Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - HALOZYME THERAPEUTICS, INC. | ex991jpm1919pressrelease.htm |

| 8-K - 8-K - HALOZYME THERAPEUTICS, INC. | a8-kjpm2019.htm |

37th Annual J.P. Morgan Healthcare Conference Building a Premier Oncology Biotech Dr. Helen Torley, President and CEO January 9, 2019

Forward-Looking Statements All of the statements in this presentation that are not statements of historical facts constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Examples of such statements include possible activity, benefits and attributes of PEGPH20, future product development and regulatory events and goals, anticipated clinical trial results and strategies, product collaborations, our business intentions and financial estimates and results, including projected revenue amounts. These statements are based upon management’s current plans and expectations and are subject to a number of risks and uncertainties which could cause actual results to differ materially from such statements. A discussion of the risks and uncertainties that can affect these statements is set forth in the Company’s annual and quarterly reports filed from time to time with the Securities and Exchange Commission under the heading “Risk Factors.” The Company disclaims any intention or obligation to revise or update any forward-looking statements, whether as a result of new information, future events, or otherwise. 1

Two Engines for Growth ENHANZE® PEGPH20 Proven ‘IV to Sub Q’ Late Stage Targeted Partnering Platform Oncology Asset Phase 3 Data Accelerating Partner Readout Currently Investment for Approvals Projected in 2H 2019 High Potential: Potential ~$1B Global ~$1B Annual Royalty Pancreas Indication Revenue Projection in 2027 with Additional Pan- ~$1B in Lifetime Milestones tumor Potential 2

Significant Value Creating Events in 2018 ENHANZE® PEGPH20 • Daratumumab SC trials targeting ~2,000 • HALO-301 enrollment completed multiple myeloma patients now initiated • Agreement reached with FDA on • De-risking progress to Phase III primary endpoint: Overall Survival – Darzalex® – Perjeta ® /Herceptin ® • Continue to expand potential – 6 new targets in Phase 1 – Roche agreement expansion: 3 additional targets Capabilities FINANCIAL • Acceleration of time to Phase 1 start: • Strong cash balance exiting 2018: 6 months $340M-350M • Expanded support to 2 new ENHANZE partners 3

ENHANZE® 4

ENHANZE® Offers Four Potential Paths for Differentiation and Value Creation for Partners Reduced Treatment Burden 1 and Healthcare Costs Darzalex® ALXN 1210 2 Potential for Competitive Differentiation BMS I/O Portfolio 3 New Intellectual Property and Exclusivity Darzalex® Changing U.S. Reimbursement OPDIVO® 4 and Care Landscape 5

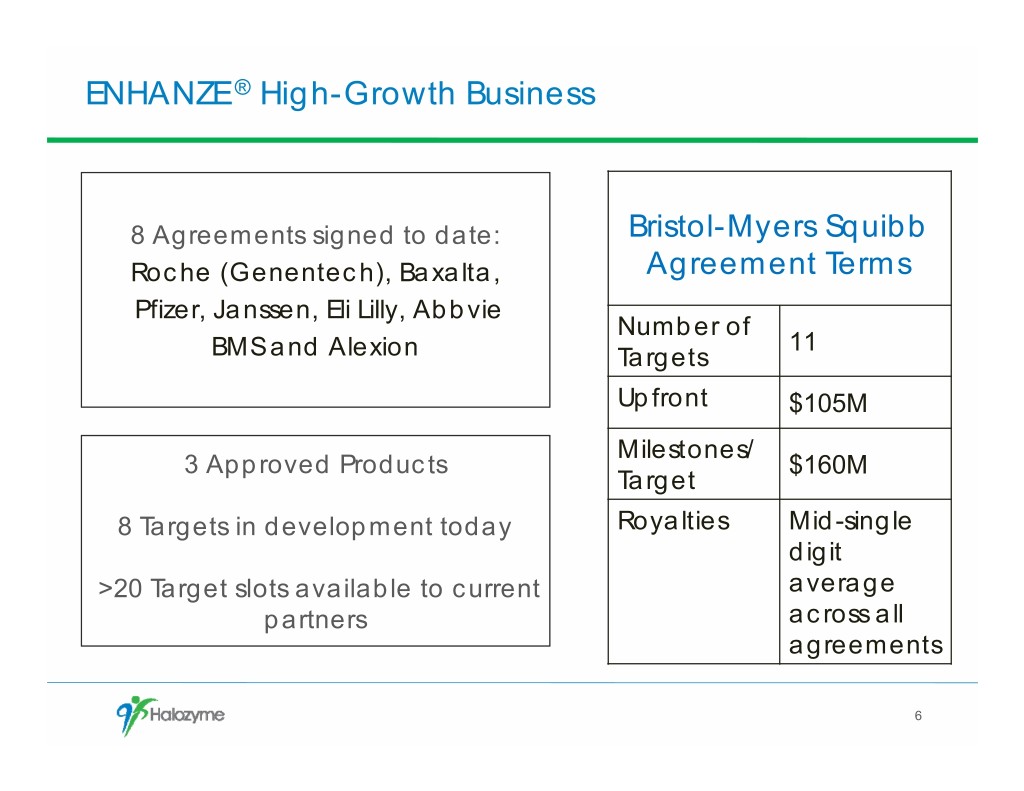

ENHANZE ® High-Growth Business 8 Agreements signed to date: Bristol-Myers Squibb Roche (Genentech), Baxalta, Agreement Terms Pfizer, Janssen, Eli Lilly, Abbvie Number of 11 BMS and Alexion Targets Upfront $105M Milestones/ 3 Approved Products $160M Target 8 Targets in development today Royalties Mid-single digit >20 Target slots available to current average partners across all agreements 6

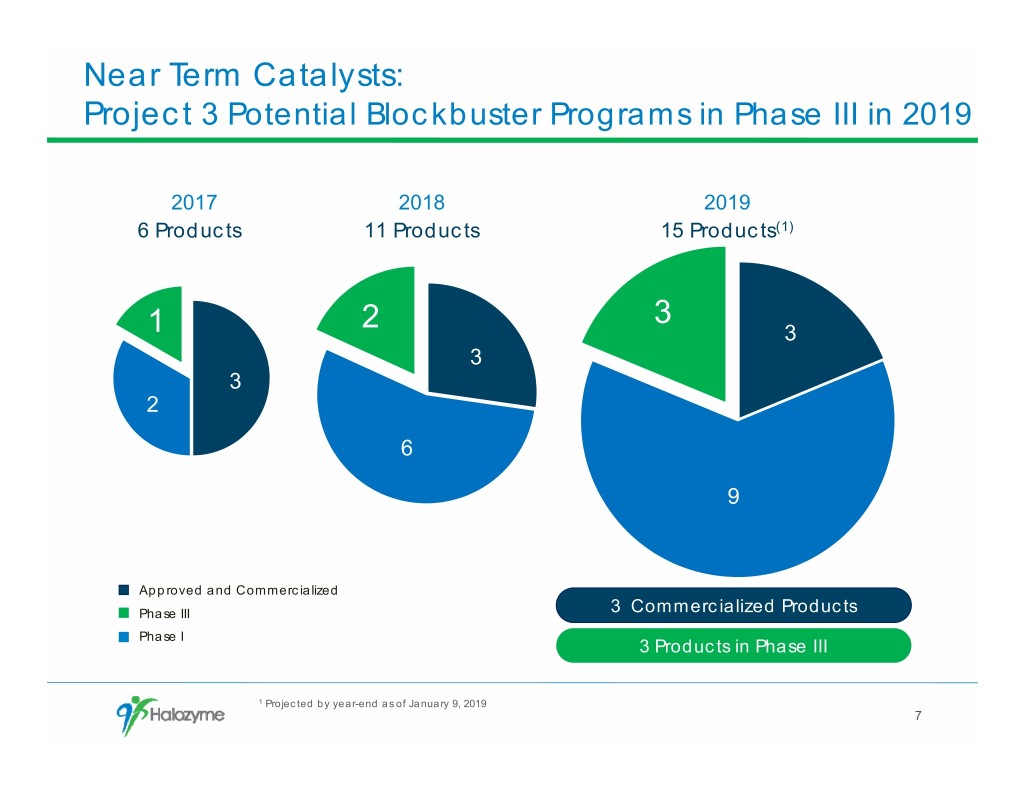

Near Term Catalysts: Project 3 Potential Blockbuster Programs in Phase III in 2019 2017 2018 2019 6 Products 11 Products 15 Products(1) 3 1 2 3 3 3 2 6 9 Approved and Commercialized Phase III 3 Commercialized Products Phase I 3 Products in Phase III 1 Projected by year-end as of January 9, 2019 7

Three Products Successfully Commercialized in Global Markets US ROW SC Formulation of Herceptin® FDA Action March 2019 8

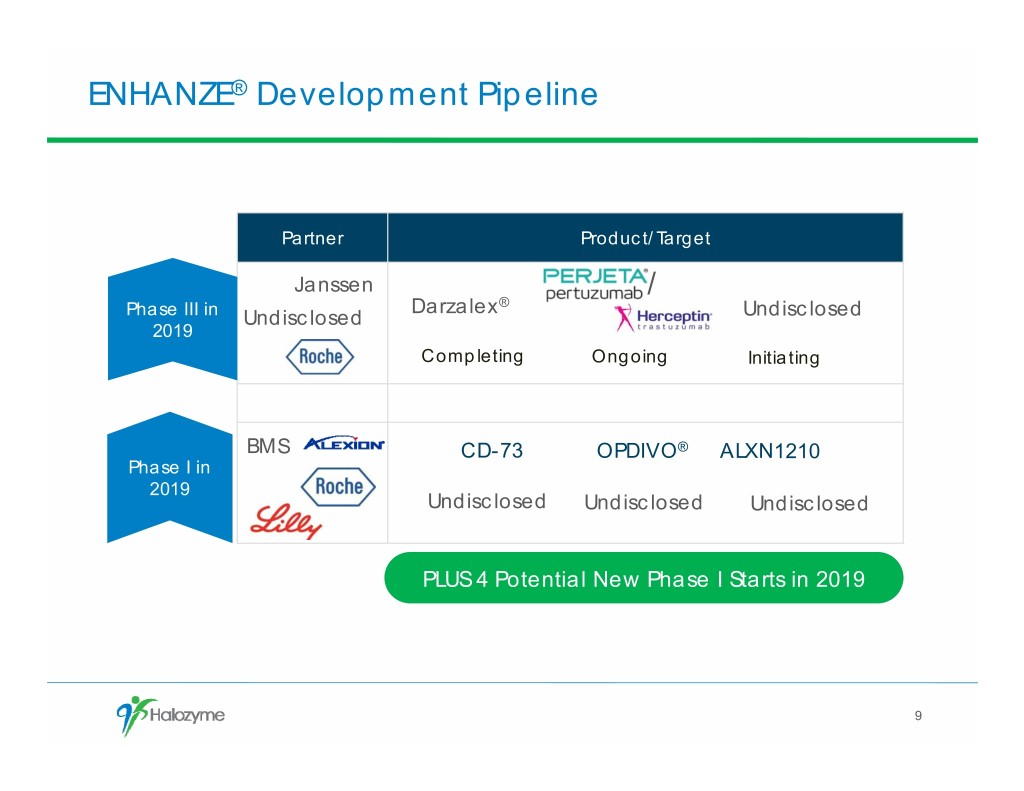

ENHANZE® Development Pipeline Partner Product/Target Janssen / Darzalex® Phase III in Undisclosed Undisclosed 2019 Completing Ongoing Initiating BMS CD-73 OPDIVO® ALXN1210 Phase I in 2019 Undisclosed Undisclosed Undisclosed PLUS 4 Potential New Phase I Starts in 2019 9

Daratumumab IV: Blockbuster Multiple Myeloma Treatment Early Launch Data Compares Analyst Estimates for Darzalex® Favorably with Other Multiple Myeloma Drug Launches ($ Millions) ($ Millions) Darzalex® 8000 2000 Empliciti® 7000 Kyprolis® 6000 1500 Ninlaro® Pomalyst® 5000 Revlimid® 4000 1000 3000 2000 500 1000 0 0 2018 2019 2020 2021 2022 2023 2024 2025 1234Year 1 2 3 Source: Analyst estimates via Nasdaq IR Insight Source: Bloomberg, company press releases • Sell-side analysts estimate >$7 billion in sales by 2025 • IV therapy, administered by infusion, initially as weekly regimen 10

Daratumumab SC: Potential Regulatory Submissions in 2H 2019 Timeline • Janssen anticipates filing regulatory submissions in H2 2019(1) Potential Benefits of Subcutaneous Formulation(2) • Faster infusion time (3-5 minutes)(3) • Well tolerated with fewer infusion related reactions (IRRs) than with IV(4) 4 Ongoing Phase 3 Trials(2) with ORR = overall response rate; PR = partial response; VGPR = very good partial response ® ENHANZE Median follow-up(4) PAVO Study: an open-label, multicenter, phase 1b clinical trial conducted patients with relapsed/refractory multiple myeloma (n=25) to evaluate a subcutaneous (SC) formulation of DARA with ENHANZE® 1 Johnson and Johnson Pharmaceutical Business Review (September 13, 2018) 2 Genmab corporate presentations (Jeffries November 2018, R&D Update and 2018 ASH Data Review December 2018) 3 Subcutaneous Delivery of Daratumumab in Patients with Relapsed or Refractory Multiple Myeloma Pavo, an Open-Label, Multicenter, Dose Escalation Phase 1b Study (Blood 2017) 4 Subcutaneous Daratumumab in Patients With Relapsed or Refractory Multiple Myeloma: Part 2 Safety and Efficacy Update of the Open-label, Multicenter, Phase 1b Study (PAVO) Ajai Chari et al (ASH December 2018) 11

Perjeta®/Herceptin® Fixed Dose Combination with ENHANZE®: Potential Regulatory Submissions 2020 Potential Opportunity ® • PERJETA indicated for use Value proposition of Perjeta®/Herceptin® with Herceptin and Fixed Dose SC with ENHANZE (3) chemotherapy for adjuvant treatment of patients with 3 HER2+ early-stage breast cancer (EBC) at high risk of recurrence • Target population size(2): ~72,000 in US and EU 5 • Strong IV adoption since launch: ~40% share in high risk early breast cancer(1) 1 Roche nine-month 2018 sales presentation and investor conference call (October 17, 2018) 2 Roche presentation, Exane BNP Paribas Conference, June 2017. Datamonitor and internal estimates, US & EU5; Target population for Herceptin in adjuvant breast cancer (US & EU5) 12 3 Roche Virtual Late Stage Pipeline Event 2018 presentation (September 18, 2019)

Increasing Commercialization Activities to Support Expected ENHANZE® Launches Facilitating Rapid Global Commercialization by Partners • PH20 API: expect to deliver 1.8 Million doses(1) in response to partner orders in 2019 • Highest demand in our history • Support regulatory submissions in ~50 countries(1) and provide rapid response to health authority questions 1 Halozyme Therapeutics. Inc. internal estimate 13

ENHANZE®: ~$1B Royalty Revenue Potential in 2027 2019-2021 Potential Cumulative ~$1 Billion Milestones = $225M-$300M All other partner products Royalties derived from products in phase 3 (2019) Herceptin, Rituximab, HyQvia 2018 2027 Projection based on approved products and assumes global approval and launches for 7 additional products in multiple indications. Includes projections for subcutaneous versions of targets not currently approved or commercially available. Innovator revenues based on Bloomberg analyst projections, when available. Conversion rates based on Halozyme internal projections. Royalty revenue projection includes targets selected but not yet disclosed. Projected royalty revenue is not risk–adjusted. 14

ENHANZE®: Royalties Already Exceed ENHANZE-only Operating Expenses 2019-2021 Potential Cumulative ~$1 Billion Milestones = $225M-$300M All other partner products Royalties derived from products in phase 3 (2019) ENHANZE-only Operating Expense Herceptin, Rituximab, HyQvia 2018 2027 Projection based on approved products and assumes global approval and launches for 7 additional products in multiple indications. Includes projections for subcutaneous versions of targets not currently approved or commercially available. Innovator revenues based on Bloomberg analyst projections, when available. Conversion rates based on Halozyme internal projections. Royalty revenue projection includes targets selected but not yet disclosed. Projected royalty revenue is not risk–adjusted. Operating expense represents pro-forma expenses that exclude COGS, and all costs related to Hylenex and PEGPH20. 15

Accelerating ENHANZE ® Growth Daratumumab Potential Approval 12 Targets in SC Regulatory for Herceptin BLA Development Submissions in 2H Existing in March 2019 in 2019 Partnerships 2019 Potential in Oncology, Pool of Potential New Rare Diseases, Blood Partners and Targets Disorders, Immunology, New Remains Sizable Partnerships CNS and more 16

PEGPH20 17

Tumor HA Overexpression Associated with Shorter Survival in Pancreas Cancer Retrospective Evaluation of Pancreatic Cancer Survival in ~50 Patients(1) HA-Low Median Survival: 24.3 months HA-High Median Survival: 9.3 months H.R. 2.6 p=0.037 1 Whatcott et al: Clin Cancer Res 2015, 21:3561-3568. HA staining by HABP. Scoring algorithm assessed percent staining and intensity. 18

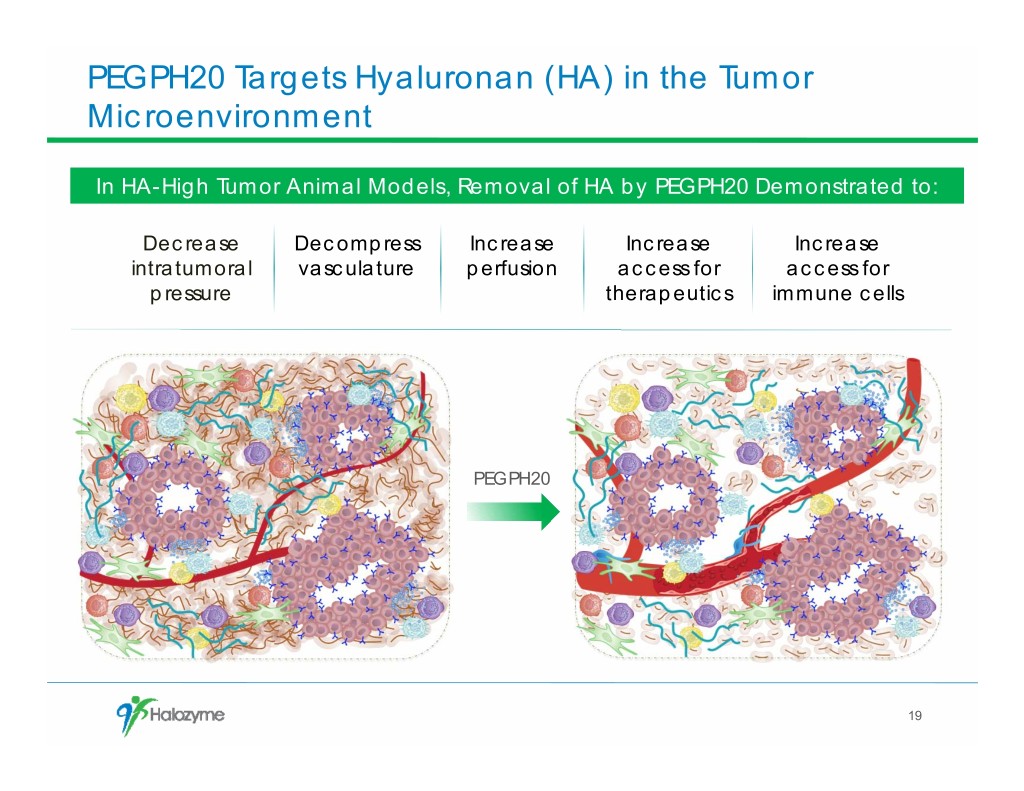

PEGPH20 Targets Hyaluronan (HA) in the Tumor Microenvironment In HA-High Tumor Animal Models, Removal of HA by PEGPH20 Demonstrated to: Decrease Decompress Increase Increase Increase intratumoral vasculature perfusion access for access for pressure therapeutics immune cells PEGPH20 19

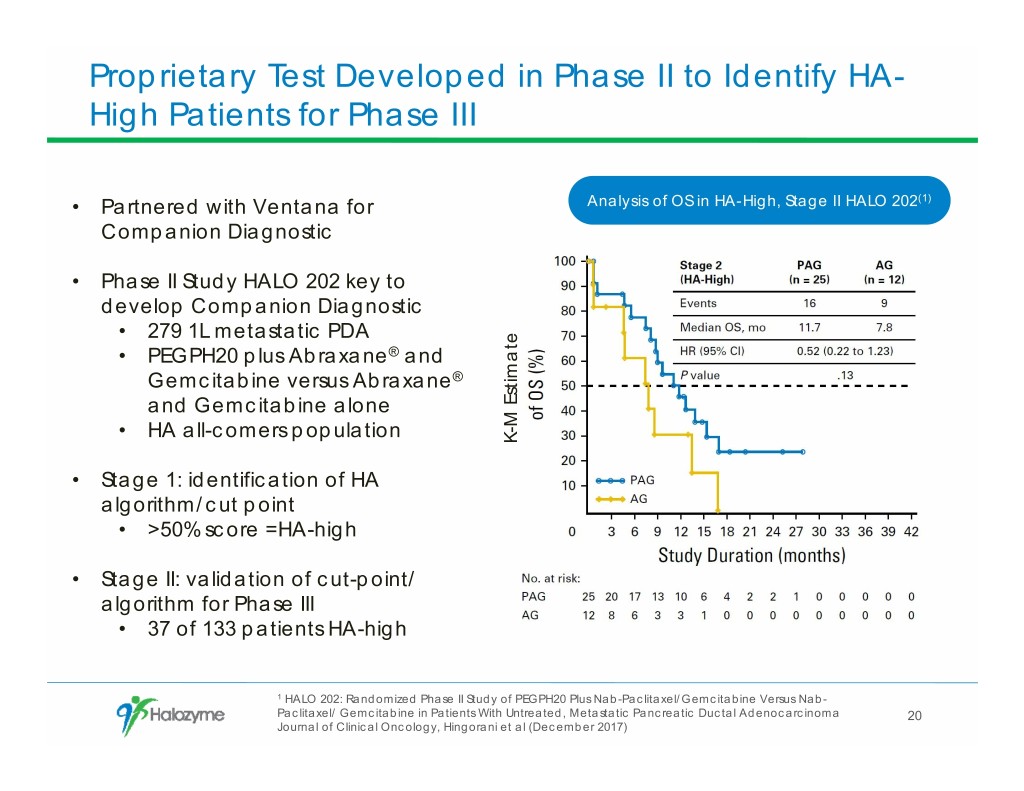

Proprietary Test Developed in Phase II to Identify HA- High Patients for Phase III • Partnered with Ventana for Analysis of OS in HA-High, Stage II HALO 202(1) Companion Diagnostic • Phase II Study HALO 202 key to develop Companion Diagnostic • 279 1L metastatic PDA • PEGPH20 plus Abraxane® and Gemcitabine versus Abraxane® and Gemcitabine alone • HA all-comers population K-M Estimate • Stage 1: identification of HA algorithm/cut point • >50% score =HA-high • Stage II: validation of cut-point/ algorithm for Phase III • 37 of 133 patients HA-high 1 HALO 202: Randomized Phase II Study of PEGPH20 Plus Nab-Paclitaxel/Gemcitabine Versus Nab- Paclitaxel/ Gemcitabine in Patients With Untreated, Metastatic Pancreatic Ductal Adenocarcinoma 20 Journal of Clinical Oncology, Hingorani et al (December 2017)

Pancreas Cancer HALO-301: Enrollment Complete with Approximately 500 Patients Global Phase 3 Trial Now Fully Enrolled: ~500 Patients PEGPH20 + ABRAXANE® 1L Metastatic + gemcitabine (PAG) PDA Primary Endpoint: High-HA • Overall Survival (OS) patients ABRAXANE® + gemcitabine N=~500 (AG) + placebo Project to achieve target number of OS events between August and November 2019, triggering final data cleaning and analysis 21

Final Analysis Plan for HALO-301: Single Primary Endpoint of Overall Survival • Fixed sample size with target number of OS events: 330 • Mature dataset supporting best test of PEGPH20 – All patient follow up of at least 8.5 months – <10% patients less than 13 months • Well powered trial – 93% power for HR = 0.67 – Minimal observable difference HR = 0.795 (e.g. median difference of 2.2 months) 22

~$1B Potential Opportunity in Pancreas Cancer 65,000 Annual Diagnosed Metastatic Pancreatic Ductal Adenocarcinoma (PDA) U.S. and EU 5(1) ~$1B ~$1B Potential Global Sales Opportunity by 2027 in HA-High 25,000 Metastatic PDA(3) Estimated Number of HA-High Patients 35–40% of Population(2) 1 SEER 18 2006-2012, Globocan 2012, DRG Epidemiology data. 2 Halozyme estimates for HA-High %. 23 3 DRG Epidemiology data, Halozyme internal estimates.

Ongoing Studies Evaluating Pan-tumor Potential of PEGPH20 Tumor Stage Status Pancreas Cancer, Gastric Cancer Gall Bladder Cancer, Cholangiocarcinoma 24

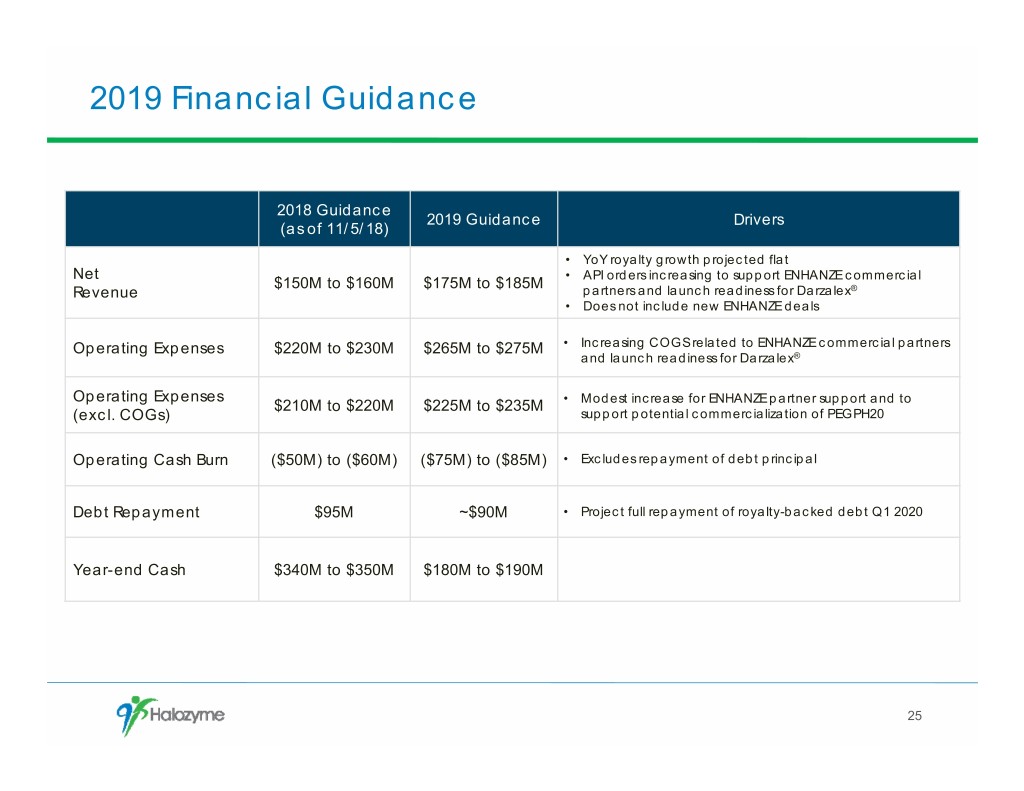

2019 Financial Guidance 2018 Guidance 2019 Guidance Drivers (as of 11/5/18) • YoY royalty growth projected flat Net • API orders increasing to support ENHANZE commercial $150M to $160M $175M to $185M Revenue partners and launch readiness for Darzalex® • Does not include new ENHANZE deals Operating Expenses $220M to $230M $265M to $275M • Increasing COGS related to ENHANZE commercial partners and launch readiness for Darzalex® Operating Expenses $210M to $220M $225M to $235M • Modest increase for ENHANZE partner support and to (excl. COGs) support potential commercialization of PEGPH20 Operating Cash Burn ($50M) to ($60M) ($75M) to ($85M) • Excludes repayment of debt principal Debt Repayment $95M ~$90M • Project full repayment of royalty-backed debt Q1 2020 Year-end Cash $340M to $350M $180M to $190M 25

Outlook • Growing ENHANZE momentum – ~$1 billion in annual royalty revenue potential by 2027 – Multiple near-term catalysts in a high margin business • Each pillar offers strong potential upside – ENHANZE: New deals plus up to $1 billion in lifetime milestones – PEGPH20: ~$1 billion global sales opportunity in pancreas cancer • Each pillar has been incrementally de-risked: – ENHANZE: 3 approved products, Herceptin® SC upcoming FDA action and Darzalex® SC regulatory submissions in 2H 2019 – PEGPH20: HALO-301 fully enrolled • Expect to end 2019 in strong financial position – Projected post-301 cash balance provides operational flexibility 26

37th Annual J.P. Morgan Healthcare Conference Building a Premier Oncology Biotech Dr. Helen Torley, President and CEO January 9, 2019