Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Riley Exploration Permian, Inc. | form8k.htm |

Exhibit 99.1

Annual Shareholders MeetingDecember 11, 2018 TENGASCO, INC. 1

Annual Shareholders Meeting – December 11, 2018Outline of Presentation Directors and OfficersForward

Looking StatementsSignificant Activities Since The Last Shareholders MeetingOil PricesCapital Spending and Drilling ResultsKansas ProductionBorrowings on Credit FacilityFinancial ReviewNine months ended September 30, 2018 and 2017Year ended

December 31, 2017 and 20162019 OutlookResults of VotingShareholder Questions 2

Annual Shareholders Meeting – December 11, 2018Directors and Officers Peter SalasDirector, Chairman of

the BoardElected to the Board in 2002 and as Chairman of the Board in 2004Matt BehrentDirector, Chairman of the Audit Committee, member of the Compensation CommitteeElected to the Board in 2007Rich ThonDirector, Chairman of the Compensation

Committee, member of the Audit Committee, Elected to the Board in 2013Mike RugenCFO since 2009 and Interim CEO since 2013Cary SorensenVP, General Counsel, and Corporate Secretary since 1999 3

Forward Looking StatementsExcept for the historical information contained in this review, the matters

discussed in this presentation are forward-looking statements within the meaning of applicable securities laws, that are based upon current expectations. Important factors that could cause actual results to differ materially from those in the

forward-looking statements include risks inherent in drilling activities, the timing and extent of changes in commodity prices, unforeseen engineering and mechanical or technological difficulties in drilling wells, availability of drilling rigs

and other services, land issues, federal and state regulatory developments and other risks more fully described in the Company’s filings with the U.S. Securities and Exchange Commission (SEC). 4

Annual Shareholders Meeting – December 11, 2018Significant Activities Since The Last Shareholders

Meeting Sold the Methane Facility assets in January 2018Received $2.65 millionRecorded a gain on the sale of approximately $1.16 millionAcquired most of the drilling program interest - $164KContinued to evaluate opportunities (primarily in

Kansas, Oklahoma, New Mexico, and Texas)Current inventoryCorporateAcquisition of producing propertiesAcreageNon-operated opportunitiesDrilled two wells – both were dry holesParticipated in seismic programsOperated opportunitiesDrilled two wells

– one producer, one dryThree polymersAlthough we continue evaluating several opportunities, no agreements have been entered into by the Company to move forward with any of the opportunities currently under evaluationCash position and credit

facilityApproximately $3.2 million cash at 12/11/2018$3 million borrowing base, subject to a credit limit based on current covenants of approximately $2.74 million$0 drawn at 12/11/2018 5

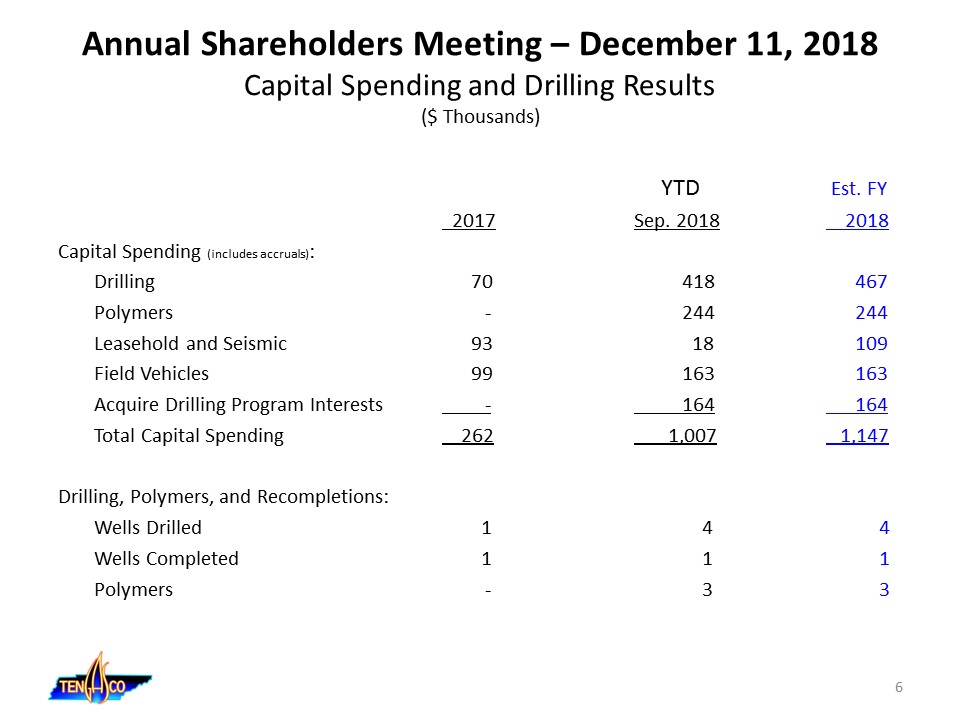

Annual Shareholders Meeting – December 11, 2018Capital Spending and Drilling Results($ Thousands) YTD

Est. FY 2017 Sep. 2018 2018Capital Spending (includes accruals): Drilling 70 418 467 Polymers - 244 244 Leasehold and Seismic 93 18 109 Field Vehicles 99 163 163 Acquire Drilling Program Interests - 164 164 Total Capital Spending 262 1,007

1,147Drilling, Polymers, and Recompletions: Wells Drilled 1 4 4 Wells Completed 1 1 1 Polymers - 3 3 6

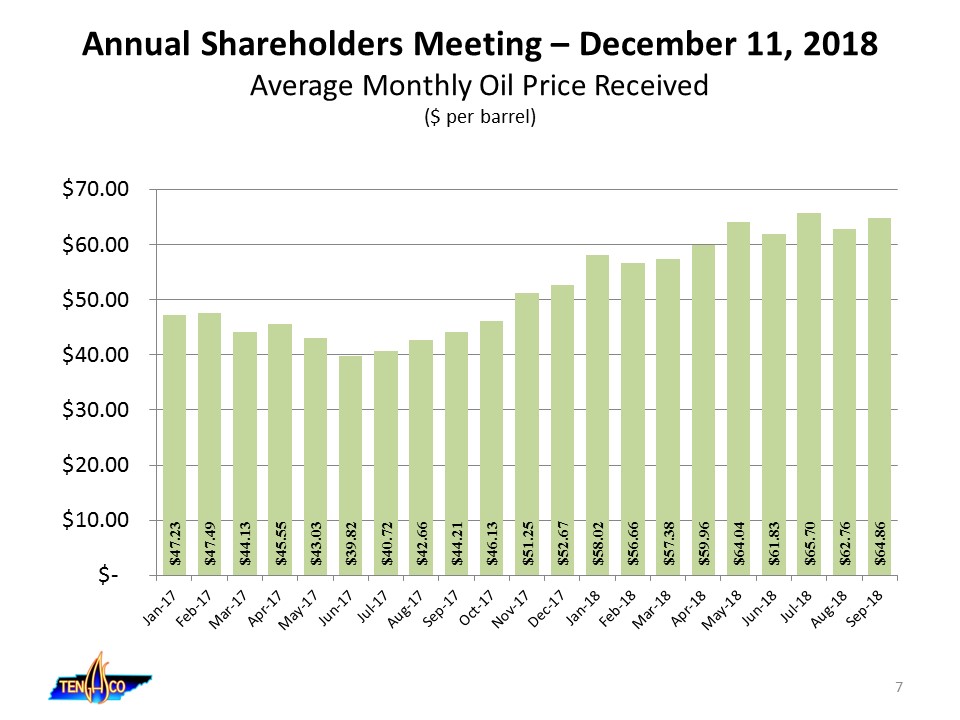

Annual Shareholders Meeting – December 11, 2018Average Monthly Oil Price Received($ per barrel) 7

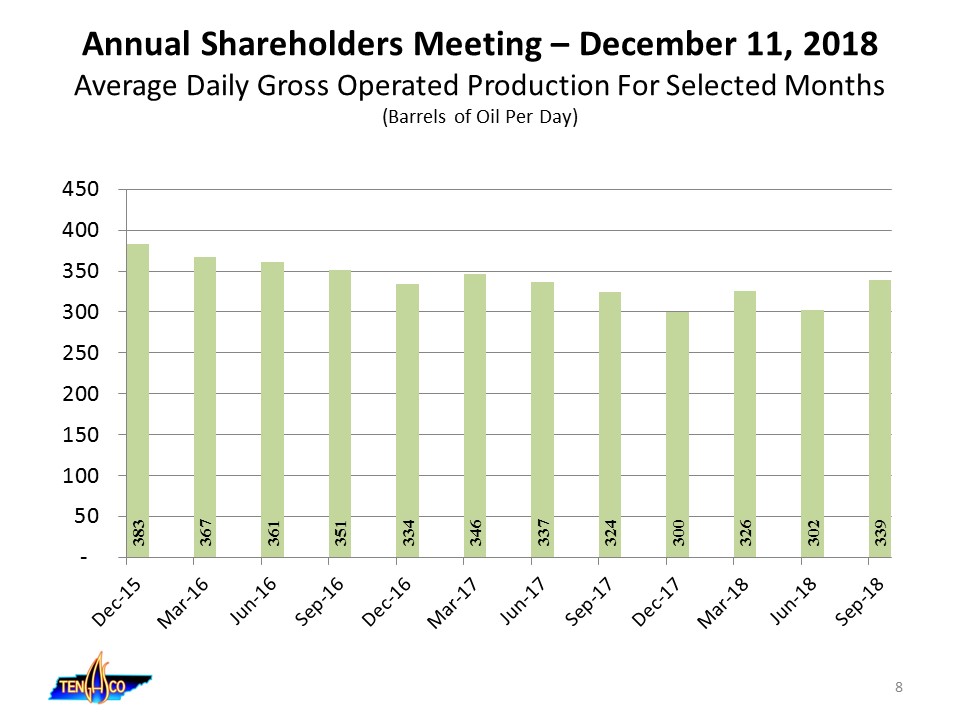

Annual Shareholders Meeting – December 11, 2018Average Daily Gross Operated Production For Selected

Months(Barrels of Oil Per Day) 8

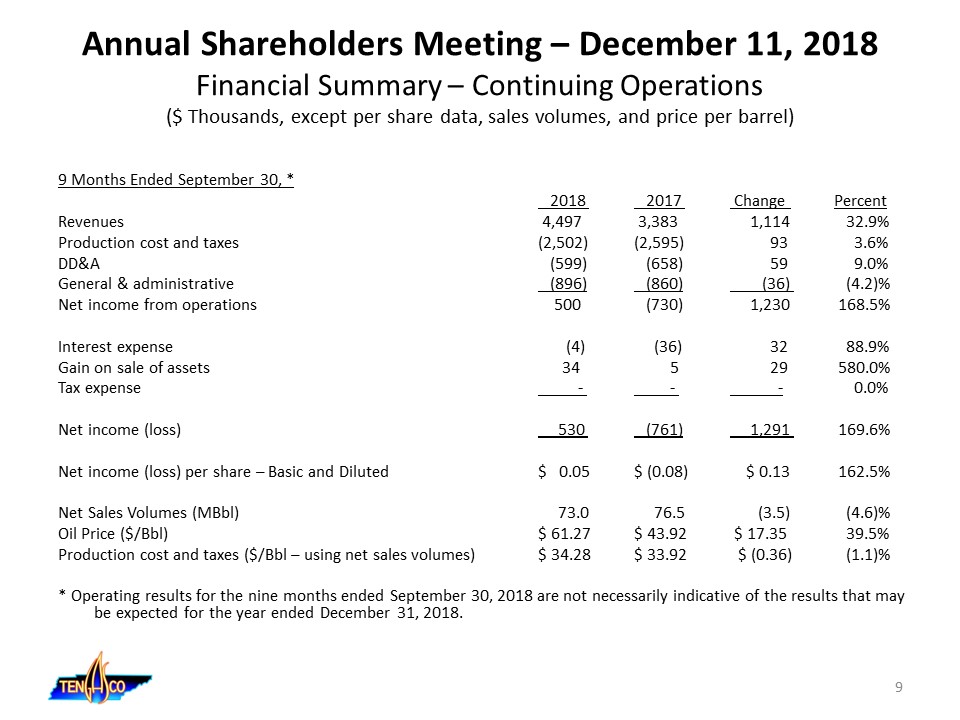

Annual Shareholders Meeting – December 11, 2018Financial Summary – Continuing Operations($ Thousands,

except per share data, sales volumes, and price per barrel) 9 Months Ended September 30, * 2018 2017 Change PercentRevenues 4,497 3,383 1,114 32.9%Production cost and taxes (2,502) (2,595) 93 3.6%DD&A (599) (658) 59 9.0%General &

administrative (896) (860) (36) (4.2)%Net income from operations 500 (730) 1,230 168.5%Interest expense (4) (36) 32 88.9%Gain on sale of assets 34 5 29 580.0%Tax expense - - - 0.0%Net income (loss) 530 (761) 1,291 169.6%Net income (loss) per

share – Basic and Diluted $ 0.05 $ (0.08) $ 0.13 162.5%Net Sales Volumes (MBbl) 73.0 76.5 (3.5) (4.6)%Oil Price ($/Bbl) $ 61.27 $ 43.92 $ 17.35 39.5%Production cost and taxes ($/Bbl – using net sales volumes) $ 34.28 $ 33.92 $ (0.36) (1.1)%*

Operating results for the nine months ended September 30, 2018 are not necessarily indicative of the results that may be expected for the year ended December 31, 2018. 9

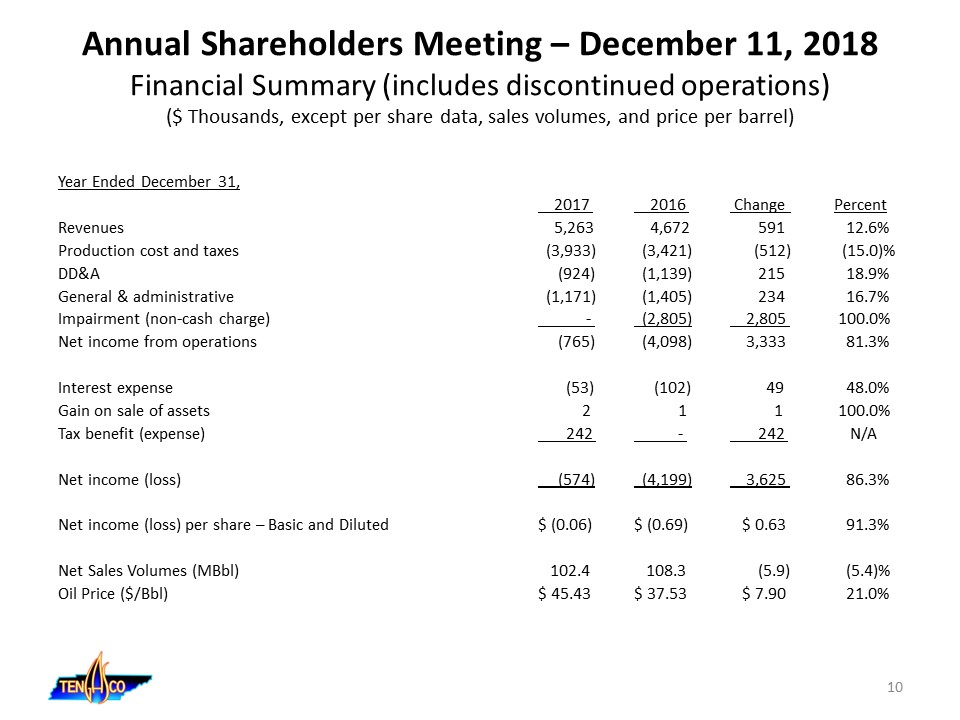

Annual Shareholders Meeting – December 11, 2018Financial Summary (includes discontinued operations)($

Thousands, except per share data, sales volumes, and price per barrel) Year Ended December 31, 2017 2016 Change PercentRevenues 5,263 4,672 591 12.6%Production cost and taxes (3,933) (3,421) (512) (15.0)%DD&A (924) (1,139) 215 18.9%General

& administrative (1,171) (1,405) 234 16.7%Impairment (non-cash charge) - (2,805) 2,805 100.0%Net income from operations (765) (4,098) 3,333 81.3%Interest expense (53) (102) 49 48.0%Gain on sale of assets 2 1 1 100.0%Tax benefit (expense)

242 - 242 N/ANet income (loss) (574) (4,199) 3,625 86.3% Net income (loss) per share – Basic and Diluted $ (0.06) $ (0.69) $ 0.63 91.3% Net Sales Volumes (MBbl) 102.4 108.3 (5.9) (5.4)%Oil Price ($/Bbl) $ 45.43 $ 37.53 $ 7.90 21.0% 10

Annual Shareholders Meeting – December 11, 20182019 Outlook Company will monitor oil prices and continue

to manage our capital spending and borrowing levelsCompany will continue to identify and evaluate opportunitiesCurrent inventoryCorporateAcquisition of producing propertiesAcreageNon-operated opportunitiesProduction Cost & General and

AdministrativeWhen wells go down and require repairs we will only perform the work if it is economic to do soContinue to review personnel, services and the service providers we use to determine if there are cost effective alternatives 11

Annual Shareholders Meeting – December 11, 2018 The Company’s management and Board of Directors want to

thank all of our employees and their families for their dedication and contribution to Tengasco. We also want to thank the shareholders for your continued support. We hope to see you again next year at our Shareholder Meeting in 2019 12

Annual Shareholders Meeting – December 11, 2018 Results of Voting 13

Annual Shareholders Meeting – December 11, 2018 Shareholder Questions to ManagementPlease state your

name, confirm you are a shareholder of the Company, and direct your questions to Mike Rugen. 14