Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ASHFORD HOSPITALITY TRUST INC | ahtinvestorpresentation8-k.htm |

January 2019

Forward Looking St atements and Non-GAAP Measures In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be considered forward-looking and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our competition, current market trends and opportunities, projected operating results, and projected capital expenditures. These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated including, without limitation: general volatility of the capital markets and the market price of our common stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the market in which we operate, interest rates or the general economy, and the degree and nature of our competition. These and other risk factors are more fully discussed in the company's filings with the Securities and Exchange Commission. EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as trailing twelve month EBITDA divided by the purchase price or debt amount. A capitalization rate is determined by dividing the property's net operating income by the purchase price. Net operating income is the property's funds from operations minus a capital expense reserve of either 4% or 5% of gross revenues. Hotel EBITDA flow-through is the change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and other terms are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC or in the appendix to this presentation. This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Ashford Hospitality Trust, Inc. or any of its respective affiliates, and may not be relied upon in connection with the purchase or sale of any such security. 2

Goals OUTPERFORM Deliver strong shareholder returns vs. peers Strategy PROTECT Protect shareholder investment through disciplined capital Opportunistically own, management strategies finance, and asset manage predominately full–service, upper upscale hotels GROW Increase the quality and performance of our portfolio through financially calibrated sales, acquisitions and proactive asset management SUCCEED Utilize competitive advantage through the Enhanced Return Funding Program ALIGN Maintain alignment with shareholders through high insider ownership 3

E x p e r i e n c e d M a n a g e m e n t T e a m J e r e m y W e l t e r D e r i c E u b a n k s D o u g l a s K e s s l e r J . R o b i s o n H a y s R o b e r t H a i m a n C h i e f O p e r a t i n g C h i e f F i n a n c i a l C h i e f E x e c u t i v e C h i e f S t r a t e g y E V P , G e n e r a l O f f i c e r O f f i c e r O f f i c e r / P r e s i d e n t O f f i c e r C o u n s e l . 13 years of hospitality . 18 years of hospitality . 34 years of real estate & . 13 years of hospitality . 15 years of hospitality experience experience hospitality experience experience experience . 8 years with Ashford (5 . 15 years with Ashford . 15 years with Ashford . 13 years with Ashford . 1 year with Ashford (14 years with predecessor) . 3 years with ClubCorp . 10 years with Goldman Sachs . 3 years of M&A years with Ashford . 5 years with Stephens . . experience at Dresser predecessor) CFA Charterholder 5 years with Trammell Crow . Investment Bank . . Inc. & Merrill Lynch Amherst College, BA . Southern Methodist Stanford University, BA . . Oklahoma State University, University, BBA . Princeton University, AB Duke University, JD BS Stanford University, MBA 4

Reasons to Own Ashford Hospitality Trust PORTFOLIO QUALITY STRATEGIC FOCUS ERFP PROGRAM HIGH DIVIDEND YIELD High quality portfolio presents an Strategy maximizes investment Innovative program provides a One of the highest dividend yields in attractive investment opportunity opportunity and value-added returns competitive advantage relative to the industry peers ASSET MANAGEMENT TRACK RECORD AFFILIATE ADVANTAGES INSIDER OWNERSHIP Best-in-class asset management Disciplined capital management that Affiliate companies offer more value Highest insider ownership among peers generates value-add opportunities seeks to enhance shareholder value and control in other parts of the creates shareholder-management business alignment 5

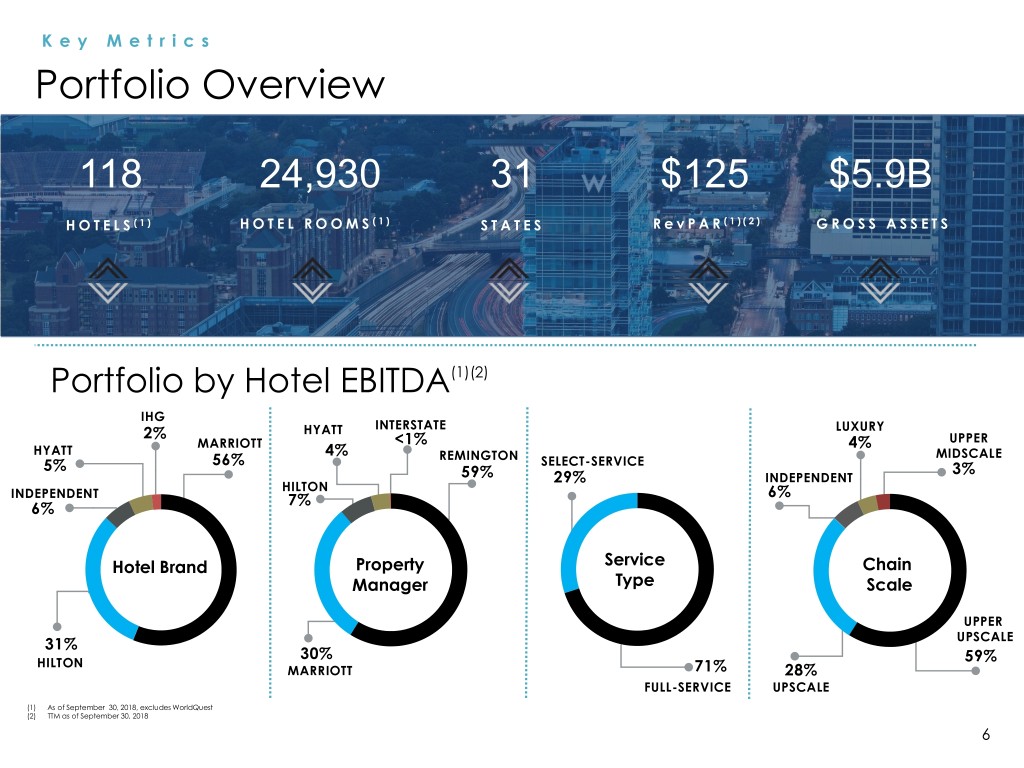

Key Metrics Portfolio Overview 118 24,930 31 $125 $5.9B H O T E L S (1) H O T E L R O O M S ( 1 ) S T A T E S R e v P A R ( 1 ) ( 2 ) G R O S S A S S E T S Portfolio by Hotel EBITDA(1)(2) IHG INTERSTATE 2% HYATT LUXURY MARRIOTT <1% 4% UPPER HYATT 4% 56% REMINGTON MIDSCALE 5% SELECT-SERVICE 3% 59% 29% INDEPENDENT HILTON 6% INDEPENDENT 7% 6% Hotel Brand Property Service Chain Manager Type Scale UPPER 31% UPSCALE 30% HILTON 59% MARRIOTT 71% 28% FULL-SERVICE UPSCALE (1) As of September 30, 2018, excludes WorldQuest (2) TTM as of September 30, 2018 6

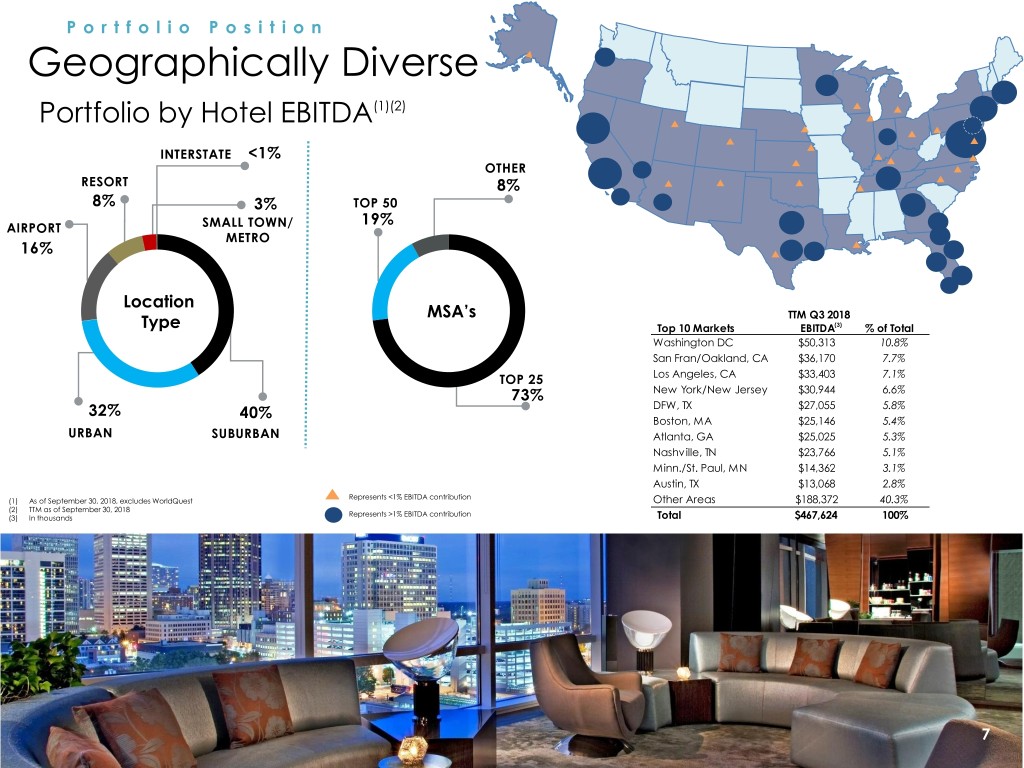

Portfolio Position Geographically Diverse Portfolio by Hotel EBITDA(1)(2) INTERSTATE <1% OTHER RESORT 8% 8% 3% TOP 50 19% AIRPORT SMALL TOWN/ METRO 16% Location MSA’s TTM Q3 2018 Type Top 10 Markets EBITDA(3) % of Total Washington DC $50,313 10.8% San Fran/Oakland, CA $36,170 7.7% TOP 25 Los Angeles, CA $33,403 7.1% 73% New York/New Jersey $30,944 6.6% 32% 40% DFW, TX $27,055 5.8% Boston, MA $25,146 5.4% URBAN SUBURBAN Atlanta, GA $25,025 5.3% Nashville, TN $23,766 5.1% Minn./St. Paul, MN $14,362 3.1% Austin, TX $13,068 2.8% Represents <1% EBITDA contribution (1) As of September 30, 2018, excludes WorldQuest Other Areas $188,372 40.3% (2) TTM as of September 30, 2018 Represents >1% EBITDA contribution (3) In thousands Total $467,624 100% 7

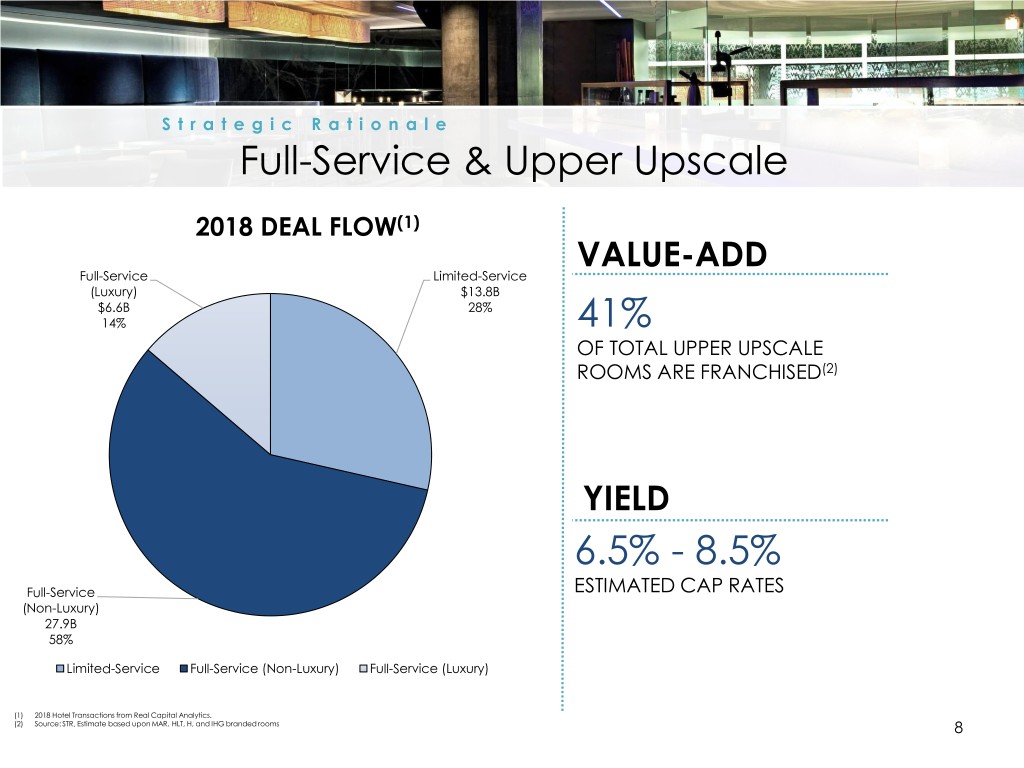

Strategic Rationale Full-Service & Upper Upscale 2018 DEAL FLOW(1) VALUE-ADD Full-Service Limited-Service (Luxury) $13.8B $6.6B 28% 14% 41% OF TOTAL UPPER UPSCALE ROOMS ARE FRANCHISED(2) YIELD 6.5% - 8.5% Full-Service ESTIMATED CAP RATES (Non-Luxury) 27.9B 58% Limited-Service Full-Service (Non-Luxury) Full-Service (Luxury) (1) 2018 Hotel Transactions from Real Capital Analytics. (2) Source: STR. Estimate based upon MAR, HLT, H, and IHG branded rooms 8

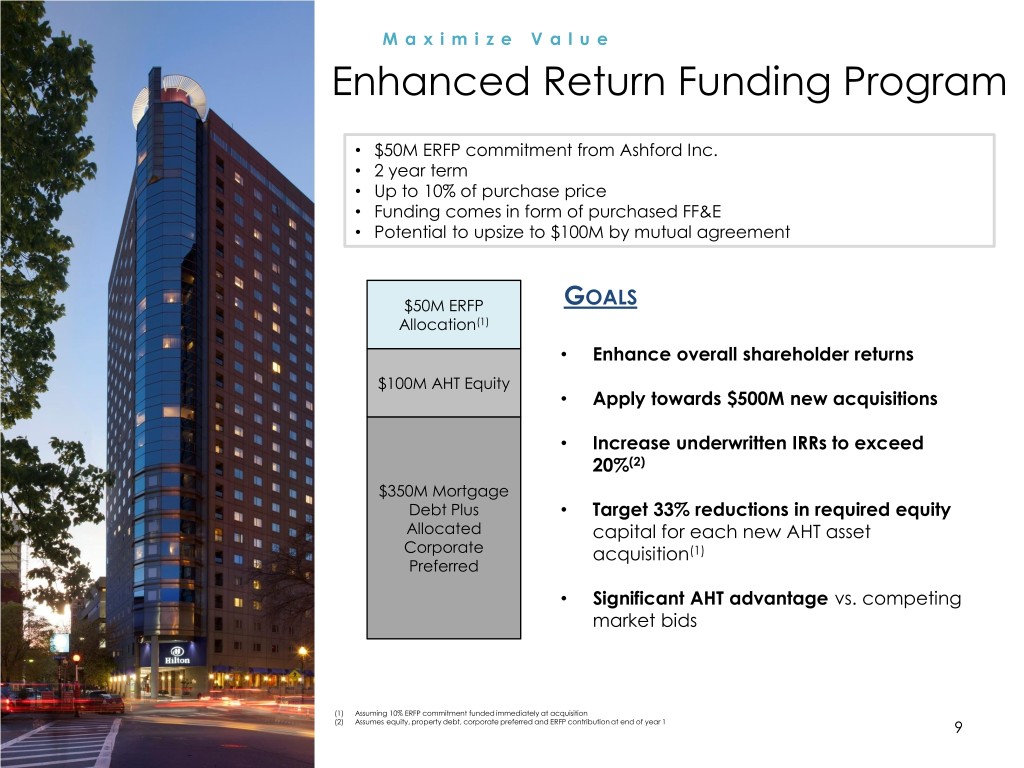

Maximize Value Enhanced Return Funding Program • $50M ERFP commitment from Ashford Inc. • 2 year term • Up to 10% of purchase price • Funding comes in form of purchased FF&E • Potential to upsize to $100M by mutual agreement $50M ERFP GOALS Allocation(1) • Enhance overall shareholder returns $100M AHT Equity • Apply towards $500M new acquisitions • Increase underwritten IRRs to exceed 20%(2) $350M Mortgage Debt Plus • Target 33% reductions in required equity Allocated capital for each new AHT asset Corporate acquisition(1) Preferred • Significant AHT advantage vs. competing market bids (1) Assuming 10% ERFP commitment funded immediately at acquisition (2) Assumes equity, property debt, corporate preferred and ERFP contribution at end of year 1 9

Attractive Dividend Yield (1) 12.0% 11.0% 10.0% 8.2% 8.0% 8.0% 7.3% 7.1% 7.0% 6.9% 6.6% 6.6% 6.5% 6.3% 6.0% 5.5% 5.5% 5.3% 5.0% 4.0% 2.0% 0.0% (2) AHT APLE RLJ CLDT BHR PK INN HT Peer CHSP XHR DRH SHO PEB HST Avg. Source: Bloomberg (1) As of January 4, 2019, annualized based on most recent dividend announcement (2) Includes recent special cash dividend Peer Avg. Includes: BHR, APLE, CLDT, PK, CHSP, HT, RLJ, XHR, DRH, PEB, HST, INN, SHO 10

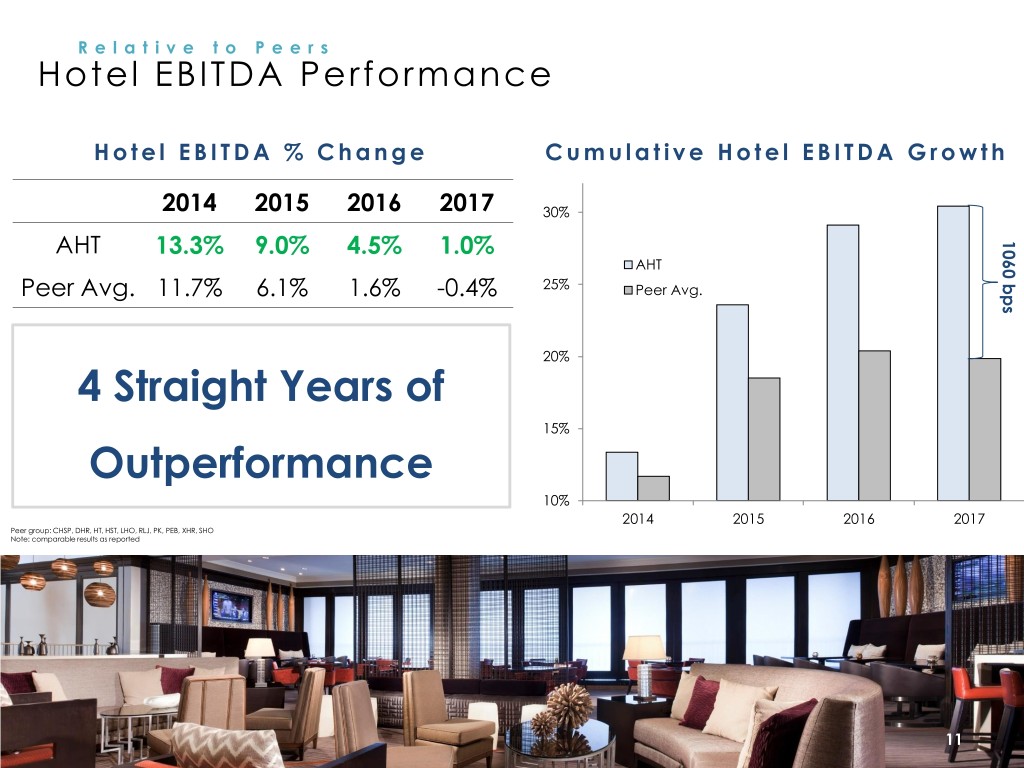

Relative to Peers Hotel EBITDA Performance H o t e l E B I T D A % C h a n g e C u m u l a t i v e H o t e l E B I T D A G r o w t h 2014 2015 2016 2017 30% AHT 13.3% 9.0% 4.5% 1.0% bps 1060 AHT Peer Avg. 11.7% 6.1% 1.6% -0.4% 25% Peer Avg. 20% 4 Straight Years of 15% Outperformance 10% 2014 2015 2016 2017 Peer group: CHSP, DHR, HT, HST, LHO, RLJ, PK, PEB, XHR, SHO Note: comparable results as reported 11

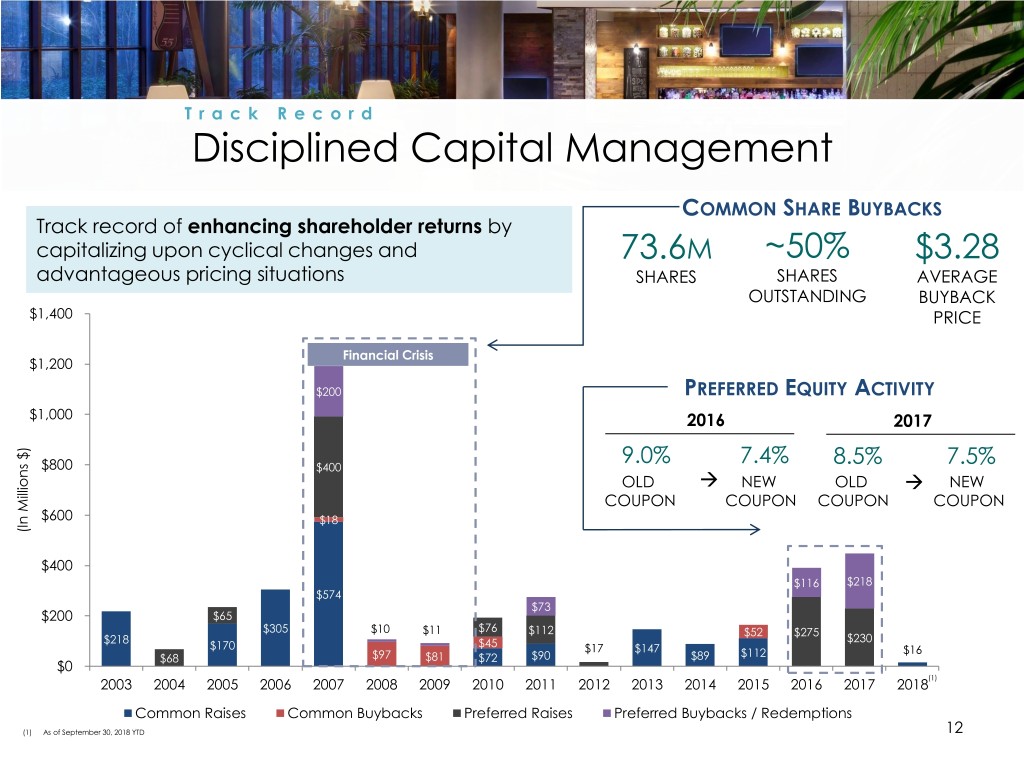

Track Record Disciplined Capital Management COMMON SHARE BUYBACKS Track record of enhancing shareholder returns by capitalizing upon cyclical changes and 73.6M ~50% $3.28 advantageous pricing situations SHARES SHARES AVERAGE OUTSTANDING BUYBACK $1,400 PRICE Financial Crisis $1,200 $200 PREFERRED EQUITY ACTIVITY $1,000 2016 2017 9.0% 7.4% 8.5% 7.5% $800 $400 OLD NEW OLD NEW COUPON COUPON COUPON COUPON $600 $18 (In Millions (In $) $400 $116 $218 $574 $73 $200 $65 $305 $10 $11 $76 $112 $52 $275 $218 $45 $230 $170 $17 $147 $16 $68 $97 $81 $72 $90 $89 $112 $0 (1) 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Common Raises Common Buybacks Preferred Raises Preferred Buybacks / Redemptions (1) As of September 30, 2018 YTD 12

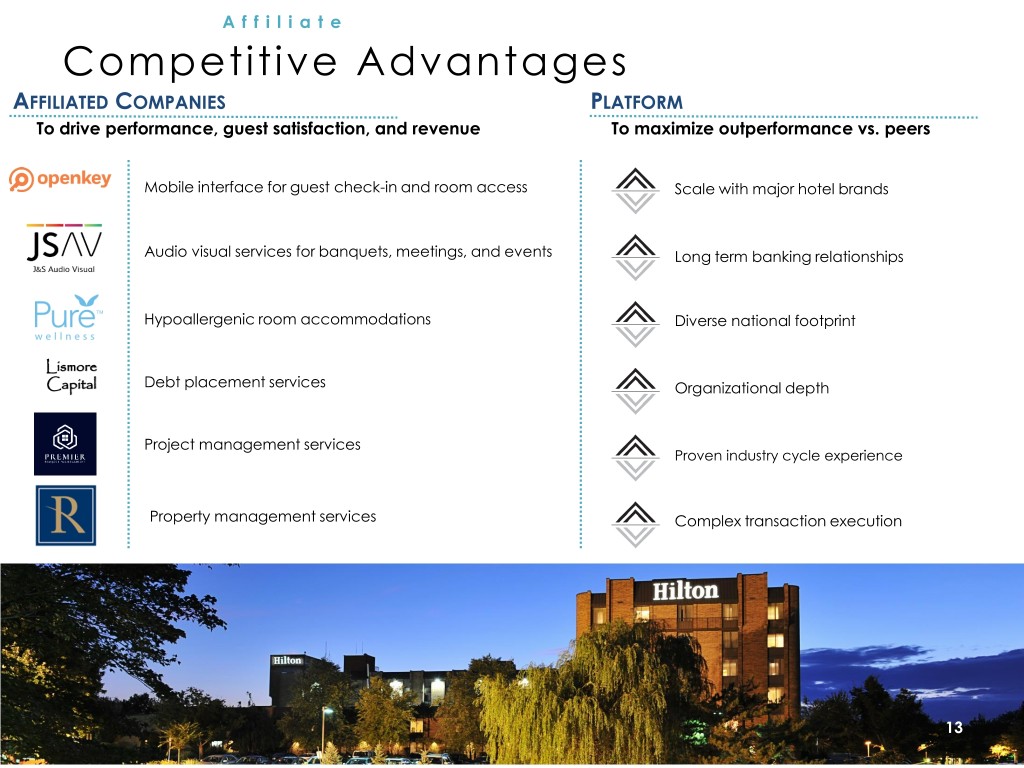

Affiliate Competitive Advantages AFFILIATED COMPANIES PLATFORM To drive performance, guest satisfaction, and revenue To maximize outperformance vs. peers Mobile interface for guest check-in and room access Scale with major hotel brands Audio visual services for banquets, meetings, and events Long term banking relationships Hypoallergenic room accommodations Diverse national footprint Debt placement services Organizational depth Project management services Proven industry cycle experience Property management services Complex transaction execution 13

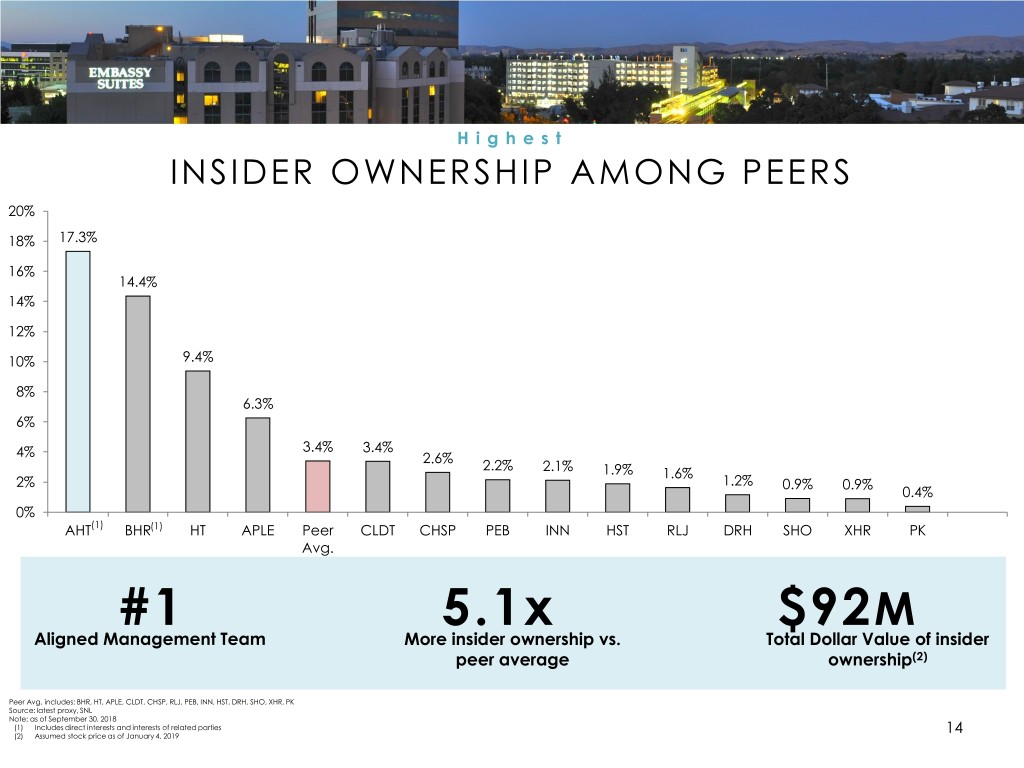

Highest INSIDER OWNERSHIP AMONG PEERS 20% 18% 17.3% 16% 14.4% 14% 12% 10% 9.4% 8% 6.3% 6% 3.4% 3.4% 4% 2.6% 2.2% 2.1% 1.9% 1.6% 2% 1.2% 0.9% 0.9% 0.4% 0% AHT(1) BHR(1) HT APLE Peer CLDT CHSP PEB INN HST RLJ DRH SHO XHR PK Avg. #1 5.1x $92M Aligned Management Team More insider ownership vs. Total Dollar Value of insider peer average ownership(2) Peer Avg. includes: BHR, HT, APLE, CLDT, CHSP, RLJ, PEB, INN, HST, DRH, SHO, XHR, PK Source: latest proxy, SNL Note: as of September 30, 2018 (1) Includes direct interests and interests of related parties 14 (2) Assumed stock price as of January 4, 2019

Transactions

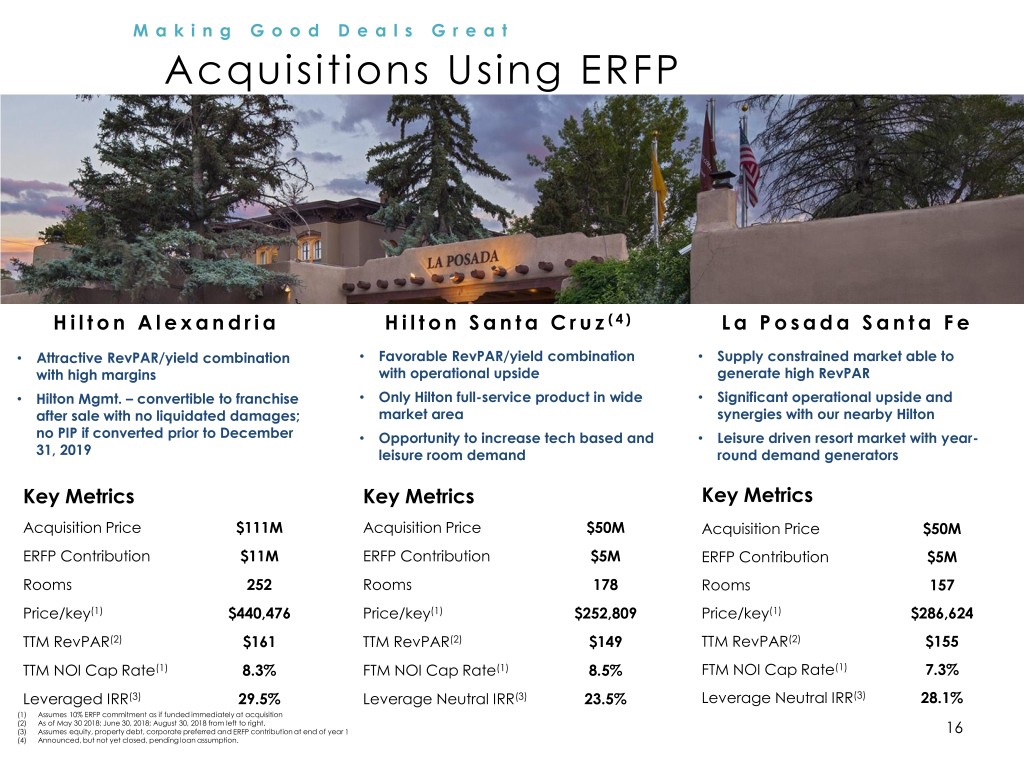

Making Good Deals Great Acquisitions Using ERFP H i l t o n A l e x a n d r i a H i l t o n S a n t a C r u z (4) L a P o s a d a S a n t a F e • Attractive RevPAR/yield combination • Favorable RevPAR/yield combination • Supply constrained market able to with high margins with operational upside generate high RevPAR • Hilton Mgmt. – convertible to franchise • Only Hilton full-service product in wide • Significant operational upside and after sale with no liquidated damages; market area synergies with our nearby Hilton no PIP if converted prior to December • Opportunity to increase tech based and • Leisure driven resort market with year- 31, 2019 leisure room demand round demand generators Key Metrics Key Metrics Key Metrics Acquisition Price $111M Acquisition Price $50M Acquisition Price $50M ERFP Contribution $11M ERFP Contribution $5M ERFP Contribution $5M Rooms 252 Rooms 178 Rooms 157 Price/key(1) $440,476 Price/key(1) $252,809 Price/key(1) $286,624 TTM RevPAR(2) $161 TTM RevPAR(2) $149 TTM RevPAR(2) $155 TTM NOI Cap Rate(1) 8.3% FTM NOI Cap Rate(1) 8.5% FTM NOI Cap Rate(1) 7.3% Leveraged IRR(3) 29.5% Leverage Neutral IRR(3) 23.5% Leverage Neutral IRR(3) 28.1% (1) Assumes 10% ERFP commitment as if funded immediately at acquisition (2) As of May 30 2018; June 30, 2018; August 30, 2018 from left to right. (3) Assumes equity, property debt, corporate preferred and ERFP contribution at end of year 1 16 (4) Announced, but not yet closed, pending loan assumption.

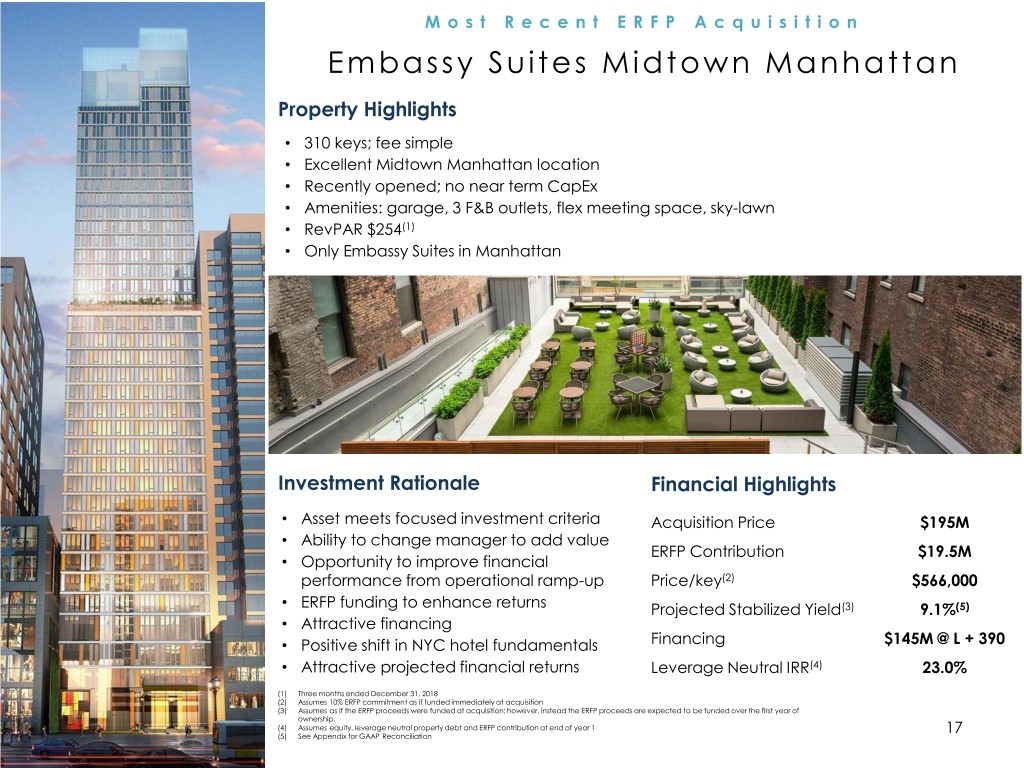

M o s t R e c e n t E R F P A c q u i s i t i o n Embassy Suites Midtown Manhattan Property Highlights • 310 keys; fee simple • Excellent Midtown Manhattan location • Recently opened; no near term CapEx • Amenities: garage, 3 F&B outlets, flex meeting space, sky-lawn • RevPAR $254(1) • Only Embassy Suites in Manhattan Investment Rationale Financial Highlights • Asset meets focused investment criteria Acquisition Price $195M • Ability to change manager to add value ERFP Contribution $19.5M • Opportunity to improve financial performance from operational ramp-up Price/key(2) $566,000 • ERFP funding to enhance returns Projected Stabilized Yield(3) 9.1%(5) • Attractive financing • Positive shift in NYC hotel fundamentals Financing $145M @ L + 390 • Attractive projected financial returns Leverage Neutral IRR(4) 23.0% (1) Three months ended December 31, 2018 (2) Assumes 10% ERFP commitment as if funded immediately at acquisition (3) Assumes as if the ERFP proceeds were funded at acquisition; however, instead the ERFP proceeds are expected to be funded over the first year of ownership. (4) Assumes equity, leverage neutral property debt and ERFP contribution at end of year 1 17 (5) See Appendix for GAAP Reconciliation

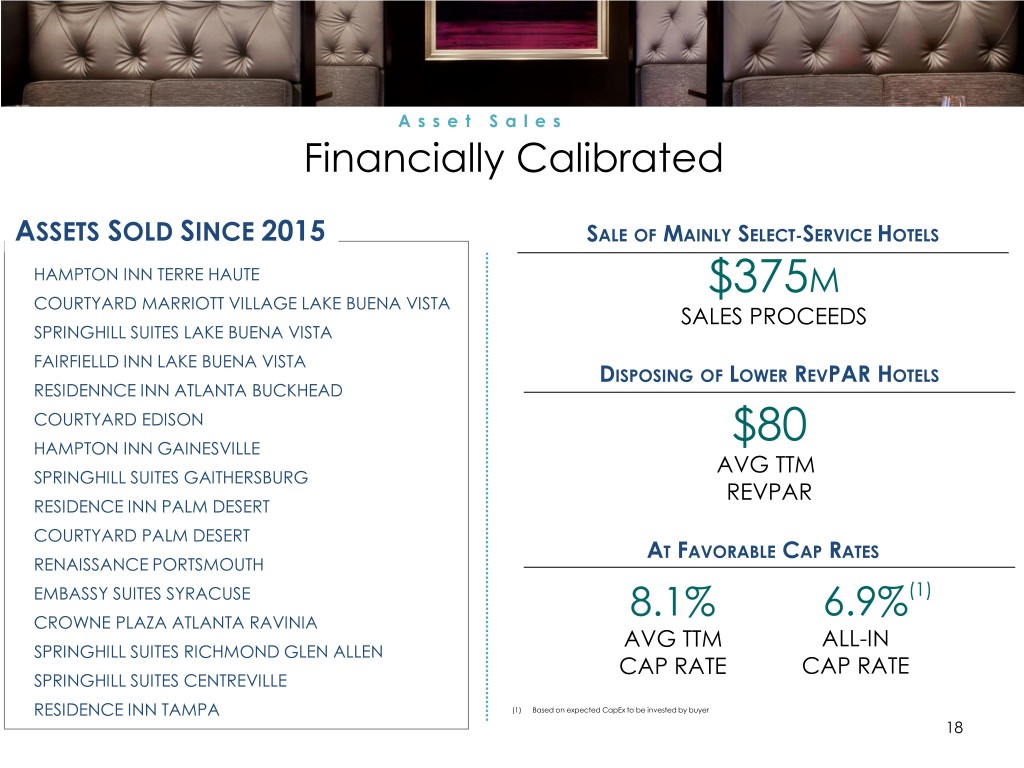

A s s e t S a l e s Financially Calibrated ASSETS SOLD SINCE 2015 SALE OF MAINLY SELECT-SERVICE HOTELS HAMPTON INN TERRE HAUTE $375M COURTYARD MARRIOTT VILLAGE LAKE BUENA VISTA SALES PROCEEDS SPRINGHILL SUITES LAKE BUENA VISTA FAIRFIELLD INN LAKE BUENA VISTA DISPOSING OF LOWER REVPAR HOTELS RESIDENNCE INN ATLANTA BUCKHEAD COURTYARD EDISON HAMPTON INN GAINESVILLE $80 AVG TTM SPRINGHILL SUITES GAITHERSBURG REVPAR RESIDENCE INN PALM DESERT COURTYARD PALM DESERT AT FAVORABLE CAP RATES RENAISSANCE PORTSMOUTH EMBASSY SUITES SYRACUSE 6.9%(1) CROWNE PLAZA ATLANTA RAVINIA 8.1% AVG TTM ALL-IN SPRINGHILL SUITES RICHMOND GLEN ALLEN CAP RATE CAP RATE SPRINGHILL SUITES CENTREVILLE RESIDENCE INN TAMPA (1) Based on expected CapEx to be invested by buyer 18

Balance Sheet

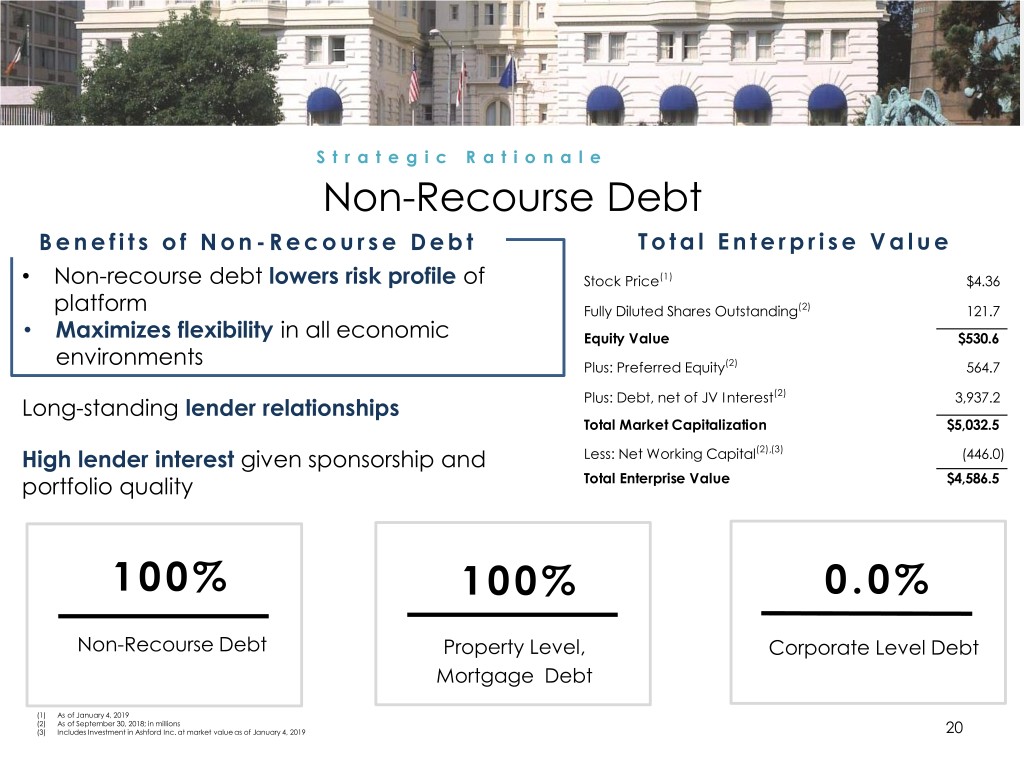

Strategic Rationale Non-Recourse Debt B e n e f i t s o f N o n - R e c o u r s e D e b t T o t a l E n t e r p r i s e V a l u e • Non-recourse debt lowers risk profile of Stock Price(1) $4.36 platform Fully Diluted Shares Outstanding(2) 121.7 • Maximizes flexibility in all economic Equity Value $530.6 environments Plus: Preferred Equity(2) 564.7 (2) Long-standing lender relationships Plus: Debt, net of JV Interest 3,937.2 Total Market Capitalization $5,032.5 High lender interest given sponsorship and Less: Net Working Capital(2),(3) (446.0) portfolio quality Total Enterprise Value $4,586.5 100% 100% 0.0% Non-Recourse Debt Property Level, Corporate Level Debt Mortgage Debt (1) As of January 4, 2019 (2) As of September 30, 2018; in millions (3) Includes Investment in Ashford Inc. at market value as of January 4, 2019 20

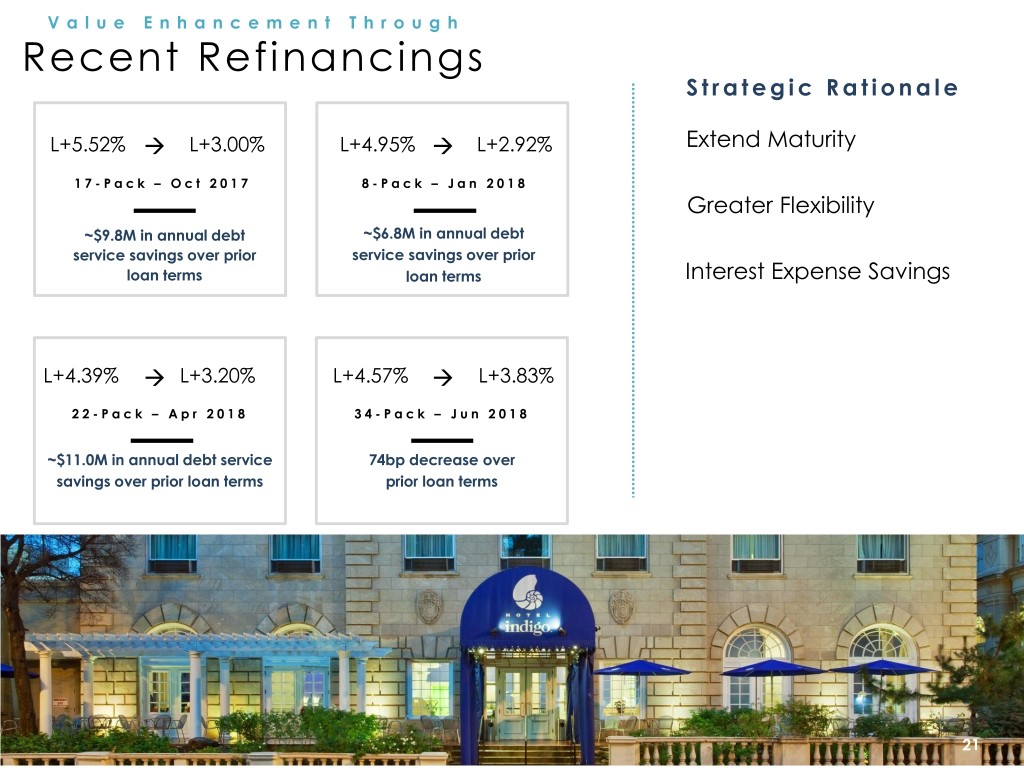

V a l u e E n h a n c e m e n t T h r o u g h Recent Refinancings S t r a t e g i c R a t i o n a l e L+5.52% L+3.00% L+4.95% L+2.92% Extend Maturity 17- P a c k – O c t 2 0 1 7 8 - P a c k – J a n 2 0 1 8 Greater Flexibility ~$9.8M in annual debt ~$6.8M in annual debt service savings over prior service savings over prior loan terms loan terms Interest Expense Savings L+4.39% L+3.20% L+4.57% L+3.83% 22- P a c k – A p r 2 0 1 8 34- P a c k – J u n 2 0 1 8 ~$11.0M in annual debt service 74bp decrease over savings over prior loan terms prior loan terms 21

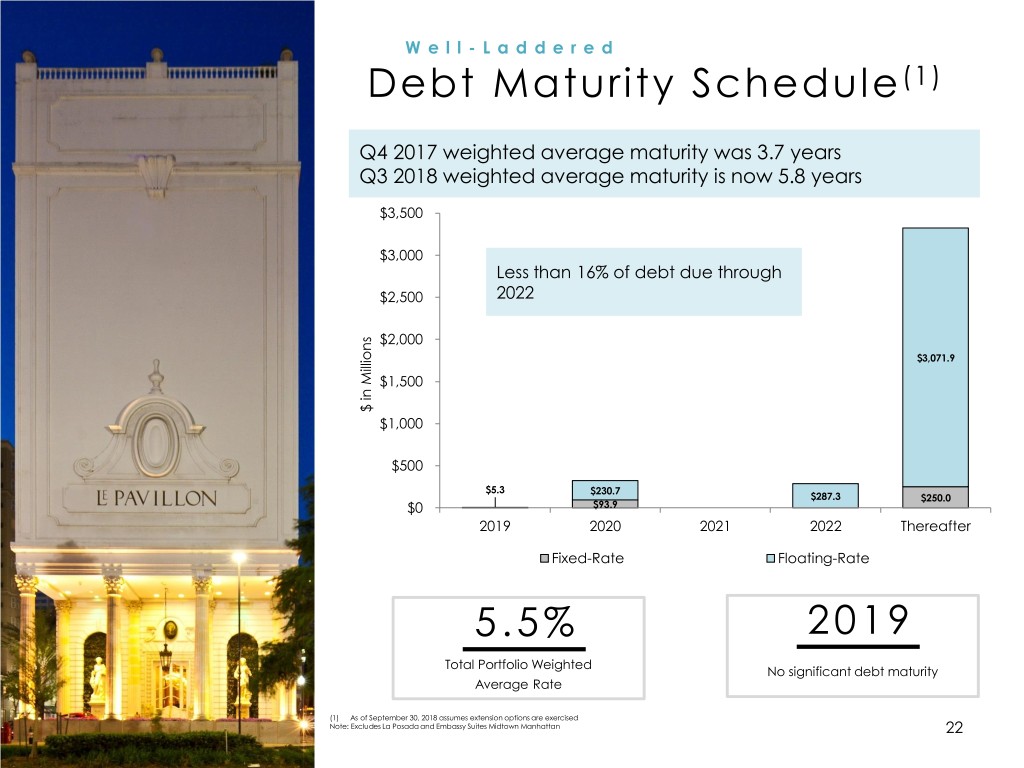

Well- Laddered Debt Maturity Schedule (1) Q4 2017 weighted average maturity was 3.7 years Q3 2018 weighted average maturity is now 5.8 years $3,500 $3,000 Less than 16% of debt due through $2,500 2022 $2,000 $3,071.9 $1,500 $ in $ Millions $1,000 $500 $5.3 $230.7 $287.3 $250.0 $0 $93.9 2019 2020 2021 2022 Thereafter Fixed-Rate Floating-Rate 5.5% 2019 Total Portfolio Weighted No significant debt maturity Average Rate (1) As of September 30, 2018 assumes extension options are exercised Note: Excludes La Posada and Embassy Suites Midtown Manhattan 22

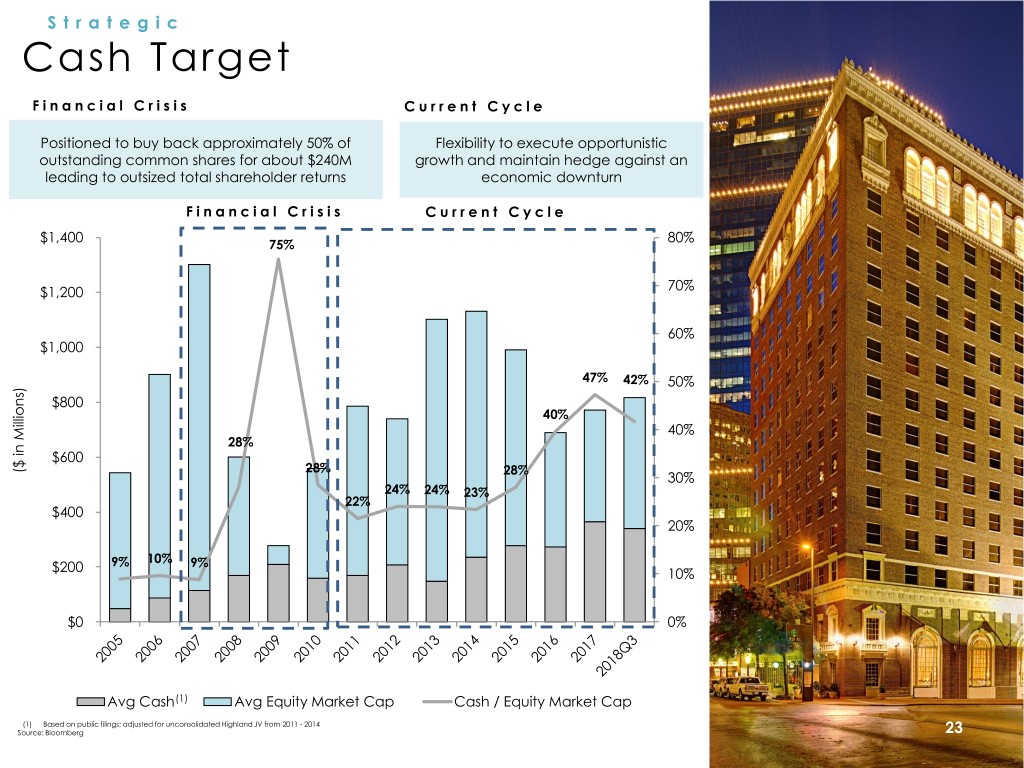

Strategic Cash Target F i n a n c i a l C r i s i s C u r r e n t C y c l e Positioned to buy back approximately 50% of Flexibility to execute opportunistic outstanding common shares for about $240M growth and maintain hedge against an leading to outsized total shareholder returns economic downturn F i n a n c i a l C r i s i s C u r r e n t C y c l e $1,400 80% 75% $1,200 70% 60% $1,000 47% 42% 50% $800 40% 40% 28% $600 ($ ($ inMillions) 28% 28% 30% 24% 24% 23% 22% $400 20% 9% 10% 9% $200 10% $0 0% Avg Cash(1) Avg Equity Market Cap Cash / Equity Market Cap (1) Based on public filings; adjusted for unconsolidated Highland JV from 2011 - 2014 Source: Bloomberg 23

Asset Management Initiatives

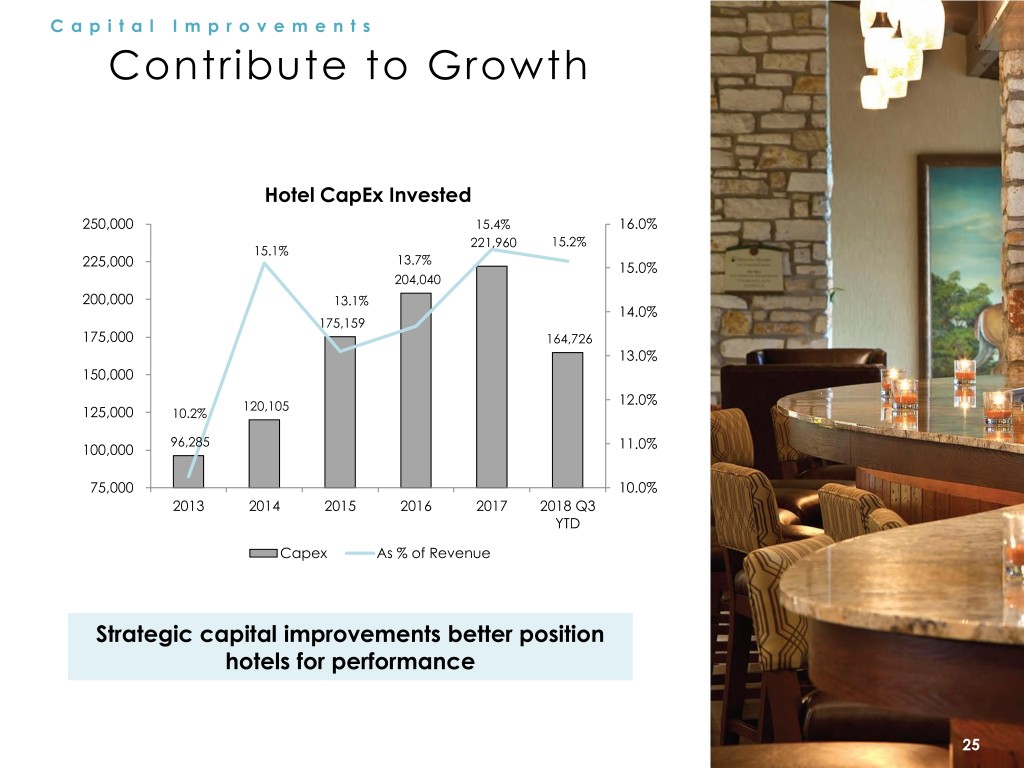

Capital Improvements Contribute to Growth Hotel CapEx Invested 250,000 15.4% 16.0% 221,960 15.2% 15.1% 13.7% 225,000 15.0% 204,040 200,000 13.1% 14.0% 175,159 175,000 164,726 13.0% 150,000 120,105 12.0% 125,000 10.2% 96,285 100,000 11.0% 75,000 10.0% 2013 2014 2015 2016 2017 2018 Q3 YTD Capex As % of Revenue Strategic capital improvements better position hotels for performance 25

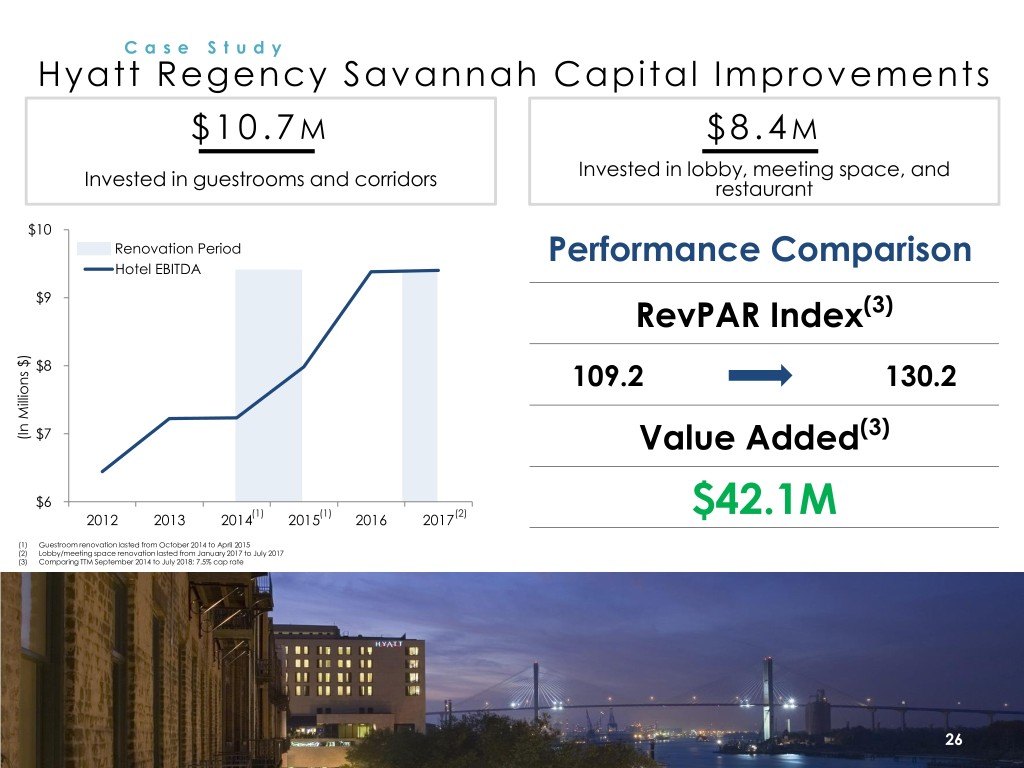

C a s e S t u d y Hyatt Regency Savannah Capital Improvements $ 1 0 . 7 M $ 8 . 4 M Invested in lobby, meeting space, and Invested in guestrooms and corridors restaurant $10 Renovation Period Performance Comparison Hotel EBITDA $9 RevPAR Index(3) $8 109.2 130.2 (3) (In Millions (In $) $7 Value Added $6 (1) (1) (2) 2012 2013 2014 2015 2016 2017 $42.1M (1) Guestroom renovation lasted from October 2014 to April 2015 (2) Lobby/meeting space renovation lasted from January 2017 to July 2017 (3) Comparing TTM September 2014 to July 2018; 7.5% cap rate 26

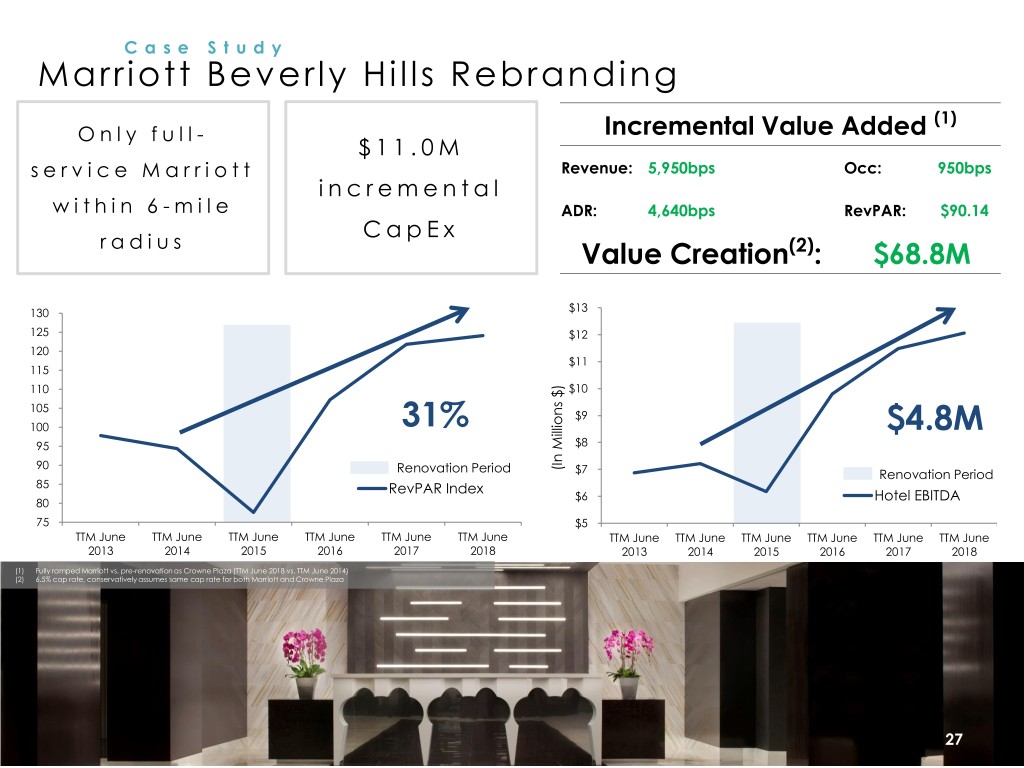

C a s e S t u d y Marriott Beverly Hills Rebranding (1) O n l y f u l l - Incremental Value Added $ 1 1 . 0 M s e r v i c e M a r r i o t t Revenue: 5,950bps Occ: 950bps i n c r e m e n t a l w i t h i n 6 - m i l e ADR: 4,640bps RevPAR: $90.14 C a p E x r a d i u s Value Creation(2): $68.8M 130 $13 125 $12 120 $11 115 110 $10 105 $9 100 31% $4.8M 95 $8 90 Renovation Period Millions (In $) $7 Renovation Period 85 RevPAR Index $6 Hotel EBITDA 80 75 $5 TTM June TTM June TTM June TTM June TTM June TTM June TTM June TTM June TTM June TTM June TTM June TTM June 2013 2014 2015 2016 2017 2018 2013 2014 2015 2016 2017 2018 (1) Fully ramped Marriott vs. pre-renovation as Crowne Plaza (TTM June 2018 vs. TTM June 2014) (2) 6.5% cap rate, conservatively assumes same cap rate for both Marriott and Crowne Plaza 27

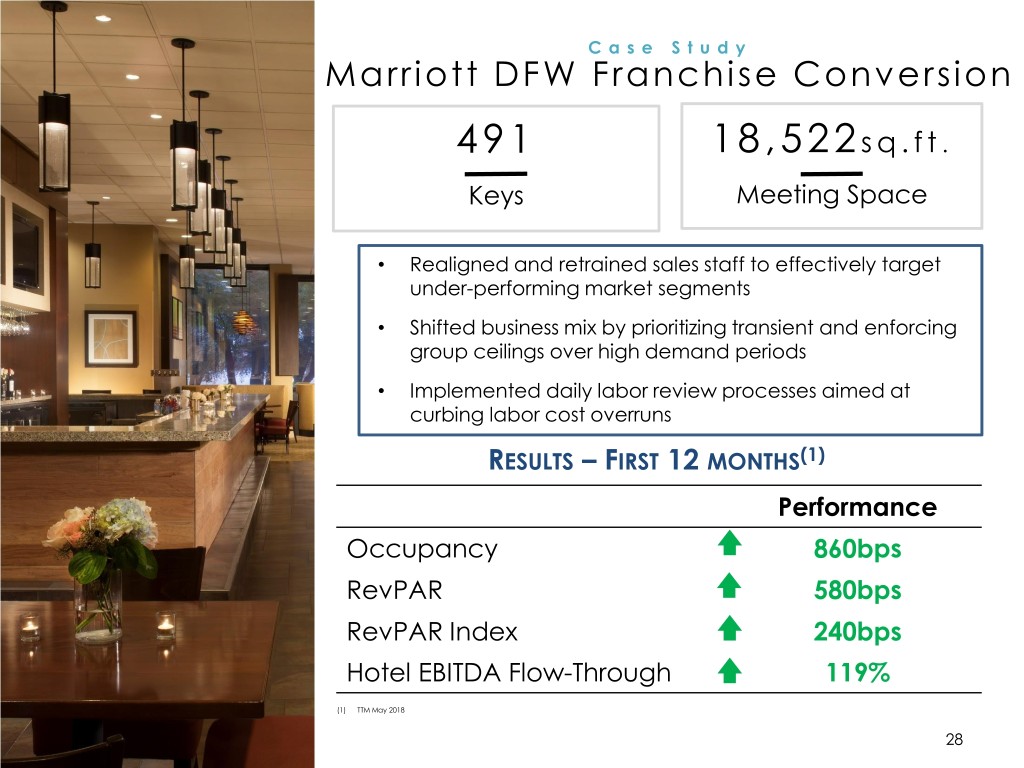

C a s e S t u d y Marriott DFW Franchise Conversion 491 18,522 s q . f t . Keys Meeting Space • Realigned and retrained sales staff to effectively target under-performing market segments • Shifted business mix by prioritizing transient and enforcing group ceilings over high demand periods • Implemented daily labor review processes aimed at curbing labor cost overruns RESULTS – FIRST 12 MONTHS(1) Performance Occupancy 860bps RevPAR 580bps RevPAR Index 240bps Hotel EBITDA Flow-Through 119% (1) TTM May 2018 28

Opportunity Revenue Initiatives Implementing aggressive strategy to increase ancillary revenue $2.2M $3.7M $400K $4.6M Resort Fee Parking Early Arrival/ Other Charge Late Departure Total Added Revenue(1): $10.9M (1) Estimated annual revenue 29

Valuation

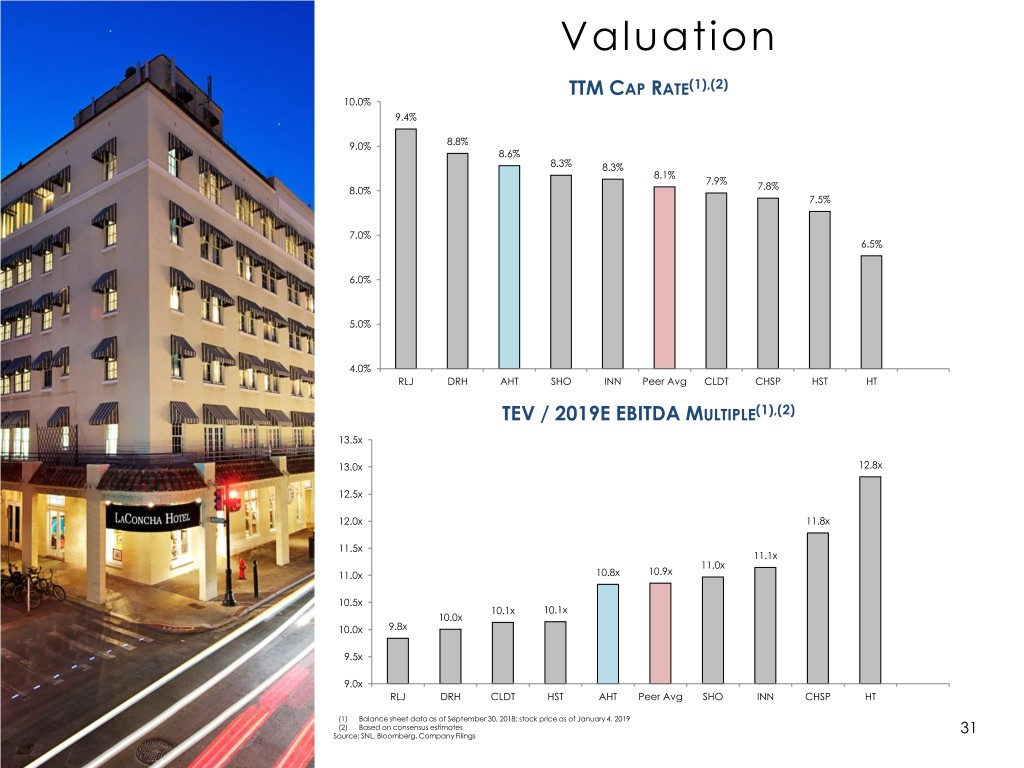

Valuation TTM CAP RATE(1),(2) 10.0% 9.4% 9.0% 8.8% 8.6% 8.3% 8.3% 8.1% 7.9% 8.0% 7.8% 7.5% 7.0% 6.5% 6.0% 5.0% 4.0% RLJ DRH AHT SHO INN Peer Avg CLDT CHSP HST HT TEV / 2019E EBITDA MULTIPLE(1),(2) 13.5x 13.0x 12.8x 12.5x 12.0x 11.8x 11.5x 11.1x 11.0x 11.0x 10.8x 10.9x 10.5x 10.1x 10.1x 10.0x 10.0x 9.8x 9.5x 9.0x RLJ DRH CLDT HST AHT Peer Avg SHO INN CHSP HT (1) Balance sheet data as of September 30, 2018; stock price as of January 4, 2019 (2) Based on consensus estimates Source: SNL, Bloomberg, Company Filings 31

STRATEGIC FOCUS PORTFOLIO QUALITY ERFP PROGRAM DIVIDEND YIELD Reasons to Own Ashford Hospitality Trust ASSET MANAGEMENT TRACK RECORD AFFILIATE ADVANTAGES INSIDER OWNERSHIP

APPENDIX

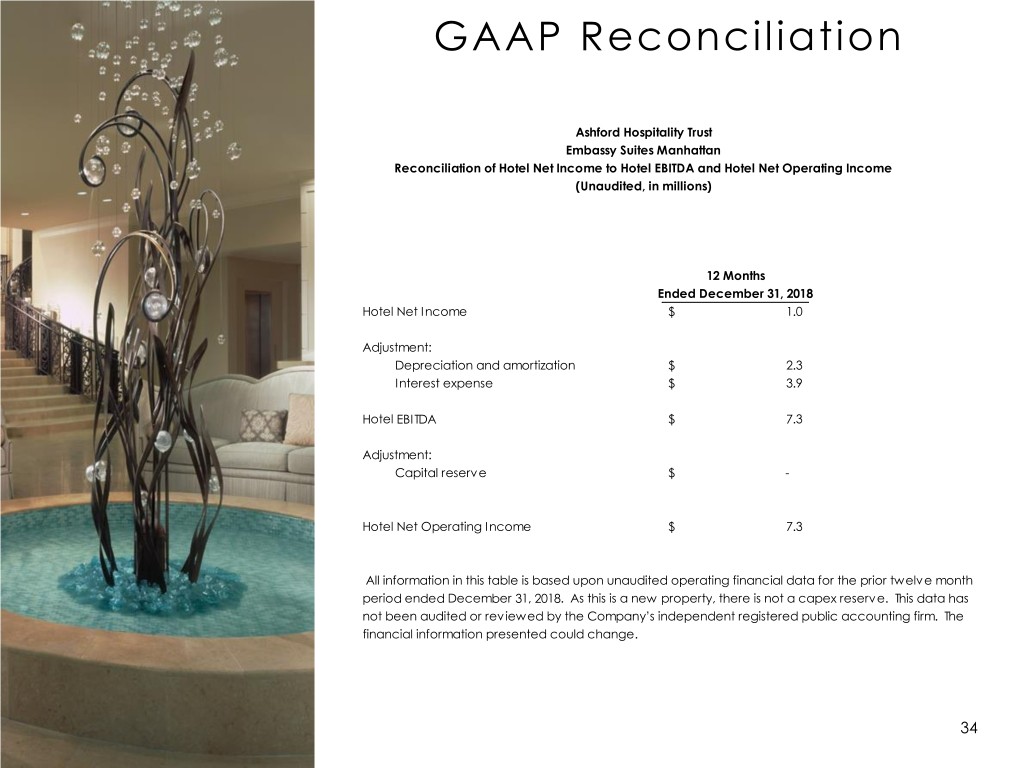

GAAP Reconciliation Ashford Hospitality Trust Embassy Suites Manhattan Reconciliation of Hotel Net Income to Hotel EBITDA and Hotel Net Operating Income (Unaudited, in millions) 12 Months Ended December 31, 2018 Hotel Net Income $ 1.0 Adjustment: Depreciation and amortization $ 2.3 Interest expense $ 3.9 Hotel EBITDA $ 7.3 Adjustment: Capital reserve $ - Hotel Net Operating Income $ 7.3 All information in this table is based upon unaudited operating financial data for the prior twelve month period ended December 31, 2018. As this is a new property, there is not a capex reserve. This data has not been audited or reviewed by the Company’s independent registered public accounting firm. The financial information presented could change. 34

January 2019