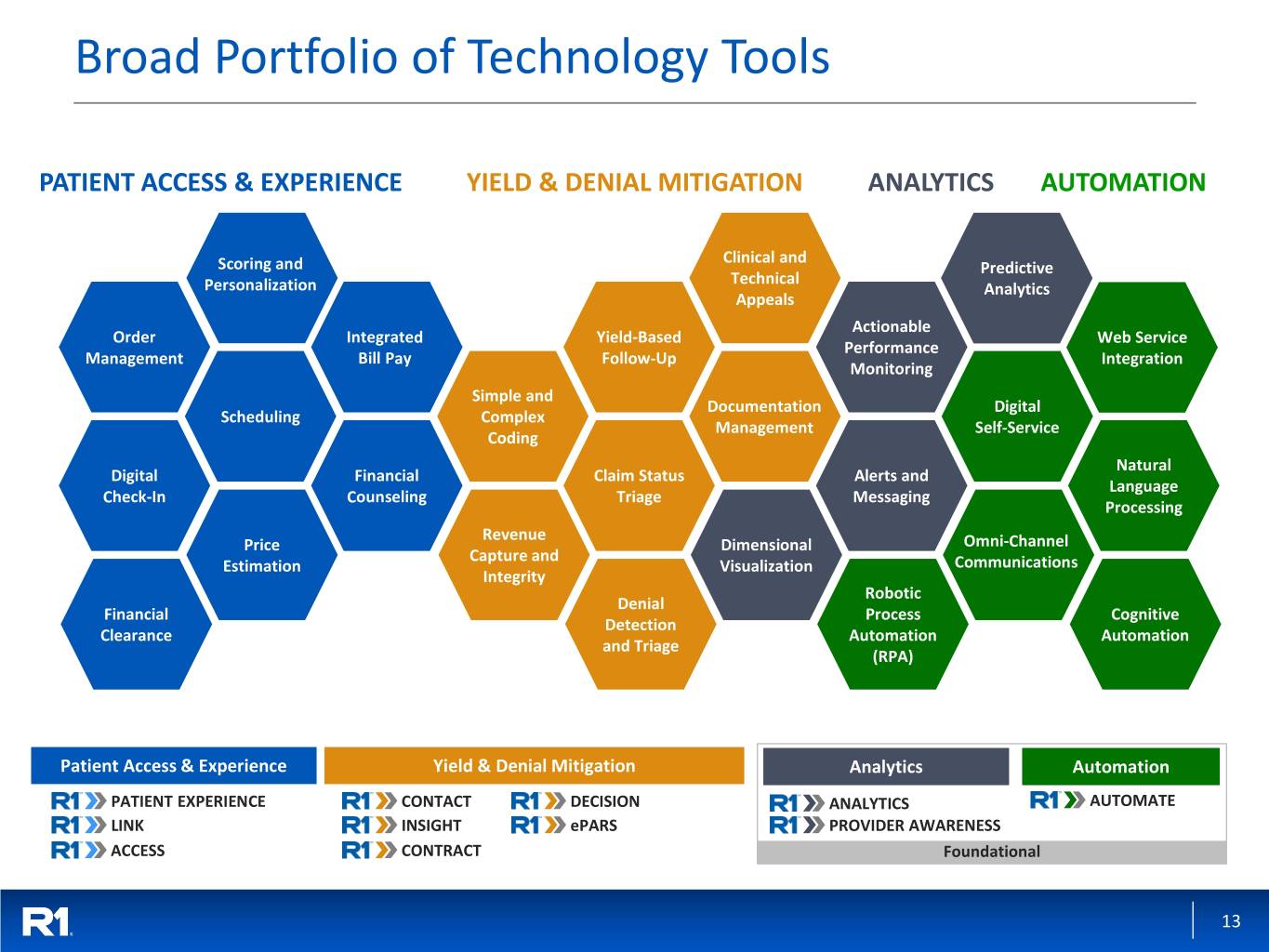

Broad Portfolio of Technology Tools PATIENT ACCESS & EXPERIENCE YIELD & DENIAL MITIGATION ANALYTICS AUTOMATION Clinical and Scoring and Predictive Technical Personalization Analytics Appeals Actionable Order Integrated Yield-Based Web Service Performance Management Bill Pay Follow-Up Integration Monitoring Simple and Documentation Digital Scheduling Complex Management Self-Service Coding Natural Digital Financial Claim Status Alerts and Language Check-In Counseling Triage Messaging Processing Revenue Price Dimensional Omni-Channel Capture and Estimation Visualization Communications Integrity Robotic Denial Financial Process Cognitive Detection Clearance Automation Automation and Triage (RPA) Patient Access & Experience Yield & Denial Mitigation Analytics Automation PATIENT EXPERIENCE CONTACT DECISION ANALYTICS AUTOMATE LINK INSIGHT ePARS PROVIDER AWARENESS ACCESS CONTRACT Foundational 13

Ability to Scale is a Key Differentiator Scaling Successfully is a Function of Several Key Variables Proven Reliable, Effective Strong Operating Scalable Capacity Talent Systems Infrastructure Planning ▪ Defined operating ▪ Ownership and ▪ Ability to support ▪ Planning & data- model and deployed talent development higher volumes driven standards for across sites utilization R1 has Proven the Ability to Scale Rapidly and Successfully 18,000 FTE Ascension $25B NPR ▪ Employees ▪ Performance ahead of Plan ▪ Net patient revenue (NPR) onboarded to Operating ▪ +8,000 YOY ▪ 600 Tech Installs since 2017 Partner Model since 2016 14

Scalable Infrastructure, Broadest RCM Capabilities High Major end-to-end Scalability Competitors Niche Competitors Low Single-focus Revenue Cycle Capabilities End-to-End 15

Strong Market Recognition Serves Customers 2015 2016 2017 Dec 31, 2018 RCM Vendor > 1,500 Beds 90 84.3 81.6 80 74.8 70 63.2 Score (out of 100) of (out Score 61.3 60 58.9 50 PX Platform BEST INNOVATIVE 2015 2016 2017 Dec 31, 2018 Average for KLAS Revenue NEW PRODUCT Cycle Outsourcing is 72.6 2018 HFMA ANNUAL MEETING Source: Based on Dec 31, 2018 KLAS data. 16

Investment Highlights 1 Large, Underpenetrated Market R1 2 Differentiated Value Proposition Investment Thesis 3 Multiple Growth & Profit Drivers 17

Multi-faceted Approach to Growth Provides visibility to EBITDA Contracted Business Rollout growth beyond 2020 Convert end-to-end pipeline New Business Wins Ramp-up modular channel Cross-sell into PAS base Selectively pursue acquisitions Expansion of Capabilities and fund internal initiatives Margin expansion through Productivity Enhancements scaling benefits and automation Creates Strong Confidence in Long-term Growth Potential 18

Our 2019 Focus Drive Margin Expansion on Contracted Business Execute Digital Transformation Launch Physician Group Solution for IDNs Convert Pipeline to Growth 19

Contracted Business Drives Margin Expansion Quorum Health, Physician Group1, and new Health System2 ($4.1B NPR) AMITA and Ascension Medical Group ($6B NPR) Intermountain ($5B NPR) Ascension Phase-2 and Wisconsin ($5B NPR) Ascension Phase-1 ($3B NPR) 2016 2017 2018 2019 2020 Year 1: Onboarding phase Year 2: Margin-ramp phase Year 3+: Steady-state phase $15+B of NPR Still In Margin-Ramp Phase Exiting 2020 Note1: $700M NPR End-to-End Operating Partner Physician Group signed in Q3 2019 20 Note2: New $1.8B NPR End-to-End Co-Managed Health System signed in Q4 2019

Digital Transformation 1 Significant 2 Proven Technology is 3 Holistic Transformation Opportunity Ready to Scale Approach ▪ Highly manual costs ▪ Digital self-service ▪ Established strategic relationships with – Labor ~80% of cost – Patient experience (PX) in world-class partners: deployment – 18K FTEs and growing – Business process ▪ Robotic Process ▪ Repetitive processes that consulting Automation (RPA) lend themselves to – Automation Anywhere automation – 100+ Bots in production ▪ Created dedicated Digital ▪ Meaningful ROI – 4 major processes fully Transformation Office: through blueprinting – Cost reduction – Dedicated top talent ▪ Predictive Intelligence & – Higher yield & cash Cognitive Machine Learning – Financial oversight Control of Process Drives Confidence in Delivering ROI 21

Automation Example: Medicaid Eligibility Historical: All Manual Processing Manual Steps to Secure Approval for Medicaid Benefits: 1.1 Account posted on worklist based on R1 rules 2.2 Visit Medicaid website and searches for patient 3.3 Read eligibility & application status 4.4 Document status 5.5 Take appropriate action based on the status Process Occurs ~250,000 Times Annually at R1 Current State: Automated Robotic Process Enabled RPA 1 2 3 Current Automated Approach: Bots 4 5 6 11. Account is digitally queued for Bot based on custom rules 22. Bot visits Medicaid website and searches for patient 33. Bot reads eligibility & application status 44. Bot documents status 5.5 Take appropriate action based on the status Bots Process Work of 30+ FTEs 24x7 22

Extrapolating Across our Footprint Completed blueprinting first 4 of 13 core revenue cycle 3 Primary Levers functions for automation future state which represent… ▪ 30 – 40M manual touches per year 1 ▪ 3,000 – 3,500 FTEs required to manage the volume Robotic Process Automation Similar Automations to Medicaid Eligibility example expected to drive… ▪ 25 – 30% reduction in manual processes 2 ▪ On just 4 core processes… this equates to 8 – 10M reduced manual touches annually Digital Self Service & Patient Experience In addition to the 4 processes currently in blueprinting … ▪ Broader R1 footprint includes additional 85 – 90M manual 3 touches per year representing further opportunities for future phases of Digital Transformation Cognitive and Machine Learning Building World-Class Structure to Deploy Across Enterprise 23

2019 Key Financial Priorities 1 Margin Expansion from Onboarded Customers 2 Ensure Digital Transformation Drives Financial ROI 3 Capital Structure Improvement 24

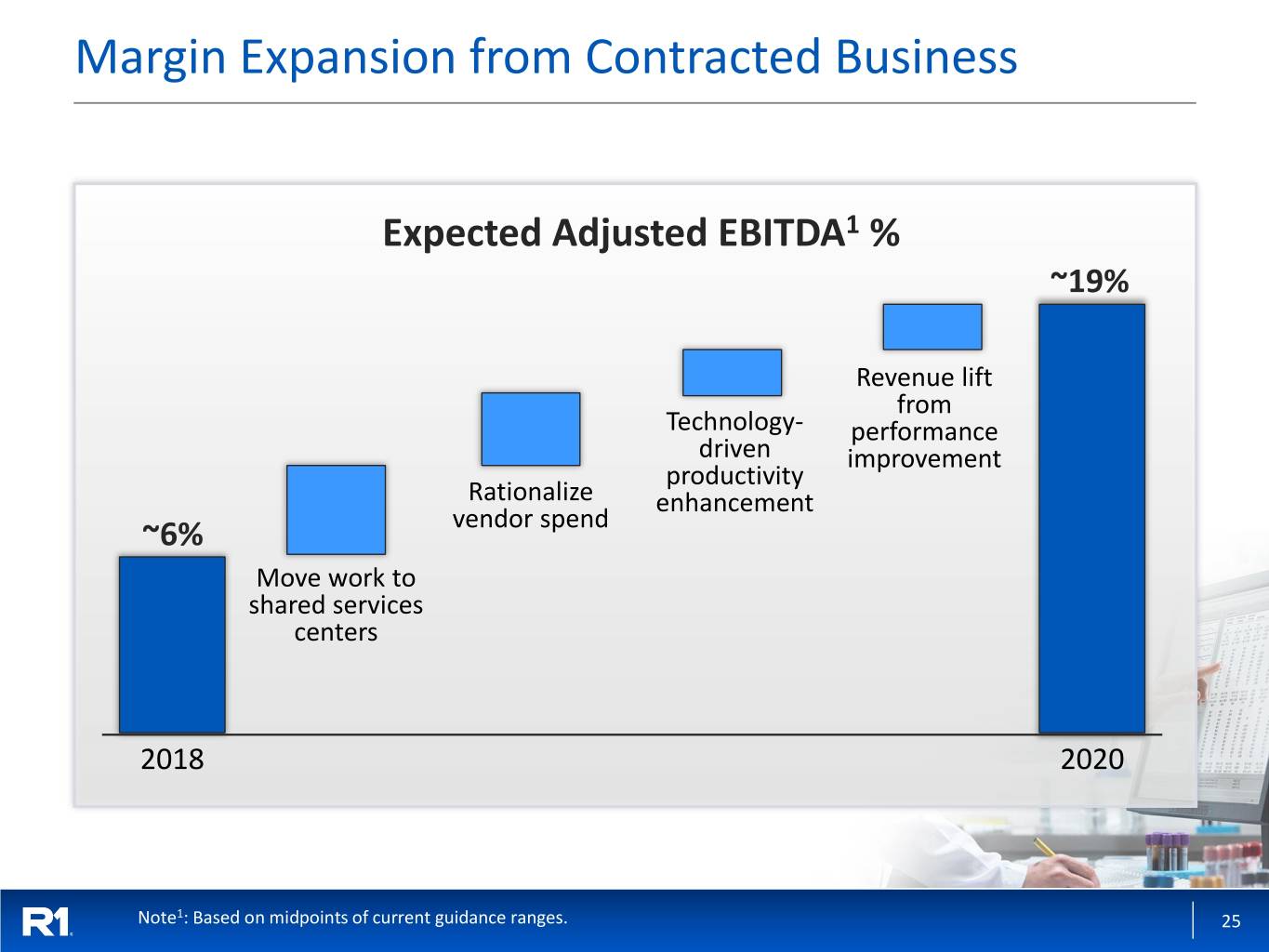

Margin Expansion from Contracted Business Expected Adjusted EBITDA1 % ~19% Revenue lift from Technology- performance driven improvement productivity Rationalize enhancement ~6% vendor spend Move work to shared services centers 2018 2020 Note1: Based on midpoints of current guidance ranges. 25

Digital Transformation Drives Financial ROI Cost per Bot RPA provides additional benefits including Development Increased accuracy & service quality (one time) $20 – 40K by avoiding human errors Infrastructure Improved internal controls through / Licensing $10K detailed activity logging / auditing Improved employee engagement by Total Cost $30 – 50K shifting staff to more interesting work Annual Reduced cycle time due to 24/7 Savings $75 – 200K operation Reduced ramp-up time due to the 3-Year ROI: 2 – 10x Range elimination of need to train staff 26

Capital Structure Improvement Data as of 9/30/19 Cash $56 million in cash and cash equivalents $321 million Term Loan A at L+2.75% Debt $50 million Revolver at L+2.75% Common Stock 113 million shares outstanding • Equivalent to 104.5 million common shares as of 9/30/19 Convertible • 200,000 shares issued in Feb. 2016 (equivalent to 80 Preferred million common shares at issuance) • 8% annual dividend payable in kind on a quarterly basis Stock for 7 years, and cash or kind thereafter • Ascension/TowerBrook: Warrant to purchase 60 million common shares at $3.50 per share Warrants • Intermountain Healthcare: Warrant to purchase 1.5 million common shares at $6.00 per share Refinanced Debt in June 2019 27

Financial Outlook $m 2019 2020 Revenue 1,175 – 1,200 1,250 – 1,400 GAAP Operating Income 55 – 70 140 – 170 Adjusted EBITDA 165 – 170 235 – 260 $m Contracted Growth1 Revenue 1,250 – 1,300 1,300 – 1,400 Adjusted EBITDA 245 – 260 235 – 245 Expected 2019 EBITDA Improvement of ~$100M Positions us well for 2020 Note: Adjusted EBITDA is a non-GAAP measure, please refer to the Appendix for a reconciliation of non-GAAP financial measures. 28 Note1: Growth scenario assumes addition of new $3B in NPR under management in mid-2019 and mid-2020.

Our 2019 Focus Drive Margin Expansion on Contracted Business Execute Digital Transformation Launch Physician Group Solution for IDNs Convert Pipeline to Growth 29

Appendix 30

Contract Economics by Engagement Model Illustrative Revenue and EBITDA contribution based on typical $3B NPR Operating Partner Co-Managed Modular $M $M $M 120-150 70-80 30-50 30-40 15-20 10-20 5-15 10-20 3-12 3-12 ~(12) ~(2.0) Year 1 Year 5 Year 1 Year 5 Year 1 Year 5 Revenue contribution EBITDA contribution 31

Financial Model for Operating Partner Model Illustrative Contribution from $3B NPR Customer Launch Growth Steady State 0 – 12 Months 12 – 36 Months 36+ Months ▪ Deploy transition resources ▪ Finalize employee transitions ▪ Continuous optimization: ▪ Perform financial assessment ▪ Transfers to Shared Services − KPI metric improvement ▪ Invest in infrastructure ▪ Complete standardization − Technology advancement ▪ Implement technology ▪ Steady state org structure − Productivity improvement Mid-Point Mid-Point Financial Impact – Mid-Point Financial Impact – $M of Range Financial Impact – $M of Range $M of Range Revenue 75 Revenue 120 Revenue 135 Adj. EBITDA Adj. EBITDA Adj. EBITDA (12) 17 35 contribution contribution contribution Adj. EBITDA Adj. EBITDA Adj. EBITDA (16%) 14% 26% contribution % contribution % contribution % Profitability Trends Up as Model is Fully Deployed 32

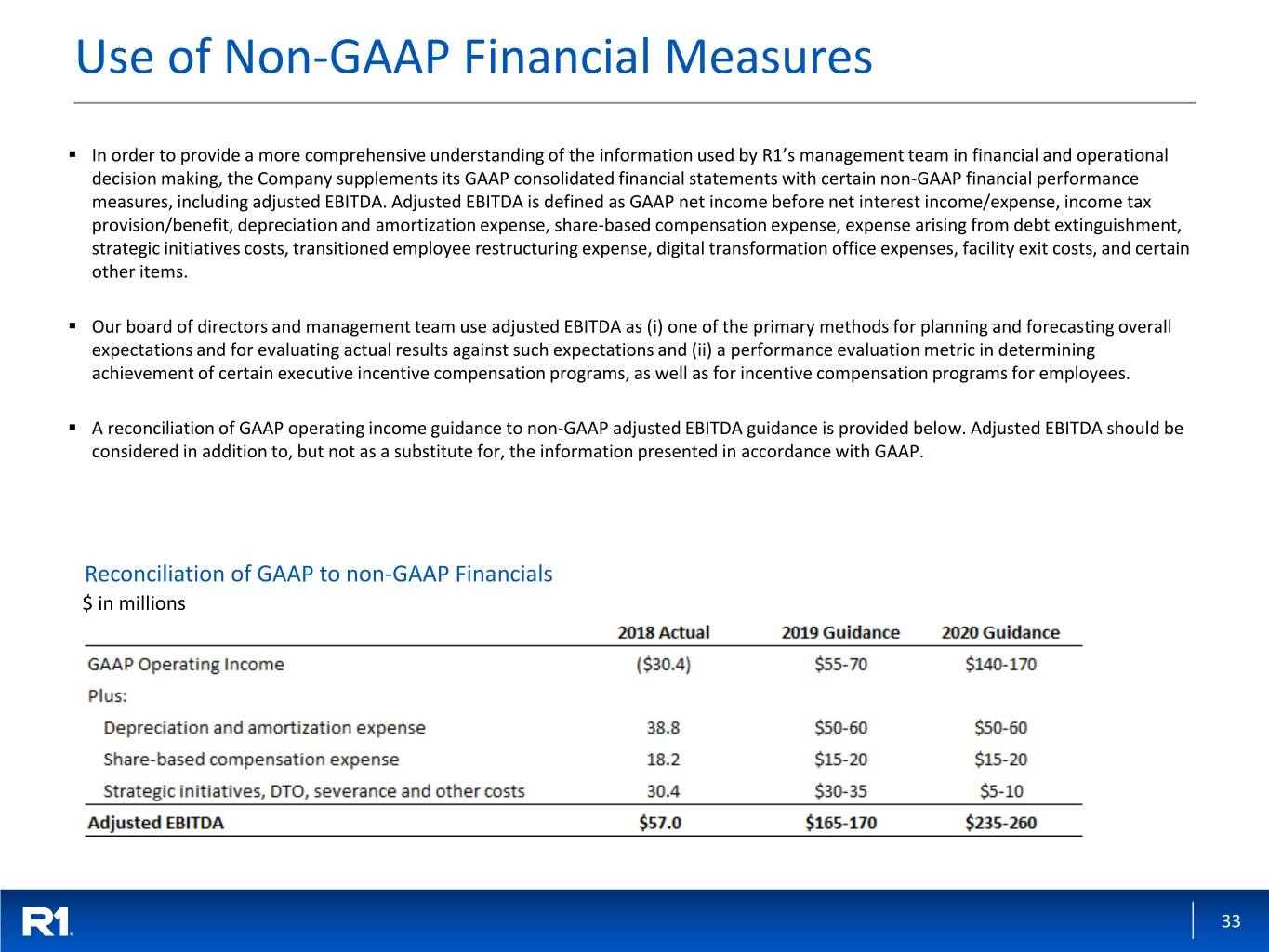

Use of Non-GAAP Financial Measures ▪ In order to provide a more comprehensive understanding of the information used by R1’s management team in financial and operational decision making, the Company supplements its GAAP consolidated financial statements with certain non-GAAP financial performance measures, including adjusted EBITDA. Adjusted EBITDA is defined as GAAP net income before net interest income/expense, income tax provision/benefit, depreciation and amortization expense, share-based compensation expense, expense arising from debt extinguishment, strategic initiatives costs, transitioned employee restructuring expense, digital transformation office expenses, facility exit costs, and certain other items. ▪ Our board of directors and management team use adjusted EBITDA as (i) one of the primary methods for planning and forecasting overall expectations and for evaluating actual results against such expectations and (ii) a performance evaluation metric in determining achievement of certain executive incentive compensation programs, as well as for incentive compensation programs for employees. ▪ A reconciliation of GAAP operating income guidance to non-GAAP adjusted EBITDA guidance is provided below. Adjusted EBITDA should be considered in addition to, but not as a substitute for, the information presented in accordance with GAAP. Reconciliation of GAAP to non-GAAP Financials $ in millions 33