Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Simpson Manufacturing Co., Inc. | form8-kitem701regfddis.htm |

Off-Season Shareholder Engagement STRENGTH BUILT IN December | 2019

Safe Harbor This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 2 IE of the Securities Exchange Act of 1934, as amended. Forward- looking statements generally can be identified by words such as "anticipate," "believe," "estimate," "expect," "intend," "plan," "target," "continue," "predict," "project," "change," "result," "future," "will," "could," "can," "may," "likely," "potentially," or similar expressions that concern our strategy, plans, expectations or intentions. Forward-looking statements include, but are not limited to, statements about future financial and operating results, our plans, objectives, business outlook, priorities, expectations and intentions, expectations for sales growth, comparable sales, earnings and performance, stockholder value, capital expenditures, cash flows, the housing market, the home improvement industry, demand for services, share repurchases, our strategic initiatives, including the impact of these initiatives on our strategic and operational plans and financial results, and any statement of an assumption underlying any of the foregoing and other statements that are not historical facts. Although we believe that the expectations, opinions, projections and comments reflected in these forward-looking statements are reasonable, such statements involve risks and uncertainties and we can give no assurance that such statements will prove to be correct. Actual results may differ materially from those expressed or implied in such statements. Forward-looking statements are subject to inherent uncertainties, risk and other factors that are difficult to predict and could cause our actual results to vary in material respects from what we have expressed or implied by these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those expressed in our forward-looking statements include, among others, those discussed under Item 1A. Risk Factors and Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations in our most recent Annual Report on Form 10-K and subsequent filings with the SEC. We caution that you should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise. Readers are urged to carefully review and consider the various disclosures made in our reports filed with the SEC that advise of the risks and factors that may affect our business, results of operations and financial condition. 2

Investment Highlights Industry leader with unique business model, strong brand recognition and trusted reputation Diversified product offerings and geographies mitigates exposure to cyclical U.S. housing market Strong market share in wood products with significant opportunities in all addressable markets Industry-leading gross profit and operating margins Strong balance sheet enables financial flexibility and stockholder returns Committed to returning a minimum of 50% of cash flow from operations to stockholders 3

Company Overview Simpson Manufacturing Co. designs, engineers and manufactures structural connectors, anchors, fasteners, software solutions and other products for new construction, repair and remodel, and do-it-yourself markets Wood Construction Products Concrete Construction Products Simpson Manufacturing Co. operates across 3 reporting segments (North America, Europe and Asia/Pacific) with 2 • Typically made of steel and are used • Composed of various materials including primarily to strengthen, support and steel, chemicals and carbon fiber used to primary product lines connect wood joints repair, protect and strengthen concrete • Produce and market over 10,000standard • Produce and market over 1,000 standard and custom products and custom products Key Facts and Figures Business Overview • Ticker: NYSE:SSD • Simpson has spent over 60 years providing the highest-quality structural • Market Cap(1): $3.60 B building solutions, and has built a strong foundation of product innovation, customer service and industry leadership • Year Founded: 1956 • Simpson is seen as a thought leader in supporting the process of • Year Public: 1994 building safer, stronger structures in collaboration with customers, • 2018 Revenue: $1.08 B specifiers and code officials (+10% year-over-year) • Simpson continues to differentiate from competitors across operating • Headquarters: Pleasanton, CA segments by designing and marketing end-to-end construction • Operations in 50 locations product systems globally • Simpson promotes a culture of employee ownership focused on the value and contributions of every employee • Employees: 3,135 (1) As of November 30, 2019. 4

5-Year Relative Total Shareholder Return Stock performance reflects clarity surrounding business strategy, growth prospects and operational efficiencies % CHANGE YTD TSR 1 YEAR TSR 3 YEAR TSR 5 YEAR TSR Simpson 52% 41% 80% 165% Manufacturing Proxy Peers 50% 30% 25% 77% SSD: +165% S&P 500 28% 16% 52% 68% DJ US TM/Building 44% 30% 28% 77% Materials & Fixtures Proxy Peers: +77% DJUSBM: +77% S&P 500: +68% Note: Proxy peer average includes: AAON, AMWD, APOG, AWI, CBPX, EXP, ROCK, IIIN, DOOR, PATK, PGTI, NX, SUM, TREX, USCR, WMS. Note: Time period spanning November 30, 2014 to November 30, 2019. Note: Total shareholder return measures the internal rate of return of all cash flows to the investor during the holding period of an investment, not solely the capital gain. 5

Strong Business Drives Stockholder Value A Unique Business Model… Enables Us to Deliver Value to Shareholders The Board employs a balanced capital allocationstrategy Aside from our strong brand recognition and trusted that utilizes free cash flow to grow the business through reputation, Simpson is unique due to our strong customer capital expenditures, acquisitions, and to provide returns to support and training, extensive product testing capabilities, stockholders through dividends and share repurchases. product availability with delivery in typically 24-48 hours or Since 2010, Simpson has grown EPS by 370% and increased less and active involvement with code officials and its quarterly dividend by 130%(1), and since 2011, agencies to improve building construction practices repurchased $398.5(1) million in shares Our 2018 Sales by Product… EPS(2) ($ USD Millions) Concrete Other Construction $0 $2.72 $165 $2.35 $1.86 $1.94 $0.97 Q3 $1.29 $1.38 $1.04 $0.87 $1.05 Q2 Wood $0.58 $0.88 Construction $0.50 $913 Q1 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 YTD and Across Operating Segments Dividends Per Share(3) ($ USD Millions) Asia/Pacific $0.86 $9 $0.81 Europe $0.70 $159 $0.62 $0.68 $0.50 $0.50 $0.50 $0.55 $0.40 $0.23 Q3 $0.23 Q2 North America $911 $0.23 Q1 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 With industry leading operating and gross YTD margins of 16.0% and 44.5% respectively (1) Quarterly dividend and stock repurchases based on quarterly earnings statements as of September 30, 2019. (2) The enactment of the Tax Cuts and Jobs Act in December 2017 resulted in a provisional net charge of $2.2 million in the fourth quarter of 2017, or an impact of $0.04 per fully diluted share. (3) Chart represents annual dividends. Part of the 2013 dividend was accelerated due to uncertainty of changes to tax code in 2013. The dividend paid in December 2012 is included 6 in 2013.

Disciplined Capital Allocation Strategy Simpson has established a current target capital return to stockholders of a minimum of 50% of cash flows from operations through both dividends and repurchases of its common stock • Improve cash flow through better management of working Cash Flow from capital and overall balance sheet discipline Operations • Committed to returning 50% of cash flow from operations to stockholders Organic Growth Share Repurchases Dividends Investments • Maintain opportunistic • Focus primarily on organic • Maintained and grown approach growth opportunities quarterly cash dividends • $49 million available for through strategic capital consistently since 2004 share repurchases (of $100 investments in the business million authorization through 2019) 7

2020 Plan(1) KEY OBJECTIVES FY 2016 Actual 2020 PLAN As of 3Q 2019(2) FOCUS ON ORGANIC 1 GROWTH • $861M Net Sales • ~8% Organic Net Sales ~10% Organic Net Sales CAGR CAGR through fiscal 2019 • 31.8% Operating • ~26% - 27% Operating 27.2% Operating Expenses RATIONALIZE COST Expenses as a % of Net Expenses as a % of Net as a % of Net Sales 2 STRUCTURE TO Sales Sales INCREASE • 16.4% Operating Income • ~16% - 17% Operating 16.5% Operating Income PROFITABILITY Margin Income Margin Margin IMPROVE WORKING • 2x Inventory Turn • Working with external Achieved significant Rate consultant to identify expense reductions in 2018 3 CAPITAL MANAGEMENT further improvements to and new initiatives expected & BALANCE SHEET inventory management to lead to cost containment DISCIPLINE beyond 2020 Plan goals IMPROVE RETURN ON INVESTED CAPITAL(3) • Execution on the 2020 Plan is expected to substantially enhance ROIC • Expect to achieve 15% to 16% ROIC target by FY 2020, up from 10.4% in FY 2016 INCREASE CAPITAL RETURN TO STOCKHOLDERS • Committed to returning 50% of cash flow fromoperations to stockholders • Utilize capital from inventory reductions and balance sheet efficiency improvements to repurchaseshares • Review properties for potential sale / sale-leaseback options; capital release to be used for repurchases (1) Note: Updated as of November 5, 2019. The initial 2020 plan was unveiled on October 30, 2017. (2) Figures represent nine months ending September 30, 2019, based on Q3 2019 10-Q filing. (3) See slide 14 for Return on Invested Capital (ROIC) definition. 8

Independent and Diverse Board Our Board is committed to being effective stewards of shareholder capital and possesses the diversity of skills and experiences to oversee the business James Andrasick Jennifer Chatman Karen Colonias Chairman Former CEO Paul J. Cortese Professor of Mgmt. President & CEO Matson Navigation Haas School of Business, Simpson Manufacturing UC Berkeley Celeste Volz Ford Gary Cusumano Robin Greenway MacGillivray Former Chairman Founder & CEO The Newhall Land and Former Senior Vice Stellar Solutions Farming Company President — One AT&T Integration, AT&T Michael Bless Phil Donaldson CEO Century Aluminum Executive VP & CFO Company Andersen Corporation Average tenure of 8 years 50% 87.5% Female Independent Directors Directors < 5 years 5-8 years 8 years+ Indicates director joined over past 3 years 9

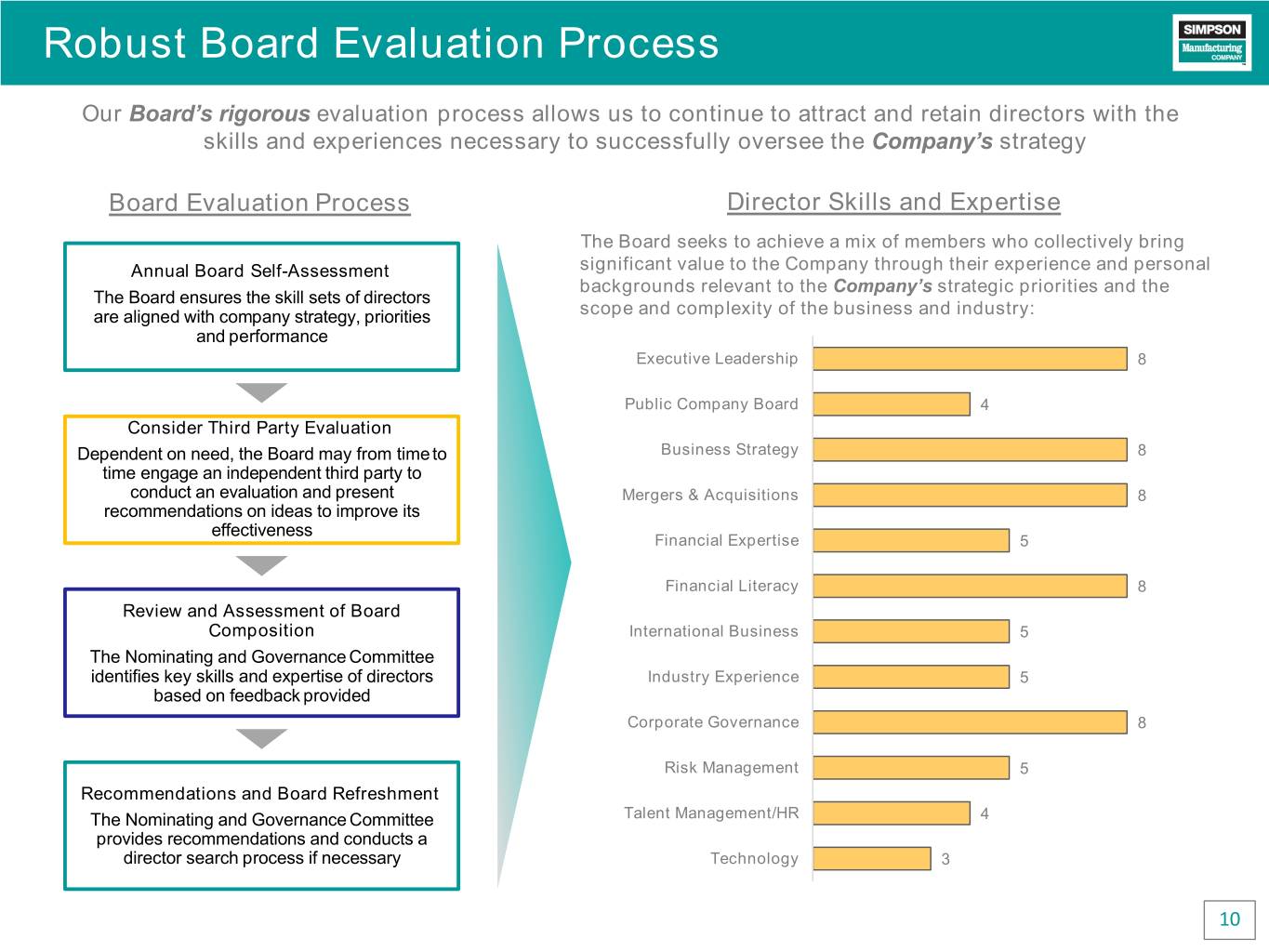

Robust Board Evaluation Process Our Board’s rigorous evaluation process allows us to continue to attract and retain directors with the skills and experiences necessary to successfully oversee the Company’s strategy Board Evaluation Process Director Skills and Expertise The Board seeks to achieve a mix of members who collectively bring Annual Board Self-Assessment significant value to the Company through their experience and personal backgrounds relevant to the Company’s strategic priorities and the The Board ensures the skill sets of directors are aligned with company strategy, priorities scope and complexity of the business and industry: and performance Executive Leadership 8 Public Company Board 4 Consider Third Party Evaluation Dependent on need, the Board may from time to Business Strategy 8 time engage an independent third party to conduct an evaluation and present Mergers & Acquisitions 8 recommendations on ideas to improve its effectiveness Financial Expertise 5 Financial Literacy 8 Review and Assessment of Board Composition International Business 5 The Nominating and Governance Committee identifies key skills and expertise of directors Industry Experience 5 based on feedback provided Corporate Governance 8 Risk Management 5 Recommendations and Board Refreshment The Nominating and Governance Committee Talent Management/HR 4 provides recommendations and conducts a director search process if necessary Technology 3 10

Board Responsiveness to Shareholder Feedback The Board and management conduct ongoing broad outreach to our shareholders to seek feedback on our executive compensation program and governance practices In response to feedback requesting increased environmental and social disclosure, we plan to publish our inaugural Sustainability Report in Spring 2020 Over the past few years, in response to shareholder feedback, the Board made several changes: Compensation Practices Governance Practices Board Structure • Adopted a median pay for median • Declassified the Board, phased in • Conducted a comprehensive performance pay philosophy over a three-year period beginning Board self assessment and third • Transformed our executive at the 2017 Annual Meeting party governance evaluation to compensation program: • Eliminated Cumulative Voting formalize director candidate search criteria - Reduced proportion • Eliminated the shareholder rights delivered through EOCPS plan • Nominated new independent - Extended all performance Reduced Director term limits for director candidates, Michael periods (added annual • new directors elected to the Board Bless and Phillip Donaldson, for measurement to EOCPS and 3- election at the 2017 and 2018 year measurement to LTIP) These practices are in addition to our: Annual Meetings, respectively - Established LTIP equity • Separate Independent Chairman • James Andrasick succeeded metrics distinct from EOCPS, and CEO roles former Chairman, Peter Louras which align with our strategy • Majority vote standard for director Jr., effective as of the end of 2018 • Adopted clawback, anti-hedging elections and anti-pledging policies • No supermajority voting provisions 11

2019 Executive Compensation Program After a period of transition, 2018 was the first year where all changes to our compensation program were fully implemented. The Board was pleased that shareholders voted to support the compensation plan with >98% support and therefore, the Compensation Committee decided to maintain our program for 2019 2019 Program Design Salary Salary is positioned to 50th percentile of peer group LongLong TermTerm 50% 50% IncentiveIncentive 60% Annual Operating Quarterly Operating 60% Profit Profit EOCPS EOCPS 20% 80% PSUs Base Salary 20% 50% 50% Three-year revenue Three-year ROIC growth following grant following grant 80% of targeted compensation Term Incentive Term - 20% RSUs is “at-risk” Three-year staggered vesting Long (20% / 40% / 40%) 12

Environmental and Safety Sustainability We are committed to protecting the environment of our employees, customers and the communities we operate in FOCUS AREAS PHILOSOPHY We do not manufacture steel or any other materials. We operate in a way that does not Manufacturing Process produce regulated external emissions. We strive to minimize waste generated by manufacturing processes though company-wide Lean practices Our facilities recycle/reuse many of the materials they use to reduce our impact on the Recycling and Water environment, including water, cardboard, plastic and glass bottles, aluminum cans, paper, Management wood pallets, electronic waste, oils, coolants and lubricants and stretch film / wrap – low density polyethylene We strive to increase energy efficiencies at our facilities to achieve environmentally-friendly, Energy Efficiency cost-effective operations, by utilizing, among other things: dimmers, motion sensors, LED lighting, heat regeneration and solar energy We support sustainable building practices, such as those established by the U.S. Green Sustainable Building Practices Building Council’s Leadership in Energy and Environmental Design (LEED) Green Building Rating System™, NAHB Green, and state and city specific green building codes z We expect our suppliers to adhere to sustainability standards and operate in a socially and Suppliers environmentally responsible manner consistent with our values Our Occupational Health and Safety program is designed to educate employees on risks Global Health & Safety Initiatives associated with our processes and to adopt new safety skills We create programs specifically focused on the enhancement of safety education, Safety Value Programs practicesand processes 13

Supporting our Employees Our Board is focused on fostering a supportive corporate culture that promotes leadership opportunities and diversity Simpson’s Culture Leadership Programs Our distinct culture is made up of the unique • We care deeply about our employees’ opportunities to thrive and succeed characteristics and talents of our employees and is • We empower our employees, broaden their innovative and creative embodied by our ‘Nine Principles of Business’ thinking, and strengthen their ability to build trust and make a positive 1. Relentless Customer Focus. The focus, the difference obsession, is on customers and users • Our Strong Leaders Program (for managers) and our Emerging Leaders 2. Long-Range View. People never sacrifice Program (for non-managers) provides employees with tools and tomorrow for the sake of today experiences to develop their fullest leadership potential 3. High-Quality Products. The company makes • We strive to develop leaders who are reflective, continuously seek quality products that contribute to the quality of opportunities to improve, and recognize the impact they have life in a significant way 4. Be the Leader. The company is the leader in Diversity its core business 5. Everybody Matters. The company dignifies the • We pride ourselves on our diverse employee base and benefit from their contribution of every individual employee at unique perspectives across our entire corporation every level • We have paved the way for gender diversity in corporate leadership with 6. Enable Growth. People are excited about their women holding 38% of the top five executive positions and board seats jobs and the possibilities for growth combined 7. Risk-Taking Innovation. Innovation and • We were recognized for our diversity efforts in corporate leadership in the creativity are encouraged; success is seldom first-ever Watermark Index and as a Finalist for NACD NXT, an initiative achieved without taking risks to highlight breakthrough corporate boardroom practices 8. Give Back. The company feels an obligation to the system and the country that spawned it, as Equal Pay well as to humanity in general 9. Have Fun, Be Humble. The company is a demanding but fun place to work, where people We are committed to internal pay equality, and we believe our executive take their responsibilities, but not themselves, compensation should be consistent and equitable to motivate our employees seriously to create shareholder value 14

Robust Board Oversight of Risk Management Our Board is actively involved in overseeing the Company’s risk management, regularly reviewing information regarding operational, financial, legal and strategic risks to ensure that shareholders’ investments are protected for the long term Board of Directors Met 6 times in 2019 Audit and Finance Compensation and Corporate Strategy Nominating and Committee Leadership and Acquisitions Governance Development Committee Committee Committee Met 6 times in 2019 Met 12 times in 2019 Met 5 times in 2019 Met 5 times in 2019 Oversees management and Responsible for overseeing Formed in 2009, this Manages risks associated evaluation of our financial the management of risks committee evaluates and with the independence of the and cybersecurity risks relating to our compensation manages our strategic risks. Board and potential conflicts plans, as well as Including identification and of interest, corporate development, attraction and prioritization of strategic guidelines, and Board retention of leadership goals and expectation nominations Management Team While each committee is responsible for evaluating certain risks and overseeing the management of these risks, our entire Board is regularly informed about such risks through executive officer reports 15

Return on Invested Capital (“ROIC”) Definition When referred to in this presentation, the Company’s return on invested capital (“ROIC”) for a fiscal period is calculated based on (i) the net income of the last four quarters as presented in the Company’s condensed consolidated statements of operations prepared pursuant to generally accepted accounting principles in the U.S. (“GAAP”), as divided by (ii) the average of the sum of the total stockholders’ equity and the total long-term liabilities at the beginning of and at the end of such period, as presented in the Company’s consolidated balance sheets prepared pursuant to GAAP for that applicable year. For the purposes of comparability in this calculation, total long-term liabilities excludes long-term finance lease liabilities, which were recognized as of June 30, 2019 as a result of the January 1, 2019 adoption of ASU 2016-02. As such, the Company’s ROIC, a ratio or statistical measure, is calculated using exclusively financial measures presented in accordance with GAAP. 16

SIMPSON’S PEOPLE MAKE THE DIFFERENCE simpsonmfg.com/financials 17